Indian Economy News & Discussion - Aug 26 2015

Re: Indian Economy News & Discussion - Aug 26 2015

https://twitter.com/harshmadhusudan/sta ... 0282004481

Harsh GuptaVerified account @harshmadhusudan 12h12 hours ago

While RBI's error along with GST, RERA, Demon etc may delay the boom (and have political consequences), it is coming. See RE (source: CLSA).

Harsh GuptaVerified account @harshmadhusudan 12h12 hours ago

Please see real interest rates in India during the last decade. Low for UPA, indeed negative for UPA2, unusually high for the Modi govt.

Re: Indian Economy News & Discussion - Aug 26 2015

Interview with Hasmukh Adia on GST.

http://timesofindia.indiatimes.com/busi ... 903871.cms

http://timesofindia.indiatimes.com/busi ... 903871.cms

Re: Indian Economy News & Discussion - Aug 26 2015

As India breaches WTO income threshold, Centre to seek export subsidy phase-out

PM Narendra Modi’s crop cover pushes insurance penetration past 1 per cent in FY17India will ask the World Trade Organisation (WTO) for a reasonable time frame of eight years to phase out its export subsidies, as the country has breached an income threshold stipulated by the multilateral body to end such sops, official sources told FE. According to the special and differential provisions in the WTO’s Agreement on Subsidies and Countervailing Measures, when a member’s per capita gross national income (GNI) exceeds $1,000 per annum (at the 1990 exchange rate) for a third straight year, it has to phase out its export subsidies. There is, however, no clarity over the time-frame of ending such subsidies, said an official. But, even then, the country won’t be in a position to introduce a fresh direct export subsidy, some analysts said. According to the WTO data, India crossed the per-capita GNI threshold in 2013, 2014 and 2015. The 2015 figures, released by the WTO recently, revealed India’s per capita GNI rose to $1,178 in 2015 from $1,051 in 2013.

The schemes that could face the heat include Merchandise Exports from India Scheme (MEIS), Export Promotion Capital Goods (EPCG) scheme and interest equalisation scheme for the textiles sector under the Foreign Trade Policy (FTP) 2015-20. Globally, zero-rating of exports are a norm and this is WTO compatible, as the idea is to neutralise the tax content in export items, and not to subsidise them. Under the Goods and Services Tax, this is to be achieved via a refund mechanism, as the tax’s structure doesn’t allow exemptions. Zero-rated supplies under the GST law includes export of goods and/or services and supply of goods and/or services to a SEZ developer or an SEZ unit.

More reforms after GST reaches revenue neutral status, says Arun JaitleyEven though the non-life insurance industry has breached the magical figure of 1 per cent penetration in terms of GDP in FY2017, the industry believes there is tremendous potential to double the figure in the next five years, say insurers. After hovering around 0.7-0.8 per cent for several years, the penetration ratio of non-life insurance industry has moved up to 1.04 per cent in March 2017, based on the revised GDP figure. This took the industry size to Rs 1.27 trillion, as per data collated by the industry body General Insurance Council, and was driven mainly by around the Rs 21,000 crore premium coming in from Prime Minister Crop Insurance Scheme.

As per the Central Statistical Office, real GDP grew to Rs 121.9 trillion in FY17, a growth of 7.1 per cent over Rs 113.81 trillion in FY16. When it comes to the general insurance industry, its business grew 33 per cent to Rs 1.27 trillion in FY2017 from Rs 96,000 crore in FY2016, or in terms of penetration at 1.04 per cent from 0.85 per cent in FY2016. There are 28 non-life insurers which include four state-owned players, two specialised insurers, and six stand- alone health insurers.

Government extends deadline to clear unsold pre-GST goodsFinance Minister Arun Jaitley on Sunday said that “bigger economic reforms” can be thought of after the newly implemented Goods and Services Tax (GST) regime reaches a revenue neutral status.

The Union Government on Friday extended the last date of using (Maximum Retail Price) MRP labelled pre-Goods and Services Tax (GST) stock to December 31. This step of the Consumer Affairs Ministry will be a relief for the traders, who were reportedly stuck with old stocks. “The Finance Ministry has given a nod to the extension of date and the Consumer Affairs Ministry will issue the notification,” the Finance Ministry sources said earlier.

