Indian Economy News & Discussion - Aug 26 2015

Re: Indian Economy News & Discussion - Aug 26 2015

Almost any bill with reasonable funding requirement can be made a money bill. Congress will fear to push the matter hard and play it safe.

Last edited by Suraj on 12 Mar 2016 09:07, edited 1 time in total.

Reason: (Edited) Please don't use political language here. Keep it to the appropriate thread.

Reason: (Edited) Please don't use political language here. Keep it to the appropriate thread.

Re: Indian Economy News & Discussion - Aug 26 2015

http://indianexpress.com/article/opinio ... iscipline/

No Proof Required: The best government for fiscal discipline

Budget 2016-17 should be regarded as perhaps the best budget since 1996. The BJP’s surprisingly good fiscal performance in 2014 and 2015 suggests that achhe din are here

No Proof Required: The best government for fiscal discipline

Budget 2016-17 should be regarded as perhaps the best budget since 1996. The BJP’s surprisingly good fiscal performance in 2014 and 2015 suggests that achhe din are here

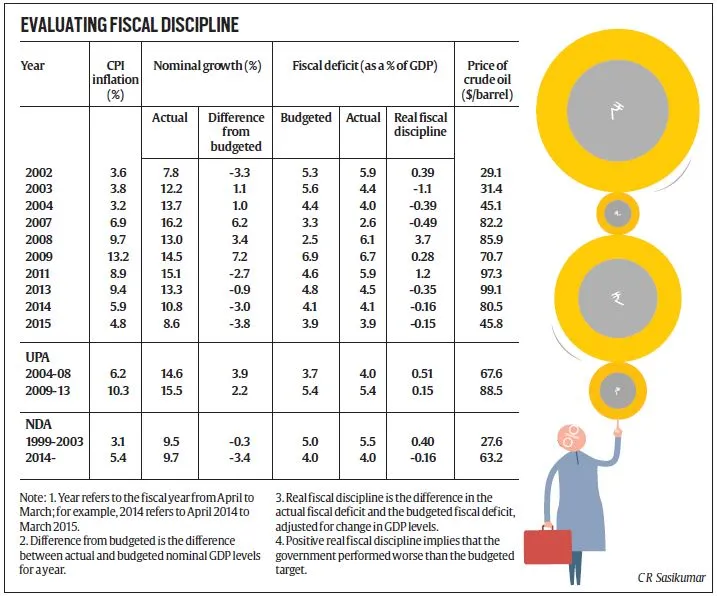

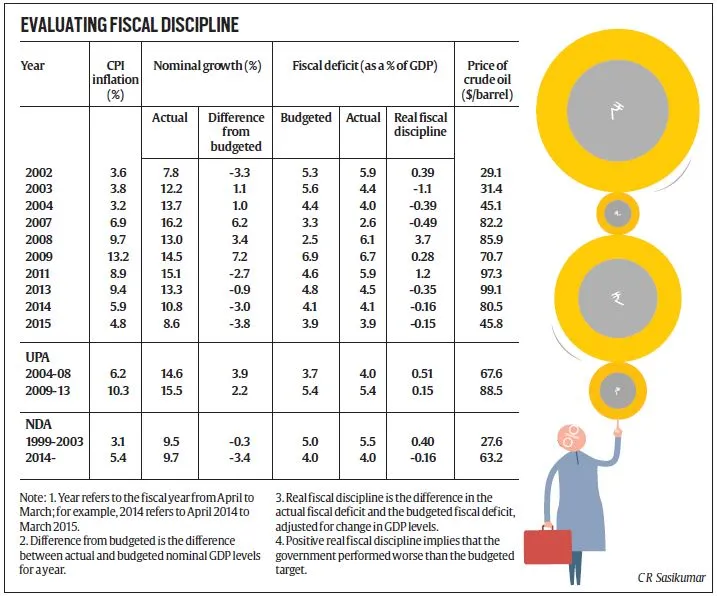

Budget 2016-17 has met with near universal approval for its commitment to the path of fiscal consolidation (and focus on agriculture). On deeper investigation, the path of fiscal consolidation for the current fiscal year is even more impressive than credited by experts. As is well known, the accounts for any fiscal year run from April to March. Throughout this article, a fiscal year will be represented by the first year — that is, April 2015 to March 2016 is year 2015.

The world, including India, has been going through a long period of declining inflation — the world since the crisis year of 2008, and India since the exit of the UPA-led government in May 2014. If this decline is broadly structural then it is likely that the government will consistently miss the targeted nominal GDP growth. This has been happening consistently in India since 2011.

Inflation (based on consumer price index) in India reached a peak of 13.2 per cent in 2009. Since 1974, retail inflation has been higher just once — in 1991, when CPI inflation hit 16.6 per cent. Now no one, not even the most apologist admirer of the UPA’s dole-onomics, has even dared to suggest that 2009 was a reform year. The financial crisis, which started in May 2008, brought down inflation rates around the world. On the other hand, in India, CPI inflation accelerated by 3.5 percentage points to 13.2 per cent. This was a policy choice made by the UPA government: Increasing doles to win over hearts and minds and votes — the economy and fiscal discipline be damned.

In February 2015, the BJP government committed itself to a 3.9 per cent fiscal deficit. This goal involved two separate targets — a target for the nominal revenue and expenditure stream of the government, and a target for nominal level of the GDP. But the denominator (actual GDP) is affected by several factors both domestic (such as weather) and international (such as global growth and oil prices). Essentially, these factors are nearly exogenous to any government. But the numerator (revenue and expenditure) is within the control of the government. The analysis of fiscal discipline should be limited to factors that the government can influence.

Our method for estimating real fiscal discipline (RFD) is straightforward. If the nominal GDP level is above the targeted mark for the year, then the fiscal deficit (as a percentage of the GDP) should come out below target; if nominal GDP level is below the targeted mark, then it should come out above the target. The RFD is, therefore, defined as the difference between the actual fiscal deficit and the budgeted fiscal deficit, after adjusting for actual GDP levels. For example, in 2011, actual nominal GDP was 2.7 per cent below target and the fiscal deficit target was 4.6 per cent of the GDP. Since the fiscal deficit target was 4.6 per cent of the GDP, a shortfall of 2.7 per cent in the GDP meant that the adjusted fiscal deficit should be (4.6x(1 + 0.027)) or 4.73 per cent. Note that the plus sign changes to a minus sign if the actual GDP level is above the budgeted level.

The table documents the performance for 20 years, including averages for different political regimes. The RFDs for the last two NDA years are near identical at minus 0.15 per cent of the GDP, that is, in both years, the fiscal deficit came out 0.15 per cent below what it should have been. The NDA has not been given any credit for its performance in 2014, partly because it increased the targeted deficit from 3.9 to 4.1 per cent of the GDP. But the decline in deficits by a cumulative 0.3 per cent of the GDP in the two years, 2014 and 2015, implies that the Narendra Modi-Arun Jaitley regime has nearly made up for that fiscal indiscipline.

One final point about Budget 2016-17. Was there a turn towards agriculture? A large element of the 80 per cent increase in the allocation for agriculture is fictitious — it is just an accounting change of Rs 15,000 crore of interest subsidy for short-term credit, which was contained in the ministry of finance accounts earlier, and is now allocated to the ministry of agriculture. However, after eliminating this transfer, agriculture, irrigation and rural development have been allocated an increase of 16 per cent. If inflation stays around 4 per cent, this will be one of the three highest increases in the last 20 years.

In sum, Budget 2016-17 should be regarded as one of the best, perhaps the best, since 1996. The NDA’s fiscal performance in 2014 and 2015 suggests that acche macro din should continue well into the future.

Re: Indian Economy News & Discussion - Aug 26 2015

Who Killed Kingfisher ?

An article that says there is a conspiracy behind KF's fall. I am just posting one of the screenshots.

An article that says there is a conspiracy behind KF's fall. I am just posting one of the screenshots.

Re: Indian Economy News & Discussion - Aug 26 2015

As we all know Govt is offering 9W led bulbs at Rs. 99/- Govt has tied up with Snapdeal to sell those LED bulbs. In snapdeal they are selling Godrej brand with Rs. 40/- as uniform delivery charges for 1-4 bulbs.

http://www.snapdeal.com/offers/delp-led

http://www.snapdeal.com/offers/delp-led

Re: Indian Economy News & Discussion - Aug 26 2015

the 40 Rupee delivery charge messes up the math for an item which costs 99 Rs.

