Page 11 of 12

Re: Indian investments thread

Posted: 09 Feb 2017 20:18

by jpremnath

Hello everyone, newbie here...why has the thread gone silent?...would love to have some discussions with the gurus on stocks during these "interesting" times...cheers..

Re: Indian investments thread

Posted: 19 May 2017 18:00

by la.khan

Need advice on TCS buyback offer, open till 31st May. TCS CMP is INR2,507. Company is offering to buy back shares at INR2,850. With so many headwinds for IT industry (automation, mass layoffs, difficult to get foreign visas, clamp down on outsourcing etc), should I participate in the buyback offer?

I have 30 shares of TCS @ INR1078. Any advice/insights welcome.

Re: Indian investments thread

Posted: 28 May 2017 21:10

by Karan M

Personally, I wouldn't sell. Indian economy is improving and TCS P/E is 19 odd, whos to say it cant land some larger domestic orders. Its nothing overpriced and its virtually debt free.. unless you need the money, keep it for a longer haul.

Re: Indian investments thread

Posted: 28 May 2017 21:10

by Karan M

BTW not a guru but an abject novice. So, take above FWIW.

Re: Indian investments thread

Posted: 23 Jul 2017 07:07

by archan

How right you were. Market has scaled lifetime highs and highs. Everyone now fears a correction

Now chipanda wants to threaten our rise..

Re: Indian investments thread

Posted: 23 Jul 2017 12:43

by Karan M

My next guess is any correction will be offset by the huge inflows from domestic MFs. Last year, FIIs pulled out several billion of dollars but there was only 1 perc drop since MFs took up the slack. A lot of people have started SIPs so cash is still flowong into equity.

Re: Indian investments thread

Posted: 23 Jul 2017 14:23

by negi

Market will in general be on the upward path until 2019 and when Modi wins it will go up further. I think 2018 will be the year when Market will see local maxima before 2019 elections.

Re: Indian investments thread

Posted: 23 Jul 2017 16:02

by Austin

negi wrote:Market will in general be on the upward path until 2019 and when Modi wins it will go up further. I think 2018 will be the year when Market will see local maxima before 2019 elections.

Hmm dont think so , Indian market is highly overvalued now , unless any one can time the market stay away and pick good stocks once they are rationalised

Re: Indian investments thread

Posted: 28 Aug 2017 23:51

by Atish

I have just been licensed by the CFTC (Commodities and Futures Trading Commission) as a CTA (Commodity Trading Advisor) . I have an established track record for trading and making money in the futures and Options markets. Anybody who is interested in this within or outside the USA please email me at

atishbazi@gmail.com.

Re: Indian investments thread

Posted: 29 Aug 2017 07:30

by sum

Saar, am a noob but could you please let me know what Options and Futures options means?

Is there a minimum amount to invest if in India?

Re: Indian investments thread

Posted: 29 Aug 2017 09:50

by Karan M

Austin wrote:negi wrote:Market will in general be on the upward path until 2019 and when Modi wins it will go up further. I think 2018 will be the year when Market will see local maxima before 2019 elections.

Hmm dont think so , Indian market is highly overvalued now , unless any one can time the market stay away and pick good stocks once they are rationalised

Depends on what you define as rationalization. You can buy when low, true, but when will that be?

Market is driven by perception and future value gets baked into P/E. So unless Pappu becomes PM, things will remain on an uptick bar the occasional drop. WW events are anyhow impossible to predict.

Re: Indian investments thread

Posted: 29 Aug 2017 09:51

by Karan M

sum wrote:Saar, am a noob but could you please let me know what Options and Futures options means?

Is there a minimum amount to invest if in India?

Just invest in some decent MF, unless you too are now a rich moneybags SoKo NRI.

Re: Indian investments thread

Posted: 29 Aug 2017 11:57

by Austin

Karan M wrote:Austin wrote:

Hmm dont think so , Indian market is highly overvalued now , unless any one can time the market stay away and pick good stocks once they are rationalised

Depends on what you define as rationalization. You can buy when low, true, but when will that be?

Market is driven by perception and future value gets baked into P/E. So unless Pappu becomes PM, things will remain on an uptick bar the occasional drop. WW events are anyhow impossible to predict.

Any thing above PE ratio 15 is bubble territory , NIFTY PE is today 25 if those charts tell me right.

