Why would Brits give anything when they themselves are in deep trouble and trying to wade the economic waters due to Brexit. I think it is Paki wishful thinking manifested into fake newsRajD wrote:In another tweet he's saying that this package was given to pak 3 days back very quietly, without any fanfare.RajD wrote:https://twitter.com/Ind4Ever/status/114 ... 72197?s=20

INTEL @ ind4ever just tweeted that the londonistan gave credit line of 4billion pounds. Is it true? When did this happen?

Pakistani Economic Stress Watch

Re: Pakistani Economic Stress Watch

Re: Pakistani Economic Stress Watch

Desperate Dims has given a televised address to the abduls and ayeshas to avail the tax amnesty scheme (Allah ke naam pe de de). He has threatened the masses that or else we have all the data/information to come after you. AoAAnujan wrote:https://tribune.com.pk/story/1995384/2- ... ct-people/

PM’s tax amnesty scheme fails to attract people

Less than 250 Pakistanis have so far availed the tax amnesty scheme and paid a paltry sum of about Rs450 million in taxes despite personal appeal by Prime Minister Imran Khan through his televised address.

Pakistani Economic Stress Watch

X Posted on the Terroristan Thread

Cheers

Cheers

Pakistani Economic Stress Watch

X Posted on the P E S W Thread

More Hanky/Panky from Terroristan

PAGE 23 CHAPTER 5 CURRENT EXPENDITURE : 2019- 20

5.1 Table-15 below presents a summary of current expenditure:

PAGE 23 CHAPTER 5 CURRENT EXPENDITURE : 2019- 20

5.1 Table-15 below presents a summary of current expenditure:

TABLE – 15 – SUMMARY 9 - Rs. in Millions

PAKISTAN DEFENCE BUDGET: IN MILLIONS OF RUPEES

------------------------------------2018 - 2019--------2019-2020

------------------------------------REVISED

Defence Affairs and Services : 1,137,710----------1,152,535

Pension - Military :-------------: 0,259,779---------0,327,088

Total :----------------------------: 0,397,489---------1,479,623

The above is a Barefaced Lie. I refer to the following :

Govt to pay Rs3.6 trillion on defence, debt servicing - Shahbaz Rana : February 7, 2019

Against the stated defence budget of Rs1.1 trillion, the finance ministry told the NFC that by the end of fiscal year 2019, Rs1.676 trillion would be spent on defence that is equal to 31.5% of the federal budget. This is the second biggest charge on the budget after debt servicing.

The Rs1.676-trillion defence expenditures are inclusive of pensions, strategic nature expenses and special military package, according to the finance ministry’s presentation.

Similarly, against Rs1.842-trillion budgeted cost of debt servicing, the finance ministry told the provinces that the debt servicing would consume minimum Rs1.95 trillion, or 36.6%, of the total budget. The central bank’s decision to increase interest rates also put additional burden of roughly Rs500 billion on the finance ministry due to high cost of borrowing.

As such - in my opinion the TOTAL DEFENCE FOR THE 2019-2020 FINANCIAL YEAR would be at least Rs. 1,979.623 Billion which at rate of US$ 1 = Terroristani Rs. 160 would be US$ 12.373 Billion. However to have Half the Defence capability as India Terroristani Defence Budget has to be at least in the US$ 20 to 25 Billion Range.

Cheers

More Hanky/Panky from Terroristan

PAGE 23 CHAPTER 5 CURRENT EXPENDITURE : 2019- 20

5.1 Table-15 below presents a summary of current expenditure:

PAGE 23 CHAPTER 5 CURRENT EXPENDITURE : 2019- 20

5.1 Table-15 below presents a summary of current expenditure:

TABLE – 15 – SUMMARY 9 - Rs. in Millions

PAKISTAN DEFENCE BUDGET: IN MILLIONS OF RUPEES

------------------------------------2018 - 2019--------2019-2020

------------------------------------REVISED

Defence Affairs and Services : 1,137,710----------1,152,535

Pension - Military :-------------: 0,259,779---------0,327,088

Total :----------------------------: 0,397,489---------1,479,623

The above is a Barefaced Lie. I refer to the following :

Govt to pay Rs3.6 trillion on defence, debt servicing - Shahbaz Rana : February 7, 2019

Against the stated defence budget of Rs1.1 trillion, the finance ministry told the NFC that by the end of fiscal year 2019, Rs1.676 trillion would be spent on defence that is equal to 31.5% of the federal budget. This is the second biggest charge on the budget after debt servicing.

The Rs1.676-trillion defence expenditures are inclusive of pensions, strategic nature expenses and special military package, according to the finance ministry’s presentation.

Similarly, against Rs1.842-trillion budgeted cost of debt servicing, the finance ministry told the provinces that the debt servicing would consume minimum Rs1.95 trillion, or 36.6%, of the total budget. The central bank’s decision to increase interest rates also put additional burden of roughly Rs500 billion on the finance ministry due to high cost of borrowing.

As such - in my opinion the TOTAL DEFENCE FOR THE 2019-2020 FINANCIAL YEAR would be at least Rs. 1,979.623 Billion which at rate of US$ 1 = Terroristani Rs. 160 would be US$ 12.373 Billion. However to have Half the Defence capability as India Terroristani Defence Budget has to be at least in the US$ 20 to 25 Billion Range.

Cheers

Pakistani Economic Stress Watch

Content and context of IMF programme

LAHORE: Every government approaches the International Monetary Fund (IMF) to tackle balance of payments crisis since it provides a natural solution to the problem. However, opposition parties raise hue and cry to achieve political mileage out of it.

The interesting phrases to score politically are “begging bowl”, “slavery” and “compromise on national sovereignty”. They ignore an important fact that the capitalist system is based on debt and the IMF and other multilateral institutions are specifically designed to assist countries facing acute external problems.

CheersThe media is replete with the analysis of the context, content and timing of the IMF programme. Some analysts argue that the IMF programme needs to be understood in historical context as Pakistan has been undertaking these programmes since 1959.

Pakistani Economic Stress Watch

MNAs barred from using word ‘selected’ for PM – Waqas Ahmed

ISLAMABAD: National Assembly Deputy Speaker Qasim Suri on Sunday directed MNAs to refrain from using the word ‘selected’ for Prime Minister Imran Khan.

