Indian Economy News & Discussion - Aug 26 2015

Re: Indian Economy News & Discussion - Aug 26 2015

Let's hope the new RBI governor will be somebody who has had little to do with former Finance Minister PC. That way the various ED run investigations ( like in Aircel-Maxis scam, PC's son Karti's benami wealth, Robert Vadra's benami wealth) can move forward with proper timely responses from the RBI.

There are more silent moles sitting in the central government offices, PSUs & etc and helping people in INC & these moles need to be still weeded out.

There are more silent moles sitting in the central government offices, PSUs & etc and helping people in INC & these moles need to be still weeded out.

Re: Indian Economy News & Discussion - Aug 26 2015

disha wrote:

The last straw for me in this debate of RExit was when finnish banks started to advice Indian PMO on how good RR is for RBI. At that stage, RR had to go. In fact Modi government gave him a fig leaf., ideally RR should have been fired.

can you please share the link about Finnish bank supporting R3?

Re: Indian Economy News & Discussion - Aug 26 2015

Lots of big fund managers, particularly bond fund managers, opined on the 'Rexit'. That is to be expected. Unlike the past, when Indian debt was not of interest to anyone, foreign funds currently own ~$50 billion of Indian govt+corporate bonds, all of it Rupee denominated debt. They're simply speaking about their own stake in our success. Rajan to them was simply a guy they knew whom they could communicate with or at least predict. I think Rajan himself has not helped the cause by resigning in an unpredictable manner. It shows up his lack of professionalism. Anyone who actually cared about the bigger picture rather than himself, would act more carefully. In any case, PMO will pick a good replacement. Arvind Subramanian seems to be a front runner. Like Rajan, he's the current CEA. Rajan too was elevated from CEA to RBI gov.

Meanwhile back to the real world, the monsoon is progressing across the country:

Monsoon rains cover half of India; to accelerate sowing

Meanwhile back to the real world, the monsoon is progressing across the country:

Monsoon rains cover half of India; to accelerate sowing

Govt kick-starts commercial coal mining with statesMonsoon rains have covered nearly half of the country, the weather department said on Monday, accelerating the planting of summer crops like paddy rice, soybeans, cotton and pulses.

The June to September monsoon is crucial for farm output and economic growth in India, where over half of arable land is fed by rain. The farm sector makes up about 15 per cent of the $2.5-trillion economy that is Asia’s third biggest.

Sowing has been held up this year due to a delay in the arrival of monsoon rains. Now conditions are becoming favourable for further progress of the monsoon in central and western India, the weather office said in a statement.

The monsoon has covered all southern and eastern states and nearly the whole of Maharashtra, the biggest producer of sugar and second biggest producer of cotton and soybeans.

“Paddy (rice) transplanting is gaining momentum in southern and eastern states,” said an official at the Agricultural Meteorology Division of India Meteorological Department.

“Soybean, cotton and pulses sowing will also gain momentum this week,” the official said.

FDI may cross $60 billion this yearTaking the first step towards commercial mining and sale of coal in India, the ministry of coal has decided to allot mines to states that would sell the mined resource to interested industries.

The Centre has identified 16 coal mines with an estimated annual capacity of 40 million tonnes. The mines have been divided for host states and non-host states. This would entail non-mine rich states owning a mine in another state and using it for commercial purposes.

This is the first step to open coal mining beyond the monopoly of state-owned Coal India, the sole miner in India for 41 years. The government plans to evolve the mechanism of commercial mining by involving the states and then private miners, said Anil Swarup, secretary, ministry of coal.

This move is likely to benefit mineral-rich states earn surplus revenue. These states were till now getting only royalty from private companies mining coal for captive use.

Cabinet to take up tomorrow extension of UDAY schemeIndia's foreign direct investment is likely to cross $60 billion this year on favourable policy environment even as the FDI flows globally are set to witness a decline, says a UN economist.

"India witnessed a rise of about 28% in FDI to $44.20 billion in 2015. We expect FDI to cross $60 billion in 2016," said Nagesh Kumar, Economist & Head, United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP's) South and South-West Asia Office, at the release of an United Nations Conference on Trade and Development (UNCTAD) report.

In India, the report said, the large increase of announced greenfield investments in manufacturing industries may provide further impetus to FDI this year.

Union Cabinet on Wednesday will consider a proposal to extend timeline for joining UDAY scheme meant for revival of debt-laden discoms and issue bonds for paying their outstandings during this financial year.

Under the UDAY scheme, the states were required to join UDAY scheme formally last financial year and issue bonds to pay off discoms' 50% debt in 2015-16. They were supposed to issue bonds to pay off additional 25% of the discoms' debt in the current financial year.

However, some states could not join the scheme and some could not issue bonds due to delay in regulatory approvals or other reasons like elections. Now with this decisions, these state would be able issue the bonds to pay of 75% of state discoms' during the current financial year itself.

Last financial year, the states issued bonds worth Rs 1 lakh crore to pay off their discoms debt.

-

Virupaksha

- BR Mainsite Crew

- Posts: 3110

- Joined: 28 Jun 2007 06:36

Re: Indian Economy News & Discussion - Aug 26 2015

How many would like to bet that R3 would become the new Amartya Sen, the go to person when NYTimes or any such gora rag wants to get the "house nigg*r" to make comments on India/tolerance/RSS

Re: Indian Economy News & Discussion - Aug 26 2015

That unfortunately looks quite likely..RR was more of a non resident than an Indian !Virupaksha wrote:How many would like to bet that R3 would become the new Amartya Sen, the go to person when NYTimes or any such gora rag wants to get the "house nigg*r" to make comments on India/tolerance/RSS

Re: Indian Economy News & Discussion - Aug 26 2015

Mod Note

Please, no more on the Rajan political topic. The topic is no longer fit for this thread.

Please, no more on the Rajan political topic. The topic is no longer fit for this thread.

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Indian Economy News & Discussion - Aug 26 2015

{deleted}

Last edited by Suraj on 23 Jun 2016 04:20, edited 1 time in total.

