Honestly speaking, almost...almost everything should cost less, except some/many services..If not, just simbly assume the buck is not passed onto to you!Sachin wrote:Is there any web site which explains the GST v/s the previous tax system? Perhaps with an explanation on how a simple purchase would have got taxed in the previous system v/s the new GST system? I have seen very many media reports, but honestly I cannot trust them. First of all they have an agenda, and secondly they don't have CAs as reporters.

GST - Discussion on all Aspects

Re: GST - Discussion on all aspects.

Re: GST - Discussion on all aspects.

twitter

"Madam #gstrollout me jaane ki Jid kar rahaa hai... Pakad ke leya ayaa hoon. Band kardo Bathroom mei Sitaram Kesri ki tarah"

Re: GST - Discussion on all aspects.

Lot of angst is there among people on GST rates., point is - earlier they were not paying *any* tax and now they are made to pay the tax.

Take the auto parts dealer in the posts above who simply said that the party is over., yes his own suppliers will force him to move into GSTN. Or he will risk being dropped off the dealership.

Take the auto parts dealer in the posts above who simply said that the party is over., yes his own suppliers will force him to move into GSTN. Or he will risk being dropped off the dealership.

Re: GST - Discussion on all aspects.

"Power will go into the hands of rascals, rogues, and freebooters. Not a bottle of water or loaf of bread shall escape taxation; only the air will be free and the blood of these hungry millions will be on the head of Attlee." - Winston Churchill, 1947.JohnTitor wrote:The toilet paper has an info graphic of items in various bands. I cant post the image here as its not an image file.

http://m.timesofindia.com/business/indi ... 396877.cms

Anyway, for the 18% band they have among other things, ATM. What is that? Are you going to be charged 18% for withdrawing your own money? If so, ack thoo on this government.

Re: GST - Discussion on all aspects.

KitKat is a particularly interesting one. In the USA, KitKat is classified as food, since it is made out of wheat flour, and is therefore free from sales tax in states where food is not taxed. The underlying classification relies on the amount of wheat flour involved.rahulm wrote:From the rate schedule, 'biscuits and waffles without chocolate'. The attention to detail and the granularity in slicing and dicing 'waffles without chocolates' is frankly incredulous and seems to be a vestige of socialist thinking.Is KitKat chocolate or biscuit?’, because chocolates and biscuits suffer different rates.

Point being that at some point there will be the exception to every rule. Good part about the GST setup is that the classifications are not directly in the politicians hands, so they can updated relatively easily without it becoming a political issue.

-

Rishirishi

- BRFite

- Posts: 1409

- Joined: 12 Mar 2005 02:30

Re: GST - Discussion on all aspects.

They really could have made it simpler. Implimented a falt 15% tax on everyting,including electricity, food etc. Each Adhar card holder could have been given a credit of say RS 8 000 in the bank to compensate for the tax on essential items.

Besides this all transactions above RS 25 000 should be based on E-invoicing together with payment. It would have been the final end of black money.

Besides this all transactions above RS 25 000 should be based on E-invoicing together with payment. It would have been the final end of black money.

Re: GST - Discussion on all aspects.

I am actually glad that confectionaries are taxed. Things like kit-kat, soda etc being taxed - even though harkens back to socialist thinking., it is important that it remains to be taxed. From the perspective of health.

Personally I do have hatred for sodas and the way it is sold in India. I do wish Kareena Kapoor when she looks back lustily in to the camera after just finishing her oh-so-cool lemony limca drink actually has written in contract that she consume 4 250 ml of limca everyday. In absence of that, a high tax rate is just fine on it.

%/%/%

Looking at the fotos of the entry nakas post-GST., it appears that the dog-biscuit industry will be in severe decline!

Personally I do have hatred for sodas and the way it is sold in India. I do wish Kareena Kapoor when she looks back lustily in to the camera after just finishing her oh-so-cool lemony limca drink actually has written in contract that she consume 4 250 ml of limca everyday. In absence of that, a high tax rate is just fine on it.

%/%/%

Looking at the fotos of the entry nakas post-GST., it appears that the dog-biscuit industry will be in severe decline!

Re: GST - Discussion on all aspects.

Taking a leaf out of #mediapimps:

Automobile companies raise prices on vehicles pre-GST

Also #Blow2Modi from the above article. People who hoarded on essential items like Maggie ketchup or cerelac infant milk powders prior to GST are unhappy with Modi.

