The hallmark of an effective bankruptcy code would be a minimal need for discretionary decisions, with almost every major step conducted in a procedural manner based on what chapter code is pursued.Yagnasri wrote:While I welcome the new bankruptcy code or whatever they plan to bring, unless there is a serious attitude change in the judges it also will fail.

Indian Economy News & Discussion - Aug 26 2015

Re: Indian Economy News & Discussion - Aug 26 2015

Re: Indian Economy News & Discussion - Aug 26 2015

November date for gold bonds

New Delhi, Oct. 30: The proposed sovereign gold bonds will offer an interest rate of 2.75 per cent and remain open for public subscription between November 5 and 20, the finance ministry said today.

Aimed at providing an alternative to buying physical gold, the gold bond scheme will offer investors a choice to buy bonds worth 2 grams of gold up to a maximum of 500 grams.

"The bonds will be issued on November 26, 2015. Applications for the bond will be accepted from November 5 to November 20, 2015. The bonds will be sold through banks and designated post offices," a finance ministry statement said.

This is the first tranche of the gold bond scheme and subsequent tranches will be notified later.

Re: Indian Economy News & Discussion - Aug 26 2015

Metro mall footfalls are down 50% this season due to online sales.

They will have to give America type deep discounts and black Fridays to survive.

They will have to give America type deep discounts and black Fridays to survive.

Re: Indian Economy News & Discussion - Aug 26 2015

Govt showers duty benefits to arrest slump in exports

Relatively less of fiscal strain so farThe government on Friday extended duty incentives under the Merchandise Exports from India Scheme (MEIS) to 110 products, including sports goods and medical equipment. The move, which will further hit the exchequer by Rs 3,000 crore, is aimed at arresting a fall in merchandise exports, which declined for the 10th consecutive month in September. The Centre, however, didn't announce interest subvention, as sought by exporters.

Through the MEIS, introduced by the Ministry of Trade and Commerce on April 1 this year, a certain percentage of the value of exports can be used to offset various duties, including customs, service tax and excise duty. Though the government retained this at two-five per cent, it increased the rate for some items such as industrial machinery, machine tools, textiles and paper.

It has also extended the countrywide coverage to items such as iron, steel, base metals and leather products, while global coverage has been accorded to commodities such as textiles, pharmaceuticals, auto components, computers and electrical products. As many as 2,228 products would get either higher MEIS rates or these incentives for export to more countries.

Federation of Indian Exports Organisation (FIEO) President S C Ralhan said the new items added to the MEIS list contributed about $10 billion to exports a year, or about three per cent to the overall value of exports. Now, the exports for which MEIS is applicable would account for about 55 per cent of the overall exports in a year ($180 billion), he added.

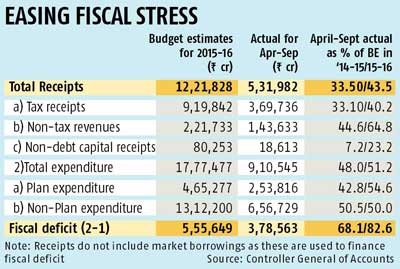

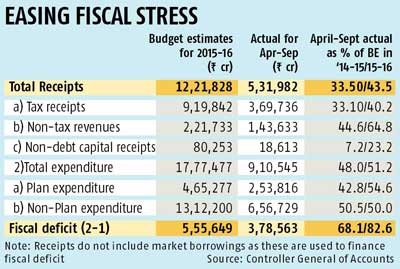

The Centre’s fiscal deficit position improved in the first half of the current financial year against that in the corresponding period of 2014-15, even as it raised capital expenditure by almost 30 per cent to spur economic growth.

The gap between expenditure and revenue was 68.1 per cent of the budget estimate in the six months till September at Rs 3.78 lakh crore, much lower than the 82.6 per cent in the corresponding period of last year, show figures issued on Friday by the Controller General of Accounts.

September's fiscal deficit was the lowest in any month this financial year, excluding the surplus in the previous month.

The government’s capital spending accounted for 62.1 per cent of what has been estimated in the year's budget. At Rs 1.28 lakh crore in the first half, it was a rise of 29.3 per cent of the Rs 99,104 crore incurred in April-September 2014. September saw the highest such spending this financial year, at Rs 30,206 crore.

The government is targeting gross domestic product (GDP) growth between 7.5 and eight per cent in 2015-16. It was seven per cent in the April-June quarter, the first of the year

Re: Indian Economy News & Discussion - Aug 26 2015

From Suraj's link previous page: BS link on external borrowing

Where? Rupee-Denominated funds market ?The draft paper also said the central bank would now allow real estate investment trusts and infrastructure investment trusts to raise rupee-denominated funds offshore, a step likely to provide some relief to the cash-strapped real estate sector in India.

