Indian Economy News & Discussion - Aug 26 2015

Re: Indian Economy News & Discussion - Aug 26 2015

Why two consecutive droughts don't affect India the way it used to?

I am amazed when people ask me why food prices, notably that of dal, have gone up. India has just suffered two consecutive droughts. The question to be asked is why, after a disastrous monsoon, food prices have risen so little.

I became a journalist in 1965, when also India was hit by two consecutive droughts. Foodgrain production fell by 20 per cent, starvation was rampant, and inflation went through the roof. India was pathetically, humiliatingly dependent for survival on US food aid, and lived a "ship to mouth" existence.

Fifty years later, two back-to-back droughts years have made so little impression on the lives and minds of people that they wonder why food prices are up. GDP data shows that agricultural production actually went up marginally in 2014-15 despite a drought. In the current financial year, agricultural GDP rose by 1.8 per cent in the first quarter and by 2.2 per cent in the second quarter, although the rainfall deficiency was 14.3 per cent this year against 12 per cent last year. TV cameramen have scoured the worst-hit districts for starving villagers but cannot easily locate any. The drought is simply not a big news story.

A bad monsoon does not just hit agricultural production and prices: it hits industry and services too. Historically, many industries — notably textiles, jute, sugar and edible oils — were dependent on farm output for raw materials. Most jobs were created in sowing, weeding, harvesting, transporting and processing produce. This explains why economist Arvind Virmani once showed that in the first 50 years after independence, no less than 45 per cent of changes in Indian GDP could be explained by changes in rainfall: other factors put together accounted for only 55 per cent.

The twin droughts of 1965 and 1966 led some foreign exerts to opine that India could never feed itself. Famine 1975, a bestselling book by William and Paul Paddock, predicted global famine by 1975. The authors said limited food surpluses of the West should be conserved for countries capable of being saved, while countries incapable of being saved, like India, should be left to starve, for the greater good of humanity. Indians were angered and horrified by the book, yet it was widely applauded in the West. Environmentalist Paul Ehrlich, author of The Population Bomb, praised the Paddock brothers sky-high for having the guts to highlight a Malthusian challenge.

Today, we seem barely aware of two successive droughts. What accounts for the change? Some think the Green Revolution increased food grain availability per head. No, grain availability peaked in 1964 and then declined. Mass starvation ended in subsequent droughts mainly because of better distribution: rural employment programmes provided just enough purchasing power in affected districts. People were still hungry, but did not starve.

Incomes rose over the years and Indians switched from cereals to superior foods. So, per capita consumption of cereals declined. This unexpectedly created grain surpluses. So, in the 1990s India became a substantial net food exporter, and the second largest rice exporter in the world. It continues to export food even in drought years. That is amazing for a country that used to be the greatest beggar for food aid.

The Green Revolution raised yields, enabling more to be produced from the same area. Tubewell irrigation meant the rabi crop increased from one-third the size of the kharif crop to as much or more. The total irrigated area increased from one third to 60 per cent. Drought proofing was substantial.

More important, agriculture's share in the economy fell steadily, from 52 per cent in 1950 to just 14 per cent today. Services now constitute 60 per cent of the economy, and don't depend on the monsoon. Industrial production has diversified into engineering and chemical products, and is no longer dominated by farm-based industries like cotton textiles, sugar, and jute textiles.

As incomes rose in the 1970s, farming patterns changed. Per capita production of foodgrains declined, but that of superior foods (like dairy products, edible oil, sugar, tea, eggs, fruit and vegetables) went up. These superior foods provided farmers with more income even as they satisfied the changing needs of a society getting better off.

The share of traditional crops — including cash crops like oilseeds, fibres and sugarcane — dropped from two-thirds to just half of total production. The other half consists mainly of fruits and vegetables, poultry, fisheries, and livestock. These activities are much less monsoon-dependent than traditional crops, and help explain why agricultural GDP managed to rise 2.2per cent in July-September this year despite a drought.

However, this success has been accompanied by grave environmental damage. Free electricity to farmers has encouraged over-pumping and alarming aquifer depletion. Politicians refuse to charge farmers for power, saying this will lose them elections. One compromise may be to give a free solar pump to every farmer, and charge for other electric supplies.

I am amazed when people ask me why food prices, notably that of dal, have gone up. India has just suffered two consecutive droughts. The question to be asked is why, after a disastrous monsoon, food prices have risen so little.

I became a journalist in 1965, when also India was hit by two consecutive droughts. Foodgrain production fell by 20 per cent, starvation was rampant, and inflation went through the roof. India was pathetically, humiliatingly dependent for survival on US food aid, and lived a "ship to mouth" existence.

Fifty years later, two back-to-back droughts years have made so little impression on the lives and minds of people that they wonder why food prices are up. GDP data shows that agricultural production actually went up marginally in 2014-15 despite a drought. In the current financial year, agricultural GDP rose by 1.8 per cent in the first quarter and by 2.2 per cent in the second quarter, although the rainfall deficiency was 14.3 per cent this year against 12 per cent last year. TV cameramen have scoured the worst-hit districts for starving villagers but cannot easily locate any. The drought is simply not a big news story.

A bad monsoon does not just hit agricultural production and prices: it hits industry and services too. Historically, many industries — notably textiles, jute, sugar and edible oils — were dependent on farm output for raw materials. Most jobs were created in sowing, weeding, harvesting, transporting and processing produce. This explains why economist Arvind Virmani once showed that in the first 50 years after independence, no less than 45 per cent of changes in Indian GDP could be explained by changes in rainfall: other factors put together accounted for only 55 per cent.

The twin droughts of 1965 and 1966 led some foreign exerts to opine that India could never feed itself. Famine 1975, a bestselling book by William and Paul Paddock, predicted global famine by 1975. The authors said limited food surpluses of the West should be conserved for countries capable of being saved, while countries incapable of being saved, like India, should be left to starve, for the greater good of humanity. Indians were angered and horrified by the book, yet it was widely applauded in the West. Environmentalist Paul Ehrlich, author of The Population Bomb, praised the Paddock brothers sky-high for having the guts to highlight a Malthusian challenge.

Today, we seem barely aware of two successive droughts. What accounts for the change? Some think the Green Revolution increased food grain availability per head. No, grain availability peaked in 1964 and then declined. Mass starvation ended in subsequent droughts mainly because of better distribution: rural employment programmes provided just enough purchasing power in affected districts. People were still hungry, but did not starve.

