Currency Demonetisation and Future course of Indian Economy

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

Ppl here extol the virtues of apps that are directly tied into bank accounts, vs. the humble "wallets" where you put money in from the bank account, but then there is no tie to the bank account.

IMO, this wallet feature is all-important. When Indians wake up to the fine Paki business of hacking and e-fraud, they will agree with me. One should as far as possible, ***NOT*** link anything to the bank account. The e-wallet puts a nice cap on the amount you can lose (say on air tickets from Berlin to Karachi as shiv bought).

FWIW.

IMO, this wallet feature is all-important. When Indians wake up to the fine Paki business of hacking and e-fraud, they will agree with me. One should as far as possible, ***NOT*** link anything to the bank account. The e-wallet puts a nice cap on the amount you can lose (say on air tickets from Berlin to Karachi as shiv bought).

FWIW.

Re: Currency Demonetisation and Future course of Indian Economy

Late evening round up... (mainly Kerala news)

- Demonetisation to delay salary disbursal in January: Isaac......

As per the "financial scientiest" Thomas Issac who also doubles as Kerala state's finance minister, the government employees may not get their salaries on time because of note crunch. The way he puts it, it is as if he and an office peon actually hand delivers the salary of each government employees through notes. But then majority of the employees have accounts in SBI, and salary gets credited. How much physical cash a person gets is then decided between the banks and that person. A minority of employees & pensioners gets paid through state treasury which still uses crude operating procedures. And this statement comes from a minister, where the state run transport corporation has salary dues for their staff for the past three months (even before demonitisation). Looks like a bulk of the state's income was through money which was not taxed by the (Central) IT Dept. And now that has got stopped. With no income, there has to be difficulties in paying salaries as well .

. - IOC fuel outlets in Kerala migrate to cashless payment mode......

- Cash withdrawal cap may not be necessary from Jan 1: Minister......

- LDF stages human chain protest against demonetisation......

Re: Currency Demonetisation and Future course of Indian Economy

Yes, UPI is a game changer (it is in the process of being available on feature phones) and can potentially make e-wallets redundant. It will lower transaction costs, not just due to lower costs (50p or less per transaction), but no costs for hardware and data transfer. Along with RuPay debitJayS wrote:We helped set up PayTM account to our office canteen guy. Currently PayTM is not charging money to transfer money to bank account. But they have 4% charge otherwise. Also one shortcoming a guy in office pointed out is PayTM does not show name of the person whom you are transferring money upfront. So if you by mistake put wrong phone number, you would know that only once money is transferred when you see wrong person name (haven't tried myself).

We now encouraged our Canteen guy to also try out UPI. Since its free and hassle free, and connected to bank account directly. I personally found UPI better than PayTM. It also gives name of person who you are sending money once you enter VPA before transacting. I feel its little more assuring. And for <1000Rs its free I guess. Even for higher amount its nominal charges. Once UPI goes full steam PayTM will have real trouble in attracting users. I find UPI to be a fantastic system. If they can get it to feature phones somehow, it would span a large section of society.

cards, it breaks the stranglehold that Mastercard and visa have on card payments.

Re: Currency Demonetisation and Future course of Indian Economy

60 lakh depositors put Rs 7 lakh crore in banks, govt probing all of them

???

So only 7 lakh crore came in? not 12.4 lakh crores? I am confused

-

Vineetmehta_del

- BRFite -Trainee

- Posts: 17

- Joined: 15 Aug 2016 15:02

Re: Currency Demonetisation and Future course of Indian Economy

Dear all,

Can you think of how Pradhan Mantri Garib Kalyan Yojana (PMGKY) can be misused by individuals or companies? My understanding from the scheme is that PM wants maximum black money to be utilized for the benefit of the poor. So one scenario could be that less money than actual is declared by the individual, another could be that the individual tries to convert black money and whatever is left is then submitted under PMGKY or a company fronts its trusted employee to declare under PMGKY, etc.

Thanks in advance.

Can you think of how Pradhan Mantri Garib Kalyan Yojana (PMGKY) can be misused by individuals or companies? My understanding from the scheme is that PM wants maximum black money to be utilized for the benefit of the poor. So one scenario could be that less money than actual is declared by the individual, another could be that the individual tries to convert black money and whatever is left is then submitted under PMGKY or a company fronts its trusted employee to declare under PMGKY, etc.

