Indian Economy - News & Discussion Oct 12 2013

Re: Indian Economy - News & Discussion Oct 12 2013

euro depreciation...

Re: Indian Economy - News & Discussion Oct 12 2013

Thanks. Forgot about that...

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Indian Economy - News & Discussion Oct 12 2013

Now you know why much of the E-Con-O-Mix is Pakistan.So, Euro depreciates and they become "less wealthy" than something else. So Indian currency depreciated by close to 20% thanks to Kangress-MMS and the run away inflation(prices literally doubled in the close to 10% inflation that UPA ran for some 7/ 8 years) . That much I can accept. Kangress made us all poorer by raising the cost of goods and services in nominal terms.Arjun wrote:Euro depreciation...

But EU has negligible inflation, so does Japan. But still the currency tanks coz all the lemmings now thing that interest rates in US are on the way up and dump Oiero to by dollah . Now a "salaryman" German /Japanese who made the same income earlier, spent the same income as earlier on his consumption basked, saved the same as earlier is now "poorer". Sure, they are "Poorer" if they want to by a Kakoose in Kaliphornicashun or a shack in Phlorida, but if they dont' give a damn about Phlorida, then what? Are they poorer at all ?

Re: Indian Economy - News & Discussion Oct 12 2013

Yeah...a little crazy. India may be forced to depreciate down the road to maintain export momentum.

PPP actually makes more logical sense - but that doesn't fetch India as much respect as one would expect from being the third largest economy. The real league table is in the nominal.

PPP actually makes more logical sense - but that doesn't fetch India as much respect as one would expect from being the third largest economy. The real league table is in the nominal.

Re: Indian Economy - News & Discussion Oct 12 2013

There's no need to depreciate currency to maintain export momentum, of which there's none anyway. ~0% growth in exports for the last 2 years, despite a weak currency. Our problem is not the exchange rate, but the weak industrial sector and the multitudes of systemic costs our exporters face. Fix those and we can easy live with a 10-15% stronger currency and ~15% annual export growth, which was the norm more than a decade.

Not that INR is very different, though - we have weakened against USD over the year:

But we have strengthened against EUR:

The new GDP estimates are slightly better than my estimate in January. We should overtake UK in 2016-17 and Germany by the end of this administration's term.

Right. Major euro depreciation.gakakkad wrote:euro depreciation...

Not that INR is very different, though - we have weakened against USD over the year:

But we have strengthened against EUR:

The new GDP estimates are slightly better than my estimate in January. We should overtake UK in 2016-17 and Germany by the end of this administration's term.

Re: Indian Economy - News & Discussion Oct 12 2013

This is why you should be careful about money flowing in and out at the drop of a hat - Jayant Sinha and Rajan notwithstanding.

Re: Indian Economy - News & Discussion Oct 12 2013

It depends how things pan out in the oil and currency markets in the next 5 years. If the GCC make significant moves towards transacting oil sales in non dollar currencies, it will be a huge boon for us.Arjun wrote:Yeah...a little crazy. India may be forced to depreciate down the road to maintain export momentum.

PPP actually makes more logical sense - but that doesn't fetch India as much respect as one would expect from being the third largest economy. The real league table is in the nominal.

-

member_28397

- BRFite

- Posts: 234

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Arjun wrote:Yeah...a little crazy. India may be forced to depreciate down the road to maintain export momentum.

PPP actually makes more logical sense - but that doesn't fetch India as much respect as one would expect from being the third largest economy. The real league table is in the nominal.

agree to keep export momentum INR should go till 70 seems will give pace to make in India as imports go high and export goes cheap plenty of international manufacturers will rush.

Re: Indian Economy - News & Discussion Oct 12 2013

Chinese export still growing despite the currency appreciation.

Re: Indian Economy - News & Discussion Oct 12 2013

That's because they're wringing out more productivity by investing in infrastructure. We have FAR worse roads, rail connectivity, and other infrastructural issues, and people worry about exchange rate. Like I said earlier, it's like owning a car with ancient antifreeze and half empty radiator, only half the engine oil, underinflated tires and worrying about not pressing the accelerator too hard, or the gradient of the road. Fix the infrastructure issues and we can absorb a significant appreciation in the Rupee.