“The government is working towards sustainable economic growth during its five years. We will create 10 million job opportunities. The tax-to-GDP ratio will be increased from 11% to 13.5%.”

Pakistan Muslim League-Nawaz (PML-N) leader Ahsan Iqbal maintained that the Pakistan Tehreek-e-Insaf (PTI) government tried to deceive the nation under the guise of austerity by auctioning off buffaloes and cars of the PM House. “In fact, the funds allocated for the PM House have been increased in the budget for the next fiscal year,” he added.

He demanded that the government should provide the details about the Rs5 trillion in loans it had taken during its 10-month tenure.

Cheers“Then the PML-N will also present itself for accountability for the Rs10 trillion loans it took during its five years of rule.”

Pakistani Economic Stress Watch

S&P BSE SENSEX

Current : 39,122.96 – Pt, Change : -71.53 - % Change : -0.18%

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,50,19,285.26 - $ 1 / I N R : 69.4150

Market Capitalization of BSE Listed Co. (U S $.) : 2,163.69 Billion

Current Index : 34,471.95 – Change : -653.30 - Percent Change : -1.9%

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 6,967,171,267,785 - $ 1 / R Tr 157.00

Market Capitalization of PSE Listed Co. (U S $.) : 44.38 Billion

B S E : P S E : : 48.75 : 1

Cheers

Current : 39,122.96 – Pt, Change : -71.53 - % Change : -0.18%

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,50,19,285.26 - $ 1 / I N R : 69.4150

Market Capitalization of BSE Listed Co. (U S $.) : 2,163.69 Billion

Current Index : 34,471.95 – Change : -653.30 - Percent Change : -1.9%

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 6,967,171,267,785 - $ 1 / R Tr 157.00

Market Capitalization of PSE Listed Co. (U S $.) : 44.38 Billion

B S E : P S E : : 48.75 : 1

Cheers

-

Ravi Karumanchiri

- BRFite

- Posts: 723

- Joined: 19 Oct 2009 06:40

- Location: www.ravikarumanchiri.com

- Contact:

Re: Pakistani Economic Stress Watch

LISTEN LIVE ON C-SPAN.... ***RIGHT NOW*** (look for it in the C-SPAN archive later, if you're reading this after an hour from now....)

Conversation with Pakistani Ambassador to the U.S. Asad Majeed Khan

Moderator: George Perkovich @ the Carnegie Endowment for International Peace, Washington D.C.

https://www.c-span.org/networks/?channel=radio

Conversation with Pakistani Ambassador to the U.S. Asad Majeed Khan

Moderator: George Perkovich @ the Carnegie Endowment for International Peace, Washington D.C.

https://www.c-span.org/networks/?channel=radio

Pakistani Economic Stress Watch

Morin’s last laugh and its rebuttal - Dilawar Hussain

CheersIn order to have the last laugh Mr Richard Morin offered his ‘version of the events’ surrounding his appointment as the CEO of Pakistan Stock Exchange (PSX) and his final bow. But he did that only by publishing an article after reaching the safety of the shores of his homeland Canada.

Pakistani Economic Stress Watch

X Posted on the Analyzing CPEC Thread

An Old Article which Spells out Terroristani Doom!

CPEC Turns into a Chinese Albatross on Pakistan’s neck Salman Rafi Sheikh December 1, 2017

On Nov. 24, a federal minister told Pakistan’s Senate that 91 percent of revenues to be generated from the US$62 billion Gwadar port and the China-Pakistan Economic Corridor that would transport the port’s imports would go to China.

Pakistan faces repaying US$16 billion in loans obtained from Chinese banks for its development, the free-trade zone surrounding it, and all communications infrastructure, at annual rates of more than 13 percent, inclusive of 7 percent insurance charges. The Pakistan government obviously has no answers on how it will repay the loan over the next 40 years out of the 9 percent of revenues the government will retain. China expects to recoup its own cost of development of the CPEC from the first four years of earnings.

Understandably gun-shy over the one-sidedness of China’s generosity, on Nov. 15 the Pakistani government turned down an offer of assistance by Beijing for construction of the US$14 billion Diamer-Bhasha Dam in Pakistan-Occupied Kashmir and said it would remove the project from the CPEC. The cost of the dam project has zoomed from US$5 billion to US$14 billion, with international lenders linking serious conditions with the provision of funding.

Pakistan thus is just one of several nations, including Sri Lanka, to have discovered the exorbitant conditions China is attaching to its massive One Belt, One Road.

“The real issue will come when some of those countries, particularly in central Asia, have to pay back some of the loans that were acquired in the Belt and Road Initiative,” Steve Tsang of London’s School of Oriental and African Studies told the Voice of America radio network. “And most of those countries will have problems paying back those loans.”

Given past practice, Pakistan will either look to the West and particularly the International Monetary Fund for loans to re-pay Chinese loans – or it will rely on Beijing for soft loans to repay the CPEC loans, thus getting caught in a vicious cycle.

In addition, what is likely to cause a lot more damage to Pakistan’s potential earning is the tax concessions and tax holidays over 20 to 40 years that Pakistan has granted to contractors and sub-contractors associated with the Chinese state-run China Overseas Port Holding Company for imports of equipment, material, plant, appliances and accessories for port and special economic zone.

According to reports, the 923-hectare free zone, which is to include factories, logistics hubs, warehousing facilities and display centers, will all be exempt both from customs duties and from provincial and federal taxes.

On the contrary, no comparable tax breaks and incentives have been provided to Pakistan’s local companies. This is likely to naturally reduce the demand for made-in-Pakistan goods because these goods, compared to Chinese goods, will be much costlier.

Even outside the free-zones, the Chinese companies’ activity amounts to disguised looting of Pakistan’s natural resources. The reason for this looting, in part, is Pakistan’s own ill-preparedness to protect its interests and revenues.

For instance, Pakistan doesn’t have a regulatory framework to oversee the export of the country’s natural resources, for example marble, allowing the Chinese companies to bypass Pakistan’s processing industries, which could otherwise be a major contributor to the country’s fast-falling value-added exports.

According to a report by the State Bank of Pakistan, Marble and Marble Products, “China is the biggest importer of marble from Pakistan; however, the marble exported to China also includes semi-processed marble, which is then re-exported from China after value addition, which is hurting Pakistan’s marble industry to a significant extent.”

