Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

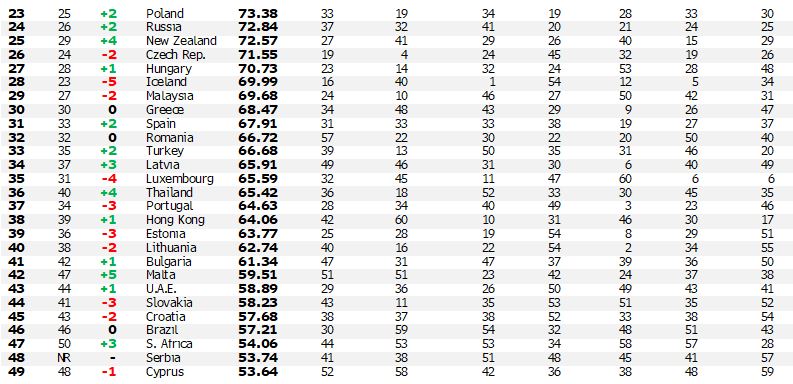

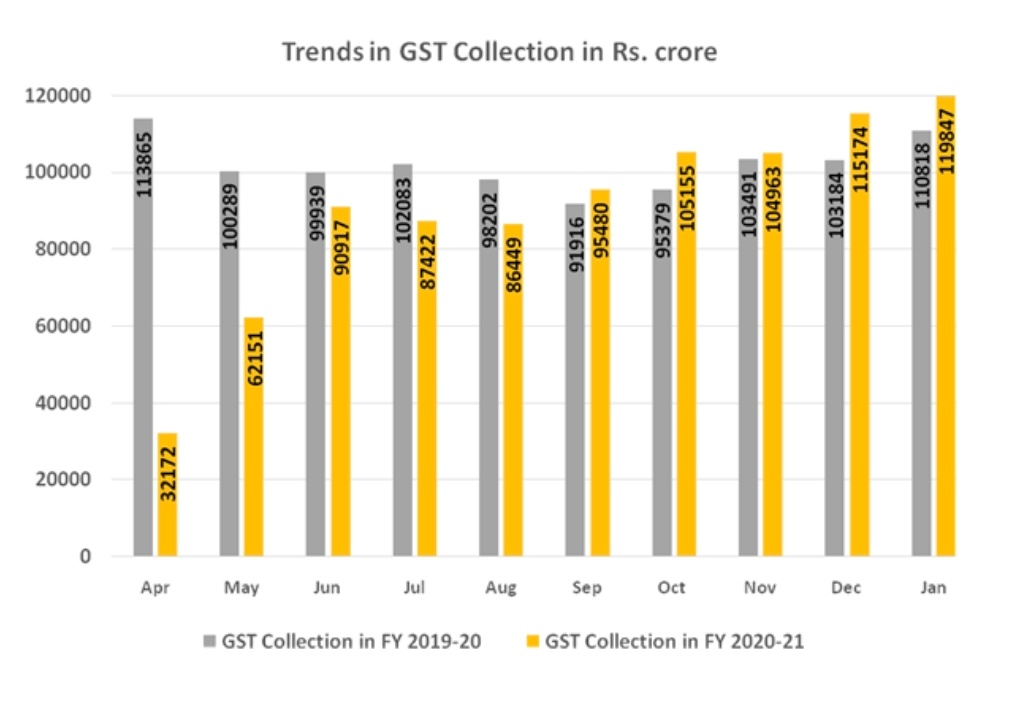

GST collections, filings scale new highs in January.

Goods and services tax (GST) collections touched a new high of nearly Rs 1.2 lakh crore in January, indicating a sharp recovery post lockdown and better compliance, manifested in record returns of 90 lakh.

The annual filing of GST returns by the extended deadline of December 31 may also have resulted in some businesses clearing their entire liability

and paying higher tax, experts said.

While finance minister Nirmala Sitharaman is set to lower the revenue estimates for the current financial year when she presents the Budget on

Monday, the latest data will provide cheer to policymakers grappling with the worst economic challenge in recent decades.

The numbers based on December sales, with returns filed in January, show that revenue from imports went up 16%, while the mop-up from domestic transactions, including services imports, was 6% higher.

“This is much better than anyone’s expectations. Usually, the end of a quarter (December in this case) is better than the initial months as companies push sales to meet quarterly targets. It seems imports have improved considerably. Christmas holidays would have seen marked improvement in people going out and on vacations. Some companies, particularly IT firms, are on a hiring spree, which would have meant more disposable income in the hands of people,” said Pratik Jain, who leads the indirect tax practice at consulting firm PwC in India.

Government sources said the recent crackdown against fraudsters has helped improve compliance and bolstered collections.Since mid-November, 274 people have been arrested with 2,700 cases lodged against 8,500 bogus entities. The drive, which leans heavily on data analysis, has helped collect Rs 858 crore from these entities.

“Closer monitoring against fake-billing, deep data analytics using data from multiple sources including GST, income tax and Customs IT systems, and effective tax administration have also contributed to the steady increase in tax revenue over the last few months,” the finance ministry said.

According to experts, the rising trend will continue in the coming months. “The surge in GST collections observed during the past four months is expected to be sustained in the coming months of the current fiscal with more service sector activities like aviation, hospitality, entertainment opening up,” said MS Mani, senior director at Deloitte India.

While anything over Rs 1 lakh in monthly collections is seen to be positive, for the last four months, the average monthly mopup has been to the tune of Rs 1.1 lakh crore.

The average year-on-year growth in GST revenue over the first four months in the second half of the financial year has been 8% compared to a 24% fall during the first half of the current financial year.

Goods and services tax (GST) collections touched a new high of nearly Rs 1.2 lakh crore in January, indicating a sharp recovery post lockdown and better compliance, manifested in record returns of 90 lakh.

The annual filing of GST returns by the extended deadline of December 31 may also have resulted in some businesses clearing their entire liability

and paying higher tax, experts said.

While finance minister Nirmala Sitharaman is set to lower the revenue estimates for the current financial year when she presents the Budget on

Monday, the latest data will provide cheer to policymakers grappling with the worst economic challenge in recent decades.

The numbers based on December sales, with returns filed in January, show that revenue from imports went up 16%, while the mop-up from domestic transactions, including services imports, was 6% higher.

“This is much better than anyone’s expectations. Usually, the end of a quarter (December in this case) is better than the initial months as companies push sales to meet quarterly targets. It seems imports have improved considerably. Christmas holidays would have seen marked improvement in people going out and on vacations. Some companies, particularly IT firms, are on a hiring spree, which would have meant more disposable income in the hands of people,” said Pratik Jain, who leads the indirect tax practice at consulting firm PwC in India.

Government sources said the recent crackdown against fraudsters has helped improve compliance and bolstered collections.Since mid-November, 274 people have been arrested with 2,700 cases lodged against 8,500 bogus entities. The drive, which leans heavily on data analysis, has helped collect Rs 858 crore from these entities.

“Closer monitoring against fake-billing, deep data analytics using data from multiple sources including GST, income tax and Customs IT systems, and effective tax administration have also contributed to the steady increase in tax revenue over the last few months,” the finance ministry said.

