Perspectives on the global economic meltdown (Jan 26 2010)

Re: Perspectives on the global economic meltdown (Jan 26 2010)

With all that gyan acquired over 100 pages of the last thread, what are the future steps (short and long term) that will be needed to stem and rebuild the economy?

Re: Perspectives on the global economic meltdown (Jan 26 2010)

What do you expect when you say rebuild the economy?ramana wrote:what are the future steps (short and long term) that will be needed to stem and rebuild the economy?

Return to pre-2008 level? Or come to a sustainable level?

What should happen to the debt that has been accumulated so far, to create pre-2008 economy?

My take on this is, last few decades (I can't really talk about the period before that) were a bubble era where people, especially those in advanced economies, could make money very easily. What happened then was that people who were enjoying the benefits began to take that as the real normal, which unfortunately wasn't true. Everyone has to work hard to earn their living. People who grew up in the bubble era are not able to cope up with that reality.

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Prad:

I was thinking about giving my perspective (read rant) of our conditions; and needed the right motivation. I will address your post under the following headings. Each heading will lead into the subsequent rant er...topic.

1) US Presidents, Politics & Current Economic conditions.

2) American lifestyle & Corporations.

3) Opportunity for highlighting Dharmic Economic Model (based on a Purusartha).

US Presidents, Politics & Current Economic conditions.

Under this category all I wish to state is that individual Presidents, however powerful, are just pieces in the big American System. In the last 20-30 years the following Presidents invoke different emotions - Reagan, Clinton, W Bush & Obama. These Presidents offer interesting sound bites but have contributed positively and negatively to the economic cycle in the country and across globe. I see Obama under these conditions, though he was my personal favorite during elections.

Well everybody agreed banks had to be given money - well "everybody" still do not see the economy recovering. Yes it did save some banks. I am sorry to say you are just parroting some rhetoric here. Sorry to say some choice views of some of the radio "pundits". What do you mean by every ounce of energy? Did he not follow after W Bush's stimulus to the bank and economy? What actions of his would make you consider that economy was/is his top priority.

If you want to know why his poll numbers have dropped or there the public is "against" him, then read a series of articles in Newsweek. Very illuminating. One article talks about why he is considered cold while Reagan, Clinton and W Bush were not.

If you read your entire post and the previous only two things stand out that can be really related to any activity - dollars going to Unions vs dollars going to the bank. Both entites invoke strog emotions from across the political spectrum. The fact is dollars need to go to all - eventually the people (not just companies or into the hands of the few).

More laterz ( I need to rush to my class ). Hopefully I will be able to write the other two topics in a day or two. I see tremendous opportunity for #3.

). Hopefully I will be able to write the other two topics in a day or two. I see tremendous opportunity for #3.

I was thinking about giving my perspective (read rant) of our conditions; and needed the right motivation. I will address your post under the following headings. Each heading will lead into the subsequent rant er...topic.

1) US Presidents, Politics & Current Economic conditions.

2) American lifestyle & Corporations.

3) Opportunity for highlighting Dharmic Economic Model (based on a Purusartha).

US Presidents, Politics & Current Economic conditions.

Under this category all I wish to state is that individual Presidents, however powerful, are just pieces in the big American System. In the last 20-30 years the following Presidents invoke different emotions - Reagan, Clinton, W Bush & Obama. These Presidents offer interesting sound bites but have contributed positively and negatively to the economic cycle in the country and across globe. I see Obama under these conditions, though he was my personal favorite during elections.

Well everybody agreed banks had to be given money - well "everybody" still do not see the economy recovering. Yes it did save some banks. I am sorry to say you are just parroting some rhetoric here. Sorry to say some choice views of some of the radio "pundits". What do you mean by every ounce of energy? Did he not follow after W Bush's stimulus to the bank and economy? What actions of his would make you consider that economy was/is his top priority.

If you want to know why his poll numbers have dropped or there the public is "against" him, then read a series of articles in Newsweek. Very illuminating. One article talks about why he is considered cold while Reagan, Clinton and W Bush were not.

If you read your entire post and the previous only two things stand out that can be really related to any activity - dollars going to Unions vs dollars going to the bank. Both entites invoke strog emotions from across the political spectrum. The fact is dollars need to go to all - eventually the people (not just companies or into the hands of the few).

More laterz ( I need to rush to my class

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Difficult question, open to varied interpretations. But that will need to be re-constructed repeatedly as time flows.ramana wrote:With all that gyan acquired over 100 pages of the last thread, what are the future steps (short and long term) that will be needed to stem and rebuild the economy?

I can think of a few very broad learnings from the current crisis that are so obvious as to be timeless only.

1. Don't spend more than your earning capacity: The excess consumption/speculation over income has to made up for by debt that has to repaid down the line. A lesson thats almost scale-invariant in that it applies equally well to individuals and households on the one hand and to local gubmints and states on the other (nations, are a slightly different ball-game as we will see).

2. History rhymes every 3rd (4th?) generation or so: The cornerstone of Austrian economics stated above gets forgotten, more typically dismissed as not relevant anymore because, "Hey, its different this time", every third or fourth generation since the lessons past are slowly lost to collective public memory.

3. The productive economy is the only real economy: The financial sector was some 5% of GDP in the 70s and is now triple that. The object lesson being it is only the real, productive manufacturing and core services sector in the economy that adds real value, sustainable heft and genuine growth. Fin sector becomes parasitic after about 5%, I'd say.

4. Fiat money regimes are inherently open to abuse: By gubmints, central banks and fin sector overlords who together form the establishment in what are called 'modern capitalist democracies'. Perhaps this point could also be alternately titled 'power tends to centralize as a result of human nature' and the powered elites will squeeze blood from a turnip.

5. Don't promise what you cannot pay: An object lesson that gubmints at all levels will learn in the coming months. The public union concessions ceded bit by bit over the past 3 decades, the pension and retirement obligations taken on with nary a thought to how they will be fulfilled (it'll be someone else in the chair when the bills come due, you see) are all coming home to roost at a street near you. It won;t be avoidable as it won't be pretty.

6. Redundancy only looks inefficient, it is actually vital to survival: A lesson western civilization will come to learn perhaps in a generation. Having destroyed their traditional family structure (that age-old last-resort institution of individual and societal support) in return for blind belief in a nanny-state looking after one's post retirement needs all the ways to the grave, things are liable to turn grave indeed mighty soon (wait for the interest rates to spike and then see the result).

7. Focus on the right metrics: The right metrics to measuring inflation were not the CPI but rather a more composite cost of living index that took into consideration climbing asset prices and soaring costs of essentials for a middle class existence such as college education and basic medical coverage. The right metric to measuring economic growth was not GDP but rise in the median real wage. Blue collar wages in the US have progressively declined every year since 1972. Manufacturing shifted out of the US despite falling real wages. The shafting of the US middle class represents the real decline of US greatness and promise. A point that the good Prof. Liz Warren makes wonderfully well in simple, beautiful terms.

And more. Kindly feel free to add to this list of learnings. And hotly debate what you disagree with. Its time to collate and delve for insight rather than get stuck forver in the data collect mold. Data collection, of course toh chalta rahega.

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Richard Duncan who proposes that instead of spending hoards of money on the financial sector, the govt instead spend 3 trillion over 10 years on potential future sectors like genetics and alternative energy. He says all that's needed is a few major break throughs in genetics (e.g. a cure for cancer). That in itself would pay off the national debt over a few years.

I thought he was insane when I heard the amount (3 trillion) but he's talking sense. Think about the productivity boost if they found a way to slow down the aging process or grow organs in labs so that you could get a mid-life refit.

He claims if nothing new comes up within the next 5 to 10 years, US will face an irreversible decline in its global economic power.

