Indian Economy - News & Discussion Oct 12 2013

Re: Indian Economy - News & Discussion Oct 12 2013

Competition Commission set for sweeping powers under IFC

http://www.business-standard.com/articl ... 239_1.html

http://www.business-standard.com/articl ... 239_1.html

Re: Indian Economy - News & Discussion Oct 12 2013

Source please. Your paraphrasing is not reliable, as the previous article demonstrates. We'll form our own judgement based on original information.vina wrote:Then Rajiv Mehrishi, the Finance Secretary came out and said that what was posted in the GOI website is the "People of India's view" and not the GOI's and that the govt has no view on any of the 400 clauses of the IFC!

Re: Indian Economy - News & Discussion Oct 12 2013

Rajan favours removing RBI Governor veto power on deciding rates

http://www.business-standard.com/articl ... 440_1.html

http://www.business-standard.com/articl ... 410_1.html

http://www.business-standard.com/articl ... 746_1.html

http://www.business-standard.com/articl ... 440_1.html

Coal imports drop for first time in 15 monthsRBI Governor Raghuram Rajan today appeared to favour doing away with the veto power of the central bank chief, arguing it would be better for a committee to decide the key rate rather than one individual.

He further said that while the details of the monetary policy committee (MPC) will have to be ironed out, "there are no differences between RBI and the government" on this matter.

"Currently, the situation is governor has a veto, that is, effectively all advice is only advice and ultimately decision is Governor's. So, if we continue to retain a veto, it doesn't change the current situation. It maintains the status quo. That is something to keep in mind," Rajan told reporters here.

The revised draft of the Indian Financial Code (IFC) as released by the Finance Ministry last month had suggested doing away with this veto power and wants the seven-member MPC to take decisions by a majority vote. Of the seven members, four would be government nominees and the rest from RBI.

Listing out "three virtues" of taking the monetary policy decision away from the Governor and giving it to a committee, Rajan said that when a committee decides on rates, it lessens the pressure on individual and also ensures continuity in policy when any single member of a committee changes.

"A committee can represent different view points and study shows that its decisions are typically better than an individual.

Second, spreading the responsibility of the decision can reduce internal and external pressure that falls on an individual. Third, a committee will ensure broad monetary policy continuity when any single member, including Governor, changes," he said.

http://www.business-standard.com/articl ... 410_1.html

Kelkar panel on PPP might push to revive 3P India plansCoal imports fell 11% to 19.3 million tonne in July from a year earlier - the sharpest and the first drop in more than a year - as local supplies rose and money losing power generators held up purchases, commodities trader mjunction said.

Prime Minister Narendra Modi has been credited with the turnaround in output by state-run Coal India , but he is now grappling with power distributors that are so deep in debt that they can't pay to buy power from generators.

Power generators, as a result, are operating both below their capacity and last year's levels.

"The demand for electricity from distribution companies is not growing the way it was projected to grow," mjunction Chief Executive and Managing Director Viresh Oberoi said in an email.

"The poor financials (of distribution companies) that reduced their purchasing capacity is also one of the reasons for lower-than-expected electricity generation."

http://www.business-standard.com/articl ... 746_1.html

Senior officials who are aware of the deliberations of the Kelkar committee on PPP, said that if 3P India was set up as proposed in the 2014-15 Budget by Finance Minister Arun Jaitley, it could serve as an advisory body with a longer-term mandate to review, examine, and suggest reforms and changes in the PPP model, as compared to panels with short terms of reference like the committee itself.

"Discussions in the panel have, among other topics, centered on the need for 3P India. It could be a 'center for excellence' for PPP projects which could hire the best talent from finance, infrastructure, government, private sector and academia to study global-best practices, review current contractual arrangements of such partnerships, and work upon improving the PPP model for infrastructure financing," a senior official said.

Presenting his first Budget, Jaitley had said last year: "PPPs have delivered some of the iconic infrastructure like airports, ports and highways which are seen as models for development globally. But we have also seen the weaknesses of the PPP framework, the rigidities in contractual arrangements, the need to develop more nuanced and sophisticated models of contracting and develop quick dispute redressal mechanism. An institution to provide support to mainstreaming PPPs called 3P India will be set up with a corpus of Rs 500 crores."

According to reports, 3P India was likely to be a non-profit company on the lines of the National Skill Development Corporation, without regulatory power, but with the mandate to look at a whole gamut of issues obstructing the growth of PPPs in India such as model concessionaire agreements, bidding process, dispute resolution mechanism. It was said the government would have a 49 per cent stake in the body. An infrastructure body, the National Investment and Infrastructure Fund (NIIF), with a similar stake by the centre, was notified last week, but with the intention of funding projects rather than advising on them.

For 3P India, even a cabinet note was prepared and sent for the Union Cabinet's approval. But for some unknown reasons, it was never taken up at the top levels and hence the proposed Rs 500 crore was not released, officials say.

The Kelkar panel, officially called the Committee on Revisiting & Revitalizing the PPP Model of Infrastructure Development, was tasked with reviewing PPP policy, analysing risks involved in PPP projects in different sectors and existing framework of sharing of such risks, suggesting optimal risk sharing mechanism between private investors and the government, and suggesting measures to improve capacity building in government for effective implementation of the PPP projects.

Apart from Kelkar, the panel comprises Rajasthan Chief Secretary C S Rajan, and Managing Director of IIFCL S B Nayar, among others. From the central government, a joint secretary each from the Roadways Ministry and the Finance Ministry are part of the panel. Sources confirmed that the meetings of the panel were still underway and hence no recommendation had been firmed up yet.

-

member_29058

- BRFite

- Posts: 735

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Deleted

Last edited by Suraj on 04 Aug 2015 23:51, edited 1 time in total.

Reason: Poster warned for repeated thread disruption

Reason: Poster warned for repeated thread disruption

Re: Indian Economy - News & Discussion Oct 12 2013

Foxconn’s Gou to Modi: Build Infrastructure to Win Investment

Foxconn Technology Group is prepared to invest as much as $2 billion on technology projects in India over the next decade if the government addresses infrastructure deficiencies, Chairman Terry Gou said in New Delhi.

“The government needs to improve infrastructure,” Gou, founder of the Taiwanese company that manufactures Apple Inc. iPhones, said at a press conference Tuesday. He specifically mentioned electricity, transport and supply chain management.

Foxconn has held talks with Adani Enterprises Ltd., a company controlled by Indian billionaire Gautam Adani, though it hasn’t made any final investment decisions, Gou said.

Prime Minister Narendra Modi is striving to turn the country into a hub for global manufacturers through his “Make in India” initiative. The Taiwanese company already produces Xiaomi and InFocus brand phones locally, and in June it tied up with SoftBank Group Corp. and Bharti Enterprises Pvt. on a $20 billion Indian solar power project.

Foxconn may build as many as 12 factories in India, though land and power need to be easier to get, Gou said. He’s looking at potential sites in the states of Gujarat, which Modi governed before becoming prime minister, and Maharashtra, where Mumbai is located. He is likely to move some manufacturing to Andhra Pradesh in the southeast, he said.