Incomes rose over the years and Indians switched from cereals to superior foods. So, per capita consumption of cereals declined. This unexpectedly created grain surpluses. So, in the 1990s India became a substantial net food exporter, and the second largest rice exporter in the world. It continues to export food even in drought years. That is amazing for a country that used to be the greatest beggar for food aid.

The Green Revolution raised yields, enabling more to be produced from the same area. Tubewell irrigation meant the rabi crop increased from one-third the size of the kharif crop to as much or more. The total irrigated area increased from one third to 60 per cent. Drought proofing was substantial.

More important, agriculture's share in the economy fell steadily, from 52 per cent in 1950 to just 14 per cent today. Services now constitute 60 per cent of the economy, and don't depend on the monsoon. Industrial production has diversified into engineering and chemical products, and is no longer dominated by farm-based industries like cotton textiles, sugar, and jute textiles.

As incomes rose in the 1970s, farming patterns changed. Per capita production of foodgrains declined, but that of superior foods (like dairy products, edible oil, sugar, tea, eggs, fruit and vegetables) went up. These superior foods provided farmers with more income even as they satisfied the changing needs of a society getting better off.

The share of traditional crops — including cash crops like oilseeds, fibres and sugarcane — dropped from two-thirds to just half of total production. The other half consists mainly of fruits and vegetables, poultry, fisheries, and livestock. These activities are much less monsoon-dependent than traditional crops, and help explain why agricultural GDP managed to rise 2.2per cent in July-September this year despite a drought.

However, this success has been accompanied by grave environmental damage. Free electricity to farmers has encouraged over-pumping and alarming aquifer depletion. Politicians refuse to charge farmers for power, saying this will lose them elections. One compromise may be to give a free solar pump to every farmer, and charge for other electric supplies.

Re: Indian Economy News & Discussion - Aug 26 2015

Talked to some agriculture startups friends, they opine that growing dal and pulses is not remunerative because harvesting is labor intensive. Unlike paddy and wheat where planting and harvesting is mechanized the pulses crop has not been mechanized and farm sizes are tiny, we need well designed machines to reduce dependence on labor since most labor is shifting to construction where pay is better

Re: Indian Economy News & Discussion - Aug 26 2015

What are the following institutions doing then?Vriksh wrote:Talked to some agriculture startups friends, they opine that growing dal and pulses is not remunerative because harvesting is labor intensive. Unlike paddy and wheat where planting and harvesting is mechanized the pulses crop has not been mechanized and farm sizes are tiny, we need well designed machines to reduce dependence on labor since most labor is shifting to construction where pay is better

1. ICRISAT

2. Agricultural universities

3. IITs

4. ITIs

Re: Indian Economy News & Discussion - Aug 26 2015

DBT, RuPay critical for 'meaningful' financial inclusion

The Pradhan Mantri Jan-Dhan Yojana (PMJDY) is arguably one of the major initiatives of the Narendra Modi-led government. While successive governments have in the past tried to cover the unbanked section of the population, the PMJDY has actually managed to make significant headway and that too at breathtaking speed.

In the report titled Inclusive Finance India Report 2015, Sriram argues PMJDY's success, unlike past programmes, is because it took "the issue of inclusion from a supply side - passive architecture-building project to the next level - the saturation of the demand side by adopting both push and pull strategies."

Re: Indian Economy News & Discussion - Aug 26 2015

I am not sure what is this "Financial Inclusion". Sounds like a big feast but somehow some people were barred from enjoying the feast and now we are including them.

Nobody is ever going to be well off by getting the Rs2 rice.

What I think this really is a govt. that wants all "informal" transactions by the poor masses of India done thorugh the banking channels.

Barber paying the farmer? Deposit in his account. So the banks can get a cut of the transaction.

So the big brother who is very "benevolent" of course, can see who is doing what and can smack down those that say to big brother "I don't like you!".

Arun Jaitley on one end says that he loves and is proud of India's informal shadow economy and then the govt tries to shine light on that shadow.

But hey this is all treasonous thing to say, we must do this to avoid "corruption" and nod our head to the govt.

Nobody is ever going to be well off by getting the Rs2 rice.

What I think this really is a govt. that wants all "informal" transactions by the poor masses of India done thorugh the banking channels.

Barber paying the farmer? Deposit in his account. So the banks can get a cut of the transaction.

So the big brother who is very "benevolent" of course, can see who is doing what and can smack down those that say to big brother "I don't like you!".

Arun Jaitley on one end says that he loves and is proud of India's informal shadow economy and then the govt tries to shine light on that shadow.

But hey this is all treasonous thing to say, we must do this to avoid "corruption" and nod our head to the govt.

Re: Indian Economy News & Discussion - Aug 26 2015

Do you have (a) source(s) to back this line of thought, or is it the usual hand-waving about "Modi bad" you're subjecting many threads to?mohanty wrote:What I think this really is a govt. that wants all "informal" transactions by the poor masses of India done thorugh the banking channels.

Barber paying the farmer? Deposit in his account. So the banks can get a cut of the transaction.

So what you are saying is that AJ/GoI should leave the informal economy the way it is, and not interfere. And we should not know the true worth of our economy, and the "informal" chaps should continue to keep their life savings in cash under their bed so big brother/banks getting cut, etc. don't happen. Of course, what you seem to imply is that such life savings will perish and these people will be subject to the govt's mercy in the event of calamities like the Chennai floods, and that is somehow okay? Oh, and playing the victim beforehand by using big words like 'treason' etc.mohanty wrote:Arun Jaitley on one end says that he loves and is proud of India's informal shadow economy and then the govt tries to shine light on that shadow.

But hey this is all treasonous thing to say, we must do this to avoid "corruption" and nod our head to the govt.

If you don't like my conclusions about your post, feel free to refute with properly backed assertions, it will be a refreshing change from your usual hand waving. Thanks.

Re: Indian Economy News & Discussion - Aug 26 2015

mohanty, you are trolling. Any more of this and you will be banned summarily and permanently. Whine in the whine thread. Or whine in another forum.

Re: Indian Economy News & Discussion - Aug 26 2015

India's petroleum products consumption growth at five-year high

If the consumption of petroleum products is an economic indicator, India has reason to cheer. The country’s consumption of domestic and industrial fuels — petrol, diesel, cooking gas, kerosene, naphtha and others — grew 17.5 per cent in October, the highest monthly growth rate in five years.

