First contracts between Russia and India in national currenices - rubles and rupees respectively - will be signed as early as in 2016. This was the opinion expressed by Russian Deputy Finance Minister Sergei Storchak in an interview to TASS.

«We will witness the transition into national currencies under particular contracts as early as next year, - he said. - As for large-scale transition, at least bilateral trade volume should increase first. The more transactions will be, the more national currencies will be used».

According to him, in order to launch this transition process, «the exporters and importers themselves should feel the benefits of using national currencies». «This can not be reached by administrative decisions, - Storchak explained. - The authorities should merely create favorable conditions, and I believe that the Russian side did do it. There are no techical obstacles to the use of the ruble.»

In early December 2014, the first meeting of Russian-Indian working group on transition to national currencies in mutual trade settlements took place. In the near future the working group will prepare recommendations on how to remove the existing barriers and encourage such operations, which will then have to be passed to the authorities of both countries. This was one of the key issues of the joint statement of Indian Prime Minister Narendra Modi and Russian President Vladimir Putin at the end of his visit to New Delhi on 11 December. «The parties shall encourage the use of national currencies in mutual settlements in bilateral trade,» - the leaders said.

India-Russia: News & Analysis

Re: India-Russia: News & Analysis

First national currenices contracts between Russia and India may be signed as early as in 2016

Re: India-Russia: News & Analysis

India to start buffalo meat supplies to Russia mid-2015

Indian companies are ready to start exporting meat and dairy products to Russia by mid-2015 if they get the approval of the Russian veterinary body Rosselkhoznadzor.

Ajay Sahai, director General of the Federation of Indian Export Organisations (FIEO), expressed confidence that the Indian companies would be granted permission to supply buffalo meat to Russia.

FIEO expressed discontent about failure to sign contracts on the shipments of buffalo meat to the Russian market despite the fact that the Russian veterinary body had in fact permitted imports of this product from four Indian companies in the end of 2014.

Rosselkhoznadzor’s officials confirmed having inspected six other Indian meat companies in late 2014. According to preliminary information, Russian veterinarians are believed to have found no faults with quality of the products and safety of the production process.

In the current economic conditions, launching Indian meat supplies to Russia is a mutually profitable step, a source at the Russian Industry and Trade Ministry opined.

Re: India-Russia: News & Analysis

Russia is making all efforts to ensure India gets SCO membership: Sergey Naryshkin

NEW DELHI: Russia today said it is making all efforts to ensure India gets full membership in the Shanghai Cooperation Organisation as it pitched for greater collaboration among the two countries and China.

Sergey Naryshkin, chairman of Russian Parliament Duma, said the two countries also discussed the possibility of a parliamentary forum of BRICS nations.

"Russia is making all efforts and in the SCO summit certain decisions will be taken to ensure India's full fledged membership at the Shanghai Cooperation Organisation," he said.

"We suggested to create a regular forum of BRICS parliamentarians. Whether this form will grow in regular assembly or any other sort of organisation...we will see," he told reporters.

Naryshkin was speaking on the sidelines of an event. SCO is a grouping founded in 2001 in Shanghai by the leaders of China, Kazakhstan, Kyrgyzstan, Russia, Tajikistan, and Uzbekistan. India is an Observer State in the organisation.

The next SCO meeting is expected to take place in July this year.

India had last year submitted a formal application for full membership of the SCO.

Being one of the largest energy consumers in the world, it feels getting the SCO membership will help it participate in major gas and oil exploration projects in Central Asia. The SCO has amongst its members some of the largest energy producers in the world.

India also feels as SCO member, it will be able to play a major role in addressing the threat of terrorism in the region. India is keen to deepen its security-related cooperation with the SCO and its Regional Anti-Terrorism Structure which specifically deals issues relating to security and defence.

India has been an observer at the SCO since 2005 and has generally participated at the ministerial-level at summits of the grouping which focuses mainly on security and economic cooperation in the Eurasian space.

Naryshkin, who is leading a delegation of Russian legislators, said the two countries also discussed procedures practised in both the houses, which can benefit each other.

During his visit, he also met President Pranab Mukherjee, Lok Sabha Speaker Sumitra Mahajan and Vice President Hamid Ansari, who is also the Chairman of Rajya Sabha.

He also pitched for greater cooperation among India, Russia and China.

"We also discussed Russia, India, China troika which is becoming a factor in international life and ensuring international stability and security.

"Such formats (cooperation between the three) serve as important sense of security in region and once again impossibilty of creating unipolarity in the world.

"Strengthening relations with India, Russia and China strengthens security in the world," Naryshkin said.

Speaking on the Ukranian crisis, Naryshkin said the crisis not only poses a risk to Europe, but also international security. He added that it is important to have a dialogue involving all parties and regions.

