Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

RBI data on external debt is readily available:

RBI data on external debt

In Sept 2017 (latest data), short term debts were $199 billion, of which original debt was $89 billion and the rest was long term debt maturing within the next year.

I'll wait for RBI's data rather than listen to anything Moody's claims. They report this in June and Sept every year.

RBI data on external debt

In Sept 2017 (latest data), short term debts were $199 billion, of which original debt was $89 billion and the rest was long term debt maturing within the next year.

I'll wait for RBI's data rather than listen to anything Moody's claims. They report this in June and Sept every year.

Re: Indian Economy News & Discussion - Nov 27 2017

A May 25 Moody's press release

https://www.moodys.com/research/Moodys- ... -PR_384313

Moody's: Currency depreciation poses risk to APAC emerging markets with high external funding needs

https://www.moodys.com/research/Moodys- ... -PR_384313

Moody's: Currency depreciation poses risk to APAC emerging markets with high external funding needs

"In Indonesia and the Philippines, currency pressure will exacerbate already weak debt-affordability metrics. If associated with capital outflows, tighter financing conditions will have wider repercussions for the balance of payments." says Anushka Shah, a Moody's Vice President and Senior Analyst.

"By contrast, India's low dependence on foreign currency to fund debt burdens limits the risk of a weaker currency transmitting into weaker debt affordability.", adds Ms Shah.

Re: Indian Economy News & Discussion - Nov 27 2017

I don't know about Indonesia and Phillipines, but India also has a substantial source of inflows in the form of foreign buyers of Rupee denominated central and state government, and corporate debt.

(May 2) Bonds gain after RBI relaxes foreign investment rules

(April 8 ) Bond investors get access to $16 billion of additional debt in India

(May 2) Bonds gain after RBI relaxes foreign investment rules

(April 8 ) Bond investors get access to $16 billion of additional debt in India

Re: Indian Economy News & Discussion - Nov 27 2017

Exports estimated to rise 20% this fiscal to $350 billion

1 year of RBI’s ‘Dirty Dozen’: How Modi’s IBC crusade on massive NPA began and created historyIndia’s exports are expected to record a growth of about 15-20 per cent and touch USD 350 billion in the current fiscal on account of a host of factors including rise in commodity prices, exporters body FIEO said today. Federation of Indian Export Organisations (FIEO) President Ganesh Gupta said despite increasing global protectionism, the country’s exports would continue to register healthy growth rates.

“Growth is looking promising this fiscal. Indian exports, which are hovering at around USD 300 billion, should show 15-20 per cent growth so as to reach USD 350 billion in this fiscal,” he told reporters here. He said the northward movement in petroleum and commodity prices and the recent depreciation of Indian rupee are supporting exports. He also urged the government to provide fiscal and non-fiscal incentives to boost the shipments in both advanced and emerging markets.

Gupta also said that although exports have recorded growth in 2017-18, labour intensive sectors such as carpet and handicrafts have definitely dented the job creation opportunities. “On a rough estimate, over USD 1 million exports create 100 jobs. Therefore, additional exports of USD 27 billion in 2017-18 should have created 2.7 million jobs in exports,” he added. In 2017-18, exports stood at about USD 303 billion.

Last June, the Reserve Bank of India (RBI) released a list of 12 companies constituting 25% of India’s total NPAs (Non-Performing Assets) under the name ‘Dirty Dozen’ after being vested with new legislative powers to initiate proceedings under the newly adopted Insolvency and Bankruptcy Code. It not only tasted its first success recently but also created history when Tata Steel bought bankrupt Bhushan Steel for around Rs 36,400 crore, which was called a “historic breakthrough” by interim Finance Minister Piyush Goyal.

Even as some of the accounts are stuck in legal battles and may take some more time, experts say that the track record is still better than previous schemes that usually took at least three to four years for bad loan resolution. Besides Tata Steel’s acquisition of Bhushan Steel, Anil Agrawal’s Vedanta also got the final nod from National Company Law Tribunal (NCLT) last month.

The noose on loan defaults was tightened way back in 2015 when the banks were asked to classify some of its ‘standard assets’ as NPA, which led to the recognition of bad loans amounting to about 11% of total advance until December 2017. In the same year, the Narendra Modi government introduced the IBC, a tailor-made code for the resolution of bad loans in the winter session of the Parliament. The code was passed by Lok Sabha and got President’s nod in May 2016.