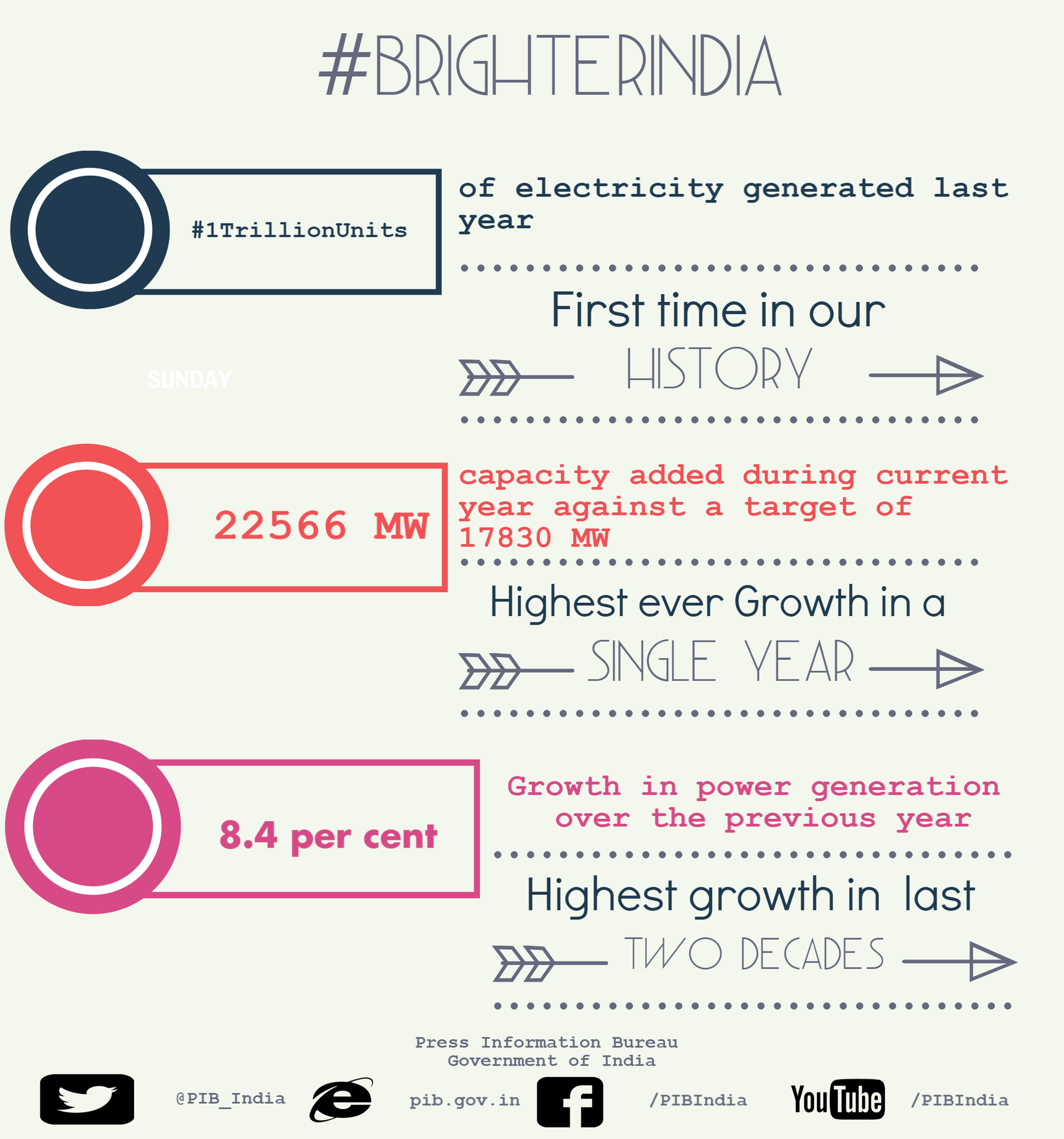

As a datapoint, we were generating 20% annual export growth in the mid-late 2000s despite Rs.40-45/$ , and now for the last two years we have 0% growth despite Rs.60-62/$ . Why ? Because we were growing our industrial output at 10-15% then, generating plenty to export. Right now our IIP is 1-2%. We're dramatically improving electricity output. Road and railways are in the hands of competent ministers, and both are getting massive boosts in investment. What remains is fixing the financial issues related to the indebtedness of industries, who overinvested until 2011 or so, and the slowdown since then has hit them hard. Once that sort out, Rupee will move towards 50/$ and exports will grow strongly too.