"It is quite obvious the Crimean crisis poses a huge risk to international security and the security of Europe. The way out is an agreement in collateral format.

"First major condition is that the two parties meet. Full restoration of peace is possible if there is political dialogue of all parties and regions of Ukraine and the call of the process will be constitutional reforms," he said.

Naryshkin said the future model of the government structure should take into consideration all the different parties of the different regions of the country.

"You can call it a federal model if you wish. We are talking about serious decentralisation of power and in Europe, many countries have experience in this sphere," he said.

Re: India-Russia: News & Analysis

SCO membership,EurAsian customs free trade bloc, rupee-rouble currency trade and the BRICS group/BRICS bank,is a momentous achievement for the member nations,and will benefit trade ,etc. esp for India. India will thus not have to rely mainly upon trade with the west for its economy,once the EurAsian/BRICS group get their act going.

Re: India-Russia: News & Analysis

Saurav Jha @SJha1618 1m1 minute ago New Delhi, Delhi

India and Russia need to close ranks. It is quite clear what is going on. Expect major announcements soon.

India and Russia need to close ranks. It is quite clear what is going on. Expect major announcements soon.

Re: India-Russia: News & Analysis

Classic case of us being penny wise and pound foolish. We still buy it because it is too good to pass up (or true).Vipul wrote:^^^ Kudankulam power will be cheaper, if its is generated!!!!

Classic Russian tactic of offering something at a lower unit cost knowing the buyer will eventually pay more on the overall life time operating costs.

Following a technical snag in the turbine generator of the first unit of Kudankulam Nuclear Power Project on Monday, authorities decided to shut down the unit for six to eight weeks.

The turbine generator has been in operation for just over 190 days for 4,701 hours and generated 282.5 crore units of power. An official statement from the project site director R S Sundar said the unit had been shut down to inspect the turbine and its associated components before resuming commercial operation. Without mentioning much about the snag in the turbine and the critical nature of some of its components, the statement said they had already replaced some components.

“It is likely to take more than eight weeks to resume operations as some of the critical components need replacement,” said a senior project official. Construction of two 1,000 MW units at the plant in collaboration with Russia at Kudankulam in Tamil Nadu’s Tiruneveli district was initiated by the Nuclear Power Corporation of India. After attaining criticality on July 2013, operations of Unit-1 had undergone a series of troubles.[/url]

Re: India-Russia: News & Analysis

Knowledge that comes from trying to run a plant and design issues is something no one will part with -- there may be uses to having to learn how to get this all correct in terms of local human capability. Better than having plants that will run fine but stop running if India tries to take care of its strategic needs by making independent decisions....can't have everything at the same time is a general rule.

Re: India-Russia: News & Analysis

True. In most (smart) commercial negotiations you mitigate that risk by DBO (design, build, operate).Tuvaluan wrote:Knowledge that comes from trying to run a plant and design issues is something no one will part with -- there may be uses to having to learn how to get this all correct in terms of local human capability. Better than having plants that will run fine but stop running if India tries to take care of its strategic needs by making independent decisions....can't have everything at the same time is a general rule.

We have this fixation about 'ToT' and PSUs and 'foreign' ownership. So we pay for the fixation.

We transform what is a simple "build it, operate it and deliver the power" proposition (beyond the usual greenpeace stuff and environmental safeguards) into a "Do we let the New East India Company" take us over? In a globalized economy, this is not smart.

The answer may lie in something the Russians of all people, came up with: gigantic floating reactor 'ships' that operate (much like drilling rigs) outside the 12 mile territorial waters and pipe in electricity. If they screw up, they are entirely liable for non delivery as well as the less likely Fukushima factor.

The whole concept of separating control and responsibility and then trying to formulate a risk management system is inherently unworkable.

Re: India-Russia: News & Analysis

IIRC, someone was arguing in this thread ^^^ that the impact on the budget if falling oil and gas prices would be counterbalanced by a tumbling Rouble. Well here's the verdict:

"Russia’s government is bracing for the impact of a widening budget deficit as the decline in the price of oil and gas, the source of about the half of state revenue, forces the Kremlin to redraw its priorities.

http://www.bloomberg.com/news/articles/ ... ves-budget

And from the WSJ (paywall):

"MOSCOW—Russia’s budget deficit more than doubled in February, the finance ministry said, amid a drop in oil prices and Western sanctions that are sending its economy toward recession.

The country’s budget deficit rose to 10.5% of gross domestic product in February from 4.2% in January, as revenues contracted even as expenditures were slightly reduced.

Russia’s revenues were hit by lower prices of oil, one of the country’s key exports, along with shrinking revenues from collection of taxes, such as value added tax, according to Vladimir Kolychev, chief economist at VTB Capital.

