No, these are regular GSecs traded in Rupees. The currency risk is entirely in the hands of the buyer. They convert their cash to rupees and buy, and convert their sale proceeds back to their currency.Austin wrote:BTW when they Foreign Buyers buy our bond they may be paying in USD or Euro to buy these Gsec bonds and earn the interest but when they redeem it do they get paid back in same USD/Euro etc ?

Indian Economy News & Discussion - Aug 26 2015

Re: Indian Economy News & Discussion - Aug 26 2015

Re: Indian Economy News & Discussion - Aug 26 2015

By Currency Risk you mean Rupee getting weeker against dollar over a period of time and wiping out the higher interest gained from Indian bond or is it something else ?Suraj wrote:No, these are regular GSecs traded in Rupees. The currency risk is entirely in the hands of the buyer. They convert their cash to rupees and buy, and convert their sale proceeds back to their currency.Austin wrote:BTW when they Foreign Buyers buy our bond they may be paying in USD or Euro to buy these Gsec bonds and earn the interest but when they redeem it do they get paid back in same USD/Euro etc ?

India Govt Bond Generic Bid Yield 10 Year

https://www.bloomberg.com/quote/GIND10YR:IND

Why would any one buy Japanese 10 Year Bond they offer 0.02 %

http://www.tradingeconomics.com/japan/g ... bond-yield

Re: Indian Economy News & Discussion - Aug 26 2015

Yes, the fact that exchange rate movements might wipe out any gains. The buyer holds the exchange rate risk. That in itself is a vote of confidence in both our government debt quality *and* the central bank's currency management policies. If FPIs had it their way, they'd want the limit raised to much more than $40 billion, because demand for these bonds far exceeds what RBI permits foreigners to hold. This demand pushes down yields, which lowers interest rates on our end. There's probably enough current demand for anywhere from $75-100 billion of Indian rupee bond holdings in foreign hands.Austin wrote:By Currency Risk you mean Rupee getting weeker against dollar over a period of time and wiping out the higher interest gained from Indian bond or is it something else ?

If you think about it, this is quite an enormous change from the past, when we had to work hard to sell a bond to a foreign investor, and not just that, but we had to denominate the bond in dollars because no one would take the exchange rate risk as well. Rewind back to the Resurgent India Bond in 1998 post Pokharan, for example. It was dollar denominated and appealed to PIOs/NRIs because it was a hard sell to the average foreign investor . Nowadays we instead see the likes of Gundlach and Gross grabbing every rupee denominated bond they can get hold of...

Re: Indian Economy News & Discussion - Aug 26 2015

Per a commentator on Bloomberg.com, one must look at both sides of the transaction, e.g., (not necessarily his exact example), it makes no sense for a USD holder to buy a Japanese 10 year bond, because the US dollar will remain strong with respect to the yen; but it makes sense for a Euro holder to buy the Japanese bond because the Euro is likely to fall relative to the yen. Why would the Euro holder not simply buy USD only? Because of wanting a diversified portfolio.Austin wrote:

Why would any one buy Japanese 10 Year Bond they offer 0.02 %

http://www.tradingeconomics.com/japan/g ... bond-yield

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Indian Economy News & Discussion - Aug 26 2015

Aaha. The desi GSec attracting droves of phoren buyers is good news indeed.

Just like USofA gets rare privilege of repaying its foreign debt in domestic currency, what we're seeing here is GoI kinda, sorta doing the same only. On a very very limited scale of course....

Also gives a hint about the scale of UPA era loot - like blood loss from an accident victim - just stopping which has now allowed so much recovery to happen.

Only. JMTPs and all that.

Just like USofA gets rare privilege of repaying its foreign debt in domestic currency, what we're seeing here is GoI kinda, sorta doing the same only. On a very very limited scale of course....

Also gives a hint about the scale of UPA era loot - like blood loss from an accident victim - just stopping which has now allowed so much recovery to happen.

Only. JMTPs and all that.

Re: Indian Economy News & Discussion - Aug 26 2015

You diversify your portfolio to minimize risk. IMO, both yen and dollar are low risk high quality securities. You may not really help your diversification.

Re: Indian Economy News & Discussion - Aug 26 2015

Karthik S, the point was that a particular investment involving an exchange rate can be understood to make/not make sense only if one knows both the source and target currencies.

Re: Indian Economy News & Discussion - Aug 26 2015

In some way its all pegged to USD and all these currencies are interdependent but we dont know how long the party will lastA_Gupta wrote:Per a commentator on Bloomberg.com, one must look at both sides of the transaction, e.g., (not necessarily his exact example), it makes no sense for a USD holder to buy a Japanese 10 year bond, because the US dollar will remain strong with respect to the yen; but it makes sense for a Euro holder to buy the Japanese bond because the Euro is likely to fall relative to the yen. Why would the Euro holder not simply buy USD only? Because of wanting a diversified portfolio.

viewtopic.php?f=2&t=6655&start=3720#p2146631

Last edited by Austin on 23 Apr 2017 22:32, edited 1 time in total.

Re: Indian Economy News & Discussion - Aug 26 2015

Austin, can you please continue the USD / other currencies talk in the perspectives on global economy thread ? This thread offered you answers to your question on Indian GSecs, but it's not a license to also discuss foreign currency and bonds. Let's keep this one on topic, ok ?

Re: Indian Economy News & Discussion - Aug 26 2015

Sounds Fine , Thanks for all your replies.Suraj wrote:Austin, can you please continue the USD / other currencies talk in the perspectives on global economy thread ? This thread offered you answers to your question on Indian GSecs, but it's not a license to also discuss foreign currency and bonds. Let's keep this one on topic, ok ?