Automobile companies raise prices on vehicles pre-GST

Also #Blow2Modi from the above article. People who hoarded on essential items like Maggie ketchup or cerelac infant milk powders prior to GST are unhappy with Modi.

Re: GST - Discussion on all aspects.

States remove barriers at borders, issue advisory for smooth truck movement

If I am an Excice Inspector monetising my authority to save for my 'daughters marriage' what am I supposed to do now ?Centre banned red beacons, babus etc are now using flags, states will come up with some other device to try and maintain corruption.

Several states including Karnataka, Andhra Pradesh and Tamil Nadu have dismantled border check posts with the advent of goods and services tax (GST), reducing some hassles for trucks that often queued up for hours to clear the biggest hurdle in the movement of goods within the country.

States have, in the meantime, sent out fresh advisories to the field officers to ensure that goods are not held up and the new rules are implemented. Assam and Uttar Pradesh have asked its officials to check the GST Identification Number, along with the invoice number, consignment notes (or bilti), tax invoice and registration of the logistic firm.

Good grief ! What is this inward permit ?Assam, which will soon come out with an "inward permit" system........

If I am an Excice Inspector monetising my authority to save for my 'daughters marriage' what am I supposed to do now ?Centre banned red beacons, babus etc are now using flags, states will come up with some other device to try and maintain corruption.

Re: GST - Discussion on all aspects.

Whe. It's all murky and hazy, always follow the money. The market likes the GST

GST launch sends FMCG shares soaring; stocks see up to 300% rise in 6 months

GST Impact on cars: Change in price of Maruti, Hyundai, Tata and Mahindra Cars

SBI to offer GST-ready solutions starting today

The largest lender State Bank of India (SBI) on Saturday announced its Goods and Services Tax (GST) ready solutions, including the introduction of online payment through internet banking and debit card.

GST impact: New tax regime to boost GDP; positive for rating, says Moody’s VP William Foster I know it's Moodys. Since, Moody likes it, then, by definition The GST is a conspiracy and not good for,India

Even if I am a trader/service provider with a < 20 lakh turnover and therefore, exempt from GST registration and compliance, I. May have no choice in the matter if I supply to a larger company who mandates all suppliers must be GST registered or I decide not to be a supplier to this company . Correct ? [PS Pls excuse the terrible grammar in this sentence ]

GST launch sends FMCG shares soaring; stocks see up to 300% rise in 6 months

GST impact on cars and two-wheelers: These cars and motorcycles just got cheaperAnalysts say that post GST implementation, most FMCG companies will be able to generate substantial savings in logistics and distribution costs as the need for multiple sales depots will be eliminated. At the moment, FMCG companies end up paying nearly 24-25% taxes including excise duty, VAT and entry tax. With a tax rate of 18% under GST, there could be a significant reduction of 6-7% in taxes.

GST Impact on cars: Change in price of Maruti, Hyundai, Tata and Mahindra Cars

SBI to offer GST-ready solutions starting today

The largest lender State Bank of India (SBI) on Saturday announced its Goods and Services Tax (GST) ready solutions, including the introduction of online payment through internet banking and debit card.

GST impact: New tax regime to boost GDP; positive for rating, says Moody’s VP William Foster I know it's Moodys. Since, Moody likes it, then, by definition The GST is a conspiracy and not good for,India

Even if I am a trader/service provider with a < 20 lakh turnover and therefore, exempt from GST registration and compliance, I. May have no choice in the matter if I supply to a larger company who mandates all suppliers must be GST registered or I decide not to be a supplier to this company . Correct ? [PS Pls excuse the terrible grammar in this sentence ]

Re: GST - Discussion on all aspects.

Is GST exempt for Churches and Mosques but is applicable to temples that exceed 20L in donations?

Re: GST - Discussion on all aspects.

I have eaten out everyday since the 1st. No change in anything

Re: GST - Discussion on all aspects.

http://www.business-standard.com/articl ... 286_1.html

The poor movie threaters in TN are going to be closed. Daily serials are the only way out.

The poor movie threaters in TN are going to be closed. Daily serials are the only way out.

Re: GST - Discussion on all aspects.

Real Paki of TN Govt to ask Municipalities to levy Entertainment Tax since GST subsumed TN Govt Entertainment Tax. Seems a deliberate ploy against the Cinema industry.