It isn’t surprising therefore that Pakistan’s share in bi-lateral trade with China stood at, in 2016, US$41.9 billion as against China’s share of almost US$ 17 billion. Pakistan’s exports to China have actually fallen in value while China’s exports have increased, raising concerns that the 1,300-km Karakoram Highway linking the port to the Chinese border is a one-way street.

Besides the fact that the Chinese companies are almost operating in Pakistan as if they were operating in China, another startling concern is that these companies are bringing in shiploads of Chinese workers, and thus only rarely form genuine partnerships with Pakistani companies. Consequently, there is little or no transfer of skills or technology, which is one reason why Pakistan cannot prevent the import of marble to China as China has the right technology to process marble while Pakistan doesn’t.

That Chinese companies are bringing in their own workers is an illustration of the internal logic of CPEC whereby China is not only expanding its industrial reach, establishing new markets but also re-locating its excess labor as well. This, according to Pakistani economist Farrukh Saleem, is how China’s labor problem connects with CPEC and Pakistan: “China produces 60 percent of the global cement output. [But] domestic demand has gone down sharply, and the CPC would have to cut roughly 390 million tonnes of cement capacity. And that would mean unemployed cement workers.” Hence the imperative of re-locating this excess labor to countries like to Pakistan.

Similarly, China’s metal smelting and rolling industry, which employs 3.63 million workers, has annual production of at 800 million tonnes as against domestic demand of 400 million tonnes, indicating the need for a sharp cut in the industry and relocation of the excess labor.

As such, by 2023, the city of Gwadar alone is expected to see 500,000 Chinese workers and professionals. Accordingly, the China Pak Investment Corporation (CPIC) announced last month a partnership with Top International Engineering Corporation (TIEC), a Chinese state-owned company, to develop China Pak Hills, the first Chinese built Master Community in Gwadar that will accommodate about 500,000 Chinese by 2023.

Therefore, with Pakistan all set to take a deep plunge into ‘Chinese communism’ and create many mini-Chinas in Pakistan, hopes of reaping the benefits out of the ambitious project have largely been misplaced and a result of misguided and misperceived policy of the Pakistan government.

But Pakistan has little to no strength in its economy to refuse the Chinese capital. With its foreign exchange reserves standing at US$19 billion and with its external debts standing at US$78 billion, there appears little to no choice for Pakistan other than to jump on the Chinese bandwagon. Still, it all depends upon what Pakistan can extract out of its partnership with the Chinese. So far, however, it is the Chinese who seem perfectly placed to benefit both strategically and economically.The External Debt of Terroristan is now US$ 105 Billion and RISING

Salman Rafi Sheikh (kingsalmanrafi@gmail.com) is a Pakistani academic and long-time contributor to Asia Sentinel

Cheers

An Old Article which Spells out Terroristani Doom!

CPEC Turns into a Chinese Albatross on Pakistan’s neck Salman Rafi Sheikh December 1, 2017

On Nov. 24, a federal minister told Pakistan’s Senate that 91 percent of revenues to be generated from the US$62 billion Gwadar port and the China-Pakistan Economic Corridor that would transport the port’s imports would go to China.

Pakistan faces repaying US$16 billion in loans obtained from Chinese banks for its development, the free-trade zone surrounding it, and all communications infrastructure, at annual rates of more than 13 percent, inclusive of 7 percent insurance charges. The Pakistan government obviously has no answers on how it will repay the loan over the next 40 years out of the 9 percent of revenues the government will retain. China expects to recoup its own cost of development of the CPEC from the first four years of earnings.

Understandably gun-shy over the one-sidedness of China’s generosity, on Nov. 15 the Pakistani government turned down an offer of assistance by Beijing for construction of the US$14 billion Diamer-Bhasha Dam in Pakistan-Occupied Kashmir and said it would remove the project from the CPEC. The cost of the dam project has zoomed from US$5 billion to US$14 billion, with international lenders linking serious conditions with the provision of funding.

Pakistan thus is just one of several nations, including Sri Lanka, to have discovered the exorbitant conditions China is attaching to its massive One Belt, One Road.

“The real issue will come when some of those countries, particularly in central Asia, have to pay back some of the loans that were acquired in the Belt and Road Initiative,” Steve Tsang of London’s School of Oriental and African Studies told the Voice of America radio network. “And most of those countries will have problems paying back those loans.”

Given past practice, Pakistan will either look to the West and particularly the International Monetary Fund for loans to re-pay Chinese loans – or it will rely on Beijing for soft loans to repay the CPEC loans, thus getting caught in a vicious cycle.

In addition, what is likely to cause a lot more damage to Pakistan’s potential earning is the tax concessions and tax holidays over 20 to 40 years that Pakistan has granted to contractors and sub-contractors associated with the Chinese state-run China Overseas Port Holding Company for imports of equipment, material, plant, appliances and accessories for port and special economic zone.

According to reports, the 923-hectare free zone, which is to include factories, logistics hubs, warehousing facilities and display centers, will all be exempt both from customs duties and from provincial and federal taxes.

On the contrary, no comparable tax breaks and incentives have been provided to Pakistan’s local companies. This is likely to naturally reduce the demand for made-in-Pakistan goods because these goods, compared to Chinese goods, will be much costlier.

Even outside the free-zones, the Chinese companies’ activity amounts to disguised looting of Pakistan’s natural resources. The reason for this looting, in part, is Pakistan’s own ill-preparedness to protect its interests and revenues.

For instance, Pakistan doesn’t have a regulatory framework to oversee the export of the country’s natural resources, for example marble, allowing the Chinese companies to bypass Pakistan’s processing industries, which could otherwise be a major contributor to the country’s fast-falling value-added exports.

According to a report by the State Bank of Pakistan, Marble and Marble Products, “China is the biggest importer of marble from Pakistan; however, the marble exported to China also includes semi-processed marble, which is then re-exported from China after value addition, which is hurting Pakistan’s marble industry to a significant extent.”

It isn’t surprising therefore that Pakistan’s share in bi-lateral trade with China stood at, in 2016, US$41.9 billion as against China’s share of almost US$ 17 billion. Pakistan’s exports to China have actually fallen in value while China’s exports have increased, raising concerns that the 1,300-km Karakoram Highway linking the port to the Chinese border is a one-way street.