Re: Indian Economy - News & Discussion Oct 12 2013

Resolving power discom woes a priority to cut NPA risk for banks

http://www.business-standard.com/articl ... 472_1.html

http://www.business-standard.com/articl ... 472_1.html

A step to protect the asset quality of banks, Reserve Bank of India chief Raghuram Rajan has said the stress from financially troubled state-owned power distribution companies (discoms) needed to be addressed on priority.

In June, the central bank's financial stability report had warned that the Rs 53,000 crore of discom loans recast by public sector banks carried a higher risk of becoming non-performing.

On Tuesday, in his post-policy review interaction with the media, Rajan said after the global overcapacity in metals, the power sector was a second source of stress for banks.

“Central to the woes in the sector are the distribution companies. If these get resolved in more permanent ways, that would alleviate some sources of stress in the sector. RBI’s focus is on how to resolve the distribution company stress in a proper way, so the power purchases go on in a more effective way,” he said.

RBI’s policy statement noted final demand for power remained strong and the recent pick-up in generation due to easing of bottlenecks in coal supply. But, this was being partly negated by structural problems on clogging of transmission grids and the dire financial state of discoms.

Re: Indian Economy - News & Discussion Oct 12 2013

Disinvestment process:

Merchant bankers chosen for stake sale of 5 PSUs

Despite talk of a weak monsoon, sowing increasing strongly. When and where the rain fell, made all the difference.

Cheery news on kharif sowing

Merchant bankers chosen for stake sale of 5 PSUs

Services PMI moderates in JulyThe finance ministry’s department of disinvestment (DoD) is said to have chosen SBI Capital, ICICI Securities, and Deutsche Bank to help it sell stake in five state-owned companies, television channels reported on Wednesday.

Early last month, DoD had issued a formal Request for Proposal (RFP) to select merchant bankers and legal advisors for disinvestment of 10 public sector units (PSUs). Two RFPs were issued for merchant bankers, for five companies each. DoD had presentations from seven merchant bankers on Wednesday, for a basket of five companies. These were NTPC, Engineers India, Bharat Electronics (BEL), National Aluminium (Nalco) and Hindustan Copper. Presentations from likely candidates for another basket of five — Oil India, Container Corporation (ConCor), NMDC, MMTC, and India Tourism (ITDC) — is scheduled on Thursday. The Centre will pare 10 per cent stake each in Oil India and NMDC, 15 per cent stake in MMTC, 12.03 per cent stake in ITDC, and five per cent stake in ConCor. The merchant bankers said to be shortlisted on Wednesday are for sale of 15 per cent stake in Hindustan Copper, 10 per cent stake in Nalco and Engineers India, and five per cent stake in NTPC and BEL. Together, these 10 could garner as much as Rs 20,000 crore for the exchequer. Apart from PSU stake sales, budgeted to get proceeds of as much as Rs 41,000 crore, the Centre has targeted Rs 28,500 crore from “strategic sales” in loss-making PSUs or other assets like warehouses, factories, hotels and office buildings which might be surplus to need.

Hence the total disinvestment target for the year is Rs 69,500 crore.

So far this financial year (starting April 1), the government has sold five per cent stake each in Power Finance Corp and Rural Electrification Corp, garnering Rs 1,500-1,600 crore from each.

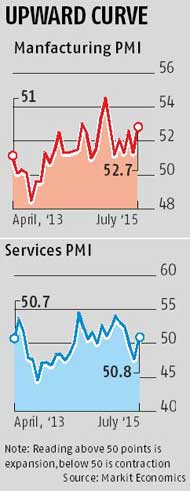

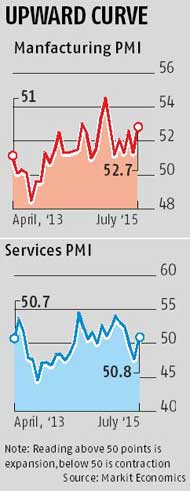

PMI rose to 50.8 points in July as new business was forthcoming against 47.7 in June and 49.6 in May. The reading above 50 is growth, and the one below it, represents contraction.

“Although growing for the first time in three months, the expansion in new business was slight,” said Markit Economics.

The upturn in incoming new work led Indian service providers to take on additional workers in July. Although slight, the rate of job creation was the quickest in two years.

This was in contrast to continued marginal job shedding in the manufacturing sector, despite much more robust growth than that of services.

Despite talk of a weak monsoon, sowing increasing strongly. When and where the rain fell, made all the difference.

Cheery news on kharif sowing

EPFO to hit stock markets todayRainfall was almost 15 per cent less than normal in July, supposedly the most important in the four-month season. Yet, the area covered under kharif crops was almost 8.6 per cent more than the same period last year and only marginally less than the average of the past five years.

Usually, when rainfall is deficit, sowing takes a backseat and farmers tend to wait to plant their crops. However, there was more than normal rain in June and farmers tend to sow on the first sight of rain. Also, distribution and timeliness seems to have been a big factor in pushing acreage.

Data from India Meteorological Department (IMD) shows that among the big areas, barring Marathwada, Vidharbha, north interior Karnataka and to some extent Madhya Maharashtra, no sub-division has been dry for more than three weeks at a stretch since June 1.

The Employees’ Provident Fund Organisation (EPFO) will enter the stock markets on Thursday. Labour Minister Bandaru Dattatreya will launch EPFO’s investment in stock markets on Thursday at 11 am in Mumbai. Neither the ministry nor EPFO officials revealed how much would be invested in exchange-traded funds (ETFs) on the inaugural day.

An EPFO official said based on the market conditions, a decision would be taken on Thursday. In FY16, the EPFO will invest around Rs 6,000 crore in ETFs issued by SBI Mutual Fund on a daily basis. An ETF is a security that tracks an index, a commodity or a basket of assets like an index fund, but trades like a stock on an exchange.

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Indian Economy - News & Discussion Oct 12 2013

Well, the Govt and RBI seem to have agreed on the monetary policy committee.

Govt to have three rubber stamping baboons, instead of the proposed 4. RBI will have 3.

The RBI Governor will have the casting vote, in case there is a tie.

Thank Goodness for small mercies. The swift kicks the Govt received made it see sense very quickly.

Govt to have three rubber stamping baboons, instead of the proposed 4. RBI will have 3.

The RBI Governor will have the casting vote, in case there is a tie.

Thank Goodness for small mercies. The swift kicks the Govt received made it see sense very quickly.

Re: Indian Economy - News & Discussion Oct 12 2013

India gets $19.78 bn FDI from nations Modi visited

http://www.business-standard.com/articl ... 566_1.html

'Disappointed' India defers EU FTA talks

http://www.business-standard.com/articl ... 418_1.html

India's state banks to raise $17 bn to meet funding needs: Jaitley

http://www.thehindubusinessline.com/ban ... yndication

http://www.business-standard.com/articl ... 566_1.html

India received $19.78 billion foreign direct investment (FDI) from 12 countries visited by Prime Minister Narendra Modi in financial year 2014-15, Parliament was informed today.

During the period, Indian companies invested $3.42 billion in these countries which include Bhutan, Brazil, Nepal, Japan, the US, Myanmar, Australia, Fiji, Seychelles, Mauritius, Sri Lanka and Singapore.