A year later, in May 2017, the RBI was vested with legislative powers to initiate proceedings to recover bad loans for an effective use of IBC. The central bank soon swung into action and released the ‘Dirty Dozen‘ list including the names of biggies such as Bhushan Steel and Essar Steel for immediate resolution and gave 488 others six months time to resolve their debt. Insolvency proceedings were initiated in most cases in following months. About 28 more companies were identified for the IBC resolution in December 2017.

What followed the IBC was an immediate and complete overhaul of the existing RBI debt-restructuring schemes into a single streamlined and timely framework in accordance with the IBC. The RBI also warned banks against ‘evergreening’ or concealing the actual status of any account, and for transparency, has asked for weekly disclosures till March 31 and monthly from April 1 on the status of defaults to the RBI credit registry — CRILC. This made more NPA monster to come out in public, showing a clearer picture of bad loans in the banking system.

A Crisil report last month said that even as India’s total NPA may surge up to Rs 11.5 lakh crore or 14% of the of bank advances due to RBI’s new framework, the corporate credit quality improved in last four years, or in the Narendra Modi era.

“Banks books are getting cleaned up and NPAs are also being recognised in a transparent manner. In the process, even if there is a (higher) provisioning requirement or even if there is a loss for one or two quarters, it is okay…,” Financial services secretary Rajiv Kumar said.

Re: Indian Economy News & Discussion - Nov 27 2017

More from Bloomberg - 20 million women have dropped out of the workforce because of safety concerns, per Bloomberg's article:

https://www.bloomberg.com/news/articles ... -workforce

https://www.bloomberg.com/news/articles ... -workforce

Re: Indian Economy News & Discussion - Nov 27 2017

Bloomberg is quoting World Bank Data and has made a headline which is misleading.A_Gupta wrote:More from Bloomberg - 20 million women have dropped out of the workforce because of safety concerns, per Bloomberg's article:

https://www.bloomberg.com/news/articles ... -workforce

Here is the link for news on same data as reported by Hindustan Times https://www.hindustantimes.com/india-ne ... pnZuJ.html

Re: Indian Economy News & Discussion - Nov 27 2017

Panagriya on reforms.

https://blogs.timesofindia.indiatimes.c ... will-show/

It seems to me they have expanded the list of reasons for low participation of women in workforce. Previously the major cause stated was rising income not needing female members to be employed. Apart from urban, educated classes females are likely to be employed in farms. Also I don't think they count females participating in economic activities like helping out with the shop, etc.

https://blogs.timesofindia.indiatimes.c ... will-show/

It seems to me they have expanded the list of reasons for low participation of women in workforce. Previously the major cause stated was rising income not needing female members to be employed. Apart from urban, educated classes females are likely to be employed in farms. Also I don't think they count females participating in economic activities like helping out with the shop, etc.

Re: Indian Economy News & Discussion - Nov 27 2017

Q4 2017-18 (Jan-Mar 2018) and full year (April 2017-Mar 2018) GDP data will be released tomorrow by CSO. Previews:

GDP growth for Q4, FY18 likely to spring a positive surprise

GDP growth for Q4, FY18 likely to spring a positive surprise

Surging costs keep cement co profits in check despite rising demandIndian economy is likely to grow between 7.1-7.6 per cent during January-March quarter (Q4) of financial year 20171-18. If it happens, then the annual growth rate will be over 6.6 per cent projected earlier.

The Government will announce the growth estimate on Thursday. Independent agencies, however, already came out with their projections.

A SBI research report said that the growth could be around 7.6 per cent, while ICRA estimated 7.4 per cent. Both of these are higher than the Central Statistical Organisation’s (CSO) own estimate of 7.1 per cent.

A research report, authored by Soumya Kanti Ghosh, Group Chief Economic Adviser of SBI, said that the GDP growth for Q4 and FY18 is likely to spring a positive surprise.

“We expect GDP growth for Q4FY18 would be around 7.6 per cent and subsequently the FY18 growth would be at 6.7 per cent,’’ it said, while adding that the industry is estimated to grow at 5.2 per cent, agriculture and services at 3.3 per cent and 8.2 per cent, respectively.

