Perspectives on the global economic meltdown (Jan 26 2010)

Re: Perspectives on the global economic meltdown (Jan 26 201

The West has no right to even conduct polls, surveys and studies on corruption in the "emerging economies" and the so-called-third-world.

Re: Perspectives on the global economic meltdown (Jan 26 201

Rahul Mehta wrote:

A few decades back, this would not have been possible, as person had option of demanding Jury Trial, and Jurors would have sided against leeches aka bankers. But banks ask customers to sign a clause that they are waiving their right for Jury Trial, and Supreme Court judges have upheld that waiver !!! So the 500-600-more cases go to one judge, who is paid to favor the banks. If these cases were going to Jurors, each case would have gone to 12 different Jurors and so these 500 cases would go to say 6000-10000 Jurors. Bribing them would have been impossible for bankers.

Suffices to say that Supreme Court judges of US have enabled bankers to loot by weakening Jury System in US. Solution? Well, I dont waste my time in typing solutions to Americans' problems. I have (120 cr - 5 cr) Indians to worry about, and thats a lot.

Before propping yourself as the messiah and the saviour of India, and complaining about the US judges, a few facts:

The article you quoted is about the initial hearing. There is no right to a jury trial to an initial hearing. In fact it is not even a trial. It is a procedure to enable the court to find out more about the case. The question of jury does not arise here. The defendant is free to sue / get relief by approaching the court.

Granted that this process in the rocket docket is flawed to the extreme but so is your pathetic attempt to portray this as the result of US SC judges being bought out and abolishing jury trials. A jury trial is the *last* stage in a process, and this docket is the beginning.

Re: Perspectives on the global economic meltdown (Jan 26 201

It’s a whole new game, and the U.S. doesn’t like the rules

New Chapter in global finance and economy {G20 summit}Poor countries are accustomed to being told by outsiders what they need to do at home if they want to participate in the global economy; in fact, that’s one way you could define the historic role of the IMF. What is different today is that the world’s dominant economy and its rising one are the two countries whose domestic priorities are causing the greatest disruption for the rest of the world.

Small countries are used to accommodating big ones. But big countries are accustomed to setting the rules. Mr. El-Erian believes that “we will be writing about this period as a period of fundamental global realignment.” A big part of that realignment is figuring out how to balance national needs against global ones, and doing that turns out to be especially hard if you are used to determining the international rules of the game.

“These comprehensive quota and governance reforms, as outlined in the Seoul Summit Document, will enhance the IMF’s legitimacy, credibility and effectiveness, making it an even stronger institution for promoting global financial stability and growth.”

Under the reform plan, China will step up as the third-biggest shareholder with 6.4 percent of voting power, outranking Germany, Britain and France.

India, Russia and Brazil will advance to the eighth, ninth and 10th places, respectively.

The U.S. will see its share fall by about 0.3 percentage point but still remain the largest holder with 17.4 percent, while keeping its veto power. Japan comes in second with 6.5 percent.

Korea will become the 16th-biggest shareholder, climbing two notches from the previous 18th. It is assigned 1.8 percent of share, up from 1.41 percent.

Re: Perspectives on the global economic meltdown (Jan 26 201

Who is the seventh?

US, Japan, PRC, Germany, UK,France, XX, India, Russia, Brazil...

Is it Italy?

Also whats th big idea of largest share holder and veto. Cant hav both in new world economy.

US, Japan, PRC, Germany, UK,France, XX, India, Russia, Brazil...

Is it Italy?

Also whats th big idea of largest share holder and veto. Cant hav both in new world economy.

Re: Perspectives on the global economic meltdown (Jan 26 201

Yes it is Italy.

Things are slowly but definitely changing, reports on G20 summit are unanimous that the summit failed. The last time they met in 2008, they managed to pump in about $14trillion into the global economy. This time, they ended up almost calling each other names.

Things are slowly but definitely changing, reports on G20 summit are unanimous that the summit failed. The last time they met in 2008, they managed to pump in about $14trillion into the global economy. This time, they ended up almost calling each other names.

Re: Perspectives on the global economic meltdown (Jan 26 201

MMS did well. In Delhi he supported the QE2.

In Seoul he supported the idea that trade imbalances are the problem.

In Seoul he supported the idea that trade imbalances are the problem.