The total outflow and inflow of foreign investment in general for 2014-15 fiscal was $6.42 billion and $75.71 billion, respectively, Commerce and Industry Minister Nirmala Sitharaman said in a written reply to Rajya Sabha.

'Disappointed' India defers EU FTA talks

http://www.business-standard.com/articl ... 418_1.html

Move follows ban on 700 pharma products tested by GVK Biosciences

India's state banks to raise $17 bn to meet funding needs: Jaitley

http://www.thehindubusinessline.com/ban ... yndication

India's state-run banks will raise ₹1.10 trillion ($17.26 billion) from market in next few years to meet their funding requirements, Finance Minister Arun Jaitley told lawmakers in parliament on Wednesday.

The finance ministry estimates debt-laden banks will need capital infusion of about $28 billion over four years.

Re: Indian Economy - News & Discussion Oct 12 2013

Rajan sounds like he's given up on the veto power thing:

Raghuram Rajan okay with 'no veto' for RBI governor on rate cuts; bats for policy continuity

Raghuram Rajan okay with 'no veto' for RBI governor on rate cuts; bats for policy continuity

At least he gets why the government clipped his wings. With a 6-member panel, he has no deciding vote unless, someone is missing.Reserve Bank of India (RBI) Governor Raghuram Rajan sought to squelch speculation about a rift with the finance ministry, suggesting that his veto over interest rates was an issue for legitimate debate. In a forceful intervention, Rajan said committees were less prone to making mistakes than personalities and would hold up better against pressure. He added that continuity was another critical element when it came to monetary policy.

"Currently, the situation is, the governor has the veto,'' Rajan said on Tuesday after announcing a monetary policy that kept policy rates unchanged. "Effectively, all advice is only advice. Ultimately, the decision is the governor's. If it continues to retain the veto, it does not change the current situation, it maintains the status quo. That is something to keep in mind.'' Rajan's views on the veto should put to rest talk of the finance ministry and central bank bickering about proposals to reduce governor's powers.

"The difficulty in the current system is it personalises the policy," Rajan said. "Policy is dependent on one person, which means you can make mistakes. Committees would be less prone to mistakes because there is a discussion among people of different hues. Committees are less susceptible to pressure, both internal as well as external pressure. It is harder to push a committee. But I think what is also important is continuity."

The agreement on the Monetary Policy Committee (MPC) between the government and RBI may provide for a sound independent panel that is insulated from external influence or the central bank's internal views, he indicated.

-

member_29058

- BRFite

- Posts: 735

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

http://swarajyamag.com/economy/reluctan ... volutions/

Reluctant Reformers And The Missing Revolutions

Reluctant Reformers And The Missing Revolutions

Those who rue the absence of the so called ‘big bang’ reforms are missing the far-reaching initiatives of the PM in the rural economy.

P.V. Narasimha Rao , the original economic reformist prime minister, often rejected the idea that he was the Margaret Thatcher of India. He strongly believed that he was in the mould of Willy Brandt, a social democrat to the core who argued that economic reforms were merely an apparatus to increase government revenues which, in turn, could lead to increased public spending and equitable wealth distribution. Contrary to general perceptions, Narasimha Rao summarily rejected the ‘trickle down’ economic philosophy and believed in greater social spending.

However, after two decades of reforms ushered in by the Narasimha Rao government, a socialist republic had started to smell a revolution in the air of 2014. For the restless 81 crore young Indians below the age of 35, Modi came to symbolize a revolution which could liberate India from its inherently systemic slow motion.

Modi seems to have understood his mandate of 2014 as primarily a vote for structural reform of the largely agrarian rural India which hardly finds space on the stock-market obsessed business channels or the Delhi-centric business broadsheets. There are three disruptive revolutions happening in rural India which could be potentially transformational by 2020.

For the last 10 years, the United Progressive Alliance (UPA) government blindly increased the minimum support price (MSP) for rice and wheat hugely just to keep a section of the voters happy (though the quantum did come down in the last two years) but eventually the voters punished it for growth stagnation. Data shows very clearly that while MSP for paddy increased by a whopping 75% from 2006 to 2011, yield growth per hectare slowed down to a mere 3.5% in the same period. Data further shows that the growth of rice yield per hectare was the highest in the period from 2001 to 2006 at 10.63% when MSP also increased at a much slower rate of 11.76%. In fact, in the last decade, Indian agronomy has seen the most unproductive phase since the pre-green revolution era in relative terms to GDP.

that politicians, in their mad rush to keep the voters happy, actually do more harm to an average farmer by increasing MSP, except where there is a genuine need to hike rates due to increase in input costs. One of the primary reasons for decline in yield per hectare during the years of higher MSP is simply because governments did not invest in technological advancements for rural India and instead concentrated on the populism of MSP.

The fact that Modi is willing to take the temporary brunt of the rural voter to create a better agrarian economy for the future is nothing short of a mini-revolution. In fact, it may have started bearing fruits already this year as there has been a whopping 400% increase in oilseed cultivation in the sowing month of June, indicating a pattern shift. The next challenge is to liberate agricultural produce from the political control of agricultural produce marketing committees (APMCs) which would truly unshackle the Indian farmer from the crutches of MSP and the Modi government has already chosen the digital pathway to achieve this.

The second part of the revolution in agronomy comes in the form of fiscal prudence. As per the Economic Survey report, India spends 2.33% of its GDP or Rs 2,35,790 crore (in 2014-15) on fertilizer, grain and sugar subsidies. These agricultural subsidies are provided both at the production and point of sale level – subsidies for urea manufacturers and indirectly through MSP for rice, wheat and sugar – as well as at the point of consumption level – controlled MRP of urea and subsidized rice, wheat and sugar at the PDS.

The economic benefit of fertilizer subsidy is mainly derived by urea manufacturers whereas the farmer benefits very little; in fact, the government ends up subsidizing lavish lifestyles of failed businessmen like Vijay Mallya through the urea route. 15% of the PDS rice, a whopping 54% and 48% of the PDS wheat and sugar are lost in leakage (although the PDS costs are not subsidies directed towards agriculture). Furthermore, according to the Economic Survey Report 2014-15, only 53% of the remaining 85% of the PDS rice actually reaches the bottom 3 deciles of the population for whom the subsidy is intended. Similarly, only 56% of the remaining 46% of the PDS wheat actually reaches the poor.

A simple back of the paper calculation tells us that more than Rs 1 lakh crore that the government spends on agricultural subsidies evaporates into a black hole. If this Rs 1 lakh crore were to be deployed to develop better agricultural infrastructure, it would be far more beneficial to rural India

If all the agrarian subsidies are directly transferred to the beneficiary’s account, after biometric verification (through tools like Aadhar), it could potentially mean an increase of a whopping 1% of the GDP for the government.

The third part of the rural revolution is a socio-economic disruption that can completely alter the way Indian villages are quantified as economic units. Deep rooted socialist tendencies of our policy makers had ensured that rural India always remains dependent on the largess of the ruling class. Be it agricultural loan waiver schemes or MNREGA, villages were always expected to be at the mercy of governments and their lady bountiful acts.

