Pakistani Economic Stress Watch

Re: Pakistani Economic Stress Watch

Has Bangladesh overtaken Pakis on GDP and per Capital GDP basis?

Re: Pakistani Economic Stress Watch

Dry coconut giving sleepless nights to baki traders

Karachi Chamber of Commerce and Industry (KCCI) President Iftikhar Ahmed Vohra has requested Finance Minister Ishaq Dar to stop the illegal barter of dry coconut on the Line of Control (LoC) between Azad Jammu and Kashmir and the Indian-held Kashmir.

Vohra, in a letter sent to Dar, said some KCCI member firms had complained about the misuse of cross-LoC trade that had brought businesses of dry coconut importers to the verge of collapse.

“Dry coconut can be removed from the barter list to save local traders from severe losses.”

He said under the cross-LoC trade, barter of goods being produced and manufactured in Azad Jammu and Kashmir and the Indian-held Kashmir was only allowed but nowadays terms and conditions were being violated as dry coconut, which was not produced in any of the two regions, was being bartered.

This dry coconut ultimately lands in Rawalpindi and is later sold in various markets of Karachi and other cities across Pakistan, resulting in losses to legal importers.

Only baki can come to exact loss calculation.....Do these guys get special education for claims such fundoo losses and starting their begging lota thing?Vohra said the misuse of trade was not only affecting local businesses but was also causing a loss of Rs1 billion per annum in lost taxes, which the national exchequer otherwise receives from the legal importers of dry coconut.

“There are speculations that dry coconut may be added to the barter list of cross-LoC trade, but it will be totally unacceptable to the local businessmen and importers.”

Vohra asked the finance minister to take steps to put an end to the illegal trade in dry coconut and ensure that the item was not added at any cost to the barter list.

Re: Pakistani Economic Stress Watch

Power Crisis in Pakistan.

A well written and accurate presentation on Pakistans energy crisis.

http://www.dawn.com/news/1171392/why-pa ... -get-worse

A well written and accurate presentation on Pakistans energy crisis.

http://www.dawn.com/news/1171392/why-pa ... -get-worse

Re: Pakistani Economic Stress Watch

Circular debt continues.

http://www.dawn.com/news/1172288/circular-debt-again

http://www.dawn.com/news/1172288/circular-debt-again

In a written statement in response to a question asked in the National Assembly on Thursday, the water and power minister confirmed that the total amount under circular debt is at Rs258bn as of end February, whereas the receivables of the Discos are Rs552bn.

-

member_22733

- BRF Oldie

- Posts: 3788

- Joined: 11 Aug 2016 06:14

Re: Pakistani Economic Stress Watch

Me thinks: Circular debt is invented to hide super-high inflation. There are obvious problems in the supply chain and naturally the demand is high (due to breeding and inbreeding). Ideally this should cause normal inflation reflecting the increase in demand but something smells of Bakistan here.

When one is hit with supply side problems causing inflation, debt is a convenient way to invest in bettering supply side. Since by the time the supply chain clears up, you can provide services at a premium prices (already high due to inflation) and pay for the debt and also have some left over to invest more.

What looks Baki to me, is that the "circular" debt is causing MORE supply side problems. I think someone "took" the money and put it into his/her pocket and forgot about improving the supply side. What we are seeing indirectly is a measure of the extent of corruption in Bakistan.

They will now raise bonds or beg 3.5 to clear the circular debt. Basically they are setting up an elaborate ponzi scheme.

When one is hit with supply side problems causing inflation, debt is a convenient way to invest in bettering supply side. Since by the time the supply chain clears up, you can provide services at a premium prices (already high due to inflation) and pay for the debt and also have some left over to invest more.

What looks Baki to me, is that the "circular" debt is causing MORE supply side problems. I think someone "took" the money and put it into his/her pocket and forgot about improving the supply side. What we are seeing indirectly is a measure of the extent of corruption in Bakistan.

They will now raise bonds or beg 3.5 to clear the circular debt. Basically they are setting up an elaborate ponzi scheme.

Re: Pakistani Economic Stress Watch

^^^ Methinks you may be correct; but with Pakistan, one never knows!

Re: Pakistani Economic Stress Watch

My earlier post referred to the pre-industrial nature of the Pakistani economy. As a comparative data point, the total electricity generation installed capacity in Pakistan is a mere 23GW. For the purposes of comparison, India added 22.6GW last year (2014-15):

pankajs wrote:PIB India @PIB_India · 25m 25 minutes ago >>

* 22,566 MW capacity added during current year against a target of 17,830 MW. Highest ever achievement in a single year. #1TrillionUnits

* Power generation during current year is 1048 BU .Growth of 8.4% over the previous year. Highest growth in last two decades. #1TrillionUnits

* Annual electricity generation crosses #1TrillionUnits. First time in our history .

