No data and slightly political post but anyway - This along with all the hungama being raised about the mandatory data localisation item in the new telecom policy is a dead-giveaway. These guys jump through hoops trying to explain away why we dont need it and why we must always keep our markets open but not insist on local production or storage. because "global markets". pickup any of the newage ngo types who work in this arena and see what they say about the localisation provision. Exact ditto eeyadichan copy/chapamaar of the us/eu trade lobbies. these are the times one really appreciates the chinese who say balls, if oyu want market access, do what we tell you.Suraj wrote:"Demand compression" is such a fancy term for "stop buying stuff" . I agree that switching to domestic sources is a far more useful idea - it's not like the economy is overheating, and trying to bridge the demand-supply gap due to a rise in the import bill by reducing demand, sounds just very wrong.

Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Petrol/diesel prices cut by center by 2.50 and MH/GJ cut by another 2.50.

https://timesofindia.indiatimes.com/bus ... 069154.cms

I expect some degree of further govt expenditure squeezing.

https://timesofindia.indiatimes.com/bus ... 069154.cms

I expect some degree of further govt expenditure squeezing.

Re: Indian Economy News & Discussion - Nov 27 2017

Up, ArPr have also cut 2.50.

Re: Indian Economy News & Discussion - Nov 27 2017

Direct tax collections up 14% on year in April-September, refunds surge too

India Services PMI: Services growth slows in September, two usual suspects make imports costlierIn what could provide a relief to the economy from a budget deficit, the net direct tax collection (after adjusting for refunds) is up by 14% in the April-September period to Rs 4.44 lakh crore. Interestingly, the gross direct tax collection (includes refunds) is up 16.7% to Rs 5.47 lakh crore. The tax refunds have also seen a surge of 30% on year.

Gross direct tax collections came in at Rs 5.47 lakh crore, up by 16.7% on year, while net direct tax collections is up 14% to Rs 4.44 lkah crore in the April-September period.

Tax refunds came in at Rs 1.03 lakh crore, up by 30.4% on year.

The net direct tax collections represent 38.6% of the total budget estimates of the direct taxes of Rs 11.5 lakh crore for 2018-19.

Advance tax collection rose 18.7% to Rs 2.1 lakh crore in the April-September period.

The gross corporate tax collections have risen by 19.5% on year. The gross personal income is up by 19.1% on year.

The country’s services sector expanded at a slower pace in September as higher fuel costs and stronger US dollar made imported goods expensive, says a survey. The seasonally-adjusted Nikkei India Services Business Activity Index touched 50.9 in September, down from 51.5 recorded in August. This is also the lowest reading in the current four-month sequence of rising activity. In PMI parlance, a print above 50 means expansion, while a score below that denotes contraction.

Although manufacturers recorded a slightly stronger increase in employment, the rise was insufficient to prevent a slowdown in overall jobs growth, the report said. Latest data showed the net rise in private sector employment was the slowest in over a year.

Re: Indian Economy News & Discussion - Nov 27 2017

I note that Ms. Chanda Kochar of ICCI bank has resigned.

Re: Indian Economy News & Discussion - Nov 27 2017

I would not be putting much stock into anything an accounting firm like KPMG says about GST.Suraj wrote:More evidence of GST’s benefit for economy: Dramatic growth in warehousing space

These guys entire business model evolves around paper churn.

The more laws taking money from the productive elements in society in tax related paper work, the more money lands up in KPMG's pockets for doing accounting services.

I would think money earned by people is better off in their pockets rather than being taken from them. It gets run through a a paper mill with people in govt and folks at KPMG all getting a cut of wealth they had no part in producing.

That can't be good for the economy.

Re: Indian Economy News & Discussion - Nov 27 2017

If that's the case then where does the money come from to fill the people's pockets in the first instance?Neshant wrote:I would think money earned by people is better off in their pockets rather than being taken from them.

Re: Indian Economy News & Discussion - Nov 27 2017

Stop trolling Neshant.Neshant wrote:I would not be putting much stock into anything an accounting firm like KPMG says about GST.Suraj wrote:More evidence of GST’s benefit for economy: Dramatic growth in warehousing space

These guys entire business model evolves around paper churn.

The more laws taking money from the productive elements in society in tax related paper work, the more money lands up in KPMG's pockets for doing accounting services.

I would think money earned by people is better off in their pockets rather than being taken from them. It gets run through a a paper mill with people in govt and folks at KPMG all getting a cut of wealth they had no part in producing.

That can't be good for the economy.

Please no one reply and derail the thread.

Re: Indian Economy News & Discussion - Nov 27 2017

About time. In fact, she should have been sacked long long back.ramana wrote:I note that Ms. Chanda Kochar of ICCI bank has resigned.