The Atal Pension Scheme and 3 different insurance schemes that the government has linked with the PMJDY bank accounts have tremendous socio-economic scale that many commentators and economists have failed to understand so far. Even if the premiums and monthly emoluments are as little as Re 1 to Rs 1400, these economic measures can have a huge two-dimensional impact.

For the first time, asset classes like insurance and pension schemes are being deployed effectively in Indian villages which creates a sense of ‘ownership’ among the rural masses that is radically different from government doles like MNREGA.

MUST MUST MUST READ FOR ALL. SPREAD ITYet, his structural rural reforms may create a revolution unbeknownst to the Delhi-based intelligentsia. A decade from now, Modi will probably be hailed as the visionary who created the rural market expansion by revolutionizing village consumption patterns and tapping surplus rural labor productively, till then, let us keep on asking, where are the big bang reforms?

Re: Indian Economy - News & Discussion Oct 12 2013

^Excellent article manoj-ji, thanks for sharing.

Re: Indian Economy - News & Discussion Oct 12 2013

Excellent move. The Swatch Bharat cannot be a dumping ground for the Western waste.

Recyclers told to use local waste as government quietly slaps ban on import of electronic, PET scrap

Recyclers told to use local waste as government quietly slaps ban on import of electronic, PET scrap

For a country long identified as a scavenger of the developed world's discarded waste, India may have embarked on a path to discard that identity now. The government has quietly banned the import of PET bottles, plastic scrap and a whole host of waste items, including electronic waste, coming from overseas for recycling, a move that experts believe will help jumpstart a waste management ethos in the country by forcing better utilisation of waste generated at home.

The ministry of enviro ..

Re: Indian Economy - News & Discussion Oct 12 2013

A quiet grass-root revolution is about to start .. http://www.newindianexpress.com/states/ ... 956454.ece

Hitherto, vendors were at the mercy of moneylenders who were charging 20 per cent interest a day.

If they sought a loan of Rs 1,000, the moneylender would give them Rs 800 after deducting the interest in advance. After sunset, they had to return Rs 1,000.

Now, armed with MUDRA cards, the women just walk into any neighbourhood ATM and draw the working capital. Interest will be charged on only the amount they have withdrawn. The annual interest for the micro loan is 10.75 per cent. Moreover, the procedures for getting the loan are simple and beneficiaries will get an insurance cover of Rs 1 lakh.

Re: Indian Economy - News & Discussion Oct 12 2013

India Inc’s capital investment to fall by 2% in 2016: Crisil

MUMBAI: Investors who are betting on companies that would benefit from a recovery in the investment cycle, may have to wait longer. Capital investments across 22 sectors have declined and are expected to fall 2 per cent in the financial year ending March 31, 2016, according to a study by ratings agency Crisil. The drop in investments would be led by the private sector, whose spending is expected to decline 8 per cent in this fiscal — for the third year in a row.

"We believe that a meaningful recovery in capital investments will only be visible from fiscal 2017 — when we expect to see a 7 per cent increase," said CrisilBSE 0.37 % on Thursday. The ratings agency said large sectors such as power generation, aluminium, steel, cement and refining & marketing are a drag, while the infrastructure segments such as urban infrastructure, national highways and renewable energy are preventing a bigger decline in overall investments.

Re: Indian Economy - News & Discussion Oct 12 2013

Better, but still do not like the idea of the executive meddling in day to day affairs. Also, this means the RBI governor is relegated to be an observer of the process from a decision maker. Why was that done? With this approach they have diluted the position of the RBI governor to an ex-officio chair.vina wrote:Well, the Govt and RBI seem to have agreed on the monetary policy committee.

Govt to have three rubber stamping baboons, instead of the proposed 4. RBI will have 3.

The RBI Governor will have the casting vote, in case there is a tie.

Thank Goodness for small mercies. The swift kicks the Govt received made it see sense very quickly.

Re: Indian Economy - News & Discussion Oct 12 2013

As Rajan himself admitted, an RBI governor does not have any rightful reason to have a veto power over rate policy. Committee based rate decisions are the way to go, with all agreements and dissentions stated publicly. Right now, the RBI governor singlehandedly decides, even without consulting his deputy directors ahead of time.

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Indian Economy - News & Discussion Oct 12 2013

Four Rubber Stamping Baboons does not a committee make. You a committee with people exercising grey matter and not biceps to affix rubber stamps in the appropriate place to do in stealth what their masters in the finance ministry dare not do openly.

Re: Indian Economy - News & Discussion Oct 12 2013

PSBs versus SEBs

http://www.financialexpress.com/article ... bs/115137/

Losing steam

http://www.financialexpress.com/article ... am/115138/

http://www.financialexpress.com/article ... bs/115137/

Losing steam

http://www.financialexpress.com/article ... am/115138/

It is a pity the central bank did not release the results of various expectations surveys before the bi-monthly credit policy on Tuesday. Had this been done, it would be that much more difficult for RBI to justify not cutting repo rates. A repo cut, it is true, alone cannot stimulate investment demand but, provided it is passed on by the banks, it gives a lot of relief to corporate borrowers and, at the margin, can stimulate consumption demand. While RBI’s reasons for not cutting rates are well-known, the surveys bring out just how weak the sentiment is across the board, and particularly worrying for the government should be the fact that RBI’s Business Expectations Index for the current quarter is at a mere 113.1—while that is lower than the last quarter’s 115.2, this is roughly the same level it was 3 years ago.

The most important finding, needless to say, is that relating to capacity utilisation. It is only when capacity utilisation levels are high that firms begin to start thinking of adding capacity. Capacity utilisation levels, using the RBI survey, were the highest in recent years in Q4FY15, at 83.2%. That is also the reason why investment levels—gross fixed capital formation—were the highest in FY12, at 38.2% of GDP. Not surprisingly, the investment planned in fixed capital is at its lowest in a few years—just 45.7% of respondents said they were planning investments in fixed capital in FY16 as compared to 49.1% in FY15 and 65.1% in FY14. Crisil points to the 5-year low in capacity utilisation being the main reason for capital formation being low and, in fact, is looking at an 8% fall in private investment this fiscal—within this, it is industrial sector capex that is expected to fall the most, by a whopping 16%. In terms of the expectations of future orders, 14.6% of respondents felt it would be below normal compared to 13.1% in the last survey round. The number of respondents expecting a fall in profit margin is higher, despite a greater number expecting a fall in raw material prices, primarily because more people are looking at a fall in selling prices.

In such a situation, it is important the government increase spending, and especially on capital expenditure. Capital expenditure is projected to rise by over 25% in FY16, but that is exaggerated by the fact that this was virtually stagnant in FY15—in comparison with FY14, capital expenditures rose just 2.5%. Indeed, in overall terms, it is worth keeping in mind that government investment is just around 4% of GDP as compared to the overall investment level of around 30% of GDP. Getting PSUs to invest more is another option that is being talked of, but this too will help only up to a point—total public sector investment, including that of PSUs, is around 7.5-8% of GDP. Between FY12 and FY14—data based on the new series is available only for these years—while government investment rose marginally from 7.4% to 7.8% of GDP and corporate investment was steady at around 11.5%, it was household investment that collapsed from 15% to 10.6% of GDP. Getting that back on track is the real challenge.