Thanks in advance.

-

Vineetmehta_del

- BRFite -Trainee

- Posts: 17

- Joined: 15 Aug 2016 15:02

Re: Currency Demonetisation and Future course of Indian Economy

The idea is to reach to the kingpins and not the pawns used by them for deposits or transfers. They will not trouble the poor / middle class people being used.Sachin wrote:Which also means that the government can use some "shock & awe" raids if some other political issues come up. Keep all the data ready, but keep the option to strike open. For example, Com. Yechuri makes some bold statements; but the very next day raids happen at a few locations which are favourites of CPI(M).Vineetmehta_del wrote:The IT guys are utilising these inputs for raids. Seems there is a clear strategy on what needs to be done and how. Also, I feel that this fight against such entities would continue for 1-2 years.

Re: Currency Demonetisation and Future course of Indian Economy

The foot soldiers will be questioned to find out the mota lotas.

Re: Currency Demonetisation and Future course of Indian Economy

Its 7 lac of the approx 14 lac crore which have reportedly been deposited.vijayk wrote:60 lakh depositors put Rs 7 lakh crore in banks, govt probing all of them

???

So only 7 lakh crore came in? not 12.4 lakh crores? I am confused

There are approx 300 million bank accounts in India, so just 2 % of accounts contributed to 50% of deposits.

The remaining 294 million averaged deposits of about Rs 24000 each. With such a low level of deposits, they would not have a problem

with cash withdrawal caps of Rs 24000 / week, or occasional shortages, as they would not need to visit a bank more than once a month. Though Rs 24,000 is an average, even at the top of this 98%, deposits are under Rs 2 lacs.

So all the fuss about queues/ shortages etc is being made by just 2% of depositors.

Re: Currency Demonetisation and Future course of Indian Economy

^^^. Interesting that is only 2% who even have the means to complain about queues. Indeed if the total amount is 24,000 Rs, they could withdraw it all in one shot and no more queues. I am assuming their incomes are way below 24,000.

Another point in the article: the 60 lakh acccounts (with 7 lakh crore ruppees) account for both companies, institutions and individuals. For individual accounts, the deposit figures are 3-4 lakh crore (does not say how many accounts). The article's source itself is quite vague though..it says 'goverment' said and 'official' said, but no mention of which dept of govt (PMO? RBI? CBI? IT dept?) or the name of the official.

Another point in the article: the 60 lakh acccounts (with 7 lakh crore ruppees) account for both companies, institutions and individuals. For individual accounts, the deposit figures are 3-4 lakh crore (does not say how many accounts). The article's source itself is quite vague though..it says 'goverment' said and 'official' said, but no mention of which dept of govt (PMO? RBI? CBI? IT dept?) or the name of the official.

Re: Currency Demonetisation and Future course of Indian Economy

Another fan of Paytm here.

I use CC for purchases above 400 or 500.

Anything less than that I am using Paytm. Very wide acceptability and very convenient.

I have ICICI bank account and netbanking and phone registered etc etc. I have installed pockets. Till today I have not found anyone willing to accept it.

I use CC for purchases above 400 or 500.

Anything less than that I am using Paytm. Very wide acceptability and very convenient.

I have ICICI bank account and netbanking and phone registered etc etc. I have installed pockets. Till today I have not found anyone willing to accept it.

Re: Currency Demonetisation and Future course of Indian Economy

I can never get these zeroes right. But does that mean 10L per depositor ? I would think thats not much - i am sure lots of cash driven people/businesses/CAs would be able to explain that.

Re: Currency Demonetisation and Future course of Indian Economy

Explain and pay tax.

Re: Currency Demonetisation and Future course of Indian Economy

check from 33 minutes on wards to end (46 minutes video talk)-talks about present govt and demonetisation.

prof Vaidyanathan says a few things which could have been better- like printing small notes well before the nov 8 shocker. no one would have guessed as it was a routine small denomination currency. could have kept the sizes of new notes the same as earlier but changed the colour etc , could have saved on recalbration of ATMs. rs 2000 not needed.