-

Bhurishrava

- BRFite

- Posts: 477

- Joined: 11 Aug 2016 06:14

Re: Pakistani Economic Stress Watch

Every figure is fudged in Pukistan

http://www.dawn.com/news/1181084/fudged ... s-feed-gdp

http://www.dawn.com/news/1181084/fudged ... s-feed-gdp

Lately, Punjab tried to revise its expected yield down to 18 million tonnes (down from 19.50 million tonnes) but was very heavily snubbed by the federal government for bringing the national production figures down by 1.5 million tonnes, or, in monitory terms, a loss of Rs45 billion – grossly affecting the GDP.

The province cannot project a lower figure for fear of the federal government, cut in GDP and lenders later questioning growth figures.

Re: Pakistani Economic Stress Watch

The USDA predicts an overall 0.5 million ton drop in wheat in Pakistan.

http://gain.fas.usda.gov/Recent%20GAIN% ... 6-2015.pdf

http://gain.fas.usda.gov/Recent%20GAIN% ... 6-2015.pdf

Re: Pakistani Economic Stress Watch

From Dawn:

Textile, clothing exports fall 1.21pc

Textile, clothing exports fall 1.21pc

and other import news from the same article a little further down:ISLAMABAD: Pakistan’s exports of textile and clothing fell by 1.21 per cent in 10 months of the current fiscal year from a year ago.

Not sure if their oil import bill has decreased because of fall in oil prices. Would be more helpful if they published their imports in barrels or metric tons or whatever. Interesting thing is that despite all that, their import bill has gone up!Oil and food: Import bill of oil and eatables in July-April 2014-15 witnessed a decline of 10.298pc to $14.06bn from $15.674bn in the same period last year.

However, total import bill during the period increased by 1.83pc to $37.763bn from $37.084bn a year ago.

The import bill of food products witnessed a surge of 21.76pc to $4.205bn as compared to $3.453bn.

The import of wheat witnessed an increase of 72.90pc; pulses 34pc and all other products 57.67pc. Import bill of sugar also increased by 11.34pc.

Oil import bill reached $9.855bn during the period under review as against $12.221bn in July-April 2014-15, a decline of 19.36pc.

Import of crude oil declined by 24.29pc and petroleum products by 16.26pc.

Re: Pakistani Economic Stress Watch

http://www.brecorder.com/fuel-a-energy/ ... ast-years/

For comparison purposes, India was at 0.6 TOE per capita in 2011.

Also see:

http://www.brecorder.com/br-research/44 ... r-revival/

"So much for power sector revival".

A key statistic:Economic Survey 2014-15 has acknowledged that electricity generation and distribution and gas distribution recorded a growth of 1.94 percent this year compared to 5.57 percent last year ...

....The Survey also rejected the claim of National Electric Power Regulatory Authority (Nepra) that the power sector crisis is responsible for 2-3 percent reduction in GDP, saying that exact cost is still unfolding for Pakistan.

....According to the Survey the government retired the circular debt (Rs 480 billion) immediately after taking oath which added 1752 MW of electricity into the system. In FY 15, the current level of circular debt is around Rs 250 billion including current payable. Interestingly, the IMF claims that circular debt has reached 500 billion ( Rs 270 billion current circular debt and Rs 230 billion parked in Power Holding Company).

....The Survey states that lower tax to GDP ratio restricted the government in financing energy projects...

TOE = Tons of Oil Equivalent.In 2014, per capita availability of primary energy supplies was estimated at 0.36 TOE.

For comparison purposes, India was at 0.6 TOE per capita in 2011.

Also see:

http://www.brecorder.com/br-research/44 ... r-revival/

"So much for power sector revival".

Re: Pakistani Economic Stress Watch

http://www.brecorder.com/business-a-eco ... 9/1192803/ArmenT wrote: Not sure if their oil import bill has decreased because of fall in oil prices. Would be more helpful if they published their imports in barrels or metric tons or whatever. Interesting thing is that despite all that, their import bill has gone up!

Despite a considerable decrease in prices of petroleum products including crude oil and closure of CNG sector during current year, the imported quantity of petroleum products did not increase. In fact import of petroleum crude declined by 6.3 percent in quantity as compared to corresponding period last year.

Re: Pakistani Economic Stress Watch

Like all Paki number...

http://arynews.tv/en/economic-survey-20 ... ion-sector

"Latest reported literacy rate declines from 60% to 58%, reveals Economic Survey 2014-15"

http://arynews.tv/en/economic-survey-20 ... ion-sector

"Latest reported literacy rate declines from 60% to 58%, reveals Economic Survey 2014-15"

Re: Pakistani Economic Stress Watch

http://arynews.tv/en/pakistan-sees-a-ri ... in-2014-15

"Pakistan sees a rise by 100,000 in the number of donkeys in 2014-15"

Seems too low.