His idea is a rather bold one but makes a lot more sense than handing out money to the useless financial 'industry' which is nothing more than a bunch of con artists.

My instinct however tells me that whenever govt gets involved in anything, costs just balloon.

http://www.netcastdaily.com/broadcast/f ... 0109-2.mp3

I thought he was insane when I heard the amount (3 trillion) but he's talking sense. Think about the productivity boost if they found a way to slow down the aging process or grow organs in labs so that you could get a mid-life refit.

He claims if nothing new comes up within the next 5 to 10 years, US will face an irreversible decline in its global economic power.

His idea is a rather bold one but makes a lot more sense than handing out money to the useless financial 'industry' which is nothing more than a bunch of con artists.

My instinct however tells me that whenever govt gets involved in anything, costs just balloon.

http://www.netcastdaily.com/broadcast/f ... 0109-2.mp3

Last edited by Neshant on 02 Feb 2010 09:29, edited 1 time in total.

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Few digressions before going to #2.

A)

>>>but let us not get into our personal opinions.

This is "perspective" dhaaga. We need personal opinions of what we see out in the World Only then we learn or relearn.

Only then we learn or relearn.

B )

I agree on somethings you say about Obama and disagree on several other things. But for now, I want to pass the opportunity of saying more on this topic. Maybe my next "perspective" will touch upon couple of things out there. You have used the word reform" at least 3 times in your last post. But have not given any idea about what exactly you have in mind. BTW, did you read the link posted by Satya above {Volcker's thoughts on reform}?

C) Regarding our "perspective" of Unkil being in decline or not. If I have to summarize several of my posts I would say that I see Unkil in a similar situation as the British found themselves in the early 20th century. What is going to happen in the future? Nobody knows. But we dig into past find data points, connect them and make projections. History shows that Empires rise and fall. There is no permanence. In that regards, yes Unkil will fall from what he is now sometime in the future. India will rise sometime in the future. To what levels? I don't know. Remember to read my #3 that will touch about "sustainability"

A)

>>>but let us not get into our personal opinions.

This is "perspective" dhaaga. We need personal opinions of what we see out in the World

B )

I agree on somethings you say about Obama and disagree on several other things. But for now, I want to pass the opportunity of saying more on this topic. Maybe my next "perspective" will touch upon couple of things out there. You have used the word reform" at least 3 times in your last post. But have not given any idea about what exactly you have in mind. BTW, did you read the link posted by Satya above {Volcker's thoughts on reform}?

C) Regarding our "perspective" of Unkil being in decline or not. If I have to summarize several of my posts I would say that I see Unkil in a similar situation as the British found themselves in the early 20th century. What is going to happen in the future? Nobody knows. But we dig into past find data points, connect them and make projections. History shows that Empires rise and fall. There is no permanence. In that regards, yes Unkil will fall from what he is now sometime in the future. India will rise sometime in the future. To what levels? I don't know. Remember to read my #3 that will touch about "sustainability"

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Great summary Hari.

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Whose economy? US's? If US goes back to the business as usual, is it in our (Indian) interest? Why should we spend any energy is brainstorming on an idea that has not worked in our best interest?ramana wrote:what are the future steps (short and long term) that will be needed to stem and rebuild the economy?

IMO, we should rather focus on:

a) What are some of the advantages we have in the current system, how to sustain them?

b) what are some of the pain points we face in the global economy?

c) Does this crisis create any opportunities to address some of the pain points identified in b)?

d) What are some of the red lines that MUST be carefuly watched and secured?

e) Who are some of the players that we wish to go away from the radar to make way for us? What moves should we make in this crisis to make that happen?

f) what internal changes need to be made to position ourselves to take advantage from this crisis or take bigger role post crisis?

g) Can we benefit more from the strategic partnership with US if g1) US comes out either maintaining status quo or comes out stronger (very unlikely) g2) or weakens further? If so, what do we want and what are we ready to give?

Re: Perspectives on the global economic meltdown (Jan 26 2010)

How do you define "productive economy"? Would domestic services like healthcare be part of the productive economy?Hari Seldon wrote: The productive economy is the only real economy

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Neshantji???Neshant wrote:I thought he was insane when I heard the amount (3 trillion) but he's talking sense. Think about the productivity boost if they found a way to slow down the aging process or grow organs in labs so that you could get a mid-life refit.

Is this all needed that is needed?

Well..bought back the memories of AIDS in Africa case study.

But the larger question is, is productivity the problem? If so, how?

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Turns out I was insufficiently effusive in my praise for Sri Obama's bold moves with Sri Volcker by his side, and in general fro the remarkable resilience and responsiveness of the US political system to distress in what the yanks call 'Main street'.

The comprehensive reform including a regulatory overhaul of the banking system that bans propreitary trading by banks on the public dole was just for starters, apparently.

Now here's what is transpiring after the bankers and their lobbyists (i.e. campaign contributors) have hit back....

The comprehensive reform including a regulatory overhaul of the banking system that bans propreitary trading by banks on the public dole was just for starters, apparently.

Now here's what is transpiring after the bankers and their lobbyists (i.e. campaign contributors) have hit back....

Wah re duniya. Jai ho only.A proposal by former Federal Reserve Chairman Paul Volcker to limit bank’s proprietary trading will be either be dropped or significantly modified in the Senate, lawmakers and staffers told dealReporter.

Senate Banking Committee ranking member Richard Shelby (R-AL) said he opposes the so-called Volcker rule and the Obama administration’s call to levy a USD 90bn tax on banks.

...

A Dodd staffer said the senator is likely to quietly drop or modify many of the recommendations in the Volcker rule to ensure Republican support for regulatory reform.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Of course. Anything that minimizes 'overhead' is good. Core services are productive by definition. The legion of administrators, mgmt and such that are== overhead (that account for some 40% odd of public edu and healthcare budgets by county and school district) are unproductive moochers.How do you define "productive economy"? Would domestic services like healthcare be part of the productive economy?

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Generally anything that boosts productivity enhances wealth be it in farming or architecture or manufacturing..etc. The reason the 90s were boom years was because computerization of the workforce had a major impact on productivity and hence profitability even if it got carried away with dot com bombs.But the larger question is, is productivity the problem? If so, how?

AIDS is not a major concern for the west (only africa) so there's no incentive to find a cure. If it killed 400 million white guys, you'd bet there would be a cure because it would be descimating productivity.

I do agree with the guy that a few major breakthrough in genetics would go a long ways towards plugging the budget deficit. Its not unlike the invention of the transistor which opened up all kinds of doors.

If science were to find a gene/s that slows down the aging process by 50% so your body did not deteriorate by age 60, it would remove a tremendous cost burden from society. It means you'd spend an extra 75% more of your life as an adult being able to work and contribute to society (tax). The huge avalanch of old guys retiring could be spread out as they are made to work longer. The savings run into the trillions and the tax revenue gains also run into the trillions from just this ONE major discovery. As it stands, the public sector is working to age 55 and retiring with lavish pensions for 30 years on the backs of the private sector tax payers!

Re: Perspectives on the global economic meltdown (Jan 26 2010)

This guy Richard Duncan isn't some chump. He wrote a book back in 2004 about the dollar crisis. Check out how his predictions have played out in hind sight - something you don't get to do with many pundits making predictions today claiming they foretold it all. :

The Dollar Crisis is divided into five parts:

Part One describes how the US trade deficits, which now exceed US$1 million a minute, have destabilized the global economy by creating a worldwide credit bubble.

Part Two explains why these giant deficits cannot persist and why a US recession and a collapse in the value of the Dollar are unavoidable.

Part Three analyzes the extraordinarily harmful impact that the US recession and the collapse of the Dollar will have on the rest of the world.