According to experts, the rising trend will continue in the coming months. “The surge in GST collections observed during the past four months is expected to be sustained in the coming months of the current fiscal with more service sector activities like aviation, hospitality, entertainment opening up,” said MS Mani, senior director at Deloitte India.

While anything over Rs 1 lakh in monthly collections is seen to be positive, for the last four months, the average monthly mopup has been to the tune of Rs 1.1 lakh crore.

The average year-on-year growth in GST revenue over the first four months in the second half of the financial year has been 8% compared to a 24% fall during the first half of the current financial year.

Re: Indian Economy News & Discussion - Nov 27 2017

An older but very pertinent article on why Desi taxpayers are the most unluckiest of all. Graphs shown are quite telling.

No wonder the clamour for H1Bs and GCs will never go away for the long foreseeable future

(Double taxed with both income tax+ indirect taxes on everything but ~0 in return since even basic things like water/security/electricity need to be arranged privately at steep costs. In place like Bluru, even basic sanitation and roads are a luxury and using NH again is with steep tolls)

Really hope that govt will consider some sops for this category too

Unjust taxes

No wonder the clamour for H1Bs and GCs will never go away for the long foreseeable future

(Double taxed with both income tax+ indirect taxes on everything but ~0 in return since even basic things like water/security/electricity need to be arranged privately at steep costs. In place like Bluru, even basic sanitation and roads are a luxury and using NH again is with steep tolls)

Really hope that govt will consider some sops for this category too

Unjust taxes

Re: Indian Economy News & Discussion - Nov 27 2017

Budget beginning shortly. January GST receipts were Rs.1.19 lakh crores as of 6pm on Jan 31

Budget notes:

- Admanirbhar and RBI stimuluses in 2020-21 totaled Rs.27 lakh crore ($375 billion).

- Admanirbhar Health Yojana (Rs.6.42 lakh crore / $89 billion over six years) plan for primary, secondary and tertiary healthcare

- Urban Swacch Bharat Mission (Rs.1.48 lakh crore / $20 billion)

- Rs.35,000 crore ($4.8 billion) for Covid vaccines

- Seven new mega textile parks above and beyond PLI to be set up in 3 years

- Rs.1.97 trillion ($27 billion) in manufacturing sector investments and incentives over 5 years.

- NHAI and PGCIL to contribute Rs5000 cr and Rs7000 cr respectively into InvITs (mutual fund like vehicles) to generate funding via equity gains.

- Capex sharply up to Rs.5.54 lakh crore ($77 billion) in 2022

- Focus on highway construction in TN, WB, KL

- Rs.1.18 trillion to MORTH, including 1.10 trillion Capex, highest ever.

- EDFC and WDFC both to be fully completed by June 2022

- Nationally 702km of metro rail operational, 1016km under construction.

- Consumers will have choice of more than one power discom.

- Fiscal deficit 9.5% in current year, estimated down to 6.8% next year.

- Ujjwala scheme to be expanded to further 10million home, totalling 90 million

- FDI in insurance allowed up to 74% up from 49%, foreign ownership allowed.

- SEBI to be regulator for gold exchanges

- LIC IPO in 2021-22

- Agri credit target raised to Rs.16.5 trillion ($230 billion)

- 1000 more Mandis integrated with e-Nam

- 5 fishing hubs

- Portal for gig workers and construction workers

Budget notes:

- Admanirbhar and RBI stimuluses in 2020-21 totaled Rs.27 lakh crore ($375 billion).

- Admanirbhar Health Yojana (Rs.6.42 lakh crore / $89 billion over six years) plan for primary, secondary and tertiary healthcare

- Urban Swacch Bharat Mission (Rs.1.48 lakh crore / $20 billion)

- Rs.35,000 crore ($4.8 billion) for Covid vaccines

- Seven new mega textile parks above and beyond PLI to be set up in 3 years

- Rs.1.97 trillion ($27 billion) in manufacturing sector investments and incentives over 5 years.

- NHAI and PGCIL to contribute Rs5000 cr and Rs7000 cr respectively into InvITs (mutual fund like vehicles) to generate funding via equity gains.

- Capex sharply up to Rs.5.54 lakh crore ($77 billion) in 2022

- Focus on highway construction in TN, WB, KL

- Rs.1.18 trillion to MORTH, including 1.10 trillion Capex, highest ever.

- EDFC and WDFC both to be fully completed by June 2022

- Nationally 702km of metro rail operational, 1016km under construction.

- Consumers will have choice of more than one power discom.

- Fiscal deficit 9.5% in current year, estimated down to 6.8% next year.

- Ujjwala scheme to be expanded to further 10million home, totalling 90 million

- FDI in insurance allowed up to 74% up from 49%, foreign ownership allowed.

- SEBI to be regulator for gold exchanges

- LIC IPO in 2021-22

- Agri credit target raised to Rs.16.5 trillion ($230 billion)

- 1000 more Mandis integrated with e-Nam

- 5 fishing hubs

- Portal for gig workers and construction workers

Re: Indian Economy News & Discussion - Nov 27 2017

Please use Budget thread for now.

Re: Indian Economy News & Discussion - Nov 27 2017

Manufacturing PMI hits 3 month high of 57.7 in January

India's factory activity expanded at its strongest pace in three months in January, fuelled by a continued recovery in demand and output, according to a private survey which also showed firms cut jobs at the slowest pace in 10 months.

The Nikkei Manufacturing Purchasing Managers' Index , compiled by IHS Markit, rose to 57.7 in January from December's 56.4, above the 50-level separating growth from contraction for the sixth straight month.

Sub indexes tracking new orders and output rose to their highest since October, indicating strong growth in demand.

"Factories continued to ramp-up production at an above-trend pace, and the sustained upturn in new work intakes suggests that there is room for capacity expansion in the near-term," noted Pollyanna De Lima, economics associate director at IHS Markit.

Re: Indian Economy News & Discussion - Nov 27 2017

https://swarajyamag.com/economy/jai-sit ... s-best-yet

Jai Sitha Raman. Why Finance Minister’s Third Budget Is Perhaps The Modi Government’s Best Yet

Jai Sitha Raman. Why Finance Minister’s Third Budget Is Perhaps The Modi Government’s Best Yet

Many things will be said about Nirmala Sitharaman’s third budget, a budget to revive the post-Covid economy. But the one thing it clearly testifies to is this: she has broken the Narendra Modi government’s tendency towards fiscal conservatism.

Finally, we have a truly growth-oriented budget, and many shibboleths of the past have been laid to rest.

Earlier, the surveys used to mutter darkly about priorities and reforms while the budgets went their own way. Not this time. Which is why bulls jumped over the moon, with the Sensex up over 2,300 points, or 5 per cent in one trading day.

This is why the fiscal deficit number is a high 9.5 per cent for 2020-21 instead of the expected 7-7.7 per cent.

Next year, it will be sharply lower at 6.8 per cent without any spending cuts, which implies that this time the growing denominator (GDP) will shrink the share of the deficit. Clever, and yet honest. Resonates with the survey’s claim that it is sustainable growth that will keep debt sustainable, and not vice-versa.

Second, despite the pushback against reforms, especially in the farm sector, the budget commits the government to not only move ahead with the privatisation of companies already put on the block (Bharat Petroleum, Air India, Shipping Corporation, Concor, etc), but adding two banks and one general insurance company to the list.

