https://swarajyamag.com/economy/what-wo ... e-reversed

What Won Modi 2019 Will Not Win Him 2024: Nine Economic Follies That Need To Be Reversed

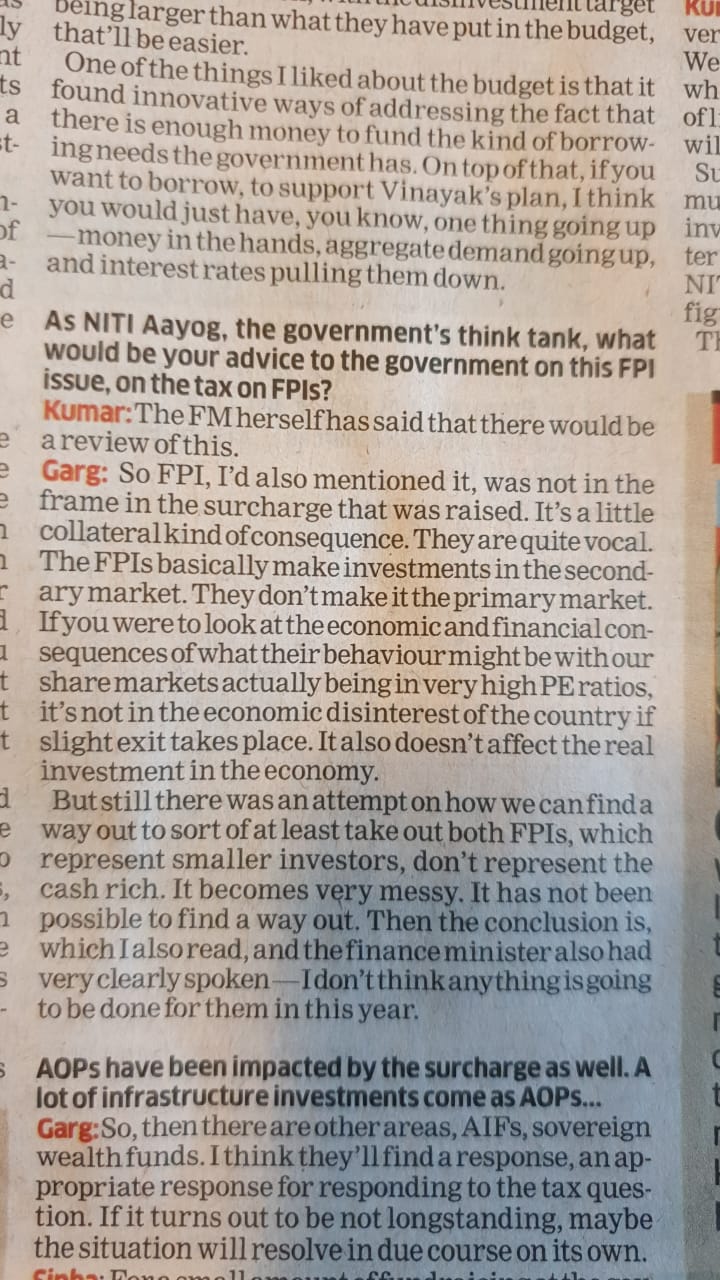

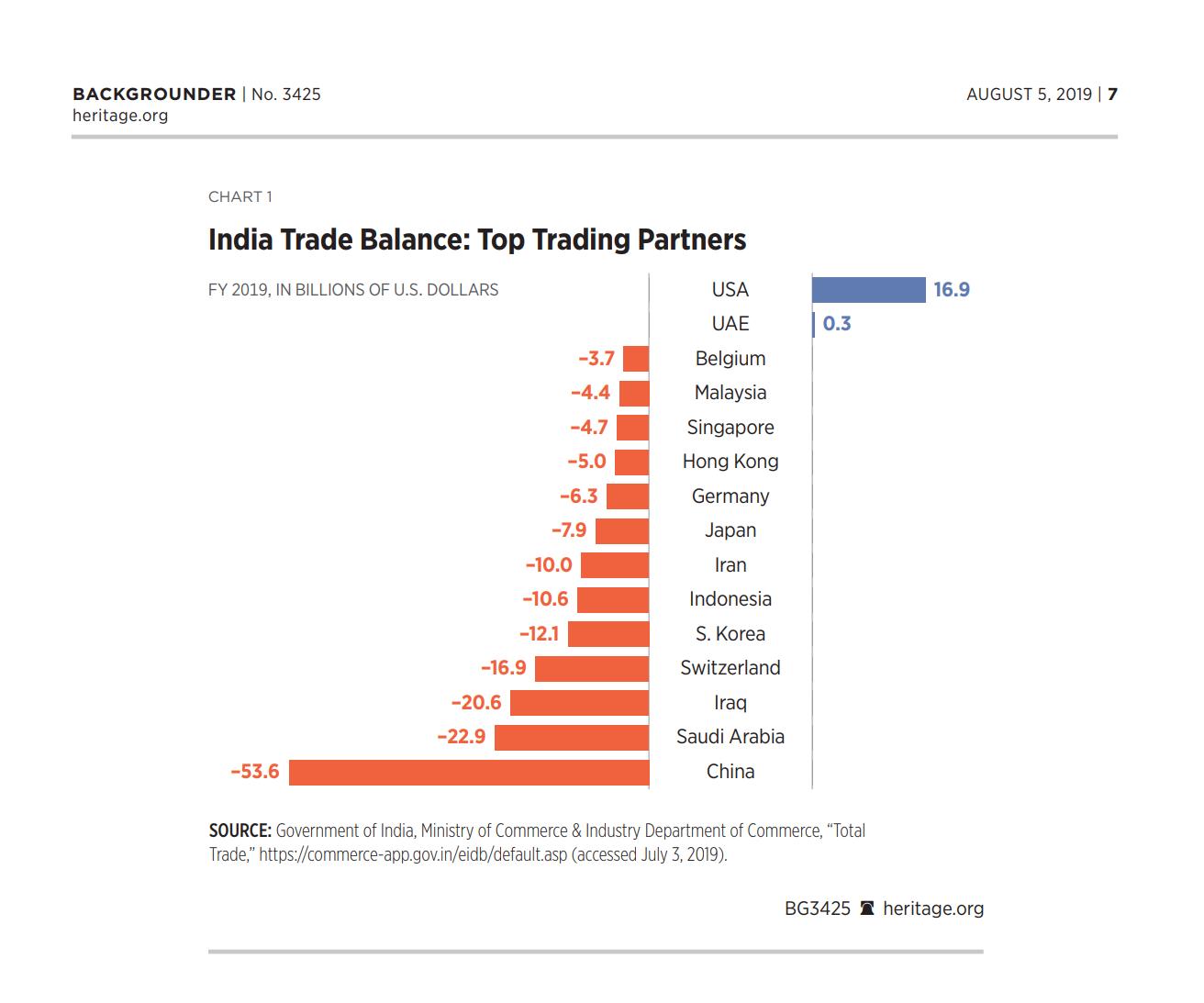

First, taxation. The emphasis on compliance is good, but only if tax rates are reasonable for individuals and corporates. The Modi government has compounded its blunders not only by raising tax rates for the better off in the recent budget, but by adding surcharges and cesses.

In 2019-24, Modi has to cut taxes – and fast.

Second, banks and the public sector.

Barring four or five large banks that can always remain in the public sector, the rest must be privatised.

The same applies to other white elephants like Air India or Bharat Sanchar Nigam. If they are not sold for a song, we will be perpetually hearing a dirge as they continue losing money hand over fist. Privatisation, in these cases, is not about earning money for the exchequer, but to avoid future liabilities of a permanent nature.

One cannot also forget the non-banking financial companies (NBFCs). The sector is teetering on the brink, and even though the stronger ones will survive, the weaker ones are afflicted not by just a liquidity problem, but a solvency one. NBFCs need to be capitalised and or merged with stronger banks, apart from being given better liquidity support.

Third, real disinvestment and strategic sales. Selling IDBI Bank to LIC or Hindustan Petroleum to ONGC or REC to Power Finance Corporation are not strategic sales. They are mere transfers from one pocket of the government to another.

Fourth, government accounts. These are a scandal. The scandal began under UPA, but Modi has not corrected it. If one were to read the comments of the Comptroller and Auditor General on India’s fiscal deficit in 2017-18, the real figure was 5.85 per cent and not the official version of 3.46 per cent.

Another technique used to show a lower fiscal deficit is to shift current year expenditures to the following year, and hoping for the best in terms of higher revenues in that year.

Fifth, the emasculation of the public sector. Fiscal deficit window-dressing requirements are forcing the government to demand buybacks of shares and higher dividends from public sector companies – a practice started by P Chidambaram, and continued under Modi as if nothing is wrong with this practice.