Besides the fact that the Chinese companies are almost operating in Pakistan as if they were operating in China, another startling concern is that these companies are bringing in shiploads of Chinese workers, and thus only rarely form genuine partnerships with Pakistani companies. Consequently, there is little or no transfer of skills or technology, which is one reason why Pakistan cannot prevent the import of marble to China as China has the right technology to process marble while Pakistan doesn’t.

That Chinese companies are bringing in their own workers is an illustration of the internal logic of CPEC whereby China is not only expanding its industrial reach, establishing new markets but also re-locating its excess labor as well. This, according to Pakistani economist Farrukh Saleem, is how China’s labor problem connects with CPEC and Pakistan: “China produces 60 percent of the global cement output. [But] domestic demand has gone down sharply, and the CPC would have to cut roughly 390 million tonnes of cement capacity. And that would mean unemployed cement workers.” Hence the imperative of re-locating this excess labor to countries like to Pakistan.

Similarly, China’s metal smelting and rolling industry, which employs 3.63 million workers, has annual production of at 800 million tonnes as against domestic demand of 400 million tonnes, indicating the need for a sharp cut in the industry and relocation of the excess labor.

As such, by 2023, the city of Gwadar alone is expected to see 500,000 Chinese workers and professionals. Accordingly, the China Pak Investment Corporation (CPIC) announced last month a partnership with Top International Engineering Corporation (TIEC), a Chinese state-owned company, to develop China Pak Hills, the first Chinese built Master Community in Gwadar that will accommodate about 500,000 Chinese by 2023.

Therefore, with Pakistan all set to take a deep plunge into ‘Chinese communism’ and create many mini-Chinas in Pakistan, hopes of reaping the benefits out of the ambitious project have largely been misplaced and a result of misguided and misperceived policy of the Pakistan government.

But Pakistan has little to no strength in its economy to refuse the Chinese capital. With its foreign exchange reserves standing at US$19 billion and with its external debts standing at US$78 billion, there appears little to no choice for Pakistan other than to jump on the Chinese bandwagon. Still, it all depends upon what Pakistan can extract out of its partnership with the Chinese. So far, however, it is the Chinese who seem perfectly placed to benefit both strategically and economically.The External Debt of Terroristan is now US$ 105 Billion and RISING

Salman Rafi Sheikh (kingsalmanrafi@gmail.com) is a Pakistani academic and long-time contributor to Asia Sentinel

Cheers

Pakistani Economic Stress Watch

S&P BSE SENSEX

Index Current : 39,434.94 - Pt. Change : +311.98 - % Change - +0.80

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,51,07,540.70 - $ 1 / I R 69.3850

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 2,177.35 Billion

P S E

Current Index : 34,190.62 – Change : -281.33 - % Change : -0.82%

Market Capitalization of BSE Listed Co. (Rs.Tr.) : 6,906,825,716,145 - $ 1 / T R 157.1012

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 43.96 Billiion

B S E : P S E : : 49.53 : 1

Cheers

Index Current : 39,434.94 - Pt. Change : +311.98 - % Change - +0.80

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,51,07,540.70 - $ 1 / I R 69.3850

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 2,177.35 Billion

P S E

Current Index : 34,190.62 – Change : -281.33 - % Change : -0.82%

Market Capitalization of BSE Listed Co. (Rs.Tr.) : 6,906,825,716,145 - $ 1 / T R 157.1012

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 43.96 Billiion

B S E : P S E : : 49.53 : 1

Cheers

Re: Pakistani Economic Stress Watch

Qatar just shelled out $3 billion in support for the 'economy', wonder how this will go down with the other Khaleejis. Fair to assume their line of credit for Saudi oil stands discontinued.

Re: Pakistani Economic Stress Watch

a twitter video has emerged from paris air show of 10 pakis pushing a jf17 slowly down the tarmac, presumably they have no money to pay a tow truck.

-

Mort Walker

- BRF Oldie

- Posts: 10040

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Pakistani Economic Stress Watch

TSP will NEVER pay back its loans.

Recently.

$6 billion IMF

$3 billion Qatar

$1 billion UAE

This is enough to sustain them for 5 years. Half to the military and half to line the pockets of the RAPEs. Expect TSP Rupee to stabilize between $1 = Rs. 165 for 2019. It will follow a stair step pattern come 2023 again.

Recently.

$6 billion IMF

$3 billion Qatar

$1 billion UAE

This is enough to sustain them for 5 years. Half to the military and half to line the pockets of the RAPEs. Expect TSP Rupee to stabilize between $1 = Rs. 165 for 2019. It will follow a stair step pattern come 2023 again.

Pakistani Economic Stress Watch

Singha Ji:Singha wrote:a twitter video has emerged from paris air show of 10 pakis pushing a jf17 slowly down the tarmac, presumably they have no money to pay a tow truck.

Actually Sir Ji they are trying to push-start the Engine!

Cheers

Re: Pakistani Economic Stress Watch

Throwing good money after the bad:

https://economictimes.indiatimes.com/ne ... 929473.cms

Ailing Pakistan gets $3 billion bailout from Qatar

The Gulf state is the 4th nation that has come forward to rescue Pakistan from default during past 11 months

Jun 24, 2019

Islamabad/Doha: Cash-strapped Pakistan on Monday secured a bailout package of USD 3 billion from oil-rich Qatar, a day after Emir Sheikh Tamim bin Hamad concluded his visit to Islamabad and agreed to cooperate in the fields of trade, anti-money laundering and curbing terror financing.

The Gulf state is the fourth nation that has come forward to rescue Pakistan from default during past 11 months as the government of Prime Minister Imran Khan tries to overcome a ballooning balance-of-payments crisis.

Earlier, China gave USD 4.6 billion in shape of deposits and commercial loans and Saudi Arabia provided USD 3 billion cash deposit and USD 3.2 billion oil facility on deferred payments. The United Arab Emirates also provided USD 2 billion cash deposit.

.....

Gautam

https://economictimes.indiatimes.com/ne ... 929473.cms

Ailing Pakistan gets $3 billion bailout from Qatar

The Gulf state is the 4th nation that has come forward to rescue Pakistan from default during past 11 months

Jun 24, 2019

Islamabad/Doha: Cash-strapped Pakistan on Monday secured a bailout package of USD 3 billion from oil-rich Qatar, a day after Emir Sheikh Tamim bin Hamad concluded his visit to Islamabad and agreed to cooperate in the fields of trade, anti-money laundering and curbing terror financing.