Third, the government has indirectly accepted that there is not going to be any revival of the investment cycle unless the government itself puts its shoulder to the wheel. This is why capital spending is rising 34 per cent next year to Rs 5.54 lakh crore, with another Rs 2 lakh crore being given to states and autonomous bodies.

Fourth, again making a virtue of necessity, the government is using the Covid crisis to boost health spending by more than two-fold, from around Rs 94,000 crore in the budget estimate of 2020-21 to nearly Rs 224,000 crore next year.

Re: Indian Economy News & Discussion - Nov 27 2017

Jaggi states another change in belief:

There's a saying in the US 'don't fight the Fed', i.e. don't invest contrary to what the US Federal Reserve system is doing to policymaking, because it amounts to an ant taking on a blue whale. When GoI now is at the front and center of a strong capex effort, the private sector feels emboldened to invest because they get to do it in the safety of the slipstream of the government's effors, in addition to the fact that there is FOMO (fear of missing out) if they don't invest while others grab the opportunity.

This is a good change in direction. There was an unnecessary lack of decisiveness earlier. The private sector isn't likely to invest enthusiastically if the government says 'pehle aap' - it would seem like the government is not sure about the situation itself.The earlier strategy was driven by a belief that government borrowings will crowd out private investment; now, there is the opposite belief, that government spending on infrastructure, partly funded by its own asset monetisation plans, will crowd in private investment. Way to go.

There's a saying in the US 'don't fight the Fed', i.e. don't invest contrary to what the US Federal Reserve system is doing to policymaking, because it amounts to an ant taking on a blue whale. When GoI now is at the front and center of a strong capex effort, the private sector feels emboldened to invest because they get to do it in the safety of the slipstream of the government's effors, in addition to the fact that there is FOMO (fear of missing out) if they don't invest while others grab the opportunity.

Re: Indian Economy News & Discussion - Nov 27 2017

https://swarajyamag.com/economy/no-fisc ... ight-notes

No Fiscal Penny-Pinching; Policy Corroboration, Focus On Healthcare And Infrastructure – Budget 2021 Hits The Right Notes

No Fiscal Penny-Pinching; Policy Corroboration, Focus On Healthcare And Infrastructure – Budget 2021 Hits The Right Notes

Firstly, India has finally gotten over the tyranny of rating agencies.

Secondly, a big push for healthcare infrastructure is a welcome move.

The Ayushmaan Bharat programme was already in place for a while covering the costs of specific treatment for about 50 crore Indians. But the physical infrastructure, including research institutions for future challenges, had not kept pace.

The 137 per cent increase in the Union Budget – a budgetary estimate of Rs. 2.27 lakh crore on healthcare is an investment in India’s human capital.

The PM Atmanirbhar Swasth Bharat Yojana will focus on this physical infrastructure. With an outlay of Rs. 64,180 crore over six years, about 29,000 health and wellness centres will come up under this programme around the country.

Every district will get an integrated public health lab. The government will help establish 12 central institutions and critical care hospital block in 602 districts.

The National Centre for Disease Control, its regional branches and metropolitan health surveillance units will be strengthened. India will also set up nine bio safety level III laboratories and four regional National Institutes for Virology, to complement the one in Pune.

These investments will have second order effects as well, not talked about in the Budget speech.

This physical infrastructure will lead to new investments in medical device manufacturing and pharmaceutical industry in general. That also dovetails with the Production Linked Incentive programme government is running for 13 industries to increase local manufacturing footprint – pharmaceutical industry is part of that.

Thirdly, the stress on building physical and financial capital continues. The government has the National Infrastructure Pipeline of Rs. 120 lakh crore to fund over the next five years.

Creation of a Development Finance Institution is a big step in funding this massive outlay.

The budgetary allocation itself has increased 34.5 per cent to Rs. 5.54 lakh crores, which is a good sign.

Fourthly, the most important statement of policy continuity was on divestment.

What the government has outlined is quite ambitious and will face stiff resistance from narrow interest groups and of course from the central government employees themselves.

The new policy has identified four strategic areas – atomic energy, space and defence, transport and telecommunications, power, petroleum, coal and minerals and banking, insurance and financial services. The policy says that outside of these areas, all public sector enterprises will be either privatised or closed.

Re: Indian Economy News & Discussion - Nov 27 2017

Exclusive | Govt won't own or fund 'Bad Bank’, loans worth Rs 2.25 lakh crore to be shifted to new entity

The government is preparing to bring stressed assets worth Rs 2.25 lakh crore under the proposed ‘Bad Bank’. The entity which will be entirely funded and managed by commercial banks, said two top bureaucrats in an exclusive interaction on February 2. As per the plan, bad loans above Rs 500 crore will be brought under the entity from 68-70 accounts, they said. The entity will be floated soon.

.

.

The funding will be done by banks from both the private sector and the public sector, they said. It is not clear what is initial capital estimated for setting up the Bad Bank.

Read full article from MoneyControl//

https://www.moneycontrol.com/news/busin ... 33831.html

The government is preparing to bring stressed assets worth Rs 2.25 lakh crore under the proposed ‘Bad Bank’. The entity which will be entirely funded and managed by commercial banks, said two top bureaucrats in an exclusive interaction on February 2. As per the plan, bad loans above Rs 500 crore will be brought under the entity from 68-70 accounts, they said. The entity will be floated soon.

.

.

The funding will be done by banks from both the private sector and the public sector, they said. It is not clear what is initial capital estimated for setting up the Bad Bank.

Read full article from MoneyControl//

https://www.moneycontrol.com/news/busin ... 33831.html

Re: Indian Economy News & Discussion - Nov 27 2017

good discussion & lots of good data points..........

INTERVIEW | Government can't sustain handouts indefinitely, says Expenditure Secretary TV Somanathan

https://www.moneycontrol.com/news/busin ... 36861.html

INTERVIEW | Government can't sustain handouts indefinitely, says Expenditure Secretary TV Somanathan

..............Somanathan said it was a conscious decision by the government to invest in infrastructure projects which will create jobs rather than provide further handouts, as the former will have long-term benefits.

Q: Finance Minister Nirmala Sitharaman has allocated Rs 35,000 crore for the COVID-19 vaccination programme in the coming year. “Without those measures our revised expenditure would have been Rs 36 lakh crore instead of Rs 34 lakh crore,” Somanthan said.

A: We do not have a specific number in mind. The costing, the cost sharing, pricing, these are as of now open questions, which will be decided between NITI Aayog, the Ministry of Health and others who are involved. From the Finance Ministry's point of view, there is an approximate knowledge of what the unit costs are. What I can say, if you take the cost of vaccinating one person, I would estimate it at roughly Rs 700 - assuming two doses per person and assuming incidentals such as syringe, transportation, cold storage......Which means the amount of money provided, if it was exclusively provided by the Budget, is sufficient to inoculate about 50 crore people.