Reason: Politics related post

Reason: Politics related post

Re: Indian Economy News & Discussion - Aug 26 2015

New textiles package targets 10 million fresh jobs, another $30 billion exports

NEW DELHI: India's cabinet on Wednesday approved a package for the textiles sector with measures such as tax sops and relaxation of labour laws, with a three-year target of 10 million more jobs, $30 billion additional exports and $11 billion fresh investment.

Briefing reporters later, officials said the package includes full burden of provident fund on government, reduction in yearly working days for calculation of income tax rebate and additional subsidy for machinery under the amended technology upgradation fund scheme.

Officials said the new package was mainly aimed at women empowerment since they constitute 70 per cent of the workforce in the garment industry. This apart, the measures are labour-friendly and will create jobs and economies of scale and boost exports, they said

Re: Indian Economy News & Discussion - Aug 26 2015

No bumpy ride for startups as Narendra Modi government okays Rs 10,000 crore corpus; to generate 18 lakh jobs

NEW DELHI: The government today approved Rs 10,000 crore 'Fund of Funds for Startups' to support them with an aim to generate employment for 18 lakh persons.

"The fund is expected to generate employment for 18 lakh persons on full deployment...A corpus of Rs 10,000 crore could potentially be the nucleus for catalysing Rs 60,000 crore of equity investment and twice as much debt investment," an official statement said.

The decision was taken in the Union Cabinet meeting chaired by Prime Minister Narendra Modi.

Re: Indian Economy News & Discussion - Aug 26 2015

I just want to make one post

{deleted}

{deleted}

Last edited by Suraj on 23 Jun 2016 04:19, edited 1 time in total.

Reason: Moved to politics thread

Reason: Moved to politics thread

Re: Indian Economy News & Discussion - Aug 26 2015

China should be seen as inspiration & not competition; India could reach there in next 10 years: Raghuram Rajan

http://economictimes.indiatimes.com/art ... aign=cppst

http://economictimes.indiatimes.com/art ... aign=cppst

Re: Indian Economy News & Discussion - Aug 26 2015

I thought the earlier view was export driven growth is not suitable for India and we shall not copy China in this.

Re: Indian Economy News & Discussion - Aug 26 2015

China-backed Asean opposes India's stand on RCEP

http://www.business-standard.com/articl ... 192_1.html

http://www.business-standard.com/articl ... 192_1.html

However, there was also a rift in Asean nations over this. “China, having demanded greater tariff reduction before also, pushed Asean members Laos and Cambodia into opposing India’s approach, which was later followed by Malaysia and Indonesia,” said one of the sources tracking the development. However, Philippines and Singapore were not on board, he added. The Asean nations want to see the agreement through as soon as possible and are being played by China against India for leverage over negotiations on services where India has taken an aggressive stance, said a commerce ministry official.

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Indian Economy News & Discussion - Aug 26 2015

Deleted

Last edited by Suraj on 24 Jun 2016 12:11, edited 1 time in total.

Reason: Moved to politics thread.

Reason: Moved to politics thread.

-

Manish_Sharma

- BRF Oldie

- Posts: 5128

- Joined: 07 Sep 2009 16:17

Re: Indian Economy News & Discussion - Aug 26 2015

I'm reporting above post as political not suitable for economy forum.

Re: Indian Economy News & Discussion - Aug 26 2015

Looks like you lost money in the market and venting out here with your spiel. Tough luck but BRF can't help you in this regard.vina wrote:Well, Brexit fallout yellow matter hits the roof and the Govt rolls out who, the Economic Affairs Super Baboon....

-

chandrasekaran

- BRFite

- Posts: 448

- Joined: 27 Nov 2008 15:07

Re: Indian Economy News & Discussion - Aug 26 2015

http://economictimes.indiatimes.com/new ... 895918.cms

Doesn't read anything like what Vina has posted. Just wanted to call this out. Thats all.

Doesn't read anything like what Vina has posted. Just wanted to call this out. Thats all.

Re: Indian Economy News & Discussion - Aug 26 2015

brexit is a good buying opportunity in india over next few days to take advantage of the temporary bottoming. what does UK produce or consume that the world needs - ARM chip licenses, bae systems weapons and RR aero engines , other than that its just a good place to park and launder money, without producing or consuming anything much physical.

Re: Indian Economy News & Discussion - Aug 26 2015

Actually the Indian stock markets are currently a bit heated up ... not cheap at all & this has been the case often.hanumadu wrote:Looks like you lost money in the market and venting out here with your spiel. Tough luck but BRF can't help you in this regard.vina wrote:Well, Brexit fallout yellow matter hits the roof and the Govt rolls out who, the Economic Affairs Super Baboon....

If you invested only in the last couple of weeks - you will be loosing money on them today. Now - if you are a long term investor (minimum of 3 years as holding period) then days like today (not exactly a black swan event, in terms of prediction) & a few more in the coming weeks (till some weak-to-hold-on-bricks also fall off) - are what matters for you to put in much of the money that you have been accumulating slow & steady like a squirrel over a long duration.

If the Indian markets fall steeply ( & there is no reason for it - unless FIIs are all dumping to save their own lives like 'Bear Sterns & such ilk') - the usual saviour of the government - LIC & some other state held insurance companies, will start buying shares to prop up the market. But the Indian economy is in a far better condition than most of the emerging & even developed countries. So the fall in Indian markets i expect - wouldn't be very steep or even long - i guess more people will be waiting to snap up shares when they go down.

Another weakness that can roil up the Indian markets is the usual suspect - monsoon. If it spreads around properly & dumps enough rain - then Indian markets would rise more.

Re: Indian Economy News & Discussion - Aug 26 2015

hanumadu wrote:Looks like you lost money in the market and venting out here with your spiel. Tough luck but BRF can't help you in this regard.vina wrote:Well, Brexit fallout yellow matter hits the roof and the Govt rolls out who, the Economic Affairs Super Baboon....

R cubed is still the governor. Shouldn't he be here in India doing his job in view of this "historical event"?