Under the existing rules, the companies had time till September 30 to clear unsold pre-GST goods with a revised MRP to be displayed along with printed sale price to reflect the changes post the new tax regime kicking in. Also, the old MRP will have to be clearly on display along with the revised MRP sticker.

Re: Indian Economy News & Discussion - Aug 26 2015

what will be other "bigger economic reform" after GST?

Re: Indian Economy News & Discussion - Aug 26 2015

Reforming the direct tax code perhaps. There has been chatter around this and it's impact could be even more significant than GSTnash wrote:what will be other "bigger economic reform" after GST?

Re: Indian Economy News & Discussion - Aug 26 2015

hanumadu wrote:Interview with Hasmukh Adia on GST.

http://timesofindia.indiatimes.com/busi ... 903871.cms

The E-way bill if and when implemented will be quite radical step. That would mean the a merchant carrying a stack of textiles (e.g. 50 sarees costing more than 50K total) from Surat to Mumbai in a "luxury bus" need to carry an E-way bill. Would the GST tallying up (1, 2 and 3) match the GST invoices with E-way bills automatically?

Re: Indian Economy News & Discussion - Aug 26 2015

This is akin to economic sabotage. No accountability as is normal in our government culture.

GSTN grossly underestimated Server Requirement and let Modi down-CEO should resign

GSTN grossly underestimated Server Requirement and let Modi down-CEO should resign

GSTN grossly underestimated Server Requirement and let Modi down-CEO should resign

September 9, 2017

When the Government was targeting 3 Crore GST payers; GSTN settled for a Rented server based in Whitefield Bangalore having capacity of only 80000 access at one time whereas the requirement was to have a Server having capacity of 5 Lakh access at one time. The Jumbo Server similar to one being used by National Stock Exchange was required to be imported by GSTN. But Consultants to GSTN and even GSTN Team could not understand the basic requirement of Hardware and Software for running Network for uploading and matching data of a magnitude required for implementation of GST.

It was mismanagement by all stakeholders. Instead of GSTN opening Return Filing Facilitation Centres in all cities; the Officials were busy with TV Channels and Webinars. Even GSTN Head Office at Aero City in Delhi did not have a Service centre for Tax payers where they could go for resolution of their issues and get them resolved on the spot. Even FinMin and GST Commissioners failed to assess that need of hour was to open Return Filing Centres in all cities and the issues in filing of returns should have been resolved by the Team of GSTN Officers, Software Vendor and GST Officers on the spot. It was a hit and run by all with GST Officers being helpless in resolving the issues as they themselves did not have access to network. Without addition of all Service Tax, Central Excise & VAT Registrations; the TRAN-1 Form did not allow; transfer of transitional credit and showed message of “Processing Error”. Even the amendment in non-core fields of registration was not reaching the Desktop of GST Officers and they were not in a position to approve the amendment and the application showed the status as “Pending Validation”. But who will validate and how to get it validated was not known to anyone. Even no one knows who will approve the Provisional Registration into final registration and without approval of registration into final registration.

Though many were given GSP Licenses but even they were not given access by GSTN and were not of much help to filers.

The Government had to face the wrath of Tax Payers on social media who were unable to access the Portal which repeatedly crashed due to heavy traffic and was not capable for upload of huge data. GSTN Helpdesk did not even acknowledge the emails sent by Taxpayers. Everyone started to blame PM and Adhia but the responsibility was on GSTN Team to assess the requirement of Hardware and Software for smooth running of Network. The Team failed to assess the requirement and the Server crashed multiple times. It was wastage of National Time with entire country trying to access the server and only lucky few could upload the returns without any error.

The Network is not going to work on existing Server and a Jumbo Server is required to be imported well before the revised due date of GSTR3. It is wiser to dispense with all returns and to provide for filing of only GSTR3B till a compatible Server is imported.

