I tried to email you. Can you please drop a mail to altair.brf AT chaachaachandrasekhar.m wrote: If you don't mind, could you give some more details, please? If you don't want to reveal here, can you please email me at chandu_miyaaATgoogle.

I want to retire to a farm eventually and have also wanted to buy some agri land since a couple of years. But, am not sure of how to make money after that from it.

Perspectives on the global economic changes

-

Altair

- BRF Oldie

- Posts: 2620

- Joined: 30 Dec 2009 12:51

- Location: Hovering over Pak Airspace in AWACS

Re: Perspectives on the global economic changes

-

member_27845

- BRFite

- Posts: 160

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

There has always been a drop after year end Xmas sales in previous years , but this year the drop is much larger !!TSJones wrote:^^^^^^^ while I respect the USDA at their respective specialty, agriculture and long term climate studies, I would note that past performance does not necessarily predict future performance. Especially for something as nebulous as GDP. Stuff happens, to put it politely. And the larger a GDP grows, the harder it is to grow. This rule applies to the US the same as everyone else.

More troubling stats.

http://www.bloomberg.com/news/articles/ ... ntory-glut

Right now, one of the world's most transparent and willing to import goods and services economies, and at this particular moment the largest economy in the world, is flush. I mean to the brim, man. We're swamped in goods and services with no great increase in demand yet seen.

Could it be due to greater online / ecommerce - deals : ie , customers are waiting for the best deals that come around Xmas and then put off purchases till the next deal cycle ?

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic changes

Major Rundi-Rudali farticle

At Global Economic Gathering, U.S. Primacy Is Seen as Ebbing

At Global Economic Gathering, U.S. Primacy Is Seen as Ebbing

Washington’s retreat is not so much by intent, Mr. Subramanian said, but a result of dysfunction and a lack of resources to project economic power the way it once did. Because of tight budgets (really?) and competing financial demands, the United States is less able to maintain its economic power, and because of political infighting, it has been unable to formally share it either.

Re: Perspectives on the global economic changes

US should write laws of global economy, not China - Obama

When 95 percent of our potential customers live abroad, we must be sure that we are writing the rules for the global economy, not a country like China," Obama said in his special message to Congress on Thursday, RIA reports.

“Our exports support more than eleven million jobs, and we know that exporting companies pay higher wages than others. Today we have the opportunity to open even more new markets to goods and services backed by three proud words: Made in America,” Obama added.

“China wants to write the rules for the world’s fastest-growing region,” the US President said in his January State of the Union address to Congress. “Why should we let that happen? We should write those rules.”

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic changes

"potential" is the keyword and that potential is dwindling by the hour. Even then, if it is based on customer base then US is the largest customer of China with imbalance of ~$400B. Based on the same (il)logic, Obama should concede the rue writing to China.

For the last 2-3 years, China is the top trading nation surpassing US. Obama is shooting himself in the foot by telling lies/half lies and/or basing his argument on illogic.

So, what happened to the Debt Ceiling? It was in suspended animation till March 2015. US is deliberately keeping the debt ceiling debate low profile due to which they are making their insecurity high profile. Being the world's largest debtor nation is not exactly a feat that will aid in writing the rules of global economy just as Greece is not being allowed to write the rules in its relation with EU/IMF.

With this kind of "leadership", no wonder US is phucked.

For the last 2-3 years, China is the top trading nation surpassing US. Obama is shooting himself in the foot by telling lies/half lies and/or basing his argument on illogic.

So, what happened to the Debt Ceiling? It was in suspended animation till March 2015. US is deliberately keeping the debt ceiling debate low profile due to which they are making their insecurity high profile. Being the world's largest debtor nation is not exactly a feat that will aid in writing the rules of global economy just as Greece is not being allowed to write the rules in its relation with EU/IMF.

With this kind of "leadership", no wonder US is phucked.

Re: Perspectives on the global economic changes

Considering the amount of damage the guy caused, its amazing how he continues to cash in.

He was giving speeches to banks at $250,000 a pop and now this.

Only in the bogus field of banking can you f up that badly and still make sh7tloads of money. Just gotta make sure you issue the bailouts to the right folks who will hire you once you leave govt. There should be a retro-active law passed which states that once you leave govt/the Federal Reserve, you can only join academia. Otherwise it just creates a revolving door of corruption.

___

Ben Bernanke To Join World's Most Levered Hedge Fund: HFT Powerhouse Citadel

Mr. Bernanke will become a senior adviser to the Citadel Investment Group, the $25 billion hedge fund founded by the billionaire Kenneth C. Griffin. He will offer his analysis of global economic and financial issues to Citadel’s investment committees. He will also meet with Citadel’s investors around the globe.

