TSJones wrote:Credit is an economy multiplier. Just because poorly regulated speculators and political zealots abuse it does not mean that credit is bad. In fact, it can be a wonderful thing that technology springs forth from. Farmers use it to leverage their crops so that they don't starve all winter. Corporations use it to build factories and equipment. Governments use it to smooth revenue flows during tax seasonal variations. I've used it to send my wife and children to college and to buy homes and cars.

Credit causes money to have velocity factor of 7 or greater! That means for every dollar deposited in the bank 7 people or business use while it is credited to that person's checking or savings account.

Paper money is the force from which giant economies grow. And someone has to be in charge of it. But they have rules that they must follow. I don't know about India central bank and how it operates, but the US congress *mandates* the mission for the US federal reserve to include two things.

1. Protect the integrity of the US banking system so that there are no general US population banking panics. In spite of what you might think, in 2008 there were no run on the banks from the general population. We all kept our money in the banks and the fed guaranteed it. The shareholders got smacked but not the depositors. Same for the insurance companies like AIG. In that regard, The Fed Reserve did its job.

2. Promote the full employment of the population of the US. That's what the quantative easing is all about.

Again, this mission is a requirement from the US Congress and the Chairman of the Fed HAS TO ANSWER TO IT.

If the US economy was on a gold standard there is no way it could have grown like it has today. Vast areas of the US would have been without money and reduced to bartering for what they need.

My friend FOFOA explains it well here.

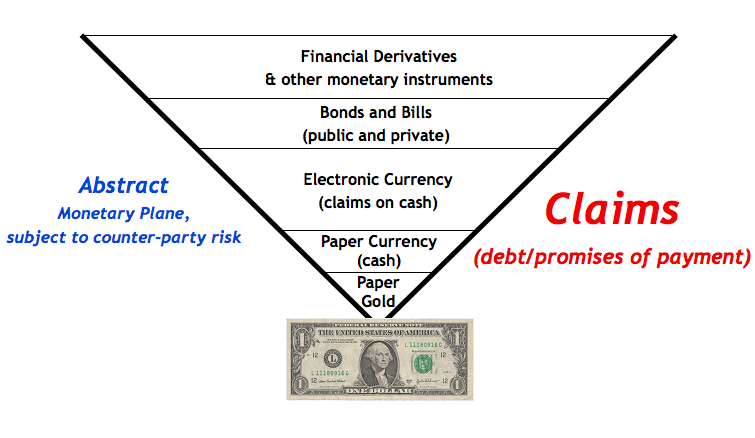

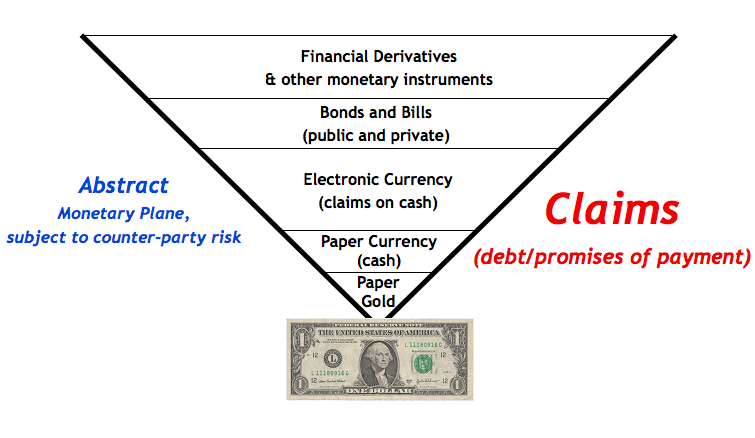

Everyone playing up in the top zone always has one eye on that single dollar bill. The perceived value of that single one dollar bill is imputed into every single contract in that upper pyramid. This is why everyone has their eye on it. Everyone knows it is not even worth the paper it is printed on, but they also know that as long as everyone else values it, it will hold its value which is the only thing holding up that entire top structure. This is called a network good that emerges from the network effect. Something has value only because a lot of people think it has value.

If you were to diminish the value of that single dollar by, say, 90%, then the whole top structure devalues 90% compared to the bottom pyramid instantly. No flow of funds is required. The reduced value is simply imputed to every quantum point in the pyramid. And no one would ride that devaluation out voluntarily when they could simply consolidate beforehand. So everyone is looking at that dollar thinking, believing, that they are quick enough to outrun everyone else at the first sign of trouble.

