What info? Any links/names to google?Acharya wrote:Just read the info again and the details of those asian crisis. This is very sophesticated financial groups which created this large network of financial links during the period of expansion from 1977-1997. After that the same groups removed themabhischekcc wrote: Capital flows to highest reward areas in times of expansion and towards safest areas when any crisis comes. Just like money flowed into the dollar when euro faced crisis now.

It is wrong to impute that effects are causes.

Perspectives on the global economic meltdown (Jan 26 2010)

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Perspectives on the global economic meltdown (Jan 26 201

I am ignorant on causes but the effects were arranged very carefully. In "When Genius Failed" (the failure of TCLM) it is explained how US policy makers pick and chose the economies to be saved. Russian economy was left to vultures.abhischekcc wrote: While it is true that money flowed back to the US after the East Asian Crisis, it it inappropriate to say that the crisis was created just to do that. Capital flows to highest reward areas in times of expansion and towards safest areas when any crisis comes. Just like money flowed into the dollar when euro faced crisis now.

It is wrong to impute that effects are causes.

Re: Perspectives on the global economic meltdown (Jan 26 201

If you are looking for a document put out by the perpetrators of this economic terrorism admitting their involvement, obviously you will find none.abhischekcc wrote: What info? Any links/names to google?

The book Diary of an Economic Hitman, although not on the SE Asian fiasco, highlights the general blueprint that has been played out for a long time.

Cause a panic/collapse/indebtedness in a third world economy and then send the IMF in to do the deed. Its a bonus if the country can be put in a debt trap situation. Keep them suckers working like slaves till the day they croak and then their children can continue paying off the debts until they croak. Every now and then a road show is taken out about debt forgiveness but what's forgiven is only a small portion of interest on the debt and its but a fraction of what's paid out.

These scams are rapidly coming to an end (except in Africa where its still going strong). The question of where's the lost revenue is going to be made up is beginning to arise. My view is that since 2000, opportunities for scamming overseas started going down hill and so the banks & financials in search of new markets to scam decided to try their luck on the domestic population.

Re: Perspectives on the global economic meltdown (Jan 26 201

Neshant has already given what to look for.abhischekcc wrote:

What info? Any links/names to google?

Also another thing is to watch the statements of the head of states of the south east asia countries after the crisis. Google what Mahathir talked about how the Wall Street jews caused the crash in his country. He was worried about the loss of per capita income which they gained over many decades and it came crashing down with the fall of their currency. He was worried that India and Indonasia will overtake with higher per capita. It shoudl tell how they were promised that they would have immediate increase in their wealth by joing the MNC and outsourcing network. It was a trap and those units now have shifted to China in less than 10 years and they have become outsourcing for Chinese units. All of countries in south east asia are setup to become dependent on PRC and supply chain to PRC. In one shot PRC gets all the network which was created for SE asia in the previous 20 years.

Re: Perspectives on the global economic meltdown (Jan 26 201

China story

...

No big marquee brands means China is stuck doing the global grunt work in factory cities while designers and engineers overseas reap the profits. Much of Apple's iPhone, for example, is made in China. But if a high-end version costs $750, China is lucky to hold on to $25. For a pair of Nikes, it's four pennies on the dollar.

"We've lost a bucketload of money to foreigners because they have brands and we don't," said Fan Chunyong, the secretary-general of the China Industrial Overseas Development and Planning Association. "Our clothes are Italian, French, German, so the profits are all leaving China. "... We need to create brands, and fast."

The problem is exacerbated by China's lack of innovation and its reliance on stitching and welding together products that are imagined, invented and designed by others. A failure to innovate means China is trapped paying enormous amounts in patent royalties and licensing fees to foreigners. .

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Perspectives on the global economic meltdown (Jan 26 201

Ramana-ji,

That problem stalks India too at certain level. We are yet to see an Indian GLOBAL brand in the following areas

- IT/Software

- Consumer Electronics

- Renewable Energy

- Food grains, Agriculture

- Engineering

That problem stalks India too at certain level. We are yet to see an Indian GLOBAL brand in the following areas

- IT/Software

- Consumer Electronics

- Renewable Energy

- Food grains, Agriculture

- Engineering

Re: Perspectives on the global economic meltdown (Jan 26 201

Governor Chris Christie of New Jersey is the only guy standing up to public sector unions which are trying to get taxpayers to pay more and more towards their salaries, pensions..etc.

In this townhall meeting, some angry teacher tries to blast him saying she should be paid $83,000 USD and that is the only reasonable compensation for the job in light of her education and experience.

and that is the only reasonable compensation for the job in light of her education and experience.

The govenors reply is simple - you dont have to do it !

In addition to job stability, teachers on average get a pension of 42 to 50K or 70% of their salary and that is guranteed by taxpayers including inflation indexed for eternity. I estimate a person would need a 2 million dollar portfolio to have that kind of retirement. They get to retire sooner than people working in the private sector. And still they want more.

[youtube]<object width="480" height="385"><param name="movie" value="http://www.youtube.com/v/aw0aBkt8CPA&hl ... ram><param name="allowFullScreen" value="true"></param><param name="allowscriptaccess" value="always"></param><embed src="http://www.youtube.com/v/aw0aBkt8CPA&hl=en_US&fs=1&" type="application/x-shockwave-flash" allowscriptaccess="always" allowfullscreen="true" width="480" height="385"></embed></object>[/youtube]

In this townhall meeting, some angry teacher tries to blast him saying she should be paid $83,000 USD

The govenors reply is simple - you dont have to do it !

In addition to job stability, teachers on average get a pension of 42 to 50K or 70% of their salary and that is guranteed by taxpayers including inflation indexed for eternity. I estimate a person would need a 2 million dollar portfolio to have that kind of retirement. They get to retire sooner than people working in the private sector. And still they want more.

[youtube]<object width="480" height="385"><param name="movie" value="http://www.youtube.com/v/aw0aBkt8CPA&hl ... ram><param name="allowFullScreen" value="true"></param><param name="allowscriptaccess" value="always"></param><embed src="http://www.youtube.com/v/aw0aBkt8CPA&hl=en_US&fs=1&" type="application/x-shockwave-flash" allowscriptaccess="always" allowfullscreen="true" width="480" height="385"></embed></object>[/youtube]

Re: Perspectives on the global economic meltdown (Jan 26 201

IMF preparing for a new global currency

http://www.imf.org/external/np/speeches/2010/051110.htm

by Dominique Strauss Kahn.

quoot from this speech of him:

Finally, in principle, a new global currency issued by a global central bank, with robust governance and institutional features, could provide a nominal anchor and risk-free asset (LOL risk free like the current system) for the system independent of national currencies. This global central bank could also serve as a lender of last resort (these a-holes will be just printing money and ripping off savers). But any such step requires considerably more debate on its merits, including on the need for a safety valve for the system given errors that might inevitably occur, as well as of its feasibility, given the very substantial multilateral effort required. I fear we are still very far from that level of global collaboration.