While Mr. Bernanke declined to disclose his compensation, he said he would be paid an annual fee but would not own a stake in the firm or receive a bonus based on its performance. His arrangement with Citadel is not exclusive, so he could take on other consulting roles. Mr. Bernanke said that he could not determine exactly how much time he expected to devote to Citadel.

He added that he did not consider himself an investor; he plans to offer Citadel his perspective on monetary issues and other matters of public policy that Citadel will use as “inputs” into its investment decisions.

“I was looking for an opportunity to use my skills and knowledge,” he said. “This is an interesting firm".

and knowledge,” he said. “This is an interesting firm".

http://www.zerohedge.com/news/2015-04-1 ... se-citadel

He was giving speeches to banks at $250,000 a pop and now this.

Only in the bogus field of banking can you f up that badly and still make sh7tloads of money. Just gotta make sure you issue the bailouts to the right folks who will hire you once you leave govt. There should be a retro-active law passed which states that once you leave govt/the Federal Reserve, you can only join academia. Otherwise it just creates a revolving door of corruption.

___

Ben Bernanke To Join World's Most Levered Hedge Fund: HFT Powerhouse Citadel

Mr. Bernanke will become a senior adviser to the Citadel Investment Group, the $25 billion hedge fund founded by the billionaire Kenneth C. Griffin. He will offer his analysis of global economic and financial issues to Citadel’s investment committees. He will also meet with Citadel’s investors around the globe.

While Mr. Bernanke declined to disclose his compensation, he said he would be paid an annual fee but would not own a stake in the firm or receive a bonus based on its performance. His arrangement with Citadel is not exclusive, so he could take on other consulting roles. Mr. Bernanke said that he could not determine exactly how much time he expected to devote to Citadel.

He added that he did not consider himself an investor; he plans to offer Citadel his perspective on monetary issues and other matters of public policy that Citadel will use as “inputs” into its investment decisions.

“I was looking for an opportunity to use my skills

http://www.zerohedge.com/news/2015-04-1 ... se-citadel

Re: Perspectives on the global economic changes

From bailouts & bonuses to banker bail-ins.

Re: Perspectives on the global economic changes

Deutsche bank gets record penalty for rate rigging.

http://finance.yahoo.com/news/deutsche- ... 38040.html

http://finance.yahoo.com/news/deutsche- ... 38040.html

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

It was a lot of fun taking interest rate from double digits 30 years ago to near zero. At zero, you can't go any lower and taking rates up is extremely painful. And once you get hooked to lower rates, no one wants a steady path of higher rates. Geopolitical motives behind this are so deep.

Let’s Talk About It: What Policy Tools Should the Fed “Normally” Use?

And as always, white papers gives a nice feeling of authenticityFed Should Make Bond Buys a Regular Policy Tool, A Boston Fed Paper Finds (Source: WSJ)

<snip>

The Federal Reserve should consider keeping bond buys as a regular tool of monetary policy rather than return to a more conventional policy relying just on setting short-term rates, a newly-released paper from the Federal Reserve Bank of Boston says.

...

But Ms. Barnes says the Fed should be open to buying more bonds in the future if necessary to influence interest rates (read: artificially keep rates low) and to maintaining a large balance sheet (is this a goal or unintended outcome??)

...

“If the Fed were to keep its newer balance sheet tools, the future conduct of monetary policy may be more effective than in the recent past (no shit), and, ultimately, this better success would help the Fed burnish its reputation for true credibility in fulfilling the dual mandate and preserving financial stability,” she adds

<snip>

Let’s Talk About It: What Policy Tools Should the Fed “Normally” Use?

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

https://mises.org/blog/chase-joins-war-cash

What are they (governments) preparing for? Pointless spelling it out. The smart can read between the lines.The war against cash has, up to now, been waged almost exclusively by national governments and official international organizations, although there are exceptions. Now the war has acquired a powerful new ally in Chase, the largest bank in the U.S. and a subsidiary of JP Morgan Chase and Co., according to Forbes, the world's third largest public company. Of course , it is hardly surprising that a crony capitalist fractional-reserve bank, which received $25 billion in bailout loans from the U.S. Treasury, should want to curry favor with its regulators and political masters and, in the process, ensure its own stability by helping to stamp out the use of cash. For the very existence of cash places the power over fractional-reserve banks squarely in the hands of their depositors who may withdraw their cash in any amount and at any time, bringing even the mightiest bank to its knees literally overnight (e.g., Washington Mutual).