Re: Perspectives on the global economic meltdown (Jan 26 201

Talking about Floor_idah,

http://www.nytimes.com/2010/11/09/us/09 ... .html?_r=1

Let the geme begin !! Chor Chor Mausere Bhai

At Legal Fringe, Empty Houses Go to the Needy

http://www.nytimes.com/2010/11/09/us/09 ... .html?_r=1

Let the geme begin !! Chor Chor Mausere Bhai

At Legal Fringe, Empty Houses Go to the Needy

NORTH LAUDERDALE, Fla. — Save Florida Homes Inc. and its owner, Mark Guerette, have found foreclosed homes for several needy families here in Broward County, and his tenants could not be more pleased. Fabian Ferguson, his wife and two children now live a two-bedroom home they have transformed from damaged and abandoned to full and cozy. In a sign of the odd ingenuity that has grown from the real estate collapse, he is banking on an 1869 Florida statute that says the bundle of properties he has seized will be his if the owners do not claim them within seven years. A version of the same law was used in the 1850s to claim possession of runaway slaves, though Mr. Guerette, 47, a clean-cut mortgage broker, sees his efforts as heroic. “There are all these properties out there that could be used for good,” he said.

The North Lauderdale authorities, though, see him as a crook. He is scheduled to go on trial in December on fraud charges in a case that, along with a handful of others in Florida and in other states, could determine whether maintaining a property and paying taxes on it is enough to lead to ownership. Legal scholars say the concept is old — rooted in Renaissance England, when agricultural land would sometimes go fallow, left untended by long-lost heirs. But it is also common. All 50 states allow for so-called adverse possession, with the time to forge a kind of common-law marriage with property varying from a few years (in most states) to several decades (in New Jersey). The statute generally requires that properties be maintained openly and continuously, which usually means paying property taxes and utility bills. It is not clear how many people are testing the idea, but lawyers say that do-it-yourself possession cases have been popping up all over the country — and, they note, these self-proclaimed owners play an odd role in a real-estate mess that never seems to end. Though they may cringe at the analogy, as squatters with bank accounts, these adverse possessors are like leeches, and it can be difficult to tell at times whether they are cleaning a wound already there, or making it worse.

Re: Perspectives on the global economic meltdown (Jan 26 201

shyam wrote: BTW, it is worth listening to Peter Schiff vs Robert Prechtor. These two people are talking about two different scenarios for future disaster

Peter Schiff believes that Fed will continue to print money to bail out government, banks and other entities that cause run away inflation. So, he is betting on investing in commodities.

But Robert Prechtor believes that when crisis happens, human behavior will go excessively in the opposit direction and resort to excessing belt tightening.

Robert Prechter believes there is an ocean of unpayable debt that is outstanding (and will soon be imploding). He says there is no way the federal reserve nor the govt will be able to print its way out of it. The amount that they can print dwarfs the amount of debt. If they crank the printing press into high gear the massive bond market will panic and interest rates will sky rocket as confidence is lost in the USD.

When that debt implodes, what will go up in value are the remaining dollars that survive. Thus he recommends preserving cash and the safest cash equivalents (i.e. govt treasury bills). He is so bearish that he doesn't even believe most of the major banks will survive nor your deposit. Many will lose their life savings and even the FDIC will go bankrupt like AIG - but this time, there will be no govt takeover.

I had a hard time trying to take in the extent of his bearishness the first time I learned about Prechter and his theories. But I'm beginning to think he may be somewhat right.

I do however believe that the US govt will change the nature of its currency and convert dollars overnight into SDR which will have far less purchasing power. People who worked hard to save their money will be cheated. I don't know if Prechter has taken that scenario into account.

Re: Perspectives on the global economic meltdown (Jan 26 201

Now, Congress is coming up with a way to fix mortgage mess. Legalize MERS, which is currently not valid and is the root of lawsuites by bond investors and foreclosure crisis.

How can they pass law to legalize illagal practice of the past?

Get Ready for the Great MERS Whitewash Bill

How can they pass law to legalize illagal practice of the past?

Get Ready for the Great MERS Whitewash Bill

When Congress comes back into session next week, it may consider measures intended to bolster the legal status of a controversial bank owned electronic mortgage registration system that contains three out of every five mortgages in the country.

The system is known as MERS, the acronym for a private company called Mortgage Electronic Registry Systems. Set up by banks in the 1997, MERS is a system for tracking ownership of home loans as they move from mortgage originator through the financial pipeline to the trusts set up when mortgage securities are sold.

The system has come under scrutiny by critics who charge MERS with facilitating slipshod practices. Recently, lawyers have filed lawsuits claiming that banks owe states billions of dollars for mortgage recording fees they avoided by using MERS.

Self-styled consumer advocate Neil Garfield says the legislation is already being drafted:

After years of negative judicial decisions about the use of a straw-man on mortgages, MERS was about to lose its existence as well as its credibility. But now all of that is set to change as Wall Street money is pouring into the coffers of those who are receptive (i.e., almost everyone in Congress). The legislation is already being drafted under the interstate commerce clause to ratify MERS and everything it did retroactively. It appears that the Obama administration is ready to pardon all the securitization deviants by signing this bill into law. This information is corroborated by several people who are in sensitive positions — persons who would be the first to know such proposals. Fortunately, there are some people in Washington who have a conscience and do not want to see this happen.