If you think you can time the market and have appetite for risk then go ahead and invest in stock if you are a swing or day trader , IF you are a long term investor ( 10-15 yrs ) then no issue , else stay safe and invest in MF.

It is not a India specific phenomena , We are in Bubble Territory Globally thanks to Unconventinal Monetary Policy and no one knows whats awaiting in weeks months and year ahead

Re: Indian investments thread

Posted: 29 Aug 2017 21:40

by Atish

The best way would be to look online. Its a little technical. I am very flexible on minimums, but i would say 5 lacs or so should be adequate. But email me eben if its lower, we can talk. My product acts as a diversifier from stock markets and mutual funds and has potential to make money in years stock market does not do well.

Re: Indian investments thread

Posted: 25 Sep 2017 15:06

by Austin

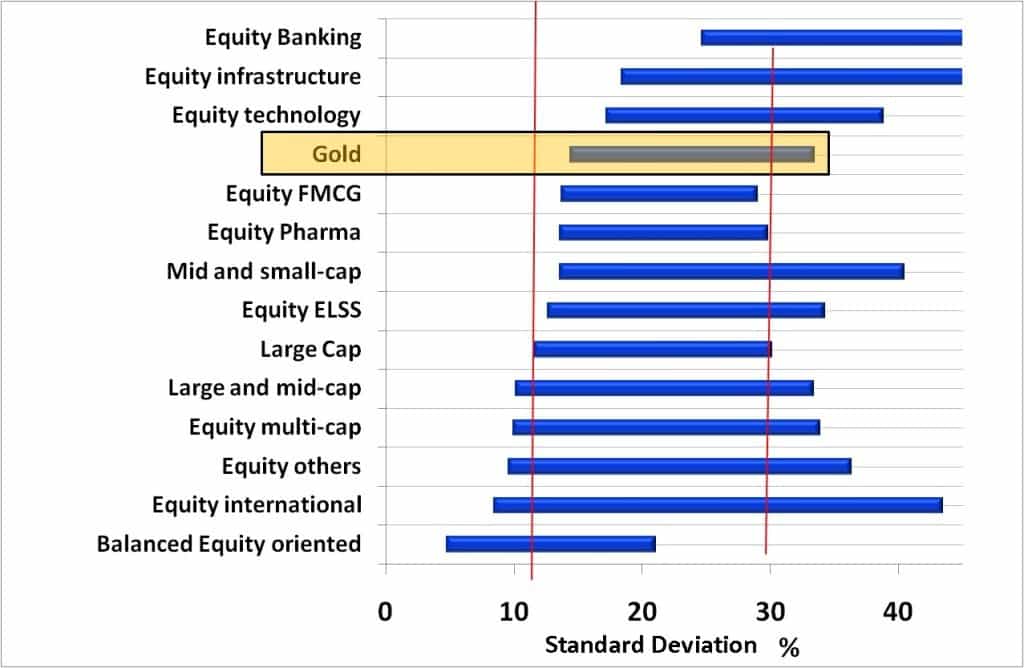

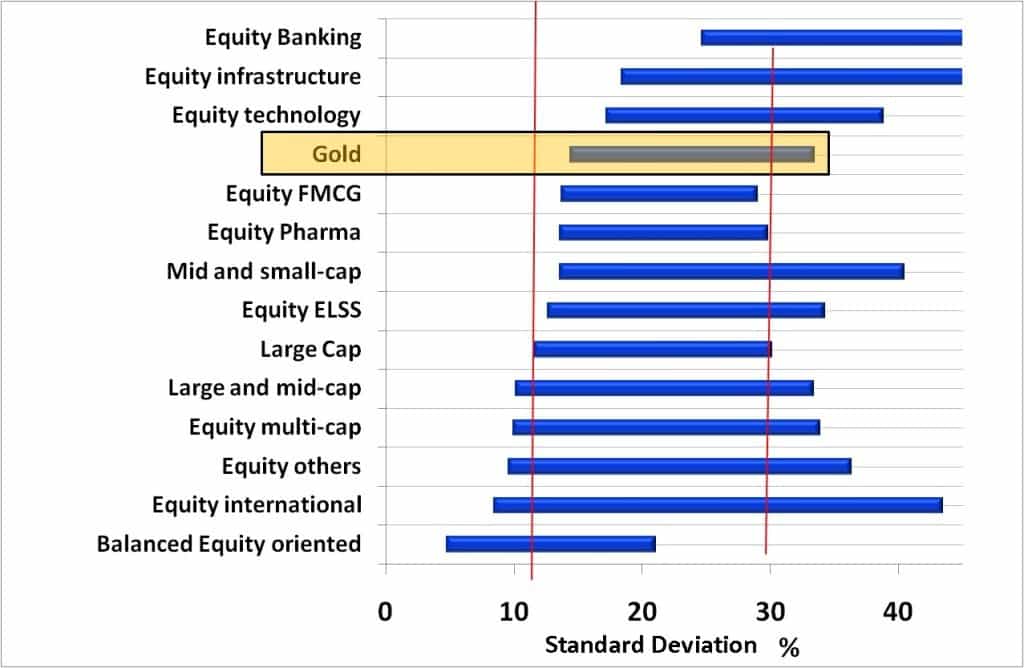

Risk Ladder for Equity Mutual Funds: Watch your step!

Re: Indian investments thread

Posted: 18 Oct 2017 03:00

by Vamsee

Vamsee wrote:This is not an investment advise but I am pretty sure HDFC Bank is currently at very good valuations. Someone holding it for next 5-10 years will do very well. The reason why it is stuck at this price for this long is because FII's have reached the limit. It is almost certain to grow 20%-25% every year for next decade

--Vamsee

==========

Disclosure: I am holding this stock since 2008.

I wrote above 3 years ago when HDFC bank was selling for Rs. 862/- Today it is Rs. 1850. Excluding dividends it grew at a CAGR of 28.99%

--Vamsee

Re: Indian investments thread

Posted: 26 Oct 2017 07:36

by UlanBatori

What are the best investment/brokerage firms in India? Full-service like Fidelity, where you don't have to see the back-office transactions where money comes out of/sweeps back into the bank account. Also of course, reliable, competent, swift, efficient, decent customer service etc.

Re: Indian investments thread

Posted: 09 Nov 2017 03:30

by nithish

Any gurus invested in these?

Re: Indian investments thread

Posted: 04 Oct 2018 21:38

by Vamsee

Re: Indian investments thread

