Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Data request: Where can I find data on the rate of increase in available workforce and rate of change in productivity in India?

Re: Indian Economy News & Discussion - Nov 27 2017

Index of Industrial Production - IIP - 2011-12 series, with 2011-12 normalized to 100 at the monthly level, last 13 months:

Notes:

Feb 2019 is a quick estimate.

Jan 2019 has undergone first revision.

Nov 2018 has undergone final revision.

Quick estimate of March 2019 will be available May 10, 2019.

Source: mospi.gov.in (Ministry of Statistics and Program Implementation).

Code: Select all

2018 Feb 127.4

2018 Mar 140.3

2018 Apr 122.6

2018 May 129.6

2018 Jun 127.7

2018 Jul 125.7

2018 Aug 128.0

2018 Sep 128.8

2018 Oct 132.8

2018 Nov 126.1

2018 Dec 134.0

2019 Jan 134.2

2019 Feb 127.5

Feb 2019 is a quick estimate.

Jan 2019 has undergone first revision.

Nov 2018 has undergone final revision.

Quick estimate of March 2019 will be available May 10, 2019.

Source: mospi.gov.in (Ministry of Statistics and Program Implementation).

Re: Indian Economy News & Discussion - Nov 27 2017

The Ministry of Commerce and Industry reports a monthly index, "Index of Eight Core Industries (Base: 2011-12=100)", via press releases on the Press Information Bureau (pib.nic.in). "The Eight Core Industries comprise 40.27 per cent of the weight of items included in the Index of Industrial Production (IIP)." These are Coal, Crude Oil, Natural Gas, Refinery Products, Fertilizers, Steel, Cement, Electricity.

The index:

Note:

Data for December 2018, January 2019 and February 2019 are provisional.

Release of the index for March, 2019 will be on Tuesday, 30th April, 2019.

The index:

Code: Select all

2018 Feb 123.2

2018 Mar 138.5

2018 Apr 124.3

2018 May 131.9

2018 Jun 131.2

2018 Jul 129.2

2018 Aug 128.8

2018 Sep 127.2

2018 Oct 134.8

2018 Nov 128.3

2018 Dec 132.2

2019 Jan 134.5

2019 Feb 125.8

Data for December 2018, January 2019 and February 2019 are provisional.

Release of the index for March, 2019 will be on Tuesday, 30th April, 2019.

Re: Indian Economy News & Discussion - Nov 27 2017

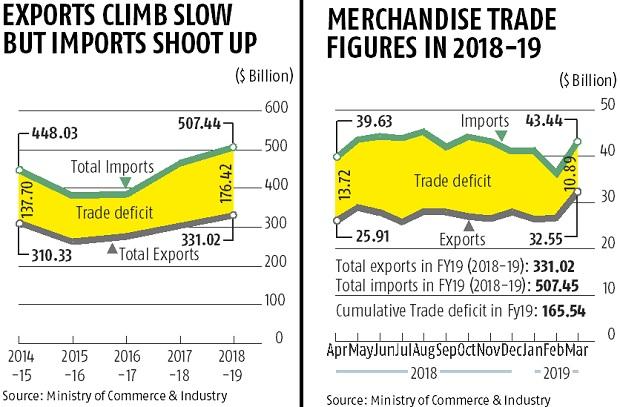

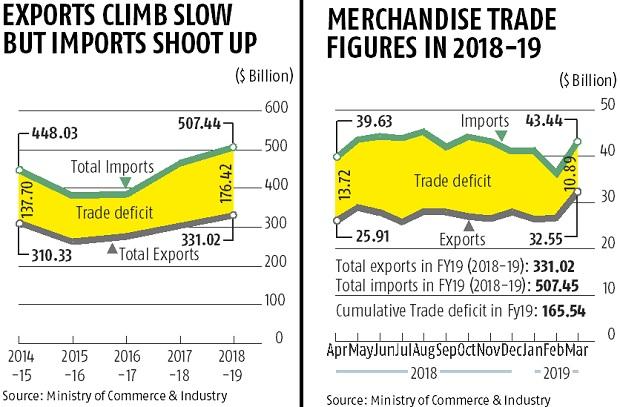

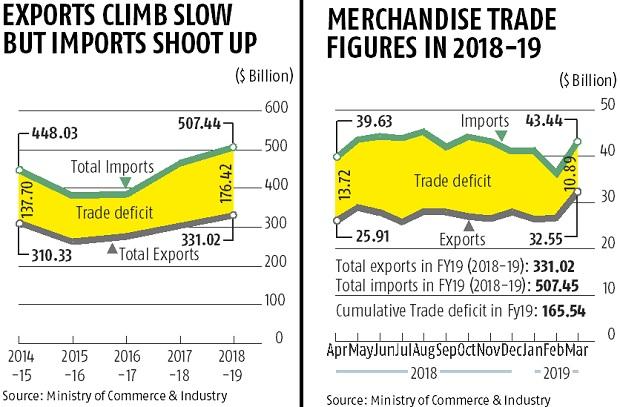

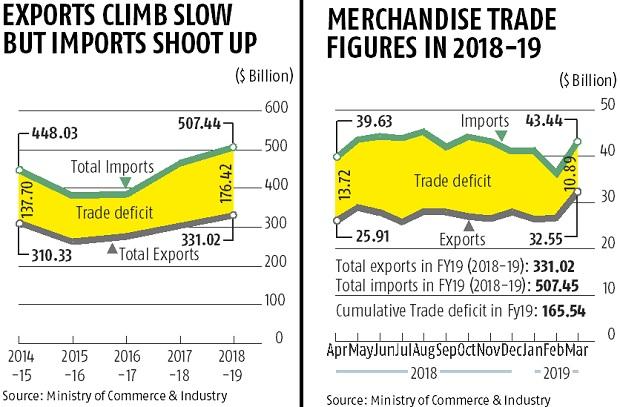

Trade data for 2018-19 is out:

Merchandise exports rise to $331 billion but deficit hits record high of $176 billion

Previous post on services trade is here

Services trade (Feb 2019)

RBI data on services trade Feb 2019

About oil and gold imports vs exports:

Merchandise exports rise to $331 billion but deficit hits record high of $176 billion

Despite exports and imports growing at the same rate of 9 per cent, India’s trade deficit reached a record high of $176 billion in 2018-19.

