A_Gupta wrote:Western ideology is quite different from economics as a (dismal) science. Ideology infects the economics profession severely, making its scientific content minimal. Per western ideology, state capitalism was not supposed to work; prosperity without a Protestant ethic or lack of individual freedom was not supposed to happen, and so on. When they predict the slowdown of China, it is one par economics, but ten parts trying to assert the primacy of their ideology; it is not an objective assessment.

Likewise, per their theories, neither India as a nation, nor India as a democracy is supposed to exist. Part of the reason they jump on every flaw of India (as compared to Pakistan, say) is not just India being held to a higher standard, but also because it reinforces their ideology. Both China and India, at a fundamental core level, offend the West. It is only to the extent the West has divorced itself from its past (e.g., deChristianized, become pantheistic or pagan) that it has accepted these two countries.

Therefore, their analyses are suspect.

I'm sorry but you are confusing political economic mumbo jumbo with hard economic theory that's empirically measurable.

Marx and Engels basic contention on why the revolution would come was also politics. But as the late Madhu Limaye once wrote, the Ford Assembly line destroyed the theory by making it possible for factory workers to buy the stuff that they produced because cost of production fell steeply. This has had a cascading effect whereby more demand leads to more production and economies of scale kick in and the cost price keeps going down resulting in virtuous cycle of demand linked to drop in price. [Just think of computers and their price for an example].

All that nonsense about Protestant work ethics and Christianized this and that are part of the legacy of politicisation of economic theory that was the hallmark of the era in which Karl Marx and Max Weber were the reigning deities of the intellectual class in Britain.

Economics as a subject has IMO outgrown that era a long time ago. It is by no means an exact science but modern economic theory and practice can very well predict broad macro economic outcomes based on empirical data that is available.

Since this is the China dhaga, let me give one piece of data that's easily verifiable, and whose source is actually the Chinese and not those Chirstianized folk who predict doom and gloom.

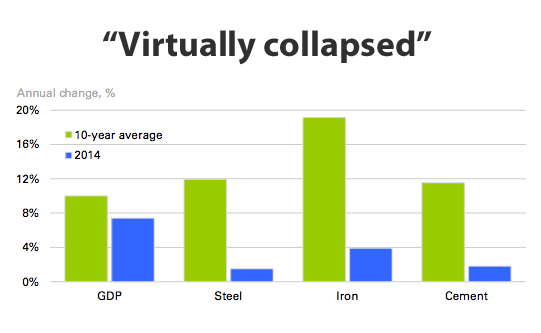

From the time when China was the fifth largest economy in the world, or in other words, less than half the size that it is today, its steel production has been

more than the combined output of the next 9 largest steel producing nations in the world and that includes the likes of Japan, South Korea, US and of course India.

It's statistically verifiable, that China even today, let alone when it was the fifth largest economy in the world does not have enough

natural demand to absorb all that steel. Steel is a slightly different commodity from an iPhone, in as much as you cannot easily sell it on the global market. Steel production (along with other sectors such as cement) is one of the reasons why China embarked on the massive infrastructure build up. They had to absorb the production or the plants would close and thousands would lose their jobs and this would lead to social unrest. Well the popular consensus is that China has reached the limit of this policy and cannot build anymore.

The above is just a snapshot. The present problems being faced by the country has been caused by a myriad of other factors and you don't need Western ideology to tell you that it is at an important crossroad in terms of its economic future. If you keep your ears to the ground as some folks do, you'll note that even the Chinese are saying the same thing, couched in politically correct language.

All the data is there and easily verifiable. You don't need ideology or theology to examine them and come to an empirical conclusion.