Part Four offers original recommendations that, if implemented, would help mitigate the damage of the coming worldwide downturn and put in place the foundations for balanced and sustainable economic growth in the decades ahead.

Part Five, which has been newly added to the second edition, describes the extraordinary evolution of this crisis since the first edition was completed in September 2002. It also considers how the Dollar Crisis is likely to unfold over the years immediately ahead, the likely policy response to the crisis, and why that response cannot succeed.

The Dollar Standard is inherently flawed and increasingly unstable. Its collapse will be the most important economic event of the 21st Century.

The Dollar Crisis is divided into five parts:

Part One describes how the US trade deficits, which now exceed US$1 million a minute, have destabilized the global economy by creating a worldwide credit bubble.

Part Two explains why these giant deficits cannot persist and why a US recession and a collapse in the value of the Dollar are unavoidable.

Part Three analyzes the extraordinarily harmful impact that the US recession and the collapse of the Dollar will have on the rest of the world.

Part Four offers original recommendations that, if implemented, would help mitigate the damage of the coming worldwide downturn and put in place the foundations for balanced and sustainable economic growth in the decades ahead.

Part Five, which has been newly added to the second edition, describes the extraordinary evolution of this crisis since the first edition was completed in September 2002. It also considers how the Dollar Crisis is likely to unfold over the years immediately ahead, the likely policy response to the crisis, and why that response cannot succeed.

The Dollar Standard is inherently flawed and increasingly unstable. Its collapse will be the most important economic event of the 21st Century.

Re: Perspectives on the global economic meltdown (Jan 26 2010)

The Obama administration seeks a $970 billion tax increase over the next decade

The Obama administration seeks a tax increase of $400 billion from businesses even as it retools a proposed crackdown on international tax-avoidance techniques.

The tax increases in the budget dwarf the tax relief.”

The $3.8 trillion spending plan for fiscal 2011 would retool three tax proposals aimed at preventing U.S. companies from shifting profits offshore that were introduced last year.

The biggest change would delete a proposal to abolish “check-the-box” rules, which allow companies to legally disregard foreign subsidiaries in tax havens when they file corporate tax returns. It also scales back a proposal to restrict the ability of companies to defer U.S. taxes on their foreign profits.

A fee imposed on 50 of the biggest financial firms such as New York-based JPMorgan Chase & Co. and Charlotte, North Carolina-based Bank of America Corp. would raise another $90 billion. Eliminating tax breaks for fossil-fuel industries would produce another $40 billion.

Capital-gains and dividend tax rates would increase to 20 percent for people earning more than $250,000.

http://www.bloomberg.com/apps/news?pid= ... qcwZCtO0_w

..........Higher Tax is the mantra of Obama..............

The Obama administration seeks a tax increase of $400 billion from businesses even as it retools a proposed crackdown on international tax-avoidance techniques.

The tax increases in the budget dwarf the tax relief.”

The $3.8 trillion spending plan for fiscal 2011 would retool three tax proposals aimed at preventing U.S. companies from shifting profits offshore that were introduced last year.

The biggest change would delete a proposal to abolish “check-the-box” rules, which allow companies to legally disregard foreign subsidiaries in tax havens when they file corporate tax returns. It also scales back a proposal to restrict the ability of companies to defer U.S. taxes on their foreign profits.

A fee imposed on 50 of the biggest financial firms such as New York-based JPMorgan Chase & Co. and Charlotte, North Carolina-based Bank of America Corp. would raise another $90 billion. Eliminating tax breaks for fossil-fuel industries would produce another $40 billion.

Capital-gains and dividend tax rates would increase to 20 percent for people earning more than $250,000.

http://www.bloomberg.com/apps/news?pid= ... qcwZCtO0_w

..........Higher Tax is the mantra of Obama..............

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Anything that adds value would be part of the productive economy - manufacturing, services, education. Even finance to the extent that banks' ability to make money out of thin air (or credit ratings) is controlled for the greater good of the nation.

------------------

Hari,

That is an excellent summary. On the face of it, it appears Marxist, but is actually anti-marxist.

If you go back in history, you will find that most of your arguments are the same as that of people/interests that were opposed to or oppressed by bankers.

Your list can be called the manifesto of the non-financial community.

------------------

>>The productive economy is the only real economy

This is what money lenders hate - they insist that money makes money.

>>Don't promise what you cannot pay

This, and fiat money systems, are inherently popular politically because they are inherently open to abuse. I know that every sane person would like to do away with vapourware, but it ain't gonna happen (soon).

>>Focus on the right metrics

Same as above. The politics of what can be said will determine this - not the search for truth. Witness the Shanghai Stats practices by CRU of the IPCC.

------------------

Hari,

That is an excellent summary. On the face of it, it appears Marxist, but is actually anti-marxist.

If you go back in history, you will find that most of your arguments are the same as that of people/interests that were opposed to or oppressed by bankers.

Your list can be called the manifesto of the non-financial community.

------------------

>>The productive economy is the only real economy

This is what money lenders hate - they insist that money makes money.

>>Don't promise what you cannot pay

This, and fiat money systems, are inherently popular politically because they are inherently open to abuse. I know that every sane person would like to do away with vapourware, but it ain't gonna happen (soon).

>>Focus on the right metrics

Same as above. The politics of what can be said will determine this - not the search for truth. Witness the Shanghai Stats practices by CRU of the IPCC.

Re: Perspectives on the global economic meltdown (Jan 26 2010)

obama will convert nasa into assam state transport corp . holder of prime property in all towns but cannot run a profitable business - soln ? rent out its property to other transport cos.

serves them right. what ISRO does in $10mil, they spend $500 mil and

still squeal about lack of funds.

---

Florida feels heat of NASA cutback

The loss of at least 7,000 jobs at NASA leaves the Space Coast with a sense of betrayal by President Barack Obama.

President Barack Obama is redirecting America's space program, killing NASA's $100 billion plans to return astronauts to the moon and using much of that money for new rocket technology research.

The moon mission, which had already cost $9.1 billion, was based on old technology and revisiting old places astronauts had already been, officials said. The previous NASA chief, in selling the old moon plan, had even called it "Apollo on steroids." The rockets were based on space shuttle boosters.

"Simply put, we're putting the science back into the rocket science at NASA," White House science adviser John Holdren said at a budget briefing Monday.

President Barack Obama is essentially grounding efforts to return astronauts to the moon and instead is sending NASA in new directions with roughly $6 billion more, according to officials familiar with the plans.

A White House official confirmed Thursday that when next week's budget is proposed, NASA will get an additional $5.9 billion over five years, as first reported in Florida newspapers. Some of that money would extend the life of the International Space Station to 2020. It also would be used to entice companies to build private spacecraft to ferry astronauts to the space station after the space shuttle retires, said the official who was not authorized to speak by name.

The money in the president's budget is not enough to follow through with NASA's Constellation moon landing plan initiated by President George W. Bush. An aide to an elected official who was told of Obama's plans, but who asked that his name not be used because of the sensitivity of the discussions, said Obama is effectively ending

President Barack Obama is essentially grounding efforts to return astronauts to the moon and instead is sending NASA in new directions with roughly $6 billion more, according to officials familiar with the plans.

NASA is facing a series of money woes that could thwart its hopes of once again becoming the world's leader in space exploration and deliver an economic knee-capping to Florida's Space Coast.

A blue-ribbon presidential panel is expected to advise the White House later this month that returning astronauts to the moon by 2020, as former President George W. Bush proposed, is financially impossible under NASA's $18.7 billion budget.

And NASA officials told a committee of the National Academy of Sciences this week that the costs of major scientific projects -- such as a successor to the Hubble Space Telescope or a new Mars lander -- are running far above the funds available from the White House or Congress.