Re: Indian Economy News & Discussion - Nov 27 2017

We are country which have historically under invested in capital expenditure and ran huge debts with low taxes. In order for our economy to properly grow we need higher taxes for some years

1) to Repay the High unsustainable debt given in previous years

2) To invest the vast sums required in capex .

Without Taxes of 15-18% of GDP we have no hope of transforming our country.

1) to Repay the High unsustainable debt given in previous years

2) To invest the vast sums required in capex .

Without Taxes of 15-18% of GDP we have no hope of transforming our country.

Re: Indian Economy News & Discussion - Nov 27 2017

^Most developed countries have high direct taxation, not indirect taxation. Indirect taxation is ok in intermediate term but our long term goal should always be to bring more people into the direct taxation net. Having high indirect taxation is actually detrimental for consumption and economy at large.

Re: Indian Economy News & Discussion - Nov 27 2017

How IL&FS Was Enriching Itself at Public Cost

How IL&FS Was Enriching Itself at Public Cost

Sucheta Dalal

04 October 2018 11

Jolted by the massive systemic risk that the defaults of Infrastructure Leasing & Financial Services (IL&FS) can create, a sleeping government has, finally, sacked a part of the board of directors of IL&FS on 1st October and injected seven new directors. It has also ordered an investigation by the SFIO (serious frauds investigation office). With many insiders starting to allege that top executives of IL&FS were gold-plating projects to create their own pot of gold, an investigation is clearly warranted.

The reconstituted board of IL&FS has to submit a resolution plan to the NCLT (National Company Law Tribunal) by 31st October. How difficult is the new board’s job? Well, it has to first understand the enormity of the problem and the modus operandi of Ravi Parthasarathy who ran the IL&FS show with his cronies for over two decades creating 175 subsidiaries and 66 joint ventures and associates (higher than those mentioned by the finance ministry’s press release). It holds assets of around Rs1,65,000 crore of which a whopping Rs30,000 crore are at risk, according to data analysed by REDD Intelligence.

Modus Operandi

The IL&FS group switched from arranging and structuring infrastructure finance, to being a partner in projects, around 2005. Typically, it leveraged its big public sector shareholding to find acceptance with state governments. It also offered a 50:50 joint venture, where the state got to appoint a non-executive chairman while IL&FS ran the show with its own managing director (MD) and virtually owned the projects.

Its flamboyant, high-spending ways were used to build deep contacts with bureaucrats in all state governments. It had dozens of IAS officers on its payroll and also doled out favours like houses/apartments for politically connected persons (PCPs), facilitating admission of their children to Ivy League universities abroad and other benefits.

The bureaucracy enjoyed its lavish spending ways; it didn’t matter that the costs were passed on to the project and borne by the public. IL&FS brought project development and fund raising ability to the table, for which it extracted hefty fees, based on the project cost. So, every cost escalation only worked to its benefit.

It also cultivated banks and other lenders assiduously. It lists over 40 domestic and international banks as lenders, apart from selling its financial paper across the spectrum. It has even managed to sell its debt to nationalised banks at a profit!

Key to the gold-plating of projects was its template capital structure that was never questioned by pliant bureaucrats representing state governments, says a former insider who wants to remain anonymous.

Although each project was structured as a 50:50 partnership, the equity capital was tiny (as low as 5%)—keeping risk capital minimal. Another 25%-30% would be brought in as subordinate debt which helped balance the debt-equity ratio. That was also subscribed by IL&FS, to give comfort to the government partner. The rest was raised through senior debt, raised mainly from public sector banks. According to this source, “the bloating debt problem of IL&FS can be understood if the debt profile of SPVs (special purpose vehicles) and the holding companies are analysed.”

Fees, Fees and More Fees

Typically, IL&FS charged multiple fees that allowed it to recover its entire investment even before the project got off the drawing board. IL&FS, as a group, earned project management fees, loan syndication fees, success fees, upfront fees, merchant banking fees, fees/charges for feasibility studies, environmental impact and social impact studies, etc. In fact, any cost or fee that could be pushed past the state government was loaded on to the project.

A good example is the Tirupur water project where an order of the Tamil Nadu High Court notes: “Out of the gross disbursement of Rs140 crore, IL&FS deducted a total amount of Rs41.24 crore whose break-up was (i) project management fee of Rs9.60 crore; (ii) costs of Rs15.15 crore for USAID loan; (iii) upfront fee of Rs66.50 lakh; (iv) merchant banking fees of Rs10.04 crore; and (v) out-of-pocket expenses of Rs5.79 crore.” The deductions were made before transferring the rest of the money to the project.