Re: Indian Economy News & Discussion - Aug 26 2015

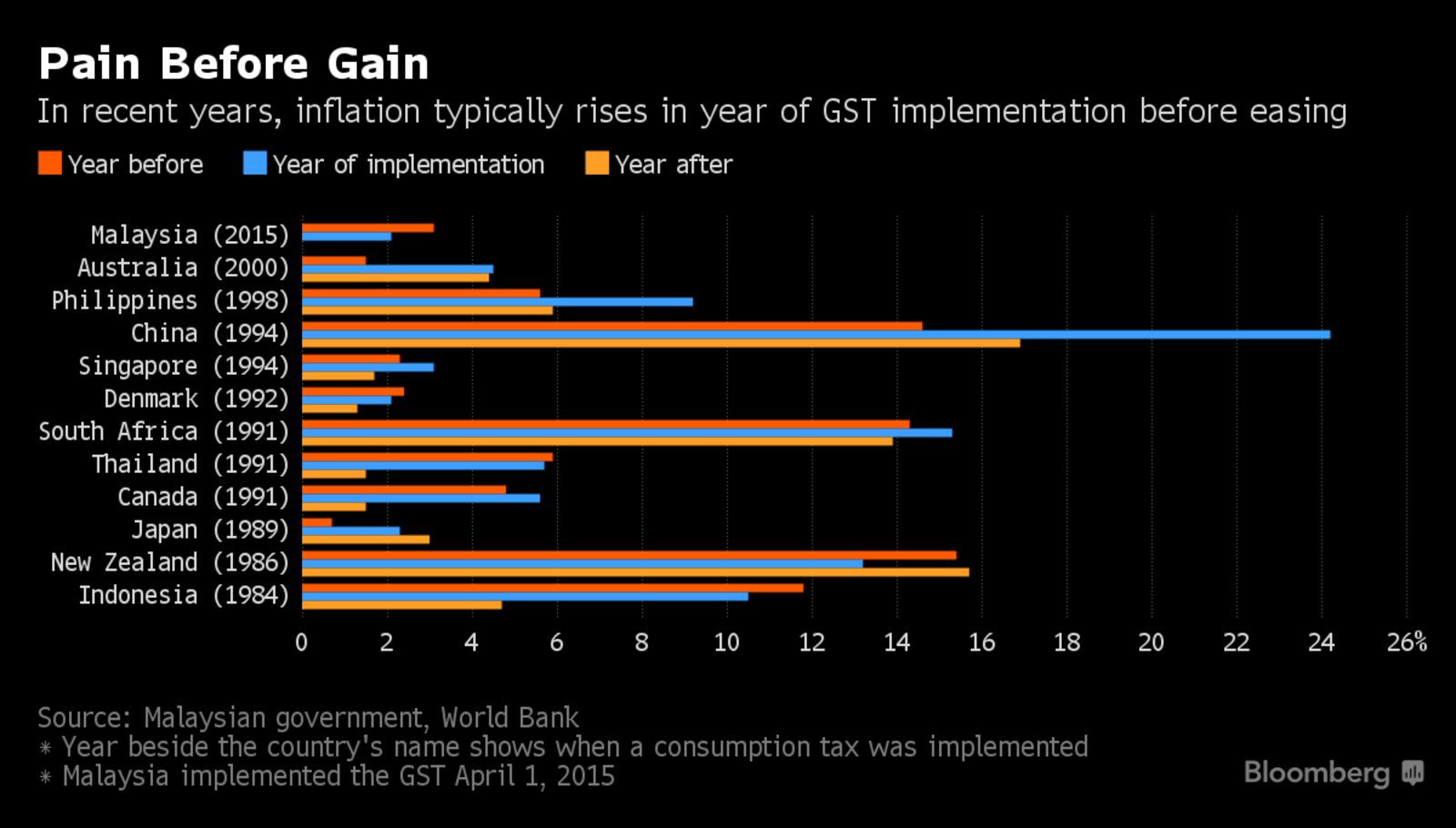

Good article on India's GST challenge from Bloomberg:

India's GST Challenge Makes Trump's Tax Overhaul Look Easy

India's GST Challenge Makes Trump's Tax Overhaul Look Easy

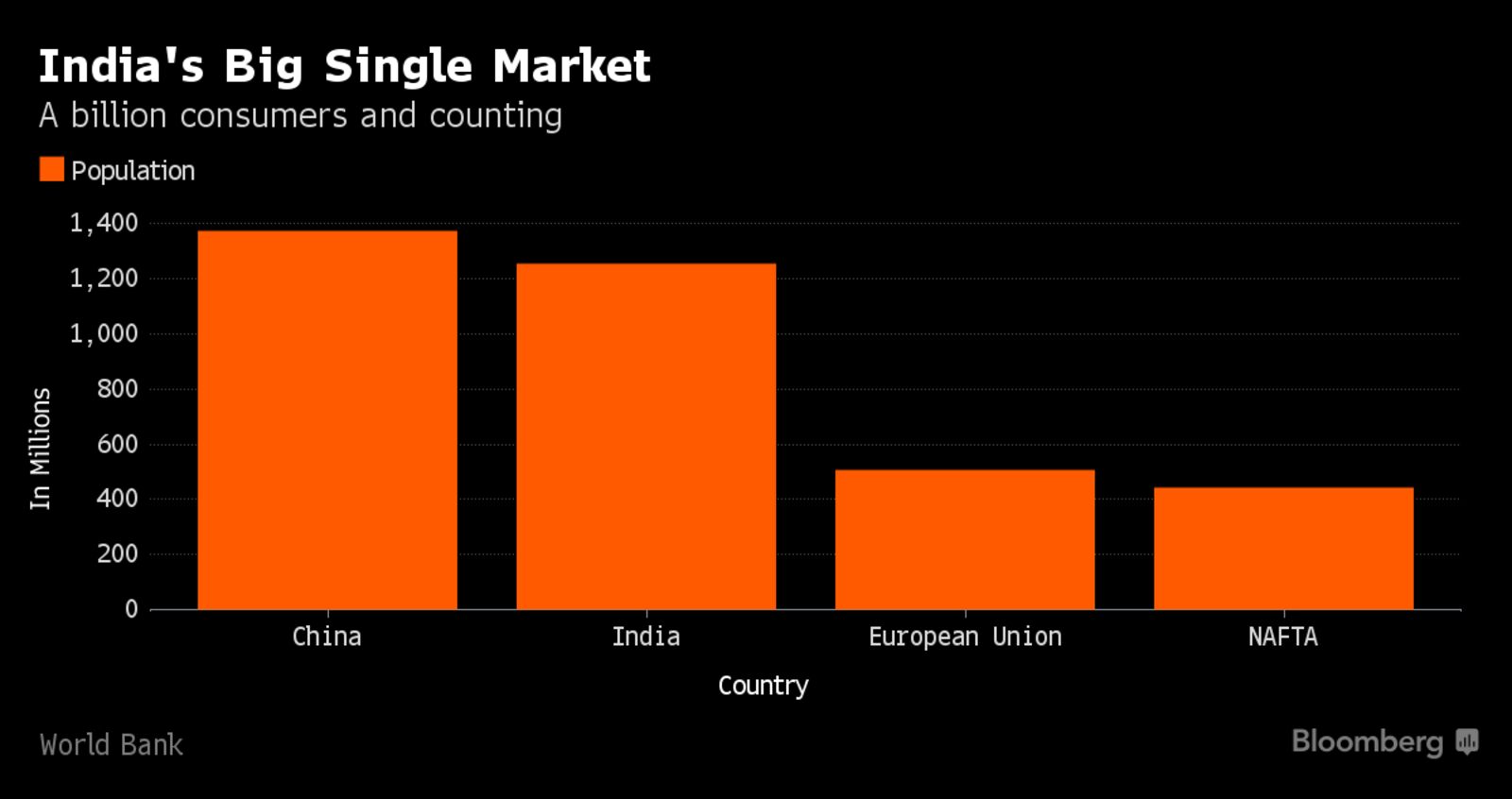

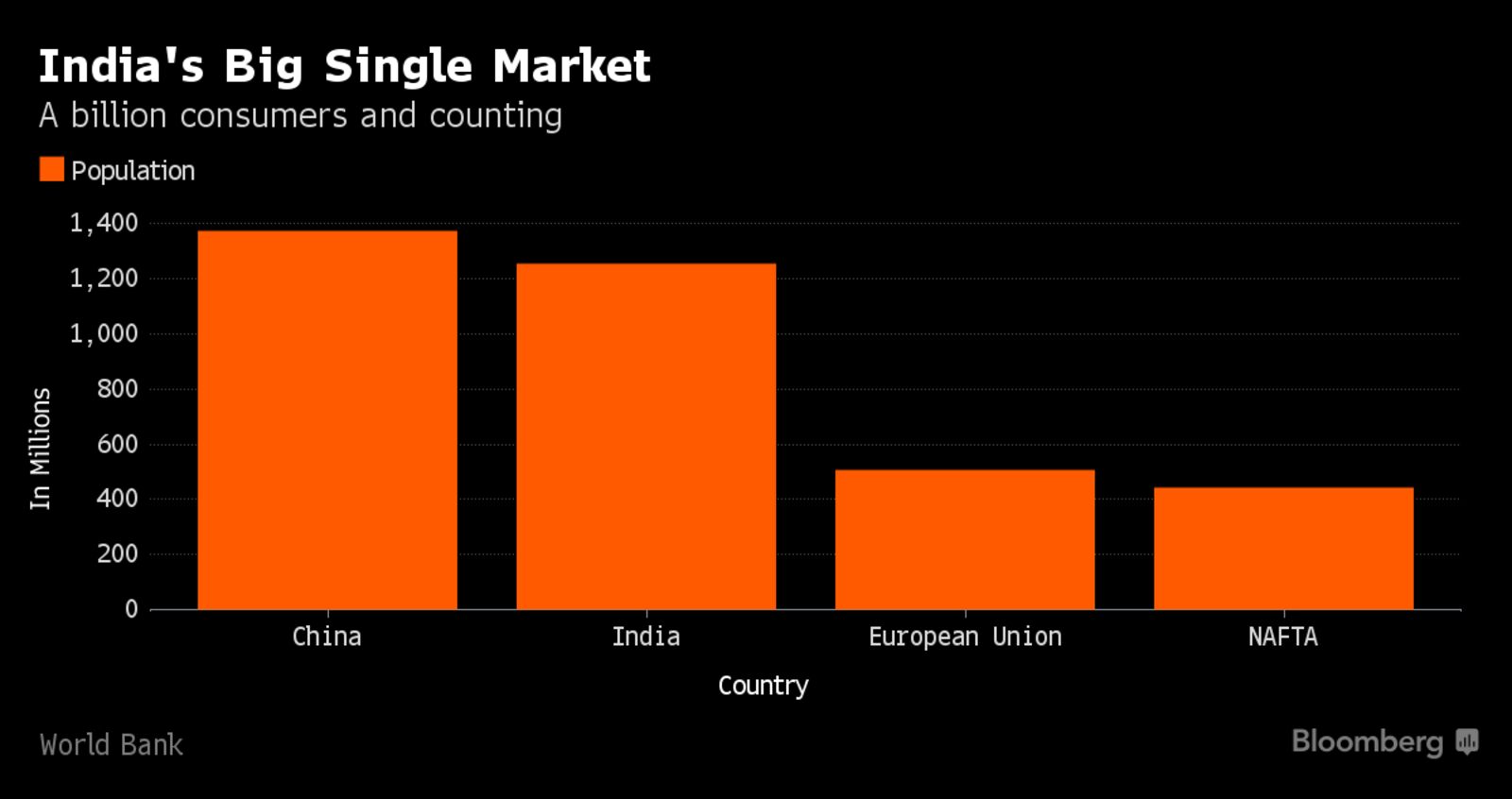

The challenge is daunting: Convert an economy of more than 1 billion consumers, 29 states, 22 official languages, 9 million businesses all operating under a spider’s web of taxes, arcane regulations and competing political ambitions into a unified common market.