-

member_29058

- BRFite

- Posts: 735

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

srin wrote:A quiet grass-root revolution is about to start .. http://www.newindianexpress.com/states/ ... 956454.ece

Hitherto, vendors were at the mercy of moneylenders who were charging 20 per cent interest a day.

If they sought a loan of Rs 1,000, the moneylender would give them Rs 800 after deducting the interest in advance. After sunset, they had to return Rs 1,000.

Now, armed with MUDRA cards, the women just walk into any neighbourhood ATM and draw the working capital. Interest will be charged on only the amount they have withdrawn. The annual interest for the micro loan is 10.75 per cent. Moreover, the procedures for getting the loan are simple and beneficiaries will get an insurance cover of Rs 1 lakh.

Poor vendors around the landmark Dufferin Clock Tower (Chikka Gadiyara) on Monday freed themselves from the clutches of private moneylenders by becoming MUDRA beneficiaries.

I hope Modiji campaigns on this

Re: Indian Economy - News & Discussion Oct 12 2013

Unfortunately, Rajan's own view of his lopsided power at setting rates, and support for the committee, are far more credible than your own dissent. He's the Governor, and is the one whose powers are being stripped, and he supports the action, on record.vina wrote:Four Rubber Stamping Baboons does not a committee make. You a committee with people exercising grey matter and not biceps to affix rubber stamps in the appropriate place to do in stealth what their masters in the finance ministry dare not do openly.

Re: Indian Economy - News & Discussion Oct 12 2013

This article takes on the 'India cannot build infrastructure because of democratic hurdles' myth:

A Japanese Development Course for India

A Japanese Development Course for India

Why is India such an infrastructure laggard, always struggling to patch things together, while China -- the world's other supergiant developing country -- races ahead? The traditional answer is that democracy is holding India back. China, we are told, was able to build top-notch road, rail and water transport networks because, as a dictatorship, it could simply order peasants to move out of the way. Many take this as a received truth -- India, they say, simply has to choose between democracy and efficient government.

But this story, convincing as it sounds, isn't right. History shows that it's possible for democracies to build effective infrastructure. Perhaps the best example is Japan.

Japan is a strongly democratic nation, consistently receiving high marks in terms of political freedoms. And it's impossible to deny that the country has built one of the world's best infrastructure systems. It's shocking how easy it is to get from Point A to Point B in Japan, whether you're a business traveler riding a high-speed train or a trucker driving down the highway.

One general lesson many people took from Japan's success -- at least, before the Japanese economy stalled out in the 1990s -- is the power of technocracy. If they work efficiently, technocracies allow democratically elected legislatures to give small groups of experts the ability to make policy in the short term, while keeping them accountable in the long term. If the technocrats overstep their bounds and do something strongly contrary to the public's wishes, the legislature can rein them in. But most of the time they can operate with a long leash, getting things done quickly and decisively. During its early development, Japan combined powerful ministries, with members recruited from top schools, with powerful public corporations.

India seems to be taking that general lesson to heart. The government of Prime Minister Narendra Modi has established a National Investment and Infrastructure Fund, for which it promises to recruit the "best talent in the world." With India's huge population and deep talent pool, it will not have to look far. In addition, Modi has promised $1 trillion of infrastructure spending by 2017.

Of course, bureaucracies are not omnipotent. Some researchers claim that Japan's system of competition between government ministries has reduced the effectiveness of Japan's infrastructure programs in recent years. And Japan has overbuilt infrastructure, according to a recent McKinsey report, in a misguided effort to stimulate growth. As for those vaunted public corporations, many are now unprofitable.

That said, India is still poor enough that a powerful elite bureaucracy may be an effective way of getting a fractious democracy to build modern infrastructure. In addition to copying Japan's classic approach, India can also leverage Japanese expertise more directly, by hiring Japanese companies to build its roads and rails.

Moreover, Japan's Prime Minister Shinzo Abe is trying to foster an alliance with India in order to hedge against the rise of China, so, Japan's government may be prepared to offer India cheap infrastructure financing. Abe recently unveiled a $110 billion funding initiative to help poor countries in Asia -- of which India is by far the biggest -- invest in infrastructure. And Japanese institutional investors, facing very low yields in Japan, have a big incentive to buy higher-yielding Indian development bonds.

Re: Indian Economy - News & Discussion Oct 12 2013

You are making this about people, while it is about governance structure and the nature of institutions.Suraj wrote:Unfortunately, Rajan's own view of his lopsided power at setting rates, and support for the committee, are far more credible than your own dissent. He's the Governor, and is the one whose powers are being stripped, and he supports the action, on record.vina wrote:Four Rubber Stamping Baboons does not a committee make. You a committee with people exercising grey matter and not biceps to affix rubber stamps in the appropriate place to do in stealth what their masters in the finance ministry dare not do openly.

The below quoted article is long but makes a good argument for why we still need a somewhat independent RBI to control monetary policy, separate and distinct from government diktats.

Indian financial code: real risk of financial capture

Fix the factor markets first before ‘fixing’ RBI

In the final analysis, the biggest risk that the draft financial code poses to Indian economic and financial stability is that it vests tremendous powers in the executive branch of the government that is vulnerable, and has proven to be so, for all forms of capture. Policy capture by the financial sector may not happen immediately but there should be no doubt that the Code lays the foundation for the capture of policy and thus of the economy by the financial sector, to happen. That is why it should be placed in the deep freezer or be subjected to fresh thinking with wider consultation.

For now, the urgent and real challenge for India is that its factor markets are broken and they need fixing. India’s Opposition parties resist the reform of its factor markets. That places India’s medium and long-term economic future in jeopardy. Instead of developing a missionary focus on them, whoever chose to put the revised draft of The Code on the website of the Ministry of Finance has caused a needless distraction. Some in the broader community too have chosen to sensationalise it and conflate the issue at hand – the threat of allowing the interests of the financial sector to dominate economic stability and economic goals of the nation – with personality clashes. This is myopia, par excellence.

RBI has been a more effective watchdog of the Indian financial system than its counterparts in the West. That is to be preserved and not sacrificed under the pretext of making RBI accountable. This game needs to be understood and the Government of India, at the highest levels, should disengage from it.

Re: Indian Economy - News & Discussion Oct 12 2013

Sorry, I disagree. That is not the end. That is merely one possible means. The end is how well the purposes of achieving economic growth priorities, are achieved. The RBI is simply a tool tasked with playing a role within the context of a greater national economic and monetary policy, and unless the rest of the system is set up such that the RBI's policy independence is a consequence, then there's no point in seeking such independence. The ECB is not a case study. They *have* to be independent of a national government because they run monetary policy independent of N different governments. In fact, it's by no means perfect, considering the Eurozone has been in tumult for close to 8 years now.ShauryaT wrote:You are making this about people, while it is about governance structure and the nature of institutions.

There's no data to prove that economic growth correlates to the independence of the central bank. Every major fast growing economy had a central bank that wasn't particularly independent. PRC's central bank is very much hand in glove with their government, and yet they have recorded the fastest sustained economic growth of any major economy. Neither Japan nor SoKo had a particularly independent central bank either; both had CBs characterized by their collaborative effort to support the activities of a much more powerful industrialization ministry, such as Japan's MITI.