This win-win structure for IL&FS was supposed to be Ravi Parthasarathy’s genius and, probably, worked in the early days, until the costs had to be passed on to users. Then, like in the Noida Toll Bridge case, public anger erupted and the Supreme Court ordered the bridge to remain toll-free. Almost every major project of IL&FS is mired such controversy and litigation.

Now, let us look at how its dubious activities were already in the public domain, but nobody would act to cut the group to size.

Some Examples of the Plunder

1. Noida Toll Bridge Company Ltd: This controversial company had given itself an assured return of over 20% (higher than its borrowing cost) which soared to 40% when its high-cost loans were renegotiated to 10% and the concession period dramatically extended from 30 years to 100 years. It was also given 30 acres of government land as a sweetener which it sold at a profit. No cost reduction was passed on to the toll-paying public. Instead, it was structured to ensure that the initial shortfall in toll collection was added to the project cost. This led to a 12 times cost escalation -- from Rs408 crore in early 2000 to over Rs5,000 crore when it was eventually scrapped by the courts.

2. Tamil Nadu Road Development Company (TNRDC): This SPV was a 50:50 joint venture between IL&FS and the Tamil Nadu government (TNGov). It implemented the Rs205 crore IT corridor road project and east coast road-widening project.

While both were equal equity partners, the subordinate loan of Rs41 crore from IL&FS earned a 15% return while the state provided an interest-free grant of Rs34 crore. This became the subject of a book—Evolution of IT Corridor by K Malmarugan and Sabina Narayan which exposes how IL&FS structures its deals.

In that project, says the book, TNGov got back Rs2 lakh on its Rs44 crore investment in the first seven years, while IL&FS got back Rs91.3 crore on its investment of Rs69.6 crore. It also sold its senior debt at a profit to Punjab National Bank and earned a 4% management fee.

Further, TNRDC was assigned a 4.9-acre plot at Rs1 crore which now has a market value of Rs50 crore, say sources. In this case, TNGov realised how it was being duped and ousted Ravi Parthasarathy as chairman of TNRDC. It also bought out IL&FS’s stake and converted it into a 100% government company.

3. Tirupur Water Project: The Tirupur water project, to privatise water supply and make it available to the wealthy, hosiery-exporting town, was conceived by IL&FS in the mid-1990s and remains mired in litigation. The allegations, again, are fat fees charged by IL&FS and false promises to investors.

Just one sentence from a hard-hitting, 2014 order by Justice V Ramasubramanian (also quoted above) encapsulates all that is wrong with this project: “The Government has pumped in money, unfortunately, only to service the debt with a pre-condition that the money will not even be used to improve the infrastructure. Investing more money just for the purpose of servicing a debt, is neither a prudent business decision nor in the interest of the public.”

A top source in TNGov says there is an unwritten understanding in the state not to do business with IL&FS anymore. Did this never reach the ears of the former finance minister, who was from Tamil Nadu? You can draw your own conclusions.

GIFT City Gujarat: The Gujarat International Finance Tec-City, again structured as a 50:50 joint venture with the Gujarat government, was extraordinary in that the head of its audit committee filed a litigation against the project in 2016. The petition, by Dr DC Anjaria, alleged that this massive, Rs70,000-crore project had been virtually gifted away to IL&FS, leading to massive losses to the state government and the people.

Here, too, IL&FS has extorted high fees. It got the land valued at Rs2/acre at a nominal price translating to a giveaway of Rs440 crore to IL&FS, says Dr Anjaria. This also has an expensive, ongoing arbitration with the original contractor consortium headed by Fairwood, with large claims and counter-claims on both sides.

Gift City has been a favourite project of prime minister Narendra Modi; but not a word about it was in the public domain until I wrote about in August this year, just before IL&FS began to default on payments.

There are similar issues with IL&FS’s ventures with the Rajasthan government, with the power project at Cuddalore and many others. But the most chilling one I have heard so far is a joint venture with RAHI Aviation to build airports at Gulbarga and Shimoga.

When things turned sour, IL&FS accused the promoter of RAHI Aviation of forgery, and worse, and got him arrested. It ensured that he remained in Arthur Road jail (Mumbai) for six months by piling on more charges. As a direct result of that fight, the project has been taken over by the Karnataka government, which also invoked bank guarantees of Rs20+ crore.

The details of what happened are the subject of a separate article; but IL&FS, which has now caused a systemic issue, lost the project and an investment of over Rs40 crore without anyone being held responsible.

Well, it is time we woke up and started asking questions and ensure that this deliberately created mess is not foisted on public sector institutions and, eventually, on the people of India.