"Pakistan sees a rise by 100,000 in the number of donkeys in 2014-15"

Seems too low.

Re: Pakistani Economic Stress Watch

http://tribune.com.pk/story/898080/alar ... al-growth/

"Bowing down: Country spends 44.5% revenue to service debt"

A slight improvement over the previous year. But with Pakistan planning to seriously go into debt to China, I think from here on out things will only get worse.

"Pakistan’s population estimated at 191.71 million – life expectancy rises for both men & women"

http://arynews.tv/en/pakistans-populati ... -men-women

http://tribune.com.pk/story/898060/bowi ... vice-debt/Large Scale Manufacturing (LSM) – which constitutes 80% of Pakistan’s manufacturing sector –registered a meagre growth of 2.5% in the first nine months (Jul-Mar) of fiscal year 2015 compared to 4.6% in the same period last fiscal year, the Economic Survey of Pakistan 2014-15 revealed.

"Bowing down: Country spends 44.5% revenue to service debt"

A slight improvement over the previous year. But with Pakistan planning to seriously go into debt to China, I think from here on out things will only get worse.

"Pakistan’s population estimated at 191.71 million – life expectancy rises for both men & women"

http://arynews.tv/en/pakistans-populati ... -men-women

The preliminary census results from 2011 are swept under the rug (197 million in 2011, http://www.dawn.com/news/706629/pakista ... since-1998 )Pakistan’s estimated population is 191.71 million in 2015 — in 2014 it was estimated at 188 million in 2014.

Re: Pakistani Economic Stress Watch

deleted - OT.

Last edited by Tuvaluan on 06 Jun 2015 01:32, edited 1 time in total.

-

member_22733

- BRF Oldie

- Posts: 3788

- Joined: 11 Aug 2016 06:14

Re: Pakistani Economic Stress Watch

The real miracle is that all this "growth" was happening ALONG with the inflation going down from 10% to 1%.  Someone really applied themselves in Madrassa Mathematics.

Someone really applied themselves in Madrassa Mathematics.

Even hardcore economists would be scratching their heads on how this miracle was pulled off, given that population growth was more than 1% itself and Bakistan never saw a deflationary period (i.e abundance of supply and abundance of supply growth) right before this miracle . I suspect heavy hand of djinn.

Even hardcore economists would be scratching their heads on how this miracle was pulled off, given that population growth was more than 1% itself and Bakistan never saw a deflationary period (i.e abundance of supply and abundance of supply growth) right before this miracle . I suspect heavy hand of djinn.

-

member_28911

- BRFite

- Posts: 537

- Joined: 11 Aug 2016 06:14

Re: Pakistani Economic Stress Watch

What is Pakistan's male birth rate ?A_Gupta wrote:http://arynews.tv/en/pakistan-sees-a-ri ... in-2014-15

"Pakistan sees a rise by 100,000 in the number of donkeys in 2014-15"

Seems too low.

Re: Pakistani Economic Stress Watch

http://www.dailytimes.com.pk/national/1 ... n-few-days

"Another petrol crisis likely to hit Punjab in few days"

"Another petrol crisis likely to hit Punjab in few days"

Petrol pump owners have warned of the possibility of another petrol crisis in the next two or three days.

According to a statement issued by the Pakistan Petrol Pump Dealers Association on Wednesday, petrol pump owners have not been supplied enough petrol to meet the demand.

“Fifty per cent less petrol has been supplied to the petrol pumps throughout Punjab, including Lahore,” the statement said.

Re: Pakistani Economic Stress Watch

http://www.dawn.com/news/1187454/is-the ... ly-growing

"Is the economy really growing?"

"Is the economy really growing?"

So it looks like much of the growth touted by the finance minister has come from the record profits made by banks on the back of heavy lending to government, from sudden increases in livestock, from large quantities of cotton being ginned, from a tremendous expansion in general government services, and from elevated levels of consumer spending and from an expansion in mining and quarrying activity, wherever this may have occurred.

This is a pretty random list if you think about it. None of these sectors have anything to do with each other, so it’s not clear what “broad-based growth” they’re talking about in the opening chapter of the Economic Survey.

Just consider, for instance, that if there is such a large increase in cotton ginning, why is the rest of the textile sector showing a declining growth rate? Where did all this ginned cotton go? There is only one customer for ginned cotton in Pakistan and that is cotton spinning. How can it be that one section of the cotton chain is booming while the rest of it is showing a steep fall in its growth rate?

There is a house building and construction boom under way. We can see these trends with the naked eye even, where appliance stores and shopping malls are packed and the roads are full of the latest models of locally assembled cars and newer varieties of used cars and swanky new buildings are being built everywhere.