Read full article from MoneyControl//That is because, through the expenditure rationalisation measures, we have saved around Rs 1.7 lakh crore.

https://www.moneycontrol.com/news/busin ... 36861.html

Re: Indian Economy News & Discussion - Nov 27 2017

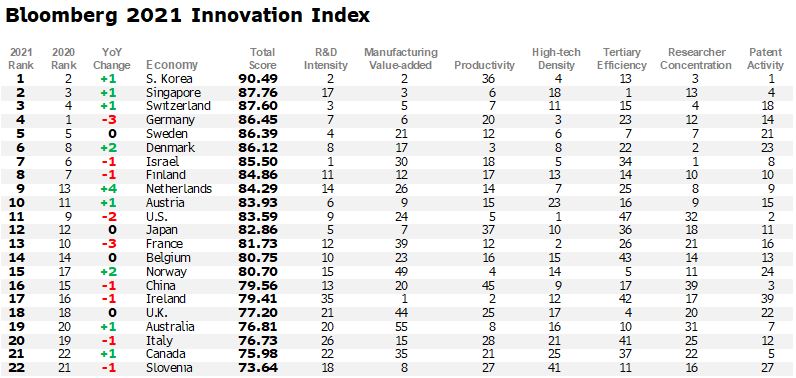

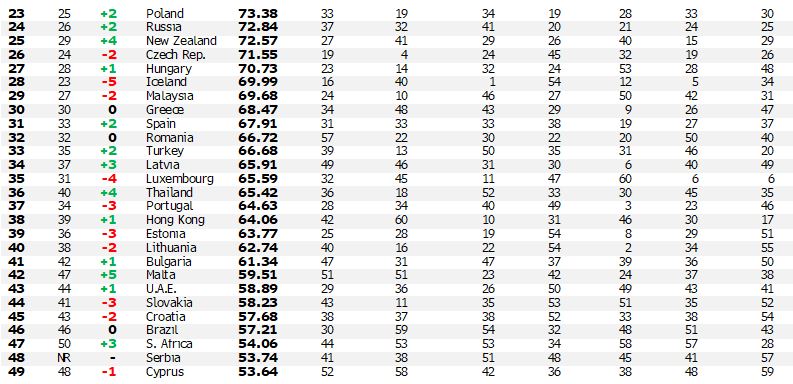

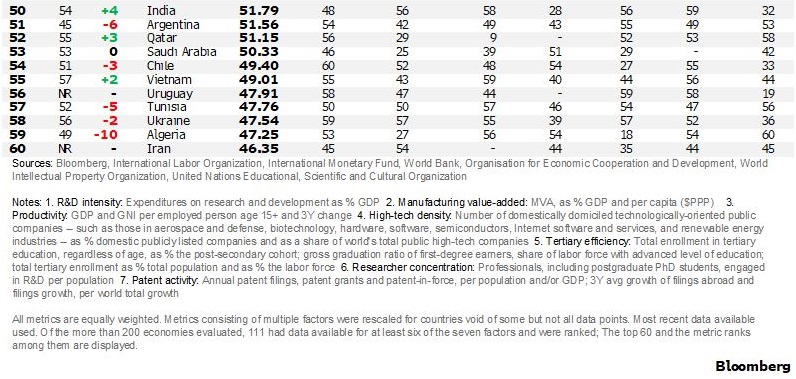

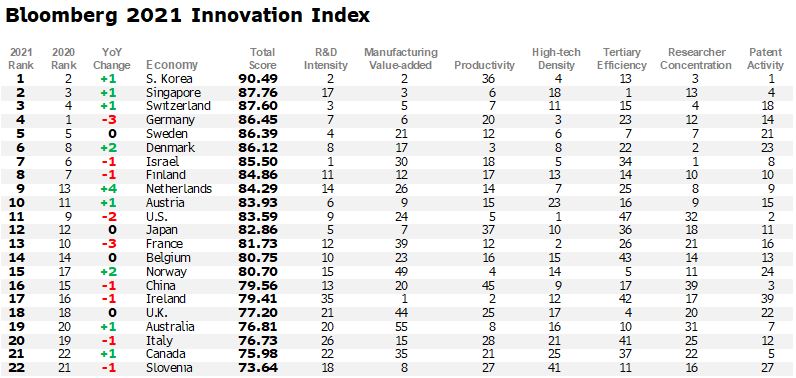

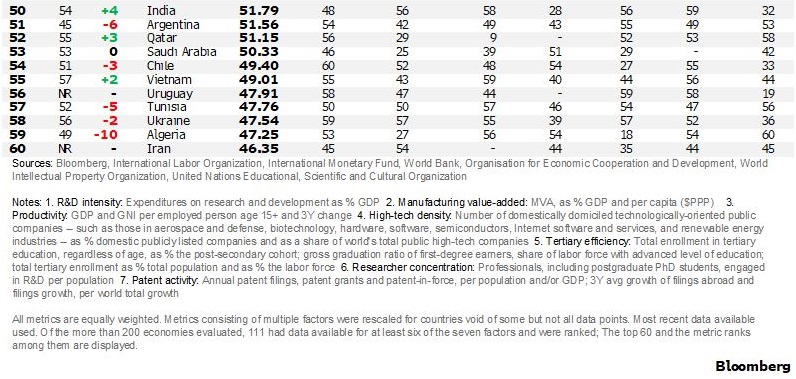

India returns to the top 50 in the Bloomberg Global Innovation Index after five years:

R&D intensity, MVA as % of GDP and Productivity should all see significant gains in the short term due to growth focused policymaking since the budget. Tertiary efficiency and researcher concentration will take longer to address.

R&D intensity, MVA as % of GDP and Productivity should all see significant gains in the short term due to growth focused policymaking since the budget. Tertiary efficiency and researcher concentration will take longer to address.

Re: Indian Economy News & Discussion - Nov 27 2017

Ministry of Finance@FinMinIndia · Jan 31

GST Revenue collection for January 2021 almost touches ₹1.20 lakh crore

Revenues for month of January 2021 are 8% higher than GST revenues in same month last year

GST revenues during January 2021 are the highest since introduction of GST

https://pib.gov.in/PressReleaseIframePa ... ID=1693779

Re: Indian Economy News & Discussion - Nov 27 2017

via@gchikermaneI've tracked the @FinMinIndia for many years now.

Never have I seen anyone speak with so much passion, clarity and conviction about the economy as @SubramanianKri and @sanjeevsanyal did yesterday with #EconomicSurvey2021.

https://www.youtube.com/watch?v=fe13dxJ ... e=youtu.be

Economic Survey 2020-21: Press Conference by Chief Economic Advisor Dr KV Subramanian

Re: Indian Economy News & Discussion - Nov 27 2017

UPI records 2.3 billion transactions worth Rs 4.2 trillion in January 2021: NITI Aayog CEO

As many as 2.3 billion transactions worth Rs 4.2 trillion were recorded through Unified Payment Interface (UPI) in the month of January this year, NITI Aayog CEO Amitabh Kant said on Wednesday.

Kant further said that UPI's transactions value jumped 76.5 per cent while transaction value jumped nearly 100 per cent.

"Phenomenal! UPI recorded 2.3 billion transactions worth Rs 4.3 trillion in Jan 2021. On a YOY basis, UPIs transaction value jumped 76.5 % while transaction value jumped nearly 100%. Took UPI 3 years to cross 1 billion transactions a month. Next billion came in less than a year," the NITI Aayog CEO tweeted.

UPI is a common system that powers multiple bank accounts into a mobile application, merging several banking Kant further said that UPI's transactions value jumped 76.5 per cent while transaction value jumped nearly 100 per cent.