Consumption of petroleum products rose 17.7 per cent to 15.2 million tonnes (mt) in October from 12.9 mt in the same month in FY15, according to data from the Petroleum Planning and Analysis Cell (PPAC), the petroleum ministry’s technical arm. A Business Standard review of the numbers showed this level has not been achieved in the period since April 2010, for which data is publicly available.

The surge in fuel consumption was led by a 16.3 per cent growth in diesel, which alone accounts for 41 per cent of the basket, followed by 14.5 per cent growth in petrol and 12.5 per cent in cooking gas usage.

He also added the trend of high fuel consumption is here to stay mainly because average global crude oil prices, which have a significant bearing on petroleum product prices, are unlikely to go up in the next financial year too. Global oil prices have slumped by more than a half since June 2014 to around $40 per barrel currently. International benchmark Brent crude, which had touched a six year low of $42.23 per barrel in August, fell 1.9 per cent to $43 a barrel on Friday while US crude West Texas Intermediate (WTI) dropped 2.7 per cent to $39.97 per barrel.

Re: Indian Economy News & Discussion - Aug 26 2015

Answer is not much... most are not able to develop solutions for such opportunities perhaps because they have never thought this was a mandate. Some machines were developed but suffered from poor design and consequent reliability issues. We have a long way to go to match Japanese, German, American design and manufacturing expertise. Rice harvesting and transplanting machines are all Japanese in origin.disha wrote:What are the following institutions doing then?Vriksh wrote:Talked to some agriculture startups friends, they opine that growing dal and pulses is not remunerative because harvesting is labor intensive. Unlike paddy and wheat where planting and harvesting is mechanized the pulses crop has not been mechanized and farm sizes are tiny, we need well designed machines to reduce dependence on labor since most labor is shifting to construction where pay is better

1. ICRISAT

2. Agricultural universities

3. IITs

4. ITIs

Dal on the other hand is predominantly grown in India and does not have foreign machinery support.

Re: Indian Economy News & Discussion - Aug 26 2015

सूखे की चपेट में उत्तर प्रदेश : घास की रोटियां खाने को मजबूर हैं लालवाड़ी के लोग...Vipul wrote:Why two consecutive droughts don't affect India the way it used to?

....

Fifty years later, two back-to-back droughts years have made so little impression on the lives and minds of people that they wonder why food prices are up. GDP data shows that agricultural production actually went up marginally in 2014-15 despite a drought. In the current financial year, agricultural GDP rose by 1.8 per cent in the first quarter and by 2.2 per cent in the second quarter, although the rainfall deficiency was 14.3 per cent this year against 12 per cent last year. TV cameramen have scoured the worst-hit districts for starving villagers but cannot easily locate any. The drought is simply not a big news story.

...

http://khabar.ndtv.com/video/show/news/ ... ght-393988

Re: Indian Economy News & Discussion - Aug 26 2015

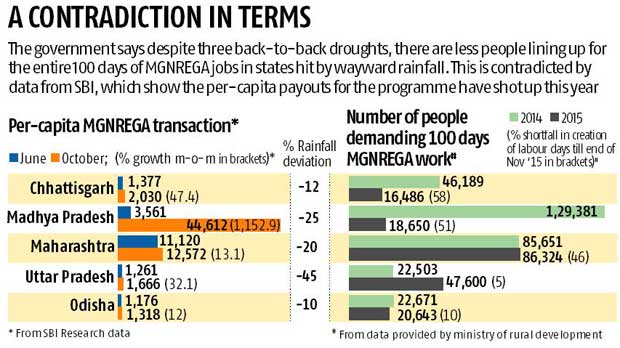

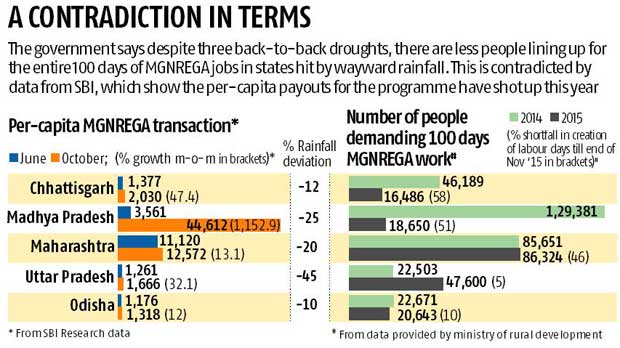

MNREGA primarily being used as a temporary backstop during drought conditions. SBI data here is skewed by per-capita reporting.

Few takers for rural job scheme, says govt; SBI data show otherwise

Few takers for rural job scheme, says govt; SBI data show otherwise

RBI mulls swapping debt for equityThe overall trend of lower enrolment for high-cost MGNREGA workers in the worst-affected states also mean the Centre is unlikely to exceed the Budget it has inked in for the programme in this financial year. The number is Rs 33,700 crore for FY16, (almost unchanged from FY15) and despite the alarming trend set forth in the SBI data, the final count will not be alarming for the finance minister.

Pronab Sen, chairman of National Statistical Commission, said he would have expected a higher aggregate number for the rural employment programme expenditure this year. "It is a safety net against climatic shocks, the sort we have had this year. In a normal year, one would have spent about Rs 33,000 crore towards it, but in a bad year that sum can and should rise to Rs 40,000-50,000 crore."

One of the causes for the low expenditure under MNREGA is because the states themselves have set a slow pace this year. Letters sent out to each state capital by the Department of Rural Development in New Delhi this week have rapped them on this score. In Madhya Pradesh, against a targeted job creation of 104 million labour days, only 41 per cent has been generated till the end of November. In Maharashtra, the rate of job creation is only 54 per cent till now.

Govt borrows Rs 3.5 lakh cr in April-SeptStrategic debt restructuring (SDR) aims to allow banks to take majority ownership of troubled firms and look for new owners. It allows banks to classify the non-performing assets (NPAs) in question as ‘standard’, rather than bad, during the 18-month process. “They (banks) have been given a window of 18 months. At this point, they are putting SDR in cases which are eligible. I think it's premature to say they (banks) are unable to find buyers,” he said. To date, SDR has been invoked in nine cases but none has yet sold assets or significantly reduced debt.

On the base rate framework, the deputy governor said it was a work in progress and could be expected shortly.