Re: Pakistani Economic Stress Watch

A detailed look at the Pak economy from the State Bank of Pakistan:

http://www.sbp.org.pk/reports/annual/arFY14/Real.pdf (PDF)

http://www.sbp.org.pk/reports/annual/arFY14/Real.pdf (PDF)

Re: Pakistani Economic Stress Watch

Pakistan's Fiscal 2015-16 Budget Was Prepared and Finalized by Nawaz Sharif and Family Insiders

ISLAMABAD:

Prime Minister Nawaz Sharif and his team have sidelined the Federal Cabinet, National Assembly Standing Committee on Finance, ruling party’s lawmakers and allied parties from consultations on the budget for fiscal 2015-16, The Express Tribune has learnt.

A source claimed that the PM’s son-in-law Capt (retd) Muhammad Safdar had put together the Public Sector Development Programme for the upcoming fiscal year. “Even Planning & Development Minister Ahsan Iqbal was kept out of the loop.”

Federal Board of Revenue (FBR) Chairman Tariq Bajwa, a close friend of the Sharif family, and Finance Minister Ishaq Dar have prepared the budget with the aid of other close friends, said the source.

Comment: : But then, Nawaz Sharif ( as owner) and his brother Shahbaz Sharif ( as manager) have always treated Pakistan as their own personal fiefdom, so there is nothing new here!Asked who attended this meeting, Khan refused to disclose their names. He only said that all the participants were picked by the minister himself.

Re: Pakistani Economic Stress Watch

Either peepuls are in for a rude shock or else we Pakistan watchers are sadly deluded. But then, one can trust Moodys, not.

http://blogs.wsj.com/frontiers/2015/06/ ... -surprise/

http://blogs.wsj.com/frontiers/2015/06/ ... -surprise/

Pakistan had a good week. Index provider MSCI surprised many observers by announcing that the South Asian nation will be included in MSCI’s 2016 review for potential upgrade to emerging markets status.

Later in the week, investors pounced on the opportunity to buy into Pakistan’s first real estate investment trust in a heavily oversubscribed IPO. And ratings agency Moody's upgraded the country’s foreign currency ratings to B3 from Caa1, citing “continued strengthening of the external payments position and sustained progress in structural reforms under the government’s program with the IMF.”

Re: Pakistani Economic Stress Watch

Basically Pukis are putting all their eggs in the CPEC basket to turn their country around. Moody's seems to have bought the story...

Well, they say a fool and his money are soon parted. When the money we are talking about is $46 Billion and the fool is the Chinese - it should be an interesting few years ahead

Well, they say a fool and his money are soon parted. When the money we are talking about is $46 Billion and the fool is the Chinese - it should be an interesting few years ahead

Re: Pakistani Economic Stress Watch

A guptaji

I am seeing the signs that

1 unkil has committed to bakis, notice the backshish from cosupfun intmonfun woban etc in full flow. Along with solahs and other goodies.

2 ganja is a businessman and knows to keep business running. See the pak rail and other stuff are not floundering. Though the circular debt and other issues are still there.

He has done few things that will improve their viability for some time such as euro bonds etc, get backshish from arabs. This has given him some space to tinker. This he has used to an extent. See also the pindi isloo brt etc project.

The chipak corridor is a huge gamble. But it gives him an aura of visionary thinker who got this landmark deal from the seena biradars, which will help him in the next election, irrespective of its success. Live to fight another day, basic baki rule.

So what people are seeing is that he is better than dus taka and knows a bit about govermund.

My final take is that he has stopped/reduced ingress in a ship with a malsi shaped hole and that in itself is big deal for bakis. But the ship ain't stable yet. And there are enough sharks in the water to rock the boat.

Another thing is that above all ganja is a master at fudging and number juggling. What we see is what we are being shown, there are still >12 hour blackout in rural and urban areas, esp non pakjabi areas.

An impression is being created with help of furrin funds to get more furrin funds by help from unkil and other fourfathers.

It only reinforces the brf wisdom that bakiland is there due to the 3.5. They will do what it takes to keep it afloat.

I am seeing the signs that

1 unkil has committed to bakis, notice the backshish from cosupfun intmonfun woban etc in full flow. Along with solahs and other goodies.

2 ganja is a businessman and knows to keep business running. See the pak rail and other stuff are not floundering. Though the circular debt and other issues are still there.

He has done few things that will improve their viability for some time such as euro bonds etc, get backshish from arabs. This has given him some space to tinker. This he has used to an extent. See also the pindi isloo brt etc project.

The chipak corridor is a huge gamble. But it gives him an aura of visionary thinker who got this landmark deal from the seena biradars, which will help him in the next election, irrespective of its success. Live to fight another day, basic baki rule.