Industry features, seamless fund routing and merchant payments. It also caters to the "Peer to Peer" collect request which can be scheduled and paid as per requirement and convenience.

As many as 2.3 billion transactions worth Rs 4.2 trillion were recorded through Unified Payment Interface (UPI) in the month of January this year, NITI Aayog CEO Amitabh Kant said on Wednesday.

Kant further said that UPI's transactions value jumped 76.5 per cent while transaction value jumped nearly 100 per cent.

"Phenomenal! UPI recorded 2.3 billion transactions worth Rs 4.3 trillion in Jan 2021. On a YOY basis, UPIs transaction value jumped 76.5 % while transaction value jumped nearly 100%. Took UPI 3 years to cross 1 billion transactions a month. Next billion came in less than a year," the NITI Aayog CEO tweeted.

UPI is a common system that powers multiple bank accounts into a mobile application, merging several banking Kant further said that UPI's transactions value jumped 76.5 per cent while transaction value jumped nearly 100 per cent.

Industry features, seamless fund routing and merchant payments. It also caters to the "Peer to Peer" collect request which can be scheduled and paid as per requirement and convenience.

Re: Indian Economy News & Discussion - Nov 27 2017

Deleted . Not the thread for political commentary.

Re: Indian Economy News & Discussion - Nov 27 2017

One nation one ombudsman: RBI to integrate consumer grievance redressal scheme

PTI Last Updated: Feb 05, 2021, 03:19 PM IS

MUMBAI: The Reserve Bank on Friday announced it will be integrating consumer grievances redressal under a single ombudsman as against three schemes working at present.

.

.

The RBI is targeting to roll out the e-Integrated Ombudsman Scheme in June 2021, he said.

https://economictimes.indiatimes.com/ne ... content=23

PTI Last Updated: Feb 05, 2021, 03:19 PM IS

MUMBAI: The Reserve Bank on Friday announced it will be integrating consumer grievances redressal under a single ombudsman as against three schemes working at present.

.

.

The RBI is targeting to roll out the e-Integrated Ombudsman Scheme in June 2021, he said.

https://economictimes.indiatimes.com/ne ... content=23

Re: Indian Economy News & Discussion - Nov 27 2017

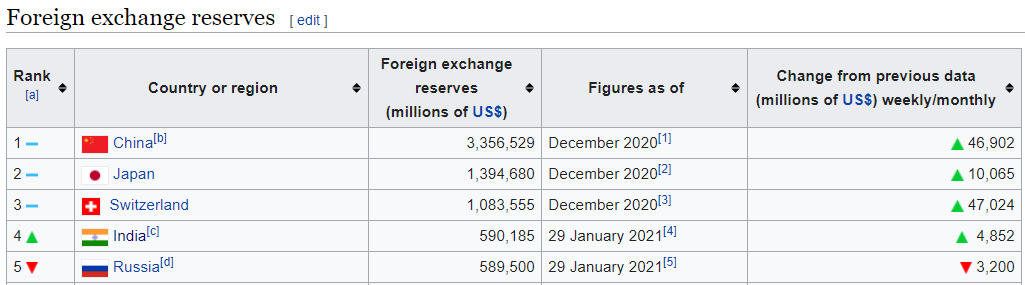

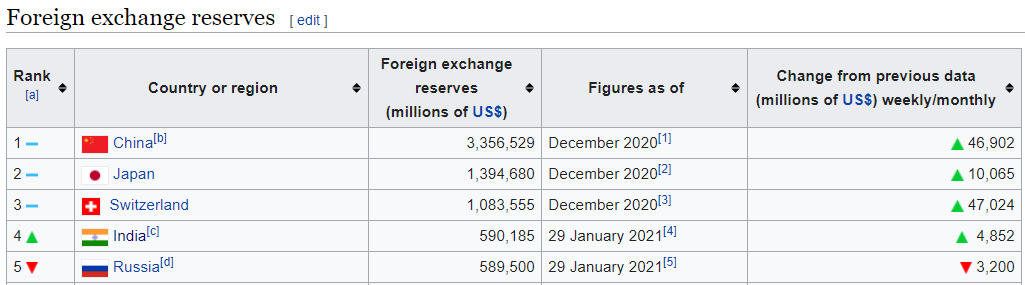

Looks like we went ahead of Russia this week and now are the 4th largest forex holders in the world. We have $590 B Forex reserves.

--Vamsee

--Vamsee

Re: Indian Economy News & Discussion - Nov 27 2017

RBI telegraphing low probability of any negative rate hike interventions, important in the context of significant spending plans in the budget:

RBI lowers inflation projection to 5.20% for Q4 FY21, sees it around 5 pc in H1 next fiscal

RBI lowers inflation projection to 5.20% for Q4 FY21, sees it around 5 pc in H1 next fiscal

India has received $358 billion in FDI over past six yearsIn its last monetary policy review of this fiscal, the RBI has decided to keep the key repo rate unchanged at 4 per cent with accommodative stance to ensure that inflation remains within the target, RBI Governor Shaktikanta Das said while unveiling the policy on Friday. Das also said the retail inflation has “returned within the tolerance band” of 4 per cent.

The Reserve Bank has the mandate to keep retail inflation at 4 per cent with a bias of plus/minus 2 per cent on either side.

RBI MPC Meeting HighlightsIndia has received USD 358.3 billion foreign direct investment (FDI) in the last six financial years (2014-20), Minister of State for Commerce and Industry Som Parkash informed the Lok Sabha on Wednesday.

“In the last six financial years (2014-20), India has received FDI inflow worth USD 358.30 billion which is 53 per cent of the FDI reported in the last 20 years (USD 681.87 billion),” he said in a written reply to the Lok Sabha.

- Repo rate unchanged at 4%

- 2021-22 GDP growth estimated to be 10.5%

- FPI investors allowed to invest in debt instruments of asset reconstruction companies.

- Continues to be major dollar buyer, but strong Rupee may still test 72.5/$ mark

Re: Indian Economy News & Discussion - Nov 27 2017

Two important elements from the above.Suraj wrote:- Repo rate unchanged at 4%

- 2021-22 GDP growth estimated to be 10.5%

- FPI investors allowed to invest in debt instruments of asset reconstruction companies.

- Continues to be major dollar buyer, but strong Rupee may still test 72.5/$ mark

1. GDP growth rate is inflation-adjusted at 10.5%. At 5% inflation level, the GDP growth is 15-16% expected for 2021-22.

2. By buying the dollar and selling rupee, RBI is ensuring that Rupee stays within 70-75 mark. So expect more rise in dollar reserves. This actually gives a lot of heft to India.

Re: Indian Economy News & Discussion - Nov 27 2017

Yes of course, RBI always reports real GDP growth projections.

GOI and RBI remain fixated on the $5 trillion target, and indicate that the 2021-22 Budget will drive capex investments to drive high growth for the next three years. However, reading between the lines, I think this also opens the door to Rupee strengthening above 70 . After all there are two ways to get to a dollar target - increase growth (bigger numerator) and strengthen the currency (lower denominator). At almost $600 billion in forex reserves it's not clear RBI will continue to permit reserves accretion by ~$150 billion a year like in 2020.

