.....and you wanna know what's funny? The banks had to pay for their rating.Austin wrote:Seems like Moody has downgraded 8 major HK bank over Snowden ?

http://21stcenturywire.com/2013/06/24/m ... arm-of-us/

Perspectives on the global economic meltdown- (Nov 28 2010)

Re: Perspectives on the global economic meltdown- (Nov 28 20

-

Theo_Fidel

Re: Perspectives on the global economic meltdown- (Nov 28 20

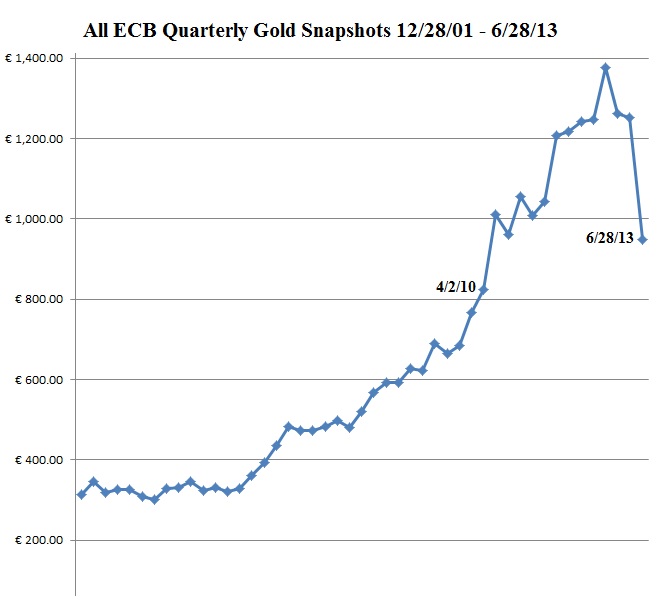

I notice the gold bugs have gone very very quiet lately....

Re: Perspectives on the global economic meltdown- (Nov 28 20

Nothing much happening on the gold front. Temporary drop in value in an overall increasing price trend. Everybody is accumulating.Theo_Fidel wrote:I notice the gold bugs have gone very very quiet lately....

Re: Perspectives on the global economic meltdown- (Nov 28 20

.....backup the truck and load up!RoyG wrote:Nothing much happening on the gold front. Temporary drop in value in an overall increasing price trend. Everybody is accumulating.Theo_Fidel wrote:I notice the gold bugs have gone very very quiet lately....

Re: Perspectives on the global economic meltdown- (Nov 28 20

Russia budget to remain in deficit for next 3 years

The deficit in the federal budget will amount to about 400bn roubles in 2014 ($12bn), and in 2015 and 2016 it will grow to 500bn roubles ($15bn), according to Prime Minister Dmitry Medvedev. That is still less than 1% of GDP, which is not considered big. Slowing GDP growth is one of the main reasons for a growing budget deficit, according to Finance Minister Siluanov. The Russian government will have to optimize their budget spending to maintain macroeconomic stability, Medvedev is reported as saying.

-

member_26147

- BRFite -Trainee

- Posts: 85

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

Government wrangling against credit agencies have been going on for a long time. These agencies kow-tow to the US govt and if they don't they get sued. S&P was sued for billions of dollars in 2013 because they downgraded US sovereign bonds from AAA to AA+. Moodys and Fitch were also 'sued' but they were able to 'settle' because they didn't downgrade US ratings. S&P lawsuit was not dropped. This is a power struggle. Whether the rival credit agency from US firm, Russia and China is a good alternative remains to be seen. China has been cooking its books and the government is in collusion with the banks and its now holding a lot of bad loans on its books, so it remains to be seen if other nations would accept the ratings of this agency. That being said, its a good start to an alternative.

Last edited by member_26147 on 25 Jun 2013 21:56, edited 1 time in total.

-

member_26147

- BRFite -Trainee

- Posts: 85

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

http://finance.yahoo.com/blogs/daily-ti ... 42253.html

In a nutshell, the ‘shadow’ banks borrow from China’s state-controlled banks, use the funds to finance construction projects and sell bonds tied to those projects with yields far above bank savings rates.

“The Ponzi scheme is going on with retail investors…they don’t want 1% or 2% in the bank or even less,” Rickards explains. “The quasi banks come along and say ‘we’ll give you 6%-7%-8%.’ They take the money, invest in these assets that are completely non-productive [with] no way to be able to pay off the debt.”

Re: Perspectives on the global economic meltdown- (Nov 28 20

Please dont make comments on somebody choice of investment model such as Gold or currency

Personal investment decision are their own but we are here to analyse the global economic trends and general trends

Personal investment decision are their own but we are here to analyse the global economic trends and general trends

-

member_26147

- BRFite -Trainee

- Posts: 85

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

Personal investments are one's own, but the collective investment of the people in a country can be analyzed. Especially if it affects the economy of the country.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Who's talking about guaranteed returns? How about letting the market decide what returns people should get. Investing is nothing more than GAMBLING in the stock market, real estate no matter what theory you spin. Gambling is an activity involving risk and reward. Lately the gamblers want the rewards and want to offload their gambling losses onto the rest of society.DhruvP wrote: Who do you propose get cheated? People who invest in promising technologies or people who try to park money to exact guaranteed returns?