Or maybe it isnt that big of an event at all.

Nifty is btw down 3%.

It isnt really that bad. Nature of our economy and market,buy on dips, hasnt changed.

Re: Indian Economy News & Discussion - Aug 26 2015

Just a small observation based on the Brexit vote and the reactions to a distant bureaucracy. Part of my reason for the opposition to the GST is the over centralization and bureaucratization of a tax structure, which inherently has to react to local factors. Especially in our setup, where the state is barred from collecting direct taxes, these pressure points between local needs and the centralized nature of GST will continue to create pressure points. Separate the two issues of a single market from GST - they can be delinked. Indian constituent units by their nature are too independent, large and diverse to be yet again be managed by New Delhi. Caveat Centralization.

Re: Indian Economy News & Discussion - Aug 26 2015

I think there is some serious oversite of elected representatives in GST. If not there already, then it is time to put them. At present most of the taxation is done just for revenue collection which itself is totally idiotic and creates huge corruption. For example, the VAT in MH is some 11% and a large level of corruption takes places because no one is willing to pay it. Same thing in respect of sales tax and others like VAT in most of the states. So a structured and well-regulated tax structure is very much needed for everyone's benefit.

But is GST the solution for that. I do not know.

But is GST the solution for that. I do not know.

Re: Indian Economy News & Discussion - Aug 26 2015

if one buys stock out of ideologies ,especially left leaning ones , losses are bound to happen...brexit is a non-event insofar as the Indian economy is concerned...now someone please buy whatever ARM/BAE stock that is available on free market while it is still cheap and lighten the white brits burden to money laundering and hosting criminals from across the world...

Re: Indian Economy News & Discussion - Aug 26 2015

Also watch the video in the link, "This brave new world: India, China, and the United States"

Re: Indian Economy News & Discussion - Aug 26 2015

Indian Economy and Stock Data

Re: Indian Economy News & Discussion - Aug 26 2015

Knitwear exporters face losses

Britain’s decision to leave European Union following a referendum, is leaving the garment exporters from Tirupur knitwear cluster with the possibilities of facing losses due to the consequent emergence of currency volatility.

The currency volatility comes mainly as knee-jerk reactions to the decision of UK to quit.

On Friday, the British pound plummeted by more than 10 per cent within six hours on the concerns that severing ties with the EU would have a cascading effect on the UK economy.

“Presently, around Rs. 2,000 crore worth of garments are exported per annum from Tirupur to Britain. Losses will be suffered on the orders that are now in the process of execution/delivery since many of the garment exporters have not opted for forward contracts”, pointed out T.R. Vijayakumar, who exports garments to UK, and also the current vice-chairman of Confederation of Indian Industry (Tirupur district council)..

.

.

.

.

“They have not been hedging much till now when comes to the trade in British Pound as it was steadier."

.

.

Re: Indian Economy News & Discussion - Aug 26 2015

No more talk of the "G2", huh ?Gagan wrote:Also watch the video in the link, "This brave new world: India, China, and the United States"

Re: Indian Economy News & Discussion - Aug 26 2015

Can you please post the link to this research report? thanksAustin wrote:Indian Economy and Stock Data

Re: Indian Economy News & Discussion - Aug 26 2015

I got it on my email will post the contentsJTull wrote:Can you please post the link to this research report? thanksAustin wrote:Indian Economy and Stock Data

Brexit - A Non-Event for India

What is BREXIT?

The European Union - often known as the EU - is an economic and political partnership involving 28 European countries. It has grown to become a "single market" allowing goods and people to move around. The United Kingdom Prime Minister, David Cameron at the time of his election had promised to hold a referendum on whether the UK should remain in the EU? The referendum has been held and the people of the UK have voted 52:48 in favour of an Exit.

What were the stakes for the British?

The UK is one of 10 member states that pays more into the EU budget than what they get out and only France and Germany contribute more. The UK's net contribution for 2014/15 was £8.8bn - nearly double what it was in 2009/10.

Post Brexit, Britain would also take back full control of its borders and reduce the number of people coming to live and/or work i.e. it will gain control over immigration within the UK-EU.

What happens next?

Technically, MPs could block an EU exit - but it would be seen as political suicide to go against the will of the people as expressed in a referendum.

The referendum result is not legally binding - Parliament still has to pass the laws that will get Britain out of the EU.

Article 50 of the treaty with EU has to be activated by the UK PM. The current PM has resigned and left it to the next PM to take a decision on Article 50. Once Article 50 is activated, Brexit is certain. Brexit should then be a two year negotiation process between the EU and the UK. In a good case, it is possible that UK postpones invoking Article 50 for 6-12 months while negotiating better terms for the UK within the EU and following up with a second referendum in 2017.

Brexit and Indian economy

It is hard to make a case of any meaningful impact on Indian economy of Brexit – either direct or indirect. The UK is a small trading partner of India – UK alone accounts for only 3.4% and 1.4% of India’s merchandise exports and imports, respectively, as of FY16. Even that should not be impacted as Brexit will change the terms of trade between UK and EU and not with India. FDI flows from UK to India stood at only US$1bn in FY15 and US$0.8bn in FY16; hence, not that significant.

Source: Finance Ministry and RBI

Impact on Indian Companies

Brexit can have some impact on Indian companies that have businesses in UK/ EU.

The medium term impact, if any, will be clear only post the revised terms of trade between UK and EU are finalized. This should take 2-3 years from now.

In the interim, the GBP depreciation is an unexpected positive for companies like Tata Steel and Tata Motors (JLR) that have manufacturing operations in the UK.

Barring these companies, the impact on other sectors like pharma, IT, banks and agrochemicals is likely to be marginal.

Capital outflows

A pessimist may argue that Brexit will lead to FII outflows from India due to risk aversion. While there is no meaningful link between Brexit and Indian economy, India is in a strong position even if there are some outflows. Consensus expects India’s CAD to remain manageable at about ~1.5% of GDP in FY17. Foreign exchange reserves at ~US$363bn seem adequate to withstand volatility in the case of global risk aversion. Net FDI inflows have increased to an all-time high of US$36bn in FY16. Impact of any FII outflows even if it does happen will not be felt by the economy, though stock markets may be impacted in the very short run.