Re: GST - Discussion on all aspects.

a temperory ploy to squeeze money out of exhibitors and distributors.Aditya_V wrote:Real Paki of TN Govt to ask Municipalities to levy Entertainment Tax since GST subsumed TN Govt Entertainment Tax. Seems a deliberate ploy against the Cinema industry.

other sources like liquor and check post hafta has been reduced to a mere trickle.

Re: GST - Discussion on all aspects.

KAR it seems has started PV posts ie physical verification posts in lieu of check posts to ensure that the e declaration actually corresponds to the goods being carried in the truck. Same shit, different name, same moolah.rahulm wrote:States remove barriers at borders, issue advisory for smooth truck movement

Several states including Karnataka, Andhra Pradesh and Tamil Nadu have dismantled border check posts with the advent of goods and services tax (GST), reducing some hassles for trucks that often queued up for hours to clear the biggest hurdle in the movement of goods within the country.States have, in the meantime, sent out fresh advisories to the field officers to ensure that goods are not held up and the new rules are implemented. Assam and Uttar Pradesh have asked its officials to check the GST Identification Number, along with the invoice number, consignment notes (or bilti), tax invoice and registration of the logistic firm.Good grief ! What is this inward permit ?Assam, which will soon come out with an "inward permit" system........

If I am an Excice Inspector monetising my authority to save for my 'daughters marriage' what am I supposed to do now ?Centre banned red beacons, babus etc are now using flags, states will come up with some other device to try and maintain corruption.

congis just cannot afford to let go any money from KAR under any circumstances.

Re: GST - Discussion on all aspects.

^Isn't that 2300 crores figure per day?

Re: GST - Discussion on all aspects.

Sunil JainVerified account @thesuniljain

The truck no longer stops here!!!! See the empty octroi post at Dahisar in Mumbai

The truck no longer stops here!!!! See the empty octroi post at Dahisar in Mumbai

Re: GST - Discussion on all aspects.

^^ #Blow2Modi., economy collapse due to roll out of GST and prior to that Demonetization.

Re: GST - Discussion on all aspects.

Chetak'ji., will this not make life difficult for the residents for that state? Think about it., the truckers and companies will prefer to send their goods to Mah or TN or AP or Telangana but not to Karnataka at the same rate since all this hassles to add up if Karnataka starts throwing tantrums.chetak wrote:KAR it seems has started PV posts ie physical verification posts in lieu of check posts to ensure that the e declaration actually corresponds to the goods being carried in the truck. Same shit, different name, same moolah.

In fact cost of shipping to some states will increase! So now it is in state's interest to dismantle their Octroi Nakas.

I am just pleasantly surprised that the lines on Nakas have disappeared within a day! This was predicted., that on GST rollout all the dog-biscuits at nakas will vanish - and now we see it.

Re: GST - Discussion on all aspects.

