Budget 2016 - news & discussions

Re: Budget 2016 - news & discussions

US IRAs have finer graduation and are not as blunt of an instrument. What is put in is deductible from income as long as income doesn't exceed a certain amount. For high earners, the only benefit provided is tax-free compounding, as any contributions made are taxed.Kakkaji wrote:If I am reading it right, the IRAs (Regular not Roth)in the US work in the same way. The amount you put in is deductible from income in the year you put it in, and then the earnings compound over the years tax-free. When you take it out after age 59.5, the entire amount is taxable as ordinary income. Makes sense as you paid no income tax on both the amount you put in and the amount earned over the years.

-

Virupaksha

- BR Mainsite Crew

- Posts: 3110

- Joined: 28 Jun 2007 06:36

Re: Budget 2016 - news & discussions

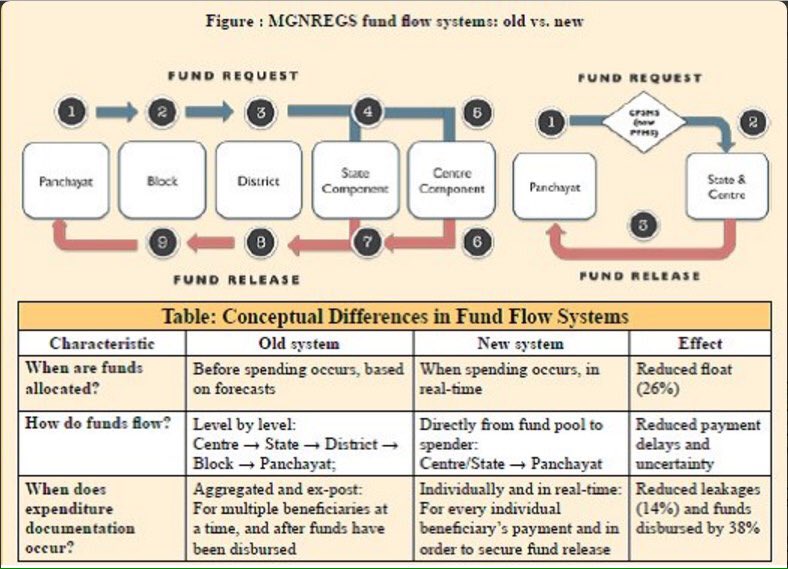

image only shows attempt to make sure that kiladars report directly to the shahenshah rather than the jagirdarsvivek.rao wrote:https://pbs.twimg.com/media/CcZpOTbUAAALoUn.jpg

this was discussed sometime ago. translated: make sure that the local politicians are beholden to the centre directly rather than the state.

Note both of them are not about giving powers to them. it is about the control levers. Also, the real local power is in the hands of the person who says such work is done by so &so and approved. At the centre level, it is the power that says this village can do this work.

Re: Budget 2016 - news & discussions

Defence Ministry Gets RS. 86,000 Crore For Modernisation.

The Defence Ministry will have about Rs. 86,000 crore for the financial year 2016-17 to fund the purchase of the French made Rafale fighters, Medium Range Surface to Air Missiles (MRSAM) and Submarines for the Indian Navy.

If the Rafale deal goes through, at an estimated cost about Rs. 60,000 crore, India will have to pay about one-sixth of the total cost in the financial year to France.

The total budget allocation for this financial year of Rs. 2,49,099 crore is an increase of nearly one per cent over last year's allocation.

This is apart from the funds for pension and allocation for payment for One Rank One Pension which stands at Rs. 82,332 crore.

The Defence Ministry returned back about Rs. 20,000 crore worth of unspent funds to the exchequer this time. "This is excess is largely because of low international fuel prices," a senior MoD official told NDTV.

Out of nearly Rs. 2,50,000 Crore allocated to the ministry, Rs. 1,62,759 crore is allocated for Revenue expenditure. It includes expenditure for Defence Ordnance factories, Research and Development, Rashtriya Rifles, Military Farms and the National Cadet Corps.

The Defence Ministry will have about Rs. 86,000 crore for the financial year 2016-17 to fund the purchase of the French made Rafale fighters, Medium Range Surface to Air Missiles (MRSAM) and Submarines for the Indian Navy.

