Perspectives on the global economic meltdown (Jan 26 2010)

Re: Perspectives on the global economic meltdown (Jan 26 201

India too should setup its own rating agency to rate for domestic and foreign debt.

Moody's, Fitch and S&P having participated in massive swindling in the housing market and with US courts ruling they are not liable for fraud (no doubt at US govt behind the scenes subversion of justice) - they can't be trusted. These jokers have turned out to have zero credibility with govt protecting them from accountability while they put out fake ratings which destroyed millions of investors.

----

China's Rating Agency Grades USA Only With AA

http://prudentinvestor.blogspot.com/201 ... -only.html

Debtors beware! China's only rating agency, Dagong Global Rating Agency, has published its first report on foreign government debt, rating 50 countries that comprise 90% of the global economy. As there has been a perennial discussion about the ratings of Western agencies it can be expected that China will put high emphasis on its own ratings when lending money to other countries.

Dagong's report attracts a lot of attention as it has graded the USA only with "AA". Altogether the rating agency arrived at 27 lower valuations and only a handful of "AAA" risks left.

Among the 50 countries, the local currency sovereign credit risk for such countries as Norway, Australia, Denmark, Luxembourg, Switzerland, Singapore, New Zealand were assigned "AAA" ratings.

China, Canada, the Netherlands, Germany were assigned "AA +". The United States and Saudi Arabia got an "AA" rating. France , the United Kingdom, Korea and Japan got "AA-"s.

The countries that were assigned local currency sovereign credit rating of "A-" level include Belgium, Chile, Spain, South Africa, Malaysia, Estonia, Russia, Poland, Israel, Italy, Portugal and Brazil.

Dagong gave China's yuan-denominated debt an "AA-plus" rating with a stable outlook -- higher than Moody's "A1" and S&P's "A-plus" -- due to its rapid growth and relatively low debt. China's foreign currency rating was "AAA" in Dagong's report.

According to Chinadaily, Guan Jianzhong, chairman of Dagong, said during a press conference in Beijing to introduce China's first sovereign credit rating report, that the current Western-led rating system "provides incorrect credit-rating information" and fails to reflect changing debt-repayment abilities. "We want to make realistic and fair ratings and mark a new beginning for reforming the irrational international rating system," Guan said.

Dagong said it rated the 50 countries according to its own credit rating standards for the sovereign entity of a central government, which include "the ability to govern a country, economic power, financial ability, fiscal status and foreign reserve".

In the report, Dagong rated US government debt AA with a negative outlook, which was lower than the firm's top AAA rating. It warned that Washington, along with Britain, France and other countries, might have trouble raising more money if they let fiscal risks get out of control.

"The interest rate on debt instruments will go up rapidly and the default risk of these countries will grow even larger," the report said.

Moody's, Fitch and S&P having participated in massive swindling in the housing market and with US courts ruling they are not liable for fraud (no doubt at US govt behind the scenes subversion of justice) - they can't be trusted. These jokers have turned out to have zero credibility with govt protecting them from accountability while they put out fake ratings which destroyed millions of investors.

----

China's Rating Agency Grades USA Only With AA

http://prudentinvestor.blogspot.com/201 ... -only.html

Debtors beware! China's only rating agency, Dagong Global Rating Agency, has published its first report on foreign government debt, rating 50 countries that comprise 90% of the global economy. As there has been a perennial discussion about the ratings of Western agencies it can be expected that China will put high emphasis on its own ratings when lending money to other countries.

Dagong's report attracts a lot of attention as it has graded the USA only with "AA". Altogether the rating agency arrived at 27 lower valuations and only a handful of "AAA" risks left.

Among the 50 countries, the local currency sovereign credit risk for such countries as Norway, Australia, Denmark, Luxembourg, Switzerland, Singapore, New Zealand were assigned "AAA" ratings.

China, Canada, the Netherlands, Germany were assigned "AA +". The United States and Saudi Arabia got an "AA" rating. France , the United Kingdom, Korea and Japan got "AA-"s.

The countries that were assigned local currency sovereign credit rating of "A-" level include Belgium, Chile, Spain, South Africa, Malaysia, Estonia, Russia, Poland, Israel, Italy, Portugal and Brazil.

Dagong gave China's yuan-denominated debt an "AA-plus" rating with a stable outlook -- higher than Moody's "A1" and S&P's "A-plus" -- due to its rapid growth and relatively low debt. China's foreign currency rating was "AAA" in Dagong's report.

According to Chinadaily, Guan Jianzhong, chairman of Dagong, said during a press conference in Beijing to introduce China's first sovereign credit rating report, that the current Western-led rating system "provides incorrect credit-rating information" and fails to reflect changing debt-repayment abilities. "We want to make realistic and fair ratings and mark a new beginning for reforming the irrational international rating system," Guan said.

Dagong said it rated the 50 countries according to its own credit rating standards for the sovereign entity of a central government, which include "the ability to govern a country, economic power, financial ability, fiscal status and foreign reserve".