Uhh.. why are central banks aka private banks hanging on to thousands of tons of gold while trying to force people to use to use paper money?Do you really think the world will go back to the ages where having saved gold coins will quadruple money somehow with you becoming a gazillionare in some set time say 15 years? If so, you're acting like a fool.

How do you know where the price of gold is going anyway. Have you already proclaimed yourself the all knowing oracle with the right the tell others how to spend their hard earned money?

If that's what you want to do with your (hopefully honestly) earned money, do it.Buying stocks on their valuation based on P/Es, return on shareholders equity, return on invested capital is all gambling.

Don't go around telling others what they should be invested in.

I seem to recall when stocks tank, these losers in the stock markets are always hollering for a bailout & stimulus - i.e. expending other people's money to shore up their losses.

Why are countries going into multi-trillions of dollars of debt & counterfeiting money to the tune of trillions to keep the stock market Ponzi scheme going, pray tell? Weren't they investing in the stock market big time prior to the 2008 crash.To me, with all the data available at my fingertips, investing in stocks is better than putting your trust in gold or clay.

People buy gold or anything else for that matter with the intent of selling it down the line at a much higher price. If they do not sell it now, it is because the price to make them sell it has not been reached. Once they sell it, they acquire things they want. Again, who are you to tell other people how to manage their money ? If you want to invest in stocks, put all 100% of your money in there by all means. Just don't expect that others should be ripped via paper printing just to make your bad investments whole. Or that others should be forced into gambling on the stock market just to push your stock prices higher. Or that govt should expend the wealth of the nation and go into debt to bail out losers and rig markets. That is pure shyster-ism.Gold is a non-driver. Its passive wealth intended to hedge. It locks money. It retards development.

You are back to your delusion that you know what's best for an economy or where prices are headed. Greece did not get anything other than a sh8t load of imploded debt despite a booming stock market circa 2008. There were tons of fools gambling in the Greek stock market who all ended up biting the dust.Its both ways. In India's situation, too much locking of money in gold is holding it back because (guess again) gold is a not a growth driver.

I said IF it goes to 100k. Almost 60,000 paper currencies have existed throughout history and practically all have ended up being worthless - which is to say their value against just about anything is now infinity.Spoken like a true gold bug! Why would the price of gold go to $100K?

Not that I think such a move is coming against the dollar soon but gold at 100k/oz would indicate hyper-inflation. $500 might buy a loaf of bread under such a scenario. Essentially purchasing power is preserved.What does anyone gain when they buy gold at their price?

Since you've already accepted that the multi-trillion dollar debts being wracked up are not going to be repaid, what do you think is the end result for many paper currencies. People are stupid to hold onto paper while its value is being eroded for the benefit of those gambling in the stock market indefinitely. And they're not going to get into the stock market Ponzi either currently being fueled by debt & market rigging rather than productive new innovations. The greater fool theory eventually runs out of fools.

How about letting the people who earned their money decide if they want to invest in gold or stocks (or anything else for that matter) ?How do you know they are not gobbling up Google or Apple? Should these companies or the global economy recover

I'm afraid you can't seem to keep your hands out of other peoples' pocket. There is a terrible tendency to reach into other peoples' pocket and tell them how they're supposed to use their money. Its a mental disease you need to eradicate from your mind.

Any attempt to force people to use their hard earned money the way you want them to use it is tyranny. You are not some all knowing oracle who knows what stocks to invest in no matter how much you fool yourself. If all these fund managers, wealth managers, bankers and assorted scammers had anywhere near the powers of prediction & prophecy they claim to have, they would not need to "manage" other people's wealth for fees nor desperately force the paper money racket upon others. The fact that they need to resort to such shenanigans is evidence they produce nothing of value for a living and they make their living by being shysters.

Re: Perspectives on the global economic meltdown- (Nov 28 20

The title is misleading.

I can see China & Russia setting up a rival to US (govt controlled) rating firms Moody's, S&P and Fitch.

But US would definitely not be setting up a rival to its own monopoly of rating agencies.

The US govt in its attempts to surpress interest rates has been coercing the above 3 rating agencies to continue with their AAA rating for US debt. S&P which tried to lower the rating from AAA to AA was made to fire its chairman just a few days after. Needless to say, the other two (Moodys and Fitch) kept the rating at AAA and did not dare lower it.

It means there is another mispricing of debt going circa pre-2008 and its YET another rigged market waiting to blow up. The only "good"? news is that the market at least knows these ratings are all fake and is beginning to price it in with higher bond yields.