A faster-than-expected spending of military expenses exacerbated the problem, Mr. Kolychev said. This could be a temporary development and the budget deficit is likely to shrink in the second half of the year, he added."

http://www.wsj.com/articles/russias-bud ... Collection

Watch for a sudden interest in selling us 7th generation MKIzed technology

"Russia’s government is bracing for the impact of a widening budget deficit as the decline in the price of oil and gas, the source of about the half of state revenue, forces the Kremlin to redraw its priorities.

http://www.bloomberg.com/news/articles/ ... ves-budget

And from the WSJ (paywall):

"MOSCOW—Russia’s budget deficit more than doubled in February, the finance ministry said, amid a drop in oil prices and Western sanctions that are sending its economy toward recession.

The country’s budget deficit rose to 10.5% of gross domestic product in February from 4.2% in January, as revenues contracted even as expenditures were slightly reduced.

Russia’s revenues were hit by lower prices of oil, one of the country’s key exports, along with shrinking revenues from collection of taxes, such as value added tax, according to Vladimir Kolychev, chief economist at VTB Capital.

A faster-than-expected spending of military expenses exacerbated the problem, Mr. Kolychev said. This could be a temporary development and the budget deficit is likely to shrink in the second half of the year, he added."

http://www.wsj.com/articles/russias-bud ... Collection

Watch for a sudden interest in selling us 7th generation MKIzed technology

Re: India-Russia: News & Analysis

^^ Russia maintains a balance budget because they are conservative in their economic spending , so the budget deficit for 2015 at $50 Oil Price would be ~ 3.8 % of GDP which they would compensate from the reserve fund.

There are countries who run 4-5 % Budget Deficit YOY without issue and borrow money from Market which leads to rise in Public Debt , Russians dont do that they keep public debt low ~ 11 % of GDP as of date and balance the deficit from Reserve Fund.

The key for them is to balance the budget a conservative view to manage finance , ofcourse they can devaluate the rouble further and maintain the budget as Rouble is getting stronger but a stronger and weaker Rouble has its own pros and cons for the economy

There are countries who run 4-5 % Budget Deficit YOY without issue and borrow money from Market which leads to rise in Public Debt , Russians dont do that they keep public debt low ~ 11 % of GDP as of date and balance the deficit from Reserve Fund.

The key for them is to balance the budget a conservative view to manage finance , ofcourse they can devaluate the rouble further and maintain the budget as Rouble is getting stronger but a stronger and weaker Rouble has its own pros and cons for the economy

Re: India-Russia: News & Analysis

^^^ Sounds like hoping we can repeal the laws of economics over the experience of doing so.

Hey but what heck we can hope there is always a first time.

Hey but what heck we can hope there is always a first time.

Re: India-Russia: News & Analysis

^^ Just look at how budget works there .......Even we in India run budget deficit of 3-4 % most of the times.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: India-Russia: News & Analysis

Austin wrote:^^ Russia maintains a balance budget because they are conservative in their economic spending , so the budget deficit for 2015 at $50 Oil Price would be ~ 3.8 % of GDP which they would compensate from the reserve fund.

There are countries who run 4-5 % Budget Deficit YOY without issue and borrow money from Market which leads to rise in Public Debt , Russians dont do that they keep public debt low ~ 11 % of GDP as of date and balance the deficit from Reserve Fund.

The key for them is to balance the budget a conservative view to manage finance , ofcourse they can devaluate the rouble further and maintain the budget as Rouble is getting stronger but a stronger and weaker Rouble has its own pros and cons for the economy

Re: India-Russia: News & Analysis

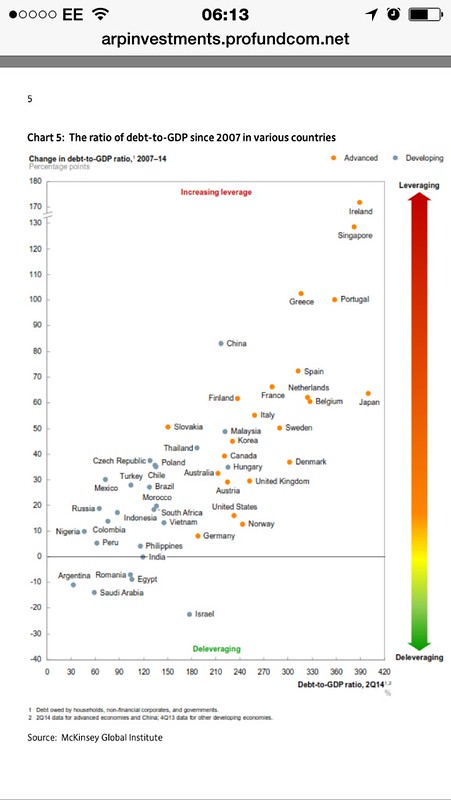

^^^ panduranghari Thanks , Yes I posted that before , Their Public debt is around 11-13 % of GDP.

