Cheers

ISLAMABAD: Striking a defiant note, Finance Adviser Dr Abdul Hafeez Shaikh on Wednesday said that he was ready to offend people for the sake of collecting Rs5.550 trillion taxes amid high probability of protests by various business bodies against the budget.

CheersShaikh also offered himself for accountability for adding nearly Rs8 trillion in public debt during his stint as finance minister from 2010-2013 after Prime Minister Imran Khan announced to form a commission. He was addressing a post budget press conference here on Wednesday.

Berry True!Anujan wrote:Pakistan has lost $1 trillion due to the world not giving Pakistan $1 Trillion

CheersISLAMABAD: Asian Development will give $3.4 billion to Pakistan in budgetary support, said Adviser to Prime Minister on Finance Dr Abdul Hafeez Shaikh.

Sir, Jacobabad base was used for ops in AFG, not for US-Iraq war. CSF was for supporting operations in AFG not in Iraq.K Mehta wrote:Yes it did, it was used as a base for staging ops. Jacobabad is still in use as a US base. And we know how much money they have got as CSF. And the Afghan war is more pertinent.CalvinH wrote: How? Did US-Iraq war benefitted Pakistan. It may lead to completely opposite of what you mention. Oil prices will go through the roof leading to more pressure on Paki economy. with Saudi backing US and Pakistan backing Saudis Paki will see more internal conflicts between Shia and Sunni.

Plus if US is able to have a favorable government in Iran they won’t need Pakistan to manage AFG.

Many bases in Balochistan have been used by America and it is right next to Iran. The main target will be strait of Hormuz and guess which naval base is sitting at the entrance of the strait.

Oil prices are being taken care of by Saudis. See how they are bankrolling them and ask yourself why is Saudi bankrolling Pakistan. Notice how Pakistan is no longer badmouthing US.

With the kind of ruthless oppression Pak army does, Shia Sunni question does not arise. Notice how Lashkar e Jhangvi has been wiped out, they were the anti Shia militia.

In ararerebuff, the Asian Development Bank (ADB) on Sunday distanced itself from a Pakistan government announcement about provision of $3.4 billion budgetary support by the Manila-based lending agency.

What a backstabbing by the Iron brother. If Pakistanis had any H&D they will avenge this humiliation!“These discussions are ongoing and details of the plans as well as the volume of ADB’s financial support, once finalised, will be contingent upon the approval of ADB management and its Board of Directors,” said ADB’s Country Director for Pakistan Xiaohong Yang in the statement.

Sir why do you have to select Iraq over Afghanistan. The crux of the matter is that pakistan received money when a neighbouring country is invaded. Whether that country is Afghanistan or Iran.CalvinH wrote: Sir, Jacobabad base was used for ops in AFG, not for US-Iraq war. CSF was for supporting operations in AFG not in Iraq.

Against Iran staging area would be Saudi Arabia not pakistan.K Mehta wrote:Sir why do you have to select Iraq over Afghanistan. The crux of the matter is that pakistan received money when a neighbouring country is invaded. Whether that country is Afghanistan or Iran.CalvinH wrote: Sir, Jacobabad base was used for ops in AFG, not for US-Iraq war. CSF was for supporting operations in AFG not in Iraq.

It will be used as a staging area for Iran attack also. And will benefit from it.

Please tell me why it will not be used as a staging area in case of Iran? Apart from the spectre of Shia militia being aided by Iran, which I believe the Pak army will be able to control and even exploit.

Pakistan would be also used and be benefited from this.abhijitm wrote: Against Iran staging area would be Saudi Arabia not pakistan.

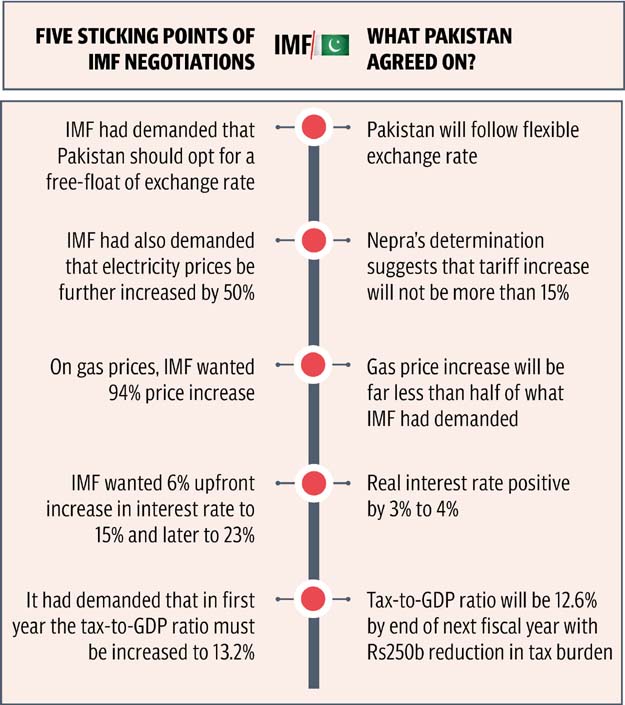

Domestic consumers are set to face up to 200% hike in gas prices from July 1, mainly due to the rupee depreciation against the dollar. However, the Petroleum Division has proposed no increase in gas prices for the elite who use gas in bulk.

The Economic Coordination Committee (ECC), scheduled to meet on Wednesday (today), is likely to approve the proposed hike in gas tariff, an official said. The Pakistan Tehreek-e-Insaf (PTI) government has already increased gas prices by up to 143% during the ongoing financial year.

The Petroleum Division has proposed 25% increase in gas prices for domestic gas consumer in the first slab. Fifty per cent (50%) increase is recommended for the second slab, 75% for the third slab, 100% for the fourth slab, 150% for the fifth slab and 200% for the sixth slab gas consumers.

Less than 250 Pakistanis have so far availed the tax amnesty scheme and paid a paltry sum of about Rs450 million in taxes despite personal appeal by Prime Minister Imran Khan through his televised address.

In another tweet he's saying that this package was given to pak 3 days back very quietly, without any fanfare.RajD wrote:https://twitter.com/Ind4Ever/status/114 ... 72197?s=20

INTEL @ ind4ever just tweeted that the londonistan gave credit line of 4billion pounds. Is it true? When did this happen?