-----------------------------------------

of course the entire video is peppered with humour and talks about caste system/Jaathi as social capital with lots of advantages.

also touches how brits upturned the existing social mobility into the system we know today.

Re: Currency Demonetisation and Future course of Indian Economy

Some of it could be legitimate, but it is a reasonable assumption that many are not. The question is how do we bring this set to even smaller so that IT and ED can manually analyze. First they need to intersect this set with set of people who filed taxes that is reasonable with this kind of savings. This also needs to be intersected with other purchases they made. This process can become as complex as we want until we get a set of most potential fraudsters. I'm confident these institutions have enough resources to implement these complex models. Once they bring it to 5-10 lakh depositors, it will become something like 50-100 accounts for each IT officer to diga goldmine of data for rest of the year.RajeshG wrote:I can never get these zeroes right. But does that mean 10L per depositor ? I would think thats not much - i am sure lots of cash driven people/businesses/CAs would be able to explain that.

Re: Currency Demonetisation and Future course of Indian Economy

Lets see how many of them declare their income voluntarily by 30th.

Re: Currency Demonetisation and Future course of Indian Economy

Assuming that 2.5 lakh is the trigger point for scrutiny - it means that 60 million Indians deposited 2.5 lakhs plus - amounting to 50% of the money that existed as Rs 500/1000 notes. 5% of Indians had 50% of the high value notes.RajeshG wrote:I can never get these zeroes right. But does that mean 10L per depositor ? I would think thats not much - i am sure lots of cash driven people/businesses/CAs would be able to explain that.

Even if you want to show 2.5 lakhs as "extra windfall income" in the 2015-16 period it won't be easy because that figure is the bottom figure for not needing to pay tax - so anyone who deposits that much should likely have been a taxpayer in the last few years. A person whose income is at least 10-15 lakhs a year from a business could possible report such a windfall income and get away. Anyone else is going to cough up tax. 7 lakh crores is a potential 3.5 lakh crores in taxes.

Yesterday I heard a colleague tell me of another colleague who was angry with Modi. The man probably had a wad of cash that he deposited (or will deposit) which will be difficult to account for - he is already among the highest taxpaying earners paid by cheque normally, with tax deducted at source. 2.5 lakhs in cash is too small a stashed sum for a man who earns 2-3 lakhs a month - so I would expect at least 50 lakhs as a "respectable" figure for a black stash. One year's income Tax due. 1 year shaved off one's life. Not a big sacrifice. Lots of people take a year off.

Last edited by shiv on 30 Dec 2016 07:14, edited 1 time in total.

Re: Currency Demonetisation and Future course of Indian Economy

I suspect that every single depositor with a PAN number who deposited over 2.5 lakhs in cash is going to get an letter and may be asked to explain before he can use that money. GoI will spend another 25 crores on letter paper and printing ink. Someone quickly email the relevant protesters so we can protest this waste of money while people die in queues. This may be windfall income for auditors employed by the depositors to think of innovative ways to explain away the cashDasari wrote: Some of it could be legitimate, but it is a reasonable assumption that many are not. The question is how do we bring this set to even smaller so that IT and ED can manually analyze. First they need to intersect this set with set of people who filed taxes that is reasonable with this kind of savings. This also needs to be intersected with other purchases they made. This process can become as complex as we want until we get a set of most potential fraudsters. I'm confident these institutions have enough resources to implement these complex models. Once they bring it to 5-10 lakh depositors, it will become something like 50-100 accounts for each IT officer to diga goldmine of data for rest of the year.

Re: Currency Demonetisation and Future course of Indian Economy

India's Demonetization Highlights The Dangers Of Monetary Monopoly

http://www.zerohedge.com/news/2016-12-2 ... y-monopoly

http://www.zerohedge.com/news/2016-12-2 ... y-monopoly

A philosophical question that economists need to answer after Lehman, zero-interest money, QEs, and demonetisation (in our case) is whether central banks ought to have that kind of monopoly over money.

Most free-market economists would agree that monopolies are bad, but they do not usually challenge the state’s monopoly over violence and law-making or the central banks’ monopoly over the issue and regulation of currency.

