Terroristan - October 8, 2018

Re: Terroristan - October 8, 2018

PPS: Cantril Ladder data has been collected since 2006. India was at around current Pakistan levels on the Cantril Ladder in 2006, and has steadily fallen since. Pakistan has pretty much remained the same.

Re: Terroristan - October 8, 2018

Mort-ullah jee, present day our economy expands by on an average 300 billion a year. ie we are adding value >size of pakee economy in less than a year.. By 2030 Indian economy would expand by 1.5 trillion a year. (Ie we would be adding a Canada every year , or a Pakistan every couple of months ).Mort Walker wrote:gakakkad wrote:

By 2030 we ll add a Pakistan every couple of months or less.

You are mistaken. I really don't like comparing India to garbage, as the comparison should be with Germany, Japan and China. It will be in the next 3 years assuming Pakistan's economy does well and there is no further devaluation to PKR. If there is currency devaluation it will happen this year or next year depending on India's performance.

Pakistan nominal GDP 2018 in USD = $278 billion

India nominal GDP 2018 in USD = $2,848 billion

Terroristan - October 8, 2018

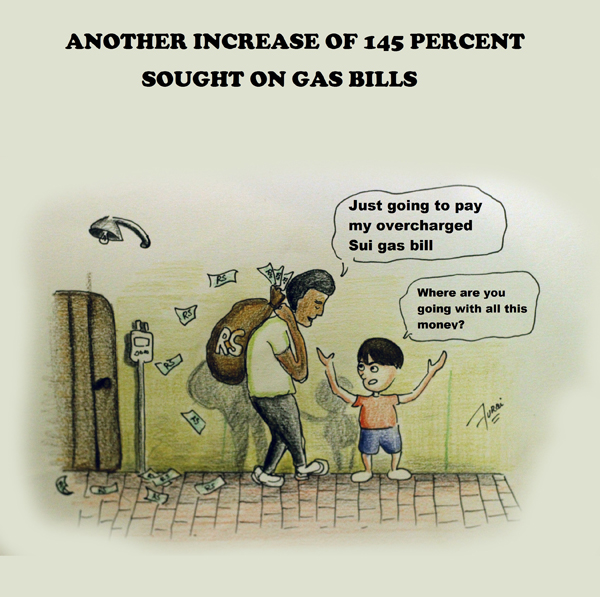

Up to 145pc rise in gas prices sought - The Newspaper's Staff

ISLAMABAD: Up to 145 per cent increase in prescribed gas prices with effect from July 1, 2019 has been sought to meet revenue requirements of the gas utilities for the next financial year, it emerged on Sunday.

The Sui Northern Gas Pipelines Limited (SNGPL) and the Sui Southern Gas Company Limited (SSGCL) have filed their petitions for tariff increase at a time when the Pakistan Tehreek-i-Insaf (PTI) government was still grappling with the political fallout of the 35pc increase it had allowed in October 2018.

In the process, four managing directors of the two companies have since been removed.

The Lahore-based SNGPL that serves Punjab and Khyber Pakhtunkhwa has demanded an average increase of Rs723 to Rs1,224 per MMBTU (Million British Thermal Unit), suggesting a rise of almost 144pc with effect from July 1 for the financial year 2019-20, said an announcement by the Oil & Gas Regulatory Authority (Ogra).

The regulator said the SNGPL had submitted the revised petition on March 19 with the request for an “increase of Rs722.51 per MMBTU in its normal business of natural gas w.e.f July 1, 2019”. As such, the SNGPL’s average prescribed price per unit would rise to Rs1,224 from its existing rate of Rs501.19.

On top of this, the company has also demanded about Rs111.32 per MMBTU under the head of diversion of RLNG to domestic consumers and Rs6,086 per MMBTU on account of LPG business.

Interestingly, the cost of SNGPL’s gas has increased by Rs66 per unit to reach Rs566.97 per unit or about 14pc when compared to its existing average prescribed price of Rs501 per unit but it was trying to recover shortfalls in revenue requirements of two years, including that of the current fiscal year.

Seeking increase in average prescribed price, the SNGPL gave a break up saying it be compensated for Rs62.3 per MMBTU, Rs98 per unit for operating cost, Rs70 per unit for guaranteed return on assets and Rs23per unit for late payment surcharge and short-term borrowing. The company demanded Rs381.54 per unit shortfall during fiscal year 2017-18 and Rs56.95 per unit for shortfall in 2018-19.

Separately, the other gas company, the SSGCL, has sought about Rs106.54 increase in its average prescribed price of Rs591.67 per unit to reach Rs698.21.

The cost of SSGCL’s gas has estimated an increase of about Rs50 per unit to Rs642 per unit from its existing prescribed price of Rs592 per unit. It sought an increase of Rs64 per unit increase in operating cost, Rs17 per unit depreciation and Rs22 per unit increase for return on assets.

Domestic gas prices are linked to international oil prices under various petroleum policies.

Prime Minister Imran Khan has repeatedly said the gas companies were losing more than Rs50 billion to theft and mismanagement.

Under the law, the regulator is required to hold public hearings on the request of gas companies and then forward its determination to the government latest by May 20.

The government is required under the law to seek any change, if it considers so, to the proposed increase for various consumer categories within 40 days to Ogra for notification with effect from July 1 but without affecting the overall determined revenues.

The gas prices are changed twice a year – on the first of July and January. Because of political transition, the last gas price increase came into effect on September 27, 2018 instead of July 1. The 35pc average price increase of September was affected with a target to recover additional revenue of Rs116 billion, while high-consumption domestic consumers faced the highest 143pc increase.

Ogra had originally recommended an 186pc increase for the first two slabs of domestic consumers and a 30pc increase for most of other categories in industry, commercial, power sectors, etc. The government, however, diverted the burden from domestic consumers to electricity, industry, commercial and fertiliser sectors that would indirectly spread out to all consumers and categories.

Cheers

ISLAMABAD: Up to 145 per cent increase in prescribed gas prices with effect from July 1, 2019 has been sought to meet revenue requirements of the gas utilities for the next financial year, it emerged on Sunday.

The Sui Northern Gas Pipelines Limited (SNGPL) and the Sui Southern Gas Company Limited (SSGCL) have filed their petitions for tariff increase at a time when the Pakistan Tehreek-i-Insaf (PTI) government was still grappling with the political fallout of the 35pc increase it had allowed in October 2018.

In the process, four managing directors of the two companies have since been removed.

The Lahore-based SNGPL that serves Punjab and Khyber Pakhtunkhwa has demanded an average increase of Rs723 to Rs1,224 per MMBTU (Million British Thermal Unit), suggesting a rise of almost 144pc with effect from July 1 for the financial year 2019-20, said an announcement by the Oil & Gas Regulatory Authority (Ogra).

The regulator said the SNGPL had submitted the revised petition on March 19 with the request for an “increase of Rs722.51 per MMBTU in its normal business of natural gas w.e.f July 1, 2019”. As such, the SNGPL’s average prescribed price per unit would rise to Rs1,224 from its existing rate of Rs501.19.

On top of this, the company has also demanded about Rs111.32 per MMBTU under the head of diversion of RLNG to domestic consumers and Rs6,086 per MMBTU on account of LPG business.

Interestingly, the cost of SNGPL’s gas has increased by Rs66 per unit to reach Rs566.97 per unit or about 14pc when compared to its existing average prescribed price of Rs501 per unit but it was trying to recover shortfalls in revenue requirements of two years, including that of the current fiscal year.

Seeking increase in average prescribed price, the SNGPL gave a break up saying it be compensated for Rs62.3 per MMBTU, Rs98 per unit for operating cost, Rs70 per unit for guaranteed return on assets and Rs23per unit for late payment surcharge and short-term borrowing. The company demanded Rs381.54 per unit shortfall during fiscal year 2017-18 and Rs56.95 per unit for shortfall in 2018-19.

Separately, the other gas company, the SSGCL, has sought about Rs106.54 increase in its average prescribed price of Rs591.67 per unit to reach Rs698.21.

The cost of SSGCL’s gas has estimated an increase of about Rs50 per unit to Rs642 per unit from its existing prescribed price of Rs592 per unit. It sought an increase of Rs64 per unit increase in operating cost, Rs17 per unit depreciation and Rs22 per unit increase for return on assets.

Domestic gas prices are linked to international oil prices under various petroleum policies.