The growth momentum in cement production is expected to continue this fiscal and the industry is likely to report a growth of 6 per cent to 316 million tonnes (mt).

The output in FY18 was up 6.3 per cent at 298 mt, against 280 mt in FY17.

The bulk of production growth was reported in the second half of FY18, largely due to lower base effect.

Sabyasachi Majumdar, Senior Vice-President, ICRA, said growth in cement production is expected to be driven by a pick-up in the affordable and rural housing segments as well as infrastructure (primarily road and irrigation projects).

Cement production increased by 10.6 per cent and 18.2 per cent respectively in the December and March quarters of last fiscal. Production was in the range of 26-27 mt between December 2017 and February 2018 and increased to 28.5 mt in March.

Higher power and fuel (increase in coal and pet coke prices) and freight costs (increase in diesel prices) will put pressure on the profitability margins and debt metrics of the cement companies.

Re: Indian Economy News & Discussion - Nov 27 2017

Another IBC case making progress:

NCLAT allows Vedanta to make upfront payment of Rs 53 bn for Electrosteel

NCLAT allows Vedanta to make upfront payment of Rs 53 bn for Electrosteel

The National Company Law Appellate Tribunal (NCLAT) on Wednesday allowed Vedanta Ltd to make an upfront payment of Rs 53.20 billion to lenders for acquisition of Electrosteel Steels.

A two-member bench also said this payment would be subject to the outcome of the petition filed by Renaissance Steel challenging Vedanta's bid.

"During the pendency, the parties may act as far the approved resolution plan and the resolution applicant may deposit the upfront amount to Committee of Creditors subject to the order of the appeal," the NCLAT bench headed by Chairman Justice S J Mukhopadhaya said.

The bench also clarified that if Renaissance Steel wins the case, then the Committee of Creditors (CoC) will have to return the money to Vedanta.

On May 17, NCLAT admitted the petition of Renaissance Steel challenging Vedanta's bid for debt-ridden Electrosteel.

Renaissance Steel's resolution application was rejected by the CoC of Electrosteel Steels.

Earlier on May 1, NCLAT had directed maintaining status quo in the case pertaining to the sale of the debt-laden firm to Vedanta Ltd.

Renaissance had submitted before the NCLAT that Vedanta is not eligible to bid for Electrosteel under section 29 A of the Insolvency and Bankruptcy Code as one of Vedanta's affiliates in Zambia -- a unit of its UK-based parent Vedanta Resources Plc -- had been found guilty of criminal misconduct.

Electrosteel owes lenders more than Rs 130 billion, of which about Rs 500 billion is to State Bank of India alone.

Last month, the Kolkata bench of the National Company Law Tribunal (NCLT) had cleared Vedanta's Rs 53.20 billion resolution plan for Electrosteel, rejecting objections by Renaissance Steel.