Capitalism has gone out the window, we are living in an era of rigged markets & cronyism. How absurd it is that in a capitalist economy, you have some guy like Bernanke at the top sitting in an ivory tower playing around with multi-trillions of dollars as if he's some all knowing oracle. It beyond absurd that free market capitalism has turned into this joke. Were he to fart on TV, the stock market would probably erase a trillion notional dollars in a few seconds.

-

abhishek_sharma

- BRF Oldie

- Posts: 9664

- Joined: 19 Nov 2009 03:27

Re: Perspectives on the global economic meltdown- (Nov 28 20

These rating agency now exist to put pressure on Growing Economies of BRICS and others it is now a Political Tool in hands of Western Gov than an impartial rating agency.Neshant wrote:The title is misleading.

I can see China & Russia setting up a rival to US (govt controlled) rating firms Moody's, S&P and Fitch.

But US would definitely not be setting up a rival to its own monopoly of rating agencies.

The US govt in its attempts to surpress interest rates has been coercing the above 3 rating agencies to continue with their AAA rating for US debt. S&P which tried to lower the rating from AAA to AA was made to fire its chairman just a few days after. Needless to say, the other two (Moodys and Fitch) kept the rating at AAA and did not dare lower it.

Every body knows and understands that so an alternate rating Agency by BRICS nation should always be welcome.

-

member_26147

- BRFite -Trainee

- Posts: 85

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

The market is deciding what returns people get. Its not you or me. And here you go again, terming investing in stock markets as gambling. You have no substantial argument on this claim but you keep repeating it hoping it to be true. Gambling is betting on odds. Investing is looking at P/Es, market capitalization, profit as a percentage of shareholder's equity etc that you know nothing of. Hence, you term it as gambling.Neshant wrote:Who's talking about guaranteed returns? How about letting the market decide what returns people should get. Investing is nothing more than GAMBLING in the stock market, real estate no matter what theory you spin. Gambling is an activity involving risk and reward. Lately the gamblers want the rewards and want to offload their gambling losses onto the rest of society.DhruvP wrote: Who do you propose get cheated? People who invest in promising technologies or people who try to park money to exact guaranteed returns?

Gold on the other hand has not many industrial uses and yet people jump into it when they get burned without knowledge on how to invest. Since, gold goes up only as a hedge, it is much more closer to gambling than investing in the stock markets.

Central banks are hanging on to gold simply because people hang on to gold. The US government was bold to remove the peg of commodities from its currency and everyone else followed. No matter how much you say or do, will make the world go back to the gold standard. Its just not possible simply because there is not enough gold on this planet to support the new monetary structure.Neshant wrote:

Uhh.. why are central banks aka private banks hanging on to thousands of tons of gold while trying to force people to use to use paper money?

How do you know where the price of gold is going anyway. Have you already proclaimed yourself the all knowing oracle with the right the tell others how to spend their hard earned money?

Also, attacking me only shows that you have no substantial case for gold except to run to it because there is a credit crisis. Based on this, you are intentionally misleading others to park all their money into gold without giving any justifiable cause but instead giving roundabouts on how everything else is gambling except buying the rare yellow metal.

Once again here, you try to attack me simply because you have no substantial reason on why and how gold is good, so you attack me without knowing anything about me, casting doubt in the minds of others that I might not have earned money potentially the honest way. I can say the same thing about you. You could be a crook that is evading taxes and think you can get away by buying gold and hiding it in a bunker. See how ridiculous that sounds?Neshant wrote:If that's what you want to do with your (hopefully honestly) earned money, do it.Buying stocks on their valuation based on P/Es, return on shareholders equity, return on invested capital is all gambling.

Don't go around telling others what they should be invested in.

I seem to recall when stocks tank, these losers in the stock markets are always hollering for a bailout & stimulus - i.e. expending other people's money to shore up their losses.

Do you have any idea of who got the bailout? It was not the people invested in the stock market. It was the people invested in derivatives of real estate. Once again, you have shown absolutely no knowledge and confirm that you're one of the 'sky is falling' type of people.

Countries went into trillions of dollars of debt due to various factors: ageing population that cannot support the social security system, banks lending to people that were not creditworthy to buy a house, banks packaging those loans and stamping them with AAA labels and selling them off to one another to keep themselves safe. Eventually the system caught up and some lost like the Lehmann brothers and Merrill Lynch and were merged into other banks that became more powerful. Nowhere did the stock market come into picture. Honest companies survived and will always survive. They posted record profits and their stock prices eventually recovered. This doesn't seem to go through your head. Instead, you run around like a headless chicken scaremongering people.Neshant wrote:Why are countries going into multi-trillions of dollars of debt & counterfeiting money to the tune of trillions to keep the stock market Ponzi scheme going, pray tell? Weren't they investing in the stock market big time prior to the 2008 crash.To me, with all the data available at my fingertips, investing in stocks is better than putting your trust in gold or clay.