The Gulf state is the fourth nation that has come forward to rescue Pakistan from default during past 11 months as the government of Prime Minister Imran Khan tries to overcome a ballooning balance-of-payments crisis.

Earlier, China gave USD 4.6 billion in shape of deposits and commercial loans and Saudi Arabia provided USD 3 billion cash deposit and USD 3.2 billion oil facility on deferred payments. The United Arab Emirates also provided USD 2 billion cash deposit.

.....

Gautam

Re: Pakistani Economic Stress Watch

Another 4-5 months worth of comfort for the Pakis. What after that? Remember they have $24-28 Billion in dues within the next 18 months.

Re: Pakistani Economic Stress Watch

maybe the plan is hope DT does not get reelected, engineer some new crisis with india and negotiate with a more sympathetic potus for durex v2.0 status.Vips wrote:Another 4-5 months worth of comfort for the Pakis. What after that? Remember they have $24-28 Billion in dues within the next 18 months.

Re: Pakistani Economic Stress Watch

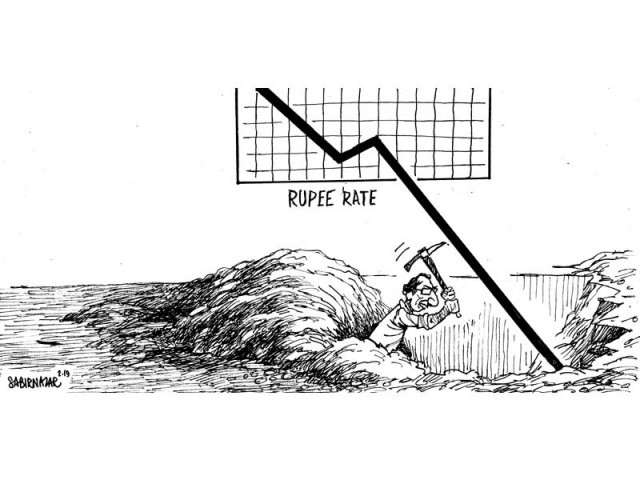

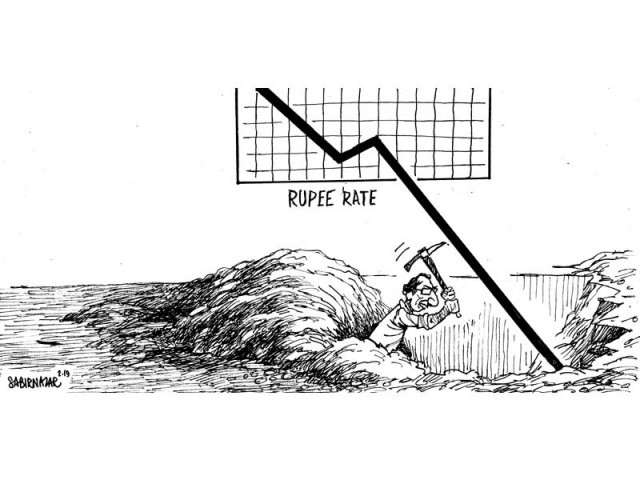

PKR downward slide continues...

Rupee hits all-time low of 161.5 against US dollar in inter-bank market https://tribune.com.pk/story/2000456/2- ... nk-market/

Rupee hits all-time low of 161.5 against US dollar in inter-bank market https://tribune.com.pk/story/2000456/2- ... nk-market/

Re: Pakistani Economic Stress Watch

I hope the locusts swarms do thier job before they are stopped by heavy moonsoon rains in Rajstan and Gujarat and Pakistan Textile Industry can violuntary shut down and sell its machinery at fire sale prices, should help the Paki BOP a little more.

Re: Pakistani Economic Stress Watch

me thinks PKR will settle @ 180.

Re: Pakistani Economic Stress Watch

I don't wish that. Our bread basket Punjab doesn't have any physical barriers for these to cross.Aditya_V wrote:I hope the locusts swarms do thier job before they are stopped by heavy moonsoon rains in Rajstan and Gujarat and Pakistan Textile Industry can violuntary shut down and sell its machinery at fire sale prices, should help the Paki BOP a little more.

Pakistani Economic Stress Watch

yensoy Ji :yensoy wrote:PKR downward slide continues...

Rupee hits all-time low of 161.5 against US dollar in inter-bank market https://tribune.com.pk/story/2000456/2- ... nk-market/

Dollar hits Rs162 in interbank trading.

Glory Glory Halleluja and the Terroristani Rupee Rate to the U S Dollar is Marching on to Rs. 200!

https://www.youtube.com/watch?v=UNk4X0shEls

Cheers

Re: Pakistani Economic Stress Watch

Only question is when the Paki toilet paper reaches that level.The rate has been commited to by the Porkis with the IMF. The Paki state oil companies had been told to take base of $1 = 180 PKR for the oil/gas imports.Atmavik wrote:me thinks PKR will settle @ 180.

Re: Pakistani Economic Stress Watch

weak pak rupee should boost lahore tourism from indian tourists

-

Mort Walker

- BRF Oldie

- Posts: 10040

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Pakistani Economic Stress Watch

The foreign money will start coming in after September. It will stabilize the PKR for 18-24 months. $10-12 billion is not a lot, but a lot for such a small economy and half of that going for defense CAPEX is still very significant. About 5-7% of their GDP.Atmavik wrote:me thinks PKR will settle @ 180.

For India, it must keep the military pressure on where it forces TSP to spend even more on defense. The goal is to divert funds from human development, health care and education. They are on their way to bhooka-nanga and it must expedited.

Last edited by Mort Walker on 26 Jun 2019 17:56, edited 1 time in total.

Re: Pakistani Economic Stress Watch

Don't want to jinx but hope it scores double century. We should then take the screenshot and savour it.

-

Mort Walker

- BRF Oldie

- Posts: 10040

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Pakistani Economic Stress Watch

The Chinese are killing their exports, but the danger is a weak PKR too quickly will be tempting in Punjab and possibly Rajasthan to trade with TSP. I think some Indian traders are rubbing their hands in glee with the declining PKR to buy Paki goods.abhijitm wrote:Don't want to jinx but hope it scores double century. We should then take the screenshot and savour it.