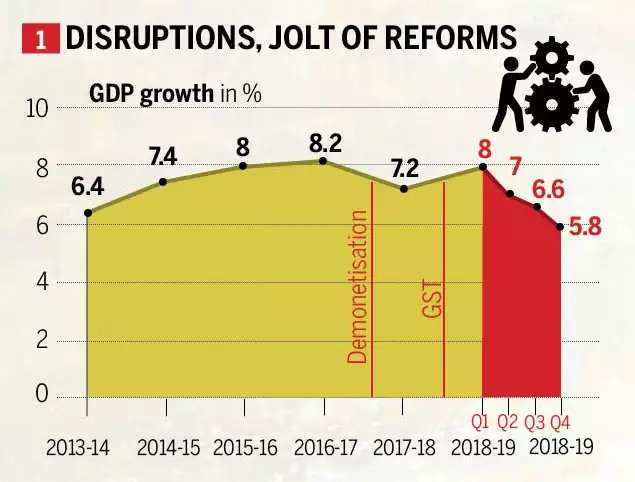

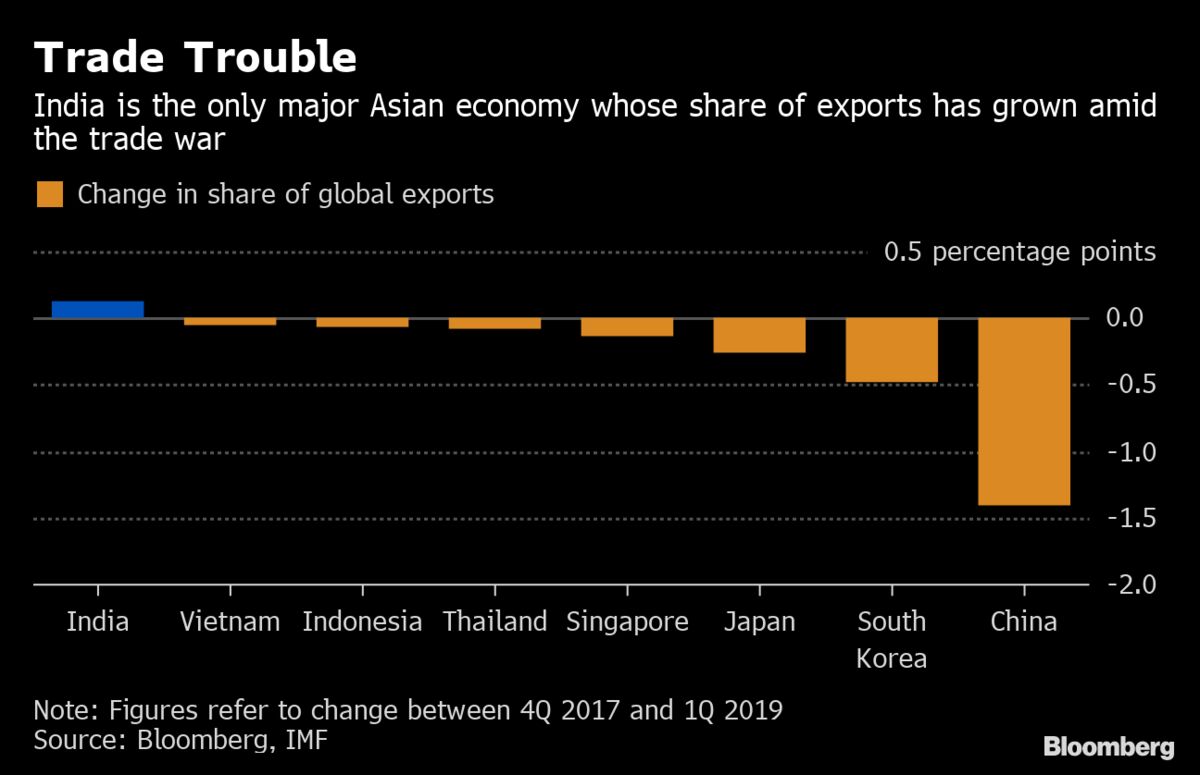

Sixth, GST. India’s biggest tax reform is floundering on the rocks of a bad design and complex rate structure. This is not Modi’s fault at all, but having legislated it, if he does not fix it in the first half of his second term, he will face electoral trouble.

GST has to be quickly brought down to three basic rates, with 15-16 per cent being the middle range, and exemptions and abnormalities being reduced to a minimum.

Seventh, the Monetary Policy Committee (MPC) and inflation targets. The MPC was given an inflation target that was too low at a time when central banks all over the world are finding it tough to raise inflation to levels they are comfortable with.

Modi needs to do two things. One is to give the MPC a dual mandate, both growth and inflation. The new target middle rate ought to be 4-5 per cent and not just 4 per cent. In the absence of a producer prices index, the wholesale prices index, probably updated and reformed, ought to be given some weightage in the MPC target setting. Modi should not wait for 2021, when the current MPC mandate ends, to make these changes.

ighth, statistics. Whether it is jobs or growth, India’s statistical system is being questioned for its credibility. Some of the criticism may be politically motivated, but surely the government can invest a bit more to find out a real figure on the jobs situation and not just rely on Employees Provident Fund data to show that the jobs market is fine.

Ninth, Modi is simply not using the economic think-tanks available to him wisely. He either thinks they offer no useful advice, or believes that his vision of doing the right things for the poor will help him cross the finish line in 2024. He could be seriously wrong.