Re: Indian Economy News & Discussion - Nov 27 2017

+101Yagnasri wrote:About time. In fact, she should have been sacked long long back.ramana wrote:I note that Ms. Chanda Kochar of ICCI bank has resigned.

Mr Chanda Kochar has dropped her right into the schitt.

I certainly wouldn't like to be sitting at that breakfast table.

Re: Indian Economy News & Discussion - Nov 27 2017

^^ you think she did not make a conscious choice to look the other way and not recuse based on conflict of interest?

breakfast table stony silence is only if one person was cheated. she is getting away lightly. no prosecution by govt. if the icici internal enquiry finds some wrongdoing , she only stands to lose some of whatever cushy severance payment they are obliged to give her. boo woo freakin hoo.

govt unable to rock the boat with PNB and Infra cos NPA stuff shaking stock markets.

breakfast table stony silence is only if one person was cheated. she is getting away lightly. no prosecution by govt. if the icici internal enquiry finds some wrongdoing , she only stands to lose some of whatever cushy severance payment they are obliged to give her. boo woo freakin hoo.

govt unable to rock the boat with PNB and Infra cos NPA stuff shaking stock markets.

Re: Indian Economy News & Discussion - Nov 27 2017

The whole board of directors team at ICICI should be sacked/dismissed for standing by Kochar and not forcing her to resign. This is no way a professional company is run. The rot is deep in the company.

-

Vikas

- BRF Oldie

- Posts: 6828

- Joined: 03 Dec 2005 02:40

- Location: Where DST doesn't bother me

- Contact:

Re: Indian Economy News & Discussion - Nov 27 2017

Stock market has taken a nose dive in last few days wiping out thousands of crores of paper (Yes, Including mine).

Re: Indian Economy News & Discussion - Nov 27 2017

RBI Monetary Policy Review: Repo rate unchanged at 6.5%

Contrary to street expectations, the Reserve Bank of India’s monetary policy committee (MPC) kept repo rate unchanged at 6.5% on Friday in its fourth bi-monthly monetary policy review for this fiscal year. Over two-thirds of 61 economists had said in a Reuters poll the RBI would hike the repo rate at least once by the end of 2018, and over half of them had expected a 25 basis points raise. The development will come as a relief to loan seekers and borrowers, who were bracing for a 25 basis points increase, which could have led to a rise in borrowing costs. Why did RBI keep repo rates unchaged? We take a look at key reasons.

While keeping the key policy rate unchaged, RBI has changed its stance from ‘Nuetral’ to ‘caliberated tightening,’ of monetary policy, in line with its objective of achieving the medium-term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth.

Re: Indian Economy News & Discussion - Nov 27 2017

Suraj, can you explain how repo rate would affect bond yields, long term and short term including G-Sec/T-Bills. I have read so much contradictory stuff on this my head spins amongst so much speculation on repo rate affecting the debt market etc.

Re: Indian Economy News & Discussion - Nov 27 2017

On paper, bond prices fall when repo rates go up, i.e. yields on offered bond issue also goes up. Bonds themselves have a fixed coupon, so their relative price attractiveness depends on how the coupon of the bond compares to the current benchmark rate. When current rate is higher than the coupon you hold, it's worth less than face value, i.e bond prices fall as rates rise. and vice versa.

However your larger question has no simple answer. There's no simple relationship between the current benchmark interest rate changing, and the movement of the yield curve (a plot of current yields of short/medium/long term bonds). Lots of other factors come into play - yields may not change much at all, or may have already priced in the expectation of a change in benchmark rates and don't move much when the rate change is actually announced. Or short term volatility (e.g. a liquidity crunch) may force up short term yields higher.

As to the current situation - the general read of why RBI didn't change rates despite nearly 70% of analysts expecting a 25bps hike, is that RBI noted that economic growth remains robust, that inflation remains muted, and that they're willing to let the exchange rate be the loose variable while prevailing oil/commodity price spike remains, rather than try to hurt the very things on the basis of which they've confidence in the economy.

However your larger question has no simple answer. There's no simple relationship between the current benchmark interest rate changing, and the movement of the yield curve (a plot of current yields of short/medium/long term bonds). Lots of other factors come into play - yields may not change much at all, or may have already priced in the expectation of a change in benchmark rates and don't move much when the rate change is actually announced. Or short term volatility (e.g. a liquidity crunch) may force up short term yields higher.

As to the current situation - the general read of why RBI didn't change rates despite nearly 70% of analysts expecting a 25bps hike, is that RBI noted that economic growth remains robust, that inflation remains muted, and that they're willing to let the exchange rate be the loose variable while prevailing oil/commodity price spike remains, rather than try to hurt the very things on the basis of which they've confidence in the economy.