Leaving aside the state’s monopoly on some kinds of power, let’s ask whether a central bank’s money monopoly is worthwhile since it does not appear to have delivered the kind of benefits to the world in recent decades which can justify the conferment of a monopoly.

The fundamental reason why we have grown to love (or learned to live with) central banks is that we cannot remember a time when they did not exist. So the argument is better the devil you know…

Re: Currency Demonetisation and Future course of Indian Economy

A tourist's Indian experience during demonetization time.

https://in.news.yahoo.com/story-why-ind ... soc_trk=tw

https://in.news.yahoo.com/story-why-ind ... soc_trk=tw

Amidst India's on-going financial crisis, across the country are taking action to uphold the country's culture of world-class hospitality.About two weeks ago, I found myself in Delhi with just Rs. 100 left in my pocket. I roamed in Delhi for 13 hours, queuing at several different ATM machines, sometimes for two hours at a stretch, only to get to the machine and have my card rejected. With a flight to Mumbai booked for the next morning, I needed cash. As the sun set that day, it took with it any hope that I was clinging to of finding cash and making my flight.

It wasn’t just the prospect of missing my flight that was driving my urgency for cash; my guesthouse bill was also well over-due and I had no idea how I was going to eat that night let alone settle my accommodation fees.

Feeling completely defeated and exhausted, I went back to my guesthouse, explained to the owner that I didn’t have the money to pay her (she didn’t have the facilities to accept a card payment), and went back to my room feeling shameful. A couple of minutes later I heard a knock on my door. I opened it to find the guesthouse owner standing there with five 100 rupee notes in her hand. "Money comes and goes," she said. "Please make sure that you take your dinner and make it to the airport for your flight," and she forced the notes into my hand.

After spending hours in long queues without any success, it was a local Delhi guesthouse owner who restored my faith in humanity and reminded me of why I love India.

With the majority of us experiencing, in varying degrees, the chaos and disruption to daily life triggered by the recent demonetization of 500 and 1000 rupee notes, the simple kindness of a stranger can make all the difference. This simple, yet extremely profound gesture showed me that amidst the dim of the on-going financial turmoil, there are people all across the country keeping the flame of humanity blazing. There are people -- ordinary, local people of India who despite their own worries and anxieties and in many cases whose livelihoods are being directly and severely impacted by the recent changes, are putting their needs aside. They are continuing efforts to ensure that India continues to be a place where guest 'is God’. And it turns out I'm not the only one who has found myself on the receiving end of such kindness. The more I travelled (when I could get the cash to do so), the more I realised that I wasn’t the only one who had experienced such incredible kindness. Matthew, a French tourist in Goa, after ordering a suit to be made, found that he was unable to get hold of cash to pay his tailor. His tailor, a small business owner with limited facilities, not only allowed him the option of paying with his credit card, but when that failed he simply gave Matthew the suit and told him to just pay him "whenever he could." If that wasn’t kind enough he also offered Matthew Rs. 2,000 in cash to help him while he tried to get some cash.

Many cash-strapped tourists have experienced incredible kindness at the hands of locals during India's recent financial crisis.

Re: Currency Demonetisation and Future course of Indian Economy

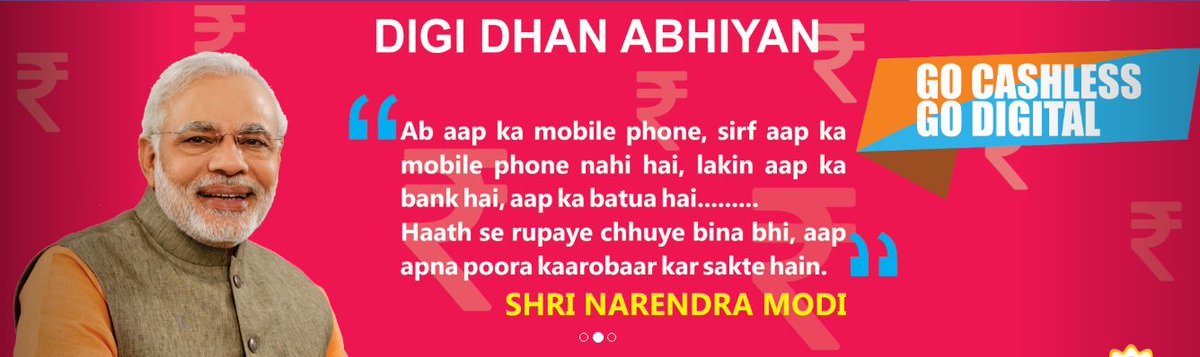

They are working on a newer version of ussd and upi apps. It will be launched by Modi today.shiv wrote:Over the past 4 weeks I have installed and uninstalled several wallets on my andhroid/andhra-ite phone.