Posted: 04 Oct 2018 21:53

by Suraj

An addendum to that is to avoid trying to catch falling knives. Always check that the fundamentals are sound beforehand, even if the market sentiment is bearish.

Re: Indian investments thread

Posted: 05 Oct 2018 00:13

by Karan M

Any recommendations Vamsee?

Re: Indian investments thread

Posted: 05 Oct 2018 00:17

by JayS

Karan M wrote:Any recommendations Vamsee?

I would accumulate blue chips at discounted rates in such scenarios.

Re: Indian investments thread

Posted: 05 Oct 2018 09:39

by Vamsee

Karan M wrote:Any recommendations Vamsee?

The following is applicable only if you are planning to hold for 5 years or more.

All the below recommendations are part of my portfolio that I neither plan to buy (no cash

) nor I plan to sell.

1) ITC ~ Rs. 283

2) Gruh Finance ~ Rs. 280

3) HDFC Bank ~ Rs. 1950

4) United Spirits ~ Rs. 480

5) CRISIL ~ Rs. 1625 or CARE ~ Rs. 1130

6) Piramal Enterprises ~ Rs. 2280

=================

They could easily go below current prices but I would be a happy buyer at these prices.

-- Vamsee

Re: Indian investments thread

Posted: 06 Oct 2018 10:27

by Karan M

Thank you.

Re: Indian investments thread

Posted: 06 Oct 2018 10:31

by Karan M

JayS wrote:Karan M wrote:Any recommendations Vamsee?

I would accumulate blue chips at discounted rates in such scenarios.

My SBI Blue Chip fund is already shedding feathers at an alarming rate. It has gone from being a peacock to a plucked chicken.

Re: Indian investments thread

Posted: 06 Oct 2018 12:41

by JayS

Karan M wrote:JayS wrote:

I would accumulate blue chips at discounted rates in such scenarios.

My SBI Blue Chip fund is already shedding feathers at an alarming rate. It has gone from being a peacock to a plucked chicken.

I also have that fund in my folio. Apart from Axis Long Term equity fund, this is second best performing fund for me. its only like 5-7% down when others are upto 20% down in last 1.5 months

The fall down is not any stock specific. Most of the companies have not seen any particular changes in their fundamentals. So whatever downfall their stocks has seen will bounce back when macro factors improve.