According to data released by the commerce and industry ministry on Monday, exports stood at $32.55 billion in March, taking the total tally in 2018-19 to $331 billion. While it is the first time that outbound trade has remained above $300 billion for two consecutive years, exports couldn't cross the government’s internal target of $350 billion. In the 2017-18 financial year, exports stood at $303.52 billion.

On the other hand, a continuous shoot up in imports, which grew at double digit levels for 6 of the last 12 months, took cumulative imports to a soaring high of $507.44 billion. This was nearly $42 billion more than India’s total bill in the preceding year.

Previous post on services trade is here

Services trade (Feb 2019)

RBI data on services trade Feb 2019

Likely services trade full year surplus will be $80-82 billion so that overall trade deficit is ~$95 billion. PIB has released their monthly trade press release for March 2019, with merchandise trade data and services trade estimates:Exports: $16.6 billion

Imports: $9.8 billion

Surplus: $6.8 billion

April 2018-Jan 2019

Exports: $186.9 billion

Imports: $115.0 billion

Surplus: $72.9 billion

About oil and gold imports vs exports:

CRUDE OIL AND NON-OIL IMPORTS:

Oil imports inMarch 2019 were USD11.75Billion (Rs. 81,609.46Crore), which was 5.55percent higher in Dollar terms (12.78percent higher in Rupee terms), compared to USD11.13Billion (Rs. 72,359.44Crore) in March 2018. Oil imports in April-March 2018-19 were USD140.47Billion (Rs. 9,83,147.76Crore) which was 29.27per cent higher in Dollar terms (40.39percent higher in Rupee terms) compared to USD108.66Billion (Rs. 7,00,320.81Crore), over the same period last year.

In this connection it is mentioned that the global Brent price ($/bbl) has decreased by 0.06% in March 2019 vis-à-vis March 2018 as per data available from World Bank (Pink Sheet).

Non-oil imports inMarch 2019 were estimated at USD31.69Billion (Rs.2,20,204.59Crore) which was at-par in Dollar terms (6.85percent higher in Rupee terms), compared to USD31.69Billion (Rs. 2,06,081.80Crore) in March 2018. Non-oil imports in April-March 2018-19 were USD366.97Billion (Rs.25,64,856.72Crore) which was 2.82per cent higher in Dollar terms (11.48percent higher in Rupee terms), compared to USD356.92Billion (Rs. 23,00,712.62Crore) in April-March2017-18.

Non-Oil and Non-Gold imports wereUSD28.42billion in March 2019, recording a negative growth of 2.67per cent, as compared to Non-Oil and Non-Gold imports in March 2018. Non-Oil and Non-Gold imports wereUSD334.15billion in April-March 2018-19, recording a positive growth of 3.37per cent, as compared to Non-Oil and Non-Gold imports in April-March 2017-18.

Re: Indian Economy News & Discussion - Nov 27 2017

Modi govt’s war on NPAs may boost India’s growth by 60 bps; Goldman Sachs explains how

Another rate cut soon? Lowest food inflation in 27 years gives RBI more headroom to support growth

States procure more than Centre on GeM portal in FY19The government’s war on non perfroming assets (NPAs) could give a boost of 60 basis points to India’s GDP in FY20, a report by global brokerage said. The measures taken by the Modi government including recovery of bad loans and bank recapitalisation will reduce costs for lenders, Goldman Sachs said. Decline in credit costs will help banks to lend more money to productive purposes, it added.

The global investment bank said that the same could be achieved through gentle trends in bad loans and the healthier NPA provisioning ratios that “proactive policies have engendered over the past two years”.

“We estimate that credit costs — how much banks set aside each year to deal with bad loans — could fall from a peak of 230 basis points of banking system assets, or around 3.3 trillion rupees ($48 billion), in FY18 to 120 basis points, or 1.9 trillion rupees, in FY20,” Bloomberg reported the brokerage as saying.

“This decline in credit costs would boost bank profitability, reduce headwinds to bank capital growth and enhance the capacity of the banking system to extend credit,” analysts led by Jonathan Sequeira, wrote.

For the first time, state governments’ procurement of commonly-used goods and services through the Government e-Marketplace (GeM) portal has exceeded that of the Centre, suggesting their increasing reliance on the platform.

According to the latest official data, purchases by various states via GeM touched Rs 9,209 crore in 2018-19 against Rs 7,947 crore by the Central government. States such as Uttar Pradesh, Maharashtra and Madhya Pradesh are among the largest buyers on the GeM platform.However, at 9.03 lakh, the number of orders placed by the Central government was higher than that of state governments (3.93 lakh) in 2018-19, suggesting that states ordered more high-value items.

Enthused by the response, GeM is now aiming to catalyse public procurement worth `50,000 crore (in terms of value of transactions) through its platform in 2019-20 against `17,325 crore in 2018-19 and `5,885 crore in the previous fiscal.The products and services available on the GeM platform are typically commonly-used ones that various Central government ministries and departments used to purchase through the erstwhile Directorate General of Supplies and Disposals (DGS&D), before the 100-year-old government procurement arm was wound up.

Another rate cut soon? Lowest food inflation in 27 years gives RBI more headroom to support growth

The Reserve Bank of India may keep its focus firmly on growth, despite a moderate rise in CPI inflation in March, as the central bank draws comfort from falling core inflation in the month and soft full-year food inflation, which fell to a 27-year low. Most experts say inflation will likely remain benign while growth uncertainties surround Indian economy.