Re: Indian Economy News & Discussion - Aug 26 2015

True but even paying interest rate at 23 % of your GDP is not a good ideaSuraj wrote:The government pays down its debt with its revenues or other non-revenue proceeds to the exchequer (e.g. disinvestment). Forex reserves are not GoI revenues for them to expropriate and use to pay down their own deficit burden. If that were permissible, then why bother with forex reserves ? They can leave a note in your bank account and take the money.

Re: Indian Economy News & Discussion - Aug 26 2015

Government to Issue Gold Bonds From November 26, Interest Fixed at 2.75%

http://profit.ndtv.com/news/economy/art ... -yourmoney

http://profit.ndtv.com/news/economy/art ... -yourmoney

Re: Indian Economy News & Discussion - Aug 26 2015

Global Brand Value of India has actually shot up over the same time-period that 'intolerance' was supposed to have dented India's image:

India becomes world's 7th most valued 'nation brand'

India becomes world's 7th most valued 'nation brand'

Re: Indian Economy News & Discussion - Aug 26 2015

I believe you mean that interest payment to revenue ratio is 22.3%; government revenue itself is around 20% of GDP (so about 4% of GDP goes in interest payments).Austin wrote:As our Debt to GDP ratio is 66.8 % and interest payment to revenue ratio is 22.3 % of GDP

Question to gurus is can we use our huge forex of $350 billion plus to pay off our Debt and say get it under 50% which also improves interest payment to revenue ratio ?

Before paying of debt the nation has to stop accumulating it. So, government has to stop running deficits. Next, government has to understand what multiplier effect its expenditures have on the economy. If it is greater than 1, then rather than paying back debt, government should merely not incur more debt, and the growing economy will reduce the existing debt into insignificance.

Re: Indian Economy News & Discussion - Aug 26 2015

^ Its also important where that 'debt' originated from. If the funds were used to pay for idiotic Con-gress social welfare (vote raising) schemes then there would be little benefit. If used for infrastructure investment, then it could be beneficial and possibly result in higher return than the interest charge incurred.

2c

2c

Last edited by Nick_S on 01 Nov 2015 18:17, edited 2 times in total.

Re: Indian Economy News & Discussion - Aug 26 2015

FWIW, some data from IMF (Oct-2015 WEO db). It looks like India is now the 7th ranked economy in MER.

According to IMF India should bypass France in 2017

According to IMF India should bypass France in 2017

Re: Indian Economy News & Discussion - Aug 26 2015

^^^ Why for Pukis estimates after 2015 is n/a. Any chances of this being their last year of solvency? Sorry if OT but my focus is single minded.

Re: Indian Economy News & Discussion - Aug 26 2015

Nick,

can you please provide the URL for that table?

Thx.

can you please provide the URL for that table?

Thx.

Re: Indian Economy News & Discussion - Aug 26 2015

However, wiki is claiming from IMF source Indian GDP crossed $2.5 trillion and per capita GDP crossed $2000 in Oct 2015.

Re: Indian Economy News & Discussion - Aug 26 2015

Nick ji,

Thx.

I would use:

https://en.wikipedia.org/wiki/List_of_c ... nominal%29 (nominal GDP, in which India stands around 8-9 and France is aorund 6)

https://en.wikipedia.org/wiki/List_of_c ... per_capita (Per capita, where India stands 125!!!! And farnce, as a comparison, is around 25)

very carefully.

Stats are always very deceiving.

Thx.

I would use:

https://en.wikipedia.org/wiki/List_of_c ... nominal%29 (nominal GDP, in which India stands around 8-9 and France is aorund 6)

https://en.wikipedia.org/wiki/List_of_c ... per_capita (Per capita, where India stands 125!!!! And farnce, as a comparison, is around 25)

very carefully.

Stats are always very deceiving.

Re: Indian Economy News & Discussion - Aug 26 2015

That's 2014 data

The latest can be seen from IMF data mapper

http://www.imf.org/external/datamapper/index.php

We are 7th in ranking at 2.2 trillion while Brazil and Italy fighting it out for 8th place with 1.8 trillion.

France is nearby at 2.4 trillion dollars.

The latest can be seen from IMF data mapper

http://www.imf.org/external/datamapper/index.php

We are 7th in ranking at 2.2 trillion while Brazil and Italy fighting it out for 8th place with 1.8 trillion.