----

I fear anyone who has worked hard to save his fiat money is going to be bamboozeled into this new fiat racket now that the present fiat ponzi scheme is collapsing. As I predicted, keynesian economics is rapidly being exposed as a money printing scam.

http://www.imf.org/external/np/speeches/2010/051110.htm

by Dominique Strauss Kahn.

quoot from this speech of him:

Finally, in principle, a new global currency issued by a global central bank, with robust governance and institutional features, could provide a nominal anchor and risk-free asset (LOL risk free like the current system) for the system independent of national currencies. This global central bank could also serve as a lender of last resort (these a-holes will be just printing money and ripping off savers). But any such step requires considerably more debate on its merits, including on the need for a safety valve for the system given errors that might inevitably occur, as well as of its feasibility, given the very substantial multilateral effort required. I fear we are still very far from that level of global collaboration.

----

I fear anyone who has worked hard to save his fiat money is going to be bamboozeled into this new fiat racket now that the present fiat ponzi scheme is collapsing. As I predicted, keynesian economics is rapidly being exposed as a money printing scam.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://www.twnside.org.sg/title/mic-cn.htm

BLACK Monday 19 October 1987 will be remembered as the largest one-day drop in the history of the New York Stock Exchange (NYSE) overshooting the collapse of 28 October 1929, which prompted the Wall Street crash and the beginning of the Great Depression. In the 1987 meltdown, 22.6% of the value of US stocks was wiped out largely during the first hour of trading on Monday morning... The plunge on Wall Street sent a 'cold shiver' through the entire financial system leading to the tumble of the European and Asian stock markets...

Almost 10 years later on Friday 15 August 1997, Wall Street experienced its largest one-day decline since 1987. The Dow Jones plummeted by 247 points. The symptoms were similar to those of Black Monday: 'institutional speculators' sold large amounts of stock with the goal of repurchasing them later but with the immediate impact of provoking a plunge in prices. Futures' and options' trading played a key role in precipitating the collapse of market values.

The tumble on 15 August 1997 immediately spilled over onto the world's stock markets triggering substantial losses on the Frankfurt, Paris, Hong Kong and Tokyo exchanges. Various 'speculative instruments' in the equity and foreign exchange markets were used with a view to manipulating price movements.

In the weeks that followed, stocks continued to trade nervously. Wide speculative movements were recorded on Wall Street; billions of dollars were transacted through the NYSE's Superdot electronic order-routing system with the Dow swinging spuriously up and down in a matter of minutes. The Asian equity and currency markets declined steeply under the brunt of speculative trading. In a three-week period the (Hong Kong) Hang Seng Index had declined by 15%. The Japanese bond market had plunged to an all-time low. In turn, billions of dollars of central bank reserves had been appropriated by institutional speculators.

Business forecasters and academic economists alike have casually disregarded the dangers alluding to 'strong economic fundamentals'; G7 leaders are afraid to say anything or act in a way which might give the 'wrong signals'... Wall Street analysts continue to bungle on issues of 'market correction' with little understanding of the broader economic picture.

In turn, public opinion is bombarded in the media with glowing images of global growth and prosperity. The economy is said to be booming under the impetus of the free market reforms. Without debate or discussion, so-called 'sound macro-economic policies' (meaning the gamut of budgetary austerity, deregulation, downsizing and privatisation) are heralded as the key to economic success.

The realities are concealed, economic statistics are manipulated, economic concepts are turned upside down. Unemployment in the US is said to be falling yet the number of people on low-wage part-time jobs has spiralled. The stock market frenzy has taken place against a background of global economic decline and social dislocation.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://www.guardian.co.uk/business/2009 ... ls-economy

Twenty-five people at the heart of the meltdown ...

The worst economic turmoil since the Great Depression is not a natural phenomenon but a man-made disaster in which we all played a part. In the second part of a week-long series looking behind the slump, Guardian City editor Julia Finch picks out the individuals who have led us into the current crisis

The Guardian, Monday 26 January 2009

Article history

Former Federal Reserve chairman Alan Greenspan, who backed sub-prime lending. Photograph: Mark Wilson/Getty Images

Alan Greenspan, chairman of US Federal Reserve 1987- 2006

Only a couple of years ago the long-serving chairman of the Fed, a committed free marketeer who had steered the US economy through crises ranging from the 1987 stockmarket collapse through to the aftermath of the 9/11 attacks, was lauded with star status, named the "oracle" and "the maestro". Now he is viewed as one of those most culpable for the crisis. He is blamed for allowing the housing bubble to develop as a result of his low interest rates and lack of regulation in mortgage lending. He backed sub-prime lending and urged homebuyers to swap fixed-rate mortgages for variable rate deals, which left borrowers unable to pay when interest rates rose.

Re: Perspectives on the global economic meltdown (Jan 26 201

^^^^

Very interesting set of people being held responsible by guardian paper.

To me looks like a bunch of WS crooks wrapped rotting fish in a newspaper and sold it as gourmet sushi and the US & European main street got the food poisoning.

I note Nassim Taleb is not in the good guys section despite getting rave reviews then.

Very interesting set of people being held responsible by guardian paper.

To me looks like a bunch of WS crooks wrapped rotting fish in a newspaper and sold it as gourmet sushi and the US & European main street got the food poisoning.

I note Nassim Taleb is not in the good guys section despite getting rave reviews then.

-

abhishek_sharma

- BRF Oldie

- Posts: 9664

- Joined: 19 Nov 2009 03:27

Re: Perspectives on the global economic meltdown (Jan 26 201

Paul Krugman on debt ratioChinmayanand wrote: How much debt is too much? How little growth is too little? No one knows for sure. Economic historians such as Kenneth Rogoff point out that at debt levels of 80-90% of GDP, a country’s real growth becomes stunted,

...…Common sense observation tells you, though, that the debt super cycle trend in the U.S. shown in the following chart is reaching unsustainable proportions and that the “growth” required to service it if real interest rates were ever to go up instead

of down would be insufficient…

Link

http://krugman.blogs.nytimes.com/2010/0 ... ommission/

But there’s actually a worse problem: I’m a great admirer of the Reinhart-Rogoff work on crises — but NOT of their work claiming that 90 percent debt/GDP ratios constitute a red line, which isn’t at all up to the standard of the other material. It’s based on a crude correlation — and as soon as you look at specific examples, it starts to look all wrong. I wrote about it here.

Reinhart and Rogoff specifically cite data from the United States showing slower growth when debt was above 90 percent of GDP. But if you know the data at all, you know that so far, the only years in which US debt was above 90 was in the immediate postwar period, when growth was indeed slow — but not because of the debt burden; instead, the US was demobilizing after the war, with many women leaving the paid work force. So it’s a terrible example to use.

And I suspect that much of the rest of their result reflects reverse causation: Japan had low debt and fast growth before the 90s, high debt and slow growth since, but surely we believe that Japan’s financial crisis is what both slowed growth and increased debt; similarly, the onset of Eurosclerosis is what led both to slowing growth and higher debt in Europe. And here’s the thing: Reinhart and Rogoff have not, as far as I can tell, made any effort to disentangle the causation here.

Re: Perspectives on the global economic meltdown (Jan 26 201

Teachers also get a 2 month vacation.Neshant wrote:Governor Chris Christie of New Jersey is the only guy standing up to public sector unions which are trying to get taxpayers to pay more and more towards their salaries, pensions..etc.

In this townhall meeting, some angry teacher tries to blast him saying she should be paid $83,000 USDand that is the only reasonable compensation for the job in light of her education and experience.