As a datapoint, we were generating 20% annual export growth in the mid-late 2000s despite Rs.40-45/$ , and now for the last two years we have 0% growth despite Rs.60-62/$ . Why ? Because we were growing our industrial output at 10-15% then, generating plenty to export. Right now our IIP is 1-2%. We're dramatically improving electricity output. Road and railways are in the hands of competent ministers, and both are getting massive boosts in investment. What remains is fixing the financial issues related to the indebtedness of industries, who overinvested until 2011 or so, and the slowdown since then has hit them hard. Once that sort out, Rupee will move towards 50/$ and exports will grow strongly too.

Re: Indian Economy - News & Discussion Oct 12 2013

Our GDP PPP improved by $620 billion between 2014 and 2015 according to IMF. That is a good chunk of change.

BTW China's GDP PPP increased by $706 billion during the same period. We are moving towards closing the gap here.

However China's nominal GDP increased by $831 billion during the same period whereas ours increased by $259 billion.

Source: http://knoema.com/nwnfkne/world-gdp-ran ... and-charts

BTW China's GDP PPP increased by $706 billion during the same period. We are moving towards closing the gap here.

However China's nominal GDP increased by $831 billion during the same period whereas ours increased by $259 billion.

Source: http://knoema.com/nwnfkne/world-gdp-ran ... and-charts

Re: Indian Economy - News & Discussion Oct 12 2013

Road and railways : That would be Minister Gadkari (transportation) and Minister Prabhu (Railways) right? Does raods come under Transportation or is there a ministry for civil public works? What about defense related public works? Is that under defense?

Re: Indian Economy - News & Discussion Oct 12 2013

VenkataS: Isn't ppp a function of standard of living?

In every developed country, wages are higher than India. In those comparison, PPP makes sense. But China and India should be compared on nominal basis. Cong(I) 10 years was bahut mehanga for Indian progress.

In every developed country, wages are higher than India. In those comparison, PPP makes sense. But China and India should be compared on nominal basis. Cong(I) 10 years was bahut mehanga for Indian progress.

Re: Indian Economy - News & Discussion Oct 12 2013

GST Bill to be tabled in Lok Sabha today

GST meet: new hurdle on 1% additional levyFinance Minister Arun Jaitley will table the 122nd constitutional amendment Bill in the Lok Sabha on Friday, to pave the way for s national goods and services tax (GST) regime. The Bill will be taken up for discussion on Monday. The government is confident it will be passed in the House on the same day, before being sent to the Rajya Sabha.

Senior ministers on Thursday said the government was keen to ensure passage of the constitutional amendment in both Houses in the current session of Parliament and did not foresee any stumbling block, with nearly all major political parties on board. Jaitley had introduced a Bill on a GST in the Lok Sabha on December 19.

The government proposes to roll out the GST, a new indirect tax regime, that will subsume various central and state levies like sales tax, excise and service tax, from April 1, 2016.

A number of state governments on Wednesday asked for an increase in the time period of the one per cent additional tax on the proposed national goods and services tax (GST) from the currently accepted two years.

The constitutional amendment Bill on GST has this: “An additional tax on the supply of goods, not exceeding one per cent, in the course of inter-state trade or commerce shall be levied and collected by the Government of India for a period of two years or such other period as the Goods and Services Tax Council may recommend.”

Business Standard has learnt from government sources privy to discussion in the empowered committee meeting on Wednesday that the time period for the additional tax could be extended, if a two-thirds majority of the empowered committee agrees. It is learnt a number of states want an increase in the timeline to a yet undecided number of years and some are willing to push for voting in the committee.

Separately, in a press briefing, Kerala’s finance minister, K M Mani, who is chairman of the empowered committee, said at the meeting, some states had expressed concern over the Central Sales Tax compensation and asked they be compensated for 10 years or beyond that for the revenue loss from a GST.