What is a surprise is how little notice the rollout of Chase's new policy has received. As of March, Chase began restricting the use of cash in selected markets, including Greater Cleveland. The new policy restricts borrowers from using cash to make payments on credit cards, mortgages, equity lines, and auto loans. Chase even goes as far as to prohibit the storage of cash in its safe deposit boxes . In a letter to its customers dated April 1, 2015 pertaining to its "Updated Safe Deposit Box Lease Agreement," one of the highlighted items reads: "You agree not to store any cash or coins other than those found to have a collectible value." Whether or not this pertains to gold and silver coins with no numismatic value is not explained.

As one observer commented:

This policy is unusual but, since Chase is the nation's largest bank, I wouldn't be surprised if we start seeing more of this in this era of sensitivity about funding terrorists and other illegal causes.

Bet on it.

Re: Perspectives on the global economic changes

Odd thing happened on Monday in FX market. In weekend was ECB's Draghi's statement 'don't short Euro' only to be met by Euro falling on Monday . Euro recovered quite a bit but bounce came later in the week not 'immediate' ,normally one except immediate bounce either caused by lack of liquidity or market following CBs. It just might be that most Euro Shorts are US based funds (do remember most parity calls within 2015 are coming from US banks ) or maybe we are seeing clear signs of CBs authority over market weakning. Shorts will be massively squeezed should Euro make a move above 1.10 . 3rd time lucky ?

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

IMVHO, Euro is weakening as Dollar strengthens. But is that the big picture? In the world today there are only three assets, gold, oil and currencies. The paper currencies, so long admired and accepted are now in a war of self destruction. They will consume each other in an end battle of "I'm the last man standing but have lost all use as a unit of value". Usually the CB do NOT issue diktats. USFR did give forward guidance of raising rates this year. Its a trial balloon and traders will start rejigging their portfolio to avoid losses as a consequence of rising rates. The overwhelming trend (among the bond investors) is to now invest in those countries who have favourable demographics, high capital account and who need oil in huge quantity and need to import it. I can think of only 2 countries who fit this- India and Indonesia.

Did Draghi actually say - don't short the Euro?

Did Draghi actually say - don't short the Euro?

Re: Perspectives on the global economic changes

Agree On many points, but did you mean to say only three "liquid" assets? If the world comes to an end, financially or as defined in modern economic theory, someone with a piece of fertile land in India, few cows, bulls, and pile of initial stock of seeds will do very well, compared to someone with a lot of gold.

Separately, on the tholla and ooro currenshies, the discount or premium conversations seem like short term distraction. As they prepare their economies and companies to position against rising economies of Asia, some quiet agreement around parity is very likely. I mean, why in the world would they allow uncertainty if the goal is to combat rising Asia? Of course they will move around, that is how FX traders make a living.

Yes, they are talking about rate rise but I doubt rates are going anywhere. In theory, you could use deflationary pressures and all economic mumbo jumbo to make an argument against higher rates, but I believe that lower rates and higher currency values offer unique geopolitical advantage, something that Eco theory does not capture or discuss openly. Take for example Brasil. Foreign debts, poor management, and artificial oil crisis depresses Brasil's oil assets, only to be scooped by opportunist investor at distressed prices with a stronger currency. And this game could be played against assets in India in a similar way.

Separately, on the tholla and ooro currenshies, the discount or premium conversations seem like short term distraction. As they prepare their economies and companies to position against rising economies of Asia, some quiet agreement around parity is very likely. I mean, why in the world would they allow uncertainty if the goal is to combat rising Asia? Of course they will move around, that is how FX traders make a living.

Yes, they are talking about rate rise but I doubt rates are going anywhere. In theory, you could use deflationary pressures and all economic mumbo jumbo to make an argument against higher rates, but I believe that lower rates and higher currency values offer unique geopolitical advantage, something that Eco theory does not capture or discuss openly. Take for example Brasil. Foreign debts, poor management, and artificial oil crisis depresses Brasil's oil assets, only to be scooped by opportunist investor at distressed prices with a stronger currency. And this game could be played against assets in India in a similar way.

Re: Perspectives on the global economic changes

^^^ Apparently he did so in some IMF even in Washington . Same stuff he repeated in 2012. CBs do give guidance in normal times but they keep a check on liquidity flow . Earlier even rumor of CB checking the market would put speed brakes in price movements but then we had no ZIRP. I accept the arguments including related facts that paper currency is losing ground but even today in financial trading its still shirt losing strategy . There were a few brief moments post 2008 crisis when COMEX gold price decoupled from USD strength but not something i would bet on regular basis. Gold just like real estate being part of your investment nest is a good thing but fully invested i don't know.