Re: Indian Economy News & Discussion - Nov 27 2017

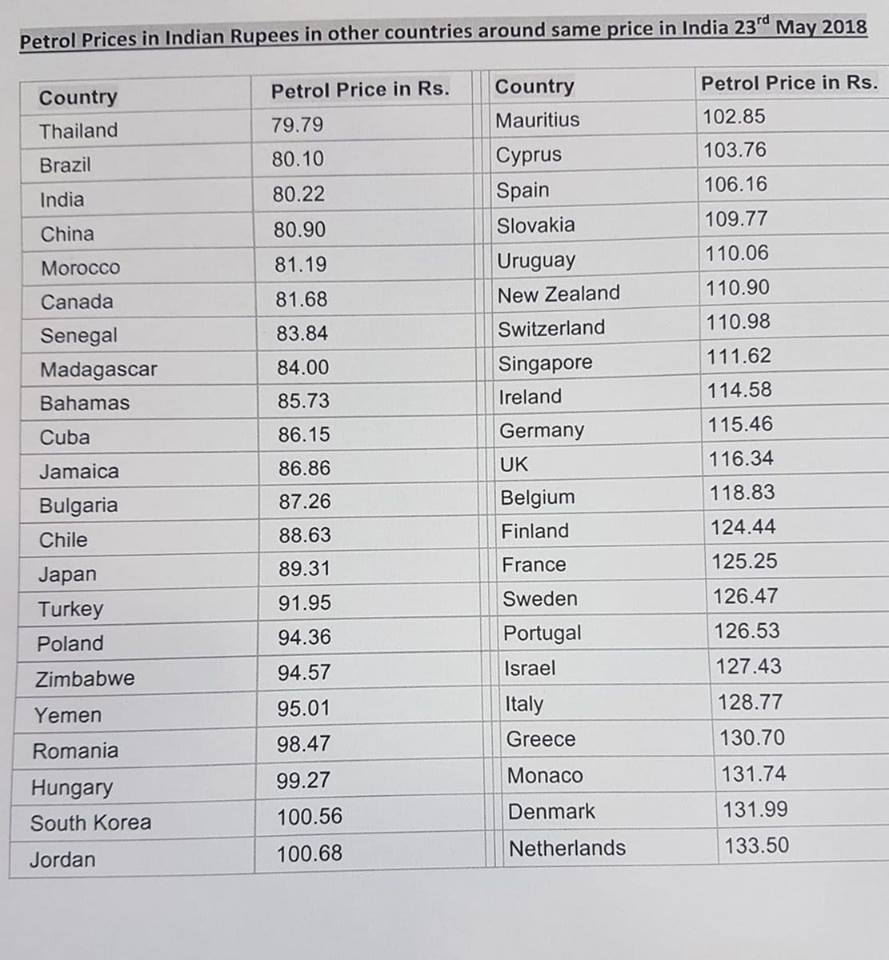

twitter

Petrol prices across the world last week. India has one of the lowest prices!

It is time to look for alternate energy sources and not depend upon this expensive and non-renewable fuel source. India imports 82% of its fuel and gas needs from outside. Too much of an energy risk.

Re: Indian Economy News & Discussion - Nov 27 2017

tradingeconomics.com reports:

https://tradingeconomics.com/india/construction-output

https://tradingeconomics.com/india/construction-output

Construction output in India increased 4.70 percent in April of 2018 over the same month in the previous year.

Re: Indian Economy News & Discussion - Nov 27 2017

The Gross Domestic Product (GDP) in India expanded 7.70 percent in the first quarter of 2018 over the same quarter of the previous year.

per https://tradingeconomics.com/india/gdp-growth-annual

per https://tradingeconomics.com/india/gdp-growth-annual

Re: Indian Economy News & Discussion - Nov 27 2017

4 quarter GDP at 7.7 with full year at 6.7%. The third quarter GDP has been revised to 7% from the earlier 7.2%.

Re: Indian Economy News & Discussion - Nov 27 2017

Excellent news . GDP data has turned out to much exceed estimated . 7.7% is right at the upper end of the range of estimates made prior to the actual report . Almost a full percentage point greater than PRCs 6.8% for the same quarter .

Re: Indian Economy News & Discussion - Nov 27 2017

Isn't this chart misleading? It does not take into account purchasing power of the currency in those countries. Rs 100 in India does not have the same value as Rs 100 in Israel.chetak wrote:twitter

Petrol prices across the world last week. India has one of the lowest prices!

It is time to look for alternate energy sources and not depend upon this expensive and non-renewable fuel source. India imports 82% of its fuel and gas needs from outside. Too much of an energy risk.

Re: Indian Economy News & Discussion - Nov 27 2017

Not happy with the chart??Trikaal wrote:Isn't this chart misleading? It does not take into account purchasing power of the currency in those countries. Rs 100 in India does not have the same value as Rs 100 in Israel.chetak wrote:twitter

No problem. Just make up one you like and put it out there, corrected for Brent and WTI, if you want and ppp in which ever currency you fancy.

I personally would have a problem with them not showing, maybe, the lower petrol prices in our own neighborhood.

Surprisingly, our entire neighborhood has lower prices and some of them are getting the stuff from India too and yet they have lower prices.

Petrol Prices Of 100 Countries Around The World. Check Out Where India Stands

As on May 23, 2018, Price (in Indian rupees)

Afghanistan 46.54

Pakistan 51.64

Malaysia 37.72

China 80.90

Bhutan 57.02

Sri Lanka 63.77

Nepal 68.74

India 80.22

Bangladesh 71.69

Mauritius 102.85

Hong Kong 144.23

Iceland 144.52

Re: Indian Economy News & Discussion - Nov 27 2017

chart above is missing the cess that funds gram sadak yojana

a portion of central excise duty (42%) goes to state as per NITI.

a portion of central excise duty (42%) goes to state as per NITI.