It will be a while before UPI apps take off.

The USSD application (Internet not required) worked once for me.

https://twitter.com/DDNewsLive/status/8 ... 2326070272

Doordarshan News @DDNewsLive 49m49 minutes ago

PM @narendramodi will be at #DigiDhanMela in Delhi's Talkatora stadium. PM will be launching #Aadhar pay and rebranded version of UPI & USSD

Re: Currency Demonetisation and Future course of Indian Economy

Minor nitpicks.shiv wrote:Assuming that 2.5 lakh is the trigger point for scrutiny - it means that 60 million Indians deposited 2.5 lakhs plus - amounting to 50% of the money that existed as Rs 500/1000 notes. 5% of Indians had 50% of the high value notes.RajeshG wrote:

I can never get these zeroes right. But does that mean 10L per depositor ? I would think thats not much - i am sure lots of cash driven people/businesses/CAs would be able to explain that.

Even if you want to show 2.5 lakhs as "extra windfall income" in the 2015-16 period it won't be easy because that figure is the bottom figure for not needing to pay tax - so anyone who deposits that much should likely have been a taxpayer in the last few years. A person whose income is at least 10-15 lakhs a year from a business could possible report such a windfall income and get away. Anyone else is going to cough up tax. 7 lakh crores is a potential 3.5 lakh crores in taxes.

Yesterday I heard a colleague tell me of another colleague who was angry with Modi. The man probably had a wad of cash that he deposited (or will deposit) which will be difficult to account for - he is already among the highest taxpaying earners paid by cheque normally, with tax deducted at source. 2.5 lakhs in cash is too small a stashed sum for a man who earns 2-3 lakhs a month - so I would expect at least 50 lakhs as a "respectable" figure for a black stash. One year's income Tax due. 1 year shaved off one's life. Not a big sacrifice. Lots of people take a year off.

60 lakhs is 6 million and its .5% of population.

Re: Currency Demonetisation and Future course of Indian Economy

For me UPI worked and USSD i found it to be pretty slow. Few days before the banking app was little slow. I have done few transactions using UPI using virtual id. Found it to be pretty easy. First tested it using 1 rupee. Nowadays using it much more widely. Safest way is to send a request to the other party to pay using the receive option. Once they accept the request, transaction is done. Chances of mistake in transaction is avoided if receive option is adopted. If all shops can have their UPI, a large number of transactions (30 percent smartphones) could take place using UPI because of it and especially in malls and all where the middle class/upper middle class/rich (most with smartphones) visit the success of UPI is more. Good that they are considering offline mode for UPI as well.

Re: Currency Demonetisation and Future course of Indian Economy

hanumadu wrote: Minor nitpicks.

60 lakhs is 6 million and its .5% of population.

It also puts paid to my own theory posted a few days ago that maybe 90% of the people had hoarded 90% of the notes in small hoards/stashes. This data (if correct) clearly shows that 99.5% of people had only 50% of the notes while 0.5% had the other 50%

Please also permit me to point out a little psychological issue that we face here. Many of us have demanded that 'Big fish must be caught". Fine - but if you ask anyone to name any big fish he would at best come up with 20 names. Now there are 6 million names. The real big fish. A classic example of the eye does not see what the mind does not know.

-

Marten

- BRF Oldie

- Posts: 2176

- Joined: 01 Jan 2010 21:41

- Location: Engaging Communists, Uber-Socialists, Maoists, and other pro-poverty groups in fruitful dialog.

Re: Currency Demonetisation and Future course of Indian Economy

Another nitpick - forgive me for this, but the 3-4lac cr is only for accounts with more than two lacs, which total 60lacs.