Pakistani Economic Stress Watch

S&P BSE SENSEX

Index Current : 39,592.08 - Pt. Change : +157.14 - % Change : +0.40

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,51,99,410.35 - $ 1 / I N R 69.3025

Market Capitalization of BSE Listed Co. (U S $.) : 2,194.20 Billion

P S E

Current Index : 34,088.56 – Change : -102.06 – Change : -0.3%

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 6,915,686,202,860 - $ 1 / 161.4311

Market Capitalization of BSE Listed Co. (U S $.) : 42.84 Billion

B S E : P S E : : 51.22 : 1

Cheers

Index Current : 39,592.08 - Pt. Change : +157.14 - % Change : +0.40

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,51,99,410.35 - $ 1 / I N R 69.3025

Market Capitalization of BSE Listed Co. (U S $.) : 2,194.20 Billion

P S E

Current Index : 34,088.56 – Change : -102.06 – Change : -0.3%

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 6,915,686,202,860 - $ 1 / 161.4311

Market Capitalization of BSE Listed Co. (U S $.) : 42.84 Billion

B S E : P S E : : 51.22 : 1

Cheers

Pakistani Economic Stress Watch

Govt borrowing to rise 84% to record Rs43.5tr in FY20 - Shahbaz Rana

ISLAMABAD: The Pakistan Tehreek-e-Insaf (PTI) government will borrow a record Rs43.5 trillion in the next fiscal year mainly for repayment and interest cost of maturing public debt, which is higher by 84% or nearly Rs20 trillion than the outgoing fiscal year.

The Ministry of Finance on Tuesday sought approval of the National Assembly for the highest-ever borrowing of Rs43.5 trillion in a single year to repay domestic and foreign debt and pay interest on these loans. Rs 43.5 Trillion = Rs 43500 Billion @ US$ 1= TR 160 it equates to US$ 271.875 BILLION i.e. Terroristan's GDP! It is Ridiculous!

Govt borrows a whopping Rs2.24tr in just five months

The Rs43.5 trillion is more than the total size of federal budget for 2019-20 at Rs7 trillion. The difference is because the government does not book loans taken for repayment of domestic and foreign loans in the budget. These transactions are settled outside the budget. The central bank borrows the money on behalf of the federal government from commercial banks.

The Rs43.5-trillion borrowing is the charged expenditure under the constitution and the National Assembly does not have the right to veto this expenditure.

The lower house of parliament can only discuss the expenditure which includes budgets for presidency, Supreme Court of Pakistan, Islamabad High Court, Auditor General of Pakistan, National Assembly, Senate, Pakistan Railways, pensions, Foreign Office other expenditure, Election Commission of Pakistan, Wafaqi Mohtasib and Federal Tax Ombudsman.

Adviser to Prime Minister on Finance Dr Abdul Hafeez Shaikh placed the Rs43.5 trillion worth of demand before the National Assembly for fiscal year 2019-20, starting July 1.

The demand was placed under Article 82 (I) of the constitution as charged expenditure. In case of “charged expenditure”, the National Assembly can only debate but cannot veto the proposed spending bill.

The borrowing plan underscores Pakistan’s growing dependence on domestic and foreign lenders at a time when the country also faces challenges to meet its external financing requirements.

For the outgoing fiscal year, the National Assembly had approved Rs23.5 trillion for obligatory expenditure and the new demand is Rs19.8-trillion or 83.6% higher than the outgoing fiscal year. This includes Rs43.3 trillion worth of debt servicing-related spending bill, which is higher by Rs19.74 trillion or 84% than the expenses approved by the National Assembly in May last year.

Except for Rs2.9 trillion that will be part of the federal budget, the rest of the amount will not be booked in the budget and will be directly borrowed from domestic and foreign markets to repay the loans obtained in the past. Interest payments on domestic and foreign loans will consume roughly 41% or Rs2.9 trillion of the proposed Rs7-trillion budget for the next fiscal year.

As against Rs21.9-trillion borrowing in the outgoing fiscal year, the government sought the National Assembly’s approval for a whopping Rs39.1-trillion borrowing for repayment of domestic debt in the next fiscal year. The amount is 78% or Rs17.2-trillion higher than the outgoing fiscal year.

The Rs39-trillion maturing domestic public debt is equal to 88% of the size of Pakistan’s economy. This will expose the government to exploitation by commercial banks, which have been dictating their terms due to the mounting financing needs.

The government has also placed another demand of Rs2.53 trillion for debt servicing, which is 80.7% or Rs1.13-trillion higher than the outgoing fiscal year. The debt servicing requirement may further increase due to the anticipated increase in interest rate by the State Bank of Pakistan (SBP) under the IMF deal.

For the next fiscal year, the federal government has projected its budget deficit at Rs3.5 trillion, which is equivalent to 8.1% of gross domestic product (GDP).

To repay foreign loans, the government has sought a whopping Rs1.1 trillion in the new fiscal year, which will be obtained from foreign lenders. The requirement for foreign loan repayment is up by 82% or Rs493.4 billion within a year.

The government has sought another Rs359.8 billion to pay interest on foreign loans, which is higher by Rs130.6 billion or 57% in a single year. Devaluation of the local currency contributed to the increase in cost of external public debt servicing.

Govt to keep details of $3.7b loan under wraps

The government has placed Rs108.3-billion demand before the National Assembly to repay short-term foreign loans, which is down by 38% or Rs66 billion.

By the end of next fiscal year, the public debt-to-GDP ratio is estimated to jump to 77.6%. The government is legally bound to limit the debt to below 60% of GDP but every successive government has breached this statutory limit.

Other charged expenditures

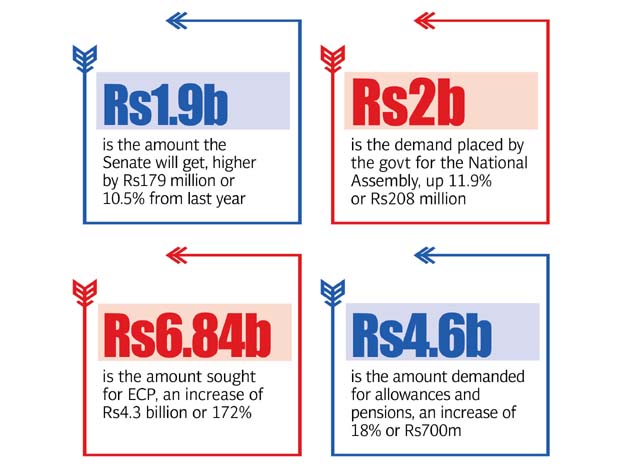

For staff, household and allowances of the president, the government has placed Rs992-million demand before the National Assembly, which is down by Rs44 million or 4.2% over the outgoing fiscal year. But both the National Assembly and Senate will get an increase in their allocations.