Re: Perspectives on the global economic meltdown (Jan 26 201

Here is an argument against MERS database.

Rumors to the Contrary Notwithstanding, You CAN Take It With You! Defiled Land Records. Convoluted Chain of Property Ownership.

Rumors to the Contrary Notwithstanding, You CAN Take It With You! Defiled Land Records. Convoluted Chain of Property Ownership.

ese are all MERS loans. Wonder what MERS says about ownership of these loans? Ah, let's find out! Easy enough to track back to the mortgages filed in the public land records, check the MERS MIN number, run it through MERS's database here & let's take a looksee....

Not to speak ill of the dearly departed, but is there some accounting flim-flam going on here?

Are these titles to American property a wee bit cloudy? Remember, these assignments of mortgage were filed in both our courts and our land records. Can we say FELONIOUS ACTS, Ladies & Gentlemen? This is a level of arrogance and disrespect for the foundations of America. Economic recovery will never occur if we define capitalism as "return & reward for defrauding one's customers, one's investors, one's insurers, and violating the laws of one's state & nation, and the constitutional property rights and rights to due process".

MERS' reliability factor as an indicator of mortgage ownership appears to be highly suspect. {Then how do you legalize MERS records?}

...

Note how all the documents are executed by representatives of the assignees, just signing nonsensical documents that transfer assets from a myriad of dead institutions over to their employers who then foreclose on American homes, evicting American families out onto the street.

Note that MERS shows these loans as ACTIVE, so what too-big-to-fail insolvent bank (or banks, could be several) is accounting for the "value" of these non-performing assets on their fictional books? And if any of these homes have a second mortgage, are those zero value assets also on the books of some secretly insolvent too-big-to-fail bank at some fantasy value to the tune of billions of pretend dollars?

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

From the HuffPo: Pure Angst

Denninger on the glaring economic failures of the Obama presidency (why the Repubs won't do any better is also emphasized in several places)

The part about the wanton, brazen acts of fraud and loot continue with nary a whisper on the street. In Oirope, at least, janta are burning up tires and staging dharnas. In amrika, it seems, silence and consent have been manufactured. Only.

To which Denninger replies, with characteristic panache (caution: inflammatroy language liberally sprayed all over, also,bring your own spoonfuls of salt)Our Wall Street billionaires easily weathered the financial storm that they themselves created. It's as if nothing had happened. The financial reforms Congress passed are weak. The biggest banks actually are bigger. And Wall Street profits and bonuses are approaching record highs. That's in stark contrast with the fact that more than 29 million Americans are without work or have been forced into part-time jobs.

...

With the Republican landslide, the super-rich have nothing to fear from Congress. No need to worry about tax increases or tighter regulations now. The hedge funds will be able to hang on to their 15 percent tax rate (by claiming their earnings as capital gains) while raking in $900,000 an hour (not a typo). Meanwhile the pressure mounts to cut social spending -- because, of course, we've got to combat the large deficits we racked up by giving tax breaks to the rich, bailing out Wall Street, and dealing with the financial crash that Wall Street created. (We get a deficit commission instead of a jobs commission?)

Denninger on the glaring economic failures of the Obama presidency (why the Repubs won't do any better is also emphasized in several places)

As usual, when KD finishes, there's little that remains to be added only.Let me guess: "Hope and Change" had nothing to do with it, right?

[The] President didn't actually:

*

Refuse to declare a banking holiday and take the banks into receivership as his first act as President. You know, after stating he wasn't elected to cater to Wall Street? Yes, that.

*

Appoint the chief looter from the NY Fed to head Treasury - a guy who admittedly cheated on his own taxes and blamed it on a computer program. Yes, the same guy who had to know that Citi was writing crap mortgages (and selling them, since those securities were repo'd through the NY Fed literally daily) and had constructive notice of Lehman's failure more than a month before it blew up. Yet this was "Hope and Change"'s choice to head Treasury.

*

Reappoint Bernanke to The Fed and remain supportive of him to this day - even after Alan Greenspan admits, this last weekend, that the banks were engaged in criminal activity. An honest politician (can you use those two words in the same sentence?) would react to this by demanding Bernanke's immediate resignation, given that Bernanke was at The Fed while Greenspan ran the joint!

*

Extort FASB to allow the banks to appear to be solvent when they're really not. Yes, that hearing. I'm sure you remember it. Spring 2009 and Kanjorski. I remember it well. Yes, it resulted in a huge stock market rally. But the bad debt is still there.

*

Spent over $3 trillion dollars of borrowed money to cover up all of the rotting dead fish on the bank balance sheets. That's right. "Stimulus" that didn't - not one dime directed into an emergency plan to, for instance, build nuclear power plants (and therefore help solve our energy dependence.) No, instead the entirety of the program was and is about covering up fraud.