So what people are seeing is that he is better than dus taka and knows a bit about govermund.

My final take is that he has stopped/reduced ingress in a ship with a malsi shaped hole and that in itself is big deal for bakis. But the ship ain't stable yet. And there are enough sharks in the water to rock the boat.

Another thing is that above all ganja is a master at fudging and number juggling. What we see is what we are being shown, there are still >12 hour blackout in rural and urban areas, esp non pakjabi areas.

An impression is being created with help of furrin funds to get more furrin funds by help from unkil and other fourfathers.

It only reinforces the brf wisdom that bakiland is there due to the 3.5. They will do what it takes to keep it afloat.

Re: Pakistani Economic Stress Watch

In the year of announcement of grandiose plans for putting up projects in the Islamic Republic of Pakistan by Taller than Himalaya’s, Deeper than Indian Ocean, Sweeter than Honey, Iron Brother Peoples Republic of China under China-Pakistan Economic Corridor aka CPEC, foreign direct investment by P.R. China in the Islamic Republic Pakistan actually collapses  :

:

What was FDI in Pakistan?

Further the collapse in P.R. Chinese FDI has been a lot sharper than the overall collapse of FDI:In another news flash, our Sino friends invested $218 million in 11MFY15, which is quite a drop from an inflow of nearly $600 million last year

From Business Recorder:In what was supposed to be a year of "stability", foreign direct investments nearly halved in the eleven months ending May 2015; from $1.5 billion in 11MFY14 to $803 million in 11MFY15.

What was FDI in Pakistan?

-

Bhurishrava

- BRFite

- Posts: 477

- Joined: 11 Aug 2016 06:14

Re: Pakistani Economic Stress Watch

In view of Ukraine and Greece bailout packages and continuing problems, it is quite possible that IMF will squeeze the paki balls a little harder next time.

Noone has unlimited money. And US troops have withdrawn too.

Noone has unlimited money. And US troops have withdrawn too.

Re: Pakistani Economic Stress Watch

^^^

http://www.pakistantoday.com.pk/2015/06 ... y-2015-16/

http://www.pakistantoday.com.pk/2015/06 ... y-2015-16/

Yeah, right!“After improving ratings from the international rating firms like Moody’s and Standard and Poor, the Pakistan’s foreign investment will shoot up in near future,” said Sohail, analyst at a brokerage house.

“Once China started pouring investment in the country, the trust of most of the foreign countries will enhance and they will invest in Pakistan,” he added.

In fact, the highest FDI worth $228 million was received from United States of America during the eleven months. Other top investors were China ($218 million), the UAE ($209 million) and Italy ($105 million).

Re: Pakistani Economic Stress Watch

http://www.nihao-salam.com/

"Nihao-Salam Pakistan China Institute promoting the CPEC".

"Nihao-Salam Pakistan China Institute promoting the CPEC".

Re: Pakistani Economic Stress Watch

http://www.brecorder.com/business-and-e ... 2015-06-12

Pakistan would remain the lowest performer in terms of Gross Domestic Product (GDP) growth rate in 2016 and 2017 in the South Asian region not even barring war-torn Afghanistan, Global Economic Prospects (GEP) report published by the World Bank maintains. GDP growth rate for Pakistan is projected by the World Bank at 5.7 percent in 2014, 4.8 percent in 2015, 4.12 percent in 2016 and 4.5 percent in 2017.

...

Afghanistan with a rate of 2 percent in 2014 and 2.5 percent in 2015 is expected to overtake Pakistan''s growth rate in 2016 with 5 percent and in 2017 with 5.1 percent. Nepal''s growth rate would be lower than Pakistan''s in 2014 with 4.8 percent and 4.4 percent in 2016 but would then overtake it with 5 percent in 2016 and 5.5 percent in 2017.

Re: Pakistani Economic Stress Watch

https://dailybrief.oxan.com/Analysis/GA ... c-Corridor

...Pakistan will struggle to invest in CPEC, especially if it maintains its stance on not financing CPEC with public debt, which already stands at 61.2% of GDP. Financing shortfall on the Pakistani side will widen the gap between promised and realised Chinese investment.

Re: Pakistani Economic Stress Watch

Foreign investment in Pakistan

(Board of Investment Prime Minister's Office website)

http://boi.gov.pk/ForeignInvestmentinPakistan.aspx

(Board of Investment Prime Minister's Office website)

http://boi.gov.pk/ForeignInvestmentinPakistan.aspx

Re: Pakistani Economic Stress Watch

More than 5,000 policemen in Lahore wear worn out uniforms because they haven’t been given a new uniform in five years, reports Nai Baat (April 28). The department is expected to give out three uniforms a year. Police officers say they cannot do that because of a lack of funds. - See more at: http://www.thefridaytimes.com/tft/nugge ... QsV2S.dpuf

Re: Pakistani Economic Stress Watch

@bhurishrava

Troops have withdrawn but CSF is still high. Do you have any time line for the ball squeezing to happen?