60 lac accounts with 2 lacs or more, totaling 3.5 lac cr (not more than 4 lac cr). They need to share more details of 50k-2lacs.

From TOI - Rs 4 lakh crore of cash deposits so far may be suspect, estimates I-T

Actually, quite well written by Sidhartha TNN. Added gems such as:

60 lac accounts with 2 lacs or more, totaling 3.5 lac cr (not more than 4 lac cr). They need to share more details of 50k-2lacs.

From TOI - Rs 4 lakh crore of cash deposits so far may be suspect, estimates I-T

Actually, quite well written by Sidhartha TNN. Added gems such as:

Data with the income tax department shows that till December 17, cash deposits of Rs 80 lakh or more added up to nearly Rs 4 lakh crore, which flowed into 1.14 lakh bank accounts.

For instance, between November 10 and the end of November, 1.77 lakh borrowers had repaid loans of over Rs 25 lakh using old notes — with the repayments adding up to nearly Rs 50,000 crore. The list included companies and firms apart from individuals.

The data is interesting considering that the scramble to deposit old currency with banks has led many to wonder whether a large number of suspected tax evaders had devised ways to launder their unaccounted money. The fear that tax dodgers may have aced the system was the goad for the government to switch gears and launch a new version of the Income Disclosure Scheme. The nature and quantum of deposits could possibly be both because of the willingness to turn undeclared income into legit money after forfeiting more than half of it by way of tax or because of the confidence that authorities would find it difficult to trawl through the mine of data to spot those who thought they had gamed the system. Importantly, the data does not bear out the widespread misuse of Jan Dhan accounts.

While deposits in Jan Dhan accounts have come under the scanner, officials said the amount involved was not very large. Contrary to the notion of widespread misuse of the nofrills bank accounts, a mere 34 saw deposits of Rs 10 lakh or more with the highest deposit being Rs 58 lakh.

Re: Currency Demonetisation and Future course of Indian Economy

http://www.outlookindia.com/website/sto ... di-/297554

No less than Aakar Patel acknowledging Modi's prowess in controlling the narrative while navigating the stormy waters in the last 50 days.

No less than Aakar Patel acknowledging Modi's prowess in controlling the narrative while navigating the stormy waters in the last 50 days.

Re: Currency Demonetisation and Future course of Indian Economy

No the explanation will probably be shown as cash on hand. Not income.shiv wrote: "extra windfall income" in the 2015-16 period it won't be easy

Re: Currency Demonetisation and Future course of Indian Economy

Shiv, a minor correction - its 6 million people (60 lac) which is about 2% of all depositors.shiv wrote:Assuming that 2.5 lakh is the trigger point for scrutiny - it means that 60 million Indians deposited 2.5 lakhs plus - amounting to 50% of the money that existed as Rs 500/1000 notes. 5% of Indians had 50% of the high value notes.RajeshG wrote:

I can never get these zeroes right. But does that mean 10L per depositor ? I would think thats not much - i am sure lots of cash driven people/businesses/CAs would be able to explain that.

Even if you want to show 2.5 lakhs as "extra windfall income" in the 2015-16 period it won't be easy because that figure is the bottom figure for not needing to pay tax - so anyone who deposits that much should likely have been a taxpayer in the last few years. A person whose income is at least 10-15 lakhs a year from a business could possible report such a windfall income and get away. Anyone else is going to cough up tax. 7 lakh crores is a potential 3.5 lakh crores in taxes.

If one considers the 5.5 million people above the trigger point of 2 lac ( 6 million people minus organisations), it is reasonable to assume they

need to have an income above 6 lac p.a (50,000 p.m gross) to keep cash of above 2 lac.

Just 2.2 million people reported incomes above Rs 5.5 lac p.a. as per IT dept.

Hence, DeMo has potentially doubled the tax base ( assuming that from 5.5 million, you exclude 2.2 million paying tax and

1.1 million being able to explain that no tax is payable on their deposits, leaving 2.2 million new taxpayers.)

IT dept separately identified 6.7 million people who made high value purchases without filing an IT return. Excluding family members of taxpayers, NRI's, people who had tax deducted but not filed returns etc, the number of people with taxable income who have not paid taxes or field return

should be anywhere from 33-50% of 6.7 million, or 2.25 million. The lower estimate roughly matches the numbers making high value deposits but not paying tax.