A major factor keeping inflation in the economy benign is subdued food prices. According to recent government data, CPI food inflation during 2018-19 remained at 0.14 percent — which is the lowest since 1991. The low inflation, keeping well below target, has allowed the RBI to shift its focus to stimulate and support growth in the economy.

“CPI inflation continues to remain comfortably below the RBI’s target of 4% and thus we continue to see room for another 25 bps of rate cut in 1HFY20. We assign a higher probability of a rate cut in August as uncertainties surrounding the outcome of the election, monsoon and budget would have partly abated by then,” said a report by Kotak Economic Research.

Re: Indian Economy News & Discussion - Nov 27 2017

The graph and the statement appear contradictory. The graph plots Rs 9,209 crore against "Centre" (light blue) and Rs 7,947 crore against "States" (Dark blue). A case of mislabelling perhaps?Suraj wrote:According to the latest official data, purchases by various states via GeM touched Rs 9,209 crore in 2018-19 against Rs 7,947 crore by the Central government.

Re: Indian Economy News & Discussion - Nov 27 2017

Kiran Kumar S

@KiranKS

India’s commercial vehicle sales hit all-time high in FY2019.

● FY 2018-19 : 10,07,319 Units

● FY 2017-18 : 8,56,453 Units

● FY 2016-17 : 7,14,082 Units

● FY 2015-16 : 6,85,704 Units

● FY 2014-15 : 6,14,948 Units

● FY 2013-14 : 6,32,851 Units

Economy is doing very well!

@KiranKS

India’s commercial vehicle sales hit all-time high in FY2019.

● FY 2018-19 : 10,07,319 Units

● FY 2017-18 : 8,56,453 Units

● FY 2016-17 : 7,14,082 Units

● FY 2015-16 : 6,85,704 Units

● FY 2014-15 : 6,14,948 Units

● FY 2013-14 : 6,32,851 Units

Economy is doing very well!

Re: Indian Economy News & Discussion - Nov 27 2017

Yes, CV sales are an extremely critical barometer of the investment cycle because it indicates that businesses are investing in capacity.

Trivia: the economy last saw 800K CV sales back in 2011-12 . It took 6 full years for the activity to ramp up enough to exceed that number again in 2017-18 , and now hitting the million mark in 2018-19 .

Trivia: the economy last saw 800K CV sales back in 2011-12 . It took 6 full years for the activity to ramp up enough to exceed that number again in 2017-18 , and now hitting the million mark in 2018-19 .

Re: Indian Economy News & Discussion - Nov 27 2017

Yes the graph is wrong- they’ve swapped the figures for central and state for the most recent year while generating the graph .Kashi wrote:The graph and the statement appear contradictory. The graph plots Rs 9,209 crore against "Centre" (light blue) and Rs 7,947 crore against "States" (Dark blue). A case of mislabelling perhaps?Suraj wrote:According to the latest official data, purchases by various states via GeM touched Rs 9,209 crore in 2018-19 against Rs 7,947 crore by the Central government.

Re: Indian Economy News & Discussion - Nov 27 2017

Total Indian exports touched $540 billion in 2018-19: Suresh Prabhu.

India recorded its highest ever exports in the last fiscal accounting for $540 billion trade. This included $330 billion in terms of merchandise export and $210 billion in terms of services, noted union minister for commerce and civil aviation Minister Suresh Prabhu.

Re: Indian Economy News & Discussion - Nov 27 2017

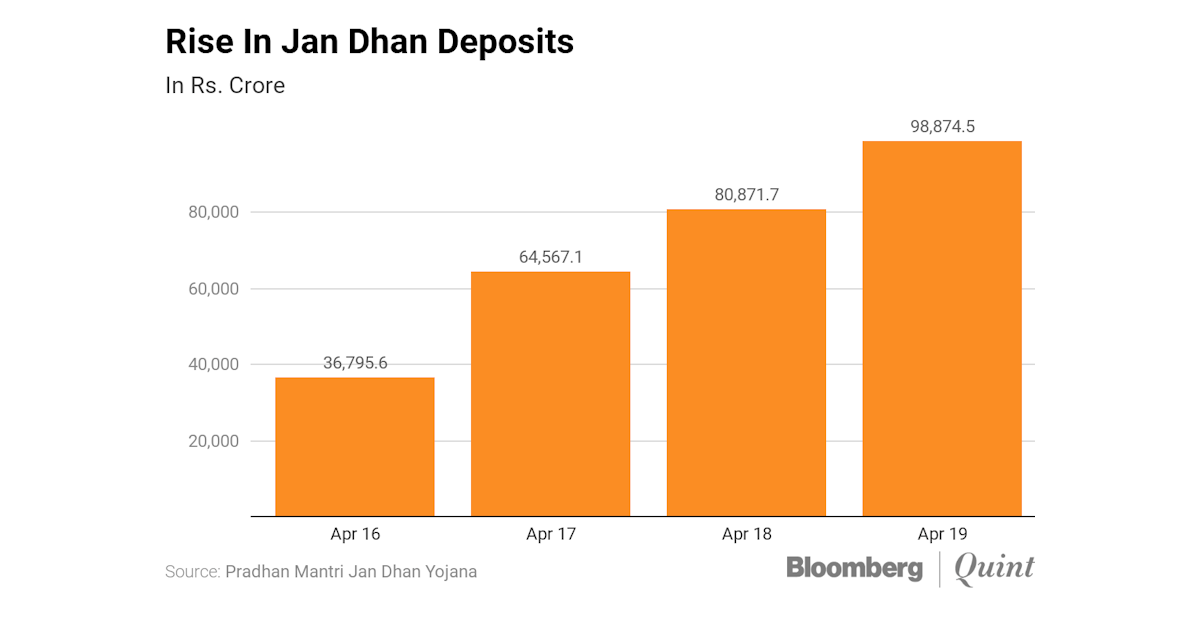

Deposits in Jan Dhan accounts to soon cross Rs 1 lakh crore mark

Finance Ministry asks CPSEs to prepare list of non-core assets, initiate talks with potential investorsThe total deposits in bank accounts opened under the Jan Dhan scheme, which was launched about five years ago by the Modi-government, are set to cross Rs 1 lakh crore soon. The total balance in the Jan Dhan accounts, which has been steadily rising, was at Rs 97,665.66 crore as on April 3, as per the latest government data. The total number of Jan Dhan accounts have crossed 35.39 crore.