Re: Indian Economy News & Discussion - Nov 27 2017

Official CSO data on Q4 and full fiscal year GDP (PDF)

Initial thoughts:

* Almost 7.5% GDP growth in second half of last fiscal.

* 7.7% GDP growth was the highest in 8 quarters.

* 7.6% gross value add in Q4 also the highest in 8 quarters.

* Q4 data will likely be revised up from 7.7% with more data available.

* Gross fixed capital formation (GFCF) or investment/GDP is growing strongly, >30% in all four quarters measured at constant prices, peaking at 32.2% in Q4 . Higher sustained rate of investment now yields higher GDP growth in future.

* Correspondingly, government final consumption expenditure (GFCE) is down from 11.8% in Q1, down to 9.5% in Q4. This is an indicator of quantum of social welfare & subsidy spending, whereas GFCF tracks capital formation.

* Falling GFCE and rising GFCF is a good sign of rising capex along with falling subsidy/welfare spending. Many are familiar with this chart on the matter.

* Private final consumption expenditure (PFCE) was stable at ~55% of GDP, rising to close to 60% of GDP in Q3 during the festival season.

* When compared to the same CSO document for 2016-17, there's a marked improvement. In particular, there's a high change in stocks (~2.5% of GDP) in the old data, indicating buildup of inventory that was not sold. In the latest report for 2017-18 on the other hand, change in stocks is 0.7% of GDP, indicating inventory buildup is much lower, and capacity utilization is reaching maximum, which in turn should drive greater investment.

Overall a very strong report, not just for the data of the concluded year, but even more so because of what the underlying metrics indicate for the future.

Initial thoughts:

* Almost 7.5% GDP growth in second half of last fiscal.

* 7.7% GDP growth was the highest in 8 quarters.

* 7.6% gross value add in Q4 also the highest in 8 quarters.

* Q4 data will likely be revised up from 7.7% with more data available.

* Gross fixed capital formation (GFCF) or investment/GDP is growing strongly, >30% in all four quarters measured at constant prices, peaking at 32.2% in Q4 . Higher sustained rate of investment now yields higher GDP growth in future.

* Correspondingly, government final consumption expenditure (GFCE) is down from 11.8% in Q1, down to 9.5% in Q4. This is an indicator of quantum of social welfare & subsidy spending, whereas GFCF tracks capital formation.

* Falling GFCE and rising GFCF is a good sign of rising capex along with falling subsidy/welfare spending. Many are familiar with this chart on the matter.

* Private final consumption expenditure (PFCE) was stable at ~55% of GDP, rising to close to 60% of GDP in Q3 during the festival season.

* When compared to the same CSO document for 2016-17, there's a marked improvement. In particular, there's a high change in stocks (~2.5% of GDP) in the old data, indicating buildup of inventory that was not sold. In the latest report for 2017-18 on the other hand, change in stocks is 0.7% of GDP, indicating inventory buildup is much lower, and capacity utilization is reaching maximum, which in turn should drive greater investment.

Overall a very strong report, not just for the data of the concluded year, but even more so because of what the underlying metrics indicate for the future.

Re: Indian Economy News & Discussion - Nov 27 2017

Given Crude prices are same for all more or less and refining costs should be in ballpark too, the difference in prices are mainly due to taxes. On a broad level, Developed countries have higher taxes in general across the spectrum to fund their proportionally higher govt spending. Poor countries have less taxes likewise.chetak wrote:

Surprisingly, our entire neighborhood has lower prices and some of them are getting the stuff from India too and yet they have lower prices.

Its upto us if we want to compare India with Nepal, Bhutan, BD or with developed nations. Just saying..

PS - Was just checking some numbers of how much aid Bhutan gets from India. Something like 90mil per year which is like 5% of their GDP. And other countries must also be giving some more.

Sweden has >8kr/ltr tax on petrol which is like 75rs or so. Ermany has like 1.2Euro per ltr. Thats 50% or so in taxes.