Govt should explore better and cost efficient delivery means to deliver these LED bulbs.

Govt should explore better and cost efficient delivery means to deliver these LED bulbs.

Re: Indian Economy News & Discussion - Aug 26 2015

It would be best if the LED bulbs are sold through the PDS outlets. The owners would be happy to sell these if they get a couple of bucks as commission.

Re: Indian Economy News & Discussion - Aug 26 2015

- Even for 4 bulbs, delivery charge is Rs. 40 only.nirav wrote:the 40 Rupee delivery charge messes up the math for an item which costs 99 Rs.

Govt should explore better and cost efficient delivery means to deliver these LED bulbs.

- Regarding better availability, I think Govt should sell these bulbs through established retailers like Reliance, More, Big Bazaar, etc. Right now Electricity board offices and PDS shops working hours clashes with salaried people working hours.

Re: Indian Economy News & Discussion - Aug 26 2015

x-posting from O & NG thread, as this is a clear reformist move, and there has been some criticism after the budget about this govt's lack of reformist creds.

New Oil Exploration Policy Is True Market-Based Reform; Dharmendra Pradhan Has Earned His Reform Stripes - R Jagannathan, Swarajya

New Oil Exploration Policy Is True Market-Based Reform; Dharmendra Pradhan Has Earned His Reform Stripes - R Jagannathan, Swarajya

This is reform. Real reform. The NDA government’s announcement of a new Hydrocarbon Exploration and Licensing Police (HELP), which replaces the controversy-ridden NELP, is likely to go down as one of its biggest market-oriented reforms to date, possibly as big as the New Telecom Policy of NDA-1, which launched the telecom revolution. The stage has been set to increase oil, gas and coal-bed methane products in the coming years dramatically.

The key features of HELP, drafted under the stewardship of Petroleum Minister Dharmendra Pradhan, are that there will be one single licensing policy for all kinds of hydrocarbon (oil, gas, coal-bed methane, shale), market-based pricing for hydrocarbon produced in deep water, ultra deep water, and high pressure temperature areas (that is, places where exploration and production are difficult), and, most importantly, offer licensees bidding based on revenue-sharing instead of profit sharing.

With this policy, Pradhan has emerged as one of the unexpected reform icons in the Modi government, after stewarding diesel price decontrol and shifting LPG subsidies to direct benefit transfers. Next on his list could be kerosene, for which pilot projects are underway.

Pradhan’s hydrocarbon licensing policy is a big shift from the profit share-based bidding process under the previous New Exploration and Licensing Policy (NELP) that resulted in endless wrangles, heartburn and arbitration involving Reliance Industries’ gasfields in the Krishna-Godavari (KG) offshore areas, among other things.

Revenue-sharing is intrinsically easier to define and capture for both parties than profit share, since profit share needs you to calculate both variable and investment costs, often leading to gold-plating of projects by contractors since this enables them to postpone sharing of profits with government. If costs are inflated, the profit share date get pushed back for the government as profits can be made only after full investment and variable costs are recovered.

But before Arvind Kejriwal rushes in to say that this was intended to benefit Reliance Industries, the policy explicitly states that HELP will apply only to new offshore oilfield projects that are yet to start commercial production as on 1 January 2016. Reliance can benefit only from bidding in new fields, and it has to win those bids in the first place.

The new, liberalised marketing and pricing freedom policy will not apply to contractors who have “pending arbitration or litigation…directly pertaining to gas pricing covering such fields”. Thus Reliance, which has arbitration and litigation going on in respect to its Krishna-Godavari fields, will not benefit from this till it settles with the government. The government’s policy also makes it clear that “all the fields currently under production will continue to be governed by the pricing regime which is currently applicable to them.”

In short, it is about future projects, and not current ones.

However, the marketing and pricing freedom indicated by the new policy is not total, and the government has put in a ceiling based on the landed cost of imported fuels. The ceiling price to be announced by the government will be the lowest among three prices – the landed price of fuel oil, the weighted average landed price of substitute fuels such as fuel oil, coal and naphtha, and the landed price of imported liquefied natural gas (LNG).

But this ceiling is generous enough to pass off as market-based pricing since the market price would anyway have been limited by the price at which one can make imports. What this formula does is limit the contractors’ ability to use kinks in an imperfect market to make large price increases. A transparently calculated ceiling price will not be too intrusive an intervention by government in market trends. It leaves ample room for discovering a true balance between demand and supply in the home market.

Another innovation introduced in HELP is the opening up of the entire Indian exploration acreage for investment instead of offering blocks bit by bit. Under the new “open acreage licensing policy”, anyone can bid for any area to explore, but the actual licence will be given only on the basis of competitive bidding. In revenue-share bids, the winner will be the party offering the highest net present value of future revenue shares over the expected life of a hydrocarbon field.

In order to encourage exploration, the government is also offering a concessional royalty scheme – which will be zero for deep water and ultra-deep water areas for seven years, and then go up to 5 percent and 2 percent for the two kinds of fields respectively. For shallow water areas, the royalty rates are down from 10 percent to 7.5 percent.

After dilly-dallying for nearly two years, the NDA government has finally bitten into real reform. Dharmendra Pradhan is the unlikely reformer who deserves kudos for this achievement.

Re: Indian Economy News & Discussion - Aug 26 2015

February retail inflation at four-month low of 5.18%

Is India Inc coming back to Indian banks for their credit needsConsumer Price Index (CPI)-based inflation for February contracted to the lowest in four months at 5.18 per cent, compared with 5.59 per cent in January and 5.37 per cent in February last year, on the back of a sharp decline in food prices, data released by the Central Statistics Office showed on Monday.

Consumer food price inflation rose 5.3 per cent for February, compared with a 6.85 per cent rise in January and 5.37 per cent in February last year, according to the data. In fact, the CPI inflation for January was the highest in 17 months, raising the prospect of a delay in any further interest rate cut by Reserve Bank of India Governor Raghuram Rajan.

The recent spurt in bank credit growth may lead to believe that Indian firms are coming back to the banking fold for their credit needs, but the reality could be more nuanced.

Credit grew 11.6 per cent year on year from 9 per cent in October.

Surely, offshore market has turned unfavourable for the Indian firms, as rupee's weakness before the Union Budget meant that the Indian companies are no longer getting loans at cheap rate post hedging, but the weakness in corporate profitability has also turned foreign investors away from lending to Indian companies.

On top of that, the spike in corporate bond yields have meant that only the top rated companies can approach this route and raise funds at a reasonable rate below banks' loan rate.

Hence, Indian companies could be coming back to the good old banks for their loan needs, some analysts feel.

Re: Indian Economy News & Discussion - Aug 26 2015

India's February trade deficit narrows to lowest since Sept 2013

Real estate regulator to be a reality soon, Parliament passes the BillIndia's trade deficit narrowed in February to its lowest since Sept. 2013 as exports contracted at a slower pace, with demand remaining weak from Europe, the country's biggest market.

India has been struggling with weak global demand although the blow has been softened by a collapse in its oil import bill and curbs on gold imports.

Cheaper Chinese exports have undercut India's engineering exports, which constitute around a quarter of total goods exports.

Prime Minister Narendra Modi's decision to impose curbs and raise tax on steel imports to protect domestic steel makers has also had the adverse impact of raising costs and sapping the ability of Indian producers of engineering goods to compete.

Sovereign, pension funds may invest $50 billion in IndiaThere’s good news for home buyers. Real estate regulator will be a reality soon as the Parliament gave its nod to the Bill today.

The Real Estate (Regulation and Development) Bill, 2013, was approved by Lok Sabha today, five days after it was passed in Rajya Sabha.

The bill seeks to create a set of rights and obligations for both the consumers and developers, according to an official statement. It will make mandatory for developers to set aside 70 per cent of sales proceeds from a project in an escrow account and compulsory approvals prior to project launches. Developers and buyers will be paying same interest rate on defaults.

Minister of Housing and Urban Poverty Alleviation Venkaiah Naidu said after passage of this Bill, existing/ongoing projects would not come to a standstill. It does not provide that the existing projects should stop all operations until complied with the provisions of the Bill.

Total PE investments in 2015 at $19.5 billion, best ever for IndiaIndia is an attractive destination for global sovereign and pension funds as they are expected to invest up to $50 billion in infrastructure sector over the next five years, says a report.

A research report by Ambit and The City of London Corporation says that sovereign wealth funds, global pension funds and insurance companies are interested to invest in infrastructure assets in India.