But that’s the goal as India gets ready to roll out a goods-and-services tax after a 10-year battle to win over the country’s powerful states and fractious federal parties. Designed to free up trade, foster tax compliance and make it easier to do business in the world’s fastest growing major economy, the GST is scheduled to go into effect on July 1.

Until now, a product or service in India is taxed multiple times at different rates as components are added and shipped between states. Everyday more than 20,000 truck divers wait in queues up to three kilometers long to pay an entry fee at 122 New Delhi checkpoints, food rotting, tempers fraying, costs rising.

A GST for India will in effect create one of the world’s biggest free trade areas. Its population of 1.3 billion is more than that of U.S., Europe, Canada and Australia combined and more states than the European Union’s 28 members.

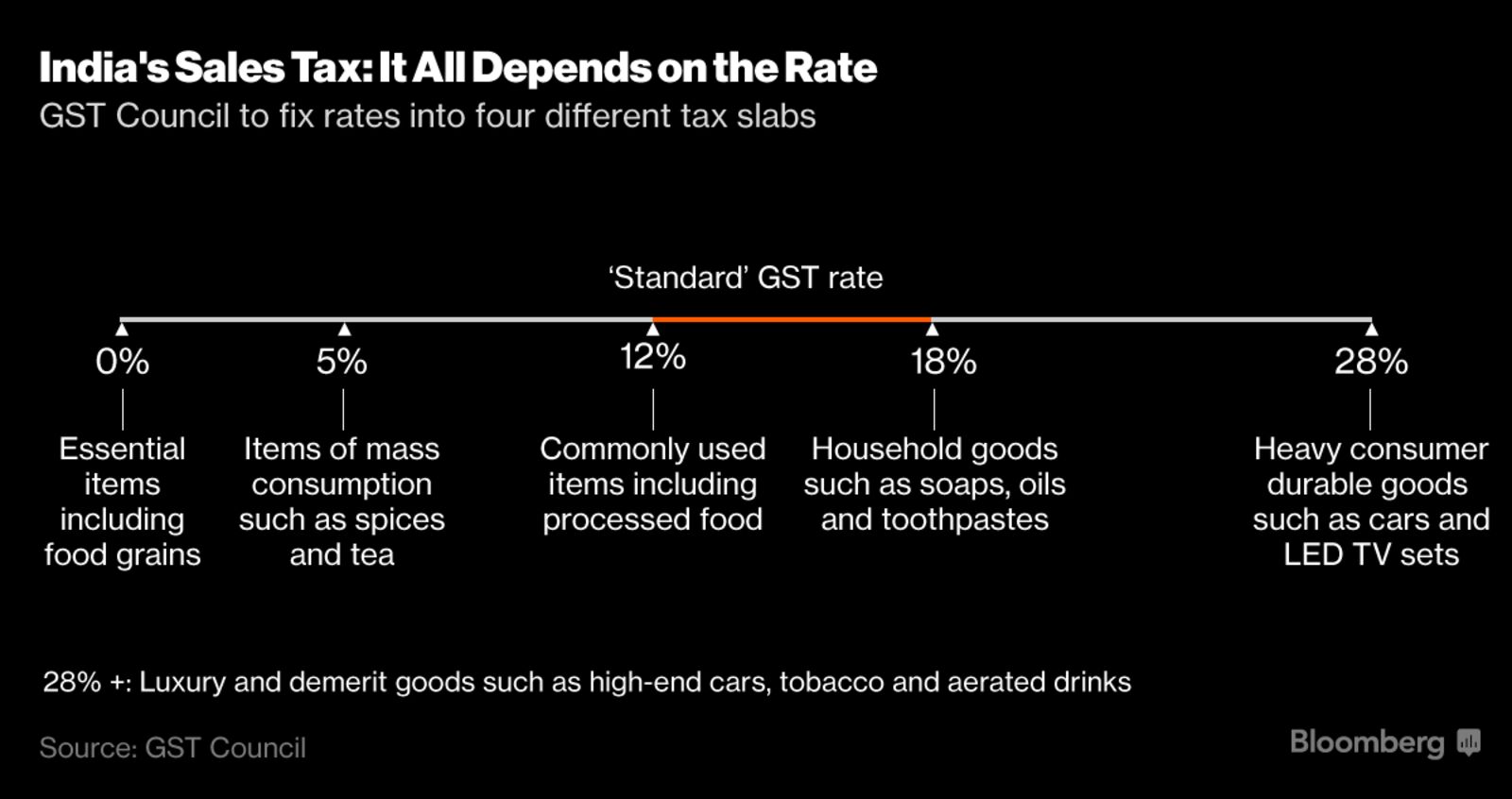

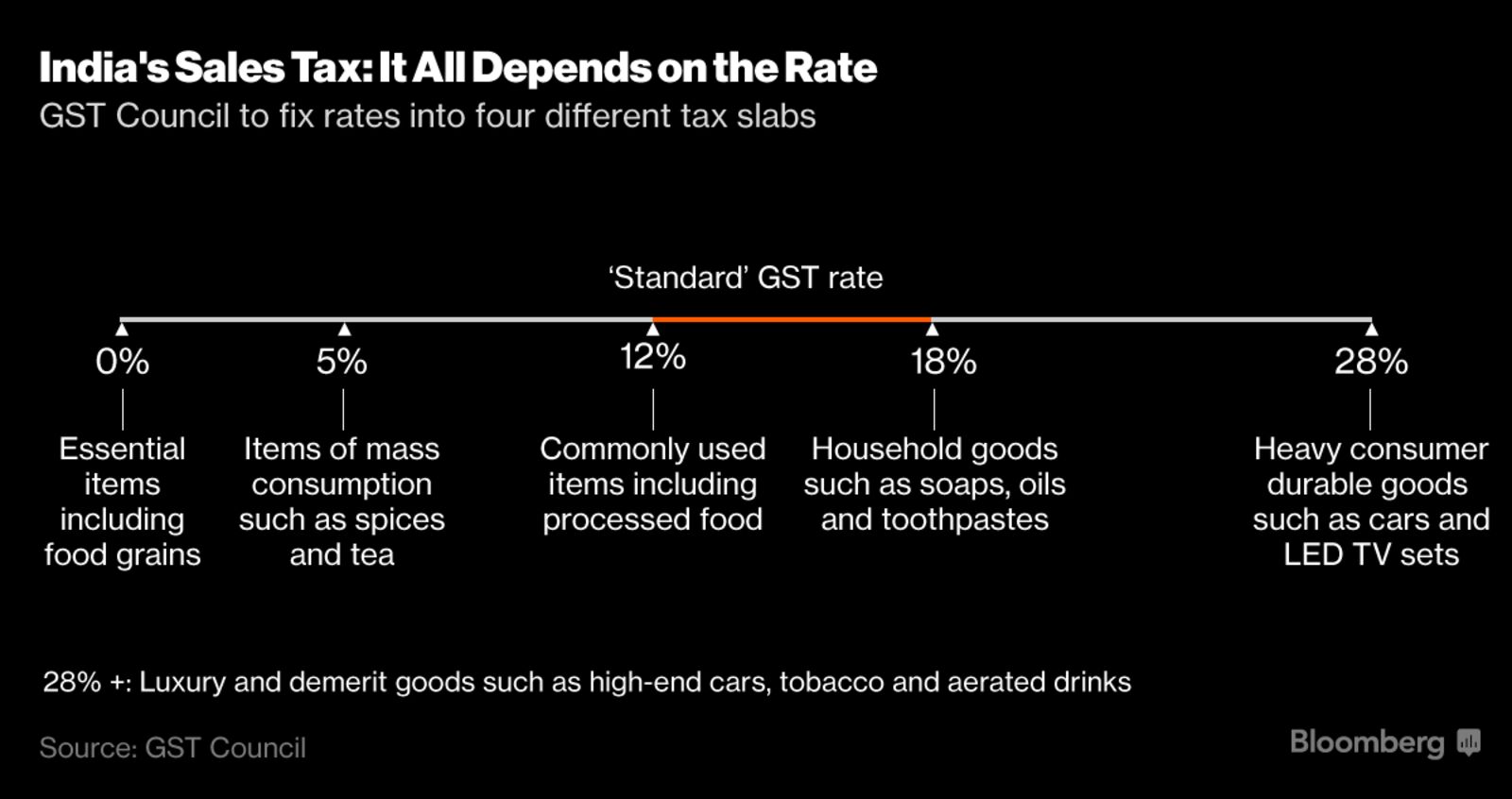

India’s tax will comprise four basic rates: 5 percent, 12 percent, 18 percent and 28 percent. While officials are yet to reveal final details of what will fall into each bracket, Finance Minister Arun Jaitley has said 50 percent of items in the retail inflation basket won’t be taxed to protect consumers.

Re: Indian Economy News & Discussion - Aug 26 2015

India's economy poised to hit $7.25 trillion by 2030: NITI Aayog

http://www.ibtimes.co.in/indias-economy ... tatadocomo

http://www.ibtimes.co.in/indias-economy ... tatadocomo

Re: Indian Economy News & Discussion - Aug 26 2015

Agriculture, the least reformed of the 3 sectors of economy, is getting some focus, with APMCs targeted for elimination:

Centre issues model law to end APMC monopoly

Centre issues model law to end APMC monopoly

Govt aims to end APMC monopoly with new model agriculture-market lawThe central government issued its model of a law to replace the one of 2003 for the Agricultural Produce Marketing Committee (APMC) Act.