*

Has failed to direct Holder to issue even one indictment against a major bank for their role in the financial mess. Over 150,000 admitted fraudulent affidavits later and an economic collapse and yet not one indictment has issued. Not one. Never mind the bogus MBS that almost-certainly have no actual securities in them - that is, they're empty boxes. How do I know this? Because there are multiple people who have it on good information that this is exactly what happened - and they're very believable, in that if it wasn't what happened someone would have shown up with a properly-endorsed note. Somewhere. Of course you can't produce what doesn't exist......

The so-called "progressives" are not progressive at all. Oh sure, we hear bleating about "Green Jobs" and similar, but this is small potatoes. The problem lies in the looting - and until it stops, there will be no solutions that work.

Democrats want to pretend they didn't have their fair part in this. Barney Frank wasn't really sleeping with one of the Fan/Fraud crowd - literally - post their "employment." There really wasn't an attempt to deflect any meaningful reform that came out of Dodd. The extortion of FASB wasn't "real." The indictments didn't need to be issued. And so on.

Cut the crap folks. The so-called "Progressives" are anything but. You want to argue over Abortion and Gays in the military as a diversion for the looting that you have permitted exactly as have the Republicans!

In short, pull your head out of your ass.

I, for one, am tired of the excuses.

The part about the wanton, brazen acts of fraud and loot continue with nary a whisper on the street. In Oirope, at least, janta are burning up tires and staging dharnas. In amrika, it seems, silence and consent have been manufactured. Only.

Re: Perspectives on the global economic meltdown (Jan 26 201

with Feds quantitative easing and PRC howling you can see

why US and TSP are jigri dost?

Both behave in a way to black mail the world to toeing their wishes.

By flooding dollars GOTUS and TSP for every unleashing terror world wide both are using "scorched earth" tactic to get away with their ways...

hence the

"Yeh dosti hum nahin todenge

Todenge dam magar tera saath na chhodenge"

So what does this leave India post facto of Obama visit

"babuji Dheere Chalna Pyaar Mein Zarrra

Sambhalna Haan

Bade Dhokey Hain Badey Dhokey Hain

Iss Raah Mein"

why US and TSP are jigri dost?

Both behave in a way to black mail the world to toeing their wishes.

By flooding dollars GOTUS and TSP for every unleashing terror world wide both are using "scorched earth" tactic to get away with their ways...

hence the

"Yeh dosti hum nahin todenge

Todenge dam magar tera saath na chhodenge"

So what does this leave India post facto of Obama visit

"babuji Dheere Chalna Pyaar Mein Zarrra

Sambhalna Haan

Bade Dhokey Hain Badey Dhokey Hain

Iss Raah Mein"

Re: Perspectives on the global economic meltdown (Jan 26 201

TUESDAY, NOVEMBER 09, 2010

The Banality of (Financial) Evil

http://charleshughsmith.blogspot.com/20 ... -evil.html

The financialized American economy and Central State are now totally dependent on a steady flow of lies and propaganda for their very survival. Were the truth told, the status quo would collapse in a foul, rotten heap.

Google's famous "don't be evil" is reversed in the American Central State and financial "industry": be evil, because everyone else is evil, too. In other words, lying, fraud, embezzlement, mispresentation of risk, material misrepresentation of facts, the cloaking of truth with half-truths, the replacement of statements of fact with propaganda and spin: these are not the work of a scattered handful of sociopaths: they represent the very essence and heart of the entire status quo.

Hannah Arendt coined the phrase the banality of evil to capture the essence of the Nazi regime in Germany: doing evil wasn't abnormal, it was normal. Doing evil wasn't an outlier of sociopaths, it was the everyday "job" of millions of people, Nazi Party members or not.

Not naming evil is the key to normalizing evil. Evil must first and foremost bederealized (a key concept in the Survival+ critique), detached from our realization and awareness by naming it something innocuous.

Here is a telling excerpt from the book Triumph of the Market:

Normalization of the unthinkable comes easily when money, status, power, and jobs are at stake.... Intellectuals will be dredged up to justify their (actions). The rationalizations are hoary with age: government knows best, ours is a strictly defensive effort, or, if it wasn't me somebody else would do it. There is also the retreat to ignorance, real, cultivated, or feigned.

Can any of the tens of thousands of people working on Wall Street or in the bowels of the Federal Reserve, Treasury, Pentagon, etc. truthfully claim they "didn't know it was wrong" to mislead the citizenry, the soldiers, the investors and the buyers of their fraud? On the contrary, every one of those tens of thousands of worker bees and managers knows full well the institution they toil for is doing evil simply by hiding the truth of its operations.

The entire status quo of the American Empire is built on lies. Now the dependence on lies, fraud and misrepresentaion is complete; Wall Street and the Empire itself would fall if the truth were finally revealed and properly identified as evil.