President Barack Obama's multi-trillion-dollar budget would boost spending for several government agencies while slashing the account for others. Here is an agency-by-agency glance:

----

But on the chopping block is the moon effort, which includes the Ares rocket program and the development of the Orion crew capsule. More than $9 billion has been spent so far on the programs and it will cost an additional $2.5 billion to shut it down.

Obama's budget lacks specifics about where astronauts will be flying next, when they will be going or in what kind of vehicle. But NASA officials insisted it did not mean an end to exploration. Instead, they promised that by shifting dollars from the Constellation program, which relied on 50-year-old technology to return to the moon, they would be able to develop ``game-changing technology that can take us further faster and more affordably into space.''

Obama's budget also includes about $2 billion in upgrades to the Kennedy Space Center over the next five years. NASA officials said they expect more launches at the Florida site. Among the changes will be moving the gates at the center so unused areas can be used by private companies.

OPPORTUNITIES?

Gov. Charlie Crist, while criticizing the elimination of the Constellation program, said there will be opportunities for state businesses in the commercial space industry.

``I will work aggressively to ensure Florida is prepared to capitalize on these possibilities,'' he said.

But private enterprise is only expected to generate 1,700 jobs in Florida, far short of the 7,000 jobs evaporating with the end of the space shuttle program. Reminding reporters that Congress holds the purse strings, U.S. Sen. Bill Nelson said, ``We've known this was coming. The question is how can we ameliorate that by bringing in additional work and keeping the finest launch team on planet earth together.''

Comments from other Florida lawmakers suggest a battle over Obama's NASA budget.

``The president's proposal lacks a bold vision for space exploration and begs for the type of leadership that he has described as critical for inspiring innovation for the 21st century,'' said U.S. Rep. Suzanne Komas, D-New Smyrna Beach.

``This budget effectively ends America's leadership in human space exploration,'' said Rep. Bill Posey, R-Rockledge. ``While the administration has thrown hundreds of billions of dollars into a failed stimulus bill, it has failed to give NASA the vision and mission to help America lead the world in space.''

UP TO CONGRESS

Dale Ketchum, director of the Spaceport Research & Technology Institute at Kennedy Space Center, said the success of Obama's vision will depend on how Congress responds.

``It's very hopeful if it's followed through aggressively and supported and funded,'' he said, saying Florida could benefit in the long run. ``But Bush's vision for space exploration was also inspiring. He just never got around to asking for the money and Congress didn't give it to him.''

serves them right. what ISRO does in $10mil, they spend $500 mil and

still squeal about lack of funds.

---

Florida feels heat of NASA cutback

The loss of at least 7,000 jobs at NASA leaves the Space Coast with a sense of betrayal by President Barack Obama.

President Barack Obama is redirecting America's space program, killing NASA's $100 billion plans to return astronauts to the moon and using much of that money for new rocket technology research.

The moon mission, which had already cost $9.1 billion, was based on old technology and revisiting old places astronauts had already been, officials said. The previous NASA chief, in selling the old moon plan, had even called it "Apollo on steroids." The rockets were based on space shuttle boosters.

"Simply put, we're putting the science back into the rocket science at NASA," White House science adviser John Holdren said at a budget briefing Monday.

President Barack Obama is essentially grounding efforts to return astronauts to the moon and instead is sending NASA in new directions with roughly $6 billion more, according to officials familiar with the plans.

A White House official confirmed Thursday that when next week's budget is proposed, NASA will get an additional $5.9 billion over five years, as first reported in Florida newspapers. Some of that money would extend the life of the International Space Station to 2020. It also would be used to entice companies to build private spacecraft to ferry astronauts to the space station after the space shuttle retires, said the official who was not authorized to speak by name.

The money in the president's budget is not enough to follow through with NASA's Constellation moon landing plan initiated by President George W. Bush. An aide to an elected official who was told of Obama's plans, but who asked that his name not be used because of the sensitivity of the discussions, said Obama is effectively ending

President Barack Obama is essentially grounding efforts to return astronauts to the moon and instead is sending NASA in new directions with roughly $6 billion more, according to officials familiar with the plans.

NASA is facing a series of money woes that could thwart its hopes of once again becoming the world's leader in space exploration and deliver an economic knee-capping to Florida's Space Coast.

A blue-ribbon presidential panel is expected to advise the White House later this month that returning astronauts to the moon by 2020, as former President George W. Bush proposed, is financially impossible under NASA's $18.7 billion budget.

And NASA officials told a committee of the National Academy of Sciences this week that the costs of major scientific projects -- such as a successor to the Hubble Space Telescope or a new Mars lander -- are running far above the funds available from the White House or Congress.

President Barack Obama's multi-trillion-dollar budget would boost spending for several government agencies while slashing the account for others. Here is an agency-by-agency glance:

----

But on the chopping block is the moon effort, which includes the Ares rocket program and the development of the Orion crew capsule. More than $9 billion has been spent so far on the programs and it will cost an additional $2.5 billion to shut it down.

Obama's budget lacks specifics about where astronauts will be flying next, when they will be going or in what kind of vehicle. But NASA officials insisted it did not mean an end to exploration. Instead, they promised that by shifting dollars from the Constellation program, which relied on 50-year-old technology to return to the moon, they would be able to develop ``game-changing technology that can take us further faster and more affordably into space.''

Obama's budget also includes about $2 billion in upgrades to the Kennedy Space Center over the next five years. NASA officials said they expect more launches at the Florida site. Among the changes will be moving the gates at the center so unused areas can be used by private companies.

OPPORTUNITIES?

Gov. Charlie Crist, while criticizing the elimination of the Constellation program, said there will be opportunities for state businesses in the commercial space industry.

``I will work aggressively to ensure Florida is prepared to capitalize on these possibilities,'' he said.

But private enterprise is only expected to generate 1,700 jobs in Florida, far short of the 7,000 jobs evaporating with the end of the space shuttle program. Reminding reporters that Congress holds the purse strings, U.S. Sen. Bill Nelson said, ``We've known this was coming. The question is how can we ameliorate that by bringing in additional work and keeping the finest launch team on planet earth together.''

Comments from other Florida lawmakers suggest a battle over Obama's NASA budget.

``The president's proposal lacks a bold vision for space exploration and begs for the type of leadership that he has described as critical for inspiring innovation for the 21st century,'' said U.S. Rep. Suzanne Komas, D-New Smyrna Beach.

``This budget effectively ends America's leadership in human space exploration,'' said Rep. Bill Posey, R-Rockledge. ``While the administration has thrown hundreds of billions of dollars into a failed stimulus bill, it has failed to give NASA the vision and mission to help America lead the world in space.''

UP TO CONGRESS

Dale Ketchum, director of the Spaceport Research & Technology Institute at Kennedy Space Center, said the success of Obama's vision will depend on how Congress responds.

``It's very hopeful if it's followed through aggressively and supported and funded,'' he said, saying Florida could benefit in the long run. ``But Bush's vision for space exploration was also inspiring. He just never got around to asking for the money and Congress didn't give it to him.''

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 2010)

^^NASA's overheads (Yup, what else will ya call it when ISRO can do in $50 mn what takes NASA $500mn??) are representative of broader systemic malaise in the land of the phree. Sample this:

Phoenix management's 6-figure salaries worry councilman, union head

Major reset is coming and no, I'm not saying it, Stein's law is.

Phoenix management's 6-figure salaries worry councilman, union head

Among this deluge of gold plated staff is an exec asst (aka office secretary) who makes $170,248 p.a.. No kidding. Check this out.About 1,375 [city] employees earn more than $88,005, or the base salary of Mayor Phil Gordon.