GOI and RBI remain fixated on the $5 trillion target, and indicate that the 2021-22 Budget will drive capex investments to drive high growth for the next three years. However, reading between the lines, I think this also opens the door to Rupee strengthening above 70 . After all there are two ways to get to a dollar target - increase growth (bigger numerator) and strengthen the currency (lower denominator). At almost $600 billion in forex reserves it's not clear RBI will continue to permit reserves accretion by ~$150 billion a year like in 2020.

Re: Indian Economy News & Discussion - Nov 27 2017

I can understand China and japan, major economies having a high forex reserves, but what’s Swiss doing in 3rd place in that list?Vamsee wrote:Looks like we went ahead of Russia this week and now are the 4th largest forex holders in the world. We have $590 B Forex reserves.

--Vamsee

Re: Indian Economy News & Discussion - Nov 27 2017

This may be a really dumb question but I couldn't find the answer anywhere else so hoping someone can clarify.

The process for accounting for real/nominal growth and adjustment for inflation etc is quite clear with positive growth in the GDP. If a country has for example, GDP of 3T, real growth of 5% and inflation of 5%, the nominal growth of 10% should take the GDP at the end of that period to 3.3T I think.

How does the real/nominal GDP growth and inflation play into the situation where we have negative growth though. Given that Indian economy is supposed to have contracted by 7.5% this fiscal, is that 7.5 % the total contraction after adjusting for inflation etc i.e taking the example GDP above 3T - 7.5% or is it 3T - (7.5% + % inflation) or is it 3T - (7.5% - % inflation)?

The process for accounting for real/nominal growth and adjustment for inflation etc is quite clear with positive growth in the GDP. If a country has for example, GDP of 3T, real growth of 5% and inflation of 5%, the nominal growth of 10% should take the GDP at the end of that period to 3.3T I think.

How does the real/nominal GDP growth and inflation play into the situation where we have negative growth though. Given that Indian economy is supposed to have contracted by 7.5% this fiscal, is that 7.5 % the total contraction after adjusting for inflation etc i.e taking the example GDP above 3T - 7.5% or is it 3T - (7.5% + % inflation) or is it 3T - (7.5% - % inflation)?

Last edited by Bart S on 06 Feb 2021 02:47, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

I think that it is because they sell a lot of their currency in exchange for a lot of foreign currency in a bid to keep their currency from appreciating. They are a small country but a pretty powerhouse economy for their size.Vadivel wrote:I can understand China and japan, major economies having a high forex reserves, but what’s Swiss doing in 3rd place in that list?Vamsee wrote:Looks like we went ahead of Russia this week and now are the 4th largest forex holders in the world. We have $590 B Forex reserves.

--Vamsee

Re: Indian Economy News & Discussion - Nov 27 2017

Inflation is a positive figure in the calculation. The calculation would therefore be 3T - 7.5 + inflation if treated that simplistically. Inflation reduces the hit here.

Regarding the Swiss, they are a major presence in the forex and carry trade market along with the Japanese. High demand for currency leads to strengthening currency that a country may not desire (same as India) and they respond by growing foreign reserves as they keep their exchange rate stable.

Regarding the Swiss, they are a major presence in the forex and carry trade market along with the Japanese. High demand for currency leads to strengthening currency that a country may not desire (same as India) and they respond by growing foreign reserves as they keep their exchange rate stable.

Re: Indian Economy News & Discussion - Nov 27 2017

^^^

Further to our growing forex reserves: India is a net creditor now

https://www.business-standard.com/artic ... 064_1.html

If you see Indias forex reserves, India has forex reserves more than $590 billion, which is the highest ever. And it is up by $119 billion from the previous year. And if you look at the external debt, it is only $554 billion. So considering the forex reserves, India is now a net creditor," the minister said.

Further to our growing forex reserves: India is a net creditor now

https://www.business-standard.com/artic ... 064_1.html

If you see Indias forex reserves, India has forex reserves more than $590 billion, which is the highest ever. And it is up by $119 billion from the previous year. And if you look at the external debt, it is only $554 billion. So considering the forex reserves, India is now a net creditor," the minister said.

Re: Indian Economy News & Discussion - Nov 27 2017

The PLI scheme has been a big success, expanding to cover more and more areas. Consumer durable goods are a major import being targeted:

Govt rolls out Rs.6200 cr PLI scheme to boost local AC and LED light production

They can drastically cut the import bill by ensuring all TVs, computers, fridges, washers, ACs, LED bulbs etc are locally made. Any value added item that can be volume made locally is a logical target for a scheme like PLI that offers incentive to greater production.

Govt rolls out Rs.6200 cr PLI scheme to boost local AC and LED light production

They can drastically cut the import bill by ensuring all TVs, computers, fridges, washers, ACs, LED bulbs etc are locally made. Any value added item that can be volume made locally is a logical target for a scheme like PLI that offers incentive to greater production.

Re: Indian Economy News & Discussion - Nov 27 2017

I am just curious , isnt this a too simplistic view of looking at it ? Are there any other measures we can use to assess the same ?Kaivalya wrote:^^^

Further to our growing forex reserves: India is a net creditor now

https://www.business-standard.com/artic ... 064_1.html

If you see Indias forex reserves, India has forex reserves more than $590 billion, which is the highest ever. And it is up by $119 billion from the previous year. And if you look at the external debt, it is only $554 billion. So considering the forex reserves, India is now a net creditor," the minister said.

Re: Indian Economy News & Discussion - Nov 27 2017

Forex reserves are usually expressed in terms of weeks or months or import cover, or their relationship to aggregate external debt. There's nothing unusual in the minister's statement. When India holds $220 billion of US treasury debt, that's effectively money India lends to the US as a creditor, and the RBI in turn holds debt issued by the US government, for which it gets interest income equal to the coupon of the treasury bonds it holds.

When some American or Briton talks about 'aid received by India' they don't realize that the Indian government is a creditor to them - far more so than any aid India has ever received from them cumulatively. They might say 'oh that's just treasury debt, not aid', but pretty much all of India's 'aid' is loans too, not grants.

For example, World Bank has two arms - IBRD the lending entity and IDA the development support organization for poor countries. Indian WB 'aid' comes as conventional loans from the IBRD, not concessional loans and grants from the IDA - the latter are meant for the poorest countries and India does not even qualify for IDA grants, and has not done so in many years.

Pretty much all of Indian 'aid' is a standard financial transaction, same as treasury borrowing that constitutes Indian holdings of US or UK debt within our forex reserves.

When some American or Briton talks about 'aid received by India' they don't realize that the Indian government is a creditor to them - far more so than any aid India has ever received from them cumulatively. They might say 'oh that's just treasury debt, not aid', but pretty much all of India's 'aid' is loans too, not grants.

For example, World Bank has two arms - IBRD the lending entity and IDA the development support organization for poor countries. Indian WB 'aid' comes as conventional loans from the IBRD, not concessional loans and grants from the IDA - the latter are meant for the poorest countries and India does not even qualify for IDA grants, and has not done so in many years.

Pretty much all of Indian 'aid' is a standard financial transaction, same as treasury borrowing that constitutes Indian holdings of US or UK debt within our forex reserves.

Re: Indian Economy News & Discussion - Nov 27 2017

Thanks for the clarification!

Re: Indian Economy News & Discussion - Nov 27 2017

Suraj san - Apologies if this is out of topic. Sometimes I get carried away.