Most of those debts for them are corporate/bank external debts which constitutes bulk of their debt , But McKinsey figures are from Q2 , most debt were paid by end of Q4

you can find update info on total debt ( Public/External ) in link below , the break up of payment etc is given

http://russia-insider.com/en/2015/02/03/3079

Most of those debts for them are corporate/bank external debts which constitutes bulk of their debt , But McKinsey figures are from Q2 , most debt were paid by end of Q4

you can find update info on total debt ( Public/External ) in link below , the break up of payment etc is given

http://russia-insider.com/en/2015/02/03/3079

All in, end-2014 external debt of Russian Government, banks and corporates stood at USD548 billion, or just below 30% of GDP - a number that, under normal circumstances would make Russian economy one of the least indebted economies in the world. Accounting for cross-firm holdings of debt, actual Russian external debt is around USD420 billion, or closer to 23% of GDP.

Re: India-Russia: News & Analysis

They are fast emptying out the $85bn Reserve Fund to finance just the current year's expenditure.Austin wrote:^^ Russia maintains a balance budget because they are conservative in their economic spending , so the budget deficit for 2015 at $50 Oil Price would be ~ 3.8 % of GDP which they would compensate from the reserve fund.

Russia to tap $50 billion from Reserve Fund as deficit balloons

It isn't that simple. What is public debt situation for other countries facing headwinds similar to Russia? Like Iran and Venezuela for starters? Most western countries running large public deficits are borrowing at very low interest rates which are coupled with low inflation. If Russia had that option it would take it happily. However its borrowing costs are currently running in excess of 13% and running up the public debt is not an option available to them (not beyond a point anyway).There are countries who run 4-5 % Budget Deficit YOY without issue and borrow money from Market which leads to rise in Public Debt , Russians dont do that they keep public debt low ~ 11 % of GDP as of date and balance the deficit from Reserve Fund.

The primary issue facing Russia is the shrinking economy and runaway inflation rather than public debt. While also the facing the challenge of refinancing the maturing private sector debt (which is increasingly cut off from western sources of funding).The key for them is to balance the budget a conservative view to manage finance , ofcourse they can devaluate the rouble further and maintain the budget as Rouble is getting stronger but a stronger and weaker Rouble has its own pros and cons for the economy

Last edited by Viv S on 14 Mar 2015 08:18, edited 1 time in total.

Re: India-Russia: News & Analysis

Russia to tap $50 billion from Reserve Fund as deficit balloons

BY DARYA KORSUNSKAYA

MOSCOW Fri Feb 27, 2015 9:57am EST

(Reuters) - Russia plans to spend more than $50 billion from its emergency Reserve Fund in 2015 as falling oil prices and a slumping economy cause the government's deficit to rise.

First Deputy Finance Minister Tatiana Nesterenko said on Friday the government would ask parliament to allow the spending of up to 3.2 trillion rubles ($52.36 billion) from the Reserve Fund in 2015, including 500 billion rubles already envisaged in the budget.

The increase means that Russia could spend well over half of the fund, currently worth $85 billion, in a single year - a rapid run-down of the fiscal buffers that underlines the precarious state of government finances.

Russia is presently revising its budget for this year, which was based on the assumption the oil price would be $100 per barrel - well above its current level of around $60 per barrel. Ministers have previously said the budget will now assume an average oil price of $50 per barrel.

Budget revenues are also much lower than expected because the economy is contracting, under pressure from Western sanctions imposed because of the Ukraine conflict as well as the lower oil price.

Nesterenko said in the worst-case scenario, the Reserve Fund could fall to as low as 1 trillion rubles by the end of the year, implying over 80 percent of the fund could be spent.

Earlier on Friday, she said the ministry projected a budget deficit of 3.7 percent of gross domestic product this year - a large increase compared with the 0.6 percent deficit originally planned for 2015.

The increase mainly reflects a large shortfall in revenues compared with previous plans. Nesterenko said these were now projected this year at 12.5 trillion rubles, down from 15.1 trillion envisaged in the budget.

Expenditures are seen at 15.2 trillion, slightly below the 15.5 trillion envisaged in the budget.

Nesterenko said that the budget projections would be even worse without some 1.07 trillion rubles in budget cuts, which the ministry believed should be larger.

The latest budget projections suggest that the ministry has largely failed in its efforts to persuade the government to impose bigger spending cuts.

They are more pessimistic than projections that were leaked to a Russian newspaper a week ago, which saw the deficit rising to 3.2 percent of GDP and 2.7 trillion rubles being spent from the Reserve Fund.