"With the infrastructure asset supply becoming scarce in western markets, there is a significant opportunity to attract meaningful investments for India from these investors," Ambit Corporate Finance Managing Director Rahul Mody said, adding that this could be up to $50 billion over the next five years.

Private equity (PE) investments during the October-December period totalled $3.9 billion, taking the deal value for the year 2015 to $19.5 billion — the "best ever" for India, says a report.

According to the PwC MoneyTree India report, a quarterly study of PE investment activity based on data provided by Venture Intelligence, the fourth quarter of 2015 saw investments worth $3.9 billion, a 12% drop as compared to the same period of 2014.

However, despite the drop, the stellar performance throughout the year helped 2015 become the best year ever, with a total of $19.5 billion worth of PE inflows across 159 deals.

"India's macros are looking good, with the current account and fiscal deficit at acceptable levels, a relatively stable rupee, inflation at below 5% and, most importantly, a declining interest rate regime. This should encourage private investment as demand picks up," PwC India leader — Private Equity, Sanjeev Krishan said.

Sectorwise, the information technology (IT) and IT-enabled services (IT & ITeS) continued to be the biggest sector, as this space attracted $1.3 billion in 93 deals, followed by the banking, financial services and insurance sector that attracted $910 million in 10 deals.

"In 2015, sectors such as banking, insurance and telecom saw the stabilisation of their business and opened up their technology spend over the year, thereby driving the growth of the Indian IT & ITeS industry," PwC India leader — Technology, Sandeep Ladda said.

"Media & entertainment sector was a surprise, attracting investments worth $414 million," the report said.

Regionally, Mumbai attracted $1.9 billion, while Bengaluru was a distant second with investments worth $733 million.

Re: Indian Economy News & Discussion - Aug 26 2015

Govt opens up coal sector beyond Coal India monopoly

Bringing cheer to fuel starved small industries, the Ministry of Coal earmarked 16 coal mines to be allocated to states for sale to MSMEs. This is also the first step towards government’s effort to open up the coal sector beyond monopoly of state owned Coal India Limited.

The government released a list of 16 mines which will be allocated to states through transparent auction process. The list is divided into 2 parts -- host state and non-host states.

The states will then mine and sell coal to their own Industries - mostly MSME’s. The effort is also to curb black marketing of coal which small industries succumb to as there is supply shortfall from Coal India.

Re: Indian Economy News & Discussion - Aug 26 2015

Despite prices of Petroleum products prices, demand is still high.

I believe this justifies Govt stand to keep the status-quo, or else the Import-Export deficit would blow out of control.

And the Kangress and Opp parties have now started targeting this very thing, i humble opinion is masses should understand Govt's stand and view it as a matter of national importance.

I believe this justifies Govt stand to keep the status-quo, or else the Import-Export deficit would blow out of control.

http://www.taipeitimes.com/News/biz/arc ... 2003639282India’s fuel demand grows for 15th consecutive month

India’s fuel demand grew for a 15th straight month as rising automobile sales and declining crude oil prices encouraged higher consumption of gasoline and diesel. Fuel use last month increased 13 percent from the previous year to 15.71 million tonnes, according to calculations based on preliminary data posted on the Web site of the Indian Oil Ministry’s Petroleum Planning & Analysis Cell.

Gasoline use jumped 11 percent to 1.82 million tonnes, while consumption of diesel, which contributes 40 percent of the nation’s total fuel use, rose about 8 percent to 6.28 million tonnes. The nation’s fuel demand growth would average approximately 5 percent this year and next year, Singapore-based BMI Research analyst Peter Lee said.

Shudder to think, what would have happened.“Our short-term outlook on India’s oil demand growth is quite bullish,” Lee said by e-mail yesterday. “Government figures show that gasoline and automotive diesel demand held up over 2015 and we expect this trend to persist for some time alongside strong growth in car sales, which will drive up domestic demand for transport-related fuels.”

And the Kangress and Opp parties have now started targeting this very thing, i humble opinion is masses should understand Govt's stand and view it as a matter of national importance.

Re: Indian Economy News & Discussion - Aug 26 2015

ANIL AGARWAL'S $10-BILLION LCD PLANT TO START PRODUCTION IN 2018

http://www.indian24news.com/business/an ... 92832-news

http://www.indian24news.com/business/an ... 92832-news

New Delhi: Vedanta group chairman Anil Agarwal's $10-billion LCD screen plant, which is billed as the country's first, will start production in 2018."Panel FAB is expected to begin by 2018 with full production over the next 10 years subject to external environment," Mr Agarwal told PTI in an interview.This will be the largest investment made in setting up of an electronics plant in India.It will be operated by Twinstar Display Technologies and will not fall under any of the Vedanta group companies' current business ambit."The proposed LCD manufacturing unit, the first of its kind in India, will be operated by Twinstar Display Technologies. It is promoted by Volcan Investments Ltd, whose other investments include Vedanta Resources and Sterlite Technologies," he said.Mr Agarwal along with his family holds a majority stake in Volcan Investments. The company clarified that the LCD plant is Mr Agarwal's personal investment and not part of his Vedanta group."We endeavour to make India a significant export hub of display units with the setting up of Panel FAB," he said.At present, all LCD displays used in mobile phones, TV screens and computers are imported. "India is one of the fastest growing markets for LCD panel based products such as TV, smartphones, tablets, desktops and laptops.""By 2020, India's LCD panel import bill is expected to touch $10 billion (about Rs 68,000). Panel FAB will not only significantly reduce this but also earn foreign exchange through exports," Mr Agarwal said.

Re: Indian Economy News & Discussion - Aug 26 2015

India's per capita income to cross Rs 1 lakh in FY17.

Rs 1 lakh — that benchmark will be achieved in the next financial year when per-capita income crosses the six-figure mark for the first time. To be sure, it's the equivalent of just $1,500 but all the same a number that has some significance in a country of 1.2 billion where 12.4% in 2011-12 were living on less than $1 a day, according to the World Bank.

Per capita income at current prices was Rs 93,231 in FY16, up 7.3% from Rs 86,879 in the year before. It stood at Rs 71,050 and 79,412 in FY13 and FY14, respectively.

At that rate of acceleration, per-capita income will exceed Rs 1 lakh in FY17. The Budget for next year, announced by finance minister Arun Jaitley on February 29, assumed a nominal GDP growth of 11%. That would mean a similar rise in net national income and, adjusted for an increase of 1.2% in population, should yield an expansion of more than 8% in percapita income.

"Nominal GDP growth has been an average 11.7% in the past four years, so with a 1.2% population growth, we can expect per capita incomes to exceed Rs 1 lakh in FY17," said Saugata Bhattacharya, chief economist, Axis Bank.

"It would be interesting to check the expenditure surveys to gauge the distribution of the rise across income classes," he added. Per capita income broadly measures quality of life in a geographical region — country, state or city.

It's arrived at by dividing the country's total income by its population. It also needs to be adjusted for inflation to see whether incomes are rising.

"At current prices, per capita income is expected to cross the threshold of Rs 1 lakh in 2016-17, which is encouraging. However, large regional variations and an urban-rural divide in income levels persist," said Aditi Nayar, chief economist at ICRA. If the average amount crosses six figures, it would have taken India almost seven years to double its per-person annual income from Rs 46,492 in FY10.

The increases in per capita income have been driven by urban growth. "Given that agriculture has suffered and the rural economy is under distress, total per capita income has grown largely on the strength of the urban economy," said Crisil chief economist DK Joshi.

"Agricultural incomes have not grown and the rural economy is languishing. Not only are incomes lower in rural areas, but inflation is also higher. In fact, poor states have seen higher inflation."

Jaitley had announced a series of steps in his Budget to spur the rural economy.

Rs 1 lakh — that benchmark will be achieved in the next financial year when per-capita income crosses the six-figure mark for the first time. To be sure, it's the equivalent of just $1,500 but all the same a number that has some significance in a country of 1.2 billion where 12.4% in 2011-12 were living on less than $1 a day, according to the World Bank.

Per capita income at current prices was Rs 93,231 in FY16, up 7.3% from Rs 86,879 in the year before. It stood at Rs 71,050 and 79,412 in FY13 and FY14, respectively.

At that rate of acceleration, per-capita income will exceed Rs 1 lakh in FY17. The Budget for next year, announced by finance minister Arun Jaitley on February 29, assumed a nominal GDP growth of 11%. That would mean a similar rise in net national income and, adjusted for an increase of 1.2% in population, should yield an expansion of more than 8% in percapita income.