Prime Minister Imran Khan has repeatedly said the gas companies were losing more than Rs50 billion to theft and mismanagement.

Under the law, the regulator is required to hold public hearings on the request of gas companies and then forward its determination to the government latest by May 20.

The government is required under the law to seek any change, if it considers so, to the proposed increase for various consumer categories within 40 days to Ogra for notification with effect from July 1 but without affecting the overall determined revenues.

The gas prices are changed twice a year – on the first of July and January. Because of political transition, the last gas price increase came into effect on September 27, 2018 instead of July 1. The 35pc average price increase of September was affected with a target to recover additional revenue of Rs116 billion, while high-consumption domestic consumers faced the highest 143pc increase.

Ogra had originally recommended an 186pc increase for the first two slabs of domestic consumers and a 30pc increase for most of other categories in industry, commercial, power sectors, etc. The government, however, diverted the burden from domestic consumers to electricity, industry, commercial and fertiliser sectors that would indirectly spread out to all consumers and categories.

Cheers

Terroristan - October 8, 2018

Pakistan won’t be importing oil as new reserves found near Karachi: Says PM - Web Desk

“We are hopeful of finding large reserves of gas and oil near the sea in Karachi. The nation should pray for this and I will soon share good news regarding this,” he said.

“God willing the reserves will be so large that we will not need to import any oil,” he shared.

Highlighting the current account deficit- a major economic challenge, Prime Minister Imran Khan said that, “I expect the nation to support me.”

“China, Malaysia, Saudi Arabia and UAEare investing in Pakistan,” he stated.

On the increase in gas prices, the premier said, “The hike in tariffs is owing to a short fall of gas and liquified natural gas (LNG). We buy @ 1,400 cubic feet of gas and sell it for Rs650.”

Cheers“The reason for the energy crisis lies in faulty transmission lines. In previous eras, no work was done on transmission lines,” the premier lamented.

Terroristan - October 8, 2018

Agreement with IMF to be reached soon: Asad Umar -Sanaullah Khan

While speaking to journalists in Islamabad, Umar said Pakistan had not changed its stance in talks with the IMF. He added that the IMF had revised their stance and "the gap" between the IMF and Pakistan had decreased.

On a related note, the finance minister said gas and electricity prices will increase gradually as subsidies are withdrawn, adding that the government subsidy on gas and electricity will not be withdrawn together.

He also added that the new IMF mission chief is to arrive in Pakistan tomorrow (March 26) for an introductory visit.

On March 16, Umar had hinted that bailout package talks with the IMF are in their final stages and the government will have further negotiations with the newly appointed IMF mission chief before reaching an agreement.

"Pakistan has come closer to reaching an agreement with the IMF as the differences between Pakistan and the IMF over a possible bailout package have decreased," he had said.

The finance minister had said that a deal would materialise only after a detailed discussion with the IMF mission chief. He made it clear that no final amount for the bailout package had been decided so far, as negotiations were still underway.

Cheers

While speaking to journalists in Islamabad, Umar said Pakistan had not changed its stance in talks with the IMF. He added that the IMF had revised their stance and "the gap" between the IMF and Pakistan had decreased.

On a related note, the finance minister said gas and electricity prices will increase gradually as subsidies are withdrawn, adding that the government subsidy on gas and electricity will not be withdrawn together.

He also added that the new IMF mission chief is to arrive in Pakistan tomorrow (March 26) for an introductory visit.

On March 16, Umar had hinted that bailout package talks with the IMF are in their final stages and the government will have further negotiations with the newly appointed IMF mission chief before reaching an agreement.

"Pakistan has come closer to reaching an agreement with the IMF as the differences between Pakistan and the IMF over a possible bailout package have decreased," he had said.

The finance minister had said that a deal would materialise only after a detailed discussion with the IMF mission chief. He made it clear that no final amount for the bailout package had been decided so far, as negotiations were still underway.

Cheers

Re: Terroristan - October 8, 2018

Check the ease with which the RAPES are lying to the aam abduls and ayeshas that it was IMF that blinked and not atami quwwat pakistanPeregrine wrote:Agreement with IMF to be reached soon: Asad Umar -Sanaullah Khan

While speaking to journalists in Islamabad, Umar said Pakistan had not changed its stance in talks with the IMF. He added that the IMF had revised their stance and "the gap" between the IMF and Pakistan had decreased.

Re: Terroristan - October 8, 2018

IMF needs Pakistan more than Pakistan needs IMF

If IMF does not give loan to Pakistan, Pakistan will take loans from China

IMF should not forget Pakistan lost $50 billion due to war on terror. Lack of funding from IMF will cause Pakistan to cut defense budget, invest more in Nukes, enrage youth, which will disturb strategic stability in South Asia.

If IMF does not give loan to Pakistan, Pakistan will take loans from China

IMF should not forget Pakistan lost $50 billion due to war on terror. Lack of funding from IMF will cause Pakistan to cut defense budget, invest more in Nukes, enrage youth, which will disturb strategic stability in South Asia.

Re: Terroristan - October 8, 2018

I am pretty confused as to whether the statement was sarcastic or deep dive of actual thoughts from a paki mind.Anujan wrote:IMF needs Pakistan more than Pakistan needs IMF

If IMF does not give loan to Pakistan, Pakistan will take loans from China

IMF should not forget Pakistan lost $50 billion due to war on terror. Lack of funding from IMF will cause Pakistan to cut defense budget, invest more in Nukes, enrage youth, which will disturb strategic stability in South Asia.

Terroristan - October 8, 2018

Anujan wrote:IMF needs Pakistan more than Pakistan needs IMF

If IMF does not give loan to Pakistan, Pakistan will take loans from China

IMF should not forget Pakistan lost $50 billion due to war on terror. Lack of funding from IMF will cause Pakistan to cut defense budget, invest more in Nukes, enrage youth, which will disturb strategic stability in South Asia.

sourav JisouravB wrote:I am pretty confused as to whether the statement was sarcastic or deep dive of actual thoughts from a paki mind.

More like "Tongue in Cheek"!

Cheers

Re: Terroristan - October 8, 2018

Pakistanis give animal husbandry a whole new meaning.Mort Walker wrote:^^^I guess if you're fukcing goats makes you happier?

Much of the metrics quoted are wrong. Maybe someone else can shed light on this some more.

Re: Terroristan - October 8, 2018

That happiness report is a joke. The bhikari (Pakistan) is apparently happier than the one providing bheek (China)

-

MeshaVishwas

- BRFite

- Posts: 876

- Joined: 16 Feb 2019 17:20

Re: Terroristan - October 8, 2018

After FATF, APG may also grey-list Pakistan

https://tribune.com.pk/story/1937237/2- ... tan/?amp=1

The noose may be tightening.

https://tribune.com.pk/story/1937237/2- ... tan/?amp=1

The noose may be tightening.

-

Vikas

- BRF Oldie

- Posts: 6828

- Joined: 03 Dec 2005 02:40

- Location: Where DST doesn't bother me

- Contact:

Re: Terroristan - October 8, 2018

If ever there was a bombing campaign by India, It should be first unleashed in Sindh. Those B@stards must face hell even before Pakjabis are brought down to knees. May the land of Sindh never see any water in Sindhu for next decade.

I wish drugs, drought, plague and locust upon them. May they be devoured by Mohajirs and Pathans first and survive underneath the big boot of a Pakjabi.

Sufi-Pasand Sindhis, my foot ?

I wish drugs, drought, plague and locust upon them. May they be devoured by Mohajirs and Pathans first and survive underneath the big boot of a Pakjabi.

Sufi-Pasand Sindhis, my foot ?

Terroristan - October 8, 2018

After FATF, APG may also grey-list Pakistan - Shahbaz Rana

ISLAMABAD: As the Asia/Pacific Group (APG) on Money Laundering begins ‘mutual evaluation’ to gauge Pakistan’s compliance with global anti-money laundering and counter-terrorism financing standards, the country faces the risk of being grey-listed by the APG due to a very high ratio of nearly 70% non-compliance.

The Financial Action Task Force (FATF) has already grey-listed Pakistan with effect from June 2018 and any adverse findings by the APG – as a result of its March 26-28 inspections – could further complicate problems for the government.

The APG is the FATF-style regional body for the Asia-Pacific region. It is an inter-governmental organisation founded in 1997 in Bangkok. The mutual evaluation process by the APG is separate from the FATF but it is based on the implementation of 40 FATF recommendations.