Problem with parity call is no one knows where will Euro find support below parity . It will be a very slippery slope below parity. European Bond Market is no longer an average player market .Again just my humble opinion.

Problem with parity call is no one knows where will Euro find support below parity . It will be a very slippery slope below parity. European Bond Market is no longer an average player market .Again just my humble opinion.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

Yes Udaym Saar. The man with bigha land, cows and Bulls will be fine. the reality is the so called Global economic crash of 2008 was not global. It was peculiarly anglosaxon. These con artists whom we label as economists, called 1997 as Asian crisis, the 1994 mexico crisis as South American crisis.

Do you really think the common man on the street cares about repo rates, CRR, LIBOR, EuRIBOR, reverse repos, loco gold, Fitch rating etc?

Fixing a parity of western currencies to ensure rising Asia ( you mean emerging Asia as western con artists call it or re emerging Asia as we should call it) does not rise?

It comes to the understanding of the dirty float. Now You know what dirty float is? Instead of fixing 1USD as 2 Euros or 100 yen, they agree to let the value float between 1.85 euro to 2.25 euro for every dollar- on those lines.

But countries are giving up the dirty float. Why is China setting up bilateral swaps with many countries? Why are they agreeing to stop the use of dollar in their trade?

http://www.ecb.europa.eu/press/pr/date/ ... 10.en.html

See they themselves cannot agree with what they want. And they cannot hold a gun over their anglosaxon friends head telling them what to do.

Earlier this month in FT, there was an article asking the ECB to intervene in forex market. The ECB declined. They have given up on the dirty float too.

Do you really think the common man on the street cares about repo rates, CRR, LIBOR, EuRIBOR, reverse repos, loco gold, Fitch rating etc?

Fixing a parity of western currencies to ensure rising Asia ( you mean emerging Asia as western con artists call it or re emerging Asia as we should call it) does not rise?

It comes to the understanding of the dirty float. Now You know what dirty float is? Instead of fixing 1USD as 2 Euros or 100 yen, they agree to let the value float between 1.85 euro to 2.25 euro for every dollar- on those lines.

But countries are giving up the dirty float. Why is China setting up bilateral swaps with many countries? Why are they agreeing to stop the use of dollar in their trade?

http://www.ecb.europa.eu/press/pr/date/ ... 10.en.html

The question also arises does US want the USD strong or weaker? Does ECB want the Euro strong or weak? And what about Japanese? Do they want Japanese yen strong? Or weak?Swap line will have a maximum size of 350 billion Chinese yuan and €45 billion.

Agreement will be valid for three years.

From the Eurosystem’s perspective, it will serve as a backstop liquidity facility.

See they themselves cannot agree with what they want. And they cannot hold a gun over their anglosaxon friends head telling them what to do.

Earlier this month in FT, there was an article asking the ECB to intervene in forex market. The ECB declined. They have given up on the dirty float too.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

Saar,satya wrote: CBs do give guidance in normal times but they keep a check on liquidity flow . Earlier even rumor of CB checking the market would put speed brakes in price movements but then we had no ZIRP. I accept the arguments including related facts that paper currency is losing ground but even today in financial trading its still shirt losing strategy . There were a few brief moments post 2008 crisis when COMEX gold price decoupled from USD strength but not something i would bet on regular basis. .

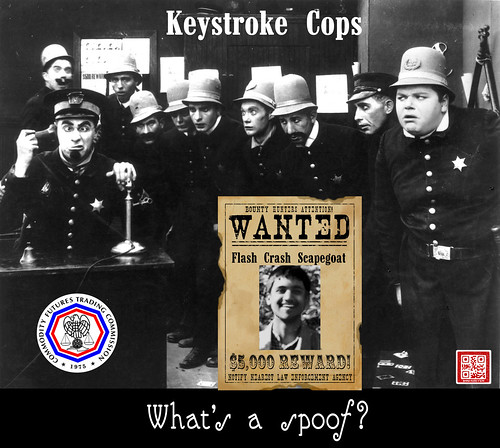

Did you read about Shri Navinder Singh

Re: Perspectives on the global economic changes

^^^ I might be wrong but my understanding is that Dude was creating & cancelling Limit Orders = showing & removing liquidity in market real fast . Most traders do change their mind on second thoughtS but don't do it on such ultra short time frame basis. Will have an impact on HFT definitely.