It is not only Hardware but Software is also full of bugs. Many Tax payers who submitted returns Online several days ago; the status of their return even after a week is being shown as “under process”. Those who got error message are unable to generate Error file.

Consultants to GSTN who failed to assess Hardware and Software requirement should be blacklisted and the Team GSTN which was not capable of identifying the basic system requirement needs to be fired. Crores of Tax Payers money handed over to GSTN, National Time and Energy was wasted as those who were assigned the responsibility miserably failed in their task and let PM Modi down.

It is time for CEO of GSTN to own the responsibility and resign.

Re: Indian Economy News & Discussion - Aug 26 2015

so your point is that people should not move towards banking and digitize transactions? Informal economy needs to be formalized and you should be happy that after 70 years someone is trying to do it.by tkiran

Informal economy (eg. Agriculture, mom&pop cash&carry shops etc.) generates 10 times employment. ie for 1 Software Engineer generated there will be 10 people getting employed in the informal economy.

-

achoudhury

- BRFite -Trainee

- Posts: 96

- Joined: 06 Oct 2016 07:43

Re: Indian Economy News & Discussion - Aug 26 2015

http://www.dnaindia.com/analysis/column ... is-2549693

The writer is Devinder Sharma.. a congress acolyte probably batting for traders obviously using farmers as shield..so take it at a bucket full of salt. But Oilseeds, pulses and sugar imports have been a reality in India for a long time now due to result of MSP policy on wheat and Rice. What was surprising to know that we also import wheat and onions. What could be the reasons current GoI is doing this. Only, thing I can think of is that our Agri Markets are controlled at many levels by very few and they can hold govt to ransom. Hence, import works like a counter to that threat. That is the benign view. But the situation is still disturbing in so many levels. With rising population, demands will only grow and we should never become dependent on food, the most basic necessity. Not sure of what GoI has come up with Agri policy and its implementation. Will post, if I find something substantial.

The writer is Devinder Sharma.. a congress acolyte probably batting for traders obviously using farmers as shield..so take it at a bucket full of salt. But Oilseeds, pulses and sugar imports have been a reality in India for a long time now due to result of MSP policy on wheat and Rice. What was surprising to know that we also import wheat and onions. What could be the reasons current GoI is doing this. Only, thing I can think of is that our Agri Markets are controlled at many levels by very few and they can hold govt to ransom. Hence, import works like a counter to that threat. That is the benign view. But the situation is still disturbing in so many levels. With rising population, demands will only grow and we should never become dependent on food, the most basic necessity. Not sure of what GoI has come up with Agri policy and its implementation. Will post, if I find something substantial.

Re: Indian Economy News & Discussion - Aug 26 2015

http://www.firstpost.com/india/slowdown ... 02395.html

Slowdown in economy is real, but Narendra Modi deserves kudos for initiating structural reform

I hope they are getting the feedback

Slowdown in economy is real, but Narendra Modi deserves kudos for initiating structural reform

after reading it all, my friend who a is a doctor said: It is all Greek and Latin to me. ALl I understand is pay more taxes.The decline in India's GDP growth and the slowdown in key sectors has triggered a raucous debate about the state of India's economy. The discourse, while not lacking in entertainment, mostly fails to tackle a key question central to the debate: if demonetisation and GST have been suicidal missions for the Indian economy, why did Narendra Modi shoot himself in the foot?

Why did Modi initiate steps that have grounded the economy and seems to have eroded considerably his political capital? Which politician does that?

The middle class is said to be BJP's core constituency. Anecdotal evidence suggests it is deeply disappointed and even angry with Modi. WhatsApp groups that had elevated the prime minister to almost demi-god status are brimming with indignation. If we accept that Modi isn’t a daft politician (even his staunchest opponents will agree), there's a need then to address this logical inconsistency in the criticism against him and his handling of the economy.

To do that, we must recognise that Modinomics is intrinsically tied to his politics, and we cannot understand the former if we see it in isolation. The prime minister's speech on Monday, for instance, the 148th birth anniversary of Mahatma Gandhi, was all about cleanliness. A man of symbolism, Modi was well aware that the occasion also marks the third anniversary of his flagship 'clean India' initiative.