(Reporting by Darya Korsunskaya, writing by Jason Bush, editing by Elizabeth Piper)

From an earlier article from Dec last year -

Russia May Burn Wealth Funds in 3 Years Without Cuts

Russia, poised to enter a recession, will burn through its rainy-day funds in three years if the government doesn’t change the budget structure, according to Finance Minister Anton Siluanov.

“If no decisions are made, we’ll burn through all the reserves in 2016-2017,” Siluanov said. “At one third of all budget spending, defense has too large a share. We need to reshuffle and restructure spending for infrastructure, education and so on.”

-

Altair

- BRF Oldie

- Posts: 2620

- Joined: 30 Dec 2009 12:51

- Location: Hovering over Pak Airspace in AWACS

Re: India-Russia: News & Analysis

Where is Putin? Its been a week now since he is off Public. No one has seen him. He cancelled all important meetings and just vanished. He is scheduled to meet with the president of Kyrgyzstan in St. Petersburg on Monday. If he doesn't we have a problem.

Re: India-Russia: News & Analysis

Reserve fund is a function of Oil Price , If Oil Price remains at $60 reserve fund will grow.Viv S wrote: They are fast emptying out the $85bn Reserve Fund to finance just the current year's expenditure.[

Russia to tap $50 billion from Reserve Fund as deficit balloons

The goal of reserve fund was to fund Budget in case of low oil price.

Many countries including India runs Runs Budget Defict close to 3-4 % of GDP nothing unusual , Russian Economist are very conservative people ( barring the Central Bank who are Moneterist ) they prefer to cut spending or borrow from Reserve fund rather then run Budget Deficit.

The borrowing cost may be high now but it was so in the last decade and they Public Debt remained low during that time too , It used to be at 8 % some in in 2006-7 till it grew in lower double digit.It isn't that simple. What is public debt situation for other countries facing headwinds similar to Russia? Like Iran and Venezuela for starters? Most western countries running large public deficits are borrowing at very low interest rates which are coupled with low inflation. If Russia had that option it would take it happily. However its borrowing costs are currently running in excess of 13% and running up the public debt is not an option available to them (not beyond a point anyway).

In any case the public would be happy to buy bond if government gives then 13 % who wouldnt.

You can check the latest figures from Central bank on Debt Link below

http://lenta.ru/news/2015/03/13/rusdebt/

Most Western Countries are on brink of Economic Collapse even the ex Fed Allan Greenspan says this QE would eventualy cause the bubble to burst not to mention China or Japan are in no better position.

Even ReserverBank Chairman Rajan made the same statement some time back. So most Central Banks know what is awaiting them

Most Western Economies have forgotten principal of sound Economic Discipline and they kept borrowing and are now reached at a point where they created economic bubble in their economy

Russian learnt the lesson the hard way in 90's and and since then learnt to live within their means are pay of their debt

Westerns banks are now refinancing the debt the Central Bank mentioned that in the link I gave and most of these are Private Debt and most Private Companies are Cash rich to pay their debtThe primary issue facing Russia is the shrinking economy and runaway inflation rather than public debt. While also the facing the challenge of refinancing the maturing private sector debt (which is increasingly cut off from western sources of funding).

http://viennacapitalist.com/2015/02/19/ ... verstated/

Last edited by Austin on 14 Mar 2015 16:59, edited 1 time in total.

Re: India-Russia: News & Analysis

Frankly speaking Sanction is a good thing for them and hopefully they last for few more years that would be a welcome catalyst for Russian to re-orient their economy to BRICS and Asia.

But EU specially led by France and Germany wants to get over it as its impacting them most.

But EU specially led by France and Germany wants to get over it as its impacting them most.

Re: India-Russia: News & Analysis

With oil at $60, Russia was still burning through its reserve fund, since its internal budgeting accounting was premised on oil remaining at $100/bl and very limited spending cuts have been sanctioned.Austin wrote:Reserve fund is a function of Oil Price , If Oil Price remains at $60 reserve fund will grow.

Oil has currently dropped back down to $45/bl and expected to stay there.

The Russian monthly budget deficit rose to 10.5% of the GDP in February, up from 4.2% in January. For the year it'll probably cross 4% of the GDP. However, where the RBI is borrowing at 8% or less, with GDP growth of over 7%, Russia is borrowing at 13%, with the GDP contracting by over 4%.Many countries including India runs Runs Budget Defict close to 3-4 % of GDP nothing unusual , Russian Economist are very conservative people ( barring the Central Bank who are Moneterist ) they prefer to cut spending or borrow from Reserve fund rather then run Budget Deficit.

By the end of the year, the Reserve Fund will have only $33bn remaining in its kitty (down from a peak of $120bn IIRC).