None of them, in retrospect, are viewed in the context of the actions of their central bankers. Can you name any of their CB heads or its famous actions, or even their history of independence as an institution etc ? There weren't any. Their economic history fundamentally revolves around the drives by their political leadership. Both Korea and Japan were characterized by periods of higher inflation during their high growth phases as a result of accommodative monetary policy, but fundamentally, a focus on industrialization that enriched them faster.

The Indian government, correspondingly chooses to make the RBI subservient to a much more powerful Finance Ministry and NITI Aayog, and I've really no problem with that. I'd rather see them do what it takes to get things done, rather than judge the relative idealism and purity of the actions taken to accomplish it. Greater ends achieved through notionally dirtier approaches, trump a focus on choosing the most perfect methods on paper.

Re: Indian Economy - News & Discussion Oct 12 2013

Suraj, correct me if I am wrong but Japan, S. Korea, Taiwan, Singapore, Malaysia all had single party rule for long periods of time with very capable leaders who looked towards the west for inspiration and mimicked them. That may have helped. Similar single party rule thing happened in India but due to ideological leanings (Communist/socialist) and lack of capability/vision it did not work in India. So we never really had the money or will to built world-class infra.

Re: Indian Economy - News & Discussion Oct 12 2013

You are rejecting just what you supported - governance structure and institutions. All those monolithic political entities also built up a monolithic economic policy entity, and gave it the power and mandate to act. Even India has a monolithic power structure largely unchanged by the coming and going of politicians - the bureaucracy.

As you're just affirming now - all these countries monopolized the levers of economic policy in the hands of a powerful industrialization-focused government entity, whether Japan's MITI, Korea's Park Chung Hee cabinet, or PRC's state council.

Every Indian government needs to do what it considers the best choices to generate the results it has been given the mandate to do. The government's task is to deliver growth, and for that purpose, reorienting arms of the government is a means that it follows. Government's cannot shy away from taking the necessary actions in fear that someone else will screw it up in future. That caveat applies to any country.

Like I stated before, there's no correlation between the relative independence of a central bank and rate of economic growth. It's a concept on paper, but it's simply a means to a certain end, not an end in itself. The end is the fastest sustainable economic growth. All I see this government doing with the RBI+government rate setting committee, is doing what others have done before to more effectively tie together the central banks actions with that of the government.

If one personally finds that abhorrent, that's really not upto me to argue with; I'll just point out again that it's the means you're focusing on.

As you're just affirming now - all these countries monopolized the levers of economic policy in the hands of a powerful industrialization-focused government entity, whether Japan's MITI, Korea's Park Chung Hee cabinet, or PRC's state council.

Every Indian government needs to do what it considers the best choices to generate the results it has been given the mandate to do. The government's task is to deliver growth, and for that purpose, reorienting arms of the government is a means that it follows. Government's cannot shy away from taking the necessary actions in fear that someone else will screw it up in future. That caveat applies to any country.

Like I stated before, there's no correlation between the relative independence of a central bank and rate of economic growth. It's a concept on paper, but it's simply a means to a certain end, not an end in itself. The end is the fastest sustainable economic growth. All I see this government doing with the RBI+government rate setting committee, is doing what others have done before to more effectively tie together the central banks actions with that of the government.

If one personally finds that abhorrent, that's really not upto me to argue with; I'll just point out again that it's the means you're focusing on.

Re: Indian Economy - News & Discussion Oct 12 2013

Suraj: We can disagree on this one. IMO, you vest too much confidence in the government of the day to do what is right, as it sees fit, without ANY checks or balances. Most of our past experience on this score has proven otherwise. The example of ECB as an example of how a separation between the N-executive powers and a central monetary unit has not helped the Euro Zone is non-sequitur, as there are far more complex issues involved in the euro zone and if anything, from a monetary policy perspective it can be argued they have done quite well - especially in light of the 2008 crisis in the US - which also separates monetary policy from the executive.

PRC, Japan are all examples of a society extremely comfortable with a hierarchical governance structure with no formal checks and balances. Cannot compare them to the diversity and needs of India. With PRC as a model argument, where the ENTIRE system is opaque and lacks accountability, we would be building not democratic institutions but a statist model. IMO, India would lay its monetary policy at peril with direct executive control, as the article also demonstrates.

PRC, Japan are all examples of a society extremely comfortable with a hierarchical governance structure with no formal checks and balances. Cannot compare them to the diversity and needs of India. With PRC as a model argument, where the ENTIRE system is opaque and lacks accountability, we would be building not democratic institutions but a statist model. IMO, India would lay its monetary policy at peril with direct executive control, as the article also demonstrates.

The Indian economy is inflation prone and fiscal populism, is its biggest contributor. From loan waivers to corporate give-aways, fiscal policy primes the pump needlessly on many occasions for non-economic considerations. In addition, laws encourage fragmentation of production and Indian supply-side operates at well below its productive capacity. That mostly explains India’s inability to sustain high economic growth rates beyond a few years. Economy quickly overheats when demand picks up because supply is unable to respond. Further, the corporate-officialdom-banking sector nexus results in too many loans in good times turning bad when economy peaks and drops. There is thus plenty of reason in the Indian context for the central bank to remain in a perpetual vigilant and adversarial mode. It provides the vital check and balance.

Re: Indian Economy - News & Discussion Oct 12 2013

Of course we can agree to disagree. I disagree with the 'we must impose a cost of being democratic upon ourselves' approach. I disagree that the cost needs to be imposed, and do not agree that the RBI's notional greater independence (as exists now) has been any sort of check or balance, or has helped the end of greater economic growth. In fact, with someone like Rajan, it has trivialized the whole thing down to a page 3 'sexy governor holds back government!' tabloid news item. Far from being independent, the RBI governor's veto is a vestige of a time when London decided interest rates, and therefore the RBI governor's veto served as the necessary enforcement means. We have simply carried it on, pretending it's an explicit check/balance of any kind, when in reality it is just a symbol of arbitrary power in one person's hand. Just as a government can drive the economy down, so can a recalcitrant RBI governor.ShauryaT wrote:Suraj: We can disagree on this one. IMO, you vest too much confidence in the government of the day to do what is right, as it sees fit, without ANY checks or balances. Most of our past experience on this score has proven otherwise. The example of ECB as an example of how a separation between the N-executive powers and a central monetary unit has not helped the Euro Zone is non-sequitur, as there are far more complex issues involved in the euro zone and if anything, from a monetary policy perspective it can be argued they have done quite well - especially in light of the 2008 crisis in the US - which also separates monetary policy from the executive.

Re: Indian Economy - News & Discussion Oct 12 2013

Ban on GVK drugs due to inaccurate data, says EU

http://www.business-standard.com/articl ... 041_1.html

http://www.business-standard.com/articl ... 041_1.html

European Union (EU) on Friday clarified the move had neither to do with the efficiency of those drugs nor was it against the Indian pharmaceutical industry. The ban, it said, was imposed due to "inaccurate data provided".