Interest rates

Considering India's relatively stable macro situation (CAD ~1.5%, Fiscal Deficit ~3.5% and stable inflation), we do not expect any negative impact on the debt markets. Even if there are some FII outflows, which may lead to liquidity tightening, RBI is likely to provide additional liquidity through repos and purchase of Gsecs in the open market operations (OMO).

Uncertainty in EU is likely to lead to USD strengthening and lower global commodity prices. Interestingly, Brent oil prices were down ~4% today. This is likely to aid continued low inflation and provide room for lower rates in India.

The impact of Brexit on all segments of debt markets today has been fairly muted. In the money market (CP & CD) and corporate bond market - yields have moved higher by just 2 to 3 bps. While the yields in treasury bills and government bond market are flat to lower as compared to the levels prevailing yesterday.

The INR was stable and depreciated marginally vs. the USD while appreciating against the Euro and the GBP.

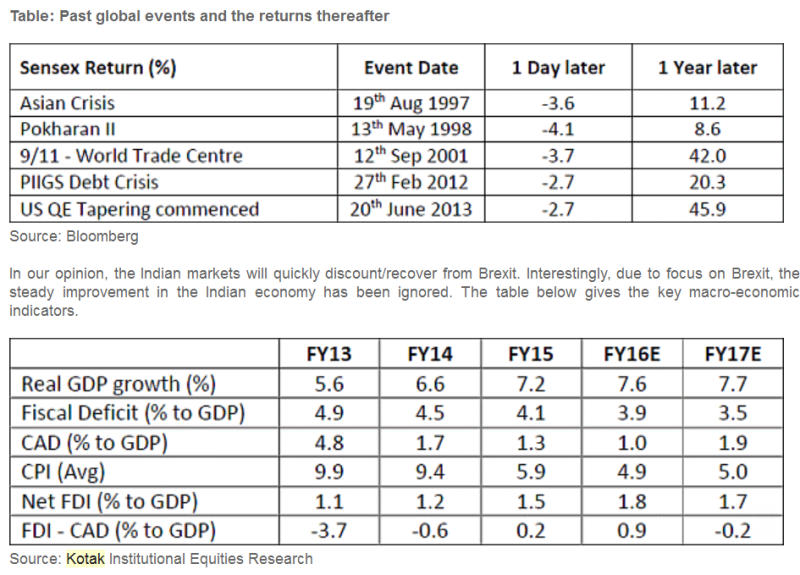

Global events - opportunities for Indian equities?

The following table lists some of the adverse developments in the world over the last two decades, the impact on the stock markets in the short run in India and the returns one year after the event. It is quite evident that on most of these occasions, the correction in the Indian stock markets was a good opportunity to invest for the long term investor. This is so because the nature of Indian economy is one of secular growth and global developments have only a marginal impact on it.

Table: Past global events and the returns thereafter

Source: Bloomberg

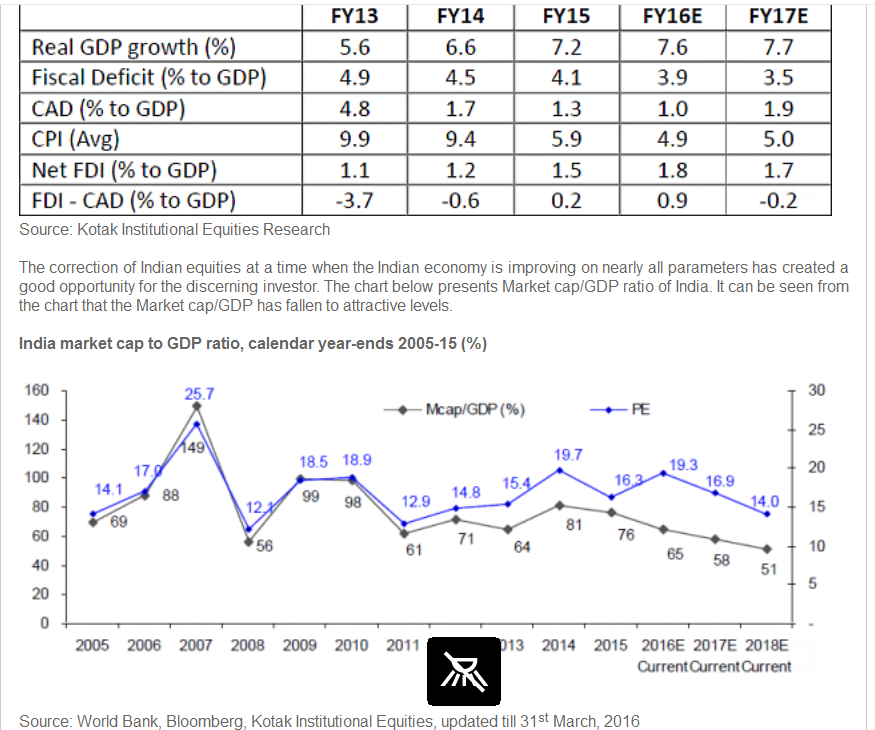

In our opinion, the Indian markets will quickly discount/recover from Brexit. Interestingly, due to focus on Brexit, the steady improvement in the Indian economy has been ignored. The table below gives the key macro-economic indicators.