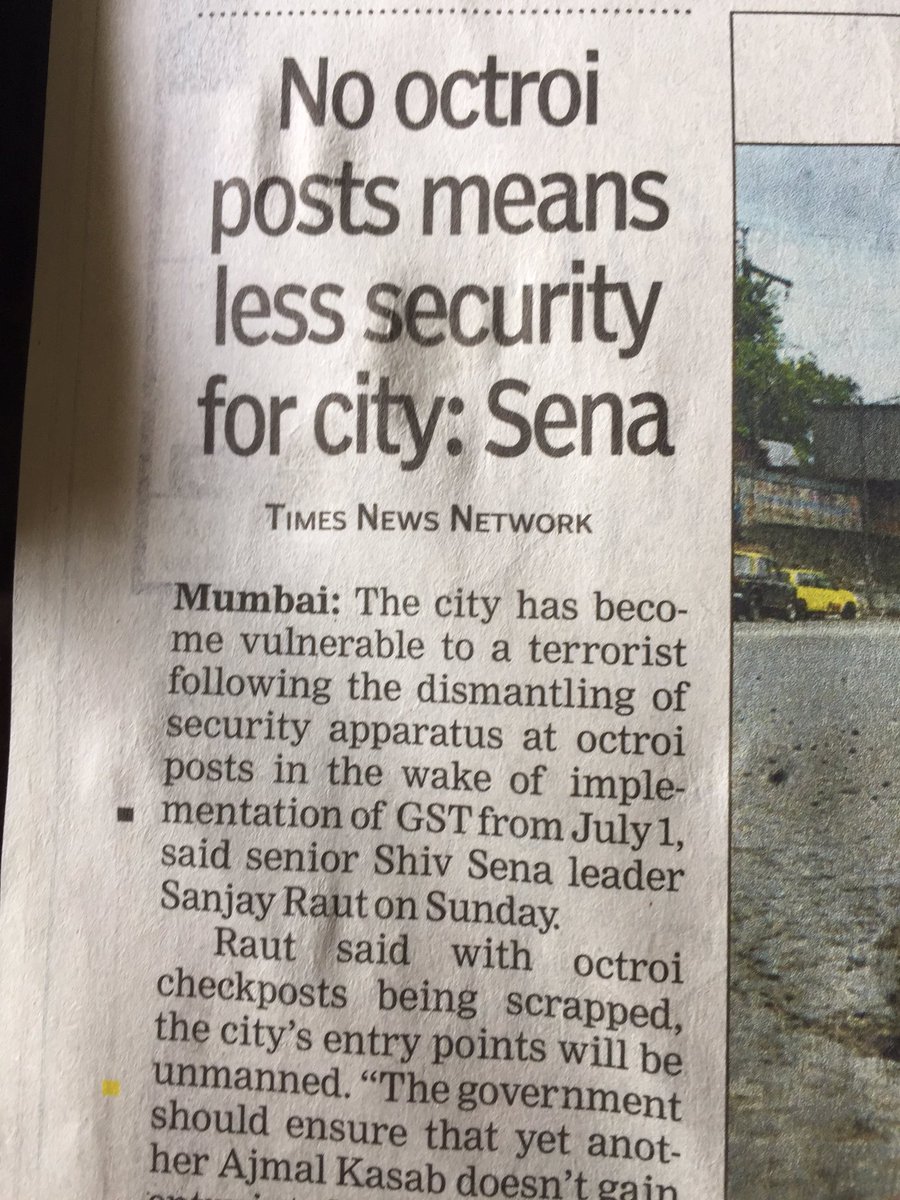

looks like chai pani has been dealt a Uge blow. shiv sena crying here ..

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: GST - Discussion on all aspects.

http://pib.nic.in/newsite/PrintRelease. ... lid=167107

Press Information Bureau

Government of India

Ministry of Finance

03-July-2017 20:51 IST

Appeal to people not to start circulating wrong messages on social media as no distinction is made in the GST Law on any provision based on religion.

There are some messages going around in the social media stating that the temple trusts have to pay the GST while the churches and mosques are exempt. This is completely untrue because no distinction is made in the GST Law on any provision based on religion.

We request to people not to start circulating such wrong messages on social media.

*****

DSM

Press Information Bureau

Government of India

Ministry of Finance

03-July-2017 20:51 IST

Appeal to people not to start circulating wrong messages on social media as no distinction is made in the GST Law on any provision based on religion.

There are some messages going around in the social media stating that the temple trusts have to pay the GST while the churches and mosques are exempt. This is completely untrue because no distinction is made in the GST Law on any provision based on religion.

We request to people not to start circulating such wrong messages on social media.

*****

DSM

Re: GST - Discussion on all aspects.

Press Information Bureau,Government of India,Ministry of Finance

03-July-2017 20:15 IST

With The Roll-Out of GST,

The Goods and Services Tax (GST) was rolled out on 1st of July 2017. With the roll-out of the GST, 22 States in India have abolished their check posts. The details are as under -

1. Andhra Pradesh

2. Arunachal Pradesh

3. Bihar

4. Gujarat

5. Karnataka

6. Kerala

7. Madhya Pradesh

8. Maharashtra

9. Sikkim

10. Tamil Nadu

11. West Bengal

12. Chhattisgarh

13. Delhi

14. Goa

15. Haryana

16. Jharkhand

17. Odisha

18. Puducherry

19. Rajasthan

20. Telangana

21. Uttar Pradesh

22. Uttarakhand

States where check posts are in the process of being abolished

1. Assam

2. Himachal Pradesh

3. Manipur

4. Meghalaya

5. Nagaland

6. Punjab

7. Mizoram

8. Tripura

******************

DSM/SS/KA

03-July-2017 20:15 IST

With The Roll-Out of GST,

The Goods and Services Tax (GST) was rolled out on 1st of July 2017. With the roll-out of the GST, 22 States in India have abolished their check posts. The details are as under -

1. Andhra Pradesh

2. Arunachal Pradesh

3. Bihar

4. Gujarat

5. Karnataka

6. Kerala

7. Madhya Pradesh

8. Maharashtra

9. Sikkim

10. Tamil Nadu

11. West Bengal

12. Chhattisgarh

13. Delhi

14. Goa

15. Haryana

16. Jharkhand

17. Odisha

18. Puducherry

19. Rajasthan

20. Telangana

21. Uttar Pradesh

22. Uttarakhand

States where check posts are in the process of being abolished

1. Assam

2. Himachal Pradesh

3. Manipur

4. Meghalaya

5. Nagaland

6. Punjab

7. Mizoram

8. Tripura

******************

DSM/SS/KA

Re: GST - Discussion on all aspects.