The APG delegation arrived in Islamabad on Monday to conduct last on-site mutual evaluation of Pakistan that began in June 2018. It will be last face-to-face meeting by the mutual evaluation team, suggesting that Islamabad does not have the luxury to take a lenient approach. The APG has done Pakistan’s second mutual evaluation in the past ten years. The last mutual evaluation took place in 2009.

The mutual evaluation would be based on a third draft of technical compliance annexure that the APG shared with Pakistan this month. There is not much difference between the first and the latest draft technical annexure, a senior Finance Ministry official who has seen the report told The Express Tribune.

The APG Executive Secretary Gordon Hook would lead the delegation that is comprised of experts from the United Kingdom, the United States, Turkey, China, Indonesia, and Maldives.

The experts would hold meetings with the State Bank of Pakistan (SBP), the Securities and Exchange Commission of Pakistan (SECP), the Federal Investigation Agency (FIA), the National Accountability Bureau (NAB), provincial Counter Terrorism Departments (CTDs) and other law enforcement agencies.

“If we go by the third draft of technical annexure shared by the APG, there are high risks of being declared non-compliant,” said a senior government official who is directly working on the mutual evaluation. Out of 40 recommendations, the APG has provisionally assessed Pakistan non-compliant on nearly 28 recommendations, he added.

Clock ticking on FATF action plan implementation

He said the country has to be fully compliant or largely compliant with at least 23 recommendations to avoid the grey list. Pakistan is already on the grey list of the FATF and even if it successfully implemented all the 27 actions determined by the FATF, its fate will hinge on the mutual evaluation report outcome.

It has also been conveyed to Finance Minister Asad Umar that the situation could worsen for Pakistan if it did not improve ranking on at least 8 to 10 recommendations, said another official who works for a counter-terrorism authority.

Umar chaired the National Executive Committee on Anti Money Laundering last week. He set up various sub-groups that would work in areas that could help improving compliance on both the FATF’s 40 recommendations and the 27-point action plan of the FATF.

A proper and coordinated response by all the domestic stakeholders was very critical to improve the compliance status of Pakistan. Officials said all the stakeholders were not on the same page, which not only created difficulties during Oct 2018 on-site inspection but might also create problems this time.

The Finance Ministry sources claimed that Pakistan was expecting to improve its rating on at least eight to ten recommendations that relate to the SECP, the Financial Monetary Unit (FMU), the SBP and the Foreign Office.

Out of 40 recommendations, Pakistan is fully compliant with hardly two, largely compliant with three and partially to largely compliant with another three. It is either partially compliant or non-compliant with the rest of the recommendations.

But Pakistani authorities believe that they have addressed the APG’s concerns in areas of customer due diligence, beneficial ownerships of legal persons, statistics, record keeping, money or value transfer services, new technologies, wire transfers, international cooperation, nuclear non-proliferation and targeted financial sanctions related to terrorism and terrorism financing.

After this last on-site visit, the APG would finalise its draft report that is expected to be shared with Islamabad by the end of April or early May for its comments. After Pakistan’s response, the Mutual Evaluation Report will be presented in the Annual General Meeting of the APG that is expected to take place in August. The APG meeting would either accept the report or suggest changes to it.

In case of the worst outcome, Pakistan may have to implement yet another Action Plan from October onwards. The FATF’s Action Plan implementation deadline is September this year. The February’s review on the implementation of the FATF Action Plan did not go well, which has increased pressure on Pakistan.

The next FATF review would take place in June in Washington and before that Pakistan will have to show compliance on 16 points that have been agreed for May in addition to three issues that were left out in the last review.

Cheers

ISLAMABAD: As the Asia/Pacific Group (APG) on Money Laundering begins ‘mutual evaluation’ to gauge Pakistan’s compliance with global anti-money laundering and counter-terrorism financing standards, the country faces the risk of being grey-listed by the APG due to a very high ratio of nearly 70% non-compliance.

The Financial Action Task Force (FATF) has already grey-listed Pakistan with effect from June 2018 and any adverse findings by the APG – as a result of its March 26-28 inspections – could further complicate problems for the government.

The APG is the FATF-style regional body for the Asia-Pacific region. It is an inter-governmental organisation founded in 1997 in Bangkok. The mutual evaluation process by the APG is separate from the FATF but it is based on the implementation of 40 FATF recommendations.

The APG delegation arrived in Islamabad on Monday to conduct last on-site mutual evaluation of Pakistan that began in June 2018. It will be last face-to-face meeting by the mutual evaluation team, suggesting that Islamabad does not have the luxury to take a lenient approach. The APG has done Pakistan’s second mutual evaluation in the past ten years. The last mutual evaluation took place in 2009.

The mutual evaluation would be based on a third draft of technical compliance annexure that the APG shared with Pakistan this month. There is not much difference between the first and the latest draft technical annexure, a senior Finance Ministry official who has seen the report told The Express Tribune.

The APG Executive Secretary Gordon Hook would lead the delegation that is comprised of experts from the United Kingdom, the United States, Turkey, China, Indonesia, and Maldives.

The experts would hold meetings with the State Bank of Pakistan (SBP), the Securities and Exchange Commission of Pakistan (SECP), the Federal Investigation Agency (FIA), the National Accountability Bureau (NAB), provincial Counter Terrorism Departments (CTDs) and other law enforcement agencies.

“If we go by the third draft of technical annexure shared by the APG, there are high risks of being declared non-compliant,” said a senior government official who is directly working on the mutual evaluation. Out of 40 recommendations, the APG has provisionally assessed Pakistan non-compliant on nearly 28 recommendations, he added.

Clock ticking on FATF action plan implementation

He said the country has to be fully compliant or largely compliant with at least 23 recommendations to avoid the grey list. Pakistan is already on the grey list of the FATF and even if it successfully implemented all the 27 actions determined by the FATF, its fate will hinge on the mutual evaluation report outcome.

It has also been conveyed to Finance Minister Asad Umar that the situation could worsen for Pakistan if it did not improve ranking on at least 8 to 10 recommendations, said another official who works for a counter-terrorism authority.

Umar chaired the National Executive Committee on Anti Money Laundering last week. He set up various sub-groups that would work in areas that could help improving compliance on both the FATF’s 40 recommendations and the 27-point action plan of the FATF.

A proper and coordinated response by all the domestic stakeholders was very critical to improve the compliance status of Pakistan. Officials said all the stakeholders were not on the same page, which not only created difficulties during Oct 2018 on-site inspection but might also create problems this time.

The Finance Ministry sources claimed that Pakistan was expecting to improve its rating on at least eight to ten recommendations that relate to the SECP, the Financial Monetary Unit (FMU), the SBP and the Foreign Office.

Out of 40 recommendations, Pakistan is fully compliant with hardly two, largely compliant with three and partially to largely compliant with another three. It is either partially compliant or non-compliant with the rest of the recommendations.

But Pakistani authorities believe that they have addressed the APG’s concerns in areas of customer due diligence, beneficial ownerships of legal persons, statistics, record keeping, money or value transfer services, new technologies, wire transfers, international cooperation, nuclear non-proliferation and targeted financial sanctions related to terrorism and terrorism financing.

After this last on-site visit, the APG would finalise its draft report that is expected to be shared with Islamabad by the end of April or early May for its comments. After Pakistan’s response, the Mutual Evaluation Report will be presented in the Annual General Meeting of the APG that is expected to take place in August. The APG meeting would either accept the report or suggest changes to it.

In case of the worst outcome, Pakistan may have to implement yet another Action Plan from October onwards. The FATF’s Action Plan implementation deadline is September this year. The February’s review on the implementation of the FATF Action Plan did not go well, which has increased pressure on Pakistan.

The next FATF review would take place in June in Washington and before that Pakistan will have to show compliance on 16 points that have been agreed for May in addition to three issues that were left out in the last review.

Cheers

Re: Terroristan - October 8, 2018

^LOL, what about the news and articles in the Paki press a few weeks back claiming that the whole world and FATF were happy with Pakiland and only Indians were raising objections. They are so full of crap as usual.

Re: Terroristan - October 8, 2018

You need help?Vikas wrote:If ever there was a bombing campaign by India, It should be first unleashed in Sindh. Those B@stards must face hell even before Pakjabis are brought down to knees. May the land of Sindh never see any water in Sindhu for next decade.