The deposits stood at Rs 96,107.35 crore on March 27 and Rs 95,382.14 crore in the week before. More than 27.89 crore account holders have been issued the Rupay debit cards. The Pradhan Mantri Jan Dhan Yojana (PMJDY) was launched on August 28, 2014 with an aim to provide universal access to banking facilities to all households.

Enthused by the success of the scheme, the government enhanced the accident insurance cover to Rs 2 lakh from Rs 1 lakh for new accounts opened after August 28, 2018. The overdraft limit was also doubled to Rs 10,000. The government also shifted the focus on accounts from ‘every household’ to ‘every unbanked adult’.

Over 50 per cent of the Jan Dhan account holders are women, while nearly 59 per cent accounts are in rural and semi-urban areas. The objective of PMJDY is to ensure access to various financial services like availability of basic savings bank account, access to need based credit, remittances facility, insurance and pension to weaker sections and low income groups. The PMJDY also envisages channelling all government benefits to the beneficiary accounts and pushing the Direct Benefit Transfer (DBT) scheme of the central government.

Govt eyes REITs model for sale of PSU assets, enemy propertyThe Finance Ministry has asked CPSEs identified for strategic sale to immediately prepare a list of assets and initiate dialogue with potential investors and bidders so that their non-core assets can be monetised quickly. Such CPSEs will have an option to either hive-off non-core assets to a Special Purpose Vehicle (SPV) or transfer sale proceeds of non-core assets to an escrow account to ring-fence the realised amount from the rest of the business, an official said.

The government has already identified about 35 CPSEs for strategic sale. These include Air India, Pawan Hans, BEML, Scooters India, Bharat Pumps Compressors, and Bhadrawati, Salem and Durgapur units of steel major SAIL. The other CPSEs for which approvals are in place for outright sale include Hindustan Fluorocarbon, Hindustan Newsprint, HLL Life Care, Central Electronics, Bridge & Roof India, Nagarnar Steel plant of NMDC and units of Cement Corporation of India and ITDC.

The government has transferred Rs 29,000 crore debt of Air India, out of the total debt of Rs 55,000 crore of the airline, to AIAHL. Besides, proceeds from the sale of four subsidiaries — Air India Air Transport Services (AIATSL), Airline Allied Services (AASL), Air India Engineering Services Ltd (AIESL) and Hotel Corporation of India (HCI)– too would be transferred to AIAHL. Also, non-core assets – painting and artefacts – as well as other non-operational assets of the national carrier too will be transferred to the SPV.

The finance ministry is looking at the innovative Real Estate Investment Trusts (REITs) model for sale of land assets of CPSEs and also those which are classified as ‘enemy property’ by the government.

REITs, which are regulated by the Sebi, are instruments for investments in real estate. Under this model of securitisation, the land assets will be transferred to a trust, providing investment opportunity for institutional investors.

The finance ministry is looking at the REITs model along with other modes like leasing or outright sale of land assets for monetising non-core assets of central public sector enterprises (CPSEs) which have been identified for strategic disinvestment, an official said.

The ministry is also considering the REITs model for monetisation of immovable enemy property.

Although market regulator Sebi had notified REITs guidelines in 2014, the market for this instrument for investment in real estate is yet to pick up.

Re: Indian Economy News & Discussion - Nov 27 2017

Direct benefit transfer of subsidies crosses ₹3-lakh-cr mark in 2018-19.

Direct benefit transfer of subsidies in cash and kind crossed the ₹3-lakh crore mark in 2018-19 to 123.8 crore beneficiaries through over 351-crore transactions.Official data reveals that DBT in both cash and kind amounted to ₹3,06,260 crore last fiscal, a 60 per cent jump from ₹1,90,870.9 crore in 2017-18.

A significant chunk of the increase is due to the launch of DBT in fertiliser where ₹39,230.64 crore was transferred in 2018-19.

Similarly, DBT in cash for PAHAL or cooking gas subsidy was higher at ₹34,604.72 crore while transfer under NREGA also increased to ₹46,181.8 crore. Cash transfers for other schemes such as pensions and health benefits more than doubled to ₹56,895.79 crore, from ₹26,455.82 crore in the previous year.

As many as 440 schemes across 55 ministries have now been on-boarded to the DBT platform. These include cooking gas subsidy or PAHAL scheme, public distribution system, MGNREGA and several scholarship schemes.

Since its inception in 2013-14, ₹6,80,056 crore has been transferred to beneficiaries using DBT.

Savings under the scheme now seem to have more or less stabilised. The official data, available for the period April to February 2018-19, reveals that total savings or “gains” amounted to ₹30,456.9 crore in the period. This was about ₹33,000 crore in 2017-18. Cumulative savings through Aadhaar-enabled DBT amounted to ₹1,20,469 crore by February-end.

Officials said that data for March and final numbers for 2018-19 are still being uploaded and the data would accordingly undergo some changes, including total fund transfers and savings. Total savings under the scheme could touch about ₹35,000 crore-40,000 crore, said a person familiar with the development.