Last edited by Deans on 30 Dec 2016 15:21, edited 1 time in total.

Re: Currency Demonetisation and Future course of Indian Economy

This is a more reasonable figure. 80L cash on hand is harder to explain.Marten wrote:From TOI - Rs 4 lakh crore of cash deposits so far may be suspect, estimates I-T

Actually, quite well written by Sidhartha TNN. Added gems such as:Data with the income tax department shows that till December 17, cash deposits of Rs 80 lakh or more added up to nearly Rs 4 lakh crore, which flowed into 1.14 lakh bank accounts.

Somehow this figure ( 4L cr ) reminds me of Bibek Debroy's estimates that 2.5L Cr would be single black while 1.5 L Cr would be double black.

Re: Currency Demonetisation and Future course of Indian Economy

I think Debroy's estimates are most reasonable i have seen so far. It might provide some context for these numbers.

http://www.business-standard.com/articl ... 633_1.html

http://www.business-standard.com/articl ... 633_1.html

The 10L depositors ( businesses/people ) could be anywhere in the transactional/legit 2LC people/2.5LC single-black/1.5LC double-blackWhile Rs 14 lakh crore is a RBI (Reserve Bank of India) figure, the break-up is my guesstimates and my guesstimates could be different from yours. Out of Rs 14 lakh crore, probably something like Rs 4 lakh crore may be black money. There are two kinds of black money. I will call one kind of black as ‘double black’ where the activity that led to generation of that income is illegal – crimes, trafficking etc.

‘Single black’ is when the activity is not illegal but you have not paid taxes. Let’s assume that out of Rs 4 lakh crore, Rs 2.5 lakh crore is single black and Rs 1.5 lakh crore is double black. So, Rs 1.5 lakh crore is roughly 10 per cent of Rs 14 lakh crore. This is completely destroyed. On Single black – Rs 2.5 lakh crore – I think a large part of it will come back into the system. Of the remaining Rs 10 lakh crore, Rs 8 lakh crore is just probably transaction-related. This cash temporarily goes out of the system, but it eventually comes back into the system.

The remaining Rs 2 lakh crore is what the people were sitting on. This is not illegal. This Rs 2 lakh crore is unproductive for the people holding on to it and for the system.

Re: Currency Demonetisation and Future course of Indian Economy

He said that Rs 1.5 lakh crores of double black is being destroyed, implying that it will not be deposited. But Rs 14 lakh crores is already back and nothing got extinguished. Is he changing the target to Rs 15.4 lakh crores? Looking at today's lines we will hit Rs 15 lakh crores. That means lot of double black too got deposited. Amazing audacity from BM hoarders.

-

nandakumar

- BRFite

- Posts: 1638

- Joined: 10 May 2010 13:37

Re: Currency Demonetisation and Future course of Indian Economy

RajeshG

"No the explanation will probably be shown as cash on hand. Not income."

If your reported incomes and known assets taken together, cannot explain the latest cash deposit post demonetisation announcement, it will be treated as income on which tax has not been paid. Cash (asset) is after all the obverse of income. What more, the ITO will distribute it over three earlier years and levy interest and penalty for non disclosure of correct taxable income in the past. The Govt is giving a way out by tempting the individual to pay 50% tax and keep 25% in interest free deposit for four years and the balance to be used as he pleases under new income disclosure scheme.

"No the explanation will probably be shown as cash on hand. Not income."

If your reported incomes and known assets taken together, cannot explain the latest cash deposit post demonetisation announcement, it will be treated as income on which tax has not been paid. Cash (asset) is after all the obverse of income. What more, the ITO will distribute it over three earlier years and levy interest and penalty for non disclosure of correct taxable income in the past. The Govt is giving a way out by tempting the individual to pay 50% tax and keep 25% in interest free deposit for four years and the balance to be used as he pleases under new income disclosure scheme.