In 2008, the average Arizona worker made just $34,335 a year, according to the U.S. Commerce Department.

Councilman Sal DiCiccio, who has criticized the size of Phoenix's spending on employees, said his calculations show the average total cost per worker is more than $100,000, something he sees as untenable as city leaders struggle to close a $245 million budget shortfall through the 2010-11 fiscal year.

Major reset is coming and no, I'm not saying it, Stein's law is.

"If something cannot go on forever, it will stop."

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Dunno who said it but I distinctly recall some gyani spout wisdom in the early days of this dhaaga to the effect that

Well, well what have we in today's WSJ then....

What's a Degree Really Worth? Earnings gap between college grads and high school grads small.

IMO, this rush of laid offs seeking to return to school will trickle down significantly when in a coupla yrs the unemp rate (official one, that is) continues to hover in the double digits, the unofficial one many basis points higher and a mass of labor oversupply in every sector one can think of.

Take the typical professional college - the law school, the MBA program, nursing school etc. In 2-3 yrs when folks joining today graduate and then find that jobs are not aplenty (simply because this wasn't a cyclical downturn that cycled its way up) and hence median wages have continued to drop whereas their student loans haven't, what do you think will happen to schools' pricing power?

The old world is gone. Many haven't realized it yet. Reality has an awful habit of asserting itself, though.

OK, not all is D&G though. Things will get worse before they get better. But get better they will. Eventually. The right thing to do is to stay flexible, liquid, mobile. Pay down the highest cost debt first and fast. Build redundancies into every crucial thing in one's lives. Shop down on everything. Wait for better deals to come. Hope and pray.

In another 5-10 yrs, things will be come back up. They have to. The new normal then will be what is happening now. Hence, any improvement over now will seem better at least.

Etc.higher ed is a bubble. Its bursting is nigh.

Well, well what have we in today's WSJ then....

What's a Degree Really Worth? Earnings gap between college grads and high school grads small.

Ok. This is the party line. So far so good.A college education may not be worth as much as you think.

For years, higher education was touted as a safe path to professional and financial success. Easy money, in the form of student loans, flowed to help parents and students finance degrees, with the implication that in the long run, a bachelor's degree was a good bet. Graduates, it has long been argued, would be able to build solid careers that would earn them far more than their high-school educated counterparts.

Oh, wait. It shall get fuzzier still. Esp when one realizes that the future needn't look like the past. And these fancy projections are all based on past (rosy timed) data.The numbers appeared to back it up. In recent years, the nonprofit College Board touted the difference in lifetime earnings of college grads over high-school graduates at $800,000, a widely circulated figure. Other estimates topped $1 million.

But now, as tuition continues to skyrocket and many seeking to change careers are heading back to school, some researchers are questioning the methodology behind the high projections.

Most researchers agree that college graduates, even in rough economies, generally fare better than individuals with only high-school diplomas. But just how much better is where the math gets fuzzy.

IMO, this rush of laid offs seeking to return to school will trickle down significantly when in a coupla yrs the unemp rate (official one, that is) continues to hover in the double digits, the unofficial one many basis points higher and a mass of labor oversupply in every sector one can think of.

Take the typical professional college - the law school, the MBA program, nursing school etc. In 2-3 yrs when folks joining today graduate and then find that jobs are not aplenty (simply because this wasn't a cyclical downturn that cycled its way up) and hence median wages have continued to drop whereas their student loans haven't, what do you think will happen to schools' pricing power?

The old world is gone. Many haven't realized it yet. Reality has an awful habit of asserting itself, though.

OK, not all is D&G though. Things will get worse before they get better. But get better they will. Eventually. The right thing to do is to stay flexible, liquid, mobile. Pay down the highest cost debt first and fast. Build redundancies into every crucial thing in one's lives. Shop down on everything. Wait for better deals to come. Hope and pray.

In another 5-10 yrs, things will be come back up. They have to. The new normal then will be what is happening now. Hence, any improvement over now will seem better at least.

Re: Perspectives on the global economic meltdown (Jan 26 2010)

discovery was showing a pgm on ares, orion, new rover etc and all the

cool and lavish facilities at nasa (incl a 100m long water tank for training).

they had a guy and a bunch of internish types cutting out cardboard and

thermocol panels to make various shapes and sizes of the Orion window

framework and test which provided the better view. they'd glue them

together and peer out at a dark stage simulating the space station

to be docked into.

another guy was having fun driving around a new uber-rover cum live-in

vehicle in a sandlot, using a laptop gui to control the thing.

cool and lavish facilities at nasa (incl a 100m long water tank for training).

they had a guy and a bunch of internish types cutting out cardboard and

thermocol panels to make various shapes and sizes of the Orion window

framework and test which provided the better view. they'd glue them

together and peer out at a dark stage simulating the space station

to be docked into.

another guy was having fun driving around a new uber-rover cum live-in

vehicle in a sandlot, using a laptop gui to control the thing.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 2010)

The Growing Underclass: Jobs Gone Forever

The US has become a high-cost, high-debt and hence, a low-growth ekhanomy. Period.

But all is not lost. The first logical step to prudence and course-correction would be to (i) get rid of both the high-cost part (i.e. institutional barriers like healthcare provision by employers, pensions and retirements of employees, other entitlements, unionization, working conditions and termination related lawsuits etc)

and then

(ii) to get rid of the high-debt part (through outright default or debt jubilee or by reworking the bankruptcy protections such that more households and businesses can claim bankruptcy and start afresh free of debt).

There, how difficult was that, eh?

Then the US can start afresh banking on its relatively young and healthy demographics, natural resources, top-class military, top-class universities, geographical isolation etc etc. How many of these advantages can a Europe, Russia or Japan claim?

All in all, I'll say it again. It'll be a painful decade to come but after that America is well placed to start over on a high note. Not so with the rest of the G7.

Have said it before and will say it again.Last night, President Obama talked about the need to put people back to work, calling job growth the “No. 1 focus in 2010."

But one major obstacle to that goal — and one that has so far gone mostly unacknowledged — is that many of the jobs slashed during this recession are not coming back.

Lots of the bloodletting we’ve seen in the labor market has probably been permanent, not just cyclical. Many employers have taken Rahm Emanuel’s famed advice — never waste a crisis — to heart, and have used this recession as an excuse to make layoffs that they would have eventually done anyway.

...

As a recent Congressional Budget Office report put it, “Recessions often accelerate the demise or shrinkage of less efficient and less profitable firms, especially those in declining industries and sectors.”

Think glassmaking. Or clerical work. Or, for that matter, newspapers.

The US has become a high-cost, high-debt and hence, a low-growth ekhanomy. Period.

But all is not lost. The first logical step to prudence and course-correction would be to (i) get rid of both the high-cost part (i.e. institutional barriers like healthcare provision by employers, pensions and retirements of employees, other entitlements, unionization, working conditions and termination related lawsuits etc)

and then

(ii) to get rid of the high-debt part (through outright default or debt jubilee or by reworking the bankruptcy protections such that more households and businesses can claim bankruptcy and start afresh free of debt).

There, how difficult was that, eh?

Then the US can start afresh banking on its relatively young and healthy demographics, natural resources, top-class military, top-class universities, geographical isolation etc etc. How many of these advantages can a Europe, Russia or Japan claim?

Oh, ok. Bring back manufacturing. Blue collar jobs that were once the backbone of the working class and gateways to the lower middle class. Have trade barriers if thats what it takes. Upto the 60s, the top tier marginal tax rate was close to 90%. It could happen again, regardless of GOP or elitist oppn.In this recession, though, the shift from temporary layoffs to permanent job loss has been especially pronounced. In fact, the share of the unemployed who lost their jobs permanently is at its highest level since at least 1967, the first year for which the Labor Department has these numbers available.