Source: Kotak Institutional Equities Research

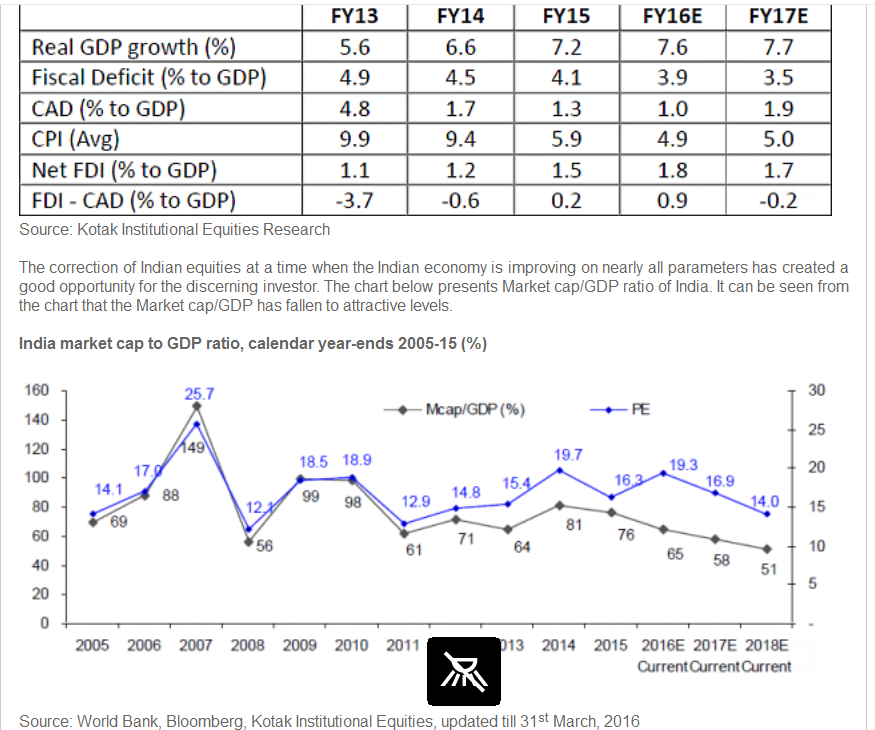

The correction of Indian equities at a time when the Indian economy is improving on nearly all parameters has created a good opportunity for the discerning investor. The chart below presents Market cap/GDP ratio of India. It can be seen from the chart that the Market cap/GDP has fallen to attractive levels.

India market cap to GDP ratio, calendar year-ends 2005-15 (%)

http://i35.servimg.com/u/f35/15/54/62/79/gdp-in10.png

Source: World Bank, Bloomberg, Kotak Institutional Equities, updated till 31st March, 2016

The policy direction in India is right and economy is making good progress on most fronts. The economy and equity markets also appear to be in transition from consumption to capex. Impact of higher infra allocation and the several steps taken by government over the last two years is expected to be felt strongly from FY17 onwards with Railways, Power Transmission and Distribution, Mining, Roads and Urban Infrastructure likely to lead growth.

Improving fundamentals of the Indian economy and attractive market cap / GDP lead to a positive outlook for the equity markets over the medium to long term.

In a lighter vein, Gold prices went up by ~5% today making Indians richer by ~$40bn. Equity markets lost ~$30bn in value today. Hence, Indians are actually better off from Brexit!

To conclude, Brexit is not a material event for the Indian markets. Indian economy is on a steady recovery path and valuations are attractive. The correction in markets thus provides an attractive entry point for the medium to long term.

Re: Indian Economy News & Discussion - Aug 26 2015

http://www.deccanchronicle.com/nation/c ... ounts.html

The income tax authorities have unearthed Rs 13,000 crore of black money from just two sets of information received in 2011 and 2013.

According to a report, the government’s crackdown on those holding undisclosed income has yielded hundreds of cases of such income stashed in banks like HSBC, Geneva. The details were received from the French government in 2011, and the unaccounted for income amounts to Rs 8,186 crore.

This is the highest ever disclosure from offshore bank accounts. It has raised a tax demand of Rs 5,377 crore against such account holders till March 31, 2016.

In the HSBC case, the government had received information about 628 bank accounts. Of these, at least 213 were found "not actionable" as they either had no money in them or they belonged to non-resident Indians. Also, in some cases, the entities remained untraceable.

The other set of information disclosed in 2013 appeared on the website of the International Consortium of Investigative Journalists (ICIJ). IT officials have discovered undisclosed income of over Rs 5,000 crore in foreign bank accounts of over 700 Indians.

So far, the IT department has filed 55 prosecution complaints before criminal courts in the ICIJ cases on charges of wilful attempt to evade tax, says the report.

In the HSBC Geneva case on the other hand, prosecution proceedings have been launched in 75 cases. The Enforcement Directorate can now initiate action under the stringent Prevention of Money Laundering Act (PMLA), since the criminal courts have taken cognisance of the matter.

There is however, relief for some individuals whose names had appeared on the ICIJ website. They have made declarations under the black money declaration window scheme, which the government had launched for a limited period during 2015. But there will be no respite for those against whom IT authorities have already launched a probe, the report says.

Re: Indian Economy News & Discussion - Aug 26 2015

Auctioning of UDAY bonds by Raj wins RBI praise

Jaipur: Successful auctioning of UDAY bonds by the state government has received appreciation from Reserve Bank of India (RBI). After assessing the whole process, RBI is now planning to introduce it as a model in other states too.

Giving its approval on the whole auctioning process, RBI in its communication to the state government asserted that the process was completely transparent and impeccable. Bonds worth Rs 20,000 crore under UDAY scheme were issued by Rajasthan government on June 21. They were oversubscribed nearly doubled by the financial institutions on June 21.

According to the sources, RBI is now planning to replicate the process in other states that are part of the Ujwal Discom Assurance Yojna (UDAY). The reason for Central Bank's enthusiastic response is that Punjab, Haryana and UP did not give encouraging results.

Earlier, Haryana had conducted auctioning of Rs 7,000 crore bonds but managed to sell only Rs 6,000 crore. Similar, experience was observed in Punjab and UP.

Bonds issued by Rajasthan and other states are a part of a tripartite agreement with the Central government and its three discoms for operational and financial turnaround of state power distribution companies. Under this, a state is expected to issue non-SLR bonds in the market directly to the respective banks and financial institutions holding the discom debt.