Looking from a race angle financial trading is supposed to be last remaining empire run by White Man where we SDREs should know our place . Should have joined one of funds in City = gave them hafta in other words.

My thinking is to set a modest target . Go for it quietly and once achieved move out quietly to some quiet place away from all this forever.

Looking from a race angle financial trading is supposed to be last remaining empire run by White Man where we SDREs should know our place . Should have joined one of funds in City = gave them hafta in other words.

My thinking is to set a modest target . Go for it quietly and once achieved move out quietly to some quiet place away from all this forever.

Re: Perspectives on the global economic changes

First Look: U.S. Dollar Substitute to Go Public on Oct 20th?

http://thecrux.com/dyncontent/dollar-su ... =MKT042439

http://thecrux.com/dyncontent/dollar-su ... =MKT042439

nd on Oct 20th of this year, the IMF is expected to announce a reserve currency alternative to the U.S. dollar, which will send hundreds of billions of dollars moving around the world, literally overnight.According to Juan Zarate, who helped implement financial sanctions while serving in George W. Bush’s Treasury department, “Once the [other currency] becomes an alternative to the dollar, rules of the game begin to change.”And Leong Sing Chiong, Assistant Managing Director at a major central bank, said this dollar alternative “is likely to transform the financial landscape in the next 5-10 years.”According to currency expert, Dr. Steve Sjuggerud (recently featured on CNBC, and Bloomberg),“I’ve been active in the markets for over two decades now… but I’ve never seen anything that could move so much money, so quickly. Hundreds of billions of dollars could change hands in a single day after this announcement is made.”“The announcement will start a domino effect, that will basically determine who in America gets rich in the years to come… and who struggles.”Dr. Sjuggerud says if you own any U.S. assets—and that includes stocks, bonds, real estate, or just cash in a bank account–you should be aware of what’s about to happen, and know how to prepare.Experts say this announcement, expected Oct. 20th, could trigger one of the most profound transfers of wealth in our lifetime..

Re: Perspectives on the global economic changes

Weaker dollar may allow USA to revive it's manufacturing unless they have lost the verve to remain in mass manufactering. China will continue to turn inwards with rising Yuan and it's rise may continue for longtime to come.

Re: Perspectives on the global economic changes

Except that the yuan is way more restricted by the Chinese government than the dollar is. If that's what you want, have at it. The dollar and the euro are far more transparent and less restricted. Could the Chinese change the so called "financial landscape"? Certainly, but they will have to give up some control in order to do it. Chinese the lender of last resort? Mmm, OK, it could happen. Black Swans do occur sometimes. But quite frankly I don't see the Chinese ever importing goods and services the way West does.Jhujar wrote:First Look: U.S. Dollar Substitute to Go Public on Oct 20th?

http://thecrux.com/dyncontent/dollar-su ... =MKT042439

nd on Oct 20th of this year, the IMF is expected to announce a reserve currency alternative to the U.S. dollar, which will send hundreds of billions of dollars moving around the world, literally overnight.According to Juan Zarate, who helped implement financial sanctions while serving in George W. Bush’s Treasury department, “Once the [other currency] becomes an alternative to the dollar, rules of the game begin to change.”And Leong Sing Chiong, Assistant Managing Director at a major central bank, said this dollar alternative “is likely to transform the financial landscape in the next 5-10 years.”According to currency expert, Dr. Steve Sjuggerud (recently featured on CNBC, and Bloomberg),“I’ve been active in the markets for over two decades now… but I’ve never seen anything that could move so much money, so quickly. Hundreds of billions of dollars could change hands in a single day after this announcement is made.”“The announcement will start a domino effect, that will basically determine who in America gets rich in the years to come… and who struggles.”Dr. Sjuggerud says if you own any U.S. assets—and that includes stocks, bonds, real estate, or just cash in a bank account–you should be aware of what’s about to happen, and know how to prepare.Experts say this announcement, expected Oct. 20th, could trigger one of the most profound transfers of wealth in our lifetime..

Re: Perspectives on the global economic changes

The one thing Greece has refused to give up are its gold reserves.

Is Greece About To "Lose" Its Gold Again?

http://www.zerohedge.com/news/2015-04-2 ... gold-again

Is Greece About To "Lose" Its Gold Again?

http://www.zerohedge.com/news/2015-04-2 ... gold-again

Re: Perspectives on the global economic changes

No. He found a way to outwit the HFT algorithms which did that by executing trades in a unique way.satya wrote:^^^ I might be wrong but my understanding is that Dude was creating & cancelling Limit Orders = showing & removing liquidity in market real fast

The HFT traders who thought they were scamming the market got outwitted themselves.