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Perspectives on the global economic meltdown (Jan 26 201

Nice one Neshant-ji. Our MMS, the spotless economist prime minister of India, supported QE2 by the wayNeshant wrote:youtube=PTUY16CkS-k

Re: Perspectives on the global economic meltdown (Jan 26 201

Hari garu: There is some degree of truth, Obama is a big let down. He has done what Bush did, no difference no change. After sending manufacturing jobs to China and elsewhere, the American industries lost union workers who were the money givers to the democrats. Now the Democratic party had to take its begging bowl to the Corporates instead of the workers. Now how would the Democrats behave in anyway different than the Republicans? He is losing support because he has not done much.

Last edited by SwamyG on 15 Nov 2010 04:58, edited 1 time in total.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

In Des, leaders like NaMo and Mayavati have indeed shown the immense power of a mass popular base - of a direct connect with the masses. They have no challengers within their states and parties because of it and are thus able to act wilfully and forcefully within their conscience to make right happen (as opposed to 'wrong'). You can try to buy/bribe or browbeat them though. Good luck with that.

Which is why, I'm surprised about sri Obama. A man with the kind of mass appeal he had back in late 2008 should have been able to get away with drastic action to make right happen. The failure comes through in sri Obama's lack of even sincere attempt in this direction, IMHO. In his lack of attempt to use his then considerable political capital to do the right thing.

Which is why, I'm surprised about sri Obama. A man with the kind of mass appeal he had back in late 2008 should have been able to get away with drastic action to make right happen. The failure comes through in sri Obama's lack of even sincere attempt in this direction, IMHO. In his lack of attempt to use his then considerable political capital to do the right thing.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

Portugal Foreign Minister Warns of Euro Exit

Fat chance Lisbon gets to leave the EU 'just like that'. The elites in Portugal are dead opposed to it. However, IMHO, the aam aadmi of portugal will be better off, eventually, should Lisbon exit. No wonder the elites are opposed, eh?A Portuguese government minister openly speculated over the weekend that his country's economic frailties could lead to its expulsion from the euro zone, underscoring the growing fear in Europe that the continent's debt woes may force leaders to restructure the currency bloc.

In an interview with the Portuguese weekly Expresso published Saturday, Foreign Affairs Minister Luis Amado said Portugal faces "a scenario of exit from the euro zone" if it fails to tackle its economic challenges.

"There has to be an effort by all political groups, by the institutions, to understand the gravity of the situation we're facing," he said.

Portugal is now the front line of the sovereign-debt crisis that already has claimed Greece and threatens Ireland, economists say. If economic weakness is sufficient to push an otherwise crisis-free country to the brink of default and rescue, then larger countries, such as Spain and Italy, could be threatened, analysts say.

Re: Perspectives on the global economic meltdown (Jan 26 201

The politicians in India, like you point out, are still dependent on the masses. The media can only damage them to an extent, because the entire country does not follow any one channel or news outlet. It is changing, but it is still not like what one has in Unkiland. So the desi politicians can make hundreds of mistakes but there is no Krsna to make them accountable. In maasa, a politician has to do few mistakes, even way out in the past, the media will blow it out of proportion and destroy her and him.

Obama had the support, but he fettered it away. He has not done enough to get support from his own base, hard core supporters still support him. But the Democratic party members seems to be unlike the Republican party members not afraid to part ways with its leaders. Many progressives see Obama as being in the pockets of lobbyists and companies. But one cannot blame him alone, the Democrats reps and senators do not have the spine and guts to do what was right, the Republicans efficiently blocked everything the Dems threw at them. Who said only in Desh the opposition party blocked anything and everything the ruling party did. The Republicans would put any desi party to shame in their way of conducting business in making laws. It is a collective failure, the Democrats, the Republicans and the administration. They are all in the pockets of the rich and the influential.

Obama had the support, but he fettered it away. He has not done enough to get support from his own base, hard core supporters still support him. But the Democratic party members seems to be unlike the Republican party members not afraid to part ways with its leaders. Many progressives see Obama as being in the pockets of lobbyists and companies. But one cannot blame him alone, the Democrats reps and senators do not have the spine and guts to do what was right, the Republicans efficiently blocked everything the Dems threw at them. Who said only in Desh the opposition party blocked anything and everything the ruling party did. The Republicans would put any desi party to shame in their way of conducting business in making laws. It is a collective failure, the Democrats, the Republicans and the administration. They are all in the pockets of the rich and the influential.

Re: Perspectives on the global economic meltdown (Jan 26 201

Excellent quote.Acharya wrote:

The financialized American economy and Central State are now totally dependent on a steady flow of lies and propaganda for their very survival. Were the truth told, the status quo would collapse in a foul, rotten heap.