-

abhishek_sharma

- BRF Oldie

- Posts: 9664

- Joined: 19 Nov 2009 03:27

Re: Perspectives on the global economic meltdown (Jan 26 201

Fareed Zakaria interviews Bill Gates, Martin Wolf, Richard Haas.

http://www.cnn.com/video/#/video/podcas ... .05.30.cnn

http://www.cnn.com/video/#/video/podcas ... .05.30.cnn

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

Neshant, Acharya,

I have read Confessions of an Economic Hitman. It does not describe the process of the SEA economic crisis. Rather, it describes how these countries were enslaved to the western financial system. The three step process was:

1. Make unrealistic projections of growth in those countries. Useful false or modifies data to do so.

2. Make large loans to these countries based on these projections. The lenders (westerners) know these loans will be defaulted on.

3. When the country defaults, use that as a pretext to buy large parts of their economy for a song.

A variant within this matrix was that the loan money was lent to buy western goods and machinery. And the money never left western shores. So the lender benefitted twice - bu retaining the principle, and then by making the lendee pay the whole amount. This is called 'skinning the donkey twice'.

Another variant of this technique was used to create the subprime crisis.

Phase 1. Insolvent demographics were to lend to, and their insolvency was hidden with the help of the rating agencies.

Phase 2. Money was lent to people who were expected to default.

Phase 3. This is were there is a difference from earlier practice.

In SEA and other developing countries, western governments could lay claim to natural resources. But since the poor of USA do not have any natural resources to their name, the entire burder of risk and repayment has been shifted to the taxpayers. So, instead of natural resources, the future income of all Americans has been tied into the financial industry (parasitry). The people of US have been enslaved, and they don't even know it.

----------------

This is not what happened in SEA crisis. The statements of financial raiders like Soros and his associates show that at first, these guys beleived in the 'Asian Century' slogans, and had invested in something they believed was a sure thing. Later, an article in The Economist (yes, that racist rag) showed them that there were large weaknesses in the ramparts of these economies. These raiders then began their familiar game, and made each small hole into a gaping one, and ultimately the crisis occured.

The crisis inadvertently spread to the US because of the large complicated bets LTCM had made.

This is what I meant when I said that capital was only chasing the highest returns. In the beginning, it went to SEA because of assured returns. Later it pulled out of SEA because that was more profitable. There was no long term game plan, in which it was predecided that capital would be put in only to be pulled out later. I mean, the decisions to put in and pull out were not taken at the same time, they were taken at different points of time. There was no Grand Conspiracy, only mere greed.

------------

However, I do believe there was a grand conspiracy in the hit against the US economy. I also believe that it was the LTCM crisis that illustrated how the US economy could be hit.

The LTCM engendered crisis in the US did not spread to the banking sector because of the Glass Steagall Act. It was repealed in 1999, the year immediately following the LTCM crisis. In the subsequent years, the foundations of the sub prime fiasco were laid. These two changes led to the destruction of the American Dream and the enslavement of the American people.

For example: Decades of Economic Gains Vanish for Blacks in Memphis

-----------------

So my question stands, do you have any link/source that shows that the crisis in SEA was planned or even ideated before the funds started pouring in?

I have read Confessions of an Economic Hitman. It does not describe the process of the SEA economic crisis. Rather, it describes how these countries were enslaved to the western financial system. The three step process was:

1. Make unrealistic projections of growth in those countries. Useful false or modifies data to do so.

2. Make large loans to these countries based on these projections. The lenders (westerners) know these loans will be defaulted on.

3. When the country defaults, use that as a pretext to buy large parts of their economy for a song.

A variant within this matrix was that the loan money was lent to buy western goods and machinery. And the money never left western shores. So the lender benefitted twice - bu retaining the principle, and then by making the lendee pay the whole amount. This is called 'skinning the donkey twice'.

Another variant of this technique was used to create the subprime crisis.

Phase 1. Insolvent demographics were to lend to, and their insolvency was hidden with the help of the rating agencies.

Phase 2. Money was lent to people who were expected to default.

Phase 3. This is were there is a difference from earlier practice.

In SEA and other developing countries, western governments could lay claim to natural resources. But since the poor of USA do not have any natural resources to their name, the entire burder of risk and repayment has been shifted to the taxpayers. So, instead of natural resources, the future income of all Americans has been tied into the financial industry (parasitry). The people of US have been enslaved, and they don't even know it.

----------------

This is not what happened in SEA crisis. The statements of financial raiders like Soros and his associates show that at first, these guys beleived in the 'Asian Century' slogans, and had invested in something they believed was a sure thing. Later, an article in The Economist (yes, that racist rag) showed them that there were large weaknesses in the ramparts of these economies. These raiders then began their familiar game, and made each small hole into a gaping one, and ultimately the crisis occured.

The crisis inadvertently spread to the US because of the large complicated bets LTCM had made.

This is what I meant when I said that capital was only chasing the highest returns. In the beginning, it went to SEA because of assured returns. Later it pulled out of SEA because that was more profitable. There was no long term game plan, in which it was predecided that capital would be put in only to be pulled out later. I mean, the decisions to put in and pull out were not taken at the same time, they were taken at different points of time. There was no Grand Conspiracy, only mere greed.

------------

However, I do believe there was a grand conspiracy in the hit against the US economy. I also believe that it was the LTCM crisis that illustrated how the US economy could be hit.

The LTCM engendered crisis in the US did not spread to the banking sector because of the Glass Steagall Act. It was repealed in 1999, the year immediately following the LTCM crisis. In the subsequent years, the foundations of the sub prime fiasco were laid. These two changes led to the destruction of the American Dream and the enslavement of the American people.

For example: Decades of Economic Gains Vanish for Blacks in Memphis

-----------------

So my question stands, do you have any link/source that shows that the crisis in SEA was planned or even ideated before the funds started pouring in?

Re: Perspectives on the global economic meltdown (Jan 26 201

Decades of gains by blacks wiped out

US has these periodic episodes where gains by newly rich are wiped out. Has anyone studied the 2001 dot com bust where the new rich who were the NASDAQ powerhouses were wiped out in just a couple of months? Its eerily similar to what we are seeing now where newly emergent middle class segments are being wiped out financially.

US has these periodic episodes where gains by newly rich are wiped out. Has anyone studied the 2001 dot com bust where the new rich who were the NASDAQ powerhouses were wiped out in just a couple of months? Its eerily similar to what we are seeing now where newly emergent middle class segments are being wiped out financially.

-

Chinmayanand

- BRF Oldie

- Posts: 2585

- Joined: 05 Oct 2008 16:01

- Location: Mansarovar

- Contact:

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

There was a very good (official) report on class-wise impact of the financial crisis in the US. I will try to locate and post a URL or download link.

Re: Perspectives on the global economic meltdown (Jan 26 201

What's the guy up to.. assuming the article is not hype?

Just a while back barclays was caught trying to sell a bunch of derivative crap into India and Society General was caught shortly there after. What exactly is the story with these derivatives? Anyone care to comment? I thought naked shorting was already illegal.

-----------

Geithner Rushes To Sabotage German Derivatives Ban

Schäuble Prepares New Moves Against Speculators

The German government is now fully committed to escalating its ongoing counterattack against international financial speculation. These moves represent an historical watershed as Germany becomes the first major economic power to roll back the tide of financial globalization, under which crackdowns on hedge funds, derivatives, and the world gambling casino were branded as taboo for national governments.