Re: Currency Demonetisation and Future course of Indian Economy

I havent seen any more estimates from Debroy since then. I havent had the chance to watch his whole interview with Barkha, maybe he said something there.Dasari wrote:He said that Rs 1.5 lakh crores of double black is being destroyed, implying that it will not be deposited. But Rs 14 lakh crores is already back and nothing got extinguished. Is he changing the target to Rs 15.4 lakh crores? Looking at today's lines we will hit Rs 15 lakh crores. That means lot of double black too got deposited. Amazing audacity from BM hoarders.

Remember this interview was in early days and his 14+ LC RBI estimate was probably based on March figures. The 15+ LC figure started becoming popular probably 2-3 weeks down the road.

I personally dont believe 14LC deposit number. There have been pretty knowledgeable folks who have expressed doubts about double-counting. So i would rather wait for RBIs official figures after double counting doubts have been cleared.

I still think there must be a significant amount of money abroad. I have seen news reports for eg where people have been caught bringing in currency from Afg, ME, Ban.

Re: Currency Demonetisation and Future course of Indian Economy

Watch the video to see how they hid the money.Rishi Bagree @rishibagree 16h16 hours ago

Money launderers masquerading as textile merchants Caught with 75 crores Cash

https://twitter.com/rishibagree/status/ ... 9764312064

Re: Currency Demonetisation and Future course of Indian Economy

Yes of course. I would be very surprised though if India doesnt have 60 lac people/orgs who dont have 10L cash on hand in a normal pre-demo 8%+ growth-rate economy. Again going by Debroy's estimates, 8 LC was transactional money. To me that sounds like a significant chunk of that 8 LC would be cash-on-hand for somebody somewhere.nandakumar wrote:RajeshG

"No the explanation will probably be shown as cash on hand. Not income."

If your reported incomes and known assets taken together, cannot explain the latest cash deposit post demonetisation announcement, it will be treated as income on which tax has not been paid.

Re: Currency Demonetisation and Future course of Indian Economy

60 lakh is 3% of households. That means a high turnover business for every 33 households.

Re: Currency Demonetisation and Future course of Indian Economy

I actually believe there is the chip in the note.hanumadu wrote:Watch the video to see how they hid the money.Rishi Bagree @rishibagree 16h16 hours ago

Money launderers masquerading as textile merchants Caught with 75 crores Cash

https://twitter.com/rishibagree/status/ ... 9764312064

Re: Currency Demonetisation and Future course of Indian Economy

That's my first thought as wellkvraghav wrote:I actually believe there is the chip in the note.hanumadu wrote:

Watch the video to see how they hid the money.

https://twitter.com/rishibagree/status/ ... 9764312064

Re: Currency Demonetisation and Future course of Indian Economy

from the comments:

Monk in a Tux @monk_in_a_tux 18h18 hours ago

@rishibagree इतना जुगाड़ ! Reminds me of d days when ppl got caught in Haryana smuggling दारू in their car's windshield washer's container.

Monk in a Tux @monk_in_a_tux 18h18 hours ago

@rishibagree इतना जुगाड़ ! Reminds me of d days when ppl got caught in Haryana smuggling दारू in their car's windshield washer's container.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

AoA! One small step for a DOO but a giant leap for us yak-herders. I got a Sarkari Baink ATM Card, shiny golden chip and all! Unfortunately they say that all their ATMs are INSIDE baink branches!

But as they say, Have Card, Will Go Ungli-Shopping! Watched proceedings in a Khadi showroom (aircondishunned, barefoot floor). Cashier was counting new stacks of 2K notes. But they prefer unglli transactions - vastly relieved at not having to count and be responsible for large amounts of cash.

Watched proceedings in a Khadi showroom (aircondishunned, barefoot floor). Cashier was counting new stacks of 2K notes. But they prefer unglli transactions - vastly relieved at not having to count and be responsible for large amounts of cash.

Small sample of results/consumer piskology: With pockets stuffed with a grand total of maybe 1500 rupees in hundreds and 20s, I authorized spending 5700 without. 30% rebate is hard to resist. I think retail economy is going to zoom.

30% rebate is hard to resist. I think retail economy is going to zoom.

But as they say, Have Card, Will Go Ungli-Shopping!

Small sample of results/consumer piskology: With pockets stuffed with a grand total of maybe 1500 rupees in hundreds and 20s, I authorized spending 5700 without.