In the report, Dagong rated US government debt AA with a negative outlook, which was lower than the firm's top AAA rating. It warned that Washington, along with Britain, France and other countries, might have trouble raising more money if they let fiscal risks get out of control.

"The interest rate on debt instruments will go up rapidly and the default risk of these countries will grow even larger," the report said.

Re: Perspectives on the global economic meltdown (Jan 26 201

US govt is definately protecting these rating agencies from prosecution for massive fraud. Perhaps they fear international investors will have a case against these fraudsters if locals are successful in sueing them.

I am at a loss to understand how free speech can be used as a defense, by a company that presents itself as an expert for hire.

Moody’s, Fitch, and S&P had a monopoly on the bond rating market, and investors such as pension funds were required by law to use their ratings. Now a judge says that they can not be sued for fraud, even though they gave bogus ratings to the CDOs that were fabricated out of sub-prime mortgages.

-------------

Judge Throws Out Suit Against Moody’s and S.&P

A federal judge in Manhattan threw out a class-action lawsuit accusing the ratings agencies Moody’s Investors Service and Standard & Poor’s of defrauding investors about the safety of $63.4 billion of mortgage debt, Reuters reports.

The plaintiffs said the securities they bought were in fact “not of the ‘best quality,’ or even ‘medium credit quality.’” They said that, after being downgraded to junk status, the securities were worth far less than they paid.

Many underlying loans were made by mortgage lenders that later became distressed or defunct, including three of the largest: Countrywide Financial, the American Home Mortgage Investment Corporation and IndyMac Bancorp.

A spokesman for Moody’s, Michael Adler, and one for S.&P., Frank Briamonte, said their agencies were pleased with the ruling.

I am at a loss to understand how free speech can be used as a defense, by a company that presents itself as an expert for hire.

Moody’s, Fitch, and S&P had a monopoly on the bond rating market, and investors such as pension funds were required by law to use their ratings. Now a judge says that they can not be sued for fraud, even though they gave bogus ratings to the CDOs that were fabricated out of sub-prime mortgages.

-------------

Judge Throws Out Suit Against Moody’s and S.&P

A federal judge in Manhattan threw out a class-action lawsuit accusing the ratings agencies Moody’s Investors Service and Standard & Poor’s of defrauding investors about the safety of $63.4 billion of mortgage debt, Reuters reports.

The plaintiffs said the securities they bought were in fact “not of the ‘best quality,’ or even ‘medium credit quality.’” They said that, after being downgraded to junk status, the securities were worth far less than they paid.

Many underlying loans were made by mortgage lenders that later became distressed or defunct, including three of the largest: Countrywide Financial, the American Home Mortgage Investment Corporation and IndyMac Bancorp.

A spokesman for Moody’s, Michael Adler, and one for S.&P., Frank Briamonte, said their agencies were pleased with the ruling.

Re: Perspectives on the global economic meltdown (Jan 26 201

May be, India can start an agency to rate rating agencies. It should use performance of past ratings done by these agencies, and the amount of money involved..

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Perspectives on the global economic meltdown (Jan 26 201

Is there anyway that USA can come out of this economic recession?

USA would have been able to absorb the RE crash ($1-2T) if it was an isolated event. But when mixed with the capital markets (intertwining of RE with capital markets, derivative products, pension programs etc.,) the impact multiplied to nearly $10T of wealth loss in 2008.

What are the options available to USA now?

Is it possible for US to offer say 1 million $M+ dwellings to Chinese citizens with an added carrot of US GC or Citizenship (to the buyer's preference)? What if this scheme is offered by a state like California where there is already a significant Chinese presence?

For USA - It would bring in $1T+ wealth into US alleviating Freddie's problems.

For China -

It's internal RE bubble can be cooled down by diverting some of the investments to USA. Naturally all these wealthy Chinese citizens will buy local business/farms etc, increasing Chinese economic influence over USA.

What would be USA and PRC's economic, strategic, political constraints, opportunities and positions?

Appreciate some thoughts...

P.S: These thoughts were initiated by another BRFite, so I am giving the credit where it truly belongs to

USA would have been able to absorb the RE crash ($1-2T) if it was an isolated event. But when mixed with the capital markets (intertwining of RE with capital markets, derivative products, pension programs etc.,) the impact multiplied to nearly $10T of wealth loss in 2008.

What are the options available to USA now?

Is it possible for US to offer say 1 million $M+ dwellings to Chinese citizens with an added carrot of US GC or Citizenship (to the buyer's preference)? What if this scheme is offered by a state like California where there is already a significant Chinese presence?

For USA - It would bring in $1T+ wealth into US alleviating Freddie's problems.

For China -

It's internal RE bubble can be cooled down by diverting some of the investments to USA. Naturally all these wealthy Chinese citizens will buy local business/farms etc, increasing Chinese economic influence over USA.