The naked CDS ban protects euroland government bonds, To that would now be added a ban on the naked shorting of those Euro zone government bonds themselves. This means that a speculator wishing to sell a Euro zone government bond short must own that bond in advance. This makes speculation more complex and expensive, and is all to the good.

Schäuble's new measures also expand protection for certain stocks and for the euro itself. The draft bill would outlaw naked shorts of all German stocks, meaning stocks whose primary listing is at a German exchange. The obvious next step is to ban naked shorting of stocks altogether.

http://rense.com/general91/geit.htm

Just a while back barclays was caught trying to sell a bunch of derivative crap into India and Society General was caught shortly there after. What exactly is the story with these derivatives? Anyone care to comment? I thought naked shorting was already illegal.

-----------

Geithner Rushes To Sabotage German Derivatives Ban

Schäuble Prepares New Moves Against Speculators

The German government is now fully committed to escalating its ongoing counterattack against international financial speculation. These moves represent an historical watershed as Germany becomes the first major economic power to roll back the tide of financial globalization, under which crackdowns on hedge funds, derivatives, and the world gambling casino were branded as taboo for national governments.

The naked CDS ban protects euroland government bonds, To that would now be added a ban on the naked shorting of those Euro zone government bonds themselves. This means that a speculator wishing to sell a Euro zone government bond short must own that bond in advance. This makes speculation more complex and expensive, and is all to the good.

Schäuble's new measures also expand protection for certain stocks and for the euro itself. The draft bill would outlaw naked shorts of all German stocks, meaning stocks whose primary listing is at a German exchange. The obvious next step is to ban naked shorting of stocks altogether.

http://rense.com/general91/geit.htm

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

The break between the Anglo Saxon world and continental Europe is becoming wider.

I hope the schism splits the western world completely - it will increase the security of the rest of the world.

I am sure Russia is backing the German moves to the hilt. Kicking Anglo Saxon out of Europe has been their long standing strategic goal.

I hope the schism splits the western world completely - it will increase the security of the rest of the world.

I am sure Russia is backing the German moves to the hilt. Kicking Anglo Saxon out of Europe has been their long standing strategic goal.

Re: Perspectives on the global economic meltdown (Jan 26 201

question is why is france and netherland not following? is france being too clever by half in their usual foxy way and seeing which side wins before declaring support for the winner? these two countries are relatively solid financially I think. denmark/norway/sweden are also on solid ground.

wrt to teachers , were US schools overstaffed with temps and "special needs teachers" in large nos but little benefits while the red meaty posts were held by oldistan with huge benefits ?

wrt to teachers , were US schools overstaffed with temps and "special needs teachers" in large nos but little benefits while the red meaty posts were held by oldistan with huge benefits ?

Re: Perspectives on the global economic meltdown (Jan 26 201

from the rense.com link:

Every country needs to identify at least one area in which it can produce the most advanced high technology capital goods for export, and strive to become the world leader in that department. This production must be capital-intensive, energy intensive, and high value added, and it must target the world export market. The goal is to produce something which the world will find simply indispensable, independent of whatever protectionist measures may or may not be enacted elsewhere. This effort can be used as a science driver along with other science drivers to restart scientific discovery and technological research and development throughout the entire national economy. This is the kind of strategy which the leaders of the southern tier nations of the euro should currently be elaborating.

And they need to act fast. By September, the tide of financial panic which is now engulfing Greece and Iberia will be in the suburbs of Paris and London .

Every country needs to identify at least one area in which it can produce the most advanced high technology capital goods for export, and strive to become the world leader in that department. This production must be capital-intensive, energy intensive, and high value added, and it must target the world export market. The goal is to produce something which the world will find simply indispensable, independent of whatever protectionist measures may or may not be enacted elsewhere. This effort can be used as a science driver along with other science drivers to restart scientific discovery and technological research and development throughout the entire national economy. This is the kind of strategy which the leaders of the southern tier nations of the euro should currently be elaborating.

And they need to act fast. By September, the tide of financial panic which is now engulfing Greece and Iberia will be in the suburbs of Paris and London .

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

>>And they need to act fast. By September, the tide of financial panic which is now engulfing Greece and Iberia will be in the suburbs of Paris and London .

I guess it is a little late to be giving that advice, if Judgement Day is just round the corner.

But I reckon, this crash was coming to the west one way or another - no way it could have been avoided. The reason is that the western economic model is based on exploiting the resources of the whole planet, and denying the same to the majority (85%) of the population of the planet. As developing countries' economies strengthen, they create domestic demand for the same resources. What is happening now is that the west has to pay higher and higher price for the same amount of resources. They are no longer able to get freebies out of us. Thence, the crash.

The mental gymnastics of the financial world have only made the dday of reckoning come faster, that is all.

I guess it is a little late to be giving that advice, if Judgement Day is just round the corner.

But I reckon, this crash was coming to the west one way or another - no way it could have been avoided. The reason is that the western economic model is based on exploiting the resources of the whole planet, and denying the same to the majority (85%) of the population of the planet. As developing countries' economies strengthen, they create domestic demand for the same resources. What is happening now is that the west has to pay higher and higher price for the same amount of resources. They are no longer able to get freebies out of us. Thence, the crash.

The mental gymnastics of the financial world have only made the dday of reckoning come faster, that is all.

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

Large developing economies are much better placed. A total meltdown of the western world will destroy the commodity pricing of the world. This will result in vastly lower prices for us in India.

Re: Perspectives on the global economic meltdown (Jan 26 201

commodity prices will go down, but a complete meltdown of westernn financial system is going to play havoc to some extent with our stock markets.

A List of things that might happen in India if a complete meltdown takes place:

1. Our IT industry will probably slow down. It will effect the hiring of freshers by IT companies and will also lead to lay offs.

2. Our markets will probably take a battering in the short term.

3. Commodity prices going down is good for us as it will decrease the inflation.

4. The wealth of our uber billionaries is going to come down.

What effects do you guys think will this meltdown have on our country.

A List of things that might happen in India if a complete meltdown takes place:

1. Our IT industry will probably slow down. It will effect the hiring of freshers by IT companies and will also lead to lay offs.

2. Our markets will probably take a battering in the short term.

3. Commodity prices going down is good for us as it will decrease the inflation.

4. The wealth of our uber billionaries is going to come down.

What effects do you guys think will this meltdown have on our country.

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

ITVity will be deeply affected if there is a complete breakdown of western economies. However, it will be a beneficiary if there is a partial breakdown, because the survivors there will seek to pare costs down to the minimum, and will seek the cheaper Indian expertise. It would probably put pressure on margins and salaries here, but not on employment. On the whole, a slowdown in the IT industry would benefit other industries that need engineers, as it would reduce the pressure to hike salaries.

The industry that would be truly affected is the Gems & Jewelery industry. It has been the largest forex earner for us for a long time, beating IT also. Problem is that not only is G&J export oriented, it is also a luxury goods industry, and feels the heat very early on in an economic downturn, and is also among the last to recover.