State discoms have a debt of Rs 80,000 crore. Earlier, on March 15, Rajasthan government issued Rs 28,500 crore worth of bonds to 26 banks in lieu of its three power discoms under the UDAY scheme. Till date, Rajasthan government has issued bonds of nearly Rs 56,000 crore.

Re: Indian Economy News & Discussion - Aug 26 2015

Indian banking's 'weak underbelly' exposed and the story is not over, says Uday Kotak

Warning of ‘more bad news’ on the stressed loans front in the Indian banking sector, eminent banker Uday Kotak has said its ‘weak underbelly’ has resurfaced strongly and the story is not over yet, though lenders have begun cleaning up their books.

Kotak also questioned whether nationalisation of banks served the purpose of checking disproportionate lending to big businesses, as most of the stress on their books is today due to loans to big corporates.

In his annual message to shareholders, the Kotak Mahindra Bank chief also pitched for an 'exit mechanism' for the sector, saying forced mergers, as practiced in past, may not be possible for public sector banks anymore due to their huge NPAs.

Kotak, who is known as one of the most vocal voices within the Indian banking industry including about its own perils, said he sees a "well-settled government" in the country today, but it "could do more to build confidence and trust among businessmen and rekindle animal spirits into the economy".

"The last financial year saw the Indian economy stretched between two ends of the string, good macro tailwinds but a difficult micro situation," he said, adding that inflation, current account and fiscal deficit were all under control, but many sectors and individual businesses struggled. "This scenario is likely to change from hereon. With Brent recovering to USD 50 levels, the benefits of lower prices will reduce, and this has the potential to increase our current account deficit and bottoming out of inflation.... It is time for the Indian micro to gear up and get back into the game," he said.

On banking sector, Kotak said, "The weak underbelly of Indian banking, something which I have been consistently pointing out through the years, has resurfaced strongly. Both public and some private sector banks have revealed stress on their balance sheets.

"The story is not over yet, and we can expect to see more bad news on this front. But it is also a fact that banks have started cleaning up their balance sheets."

Among the lessons from the problems in banking sector, Kotak said banks should understand they are not private equity investors and recovery of money should be at the heart of lending.

"Return of capital is more important than return on capital. If banks think they cannot recover money, they should not lend in the first place," he said, while suggesting a serious overhaul of the recovery mechanism in the country. He also blamed the banks for ‘postponing the pain’ for the last many years, saying it has had a ballooning effect on exposures.

Kotak further said, "Banks were nationalised 47 years ago. One of the reasons for this was that private banks were lending disproportionately to big businesses. Access to funds from banks was not easy for the common man. Nationalisation was supposed to change this. Today’s irony is that the biggest losses booked by banks, including public sector banks (PSBs),are on account of lending to big businesses. "Effectively, public policy actions supposedly done 'in public interest', are instead going 'against public interest'."

Going ahead, Kotak said, the Bankruptcy Code is a good step but it will take at least a year to become fully effective as the entire ecosystem needs to be created. "When I look at our challenges across BIFR, SARFAESI, DRTs, DRATs, and the judicial system, I hope we do better this time. Good intent needs to be backed by good people and execution. Simultaneously, the country needs to rethink the architecture of Indian banking boldly," he said.

He warned that the economy could face headwinds because of banking capacity constraints, given its dependence on 70-30 mix between public and private sector banking. Kotak also said that technology is changing the contours of banking while at the same time the sector has been opened up and new players will soon open shop. "In a short time, we are likely to see 20 to 30 new banks between payment banks, small finance banks, and new on-tap banks. There will be many more new banks than before, and while this is good for capacity building, it will come with its issues.

"In India we still do not have an exit mechanism for banks. Whenever there was a problem, the policy makers chose to merge the troubled entity with another bank, in most cases a public sector bank (PSB). Now PSBs are no more in a position to absorb such entities easily because of the high non-performing assets (NPAs) which have put their capital under severe strain. In this context, the banking industry needs a defined framework, where easy entry is accompanied by an exit mechanism.

"The entire banking sector therefore needs to be reconfigured and re-engineered. This requires political will and consensus which is not easy," Kotak said.

He exuded confidence in growth prospects of his own bank, as also about insurance and mutual fund businesses, and said the integration of ING Vysya Bank would be completed this month. "Another area of focus for us going forward is the area of analytics. We are gearing up the organisation for increased intelligence, speed of response and increased productivity on asset, liability, and services areas," he said.

Re: Indian Economy News & Discussion - Aug 26 2015

Et.

So unless top 50 cities are brought into active market, e-commerce party is over...

Behind numerous headlines of a cash crunch hit ting major Indian e-commerce companies, and commerce companies, and their valuations being questioned, is a revelation not too many people are talking about. Indian e-commerce was emblematic of frenetic growth until very recently, but the last six to eight months have seen the industry come to a grinding halt, making it an inflection point for all the players involved.

TOI accessed and analysed data for top e-tailers, which revealed that the online retail market stagnated between May 2015 and 2016 in terms of the value of goods sold. While in May last year, the e-commerce biggies clocked a gross merchandise value, or GMV , run rate of $9 billion, that number has only inched up to about $10 billion at the end of May this year, translating into an 11% annual growth. In December last year, the total GMV run rate had reached $10.5 billion on the back of the festive season, which typically sees a rush of discounting from all e-tailers.

GMV is overall sales on an online marketplace, excluding discounts and returns which are an integral part of the e-commerce market.

The data gleaned from primary research and vetted by multiple stakeholders in the industry indicated that Flipkart, the country's largest online retail player, has seen its GMV run rate stall at about $4 billion for almost a year, while an aggressive Amazon has gone from clocking $1 billion to $2.7 billion in gross sales. However, Amazon's operations in India only began three years ago and it's been gaining ground on a smaller base. What's worth noting is that Flipkart notched up a 400% growth the year before, when it's GMV zoomed from $1 billion to $4 billion, post which the numbers have gone flat.

Gurgaon-based Snapdeal, on the other hand, has seen an almost 50% knock-down in sales numbers after similar highs it touched exactly a year ago. The company said as of June, its GMV run rate was more than $2.5 billion.