The median base lending rates of banks have come down by about 60 basis points as against a 125-basis point policy rate reduction since January. Base rate is the minimum benchmark rate below which a bank cannot lend.

The government borrowed Rs 3.51 lakh crore gross and Rs 2.14 lakh crore net in the first six months of 2015-16, according to the finance ministry's quarterly report on debt management released on Tuesday. This is 58.5 per cent of the full-year gross borrowing target of Rs 6 lakh crore and 47 per cent of the net borrowing target of Rs 4.56 lakh crore, respectively.

The total public debt (excluding liabilities under the 'public account') of the government increased to Rs 54.12 lakh crore at end-September 2015, from Rs 53.01 lakh crore at end-June 2015, the report noted.

"This represented a quarter-on-quarter increase of 2.1 per cent (provisional) compared with an increase of 3.2 per cent in the previous quarter (first quarter of 2015-16)," it said.

Internal debt constituted 92.1 per cent of public debt, compared to 92.3 per cent in the previous quarter. Marketable securities (consisting of rupee-denominated dated securities and treasury bills) accounted for 84.5 per cent of total public debt, the same level as of end-June 2015.

"Thus, the rollover risk in debt portfolio continues to be low. The implementation of budgeted buyback/switches in coming months is expected to reduce rollover risk further," the report noted.

According to the report, the outstanding internal debt of the government at Rs 49.85 lakh crore constituted 37.4 per cent of GDP at end-September 2015, compared to 37.8 per cent at end-June 2015.

Re: Indian Economy News & Discussion - Aug 26 2015

^^ IMHO Another reason you do not see the widespread effect of drought is because of increased job opportunities in the construction sector in semi urban (massive road building by Govt) and in urban areas in the private sector. In 1966-69 there were no such opportunities for the migrating labor and hence the effect was wide felt.

Re: Indian Economy News & Discussion - Aug 26 2015

As of about five years ago, the majority of rural GDP was non-farm activity, even though the majority of rural labour force was still involved in farm activity. In other words, >50% of rural economic activity was being generated outside fields by <50% of the rural population who were working outside fields. Slowly, even the labour force involved in farming is heading down, and will be below 50% . At that point, it can be factually said that the majority of the rural population don't directly work on farms. That also reduces the direct effect of droughts on them, since their farms can be consolidated and cultivated with much greater mechanization by larger agricultural entities.

-

Virupaksha

- BR Mainsite Crew

- Posts: 3110

- Joined: 28 Jun 2007 06:36

Re: Indian Economy News & Discussion - Aug 26 2015

The debt for equity swap was prominent in 80s and the politics ensured that only and only worst apples went through this. Banks do not have the capability to run them profitably nor is that any way related to their core business. Half of the PSUs of that era came by this route.

They should just auction it off to company restructuring private equity companies, with the rider that there is no relation to the existing promoters.

They should just auction it off to company restructuring private equity companies, with the rider that there is no relation to the existing promoters.

Re: Indian Economy News & Discussion - Aug 26 2015

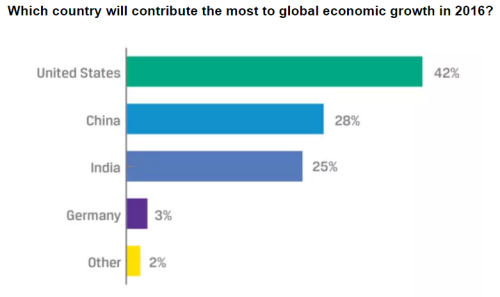

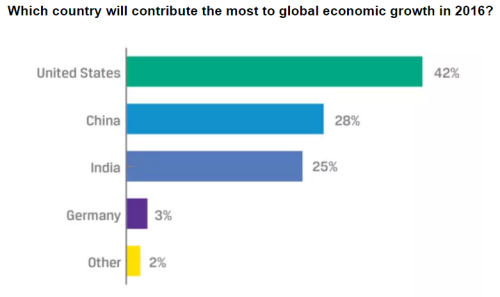

Where are we in term of GDP? Any comparison with China?

Re: Indian Economy News & Discussion - Aug 26 2015

A lot of things have been done before. That's always going to be the case when ~70 years have elapsed. The question is, can the government do it effectively ? For example, financial inclusion was a stated goal of IG when banks were nationalized in 1971. Yet, it took until PMJDY in 2014-15 to get it largely done.Virupaksha wrote:The debt for equity swap was prominent in 80s and the politics ensured that only and only worst apples went through this. Banks do not have the capability to run them profitably nor is that any way related to their core business. Half of the PSUs of that era came by this route.

They should just auction it off to company restructuring private equity companies, with the rider that there is no relation to the existing promoters.

Don't get hung up on ideas. It's effectiveness of implementation that matters much more. A lot of times the criticism is politically biased 'previous government started it' or just 'this has been tried before'. None of that is relevant. What matters is who gets it done well, through careful understanding of the problem and the formulation of an efficient solution.

Re: Indian Economy News & Discussion - Aug 26 2015

India to save Rs 2 lakh cr ($32 billion) on crude imports as oil hits 11-year low

With the Indian basket of crude oil price plummeting to an 11-year-low of $37.34 a barrel, the country is set to save Rs 2.14 lakh crore on its oil import bill alone in FY16, according to the oil ministry. This is in addition to the benefits to the government in the form of lower petroleum subsidy and expected cuts in fuel prices for consumers.

The price of the basket of crude that India buys, came down to $37.34 (Rs 2,494) a barrel on Tuesday, on an exchange rate of Rs 66.8 a dollar, a 3.2 per cent decline over Monday’s price of $38.61 a barrel.

Experts say there is a possibility of the oil prices breaching the record levels in a day or two and take a long time to recover from the low levels thereafter, given the refusal by the Organization of Petroleum Exporting Countries (Opec) at a meeting in Vienna last week, to impose a fresh cap on production by member nations creating a supply glut.

The ministry has estimated India will import 188.23 million tonne (mt) of crude oil in FY16 at a cost of Rs 4,72,932 crore, compared to 189.43 mt crude worth Rs 6,87,416 crore imported in FY15, saving Rs 2,14,484 crore on fuel bill.

Indirect tax collections up 34% during Apr-NovThe main reason why the drop in petrol and diesel prices has not kept pace with the crash in global crude prices is the five excise duty hikes since November 2014 to increase revenue collection. Excise duty on petrol and diesel has doubled since the new government came to power in May 2014.