D&G bottomline?There are multiple ways to explain why permanent job-losers represent a higher share of the unemployed this time around. Maybe, as others have suggested, many of the jobs gained in the boom years were built on phantom wealth. Or maybe the culprit is a corollary of Moore’s Law, the idea of exponential advances in technology over time. That might suggest that innovation and automation displace more and more workers by the time each recession rolls around.

Whatever the underlying cause, the result is disconcerting: compared with previous recessions, many more of the employment gains in this recovery will have to come from new jobs.

That is much easier said than done.

Workers whose entire occupations — not just the previous payroll positions they held — are disappearing (think: auto workers) will need to start over and find a new career path. But the new skills they will need take a long time to acquire.

What’s more, in addition to obtaining new degrees or training, some workers may need to move to new places in order to start a different career. But sharp declines in housing prices, plus high loan-to-value ratios on many mortgages before the downturn, will make that transition harder. Homeowners who are “underwater” — that is, who owe more in mortgage payments than their house is actually worth — may not be able to sell their house for enough money to enable them to buy a home in a new area.

Author entirely omits the coming next big jobs cut - the formerly secure sarkari jobs positions. With local and state gubmints in total chaos financially, I'd wager stormy ride for public workers next.All of which is to say that many of the Americans who are already out of work are likely to stay in that miserable state for a long, long time. And the longer they stay unemployed, the harder it will be for them to transition back into the work force, further adding to America’s growing underclass.

The administration is likely to have a big labor (and class) problem on its hands, and one that won’t be solved merely by an increase in the gross domestic product.

All in all, I'll say it again. It'll be a painful decade to come but after that America is well placed to start over on a high note. Not so with the rest of the G7.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 2010)

High drama in the eurozone. Keep watching the drama meter in this area in 2010, will sure throw up some unseemly climaxes, IMHO.

Funds flee Greece as Germany warns of "fatal" eurozone crisis

Who else but Sri AEP in the telegraf.

. I'd be worried if there was silent resignation instead of agitated dramabazi.

. I'd be worried if there was silent resignation instead of agitated dramabazi.

Scary. read it all.

Funds flee Greece as Germany warns of "fatal" eurozone crisis

Who else but Sri AEP in the telegraf.

You have to wonder what's playing out here. EMU is a German project first and foremost and theyre effectively saying they'll let it die. In a way, what other choice do they have? Its not as if their bailing out the laggards today will stop a default tomorrow.Germany has triggered a near-panic flight from southern European debt markets by warning that there will be no EU bail-outs, even though it fears the region's economic crisis has turned dangerous and could prove "fatal" for the entire eurozone.

...

However, a key trigger yesterday was testimony in Germany's parliament by economy minister Rainer Brüderle, who said there would be "no bail-outs" for struggling debtors and no move to a "European economic government". "A few European nations are exhibiting dangerous weaknesses. That could have fatal consequences for all countries in the eurozone," he said. Despite the warning, he said each country must solve its own problems. "Germany is not in a mood to be the deep pocket for what they consider profligate, southern neighbours," said hedge fund doyen George Soros.

Wild ride, eh?The yield on 10-year Greek bonds blasted upwards by over 40 basis points to 7.15pc in a day of wild trading. Spreads over German Bunds reached almost four percentage points, by far the highest since Greece joined the euro, and close to levels that risk a self-feeding spiral. Contagion hit Portuguese, Spanish, Irish, and Italian bonds.

RegularGeorge Papandreou, the Greek premier, said in Davos that his country had been singled out as the weak link in a "attack on the eurozone" by speculators and political foes. "We are being targeted, particularly by those with an ulterior motive."

Marc Ostwald, from Monument Securities, said the botched bond issue of €8bn (£6.9bn) of Greek debt earlier this week has made matters worse. Many of the investors were "hot money" funds that bought on rumours that China was emerging as a buyer, offering them a chance for quick profit. When the China story was denied by Beijing and Athens, these funds rushed for the exit.

And set off a domino effect in the neighborhood as well.Tim Congdon, from International Monetary Research, said the danger is that wealthy Greeks may shift money to bank accounts abroad if they lose confidence (akin to Mexico's Tequila Crisis in 1994-1995). This would set off a banking crisis and become self-fulfilling. Greece has been financing current account deficits – 15pc of GDP in 2008 – through its banks, which have built up €110bn foreign liabilities. "If foreign creditors want their money back, defaults and/or a macroeconomic catastrophe appear inevitable," Mr Congdon said.

We'll see about that.Adding to worries, Moody's has issued an alert on Portugal's "adverse debt dynamics", saying Lisbon needs a "credible plan" to reduce a structural deficit stuck at 7pc of GDP rather than "one-off measures". The deeper concern is Spain, where youth unemployment has reached 44pc and the housing bust has a long way to run. Nouriel Roubini – the economist known as 'Dr Doom' – said Spain is too big to contain. "If Greece goes under that's a problem for the eurozone. If Spain goes under it's a disaster," he said. Jose Luis Zapatero, Spain's premier, replied wearily: "Spanish public debt (52pc of GDP) is 20pc lower than Europe's average; our treasury spends 5pc of revenues on debt costs, less than France and Germany. Nobody is going to leave the euro," he said.

Scary. read it all.

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Hari, Thanks for the list and will mull over it.

BTW, off topic but when medieval India went for trading as the way to grow the economy (Your #3 axiom) they too suffered reverses of a horrible nature. Same thing with the traders in areas now called TSP and BD. It added to the mess.

BTW, off topic but when medieval India went for trading as the way to grow the economy (Your #3 axiom) they too suffered reverses of a horrible nature. Same thing with the traders in areas now called TSP and BD. It added to the mess.

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic meltdown (Jan 26 2010)

OK. My specific reference was to your or Richard Duncan's view of "all that is needed to fix" implying that productivity alone will fix all that is wrong with US economy.Neshant wrote:I do agree with the guy that a few major breakthrough in genetics would go a long ways towards plugging the budget deficit. Its not unlike the invention of the transistor which opened up all kinds of doors.

Following are some(not exhaustive) of the major problems/cracks surfaced during the crisis and I am sure some of them are related:

1.Credit Freeze (HUGE stress in sub prime loans -> banks experiencing losses-> wanted gov to bail them out->credit freeze was simply an arm twisting mechanism used)

2.Credit freeze at commercial level spiraling into consumer further worsening real economy

3.Credit freeze made debt servicing difficult both at consumer and commercial level making the debt markets vulnerable

4.Debt markets vulnerability impacted demand (US consumer on steroid) leading to missed revenues, losses, and eventually job losses

5.Massive trade deficit particularly with China (massive imports of cheap goods outsourced from China without comparable match in exports)

6.Govt facing lower taxes ( or at least the prospect of), increased debt servicing costs and not so easy access to Chinese debt, now feels it is difficult to honor entitlements

I am sure we can add many to the above and it is worth to reiterate that most of the above are interlinked (especially 2, 3 4 are linked to 1).

Of the above, only 6 has somewhere linked to American productivity whereby if increased you can defer the burden for a while. Issues arising out of 5 (cheap Chinese imports) are not related to productivity because the benefits(actually profits) of outsourcing far outweigh producing those goods in yamrica. Top3 are hardly related to productivity.

Currently the issue is US monetary / financial system and it stands exposed. Productivity or lack thereof has little role or tangential role in fixing that.

US is in a jam right now and the only solution is fix its systems. However, I do believe it has time. My earlier post about a report from Zero Hedge indicates that there still at least two/three major avenues where US can raise money

a) US banking system itself which are sitting on loads of cash

b) Swiss banking system - all UBS and CS related news MUST be seen from this perspective. This will have HUGE implications for Euro also.

c) US Household sector ( conveniently Hedge funds are clubbed into these). a and c will enter on a steeper interest rate curve.