"Nominal GDP growth has been an average 11.7% in the past four years, so with a 1.2% population growth, we can expect per capita incomes to exceed Rs 1 lakh in FY17," said Saugata Bhattacharya, chief economist, Axis Bank.

"It would be interesting to check the expenditure surveys to gauge the distribution of the rise across income classes," he added. Per capita income broadly measures quality of life in a geographical region — country, state or city.

It's arrived at by dividing the country's total income by its population. It also needs to be adjusted for inflation to see whether incomes are rising.

"At current prices, per capita income is expected to cross the threshold of Rs 1 lakh in 2016-17, which is encouraging. However, large regional variations and an urban-rural divide in income levels persist," said Aditi Nayar, chief economist at ICRA. If the average amount crosses six figures, it would have taken India almost seven years to double its per-person annual income from Rs 46,492 in FY10.

The increases in per capita income have been driven by urban growth. "Given that agriculture has suffered and the rural economy is under distress, total per capita income has grown largely on the strength of the urban economy," said Crisil chief economist DK Joshi.

"Agricultural incomes have not grown and the rural economy is languishing. Not only are incomes lower in rural areas, but inflation is also higher. In fact, poor states have seen higher inflation."

Jaitley had announced a series of steps in his Budget to spur the rural economy.

Re: Indian Economy News & Discussion - Aug 26 2015

Andy Mukherjee covers the POMIS rate cut:

India's Stealth Rate Cut

India's Stealth Rate Cut

India just ushered in an interest-rate cut, via the backdoor.

Although paying postal-savings depositors slightly less for their cash may appear a minor tweak, the move could end up having a bigger salutary effect on bank balance sheets, and the country's nervous bond market, than the Reserve Bank of India's 125 basis-point reduction since early 2015.

In an unexpected decision Friday, the government trimmed the one-year time deposit rate on postal savings to 7.1 percent from 8.4 percent. By comparison, State Bank of India, the country's largest lender, pays 7.25 percent annually for one- to three-year funds.

The nation's tax-free public provident fund, which is used by the self-employed as well as the salaried, will now offer 8.1 percent, down from 8.7 percent.

In aggregate, India's so-called National Small Savings Fund has $144 billion in the pool. To keep the fund from becoming unsustainable, both the federal and state governments are forced to borrow from it at more expensive rates than the bond market charges them. The middle class is naturally upset that authorities are no longer keen to expand this kitty by handing out overly generous risk-free returns, but investors in the country's bad loan-addled banks should be chuffed.

With government-sponsored small savings plans being told to curb payouts, it's quite likely that at least some of their customers will gravitate toward the banking system. And given just how high some banks' interest cost-to-income ratio has become, particularly for the weaker state-run ones, lenders as a whole will jump at the opportunity to regain access to cheaper funds.

Cutting deposit rates, along with slashing lending charges in tandem to push more money out the door, is one way for banks to boost flagging returns on equity amid high provisioning costs for soured debt. On paper, credit growth is at a 20-month high, but, as Bloomberg News reporters Anto Antony and Divya Patil point out, that's largely because companies have substituted their commercial-paper issuance with bank borrowing. A genuine recovery is still some way off.

Until then, banks can use the extra deposits coming their way to bulk up their bond portfolios. That would work to calm investors who have been worried about the market's ability to absorb a surge in issuance as state governments swap high-cost bank loans on their near-bankrupt power distribution companies' balance sheets with notes. Several states have already paid an average coupon of 8.49 percent to raise 10-year money this year, more than 2015's 8.15 percent.

An arguably bigger bonus, however, would be if Friday's move improves the transmission of the RBI's monetary easing. Not only would that help lower borrowing costs for highly leveraged infrastructure and metals companies such as Bhushan Steel and Jaiprakash Associates, it might also persuade central bank chief Raghuram Rajan to accept another term once his current tenure ends in September. A governor and the government working from the same playbook would go a long way in reducing investor anxiety.

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Indian Economy News & Discussion - Aug 26 2015

The Modi govt's economics policies are increasingly turning into a smokes and mirrors show. Despite all the pious protestations to the contrary, about "ease of doing business", "tax reforms" ,"non adversarial tax regime","cutting down litigation" and a whole host of things, the govt has been long on talk and very short on actual action on the ground. No wonder the Industry in general is pissed.

The basic fact is that as Arun Shourie very preceptively described , this govt is Congress + Cow. The Modi Govt is just the Congress govt in another name. The basic instincts are the same, which is highly protectionist, onerous laws, many times contradictory to enforce the protectionism, huge barriers to free competition and micro management of business via very intrusive and completely idiotic regulations and rules , beyond what the underlying laws themselves . This repeats itself in industry after industry (transport, communications, financial services, manufacturing , defence ,... anything, you name it). The only place it is NOT so, is in it is the export oriented IT industry and foreign back offices which look outside India for markets and revenues.

Rather than fundamentally re-structuring the economy away from the Nehruvian "Mixed Economy" model, with the "commanding heights" to PSUs nonsense and a bunch of useless parasitical Baboons sitting on the private sector, the Modi Govt thinks that it can run that "Nehruvian" freak show better than the Congress. ie. This govt with it's ministers and Baboons has superior "command and control" expertise over the Congress.

Consider this searing article in Bloomberg on the latest fiasco from the Ministry of Shipping .

Botched Rules Trip Modi Dream of Shipping Hub Rivalling Singapore

Summary of the article

So yeah, the Govt will put out "headlines" of "New Shipping Laws" , but look under the hood it is absolutely half baked and unworkable.

It is easy to quote the shipping laws, because it got published and is public domain, but this story is the same in industry after industry.

Consider the long standing need to resolve the absolute tangled mess and litigation going back a few decades on what is a capital gain and what is business income per Indian laws (this is a unique problem in India ALONE and nowhere else in the world , how it can be so boggles the imagination) . And while the Govt fixed that problem for FIIs ALONE in the 2015 budget, for every domestic guy, it is left unresolved and they are thrown under the bus.

In the spirit of "lessening litigation" , the CBDT came out with a "Circular" on 29th Feb, which basically said,

1. If the taxpayer classifies their income as business income, we wont be a bunch of dix and contest that as capital gains

2. For anything held above 12 months, if the taxpayer consistently classifies this as cap gains, we wont be a bunch of dix , like we were earlier, dispute those on whim as business income and litigate on that and send notices.

3. In all other cases, there is no change in situation.

Now 1. and 2. are non issues. For 1. , no idiot will go classify cap gain as business income , so it is an impossible situation, and for 2, it is well accepted legal position and something which only the CBDT will go and litigate at an attempt at shake down earlier.

Now 3. IS the main issue, the elephant in the room, which is left totally unaddressed and hanging in the air, which is where the most litigations happen and where you basically need to stop being a bunch of Baboons and let globally accepted and well settled jurisprudence work, but no, the Baboons think they can make things up on the fly , write "Circulars" , do a King Canute ordering the waves to go back , and things will work that way.

So , net result, WHAT exactly has this CBDT circular of 29th Feb achieved on substantive issues, other than wasting time and paper? Zilch.

Similar story with REITs. I had said that Chidambaram and his Baboons introduced REITs with India without pass thrus and it did not take off and I also said the the Modi govt even if it extends pass thrus still cannot get REITs off the ground ( one poster Hari Seldon iirc, took exception to that logic..), but talk to a few folks in the industry and they will tell you why that is so, even after the current notifications. It needs an entire whole ecosystem to work, and not some piecemeal stuff, torn apart at the edges due to competing pushes and pulls from interest quarters and handed out in drips over time grudgingly as if a favour will simply not do. Sure, it generates headlines, every time there is a drip, but it is of no consequence.

I was talking to a former CFO of an IT major, and he told me that the local IT Commissioner Baboon during his tenure as CFO , called him and demanded service tax for a transaction that IT major had done wholly overseas and said that he would send a notice. The CFO told him to go ahead and send the notice and that he will litigate, it will lie in the courts for 15 years and get thrown out.

THIS is the problem. The Baboons have zero cost of being a bunch of Dix. The economy pays a massive price for their idiocy (in terms of lost competitiveness, efficiency, growth, huge costs, lower growth). They have no cost in terms of litigation, reputation risks, lost profits etc, while the guys on the other end have all those costs and risks.