2016, 18, 20?

Meanwhile

http://tribune.com.pk/story/906246/worl ... rt-growth/

Troops have withdrawn but CSF is still high. Do you have any time line for the ball squeezing to happen?

2016, 18, 20?

Meanwhile

http://tribune.com.pk/story/906246/worl ... rt-growth/

http://tribune.com.pk/story/904070/bail ... er-waters/WASHINGTON: The World Bank and Pakistan on Thursday signed the Second Fiscally Sustainable and Inclusive Growth Development Policy Credit (DPC). The credit amount of $500m is to support Pakistan’s efforts to reinvigorate growth and stabilise the economy, Radio Pakistan reported.

The accord was signed in Washington between the World Bank Vice President, South Asian region Annette Dixon and Pakistan’s Ambassador to the United States Abbas Jilani.

During the session, Jilani stated that another credit agreement of the same kind, worth $500 million would be signed in September this year for energy sector reforms.

http://tribune.com.pk/story/904962/miss ... ergy-loan/ISLAMABAD:

Pakistan and International Monetary Fund’s (IMF) relations will now test deeper waters as the Washington-based lender now expects Islamabad to start focusing on deep structural reforms, particularly in neglected areas of energy and taxation.

The upcoming approval of the eighth loan tranche of $506 million by the Executive Board of the IMF, which is tentatively scheduled to meet on June 26, will mark the beginning of phase-II that will focus on areas that Pakistan has so far failed to deliver in.

In a recent conversation with journalists, IMF Resident Representative in Pakistan Tokhir Mirzoev said the primary focus in the initial stages of the programme was on measures to stabilise the economy.

Key achievements to date include a low interest rate, low inflation, declining budget deficit, and higher reserve buffers.

After the stabilisation, the IMF now wants Pakistan to implement reforms in troublesome areas.

At a joint press conference in May, IMF Mission Chief Harald Finger emphasised structural reforms in tax administration, energy sector, restructuring of state-owned enterprises, and improving the business climate will be a priority in the remainder period of $6.6-billion bailout package.

In its last communiqué issued in May the IMF states, “The authorities’ reform programme has reached its mid-point, and already produced important economic achievements: near-term risks have receded, foreign exchange buffers have been rebuilt, and the budget deficit has narrowed substantially.

“In an environment of low international oil prices, these achievements create ideal conditions to focus on deep structural transformation of the economy,” said Mirzoev.

He said it would be important for the government to use this opportunity to advance structural reforms in the remainder period of the IMF programme, which is going to end in September 2016.

Meanwhile, progress on taxation reforms has been slow. In fiscal year 2014-15 budget, which is ending on June 30, the government withdrew Rs103 billion Statutory Regulatory Orders.

There was hope that the cost of tax exemptions that the government estimated at Rs477 billion by the end of fiscal year 2013-14 would come down to around Rs375 billion by close of this fiscal year.

However, the Economic Survey of Pakistan that the Finance Minister launched early this month revealed that instead of coming down, the cost of tax exemptions has gone up to Rs665 billion.

Out of Rs665 billion tax exemption, the cost of sales tax exemptions was Rs478 billion, according to the survey.

An amount of Rs389 billion was lost due to exemptions given to industries under the sixth schedule of the Sales Tax Act.

An amount of Rs286 billion was lost at the domestic stage and another Rs103 billion at the imports stage. The IMF said it was examining the reasons behind surge in cost of tax exemptions.

When asked, FBR Chairman Tariq Bajwa did not have answer as to why the cost went up despite withdrawing the SROs.

Tax collection has been a long-standing concern. As against the original target of Rs2.810 trillion, the FBR will be unable to collect more than Rs2.6 trillion despite levying Rs360 billion additional taxes in a single year.

The numbers of income tax filers stood at only 880,000, said Bajwa last week. The target was 1.2 million people.

ISLAMABAD:

The Asian Development Bank has postponed the approval of the second $400 million tranche of a $2 billion loan for energy sector reforms due to the government’s inability to meet many of the preconditions that it had promised to deliver on before the lender’s most recent board meeting.

As of now, the Board of Directors of the Manila-based lending agency will not take up Pakistan’s case for approval of a $400 million loan in its June 29 meeting, according to officials at the Finance Ministry. The ADB’s decision to defer the approval deals a blow to the government that has been making claims of progress on the energy front.