Stocks like Maruti, HDFC, Reliance, DMart will bounce back sooner. Some other stocks like Tata Steel, Tata motors might take time, especially the small caps. Buy only for more than 2yr horizon. At least I do not see any stability coming before LS elections. This is most volatile year in my experience of 6yrs of investing.

Re: Indian investments thread

Posted: 06 Oct 2018 12:53

by neerajb

Guru log, what's your take on Tata motors for long term i.e. 5-10 years horizon? It has hit 52 week low twice and DVR is trading at 120 levels now. With their current/upcoming product lineup, I don't see any hindrance in Tata motors gaining the top spot.

Re: Indian investments thread

Posted: 06 Oct 2018 13:04

by jpremnath

I have been averaging TaMo for a while now..but it will take atleast 3 or 4 years before the stock gets back its mojo...the huge capex announced by jlr has spooked investors...Most of jlr products barring ipace and fpace are getting stale now and they need a grand refresh to get back that oomph factor...

I see lots of positives...mainly the valuation..the whole of TaMo is valued at 10 billion dollars or less. While companies like Volvo cars are valued at 30billion $... The Indian operations are seeing a huge turnaround in both CV and PV segments..I foresee them coming a close third in PV market behind Hyundai. But these are just calculations...

So anyone wanting to buy into TaMo shouldnt do it unless they hold it for another 5 or 6 years...

Re: Indian investments thread

Posted: 06 Oct 2018 13:07

by JayS

neerajb wrote:Guru log, what's your take on Tata motors for long term i.e. 5-10 years horizon? It has hit 52 week low twice and DVR is trading at 120 levels now. With their current/upcoming product lineup, I don't see any hindrance in Tata motors gaining the top spot.

TML stock is weak due to JLR currently. JLR has shown reduced earnings in last couple of years and Brexit is not particularly good for it. On top of it Parent TML is pulling money from it. So JLR performance looks like it will remain below par for some time to come. I have seen some opinions saying JLR might lose out on EV front due to its below par investment on this front compared to the competitors. While TML domestic business is going leaps and bounds. I am personally bullish on the stock. I have bought the stock recently and will again buy some once I feel the current downtrend bottoms out. But it may take a while to come up, in line with the strong performance domestic TML unit is showing.

TML should reach 2nd spot in domestic passenger car segment in coming years. Dethroning Maruti is rather tough.

Re: Indian investments thread

Posted: 28 Mar 2019 19:48

by UlanBatori

Guru log: Pooch 4 u.

Are Indian Mutual Funds approved for NRE accts (which means input in foreign currency, output in rupees to NRE acct) qualified as "QEF" under Unkil's kind Eye Arr Ess laws? If u don't know what QEF is, that filters out everyone who does not know the answer.

More reasonably, how does one go about finding out whether a specific fund qualifies? I know they publish NAV, they give out dividends with proper announcements, same as Yoo-Ess Mutual Funds, but obviously they don't provide a US Phorm 1099.

They are not taxable in desh, so one does not have to worry about seeking Tax Credit in Yoo Ess: just pay tax on the whole thing. Which is why the above is pretty important.

Also in Ulan Bator Caves, v r law-abiding, so we went into this with eyes open and assuming that only the Mark-2-Market option would be available. But now it appears that QEF MAY be feasible.... (Makes no difference this year since NAV gain is biss-boor and dividend is always hit with ordinary dividend rate I believe, not Qualified Dividend).

The lack of QEF means that if and when one does get a capital gain at sale time, they will hit with the MAXIMUM marginal rate (~46% incl. State tax) rather than the low, low rate that applies to us poor yak-herders, let alone the LT ca gain rate.

Re: Indian investments thread

Posted: 29 Mar 2019 03:15

by UlanBatori

Amazing! My 6th coujin tried filling Phorm 8621, and it appears that

all the scare-mongering about YY SHOULD NOT OWN PHOREN MUTUAL PHUNDS!!!

is exactly that.

Yeah, if you are into it for tax evasion, the Bredators may be aware of it. Also, I see that closed-end deals where you cannot get any money for 5 years, is a problem because fundamental premise appears to be that you must not be able to do a 401-K by putting your money in a Phoren Phund. You have to pay tax annually. But c b lo: even that may not be so bad this year!!