We NEED an absolute restructuring of the Indian economy away from this Nehruvian "mixed economy"nonsense. If that is the not the case, policy making will ALWAYS be a tilted field , and attempts to strangulate a competitor to protect an inefficient and comatose PSU incumbent (think Air India, BSNL, all the Ordnance FB etc.. etc..) will continue, and will continue killing competitors (like Jet and Kingfisher, which might have survived if the govt allowed AI to go belly up ,like in a normal market environment and the AI capacity went out of the market, but now it is Mallya on the run and Jet sold to Etihad ,while the AI parasites continue to sit around sucking blood as always). The Vajpayee govt did some great bolds steps in that via the Privatisation (which is an absolute necessity). The Modi govt is NOT the Vajpayee govt. Lets face it. I am not holding out any hope for this govt to do anything great , and if any improvement comes it will be purely by accident (like commodity prices coming down) and some incrementalism. India NEEDs a crisis for reforms (indeed all reforms in India happen only in crisis). So I guess we will have to wait for either an external crisis (like a major global economic shock), or the current administration driving India into an economic crisis.

The basic fact is that as Arun Shourie very preceptively described , this govt is Congress + Cow. The Modi Govt is just the Congress govt in another name. The basic instincts are the same, which is highly protectionist, onerous laws, many times contradictory to enforce the protectionism, huge barriers to free competition and micro management of business via very intrusive and completely idiotic regulations and rules , beyond what the underlying laws themselves . This repeats itself in industry after industry (transport, communications, financial services, manufacturing , defence ,... anything, you name it). The only place it is NOT so, is in it is the export oriented IT industry and foreign back offices which look outside India for markets and revenues.

Rather than fundamentally re-structuring the economy away from the Nehruvian "Mixed Economy" model, with the "commanding heights" to PSUs nonsense and a bunch of useless parasitical Baboons sitting on the private sector, the Modi Govt thinks that it can run that "Nehruvian" freak show better than the Congress. ie. This govt with it's ministers and Baboons has superior "command and control" expertise over the Congress.

Consider this searing article in Bloomberg on the latest fiasco from the Ministry of Shipping .

Botched Rules Trip Modi Dream of Shipping Hub Rivalling Singapore

Summary of the article

Code: Select all

New India shipping laws are half baked and fall short - Industry

Curbs, costs mean that shippers prefer Colombo, Singapore, Dubai

It is easy to quote the shipping laws, because it got published and is public domain, but this story is the same in industry after industry.

Consider the long standing need to resolve the absolute tangled mess and litigation going back a few decades on what is a capital gain and what is business income per Indian laws (this is a unique problem in India ALONE and nowhere else in the world , how it can be so boggles the imagination) . And while the Govt fixed that problem for FIIs ALONE in the 2015 budget, for every domestic guy, it is left unresolved and they are thrown under the bus.

In the spirit of "lessening litigation" , the CBDT came out with a "Circular" on 29th Feb, which basically said,

1. If the taxpayer classifies their income as business income, we wont be a bunch of dix and contest that as capital gains

2. For anything held above 12 months, if the taxpayer consistently classifies this as cap gains, we wont be a bunch of dix , like we were earlier, dispute those on whim as business income and litigate on that and send notices.

3. In all other cases, there is no change in situation.

Now 1. and 2. are non issues. For 1. , no idiot will go classify cap gain as business income , so it is an impossible situation, and for 2, it is well accepted legal position and something which only the CBDT will go and litigate at an attempt at shake down earlier.

Now 3. IS the main issue, the elephant in the room, which is left totally unaddressed and hanging in the air, which is where the most litigations happen and where you basically need to stop being a bunch of Baboons and let globally accepted and well settled jurisprudence work, but no, the Baboons think they can make things up on the fly , write "Circulars" , do a King Canute ordering the waves to go back , and things will work that way.

So , net result, WHAT exactly has this CBDT circular of 29th Feb achieved on substantive issues, other than wasting time and paper? Zilch.

Similar story with REITs. I had said that Chidambaram and his Baboons introduced REITs with India without pass thrus and it did not take off and I also said the the Modi govt even if it extends pass thrus still cannot get REITs off the ground ( one poster Hari Seldon iirc, took exception to that logic..), but talk to a few folks in the industry and they will tell you why that is so, even after the current notifications. It needs an entire whole ecosystem to work, and not some piecemeal stuff, torn apart at the edges due to competing pushes and pulls from interest quarters and handed out in drips over time grudgingly as if a favour will simply not do. Sure, it generates headlines, every time there is a drip, but it is of no consequence.

I was talking to a former CFO of an IT major, and he told me that the local IT Commissioner Baboon during his tenure as CFO , called him and demanded service tax for a transaction that IT major had done wholly overseas and said that he would send a notice. The CFO told him to go ahead and send the notice and that he will litigate, it will lie in the courts for 15 years and get thrown out.

THIS is the problem. The Baboons have zero cost of being a bunch of Dix. The economy pays a massive price for their idiocy (in terms of lost competitiveness, efficiency, growth, huge costs, lower growth). They have no cost in terms of litigation, reputation risks, lost profits etc, while the guys on the other end have all those costs and risks.

We NEED an absolute restructuring of the Indian economy away from this Nehruvian "mixed economy"nonsense. If that is the not the case, policy making will ALWAYS be a tilted field , and attempts to strangulate a competitor to protect an inefficient and comatose PSU incumbent (think Air India, BSNL, all the Ordnance FB etc.. etc..) will continue, and will continue killing competitors (like Jet and Kingfisher, which might have survived if the govt allowed AI to go belly up ,like in a normal market environment and the AI capacity went out of the market, but now it is Mallya on the run and Jet sold to Etihad ,while the AI parasites continue to sit around sucking blood as always). The Vajpayee govt did some great bolds steps in that via the Privatisation (which is an absolute necessity). The Modi govt is NOT the Vajpayee govt. Lets face it. I am not holding out any hope for this govt to do anything great , and if any improvement comes it will be purely by accident (like commodity prices coming down) and some incrementalism. India NEEDs a crisis for reforms (indeed all reforms in India happen only in crisis). So I guess we will have to wait for either an external crisis (like a major global economic shock), or the current administration driving India into an economic crisis.

Re: Indian Economy News & Discussion - Aug 26 2015

@Vina

Agree with most of what you have written sir. So while it is desirable, it may not be politically feasable. Full level changes like provitisation of the PSU Banks will be difficult to achive and too much costly in politicla terms. Leftist ideas are still capable of cheating people and has huge gangs of politicos like Nitish and Pappu behind them. BJP can not fight it at present.

Agree with most of what you have written sir. So while it is desirable, it may not be politically feasable. Full level changes like provitisation of the PSU Banks will be difficult to achive and too much costly in politicla terms. Leftist ideas are still capable of cheating people and has huge gangs of politicos like Nitish and Pappu behind them. BJP can not fight it at present.

Re: Indian Economy News & Discussion - Aug 26 2015

India's balance of payments swing to modest surplus

http://economictimes.indiatimes.com/art ... aign=cppst

http://economictimes.indiatimes.com/art ... aign=cppst

MUMBAI/NEW DELHI: India's balance of payments swung to a surplus in October-December, marking a modest upturn in its financial position that analysts believe may prove resistant to global economic fragility. Monday's central bank data also showed a narrowing of the current account

deficit and higher foreign investments. Volatile oil prices and worries about China's economy have hit foreign appetite for Indian assets and, while the European Central Bank and the Bank of Japan are

providing plenty of monetary stimulus, the US Federal Reserve is expected to continue raising interest

rates, although only slowly. The risks to capital flows could be sharper outflows in foreign direct investments and we could also see some slowing of remittances on account of depressed oil prices for a prolonged period," said Shubhada Rao, chief economist at Yes Bank. The fourth quarter balance

of payments surplus was $4.1 billion, reversing a deficit of $856 million in July-September. The current account deficit narrowed to $7.1 billion, or 1.3 percent of gross domestic product, from $8.7 bill ..Analysts expect a balance of payments surplus of nearly $15 billion for the full fiscal year ending in March, and a similar surplus in the coming fiscal year. Those are much healthier levels than in 2013, when anticipation of a reining-in of the Fed's then stimulus programme led to big outflows that ballooned the balance of payments deficit and sent the current account gap to a record high of 4.8 percent of GDP. Since then India's economy has picked up and inflation eased, and the central bank is widely expected to cut interest rates by at least 25 basis points at its policy review on April 5. But India's external financial position seems unlikely to improve much from current levels. Foreign investors have dipped in and out of Indian shares and bonds in the past two quarters, and a weakening global economy is raising concerns about exports and remittances. The trade balance stayed in deficit in the December quarter, narrowing to $34.0 billion from $37.4 billion in the previous three months. The capital account, which includes foreign direct investments and portfolio flows, registered a $10.54 billion surplus in October-December, up from $8.58 billion in the previous quarter.