A deep recession in the west will reduce energy/oil prices, which will reduce the linked natural gas prices, which will reduce the price of fertilizers, and therefore of food. Lower energy prices will of course impact inflation at all levels. So mango people will benefit.

The industry that would be truly affected is the Gems & Jewelery industry. It has been the largest forex earner for us for a long time, beating IT also. Problem is that not only is G&J export oriented, it is also a luxury goods industry, and feels the heat very early on in an economic downturn, and is also among the last to recover.

A deep recession in the west will reduce energy/oil prices, which will reduce the linked natural gas prices, which will reduce the price of fertilizers, and therefore of food. Lower energy prices will of course impact inflation at all levels. So mango people will benefit.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://www.istockanalyst.com/article/vi ... 3/pageid/1

Double-Dip

"There are some parts of the global economy that are now at the risk of a double-dip recession, certainly seeing that risk in the euro zone...From here on I see things getting worse."

Roubini also named Japan with its anemic growth and the U.S. when inventory adjustment goes away and fiscal stimulus becomes a drag in the 2nd half of this year, as possible candidates for a double-dip recession.

A Mission Impossible Train Wreck

Fixing the debt problems in Greece and other troubled nations would be "mission impossible." Governments need to raise taxes and cut spending. "Otherwise we're going to get a fiscal train wreck… and it's going to take years of sacrifices."

My Thoughts

The market hates uncertainty. When investors get scared, they piled into cash equivalents. Spiking treasury demand sent yields on 30-year Treasurys briefly dipped below 4%, the first time since October, while the VIX fear index has almost doubled this month to 40.10.

The market is saying it is unwilling to buy stocks given the uncertainty mainly from the euro zone, financial reform, and signs of economic slowdown in China. Commodities ranging from gold, crude oil, metals to sugar and coffee also fell as investors fled risky assets on fears the euro zone's debt crisis will crimp global growth.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://www.amazon.com/Crisis-Economics- ... 1594202508

Bremmer: Should we then worry about the risk of a collapse of the European Monetary Union--the so-called “eurozone?”

Roubini: This is a serious and rising risk. The dilemma for Greece and the other fiscally challenge countries dubbed the PIIGS — that’s Portugal, Italy, Ireland, Greece, Spain — is that, whereas fiscal consolidation is necessary to prevent an unsustainable increase in the spread on sovereign bonds, the short-run effects of raising taxes and cutting government spending tend to cause economic contraction. This, too, complicates the public-debt dynamics and impedes the restoration of public-debt sustainability. Indeed, this was the trap faced by Argentina in 1998-2001, when needed fiscal contraction exacerbated recession and eventually led to default.

In countries like the eurozone members, a loss of external competitiveness, caused by tight monetary policy and a strong currency, erosion of long-term comparative advantage relative to emerging markets, and wage growth in excess of productivity growth, impose further constraints on the resumption of growth. If growth does not recover, the fiscal problems will worsen while making it more politically difficult to enact the painful reforms needed to restore competitiveness.

A vicious circle of public-finance deficits, current-account gaps, worsening external-debt dynamics, and stagnating growth can then set in. Eventually, this can lead to default on euro-zone members’ public and foreign debt, as well as exit from the monetary union by fragile economies unable to adjust and reform fast enough.

Provision of liquidity by an international lender of last resort – the European Central Bank, the IMF, or even a new European Monetary Fund – could prevent an illiquidity problem from turning into an insolvency problem. But if a country is effectively insolvent rather than just illiquid, such “bailouts” cannot prevent eventual default and devaluation (or exit from a monetary union) because the international lender of last resort eventually will stop financing an unsustainable debt dynamic, as occurred Argentina (and in Russia in 1998). Thus, the weakest links of the EMU – countries such as Greece may be eventually be forced to default and to exit the monetary union to regain their competitiveness and growth through a depreciation of their new national currency.

Bremmer: So how can we properly deal with the fallout of financial crises? How to properly reduce private and public debts?

Roubini: Cleaning up high private-sector debt and lowering public-debt ratios by growth alone is particularly hard if a balance-sheet crisis leads to an anemic recovery. And reducing debt ratios by saving more leads to the paradox of thrift: too fast an increase in savings deepens the recession and makes debt ratios even worse.

At the end of the day, resolving private-sector leverage problems by fully socializing private losses and re-leveraging the public sector is risky. At best, taxes will eventually be raised and spending cut, with a negative effect on growth; at worst, the outcome may be direct capital levies (default) or indirect ones (the inflation tax if large budget deficits are sharply monetized).

Unsustainable private-debt problems must be resolved by defaults, debt reductions, and conversion of debt into equity. If, instead, private debts are excessively socialized, the advanced economies will face a grim future: serious sustainability problems with their public, private, and foreign debt, together with crippled prospects for economic growth.

Bremmer: In the book you propose radical reforms of the system of regulation and supervision of banks and other financial institutions and criticize the more cosmetic reforms now considered by the US Congress and in other countries. Why the need for radical reform?

Roubini: If reforms will be cosmetic we will not prevent future asset and credit bubbles and we will experience new and more virulent crises. The currently proposed reforms of “too-big-to-fail” financial institutions are not sufficient: imposing higher capital levies on these firms and have a resolution regime for an orderly shutdown of large systemically important insolvent firms will not work. If a financial firm is too-big-to-fail it is just too big: it should be broken up to make it less systemically important. And in the heat of the next crisis using a resolution regime to close down too-big-to-fail firms will be very hard; thus, the temptation to bail them out again will be dominant.

Also, the modest Volcker Rule – that may not even be passed by Congress because of the banking lobbies power – does not go far enough. It correctly points out that banking institutions that have access to insured deposits and to the lender of last resort support of the Fed should not be allowed to engage into risky activities such as prop trading, hedge funds and private investments. But more needs to be done: we need to go back to the more radical separation between commercial and investment banking that the Glass Steagall Act had imposed. Repealing this Act was a mistake that led to excessive risk taking and leverage by both banks and non-bank financial institutions.

Finally, the government should regulate much more tightly toxic and dangerous over-the-counter derivative instruments; and compensation of bankers and traders should be subject to radical “clawbacks”: bonuses should not be paid outright but go into a fund and clawed back if the initial investments/trades turned out to be risky and money losing over time.

Bremmer: Have we learned the lessons from the last financial crisis or are we planting the seeds of the next one?

Roubini: I fear that we have not learned those lessons and that part of the policy response is now creating a new global asset bubble that will cause a bigger financial crisis in the next few years. For one thing, there is a lot of talk about better regulation an supervision of the financial system but the financial industry is back to business as usual – rebuilding leverage, engaging in prop trading and other risk behavior, compensating bankers and traders with indecent bonuses - and is lobbying against better regulation and supervision. Governments are talking about reforms but almost no one has implemented them.