Exactly. Borrowing cost was even higher for Russia in the last decade making the option of running up public debt more elusive still. Its by necessity (i.e. high interest rates), rather than by choice.The borrowing cost may be high now but it was so in the last decade and they Public Debt remained low during that time too , It used to be at 8 % some in in 2006-7 till it grew in lower double digit.

Err... most investors. If the public was lapping up the bonds, it would drive down the bond yields. Free market at work.In any case the public would be happy to buy bond if government gives then 13 % who wouldnt.

I think most people would consider Russia a lot closer to economic collapse than any Western state (with the exception of Greece).Most Western Countries are on brink of Economic Collapse even the ex Fed Allan Greenspan says this QE would eventualy cause the bubble to burst not to mention China or Japan are in no better position.

Japan's public debt has been over 100% of the GDP for decades and they're still a prosperous country by any metric. None of the countries in question are defaulting on their debt obligations.Most Western Economies have forgotten principal of sound Economic Discipline and they kept borrowing and are now reached at a point where they created economic bubble in their economy

Russian learnt the lesson the hard way in 90's and and since then learnt to live within their means are pay of their debt

On the other hand, Venezuela with public debt at just 50% of the GDP is on its knees in economic terms. Willingness to borrow needs to be coupled with investors willing to lend (at a affordable rates).

A good proportion of Russian firms are still very much under sanctions and cut off from western sources for funding. The Russian private sector has $110 billion in foreign debt maturing just this year. Even assuming a third of that figure was a result of 'internal loans' (rerouted oligarchic funds), that still leaves $70-80bn pending. A huge number relative to Russia's forex reserves, which are down to $350bn (from $550bn), not all of which is liquid.Westerns banks are now refinancing the debt the Central Bank mentioned that in the link I gave and most of these are Private Debt and most Private Companies are Cash rich to pay their debt

http://viennacapitalist.com/2015/02/19/ ... verstated/

Last edited by Viv S on 14 Mar 2015 18:18, edited 3 times in total.

Re: India-Russia: News & Analysis

Foreign debt burden at heart of Russian economic worries

By Jason Bush and Alexander Winning

MOSCOW Mon Feb 16, 2015 4:15pm GMT

(Reuters) - Looming debt repayments by Russian companies are now central to discussions of Russia's ability to weather the financial shocks caused by low oil prices and Western sanctions, but the picture is more complex than commonly believed.

Despite last week's agreement aimed at ending the war in Ukraine, the sanctions are expected to remain for the foreseeable future, perhaps for years if the Ukraine deal fails to lead to a durable peace, leaving Russian companies largely cut off from Western financing.

As long as Western banks refuse to lend, many analysts assume the state will need to help companies repay their $550 billion in foreign debts. The whole debt burden "has to all intents and purposes been transferred to the national balance sheet", analysts at London consultancy Trusted Sources said in a recent report.

Pessimists therefore worry that even Russia's $375 billion in central bank foreign exchange reserves will eventually run out. At the very least, sizeable foreign debt repayments add to the strain on the balance of payments, weighing on the rouble.

But other analysts say these fears are overblown: the debt burden may be far less than it appears on paper, and companies also have huge assets that can help shoulder the burden.

HEAVY BURDEN?

According to central bank data, Russian companies and banks need to repay $109 billion in foreign debt in 2015, a heavy burden at a time when low oil prices have sunk export earnings and Western sanctions have stemmed capital inflows.

These sanctions are widely believed to prevent companies from refinancing foreign debts by taking out new foreign loans. But official figures tell a surprisingly different story.

Last year, net private sector debt repayments amounted to around $40 billion, or less than half of the $100 billion which the central bank said fell due, or implying the rest was refinanced or rescheduled.

Even in the fourth quarter, after Western sanctions were tightened, the size of net redemptions was only around half of debts falling due.

That suggests that many "foreign" debts are really debts to fellow Russians operating from offshore.

"Some part of the debt, around 40-50 percent, was related to recycling of Russian capital: money originally flowing away from Russia and then coming back as loans," said Alfa Bank economist Natalia Orlova.

This bullish view is backed-up by bottom-up analysis of the how much major companies owe to Western creditors. Data compiled by VTB Capital showed that the 15 biggest debtors had to repay only $45 billion in syndicated loans and Eurobonds this year, and $38 billion next year.

Not everyone is so optimistic. Credit Suisse economist Alexei Pogorelov said that even debts to Russians need to be repaid, though they may be easier to reschedule.

"The truth is probably in the middle," he said, estimating the real repayments required this year at $70-80 billion, between optimistic estimates and the official figures.

A further complication will be the impact if Russia loses its investment grade rating from a second major rating agency, following its downgrade to "junk" status by S&P in January.

By triggering early redemption clauses, a second downgrade could add $20-30 billion in debt redemptions this year, analysts estimate.

OVERLOOKED ASSETS

While Russian companies' large foreign debts are widely discussed, their even larger foreign assets, worth almost a trillion dollars as of October, are often overlooked.