So, for now, US can continue to be on debt binge but will have to change its system in not so distant future. All just IMO.

Regarding AIDS in Africa comment:

Your post (just after response to my post) talks about dollar crisis largely arising out of external debt/trade deficit. Internal productivity has hardly any bearing on it unless US reduces deficit by selling the so called miracle drug outside US. And we know how good US is in selling and making money off such medicines. That is/was what I was questioning.

Re: Perspectives on the global economic meltdown (Jan 26 2010)

All the mortgages on CRE - commercial = few groups are planning to stop payment at the same time so that they can get concessions from th lending banks. Desi groups too

Re: Perspectives on the global economic meltdown (Jan 26 2010)

I'm not sure I follow what you are saying. I'm not focused on the financing & high rolling solutions as I've found them to be pointless nonsense. Increasing this metric by .25 and decresing that metric by .35 is a futile exercise that won't change anything.

What I'm focused on is the real economy and the productivity thereof. Its the main thing that drives the creation of wealth for a country.

You start off with #1 Credit Freeze when really you should start with the genesis of the problem back in 2003. The lack of any productive industry offering wide-scale employment after the IT boom of the 90s is what led to the government (unwittingly) promoting this giant mortgage scam. I think they intended the mortgage bubble as a stop gap measure until some real (productive) industry came along but got carried away since no real industry came.

The growth seen from then on was all bogus (read unproductive).

I always ask myself if what a company is doing is productive or unproductive. If they are adding to the productivity of society (a wide definition), they are creating wealth. If they are subtracting from it, they are scammers. A good example of the latter is the financial 'industry' which increasingly looks little more than a middle man industry needlessly raising the cost of every transaction. Its purpose was to exist as a consequence of wealth but they have managed to con society and it seems the government into thinking they are creators of wealth.

Duncan is talking about returning the focus to the real economy which is from where wealth springs. The days of scamming nations, taking their resources & labor in exchange for worthless paper will come to a sudden end sooner than people expect. Ultimately the only way trade will balance is if US has something of value to sell to the world and that comes from creating things that enhance productivity be it techology, scientific discovery or creativity. I think many in the financial world are still thinking they can pull wool over the eyes of developing nations, get them into debt and keep them in debt trap - and that's what they will 'export' along with worthless paper to balance their deficits. But these scams will fall by the way side soon and with it the scammers themselves.

The definition of productivity is wide but financial con artistry isn't among it.

What I'm focused on is the real economy and the productivity thereof. Its the main thing that drives the creation of wealth for a country.

You start off with #1 Credit Freeze when really you should start with the genesis of the problem back in 2003. The lack of any productive industry offering wide-scale employment after the IT boom of the 90s is what led to the government (unwittingly) promoting this giant mortgage scam. I think they intended the mortgage bubble as a stop gap measure until some real (productive) industry came along but got carried away since no real industry came.

The growth seen from then on was all bogus (read unproductive).

I always ask myself if what a company is doing is productive or unproductive. If they are adding to the productivity of society (a wide definition), they are creating wealth. If they are subtracting from it, they are scammers. A good example of the latter is the financial 'industry' which increasingly looks little more than a middle man industry needlessly raising the cost of every transaction. Its purpose was to exist as a consequence of wealth but they have managed to con society and it seems the government into thinking they are creators of wealth.

Duncan is talking about returning the focus to the real economy which is from where wealth springs. The days of scamming nations, taking their resources & labor in exchange for worthless paper will come to a sudden end sooner than people expect. Ultimately the only way trade will balance is if US has something of value to sell to the world and that comes from creating things that enhance productivity be it techology, scientific discovery or creativity. I think many in the financial world are still thinking they can pull wool over the eyes of developing nations, get them into debt and keep them in debt trap - and that's what they will 'export' along with worthless paper to balance their deficits. But these scams will fall by the way side soon and with it the scammers themselves.

The definition of productivity is wide but financial con artistry isn't among it.

Re: Perspectives on the global economic meltdown (Jan 26 2010)

The US treasury is about to grab people's 401k retirement funds to pledge as collateral against the debt ?

-----------

The Treasury Is Soliciting Your Feedback Regarding The Proposed Annuitization Of 401(k)

The Department of Labor and the Department of the Treasury (the "Agencies") are currently reviewing the rules under the Employee Retirement Income Security Act (ERISA) and the plan qualification rules under the Internal Revenue Code (Code) to determine whether, and, if so, how, the Agencies could or should enhance, by regulation or otherwise, the retirement security of participants in employer-sponsored retirement plans and in individual retirement arrangements (IRAs) by facilitating access to, and use of, lifetime income or other arrangements designed to provide a lifetime stream of income after retirement. The purpose of this request for information is to solicit views, suggestions and comments from plan participants, employers and other plan sponsors, plan service providers, and members of the financial community, as well as the general public, on this important issue.

http://www.zerohedge.com/article/treasu ... ation-401k

-----------

The Treasury Is Soliciting Your Feedback Regarding The Proposed Annuitization Of 401(k)

The Department of Labor and the Department of the Treasury (the "Agencies") are currently reviewing the rules under the Employee Retirement Income Security Act (ERISA) and the plan qualification rules under the Internal Revenue Code (Code) to determine whether, and, if so, how, the Agencies could or should enhance, by regulation or otherwise, the retirement security of participants in employer-sponsored retirement plans and in individual retirement arrangements (IRAs) by facilitating access to, and use of, lifetime income or other arrangements designed to provide a lifetime stream of income after retirement. The purpose of this request for information is to solicit views, suggestions and comments from plan participants, employers and other plan sponsors, plan service providers, and members of the financial community, as well as the general public, on this important issue.

http://www.zerohedge.com/article/treasu ... ation-401k

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Neshantji,

We are sure talking past each other. You may have made you point on a different plane and I was relating it to the present context of crisis. I agree with you for the most part.

Meanwhile the following ( it will be interesting evening watching the recorded hearing on CSPAN):

Today's Banking, Housing, and Urban Affairs Committee hearing with Paul Volker

http://www.youtube.com/watch?v=RbZG0V3V1EQ

We are sure talking past each other. You may have made you point on a different plane and I was relating it to the present context of crisis. I agree with you for the most part.

Meanwhile the following ( it will be interesting evening watching the recorded hearing on CSPAN):

Today's Banking, Housing, and Urban Affairs Committee hearing with Paul Volker

http://www.youtube.com/watch?v=RbZG0V3V1EQ

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Naah. There is a lot of angst that the 401k is not a suitable retirement plan. All these moves towards making the 401k more predictable like a traditional pension are because the politicians are hearing from people about the problems described in this article.Neshant wrote:The US treasury is about to grab people's 401k retirement funds to pledge as collateral against the debt ?

Re: Perspectives on the global economic meltdown (Jan 26 2010)

its all great but where's the money going to come from to gurantee the value of those 401k annuities.

sounds like the plan of the government is to balance deflation by printing and spendng a load of money in the most wasteful manner.

sounds like the plan of the government is to balance deflation by printing and spendng a load of money in the most wasteful manner.

Re: Perspectives on the global economic meltdown (Jan 26 2010)

predictions from the pimps from PIMCO

--------

El-Erian Says Retreat in Stocks Will Worsen as Economy Slumps

Feb. 3 (Bloomberg) -- Mohamed A. El-Erian, whose firm runs the world’s biggest mutual fund, said the largest stock market decline in 11 months may worsen amid persistent U.S. joblessness and economic growth that trails analysts’ forecasts.