People buy stocks, gold or anything including real estate to sell it down the line at a higher price. What is your point here? People are pulling money out of emerging markets to invest in stocks in western nations. Again you try to attack me here thinking that I somehow am telling people how to manage their money. This is a classic case of pot calling the kettle black. I read through this thread and you have been scaremongering people to put their money in gold for years now. This is a classic case of fear-mongering by gold bugs to increase commodity prices because they are invested in it. Except, in their case, its fear in a crisis and an attempt to increase their commodities investment during a crisis. This is pure absurdity.Neshant wrote:People buy gold or anything else for that matter with the intent of selling it down the line at a much higher price. If they do not sell it now, it is because the price to make them sell it has not been reached. Once they sell it, they acquire things they want. Again, who are you to tell other people how to manage their money ? If you want to invest in stocks, put all 100% of your money in there by all means. Just don't expect that others should be ripped via paper printing just to make your bad investments whole. Or that others should be forced into gambling on the stock market just to push your stock prices higher. Or that govt should expend the wealth of the nation and go into debt to bail out losers and rig markets. That is pure shyster-ism.Gold is a non-driver. Its passive wealth intended to hedge. It locks money. It retards development.

I wasn't the one making the claim that gold prices will hit $100,000.Neshant wrote:You are back to your delusion that you know what's best for an economy or where prices are headed. Greece did not get anything other than a sh8t load of imploded debt despite a booming stock market circa 2008. There were tons of fools gambling in the Greek stock market who all ended up biting the dust.Its both ways. In India's situation, too much locking of money in gold is holding it back because (guess again) gold is a not a growth driver.

When you say a price, you have to justify why that price can be reached. You didn't and you cannot. People used clay tablets as money in the past, then silver and then gold and finally currency. Paper currency will go out too and will be replaced with something else. Money is a medium of creating and conserving wealth. When people realize that gold nuts are over-speculating and will lose money, gold will lose its lustre. And remember, whoever has the biggest guns controls power and the medium of wealth.Neshant wrote:I said IF it goes to 100k. Almost 60,000 paper currencies have existed throughout history and practically all have ended up being worthless - which is to say their value against just about anything is now infinity.Spoken like a true gold bug! Why would the price of gold go to $100K?

I don't see any signs of hyper-inflation in the US. Do you watch peter schiff a lot? If anything, the economy looks like it will go into a double-dip if the Fed stops purchasing. I can see signs of deflation everywhere in the US. Produce is getting cheaper, finished goods are getting cheaper, electronics prices are getting slashed in half. The Fed is trying to prevent that. Your hyper-inflation scenario is not likely.Neshant wrote:Not that I think such a move is coming against the dollar soon but gold at 100k/oz would indicate hyper-inflation. $500 might buy a loaf of bread under such a scenario. Essentially purchasing power is preserved.What does anyone gain when they buy gold at their price?

Neshant wrote:Since you've already accepted that the multi-trillion dollar debts being wracked up are not going to be repaid, what do you think is the end result for many paper currencies. People are stupid to hold onto paper while its value is being eroded for the benefit of those gambling in the stock market indefinitely. And they're not going to get into the stock market Ponzi either currently being fueled by debt & market rigging rather than productive new innovations. The greater fool theory eventually runs out of fools.

Who is not letting the people decide where they want to invest? I'm debating for the case of stocks just like you're debating the case for gold. Equal equal only.Neshant wrote:How about letting the people who earned their money decide if they want to invest in gold or stocks (or anything else for that matter) ?How do you know they are not gobbling up Google or Apple? Should these companies or the global economy recover

Neshant wrote:I'm afraid you can't seem to keep your hands out of other peoples' pocket. There is a terrible tendency to reach into other peoples' pocket and tell them how they're supposed to use their money. Its a mental disease you need to eradicate from your mind.

Fund managers, wealth managers have a disclaimer that says investing in stock market and commodities have risks associated with them. Gold owners on the other hand claim that if everyone buys gold, everyone will become millionaires in a few years by parking their money into a bunker. The fact that they resort to these shenenigans is evidence that they produce nothing of value and are a burden on the economy of their country.Neshant wrote:Any attempt to force people to use their hard earned money the way you want them to use it is tyranny. You are not some all knowing oracle who knows what stocks to invest in no matter how much you fool yourself. If all these fund managers, wealth managers, bankers and assorted scammers had anywhere near the powers of prediction & prophecy they claim to have, they would not need to "manage" other people's wealth for fees nor desperately force the paper money racket upon others. The fact that they need to resort to such shenanigans is evidence they produce nothing of value for a living and they make their living by being shysters.

-

member_26147

- BRFite -Trainee

- Posts: 85

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

Gold nears three-year low; set for record quarterly loss.

http://finance.yahoo.com/news/gold-silv ... 27152.html

http://finance.yahoo.com/news/gold-silv ... 27152.html

The part in bold proves my point that gold speculation is going on at the grass-roots level in India and China. People are taking loans (based on paper currency) for buying gold 'anticipating' hyper-inflation.Prices could slide to levels below $1,000 per ounce, investors and analysts said, with stock markets rising and scant potential for U.S. or European data or developments to reverse an accelerating move out of bullion.