Many of these assets are foreign direct investments and loans, which may not be easy to liquidate to cover debts. But they also included over $220 billion in cash, deposits and portfolio investments, central bank data shows.

The two largest debtors, the state energy companies, Rosneft and Gazprom, are alone believed to be sitting on tens of billions of dollars.

As of Sept. 30, their published accounts show, Gazprom held the equivalent of $19 billion in cash and short-term deposits. Rosneft had $16.4 billion in cash and deposits, mostly in dollars.

In an October report, ratings agency Moody's estimated that companies it rated had $160 billion in cash reserves and committed credit lines.

"As of June 2014 the bulk of our rated companies had sufficient liquidity to service their debt through the end of 2015," said Moody's analyst Artem Frolov. "Overall we would expect that those corporates that had liquidity funds in foreign currency would continue to hold them."

But just because some companies have ample foreign currency assets, it doesn't follow that they will use them to repay debts, said Pogorelov from Credit Suisse.

They may instead prefer to hoard their foreign currency and convert rubles instead, with negative implications for capital outflows and the rouble.

"The risk is that going forward you might be cut off from international financing for an extended period of time, which means that any foreign assets you have right now, you cannot waste," he said.

And the focus on the debt repayment issue may ultimately be missing the point.

Last year, reductions in foreign liabilities accounted for only a third of net capital outflows that totaled a record $151.5 billion, with demand for foreign currency cash and foreign direct investments covering most of the rest.

Bolstering public confidence in the rouble, and stemming chronic capital flight, may therefore be bigger challenges for Russia than helping companies repay their debts.

"We do not find this (foreign debt) issue to be acute," Alfa Bank analysts said in a recent report. "Still, capital account weakness transcends the foreign debt issue."

Re: India-Russia: News & Analysis

Diversifying trading partners is all well and good, but they'd do well to focus on reforming their economy to reduce dependency on commodities export.Austin wrote:Frankly speaking Sanction is a good thing for them and hopefully they last for few more years that would be a welcome catalyst for Russian to re-orient their economy to BRICS and Asia.

After Russia (and EEU states).But EU specially led by France and Germany wants to get over it as its impacting them most.

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: India-Russia: News & Analysis

Oil crisis is LTCM redux.

Re: India-Russia: News & Analysis

Interesting to see US TV shows from just after Sochi olympics have lines like "this is the new cold war", "the mafia works with the russian govt." and "Russian intel is not to be trusted" (unlike, you know, paki intel and american intel). The americans are trying to kickstart a new cold war, first attempt was a bust but that shouldn't stop them from trying again...

Re: India-Russia: News & Analysis

Russia coup rumours http://www.ibtimes.co.in/rumours-claim- ... oup-626276

Philip must be devastated.. Has any mod checked up on him to see if Philip is alright

Philip must be devastated.. Has any mod checked up on him to see if Philip is alright

Re: India-Russia: News & Analysis

This rumour about Putin being ill etc. has all the marks of a psy-op run by the GOTUS -- they obviously have intel on Putin's health and know he cannot make public appearances for a bit. Medvedev has been groomed to be Putin's successor, and not to mention Putin is not some sort of monarch the west makes him out to be. All the American drones and sources are busy spreading these rumours...getting their red-white-and-blue freedom gonads crushed in Ukraine must hurt a bit.

However, the fact that EU is now raising the stakes by providing military aid and weapons to ukrainian Nazis in Kyev says they know something about Russia/Putin that is not yet in the public domain. The intent seems to be to get russia to restart the cold war again and restart all the hype about X minutes to midnight and have all the slimy "scientist" crowd give lectures to everyone on nuclear war...it is like the 90s and 2000's never happened and happy days are here again.

However, the fact that EU is now raising the stakes by providing military aid and weapons to ukrainian Nazis in Kyev says they know something about Russia/Putin that is not yet in the public domain. The intent seems to be to get russia to restart the cold war again and restart all the hype about X minutes to midnight and have all the slimy "scientist" crowd give lectures to everyone on nuclear war...it is like the 90s and 2000's never happened and happy days are here again.

Re: India-Russia: News & Analysis

Well its already a known fact who Putin really is and where he disappeared

http://www.christianpost.com/news/satan ... er-126059/

http://www.christianpost.com/news/satan ... er-126059/

Re: India-Russia: News & Analysis

Austin, Of course, nothing like reading the wisdom of christian post to understand what truly goes behind the scenes, and what Satan and Dajjal are upto these days...though Dajjal's exploits can only be read in newspapers in muslim theocracies.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: India-Russia: News & Analysis

No. If you think LTCM was a crisis, then you need to read about it again.RamaY wrote:Oil crisis is LTCM redux.