He added that manufacturing states such as Maharashtra and Gujarat have demanded they be allowed to levy two per cent additional tax over and above the state GST rate, though no decision had been taken on this. For a decision, this provision also requires a two-third majority in the committee.

If the Centre and the states do not agree on the rate or schedule of the additional tax, it is likely to disrupt the planned rollout date of GST, sources said.

Re: Indian Economy - News & Discussion Oct 12 2013

+1 to Suraj San's post.

Modi Sarkar is rightly concentrating on Energy, Transport and Financial services. Properly executed schemes like Jan-dhan yojna, MUDRA is going to have an impact on SMEs which will give additional thrust beyond fixing the industry indebtedness.

Add to that., GST is going to be one of the real kicker. It will not just streamline tax collection and movement of goods and services., it will actually increase business and industrial productivity.

Modi Sarkar is rightly concentrating on Energy, Transport and Financial services. Properly executed schemes like Jan-dhan yojna, MUDRA is going to have an impact on SMEs which will give additional thrust beyond fixing the industry indebtedness.

Add to that., GST is going to be one of the real kicker. It will not just streamline tax collection and movement of goods and services., it will actually increase business and industrial productivity.

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Indian Economy - News & Discussion Oct 12 2013

Dunno. Other than trying to get that empty building that Modi built in Guj as "GIFT" , they seem to be running around like headless chickens.Financial services

Re: Indian Economy - News & Discussion Oct 12 2013

A lot of progress has been made with GIFT. Give it time.vina wrote:Dunno. Other than trying to get that empty building that Modi built in Guj as "GIFT" , they seem to be running around like headless chickens.Financial services

Re: Indian Economy - News & Discussion Oct 12 2013

The Indian Banking sector is set to be dramatically transformed over the next 5 years.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

How is it different from America? As zerohedge puts it - If you looked at the U.S. economy under a microscope, what you’d see is a gigantic cancerous blob of cronyism surrounded by tech startups and huge prisons. If you zeroed in on the cancerous tumour, at the nucleus you’d see a network of crony institutions like the Federal Reserve, intelligence agencies, TBTF Wall Street banks and defence contractors. Pretty close to that, you’d probably find the Ford Foundation, Templeton Foundation, Clinton Foundation. A veritable clearinghouse for cronyism masquerading as a charity.vina wrote:Dunno. Other than trying to get that empty building that Modi built in Guj as "GIFT" , they seem to be running around like headless chickens.Financial services

At least GIFT was started with honest intention. Not for money laundering like Credit Suisse et al are doing in India.

Re: Indian Economy - News & Discussion Oct 12 2013

Under RBI’s priority lending, small farmers to get bigger loans

http://www.financialexpress.com/article ... ans/66397/

http://www.financialexpress.com/article ... ans/66397/

Revamping the priority sector lending (PSL) norms for banks, the Reserve Bank of India (RBI) on Thursday set targets for lending to small & marginal farmers, revised the limits for housing loans under such lending and asked foreign banks to achieve targets by March 2018.

The RBI has also removed the distinction between direct and indirect agriculture and also added medium enterprises, social infrastructure and renewable energy to the priority sector, in addition to the existing categories.

“The lending to agriculture sector has been re-defined to include farm credit (which will include short-term crop loans and medium/long-term credit to farmers), agriculture infrastructure and ancillary activities,” the RBI said in a notification. The total PSL target will remain at 40 per cent of the bank credit.

Within the 18 per cent target set for agriculture, the RBI has fixed a target of 8 per cent lending target for small and marginal farmers to be achieved in a phased manner — 7 per cent by March 2016 and 8 per cent by March 2017.

For the purpose of computation of 7-8 per cent target, small and marginal farmers will include: farmers with landholding of up to 1 hectare (considered as marginal farmers and farmers with a landholding of more than 1 hectare and up to 2 hectares (small farmers), landless agricultural labourers, tenant farmers, oral lessees and share-croppers.Similarly, it has fixed a target of 7.5 per cent for micro enterprises in a phased manner — 7 per cent by March 2016 and 7.5 per cent by March 2017.