Calling it a "people's movement", Modi likened the Swacchh Bharat Abhiyan to Satyagraha and termed the participants 'Swachhagrahis'. Beyond the obvious attempt to use Gandhi as a totem for his pet project and the not-so-subtle pitch to be considered as the 'father of New India', Modi's focus on cleanliness was apparent.

In little over three years in power, Modi government has shown a figurative and literal obsession with cleanliness. On Sunday, urban Maharashtra was declared open defecation free. This hurry to erect a nationwide sanitation framework and push for a mass behavioral change has bordered on impracticality at times. The public-shaming strategy has invited charges of insensitivity.

Modi is evidently convinced of the efficacy of his policy and has shown an unflinching ability to stay the course.

I hope they are getting the feedback

Last edited by vijayk on 02 Oct 2017 22:45, edited 1 time in total.

Re: Indian Economy News & Discussion - Aug 26 2015

You are right in that this is an agenda driven post not withstanding facts stated. Lets look at an example for the articleachoudhury wrote:http://www.dnaindia.com/analysis/column ... is-2549693

The writer is Devinder Sharma.. a congress acolyte probably batting for traders obviously using farmers as shield..so take it at a bucket full of salt. But Oilseeds, pulses and sugar imports have been a reality in India for a long time now due to result of MSP policy on wheat and Rice. What was surprising to know that we also import wheat and onions. What could be the reasons current GoI is doing this. Only, thing I can think of is that our Agri Markets are controlled at many levels by very few and they can hold govt to ransom. Hence, import works like a counter to that threat. That is the benign view. But the situation is still disturbing in so many levels. With rising population, demands will only grow and we should never become dependent on food, the most basic necessity. Not sure of what GoI has come up with Agri policy and its implementation. Will post, if I find something substantial.

Lets assume that the facts are correct but see how it is presented.How can a surge in imports be justified at the time of a bumper harvest. With a record 97 million tonnes of wheat production, allowing nearly 8 lakh tonnes of wheat imports at zero duty from Ukraine and Russia makes little economic sense.

97 million and 8 lakh are used in the same sentence drawing a defacto comparison and this is deliberate. How can million be compared to lakh?

He could have said "97 million .... 0.8 million" or "970 lakh .... 8 lakh" instead it will be read as "97 ... ... 8 ...".

Let me take another example i.e. of Sugar. Are the sugar prices low in spite of a bumper crop? And everyone know what happens to the sugar prices during festive season lasting up to Diwali. GOI is fully justified in trying to protect itself from the black marketeers who search for precisely such opportunities.

Anyway when did the agri import policy start? What was done by the previous governments to mitigate the shortage? It is well know that India will become a major importer of 5 essential agri basket by 2050 including Milk, Oilseed, Lentil, fruits and vegetables per one foreign study [FAO/IMF/WTO/??] I had seen more than 2-3 years back. from memory so could be slightly off. Unfortunately I am unable to locate it again the last time I wanted to quote it.

Infact Modi GOI has started working on a long-term plan to meet the looming food related challenge by making adjustments to the MSP, Food park, Cold chain, Irrigation, river linking, etc. These things require investment and take time.

Re: Indian Economy News & Discussion - Aug 26 2015

Hi, I'll be moving all the health and life expectancy talk to the Healthcare thread. Please continue there.

Re: Indian Economy News & Discussion - Aug 26 2015

Another story illustrating the transformative changes in the economy that are resulting from GST:

What triggers Kachha credit rates falling?

What triggers Kachha credit rates falling?

MUMBAI: Interest rates that money lenders charged borrowers hardly budged for decades irrespective of policy decisions. But even that is collapsing faster than what it is in the formal banking system, thanks to the implementation of Goods and Services Tax. Borrowing in the informal market is no more lucrative.

Lenders who fund small traders and merchants have lowered their rates to just a third of what they were charging, but still the demand is not showing up.