France is nearby at 2.4 trillion dollars.

Re: Indian Economy News & Discussion - Aug 26 2015

Add-on insurance edge for RuPay

Calcutta, Nov. 1: The National Payments Corporation of India (NPCI), which developed the country's home-grown card payment system RuPay, has attributed the system's rapid growth to the insurance cover it provided to its card-holders.

"The government had weighed and evaluated all card payment systems. At that time, the RuPay card had an inbuilt accident insurance of Rs 1 lakh. When the PMJDY scheme was launched, it was thought that along with the opening of accounts let people have an access to accident insurance. Then (Jan Suraksha) insurance schemes were not present. So, the government chose RuPay by its intrinsic strength," Hota said.

Re: Indian Economy News & Discussion - Aug 26 2015

Government to launch a series of policy reforms after Bihar polling ends

NEW DELHI: The government plans to launch a series of policy reforms as soon as polling ends in Bihar on November 5, signalling its intent to get moving again on economic changes and putting the Opposition on notice before Parliament convenes for the winter session.

Key to the Narendra Modi government's renewed development push will be power, labour and infrastructure, three senior government officials told ET. Among the highlights are a revival package for power distribution companies, freeing up labour rules and a possible push for the railways.

"The government is not going to wait till the Budget to kick in reforms in various sectors. We will start witnessing action right after the Bihar elections," said one of the officials.

The road map for the phasing out of corporate tax exemptions and reduction in the tax rate to 25% is being drawn up. Besides this, the Startup India, Standup India plan and the rollout of the National Investment and Infrastructure Fund (NIIF) are also being worked on.

A simpler foreign direct investment ( FDI) policy, further easing of the external commercial borrowing (ECB) regime and changes in the public-private partnership (PPP) framework to attract more private investment could also be announced.

"A lot of work is going on in the government. You will see action after the Bihar elections are over," said one of the officials.

By pushing hard on its reforms agenda, the government wants to set the stage for passage of the goods and services tax (GST) Bill in Parliament. GST is scheduled to be rolled out on April 1 next year.

"In the 20 days window between the Bihar elections and the winter session of Parliament, lot of action should happen," said one of the officials cited above.

-

amit

- BRF Oldie

- Posts: 4325

- Joined: 30 Aug 2007 18:28

- Location: The Restaurant at the End of the Universe

Re: Indian Economy News & Discussion - Aug 26 2015

This Forbes article needs to be quoted extensively and I would urge poster, who haven't read it, to go through it in fullNRao wrote:Why India's Tortoise May Beat China's Hare

In part because of China’s faltering, the progress of Indian economic reform is now front and center, with a debate about how in the years ahead the trajectory of India’s economy will stack up against China’s. Indeed, the intense draw of India to business headlines around the world has been the country’s strong macroeconomic growth performance in the past few years, especially when compared with China. New IMF data indicate that not only did India’s rising real GDP growth rate catch up with where China’s growth rate had decreased to in 2014–7.3 percent–but they project that as China’s growth rate continues to decline–to 6.8 percent in 2015 and then decrease further to 6.3 percent in 2016—India’s growth rate will substantially exceed China’s over the same period, reaching 7.5 percent in 2016.

The following is something we all know and understand but it's still helpful to put out for a sense of perspective:ike Aesop’s Hare, China has been growing at a blazing pace for years. According to China’s official statistics, average GDP growth of the country over 1980-2014 was 9.8 percent. Few if any other nation in modern times has come close to such an accomplishment, and there is little question about the incredible ingenuity of the China’s leaders. India’s GDP growth over 1980-2104 averaged 6.2 percent–more the speed of Aesop’s Tortoise. Still, a strong performance by any standard, and certainly enviable for most countries around the world.{This is something we sometimes tend to forget. This has been achieved despite all the trials and tribulations that we've gone through over the decades and more importantly the speed is ready to pick up and not falter}

China’s growth has been fueled by an excessive reliance on a mercantilist strategy of providing the world with vast amounts of cheaply priced exports rather than building a large, vibrant consumer market at home. Coupling this has been Beijing’s huge—and often wasteful—investment in lumbering state-owned enterprises (SOEs), which, despite the growth of private sector firms in certain sectors of the economy, have consolidated in number and grown ever larger over time; a moribund system of state-owned ‘banks’, who pretend to lend money to SOEs, who, in turn, pretend to pay back the banks; a breathtaking infrastructure network of modern airports, highways, ports and railways, some of which operate way below capacity; and real estate, where overspending has created an untold number of unoccupied buildings and huge market bubbles.