I wish drugs, drought, plague and locust upon them. May they be devoured by Mohajirs and Pathans first and survive underneath the big boot of a Pakjabi.

Sufi-Pasand Sindhis, my foot ?

Terroristan - October 8, 2018

X Posted on the P E S W Thread

State Bank slashes growth forecast, again - Shahid Iqbal

State Bank slashes growth forecast, again - Shahid Iqbal

KARACHI: Growth in the current fiscal year will “moderate significantly”, the State Bank of Pakistan (SBP) said in its second quarterly report released on Monday.

It is now projected to land in a range between 3.5 and 4 per cent, indicating sharp decline compared to 5.2pc growth in FY18 or the target of 6.2pc for the current fiscal year.

The sharp deceleration is already visible across the board, according to the report, and is attributable to slower growth in agriculture as well as “stabilisation measures taken to preserve macroeconomic stability.”

CheersIn the previous quarterly report the SBP had downgraded the growth forecast to a range between 4.0 and 4.5pc, significantly lower from the starting year target of 6.4pc. With the further downgrade the growth rate is approaching nearly half of what it was expected to be when the fiscal year began.

Terroristan - October 8, 2018

X Posted on the P E S W Thread

World Bank advises Pakistan to set currency free of state control - Salman Siddiqui

KARACHI : Following the International Monetary Fund (IMF), the World Bank (WB) has also suggested to Pakistan to leave its currency free from state control to let it find equilibrium against the dollar and other major currencies in a bid to help domestic economy grow to its true potential.

“The [rupee-dollar] exchange rate should be based on market system,” World Bank Group Country Director for Pakistan Patchamuthu Illangovan said while addressing at C100 Think Tank on Monday.

He added that state’s control over currency restricted export growth, resulting into partial consumption of the State Bank of Pakistan’s foreign currency reserves to finance international payments mainly on import and debt repayment counters and created balance of payment deficit.

“If you had retailed the 2005 market share of export globally (then) today you would have been exporting four times more than what you should be today,” he said, “Pakistan’s exports would have been worth over $108 billion today instead of around $25 billion in actual.”

Earlier, the IMF urged Pakistan to leave rupee free from the state’s control as a measure to help the economy flourish. To recall, Pakistan has been in talks with the international monetary institution to obtain a bailout for covering financing gaps on external front and fixing the faltering economy through structural reforms.

Giving reference to the World Bank’s recently launched report “Pakistan@100: Shaping The Future 2047”, Illangovan said the government has appreciated the anticipation which suggests Pakistani economy potential at $2 trillion by 2047, subject to controlling population growth rate and massive policy making and structural reforms. Patchamuthu Illangovan Sings "Glory Glory Hallelujah"

GDP growth at 30-35%

The country director further said Pakistan can achieve the projected economic potential much before 2047 if it removes gender inequality by encouraging women to pay their part in economic development.

“Pakistan’s economy has a potential to grow at 30-35% per annum if gender gap is narrowed close to equal,” he said. He, however, simultaneously urged private sector to equally play their important role in shaping Pakistan’s future.

“Targets (in the report) are achievable. Government cannot do it all alone as the private sector needs to come forward…create investment climate,” he said, adding Pakistan outperformed its regional peers till the 1960s.

Later on, however, the rate of investment in Pakistan fell to a historical low of about almost half of what other countries maintained in South Asia.

The World Bank country director further remarked Pakistan had done a remarkable job in promoting ease of doing business and poverty alleviation in recent years but it needs to further progress on these fronts. He urged parliamentarians to devise a policy to fight against water scarcity in the country.

Meanwhile, World Bank Group Chief Economist Hans Timmer said financial crisis comes after every 40 years at a global level and reshapes the world economy.

“The 2008 recession shifted economic power to the US while China is becoming a dominant player,” noted Timmer, urging nations, particularly Pakistan, to deploy technology for achieving economic growth.

KASBL CEO and Former Chairman Pakistan Stock Exchange Munir Kamal said Pakistan’s economy has lagged behind India, Bangladesh and Vietnam because they grew their exports through taking full advantage of economic growth in China.

He urged Pakistan to do the same through linking supplies to China from three under construction special economic zones which are part of the greater China-Pakistan Economic Corridor (CPEC).

Cheers

World Bank advises Pakistan to set currency free of state control - Salman Siddiqui

KARACHI : Following the International Monetary Fund (IMF), the World Bank (WB) has also suggested to Pakistan to leave its currency free from state control to let it find equilibrium against the dollar and other major currencies in a bid to help domestic economy grow to its true potential.

“The [rupee-dollar] exchange rate should be based on market system,” World Bank Group Country Director for Pakistan Patchamuthu Illangovan said while addressing at C100 Think Tank on Monday.

He added that state’s control over currency restricted export growth, resulting into partial consumption of the State Bank of Pakistan’s foreign currency reserves to finance international payments mainly on import and debt repayment counters and created balance of payment deficit.

“If you had retailed the 2005 market share of export globally (then) today you would have been exporting four times more than what you should be today,” he said, “Pakistan’s exports would have been worth over $108 billion today instead of around $25 billion in actual.”

Earlier, the IMF urged Pakistan to leave rupee free from the state’s control as a measure to help the economy flourish. To recall, Pakistan has been in talks with the international monetary institution to obtain a bailout for covering financing gaps on external front and fixing the faltering economy through structural reforms.

Giving reference to the World Bank’s recently launched report “Pakistan@100: Shaping The Future 2047”, Illangovan said the government has appreciated the anticipation which suggests Pakistani economy potential at $2 trillion by 2047, subject to controlling population growth rate and massive policy making and structural reforms. Patchamuthu Illangovan Sings "Glory Glory Hallelujah"

GDP growth at 30-35%

The country director further said Pakistan can achieve the projected economic potential much before 2047 if it removes gender inequality by encouraging women to pay their part in economic development.

“Pakistan’s economy has a potential to grow at 30-35% per annum if gender gap is narrowed close to equal,” he said. He, however, simultaneously urged private sector to equally play their important role in shaping Pakistan’s future.

“Targets (in the report) are achievable. Government cannot do it all alone as the private sector needs to come forward…create investment climate,” he said, adding Pakistan outperformed its regional peers till the 1960s.

Later on, however, the rate of investment in Pakistan fell to a historical low of about almost half of what other countries maintained in South Asia.

The World Bank country director further remarked Pakistan had done a remarkable job in promoting ease of doing business and poverty alleviation in recent years but it needs to further progress on these fronts. He urged parliamentarians to devise a policy to fight against water scarcity in the country.

Meanwhile, World Bank Group Chief Economist Hans Timmer said financial crisis comes after every 40 years at a global level and reshapes the world economy.

“The 2008 recession shifted economic power to the US while China is becoming a dominant player,” noted Timmer, urging nations, particularly Pakistan, to deploy technology for achieving economic growth.

KASBL CEO and Former Chairman Pakistan Stock Exchange Munir Kamal said Pakistan’s economy has lagged behind India, Bangladesh and Vietnam because they grew their exports through taking full advantage of economic growth in China.

He urged Pakistan to do the same through linking supplies to China from three under construction special economic zones which are part of the greater China-Pakistan Economic Corridor (CPEC).

Cheers

Re: Terroristan - October 8, 2018

https://www.dawn.com/news/1472015/why-d ... der-firing

Read in full and some very important datapoints to understand the impact on POK both of Paki terrorist propensity, and the Indian reaction to it, apart from the pathetic nature of Paki society and women's rights in particular.Why don't Kashmiri women want to hide in bunkers during cross-border firing?

“When you’re so close to each other, in this small space, you can understand what would transpire."

“After the 2005 earthquake, several girls were kidnapped, sexually abused or raped in the camps. We had all heard stories about what happened to them… we didn’t want to risk our safety or that of our children… so we picked up our belongings and came here instead…”

Re: Terroristan - October 8, 2018

Moeed Yusuf, the slimy snake oil salesman and spokesman/point-man for the ISI in foreign capitals, writes a column in Dawn:

https://www.dawn.com/news/1471933/going-forward

Provides a valuable insight into what the thinking is and what they are trying to do.

1> Narrative that the 'isolate Pakistan' policy hasn't worked. You hear Pakis screaming about this all the time, but the hope is that some like minded Indians will peddle this narrative within India, where they hope to influence public and govt opinion through that.