What would be USA and PRC's economic, strategic, political constraints, opportunities and positions?

Appreciate some thoughts...

P.S: These thoughts were initiated by another BRFite, so I am giving the credit where it truly belongs to

Re: Perspectives on the global economic meltdown (Jan 26 201

If it is only this much, USG could have easily borrowed $2T and paid off all mortgage loans so that all derivatives built using them are stable.RamaY wrote:USA would have been able to absorb the RE crash ($1-2T) if it was an isolated event. But when mixed with the capital markets (intertwining of RE with capital markets, derivative products, pension programs etc.,) the impact multiplied to nearly $10T of wealth loss in 2008.

The problem is much deeper than this simple scenario.

Re: Perspectives on the global economic meltdown (Jan 26 201

So what is the problem? Everyone think they know the facts but do not present a solution.

Re: Perspectives on the global economic meltdown (Jan 26 201

ramana wrote:So what is the problem? Everyone think they know the facts but do not present a solution.

Re: Perspectives on the global economic meltdown (Jan 26 201

I see a glut of low priced condos on the market in my city. Most of them are priced lower than the equivalent in Indian cities, plus credit is cheap with the 1 YR ARM at 3% or lower. Since the apartment vacancy rate is low (~6%) in the same area, I picked up a couple to flog as rentals and plan on picking up more as good deals come on the market.

Re: Perspectives on the global economic meltdown (Jan 26 201

Housing prices in US are supposed to fully bottom out by 2013. Buying now is a folly, IMO.

Re: Perspectives on the global economic meltdown (Jan 26 201

^^^

Rental properties are cashflowing much easier because of depressed prices and cheap credit. And people are avoiding buying, but they still need a place to live, so renters are easy to find.

Rental properties are cashflowing much easier because of depressed prices and cheap credit. And people are avoiding buying, but they still need a place to live, so renters are easy to find.

Re: Perspectives on the global economic meltdown (Jan 26 201

ramana wrote:So what is the problem? Everyone think they know the facts but do not present a solution.

Do you expect BRFites to perform better than these experts?

Re: Perspectives on the global economic meltdown (Jan 26 201

There are structural problems with huge expenses on wars, hollowing out of manufacturing, gross inefficiencies in big sectors such as healthcare, and theft on an unimaginable scale by the elites that own the US (bank bailouts etc). Also, same elites are pushing lunatic schemes like the global warming scam. However, it may not be lunacy from the point of view of those elites - they may have their own reasons.ramana wrote:So what is the problem? Everyone think they know the facts but do not present a solution.

Re: Perspectives on the global economic meltdown (Jan 26 201

Good video on the current economic crisis

Watch on youtube for the remaining parts (1-6).

Watch on youtube for the remaining parts (1-6).

Re: Perspectives on the global economic meltdown (Jan 26 201

Ferguson, talking about how American Empire can collapse

Ferguson said the financial crisis that started in 2007 has “has accelerated a fundamental shift in the balance of power,” with the U.S. shedding power and China absorbing it.

Solution:“I’ve just come back from China — a two-week trip there — and the thing I heard most often was, ‘You can’t lecture us about the superiority of your system anymore. We don’t need to learn anything from you about financial institutions and forget about democracy. We see where it has got you.’”

{I am little D&G on that front.}Ferguson said, “I think there is a way out for the United States. I don’t think its over. But it all hinges on whether you can re-energize the real mainsprings of American power. And those two things are technological innovation and entrepreneurship.

-

Bade

- BRF Oldie

- Posts: 7212

- Joined: 23 May 2002 11:31

- Location: badenberg in US administered part of America

Re: Perspectives on the global economic meltdown (Jan 26 201

Continued innovation resulting in huge financial gains is not guaranteed if one looks back at different phases of human entrepreneurship. The next phase of most of the economic activities at a massive scale is going to be towards addressing the needs of the developing world using existing technologies. This itself is huge, but most of the corporations and people holding on to the capital have not realized it or do not want to believe it. The profit margins are going to be small but scale will be huge to compensate for that. The only way out of any global recession is more resources being devoted to such activities. This can also engage the trained and unemployed workforce within the developed world, but they need to change their worldview first and accept it.Ferguson said, “I think there is a way out for the United States. I don’t think its over. But it all hinges on whether you can re-energize the real mainsprings of American power. And those two things are technological innovation and entrepreneurship.

Re: Perspectives on the global economic meltdown (Jan 26 201

SwamyG, have you met a venture vulture? For piddly sums they want over 50% of the venture.

There is a movement ot be self funded to avoid vulture investing.

Again its the finance guys who are killing innovation.

There is a movement ot be self funded to avoid vulture investing.

Again its the finance guys who are killing innovation.