They then were eager to have him arrested since he beat them at their own scam.

Re: Perspectives on the global economic changes

Worthless SDR toilet paper coming our way once national currencies fail?

http://www.zerohedge.com/news/2015-04-25/gold-sdr-brics

http://www.zerohedge.com/news/2015-04-25/gold-sdr-brics

Re: Perspectives on the global economic changes

http://www.economicprinciples.org/

http://www.bwater.com/Uploads/FileManag ... ciples.pdf

http://en.wikipedia.org/wiki/Ray_Dalio

Dalio practices the Transcendental Meditation technique

In 2007, Ray Dalio predicted the global financial crisis,[11] and in 2008 published an essay, "How the Economic Machine Works; A Template for Understanding What is Happening Now",[12] which explained his model for the economic crisis. He self-published a 123 page volume called Principles, in 2011, which outlined his logic and personal philosophy for investments and corporate management based on a lifetime of observation, analysis and practical application through his hedge fund.[13][14][15] In 2013 Dalio began sharing his "investment secrets" and economic theories on YouTube via a 30 minute animated video which he narrates, called How The Economic Machine Works; the video has since been viewed over 1.5 million times,[16] and has been translated and made available in Japanese, Chinese, Russian, Spanish, German, Italian and French.[17]

http://www.bwater.com/Uploads/FileManag ... ciples.pdf

http://en.wikipedia.org/wiki/Ray_Dalio

Dalio practices the Transcendental Meditation technique

In 2007, Ray Dalio predicted the global financial crisis,[11] and in 2008 published an essay, "How the Economic Machine Works; A Template for Understanding What is Happening Now",[12] which explained his model for the economic crisis. He self-published a 123 page volume called Principles, in 2011, which outlined his logic and personal philosophy for investments and corporate management based on a lifetime of observation, analysis and practical application through his hedge fund.[13][14][15] In 2013 Dalio began sharing his "investment secrets" and economic theories on YouTube via a 30 minute animated video which he narrates, called How The Economic Machine Works; the video has since been viewed over 1.5 million times,[16] and has been translated and made available in Japanese, Chinese, Russian, Spanish, German, Italian and French.[17]

Re: Perspectives on the global economic changes

You can't artificially force the market in the direction you want and that was what the guy was doing by injecting a gazillion market orders and then cancelling them. The Hunt brothers got into a whole lot of trouble for trying to jack up the silver futures market and corner the market about 30 years ago. Regulators came down on them like a ton of bricks. If you submit a market order, it had better be genuine or else. They will tolerate an occasional mistake but it had better not fit into a pattern. Artificially jacking up the market through bogus orders and then shorting them will get your wee-wee whacked. Big time.Neshant wrote:No. He found a way to outwit the HFT algorithms which did that by executing trades in a unique way.satya wrote:^^^ I might be wrong but my understanding is that Dude was creating & cancelling Limit Orders = showing & removing liquidity in market real fast

The HFT traders who thought they were scamming the market got outwitted themselves.

They then were eager to have him arrested since he beat them at their own scam.

FBI is investigating this guy for massively shorting Herbalife.

http://www.nytimes.com/2014/03/10/busin ... .html?_r=0

Re: Perspectives on the global economic changes

He wasn't doing what you said, he was outsmarting those who were doing it - namely the HFT algorithms. He found a way to make their spoof orders (used to manipulate the derivative price) get filled - resulting in big losses for those market manipulators.

Exactly how he did what he did is decribed here. Too technical for me to understand but it seems he exploited a loophole to mask his orders and put it in when the HFT trade bots didn't expect it.

Were he an employee at Goldman Sachs, you can be sure no arrest would have been made and he'd be making good money & bonuses.

The guy is the Edward Snowden of HFT. Now just watch how he dies from an 'accident'.

http://www.zerohedge.com/news/2015-04-2 ... r-own-game

Exactly how he did what he did is decribed here. Too technical for me to understand but it seems he exploited a loophole to mask his orders and put it in when the HFT trade bots didn't expect it.

Were he an employee at Goldman Sachs, you can be sure no arrest would have been made and he'd be making good money & bonuses.

The guy is the Edward Snowden of HFT. Now just watch how he dies from an 'accident'.

http://www.zerohedge.com/news/2015-04-2 ... r-own-game

Re: Perspectives on the global economic changes

We'll see. He's rich and he can afford an excellent lawyer.