Re: Indian Economy News & Discussion - Aug 26 2015

RBI to cut rates by 25 bps on Apr 5, 50 bps in FY17: BofA-ML

India attracts over Rs 1.28 lakh cr ($22 billion) in electronic manufacturing: PrasadReserve Bank is likely to go for a 50 basis points rate cut next fiscal year and out of this 25 bps cut may be affected in the policy review meet next month amid slackening economic recovery, says a report.

The financial services major said it estimated that old GDP growth slipped to 4.6% in the December quarter, well below our calculated 7-7.5% potential. Our lead industrial indicator is slipping as industrial production contracted for three consecutive months through January.

Declining inflation and negative industrial outlook have strengthened a case for RBI cutting interest rate in its first bi-monthly monetary policy for 2016-17 on April 5.

"We have raised our RBI rate cut forecast to 50 bps in FY17 from 25 bps earlier. We see 25 bps cuts on April 5 and in August. After all, the recovery is slackening," Bank of America Merrill Lynch (BofA-ML) said in a research note.

RBI Governor Raghuram Rajan on February 2, left the key interest rate unchanged citing inflation risks and growth concerns.

According to the global brokerage major, the onus of recovery is now on the central bank, as the government has stuck to its fiscal roadmap.

"The onus of recovery is now on RBI, with Finance Minister Jaitley cutting his FY17 fiscal deficit target to 3.5% of GDP, in line with the pre-committed fiscal path," the report said adding that small saving rate cuts should also help the monetary policy transmission.

The report, however, noted the scope for further RBI rate cuts is limited, as the repo rate, at 6.25%, would be well below medium-term average 7% CPI inflation.

FinMin reviews banks' loan recoveryTotal investments in electronics manufacturing sector in India, one of the world's largest consumer electronics market, has crossed Rs 1.28 lakh crore, Communications and IT Minister Ravi Shankar Prasad said today.

"When our government came (in 2014), the total investment in electronics manufacturing was around Rs 11,700 crore and as of two days ago it is Rs 1,28,000 crore plus," Prasad said.

Government was working towards making India a hub for electronics manufacturing, in which the Centre and states have to play a crucial part, he added.

Prasad said India is fast adopting technology and the country is likely to have half a billion Internet users by the end of this year.

"It took 2.5-3 years for Internet users to go from 200 to 300 million. It has taken a year to reach 400 million and when Internet service providers said we have reached 400 million, I was really surprised. I think the target of 500 million by 2017... Maybe this will come by this year-end," he said.

Modi to meet bankers, insurers on crop insuranceThe finance ministry on Monday held a meeting with senior officials of public sector banks (PSBs) to review their efforts for loan recovery, including from Kingfisher Airlines.

The meeting was part of the ministry's exercises to clean up the balance sheets of PSBs. It also deliberated on the ways banks can be more proactive in dealing with cases of wilful and genuine defaulters.

Gross non-performing assets (NPAs) of PSBs rose to Rs 3.61 lakh crore at the end of December 2015, while those of private lenders were at Rs 39,859 crore.

Gross NPA ratio as percentage of advances rose to 7.30 per cent. For private banks, it stood at 2.36 per cent as of December-end.

There are some 7,686 wilful defaulters who owe Rs 66,190 crore to PSBs; 6,816 cases have been filed and First Information Reports have been lodged in 1,669 cases. Banks have initiated action under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act in 584 such cases.

rime Minister Narendra Modi is set to meet senior officials of all banks and insurance companies in Mumbai on Tuesday to discuss the implementation of the government's crop insurance scheme, an official source said on Monday.

The finance ministry source said Finance Minister Arun Jaitley will also attend the meeting at the National Bank for Agriculture and Rural Development office along with officials of the finance and agriculture ministries.

The meeting will discuss ways to bring more loanee farmers under the 'Pradhan Mantri Fasal Beema Yojana' (PMFBY) so as to realise the target of 50 per cent insurance coverage.

Of the farm credit target of Rs 8.5 lakh crore set for this financial year, only Rs 75,000 crore is under crop insurance.

Currently, only around 25 per cent of the country's total crop area is covered by insurance.

Drought and unseasonal rains last year forced the state governments to seek over Rs.10,100 crore from the National Disaster Response Fund.

Under the new crop insurance scheme to be implemented from April 1 for kharif crops to be sown from June and available to both loanee and non-loanee farmers, the premium is a low two per cent of sum insured for all kharif crops and 1.5 per cent for all rabi crops.

For annual commercial and horticultural crops, farmers will have to pay a premium of 5 per cent. The remaining premium share, as was the case with previous schemes, will be borne equally by the central and state governments.

Re: Indian Economy News & Discussion - Aug 26 2015

{Deleted. Please post your political diatribes in the political thread}

Last edited by Suraj on 23 Mar 2016 19:26, edited 1 time in total.

Reason: Please don't make a mess here

Reason: Please don't make a mess here

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Indian Economy News & Discussion - Aug 26 2015

{Deleted. Please post your political diatribes in the political thread}

Last edited by Suraj on 23 Mar 2016 19:27, edited 1 time in total.

Reason: Please stop trolling

Reason: Please stop trolling

Re: Indian Economy News & Discussion - Aug 26 2015

The honeymoon period for Modi government is over with 2 years gone by and no worth saying move on privatization or cutting government flab. The Indian economy will splutter at 7 % growth rate and no possibility of above 10% growth.

In 2019 election it may come back but will be reduced majority and lesser incentive for economic reforms.

The problem is playing traditional politics for short term gain and lack of will to really rock the boat and take painful decisions.

The only grace is to bring honesty at top level resulting in faster decision making rather than structurally changing the kleptocratic system that India is promoted by traditional divisive politics so that the ruling class supremacy continues and they become richer through their kleptocratic ways and their party cadre are protected and financed by black money to continue their hold on power for ever and the black economy flourishes with no police/judicial reforms so that their criminality is protected by remaining punishment free.

In 2019 election it may come back but will be reduced majority and lesser incentive for economic reforms.

The problem is playing traditional politics for short term gain and lack of will to really rock the boat and take painful decisions.

The only grace is to bring honesty at top level resulting in faster decision making rather than structurally changing the kleptocratic system that India is promoted by traditional divisive politics so that the ruling class supremacy continues and they become richer through their kleptocratic ways and their party cadre are protected and financed by black money to continue their hold on power for ever and the black economy flourishes with no police/judicial reforms so that their criminality is protected by remaining punishment free.

Re: Indian Economy News & Discussion - Aug 26 2015

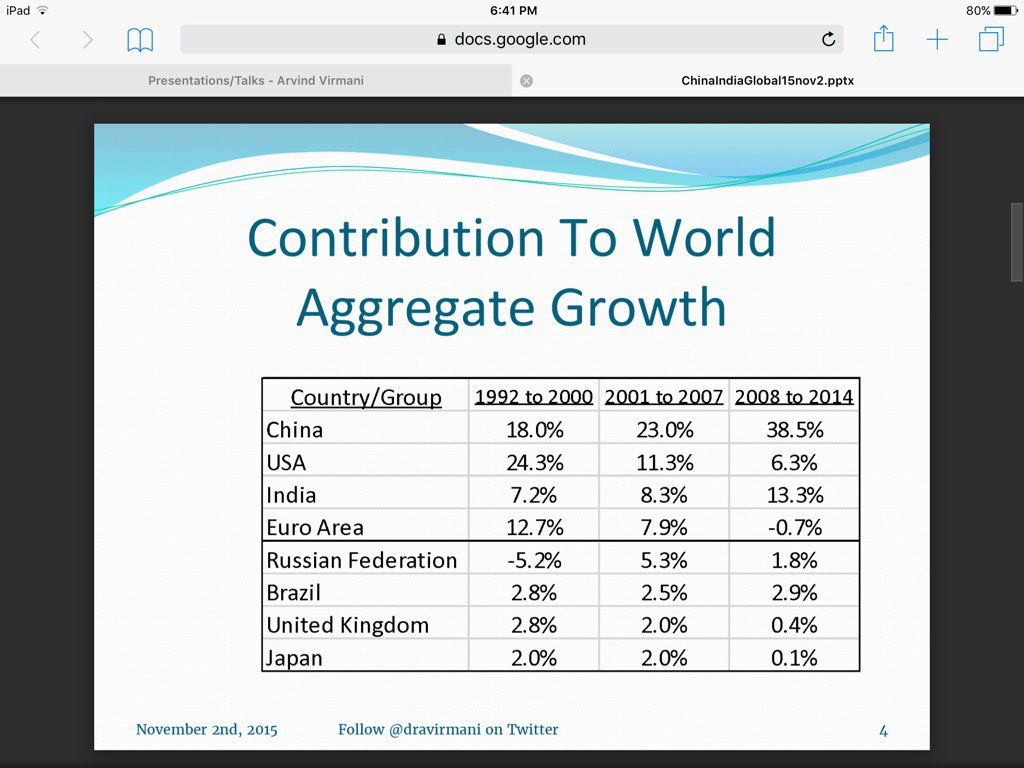

From the above numbers, India and China are contributing towards half the growth is big. This is even more so, if we consider both together are one third of the world population. Having been in Europe and India during the 2000-2015 period, I can actually feel the stagnation and steady improvement of lifestyle in India. Due to the massive starting difference, for most people, it is difficult to perceive the phase lag in Europe (for most Europeans), since they only look at the current situation in India and Europe.