Google's famous "don't be evil" is reversed in the American Central State and financial "industry": be evil, because everyone else is evil, too. In other words, lying, fraud, embezzlement, mispresentation of risk, material misrepresentation of facts, the cloaking of truth with half-truths, the replacement of statements of fact with propaganda and spin: these are not the work of a scattered handful of sociopaths: they represent the very essence and heart of the entire status quo.

Vast numbers of suckers will be needed in the next few years to offload massive losses, bailouts and bonuses of banking crooks through taxation, inflation, austerity (for the real working class) and other ripoff schemes. The need for suckers is critical.

I stand by my prediction that in 3 to 5 years, the federal reserve will be shut down.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

swamyg,

JMTs and all that.

I think you're overlooking my main point here. In India, the netas are more powerful and hence richer than the corporations. GoI contracts alone yield more in neta revenue than the paltry few millions the lobbyists have used to buy so many votes in the US congress. Partly this is because, the US corpos ID rising stars early and get them hooked to lobbyist and campaign cash then on itself. In India, the neta class is immune to that kinda blackmail. Neta may take lobbyist/corpo cash when convenient and brazenly show ungli when required with zero fear of corpo/media backlash etc.The politicians in India, like you point out, are still dependent on the masses. The media can only damage them to an extent, because the entire country does not follow any one channel or news outlet. It is changing, but it is still not like what one has in Unkiland. So the desi politicians can make hundreds of mistakes but there is no Krsna to make them accountable. In maasa, a politician has to do few mistakes, even way out in the past, the media will blow it out of proportion and destroy her and him.

JMTs and all that.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://www.telegraph.co.uk/news/worldne ... l-out.htmlIreland fights to stave off £77 billion bail-out

Ireland was fighting for its political and economic independence last night as secret negotiations began in Brussels over an international bailout of up to £77billion.

Talks went on into the night as Irish ministers insisted that they could manage their stricken finances but other Governments expressed concerns that an emergency bail-out may be required as early as today.

Investors have rushed to sell Irish debts in recent weeks and there is growing speculation that if Europe fails to intervene there may be a run on other countries, including Spain and Portugal. The EU rescue package, seen as “very likely” by European officials, could cost the British taxpayers as much as £7billion following a deal agreed by Alistair Darling when he was still chancellor in the political limbo following the general election in May. Under its terms, Britain agreed to underwrite EU plans to rescue countries in difficulty.

David Cameron has publicly expressed support for steps to assist Ireland. Several British banks, particularly RBS, have exposure to Irish government debt amounting to billions of pounds and have watched their shares fall over the past week.

Ireland has experienced the worst recession of any major economy and has amassed government debts of more than €100 billion (£85billion). It has an unemployment rate almost twice as high as Britain at 13.2 per cent and currently has a record deficit equivalent to 32 per cent of its gross domestic product.

rescue deal would be deeply unpopular with Irish voters, who value national independence and the low-tax regime that pulled in foreign investment from America and other non-European companies, fuelling high Irish growth rates over the past 20 years

Re: Perspectives on the global economic meltdown (Jan 26 201

ambrose evans-pritchard of the telegraph of uk wants europe to also print currency like the us federal reserve. worth reading in full.

http://www.telegraph.co.uk/finance/comm ... oment.htmlUnless the ECB takes fast and dramatic action, it risks destroying the currency it is paid to manage, and allowing a political catastrophe to unfold in Europe.

If mishandled, Ireland could all too easily become a sovereign version of Credit Anstalt - the Austrian bank that brought down the central European financial system in 1931, sent tremors through London and New York, and set off the second deeper phase of the Great Depression, the phase when politics turned ugly.

“Does the ECB understand the concept of contagion?” asked Jacques Cailloux, chief Europe economist at RBS. Three EMU countries have already been shut out of the capital markets, and footloose foreign creditors hold €2 trillion of debt securities issued by Spain, Portugal, Ireland and Greece.

Portugal is in worse shape than Ireland. Total debt is 330pc of GDP. The current account deficit is near 12pc of GDP (while Ireland is moving into surplus). Portuguese banks rely on foreign wholesale funding to cover 40pc of assets.

The country has been trapped in perma-slump with an over-valued currency for almost a decade. Successive waves of austerity have failed to make a lasting dent on the fiscal deficit, yet have been enough to sap the authority of the ruling socialists and revive the far-Left.

Former ministers are already talking openly of the need for an EU-IMF rescue. It is hard to see how Portugal could avoid being sucked into the vortex alongside Ireland. Europe and the IMF would then face a cumulative bail-out bill of €200bn or so. That stretches the EFSF to its credible limits.

The focus would shift instantly to Spain, where economic growth stalled to zero in the third quarter, car sales fell 38pc in October, a 5pc cut in public wages has yet to bite, and roughly 1m unsold homes are still hanging over the property market. The problem is not the Spanish state as such: the Achilles Heel is corporate debt of 137pc of GDP, and the sums owed to foreign creditors that must be rolled over each quarter.