In the meanwhile interest rates remain close to zero in most advanced economies and they are also very low in many overheating emerging markets. Also dollar funded carry trades are feeding asset bubbles globally. Thus, part of the sharp rise in risky asset prices since March 2009 is driven by a wall of liquidity chasing assets that are becoming overpriced: US and global equities, credit, oil and commodity prices, emerging markets asset prices. And if this bubble eventually gets out of hand the eventual bust could lead to another and bigger global financial crisis in the next two or three years.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://video.ft.com/v/88437679001/May-2 ... est-sister

May 27: Why the dollar isn’t the ugliest sister

May 27 2010 James Mackintosh, investment editor, explains how the dollar remains the world’s reserve currency despite the enormous US budget deficit. (1m 48sec)

May 27: Why the dollar isn’t the ugliest sister

May 27 2010 James Mackintosh, investment editor, explains how the dollar remains the world’s reserve currency despite the enormous US budget deficit. (1m 48sec)

Re: Perspectives on the global economic meltdown (Jan 26 201

Back in 2001 in the aftermat of the NASDAQ meltdown, I used to hear many of my associates lamenting the loss of their hard earned money, (~$100K) in the stockmarket in the dot com craze. The same jokers refuse to admit that they made a mistake and went out and paid $600K - $800 K for 30 year houses in Sunnyvale.

These same people spout endless words of wisdom on how there is never a bad time to enter the stockmarket...only to lose most of their 401K savings as well....

After staying in the industry for 15 years and having been through 3 recessions, I have realized that the US market is a great equalizer, what it gives with one hand it will take away with the other. Around the time your checking account reaches a certain amt start excpecting the banks to start making phone and slick advisors offering to ut your money in schemes whic according to them will never fail. It is a matter of time before you fall for one of those schemes.

The net result is that all the Bay area Dink combos working at Sun + Cisco/Oracle + Intuit etc. and taking home $200K salaries for starters do not have much to write home about. Their net worth would not exceed $1 /1.5 million when their counterparts in India have comparable assets and have taken care of their parental obligations as a bonus.

Bottomline...the stockmarket is too complicated for people like me...Hence if I don't understand it, I dont need it.

These same people spout endless words of wisdom on how there is never a bad time to enter the stockmarket...only to lose most of their 401K savings as well....

After staying in the industry for 15 years and having been through 3 recessions, I have realized that the US market is a great equalizer, what it gives with one hand it will take away with the other. Around the time your checking account reaches a certain amt start excpecting the banks to start making phone and slick advisors offering to ut your money in schemes whic according to them will never fail. It is a matter of time before you fall for one of those schemes.

The net result is that all the Bay area Dink combos working at Sun + Cisco/Oracle + Intuit etc. and taking home $200K salaries for starters do not have much to write home about. Their net worth would not exceed $1 /1.5 million when their counterparts in India have comparable assets and have taken care of their parental obligations as a bonus.

Bottomline...the stockmarket is too complicated for people like me...Hence if I don't understand it, I dont need it.

-

Chinmayanand

- BRF Oldie

- Posts: 2585

- Joined: 05 Oct 2008 16:01

- Location: Mansarovar

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

a guy I know in SJC has built up a portfolio of 3 rental properties here in blr and made them span from flat, uber flat,villa. his amdani could be around 1L between the three every month. I see renewed interest from well off NRIs to buy up properties here. lot of villa projects being advertized to soak up that demand. there is a huge hoarding on the way out of BIAL just before you reach the highway

even though prices could go down or stagnate atleast assets here are unlikely to evaporate overnight like US financial instruments if the day of the dog dawns.

even though prices could go down or stagnate atleast assets here are unlikely to evaporate overnight like US financial instruments if the day of the dog dawns.

Re: Perspectives on the global economic meltdown (Jan 26 201

A new book making the rounds

Google books:

End of Influence

Brief overview in FP journal.

The End of Influence

GD new icon for you!

Google books:

End of Influence

Brief overview in FP journal.

The End of Influence

GD new icon for you!

As the United States emerged in the aftermath of World War I as the top power and giant money master, American jazz swept through Europe, faster than Ford and Kodak. Later, especially after World War II, Europeans eagerly welcomed the onslaught of American movies. Most Europeans encountered America at the movies, but two generations of rather privileged Europeans traveled to America to see for themselves (many sponsored by the State Department), to behold the skyscrapers of New York, the George Washington and Golden Gate bridges, and the houses of rather ordinary people with huge shiny cars, washing machines, televisions, and the orthodontically enhanced smiles on tall, milk- and meat-fed women.

Re: Perspectives on the global economic meltdown (Jan 26 201

Paul:

Can you help me find a $600-$800K home in Sunnyvale, please. I will give you 5% in kickbacks if you have one to sell. And this desi-fetish about newer homes I can not understand. Most older homes have a bigger lot, a more established and green neighborhood and better location. IMHO buying an older home and remodeling it to your needs is much better option than paying a premium for that new home.

DINKs taking home $200-$300K can easily afford $1.2M home with $200K down. After the tax deductions for the mortgage interest kicks in, it is often comparable if not cheaper than renting. The last time I owned a home in the Bay Area, my net cost of ownership was the same as what it cost my nanny to own her condo costing 60% less. And owning a home comes without all the hassles of renting (home owners wants to sell, wants to raise rents, wants to move in himself etc.).

Regarding investing: Most first gen Indians do not spend the time to understand the stock markets. Anyone who is investing in the stock market needs to read at least a few good books about how markets operate and the history of the markets for the past 100-200 years. And something as simple as the NYSI can keep you in the right side of the trade. Buy when NYSI is rising, sell (or go short) when NYSI is falling.

http://stockcharts.com/h-sc/ui?s=$NYSI& ... 5466143524

Note that most bear markets start with the NYSI falling below zero. If you have stocks right now, sell the rallies.

Can you help me find a $600-$800K home in Sunnyvale, please. I will give you 5% in kickbacks if you have one to sell. And this desi-fetish about newer homes I can not understand. Most older homes have a bigger lot, a more established and green neighborhood and better location. IMHO buying an older home and remodeling it to your needs is much better option than paying a premium for that new home.

DINKs taking home $200-$300K can easily afford $1.2M home with $200K down. After the tax deductions for the mortgage interest kicks in, it is often comparable if not cheaper than renting. The last time I owned a home in the Bay Area, my net cost of ownership was the same as what it cost my nanny to own her condo costing 60% less. And owning a home comes without all the hassles of renting (home owners wants to sell, wants to raise rents, wants to move in himself etc.).

Regarding investing: Most first gen Indians do not spend the time to understand the stock markets. Anyone who is investing in the stock market needs to read at least a few good books about how markets operate and the history of the markets for the past 100-200 years. And something as simple as the NYSI can keep you in the right side of the trade. Buy when NYSI is rising, sell (or go short) when NYSI is falling.

http://stockcharts.com/h-sc/ui?s=$NYSI& ... 5466143524

Note that most bear markets start with the NYSI falling below zero. If you have stocks right now, sell the rallies.

Re: Perspectives on the global economic meltdown (Jan 26 201

VikramS:

You have missed the prime point in my post...what I am saying is that savvy people in India have made more money or are at a comparable level as far as assets are concerned and since they are closer to their parents are in a position to look after their obligations as well. Overall they have a better progress report card compared to their NRI brethren.

I moved out of the bay area in 2005, I am not a real estate agent and I have a full time job, wish I could help...thanks for the offer though.

Hot off the presses:

HP to cut 9000 jobs

You have missed the prime point in my post...what I am saying is that savvy people in India have made more money or are at a comparable level as far as assets are concerned and since they are closer to their parents are in a position to look after their obligations as well. Overall they have a better progress report card compared to their NRI brethren.