Re: Perspectives on the global economic changes

http://totalwealthresearch.com/rickards ... 41&from=fb

Five Signs the World Is On the Cusp of “All-Out War”

Should the rise of conflicts across the Middle East and Ukraine serve as a warning sign that something much more dangerous is approaching?

Five Signs the World Is On the Cusp of “All-Out War”

Should the rise of conflicts across the Middle East and Ukraine serve as a warning sign that something much more dangerous is approaching?

Re: Perspectives on the global economic changes

He was not FZ show today and very high on China which he think will still grow in long term.svinayak wrote:http://www.economicprinciples.org/

http://www.bwater.com/Uploads/FileManag ... DalioDalio practices the Transcendental Meditation technique

In 2007, Ray Dalio predicted the global financial crisis,[11] and in 2008 published an essay, "How the Economic Machine Works; A Template for Understanding What is Happening Now",[12] which explained his model for the economic crisis. He self-published a 123 page volume called Principles, in 2011, which outlined his logic and personal philosophy for investments and corporate management based on a lifetime of observation, analysis and practical application through his hedge fund.[13][14][15] In 2013 Dalio began sharing his "investment secrets" and economic theories on YouTube via a 30 minute animated video which he narrates, called How The Economic Machine Works; the video has since been viewed over 1.5 million times,[16] and has been translated and made available in Japanese, Chinese, Russian, Spanish, German, Italian and French.[17]

Re: Perspectives on the global economic changes

I'm wary of these guys who pop out of nowhere claiming they predicted the 2008 disaster.

The only documented case of such a prediction being made prior to 2008 came from Peter Schiff (who had been preaching collapse since 2001) and Robert Prechter (who expected the collapse as early as 1990)!

But their prediction of the housing market leveraged bubble was spot on and it occurred prior to 2007.

Aside from those 2, nobody else seems to have predicted anything with documented proof of their pre 2007 prediction.

So beware of guys claiming they predicted the Great Recession.

Most were probably making predictions like this joker :

The only documented case of such a prediction being made prior to 2008 came from Peter Schiff (who had been preaching collapse since 2001) and Robert Prechter (who expected the collapse as early as 1990)!

But their prediction of the housing market leveraged bubble was spot on and it occurred prior to 2007.

Aside from those 2, nobody else seems to have predicted anything with documented proof of their pre 2007 prediction.

So beware of guys claiming they predicted the Great Recession.

Most were probably making predictions like this joker :

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic changes

I read the Sarao articles, thanks for sharing.

I think I get the gist of what he was doing. See, since the advent of HFTs, the markets have become fundamentally broken. The HFTs themselves work by placing and removing orders (they place orders in multiple markets, and when someone tries to buy it in one market, HFTs remove the orders from other markets - thus contributing to the overall schizophrenic nature of the markets).

What Sarao was doing was this - he had created a system to monitor the ENTIRE market structure. I believe he was an extremely good pattern recognizer - when he watched his screen, he was unconciously picking up 'gaps' in the market, and he was then trading on them. Since gaps can open in the markets very quickly and for a very short duration, he had to change his trading positions on the fly. That is why he said that he changes his mind very rapidly.

Why the HFTs are spooked is because this guy can open and close markets in such ways that their algorithms are incapable of anticipating. Hence, those jokers' trading 'strategies' become outmoded the moment Sarao starts trading them.

Look, it is a fallacy to think that HFTs are fast. HFTs algorithms take a lot of time to build, and are always tested using past data. When a guy is trading without and legacy data and maintains the flexibility that Sarao did, his trading strategies will always be more up-to-date than HFTs.

Just look at the disadvantages that Sarao had:

1. He had no dedicated trading box - he was trading using his own computer and was only as fast as his fingers and mouse allowed him to be.

2. He did not even have a direct data feed from the market!

3. He was trading from London, whereas most HFTs have their servers in NY, and are located near the exchanges.

Despite having no speed or computing advantage, he beat the frat boys. This guy is a genius! He should be given the Nobull Piss Prize for Economics.

I think I get the gist of what he was doing. See, since the advent of HFTs, the markets have become fundamentally broken. The HFTs themselves work by placing and removing orders (they place orders in multiple markets, and when someone tries to buy it in one market, HFTs remove the orders from other markets - thus contributing to the overall schizophrenic nature of the markets).

What Sarao was doing was this - he had created a system to monitor the ENTIRE market structure. I believe he was an extremely good pattern recognizer - when he watched his screen, he was unconciously picking up 'gaps' in the market, and he was then trading on them. Since gaps can open in the markets very quickly and for a very short duration, he had to change his trading positions on the fly. That is why he said that he changes his mind very rapidly.