Re: Indian Economy News & Discussion - Nov 27 2017

The GDP news obscured the news on strong core sector growth in the first month of current fiscal:

Core sector growth jumps to 4.7% in April

The core sector data is also pretty strong, because the impressively high cement output growth. Construction tends to slow down as hot summer hits and monsoon is around the corner, so high construction driven cement output growth in April is very good.

Core sector growth jumps to 4.7% in April

Personally I think core sector growth is skewed by the nature of the composition of the basket. I'd described my criticisms in this post a month ago.An increase in cement and coal production pushed core sector growth to 4.7 per cent in April, compared to 2.6 per cent in the same month last year. The core sector growth was at 4.4 per cent in March this year.

The core sector comprises eight key industries and contributes over 40 per cent to overall industrial production.

According to data released by Commerce and Industry Ministry, while cement production increased by 16.6 per cent in April this year over April last, coal production went up by 16 per cent during the same period. Higher cement outgo indicates construction sector is accelerating and this is good news for the entire economy, especially from employment point of view as construction sector has very high potential to create direct and indirect employment.

Increase in coal production has come at a time when there is higher demand from the power sector There is also an indication that if production continues at the same rate during the coming months, the electricity situation will improve. Meanwhile, electricity generation increased by 2.2 per cent in April. Its cumulative index increased by 5.3 per cent during April-March, 2017-18 over the corresponding period of previous year.

Fertilizers production went up by 4.6 per cent in April while steel production increased by 3.5 per cent. Among petroleum products, natural gas and refinery production went up by 7.4 per cent and 2.7 per cent respectively. However, crude production declined 0.8 per cent.

The core sector data is also pretty strong, because the impressively high cement output growth. Construction tends to slow down as hot summer hits and monsoon is around the corner, so high construction driven cement output growth in April is very good.

Re: Indian Economy News & Discussion - Nov 27 2017

Sorry, I did not see this post until I was looking for something else. What are you missing ? Nothing. GoI's planning just what you indicate:suryag wrote:Suraj and other learnerd saars - the oil price assumed in the budget was 70$/barrel. Based on this they would have made a projected revenue receipt from excise duty and planned out the development activities. Now i understand the situation of the GoI w.r.t fiscal deficit and infrastructure funding would be hit if they reduce their levies far below what the realisation would have been at 70$ but what prevents the GoI from keeping the excise levy at a level where they would be revenue neutral and not reap profits for the amount exceeding 70$. Seems to be relaitvely straight forward or am i missing something here ?

Windfall oil tax on ONGC in offing to soften fuel prices

Re: Indian Economy News & Discussion - Nov 27 2017

Analysis of investment growth in latest GDP data:

Investment picks up to a seven-quarter high of 14.4% in Q4 of 2017-18

Investment picks up to a seven-quarter high of 14.4% in Q4 of 2017-18

Non-food credit grew 10.7% in April 2018Investment growth leap-frogged to a seven-quarter high of 14.4 per cent in the fourth quarter of 2017-18, up from the 9.1 per cent in the third quarter, according to the data released by the central statistics office (CSO).

Gross fixed capital formation (GFCF) had previously grown by a mere 0.8 per cent in the first quarter, suggesting a steady build-up in investment activity over the past year.

Investments alone accounted for 4.6 percentage points of growth in gross domestic product (GDP) in the fourth quarter, replacing private final consumption expenditure as the biggest contributor to growth. GDP grew by 7.7 per cent in the fourth quarter.

For the full year, gross fixed capital formation grew by 7.6 per cent in 2017-18, down from the 10.1 per cent in 2016-17, primarily due to sluggish growth in the first half of 2017-18.

“The increase in public spending is starting to show in the investment numbers,” said Pronab Sen, former chief statistician of India.

“I think the infrastructure component in construction, particularly roads, is driving investment. This is likely to have spillover effects,” he added.

The construction sector grew by a robust 11.5 per cent in the fourth quarter, up from 6.6 per cent in the third quarter. Separately, the core sector data show that cement grew by a healthy 18.5 per cent in the fourth quarter while steel saw growth of 3.8 per cent.

Non-food credit demand rose by 10.7 per cent in April 2018 as against an increase of 4.5 per cent during the same period last year, according to data released by the Reserve Bank of India (RBI) on Thursday. Non-food credit for the month of April stood at Rs 75,804 billion.