The use of Aadhaar, mobile phones and direct transfers into the beneficiaries’ bank accounts have helped the government plug leakages.

Fake connections

For instance, the data estimates that 4.09 crore duplicate, fake or non-existent, inactive LPG connections were eliminated with the use of DBT in the PAHAL scheme. In addition there are 1.94 crore non-subsidised LPG consumers, including 1.04 crore ‘Give It Up’ consumers that led to the gains.

In the case of PDS, 2.82-crore duplicate and fake or non-existent ration card were deleted.

Direct benefit transfer of subsidies in cash and kind crossed the ₹3-lakh crore mark in 2018-19 to 123.8 crore beneficiaries through over 351-crore transactions.Official data reveals that DBT in both cash and kind amounted to ₹3,06,260 crore last fiscal, a 60 per cent jump from ₹1,90,870.9 crore in 2017-18.

A significant chunk of the increase is due to the launch of DBT in fertiliser where ₹39,230.64 crore was transferred in 2018-19.

Similarly, DBT in cash for PAHAL or cooking gas subsidy was higher at ₹34,604.72 crore while transfer under NREGA also increased to ₹46,181.8 crore. Cash transfers for other schemes such as pensions and health benefits more than doubled to ₹56,895.79 crore, from ₹26,455.82 crore in the previous year.

As many as 440 schemes across 55 ministries have now been on-boarded to the DBT platform. These include cooking gas subsidy or PAHAL scheme, public distribution system, MGNREGA and several scholarship schemes.

Since its inception in 2013-14, ₹6,80,056 crore has been transferred to beneficiaries using DBT.

Savings under the scheme now seem to have more or less stabilised. The official data, available for the period April to February 2018-19, reveals that total savings or “gains” amounted to ₹30,456.9 crore in the period. This was about ₹33,000 crore in 2017-18. Cumulative savings through Aadhaar-enabled DBT amounted to ₹1,20,469 crore by February-end.

Officials said that data for March and final numbers for 2018-19 are still being uploaded and the data would accordingly undergo some changes, including total fund transfers and savings. Total savings under the scheme could touch about ₹35,000 crore-40,000 crore, said a person familiar with the development.

The use of Aadhaar, mobile phones and direct transfers into the beneficiaries’ bank accounts have helped the government plug leakages.

Fake connections

For instance, the data estimates that 4.09 crore duplicate, fake or non-existent, inactive LPG connections were eliminated with the use of DBT in the PAHAL scheme. In addition there are 1.94 crore non-subsidised LPG consumers, including 1.04 crore ‘Give It Up’ consumers that led to the gains.

In the case of PDS, 2.82-crore duplicate and fake or non-existent ration card were deleted.

Re: Indian Economy News & Discussion - Nov 27 2017

interesting data if anyone is interested. shows the GDP of states of india. at 250 billion usd tamil nadu is nearly equivalent to paki GDP

https://en.wikipedia.org/wiki/List_of_I ... ies_by_GDP

List of Indian states and union territories by GDP

Rank State/Union territory Nominal GDP

(INR, ₹) Nominal GDP

(USD, $) Data year Comparable Country

1 Maharashtra ₹27.96 lakh crore $430 billion 2018–19 est.[3]

2 Tamil Nadu ₹17.25 lakh crore $250 billion 2019–20 est.[4]

Finland

3 Karnataka ₹15.88 lakh crore $226 billion 2019–20 est.[5]

Portugal

4 Uttar Pradesh ₹15.79 lakh crore $225 billion 2019–20 est.[6]

Egypt

5 Gujarat ₹14.96 lakh crore $213 billion 2018–19 est.[7]

Egypt

6 West Bengal ₹13.14 lakh crore $187 billion 2019–20 est.[8]

Qatar

7 Andhra pradesh ₹10.49 lakh crore $150 billion 2019–20 est.[9]

Kuwait

8 Kerala ₹8.75 lakh crore $125 billion 2019–20 est.[10]

Angola

9 Telangana ₹8.42 lakh crore $120 billion 2018–19 est.[11]

Angola

10 Madhya Pradesh ₹8.26 lakh crore $118 billion 2018–19 est.[12]

Morocco

11 Haryana ₹7.84 lakh crore $112 billion 2019–20 est.[13]

Morocco

12 Delhi ₹7.80 lakh crore $110 billion 2018–19 est.[14]

Morocco

13 Rajasthan ₹7.67 lakh crore $127 billion 2016–17 [15]

Angola

14 Punjab ₹5.77 lakh crore $78 billion 2019–20 est.[16]

Ethiopia

15 Bihar ₹5.15 lakh crore $73 billion 2018–19 est.[17]

Dominican Republic

16 Odisha ₹4.43 lakh crore $70 billion 2018–19 est.[18]

Oman

17 Assam ₹3.74 lakh crore $54 billion 2019–20 est.[19]

Lebanon

18 Chhattisgarh ₹3.63 lakh crore $52 billion 2019–20 est.[20]

Macau

19 Jharkhand ₹3.45 lakh crore $50 billion 2019–20 est.[21]

Serbia

20 Uttarakhand ₹2.63 lakh crore $37 billion 2019–20 est.[22]

Sudan

21 Himachal Pradesh ₹1.69 lakh crore $24 billion 2019–20 est.[23]

Estonia

22 Jammu and Kashmir ₹1.57 lakh crore $22 billion 2018–19 est.[24]

Estonia

23 Goa ₹70,400 crore $11 billion 2016–17 est.[25]

Republic of Congo

24 Tripura ₹34,368 crore $5.2 billion 2015–16[26][27]

Fiji

25 Puducherry ₹32,215 crore $4.8 billion 2017–18[28][27]

Barbados

26 Chandigarh ₹31,823 crore $4.6 billion 2016–17 [27]

Maldives

27 Meghalaya ₹27,228 crore $4.1 billion 2016–17[27]

Swaziland

28 Sikkim ₹22,248 crore $3.3 billion 2017–18 [29][27]

Suriname

29 Nagaland ₹21,488 crore $3.2 billion 2016–17[27]

Burundi

30 Manipur ₹21,066 crore $3.2 billion 2016–17 [26][27]

Liberia

31 Arunachal Pradesh ₹20,259 crore $3.0 billion 2016–17 [27]

Andorra

32 Mizoram ₹17,613 crore $2.5 billion 2016–17 [27]

Bhutan

33 Andaman and Nicobar Islands ₹6,649 crore $1 billion 2016–17[30][27]

Gambia

—

India ₹187 lakh crore $2.65 trillion 2018 or 2017 est.[31]