The RBI said loans to individuals for educational purposes, including vocational courses up to Rs10 lakh irrespective of the sanctioned amount, will be considered as eligible for priority sector. On the housing segment, it said loans up to Rs 28 lakh in metropolitan centres and loans up to Rs 20 lakh in other centres for purchase/construction of a dwelling unit per family will be considered as PSL provided the overall cost of the dwelling unit in the metropolitan centre and at other centres should not exceed Rs 35 lakh and Rs 25 lakh respectively.

Further, loans sanctioned by banks for housing projects exclusively for economically weaker sections and low income groups, the total cost of which does not exceed Rs 10 lakh per dwelling unit, will also be considered as PSL.

It said foreign banks with 20 branches and above will have priority sector targets and sub-targets for agriculture and weaker sections, which are to be achieved by March 31, 2018 as per the action plans submitted by them and approved by RBI. Foreign banks’ sub-targets for small and marginal farmers and micro enterprises would be made applicable post 2018 after a review in 2017.

“Foreign banks with less than 20 branches will move to total priority target of 40 per cent on par with other banks by 2019-20, and sub-targets for these banks, if to be made applicable post 2020, would be decided in due course,” the RBI said. Bank loans to food and agro processing units will be part of agriculture.

According to the RBI, export credit up to 32 per cent will be eligible as part of priority sector for foreign banks with less than 20 branches. For other banks, the incremental export credit over corresponding date of the preceding year will be reckoned up to 2 per cent.

Re: Indian Economy - News & Discussion Oct 12 2013

How and who said that?Arjun wrote:The Indian Banking sector is set to be dramatically transformed over the next 5 years.

Re: Indian Economy - News & Discussion Oct 12 2013

That was in response to the previous posts concerning speed of change in Financial Services. Once the Small Bank / Payment Bank licenses are handed out in a few months, the banking sector will see some fairly dramatic change.

Re: Indian Economy - News & Discussion Oct 12 2013

@vina,

You need regulatory and other clearances to operate international financial centers. Most of these were blocked by Congress govt. Most have been now cleared post-Modi elections i.e. in one year. This may also help the one being put up in Kolkata (much smaller). Mumai is planning to turn BKC into one or setup another nearby.Kindly visit SSC and see the GIFT thread and you will find out what were the issues.

You need regulatory and other clearances to operate international financial centers. Most of these were blocked by Congress govt. Most have been now cleared post-Modi elections i.e. in one year. This may also help the one being put up in Kolkata (much smaller). Mumai is planning to turn BKC into one or setup another nearby.Kindly visit SSC and see the GIFT thread and you will find out what were the issues.

Re: Indian Economy - News & Discussion Oct 12 2013

A lot can be done in financial services that doesn't involve Londonistan style 'financial center' activity. We're simply far from sophisticated when it comes to issuing and using debt as a tool to finance development. We can't keep growing simply upon current revenues alone, especially when a fiscal deficit burden means some of those revenues go towards paying down prior borrowing.

A lot of seemingly basic things can be innovations in financial services activity:

Govt allows investing 5% of EPFO corpus in stock markets

EPFO may invest up to Rs 90,000 cr in equities

Govt to launch 40-year bonds in first half of FY2016

NHAI turns to tax-free bonds to raise Rs 28k cr in FY16

A lot of seemingly basic things can be innovations in financial services activity:

Govt allows investing 5% of EPFO corpus in stock markets

EPFO may invest up to Rs 90,000 cr in equities

Govt to launch 40-year bonds in first half of FY2016

NHAI turns to tax-free bonds to raise Rs 28k cr in FY16

"Financial services" has therefore a lot of headroom to develop in. Even PMJDY and MUDRA are major financial innovations. It need not all be about gleaming downtown with glass skyscrapers. GIFT itself is more of poster child of the smart city project, and from Skyscrapercity India, it does seem to be coming together nicely. If it proves such a project can be funded and implemented without major govt handholding, that in itself will provide a prototype of the smart city development scheme. Remember, until the 1980s, Shenzhen was a fishing village. I'm sure there were people in old established Canton (Guangzhou) city nearby then, who dismissed Shenzhen as a nobody, and yet Shenzhen is now the more posh place to be - wealthier and more advanced than Guangzhou.The government is pushing ahead with plans to raise funds for roads, railways and irrigation through the tax-free infrastructure bond route.