Re: Perspectives on the global economic meltdown (Jan 26 201

Bade sir, I agree with what you say. but exceptions like Apple/BMW who build and price their products purely for a market in the rich countries and do well in terms of profit are going to be trotted out as a contrarian view. so long as they can keep the "need" to buy and replace expensive stuff on short cycles going, the myth will last. but it cannot continue indefinitely.

only few cos like Nokia and Tata are designing complex end products affordable enough for mass market in developing world. the chinese cos are also well placed to profit from developing markets....99.99% of the world has no use for a $10 teaspoon made with aerospace aluminium and milled on cnc machines normally used for submarine properllers from a single ingot

only few cos like Nokia and Tata are designing complex end products affordable enough for mass market in developing world. the chinese cos are also well placed to profit from developing markets....99.99% of the world has no use for a $10 teaspoon made with aerospace aluminium and milled on cnc machines normally used for submarine properllers from a single ingot

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

FT's Sri martin Wolf gets it 400% right again. Hits this one outta the ballpark. Way outta.

Three years and new fault lines threaten

Yves Smith says it closer to the way I see it though:

Achcha, adi sarey kani, what's all this "faultline-vaultline" Sri Wolf keeps yappng about?

We'd be worse fools than we have shown ourselves to be in the past if we fell for such snake oil, again. Luckily, PRC will show the way in how to treat western leadership pretensions with the deference they deserve. Ta da.

Added later:

More Yves. The dame is articulate if nothing. Speaks on the faultline thingie:

Three years and new fault lines threaten

Then, Sri Wolf goes on subtly warming jingo cockles....It is nearly three years since the world became aware of the coming financial tremors. Since then we have experienced a financial sector earthquake, a collapse in economic activity and an unprecedented monetary and fiscal response.

The world economy has now recovered. {Where are the sneer quotes on 'recover', eh?}

But this crisis is far from over. {Agreed. Onlee.}

Yawn. The demise of the west is overdone. Dollops of QE (Both Ben bhaiya and the ECB are buying up sovereign bonds as we speak, or soon will, IMHO, to keep LT interest rates manageble) can buy the insolvent emerged sovereigns many more years, maybe a generation's worth more. After that, who knows or cares? The G-20 like the COTUS nowadays, is all talk-shop with zero real power, IMHO. So yeah, ye high-talk thoda light lo.We already know that the earthquake of the past few years has damaged western economies, while leaving those of emerging countries, particularly Asia, standing. It has also destroyed western prestige. The west has dominated the world economically and intellectually for at least two centuries. That epoch is over (see charts). Hitherto, the rulers of emerging countries disliked the west’s pretensions, but respected its competence. This is true no longer. Never again will the west have the sole word. The rise of the Group of 20 leading economies reflects new realities of power and authority.

But here's the damning piece...The era of easy credit, much of it backed by housing, is now over (see chart). Meanwhile, in all western countries, the state supports the welfare of the individual. But the fiscal consequences of this crisis – a huge rise in deficits – will interact with pressures from ageing, to make fiscal stringency the theme of policy for decades. The long bear market in shares and prospects for a “jobless recovery” add further to these woes.

Sri wolf, in classic brit understatement ishtyle uses the quaint word 'Stunning'.In his book, Prof Rajan points to domestic political stresses within the US. Related stresses are emerging in western Europe. I think of it as the end of “the deal”. What was that deal? It was the post-second-world-war settlement: in the US, the deal centred on full employment and high individual consumption. In Europe, it centred on state-provided welfare.

In the US, soaring inequality and stagnant real incomes have long threatened this deal. Thus, Prof Rajan notes that “of every dollar of real income growth that was generated between 1976 and 2007, 58 cents went to the top 1 per cent of households”. {OMG. Boing Boing....are those alarm bells or are those alarm bells??}

This is surely stunning.

Yves Smith says it closer to the way I see it though:

It isn’t merely stunning, it’s destructive.

Rajan isn’t the first to put together the story line recounted by Wolf, but it is likely that his book does it in a more comprehensive fashion....[Thomas Palley] argued that policy-makers retreated from full employment as a goal, since it allows workers to demand higher wages, which in turn causes inflation.

Reducing worker bargaining power led to disinflation, lower interest rates led to rising asset prices {which again disproportionately benefits the top 1% class}, which in combination with financial innovation, created an until-recently reinforcing cycle whereby rising asset prices funded consumption{We all know how that ended. And yup, make no mistake, ended it has. Khallas.}. Palley further contended that this was inherently a self-limiting paradigm, and we had reached the end of the road.{Aameen}

Achcha, adi sarey kani, what's all this "faultline-vaultline" Sri Wolf keeps yappng about?

Here's the anguished punchline... full of bait too“The political response to rising inequality ... was to expand lending to households, especially low-income ones.” This led to the financial breakdown. As Prof Rajan notes: “[the financial sector’s] failings in the recent crisis include distorted incentives, hubris, envy, misplaced faith and herd behaviour. But the government helped make those risks look more attractive than they should have been and kept the market from exercising discipline.”

{OK, this is how said faultlines first started to manifest - first micro-cracks in the damn, lessay}

...