Rates have dipped to a third to 6% from 9-18 % about six-nine months, said two dealers aware of the market dynamics

A huge army of businessmen borrowed in an informal market from money lenders to avoid getting trapped by the banking system and the tax department. This was known as `Kachha Credit’ among the practitioners. With the implementation of the GST which produces a chain of transaction till it reaches the ultimate consumer, merchants have little scope to escape accounting for their trades.

Re: Indian Economy News & Discussion - Aug 26 2015

Pause before you leap - Sajjid Z. Chinoy

So what’s accentuated the slowdown in the last three quarters?

Much stronger import growth! Imports contracted almost five per cent in the year before demonetisation, in real terms. Since demonetisation, they have been growing at 13 per cent. The increase is across the board — jewellery, electronics, paper, plastics and chemicals. Stronger imports alone subtract 300 bps from headline growth — even after adjusting for imports that are re-exported. Therefore, stronger imports can explain the entire slowdown since demonetisation, and then some. Furthermore, even as imports have surged domestic production has softened, and is lower than what the pre-demonetisation momentum would have implied.

...

Instead, supply-side shocks need supply-side solutions. We need to continue improving the regulatory and business environment for SMEs, improve their access to credit, resolve teething GST problems and simplify the burdens of firms competing in the formal sector. More generally, we need to keep pushing hard on the stressed-asset resolution, so that the twin-balance sheet problem does not remain a binding constraint for larger firms.

Re: Indian Economy News & Discussion - Aug 26 2015

Computerization is the only way to curb the menace of corruption. A network where all the information cannot be destroyed is the only way to curb corruption in public offices. I have personal experience of seeing corruption getting eradicated in some public offices. All the other measures to eradicate the corruption in public offices is useless.SBajwa wrote:so your point is that people should not move towards banking and digitize transactions? Informal economy needs to be formalized and you should be happy that after 70 years someone is trying to do it.by tkiran

Informal economy (eg. Agriculture, mom&pop cash&carry shops etc.) generates 10 times employment. ie for 1 Software Engineer generated there will be 10 people getting employed in the informal economy.

The point I am making is beyond corruption.

The small businesses are fraught with very high risk. They depend on big businesses. For example, say, a MNC automotive OEM wants to set up a manufacturing unit in India, they may pour-in huge investment in plant, and may recruit around 2000 employees, they will supplement another 2000 personnel on contract for ad-hoc jobs. Then they will have tier1 suppliers, either new or old ones with increased capacity which will also generate say around 10000 employment. But actually they will generate around 100000 employment in unorganised sector such as chaiwalas, auto/taxi walas, shops, schools and housing etc., They are all in unorganised sector as the chance of surviving is only one in 10. (What I mean to say is that out of a million people trying to take advantage of such industry, only 100,000 would be able to get the success.). The biggest risk is that when the automotive OEM itself failed. In case of China it happened that 10s of OEMs queued up, it was a never ending story.

Now the government wants these small businesses to be organised, which happened in US over decades, and in China it's still happening. What goi is doing is asking a std 1 student to solve a problem in trigonometry. No doubt the intention is good, chances of failure is also high.

Re: Indian Economy News & Discussion - Aug 26 2015

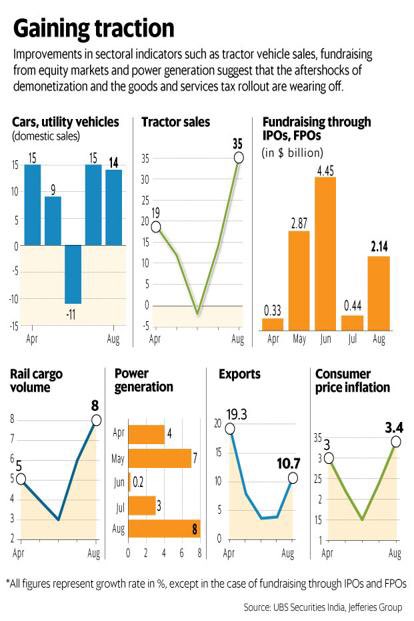

When I heard Yashwant Sinha I kind of thought that we were past the trough. Usually the noise is the highest at the peak/trough and a BJP member speaking out against a sitting BJP PM is as good as it gets. While it caused angst there couldn't have been a better indicator of the trend reversal.