The duty on petrol has risen from Rs 9.48 per liter to Rs 19 per liter. Similarly the excise duty on diesel has gone up from Rs 3.65 per liter to Rs 10.6 per liter at present. "As per our estimates, there is a further possibility of increase in excise duty. There is room for the government to opt for another round of duty hike given the deficit on disinvestment proceeds and tax collections. However, some benefit could still be passed on to consumers as the decline in crude price has been sharp," Ravichandran said.

Siddhivinayak temple to give gold scheme a boostIndirect tax collections rose 34.3 per cent in the first eight months of 2015-16, led by high excise collections, signaling a pick-up in economic activity. A part of the collections was on account of additional revenue measures announced in the current year, data released by the ministry of finance on Wednesday showed.

Revenue on account of indirect tax stood at Rs 4.38 lakh crore in the April-November 2015 period from Rs 3.26 lakh crore in the year-ago period. Collections in the first eight months of FY16 were 67.8 per cent of the entire financial year's target. Indirect tax collection in November rose 24.3 per cent to Rs 55,297 crore.

The government's additional revenue measures including the excise rise on diesel and petrol, increase in clean energy cess, withdrawal of exemptions for motor vehicles, capital goods and consumer durables, and the increase in service tax from 12.36 to 14 per cent were attributed to the high collection.

The growth in indirect tax collections in the first six months including service tax, excise duty and customs are close to double the 19 per cent estimated in the Budget.

CCEA okays 150,000 tonnes of pulses buffer stockOne of the most popular temples in India may soon make the first substantial contribution to Prime Minister Narendra Modi's plan to recycle tonnes of idle bullion to reduce imports and the country's current account deficit.

Mumbai's two-century-old Shree Siddhivinayak temple, devoted to Ganesha, is considering depositing some of its 160 kilogrammes (kg) of gold with banks, according to a spokesman.

The deposit would be a big boost for the gold monetisation scheme that has attracted only one kg in its first month.

"We are planning to melt 40 kg of jewellery with lower purity to make bars and deposit those bars under the gold monetisation scheme," Sanjiv Patil, executive officer of the temple trust told Reuters on Wednesday.

To insulate against any sudden spike in the price of pulses, the Cabinet Committee on Economic Affairs (CCEA) on Wednesday cleared a proposal to create 150,000 tonnes of buffer stock through domestic procurement at market rates. Of this, 50,000 tonnes would be purchased from farmers during the 2015-16 kharif season, while another Rs 1 lakh tonnes would be purchased from the rabi crop of the same year.

The Food Corporation of India, National Agricultural Cooperative Marketing Federation of India, Small Farmers’ Agribusiness Consortium and other agencies would be engaged in purchasing the crop from farmers.

The payment for these purchases would be made from the price stabilisation fund created by the government.

“This will encourage farmers to take up pulses production on a larger scale and will enable India to help achieve self-sufficiency in pulses in a few years,” said an official statement.

Re: Indian Economy News & Discussion - Aug 26 2015

'Indian economy to become 100% digitized by 2020'

http://timesofindia.indiatimes.com/tech ... 125065.cms

http://timesofindia.indiatimes.com/tech ... 125065.cms

NEW DELHI: The Indian economy, which is currently 50% digitized, is expected to reach 100% by 2020, a top official said on Thursday, The digital transformation is being fueled by rapid innovation in the technology space, said National Cyber Security Coordinator Gulshan Rai at the 3rd edition of the National CIO Summit organized by Confederation of Indian Industry. On the flip side, this transformation makes any country vulnerable to cyberthreats, he said. India ranks amongst the five top most countries for malware penetration and security breaches. Mobility, social networking, customer centricity and optimization of supply chain are four key forces driving the digital transformation, said KPMG director Arnab Mitra. Organizations need to build capabilities to walk through this transformation, he said, adding successful digital transformation depend on degree of simplicity from adoption perspective, the risks identified and a proper mitigation plan needs to be in place.

Re: Indian Economy News & Discussion - Aug 26 2015

October IIP growth at 9.8%

Which Nation Will Drive Global Growth in 2016?

Domestic passenger car sales jump 10% in NovemberRaising hopes that India’s gross domestic product (GDP) growth during the December quarter would exceed the previous quarter’s 7.4 per cent, the country’s industry in October expanded at a near-double-digit rate of 9.78 per cent, mainly because of higher as demand during the festival month.

The index of industrial production (IIP) rose 9.8 per cent during the month, compared with 3.8 per cent in September (revised from 3.6 per cent). The growth rate for October this year looked even better because the country’s industrial production had contracted 2.7 per cent in the same month last year.

During the first seven months of the current financial year, IIP rose 4.8 per cent, compared with 2.2 per cent in the corresponding period of last financial year.

In October, manufacturing rose 10.6 per cent, electricity nine per cent, and mining 4.7 per cent. The rise was mainly because of high 42.2 per cent growth seen in consumer durables, and 16.1 per cent expansion in capital goods.

In value terms, industry grew 6.80 per cent in the September quarter of the current financial year, according to GDP data for the three-month period, against 6.5 per cent in the June quarter. Industry accounts for almost 32 per cent of GDP these days.

Passenger car sales in India rose 10.39 per cent in November — 13th consecutive month of growth — as the domestic auto industry continues to drive on the slow road to recovery. According to the data released by Society of Indian Automobile Manufacturers (SIAM), domestic car sales in November stood at 1,73,111 units compared with 1,56,811 units in the same month last year.

Overall passenger vehicle sales during the month grew by 11.4 per cent to 2,36,664 units as against 2,12,437 units in the year-ago period.

Sales of commercial vehicles were up 8.56 per cent to 51,766 units in November, Siam said.

Which Nation Will Drive Global Growth in 2016?

Re: Indian Economy News & Discussion - Aug 26 2015

Assessing the Progress and Promise of Economic Reform in India - Google Hangout with Jayant Sinha - American Enterprise Institute

In that video Jayant clearly articulates the difference between Congress' approach and that of the BJP - demand vs supply side.

CEA Arvind Subramanian on NDTV

In that video Jayant clearly articulates the difference between Congress' approach and that of the BJP - demand vs supply side.