Agriculture is a state subject; the Centre can recommend what it wishes to see. The new model would open the door for multiple modes for sale and purchase of produce -- private wholesale market ('mandis'), market yards operated by groups of individuals, licences to private entities for temporary bulk purchase directly from farmers. All towards the aim of ending the decades-old stranglehold of mandis in this regard.

The mandi tax, by the new model law, won't be under any condition be charged from the farmer or seller. Commission agents would ot be allowed a commission of more that two per cent by value for non-perishable items; for perishables like fruit and vegetables, not more than four per cent.

The Act would also empower the state director of agricultural marketing as the sole authority for granting trading licences to traders or commission agents, taking this over from existing APMCs.

The new model was unveiled at a meeting between the central and state agriculture and agricultural marketing ministers. "The majority of states were positive about the new Act. Some others said they'd first study it and then comment," said agriculture minister Radha Mohan Singh.

In a major move to liberalise agri-markets, the Centre has come out with a draft model law that seeks to end monopoly of traditional APMC mandis and allow private players and others to set up wholesale markets.

It would be a major agri-reform, if at least 15 BJP-ruled states adopt the new model law — Agricultural Produce and Livestock Marketing (Promotion and Facilitating) Act (APLM), 2017, as it provides wider options for farmers to sell produce and get better prices.

At present, farmers can sell their produce at regulated APMC (Agriculture Produce Marketing Committee) mandis only. There are 6,746 such mandis and each one is located at a gap of 462 km. They are subjected to different kinds of fees.