"The decision concerning a ban on 700 generic drugs was based on scientific - and not trade - considerations, and in accordance with the advice of the scientific committee of the EMA (European Medicines Agency). Such procedures do not question the reputation of the companies or countries concerned, nor of generic medicinal products. These are integral part of a rigorous scientific assessment process," Cesare Onestini, acting head of the European Union's delegation to India, told Business Standard.

He added that the scientific committee concerned had noted there was no evidence of harm or lack of effectiveness in the medicines. However, the committee believed GVK Biosciences provided "inaccurate data".

He added that the EU was keen to continue work towards a successful conclusion of its proposed free trade agreement (FTA) with India.

On India deferring the talks between chief trade negotiators, Onestini said EU hoped "a solution will be found to the current deferral".

Re: Indian Economy - News & Discussion Oct 12 2013

They're just attempting brinkmanship by imposing tariff barriers. Good thing we responded by walking away from the FTA talks. Now they are back with 'clarifications' like this, about their decision. Next step for them is to say it's a misunderstanding and reverse the ban.nawabs wrote:Ban on GVK drugs due to inaccurate data, says EU

http://www.business-standard.com/articl ... 041_1.htmlEuropean Union (EU) on Friday clarified the move had neither to do with the efficiency of those drugs nor was it against the Indian pharmaceutical industry. The ban, it said, was imposed due to "inaccurate data provided".

"The decision concerning a ban on 700 generic drugs was based on scientific - and not trade - considerations, and in accordance with the advice of the scientific committee of the EMA (European Medicines Agency). Such procedures do not question the reputation of the companies or countries concerned, nor of generic medicinal products. These are integral part of a rigorous scientific assessment process," Cesare Onestini, acting head of the European Union's delegation to India, told Business Standard.

He added that the scientific committee concerned had noted there was no evidence of harm or lack of effectiveness in the medicines. However, the committee believed GVK Biosciences provided "inaccurate data".

He added that the EU was keen to continue work towards a successful conclusion of its proposed free trade agreement (FTA) with India.

On India deferring the talks between chief trade negotiators, Onestini said EU hoped "a solution will be found to the current deferral".

Re: Indian Economy - News & Discussion Oct 12 2013

Foxconn to invest $5 billion in Maharashtra, gets 1,500 acres for plant

http://www.financialexpress.com/article ... nt/115922/

NIYATAM: NITI Aayog’s push to improve states’ efficiency

http://www.financialexpress.com/article ... cy/115812/

http://www.financialexpress.com/article ... nt/115922/

NIYATAM: NITI Aayog’s push to improve states’ efficiency

http://www.financialexpress.com/article ... cy/115812/

The NITI Aayog plans to work with states to prune their administrative structure to improve their efficiency and governance. The move is part of a larger interaction with states called NIYATAM or NITI Initiative to Yield Aspirational Targets and Actionable Means, where the NITI Aayog plans to engage with them on six issues.

“An average state does not require more than 20 departments to run its administration. But most states have a much larger structure as they feel that the 15 per cent ceiling should be met,” said an official familiar with the development.

The size of a government’s council of ministers depends on the Constitution (91st Amendment) Act, 2003 that limits the size of all ministries in India to 15 per cent of the total number of members in the Lok Sabha or state assembly.

At present, states such as Uttar Pradesh have 56 government departments and an equal number of ministers, apart from the chief minister. Similarly Bihar and Jharkhand have 44 government departments each while Kerala has 46 government departments.

According to the plan being worked out by the NITI Aayog, each state should ideally have about 20 departments. The Aayog would work with states to this end, starting with Kerala, Rajasthan, Jharkhand and Uttar Pradesh.

Meanwhile, as part of the NIYATAM initiative, the NITI Aayog will also work with states to rationalise the number of schemes at both the state level as well as those that are centrally funded. “With the recommendations of the Fourteenth Finance Commission giving more revenue share to states, this will help them formulate their Budgets next fiscal,” said the official.

Additionally, the agency is also planning to monitor the improvement in states’ development by collecting data on a set of indicators such as education, health, roads, water, electricity, mobile penetration. “The data will be used to monitor each state’s individually and not for inter-state comparisons,” stressed the official.

The sources of data collection are likely to be finalised by the month end and would be started in the states of Kerala, Rajasthan and Jharkhand at first.

The Aayog also proposes to work on district planning and building by examining the baseline indicators and strengths and weaknesses of each district. “The idea is to figure out what needs to be done in that district in terms of public and private participation,” said the official, adding that all districts in the country would be eventually covered.

While the plan is still under finalisation, it is likely to be rolled out first in one large state and one small state. Madhya Pradesh or Rajasthan and Sikkim are some of the potential states where it could be rolled out first.

The Aayog is also planning to establish a results framework document at the block level. But the proposal is only at an initial stage and is being worked out by the Cabinet Secretariat.

As part of its move to improve efficiency in government functioning, the Aayog is also planning to look at revamp of laws. “This can be done in four ways — by repealing old laws, rationalisation and consolidating the ones that remain and introducing Bills where there is a vacuum and examining the amount of state intervention required,” explained the official, adding that this has already started in Rajasthan where the repealing work is almost over.

Re: Indian Economy - News & Discussion Oct 12 2013

Taiwan's Foxconn to invest $5 bn in India plant

Apple iPhone manufacturer Foxconn has agreed to invest $5 billion on a new plant in the western Indian state of Maharashtra, a government official said Saturday, in a major boost for Prime Minister Narendra Modi.

The Taiwanese firm's chairman Terry Gou signed a memorandum of understanding with Maharashtra's chief minister Devendra Fadnavis in India's financial capital of Mumbai.

"Extremely elated to witness the signing of 5 billion dollar MoU between GoM (government of Maharashtra) & Foxconn with employment generation of 50,000", Fadnavis wrote on Twitter.

The investment on the new manufacturing facility will take place over five years.

The Apple supplier, also known as Hon Hai Precision Industry, is the world's largest computer components manufacturer and also assembles products for Sony and Nokia.

Setting up a facility in India could help cut Foxconn's labour costs and boost sales of iPhones in a country that boasts 952 million mobile connections.

Re: Indian Economy - News & Discussion Oct 12 2013

http://timesofindia.indiatimes.com/busi ... 404076.cms

'm trying to understand gold price and forex reserve.. how can this happen?

'm trying to understand gold price and forex reserve.. how can this happen?

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Indian Economy - News & Discussion Oct 12 2013

Because some of the Forex are kept in gold.SaiK wrote:http://timesofindia.indiatimes.com/busi ... 404076.cms

'm trying to understand gold price and forex reserve.. how can this happen?

Re: Indian Economy - News & Discussion Oct 12 2013

1500 acres.Suraj wrote:Taiwan's Foxconn to invest $5 bn in India plant

and the rest of the idiots keep crying about LAB

Re: Indian Economy - News & Discussion Oct 12 2013

Weak crude oil may bring Rs 88,800-cr gains this year

The country is set to save Rs 88,800 crore this financial year, thanks to a drop in the price of the Indian basket of crude oil to a six-month low of $49.11 a barrel. The crude oil price decline has mainly been on account of higher drilling activity and stockpile in the US, a strong dollar, an ailing Chinese economy, and the prospect of Iran boosting production after sanctions on the country were lifted recently.