Re: Indian Economy News & Discussion - Nov 27 2017

Its a bold decision by RBI/MPC. Even though its against my personal expectation, I am happy about it. Of coarse share market doesn't look so happy. The RBI stand and recent announcement in cutting of borrowing are two key indicators I would say the we saw in last few days, that show Indian economy is strong.

Re: Indian Economy News & Discussion - Nov 27 2017

Yes it's bold, and a case of RBI telegraphing that it doesn't believe the macroeconomic situation is weak. Most people are fixated on the exchange rate itself, and see the rapid erosion as a cause for alarm.

RBI saw it differently. It saw it as one of several levers it could manipulate - especially among the trinity of interest rate, inflation rate and exchange rate. It saw that growth remains robust, IIP is still solid (except for oil, as expected), and inflation especially in food still muted. Therefore they decided that the exchange rate would absorb the shock of the external oil/commodity actions, so it can keep the other rates stable.

The markets are reacting negatively as their hope for firm RBI action over exchange rates was disappointed. So that means RBI will let exchange rates move if needed. Maybe they'll use some forex reserves to maintain the exchange rate, but they don't intend to use higher interest rates to attract capital and thus strengthen the Rupee, for now.

RBI saw it differently. It saw it as one of several levers it could manipulate - especially among the trinity of interest rate, inflation rate and exchange rate. It saw that growth remains robust, IIP is still solid (except for oil, as expected), and inflation especially in food still muted. Therefore they decided that the exchange rate would absorb the shock of the external oil/commodity actions, so it can keep the other rates stable.

The markets are reacting negatively as their hope for firm RBI action over exchange rates was disappointed. So that means RBI will let exchange rates move if needed. Maybe they'll use some forex reserves to maintain the exchange rate, but they don't intend to use higher interest rates to attract capital and thus strengthen the Rupee, for now.

Re: Indian Economy News & Discussion - Nov 27 2017

I was expecting a raise. Lets see how this pans out. As pointed out above the macroeconomic fundamentals of the economy look solid at present except niggles like NPA. May be it is a signal to prevent more speculation in the currency market.

Re: Indian Economy News & Discussion - Nov 27 2017

50.9 services pmi in September

https://www.business-standard.com/artic ... 377_1.html

https://www.business-standard.com/artic ... 377_1.html

Re: Indian Economy News & Discussion - Nov 27 2017

Growth in India firming up, projected to accelerate further: World Bank

Growth in India is firming up and projected to accelerate to 7.3 per cent in the 2018-19 fiscal and 7.5 per cent in the next two years, the World Bank said on Sunday.

The global lender said that the Indian economy appears to have recovered from the temporary disruptions caused by demonetisation and the introduction of the Goods and Services Tax (GST).

Growth reached 6.7 per cent in fiscal year 2017/18, with a significant acceleration in recent months, it said.

“Prompted by the adoption of the ‘Goods and Services Tax’ (GST) and the recapitalisation of banks, growth in India is firming up and it is projected to accelerate further,” the World bank said in its latest report on South Asia.

Growth in India, it said, is expected to rise to 7.3 per cent in fiscal year 2018/19, and to 7.5 per cent in the following two years, with stronger private spending and export growth as the key drivers.

On the production side, the turnaround in the second half was led by manufacturing (that grew at 8.8 per cent versus 2.7 per cent in the first half). Agriculture growth improved, and services growth held steady at 7.7 per cent, the report said.

On the demand side, the pick-up in growth was reflected in a sharp acceleration in gross fixed capital formation to 11.7 per cent in the second half, from 3.4 per cent in the first.

Consumption, growing at seven per cent in the second half, remained the major driver of growth, the report said.

Re: Indian Economy News & Discussion - Nov 27 2017

https://m.dailyhunt.in/news/india/engli ... s=twt&s=pa

How India Is One Step Closer To Domestic Lithium-Ion Battery Manufacturing

How India Is One Step Closer To Domestic Lithium-Ion Battery Manufacturing

The global industry is ramping up their battery manufacturing operations as the push for vehicle electrification continues. India is slated to join the select number of countries with lithium-ion battery manufacturing capacity. This is, no doubt, positive for both the Indian economy and the ambitious electric vehicle (EV) targets set by the government. India's lack of mineral reserves, however, requires it to establish partnerships with more resource abundant countries and compete to attract more foreign investment to spur the battery manufacturing industry.

Last week we mentioned how the low GST on electric vehicles (EVs) should boost the industry and stated that similar efforts must be made to incentivise compatible charging infrastructure. Foxconn's announcement to invest $5 billion in Indian manufacturing shows policy-makers are headed in the right direction and validates their decision to impose a 10% import duty on phones and key parts under the new GST era. What does a mobile phone company coming to India have to do with EVs? Batteries. Yes some of the same technology in your phone is applicable for EVs. Foxconn CEO Terry Gou said that part of that $5 Bn will go towards lithium-ion cell factories and printed circuit board(PCB) facilities.