"Most states have agreed to implement the new model Act. Its implementation will help in doubling farmers' income by 2022," Agriculture Minister Radha Mohan Singh told reporters after a day-long meeting with state agri-ministers on the issue here.

Re: Indian Economy News & Discussion - Aug 26 2015

Considering our population in 2030, this is still on lower side for India to have a decent enough HDI.Austin wrote:India's economy poised to hit $7.25 trillion by 2030: NITI Aayog

http://www.ibtimes.co.in/indias-economy ... tatadocomo

Re: Indian Economy News & Discussion - Aug 26 2015

at current prices/exchange rate?Austin wrote:India's economy poised to hit $7.25 trillion by 2030: NITI Aayog

http://www.ibtimes.co.in/indias-economy ... tatadocomo

Re: Indian Economy News & Discussion - Aug 26 2015

^^ Indian economy hitting $8T nominal GDP by 2030 at current prices/exchange is not surprising.

Economy GDP has no correlation with HDI. Even though high level of economy does spare more resources for HDI and hence a concomitant rise in HDI., all one has to look at is Saudi Barbaria and Bhutan.

Here is the top line stats of Saudi Barbaria:

Header: Life expectancy at Birth Expected years of schooling Mean years of Schooling GDP

Saudi Barbaria 74.4 16.1 9.6 19

Bhutan 69.9 12.5 3.1 164

An average S. Barbarian at birth expects to live *just* 5 years more than the average Bhutanese., but the GDP of S. Barbaria is 8x more! This itself indicates that one of the biggest component of HDI (life expectancy) is not correlated at all with GDP. The other components are expected years of education and actual average education or rather the ratio of it.

So what does all the years in schooling do to a S. Barbarian? Produce more barbarism? Women empowerment if factored in HDI will put Saudi Barbaria down at zero and the very bottom of table (bakistan has better women empowerment than S. Arabia) and Bhutan up very high. And this has nothing to do with women in workforce (since unorganized rural farm work force is some how ignored!)., and even on that count if accounted for - we know where S. Barbaria is and where Bhutan is.

In essence, GDP is just a number to indicate how well the country is doing in financial metrics with respect to other countries. The number for GDP is useful and has its own dynamics., for example for a $4T economy - a 2.5% spending on defense will be $10 B. But that may be 25% spending for another country!

Economy GDP has no correlation with HDI. Even though high level of economy does spare more resources for HDI and hence a concomitant rise in HDI., all one has to look at is Saudi Barbaria and Bhutan.

Here is the top line stats of Saudi Barbaria:

Header: Life expectancy at Birth Expected years of schooling Mean years of Schooling GDP

Saudi Barbaria 74.4 16.1 9.6 19

Bhutan 69.9 12.5 3.1 164

An average S. Barbarian at birth expects to live *just* 5 years more than the average Bhutanese., but the GDP of S. Barbaria is 8x more! This itself indicates that one of the biggest component of HDI (life expectancy) is not correlated at all with GDP. The other components are expected years of education and actual average education or rather the ratio of it.

So what does all the years in schooling do to a S. Barbarian? Produce more barbarism? Women empowerment if factored in HDI will put Saudi Barbaria down at zero and the very bottom of table (bakistan has better women empowerment than S. Arabia) and Bhutan up very high. And this has nothing to do with women in workforce (since unorganized rural farm work force is some how ignored!)., and even on that count if accounted for - we know where S. Barbaria is and where Bhutan is.

In essence, GDP is just a number to indicate how well the country is doing in financial metrics with respect to other countries. The number for GDP is useful and has its own dynamics., for example for a $4T economy - a 2.5% spending on defense will be $10 B. But that may be 25% spending for another country!

Re: Indian Economy News & Discussion - Aug 26 2015

Assuming that our GDP is $2.6 Trillion this year.

In 10 years (by 2027 and assuming average annual inflation rate is 3% and assuming a 2% average Rupee appreciation per year) we can be a:

$8 trillion economy if we grow at an annualized GDP growth rate of 7% per year (total average growth rate per year = 12% (7% GDP + 3% Inflation + 2% Rupee appreciation))

$10.5 economy if we grow at an annualized GDP growth rate of 10% per year (total average growth rate per year = 15% (10% GDP + 3% Inflation + 2% Rupee appreciation))

The above is what we should aim for in terms of GDP.

In terms of HDI, our HDI is at 0.625 range right now, we should aim for a HDI of 0.725 by 2027. Hopefully by that year the literacy rate nationally is between 87-90% (with most children achieving at least 12 years of education) and IMR is at 15 with corresponding reductions in other health indicators.

These are very achievable targets, however it requires strong leadership at the center.

In 10 years (by 2027 and assuming average annual inflation rate is 3% and assuming a 2% average Rupee appreciation per year) we can be a:

$8 trillion economy if we grow at an annualized GDP growth rate of 7% per year (total average growth rate per year = 12% (7% GDP + 3% Inflation + 2% Rupee appreciation))

$10.5 economy if we grow at an annualized GDP growth rate of 10% per year (total average growth rate per year = 15% (10% GDP + 3% Inflation + 2% Rupee appreciation))

The above is what we should aim for in terms of GDP.

In terms of HDI, our HDI is at 0.625 range right now, we should aim for a HDI of 0.725 by 2027. Hopefully by that year the literacy rate nationally is between 87-90% (with most children achieving at least 12 years of education) and IMR is at 15 with corresponding reductions in other health indicators.

These are very achievable targets, however it requires strong leadership at the center.

Re: Indian Economy News & Discussion - Aug 26 2015

>>for example for a $4T economy - a 2.5% spending on defense will be $10 B. But that may be 25% spending for another country!

minor nitpick... 2.5% of 4T is 100 b not 10 B...once we hit 4T (around 2020-2021) our defense budget will be equal to 30-50% of pakistans GDP. (Depending upon the extent they fudge there books)...

minor nitpick... 2.5% of 4T is 100 b not 10 B...once we hit 4T (around 2020-2021) our defense budget will be equal to 30-50% of pakistans GDP. (Depending upon the extent they fudge there books)...