I think of it as the end of “the deal”. What was that deal? It was the post-second-world-war settlement: in the US, the deal centred on full employment and high individual consumption. In Europe, it centred on state-provided welfare.

...

It is little wonder then that the politics of western countries and, above all, of the US have become discordant. President Barack Obama – a pragmatic centrist – is vilified. On the right, the call is to overthrow the modern government in an effort to return to the 18th century. This, then, is a crisis of government itself.

...

Exacerbating these internal fault lines within western economies are those in the world economy. {Anyone recall the famous 'Asian savings glut' statement, eh?} Here Prof Rajan notes two risks: first, the structural export-dependency of a number of economies, particularly Japan, Germany and now China; and, second, the unresolved clash of financial systems. The interaction between global fault lines and those inside the domestic economies of western countries, particularly the US, helped trigger the crisis and now make it hard to rebuild after it.{Aameen}

...

The crisis, then, can be seen as the product of fault lines inside advanced western economies – above all, the US – and in the relationships between advanced countries and the rest of the world. The challenge of returning to some form of reasonable stability, while maintaining an open global economy, is enormous. Anybody who thinks that the present fragile recovery represents success with these tasks is myopic, at best.

{yap yap blah blah}

Wah bhai wah. Matlab, westerners having lived the high-life, its time now for shared sacrifice from the ars-whole world, including the boor SDRE one, to help put the world economy back on track.The west is not the power it was; {You're kiddin', PRC certainly doesn't seem to believe such misleading propagandu}

its debt-fuelled consumers are not the source of demand they were; {And will not be for at least a generation if not more. Deleveraging is all the rage in the household sector now}

the west’s financial system is not the source of credit it was; {Then plz stop extending unlimited credit to TSP!}

and the integration of economies is not the driving force it proved to be over the past three decades. {Yup, the so-called 'integration' is largely done with. It overshot the optimal level and will retreat a bit now.}

Leaders of the world’s principal economies – both advanced and emerging – will need to reform co-operatively and deeply if the world economy is not to suffer further earthquakes in years ahead.

We'd be worse fools than we have shown ourselves to be in the past if we fell for such snake oil, again. Luckily, PRC will show the way in how to treat western leadership pretensions with the deference they deserve. Ta da.

Added later:

More Yves. The dame is articulate if nothing. Speaks on the faultline thingie:

I am not terribly optimistic about the survival of the “open world economy”. I believe that (absent measures like Keynes’ Bancor proposal) large trade flows over time produce destabilizing international capital flows. Citizens are not prepared to suffer sudden, dramatic losses of savings and high odds of unemployment or reduced income in the name of world trade. Containing the downside would require a considerable loss of national sovereignity, which again few are prepared to accept.

Moreover, much of America seems blithely unaware of our diminished role in the world. Likewise, financiers, having wrested massive concessions from national governments (bailouts with almost no concessions demanded of them) if anything view themselves as even more influential than before the crisis. In other words, both the distorted self image of key players and a reluctance to admit the deep seated nature of the problems make a happy resolution unlikely.

Last edited by Hari Seldon on 14 Jul 2010 21:58, edited 1 time in total.

Re: Perspectives on the global economic meltdown (Jan 26 201

I was thinking more about this innovation, entrepreneurship ityadi. The last two big ones in the last two decades - Internet and CDOs both actually leveled the playing field for the East and poorer countries. In USA, the rich become richer, the poor became poorer. But in countries like India, the internet along with the information age moved millions out into the middle class. The CDOs and various financial schemes actually brought down the image of West in the eyes of the East; and also shifted the global power to the East.

So the last two major innovations, though helped the West in short term, actually helped the developing countries in the long run. I am sure people through out ages would have negatively commented about the impossibility of innovating further. For example, a dude in 1900 would have proclaimed: "there is nothing more to be invented". Lo and beyond airplanes are invented. Airplanes address the travel problem.

In order for the West to continue to occupy the higher pedestal, the West have to essentially produce goods cheaply. Next, it has to reduce the energy costs. The West already offshored the manufacturing to China, Mexico ityadi countries. If it pulls them back, it is going to take a big hit in short term. But that is the only sustainable model in long term - a country has to have a manufacturing base. But how is it going to bring down energy costs? Solar, wind, geothermal......?

Innovations like nanotechnology, flexible electronics ityadi are all nice and dandy; but what problems do these solve? Unless they solve some human problems they will be nice to have onlee; without making a global impact. Let us take telecommunication; it has helped solve several problems in India and other developing countries. Rural folks, farmers, sales agents... use it to solve some common problems.

The 3 basic necessities across globe are: Some of the common problems that humans worry about are: 1)Food 2)clothing & shelter 3)Health

Transportation, Communication, Education et al are just means to provide the basic 3. After the basic 3 are met, only then the humans think about Recreation. So we have airplanes now. How fast can humans travel across the globe? Say for example, if the travel time between India and USA is reduced to 1 hour. Can it be commercialized? Can the human body be, routinely, punished with such great speeds? Communication; we already have wireless. Would it be called innovation if we have merely a chip embedded inside our body that allows us to communicate wireless? What does it solve that we already have not solved?