For an example of implications of china's net creditor status of 1.5 T$ here is a study from harvard business review

https://hbr.org/2020/02/how-much-money- ... -owe-china

For an example of implications of china's net creditor status of 1.5 T$ here is a study from harvard business review

https://hbr.org/2020/02/how-much-money- ... -owe-china

Re: Indian Economy News & Discussion - Nov 27 2017

https://news.bitcoin.com/indian-governm ... rency-law/

Govt. has proposed a bill to ban all "Private Crytocurrencies" aka Bitcoin, Ether, etc. & Introduce Digital Rupee.

https://swarajyamag.com/economy/why-ind ... uy-bitcoin

Govt. has proposed a bill to ban all "Private Crytocurrencies" aka Bitcoin, Ether, etc. & Introduce Digital Rupee.

Considering our Gold import bill & Bitcoin touted as an Asset Class investment & Digital Gold, I don't see the rationale behind this. None of the G20 economies have "banned" any crypto.The bill seeks to ban cryptocurrencies while creating a framework for the official digital currency to be issued by the central bank, the Reserve Bank of India (RBI).

GoI's hurry to bring this legislation via Ordinance rather than taking all stakeholders into confidence reels of something serious that is not in public domain.The PMO, Finance Ministry, and Cabinet Secretariat have started preparing the draft details of the ordinance. The government is of the firm view that they want to introduce the law within a month of clearance of the ordinance.

Alternate view from Swarajya“They want this bill to be cleared as soon as possible,” reporter Timsy Jaipuria noted. She added that “the cabinet is understood to have given clearance to this particular proposal that this bill can be introduced via an ordinance route in its last meeting which was held on Feb. 3.”

https://swarajyamag.com/economy/why-ind ... uy-bitcoin

OTOH Pakistan Govt has sanctioned 2 State Owned Bitcoin mining farms, so are Ukraine & few others. USA govt. owns 70k+ bitcoins & China some undisclosed quantity. Hard to explain GoI's bellicosity towards Crypto. It's too small in India to be of any threat to any kind of financial order.One of the likely justifications is to protect India's national security. But as we'll see, Bitcoin and allied decentralised technologies are actually essential to India's national security.

As such, if India bans cryptocurrency, it doesn't just criminalise the holdings of countless innocent Indians. It repels a trillion dollars in crypto capital from coming to India in the first place. The proposed crypto ban would itself cause capital flight.

Re: Indian Economy News & Discussion - Nov 27 2017

There's a separate thread for blockchain and crypto. Please develop the conversations there. Official regulation of blockchain technology and cryptocurrencies are an entire topic in themselves and are nowhere as simplistic as one post makes it out to be.

-

Mort Walker

- BRF Oldie

- Posts: 10046

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Indian Economy News & Discussion - Nov 27 2017

Thanks for posting this. PM Modi also made a big announcement some time back on Twitter.kit wrote:India Building a $60 billion NG Grid Pipeline

$60 Billion Natural Gas Grid: Challenges And Prospects

Re: Indian Economy News & Discussion - Nov 27 2017

A thought-provoking analysis by S.Gurumurthy about the role of RBI in generating (or suppressing) growth. Apparently, there is still an element of risk from RBI policy, so how they approach the NPA issue is key.

Posting the full article as it has raised some important points, including how RBI can (and did) play a role in suppressing growth earlier, thanks to a certain rockstar economist. The timeline described in the article is important for future reference. And since the post-Covid economy is poised for a sustained period of growth, on the back of a great investment-driven budget, we need to be cognizant of risks that could derail our plans. Please read in full and share.

What can torpedo the budget and economy? - S. Gurumurthy, TNIE

Posting the full article as it has raised some important points, including how RBI can (and did) play a role in suppressing growth earlier, thanks to a certain rockstar economist. The timeline described in the article is important for future reference. And since the post-Covid economy is poised for a sustained period of growth, on the back of a great investment-driven budget, we need to be cognizant of risks that could derail our plans. Please read in full and share.

What can torpedo the budget and economy? - S. Gurumurthy, TNIE

I hear from (business) borrowers that the norms have been eased somewhat (not sure whether due to FinMin or RBI directives), but banks have been a bit more easy on borrowers with outstanding debt. Perhaps it's due to the Covid-relief measures, which means the prior system of exact accounting of NPAs will indeed be back in force, as per SG, the Rajan-era NPA norms haven't really been diluted. Given SG's pull with this govt, I hope NS is made aware of this issue and some discussions have been initiated with RBI to walk back some of their prescriptions.The Reserve Bank of India now forecasts a base level NPA of 13.5% to a worse case level of 14.8% by September 2021. This recalls the peak NPA of 14.6% in 2017-18. The question is: will the Rajan whip of 2016 be back to force provide for NPAs.

The Covid-hit world GDP shrank by 3.5% in 2020. Shoppers have fallen by 20% in the US and 97% in Germany compared to pre-Covid levels. Many analysts believe that global travel and tourism won’t return to the pre-pandemic normal until 2025. The Western world is still grimly fighting the Covid menace.

World looks to India

Against this background, the IMF projects that the growth of India (11.5%), China (8.2%) and the US (5.1%) would lead the global recovery. India’s Economic Survey projects the Nominal GDP growth at 14+% and the Real at 11%. India, which seems to have overcome the Covid-19 challenge, invented its own vaccine and is poised to make billions of vaccines for the world. And the world is keen to include India in the global supply chain hitherto dominated by China. The world’s expectation is a new geo-political status for India. If India grows, it will recover and contribute to the world’s recovery and win acclaim. If it dithers, not only the huge investment it is making for growth will go down the drain, it will also disappoint the world. Stakes are huge.

Fundamental differentials

The risks to India’s well-conceived growth in the Budget lie not in, but outside, the Budget. It is obvious to the eyes of those who look deep into the fundamental differentials that set India apart. As the saying goes, what is obvious is the most difficult to detect. Deep fundamental differences distinguish the Indian economy from the Anglo-Saxon West it tends to copy. While India is dominantly family-oriented, the West is predominantly individualist. This differential affects not only spending, savings and investment, but also the State-Individual financial relations and a host of economic issues.

The default savings mode in Anglo-Saxon economies is equity. But that is the last option in India. Indian families prefer safe, not risky, investments because traditional families have to take care of elders, infirm and unemployed through their own savings. That burden is outsourced to governments in the Anglo-Saxon world by universal social security and pension schemes. This enables the individual freed from such obligations to go for risky savings and lavish spending. The traditional Indian families therefore save a lot. Theirs is about one-fifth of the national savings.

And most of it is in safe mode. The latest RBI data says that bank deposits constitute 51.5% of the financial savings, PF and pension funds 26.2%, and insurance 17.14%, making the safe investment 94.8% -- leaving just 5.2% in risky equity. A study says just 18 million Indians invest in equities. In contrast, 55% of American adults invest in equity. Why? The universal social security in the US frees families from the need for safe savings, and allows them to spend lavishly. The Indian government will go bankrupt if it thinks of universal social security.