If the Rafale deal goes through, at an estimated cost about Rs. 60,000 crore, India will have to pay about one-sixth of the total cost in the financial year to France.

The total budget allocation for this financial year of Rs. 2,49,099 crore is an increase of nearly one per cent over last year's allocation.

This is apart from the funds for pension and allocation for payment for One Rank One Pension which stands at Rs. 82,332 crore.

The Defence Ministry returned back about Rs. 20,000 crore worth of unspent funds to the exchequer this time. "This is excess is largely because of low international fuel prices," a senior MoD official told NDTV.

Out of nearly Rs. 2,50,000 Crore allocated to the ministry, Rs. 1,62,759 crore is allocated for Revenue expenditure. It includes expenditure for Defence Ordnance factories, Research and Development, Rashtriya Rifles, Military Farms and the National Cadet Corps.

-

gashish

- BRFite

- Posts: 272

- Joined: 23 May 2004 11:31

- Location: BRF's tailgate party, aka, Nukkad thread

Re: Budget 2016 - news & discussions

Budget 2016: Government to give 5 crore LPG connections on concessional rate

5 crore LPG connections to BPL families will have far-reaching effects, if executed with the same success as PMJDY was.

This is massive, given that current LPG connections are anywhere between 9-12 crores, ~50% jump just in 3 years!

Besides improving of quality of life of BPL housewives, it will create rural jobs in supply chain of gas cylinder distribution.

5 crore LPG connections to BPL families will have far-reaching effects, if executed with the same success as PMJDY was.

This is massive, given that current LPG connections are anywhere between 9-12 crores, ~50% jump just in 3 years!

Besides improving of quality of life of BPL housewives, it will create rural jobs in supply chain of gas cylinder distribution.

-

nandakumar

- BRFite

- Posts: 1641

- Joined: 10 May 2010 13:37

Re: Budget 2016 - news & discussions

nelsonnelson wrote:The Provident Fund contribution is not tax exempt in its entirety. There is a limit of Rs 1.5 lakh with competion from life insurance premia, home loan principal repayment, children education expenditure, etc. So the fear is that it will be taxed thrice. From "Exempt- Exempt - Exempt " to "Tax - Tax - Tax". At the least, a sizeable portion of the corpus.

The law today exempts an employer's contribution to PF in entirety. It is this sum which is sought to be taxed upon withdrawal, partially. The exemption limit that you are talking about is employees' contribution to PF, post office savings life insurance premium etc which is subject to a ceiling of 1.5 lakhs.

-

nandakumar

- BRFite

- Posts: 1641

- Joined: 10 May 2010 13:37

Re: Budget 2016 - news & discussions

nelsonnelson wrote:The Provident Fund contribution is not tax exempt in its entirety. There is a limit of Rs 1.5 lakh with competion from life insurance premia, home loan principal repayment, children education expenditure, etc. So the fear is that it will be taxed thrice. From "Exempt- Exempt - Exempt " to "Tax - Tax - Tax". At the least, a sizeable portion of the corpus.

The law today exempts an employer's contribution to PF in entirety. It is this sum which is sought to be taxed upon withdrawal, partially. The exemption limit that you are talking about is employees' contribution to PF, post office savings life insurance premium etc which is subject to a ceiling of 1.5 lakhs.

Re: Budget 2016 - news & discussions

Defence allocation lowest since 1962.

Allocations for the three services on account of capital expenditure provide some indication of what contracts might be signed. The army is the big gainer, with its capital allocation up from Rs 18,486 crore to Rs 22,110 crore. This jump suggests the likelihood of artillery gun contracts being concluded, including the purchase of M777 ultralight howitzers from BAE Systems. The navy has been given a marginal raise, which suggests that its flow of new warships is likely to continue smoothly. Significantly, the Indian Air Force (IAF) allocations have been marginally reduced. This suggests the defence ministry is not expecting to sign a contract next year for the Rafale fighter - for which it would have to allocate about Rs 10,000 crore as the signing amount.