Finance Minister Arun Jaitley, in his Budget speech had said: "I intend to permit tax-free infrastructure bonds for the projects in the rail, road and irrigation sectors."

Re: Indian Economy - News & Discussion Oct 12 2013

Saar, I am raising the same qns that I posted in the Indian Railways thread. Excuse an economics neophyte.

This is on the NHAI's tax free bonds:

*Will my relatives ( small time business people) in Desh be able to buy the bonds hassle-free in Indian Rupees?

*What is the expected lock-in period and expected interest rate?

*Is there any way I can buy these bonds from Khanate?

*Tax free means the interest paid by NHAI to me for buying these bonds is non-taxable?

Thanks in advance.

This is on the NHAI's tax free bonds:

*Will my relatives ( small time business people) in Desh be able to buy the bonds hassle-free in Indian Rupees?

*What is the expected lock-in period and expected interest rate?

*Is there any way I can buy these bonds from Khanate?

*Tax free means the interest paid by NHAI to me for buying these bonds is non-taxable?

Thanks in advance.

Re: Indian Economy - News & Discussion Oct 12 2013

It's not that you're a neophyte, but that it was only recently announced, and usually detalis are too boring for press to report. Feel free to dig into google chacha yourself and post what you find.

Re: Indian Economy - News & Discussion Oct 12 2013

For NHAI tax free bonds - most relevant information can be gleaned from here:

http://articles.economictimes.indiatime ... free-bonds

http://www.nhai.org/Doc/23dec11/Disclai ... 0CLEAN.pdf

Specifically.,

1. Any investment <5 lacs or < 10 lacs is going to be "hassle free" in Indian Rupees.

2. The lock-in period is going to be generally 10-15 years. However when the bonds are actually announced you will know the actual lock in period.

3. Expect the tax free rate to be @6-8%. It cannot be higher than the bank rate for a long term instrument (CD)

4. NRIs can invest., though not sure about PIOs and OCIs.

http://articles.economictimes.indiatime ... free-bonds

http://www.nhai.org/Doc/23dec11/Disclai ... 0CLEAN.pdf

Specifically.,

1. Any investment <5 lacs or < 10 lacs is going to be "hassle free" in Indian Rupees.

2. The lock-in period is going to be generally 10-15 years. However when the bonds are actually announced you will know the actual lock in period.

3. Expect the tax free rate to be @6-8%. It cannot be higher than the bank rate for a long term instrument (CD)

4. NRIs can invest., though not sure about PIOs and OCIs.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Frederic Saar,

I may be very wrong but the bonds issued for railways will be primarily for institutional investors. You could then invest through these middlemen. You may even see many JV of India based and western institutions which may allow an Indian living in west invest in India and still repatriate the profits overseas.

At the moment, there are huge pension funds in West and East searching for investments with hope that there will be long term returns. As the west ages, the funds will need guaranteed returns. Indian investments (kind of) guarantee that. In spite of the negativity created by Radiamedia and Congis, in spite of the introduction of MAT, in spite of closure of Mauritius route investments are FLOWING in.

Interestingly, as these billion dollar pension funds see returns, they will send even more money. We can in theory change the game. As many directors on the boards of these pension funds are in cahoots in government, we could tell many of these funds to make their governments to start recognising Aksai Chin POK as Indian territory etc.

Unless you are loaded, you may not get a look in at the early stages of these bond issuance. But perhaps later. Unfortunately those are the current rules of the game.

I may be very wrong but the bonds issued for railways will be primarily for institutional investors. You could then invest through these middlemen. You may even see many JV of India based and western institutions which may allow an Indian living in west invest in India and still repatriate the profits overseas.

At the moment, there are huge pension funds in West and East searching for investments with hope that there will be long term returns. As the west ages, the funds will need guaranteed returns. Indian investments (kind of) guarantee that. In spite of the negativity created by Radiamedia and Congis, in spite of the introduction of MAT, in spite of closure of Mauritius route investments are FLOWING in.

Interestingly, as these billion dollar pension funds see returns, they will send even more money. We can in theory change the game. As many directors on the boards of these pension funds are in cahoots in government, we could tell many of these funds to make their governments to start recognising Aksai Chin POK as Indian territory etc.