2> Quote:

"Pulwama showed that there isn’t a military option left in South Asia. India’s deterrent doesn’t work at sub-conventional, limited-escalation levels. Major war — where India has an advantage — is both unacceptable to the world and ultimately suicidal."

Based on the above reading of the conflict, they seem to either

a> Genuinely misread the situation and the way that it was seen in India and the rest of the world

or

b> Seeking to push that narrative as a propaganda exercise, to their own population but more importantly to India and Paki-loving (for political expediency or whatever reason) Indians.

3> Pushing hard for deescalation and peace talks as a tactical/taquiya move as the less insane among the Pakis see it as their only chance of some negotiated deal to their advantage, before India moves on to a different league (in their minds that is, India in reality has always been in a different league) and becomes too strong to pay any attention to them (power differential growing in his words).

It could also be that the Pulwama attack was engineered specifically to draw Indian retaliation followed by 'international kammunity' pressure, and all the Paki shills in India and the West advocating for some kind of talks and negotiation. Pakis keep repeating ad nauseum that they want 'resolution of issues through talks' and this is basically what they have in mind.

4> They are still under the delusion that India or the world cares about the militancy and unrest in Kashmir, and view it as leverage to get India to negotiate with them, so there will be a lot more support for militancy and terrorism.

5> The new generation of Indian media (flawed and useless as they seem to jingos) have really unnerved them. It looks like they had gotten used to the timid self loathing anchors of the past and downright mischievous ones like Rajdeep/Sagarika with MSA type losers getting a lot of attention, and assumed that the average Indian is timid and scared. The recent media coverage has shown them a large population baying for Paki blood, aptly reinforced by media narratives. However they still chalk that down to media whipping up emotions, due to cognitive dissonance or plain dishonesty on their part.

https://www.dawn.com/news/1471933/going-forward

Provides a valuable insight into what the thinking is and what they are trying to do.

1> Narrative that the 'isolate Pakistan' policy hasn't worked. You hear Pakis screaming about this all the time, but the hope is that some like minded Indians will peddle this narrative within India, where they hope to influence public and govt opinion through that.

2> Quote:

"Pulwama showed that there isn’t a military option left in South Asia. India’s deterrent doesn’t work at sub-conventional, limited-escalation levels. Major war — where India has an advantage — is both unacceptable to the world and ultimately suicidal."

Based on the above reading of the conflict, they seem to either

a> Genuinely misread the situation and the way that it was seen in India and the rest of the world

or

b> Seeking to push that narrative as a propaganda exercise, to their own population but more importantly to India and Paki-loving (for political expediency or whatever reason) Indians.

3> Pushing hard for deescalation and peace talks as a tactical/taquiya move as the less insane among the Pakis see it as their only chance of some negotiated deal to their advantage, before India moves on to a different league (in their minds that is, India in reality has always been in a different league) and becomes too strong to pay any attention to them (power differential growing in his words).

It could also be that the Pulwama attack was engineered specifically to draw Indian retaliation followed by 'international kammunity' pressure, and all the Paki shills in India and the West advocating for some kind of talks and negotiation. Pakis keep repeating ad nauseum that they want 'resolution of issues through talks' and this is basically what they have in mind.

4> They are still under the delusion that India or the world cares about the militancy and unrest in Kashmir, and view it as leverage to get India to negotiate with them, so there will be a lot more support for militancy and terrorism.

5> The new generation of Indian media (flawed and useless as they seem to jingos) have really unnerved them. It looks like they had gotten used to the timid self loathing anchors of the past and downright mischievous ones like Rajdeep/Sagarika with MSA type losers getting a lot of attention, and assumed that the average Indian is timid and scared. The recent media coverage has shown them a large population baying for Paki blood, aptly reinforced by media narratives. However they still chalk that down to media whipping up emotions, due to cognitive dissonance or plain dishonesty on their part.

Terroristan - October 8, 2018

X Posted on the P E S W Thread

Soup onullah! L'évacuation du matin a frappé le ventilateur!

Pakistan’s financing needs may hit $50b in next 2 years - Shahbaz Rana

ISLAMABAD: Pakistan’s gross financing needs in the next two years could hit a minimum $50 billion and it will have to get short-term debt rolled over besides securing new loans to meet external obligations, said Shahid Kardar, former governor of the central bank on Tuesday.

He stated this while speaking at an event organised by the embassy of Switzerland in Islamabad, which discussed the challenges faced by Pakistan’s economy and the way forward.

Kardar said the International Monetary Fund’s (IMF) financing envelope would not be that big to meet the external financing needs.

As per Pakistan’s entitlement, it can secure a net $6 billion from the IMF after excluding outstanding liabilities, said the former central bank governor.

Even the $50 billion financing requirement, on an average of $25 billion a year, seems very conservative given the external sector challenges being faced today. This requirement is worked out on the assumption of a single-digit current account deficit in dollar terms.

Pakistan remains firm, IMF changes its stance: Umar

It seems that due to the huge external financing requirement, Pakistan’s reliance on the club of friendly countries will continue in coming years or else it will be in trouble.

The government would have to contract nearly $35 billion in the next over two years to meet the financing needs, said Kardar.

Pakistan’s external debt and liabilities have already crossed $100 billion. The amount that will have to be rolled over or rescheduled into long-term loans will be over $15 billion in just two years.

Pakistan’s gross official foreign currency reserves of $10.6 billion have primarily been built on borrowed foreign funds. So far, the government has secured $9.2 billion in emergency loans from China, Saudi Arabia and the United Arab Emirates. Only China gave $4.2 billion since July last year.

IMF asks Pakistan to take decisive actions

The government is contracting expensive commercial loans at a time when it has much cheaper longer-maturity debt available from the World Bank, Asian Development Bank and IMF. However, loans from these countries are pegged with structural reforms, which are often painful and politically unpopular.

Kardar said it seemed that the IMF had frontloaded conditions for the under-discussion programme, which may create serious problems for the government. He was of the view that due to the prevailing macroeconomic conditions, poverty in the country could go up in the next two years.

He said the nature of problems suggested that it would require four years to address the structural issues but the IMF wanted to do most of it upfront, which could be problematic.

Finance Minister Asad Umar said on Monday the IMF had budged from its hard position, hoping that an agreement could be signed by the third week of next month.

Like the finance minister, Kardar also criticised past IMF policies, saying the IMF had failed in its own areas of core competence like taxation. It was on the IMF watch when Pakistan ended up distorting the tax structure including introduction of the concept of higher tax rates for non-filers of tax returns. Ah So! - Of course it is not the Fault of the Stupid Terroristanis!

Umar also blamed the IMF for the current economic mess as the macroeconomic situation could not improve despite signing 21 programmes with the fund.

Kardar said due to the serious nature of structural issues, the average annual growth rate for the next two to three years could be 3%, which would not be sufficient to create adequate job opportunities.

Independent economists have time and again said Pakistan needs to grow at a pace of 8% to absorb the additional 40 million youth, who will enter the labour force over the next 35 years.

Pakistan requires an increase in its investment and savings ratios to create an enabling environment for the creation of jobs. However, low tax revenues have restrained the government’s ability to enhance public investment.

Kardar said this year, the tax-to-GDP ratio may fall below last year’s level of 13% as the Federal Board of Revenue struggled to enhance its collection.

“The federal government also needs to get its act together by curtailing expenditures in areas which fall in the provincial domain,” said Kardar. He also sought a review of the independent power producers (IPPs) policy, which had given undue benefits to the producers at the expense of electricity consumers.

He said the IPPs had been given massive concessions and high rates of return at a time when global prices were going down.

Kardar also struck a positive note, saying the foreign direct investment may pick up due to a semblance of political stability. But foreign investors will only follow a boom that has to be created by domestic investors.

Cheers

Soup onullah! L'évacuation du matin a frappé le ventilateur!

Pakistan’s financing needs may hit $50b in next 2 years - Shahbaz Rana

ISLAMABAD: Pakistan’s gross financing needs in the next two years could hit a minimum $50 billion and it will have to get short-term debt rolled over besides securing new loans to meet external obligations, said Shahid Kardar, former governor of the central bank on Tuesday.

He stated this while speaking at an event organised by the embassy of Switzerland in Islamabad, which discussed the challenges faced by Pakistan’s economy and the way forward.