FYI.... 30 year old Homes in Sunnyvale off Wolfe road were selling for $600K in 2003 - 2004 period ( I am referring to this period in my original post).Can you help me find a $600-$800K home in Sunnyvale, please. I will give you 5% in kickbacks if you have one to sell. And this desi-fetish about newer homes I can not understand. Most older homes have a bigger lot, a more established and green neighborhood and better location. IMHO buying an older home and remodeling it to your needs is much better option than paying a premium for that new home.

I moved out of the bay area in 2005, I am not a real estate agent and I have a full time job, wish I could help...thanks for the offer though.

What if they lose their jobs??? Have you accounted for the risk factor. I know of several couples who have made this mistake.DINKs taking home $200-$300K can easily afford $1.2M home with $200K down. After the tax deductions for the mortgage interest kicks in, it is often comparable if not cheaper than renting. The last time I owned a home in the Bay Area, my net cost of ownership was the same as what it cost my nanny to own her condo costing 60% less. And owning a home comes without all the hassles of renting (home owners wants to sell, wants to raise rents, wants to move in himself etc.).

Hot off the presses:

HP to cut 9000 jobs

I wish it were that simple. Millions of bay boomers who have been through many recessions have also lost their savings in the stock market and they are in the same boat as first gen Indians. FOr millions investing money in the stock market, it is only a few hundred who will come out on top in the end (standard Amway jargon) You cannot win a rigged game.Regarding investing: Most first gen Indians do not spend the time to understand the stock markets. Anyone who is investing in the stock market needs to read at least a few good books about how markets operate and the history of the markets for the past 100-200 years. And something as simple as the NYSI can keep you in the right side of the trade. Buy when NYSI is rising, sell (or go short) when NYSI is falling.

http://stockcharts.com/h-sc/ui?s=$NYSI& ... 0713527484

Re: Perspectives on the global economic meltdown (Jan 26 201

Paul:

Unlike the old India, there are always risks in the US society. What you got to do is get a realistic estimate of your risk tolerance and appetite and not over-leverage. At the worst you will give the keys to your home to your bank and walk away; but the sun will still shine.

During this downturn, I have not heard of too many core tech people not being able to find jobs. This was very different from the post dotcom bubble. Part of the reason is that outsourcing has ensure that the jobs which have remained in the valley do command a premium in terms of the employee capability and those skill-sets are still in demand. The lower-to-mid skill jobs have pretty much migrated out of the area.

The other interesting part is that the in the Bay Area the more desirable neighborhoods have held up their values much better. In the $800K-$1.2M market where most Dinks operate , prices are within 10-15% of their peak values. Part of the reason is the artificial supply constraints and desirable schools; of course tax policy goes a long way in making it affordable.

I agree with you about how so many US based people have seen their wealth erode. The US is trying hard not to stagnate while India is still growing at 8%.

Throughout history bear markets have lasted almost two decades or an entire generation. That is roughly the amount of time needed to cleanse the system. We are still about half way through that bear market in terms of time; there is a lot of pain yet to come.

But one lesson I have learnt is that in the capitalist society, you can not live without having some tolerance for risk. Otherwise fear will paralyze you and make your life hell. What you need to ensure is that the risks you take are measured; never gamble with money you can not afford to lose.

Unlike the old India, there are always risks in the US society. What you got to do is get a realistic estimate of your risk tolerance and appetite and not over-leverage. At the worst you will give the keys to your home to your bank and walk away; but the sun will still shine.

During this downturn, I have not heard of too many core tech people not being able to find jobs. This was very different from the post dotcom bubble. Part of the reason is that outsourcing has ensure that the jobs which have remained in the valley do command a premium in terms of the employee capability and those skill-sets are still in demand. The lower-to-mid skill jobs have pretty much migrated out of the area.

The other interesting part is that the in the Bay Area the more desirable neighborhoods have held up their values much better. In the $800K-$1.2M market where most Dinks operate , prices are within 10-15% of their peak values. Part of the reason is the artificial supply constraints and desirable schools; of course tax policy goes a long way in making it affordable.

I agree with you about how so many US based people have seen their wealth erode. The US is trying hard not to stagnate while India is still growing at 8%.

Throughout history bear markets have lasted almost two decades or an entire generation. That is roughly the amount of time needed to cleanse the system. We are still about half way through that bear market in terms of time; there is a lot of pain yet to come.

But one lesson I have learnt is that in the capitalist society, you can not live without having some tolerance for risk. Otherwise fear will paralyze you and make your life hell. What you need to ensure is that the risks you take are measured; never gamble with money you can not afford to lose.

Re: Perspectives on the global economic meltdown (Jan 26 201

there's no easy money to be made on the stock market.

i bought some BP stock tempted by the 8% divident just a couple of days ago and I'm getting killed. Well I intend to hold it for the long term (<- famous last words). I should have followed through on my plan to purchase put options when I bought it but being young & stupid, I thought it might be a waste.

Anyways, I've since bought some call options on the sucker so I hope it rises. If it does I might just exercise the options.

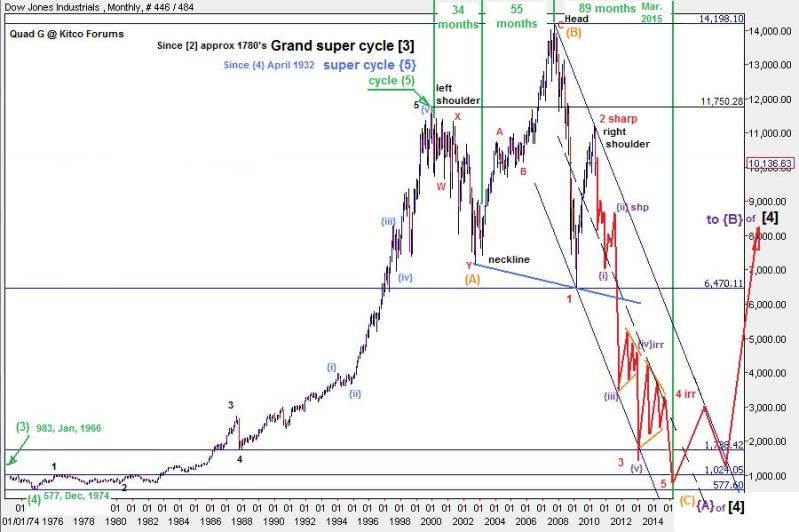

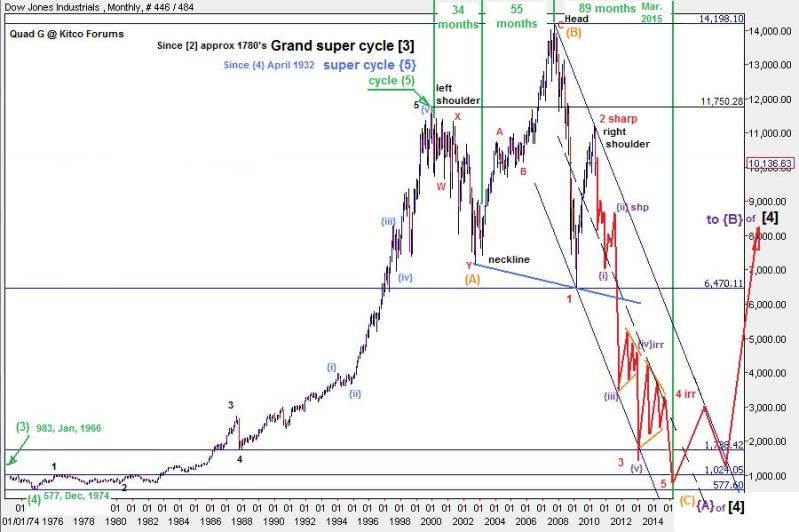

Now from one nightmare to another. What do you think of the chart below? Is all hell about to break loose and will the stock market bottom only in early 2015 ?