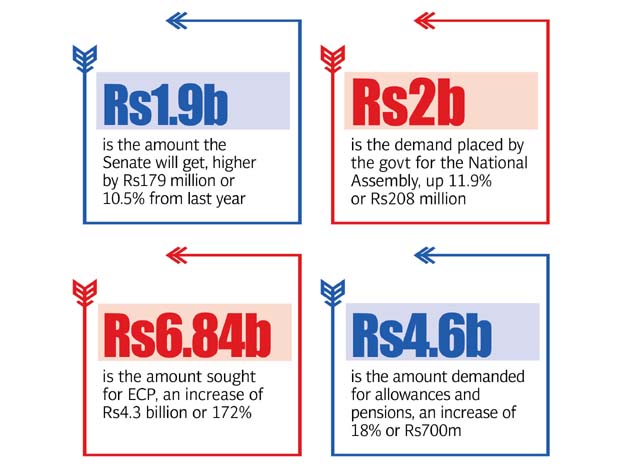

The government has placed a demand of Rs2 billion for the National Assembly, up by Rs208 million or 11.9%. The Senate will get Rs1.9 billion, also higher by Rs179 million or 10.5%.

The government has sought Rs2.1 billion for charged expenditures of the Supreme Court of Pakistan, which is higher by Rs131 million or 6.6%. For charged expenditures of the Islamabad High Court, a Rs579-million demand has been placed before the National Assembly, higher by Rs52 million or nearly 10%. The Election Commission of Pakistan will get Rs6.84 billion, an increase of Rs4.3 billion or 172% over last year.

The government has cut other expenditures of the Foreign Office by 50% to Rs75 million for the next fiscal year, but the Ministry of Law and Justice will get Rs255.3 million for charged expenditures, up by 8%. For superannuation allowances and pensions, the government has placed Rs4.6 billion worth of demand, an increase of 18% or Rs700 million.

Cheers

ISLAMABAD: The Pakistan Tehreek-e-Insaf (PTI) government will borrow a record Rs43.5 trillion in the next fiscal year mainly for repayment and interest cost of maturing public debt, which is higher by 84% or nearly Rs20 trillion than the outgoing fiscal year.

The Ministry of Finance on Tuesday sought approval of the National Assembly for the highest-ever borrowing of Rs43.5 trillion in a single year to repay domestic and foreign debt and pay interest on these loans. Rs 43.5 Trillion = Rs 43500 Billion @ US$ 1= TR 160 it equates to US$ 271.875 BILLION i.e. Terroristan's GDP! It is Ridiculous!

Govt borrows a whopping Rs2.24tr in just five months

The Rs43.5 trillion is more than the total size of federal budget for 2019-20 at Rs7 trillion. The difference is because the government does not book loans taken for repayment of domestic and foreign loans in the budget. These transactions are settled outside the budget. The central bank borrows the money on behalf of the federal government from commercial banks.

The Rs43.5-trillion borrowing is the charged expenditure under the constitution and the National Assembly does not have the right to veto this expenditure.

The lower house of parliament can only discuss the expenditure which includes budgets for presidency, Supreme Court of Pakistan, Islamabad High Court, Auditor General of Pakistan, National Assembly, Senate, Pakistan Railways, pensions, Foreign Office other expenditure, Election Commission of Pakistan, Wafaqi Mohtasib and Federal Tax Ombudsman.

Adviser to Prime Minister on Finance Dr Abdul Hafeez Shaikh placed the Rs43.5 trillion worth of demand before the National Assembly for fiscal year 2019-20, starting July 1.

The demand was placed under Article 82 (I) of the constitution as charged expenditure. In case of “charged expenditure”, the National Assembly can only debate but cannot veto the proposed spending bill.

The borrowing plan underscores Pakistan’s growing dependence on domestic and foreign lenders at a time when the country also faces challenges to meet its external financing requirements.

For the outgoing fiscal year, the National Assembly had approved Rs23.5 trillion for obligatory expenditure and the new demand is Rs19.8-trillion or 83.6% higher than the outgoing fiscal year. This includes Rs43.3 trillion worth of debt servicing-related spending bill, which is higher by Rs19.74 trillion or 84% than the expenses approved by the National Assembly in May last year.

Except for Rs2.9 trillion that will be part of the federal budget, the rest of the amount will not be booked in the budget and will be directly borrowed from domestic and foreign markets to repay the loans obtained in the past. Interest payments on domestic and foreign loans will consume roughly 41% or Rs2.9 trillion of the proposed Rs7-trillion budget for the next fiscal year.

As against Rs21.9-trillion borrowing in the outgoing fiscal year, the government sought the National Assembly’s approval for a whopping Rs39.1-trillion borrowing for repayment of domestic debt in the next fiscal year. The amount is 78% or Rs17.2-trillion higher than the outgoing fiscal year.

The Rs39-trillion maturing domestic public debt is equal to 88% of the size of Pakistan’s economy. This will expose the government to exploitation by commercial banks, which have been dictating their terms due to the mounting financing needs.

The government has also placed another demand of Rs2.53 trillion for debt servicing, which is 80.7% or Rs1.13-trillion higher than the outgoing fiscal year. The debt servicing requirement may further increase due to the anticipated increase in interest rate by the State Bank of Pakistan (SBP) under the IMF deal.

For the next fiscal year, the federal government has projected its budget deficit at Rs3.5 trillion, which is equivalent to 8.1% of gross domestic product (GDP).

To repay foreign loans, the government has sought a whopping Rs1.1 trillion in the new fiscal year, which will be obtained from foreign lenders. The requirement for foreign loan repayment is up by 82% or Rs493.4 billion within a year.

The government has sought another Rs359.8 billion to pay interest on foreign loans, which is higher by Rs130.6 billion or 57% in a single year. Devaluation of the local currency contributed to the increase in cost of external public debt servicing.