In no small way, China’s racing endurance to date has been made possible by the dominance throughout all aspects of the economy of the Communist Party, and questioning the Party’s aims is not tolerated. In this setting, it is understandable why the uppermost goal of the Chinese leadership is to maintain the country’s social stability, including through the controlled growth of the population. However, now as the growth of the nation’s labor force has begun to shrink and the average age of the population is increasing, China’s wages have risen to the point where other countries—including India—are becoming more competitive.

Now here are some very interesting perspectives put forward by the author:New IMF data indicate that not only did India’s rising real GDP growth rate catch up with where China’s growth rate had decreased to in 2014–7.3 percent–but they project that as China’s growth rate continues to decline–to 6.8 percent in 2015 and then decrease further to 6.3 percent in 2016—India’s growth rate will substantially exceed China’s over the same period, reaching 7.5 percent in 2016.

The most notable to take into account when assessing these countries’ economic destinies concern the prospects for international integration, which is key for any country to strengthen its global competitiveness; improve its access to external (as well as the domestic generation of) advances in technology and innovation; and enhance both the efficiency of its enterprises and the acumen of its business leaders and public policy decision-makers.

Now it gets really interesting:In China, reflecting the country’s still heavy, indeed actually growing, reliance on fixed investment—rather than a shift towards consumption, as habitually embodied in the Party’s formal pronouncements to the contrary—as a share of GDP the industrial sector comprises 44 percent and the services sectors account for 46 percent (with the balance occurring in agriculture). By contrast, in India, industry accounts for 24 percent, while services comprise 58 percent, illustrative of the country’s emphasis on development of human capital, the key intangible asset needed for economic success in today’s globalized marketplace.

In the sphere of international trade, India’s economy is actually more extensively integrated into the world’s trading system than China’s. No doubt this will be a shock to most observers, since China’s global share of exports of goods and services is about five times as large as India’s. The problem with that perspective is it does not adjust for the differences in the scale of output between the two countries: China accounts for about 17 percent of the world’s GDP, whereas India’s output constitutes about 7 percent.

Measured correctly, while India’s total trade in goods and services (that is, the sum of exports and imports) accounts for 50 percent of the country’s GDP, for China, the comparable measure is only 42 percent. Perhaps even more important is that for exports alone, they actually constitute a larger share of GDP for India than they do for China.

The story is remarkably similar in the case of foreign direct investment (FDI), where, by committing to significant, tangible ownership of in-country productive facilities (rather than as a minority, passive shareholder), external investors vote with their feet and wallets as to the economic prospects of an economy. Indeed, despite China attracting annual FDI inflows twelve times India’s volume, it is striking that as a share of each country’s GDP, the cumulative flows of FDI into India today is 12.3 percent, whereas for China the analogous figure is 10.5 percent.

Over the last decade, even though Chinese firms pursued significantly fewer acquisitions or greenfield investments in the G-20 countries than did Indian businesses, China’s enterprises were only able to successfully complete about 50 percent of their proposed transactions, whereas India’s firms successfully closed on almost 70 percent of their deals. No doubt the differences in these track records are due, perhaps in large part, to the fact that the typical Chinese firm is a state-owned enterprise, while most Indian firms are in the private sector.{We all know about the Alibabas, Huaweis and Lenovos - all great brands undoubtedly - but at the country level this is the picture}

The above is IMO the most important point of all.Of course, many factors will impact how this economic race between India and China turns out. Needless to say, in a very real sense it is just beginning. And who might look like the winner today may well not be the first to cross the finish line. In the end, however, as has always been the case throughout the world’s economic history, it will boil down to human capital. It will not hurt India that one of its main assets propelling it forward is youth: India’s median age is 27, compared with China’s 37. Unless China’s recent lifting of its one-child policy has a dramatic effect, by 2030 India’s population will exceed China’s, with an additional 300 million included in its labor force. By that time, no matter how fast China is able to sprint, as long as India adopts a slower yet steadier pace, coupled with continual enhancement of the talent of its people through greater investment in the entire population’s education, it will likely win.