Re: Indian Economy News & Discussion - Aug 26 2015

We cannot spend our GDP on Defence , It will be the budget that will be spent which has to increase both in terms of revenue and expenditure.

Saudi Barbaria spends 10 % of their GDP on defence but 36 % of Budget expenditure on it.

Saudi Barbaria spends 10 % of their GDP on defence but 36 % of Budget expenditure on it.

Re: Indian Economy News & Discussion - Aug 26 2015

Maybe not, but defence production can and should be a much more significant share of GDP. We need a vastly bigger military industrial complex capable of producing most of the basic munitions and supplied needed for defense. It's really ridiculous that the 3rd largest economy in the world imports basic defence gear like hand guns and bullets.

Re: Indian Economy News & Discussion - Aug 26 2015

Modi better than Trump; India will outperform US over 5-10 years: Marc Faber

http://www.moneycontrol.com/news/busine ... 65349.html

http://www.moneycontrol.com/news/busine ... 65349.html

On a day when market scaled record high on Tuesday, Marc Faber cemented bullish sentiment further by saying that India will continue to outperform the US and other western markets, he said in an exclusive interview with CNBC-TV18.

The editor and publisher of The Gloom, Boom, and Doom Report said that India has got a new government with (Prime Minister) Narendra Modi leading the charge from the front, has much better chance of implementing reforms than say US President, Donald Trump.

Commenting on the economy he said that central banks in emerging economies (EMs) such as India are much more responsible and educated about perils of money printing. RBI’s former governor Raghuram Rajan & present governor Urjit Patel have done a good job in stabilising the rupee.

Indian market is up 13 percent in local currency and in dollar terms, the market is up close to 18 percent led by a rise in the rupee. The currency is very important for foreign investors. A strong currency can pull foreign investors towards India, he said.

“I remain constructive on India and over the next 10-20 years, India has the potential to grow at 5-7 percent each year – which is huge compared to growth rate seen in the US or Europe,” said Faber.

India, according to PwC, in 20-30 years will become a second largest economy in the world similar to China. He also highlighted that only marginal amount of domestic saving find its way to Indian equity markets.

The wealthy families should at least put 20 percent of the money in Indian equities or Indian properties and direct investment because it is time to look forward.

Today, US stock market is 53 percent of the global stock market capitalisation now. But, in 10-20 years, it will be reduced to 20 percent and India and China will hog lion share up to 50 percent, highlights Faber.

Re: Indian Economy News & Discussion - Aug 26 2015

Putting savings in stocks is one thing I wouldn't want Indian families to emulate Americans. We are better off being a savings based society like Germany and Japan.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Indian Economy News & Discussion - Aug 26 2015

The japanese pension nd mutual funds are also invested in stocks bonds and foreign projects with low interest payback like freight corridor and stakes in real estate developers here.Karthik S wrote:Putting savings in stocks is one thing I wouldn't want Indian families to emulate Americans. We are better off being a savings based society like Germany and Japan.

Re: Indian Economy News & Discussion - Aug 26 2015

The US issue is not household ownership of shares as such. Rather, the problem is the economic paradigm seeking shareholder value maximization above all else. For a long time, the US sought to maximize value for stakeholders, as opposed to shareholders. That broke down in the 1970s and especially in the Reagan era, as capital gains taxes were lowered and shareholder value became the primary objective. This resulted in wage stagnation despite rising productivity.Karthik S wrote:Putting savings in stocks is one thing I wouldn't want Indian families to emulate Americans. We are better off being a savings based society like Germany and Japan.

US productivity, compensation and wages

India should ensure that wages are commensurate with productivity gains, and not make the US mistake of shareholder value at the cost of all else.

Re: Indian Economy News & Discussion - Aug 26 2015

These idiots will ensure BJP lose the election in 2019. While there is the reason for the farmers not to pay IT, the IT on farming activity will be political suicide. In fact, BJP needs to relook at the Chidu 2.0 policies of kungfu fighter on taxation, particularly the IT slabs.Hari Seldon wrote:Farmers should pay income tax, says NITI Aayog (mint)

Re: Indian Economy News & Discussion - Aug 26 2015

Anyone who earns above a certain limit should be the right term. They have to raise the tax limit above a certain earning level and then implement it. May be something like 5-6 lakhs? Gurus can enlighten.

Especially is there any data of people who earns in crores or above certain lakhs and still call themselves as farmers? I think once even Amitabh bachan called himself a farmer in his tax returns. Am i right?

Especially is there any data of people who earns in crores or above certain lakhs and still call themselves as farmers? I think once even Amitabh bachan called himself a farmer in his tax returns. Am i right?

-

A Deshmukh

- BRFite

- Posts: 522

- Joined: 05 Dec 2008 14:24

Re: Indian Economy News & Discussion - Aug 26 2015

There is a huge amount of tax evasion happening under "agricultural income".Yagnasri wrote:These idiots will ensure BJP lose the election in 2019. While there is the reason for the farmers not to pay IT, the IT on farming activity will be political suicide. In fact, BJP needs to relook at the Chidu 2.0 policies of kungfu fighter on taxation, particularly the IT slabs.Hari Seldon wrote:Farmers should pay income tax, says NITI Aayog (mint)

there has to be some way to end this.

Ideally, all income should be income - irrespective of whether it is salary or farming or industry or trading or investing or inheritance/gift.

Congi policy of appeasement of each section of society needs to end.

Re: Indian Economy News & Discussion - Aug 26 2015

Sir, I agree that it is an ideal condition. But we are in real world. We can no doubt look into the so called agri income in IT returns. If anything the entire IT slabs are to be drastically revised.