I am stumped when scholars, economists and professors talk about innovation and how it alone can lead the West out of the dump.

Any economic model that does not take into account sustainability and balancing will wither in long term. Dharmavae jayate

~just some rambling.

So the last two major innovations, though helped the West in short term, actually helped the developing countries in the long run. I am sure people through out ages would have negatively commented about the impossibility of innovating further. For example, a dude in 1900 would have proclaimed: "there is nothing more to be invented". Lo and beyond airplanes are invented. Airplanes address the travel problem.

In order for the West to continue to occupy the higher pedestal, the West have to essentially produce goods cheaply. Next, it has to reduce the energy costs. The West already offshored the manufacturing to China, Mexico ityadi countries. If it pulls them back, it is going to take a big hit in short term. But that is the only sustainable model in long term - a country has to have a manufacturing base. But how is it going to bring down energy costs? Solar, wind, geothermal......?

Innovations like nanotechnology, flexible electronics ityadi are all nice and dandy; but what problems do these solve? Unless they solve some human problems they will be nice to have onlee; without making a global impact. Let us take telecommunication; it has helped solve several problems in India and other developing countries. Rural folks, farmers, sales agents... use it to solve some common problems.

The 3 basic necessities across globe are: Some of the common problems that humans worry about are: 1)Food 2)clothing & shelter 3)Health

Transportation, Communication, Education et al are just means to provide the basic 3. After the basic 3 are met, only then the humans think about Recreation. So we have airplanes now. How fast can humans travel across the globe? Say for example, if the travel time between India and USA is reduced to 1 hour. Can it be commercialized? Can the human body be, routinely, punished with such great speeds? Communication; we already have wireless. Would it be called innovation if we have merely a chip embedded inside our body that allows us to communicate wireless? What does it solve that we already have not solved?

I am stumped when scholars, economists and professors talk about innovation and how it alone can lead the West out of the dump.

Any economic model that does not take into account sustainability and balancing will wither in long term. Dharmavae jayate

~just some rambling.

Re: Perspectives on the global economic meltdown (Jan 26 201

Hari Seldon, Welcome back. Missed your pithy remarks.

On an aside Robert McElvaine, a Great Depression/New Deal scholar says the biggest effect of that crisis was to transfer the wealth from the top 25% to the middle 50% and it was the consumption by these folks that drove the economy. The bottom 25% continued to own 4-5% of the wealth throughout the century.

By around the mid 1980s the top wealthy were getting their old share back and he was worried about that. I guess the time bomb really setoff in the policies of the 80s - the Reagan Revolution. All this new analsysi is dressing the turkey to make it look like an eagle.

On an aside Robert McElvaine, a Great Depression/New Deal scholar says the biggest effect of that crisis was to transfer the wealth from the top 25% to the middle 50% and it was the consumption by these folks that drove the economy. The bottom 25% continued to own 4-5% of the wealth throughout the century.

By around the mid 1980s the top wealthy were getting their old share back and he was worried about that. I guess the time bomb really setoff in the policies of the 80s - the Reagan Revolution. All this new analsysi is dressing the turkey to make it look like an eagle.

Re: Perspectives on the global economic meltdown (Jan 26 201

For folks who want to read Wolf's article but wanna bypass FT login, here you go: http://thetreeofliberty.com/vb/showthread.php?t=110552

Re: Perspectives on the global economic meltdown (Jan 26 201

They are quite right. The West simply cannot produce cheap goods like manufacturing because people in many other countries are willing to precisely just that for a fraction of western wages. Or to think of it another way, would you build factories in the US and pay guys $4/hour?SwamyG wrote:

In order for the West to continue to occupy the higher pedestal, the West have to essentially produce goods cheaply. Next, it has to reduce the energy costs. The West already offshored the manufacturing to China, Mexico ityadi countries. If it pulls them back, it is going to take a big hit in short term. But that is the only sustainable model in long term - a country has to have a manufacturing base. But how is it going to bring down energy costs? Solar, wind, geothermal......?

----------------------------------------------------------

I am stumped when scholars, economists and professors talk about innovation and how it alone can lead the West out of the dump.

Although you are right that people in other countries can do innovative/high tech/yadda yadda things just as well, but that in itself does not mean that the US must go back to producing shoes and cars, US industries need to find things they are at a competitive advantage due to either capital investment or economies of scale. You mentioned airplanes, not everyone can make airplanes and jet engines right? But everyone can make automobiles.

Re: Perspectives on the global economic meltdown (Jan 26 201

Ricardo's theory of competetive advantage!

Re: Perspectives on the global economic meltdown (Jan 26 201

And krugman's theory of specialization due to economy of scale as well.ramana wrote:Ricardo's theory of competetive advantage!