CEA Arvind Subramanian on NDTV

Re: Indian Economy News & Discussion - Aug 26 2015

http://www.firstpost.com/business/octob ... 43084.html

October industrial growth hits 5-year high but not time yet to celebrate

October industrial growth hits 5-year high but not time yet to celebrate

The factory output numbers for October has come at five year-high, but it is too risky to begin celebrations yet.

This spike is more on account of a seasonal jump in manufacturing, especially consumer durables during the festival season and it may be difficult to hold in November since base effect can very well play spoil sport.

The index of industrial production (IIP) grew 9.8 percent in October compared with a growth of 3.8 percent in the preceding month. The manufacturing segment grew by 10.6 percent in October compared with 2.9 percent in September, while the consumer durables grew 42.2 percent compared with a growth of 8.4 percent in the month before.

Similarly, consumer goods grew 18.4 percent as compared with 1.2 percent on month. The growth in the capital goods segment - a pointer of the investment activity in the economy - at 16.1 percent (as against 10.3 percent in the preceding month) is an encouraging sign. These are the areas that have contributed to the five-year spike in the factory output.

-

nandakumar

- BRFite

- Posts: 1641

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Aug 26 2015

The firstpost article is based on flawed logic. The growth in output is a seasonal month on month comparison from previous year to the current. It was festival season October last year, too.

-

Varoon Shekhar

- BRF Oldie

- Posts: 2178

- Joined: 03 Jan 2010 23:26

Re: Indian Economy News & Discussion - Aug 26 2015

The first item in BBC's reputed "India Business Report" was about how the hike in US interest rates, will adversely affect India on the whole.

Story wasn't alarmist, but did mention that increased attractiveness of the US because of better returns, will likely cause more companies to set up shop there, instead of coming to India. Also, that imports for India, particularly oil, will be more expensive.

It did say that exports would be helped,by a higher dollar.

Is this a large topic in India presently?

Story wasn't alarmist, but did mention that increased attractiveness of the US because of better returns, will likely cause more companies to set up shop there, instead of coming to India. Also, that imports for India, particularly oil, will be more expensive.

It did say that exports would be helped,by a higher dollar.

Is this a large topic in India presently?

Re: Indian Economy News & Discussion - Aug 26 2015

We need to attain Vikas (full advancement up to the levels of America by 2030). We need to invest in infra! [water ways, electricity, roads and expressways, rails, data-comm, smarter cities]

India worries it compromised too much on climate treaty

http://bigstory.ap.org/article/2ddfebb3 ... ate-treaty

"While India should certainly do its part, it is important that these mechanisms keep pressure on developed countries for more ambitious actions, to allow countries like India the carbon space to meet our development needs."

That's largely due to the fact that India — the world's third-largest carbon emitter among nations — has no plans to curb its coal use any time soon. While both the U.S. and China have leveled their coal use in the last few years, India has committed to tripling its coal-fired electricity capacity to 450 gigawatts by 2030.

There are still some 300 million Indians — a quarter of the population — with no electricity at all, while a vast amount of infrastructure is yet to be built.

"As a large developing country with little historic responsibility for the problem and considerable energy needs, this was an important outcome for India."

Re: Indian Economy News & Discussion - Aug 26 2015

Thanks! Pranjul Bhandari and Sadananda Dhume do spell out some stumbling blocks to success.KrishnaK wrote:Assessing the Progress and Promise of Economic Reform in India - Google Hangout with Jayant Sinha - American Enterprise Institute

In that video Jayant clearly articulates the difference between Congress' approach and that of the BJP - demand vs supply side.

Re: Indian Economy News & Discussion - Aug 26 2015

Exports fall for 12th straight month, down 24% in Nov

Growth in cargo handled at major ports slows

From Jan 1, PAN mandatory for transactions above Rs 2 lakh

Atal Pension Yojana likely to miss December target

Interestingly, the exports are down in price terms, but not in volume terms. The value drop is a result of the collapse in global commodity prices.India’s merchandise exports fell for the twelfth consecutive month in November this year. During the 2008-09 global financial meltdown, the decline was for nine months on the trot.

Last month, exports contracted 24 per cent — the steepest fall in recent years —to $20 billion, according to data released by the commerce ministry on Tuesday. Compared to this, exports were $26 billion in November 2014, Exports had last recorded growth a year ago, rising 7.3 per cent year-on-year. The rate of drop in exports for November is the highest since then. Besides global slowdown, the fall is attributed to a decline in global commodity prices.

Imports, too, declined 30 per cent to $30 billion in November compared with the year-ago period, when it was $43 billion. During April-November 2015, India’s cumulative imports were $261 billion. This is a 17 per cent drop from $316 billion, the cumulative figure for the same period last year.

Growth in cargo handled at major ports slows

The cargo volume handled by the major ports, at 397 million tonnes, rose 3.32 per cent during the period over the year-ago period. The cargo growth was 5.20 per cent, at 384 million tonnes, in April-November 2014.

From Jan 1, PAN mandatory for transactions above Rs 2 lakh

While PMJDY has ~195 million new accounts and JSY insurance accounts number 120 million, the pension scheme is slow to take off:In a bid to curtail domestic black money flow, the finance ministry on Tuesday announced mandatory furnishing of permanent account number (PAN) for all transactions above Rs 2 lakh through all payment modes with effect from January 1, 2016. This is a relaxation from an proposal to make PAN mandatory for sale and purchase of items above Rs 1 lakh.

"We have received a lot of representations. We will give breathing time to taxpayers," said revenue secretary Hasmukh Adhia.

Accepting the recommendations of the special investigation team on black money, finance minister Arun Jaitley had in the 2015-16 Budget proposed to make PAN details mandatory for all sale and purchase of Rs 1 lakh and above. However, it met with resistance from trade and industry associations that argued the lower limit would affect business.

Atal Pension Yojana likely to miss December target

GST draft model law to be finalised in a monthWith the number roped in so far being just five per cent of the target, the Pension Fund Regulatory and Development Authority (PFRDA) is working out plans to improve reach and information dissemination. APY numbers are in contrast to the overwhelming response for the other universal security schemes launched simultaneously by the Modi regime, including cover for life and accident. About 120 million policies under the Jan Suraksha Yojana have been sold during this period.

"We have crossed one million subscribers. Though it is much lower than our target, the scheme is picking up now. Huge interest has been shown by the private sector banks. It is challenging to convince people to invest for their retirement," said R V Verma, member (finance) PFRDA.