An email sent to Flipkart's spokesperson did not elicit a response till the time of going to press. In an earlier interaction with TOI, Amit Agarwal, Amazon's India head, had said the online retailer hadn't witnessed any signs of a slowdown and, instead, had grown shipments impressively at 150% in the first quarter of the calendar year.

E-commerce companies earn anywhere between 5% and 15% in commission from sellers, which makes up their revenue. GMV had been the key metric for all e-tailers in India to show rapid growth and ratchet up their valuations in multi-billion dollar fund-raises over the past two years. But with sales staying flat or declining, most e-commerce players are now starting to focus on returning customers, which their founders keep stressing in media interactions.GMV run rate varied from month to month and is pretty jagged, depending on promotions and discounts that are available at the time. But the data collated by TOI points to a palpable slowdown for the first time after a heady period of growth.

Reduced discounting slowing growth?

Post March this year, most e-tailers have reduced promotional campaigns after the Indian government introduced new policy guidelines for online marketplaces. The fresh rules prohibit online retailers from offering discounts directly. Cash burn for Amazon, for instance, had risen up to almost $80-90 million per month in the early part of the year -more than double of Flipkart's -but has since stabilized, people privy to the matter said. Amazon's Agarwal, when asked about it recently, did not give details on the mounting cash burn involved in weaning away Indian consumers from rivals.

An investor who has been tracking e-commerce says if the market has momentarily stopped growing, it's because online players have reduced investments into market development. A slug of risk capital came into India's online commerce industry, with Flipkart leading the pack. Founded in 2007 as an online bookstore, the Bengaluru-based poster boy of India's thriving startup ecosystem scooped up $3.2 billion, a majority of the funding coming over the past two years, while Snapdeal collected $1.3 billion. The Jeff Bezos-led Amazon, too, has been pumping billions into India, the latest being a $3-billion investment announcement -taking its overall commitment for the country to $5 billion in three years of launching here.

Has Online Consumer Base Capped Out?

India's online shopping market, according to rough estimates, is 60-70 million, and is expected to go up to 100 million in the next few years. A notable spike happened in the past three years, but the divide between tier I and tier II cities is still very wide. The top 6-8 cities contribute 90% of sales for all the consumer internet players, including app-based cab aggregators like Ola and Uber.

In an earlier interaction with TOI, Binny Bansal, cofounder & CEO, Flipkart, said the e-commerce major was keenly looking at ways to tap into its existing base of users. "There are 50-60 million consumers buying online today. Given the large base, it makes sense to ensure you are selling more to the same customers as that opportunity is big enough compared to three years back," he had said. Snapdeal's co-founder & CEO Kunal Bahl, too, has reiterated his focus on the e-tailer's high-value consumers, suggesting GMV was not the metric his company was chasing anymore. "Our GMV run rate continues to be healthy and above $2.5 billion. We are significantly focused on delivering the best experience, growing our net revenue which has increased three times in the last 12 months," a Snapdeal spokesperson said in an emailed response to TOI. GMV was described by many as a vanity metric during the past few years when e-commerce registered exponential growth.

"The moment of reckoning is coming or may have come already for Indian e-commerce companies. The ease with which these companies have been able to raise money from VCs may have made them all sloppy , and the test then will be which ones can now work on the `building-a-business' channel. As for whether the fault lies with Indian consumers for not jumping fast enough onto the online wagon, it is a chicken-and-the-egg problem that we have to deal with," says Aswath Damodaran, professor of finance at the Stern School of Business at New York University.

What all of this will mean for online retailers is that from here on, raising new capital at present valuations will be a very tough proposition. Flipkart has been conserving cash and has substantially brought down its burn rate to wade through this phase of slow growth.Besides Amazon, there's Alibaba stitching up plans for a direct entry into e-commerce, making it a contest between the two global powerhouses and the Indian incumbents. The next one year will be extremely significant for the local online retailers as they go back to the basics and try to make their businesses self-sustaining while moving towards a tough path to profitability.

So unless top 50 cities are brought into active market, e-commerce party is over...

Behind numerous headlines of a cash crunch hit ting major Indian e-commerce companies, and commerce companies, and their valuations being questioned, is a revelation not too many people are talking about. Indian e-commerce was emblematic of frenetic growth until very recently, but the last six to eight months have seen the industry come to a grinding halt, making it an inflection point for all the players involved.

TOI accessed and analysed data for top e-tailers, which revealed that the online retail market stagnated between May 2015 and 2016 in terms of the value of goods sold. While in May last year, the e-commerce biggies clocked a gross merchandise value, or GMV , run rate of $9 billion, that number has only inched up to about $10 billion at the end of May this year, translating into an 11% annual growth. In December last year, the total GMV run rate had reached $10.5 billion on the back of the festive season, which typically sees a rush of discounting from all e-tailers.

GMV is overall sales on an online marketplace, excluding discounts and returns which are an integral part of the e-commerce market.

The data gleaned from primary research and vetted by multiple stakeholders in the industry indicated that Flipkart, the country's largest online retail player, has seen its GMV run rate stall at about $4 billion for almost a year, while an aggressive Amazon has gone from clocking $1 billion to $2.7 billion in gross sales. However, Amazon's operations in India only began three years ago and it's been gaining ground on a smaller base. What's worth noting is that Flipkart notched up a 400% growth the year before, when it's GMV zoomed from $1 billion to $4 billion, post which the numbers have gone flat.

Gurgaon-based Snapdeal, on the other hand, has seen an almost 50% knock-down in sales numbers after similar highs it touched exactly a year ago. The company said as of June, its GMV run rate was more than $2.5 billion.

An email sent to Flipkart's spokesperson did not elicit a response till the time of going to press. In an earlier interaction with TOI, Amit Agarwal, Amazon's India head, had said the online retailer hadn't witnessed any signs of a slowdown and, instead, had grown shipments impressively at 150% in the first quarter of the calendar year.