Re: Indian Economy News & Discussion - Aug 26 2015

looks like paytm is going to be de-facto a alibaba branch in india and their proxy against amazon,snapdeal and flipkart. its their only investor and has pumped in lot of money. i would not underestimate alibaba if i were amazon...amazon surely has great tech and software but its not so essential for a jugaad type place like chindia....so long as merchants find a reliable platform and low transaction costs they will play ball and not demand apps, uber smooth UX and so on. could end up having a huge b2b customer base while amazon/flipkart spend a ton on b2c public face and glamour. a guy in a kanpur bylane setting 10 tons of betel nut supari to another in jaipur is probably where they want to cash in big.

http://www.ft.com/cms/s/0/18c7bfe2-7ee5 ... z3qJeLYoeb

http://www.ft.com/cms/s/0/18c7bfe2-7ee5 ... z3qJeLYoeb

Re: Indian Economy News & Discussion - Aug 26 2015

long time since I posted anything soothing. here is the newly opened flipkart warehouse in hyderabad.

Hyderabad: E-commerce giant, Flipkart, opened its largest fulfilment centre here in Hyderabad on Friday, taking its total warehouse strength in the country to 17. Spread over 2.2 lakh square feet and with a storage capacity of 5.89 lakh cubic feet, this is Flipkart’s 17th warehouse in the country. -

The firm delivers six lakh orders a day. Equipped with a 1-km-long conveyer belt with ‘intelligent’ systems attached to it, which is expected to reduce motion wastage by 75 percent, the centre has automated sorters to separate shipments based on pin codes. It can sort 6,000 shipments an hour. -

See more at: http://allindiaroundup.com/news/flipkar ... 6RJhy.dpuf

See more at: http://allindiaroundup.com/news/flipkar ... 6RJhy.dpuf

Hyderabad: E-commerce giant, Flipkart, opened its largest fulfilment centre here in Hyderabad on Friday, taking its total warehouse strength in the country to 17. Spread over 2.2 lakh square feet and with a storage capacity of 5.89 lakh cubic feet, this is Flipkart’s 17th warehouse in the country. -

The firm delivers six lakh orders a day. Equipped with a 1-km-long conveyer belt with ‘intelligent’ systems attached to it, which is expected to reduce motion wastage by 75 percent, the centre has automated sorters to separate shipments based on pin codes. It can sort 6,000 shipments an hour. -

See more at: http://allindiaroundup.com/news/flipkar ... 6RJhy.dpuf

See more at: http://allindiaroundup.com/news/flipkar ... 6RJhy.dpuf

-

amit

- BRF Oldie

- Posts: 4325

- Joined: 30 Aug 2007 18:28

- Location: The Restaurant at the End of the Universe

Re: Indian Economy News & Discussion - Aug 26 2015

Singha, that looks very TFTA indeed! Thanks for sharing.

Re: Indian Economy News & Discussion - Aug 26 2015

@ 1.2 lakh shipments per day, it is still around 7 times less than the amzn depot in california. but way I see it, such uber centers will form from these seeds using incremental adds. amzn has more robotics, more belts, and cute lil "kiva" robots.

- reminds of the dormant spaceship in "Rama" novel of ac clarke that comes to life as it nears the earth, and armies of spider robots go around doing stuff infront of the amazed human cosmonauts.

trucking business will have to integrate technology to cope. no more a beat up tata ace moving around. there is atleast one IOT co in india offering tracking data to trucking cos to use for their own management systems.

- reminds of the dormant spaceship in "Rama" novel of ac clarke that comes to life as it nears the earth, and armies of spider robots go around doing stuff infront of the amazed human cosmonauts.

trucking business will have to integrate technology to cope. no more a beat up tata ace moving around. there is atleast one IOT co in india offering tracking data to trucking cos to use for their own management systems.

-

amit

- BRF Oldie

- Posts: 4325

- Joined: 30 Aug 2007 18:28

- Location: The Restaurant at the End of the Universe

Re: Indian Economy News & Discussion - Aug 26 2015

True the supporting infra needs to be ramped up. But if there's a demand and money seems to be no problem, it's going to happen very fast.Singha wrote:@ 1.2 lakh shipments per day, it is still around 7 times less than the amzn depot in california. but way I see it, such uber centers will form from these seeds using incremental adds. amzn has more robotics, more belts, and cute lil "kiva" robots.

trucking business will have to integrate technology to cope. no more a beat up tata ace moving around. there is at least one IOT co in india offering tracking data to trucking cos to use for their own management systems.

Re comparison with Amazon, that's true still a way to go but look at the speed of ramp up, who'd have thought a desi startup would suddenly appear on the rear view mirror of the big gorilla and moving very fast!