Kardar said the International Monetary Fund’s (IMF) financing envelope would not be that big to meet the external financing needs.

As per Pakistan’s entitlement, it can secure a net $6 billion from the IMF after excluding outstanding liabilities, said the former central bank governor.

Even the $50 billion financing requirement, on an average of $25 billion a year, seems very conservative given the external sector challenges being faced today. This requirement is worked out on the assumption of a single-digit current account deficit in dollar terms.

Pakistan remains firm, IMF changes its stance: Umar

It seems that due to the huge external financing requirement, Pakistan’s reliance on the club of friendly countries will continue in coming years or else it will be in trouble.

The government would have to contract nearly $35 billion in the next over two years to meet the financing needs, said Kardar.

Pakistan’s external debt and liabilities have already crossed $100 billion. The amount that will have to be rolled over or rescheduled into long-term loans will be over $15 billion in just two years.

Pakistan’s gross official foreign currency reserves of $10.6 billion have primarily been built on borrowed foreign funds. So far, the government has secured $9.2 billion in emergency loans from China, Saudi Arabia and the United Arab Emirates. Only China gave $4.2 billion since July last year.

IMF asks Pakistan to take decisive actions

The government is contracting expensive commercial loans at a time when it has much cheaper longer-maturity debt available from the World Bank, Asian Development Bank and IMF. However, loans from these countries are pegged with structural reforms, which are often painful and politically unpopular.

Kardar said it seemed that the IMF had frontloaded conditions for the under-discussion programme, which may create serious problems for the government. He was of the view that due to the prevailing macroeconomic conditions, poverty in the country could go up in the next two years.

He said the nature of problems suggested that it would require four years to address the structural issues but the IMF wanted to do most of it upfront, which could be problematic.

Finance Minister Asad Umar said on Monday the IMF had budged from its hard position, hoping that an agreement could be signed by the third week of next month.

Like the finance minister, Kardar also criticised past IMF policies, saying the IMF had failed in its own areas of core competence like taxation. It was on the IMF watch when Pakistan ended up distorting the tax structure including introduction of the concept of higher tax rates for non-filers of tax returns. Ah So! - Of course it is not the Fault of the Stupid Terroristanis!

Umar also blamed the IMF for the current economic mess as the macroeconomic situation could not improve despite signing 21 programmes with the fund.

Kardar said due to the serious nature of structural issues, the average annual growth rate for the next two to three years could be 3%, which would not be sufficient to create adequate job opportunities.

Independent economists have time and again said Pakistan needs to grow at a pace of 8% to absorb the additional 40 million youth, who will enter the labour force over the next 35 years.

Pakistan requires an increase in its investment and savings ratios to create an enabling environment for the creation of jobs. However, low tax revenues have restrained the government’s ability to enhance public investment.

Kardar said this year, the tax-to-GDP ratio may fall below last year’s level of 13% as the Federal Board of Revenue struggled to enhance its collection.

“The federal government also needs to get its act together by curtailing expenditures in areas which fall in the provincial domain,” said Kardar. He also sought a review of the independent power producers (IPPs) policy, which had given undue benefits to the producers at the expense of electricity consumers.

He said the IPPs had been given massive concessions and high rates of return at a time when global prices were going down.

Kardar also struck a positive note, saying the foreign direct investment may pick up due to a semblance of political stability. But foreign investors will only follow a boom that has to be created by domestic investors.

Cheers

-

Vikas

- BRF Oldie

- Posts: 6828

- Joined: 03 Dec 2005 02:40

- Location: Where DST doesn't bother me

- Contact:

Re: Terroristan - October 8, 2018

In reality, Pakis never expected a response of this scale to Pulwama. For them it would have been business as usual with some strictness in Kashmir and that's it.

With India crossing the red lines, Paki craziness now is left with puling the trigger of the gun they are pointing at their head.

DIm is clueless and so is his team while crore commanders don't know who will slam them next. It might be the local Abdul getting tired and restless. Also with Afgh theater heating up with new elections and return of the Taliban, Surely Pakis live in interesting times.

With India crossing the red lines, Paki craziness now is left with puling the trigger of the gun they are pointing at their head.

DIm is clueless and so is his team while crore commanders don't know who will slam them next. It might be the local Abdul getting tired and restless. Also with Afgh theater heating up with new elections and return of the Taliban, Surely Pakis live in interesting times.

-

sanjaykumar

- BRF Oldie

- Posts: 6127

- Joined: 16 Oct 2005 05:51

Re: Terroristan - October 8, 2018

^^^

Pulwama showed that there isn’t a military option left in South Asia. India’s deterrent doesn’t work at sub-conventional, limited-escalation levels. Major war — where India has an advantage — is both unacceptable to the world and ultimately suicidal.

Actually Balakot showed that Pakistan's sub-conventional strategy does not work without the US as a benefactor. As they learned, an uninhibited Indian response renders such a policy suicidal for Pakistan. It is especially dangerous for their military, which ha sbeen shown up as incompetent and ineffective. I am not sure how Moeed Yusuf missed this. India's response demonstrated that China cannot replace the US specifically as an indulgent patron, to both Pakistan and more importantly to the Chinese.

You can take a Paki out of Pakistan but.....

Pulwama showed that there isn’t a military option left in South Asia. India’s deterrent doesn’t work at sub-conventional, limited-escalation levels. Major war — where India has an advantage — is both unacceptable to the world and ultimately suicidal.

Actually Balakot showed that Pakistan's sub-conventional strategy does not work without the US as a benefactor. As they learned, an uninhibited Indian response renders such a policy suicidal for Pakistan. It is especially dangerous for their military, which ha sbeen shown up as incompetent and ineffective. I am not sure how Moeed Yusuf missed this. India's response demonstrated that China cannot replace the US specifically as an indulgent patron, to both Pakistan and more importantly to the Chinese.

You can take a Paki out of Pakistan but.....

Re: Terroristan - October 8, 2018

Some Terroristan data from the "World Happiness Report 2019".

https://observingliberalpakistan.blogsp ... -2019.html

https://observingliberalpakistan.blogsp ... -2019.html

Re: Terroristan - October 8, 2018

https://twitter.com/USAmbKabul/status/1 ... 4629656577Some aspects of #cricket apply well in diplomacy, some do not. @ImranKhanPTI, important to resist temptation to ball-tamper with the #Afghanistan peace process and its internal affairs. #AfgPeace

"Official Twitter Account of U.S. Ambassador to the Islamic Republic of Afghanistan John R. Bass."

This was real funny.

Re: Terroristan - October 8, 2018

i mean on Paki happiness index... when u get to kidnap girls... marry ur cousins...marry 4 to 6 times... bugger goats and small kids.. happiness index is gonna be high ??

Re: Terroristan - October 8, 2018

Mazari madam went ballistic when US ambassador in kabul criticised the pak PM

Re: Terroristan - October 8, 2018

X Posted from the Pakistan Economic Stress Watch thread.

The Mohammadden Terrorism Fomenting Islamic Republic of Pakistan is heading towards getting turfed out of the MSCI Emerging Market Index :

Pakistan’s Emerging-Market Status Just Got Into Big Trouble

The Mohammadden Terrorism Fomenting Islamic Republic of Pakistan is heading towards getting turfed out of the MSCI Emerging Market Index :

Pakistan’s Emerging-Market Status Just Got Into Big Trouble

Last edited by arun on 28 Mar 2019 12:50, edited 1 time in total.

Re: Terroristan - October 8, 2018

LOL... by using the phrase 'Little Pygmy' she also indulged in casual racism.

Re: Terroristan - October 8, 2018

Re: USAmbKabul pulling down Dimran's langot..

Happens only when you are beggar nation with delusions of grandeur and obsessed about ishtrategic depth..

I predict that the pakis will overplay their hand as per frickin usual and piss the Trump off severely..

Happens only when you are beggar nation with delusions of grandeur and obsessed about ishtrategic depth..

I predict that the pakis will overplay their hand as per frickin usual and piss the Trump off severely..

Re: Terroristan - October 8, 2018

Ofcourse we know Pak will not change it's behavior. Neither will be go for war."Pulwama showed that there isn’t a military option left in South Asia. India’s deterrent doesn’t work at sub-conventional, limited-escalation levels. Major war — where India has an advantage — is both unacceptable to the world and ultimately suicidal."