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: India-Russia: News & Analysis

I meant the impact of LTCM on Russia and how IMF/WB declined to help Russia for geopolitical reasons.panduranghari wrote:No. If you think LTCM was a crisis, then you need to read about it again.RamaY wrote:Oil crisis is LTCM redux.

Re: India-Russia: News & Analysis

Putin & Pappu are chilling together.

Re: India-Russia: News & Analysis

https://www.youtube.com/watch?v=9J7nq6L74X0

Putin resurfaces after 10-day absence

yet another w corporate media rumor-mill FAIL on Putin's and Russia

When the propaganda does not work the MIC corp media will try lot of different ways

Putin resurfaces after 10-day absence

yet another w corporate media rumor-mill FAIL on Putin's and Russia

When the propaganda does not work the MIC corp media will try lot of different ways

Re: India-Russia: News & Analysis

Tanaji,famous lines from an old poem by Lord Tennyson."The Brook".

"Till last by Philip's farm I flow. To join the brimming river, For men may come and men may go, But I go on for ever."

Re: India-Russia: News & Analysis

On the Russian air force: opinion : powerful but fading.

http://www.japantimes.co.jp/opinion/201 ... RFcmGYbhDQ

http://www.japantimes.co.jp/opinion/201 ... RFcmGYbhDQ

Russia’s advanced, “fifth-generation” T-50 stealth fighter, which is still in development, is also having problems. The Kremlin doesn’t disclose what is the matter with the jet, a potential rival to the stealthy American F-22 Raptor. But we can glean some information. Russia and India are co-developing a version for the Indian Air Force, so its generals have had a close look at the T-50. They don’t like what they see. They think the T-50 is too expensive and has too many shoddy parts. The plane’s “engine was unreliable, its radar inadequate, its stealth features badly engineered,” according to India’s Business Standard, which acquired notes from a 2013 meeting of Indian air force officers.

But the T-50 is still a powerful, fast and long-range fighter, and the Kremlin wants to arm it with its modern, long-range Kh-58UShE radar-homing missiles. The U.S. F-22 and F-35 stealth fighters, and their missiles, are comparatively slower, and the missiles have shorter ranges.

Re: India-Russia: News & Analysis

Interesting videoclip of the PAK_FA here.

https://www.youtube.com/embed/kG7KeUrcb ... ransparent

https://www.youtube.com/embed/kG7KeUrcb ... ransparent

Re: India-Russia: News & Analysis

"Ural-tool-Pumori" launched a Russian-Indian machine tools

http://sdelanounas.ru/blogs/60310/

http://sdelanounas.ru/blogs/60310/

The company "Ural-tool-Pumori" (Perm, part of the Ural Machine Corporation "Pumori") released the first Russian-Indian machining center "Center VF400 T & Cs."

Assembling the machine marked a new stage of cooperation with the Indian machine tool company now Ace Manufacturing Systems (AMS), the press service of the CMB "Pumori".

AMS is part of the ACE Micromatic Group is India's largest manufacturer of horizontal and vertical CNC machining centers. The company is constantly expanding its range of supplied equipment, expanding supply both the domestic market and for export. The main export countries are Brazil, Egypt, Germany, Spain, UK, Japan and the US, these countries supplied more than 200 CNC machines.

Cooperation T & Cs and AMS began in 2007 with deliveries to Russia CNC machining centers. In December 2013 an agreement was signed to assemble machines in the Perm region. Under this agreement, the company has delivered AMS frame of the machine, and all necessary components were manufactured in the Perm region. High quality requirements have led to the need to carefully approach the selection of manufacturers and suppliers. Was important not only qualitatively geometry made in strict accordance with the drawings, but also appearance. The machine is made of "Ural-tool-Pumori" passed all necessary tests and meets all the requirements of the equipment produced in the territory of the Russian Federation, as evidenced by a certificate of conformity.

Manufacturing of machinery in Russia using Russian-made components has allowed to reduce the cost of the machine, thus creating, competition imported equipment, which is important in light of the current situation.

In 2015, the planned production of CNC machining center - "Center of the T & Cs WF-450/1000", as well as other models of the total amount of not less than 20 pieces. In the long term - the creation of an assembly center in Perm. This project is only possible if the localization of production, which involves the creation of new jobs in the Perm region and the placement of orders for components from local manufacturers.

Re: India-Russia: News & Analysis

RT @RT_com 57m57 minutes ago

Russia to build Jordan’s first $10bn nuclear power plant by 2022 http://on.rt.com/c2vmd7

Re: India-Russia: News & Analysis

An article worrying about how Russia will kowtow to China and leave Indian military transport needs in the dust:

http://groundreport.com/moscow-opts-out ... m-beijing/

http://groundreport.com/moscow-opts-out ... m-beijing/