Govt to keep details of $3.7b loan under wraps

The government has placed Rs108.3-billion demand before the National Assembly to repay short-term foreign loans, which is down by 38% or Rs66 billion.

By the end of next fiscal year, the public debt-to-GDP ratio is estimated to jump to 77.6%. The government is legally bound to limit the debt to below 60% of GDP but every successive government has breached this statutory limit.

Other charged expenditures

For staff, household and allowances of the president, the government has placed Rs992-million demand before the National Assembly, which is down by Rs44 million or 4.2% over the outgoing fiscal year. But both the National Assembly and Senate will get an increase in their allocations.

The government has placed a demand of Rs2 billion for the National Assembly, up by Rs208 million or 11.9%. The Senate will get Rs1.9 billion, also higher by Rs179 million or 10.5%.

The government has sought Rs2.1 billion for charged expenditures of the Supreme Court of Pakistan, which is higher by Rs131 million or 6.6%. For charged expenditures of the Islamabad High Court, a Rs579-million demand has been placed before the National Assembly, higher by Rs52 million or nearly 10%. The Election Commission of Pakistan will get Rs6.84 billion, an increase of Rs4.3 billion or 172% over last year.

The government has cut other expenditures of the Foreign Office by 50% to Rs75 million for the next fiscal year, but the Ministry of Law and Justice will get Rs255.3 million for charged expenditures, up by 8%. For superannuation allowances and pensions, the government has placed Rs4.6 billion worth of demand, an increase of 18% or Rs700 million.

Cheers

Re: Pakistani Economic Stress Watch

These guys should seriously stop talking in PKR currency and should quote the numbers in USD instead. It is difficult to keep up with the exchange rate. Today's 2 trillion PKR tomorrow becomes 2.5 trillion. <facepalm>

Re: Pakistani Economic Stress Watch

Finally! I have been waiting for this day since yonder. More than 50:1...Take that kuffars.

Re: Pakistani Economic Stress Watch

By 2030 , this will be GDP ration also, may be Paki will even "force" us to do better. My dream of Crores of unwashed Paki looking for food and water at Wagha shall soon come true. Need truck mounted AK 630 every hundred yard to make proper PakenganBhaarta.Jay wrote:

Finally! I have been waiting for this day since yonder. More than 50:1...Take that kuffars.

-

Mort Walker

- BRF Oldie

- Posts: 10040

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Pakistani Economic Stress Watch

Bah! Bakistan is aatmitaakat you kufrs.Jay wrote:

Finally! I have been waiting for this day since yonder. More than 50:1...Take that kuffars.

Re: Pakistani Economic Stress Watch

As has been made clear in prior discussions, Indian Army will not fire on unarmed civilians. BSF might do so but very selectively and only to deter others from jumping the fence. Machine-gunning Pakis should not even be part of our vocabulary. We can build a mega fence, we can electrify it; but we should never be in a situation where we ask a soldier to rain fire on unarmed civilians. We are not a rascal like Gen Dyer. It is against our dharma.

Re: Pakistani Economic Stress Watch

Something is terribly wrong with our DNA to create false equivalence of our situation and Gen Dyer.The khan market, lutyens gang, tukde tukde gang and the psuedo secularists like Khangress would love to quote this equation and have an orgasm at the thought of more artificially created Waynads in India.

There is no comparison. Gen Dyer did something for his sadistic pleasure, while what Indians will do (or not to do) will literally decide if bharat varsh and dharma survives or not.

Sometimes dharma dictates killing of asuras to maintain dev rajya. Please no need to be torchbearer of humanity or misplaced (and lethal) sympathy. What needs to be done needs to be done for getting the message across or you will have the low-lifes flooding into the country one way or the other.

We have gone through the various scenarios like fencing, laying mines etc but nothing beats the MMG/HMG in a picket line as a deterrence value.

The liberal hearts can do a candle march and suggest a UN supervised camp well within the pakistani territory and way from Indian borders.

Want to bet what will be a statistic that will emerge 9 months later? The abduls/ayeshas will simply procreate more and more energized by the free ration. Rohingyas are doing the same all over in Bharat varsh and Bangladeshi refugee camps right now as you are reading this.

There is no comparison. Gen Dyer did something for his sadistic pleasure, while what Indians will do (or not to do) will literally decide if bharat varsh and dharma survives or not.

Sometimes dharma dictates killing of asuras to maintain dev rajya. Please no need to be torchbearer of humanity or misplaced (and lethal) sympathy. What needs to be done needs to be done for getting the message across or you will have the low-lifes flooding into the country one way or the other.

We have gone through the various scenarios like fencing, laying mines etc but nothing beats the MMG/HMG in a picket line as a deterrence value.

The liberal hearts can do a candle march and suggest a UN supervised camp well within the pakistani territory and way from Indian borders.

Want to bet what will be a statistic that will emerge 9 months later? The abduls/ayeshas will simply procreate more and more energized by the free ration. Rohingyas are doing the same all over in Bharat varsh and Bangladeshi refugee camps right now as you are reading this.

Re: Pakistani Economic Stress Watch

Hats off to you for initiating and sustaining this exercise! I remember your posts when the ratio was hovering around 32:1, and this is a good opportunity to thank you for your efforts!Peregrine wrote:S&P BSE SENSEX

Index Current : 39,592.08 - Pt. Change : +157.14 - % Change : +0.40

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,51,99,410.35 - $ 1 / I N R 69.3025

Market Capitalization of BSE Listed Co. (U S $.) : 2,194.20 Billion

P S E

Current Index : 34,088.56 – Change : -102.06 – Change : -0.3%

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 6,915,686,202,860 - $ 1 / 161.4311

Market Capitalization of BSE Listed Co. (U S $.) : 42.84 Billion

B S E : P S E : : 51.22 : 1

Cheers

Re: Indian Economy News & Discussion - Nov 27 2017

1 $ is presently 84 bd taka, and 160 tsp rupee.

i heard imf has mandated that tsp rupee be further devalued to 180.

so bd currency is quite stable and not the toilet paper that is the tsp rupee.

paks who earn in riyals & dirhams in gulf and dollars in west will be loathe to send money back given the devaluations.

i heard imf has mandated that tsp rupee be further devalued to 180.

so bd currency is quite stable and not the toilet paper that is the tsp rupee.

paks who earn in riyals & dirhams in gulf and dollars in west will be loathe to send money back given the devaluations.