http://www.financialexpress.com/economy ... up/880030/

September manufacturing grows for second month, hiring picks up

http://www.financialexpress.com/economy ... up/880030/

September manufacturing grows for second month, hiring picks up

Manufacturing activity in India expanded in September for the second month in a row, driven up by an increase in output and new orders, even as their growth pace remained weak in the context of a historical trend, a survey said today. The Nikkei India Manufacturing Purchasing Managers’ Index (PMI) came in at 51.2 in September, little changed from its August reading, pointing to an ongoing recovery in business conditions, post-GST launch. The figure was below the long-run trend of 54.1. A reading above 50 denotes expansion and one below this mark means contraction.

“September data painted an encouraging picture as the sector continued to recover from the disruptions caused by the introduction of GST in July,” said Aashna Dodhia, Economist at IHS Markit, and author of the report. Dodhia further said: “Business confidence strengthened among manufacturers as they reportedly anticipate long-term benefits from recent government policies. This was confirmed as the sector experienced meaningful gains in employment.” On the back of more new work orders, Indian manufacturers raised their staffing levels at the fastest pace since October 2012.

Re: Indian Economy News & Discussion - Aug 26 2015

Both demon and gst are essenrially tax reforms aimed at imcreasing the tax base and tax receipt. As a bi product these are also anti corruption reforms. That is why there is no riot on the steets as mango people are out of tax bracket and only the tax evadors are moaning loudly.

Re: Indian Economy News & Discussion - Aug 26 2015

There are quite a few posters who argue the return on tax. I would say that your tax money is keeping you safe in a very tough hood. What else do u want?

Re: Indian Economy News & Discussion - Aug 26 2015

Two consecutive months of positive manu PMI means growth recovery post-shock is happening. How fast is the question?

Re: Indian Economy News & Discussion - Aug 26 2015

Demon killed local manufacturing/biz at the smaller and lower ends of the economy but which are the foundation of mass employment.Cheap Chinese goods are invading the country replacing Indian products.That's why imports have surged.Imposing high duties and bans on key Chin goods will see a surge in local industry.Why the FM "can't smell the chai" beats me.For some reason best known to the vested insider interests,we are mollycoddling China our worst enemy.I cannot see a surge or major improvement in the economy until the next gen.election is over.Come 2018 and all parties will be in pre-election mode spinning their conflicting tales .

I agree with an above quote.Great improvement in price hikes! Yesterday I was horrified to see GST has increased my coffee and snack bill at a usual haunt by over 25%.

Petrol/diesel prices no joke,rising by the day despite cheaper US oil reaching India! The economy will determine the outcome of the next election.The either "feel good" or " feel bad" factor about the NDA-2 at election time will determine whether it will get a second term all on its own.

I agree with an above quote.Great improvement in price hikes! Yesterday I was horrified to see GST has increased my coffee and snack bill at a usual haunt by over 25%.

Petrol/diesel prices no joke,rising by the day despite cheaper US oil reaching India! The economy will determine the outcome of the next election.The either "feel good" or " feel bad" factor about the NDA-2 at election time will determine whether it will get a second term all on its own.

Re: Indian Economy News & Discussion - Aug 26 2015

NS had already imposed dumping duties on a number of items imported from China before she became RM e.g. solar panels. But more needs to be done.

Re: Indian Economy News & Discussion - Aug 26 2015

Can someone explain the logic and

Re: Indian Economy News & Discussion - Aug 26 2015

I see the same question from many people. Just remember that service tax has gone up and manu tax has remained same or gone down in several cases. Earlier you would pay multiple taxes you did not think about. Now you pay a single tax.

Re: Indian Economy News & Discussion - Aug 26 2015

Also liquor, petrol, diesel and perhaps tobacco are not under GST.

Re: Indian Economy News & Discussion - Aug 26 2015

Primary food items are not taxed.

Re: Indian Economy News & Discussion - Aug 26 2015

If there is one man in India who's advice should be acted upon by ANY government, it is Arun Shourie. May you live many more years and provide fearless critique of those in power and their follies.