Re: Budget 2016 - news & discussions

making PF taxable on withdrawal is cruel blow to middle class who keep aside this money for retirement living expenses and big things like childrens higher study, marriage etc.

Re: Budget 2016 - news & discussions

Vina, How does PF withdrawal impact the middle class? Will it get rolled back? How much is it expected to bring in? Can the GSt is its passed tide the amount?

-

member_24684

- BRFite

- Posts: 197

- Joined: 11 Aug 2016 06:14

Re: Budget 2016 - news & discussions

does anyone confirm, are these figures include the pay and allowancesVipul wrote:Budget 2016: MHA gets Rs 77,383.12 cr in 2016-17 budget, a 24.56 pc hike.

The Home Ministry has been allocated over Rs 77,000 crore in 2016-17 budget, a steep hike of 24.56 per cent, majority of which have been earmarked for paramilitary forces like CRPF and BSF, responsible for internal security and border guarding duties.

Presenting the general budget in Parliament, Finance Minister Arun Jaitley announced an outlay of Rs 77,383.12 crore to the Home Ministry of which Rs 67,408.12 crore is under non-plan and Rs 9,975 crore under plan heads. In the 2015-16 budget, Home Ministry was allocated Rs 62,124.52 crore.

Re: Budget 2016 - news & discussions

I think the PF is taxed if withdrawn before retirement.

That is if you leave a job & withdraw your entire PF without transferring it to an annuity & before your retirement age., you pay taxes! This is actually a good thing.

That is if you leave a job & withdraw your entire PF without transferring it to an annuity & before your retirement age., you pay taxes! This is actually a good thing.

Re: Budget 2016 - news & discussions

the PF thing is a push to get people to invest in financial security rather than a meaningful taxation source. 40% is left tax free, the rest has to be invested in annuity to avoid tax.

Re: Budget 2016 - news & discussions

Okay with taxing EPF, but they should have taxed only the interest and given indexation benefits at least. Right now, instead of putting money in EPF, I think I could put it in a very low yield liquid fund and still be better off

Re: Budget 2016 - news & discussions

the nudge is towards NPS.

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Budget 2016 - news & discussions

It is a "Cash flow" management exercise by the govt. What they are saying is that we will let you withdraw 40% of the contributions you make going forward (the contributions made as of yesterday are 100% tax free on withdrawal ) tax free, while the 60% of the remaining will suffer tax, UNLESS you invest in specified annuity schemes (the corpus of which is inheritable by your heirs).They really don't want you to withdraw the cash, but rather incentivise you to keep it invested and within the system. A good way of raising long term funds / perpetual bonds kind of thing.ramana wrote:Vina, How does PF withdrawal impact the middle class? Will it get rolled back? How much is it expected to bring in? Can the GSt is its passed tide the amount?

So in effect what the govt is doing is , saying, contribute, but don't ask for 60% of your money back as lump sum, but rather, we will give you an annuity based on it .. So in some ways it is both good and bad , and I haven't read the details, and questions arise, on how much is the annuity, how long will it be (will it be for life ?), etc.. It does give someone a steady income potentially perennially (which is good) and prevents people from spending it on wasteful expenses and being dependent on the kids later in life. Have to look at the details really.

Re: Budget 2016 - news & discussions

^^ As Rahul M pointed out., it is a nudge towards NPS.

IMHO, this is a very very good step by the GOI., first of all a tax loophole was closed. I myself have availed the tax loophole and now wished that I had the ability to put it an annuity which is payable at 60 years.

Second., and very importantly is that it brings the tax treatment of retirement in line with other economies. So an abdul working in khan land on H1B, goes back to India - he/she can take the 401(k) contributions out of US and into the Indian annuity. This is a major thing., since desi abduls not putting in money in the 401(k) here since they are unsure of their future status (R2I/GC/US-Citizen etc) end up paying more in taxes than required. Imagine if they are able to pay 15k USD per year for 6 years and with some growth, they can take 65 lakhs to India and put it in their annuity (and say at the age of 40 they do R2I). For 8% growth at 65 lakhs, when they retire in 60 they may end up getting 2.5 crore in Indian Rs.