The Central Electrochemical Research Institute (CERI) in Tamil Nadu is also working on lithium-ion manufacturing in India and has targeted a capacity of 100 units per day by September 2017. Bharat Heavy Electricals Ltd (BHEL) reached an MOU with the Indian Space and Research Organisation (ISRO) to develop lithium-ion batteries shortly after automaker Suzuki announced a $184 Mn investment for a factory with partners Toshiba Corp. and Denso Corp. in April.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Indian Economy News & Discussion - Nov 27 2017

^ Great news. Have been hearing about hyderogen fuel cells and ammonia based alternatives for a while now. Makes sense from India's POV to diversify risk and invest in different technologies in parallel. Only.

Re: Indian Economy News & Discussion - Nov 27 2017

^^

Good to hear but we must really up our efforts to aquire the source materials as well.

One Chinese company now controls most of the metal needed to make the world’s advanced batteries

Good to hear but we must really up our efforts to aquire the source materials as well.

One Chinese company now controls most of the metal needed to make the world’s advanced batteries

Surprisingly, even though China has large reserves of lithium ore, it doesn’t currently produce as much of it. The leaders are Australia, Chile, and Argentina.

That explains why China is wading into a corporate deal involving a Chilean mining company. To maintain its dominance in the lithium-ion market, Chinese manufacturers needs access to lots of cheap lithium. Along with the stake in SQM, Tianqi owns 51% of Australia’s Greenbushes lithium mine, giving it effective control nearly half the current global production of the metal

Re: Indian Economy News & Discussion - Nov 27 2017

Major SEZ policy revamp: Fiscal sops for SEZs must be linked to investments, jobs

WorldSteel statistics August 2018

2. India 71.2MT

3. Japan 70.2MT

4. USA 56.9MT

5. SoKo 48.3MT

India now produces more steel than all of former USSR combined, and almost as much as all of North America (US+Canada+Mexico).

India continues to outpace Japan as the world #2 in steel output so far this year from Jan-Aug:A major over-haul of the existing Special Economic Zones (SEZs) policy by delinking fiscal incentives from exports and linking them to investments made and employment generated has been proposed by the review committee constituted earlier this year by the Centre.

Other recommendations

- Reincarnation of SEZs as Employment and Economic Enclaves (3Es).

- Flexibility to enable 3E units to seamlessly support businesses outside the zones.

- Development of last mile and first mile connectivity infrastructure

- Supply of power directly to units from IPPs at competitive rates

- Fast-tracking various approvals through online application process

- Integrating MSMEs with the 3Es and giving additional incentives to zones focusing on priority industries

- For services SEZs, tax benefits must be retained

The main focus of the recommendations of the SEZ committee is on migration from export focus to economic and employment growth focus, as per the report. For this to be achieved, incentives for the manufacturing SEZs have be based on specific parameters including demand, investment, employment and technology.

At present, SEZ units get 100 per cent income tax exemption on export income for first 5 years, 50 per cent for next five years and thereafter 50 per cent of the ploughed back export profit for next 5 years. However, the exemption comes with a sunset clause to be effective from April 1 2020.

SEZ developers, on the other hand, get income tax exemption for a block of 10 years in a period of 15. The sunset clause for developers is already effective from last year. SEZs are, however, subjected to a Minimum Alternate Tax of 18.5 per cent and a Dividend Distribution Tax.

WorldSteel statistics August 2018

2. India 71.2MT

3. Japan 70.2MT

4. USA 56.9MT

5. SoKo 48.3MT

India now produces more steel than all of former USSR combined, and almost as much as all of North America (US+Canada+Mexico).

Re: Indian Economy News & Discussion - Nov 27 2017

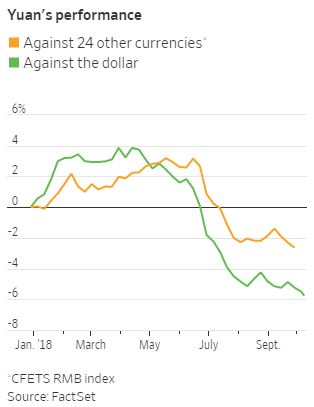

BTW, INR is not only one facing headwind. This is more or less accross the board in emerging markets.

Indian Economy News & Discussion - Nov 27 2017

India's debt lower than best, emerging - market economies: IMF

WASHINGTON: India's debt is lower than the best or emerging market economies in the world, a top IMF official has said as he cautioned that the global debt has reached a new record high of $182 trillion in 2017.