Re: Indian Economy News & Discussion - Aug 26 2015

if you move around in factory areas of india now(eg jigani road bluru), they look every bit as neat and khanish as industrial estates say north of bangkok, guangzhou, singapore jurong or the khanlands newer plants. to-spec paving all over, big sunny lunch rooms for the workers, attached office areas for the white collar crew, loading docks(no labour moving stuff manually like sacks of rice), semi trailers hauling kit day and night. only scale needs building up.

cos who have invested money in putting up new plants have not spared expenses to make them useable and neat.

cos who have invested money in putting up new plants have not spared expenses to make them useable and neat.

Re: Indian Economy News & Discussion - Aug 26 2015

From limited usage I find Flipkart's website more user friendly than amazon's. It probably has more products too than amazon.

Re: Indian Economy News & Discussion - Aug 26 2015

they are about level on SKUs I think, but amazon tends to undercut fkart prices in almost everything.

Re: Indian Economy News & Discussion - Aug 26 2015

My experience with Indian online-shopping:

Products: snapdeal > amazon > flipkart

UI: flipkart > amazon > snapdeal

Delivery: amazon > flipkart > snapdeal

Products: snapdeal > amazon > flipkart

UI: flipkart > amazon > snapdeal

Delivery: amazon > flipkart > snapdeal

Re: Indian Economy News & Discussion - Aug 26 2015

Core sector growth up 3.2% in September; fastest in 4 months

India Inc's sales, profit move in opposite directionsFertilisers and electricity were two beacons of hope among the eight core industries, which in September grew at a four-month-high rate of 3.2 per cent on a year-on-year basis, showed data released on Monday.

However, the main number hid the dismal growth registered by most of the six other industries, three of which showed a decline in output in September.

The growth rate in August as well as September, 2014 was 2.6 per cent. The September, 2015 growth rate, as such, might look magnified because of a low base of a year earlier.

In the first six months of the current financial year, the core industries’ production grew 2.3 per cent, a rate less than half the 5.1 per cent seen in the corresponding period of 2014-15.

Core sector industries account for almost 38 per cent of the Index of Industrial Production (IIP). The IIP numbers for September are due later this month.

Production in three key industries — crude oil, steel and cement — saw contraction in the month. By comparison, only one industry, steel, had seen production decline in August. Fertilisers continued to grow at the highest rate, registering an 18.1 per cent increase in September, against 12.59 per cent the previous month. Much of the increase, though, came on the back of a huge contraction of 12.6 per cent seen in September last year. The case was similar for the electricity sector, where generation rose 10.8 per cent, compared with 3.6 per cent in the same month a year ago.

7.5% growth in FY16, higher growth next year: Moody'sThe second quarter earnings season is turning out to be a study in contrast. India Inc's revenues and profits are now moving in opposite directions, thanks to a combination of poor demand and a collapse in global commodity prices.

For 622 companies whose Q2 numbers were available till Monday morning, net sales were down 4.4 per cent on a year-on-year (y-o-y) basis (second lowest in eight years), while adjusted net profit was up 7.7 per cent, growing at the fastest pace in the last four quarters.

Gold monetisation scheme to help cut loan ratesProjecting stable growth rate for India, Moody’s Investors Service on Monday said the economy would grow at 7.5 per cent in the current financial year and improve marginally in the following year.

“We expect that India's real GDP will grow at 7.5 per cent in the financial year ending March 31, 2016 (FY16) and 7.6 per cent in FY17. These rates would be slightly faster than the 7.4 per cent recorded in FY15 and substantially better than FY12-14,” it said in a report, adding “India's economic growth will remain stable”.

India’s average annual expansion of 7.7 per cent over the past decade is one of the fastest growth rates globally, as its favourable demographics and the opportunities, afforded by a large and diverse national market with high levels of savings, have overcome the effects of weak physical infrastructure and sometimes disjointed policies.

However, during this long growth period, the country experienced a significant slowdown in FY12-13, driven in part by policy bottlenecks impacting project investments, the report said.

As the gold monetisation scheme is all set to start from Thursday, non-banking financial companies (NBFCs) active in gold loan business are looking to cash in. Rolling out new schemes, these companies seek to attract more customers, as interest rates applied on loans against gold are expected to come down.

“Definitely interest rates will come down,” said Thomas George Muthoot, director of Muthoot Fincorp, a leading gold loan company. Gold bond schemes will trigger fresh monetisation and competition in the business, as even physical infrastructure to handle and store gold is not a must for doing business. Gold loans can be released online or by bank transfers on the basis of demat accounts of gold deposits or bonds which will be used as collateral. So, “new players will enter the business. Obviously, this will cut down the interest rates," he said. At present, interest rates on various gold loans range from 12 to 18 per cent. New attractive packages offering loans at lower rates will also be there once the scheme becomes successful.