With the change in the treatment of tax benefit for retirement accounts, the above is now possible.

I still do not understand the rona-dhona that is happening.

IMHO, this is a very very good step by the GOI., first of all a tax loophole was closed. I myself have availed the tax loophole and now wished that I had the ability to put it an annuity which is payable at 60 years.

Second., and very importantly is that it brings the tax treatment of retirement in line with other economies. So an abdul working in khan land on H1B, goes back to India - he/she can take the 401(k) contributions out of US and into the Indian annuity. This is a major thing., since desi abduls not putting in money in the 401(k) here since they are unsure of their future status (R2I/GC/US-Citizen etc) end up paying more in taxes than required. Imagine if they are able to pay 15k USD per year for 6 years and with some growth, they can take 65 lakhs to India and put it in their annuity (and say at the age of 40 they do R2I). For 8% growth at 65 lakhs, when they retire in 60 they may end up getting 2.5 crore in Indian Rs.

With the change in the treatment of tax benefit for retirement accounts, the above is now possible.

I still do not understand the rona-dhona that is happening.

Re: Budget 2016 - news & discussions

The rhona-dhona can be attributed to words of FM in his budget speech and ambiguity otherwise. The lack of clarity pertains to some questions-

Q. Is GPF (statutory) included in the new tax ambit?

No.

Q. Is PPF included in the new tax ambit?

No.

Q. Are EPF and other "Recognised Provident Fund" taxable at the time of contribution?

Partly yes, employers' contribution beyond 12% of pay or 1.5 lakh per annum and employees' contribution beyond amount exempted under s 80C is taxable.

Q. Are EPF and other "Recognised Provident Fund"taxable at the time of withdrawal?

Partly yes, final lumpsum withdrawal(contribution and interest accruing after 01 Apr 2016) is taxable upto 60% of balance at the time of superannuation.

Q. Is premature withdrawal taxable?

No word on it, as of now.

http://www.incometaxindia.gov.in/_layou ... t=&isdlg=1

http://indiabudget.nic.in/ub2016-17/fb/bill.pdf

Q. Is GPF (statutory) included in the new tax ambit?

No.

Q. Is PPF included in the new tax ambit?

No.

Q. Are EPF and other "Recognised Provident Fund" taxable at the time of contribution?

Partly yes, employers' contribution beyond 12% of pay or 1.5 lakh per annum and employees' contribution beyond amount exempted under s 80C is taxable.

Q. Are EPF and other "Recognised Provident Fund"taxable at the time of withdrawal?

Partly yes, final lumpsum withdrawal(contribution and interest accruing after 01 Apr 2016) is taxable upto 60% of balance at the time of superannuation.

Q. Is premature withdrawal taxable?

No word on it, as of now.

http://www.incometaxindia.gov.in/_layou ... t=&isdlg=1

http://indiabudget.nic.in/ub2016-17/fb/bill.pdf

Re: Budget 2016 - news & discussions

>>H1B, goes back to India - he/she can take the 401(k) contributions out of US and into the Indian annuity.

any withdrawal of 401k before age 55 attracts heavy tax penalty. it does not matter where the money is going..massa will deduct tax.

any withdrawal of 401k before age 55 attracts heavy tax penalty. it does not matter where the money is going..massa will deduct tax.

Re: Budget 2016 - news & discussions

After leaving job , you can rollover into IRA and from there you can withdraw and not pay penalty and only pay income tax - which should be low because you are no longer earning in dollars over in massa.

Re: Budget 2016 - news & discussions

Sir., you are ABSOLUTELY WRONGSingha wrote:>>H1B, goes back to India - he/she can take the 401(k) contributions out of US and into the Indian annuity.

any withdrawal of 401k before age 55 attracts heavy tax penalty. it does not matter where the money is going..massa will deduct tax.

Within Massa you can roll it into rollover IRA.

Outside of Massa you can roll into an equivalent defined retirement plan. The txn has to be handled by the Social security services into the destination (outside of Massa's) equivalent administration of defined retirement plans.