Do not watch this for dissecting numbers. It is about credibility, predictability and the willingness to listen. This is what separates great leaders from failed ones. I wish this prime minister succeeds based on India's success.

Re: Indian Economy News & Discussion - Aug 26 2015

He has gone bonkers. One of the purposes of doing demo was to bring the black economy to white. It is only money laundering if taxes are not paid. And I believe he is not an economist but a journalist. Lost respect.

Re: Indian Economy News & Discussion - Aug 26 2015

You are incorrect. The man has a Phd in economics and started his career in the world bank.Supratik wrote:He has gone bonkers. One of the purposes of doing demo was to bring the black economy to white. It is only money laundering if taxes are not paid. And I believe he is not an economist but a journalist. Lost respect.

Re: Indian Economy News & Discussion - Aug 26 2015

OK but he is wrong in saying it is money laundering. They are going through all deposited money with a comb. It is money laundering only if taxes are not paid. He can argue about jobs and business losses in informal sector. That is a risk to break the vicious cycle.

Re: Indian Economy News & Discussion - Aug 26 2015

Precisely, Money deposited by account holders will need to be explained. Tax compliance, tax collection and and penalty figures thereon will go up in the forthcoming years.

-

Rishirishi

- BRFite

- Posts: 1409

- Joined: 12 Mar 2005 02:30

Re: Indian Economy News & Discussion - Aug 26 2015

It is very hard to estimate such things. One has to consider issues like peek load, error corrections, population, etc. To fire the people may not be the answer if it was caused by a lot of unknown factors. Actually they will have learned some valuable lessons.

chetak wrote:This is akin to economic sabotage. No accountability as is normal in our government culture.

GSTN grossly underestimated Server Requirement and let Modi down-CEO should resign

GSTN grossly underestimated Server Requirement and let Modi down-CEO should resign

September 9, 2017

When the Government was targeting 3 Crore GST payers; GSTN settled for a Rented server based in Whitefield Bangalore having capacity of only 80000 access at one time whereas the requirement was to have a Server having capacity of 5 Lakh access at one time. The Jumbo Server similar to one being used by National Stock Exchange was required to be imported by GSTN. But Consultants to GSTN and even GSTN Team could not understand the basic requirement of Hardware and Software for running Network for uploading and matching data of a magnitude required for implementation of GST.

It was mismanagement by all stakeholders. Instead of GSTN opening Return Filing Facilitation Centres in all cities; the Officials were busy with TV Channels and Webinars. Even GSTN Head Office at Aero City in Delhi did not have a Service centre for Tax payers where they could go for resolution of their issues and get them resolved on the spot. Even FinMin and GST Commissioners failed to assess that need of hour was to open Return Filing Centres in all cities and the issues in filing of returns should have been resolved by the Team of GSTN Officers, Software Vendor and GST Officers on the spot. It was a hit and run by all with GST Officers being helpless in resolving the issues as they themselves did not have access to network. Without addition of all Service Tax, Central Excise & VAT Registrations; the TRAN-1 Form did not allow; transfer of transitional credit and showed message of “Processing Error”. Even the amendment in non-core fields of registration was not reaching the Desktop of GST Officers and they were not in a position to approve the amendment and the application showed the status as “Pending Validation”. But who will validate and how to get it validated was not known to anyone. Even no one knows who will approve the Provisional Registration into final registration and without approval of registration into final registration.

Though many were given GSP Licenses but even they were not given access by GSTN and were not of much help to filers.

The Government had to face the wrath of Tax Payers on social media who were unable to access the Portal which repeatedly crashed due to heavy traffic and was not capable for upload of huge data. GSTN Helpdesk did not even acknowledge the emails sent by Taxpayers. Everyone started to blame PM and Adhia but the responsibility was on GSTN Team to assess the requirement of Hardware and Software for smooth running of Network. The Team failed to assess the requirement and the Server crashed multiple times. It was wastage of National Time with entire country trying to access the server and only lucky few could upload the returns without any error.