Vitor Gasper, International Monetary Fund (IMF) director of fiscal affairs department, said India's debt was substantially less than the global debt as percentage of world gross domestic product (GDP).

In India, private debt in 2017 was 54.5 per cent of the GDP and the general government debt was 70.4 per cent of the GDP, a total debt of about 125 per cent of the GDP, according to the latest IMF figures. In comparison, debt of China was 247 per cent of the GDP.

"So, it (India's debt) is substantially less than the global debt as percentage of world GDP," Gasper told PTI.

India's debt is below the average of advanced economies and below the average of emerging market economies, he said.

"There is a positive relation between the debt to GDP ratio and the level of GDP per capita. If you compare around the world with the best economies or emerging market economies, the level of debt in India is lower," the top IMF official said.

The IMF is very much stressing that global debt at $182 trillion in 2017 is at a new record high, he said.

Debt in advanced economies, since the global financial crisis, has increased quite substantially while the private sector has been very gradually leveraging, he added.

"If you look at emerging market economies, that includes India, you see that private debt in the last 10 years has increased quite substantially, although in the last two years, since the end of 2015, 2016 and 2017, there is a slowdown in the process of leveraging, but debt is very high and public debt is a very high as well," Gasper said.

In the last few years in India private debt has declined from almost 60 per cent to 54.5 per cent.

"So, it's very stable. So, what you do see is that emerging market economies, which is where India is, there's a very fast buildup in private debt with a slowdown in the last two years, But India is basically steady. So, India is not an emerging market economy where leveraging is progressing fast," Gasper said.

According to Gasper, in emerging market economies private debt has risen much faster than public debt.

"Take China, for example. Total debt is 247 per cent of the GDP. But the dividing line between what is public and private debt in China is blurry. This blurriness reflects the very large number of public units and corporations, the complex layers of government, and widespread sub-national off-budget borrowing," he said.

"As a result, estimates of 2017 public debt vary considerably: the official government debt figure is 37 per cent of GDP, while the data reported in the latest World Economic Outlook show it at 47 per cent of GDP, and the 'augmented' debt measure, which includes more off budget borrowing by local governments, stands at 68 per cent of GDP," he said.

As China works to compile a full general government balance sheet, this picture will come into clearer focus, he added.

Gasper said China had substantial government assets, reflecting years of high infrastructure investment.

These assets are larger than its liabilities, putting net worth — the difference between assets and liabilities — well above 100 per cent of the GDP, the highest among emerging economies, he said.

"This is a significant buffer when compared to total debts of public corporations, particularly considering that public corporations also have assets. So, while debt-related risks in China are large, there are also buffers. Moreover, the government is taking steps to contain risks by reining in off-budget borrowing and strengthening oversight, resulting in a slowdown in the build-up of debt," he said.

Cheers

WASHINGTON: India's debt is lower than the best or emerging market economies in the world, a top IMF official has said as he cautioned that the global debt has reached a new record high of $182 trillion in 2017.

Vitor Gasper, International Monetary Fund (IMF) director of fiscal affairs department, said India's debt was substantially less than the global debt as percentage of world gross domestic product (GDP).

In India, private debt in 2017 was 54.5 per cent of the GDP and the general government debt was 70.4 per cent of the GDP, a total debt of about 125 per cent of the GDP, according to the latest IMF figures. In comparison, debt of China was 247 per cent of the GDP.

"So, it (India's debt) is substantially less than the global debt as percentage of world GDP," Gasper told PTI.

India's debt is below the average of advanced economies and below the average of emerging market economies, he said.

"There is a positive relation between the debt to GDP ratio and the level of GDP per capita. If you compare around the world with the best economies or emerging market economies, the level of debt in India is lower," the top IMF official said.

The IMF is very much stressing that global debt at $182 trillion in 2017 is at a new record high, he said.

Debt in advanced economies, since the global financial crisis, has increased quite substantially while the private sector has been very gradually leveraging, he added.

"If you look at emerging market economies, that includes India, you see that private debt in the last 10 years has increased quite substantially, although in the last two years, since the end of 2015, 2016 and 2017, there is a slowdown in the process of leveraging, but debt is very high and public debt is a very high as well," Gasper said.

In the last few years in India private debt has declined from almost 60 per cent to 54.5 per cent.

"So, it's very stable. So, what you do see is that emerging market economies, which is where India is, there's a very fast buildup in private debt with a slowdown in the last two years, But India is basically steady. So, India is not an emerging market economy where leveraging is progressing fast," Gasper said.

According to Gasper, in emerging market economies private debt has risen much faster than public debt.