The risks are obvious. Unless core EMU countries raise fresh funds to boost the collateral of the rescue fund, markets will not believe that the EFSF has the firepower to stand behind Spain. Will Germany’s Bundestag vote more funds? Will the Dutch? Tweede Kamer, where right-wing populist Geert Wilders now holds the political balance, adamantly opposes such help, and might well use such a crisis to launch a bid for power.

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic meltdown (Jan 26 201

Folks,

Are there any good takes (articles/OPEDs or even posts here, if I have missed) posted on where exactly France is with respect to EURO crisis? We have heard where Germany stands and kind of have assessment of its concerns but somehow I couldn't get hold of France's position.

Secondly, the related aspect of Germany-France (combined) take on this? Have there been any visible disagreements between them?

Are there any good takes (articles/OPEDs or even posts here, if I have missed) posted on where exactly France is with respect to EURO crisis? We have heard where Germany stands and kind of have assessment of its concerns but somehow I couldn't get hold of France's position.

Secondly, the related aspect of Germany-France (combined) take on this? Have there been any visible disagreements between them?

Re: Perspectives on the global economic meltdown (Jan 26 201

----------

QE2 - The largest tax ever levied on The American People - and entirely illegal.

QE2 - The largest tax ever levied on The American People - and entirely illegal.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

satya,

IMHO the French position is ambiguous. At the least they appear undecided. First they blast the austerity drive and attack the 'speculators' driving up bond yields and thereby sovereign borrowing costs, then the much touted shock-and-awe of a trillion euro backstop having melted within weeks of announcement, Paris is now a follower to German lead in the general economic area. Its a sink or swim situ for them. The austerity boat, that the Germany led EU is banking on calls for trimming deficits the hard way. That's fine for Germany, I guess, which is itself a surplus country. France is already seeing the beginning of civil unrest following the austerity climbdowns.

Meanwhile, some more TAE tweets:

IMHO the French position is ambiguous. At the least they appear undecided. First they blast the austerity drive and attack the 'speculators' driving up bond yields and thereby sovereign borrowing costs, then the much touted shock-and-awe of a trillion euro backstop having melted within weeks of announcement, Paris is now a follower to German lead in the general economic area. Its a sink or swim situ for them. The austerity boat, that the Germany led EU is banking on calls for trimming deficits the hard way. That's fine for Germany, I guess, which is itself a surplus country. France is already seeing the beginning of civil unrest following the austerity climbdowns.

Meanwhile, some more TAE tweets:

How to make the dollar sound again http://nyti.ms/byBwXQ Op-Ed in the NYT by James Grant, calling for a return to the Gold Standard

Social Security judges facing more violent threats http://yhoo.it/c6XzM9 Public anger is growing

Europe stumbles blindly towards its 1931 moment http://bit.ly/aw6F5r That word 'contagion' is back in vogue again! :O

Wow -- Check Out How Blatantly Our [US] Government Misled Us With The October Jobs Numbers! http://read.bi/bQ7pIz 200,000 jobs created by magic??

Ireland denies €60bn bail-out talk as EU puts on pressure http://bit.ly/bdtq7h Ooooh! This will be a fun week of denial and games.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

Bery bery interesting onlee.....

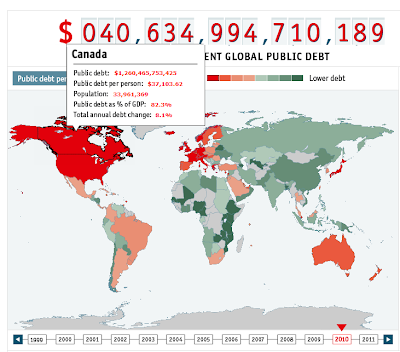

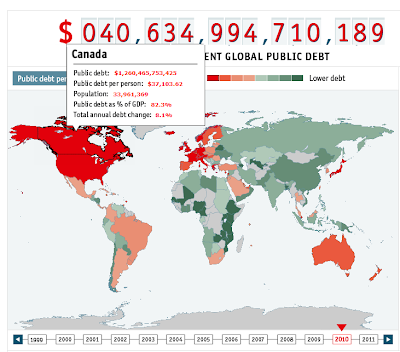

http://www.economist.com/content/global_debt_clock

Compare per capita public debt for the rising Asian giants China (~$724) and India (~711) against the emerged khanomies - unkil (~$29k), UQ (~$26k), Canada (~$37k), Ozistan (~$11k) et al to get a feel for the sheer scale of living beyond means by the extend and pretend ponzi on and on for the past few decades. Wow only. All figs in USF

http://www.economist.com/content/global_debt_clock

Compare per capita public debt for the rising Asian giants China (~$724) and India (~711) against the emerged khanomies - unkil (~$29k), UQ (~$26k), Canada (~$37k), Ozistan (~$11k) et al to get a feel for the sheer scale of living beyond means by the extend and pretend ponzi on and on for the past few decades. Wow only. All figs in USF

Re: Perspectives on the global economic meltdown (Jan 26 201

Does public debt also include stuff like mortgages?