-

soumik

- BRFite

- Posts: 133

- Joined: 15 Jan 2009 21:01

- Location: running away from ninja monkey asassins

Re: Indian Economy News & Discussion - Aug 26 2015

BIG POLICY MOVES MADE TODAY!

http://economictimes.indiatimes.com/new ... 529333.cms

Govt approves framework for 75$ billion investment by UAE into infra here!

http://economictimes.indiatimes.com/new ... 527925.cms

Dearness allowance of nearly 1 crore people hiked by 6%

BIGGEST BANG FOR THE BUCK!

NAMO PLANS TO SELL 49% OF AI

http://economictimes.indiatimes.com/ind ... 525794.cms

http://economictimes.indiatimes.com/new ... 529333.cms

Govt approves framework for 75$ billion investment by UAE into infra here!

http://economictimes.indiatimes.com/new ... 527925.cms

Dearness allowance of nearly 1 crore people hiked by 6%

BIGGEST BANG FOR THE BUCK!

NAMO PLANS TO SELL 49% OF AI

http://economictimes.indiatimes.com/ind ... 525794.cms

Re: Indian Economy News & Discussion - Aug 26 2015

The question is, who will buy it?soumik wrote:BIGGEST BANG FOR THE BUCK!

NAMO PLANS TO SELL 49% OF AI

http://economictimes.indiatimes.com/ind ... 525794.cms

I think the Govt will have to force LIC and PSU banks to buy the stake. I doubt there will be any demand from private investors for stake in AI at this time.

-

soumik

- BRFite

- Posts: 133

- Joined: 15 Jan 2009 21:01

- Location: running away from ninja monkey asassins

Re: Indian Economy News & Discussion - Aug 26 2015

Its still the third biggest carrier by passenger volumes, there will be buyers!Kakkaji wrote:The question is, who will buy it?soumik wrote:BIGGEST BANG FOR THE BUCK!

NAMO PLANS TO SELL 49% OF AI

http://economictimes.indiatimes.com/ind ... 525794.cms

I think the Govt will have to force LIC and PSU banks to buy the stake. I doubt there will be any demand from private investors for stake in AI at this time.

The bigger issue is how the unions will react to the sale, any potential buyer will want to reduce losses by axing extra staff(and there are many) and reduce/control freebies as well.

Re: Indian Economy News & Discussion - Aug 26 2015

Not without management control.soumik wrote:Its still the third biggest carrier by passenger volumes, there will be buyers!

Re: Indian Economy News & Discussion - Aug 26 2015

AI may turn black pretty soon with improvements under new govt. It may be possible to sell stakes at that point. Use the money saved to buy strategic airlift capability. AI unions are a small but vocal group only.

Re: Indian Economy News & Discussion - Aug 26 2015

There should be no base price for sale of AI and even if one buyer who is technically proficient is found the sale should go through.

Re: Indian Economy News & Discussion - Aug 26 2015

I've a problem with people constantly whining in this thread "why doesn't GoI do XYZ ??!", as if it's all about coming up with an idea. In this case, AI privatization. The idea of privatization is not a new proposal any of us are making. It's quite conceited to center your argument upon it in the form of "why don't they just privatize AI ? Simple!" It comes across as nothing more than an attempt to demonstrate how smart they are for supposedly coming up with a cool idea. It's not a cool or new idea. It's probably been publicly proposed at least once even before the poster was born. That includes me.

What would be really smart and dogged is doing a detailed analysis of what stops GoI from doing so. Is it ideological ? If so, quotes from political masters on those lines help. Is it union issues or potential for political logjams triggered by opposition union battles ? Is it a lack of the managerial personnel available to be deputed to the aviation ministry for a sufficient duration of time to execute the privatization process ? Emotionally charged verbal outbursts don't really provide much useful information.

There's no shortage of ideas in this country. There's also no shortage of people mocking poorly executes ideas. In fact, it's quite ironic that the same persons often do both those, often in one post. Ideas are not as important as effective execution. Even a carefully considered and executed partial solution is far more effective than a grand idea whose implementation was a complete mess. What's more, talking of big ideas is not impressive. Being able dig down the details of what it takes to get it done, or what currently prevents it from being done, is much more important.

What would be really smart and dogged is doing a detailed analysis of what stops GoI from doing so. Is it ideological ? If so, quotes from political masters on those lines help. Is it union issues or potential for political logjams triggered by opposition union battles ? Is it a lack of the managerial personnel available to be deputed to the aviation ministry for a sufficient duration of time to execute the privatization process ? Emotionally charged verbal outbursts don't really provide much useful information.

There's no shortage of ideas in this country. There's also no shortage of people mocking poorly executes ideas. In fact, it's quite ironic that the same persons often do both those, often in one post. Ideas are not as important as effective execution. Even a carefully considered and executed partial solution is far more effective than a grand idea whose implementation was a complete mess. What's more, talking of big ideas is not impressive. Being able dig down the details of what it takes to get it done, or what currently prevents it from being done, is much more important.

Re: Indian Economy News & Discussion - Aug 26 2015

Suraj San

Privatition of AI is not politically feasible at this time. Being a high-profile company, there will be massive Union opposition with nationwide strikes. Plus the opposition will paralyze Parliament on this issue.

I think the Government will do sneaking privatization of AI by converting its bank debt into equity

Privatition of AI is not politically feasible at this time. Being a high-profile company, there will be massive Union opposition with nationwide strikes. Plus the opposition will paralyze Parliament on this issue.

I think the Government will do sneaking privatization of AI by converting its bank debt into equity

Last edited by Kakkaji on 24 Mar 2016 13:55, edited 1 time in total.

Re: Indian Economy News & Discussion - Aug 26 2015

India will outperform emerging markets and investors are banking on country’s growth story

Doom Gloom or Boom ?

Doom Gloom or Boom ?

As per a survey by Morgan Stanley, 52% of the respondents in the survey said they expected India to outperform emerging markets in 2016 and 85% had done so in the previous survey in 2015.

Although many investors have withdrawn assets from India, many major foreign investors still see Indian economy as a bright spot.Reportedly, foreign investors have raked in nearly Rs 13,000 crore into Indian equities after withdrawing nearly Rs 26,200 crore in the first two months of the year.

-

subhamoy.das

- BRFite

- Posts: 1027

- Joined: 11 Aug 2016 06:14

Re: Indian Economy News & Discussion - Aug 26 2015

Kakkaji wrote:Susan San

Regarding the hurdles with privatization, that is my point. People prefer to ignore the details and just be the 'idea guru', as if the idea is unique. In almost every case there's nothing revealing about the idea. It's essentially popular wisdom. What's lacking is effort to grasp or understand what affects execution.

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Indian Economy News & Discussion - Aug 26 2015

About the recent EET taxation of EPF and PPF proposal and it's withdrawal in the budget, the question that always was left unanswered was Why Not the Baboons ? Why not do the same for the GPF.

The answer for that I stumbled on by accident in a recent article (two or three days ago ) in The Hindu, which was in a different context. It is like this. The GPF stuff is purely "notional" . The govt really doesn't pay it's contribution out and the baboon receiving the salary don't either. Both are simply just accounting entries in a journal , saying govt paid X and baboon paid Y. That is all. There is NO cash transfer that ever happens , and hence NO actual corpus. So what happens on retirement, is that the pensions are paid out on a "pay as you go" basis to the retiree.