In the latest move, India's central bank told rural regional banks on Tuesday they could no longer provide loans against gold jewellery and coins.

Worries about a liquidity crunch in China, the world's second-largest gold consumer, drove down share prices despite attempts by the Chinese central bank to soothe markets. Physical gold demand could be hurt by a slowdown in Chinese growth, analysts said.

-

member_26147

- BRFite -Trainee

- Posts: 85

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

India's gold imports surged in May and gold and oil imports are one of the driving factors behind India's current account deficit — when the value of imports exceeds that of exports. And the current account deficit can hurt economic growth.

CAD reached a record high of 6.7% of GDP in the last quarter and has been blamed for weakening the Indian rupee.

Read more: http://www.businessinsider.com/india-ra ... xes-2013-6

-

member_26147

- BRFite -Trainee

- Posts: 85

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

http://www.livemint.com/Money/Z3yYqcyua ... holds.htmlAs retail investors we need to understand that buying gold is the easiest way to hedge our portfolios against rupee depreciation, inflation and to introduce global diversification—but this should not be more than 5-10% of the overall portfolio. Equities remain the best inflation hedge over the long term—though the current point to point return numbers look dismal. But remember, equity is a long-term investment and is linked to the growth of the country. And, that democracies have a way of going to the brink, having a gun to the political head before tough decisions are taken. We’re at that point. So, stay with keeping about half the assets in equities. The rest stays in long-term, tax-friendly products that are zero risk. Anything more than that needs a financial planner who works for you and not for his commission. These are tough to find—so stay with the basics and stay safe.

Re: Perspectives on the global economic meltdown- (Nov 28 20

http://www.bloomberg.com/news/2013-06-2 ... axis-.html

Why Are So Many College Graduates Driving Taxis?

Why Are So Many College Graduates Driving Taxis?

It’s a parent’s nightmare: shelling out big money for college, then seeing the graduate unable to land a job that requires high-level skills. This situation may be growing more common, unfortunately, because the demand for cognitive skills associated with higher education, after rising sharply until 2000, has since been in decline.Let’s start with some basic facts. There have always been some graduates who wind up in jobs that don’t require a college degree. But the share seems to be growing. In 1970, only 1 in 100 taxi drivers and chauffeurs in the U.S. had a college degree, according to an analysis of labor statistics by Ohio University’s Richard Vedder, Christopher Denhart and Jonathan Robe. Today, 15 of 100 do.

It’s hard to believe this is because the skill required to drive a taxi has risen substantially since 1970. If anything, GPS technology may have had the opposite effect. (Acquiring “the knowledge” of London streets, as taxi drivers there are required to do, is cognitively challenging, but it may no longer be necessary.)

Falling Wages

Not necessarily, Beaudry and his colleagues argue. They find that while wages for jobs requiring cognitive skills have declined, the shift of high-skilled workers into those jobs has depressed wages for manual workers even more.

That’s a provocative argument. Still, it may be that the Beaudry team’s results are sensitive to the way they define “cognitive” jobs and “manual” ones. Also, it’s not entirely clear how much the recent recession has influenced their results.

In any case, the findings will do little to calm the nerves of graduates who are anxious to find jobs.The cold comfort I can offer is this: Going to college may still be worthwhile -- if not to be sure of qualifying for skilled jobs, then at least to avoid the even worse prospects of those who don’t get a degree.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Other way around.kmkraoind wrote:RBI had purchased 200 tonnes of gold at $1,054 per ounce, now gold is nearing $1300 mark. When RBI purchased gold in Nov 2009, USD-INR was at @46-47, now hovering at 59-60@. It means at rupee terms. Any further fall in gold prices means, RBI is at paper losses.

Gold is purchased in dollars not rupees.

The rupee has depreciated against gold which means the value of gold in rupees has risen not fallen.

The more the rupee falls in value, the greater the value of that initial gold purchase.

Re: Perspectives on the global economic meltdown- (Nov 28 20

If the market is deciding what returns people get, why the need to push people into stock purchases? Or "stimulus" aka running up debt with multi-trillions of dollars? Or print money (aka counterfeit money thereby robbing savers, wage earners & pensioners) to bailout those who are losing in the stock market. Or to limit peoples' purchase of gold with taxes and levies to "manage" people's money into stocks?DhruvP wrote: The market is deciding what returns people get.

Playing with stocks is gambling. You are merely playing odds. Looking at P/E and earnings is looking at the past and betting the future will be based on the past - with a whole lot of it already priced into the stock well before you get a chance to gamble on it.You have no substantial argument on this claim but you keep repeating it hoping it to be true. Gambling is betting on odds.