The Network is not going to work on existing Server and a Jumbo Server is required to be imported well before the revised due date of GSTR3. It is wiser to dispense with all returns and to provide for filing of only GSTR3B till a compatible Server is imported.

It is not only Hardware but Software is also full of bugs. Many Tax payers who submitted returns Online several days ago; the status of their return even after a week is being shown as “under process”. Those who got error message are unable to generate Error file.

Consultants to GSTN who failed to assess Hardware and Software requirement should be blacklisted and the Team GSTN which was not capable of identifying the basic system requirement needs to be fired. Crores of Tax Payers money handed over to GSTN, National Time and Energy was wasted as those who were assigned the responsibility miserably failed in their task and let PM Modi down.

It is time for CEO of GSTN to own the responsibility and resign.

Re: Indian Economy News & Discussion - Aug 26 2015

He single handedly defeated Vajpayee.ShauryaT wrote:If there is one man in India who's advice should be acted upon by ANY government, it is Arun Shourie. May you live many more years and provide fearless critique of those in power and their follies.

Do not watch this for dissecting numbers. It is about credibility, predictability and the willingness to listen. This is what separates great leaders from failed ones. I wish this prime minister succeeds based on India's success.

He sold profitable industries to friendly industrialist gang.

Re: Indian Economy News & Discussion - Aug 26 2015

You are right, when and if taxes are "collected" on the deposited monies, we will have an accounting of it then. Till that time, it will remain laundered. I guess you have high confidence in such an outcome, many do not.Supratik wrote:OK but he is wrong in saying it is money laundering. They are going through all deposited money with a comb. It is money laundering only if taxes are not paid. He can argue about jobs and business losses in informal sector. That is a risk to break the vicious cycle.

Re: Indian Economy News & Discussion - Aug 26 2015

Our IT software and portal handles such peak loads without such issues and has been doing so for years.Rishirishi wrote:It is very hard to estimate such things. One has to consider issues like peek load, error corrections, population, etc. To fire the people may not be the answer if it was caused by a lot of unknown factors. Actually they will have learned some valuable lessons.

chetak wrote:This is akin to economic sabotage. No accountability as is normal in our government culture.

GSTN grossly underestimated Server Requirement and let Modi down-CEO should resign

We have the capability and the expertise to handle such high peak load portals.

We are slow to fix accountability and penalize incompetent high ranking staff who are more often than not, made heads of institutions because of who they are connected to and not because of what they bring to the table.

Re: Indian Economy News & Discussion - Aug 26 2015

these are headline and eyeball grabbing statements made without evidence or fear of libel laws.ShauryaT wrote:You are right, when and if taxes are "collected" on the deposited monies, we will have an accounting of it then. Till that time, it will remain laundered. I guess you have high confidence in such an outcome, many do not.Supratik wrote:OK but he is wrong in saying it is money laundering. They are going through all deposited money with a comb. It is money laundering only if taxes are not paid. He can argue about jobs and business losses in informal sector. That is a risk to break the vicious cycle.

He has nothing to say and to cover up that fact, he has to say things very loudly and publicly. This is just like yeshwant sinha whose outpouring of angst and opposition from a suddenly awakened, slumbering conscience was triggered reportedly after his strident demand to be made chairman of the BRICS bank was turned down by the PM.

This one post one family norm instituted by the PM has created some long term enemies. In RAJ, one family demanded both the CM as well as a cabinet post for the family, yeshwant was also "very firmly advised" that either he or his son would be accommodated but not both and the choice was his to make.

what do these guys really want at the ripe old age of 84??

Re: Indian Economy News & Discussion - Aug 26 2015

RBI would most likely stay pat and hold it steady, maintaining the policy repo rate at 6%. That would be the common sense path for RBI to take while waiting for the GoI's deficit stimulus which should be forthcoming given the last consecutive five quarters' decline in growth rate. Sharp uptick in Korean gold purchase is not going to help this current quarter numbers. Stimulus has to come from either government or RBI, preferably from the first, if not we'd see a monetary easing in the form of RBI's 25 to 50 basis point cut in 6 months. If GoI sticks to fiscal discipline instead of looking to fiscal expansion, RBI needs to step in.