Re: Perspectives on the global economic meltdown (Jan 26 201

It'll be funny to watch US citizens travelling in buses and trains more and more while living in rental accomodations competing with Indians and Chinese in both blue-collar and white-collar jobs if the dollar is indeed devalued or is dethroned from being the worl'd reserve currency

Re: Perspectives on the global economic meltdown (Jan 26 201

I am almost on the verge of throwing this "Comparative Advantage" thingie out the door. I am not an economist or economics student, though I had an Economics as a subject in my Masters; so I might be naive, ignorant or rude in dismissing. But why? Because like all old adages and proverbs, everything has a context and framework.

Which is more essential or useful an airplane or a car? The infrastructure needed for car can be used by other modes of transportation as well.

Running a country is not the same as running an economy. Running a country means having a greater flexibility and options. When tough times hit, one needs to have the ability (feasibility) to produce ones goods.

Which is more essential or useful an airplane or a car? The infrastructure needed for car can be used by other modes of transportation as well.

Running a country is not the same as running an economy. Running a country means having a greater flexibility and options. When tough times hit, one needs to have the ability (feasibility) to produce ones goods.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

TAE tweets:

https://twitter.com/AutomaticEarth

Ireland and iceland shall be the competing models for upcoming greece/portugal wannabes, perhaps.

Chalo, ciao for today.

https://twitter.com/AutomaticEarth

Unfunded liabilities that cannot be funded will not be funded. Nothing complicated here, IMO. Anyway BoE's QEing can and will take flight again. Interest burden on existing and coming debt simply cannot be allowed to attain escape velocity.UK public sector could have £4 trillion of hidden debts http://bit.ly/c0RGz6 WOW!

UK Part-time workforce reaches record levels, 27pc of the Work Force http://bit.ly/bmevgY

Expect more tax related raids in the coming days onlee. Once it becomes commonplace and acceptable, maybe our babus will get in on it too, who knows?Duesseldorf Prosecutor Raids Credit Suisse In Germany http://bit.ly/asuUfM On tax evasion suspicions.

[Quality] Jobs remain the #1 issue. Always have and will. Elites seem to be softening up lay janta to accept much reduced terms and benefits in employment post crisis, seems like.Fears grow as millions lose jobless benefits http://bit.ly/bhE598 "It's too late for me now," Deborah Coleman, 58 who lost benefits in April

Why We Can’t Rely on Foreign Consumers to Rescue American Jobs, and Why Today’s “Jobs for America Summit” is a Bad Joke http://bit.ly/bbH35h

Sri Obama is messiah no more? I do hope he wins another term though, unlikely as that is. Clueless+indecisive in the WH is way better than bone-headed+malicious in there onlee.60pc have lost faith in Obama http://bit.ly/acwTZX A complete reversal from 18 months ago.

*Chuckle* Obama enlists Bill Clinton's aid on economy

Poor Ireland. I feel sorry for the folks, fellow sufferers of English colonism and tyranny. Ireland is playing by the rules, being the good munna Yindia typically has been in 'international' circles. And has what to show for it exactly?Ireland: a jobless recovery is no recovery at all and political leadership, from any quarter, is entirely absent. http://bit.ly/aO3Xuy

Ireland and iceland shall be the competing models for upcoming greece/portugal wannabes, perhaps.

Ah, how the mighty fall. Once that veneer of invincibility cracks, its amazing how swift and vicious the next attack becomes. Go brazil indeed.Brazil's federal police are investigating Goldman Sachs Group Inc for the alleged use of insider information http://bit.ly/cNEavz Go Brazil!

Chalo, ciao for today.

Re: Perspectives on the global economic meltdown (Jan 26 201

I shudder to think what these Goldman scoundels will be doing in India. Probably a whole bunch of fast talking grease balls are being recruited to CON-vince the govt to lossen up all regulation so the swindling of the stock market can begin.Hari Seldon wrote:TAE tweets:

Brazil's federal police are investigating Goldman Sachs Group Inc for the alleged use of insider information http://bit.ly/cNEavz Go Brazil!

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

From asia times:

Georgia on borrowed time

Georgia, most willing to play munna i.e. cat's paw to paschimi powers in Russia'a underbelly, has naught to show for its surplus fealty. LOL.

Lezhope the natural limits of paschimi benefaction on TSP also hit their natural limits mighty soon. That'll be the day, eh?

Georgia on borrowed time

ROFL onlee.The government of Georgia is confident it can avoid a debt crisis as borrowing and the cost of interest payments increase in relation to the size and pace of the growth of the economy. The optimism appears to overlook the struggling state of the country's usual benefactors.

Georgia, most willing to play munna i.e. cat's paw to paschimi powers in Russia'a underbelly, has naught to show for its surplus fealty. LOL.

Lezhope the natural limits of paschimi benefaction on TSP also hit their natural limits mighty soon. That'll be the day, eh?