We will hit many times. Force Pak in to a arms race and attrition war. It is up to Pak if it wants to go to war..

Terroristan - October 8, 2018

FATF affiliate not happy with steps to block banned groups funding - Khaleeq Kiani

CheersISLAMABAD: A delegation of the Asia-Pacific Group (APG) on money laundering, a regional affiliate of the Financial Action Task Force (FATF), has expressed serious reservations over insufficient physical actions on ground against proscribed organisations (POs) to block flow of funds and activities and is likely to issue a formal warning before its departure on Thursday (today).

Terroristan - October 8, 2018

X Posted on the P E S W Thread

Experts reject claim of major oil, gas discovery - Khalid Mustafa

ISLAMABAD: The Petroleum Division authorities are clueless as to why Prime Minister Imran Khan time and again announces that Pakistan is going to discover the biggest oil and gas reserves in the country’s deep sea, as drilling up to the required depth of 5,500 meters will complete by the end of April.

The Kekra-1 well, G Block has been drilled to a depth of 3,700 meters so far. In a second interaction with the media persons on Monday, Imran again reiterated that Pakistan was going to have a massive oil and gas discovery without knowing the repercussions of his announcements on the stock exchange businesses.

However, till Saturday last, dated January 9, the well was drilled at a depth of 3,700 meters which is far away from the target of 5500 meters.

So it is too much early to claim a major discovery. A top official said he did not know who was briefing the premier at this stage that a major discovery was on the cards. In kekra-1 well, he said, earlier the well was drilled to a depth of 4,900 meters when a high pressure was felt causing huge mud loss and because of unsafe operation the well was plugged. Then the first side tracking started and when it reached down to 3100 meters, then it again met failure which is why the hole was also blocked and now the second side tracking is underway owing to which the well is drilled by 3,700 meter and the target of 5500 meters is still 1,800 meters away, a top relevant official told this reporter quoting the data of ENI — the lead operator of the well. ENI, an Italian company, is operator of the Kekra well-1. Exxon Mobile, OGDCL and Pakistan Petroleum Limited (PPL) are the sleeping partners of the joint venture.

The spud drilling activities at Kekra-1 well was kicked off with $75-80 million by joint venture with 25 percent share each.

He said there were two types of pressure kicks; one’s called the water pressure kick and the other gas pressure kick. The official said the well at the depth of 4,800 meters was plugged because of kick pressure owing to which drilling activities had to be halted on account of huge mud loss. And after pause of some days, from one side, first side tracking process initiated and when drilling reached a depth of 3100 meters it met failure and the first side tracking had also be stopped and now the second side tracking is going on owing to which the drilling has reached the depth of 3,700 meters as of today. However, when contacted Mr Irtiza Sayyed, CEO ExxonMobile, said he was travelling and it was better to ask the ENI which was lead operation of Kekra-1.

ENI country representative Kamran Mian showed his inability to respond to any question saying under protocol he was no allowed to speak about any information on exploration activities at Kekra-1.

Additional Secretary and spokesman for the Petroleum Division Sher Afgan, however, confirmed that when drilling reached a depth of 4,800 meters, the sudden kick pressure came up causing imbalance to the drilling structure owing to which the drilling braved the mud loss.

The ExxonMobile had to again spud the well by 1,500 meters. He confirmed that first side tracking, which after 3100 meters depth, met failure and now the second side tracking was underway.

GA Sabri, former special secretary Ministry of Petroleum and Natural Resources and former DG Oil, said prior to drilling the Kekra-1, the probability of discovery was 19 percent, but after two sides tracking, the probability had reduced.

He said the target was 5,500 meters and ExxonMobile was yet to go 1800 meters deep. He said kick pressure was no sign of a major discovery. He said TOTAL had earlier spud the well in G Block and its depth target was 5,000 meter, but it abandoned the well just before 5,000 meter depth ensuring no discovery.

Ghulam Mustafa, former OGDCL drilling engineer, said he felt that formation pressure was on the higher side whereas mud was on the lower side due to which when high pressure came out the structure got imbalanced. However, he needs the answer as to why the well is plugged, as it could have been managed. He said if the first side tracking had got initiated then why it was also plugged.

Mustafa said now rigs with high technology were being used for ultra-deep exploration activities having the capacity to initiate side tracking from five sides. He shared his experience of exploration activities at well no. 7-A in Dhakni oilfield saying side tracking was done from four sides, but all endeavours met failure.

However, DG Petroleum Concessions Qazi Saleem said the preliminary investment of $75-80 million for drilling endeavour was usually considered in the world of oil and gas as the sunk investment assuming the well emerges as dried one. The drilling activity is always a risky business which is why investment in drilling is named as sunk investment. The DGPC disclosed about 17 wells in Pakistan’s deep sea were drilled in the past, but all endeavours failed. Highlighting the background of the drilling activities done in the past in ultra-deep sea of Pakistan, he said the first offshore well was drilled in 1963 by the US company Sun Oil but the well was found dried.

The same .Sun Oil Company in 1964 spud two wells in Pakistan’s deep sea but both also went dried. After a lapse of eight years, Winter Shall from Germany explored three wells in ultra-deep sea which later on got abandoned as nothing was discovered. He further stated that Winter Shall drilled two wells in 1972 and third one in 1975 but no oil and gas was discovered.

He said in 1976, Marathon Oil Company from US endeavoured for drilling, but nothing was discovered. In 1978, Husky Company from Canada also spud the well, but no success was met. Then after seven years’ time, it was OGDCL that spud the well in 1985, but again no discovery was made. Likewise, in 1989, Occidental company explored the well but that too went dried.

In 1992, Canterbury from New Zealand and in 1999-2000 Ocean company from US spud two wells but both went dried. In 2004, TOTAL — a French company — also explored one well but that was also abandoned.

Pakistan Petroleum Limited tried in 2005 and Shell from Netherlands endeavoured in 2007 and Shark-1 went in 2010 for drilling in Pakistan’s deep sea but all went in vain. In toto, 17 serious attempts were made for wells drilling for oil and gas, but nothing was discovered.

Cheers

Experts reject claim of major oil, gas discovery - Khalid Mustafa

ISLAMABAD: The Petroleum Division authorities are clueless as to why Prime Minister Imran Khan time and again announces that Pakistan is going to discover the biggest oil and gas reserves in the country’s deep sea, as drilling up to the required depth of 5,500 meters will complete by the end of April.

The Kekra-1 well, G Block has been drilled to a depth of 3,700 meters so far. In a second interaction with the media persons on Monday, Imran again reiterated that Pakistan was going to have a massive oil and gas discovery without knowing the repercussions of his announcements on the stock exchange businesses.

However, till Saturday last, dated January 9, the well was drilled at a depth of 3,700 meters which is far away from the target of 5500 meters.

So it is too much early to claim a major discovery. A top official said he did not know who was briefing the premier at this stage that a major discovery was on the cards. In kekra-1 well, he said, earlier the well was drilled to a depth of 4,900 meters when a high pressure was felt causing huge mud loss and because of unsafe operation the well was plugged. Then the first side tracking started and when it reached down to 3100 meters, then it again met failure which is why the hole was also blocked and now the second side tracking is underway owing to which the well is drilled by 3,700 meter and the target of 5500 meters is still 1,800 meters away, a top relevant official told this reporter quoting the data of ENI — the lead operator of the well. ENI, an Italian company, is operator of the Kekra well-1. Exxon Mobile, OGDCL and Pakistan Petroleum Limited (PPL) are the sleeping partners of the joint venture.

The spud drilling activities at Kekra-1 well was kicked off with $75-80 million by joint venture with 25 percent share each.

He said there were two types of pressure kicks; one’s called the water pressure kick and the other gas pressure kick. The official said the well at the depth of 4,800 meters was plugged because of kick pressure owing to which drilling activities had to be halted on account of huge mud loss. And after pause of some days, from one side, first side tracking process initiated and when drilling reached a depth of 3100 meters it met failure and the first side tracking had also be stopped and now the second side tracking is going on owing to which the drilling has reached the depth of 3,700 meters as of today. However, when contacted Mr Irtiza Sayyed, CEO ExxonMobile, said he was travelling and it was better to ask the ENI which was lead operation of Kekra-1.

ENI country representative Kamran Mian showed his inability to respond to any question saying under protocol he was no allowed to speak about any information on exploration activities at Kekra-1.