-----------

Dow Super-Cycle chart 5-30-10

Notes:

1) Grand Super Cycle wave {A} of [4] has yet to complete, and is likely to target the previous wave (3) and (4) zone which would be the bear market expanding triangle correction between 1966 and 1974, with a price territory of 577 - 999.

2) The monthly chart is showing a very nice golden ratio time relationship, wave (A) took approx. 34 months and wave (B) approx. 55 months, the next ratio component is 89. From the wave (B) top in Oct 2007, 89 months points to a potential bottom in March 2015.

3) The current wave down is pictured as the continuation of a 5 wave descent as wave ( C) of a 3-3-5 expanding flat correction. Another possibility, just as likely, is one more leg down lower than 6740 to make the third leg of ( C) of {A} inside an expanding triangle, but may not go the distance to sub 1000 until several years later as wave {E}.

4) The large H&S pattern has enough weight (7569 pts) to peg the index to zero upon tripping the neckline (currently below at 6330), but sub 1000 is close enough.

5) The Cycle (4) bottom in 1974 to the cycle (5) top in 2000 equals 26 years. The 61.8% retracement of of 26 years equals 16 years, or a potential time target of 2016

6) Since cycle wave (5) was a mania wave, the current correction should finish below the start of the mania breakout level. In this case, the Dow breakout was clearly 1000.

7) What could derail this bearish course? at this point I still see some potential for the Dow to rally to 11,300 to 11,9xxx but the odds are against it IMHO.

The smaller intervals inside the redline projection is an example path of what a 5 wave structure may look like.

The smaller intervals inside the redline projection is an example path of what a 5 wave structure may look like.

9) {B} of [4] moving up from a 2015 -2016 low @ sub-1000, would likely target at least the 61.8% to 78.6% retracement level or approx 8,400 to 10,700 pts.

10) Wave 1 of ( C) measures 7728 pts, wave 3 down should be larger, the smallest fibo multiplier would be 1.272 giving a product of 9830 (7728 x 1.272). If wave 2 has officially ended at 11258, then wave 3 could target 1428 by late 2012.

Thanks to Robert Prechter and Daneric for some data points.

i bought some BP stock tempted by the 8% divident just a couple of days ago and I'm getting killed. Well I intend to hold it for the long term (<- famous last words). I should have followed through on my plan to purchase put options when I bought it but being young & stupid, I thought it might be a waste.

Anyways, I've since bought some call options on the sucker so I hope it rises. If it does I might just exercise the options.

Now from one nightmare to another. What do you think of the chart below? Is all hell about to break loose and will the stock market bottom only in early 2015 ?

-----------

Dow Super-Cycle chart 5-30-10

Notes:

1) Grand Super Cycle wave {A} of [4] has yet to complete, and is likely to target the previous wave (3) and (4) zone which would be the bear market expanding triangle correction between 1966 and 1974, with a price territory of 577 - 999.

2) The monthly chart is showing a very nice golden ratio time relationship, wave (A) took approx. 34 months and wave (B) approx. 55 months, the next ratio component is 89. From the wave (B) top in Oct 2007, 89 months points to a potential bottom in March 2015.

3) The current wave down is pictured as the continuation of a 5 wave descent as wave ( C) of a 3-3-5 expanding flat correction. Another possibility, just as likely, is one more leg down lower than 6740 to make the third leg of ( C) of {A} inside an expanding triangle, but may not go the distance to sub 1000 until several years later as wave {E}.

4) The large H&S pattern has enough weight (7569 pts) to peg the index to zero upon tripping the neckline (currently below at 6330), but sub 1000 is close enough.

5) The Cycle (4) bottom in 1974 to the cycle (5) top in 2000 equals 26 years. The 61.8% retracement of of 26 years equals 16 years, or a potential time target of 2016

6) Since cycle wave (5) was a mania wave, the current correction should finish below the start of the mania breakout level. In this case, the Dow breakout was clearly 1000.

7) What could derail this bearish course? at this point I still see some potential for the Dow to rally to 11,300 to 11,9xxx but the odds are against it IMHO.

9) {B} of [4] moving up from a 2015 -2016 low @ sub-1000, would likely target at least the 61.8% to 78.6% retracement level or approx 8,400 to 10,700 pts.

10) Wave 1 of ( C) measures 7728 pts, wave 3 down should be larger, the smallest fibo multiplier would be 1.272 giving a product of 9830 (7728 x 1.272). If wave 2 has officially ended at 11258, then wave 3 could target 1428 by late 2012.

Thanks to Robert Prechter and Daneric for some data points.

Re: Perspectives on the global economic meltdown (Jan 26 201

Neshant:

Lessons learnt the tough way.

(1) Never fight the trend.

(2) BP is now political. They can be wiped out/nationalized to pay for the damage. And this game will drag on till the elections are over.

Collar your position.

-> Sell a Call (say 5% above current price) and use the proceeds to

-> Buy a Put (say 5% below current price)

(3) Do not average down (i.e. buy calls to recover your losses).

--------------------------------------

Prechter is right once every 30 years.

Daneric is a great EW guy too.

Helicopter Ben will drop more dollars if needed. It is unlikely that they will allow another asset price collapse without trying hard to print their way through.

Typically all major economic declines end in a war.

Short term the market is much more likely to go down. Sell rallies.

Lessons learnt the tough way.

(1) Never fight the trend.

(2) BP is now political. They can be wiped out/nationalized to pay for the damage. And this game will drag on till the elections are over.

Collar your position.

-> Sell a Call (say 5% above current price) and use the proceeds to

-> Buy a Put (say 5% below current price)

(3) Do not average down (i.e. buy calls to recover your losses).

--------------------------------------

Prechter is right once every 30 years.

Daneric is a great EW guy too.

Helicopter Ben will drop more dollars if needed. It is unlikely that they will allow another asset price collapse without trying hard to print their way through.

Typically all major economic declines end in a war.

Short term the market is much more likely to go down. Sell rallies.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://money.cnn.com/2010/05/28/news/ec ... e.fortune/

Several downtrodden cities are on the verge of defaulting on their debt, putting financially encumbered states and taxpayers on the hook to pick up the tab. The National League of Cities says municipal governments will probably come up $56 billion to $83 billion short between now and 2012. That's the tab for decades of binge spending; municipal defaults could be our collective hangover.

Municipal bonds, issued to fund public projects such as roads and public buildings, have historically been seen as one of the safest places to invest, which is why 80% of municipal bond holders are individual households and mutual fund investors, explains Jeffrey Cleveland, municipal bond analyst at Payden & Rygel Investment Management.

Re: Perspectives on the global economic meltdown (Jan 26 201

Thanks for the tip.VikramS wrote:Lessons learnt the tough way.