Credit to agriculture and allied activities increased by 5.9 per cent in April as compared with an increase of 7.4 per cent in the same month of the previous year.

Credit growth for the industry was muted and only increased by one per cent in April 2018 as compared with a contraction of 1.4 per cent during the same period last year. Credit to medium enterprises grew the most by 3.6 per cent over the previous year. “Credit to major sub-sectors such as textiles, engineering, food processing, construction and rubber, plastic & their products accelerated,” said RBI.

However, credit to infrastructure, basic metal & metal products, chemicals & chemical products, gems & jewellery and cement & cement products contracted,” said the RBI in a statement.

Credit to the services sector increased by 20.7 per cent in April 2018. This is a four-fold increase as against the same period last year.

Personal loans also increased by 19.1 per cent in April 2018 as compared with an increase of 14.4 per cent in April 2017, with credit cards, housing loans and loans against fixed deposits seeing the strongest growth.

Re: Indian Economy News & Discussion - Nov 27 2017

The Nikkei Manufacturing PMI in India fell to 51.2 in May of 2018 from 51.6 in the preceding month and missing market consensus of 51.5.

https://tradingeconomics.com/india/manufacturing-pmi

https://tradingeconomics.com/india/manufacturing-pmi

Re: Indian Economy News & Discussion - Nov 27 2017

India's fiscal deficit narrowed to INR 1.52 trillion in April of 2018 from INR 2.06 trillion in the same period of the previous fiscal year. April 2018 is the first month of the new 2018-2019 fiscal year. The budget gap was equivalent to 24.3 percent of the government’s target for the whole financial year, compared with 37.6 percent last year. Total expenditure went down 7.7 percent year-on-year to INR 2.23 trillion, equivalent to 9.1 percent of FY19 estimate (11.3 percent a year earlier). Revenues jumped 95.6 percent year-on-year to INR 0.714 trillion or 3.9 percent of the estimate (2.3 percent a year earlier). The budget deficit for the 2017-18 fiscal year which ended in March was revised higher to 3.53 of the GDP from 3.24 percent.

https://tradingeconomics.com/india/gove ... dget-value

https://tradingeconomics.com/india/gove ... dget-value

Re: Indian Economy News & Discussion - Nov 27 2017

Ministry of Finance

New Benami Transactions Informants Reward Scheme, 2018 launched by the Income Tax Department

To get people’s participation in the Income Tax Department’s efforts to unearth black money and to reduce tax evasion

http://pib.nic.in/PressReleaseIframePag ... ID=1534071

---------------

http://pib.nic.in/PressReleaseIframePag ... ID=1534070

Ministry of Finance

Income Tax Department issues Revised Income Tax Informants Reward Scheme, 2018

Posted On: 01 JUN 2018 1:09PM by PIB Delhi

With the objective of obtaining people’s participation in the Income Tax Department’s efforts to unearth black money and reduce tax evasion, a new reward scheme titled “Income Tax Informants Reward Scheme, 2018” has been issued by the Income Tax Department, superseding the earlier reward scheme issued in 2007.

--------------

New Benami Transactions Informants Reward Scheme, 2018 launched by the Income Tax Department

To get people’s participation in the Income Tax Department’s efforts to unearth black money and to reduce tax evasion

http://pib.nic.in/PressReleaseIframePag ... ID=1534071

---------------

http://pib.nic.in/PressReleaseIframePag ... ID=1534070

Ministry of Finance

Income Tax Department issues Revised Income Tax Informants Reward Scheme, 2018

Posted On: 01 JUN 2018 1:09PM by PIB Delhi

With the objective of obtaining people’s participation in the Income Tax Department’s efforts to unearth black money and reduce tax evasion, a new reward scheme titled “Income Tax Informants Reward Scheme, 2018” has been issued by the Income Tax Department, superseding the earlier reward scheme issued in 2007.

--------------

Re: Indian Economy News & Discussion - Nov 27 2017

Complaint about the Gross Value Add deflator used to compute the GDP (2016)

https://www.livemint.com/Opinion/58qihT ... ot-71.html

https://www.livemint.com/Opinion/58qihT ... ot-71.html

Re: Indian Economy News & Discussion - Nov 27 2017

Above is mumbo jumbo. Likely politically motivated. When GDP growth is 5.7% all statistics are brilliant and the PM should resign. When GDP growth is 7.7% CSO is fudging data and PM should resign. Also PMI has not fallen. It has risen less. Anything about 50 is a rise.