Re: Budget 2016 - news & discussions

There is additional 10% penalty. So even if your tax rate is low 8% you will end up with a 18% loss (assuming you are tax resident). But once you lose your Tax residency - you have to pay 33% non-resident tax.Gus wrote:After leaving job , you can rollover into IRA and from there you can withdraw and not pay penalty and only pay income tax - which should be low because you are no longer earning in dollars over in massa.

As such things get dicey.

Re: Budget 2016 - news & discussions

it does not matter what urbane explanations and FAQs are trotted out. you cannot slap someone hard and then expect things will be ok with a drink later.

just look at any SM/media comments section - with this single brilliant move the GOI has made the urban educated forward thinking class (who voted heavily for namo last time) deeply resentful and suspicious.

the honeymoon is well and truly over. if the politics is going to be that of sops to win elections, the urban middle class will also now demand their pound of flesh from the feeding trough, else even the UPA sarkaar was the same barring high oil prices. there is as yet no boom in jobs or opportunity for kids. inside the cities the municipalities remain equally korrupt and work equally shoddy.

people worldwide have no issues with high level korruption if jobs are strong, food , utilities and education is cheap and local services are delivered well. this is the "model" by which all gulf monarchies are run...and even in US / China the high level korruption continues unabated.

just look at any SM/media comments section - with this single brilliant move the GOI has made the urban educated forward thinking class (who voted heavily for namo last time) deeply resentful and suspicious.

the honeymoon is well and truly over. if the politics is going to be that of sops to win elections, the urban middle class will also now demand their pound of flesh from the feeding trough, else even the UPA sarkaar was the same barring high oil prices. there is as yet no boom in jobs or opportunity for kids. inside the cities the municipalities remain equally korrupt and work equally shoddy.

people worldwide have no issues with high level korruption if jobs are strong, food , utilities and education is cheap and local services are delivered well. this is the "model" by which all gulf monarchies are run...and even in US / China the high level korruption continues unabated.

Re: Budget 2016 - news & discussions

I am suspecting mutual funds and other saving schemes lobbies who were aiming for that nail in ppf and epf are finally able to get through the BJP lawmakers.

Once you start vandalising the benefits under the cover of greater financial management and parity for corporates then where it will stops?

Once you start vandalising the benefits under the cover of greater financial management and parity for corporates then where it will stops?

Re: Budget 2016 - news & discussions

Also this philosophical argument of tax exemption on retirement funds is unjust and it is just a favour by BJP and it can be taken back any time at will then first give me my just befefits of affordable education, good infra, senior citizen welfare, healthcare etc. Once you provide me that then who will oppose to pay tax? But do that first and until then hands off my money.

Re: Budget 2016 - news & discussions

ndtv -Partial Retreat On Provident Fund Tax? PM To Decide, Say Sources

-

member_28990

- BRFite

- Posts: 171

- Joined: 11 Aug 2016 06:14

Re: Budget 2016 - news & discussions

this EPF thing is going to bite back the sarkaar. My entire circle of family and friends, some of whom voted for NaMo last time feeling completely betrayed. The thing is, most Indian middle class are emotional about things like "pension" - no matter what logic you apply the perception battle is lost - "the govt. wants to tax my pension savings" narrative is everywhere.

Re: Budget 2016 - news & discussions

^^ yes. Same sentiments from people around me here.

Re: Budget 2016 - news & discussions

I think taxing the EPF thus is a wrong move because EPF over the years has devolved to a point where it is mostly used by financially unsophisticated and low earning population. This set does not have many assets or a safety net to fall back on.

Those well off have already migrated away from the EPF to greener pastures. For example, at the software company I worked at, all employees got together and had the EPF contribution reduced to Rs. 600/month, since no one ever expected to get the money back from the government. So the marginal benefit to the government treasury from this move is going to be minimal.

Why bother?

Those well off have already migrated away from the EPF to greener pastures. For example, at the software company I worked at, all employees got together and had the EPF contribution reduced to Rs. 600/month, since no one ever expected to get the money back from the government. So the marginal benefit to the government treasury from this move is going to be minimal.

Why bother?