Most leading players are planning new schemes such as special over draft facilities on gold bonds. One can take loans against gold bonds, just like one can take loans against shares. Besides, the credit amount could be higher than one could get against shares. "This will enthuse business and it is likely that there will be manifold increase in business," said a top-level officer of another NBFC.

At present, the average annual business is Rs 50,000 crore in the organised gold loan business segment with an average combined annual growth rate of 43 per cent. "We are in the process of devising new schemes to attract more customers to our branches. It is inevitable," the officer quoted above said.

Re: Indian Economy News & Discussion - Aug 26 2015

amazon (US site) real value is with every book, there is a list of used book sellers for the same at very cheap prices if you dont need mint condition or latest edition. yet to happen in amazon india.

-

Melwyn

Re: Indian Economy News & Discussion - Aug 26 2015

Finally some good news for NE Region. 60 years of wasted opportunities.

Nitin Gadkari announces Rs 10,000 crore projects for Nagaland

Nitin Gadkari announces Rs 10,000 crore projects for Nagaland

KOHIMA: The Union government today announced Rs 10,000 crore road and bridge development projects for Nagaland besides committing a slew of road projects for the entire northeast India in five year period.

Road and Highways minister Nitin Gadkari told reporters here that Nagaland road project will be taken up till March 2017.

Turning to the infrastructure development of entire northeast India, Gadkari pledged the Centre's wish in according the highest priority for development of the region.

Towards that objective, the Centre decided to have roads of more than 10,000km in length in the region which would incur an approximate cost of Rs 1 lakh crore in a five-year span, he said.

Gadkari was talking to media at the Raj Bhavan after laying the foundation stone for four-laning of Dimapur-Kohima National Highway 29 near Chathe River Bridge, Patkai College junction Chumukedima in Dimapur district and gracing the Birth Centenary Celebration of Rani Gaidinliu at Peren district.

On the Nagaland projects, Gadkari said the 43 km-long four laning of NH-39 will be completed at an estimated cost of Rs 1,200 crore.

Re: Indian Economy News & Discussion - Aug 26 2015

FinMin to ease transfer pricing rules

Manufacturing PMI falls to 22-month low

RBI fixes issue price of gold bond at Rs 2,684 per gmThe finance ministry is streamlining safe harbour rules and advance agreements, two mechanisms to determine the price of services rendered by a multinational to its subsidiary in India.

Safe harbour rules - directives on margins the tax authorities should accept for the transfer price declared by an assessee - have drawn a tepid response since they were introduced a couple of years ago. There is also a huge backlog in advance pricing agreements (APAs), an ahead-of-time understanding between a taxpayer and the tax authority on an appropriate transfer pricing methodology.

Govt to procure 350,000 tonnes of pulses to check price riseThe Reserve Bank of India (RBI) has fixed the issue price of sovereign gold bond — which will be open for subscription from Friday — at Rs 2684 per gm of gold.

The rate has been fixed on the basis of a simple average of closing price for gold of 999 purity of the previous week (October 26 to 30) published by the India Bullion and Jewellers Association Ltd (IBJA), the central bank said in a statement. These bonds will be issued on November 26 and applications for the bond will be accepted from November 5 to 20.

Only domestic investors are allowed to subscribe to these bonds, which will offer an annual interest rate of 2.75 per cent. The minimum amount that an investor has to buy is two gms, while the upper limit is 500 gms per financial year.

Pulses prices to ease on harvest: JaitleyIn a bid to check spiralling prices of pulses, the government would procure 350,000 tonnes of pulses in the 2015-16 crop year, to create buffer stock, minister of state for agriculture Sanjeev Balyan said here on Tuesday. Procurement will be done through domestic purchases as well as imports. The move is aimed at preventing further price rise in pulses.

Out of 350,000 tonnes, about 150,000 tonnes of tur and urad would be procured in the ongoing kharif marketing season, while 200,000 tonnes of chana and masoor will be bought in the rabi season.

Over a period of time, the government might scale up buffer stocks to 500,000 tonnes, a senior official said.

Last month, the Centre had announced it would create a buffer stock of lentils, which will be offloaded in the market if prices soar.

Hiring growth despite lower PMI suggests the soft demand is a blip and companies are investing in labour before anticipated demand growth:As high prices of pulses continue to hurt consumers, Finance Minister Arun Jaitley on Tuesday said the rates will come down soon in view of good harvest and action taken against hoarders. With the government under attack from opposition parties on the issue, Jaitley said retail inflation has come to down to about four per cent from 12 per cent last year.