Investing is looking at P/Es, market capitalization, profit as a percentage of shareholder's equity etc that you know nothing of.

That aside, there's the growing trend of insider trading, high frequency trading, front running and fake statistics being used which you know nothing of.

Not one of these market analysts, money managers, wealth advisors, and other fancy titled paper shufflers looking at P/Es and earnings predicted the 2008 crash.

Central banks are hanging on to gold simply because people hang on to gold.

Central banks hang onto gold and are in fact one of the largest holders of gold because they know historically its the only money that has survived the test of time.

That's as stupid as saying there are not enough trees in the world to support paper money.Its just not possible simply because there is not enough gold on this planet to support the new monetary structure.

Or not enough electrons in the universe to create 1s and 0s to create money.

Gold like anything else is a function of price. At $100k/oz, gold is readily available in the market - everyone wants to sell it and nobody wants to buy it. At $2/oz, nobody would be selling their gold. Price determines availability.

I don't think you even understand what I'm saying.Also, attacking me only shows that you have no substantial case for gold except to run to it because there is a credit crisis.

People who earn the wealth should determine how they should store their wealth, how they should spend/invest their wealth. Some pretend-oracle central banker or money manager sitting in an ivory tower who claims to know what people should be putting their money in a charlatan. He doesn't know any more than anyone else about future price action - though he may pretend to. Inevitably he ends up using his position of power to aid his cronies (private banks in the case of central bankers) and uses nonsensical justification & jargon to tell everyone why stealing their savings & wages is in the best interest of society.

I never said people should invest in gold. I said the people who earn the money should have the right to invest their money as they see fit without pretend-oracles showing up to "manage" or spend the money for them. Money printing, running up national debt to "stimulate" the losses of private bankers to profit, bailouts and other stuff are scams by private bankers to offload the losses of private bankers & high rollers onto others. What I like about gold is that it protects against the latter. But far from me to tell people that they should invest in gold.Based on this, you are intentionally misleading others to park all their money into gold

Do you even know what most derivatives are based on. They are based on options on stocks, options on real estate prices, options on just about everything. The phoney run up in the stock market by taking on trillions in national debt + money printing + outright giveaway of money via "lending" at sub-par interest rates to banks is nothing more than a transfer of money from present & future generations to shore up the leverage gambling bets of bankers. That shoring up is done by temporary price fixing (aka pumping up stocks, real estate) so banking crooks can get out from under their GAMBLING bets unscathed. The corresponding loss is transferred to society. Look its obvious you know next to nothing about this.Do you have any idea of who got the bailout? It was not the people invested in the stock market. It was the people invested in derivatives of real estate.

Did the global population suddenly age in 2008?Countries went into trillions of dollars of debt due to various factors: ageing population that cannot support the social security system,

Are you crazy. The entire derivative bubble is played out on the stock market. Till today the losses are being hidden off the books. Who do you think is going to be made to eat the losses of the implosion of one of the biggest credit bubbles in history. Or do you think the losses simply disappeared into thin air.banks lending to people that were not creditworthy to buy a house, banks packaging those loans and stamping them with AAA labels and selling them off to one another to keep themselves safe. Nowhere did the stock market come into picture.

I don't have to justify anything. It is the market that should decide what the price of something is. That is the whole point of capitalism. Any system trying to "manage" people into investing in some investment based on the visions of an economic tsar sitting in an ivory tower isn't capitalism.When you say a price, you have to justify why that price can be reached.

The good thing about 2008 is that it exposed all these charlatan central bankers as being clueless. Not one of them saw the biggest credit implosion in history even while sitting atop of it - all the while giving speeches about how the fundamentals of the economy are strong and justify rising real estate prices. It turns out they don't know anything about where prices are headed any more than anyone else. Yet they continue pretending as if they do.

During this deflationary crash of 2008, people with cash should have seen a massive sustained rise in the purchasing power of their cash. But this did not happen. The massive gains that these cash holders should have experienced was instead stolen from them through money printing (aka counterfeiting) to shore up the bad gambling bets of private bankers (i.e. pump up the stock market, bailouts, real estate..etc). Inflation is thus the **loss of gains** in purchasing power that cash holders experienced. As Milton Friedman said, inflation is a monetary phenomena (aka money printing) everywhere and always. Not just a rise in prices.I don't see any signs of hyper-inflation in the US.

By the way, when prices of housing and everything else were rising pre-2008, did you notice Bernanke who now talks about "price stability" stayed quiet. When the private banks that setup the Federal Reserve stand to profit from getting people into debt, he's cool with it. When the private banks find they are on the losing side of the trade circa 2008, they holler for bailouts, money printing, "stimulus" spending and other means of transferring their losses onto society. Ever wonder why ?