Re: Perspectives on the global economic meltdown (Jan 26 201

I don't think so. I think Public Debt means government borrowings (federal, state, city, etc.).Tanaji wrote:Does public debt also include stuff like mortgages?

Re: Perspectives on the global economic meltdown (Jan 26 201

Mortgages, Credit Cards, Auto Loans, student loans etc are private debt.

Re: Perspectives on the global economic meltdown (Jan 26 201

GOP economists crticise QE2 as inflationary and devaluing the $.

LINK

Repubs are very serious about $. The talk is there are back room moves moves for euroizing the Dollar.

LINK

Repubs are very serious about $. The talk is there are back room moves moves for euroizing the Dollar.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://www.bloomberg.com/news/2010-11-1 ... ecast.html

Beginning of NO G&D

Beginning of NO G&D

Japan’s economy grew more than forecast in the third quarter as consumer spending increased, shielding the expansion from a stronger yen and export slowdown likely to have a greater impact this quarter.

Gross domestic product rose an annualized 3.9 percent in the three months ended Sept. 30, following a revised 1.8 percent expansion in the previous quarter, the Cabinet Office said in Tokyo today. In nominal terms, the economy grew 2.9 percent. Consumption, accounting for about 60 percent of GDP, led the gain as households stepped up purchases of fuel-efficient cars ahead of the expiration of a subsidy program and as smokers stocked up before an Oct. 1 tobacco-tax rise. The yen’s climb to a 15-year high will probably damp growth this quarter as companies from Sharp Corp. to Nikon Corp. cut profit forecasts.

Re: Perspectives on the global economic meltdown (Jan 26 201

Why do economists (and politicians) who postulate when given a chance, by appointments, to do something change their tune? The reality strikes them. But they do not have the stomach to do the correct thing as it entails short term disaster to the country and immediate disaster for their careers. For example, instead of giving money to the banks, why did they not give the money to the actual mortgage holders? They are ALL caught up in their pet ideologies (and <add your favorite CT theories here).ramana wrote:GOP economists crticise QE2 as inflationary and devaluing the $.

LINK

Repubs are very serious about $. The talk is there are back room moves moves for euroizing the Dollar.

Re: Perspectives on the global economic meltdown (Jan 26 201

So the Jefforsonians and Hamiltonians form the middle two-thirds of the body politic.

Re: Perspectives on the global economic meltdown (Jan 26 201

I see a lot of names on here who just a few months ago were arguing with me about bailouts, money printing & banking BS...and are now suddenly talking Austrian economics.

Re: Perspectives on the global economic meltdown (Jan 26 201

It is actually a tax levied on the creditors to the American people, including China and Japan.Acharya wrote:----------

QE2 - The largest tax ever levied on The American People - and entirely illegal.

Re: Perspectives on the global economic meltdown (Jan 26 201

Up against the mainstream, be satisfied with heads they win, tails you lose.Neshant wrote:I see a lot of names on here who just a few months ago were arguing with me about bailouts, money printing & banking BS...and are now suddenly talking Austrian economics.

Re: Perspectives on the global economic meltdown (Jan 26 201

IMO, Austrian economics will work perfectly in a closed economy or when gold is the legal tender. In the current ponzi scheme globalized economy, any major country that follows Austrian economics will lose badly. The weakness I see is that this economics doesn't consider geopolitical situation. If US were to follow Austrian economics strictly, its GDP will instantly contract by about 50% (my guess). The psychological impact of that on the world will be a huge loss for US. As part of cutting govt. expenses, it will have to cut its huge defense budget and the geopolitical loss due to that will be really significant. US will become just another major country after that.Neshant wrote:I see a lot of names on here who just a few months ago were arguing with me about bailouts, money printing & banking BS...and are now suddenly talking Austrian economics.

My guess is that US will sincerely follow austerity measure only if it is sure that it can bring down rest of the world along with it. Then it can reconstruct quickly so that it rises up before others. Till then it will try different measures of printing and cutting to kick the can farther, till it can hook all other nations into the crisis.

Re: Perspectives on the global economic meltdown (Jan 26 201

Fears of PRC cutting back its economy are dragging Wall Street down!

I thought the mantra was US$ goes down or devalues (Feds are doing it with QE2) and PRC economy slows down. So why the market is going down? Are there other factors at work?

I thought the mantra was US$ goes down or devalues (Feds are doing it with QE2) and PRC economy slows down. So why the market is going down? Are there other factors at work?