Re: Indian Economy News & Discussion - Nov 27 2017

The article's primary argument is that CSOs deflator is wrong because according to it, in second half of last fiscal exports and industrial output rose , which it claims is wrong. But well, the article is wrong - exports and industrial output *did* rise strongly. IIP has for several months scaled new highs, as the data posted here indicated. Exports also rebounded last fiscal to over $300 billion, with the major rise coming in the second half.

Also, yes any number for PMI above 50 is a gain. A drop in PMI from 51.6 to 51.2 isn't really much . Whether it matters really depends on which of the PMI components moved. It's a survey. It gets sent out to people asking them to rate various things like current order backlog, new orders, inventories, employment, supplier delay. They are to answer better, same or worse. Same on everything will return a PMI of 50. The ratio of betters and worses tilts it above or below 50 .

As an example, you could have the PMI worsen because growing demand is causing longer supplier lead times or hiring trouble, but it doesn't translate to dropping growth, but rather the opposite - overheating.

Also, yes any number for PMI above 50 is a gain. A drop in PMI from 51.6 to 51.2 isn't really much . Whether it matters really depends on which of the PMI components moved. It's a survey. It gets sent out to people asking them to rate various things like current order backlog, new orders, inventories, employment, supplier delay. They are to answer better, same or worse. Same on everything will return a PMI of 50. The ratio of betters and worses tilts it above or below 50 .

As an example, you could have the PMI worsen because growing demand is causing longer supplier lead times or hiring trouble, but it doesn't translate to dropping growth, but rather the opposite - overheating.

Re: Indian Economy News & Discussion - Nov 27 2017

^^^Suraj, The article is from march 2016.

Re: Indian Economy News & Discussion - Nov 27 2017

Clearly I need to post only after my morning coffee

Re: Indian Economy News & Discussion - Nov 27 2017

So the article is from 2016. Probably being spread to time with the new GDP numbers. Even if it is from 2016 it is mumbo jumbo. What we call in scientific lingo "hand waiving". No definitive root cause determined.

Re: Indian Economy News & Discussion - Nov 27 2017

E.g., this press note from MOSPI

http://www.mospi.gov.in/sites/default/f ... 1may18.pdf

At current prices the GDP growth rate in Q4 is 10.9% and at constant prices, it is 7.7%. The criticism is that "do you believe the deflator is as small as 3.2%?" etc., etc.

Anyway, with the new (2011-12) series of GDP, the data sourcing is much better aligned with international practices than the old 2004-05 series. Can we examine whether the GVA deflator calculation is also better aligned with international practices?

Re: Indian Economy News & Discussion - Nov 27 2017

Sure, "we" here means you, right ?A_Gupta wrote:Can we examine whether the GVA deflator calculation is also better aligned with international practices?

Re: Indian Economy News & Discussion - Nov 27 2017

^^^ If you can help point me, I'll be happy to try.

Here's an October 2017 article complaining about the GVA deflator.

https://www.livemint.com/Opinion/F6IsyP ... t-way.html

PS: and a September 2017 article complaining about the GVA deflator.

https://www.thehindubusinessline.com/op ... 840692.ece

Here's an October 2017 article complaining about the GVA deflator.

https://www.livemint.com/Opinion/F6IsyP ... t-way.html

PS: and a September 2017 article complaining about the GVA deflator.

https://www.thehindubusinessline.com/op ... 840692.ece

Re: Indian Economy News & Discussion - Nov 27 2017

She says GVA deflator is wrong and then is unable to pinpoint root cause. It is like your doctor saying your ailment is definitely fever which may be due to cancer, malaria, AIDS and Zica virus infection.

Re: Indian Economy News & Discussion - Nov 27 2017

The Hindu article is better.

Re: Indian Economy News & Discussion - Nov 27 2017

India's Gross Fixed Capital Formation is trending higher.

https://www.bloomberg.com/news/articles ... e-on-table

https://www.bloomberg.com/news/articles ... e-on-table