So there you have it. It is ONLY the private sector that ACTUALLY fund it's pension pay via actual cash (by the company and the salaried person) and a corpus exists ! In the GPF case, there is no corpus. Since only the EPF/PPF etc is REAL , the Baboons got the bright idea of trying to get their flea picking hands on it and grab it in perpetuity, and dole it out as patronage. Now, they couldn't do the same with the GPS , since it is purely fictional!

Now, if a private sector company /employer did what the Govt does with the GPF and does some fiction accounting for pension liabilities and not actually physically put up the cash for pension contributions and the pf dues from the employees, the CFO and CEO will be SENT TO JAIL. The Govt has in reality a MASSIVE unfunded pension liability. What they have done is thrown the tab of feeding the Baboons and other bloodsuckers not just on you, but on to your children as well and THEIR unborn children too. The tax contributions of your children and grand children are already pencilled in to keep the current Govt Baboons mooching on them for the next 20/30/40 years, even if the babu retires today!

There you are folks. And now the govt has handed out a 6% increase in "DA" to the Govt baboons (including the retirees) a total of around 115% or so of their "basic" . So you as a tax payer are not just feeding the tax moochers who are serving TODAY, but also the critters who retired some 110/20/30 years ago and who mooched on your parents.

No wonder this country is so starved historically of investment. The future cash flows and taxes have already been "borrowed" and spent, by having this massive unfunded liability , that simply crowded out any sanity in govt finances. No wonder pensions and interest is the single biggest spending item in the Indian budget !

The answer for that I stumbled on by accident in a recent article (two or three days ago ) in The Hindu, which was in a different context. It is like this. The GPF stuff is purely "notional" . The govt really doesn't pay it's contribution out and the baboon receiving the salary don't either. Both are simply just accounting entries in a journal , saying govt paid X and baboon paid Y. That is all. There is NO cash transfer that ever happens , and hence NO actual corpus. So what happens on retirement, is that the pensions are paid out on a "pay as you go" basis to the retiree.

So there you have it. It is ONLY the private sector that ACTUALLY fund it's pension pay via actual cash (by the company and the salaried person) and a corpus exists ! In the GPF case, there is no corpus. Since only the EPF/PPF etc is REAL , the Baboons got the bright idea of trying to get their flea picking hands on it and grab it in perpetuity, and dole it out as patronage. Now, they couldn't do the same with the GPS , since it is purely fictional!

Now, if a private sector company /employer did what the Govt does with the GPF and does some fiction accounting for pension liabilities and not actually physically put up the cash for pension contributions and the pf dues from the employees, the CFO and CEO will be SENT TO JAIL. The Govt has in reality a MASSIVE unfunded pension liability. What they have done is thrown the tab of feeding the Baboons and other bloodsuckers not just on you, but on to your children as well and THEIR unborn children too. The tax contributions of your children and grand children are already pencilled in to keep the current Govt Baboons mooching on them for the next 20/30/40 years, even if the babu retires today!

There you are folks. And now the govt has handed out a 6% increase in "DA" to the Govt baboons (including the retirees) a total of around 115% or so of their "basic" . So you as a tax payer are not just feeding the tax moochers who are serving TODAY, but also the critters who retired some 110/20/30 years ago and who mooched on your parents.

No wonder this country is so starved historically of investment. The future cash flows and taxes have already been "borrowed" and spent, by having this massive unfunded liability , that simply crowded out any sanity in govt finances. No wonder pensions and interest is the single biggest spending item in the Indian budget !

Re: Indian Economy News & Discussion - Aug 26 2015

Vina _ I agree and how cleverly covered by Media what is the Legacy of 65 years of rule.

Re: Indian Economy News & Discussion - Aug 26 2015

Add to that , they get interest free loans as many times they want. But isn't some amount deducted from the salary for GPF or it just for records. Have to check the interest rate too.vina wrote:About the recent EET taxation of EPF and PPF proposal and it's withdrawal in the budget, the question that always was left unanswered was Why Not the Baboons ? Why not do the same for the GPF.

The answer for that I stumbled on by accident in a recent article (two or three days ago ) in The Hindu, which was in a different context. It is like this. The GPF stuff is purely "notional" . The govt really doesn't pay it's contribution out and the baboon receiving the salary don't either. Both are simply just accounting entries in a journal , saying govt paid X and baboon paid Y. That is all. There is NO cash transfer that ever happens , and hence NO actual corpus. So what happens on retirement, is that the pensions are paid out on a "pay as you go" basis to the retiree.

So there you have it. It is ONLY the private sector that ACTUALLY fund it's pension pay via actual cash (by the company and the salaried person) and a corpus exists ! In the GPF case, there is no corpus. Since only the EPF/PPF etc is REAL , the Baboons got the bright idea of trying to get their flea picking hands on it and grab it in perpetuity, and dole it out as patronage. Now, they couldn't do the same with the GPS , since it is purely fictional!

Now, if a private sector company /employer did what the Govt does with the GPF and does some fiction accounting for pension liabilities and not actually physically put up the cash for pension contributions and the pf dues from the employees, the CFO and CEO will be SENT TO JAIL. The Govt has in reality a MASSIVE unfunded pension liability. What they have done is thrown the tab of feeding the Baboons and other bloodsuckers not just on you, but on to your children as well and THEIR unborn children too. The tax contributions of your children and grand children are already pencilled in to keep the current Govt Baboons mooching on them for the next 20/30/40 years, even if the babu retires today!

There you are folks. And now the govt has handed out a 6% increase in "DA" to the Govt baboons (including the retirees) a total of around 115% or so of their "basic" . So you as a tax payer are not just feeding the tax moochers who are serving TODAY, but also the critters who retired some 110/20/30 years ago and who mooched on your parents.

No wonder this country is so starved historically of investment. The future cash flows and taxes have already been "borrowed" and spent, by having this massive unfunded liability , that simply crowded out any sanity in govt finances. No wonder pensions and interest is the single biggest spending item in the Indian budget !

Re: Indian Economy News & Discussion - Aug 26 2015

vina,

As for your gripe about tax-payers being short-changed by this, apparent, govt largess, I've couple of observations. In India only the salaried really pay the personal income tax, and public sector employees are the single biggest group of tax-payers. Secondly, pensions are not tax-free and income tax is applicable for retirees too.

Then, DA is the adjustment for inflation. Public Sector employees in some countries (such as UK) get automatic adjustment to their basic pay buy sliding up to the next pay slab. In India they keep the basic pay fixed until a new pay commission recommends merging previous inflation adjustments (DA) into the basic pay.

As for your whine on retirees getting DA, I don't see why they shouldn't get inflation protection. In the end, purchasing power must be maintained otherwise you risk making retirees poorer as time goes by. Even in DC (Defined Contribution) plans (as opposed to DB-Defined Benefit), when you retire you usually get inflation-indexed annuity.

As for your gripe about tax-payers being short-changed by this, apparent, govt largess, I've couple of observations. In India only the salaried really pay the personal income tax, and public sector employees are the single biggest group of tax-payers. Secondly, pensions are not tax-free and income tax is applicable for retirees too.

Then, DA is the adjustment for inflation. Public Sector employees in some countries (such as UK) get automatic adjustment to their basic pay buy sliding up to the next pay slab. In India they keep the basic pay fixed until a new pay commission recommends merging previous inflation adjustments (DA) into the basic pay.

As for your whine on retirees getting DA, I don't see why they shouldn't get inflation protection. In the end, purchasing power must be maintained otherwise you risk making retirees poorer as time goes by. Even in DC (Defined Contribution) plans (as opposed to DB-Defined Benefit), when you retire you usually get inflation-indexed annuity.

Re: Indian Economy News & Discussion - Aug 26 2015

The problem is pensioners should get minimum survival pension and for welfare state at par with the developed one all citizens of India who cant earn and are in need should also get it and we have in this country overstaffed, inefficient and even currupt employees getting ever increasing fat pensions while street children who are in dire need die on roads.

This fat pensions, inefficient govt/psu sector ties us into this cycle of poverty, naxalism,terrorism and sectarian/ethnic/caste conflict.

The overall concept is loot sake to loot.

This fat pensions, inefficient govt/psu sector ties us into this cycle of poverty, naxalism,terrorism and sectarian/ethnic/caste conflict.

The overall concept is loot sake to loot.