22 states scrap checkposts for smooth GST rollout

Behind the GST scenes, a team of 10, countless questionsA session of the assembly of J&K, which is yet to enact the law+ for the implementation of GST, has been convened on Tuesday to consider approving the legislation.

[a team of about 10 central government officers stationed at the GST Feedback and Action Room of the Finance Ministry is putting in about 14 hours daily, starting from 8 am, to monitor real-time feedback on the transition from across the country./quote]

Officials from the states are also sending their feedback to the team, which is being monitored, alongside external feedback channels such as Twitter. “Twitter handles are being handled by Directorate General of Taxpayer Services. There are two Twitter handles and there is a group designated to handle this. They are mostly from the GST policy wing of the CBEC, they are divided among officers section-wise — registration, returns, refunds, migration,” said Sarna.

Re: GST - Discussion on all aspects.

Could be. I don't think the article specifies. 2300 per year sounds too low.disha wrote:^Isn't that 2300 crores figure per day?

State corruption thrived in naked. I would wait and watch. The lootmar shock is going to hurt the state governments. I won't be surprised if they are hatching alternate plans - eg door to door extortion of businesses. Seriously

I mean what would an excise inspector who paid 30 lakhs or so for a posting say a year ago do? He had every expectation that he would recover and then grow his investment. There would be thousands upon thousands of such people across the country who will be smarting financially and frothing at the mouth.

Since these bribes would have been paid with the tacit understanding and connivance of the state government, the government now has to look after these people. Honour and code among thieves etc.

Last edited by rahulm on 04 Jul 2017 10:36, edited 2 times in total.

Re: GST - Discussion on all aspects.

Well, there is a lot of angst too among thieves whenever a new police check post is set up.disha wrote:Lot of angst is there among people on GST rates., point is - earlier they were not paying *any* tax and now they are made to pay the tax.

Take the auto parts dealer in the posts above who simply said that the party is over., yes his own suppliers will force him to move into GSTN. Or he will risk being dropped off the dealership.

Re: GST - Discussion on all aspects.

Sir, Udupi restaurants (non AC) in mumbai now putting '18% GST will be added' sticker on the menu card and on the bill (but asking if you want to retain the bill). So their prices have directly gone up 18%. People grumbling to the waiters but paying up.rahulm wrote:I have eaten out everyday since the 1st. No change in anything

-

putnanja

- BRF Oldie

- Posts: 4668

- Joined: 26 Mar 2002 12:31

- Location: searching for the next al-qaida #3

Re: GST - Discussion on all aspects.

Actually, they should be paying only 3.5% extra, as earlier VAT was 14% + Krishi Cess + Swatchh Bharat cess. Someone has to question these restaurants. Either they were not paying VAT earlier, or are making money by using GST as its straight profit of 14.5%Manish_P wrote:Sir, Udupi restaurants (non AC) in mumbai now putting '18% GST will be added' sticker on the menu card and on the bill (but asking if you want to retain the bill). So their prices have directly gone up 18%. People grumbling to the waiters but paying up.rahulm wrote:I have eaten out everyday since the 1st. No change in anything

Re: GST - Discussion on all aspects.

GST at non-AC restaurants should be 12% (18% is for AC restaurants). Less than VAT. Next time you visit one, retain the bill. Report them if it says 18%.Manish_P wrote:Sir, Udupi restaurants (non AC) in mumbai now putting '18% GST will be added' sticker on the menu card and on the bill (but asking if you want to retain the bill). So their prices have directly gone up 18%. People grumbling to the waiters but paying up.

Re: GST - Discussion on all aspects.

What if the restaurant is both.. i mean it has an AC section, but you were seated in the Non-Ac section ?Viv S wrote:GST at non-AC restaurants should be 12% (18% is for AC restaurants). Less than VAT. Next time you visit one, retain the bill. Report them if it says 18%.Manish_P wrote:Sir, Udupi restaurants (non AC) in mumbai now putting '18% GST will be added' sticker on the menu card and on the bill (but asking if you want to retain the bill). So their prices have directly gone up 18%. People grumbling to the waiters but paying up.