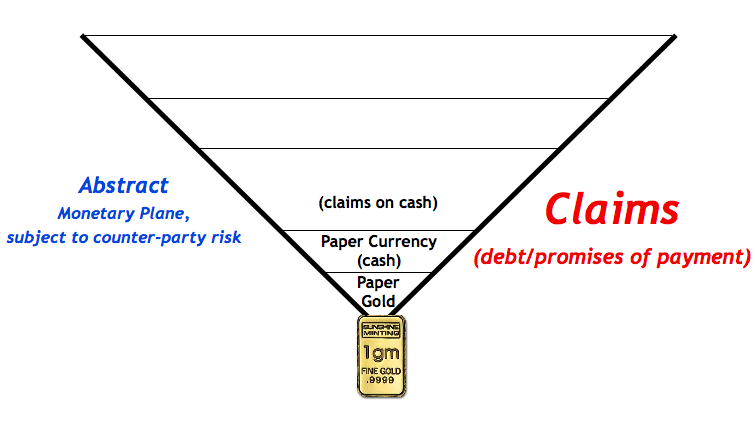

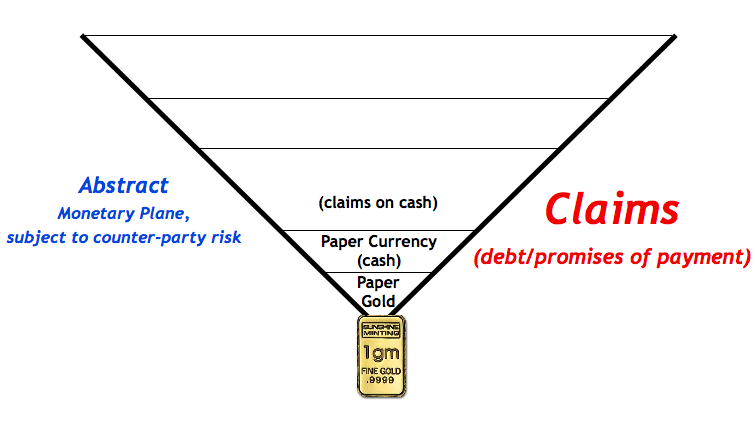

Now, in order to understand how this relates to Freegold, we need to mentally picture something resembling this upper pyramid thousands of years ago when the money concept first emerged. Money was, is, and always has been that mental concept whereby we trade real goods in their relative value implicated by conceptual units of a network good. If you owed me a cow and the going price for a cow was three ounces of gold, I'd probably just say you owed me three ounces. But that doesn't mean you'd ever pay me three ounces of gold. You might just pay me back my cow. Or perhaps you'd pay me in milk over time. If I gave you credit to buy some of my chickens you might pay me back with eggs over time. But on the books it would be recorded in gold, even though neither of us ever had any actual gold.

Can you see it? This is the concept of money. This is what money actually is. And under that upper pyramid of 2,000 years ago you'd actually see a picture of a gram of gold sitting at the bottom.

Yes, it was still a network good just like the dollar is today, but people wouldn't have to keep such a close eye on it for a couple different reasons. First of all, the upper pyramid was not so big that it actually threatened to crush its foundation. And second, there was no one aside from a few gold miners that was able to threaten the foundation by multiplying it. (Note that the monetary base at the bottom of our modern pyramid has been multiplied 325%, that's 3.25x, in the last three years. The gold base usually multiplies only about 6% over that same timeframe.)

So now that we understand the different between a fragile foundation supporting a monstrosity versus a solid foundation supporting a much smaller, much more constrained credit structure, how would Freegold make both better?

Well, I would argue that life in the physical plane is better under a healthy and vibrant (relatively large) credit system (upper pyramid). And don't let the word credit fool you into thinking I'm talking about yucky debt and evil usury. If Bill Gates showed up at my house and wanted my grand piano, he wouldn't have to carry a bag of cash with him. I'd accept his signature (maybe even just a hand shake) along with a nice agreed price. Think of Oprah Winfrey paying $52 million in 2001 for that Montecito house that was only worth half that at the time, but she really wanted it after filming there, and it wasn't for sale. At first the owner told her "sorry, not for sale." I imagine she then said "fifty million" and they said "fifty-two and it's yours." Now that's some credit (credibility)!

In both cases the deals were done with credit. A healthy credit (money concept) system lubricates a vibrant economy. But that doesn't mean that Bill Gates went into (bad) debt over my piano. Sure, you can have debt and even interest that is good and healthy for the economy. There is nothing intrinsically bad about borrowing capital for productive purposes. Just like the guy that borrowed a cow and paid with milk, or paid for the chickens with eggs. Same principle. We simply structure the agreement around conceptual units (credits) of the network good.

So how can we have a network good that is easy enough that it doesn't stifle the credit structure below its healthy potential, yet hard enough that it doesn't grow into an unhealthy monstrosity capable of bringing the whole thing down? This is exactly what Freegold does. It opens a free-flowing two-way trading valve between money and physical gold. And the flow through this open valve between the pyramids becomes the public indicium of the health of the upper credit system. Without such a valve, you either have strangling constraint or no indicia (indicator) of unhealthy growth.

Without such a pairing as fiat + Freegold at the center of the hourglass, you will lurch back and forth between depressions and hyperinflations, century after century, with a few really nasty episodes like the French Revolution thrown in. Imagine coming up with this Thought out of thin air. Luckily we had the Gold Trail to lead us here. But this is how a grand induction works. Musta been quite the Aha moment for those guys when they finally worked it out!