The celebrated high Sensex and Nifty are driven by global liquidity, not domestic risk savings. If the Indian savings go mostly into banks, Indian business finance cannot but be bank-driven. All attempts from the 1990s to turn the Indians away from banks to Dalal Street have failed. Indian economy will continue to be bank driven till Indians give up their traditional family culture. Being a bank-based economy is no shame. It is no sign of financial backwardness as the US used to mock Japan before 2008. Like Indians, Japanese, too, invest less than 10% of their savings in equity. Also, only one in seven Germans invest in equity. And yet Japan and Germany are efficient. Now it is necessary to recall how not factoring the Indian differential into the prudential norms for providing bank credit to business did the Indian economy in from 2016, as a similar situation is emerging in 2021-22.

An instructive recall

Raghuram Rajan was Chief Economic Adviser to the UPA II from August 2012 to September 2013, and from September 2013 to September 2016 he was the RBI governor. As governor, Rajan cornered glory for detonating the Non Performing Assets (NPA) bomb on the Modi 1.0 regime, even though Rajan himself had said that reckless lending by banks in 2006-08 was the origin of bad loans and blamed the UPA decade for the bad loan mess [theprint.in 11.9.2018].

Rajan could not deny knowing that the NPA had been kept neutralised by loan restructuring schemes and he had accepted that model from 2012 to 2016. The 2012-13 Economic Survey Rajan had authored as Advisor to the UPA II said that “some sectors are experiencing” NPAs because of slowdown and high levels of leverage, adding that some of the reasons for the increase in NPAs are technical, but stress also stems from slow growth and project delays.

A revival of growth will help contain NPAs.” Rajan first talked about NPA only a year after he became governor, on September 15, 2014 at the FICCI/IBA Banking Conference where he just said, “NPAs have increased.” The Rajan-led RBI report released in September 2014 said the ‘NPAs had risen because of cyclical downturn but their growth had moderated,’ cautioning not to be overly confident “the worst is over”. Further, the Rajan-headed RBI report in August 2015 spoke of the NPAs rising steadily from 2.2% in 2010 to 4.7% in 2015.’ That was all.

Despite being in the know of the NPAs before 2008, either as Advisor to the UPA in 2012, and as the RBI governor in 2013 till mid-2016, Rajan never foresaw or forced an NPA crisis. And even as the NPA was rising, the economy too was doing extremely well with the GDP rising from 6% in 2013-14 to 8% in 2014-15 and to 8.2% in 2015-16. Suddenly, in mid-2016 Rajan wielded his sledgehammer and mandated that all NPAs must be identified on arithmetic formulae and provided for, even if the debtor was viable, driving the entire banking system and the economy into despair.

NPA sledgehammer in 2016, GDP crash

Under the force of the Rajan mandate, the NPA of 5% in 2014-15 shot up to 9.3% in 2015-16, 11.7% in 2016-17 and 14.6% in 2017-18. The consequences were enormous and predictable. Forced provisions eroded banks’ capital, landing them in crisis. The government had to shell out `3.2 lakh crore to recapitalise the banks. This affected the government’s fiscal side. In the melee and time gap between provisioning and recap, the banks’ credit to business declined and the economy crashed.

The credit to industry declined; as of November 2020 it stood almost where it was five years ago. The credit to Micro and Small Enterprises, too, declined and stood in November 2020 at less than where it was five years ago. And the GDP growth that had taken off from 6% in 2013-14 to a high of 8.2% in 2015-16 and stood at 7.2% in 2016-17, crashed to 5% in 2019-20. Compare this with what happened from 2014-15 to 2016-17. The hidden NPA from 2006-08 did exist in 2016, but that did not affect growth, as it did not stop credit delivery. Even when the debt is secured by collaterals and recoverable and the debtor is viable, Rajan mandated provisioning and that strangled credit delivery and consequently cost the growth from 2016.

The torpedo replay of 2016-18 in 2021-23

The RBI now forecasts a base level NPA of 13.5% to a worse case level of 14.8% by September 2021. This recalls the peak NPA of 14.6% in 2017-18. The question is: will the Rajan whip of 2016 be back to force provide for NPAs. If it does, the government will find it difficult to realise the dream growth projected by the Budget 2021. It may even have a crisis on its hand with banks forced to make arithmetic-based provision landing in losses and the government having to recap the banks. A replay of the 2016 whip can torpedo and sink the Budget and the economy.

When Rajan cracked the whip in 2016, the banks had no surplus funds, till the fortuitous demonetisation put funds in their hands. Now, in January 2021, the banks, unable to find borrowers to lend, have a surplus of 6.72 lakh crore, which they have parked with the RBI at 3.35%. Everyone pretends, like the emperor in clothes, that there is just credit aversion and so no borrowers. But the reality is that the viable borrowers — all of whom are unlisted companies and MSMEs — hit by downturn have been declared as defaulters and disqualified to borrow.

Banks can generate funds overnight but cannot create borrowers instantly. Borrowers are the asset base of the banks. With the borrowers shut out, banks can’t and therefore don’t lend. How long can banks keep the monies with RBI at such low interest as 3.35%? Banks thrive on lending and earning margin on interest paid. If they do not lend they do not earn at all. If the banks got into difficulties by recklessly lending in the UPA period, they will now get into trouble by not lending. Besides, there is a paradox of liquidity infusion and liquidity absorption happening at the same time. The RBI is infusing liquidity into the banking system as Covid-19 stimulus on the one hand, and on the other, the banks are depositing surplus cash with the RBI!

Learn from the Japanese experience

Here is Japanese experience that can help India. In the late 1990s, Japanese banks made crash provision for NPAs. Consequent recap of banks cost the Japanese government a trillion dollars. The Japanese also brought the same bankruptcy law we adopted. In a paper titled “Japan’s disposal of bad loans: failure or success. A review of Japan’s experience with bad debt disposals and its implications for global financial crisis,”

Richard Coo and Masaya Sasaki of Nomura Research Institute [March 2010] reviewed the Japanese experience and concluded that there is no need to rush to bad debt disposal and it is possible to deal with the problem at minimum cost to the taxpayers by “putting the time on our side”, adding the government must encourage banks to dispose of their bad loans gradually in a credible fashion. Unlike our banks whose funds were frozen in sticky loans in functioning businesses, Japanese banks lost money in asset bubbles that would take longer to recover. The lesson from Japan is self-evident: Give time to banks to deal with NPAs, and avoid crash provisioning by blind application of the rules of arithmetic.

s gurumurthy

Editor, Thuglak, and commentatoron economic and political affairs

Re: Indian Economy News & Discussion - Nov 27 2017

Swapan Dasgupta has a great article on the history of the Union Budget since the 1970s, and what’s changed now:

The Rites of Liberation

A very long article describing in detail how this budget represents a clean break from Nehruvian policy making and view of the economy:

The New Deal

The Rites of Liberation

A very long article describing in detail how this budget represents a clean break from Nehruvian policy making and view of the economy:

The New Deal

Re: Indian Economy News & Discussion - Nov 27 2017

arshyam wrote:A thought-provoking analysis by S.Gurumurthy about the role of RBI in generating (or suppressing) growth. Apparently, there is still an element of risk from RBI policy, so how they approach the NPA issue is key.

...

What can torpedo the budget and economy? - S. Gurumurthy, TNIE...

...

A very good article. Thanks for sharing.

Bankers, who think business activities as a continuous function and not account for its seasonality (people such as Rajan), are detrimental and may force the economy of a country to the ground.