Unless you are loaded, you may not get a look in at the early stages of these bond issuance. But perhaps later. Unfortunately those are the current rules of the game.

Re: Indian Economy - News & Discussion Oct 12 2013

Thanks all. I am currently reading a book "One Nation Under Debt"

http://www.amazon.com/One-Nation-Under- ... 0071543937

Talks about how the American financial system that was in ruins after 1778 was largely bolstered up by government issued bonds - bonds bought by Joe and Jane on the street - traces the origin of these government securities to the Dutch trading houses in the 16th and 17th centuries - then the government of William Pitt the Younger and his deft debt management, sinking fund , the financing of the major portions of the Napoleonic Wars through astute debt management - lessons for the budding United States - how the later politicians hijacked the national debt to be sacrificed at the altar of populist politics etc.

I wanted to be a Joe, who in his small way, was able to contribute the rocket called Indian Economy that is going to soar pretty soon.

http://www.amazon.com/One-Nation-Under- ... 0071543937

Talks about how the American financial system that was in ruins after 1778 was largely bolstered up by government issued bonds - bonds bought by Joe and Jane on the street - traces the origin of these government securities to the Dutch trading houses in the 16th and 17th centuries - then the government of William Pitt the Younger and his deft debt management, sinking fund , the financing of the major portions of the Napoleonic Wars through astute debt management - lessons for the budding United States - how the later politicians hijacked the national debt to be sacrificed at the altar of populist politics etc.

I wanted to be a Joe, who in his small way, was able to contribute the rocket called Indian Economy that is going to soar pretty soon.

Re: Indian Economy - News & Discussion Oct 12 2013

Do a review of that book in detail here . It can only benefit others for more people to get enthusiastic about the thread topic and become regulars here

Re: Indian Economy - News & Discussion Oct 12 2013

panduranghari: well said, (but you also forgot Kissingerpanduranghari wrote: ... Ford Foundation, Templeton Foundation, Clinton Foundation. A veritable clearinghouse for cronyism masquerading as a charity.

Re: Indian Economy - News & Discussion Oct 12 2013

Suraj: Is 40 years too long a maturity period? The max I have seen in the US is 30 years - Seattle Port Trust which was giving a decent 5% (federal, I don't remember whether state was also) tax free which was called.

I am sure 10-15 year bonds also will have a few times it can be called. FD interest is taxed, right? As for US citizens investing in tax free binds in India, they would have to pay the difference in tax between their tax liability in the US and the taxes paid in India. For example somebody is say in the 33% tax bracket in the US, then since no tax has been paid in India, she will have to shell out 33% - the highest rate - in the US to Feds plus whatever the state tax rate is to state treasury. That said, if the rates are higher than 6%, still is not a bad deal - there are no bonds in the US today that give you more than 3% tax free. The higher your tax bracket in the US, the higher the coupon of the Indian bonds have to be for it to make it worth your while. The highest tax slab in the US is about 49% (I think). So it is advantageous only if the coupon rate is higher than 7% or so.

Of course, as things come online, they will get into the portfolios of various bond funds which probably will ladder (and minimize risk, of course).

I am sure 10-15 year bonds also will have a few times it can be called. FD interest is taxed, right? As for US citizens investing in tax free binds in India, they would have to pay the difference in tax between their tax liability in the US and the taxes paid in India. For example somebody is say in the 33% tax bracket in the US, then since no tax has been paid in India, she will have to shell out 33% - the highest rate - in the US to Feds plus whatever the state tax rate is to state treasury. That said, if the rates are higher than 6%, still is not a bad deal - there are no bonds in the US today that give you more than 3% tax free. The higher your tax bracket in the US, the higher the coupon of the Indian bonds have to be for it to make it worth your while. The highest tax slab in the US is about 49% (I think). So it is advantageous only if the coupon rate is higher than 7% or so.

Of course, as things come online, they will get into the portfolios of various bond funds which probably will ladder (and minimize risk, of course).

Re: Indian Economy - News & Discussion Oct 12 2013

France issues 50 year bonds. Japan and US have talked about 100 year bonds.