Additional Secretary and spokesman for the Petroleum Division Sher Afgan, however, confirmed that when drilling reached a depth of 4,800 meters, the sudden kick pressure came up causing imbalance to the drilling structure owing to which the drilling braved the mud loss.

The ExxonMobile had to again spud the well by 1,500 meters. He confirmed that first side tracking, which after 3100 meters depth, met failure and now the second side tracking was underway.

GA Sabri, former special secretary Ministry of Petroleum and Natural Resources and former DG Oil, said prior to drilling the Kekra-1, the probability of discovery was 19 percent, but after two sides tracking, the probability had reduced.

He said the target was 5,500 meters and ExxonMobile was yet to go 1800 meters deep. He said kick pressure was no sign of a major discovery. He said TOTAL had earlier spud the well in G Block and its depth target was 5,000 meter, but it abandoned the well just before 5,000 meter depth ensuring no discovery.

Ghulam Mustafa, former OGDCL drilling engineer, said he felt that formation pressure was on the higher side whereas mud was on the lower side due to which when high pressure came out the structure got imbalanced. However, he needs the answer as to why the well is plugged, as it could have been managed. He said if the first side tracking had got initiated then why it was also plugged.

Mustafa said now rigs with high technology were being used for ultra-deep exploration activities having the capacity to initiate side tracking from five sides. He shared his experience of exploration activities at well no. 7-A in Dhakni oilfield saying side tracking was done from four sides, but all endeavours met failure.

However, DG Petroleum Concessions Qazi Saleem said the preliminary investment of $75-80 million for drilling endeavour was usually considered in the world of oil and gas as the sunk investment assuming the well emerges as dried one. The drilling activity is always a risky business which is why investment in drilling is named as sunk investment. The DGPC disclosed about 17 wells in Pakistan’s deep sea were drilled in the past, but all endeavours failed. Highlighting the background of the drilling activities done in the past in ultra-deep sea of Pakistan, he said the first offshore well was drilled in 1963 by the US company Sun Oil but the well was found dried.

The same .Sun Oil Company in 1964 spud two wells in Pakistan’s deep sea but both also went dried. After a lapse of eight years, Winter Shall from Germany explored three wells in ultra-deep sea which later on got abandoned as nothing was discovered. He further stated that Winter Shall drilled two wells in 1972 and third one in 1975 but no oil and gas was discovered.

He said in 1976, Marathon Oil Company from US endeavoured for drilling, but nothing was discovered. In 1978, Husky Company from Canada also spud the well, but no success was met. Then after seven years’ time, it was OGDCL that spud the well in 1985, but again no discovery was made. Likewise, in 1989, Occidental company explored the well but that too went dried.

In 1992, Canterbury from New Zealand and in 1999-2000 Ocean company from US spud two wells but both went dried. In 2004, TOTAL — a French company — also explored one well but that was also abandoned.

Pakistan Petroleum Limited tried in 2005 and Shell from Netherlands endeavoured in 2007 and Shark-1 went in 2010 for drilling in Pakistan’s deep sea but all went in vain. In toto, 17 serious attempts were made for wells drilling for oil and gas, but nothing was discovered.

Cheers

Re: Terroristan - October 8, 2018

Limited scale escalation will do significant damage to whatever is left of their economy. It will be interesting to see the consequence of an OPEC production cut after the 2020 US presidential elections. Did someone mention Farkhor recently?nam wrote:Ofcourse we know Pak will not change it's behavior. Neither will be go for war."Pulwama showed that there isn’t a military option left in South Asia. India’s deterrent doesn’t work at sub-conventional, limited-escalation levels. Major war — where India has an advantage — is both unacceptable to the world and ultimately suicidal."

We will hit many times. Force Pak in to a arms race and attrition war. It is up to Pak if it wants to go to war..

Re: Terroristan - October 8, 2018

After getting just small aid from so called friends (It is actually a loan) and living day to day hand to mouth, pakis are desperate to let their aam abduls know all ij well and are now reduced to paddling lies and living on false hopes.Peregrine wrote:X Posted on the P E S W Thread

Experts reject claim of major oil, gas discovery - Khalid Mustafa

ISLAMABAD: The Petroleum Division authorities are clueless as to why Prime Minister Imran Khan time and again announces that Pakistan is going to discover the biggest oil and gas reserves in the country’s deep sea, as drilling up to the required depth of 5,500 meters will complete by the end of April.

The Kekra-1 well, G Block has been drilled to a depth of 3,700 meters so far. In a second interaction with the media persons on Monday, Imran again reiterated that Pakistan was going to have a massive oil and gas discovery without knowing the repercussions of his announcements on the stock exchange businesses.

However, till Saturday last, dated January 9, the well was drilled at a depth of 3,700 meters which is far away from the target of 5500 meters.

So it is too much early to claim a major discovery. A top official said he did not know who was briefing the premier at this stage that a major discovery was on the cards. In kekra-1 well, he said, earlier the well was drilled to a depth of 4,900 meters when a high pressure was felt causing huge mud loss and because of unsafe operation the well was plugged. Then the first side tracking started and when it reached down to 3100 meters, then it again met failure which is why the hole was also blocked and now the second side tracking is underway owing to which the well is drilled by 3,700 meter and the target of 5500 meters is still 1,800 meters away, a top relevant official told this reporter quoting the data of ENI — the lead operator of the well. ENI, an Italian company, is operator of the Kekra well-1. Exxon Mobile, OGDCL and Pakistan Petroleum Limited (PPL) are the sleeping partners of the joint venture.

The spud drilling activities at Kekra-1 well was kicked off with $75-80 million by joint venture with 25 percent share each.

He said there were two types of pressure kicks; one’s called the water pressure kick and the other gas pressure kick. The official said the well at the depth of 4,800 meters was plugged because of kick pressure owing to which drilling activities had to be halted on account of huge mud loss. And after pause of some days, from one side, first side tracking process initiated and when drilling reached a depth of 3100 meters it met failure and the first side tracking had also be stopped and now the second side tracking is going on owing to which the drilling has reached the depth of 3,700 meters as of today. However, when contacted Mr Irtiza Sayyed, CEO ExxonMobile, said he was travelling and it was better to ask the ENI which was lead operation of Kekra-1.

ENI country representative Kamran Mian showed his inability to respond to any question saying under protocol he was no allowed to speak about any information on exploration activities at Kekra-1.

Additional Secretary and spokesman for the Petroleum Division Sher Afgan, however, confirmed that when drilling reached a depth of 4,800 meters, the sudden kick pressure came up causing imbalance to the drilling structure owing to which the drilling braved the mud loss.

The ExxonMobile had to again spud the well by 1,500 meters. He confirmed that first side tracking, which after 3100 meters depth, met failure and now the second side tracking was underway.

GA Sabri, former special secretary Ministry of Petroleum and Natural Resources and former DG Oil, said prior to drilling the Kekra-1, the probability of discovery was 19 percent, but after two sides tracking, the probability had reduced.

He said the target was 5,500 meters and ExxonMobile was yet to go 1800 meters deep. He said kick pressure was no sign of a major discovery. He said TOTAL had earlier spud the well in G Block and its depth target was 5,000 meter, but it abandoned the well just before 5,000 meter depth ensuring no discovery.

Ghulam Mustafa, former OGDCL drilling engineer, said he felt that formation pressure was on the higher side whereas mud was on the lower side due to which when high pressure came out the structure got imbalanced. However, he needs the answer as to why the well is plugged, as it could have been managed. He said if the first side tracking had got initiated then why it was also plugged.

Mustafa said now rigs with high technology were being used for ultra-deep exploration activities having the capacity to initiate side tracking from five sides. He shared his experience of exploration activities at well no. 7-A in Dhakni oilfield saying side tracking was done from four sides, but all endeavours met failure.

However, DG Petroleum Concessions Qazi Saleem said the preliminary investment of $75-80 million for drilling endeavour was usually considered in the world of oil and gas as the sunk investment assuming the well emerges as dried one. The drilling activity is always a risky business which is why investment in drilling is named as sunk investment. The DGPC disclosed about 17 wells in Pakistan’s deep sea were drilled in the past, but all endeavours failed. Highlighting the background of the drilling activities done in the past in ultra-deep sea of Pakistan, he said the first offshore well was drilled in 1963 by the US company Sun Oil but the well was found dried.