The Indian basket represents the average price of Oman and Dubai sour-grade and sweet Brent crude oil processed in Indian refineries (in the ratio of 72:28). The current price of the Indian basket is the lowest since 30 January, when it stood at $46.28 a barrel. Between April 1 and August 6 this year, the price has averaged at $58 a barrel.

“The government had budgeted for an average crude oil price of $70 a barrel for this financial year. If the average price of $58 a barrel is sustained for the rest of the year, it will lead to a saving of Rs 78,000 crore in companies’ import bill, and of around Rs 10,800 crore in the government’s subsidy bill,” said K Ravichandran, senior vice-president at research & ratings agency Icra.

Re: Indian Economy - News & Discussion Oct 12 2013

In the politics thread, people are commenting that the Modi Govt is not doing anything

State-specific drill on power dues

State-specific drill on power dues

New Delhi, Aug. 9: A proposed plan to restructure the dues of ailing state electricity boards (SEBs) envisages state-specific packages, a sharp departure from the one-size-fits-all approach of the previous plan. The finance ministry is working on such a scheme, which will also help banks whose claims on SEBs stand at a massive Rs 3 lakh crore.

According to officials, the restructuring programmes will be linked to specific policy changes adopted by the states to raise tariff as well as reduce pilferage and transmission and distribution losses.

The restructuring package will include measures such as swapping high-cost loans, with interest rates of 10-14 per cent, for loans at lower rates spread over longer periods of time.

Some electricity boards may also be given a moratorium in return of promises to stick to a timetable for reforms.

Officials said escrow accounts of the receivables were also being mulled, particularly for bad cases of default.

The accumulated losses of state distribution companies (discoms) have risen to a massive Rs 2.1 lakh crore as they have failed to recover from bailouts.

The worst performer has been north India, where the electricity boards and discoms have loans of about Rs 1,57,634 crore and accumulated losses at Rs 1,43,715 crore.

The Rajasthan electricity board has accumulated losses of more than Rs 60,000 crore as of March 2014, while Uttar Pradesh faced a staggering loss of Rs 81,000 crore.

The short-term debt of the Rajasthan SEB stood at Rs 50,000 crore.

Officials said no state electricity board had been able to come up with a plan for 100 per cent metering.

Transmission and distribution losses of SEBs in India accounted for 23 per cent of the total power in the system compared with 6 per cent in China and 4 per cent for most of the developed countries.

Even Bangladesh, which receives electricity from the Indian grid, has a far lower transmission and distribution loss rate of 12 per cent.

Coal linkage

The Prime Minister's Office has asked the coal ministry to increase coal linkages to all sectors, including power, according to PTI.

The direction comes at a time the government is considering a coal linkage auction and has sought comments from stakeholders on the draft auction methodology.

Re: Indian Economy - News & Discussion Oct 12 2013

Commerce Min moves Cabinet note on interest subvention scheme

http://www.business-standard.com/articl ... 081_1.html

http://www.business-standard.com/articl ... 752_1.html

http://www.thehindubusinessline.com/eco ... yndication

http://www.business-standard.com/articl ... 081_1.html

Trade threatsUnder this scheme, banks provide exporters credit at subsidised rates and are later compensated by govt

http://www.business-standard.com/articl ... 752_1.html

‘Delay in subsidy announcement holding back export initiatives’Concerns have repeatedly been expressed about the negative trend in Indian exports. They have been declining on a year-on-year basis for the last seven months. In the first quarter of 2015-16, merchandise exports declined by 16.8 per cent over the corresponding period of last year. This newspaper reported on Saturday that several key labour-intensive sectors, like leather and textiles, were witnessing significant reductions in their export volumes, which was driving producers to shut down factories. There are a number of risks emerging from this situation, both at the macro and micro levels. At the aggregate level, India has been enjoying the benefits of a considerably narrowed current account deficit on account of lower global commodity prices. If exports continue to decline, the vulnerability on this front may increase. As far as sectors and businesses are concerned, clearly, a persistent decline in volumes is going to hit employment, with a disproportionate impact on jobs because of the relatively high labour-intensity of manufactured exports.

At the aggregate level, while exports declined by 16.8 per cent, imports also declined by 12.6 per cent during the first quarter. There was a significant decline in oil prices over this period; oil and petroleum product imports were almost 40 per cent lower during April-June 2015 over the same period last year. While oil exports are not separately reported in the monthly press releases, they have been a large contributor to export revenues due to high crude oil prices and would have declined commensurately with these. Overall, the trade deficit for the first quarter came in at $32.2 billion, only about $0.8 billion lower than the first quarter of last year. This does not suggest an imminent threat to India's balance of payments. Obviously, though, if exports continue to decline, even a moderate increase in the prices of crude oil and other commodities could exert pressure on the current account.

It is the sectoral picture that highlights the factors behind the decline and possible policy responses. Adversely impacted firms are pointing to stiff competition from countries like Bangladesh and Vietnam in leather and textile products. China's slowdown is impacting the exports of textile intermediates. The underlying theme is one of a relatively weak competitive position in a situation in which surplus global capacity has caused producers in competing companies to create aggressive strategies to capture and retain market share. Currency appreciation in real terms is one contributory factor. Other problems include high unit labour costs, and huge disadvantages on the logistics front, both in terms of time and expense. Add to this the deterioration in the ease of doing business and the disadvantage increases. What the export numbers underline is that the time frame in which the pieces need to be put together is shrinking. Declining export earnings are inconsistent with the growth acceleration to which the government aspires.

http://www.thehindubusinessline.com/eco ... yndication

Sakthivel wanted the government to reclassify the export country groups (currently A, B and C groups) in view of the changing global scene. The government has classified the countries into A (which includes USA and European Union), and B and C for administration of incentives under the Merchandise Export from India Scheme (MEIS) and others. Sakthivel wanted Russia and South American countries to be included in the grouping so that the exporters could get the incentives. He also called for paying better incentives for exports to European Union.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Thats inaccurate.RamaY wrote:Because some of the Forex are kept in gold.SaiK wrote:http://timesofindia.indiatimes.com/busi ... 404076.cms

'm trying to understand gold price and forex reserve.. how can this happen?

Every central bank has assets and reserves.

Assets are things like Gold. Reserves are things denominated in foreign currencies. NO central bank holds foreign currency. They hold bonds in that currency. THe purpose of reserves is to buy your own currency (for RBI - INR) overseas when it is being attacked by speculators. By selling reserves (i.e. bonds mostly) they reduce the amount of INR available overseas. THis reduces the ammunition that speculators have. IN technical terms, they are prevented from shorting the rupee. Assets on the other hand are used as a last resort thing. WHen you run out of reserves, then you use assets. Remember 1991?

The financial journalists do not understand these basics and they are pulling things out of their collective arses and want us to listen to them.

Re: Indian Economy - News & Discussion Oct 12 2013

......so you are flat denying this statement in the above article?

https://www.gfmag.com/global-data/econo ... by-country

another link...Gold reserves in the world's largest gold consuming nation constitute nearly 15 percent of forex.

https://www.gfmag.com/global-data/econo ... by-country

International reserves are a country’s “external assets”—including foreign currency deposits and bonds held by central banks and monetary authorities, gold and SDRs.