Ultimately there has to be a deflation - its just a question of who's back the losses will be offloaded. With paper money and central banks (aka private banks) in control of the monetary system, to me its obvious who will end up holding the bag. Its only a question of which way this tree will fall. Will there be a declaration of non-payment of debt via currency devaluation (in which case gold benefits) or will the private bankers force society to pay for their debts through belt tightening (in which case cash is king).If anything, the economy looks like it will go into a double-dip if the Fed stops purchasing. I can see signs of deflation everywhere in the US.

The stock market has nothing driving it except money printing and deficit spending. I get the same feeling with the stock market I got post 2002 in which I could see no driver for its rise. Central bankers are certainly spending gobs of peoples' money by running up debt & printing money to get as many suckers into the stock market to re-inflate the imploded bubble. I'd be willing to bet there is a whole lot of money being expended to pump up the stock market & real estate than the pumping actually generates in real economic activity. i.e. for every dollar spent in deficit pumping, the economy is experiencing far less than a dollar in real returns.People are getting into the stock market like crazy. They are selling bonds like crazy.

Bankers are hoping some great new industry comes along that actually generates real returns to cover the massive cost of this pumping. But if that does not happen soon, the enormous costs of this bogus "stimulus" will be dumped onto the backs of society.

We'll see how this ends.

Isn't that your whole premise. People should use their money the way you want them to. Or people should have their money stolen from them via money printing because some wise oracle at the top claims to know whats best for all.Who is not letting the people decide where they want to invest?

Fund managers, wealth managers, bankers..etc have an interest in keeping the paper money, money printing and inflation going on. There is hardly anything productive this entire banking "industry" generates. Its an entire industry which plies its trade off fraudulent extraction of hard earned wealth from productive society. Watch my favourite video below on the scam of central banking.Fund managers, wealth managers have a disclaimer that says investing in stock market and commodities have risks associated with them.

Re: Perspectives on the global economic meltdown- (Nov 28 20

My favourite video.

The only part I don't like is his recommendation that the monetary system should be based on gold.

The only fair monetary system is one in which the people who earn the wealth get to decide what the medium of wealth preservation and exchange should be. Not someone who decides for them it should be gold or anything else.

Nevertheless, its an excellent exposure of the con artistry of central banking.

The only part I don't like is his recommendation that the monetary system should be based on gold.

The only fair monetary system is one in which the people who earn the wealth get to decide what the medium of wealth preservation and exchange should be. Not someone who decides for them it should be gold or anything else.

Nevertheless, its an excellent exposure of the con artistry of central banking.

Re: Perspectives on the global economic meltdown- (Nov 28 20

"The only fair monetary system is one in which the people who earn the wealth get to decide what the medium of wealth preservation and exchange should be. Not someone who decides for them it should be gold or anything else."

in other words what you want is a barter economy.

in other words what you want is a barter economy.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Some of the Central banks of the more indebted nations may be tempted to liquidate part of their gold holdings and thus further depress the gold market. He points specifically to Cyprus where a report that it might sell a small fraction -- some €400 million ($520 million) -- of its gold reserves may have contributed to triggering a 13% fall in gold prices in April. Countries like Italy, which has massive gold reserves (above $130 billion), could be similarly tempted, driving down prices

Thailand is selling 150 tons of gold. SriLanka is selling 200 tons, HK is selling another 100 tons

Re: Perspectives on the global economic meltdown- (Nov 28 20

Good opportunity for India to buy, but we all know what our finanace minister is going to do.

Re: Perspectives on the global economic meltdown- (Nov 28 20

TSJones wrote:"The only fair monetary system is one in which the people who earn the wealth get to decide what the medium of wealth preservation and exchange should be. Not someone who decides for them it should be gold or anything else."

in other words what you want is a barter economy.

The average guy is too dumb to contemplate any medium of exchange other than printed paper some private bankers tell him is money.

A glimpse into how powerful the market is at creating a medium of exchange is bitcoin. Despite threats of imprisonment made against anyone trying to create a private currency to compete with the paper issued by central banks, the market managed to come up with a decentralized currency that nobody can control or shut down.

All voluntary usage of currencies be it physical or through a digital exchange is barter. It's not barter but robbery when one entity like private bankers forces society to use their paper. This via threats of imprisonment and wealth confiscation as punishment for not participating in their paper racket - which is what taxation payable only in fiat money is all about. Meanwhile these thieves control the printing press - the means of counterfeiting for which they have given themselves legal cover.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Gold is starting to crash through production cost levels

http://finance.yahoo.com/news/gold-cras ... 11104.html

....price should stabilize as miners are put out of business.

http://finance.yahoo.com/news/gold-cras ... 11104.html

....price should stabilize as miners are put out of business.

-

Theo_Fidel

Re: Perspectives on the global economic meltdown- (Nov 28 20

^^^

Not so sure, A huge chunk of the base producers are sitting at marginal costs of $700-$800 +/-. It however take 10 years to bring a gold mine to production, except in china. While the wild cats and weak players will be purged I think gold has a ways to fall. The only thing holding it up from durable demand side was India , Demand of 500 tonnes +/-. Production however exceeds 2,500 tonnes right now. And there is an incredible amount of capacity still coming on stream. Miners have also gotten fat , inefficient and bloated, there is a lot of fat that can be cut still.