France

https://en.wikipedia.org/wiki/List_of_I ... ies_by_GDP

List of Indian states and union territories by GDP

Rank State/Union territory Nominal GDP

(INR, ₹) Nominal GDP

(USD, $) Data year Comparable Country

1 Maharashtra ₹27.96 lakh crore $430 billion 2018–19 est.[3]

2 Tamil Nadu ₹17.25 lakh crore $250 billion 2019–20 est.[4]

Finland

3 Karnataka ₹15.88 lakh crore $226 billion 2019–20 est.[5]

Portugal

4 Uttar Pradesh ₹15.79 lakh crore $225 billion 2019–20 est.[6]

Egypt

5 Gujarat ₹14.96 lakh crore $213 billion 2018–19 est.[7]

Egypt

6 West Bengal ₹13.14 lakh crore $187 billion 2019–20 est.[8]

Qatar

7 Andhra pradesh ₹10.49 lakh crore $150 billion 2019–20 est.[9]

Kuwait

8 Kerala ₹8.75 lakh crore $125 billion 2019–20 est.[10]

Angola

9 Telangana ₹8.42 lakh crore $120 billion 2018–19 est.[11]

Angola

10 Madhya Pradesh ₹8.26 lakh crore $118 billion 2018–19 est.[12]

Morocco

11 Haryana ₹7.84 lakh crore $112 billion 2019–20 est.[13]

Morocco

12 Delhi ₹7.80 lakh crore $110 billion 2018–19 est.[14]

Morocco

13 Rajasthan ₹7.67 lakh crore $127 billion 2016–17 [15]

Angola

14 Punjab ₹5.77 lakh crore $78 billion 2019–20 est.[16]

Ethiopia

15 Bihar ₹5.15 lakh crore $73 billion 2018–19 est.[17]

Dominican Republic

16 Odisha ₹4.43 lakh crore $70 billion 2018–19 est.[18]

Oman

17 Assam ₹3.74 lakh crore $54 billion 2019–20 est.[19]

Lebanon

18 Chhattisgarh ₹3.63 lakh crore $52 billion 2019–20 est.[20]

Macau

19 Jharkhand ₹3.45 lakh crore $50 billion 2019–20 est.[21]

Serbia

20 Uttarakhand ₹2.63 lakh crore $37 billion 2019–20 est.[22]

Sudan

21 Himachal Pradesh ₹1.69 lakh crore $24 billion 2019–20 est.[23]

Estonia

22 Jammu and Kashmir ₹1.57 lakh crore $22 billion 2018–19 est.[24]

Estonia

23 Goa ₹70,400 crore $11 billion 2016–17 est.[25]

Republic of Congo

24 Tripura ₹34,368 crore $5.2 billion 2015–16[26][27]

Fiji

25 Puducherry ₹32,215 crore $4.8 billion 2017–18[28][27]

Barbados

26 Chandigarh ₹31,823 crore $4.6 billion 2016–17 [27]

Maldives

27 Meghalaya ₹27,228 crore $4.1 billion 2016–17[27]

Swaziland

28 Sikkim ₹22,248 crore $3.3 billion 2017–18 [29][27]

Suriname

29 Nagaland ₹21,488 crore $3.2 billion 2016–17[27]

Burundi

30 Manipur ₹21,066 crore $3.2 billion 2016–17 [26][27]

Liberia

31 Arunachal Pradesh ₹20,259 crore $3.0 billion 2016–17 [27]

Andorra

32 Mizoram ₹17,613 crore $2.5 billion 2016–17 [27]

Bhutan

33 Andaman and Nicobar Islands ₹6,649 crore $1 billion 2016–17[30][27]

Gambia

—

India ₹187 lakh crore $2.65 trillion 2018 or 2017 est.[31]

France

Re: Indian Economy News & Discussion - Nov 27 2017

TN is stagnating, expect KA to take over #2 in the coming years

Re: Indian Economy News & Discussion - Nov 27 2017

The second Rupee-Dollar Swap Auction by RBI - also of $5 billion - went very well:

RBI sets high cut-off at forex swap auction, forward rates jump

RBI sets high cut-off at forex swap auction, forward rates jump

The Reserve Bank of India on Tuesday set a cut-off at its second dollar/rupee swap auction at a much higher than expected premium, in a sign that the system is flush with dollar liquidity that banks are struggling to find buyers for.

The RBI set a premium of 8.38 rupees at the three-year buy-sell swap auction and accepted the entire planned $5 billion up on offer.

The RBI has been conducting the auctions in a bid to absorb the dollars in the system and prevent a sharp rise in the currency while also providing rupee liquidity to the banks.

The rupee which was lower through the session, recovered following the auction results to end at 69.6250 per dollar after touching a low of 69.84 earlier and slightly stronger than its previous close of 69.68.

Following the auction, the one-year onshore dollar/rupee forward premium jumped to 325.25 points, its highest level since Oct. 31, 2018.

The central bank received a total of 255 offers worth a total of $18.65 billion and it accepted only five offers worth a total $5 billion, it said in a release.