PFRDA, the nodal agency for APY, has pitched for an extension of co-contribution incentive by the government beyond December 31 to attract subscribers.

According to the current scheme, the government would co-contribute 50 per cent of the subscriber's contribution or Rs 1,000 per annum, whichever is lower, to each eligible subscriber account for five years to 2019-20. Only those who don't pay income tax can apply for the scheme by December 31.

The draft model law on Goods and Services Tax (GST) will be finalised in a month's time, a top finance ministry official today said.

Once the Constitution amendment bill to roll out GST is passed by Parliament, the centre and states will have to adopt their own law to give effect to the new indirect tax regime.

Re: Indian Economy News & Discussion - Aug 26 2015

I fear GST won't be passed in modi I. Have to wait for modi II and RS majority with speakership

Re: Indian Economy News & Discussion - Aug 26 2015

Maybe, but let's leave the politics for the politics thread.

Re: Indian Economy News & Discussion - Aug 26 2015

Cabinet allows states to mine & sell coal, ends monopoly of Centre

Make in India has tremendous impact on investmentsEnding 41-year-old monopoly of central government over mining and sale of coal, the Cabinet Committee of Economic Affairs (CCEA) approved allotment of coal mines to states for mining and commercial sale to medium and small industries in their state.

The statement of the government said, CCEA gave its approval for allotting coal mines to central and state PSUs for sale of coal, especially to medium, small and cottage industries under the provisions of the Coal Mines (Special Provisions) Act, 2015.

This move is likely to benefit the mineral rich states to earn surplus revenue which were until now getting only royalty amount from private companies mining coal for captive use. This is pursuant to the enabling act on commercial mining and sale of coal in the new Coal Ordinance (Special Provisions), 2014.

Currently, states are allotted coal blocks but with specified end use such as power production, steel and iron production etc.

India recorded $17.5 b PE investments in 2015: PwC"The Make in India initiative of the government has made a tremendous impact on the investment climate of the country, as shown by significant growth of the overall foreign direct investment (FDI)", Commerce and Industry Minister Nirmala Sitharaman said in a written reply to the Rajya Sabha.

The flagship program of the Modi government aims at developing the country as a global hub for manufacturing, innovation and design for both domestic and foreign markets.

The initiative was launched in September last year by the Centre to focus on invigorating the country's manufacturing sector. India received $ 32.87 billion in FDIs from October 2014 to September this year.

Private equity (PE) investments in India touched a record high of $17.5 billion in 2015 across 685 deals, breaching the previous high of $14.7 billion recorded in 2007, a PwC report says.

According to the report, PE investments (excluding real estate deals) till December 14, this year stood at $17.5 billion, registering a jump of 34% over calendar year 2014, which saw $13 billion invested across 560 deals.

The surge in PE investments this year was largely owed to the e-commerce sector, which saw deals worth $5.3 billion across 290 deals.

The other sectors, which outperformed this year were, financial services and healthcare, which contributed deals worth $2.4 billion and $1.58 billion, respectively.

Re: Indian Economy News & Discussion - Aug 26 2015

{Deleted}

Last edited by Suraj on 17 Dec 2015 10:32, edited 1 time in total.

Reason: Moved to politics thread. Continue there.

Reason: Moved to politics thread. Continue there.

Re: Indian Economy News & Discussion - Aug 26 2015

Great news for states like WB, OR, JH, KT. This should be extended to minerals, oil and gas, etc.

Re: Indian Economy News & Discussion - Aug 26 2015

x-post from the railways thread:

http://www.business-standard.com/articl ... 114_1.html

(from November). Railways related, but there is a key statement:

The Indian economy has a GDP-transport elasticity of 1.25 (For every one per cent growth in GDP, transport sector has to grow by 1.25 per cent).

Comparison: European Union:

http://eutransportghg2050.eu/cms/assets ... i-ISIS.pdf

http://www.business-standard.com/articl ... 114_1.html

(from November). Railways related, but there is a key statement:

The Indian economy has a GDP-transport elasticity of 1.25 (For every one per cent growth in GDP, transport sector has to grow by 1.25 per cent).

Comparison: European Union:

http://eutransportghg2050.eu/cms/assets ... i-ISIS.pdf

• For passenger transport, the GDP elasticity is equal to 0.65 on average for the period 2005 to 2030.

• For freight transport, the GDP elasticity of activity is projected to decrease gradually, first down to 0.92 in 2005-2010, and then further down to 0.72 between 2010 and 2030.

Re: Indian Economy News & Discussion - Aug 26 2015

Watching Rajya Sabha TV yesterday it seems like the Japanese want to make south India (Chennai-banglore-mumbai) a hub for manufacture and export to Africa and Middle East. can this be extended to Manglore also? what do gurus think about this plan ?

Re: Indian Economy News & Discussion - Aug 26 2015

will India be as badly affected, if they manage to pass it????

Africa at risk as rich nations plot new deal

IN SUMMARY

Trade experts warned that the adoption of those rules will kill companies in the developing world, deny government taxes and the right to regulate trading activities in their jurisdiction.

The proposals on procurement, investment and competition basically mean that developed countries will dictate the terms under which their companies operate in poor countries.

More than 453 global civil society groups are against inclusion of these new issues in the Doha discussions. The activists have since Tuesday sounded the alarm that developing countries are at risk if they agree to the new agenda

Africa at risk as rich nations plot new deal

Africa at risk as rich nations plot new deal

The United States and the European Union are pushing to have multinationals exempted from local laws in developing countries.

If adopted, the proposed trading rules will mean that multinationals such as Google, Facebook and financial institutions with roots in US and EU will operate locally without submitting to local regulation.

They will not be required to give local companies preference in procurement nor will their subsidiaries be required to have local participation in their ownership.

Trade experts warned that the adoption of those rules will kill companies in the developing world, deny government taxes and the right to regulate trading activities in their jurisdiction.

Presented to the World Trade Organisation (WTO) ministerial meeting, currently going on in Nairobi, as “new issues” the rules were rejected at the Singapore Ministerial meeting in 1996.

“The developed countries have insisted that if developing countries want the Doha agenda to continue, they must agree first for the new issues to be part of the negotiations,” Ms Sophia Murphy senior adviser, Institute for Agriculture and Trade Policy, University of British Colombia, told the Daily Nation on Thursday.