Re: GST - Discussion on all aspects.

You mean like this >> In BLR Police vans come daily to collect hafta from all the shops in my area. Like 50 buck per small shop. May be more from bigger restaurants, shops.rahulm wrote: State corruption thrived in naked. I would wait and watch. The lootmar shock is going to hurt the state governments. I won't be surprised if they are hatching alternate plans - eg door to door extortion of businesses. Seriously

I am pretty sure the corrupt system will find its ways to suck juice out of people. Making laws and systems is OK, but the implementation should be ruthless. It would bode well if GOI squashes all the malpractices arising under new GST in initial days with ultra-high prejudice to set precedence of intolerance (e.g. cancelling license for those who are caught for malpractices with steep penalties, officers in connivance fired etc). But we know better what will happen. Of coarse expect state governments to meddle there as well. And many of the bizmen to also help for whom older system was a matter of convenience.

Re: GST - Discussion on all aspects.

Not trueKarthik S wrote:Is GST exempt for Churches and Mosques but is applicable to temples that exceed 20L in donations?

https://twitter.com/FinMinIndia

https://twitter.com/FinMinIndia/status/ ... 2286922753

https://twitter.com/FinMinIndia/status/ ... 6482022400

https://twitter.com/FinMinIndia/status/ ... 2416779265

Last edited by ashthor on 04 Jul 2017 14:00, edited 1 time in total.

Re: GST - Discussion on all aspects.

were the office catering business tax free earlier?

they have raised prices in our office from 20 to 25%

Rs 40 chole-rice has become Rs50 (now they show base price as Rs42 and GST of around Rs8)

Rs 100 roomali roti-salad-dal-paneer bhuji Rs 100->Rs120 (20% hike)

they have raised prices in our office from 20 to 25%

Rs 40 chole-rice has become Rs50 (now they show base price as Rs42 and GST of around Rs8)

Rs 100 roomali roti-salad-dal-paneer bhuji Rs 100->Rs120 (20% hike)

Re: GST - Discussion on all aspects.

Perhaps case wherein these caterers were not paying taxes before.

Re: GST - Discussion on all aspects.

This was expected to happen. Saving grace is it's a one time gouge to 'adjust madi' with being a part of the tax net. Doesn't justify it though.

The price before GST was probabky the 'tax evasion' price. Or, maybe, some are seeing this a a wonderful one in a long while opportunity to rake it in.

Either way, competitive pressures should even things out.

inflation fugues over the next few quarters should tell us the story.

The price before GST was probabky the 'tax evasion' price. Or, maybe, some are seeing this a a wonderful one in a long while opportunity to rake it in.

Either way, competitive pressures should even things out.

inflation fugues over the next few quarters should tell us the story.

Last edited by rahulm on 04 Jul 2017 14:22, edited 1 time in total.

Re: GST - Discussion on all aspects.

Not the first case I heard where food price was increased under the pretext of GST. Like this example some have hiked base price as well. Either they were not paying taxes or they are simply increasing their margin now. Even if its the former case, and they are now paying 18% tax as addition, it should not be 18% net hike in total price as they are suppose to pass on benefits of ITC that they would be getting (and there would surely be some). For example, most of the branded packaged food items such as flour, edible oil etc has 5% tax which can be claimed as ITC. The seller should adjust his base price such that the base price + 18% GST would reflect this ITC as passed on to the customer. If seller is not doing it, you should report him to government under anti-profiteering law. Ideally speaking.Singha wrote:were the office catering business tax free earlier?

they have raised prices in our office from 20 to 25%

Rs 40 chole-rice has become Rs50 (now they show base price as Rs42 and GST of around Rs8)

Rs 100 roomali roti-salad-dal-paneer bhuji Rs 100->Rs120 (20% hike)

I don't know how big is your office canteen. But generally if its of decent size he must have been paying taxes already. In any case, your company HR should be able to get the things cleared out and make sure he is not overcharging you under the GST pretext.

Re: GST - Discussion on all aspects.

Restaurant bills are seeing a marginal reduction. This increase might be due to earlier evasion.

Re: GST - Discussion on all aspects.

Even mineral water cans prices have increased from Rs 30 to Rs 35.