Re: Perspectives on the global economic meltdown (Jan 26 201

I believe the plan is for China takes over the handouts once its sufficiently developed or spilts it with the US.Hari Seldon wrote: Georgia, most willing to play munna i.e. cat's paw to paschimi powers in Russia'a underbelly, has naught to show for its surplus fealty. LOL.

Lezhope the natural limits of paschimi benefaction on TSP also hit their natural limits mighty soon. That'll be the day, eh?

-

derkonig

- BRFite

- Posts: 952

- Joined: 08 Nov 2007 00:51

- Location: Jeering sekular forces bhile Furiously malishing my mijjile @ Led Lips Mijjile Malish Palish Parloul

Re: Perspectives on the global economic meltdown (Jan 26 201

Aren't you happy that the CON-gress is power?Neshant wrote: I shudder to think what these Goldman scoundels will be doing in India. Probably a whole bunch of fast talking grease balls are being recruited to CON-vince the govt to lossen up all regulation so the swindling of the stock market can begin.

Re: Perspectives on the global economic meltdown (Jan 26 201

What part of comparative advantage do you disagree with?SwamyG wrote:I am almost on the verge of throwing this "Comparative Advantage" thingie out the door. I am not an economist or economics student, though I had an Economics as a subject in my Masters; so I might be naive, ignorant or rude in dismissing. But why? Because like all old adages and proverbs, everything has a context and framework.

Which is more essential or useful an airplane or a car? The infrastructure needed for car can be used by other modes of transportation as well.

Running a country is not the same as running an economy. Running a country means having a greater flexibility and options. When tough times hit, one needs to have the ability (feasibility) to produce ones goods.

Re: Perspectives on the global economic meltdown (Jan 26 201

I have nothing against the theory per se; I understand it has assumptions to go with too. Running a country is not the same as running an economy, one reason why when somebody suggests that we should have a successful CEO run the country I get immense takleef.Carl_T wrote:What part of comparative advantage do you disagree with?

A great example is nana sa pyara sa maasa. Look what is happening to it, it has dished out major manufacturing jobs to developing countries thinking about the bottom line. People are running out of jobs now. Vast prosperity increased their population, lifestyle and life span. Now it needs jobs to support their standard of living. Building airplanes for rest of the World is not going to feed and provide health for them all.

Re: Perspectives on the global economic meltdown (Jan 26 201

I see the situation as hopeless for US and China. They are locked into a gravitational decaying orbit around each other, eventually colliding into each other.

I for one am glad, we're doing things at our own pace now!

I for one am glad, we're doing things at our own pace now!

Re: Perspectives on the global economic meltdown (Jan 26 201

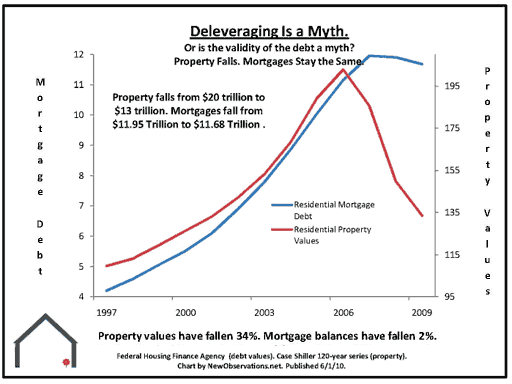

There is a huge gap between residential property values and residential mortgage debt changes. Inevitably, they have to match. i.e. sooner or later, massive debt defaults should occur.

Re: Perspectives on the global economic meltdown (Jan 26 201

It will most likely be a mix of both. Defaults and Property values rising a bit.paramu wrote:There is a huge gap between residential property values and residential mortgage debt changes. Inevitably, they have to match. i.e. sooner or later, massive debt defaults should occur.

Re: Perspectives on the global economic meltdown (Jan 26 201

In the long term, yes.

When people start defaulting, it can only depress property prices.

When people start defaulting, it can only depress property prices.

Re: Perspectives on the global economic meltdown (Jan 26 201

So right now $7T worth of property is being mortgaged at $11.68T a gap of ~$4.68T? So banks must be making lots of money by not rewriting the loans. In what time period will the $7T equal the $11.68T in mortgages at say 5% growth? If its too long then defaults will increase.

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Perspectives on the global economic meltdown (Jan 26 201

^ That would be about 10 years.

But if allah pulls another bank down for any other reason, the equilibrium can be achieved sooner

But if allah pulls another bank down for any other reason, the equilibrium can be achieved sooner

Re: Perspectives on the global economic meltdown (Jan 26 201

The bank balance sheet is negative and busted. Hence Banks are insolvent.ramana wrote:So right now $7T worth of property is being mortgaged at $11.68T a gap of ~$4.68T? So banks must be making lots of money by not rewriting the loans. In what time period will the $7T equal the $11.68T in mortgages at say 5% growth? If its too long then defaults will increase.