As for individual investors abroad, I don't think either NHAI or any other entity really bothers about such mango men issues, to be honest. Institutional investors are whom they're interested in.

As for individual investors abroad, I don't think either NHAI or any other entity really bothers about such mango men issues, to be honest. Institutional investors are whom they're interested in.

Re: Indian Economy - News & Discussion Oct 12 2013

R Jaggi on the Land Acquisition Bill and the costs of subsidizing farm employment:

Land bill row: India's farm economy is broke; more subsidies and freebies won't fix it

Land bill row: India's farm economy is broke; more subsidies and freebies won't fix it

The suicide of farmer Gajendra Singh in full public view at an Aam Aadmi Party rally in Delhi yesterday (22 April) should bring national focus to the issue of farm distress. Unfortunately, politicians will demand solutions that will at best tackle the symptoms, not the underlying disease. They will demand farm debt waivers, more compensation for crops destroyed by unseasonal rain or hailstorm, higher minimum support prices for farm produce, and lower fertiliser prices, among other things.

All these have been tried repeatedly but farmer suicides continue to happen by the thousand. The Economic Times today (23 April) puts the number of farmer suicides in 2013 at 11,772. Even though the figures relate to “accidental deaths and suicides in India” and may not all be real farmer suicides that relate only to farm debt issues, no one can is serious enough to warrant attention.

The truth is Indian farming is broke. It is simply unviable for most of the people who are forced make a living from it. If Rs 2,00,000 crore of food and fertiliser subsidies, and possibly other Rs 1,00,000 crore of other subsidies (in power, fuel, seeds, etc) every year cannot make farming worthwhile we are clearly throwing money in the wrong direction.

One simple number should explain why this is so: more than 50 percent of the population generates barely 15 percent of GDP. This is unsustainable. The remedy is to get as many people off the farm as quickly as possible, not offer them more money to stay on it. As long as so many people are stuck to the farm, neither their incomes nor farm productivity will rise to viable levels. That’s where the government’s money should go.

More telling is this statistic: India’s total land under cultivation has remained fixed at 140-150 million hectares for over 40 years, but the number of farmers trying to make a living from farming has doubled. We are adding one crore additional farmers every five years – a demographic curse rather than a dividend. The average size of an Indian farm holding has fallen from two hectares to 1.15 between 1976 and now, and it is falling further.

Re: Indian Economy - News & Discussion Oct 12 2013

Suraj, give me a few days and I will do a detailed write-up.Suraj wrote:Do a review of that book in detail here . It can only benefit others for more people to get enthusiastic about the thread topic and become regulars here

Robert E Wright, the author, is an avid preacher of the "Development Diamond" model.

http://w4.stern.nyu.edu/sternbusiness/s ... rowth.html

He talks in detail about this growth diamond model, applies this model to the early colonial and independence era America, compares the growth of Canada as a crown colony and after vis a vis USA, justifies the application of the growth diamond model to the Canadian case as above etc etc."History shows that over time, healthy, sustainable economies possess four dynamic, human-made factors: (1) political systems geared to enabling economic growth, (2) an effective financial system, (3) vibrant entrepreneurship, and (4) sophisticated managerial capabilities."

Overall, the book starts off as a thesis on the early financial history of USA and ends up with some very interesting models for analysing developmental economics. Must say, I could not help but draw parallels to the Indian situation at every other line while I was reading this book.

Re: Indian Economy - News & Discussion Oct 12 2013

Won't 'monetizing' gold - which is actually property of temple deity, including jewelry and so on and not some bare gold collection from treasure the owner of which is unknown - definitely destroy intrinsic value of gold ornaments and, more importantly, historic significance?

The article itself states clearly that temples auction gold. What the article does not state, in any detail, is that temples also do charity. But it is left to imagination of readers only.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Thank you Shri PadmanaBhaswamy and Shri Siddhivinayak for this. Otherwise the buffoon Jet Li will want all this gold to be sold in open market for his pet projects. If that happens, it will lead to JetLi bottom replacing Browns Bottom as the butt of jokes.Most of this temple gold is neither traded nor monetized, Finance Minister Arun Jaitley said in a budget speech in February. By contrast, the Indian government’s gold reserves amount to only about 550 tons.