E-commerce companies earn anywhere between 5% and 15% in commission from sellers, which makes up their revenue. GMV had been the key metric for all e-tailers in India to show rapid growth and ratchet up their valuations in multi-billion dollar fund-raises over the past two years. But with sales staying flat or declining, most e-commerce players are now starting to focus on returning customers, which their founders keep stressing in media interactions.GMV run rate varied from month to month and is pretty jagged, depending on promotions and discounts that are available at the time. But the data collated by TOI points to a palpable slowdown for the first time after a heady period of growth.

Reduced discounting slowing growth?

Post March this year, most e-tailers have reduced promotional campaigns after the Indian government introduced new policy guidelines for online marketplaces. The fresh rules prohibit online retailers from offering discounts directly. Cash burn for Amazon, for instance, had risen up to almost $80-90 million per month in the early part of the year -more than double of Flipkart's -but has since stabilized, people privy to the matter said. Amazon's Agarwal, when asked about it recently, did not give details on the mounting cash burn involved in weaning away Indian consumers from rivals.

An investor who has been tracking e-commerce says if the market has momentarily stopped growing, it's because online players have reduced investments into market development. A slug of risk capital came into India's online commerce industry, with Flipkart leading the pack. Founded in 2007 as an online bookstore, the Bengaluru-based poster boy of India's thriving startup ecosystem scooped up $3.2 billion, a majority of the funding coming over the past two years, while Snapdeal collected $1.3 billion. The Jeff Bezos-led Amazon, too, has been pumping billions into India, the latest being a $3-billion investment announcement -taking its overall commitment for the country to $5 billion in three years of launching here.

Has Online Consumer Base Capped Out?

India's online shopping market, according to rough estimates, is 60-70 million, and is expected to go up to 100 million in the next few years. A notable spike happened in the past three years, but the divide between tier I and tier II cities is still very wide. The top 6-8 cities contribute 90% of sales for all the consumer internet players, including app-based cab aggregators like Ola and Uber.

In an earlier interaction with TOI, Binny Bansal, cofounder & CEO, Flipkart, said the e-commerce major was keenly looking at ways to tap into its existing base of users. "There are 50-60 million consumers buying online today. Given the large base, it makes sense to ensure you are selling more to the same customers as that opportunity is big enough compared to three years back," he had said. Snapdeal's co-founder & CEO Kunal Bahl, too, has reiterated his focus on the e-tailer's high-value consumers, suggesting GMV was not the metric his company was chasing anymore. "Our GMV run rate continues to be healthy and above $2.5 billion. We are significantly focused on delivering the best experience, growing our net revenue which has increased three times in the last 12 months," a Snapdeal spokesperson said in an emailed response to TOI. GMV was described by many as a vanity metric during the past few years when e-commerce registered exponential growth.

"The moment of reckoning is coming or may have come already for Indian e-commerce companies. The ease with which these companies have been able to raise money from VCs may have made them all sloppy , and the test then will be which ones can now work on the `building-a-business' channel. As for whether the fault lies with Indian consumers for not jumping fast enough onto the online wagon, it is a chicken-and-the-egg problem that we have to deal with," says Aswath Damodaran, professor of finance at the Stern School of Business at New York University.

What all of this will mean for online retailers is that from here on, raising new capital at present valuations will be a very tough proposition. Flipkart has been conserving cash and has substantially brought down its burn rate to wade through this phase of slow growth.Besides Amazon, there's Alibaba stitching up plans for a direct entry into e-commerce, making it a contest between the two global powerhouses and the Indian incumbents. The next one year will be extremely significant for the local online retailers as they go back to the basics and try to make their businesses self-sustaining while moving towards a tough path to profitability.

Re: Indian Economy News & Discussion - Aug 26 2015

http://www.tribuneindia.com/news/nation ... 58167.html

Panel, and not just RBI Guv, to fix interest rate - a 6-member committee to decide rate at Aug 9 review

Panel, and not just RBI Guv, to fix interest rate - a 6-member committee to decide rate at Aug 9 review

In a sweeping change, the government today enforced a law for setting up a broad-based, six-member committee that is likely to decide on interest rate at the next monetary policy in August, with the RBI Governor having a casting vote in case of a tie.

Under the current system, the Governor has overriding powers to accept or reject the recommendation of the Reserve Bank of India’s panel on monetary policy.

The government has kicked-off the process of setting up a Monetary Policy Committee (MPC), which will take over the job of interest rate setting from the central bank.

“The government has decided to bring the provisions of the amended RBI Act regarding constitution of MPC into force on June 27, so that the statutory basis of MPC is made effective,” said and official statement.

The MPC will set interest rates by majority, with a casting vote for the central bank Governor in the event of a tie.

Officials said the MPC is likely to be in place by next month and the monetary policy review scheduled on August 9 will be done by the committee. The review will be the last monetary policy of RBI Governor Raghuram Rajan, who completes his three-year term on September 4.

The government said a committee-based approach would add value and transparency to the monetary policy decisions. Out of the six members, three will be from the RBI, including its Governor, who will be the ex-officio chairperson, the Deputy Governor and one other officer.

The other three members will be appointed by the Centre on the recommendations of a committee headed by the Cabinet Secretary. These three will be experts in the field of economics, banking, finance or monetary policy and will be appointed for a period of four years.

Re: Indian Economy News & Discussion - Aug 26 2015

Another structural reform. Another important step in conveying we're serious about our economy.wig wrote:http://www.tribuneindia.com/news/nation ... 58167.html

Panel, and not just RBI Guv, to fix interest rate - a 6-member committee to decide rate at Aug 9 review

Re: Indian Economy News & Discussion - Aug 26 2015

Does anyone here know the ISINs for all these UDAY bonds issued to date? Or could you point me to a link. Google isn't throwing up anything. Even though they're private placements, they should have ISINs.

Re: Indian Economy News & Discussion - Aug 26 2015

No right thread for this article. Which is long and interesting.

PM Narendra Modi speaks to Times Now's Arnab Goswami: Full Transcript

PM Narendra Modi speaks to Times Now's Arnab Goswami: Full Transcript