Re: Indian Economy News & Discussion - Aug 26 2015

Some income should be excluded from farm income like corporate earnings. If you cannot tax farm income, exclude some part of it which by value is large but small by numbers.

Re: Indian Economy News & Discussion - Aug 26 2015

Tax farm income over a land holding of say 10 acres or more, this will exclude the subsistence and small time farmers.

I picked the figure of 10 acres somewhat arbitrarily, this should be a number govt. thinks is appropriate.

I picked the figure of 10 acres somewhat arbitrarily, this should be a number govt. thinks is appropriate.

Re: Indian Economy News & Discussion - Aug 26 2015

That's a good idea, 10 acres or so per household. But post 2019, hopefully, our society will be more evolved and understand that tax has to be paid for the betterment of the country.Dipanker wrote:Tax farm income over a land holding of say 10 acres or more, this will exclude the subsistence and small time farmers.

I picked the figure of 10 acres somewhat arbitrarily, this should be a number govt. thinks is appropriate.

Re: Indian Economy News & Discussion - Aug 26 2015

There's no reason to be so harsh at the NITI Aayog like this. It's their job to come up with such economic proposals. It's the politicians' jobs to consider the political ramifications. So why call them idiots ? They are the entity specifically tasked with looking into areas of reform. They are simply doing what they are supposed to be doing.Yagnasri wrote:These idiots will ensure BJP lose the election in 2019. While there is the reason for the farmers not to pay IT, the IT on farming activity will be political suicide. In fact, BJP needs to relook at the Chidu 2.0 policies of kungfu fighter on taxation, particularly the IT slabs.Hari Seldon wrote:Farmers should pay income tax, says NITI Aayog (mint)

As others have subsequently argued, taxing agricultural income itself isn't an issue. A lot of wealthy have farm income. GoI should bite the bullet and just do something straightforward like increase the tax free slab to 5 lakh, but make ALL income taxable, farm or non farm. Any marginal farmer coming under 5 lakh will owe no tax, and above that he's arguably no marginal farmer anyway, so a flat rate applicable across the board is fine.

-

Marten

- BRF Oldie

- Posts: 2176

- Joined: 01 Jan 2010 21:41

- Location: Engaging Communists, Uber-Socialists, Maoists, and other pro-poverty groups in fruitful dialog.

Re: Indian Economy News & Discussion - Aug 26 2015

One must be plain crazy to even try imposing an agricultural tax on farmers in this country. It is political suicide for any party.Dipanker wrote:Tax farm income over a land holding of say 10 acres or more, this will exclude the subsistence and small time farmers.

I picked the figure of 10 acres somewhat arbitrarily, this should be a number govt. thinks is appropriate.

BJP has enough troubles to take on this fool's errand.

Would be better to tax transactions at the mandi instead. Start with taxing annual transactions above 10 lacs at the middleman level -- these are the folks who are enjoying the benefits the most. The mercantile class in India is and has always been the most corrupt (it is not just the babus) and is the main source of theft of tax. The kind of ostracisation that happens to single farmers is unbelievable. Focus on the lower hanging fruit first.

Re: Indian Economy News & Discussion - Aug 26 2015

I'll hold a contrarian opinion here : all those poor farmers are in fact the ones who know best , just how much misuse of the 'no tax on agricultural income' exists . If anything, demonetization affects the poor far more, in the form of an immediate short term disruption in their economic lives .

'Tax on agricultural income' is not 'tax the poor farmers' . Even the poor non agricultural folks (i.e. Under 2.5 lakh) aren't taxed . GoI just needs to state 'ALL income over 5lakh will be taxed' for example , and just remove references to agriculture altogether . I also think that as with many other initiatives, the only person with the credibility to do this is Modi .

'Tax on agricultural income' is not 'tax the poor farmers' . Even the poor non agricultural folks (i.e. Under 2.5 lakh) aren't taxed . GoI just needs to state 'ALL income over 5lakh will be taxed' for example , and just remove references to agriculture altogether . I also think that as with many other initiatives, the only person with the credibility to do this is Modi .

Re: Indian Economy News & Discussion - Aug 26 2015

Would making filing IT returns mandatory be an interim step to guage reactions?

Re: Indian Economy News & Discussion - Aug 26 2015

as agriculture is moving more into coops and corps, they need to be taxed appropriately.

the small farmer way of running 2-5 acres and sustaining themselves are a dying breed. either they have already sold out, or none of their sons will continue that way of life. These are the ones who may have deserved IT exemption, but this situation is becoming obsolete in many parts of the country.

the small farmer way of running 2-5 acres and sustaining themselves are a dying breed. either they have already sold out, or none of their sons will continue that way of life. These are the ones who may have deserved IT exemption, but this situation is becoming obsolete in many parts of the country.

Re: Indian Economy News & Discussion - Aug 26 2015

Actually a limit of 10 acres or more or something like that exempts up to 97% of the all farmers who are subsistence/small farmers and taxes only the 3% fat cat farmers, so it is not that big of a political risk. But raising the slab to all income 5 lakh and above taxable sounds like a better idea.

-

atamjeetsingh

- BRFite -Trainee

- Posts: 47

- Joined: 15 Aug 2016 04:31

Re: Indian Economy News & Discussion - Aug 26 2015

I would go with this idea mandatory IT return for everyone and you will receive benefits from state only if you file IT return. May be after 5-10yrs after there is enough data available govt can analyze who can be taxed and how?Prasad wrote:Would making filing IT returns mandatory be an interim step to guage reactions?

Re: Indian Economy News & Discussion - Aug 26 2015

Maybe the first step could be to tax farm income when the assessee has dual income, i.e., farming and farm-related activity is not his sole source of income. That would get rid of the convenient loophole for professionals and businessmen.