He said that in almost all states, the price of pulse has started becoming moderate in last five seven days and it is being sold at Rs 120 per kg in Safal shops in Delhi.

Manufacturing PMI falls to 22-month low

Manufacturing sector growth slowed to almost a two-year low in October despite the month being a festival season, showed the widely-tracked Nikkei Purchasing Managers’ Index (PMI).

Output growth eased due to a slowdown in new order growth. However, companies employed additional hands, for the first time since January, on the hope of an increase in demand.

PMI fell to a 22-month low of 50.7 in October against 51.2 in September. A reading above 50 indicates expansion and one below it shows contraction.

-

member_28397

- BRFite

- Posts: 234

- Joined: 11 Aug 2016 06:14

Re: Indian Economy News & Discussion - Aug 26 2015

If current growth trend continues and rupee is stable to strong we are looking to cross UK before NaMo starts his 2nd term as PMuddu wrote:That's 2014 data

The latest can be seen from IMF data mapper

http://www.imf.org/external/datamapper/index.php

We are 7th in ranking at 2.2 trillion while Brazil and Italy fighting it out for 8th place with 1.8 trillion.

France is nearby at 2.4 trillion dollars.

Re: Indian Economy News & Discussion - Aug 26 2015

66% cos miss street Q2 rev estimates: What's driving this?

About two-thirds of top companies have missed street expectations so far in the second quarter. Among 161 BSE 500 companies that have been tracked, 108 have reported below par results and only 53 managed to beat estimates.

Consumer goods sector has been the worst performing with all 13 companies that have reported results so far have been below estimates. This underlines the fact that demand is still weak.

Auto companies are also struggling with 13 out of 16 companies missing sales estimates. Pharma is next with 13 out of 20 companies falling short of expectations.

On the profit front, companies have fared better--- out of 161, 86 companies have beaten estimates and 75 have missed the mark. Reduction in input costs is helping margins and hence translating into higher profits.

In an interview with CNBC-TV18, Rajiv Kumar, Senior Fellow at Centre for Policy Research, blamed the "pervasive and persistent demand deficiency" in the economy due to weak rural incomes and said demand is unlikely to perk up in the near future.

"I am afraid even the investment demand is unlikely to perk up," he said, adding that the finance minister should loosen the government's purse strings to compensate for demand via public spending.

Re: Indian Economy News & Discussion - Aug 26 2015

^^^ There's a problem -- "didn't meet estimates" and "didn't do well" are two different things. E.g., if India as a whole grows at 7.5% and the expectation was 7.6%, then India didn't meet the estimates, but the sky is hardly falling. What are the hard numbers - actually sales and profit growth, rather than "did growth meet expectations?"

Re: Indian Economy News & Discussion - Aug 26 2015

E.g.,

http://www.livemint.com/Companies/ruzr3 ... crore.html

"Ashok Leyland’s Q2 profit rises 137 % to Rs286.81 crore

Net sales up 51.6 % to Rs.4,878.81 crore, falling short of the Rs.5,197.10 crore estimated by analysts "

What a disappointment!

Likewise:

http://www.livemint.com/Companies/l7pAC ... ses-9.html

What a disappointment!

Here's another outstanding disappointment: the analysts expected a 36% jump in profits.

ABB India Q3 profit up 30.6%, misses estimates

http://www.livemint.com/Companies/t7JN6 ... mates.html

http://www.livemint.com/Companies/ruzr3 ... crore.html

"Ashok Leyland’s Q2 profit rises 137 % to Rs286.81 crore

Net sales up 51.6 % to Rs.4,878.81 crore, falling short of the Rs.5,197.10 crore estimated by analysts "

What a disappointment!

Likewise:

http://www.livemint.com/Companies/l7pAC ... ses-9.html

I.e., Essar Ports grew its profit by 9%, the analysts expected 23.4%.Essar Ports Ltd on Wednesday said its consolidated net profit for the quarter ended 30 September rose 9% from a year ago on higher net sales and other income.

Net profit rose to Rs.104.97 crore from Rs.96.10 crore a year ago. The company was expected to post a profit of Rs.118.6 crore, according to a survey of analysts’ estimates by Bloomberg.

What a disappointment!

Here's another outstanding disappointment: the analysts expected a 36% jump in profits.

ABB India Q3 profit up 30.6%, misses estimates

http://www.livemint.com/Companies/t7JN6 ... mates.html