Something has to give....

Not so sure, A huge chunk of the base producers are sitting at marginal costs of $700-$800 +/-. It however take 10 years to bring a gold mine to production, except in china. While the wild cats and weak players will be purged I think gold has a ways to fall. The only thing holding it up from durable demand side was India , Demand of 500 tonnes +/-. Production however exceeds 2,500 tonnes right now. And there is an incredible amount of capacity still coming on stream. Miners have also gotten fat , inefficient and bloated, there is a lot of fat that can be cut still.

Something has to give....

Re: Perspectives on the global economic meltdown- (Nov 28 20

Now they are not only forecasting a U.S. dollar and bond crisis and a global financial crisis in 2013, but saying that it will more than likely surpass the one in 2008 substantially.

"The US is close to stall speed and another recession. China is slowing down. Europe is in recession. All the emerging markets are slowing down. Then there is the potential war in the Middle East, a perfect storm... and the same policy bullets are not available as in 2008..."

-

Theo_Fidel

Re: Perspectives on the global economic meltdown- (Nov 28 20

Cash cost for mining gold by different companies. 2012 Cash cost. $500-$1200 type range. There are many mines that are still at $300/oz.

Re: Perspectives on the global economic meltdown- (Nov 28 20

China will speed up the liberalization of the yuan ( via interfax )

Shanghai. June 28. INTERFAX.RU - China will accelerate the liberalization of the yuan, but the process will be flexible, said the People's Bank of China (PBOC) Governor Zhou Xiaochuan.

"The process of making the yuan convertible currency on capital account will be accelerated," - he said, speaking at a financial forum in Shanghai on Friday.

The head of China's Central Bank has not given any specific guidance on the timing, but noted that the plan for the twelfth five-year plan already laid indication of the gradual opening of the capital account, which includes investment. Yuan has a convertible currency on the current account, which includes trade.

Zhou Xiaochuan said that the PBC will continue to implement a prudent monetary policy. He noted that the Central Bank has a variety of tools for the correction of the level of liquidity to stabilize markets.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Seems like weak Rupee is not the only game in town , Rouble too has weakened

Russia backs weaker rouble to boost budget and growth

Russia backs weaker rouble to boost budget and growth

-

nandakumar

- BRFite

- Posts: 1674

- Joined: 10 May 2010 13:37

Re: Perspectives on the global economic meltdown- (Nov 28 20

TheoTheo_Fidel wrote:Cash cost for mining gold by different companies. 2012 Cash cost. $500-$1200 type range. There are many mines that are still at $300/oz.

Should we not also take into account the production of cost of extracting gold from anode slime that remains after smelting of copper? My impression is that this is a major source of fresh gold output in the world. Chinese gold production comes primarily from copper production. The sterlite plant in Tuticorin produces roughly 25 tonnes of gold from the slime that it exports to its subsidiary company in Dubai which converts it into gold. Hindalco's copper plant too has a gold refinery in Dadra Nagar haveli. The extraction cost of gold from anode slime is way below that of current gold prices and hence will keep flooding the market.

nandakumar

Re: Perspectives on the global economic meltdown- (Nov 28 20

A do it youself hedge fund site....

http://finance.yahoo.com/news/financial ... 23956.html

...yes, I trust the quant!

http://finance.yahoo.com/news/financial ... 23956.html

...yes, I trust the quant!

Re: Perspectives on the global economic meltdown- (Nov 28 20

I think world yearly gold consumption could easily handle copper by product gold production. Quite easily....nandakumar wrote: Theo

Should we not also take into account the production of cost of extracting gold from anode slime that remains after smelting of copper? My impression is that this is a major source of fresh gold output in the world. Chinese gold production comes primarily from copper production. The sterlite plant in Tuticorin produces roughly 25 tonnes of gold from the slime that it exports to its subsidiary company in Dubai which converts it into gold. Hindalco's copper plant too has a gold refinery in Dadra Nagar haveli. The extraction cost of gold from anode slime is way below that of current gold prices and hence will keep flooding the market.

nandakumar

Re: Perspectives on the global economic meltdown- (Nov 28 20

The only thing that will make gold go through the roof is the answer to the question :

How is all this debt being wracked up going to be repaid.

How is all this debt being wracked up going to be repaid.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

The change is near.

Re: Perspectives on the global economic meltdown- (Nov 28 20

...hoping for a gold bounce? look east

http://finance.yahoo.com/news/hoping-go ... 00826.html

Indian wedding season will soon arrive...

http://finance.yahoo.com/news/hoping-go ... 00826.html

Indian wedding season will soon arrive...

Re: Perspectives on the global economic meltdown- (Nov 28 20

U.S. Dollar Collapse? Chinas New Gold Currency Coming?