-

ArjunPandit

- BRF Oldie

- Posts: 4056

- Joined: 29 Mar 2017 06:37

Re: Indian Economy News & Discussion - Nov 27 2017

Suraj sir,

what is your opinion of this (and other) swap auction on the

1. INR exchange rates,

2. India's fx reserve rqmts,

3. INR as a currency

4. any other factors

what is your opinion of this (and other) swap auction on the

1. INR exchange rates,

2. India's fx reserve rqmts,

3. INR as a currency

4. any other factors

Re: Indian Economy News & Discussion - Nov 27 2017

Notable is the rise and rise of Karnataka..with the engine called Bangaluru firing on all cylinders. Wont be surprised if they overtake TN within a few years...TS and AP data is also interesting...an undivided AP would have been the second biggest economy?... And KL with all the commie virus infection, still manages a respectable size without any notable industries..if we never had this marxist circus, Kl would have been something else entirely...VikramA wrote: 3 Karnataka ₹15.88 lakh crore $226 billion

7 Andhra pradesh ₹10.49 lakh crore $150 billion

8 Kerala ₹8.75 lakh crore $125 billion

9 Telangana ₹8.42 lakh crore $120 billion

Re: Indian Economy News & Discussion - Nov 27 2017

Don't sir me pleaseArjunPandit wrote:Suraj sir,

what is your opinion of this (and other) swap auction on the

1. INR exchange rates,

2. India's fx reserve rqmts,

3. INR as a currency

4. any other factors

In general, these auctions seem to have at least a stabilizing, if not strengthening influence on the rupee. There's not much new in the 2nd round other than the fact that the first one was so heavily oversubscribed that the second had to be quickly organized, and from the RBI report, the 2nd round was even more heavily oversubscribed ($18B+ in offers for $5 billion, compared to $16.5 billion in the first round).

Banks flush with another Rs 35,000 crore as RBI’s second $5 billion forex swap draws success

The Reserve Bank of India (RBI) undertook the second $5 billion forex swap auction on Tuesday. The move was taken in order to improve the pace of monetary transmission and improve the liquidity in the economy. Under the foreign exchange swap, the RBI bought $5 billion from the market through auction for three years. However, it will sell the same amount back to the respective counterparties during the same month in 2022.

The decision to conduct purchase of government securities under open market operations (OMO) for an aggregate amount of Rs 125 billion on May 02, 2019 through multi-security auction using multiple price method was based on the prevailing liquidity conditions and durable liquidity needs going forward, the RBI said in a statement.

The move helped RBI attract bids worth $18.65 billion for the auction, from which, it accepted 5 offers. The bids were accepted at a premium of Rs 8.38, which is higher than Rs 7.76 in the first auction carried in March 2019. Thus, the total liquidity injected into the banking system via the swap operation amounts to be Rs 34,874 crore, RBI said.

Re: Indian Economy News & Discussion - Nov 27 2017

India sets a record foodgrains target of 291 million tonnes

The government has set an ambitious foodgrains target of 291.1 million tonnes (mt) for 2019-20, nearly 2.6 per cent more than the previous year’s 283.7 mt, as a favourable monsoon is anticipated in the current season.

While the target set for rice is 116 mt, 3 mt more than that in 2018-19, wheat production target is set at 100.5 mt, which is marginally higher than the previous year’s (July-June) 100 mt, said Agricultural Ministry sources at the National Kharif Campaign conference on Thursday.

However, as per the second advance estimates for 2018-19, rice output is projected to be 115.6 mt, while that of wheat is 99.12 mt.

Re: Indian Economy News & Discussion - Nov 27 2017

A billion Internet users to drive demand; India staring at $6 trillion consumption opportunity.

India is staring at a massive consumer demand arising from a clutch of favourable factors, with the domestic consumption opportunity alone in 2030 set to grow as big as more than twice the entire present GDP. Increased incomes, a billion diverse internet users and a very young population will drive the consumer demand in the future, increasing it tremendously by 2030, according to a World Economic Forum report.

India’s domestic consumption, which powers 60 percent of GDP today, is expected to grow into a $6 trillion opportunity by 2030, according to the World Economic Forum. Growth in income will convert the Indian economy from a bottom-of-the-pyramid economy to a middle-class led one, with consumer expenditure growing from $1.5 trillion today to nearly $6 trillion by 2030, said the WEF report on ‘Future of Consumption in Fast-Growth Consumer Markets: India’ released recently.

Here the upper-middle income and high income segments will grow from being one in four households today, to one in two households by 2030, the report said. At the same time, India will also uplift around 25 million households out of poverty and reduce the share of households below the poverty line from 15 percent today to 5 percent, the report added.

While metros and emerging boom towns would continue to drive economic growth, rural per capita consumption will rise faster than in urban areas mimicking consumption patterns of urban counterparts, it said. Further, the consumption growth will be supported by the young working age population in the country. Unlike many ageing nations in the West and East, India will remain a nation with a young population with a median age of 31, said the report.

Re: Indian Economy News & Discussion - Nov 27 2017

Increase in UPI transactions from 178 million in March'18 to 800 million in March'19 is highly commendable. Achievements like these don't just need technology, they need sound LEADERSHIP. I hope the current leadership continues for 5 more years.

UPI scores 87% transaction success rate this March

UPI scores 87% transaction success rate this March

A success rate of more than 85% for UPI is ‘commendable’ given that cards are also in the range of 90%, top executives in the payments industry said.............

UPI, which was set up in 2016, has seen exponential growth over the past year. In March, the number of UPI transactions stood at around 800 million, from 178 million in the year-ago period.........

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.business-standard.com/artic ... 810_1.html

India's March infrastructure output grows 4.7% year-on-year: Govt

The growth of eight core sectors improved marginally to 4.7 per cent in March 2019 against 4.5 per cent in the same month last year.