The government was eager that the ADB should approve the loan before June 30 – the last day of the outgoing fiscal year 2015. The delay in approval will disturb its plans to build foreign currency reserves to the satisfaction of the International Monetary Fund besides denting the government’s claims of success in improving the mostly state-owned energy sector.

The ADB’s decision to delay the approval of the second tranche is different from the approach that the World Bank has adopted towards Pakistan.Despite missing all the targets that the World Bank had set for Pakistan under its first tranche of $600 million that it approved last year, the Washington-based lender is going to approve $1 billion for power and growth this month.

However, the Finance Ministry insists that the World Bank is approving loans only after it was satisfied with Islamabad’s performance.

The $400 million ADB loan was critical to meet the IMF’s projections of building up Pakistan’s foreign exchange reserves. For the last quarter of the outgoing fiscal year (April-June), the IMF had set a $6.75 billion Net International Reserves target for the government. But the Finance Ministry said that the NIR target was subject to approval of the ADB and the World Bank loans.

The IMF had also projected gross official foreign currency reserves at $15.4 billion for the outgoing fiscal year. By first week of June, the State Bank of Pakistan’s official reserves stood at $12.3 billion, according to the central bank. Pakistan will receive $1 billion from the World Bank and $506 million from the IMF before end of this month, taking its gross official reserves to close to $14 billion, still short of the IMF’s projections by roughly $1.4 billion.

Re: Pakistani Economic Stress Watch

Note this focus on FE levels.

This is to get more funds from IBRD. To apply for these grants certain amount of FE reserve is needed, which is x number of reserve needed to buy fuel(?) per month or week.

Various fudging and number juggling attempts have been made to reach there, including showing private banks FE reserve as part of national reserve.

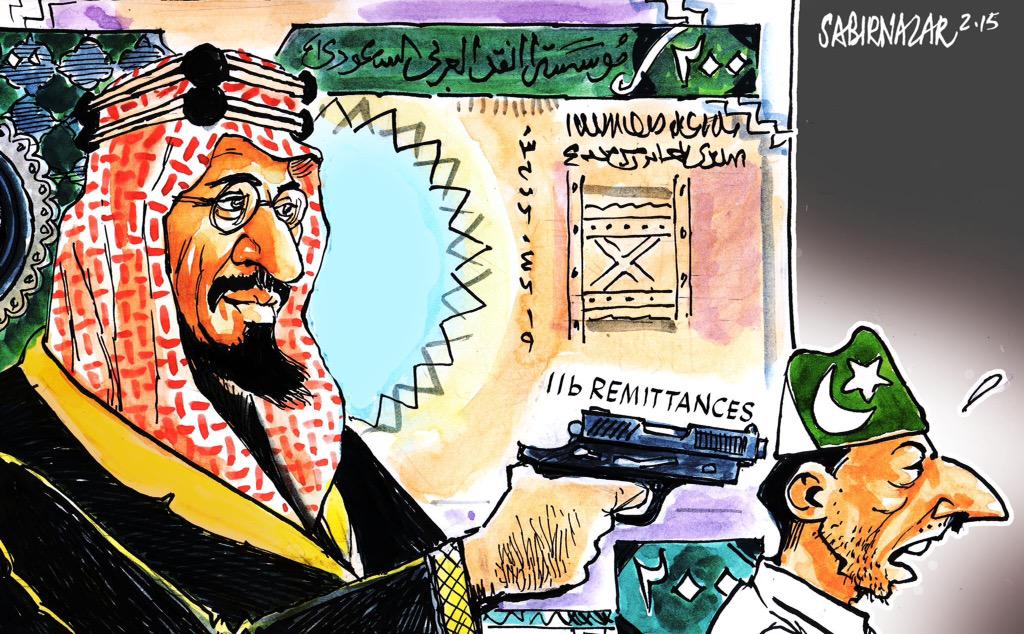

Last year bakis got 3.2 billion $ from wb and IMF, plus 0.4 billion $ from adb. Anonymous donation of 1.5 billion $ and 0.7 billion $ from CSF. Plus some 2 billion $ from eurobonds and 1 billion $ from sukuk, another billion from privatization. Total 9.8 billion dollars.

Jica dfid fmf etc additional. Remittances would also add to this.

Last year their FE reserve was 8.6 billion dollars.

The "circular debt" is around 4 billion dollars and ballooning. This will hit their reserve real bad.

Ganja is planning another round of eurobonds.

Note: last month article.

http://tribune.com.pk/story/882730/buil ... scal-2016/

This is to get more funds from IBRD. To apply for these grants certain amount of FE reserve is needed, which is x number of reserve needed to buy fuel(?) per month or week.

Various fudging and number juggling attempts have been made to reach there, including showing private banks FE reserve as part of national reserve.