Why the HFTs are spooked is because this guy can open and close markets in such ways that their algorithms are incapable of anticipating. Hence, those jokers' trading 'strategies' become outmoded the moment Sarao starts trading them.

Look, it is a fallacy to think that HFTs are fast. HFTs algorithms take a lot of time to build, and are always tested using past data. When a guy is trading without and legacy data and maintains the flexibility that Sarao did, his trading strategies will always be more up-to-date than HFTs.

Just look at the disadvantages that Sarao had:

1. He had no dedicated trading box - he was trading using his own computer and was only as fast as his fingers and mouse allowed him to be.

2. He did not even have a direct data feed from the market!

3. He was trading from London, whereas most HFTs have their servers in NY, and are located near the exchanges.

Despite having no speed or computing advantage, he beat the frat boys. This guy is a genius! He should be given the Nobull Piss Prize for Economics.

Re: Perspectives on the global economic changes

^^ have to agree.

Re: Perspectives on the global economic changes

The dollar substitute seems to be not very well understood. Not much info on the internet. Who decides what here, will it be backed by gold (or will gold be 'lost' post financial meltdown or revolution), and so on. Billions of $$ moving overnight must be understood more clearly.Jhujar wrote:First Look: U.S. Dollar Substitute to Go Public on Oct 20th?

http://thecrux.com/dyncontent/dollar-su ... =MKT042439

<SNIP>

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

He should. But he will be made an example of, if he is extradited to USA.abhischekcc wrote: Despite having no speed or computing advantage, he beat the frat boys. This guy is a genius! He should be given the Nobull Piss Prize for Economics.

If the HFT algorithms were any good, they should be able to filter out all the noise. But they could not.

http://www.bloombergview.com/articles/2 ... ng-pantherWhenever I talk to people about high-frequency trading I ask them: "What should I think about spoofing?" My basic problem is that it seems so dumb. I mean, this is spoofing:

Widgets are quoted at $100 bid, $105 ask and last traded at $102.50.

You place an order to sell a million widgets at $104.

You immediately place an order to buy 10 widgets at $101.

Everyone sees the million-widget order and is like, "Wow, lotta supply, the market is going down, better dump my widgets!"

So someone is happy to sell you 10 widgets for $101 each.

Then you immediately cancel your million-widget order, leaving you with 10 widgets for which you paid $1,010.

Then you place an order to buy a million widgets for $101, and another order to sell 10 widgets at $104.

Everyone sees the new million-widget order, and since no one has any attention span at all, they are like, "Wow, lotta demand, the market is going up, better buy some widgets!"

So someone is happy to buy 10 widgets from you for $104 each.

Then you immediately cancel your million-widget order, leaving you with no widgets, no orders and $30 in sweet sweet profits.

Ugh doesn't that sound dumb? For two reasons. First of all, it is terribly risky. What if, unbeknownst to you, someone really wanted to buy widgets? You waltz in with your million-widget sell order, get lifted and all of a sudden you are short a million widgets at $104, $1.50 above the last trade. That is an awful risk to take for the prospect of making $30.1

Second, though, it relies on a certain dumbness in your counterparties. You've done nothing here to deceive anyone about the value of widgets; you're not publishing fake research about blight in the Siberian widget fields or touting a new social network that will render widgets obsolete. All you're doing is modifying the order book so that it looks like there are more sellers (or buyers) of widgets than there were before. Anyone who had good fundamental reasons for buying or selling widgets at $100 or $105 before your order should have the same reasons after it. You're confusing only those with no opinions of their own, who decide what they want to do based on what other people are doing.

But, yes, of course, spoofing exists. Michael Coscia had a brief but lucrative and eventful career as an algorithmic spoofer; it seems to have started in August 2011 when he "devised, implemented, and executed a high-frequency trading strategy in which he entered large-volume orders that he intended to immediately cancel before they could be filled by other traders," and it culminated yesterday in his indictment by federal prosecutors. In between, he and his firm, Panther Energy Trading LLC, settled spoofing charges in 2013 with the U.K. Financial Conduct Authority for about $900,000, and with the U.S. Commodity Futures Trading Commission for $2.8 million.2 And now he gets to be "the first federal prosecution nationwide under the anti-spoofing provision that was added to the Commodity Exchange Act by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act."

Re: Perspectives on the global economic changes

In retrospect I find it amusing he says that with such calmness and confidence as if he has complete control over the marketNeshant wrote: Most were probably making predictions like this joker :

Good to see the Central Bankers maintain the same calmness and confidence over the current financial situation