Investors have wrongly priced in an “orderly” withdrawal of stimulus measures, a rebound in bank lending and coordinated government policy to restore growth, the chief executive officer of Pacific Investment Management Co. wrote in a Bloomberg News column. That means Wall Street projections for gains in 2010 may prove incorrect and prices will slump, he said.

http://www.bloomberg.com/apps/news?pid= ... yeLU&pos=5

--------

El-Erian Says Retreat in Stocks Will Worsen as Economy Slumps

Feb. 3 (Bloomberg) -- Mohamed A. El-Erian, whose firm runs the world’s biggest mutual fund, said the largest stock market decline in 11 months may worsen amid persistent U.S. joblessness and economic growth that trails analysts’ forecasts.

Investors have wrongly priced in an “orderly” withdrawal of stimulus measures, a rebound in bank lending and coordinated government policy to restore growth, the chief executive officer of Pacific Investment Management Co. wrote in a Bloomberg News column. That means Wall Street projections for gains in 2010 may prove incorrect and prices will slump, he said.

http://www.bloomberg.com/apps/news?pid= ... yeLU&pos=5

Re: Perspectives on the global economic meltdown (Jan 26 2010)

From All Star Investor. com. Charts for YTD 2010

Last edited by ramana on 04 Feb 2010 23:45, edited 1 time in total.

Reason: ramana

Reason: ramana

Re: Perspectives on the global economic meltdown (Jan 26 2010)

Acharya: please post a URL that explain whats in the image, for everyone's benefit.

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic meltdown (Jan 26 2010)

This one touches upon what Neshant and I were discussing albeit on a different plane (he was talking from a prognosis perspective and I was talking more on the short term perspective and inevitability of some solutions before we even begin to look at the "original sin" - diversion from real economic activity).

This article takes a jibe at that but again, the moment the author begins to talk about solutions, it will (for some like me) start sounding, how shall I say, ludicrous. That is because I believe we are just too deep into the current financial system and at least in my life time will not change much. I will be glad to be proven wrong.

The Emperor's New Statistics

Added later:

This article takes a jibe at that but again, the moment the author begins to talk about solutions, it will (for some like me) start sounding, how shall I say, ludicrous. That is because I believe we are just too deep into the current financial system and at least in my life time will not change much. I will be glad to be proven wrong.

The Emperor's New Statistics

Added later:

We would also have to believe that Wall Street is an American phenomenon, dedicated to the welfare of our nation. Wall Street is actually an arm of that London-centered global financial oligarchy known as the British Empire, and its actions are designed to destroy our nation. As it has

Remember in the initial days, perhaps within first 5-10 pages of this thread, we talked about the new world and old world coming to the fore. It will be interesting if this comes more to the surface and cause permanent, grave, and overt fissures between the two. I will make an offering of 10 coconuts to my istadevata.After the war, we had the great promise of the Atoms for Peace program and the peaceful use of nuclear power. But that was shut down by a campaign organized by the British, who wanted to stop the world from advancing to a new technological level. As a result, our scientific advancement was halted in crucial areas, and our economy began to stagnate. Since then, we have watched one industry after another wither, to the point where we are today just a shadow of our former productivity.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 2010)

^^ Yup, wouldn't shed any tears for UK-stani problems. And be sure, they're coming. The problems, I mean.

Meanwhile, in the land of the free and the home of the brave, birth and death is a fact of life, or so they thought. Turns out twas also the fiction of life. Sample this from Mish's stable:

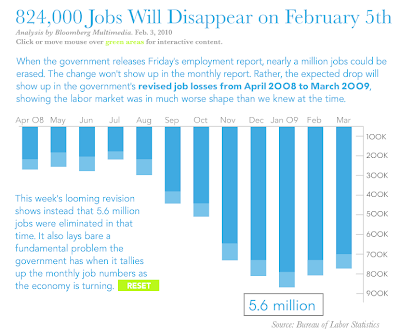

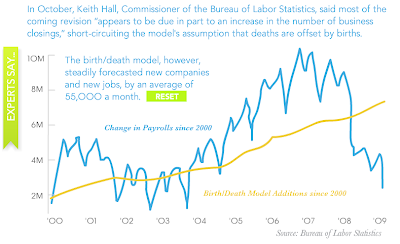

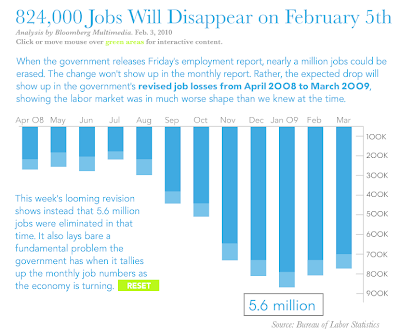

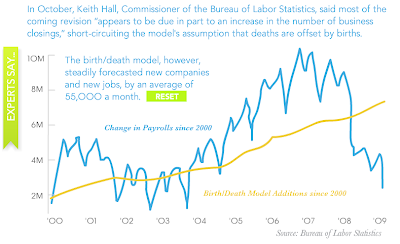

824,000 Will Disappear On February 5; BLS Admits Flawed Model But Plans No Changes

Nope, no silver lining there. There's one kind of suffering - that leads to strength and to better days ahead. And then there's pointless suffering like the one gotus will unwittingly visit on our lonely planet, seems like.

Re the bolded part, how many wanna bet there'll be further downward revisions down the line? The Birth death model is flawed but kicks the official unemployment recognition can down the road. just like mark-to-myth and foreclosure postponement allows all manner of dubious fin institutions to kick their cans down the road only. In the meantime, we are all waiting for Godot. Some miracle that'll magically rescue us from D&G. Because, we're special and we're here and hence entitled to boundless khanomic growth only. No?

Jai Ho.

Meanwhile, in the land of the free and the home of the brave, birth and death is a fact of life, or so they thought. Turns out twas also the fiction of life. Sample this from Mish's stable:

824,000 Will Disappear On February 5; BLS Admits Flawed Model But Plans No Changes

On Friday, expect to see the BLS revise job creation estimates down by a whopping 824,000 jobs. The culprit is a birth-death model far out of sync with reality.

Originally the BLS said 4.8 million jobs were lost between April 2008 and March 2009.

This is what it looks like now.

Nope, no silver lining there. There's one kind of suffering - that leads to strength and to better days ahead. And then there's pointless suffering like the one gotus will unwittingly visit on our lonely planet, seems like.

The labor department says there are flaws in its model but defends the process and says "no changes to the current modeling technique are scheduled at this time." Please note that the birth death model has added 990,000 jobs since April. Those jobs are not reflected in the upcoming 824,000 revision.

Re the bolded part, how many wanna bet there'll be further downward revisions down the line? The Birth death model is flawed but kicks the official unemployment recognition can down the road. just like mark-to-myth and foreclosure postponement allows all manner of dubious fin institutions to kick their cans down the road only. In the meantime, we are all waiting for Godot. Some miracle that'll magically rescue us from D&G. Because, we're special and we're here and hence entitled to boundless khanomic growth only. No?

Jai Ho.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 2010)

So it begins. Even mainstream dinosaur media is noticing. Aur kya kehna.

CNN segment on the pensions bomb

CNN segment on the pensions bomb

Re: Perspectives on the global economic meltdown (Jan 26 2010)

More D&G for Greece:

Greece’s biggest union is set to approve the second mass strike this month, showing that Prime Minister George Papandreou’s parliamentary majority may not be enough to guarantee implementation of his plan to cut the European Union’s largest deficit.

GSEE, which represents about 2 million workers in the private sector, is meeting in Athens today to approve the walkout for Feb. 24. The main public-employee union plans a Feb. 10 job action to protest spending cuts as Papandreou steps up budget cuts to persuade investors Greece won’t need a bailout