Last year bakis got 3.2 billion $ from wb and IMF, plus 0.4 billion $ from adb. Anonymous donation of 1.5 billion $ and 0.7 billion $ from CSF. Plus some 2 billion $ from eurobonds and 1 billion $ from sukuk, another billion from privatization. Total 9.8 billion dollars.

Jica dfid fmf etc additional. Remittances would also add to this.

Last year their FE reserve was 8.6 billion dollars.

The "circular debt" is around 4 billion dollars and ballooning. This will hit their reserve real bad.

Ganja is planning another round of eurobonds.

Note: last month article.

http://tribune.com.pk/story/882730/buil ... scal-2016/

ISLAMABAD:

In a bid to meet the International Monetary Fund’s requirement to raise gross official foreign currency reserves to $20 billion, Pakistan is planning to raise $1 billion from international debt markets through a Eurobond offering during fiscal year 2016.

For the next fiscal year, IMF balance of payments projections show that Pakistan is required to increase its gross official foreign currency reserves to $20.2 billion, excluding the commercial banks’ reserves. This would require Pakistan to add an additional $5 billion in the reserves held by State Bank of Pakistan, which seems a monumental task. For the outgoing fiscal 2015, the IMF has asked Pakistan to increase the reserves to $15.4 billion.

As of May 1, the SBP’s gross official reserves stood at $12.51 billion and the government needs another $2.8 billion to hit the annual target. It is expecting a $500-million IMF tranche and $1.4 billion from the World Bank and the Asian Development Bank before the end of June.

Earlier, in March last year, the government raised $2 billion by floating five- and 10-year dollar-denominated bonds at interest rates ranging between 7.25% and 8.25%. In the second attempt, the government issued five-year $1 billion Ijara-Sukuk bonds at 6.75%.

The only increase in the reserves through non-debt instruments was the $1.5 billion ‘gift’ from Saudi Arabia and over $1 billion in proceeds of from the sale of government stakes in companies like Habib Bank, United Bank and Pakistan Petroleum.

Huge external borrowings were largely facilitated because of the umbrella of the IMF bailout programme, wrote Dr Hafiz Pasha, a former finance minister, in the latest report on Pakistan’s state of economy issued by the Institute of Policy Reforms, an Islamabad-based think tank. The IPR has projected that in the next fiscal year the current account deficit – the gap between foreign receipts and payments – is likely to widen by over $3 billion to $5.4 billion.

It said that this is largely due to larger imports of machinery for power projects being executed with the Chinese assistance.

Re: Pakistani Economic Stress Watch

Monsoon rains in Bakistan will be deficient this year. Not just delayed - but real deficient.

And because of massive deforestation in bakistan, at places there will be rain - they will see floods.

In effect, the bakistani economy will suffer another agrarian crisis and they may end up into deep doo-doo. Even poonjaab will have issues growing food for the piglets.

And because of massive deforestation in bakistan, at places there will be rain - they will see floods.

In effect, the bakistani economy will suffer another agrarian crisis and they may end up into deep doo-doo. Even poonjaab will have issues growing food for the piglets.

Re: Pakistani Economic Stress Watch

Dishaji you mean to say Karachi will be having real baking heat this time?

Re: Pakistani Economic Stress Watch

Analysis of baki budget 2015-6 by a non-economist:

The baki budget 2015-6 is supposed to be of PKR 4.4 trillion ~$ 44 billion. My guesstimate is that it will be around 4.3 trillion PKR or less. The figures below show the amount shown in the baki budget (**- my guesstimate) All figures in trillion PKR.

Amount purpose

1.280 Interest repayment

0.330 Debt repayment

0.790 Military expense

0.330 Government expense

0.230 Pensions

0.300** CSF and "contingent liability" (military other expense)

-----------------------

3.260 nonnegotiable expense

0.700 Public sector development program

0.200 Other development program

0.100. Provincial development program

-------

~4.3 trillion PKR used up. Other and provincial development programs will be cut to fund other programs.

The baki budget 2015-6 is supposed to be of PKR 4.4 trillion ~$ 44 billion. My guesstimate is that it will be around 4.3 trillion PKR or less. The figures below show the amount shown in the baki budget (**- my guesstimate) All figures in trillion PKR.

Amount purpose

1.280 Interest repayment

0.330 Debt repayment

0.790 Military expense

0.330 Government expense

0.230 Pensions

0.300** CSF and "contingent liability" (military other expense)

-----------------------

3.260 nonnegotiable expense

0.700 Public sector development program

0.200 Other development program

0.100. Provincial development program

-------

~4.3 trillion PKR used up. Other and provincial development programs will be cut to fund other programs.

Re: Pakistani Economic Stress Watch

@K Mehta -- any idea how much funds the Pakistan federal government has to put up in order to get the Chinese investments in the MoUs?