-

Neela

- BRF Oldie

- Posts: 4104

- Joined: 30 Jul 2004 15:05

- Location: Spectator in the dossier diplomacy tennis match

Re: Budget 2016 - news & discussions

Now my suspicions on Jetli seem to get more concrete.

Middle class gave unflinching support to Modi especially on SM.

This EPF tax move appears to target that crowd.

By the way, contributions to PF is from income already taxed.

Middle class gave unflinching support to Modi especially on SM.

This EPF tax move appears to target that crowd.

By the way, contributions to PF is from income already taxed.

Re: Budget 2016 - news & discussions

Revenue secretary clarifies that interest accrued on 60% of principal after 1st April only will be taxed..I can see some damage control there..why not withdraw the whole proposal lock stock and barrel instead of beating around the bush..if continued with this nonsense BJP will lose more capital (political) that the public.

Re: Budget 2016 - news & discussions

There is this huge lower, sub lower middleclass segment who will accumulate about 20 to 30 lakh at maturity. Taxing 3.5 lakhs on 18 lakh withdrawal (since that withdrawal alone will put them in 30% bracket) and giving them back 14.5 lakh is huge huge blow. I dont have words to express my anger.

Now what? BJP is going to slab the withdrawals ?

Now what? BJP is going to slab the withdrawals ?

Re: Budget 2016 - news & discussions

^^ I understand that people are impatient and they see only the next benefit.

Put it this way, if the government listens to the shor-gul on Twitter/SM/MSM, and they roll this thing back - isn't it an example of a Government which is listening?

Or even the above statement will lead to rona-dhona?

Put it this way, if the government listens to the shor-gul on Twitter/SM/MSM, and they roll this thing back - isn't it an example of a Government which is listening?

Or even the above statement will lead to rona-dhona?

Re: Budget 2016 - news & discussions

Aren't you spreading a lie? Maturity of what? The "annuity"? When is the withdrawal? And for what purpose?abhijitm wrote:There is this huge lower, sub lower middleclass segment who will accumulate about 20 to 30 lakh at maturity. Taxing 3.5 lakhs on 18 lakh withdrawal (since that withdrawal alone will put them in 30% bracket) and giving them back 14.5 lakh is huge huge blow. I dont have words to express my anger.

Now what? BJP is going to slab the withdrawals ?

Re: Budget 2016 - news & discussions

Why the outcry? Its only applicable prospectively, so not an unfair ask. Plus they've now made NPS a more lucrative option by aligning the taxability of withdrawals from EPF corpus to what the NPS provides. Its important from a long term govt. finances management PoV.

Agree that it is the Class III employees, PSU, railway staff who rely on EPF the most. However, this will only effect the interest accrued on deposits made post April 1, 2016.

Agree that it is the Class III employees, PSU, railway staff who rely on EPF the most. However, this will only effect the interest accrued on deposits made post April 1, 2016.

Re: Budget 2016 - news & discussions

Reason for outcry, who will calculate compounded interest for 60% of the contribution made after April 2016, in say 2045 when I retire?

Re: Budget 2016 - news & discussions

Disha, I can understand what you say. But the problem with this money is that there is lot of sentiments attached to it. More than the sentiments, there is a lot of planning that goes before one retires and the epicentre of all this planning is this retirement benefits..be it daughters marriage , buying a new home or going on a tour or pilgrimage..everthing is planned looking at this money. Now if anyone tries to takeaway even one paise from it, they will become hugely unpopular. Not worth a try IMO.

Re: Budget 2016 - news & discussions

I do not understand why Jaitley has to do this. This will help only after 10 years as the current amount is not applicable. Why should he help the congress govt?

Re: Budget 2016 - news & discussions

Agree to that. This is an emotional response and not a rational response. Anyway, looks like the Modi Sarkar is "downhill skiing"geeth wrote:Disha, I can understand what you say. But the problem with this money is that there is lot of sentiments attached to it. More than the sentiments, there is a lot of planning that goes before one retires and the epicentre of all this planning is this retirement benefits..be it daughters marriage , buying a new home or going on a tour or pilgrimage..everthing is planned looking at this money. Now if anyone tries to takeaway even one paise from it, they will become hugely unpopular. Not worth a try IMO.