So best bet is a dividend-paying fund, and modern desi funds appears to have NAVs, dividend payouts etc just like Yoo Ess Mutual funds. They don't make a Cap Gain Distribution that reduces NAV, which means Unkil hit you with the equivalent Cap Gain every year by looking at NAV change/ reinvestment. BUT.. here is what amazes me:

U GET LT GAIN TREATMENT FOR 1 YEAR'S GAIN!!!!

Trying to see what I am missing here: apparently if it is a QEF one also gets qual. dividend treatment for the dividend, but that remains to be seen. Point is that in 2018 most funds posted negative NAV gain... so effectively one picks up a neat LT Loss without selling anything! Of course next year one hopes to recoup that and more in NAV, but again, only LT CG!!

Can this be true, hain?

IS there a Tooth Fairy, hain?

Re: Indian Economy News & Discussion - Nov 27 2017

Posted: 03 Oct 2019 06:13

by vish_mulay

Mods delete if this is not appropiate. Personally know two families who took investment E visa and regretting it now. They never took in the account the FATCA and its implications for the Indian income/investments. Now trying arm and legs to get away but cant since once you accept GC, quiting is not that easy.

Re: Indian Economy News & Discussion - Nov 27 2017

Posted: 03 Oct 2019 09:11

by vera_k

If less than 8 years have passed, they can always surrender the green card and get away without long term implications. This was advice from my Arthur Andersen CPA back in the day, but its still valid.

Frequently asked questions

2. I was a long-term resident of the United States prior to surrendering my green card. What is my U.S. tax filing obligation?

You are a long-term resident for U.S. federal income tax purposes if you were a lawful permanent resident of the United States (green card holder) in at least 8 of the last 15 tax years ending with the year your residency ends. In determining if you meet the 8-year requirement, do not count any year that you are treated as a resident of a foreign country under a tax treaty and do not waive treaty benefits.

Re: Indian investments thread

Posted: 11 Jan 2021 02:25

by vera_k

Need to open a bank account in India. Have so far avoided it because the accounts use a One Time Password that rely on phones numbers issued in India.

Are there any banks known to issue bank accounts that work with passwords over email or US phone numbers?

Re: Indian investments thread

Posted: 11 Jan 2021 02:36

by Vivek K

ICICI works with OTPs sent to US phones - but you will need to have Non Resident accounts.

Re: Indian investments thread

Posted: 11 Jan 2021 02:42

by kit

vera_k wrote:Need to open a bank account in India. Have so far avoided it because the accounts use a One Time Password that rely on phones numbers issued in India.

Are there any banks known to issue bank accounts that work with passwords over email or US phone numbers?

Even SBI is now sending OTP to foreign numbers

Re: Indian investments thread

Posted: 19 Jan 2021 07:59

by vera_k

Next question - what's a good way to transfer $s to an Indian account? Looking for both a good exchange rate and high transaction limit.

Re: Indian investments thread

Posted: 20 Jan 2021 22:43

by venkat_kv

vera_k wrote:Next question - what's a good way to transfer $s to an Indian account? Looking for both a good exchange rate and high transaction limit.

Not sure on the latest saar, but last i checked remit2india is a good site with good rates. but it takes a week to 10 days depending on when the transfer was initiated. (weekdays will be quicker, weekends will add the additional days for transfer).

if you want instant transfer then there is Xoom. although its rates are 10-15 cents lower than remit2india. but money get transferred on the same day.

Re: Indian investments thread

Posted: 20 Jan 2021 23:04

by vera_k

Thanks. Banks allow high limits but poor transaction costs. The remittance sites have better rates, but very low sending limits. Remitly seems to have the highest daily sending limit, but slightly worse rates. The best I've found so as a consumer is making daily transactions for a few weeks.

Re: Indian investments thread

Posted: 21 Jan 2021 06:43

by venkat_kv

vera_k wrote:Thanks. Banks allow high limits but poor transaction costs. The remittance sites have better rates, but very low sending limits. Remitly seems to have the highest daily sending limit, but slightly worse rates. The best I've found so as a consumer is making daily transactions for a few weeks.

I am not sure of limits on other sites, but remit2india has $25K (US) limit per month. if sending more there is additional forms to be filled i guess electronically, you do have to send 1000 or more dollars in each remittance to avoid a fee for the transfer. same for Xoom i believe as well.