Ms Murphy added that under the procurement regulations that are being pushed by developed countries at the WTO, foreign firms want to bid for local contracts because they believe they are more efficient, a move likely to deny opportunities for Africans.

“The investment regulations will reduce barriers to foreign investors to come and invest locally, competition policy on the other hand supports the procurement rules,” said Ms Murphy.

The ‘Singapore issues’ have emerged as great barriers to the WTO negotiations, almost stalling talks.

CATCHING TAX CHEATS

The European Union (EU) Commissioner for Trade Cecilia Malmström on Wednesday evening, revealed that the commission is very interested in having the new issues tabled for discussion.

“I believe that these regulations will in turn strengthen African economies, though if any issues emerge in the process, we will deal with them through Economic Partnership Agreements which are tailor-made for the region,” said Ms Malmström.

In case the regulations are tabled for the next round of discussions, there is a possibility that they will be adopted.

The proposals on procurement, investment and competition basically mean that developed countries will dictate the terms under which their companies operate in poor countries.

More than 453 global civil society groups are against inclusion of these new issues in the Doha discussions. The activists have since Tuesday sounded the alarm that developing countries are at risk if they agree to the new agenda

Re: Indian Economy News & Discussion - Aug 26 2015

There is a serious campaign going on against India right now. NS is defending For India...

India blocking WTO? Disagree, says Sitharaman as it battles to save Doha

India blocking WTO? Disagree, says Sitharaman as it battles to save Doha

By Kirtika Suneja, ET Bureau | 18 Dec, 2015, 09.42PM IST

NAIROBI: With a few hours left for the tenth WTO ministerial to end, India is striving hard to save the Doha Development Agenda from getting buried amid speculation that New Delhi was being a deal breaker again. The action moved to Twitter as stalemate continued in the closed door meetings with no clarity emerging on the bargaining chips being used by the developed and developing countries .

India's efforts to get a deal on agriculture were perceived by some as blocking a deal in Nai ..

Re: Indian Economy News & Discussion - Aug 26 2015

@TimesNow

India becomes largest

remittances receiving country at $72 billion this year followed by China at $64 billion: World Bank (

India becomes largest

remittances receiving country at $72 billion this year followed by China at $64 billion: World Bank (

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Indian Economy News & Discussion - Aug 26 2015

Ok. The mystery is finally "solved" . What mystery you ask ? It is this. The RBI started cutting interest rates when the 10 year bond yield was approx 7.75% or so. There have been 4 rate cuts with for a total cut of 100bps (i.e. 1%) on the repo rate , the RBI has increased the quote for foreign entities to by GOI bonds , increasing potential demand, has denominated the limit in Rupees (to prevent the depreciation of rupee to artificially hitting that gap). Despite all this the 10 year yield is stuck at 7.8% !

Why is that so ? The Govt has been borrowing like there is no tomorrow. The borrowings have reached a record 5.5L crores, the last two RBI bond issues have flopped, forcing the primary dealers to pick them up. There is no demand for the flood of GOI bonds . And mind you, this year, the Govt has had a windfall in terms of tax receipts from increasing taxes on oil and hence indirect taxes have been massive !

This entire thing of Govt borrowing and spending via fiscal deficit (the classic Keynesian Kakkoose) has come a cropper. Growth is moderate at best and it is debatable how much the govt spending has actually resulted in higher growth. The Govt's spending agenda is actually squeezing out private investment and spending by keeping actual interest rates high. If the interest rates had fallen by some 100 bps following RBI cuts and the oil prices had been passed on, the chances are that we could have hit similar growth rates.

Next year is going to be worse. The OROP and Pay commission recommendations would start kicking in, the borrowings will increase and the interest rates are not going to drop. The Govt is on a Kangress like spending binge.

Trouble is, I have not been able to make out exactly WHERE the govt has been spending and which sectors are seeing a demand pick up. Would appreciate it if anyone could throw some light on it.

I fervently wish this Govt changes tack next year and gets out of this "Keynesian Kakkoose" this pump priming is already a miserable failure in India, given current situation . The only times when India had sustainable growth was when the fisc was in control and real and nominal interest rates fell to 6% or so. All other growth spurts have been transitory , not shock proof and ended badly.

If for any reason there is an oil shock , this Govt's economic program is going to end miserably if they continue on the current path.

Why is that so ? The Govt has been borrowing like there is no tomorrow. The borrowings have reached a record 5.5L crores, the last two RBI bond issues have flopped, forcing the primary dealers to pick them up. There is no demand for the flood of GOI bonds . And mind you, this year, the Govt has had a windfall in terms of tax receipts from increasing taxes on oil and hence indirect taxes have been massive !

This entire thing of Govt borrowing and spending via fiscal deficit (the classic Keynesian Kakkoose) has come a cropper. Growth is moderate at best and it is debatable how much the govt spending has actually resulted in higher growth. The Govt's spending agenda is actually squeezing out private investment and spending by keeping actual interest rates high. If the interest rates had fallen by some 100 bps following RBI cuts and the oil prices had been passed on, the chances are that we could have hit similar growth rates.

Next year is going to be worse. The OROP and Pay commission recommendations would start kicking in, the borrowings will increase and the interest rates are not going to drop. The Govt is on a Kangress like spending binge.

Trouble is, I have not been able to make out exactly WHERE the govt has been spending and which sectors are seeing a demand pick up. Would appreciate it if anyone could throw some light on it.

I fervently wish this Govt changes tack next year and gets out of this "Keynesian Kakkoose" this pump priming is already a miserable failure in India, given current situation . The only times when India had sustainable growth was when the fisc was in control and real and nominal interest rates fell to 6% or so. All other growth spurts have been transitory , not shock proof and ended badly.

If for any reason there is an oil shock , this Govt's economic program is going to end miserably if they continue on the current path.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Indian Economy News & Discussion - Aug 26 2015

^^Well, there's some fixed asset creation happening on the ground - in roads, power, ports. Blocked projects have been cleared and implementation is on full swing. Don't know about any other infra such as smart cities and what not.

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Indian Economy News & Discussion - Aug 26 2015

Okay. But none of the infra companies are actually seeing any big uptick in revenues . Where is the money going ? This is a straight cash expense. Must be going somewhere . I can't figure out where.Hari Seldon wrote:^^Well, there's some fixed asset creation happening on the ground - in roads, power, ports. Blocked projects have been cleared and implementation is on full swing. Don't know about any other infra such as smart cities and what not.