"Take China, for example. Total debt is 247 per cent of the GDP. But the dividing line between what is public and private debt in China is blurry. This blurriness reflects the very large number of public units and corporations, the complex layers of government, and widespread sub-national off-budget borrowing," he said.

"As a result, estimates of 2017 public debt vary considerably: the official government debt figure is 37 per cent of GDP, while the data reported in the latest World Economic Outlook show it at 47 per cent of GDP, and the 'augmented' debt measure, which includes more off budget borrowing by local governments, stands at 68 per cent of GDP," he said.

As China works to compile a full general government balance sheet, this picture will come into clearer focus, he added.

Gasper said China had substantial government assets, reflecting years of high infrastructure investment.

These assets are larger than its liabilities, putting net worth — the difference between assets and liabilities — well above 100 per cent of the GDP, the highest among emerging economies, he said.

"This is a significant buffer when compared to total debts of public corporations, particularly considering that public corporations also have assets. So, while debt-related risks in China are large, there are also buffers. Moreover, the government is taking steps to contain risks by reining in off-budget borrowing and strengthening oversight, resulting in a slowdown in the build-up of debt," he said.

Cheers

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.businesstoday.in/current/ec ... 84581.htmlIndia's draft electronics policy aims $400 billion manufacturing industry by 2025

The country's draft electronics policy released by the IT ministry on Wednesday has set an ambitious target of creating a $400 billion electronics manufacturing industry by 2025, with the mobile phone devices segment accounting for three-fourths of the production. The draft National Policy on Electronics (NPE) aims to promote domestic manufacturing in the entire value-chain of ESDM (electronic system design and manufacturing) for spur economic development.

Re: Indian Economy News & Discussion - Nov 27 2017

Good trendby Swarajya Staff - Oct 11 2018, 3:13 pm,

Honda Announces Third Plant In India: Rs 9,200 Crore Unit To Come-Up In Gujarat For Electric And Hybrid Vehicles

Honda Clarity, the company’s fully electric vehicle (Official Honda Website)

Japanese automaker Honda will be setting up its third manufacturing unit in India, Times of India has reported. The new unit will focus on electric and hybrid cars and will come up in Gujarat at a cost of Rs 9,200 crore.

https://gadgets.ndtv.com/mobiles/news/q ... ad-1928705

Qualcomm in Hyderabad (3000 cr)

Honda electric/hybrid

Xiaomi, Foxconn open phone factory in Andhra Pradesh - Technology .

https://www.indiatoday.in/technology/ne ... 2015-08-10

-

Raveen

- BRFite

- Posts: 841

- Joined: 18 Jun 2008 00:51

- Location: 1/2 way between the gutter and the stars

- Contact:

Re: Indian Economy News & Discussion - Nov 27 2017

{Deleted. Please see the moderation note above about not feeding trolls.}

Re: Indian Economy News & Discussion - Nov 27 2017

Industrial Production growth YoY Aug 4.3%

Manufacturing Production growth YoY Aug 4.6%

tradingeconomics.com, or e.g.,

https://www.business-standard.com/artic ... 871_1.html

Manufacturing Production growth YoY Aug 4.6%

tradingeconomics.com, or e.g.,

https://www.business-standard.com/artic ... 871_1.html

Re: Indian Economy News & Discussion - Nov 27 2017

Posting here for now. Will move elsewhere or delete if posters cannot stay on topic:

US makes last-ditch effort in urging India to go easy on data localisation

US makes last-ditch effort in urging India to go easy on data localisation

Two US senators have called on Prime Minister Narendra Modi to soften India’s stance on data localisation, warning that measures requiring it represent “key trade barriers” between the two nations.

In a letter sent to Modi on Friday and seen by Reuters, US Senators John Cornyn and Mark Warner — co-chairs of the Senate’s India caucus that comprises over 30 senators — urged India to instead adopt a “light-touch” regulatory framework that would allow data to flow freely across borders.

Global payments companies including Mastercard, Visa and American Express have been lobbying the finance ministry and the Reserve Bank of India (RBI) to relax proposed rules that require all payment data on domestic transactions in India be stored inside the country by October 15.

The letter is most likely a last-ditch effort after the RBI told officials at top payment firms this week that the central bank would implement, in full, its data localisation directive without extending the deadline, or allowing data to be stored both offshore as well as locally — a practice known as data mirroring.

Re: Indian Economy News & Discussion - Nov 27 2017

Meantime fkart is jumping up and down in glee at selling 1 million made in china phones in 30 mins under big billion make china great day

Time to firce these dalals like paytm snd fkart and amzn to support make in india with higher taxes

Time to firce these dalals like paytm snd fkart and amzn to support make in india with higher taxes