India's March infrastructure output grows 4.7% year-on-year: Govt

The growth of eight core sectors improved marginally to 4.7 per cent in March 2019 against 4.5 per cent in the same month last year.

Re: Indian Economy News & Discussion - Nov 27 2017

New data for March 2019, revised data for December 2018 and February 2019.

The Ministry of Commerce and Industry reports a monthly index, "Index of Eight Core Industries (Base: 2011-12=100)", via press releases on the Press Information Bureau (pib.nic.in). "The Eight Core Industries comprise 40.27 per cent of the weight of items included in the Index of Industrial Production (IIP)." These are Coal, Crude Oil, Natural Gas, Refinery Products, Fertilizers, Steel, Cement, Electricity.

The index: (note I've changed it to reverse-chronological order, so that the latest is on the top.

Notes

0. Revisions of provisional data from the previous report are shown above.

1. Data for January, 2019, February, 2019 and March, 2019 are provisional

2. Release of the index for April, 2019 will be on Friday, 31st May, 2019.

The Ministry of Commerce and Industry reports a monthly index, "Index of Eight Core Industries (Base: 2011-12=100)", via press releases on the Press Information Bureau (pib.nic.in). "The Eight Core Industries comprise 40.27 per cent of the weight of items included in the Index of Industrial Production (IIP)." These are Coal, Crude Oil, Natural Gas, Refinery Products, Fertilizers, Steel, Cement, Electricity.

The index: (note I've changed it to reverse-chronological order, so that the latest is on the top.

Code: Select all

2019 Mar 145.0

2019 Feb 125.9 (revised from 125.8)

2019 Jan 134.5

2018 Dec 131.5 (revised from 132.2)

2018 Nov 128.3

2018 Oct 134.8

2018 Sep 127.2

2018 Aug 128.8

2018 Jul 129.2

2018 Jun 131.2

2018 May 131.9

2018 Apr 124.3

2018 Mar 138.5

2018 Feb 123.2

0. Revisions of provisional data from the previous report are shown above.

1. Data for January, 2019, February, 2019 and March, 2019 are provisional

2. Release of the index for April, 2019 will be on Friday, 31st May, 2019.

Re: Indian Economy News & Discussion - Nov 27 2017

GST collection jumps to Rs 1.13 lakh crore in April, the highest since its rollout

The GST collections in April jumped to its highest level of Rs 1,13,865 crore since its roll out in 2017. While collections have been gradually increasing since August, they hit a record high last month of Rs 1.06 lakh crore, up from Rs 97,247 crore in the previous month, on the back of high compliance and increased number of returns.

The total gross GST revenue collected in the month of April, 2019, is Rs 1,13,865 crore of which CGST is Rs 21,163 crore, SGST is Rs 28,801 crore, IGST is Rs 54,733 crore, the ministry of finance said in a statement.

The ministry said the total number of GSTR 3B Returns filed for the month of March up to 30th April, 2019 is 72.13 lakh. The Centre has settled Rs 20,370 crore to CGST and Rs 15,975 crore to SGST from IGST as regular settlement. Rs 12,000 crore has been settled from the balance IGST available with the Centre on provisional basis in the ratio of 50:50 between Centre and the States.

Re: Indian Economy News & Discussion - Nov 27 2017

Cement demand likely to grow 8% in FY’20: ICRA

The domestic cement demand is likely to grow by eight per cent this fiscal which may push the capacity utilisation to 71 per cent, the ICRA report said on Wednesday.

The growth in demand will be driven by a likely 18-20 million tonnes per annum (mtpa) of additional production capacity during the fiscal.

The domestic cement production rose by around 13 per cent between April 2018 and February 2019 as compared to six per cent year-on-year growth in FY18, the rating agency said.

“For FY20, we expect a demand growth of eight per cent and given the limited capacity addition, this is likely to see an improvement in the industry’s utilisation to 71 per cent in FY’20 from 65 per cent in FY18. Improved capacity utilization is likely to support the price uptick which has been seen since March 2019,” ICRA senior vice president Sabyasachi Majumdar said.

He further said around 18-20 mtpa capacity is likely to get added in FY’20.

Re: Indian Economy News & Discussion - Nov 27 2017

https://asia.nikkei.com/Business/Market ... n-in-April

India manufacturing PMI slows again in April

May 02, 2019 14:01 JST

India manufacturing PMI slows again in April

May 02, 2019 14:01 JST

TOKYO -- Growth in India's manufacturing sector slowed further to an eight-month low in April due to a softer increase in new orders, according to a survey.

The Nikkei India Manufacturing Purchasing Managers' Index, or PMI, declined from 52.6 in March to 51.8 in April, although it remained above the 50-point level separating expansion from contraction. The reading was the weakest since August 2018.

The slowdown was due to a weaker order book volumes, which the survey attributed to business activity curbed by the general election that began in April and runs through May. Some of the slowdown, however, was offset by solid export growth.

"Growth continued to soften and the fact that employment increased at the weakest pace for over a year suggests that producers are hardly gearing up for a rebound," said Pollyanna De Lima, Principal Economist at IHS Markit, which compiles the survey.

"Disruptions arising from the elections was a key theme. Also, firms seem to have adopted a wait-and-see approach on their plans until public policies become clearer upon the formation of a government."

Re: Indian Economy News & Discussion - Nov 27 2017

National Family Health Survey - 5 is getting off the ground.

http://rchiips.org/nfhs/NFHS-5sub_presentation.shtml

This will yield crucial info. about India's demographic transition, I would think.

The most recent news re: population growth is

https://www.msn.com/en-in/news/newsindi ... ar-BBVMpp9

http://rchiips.org/nfhs/NFHS-5sub_presentation.shtml

This will yield crucial info. about India's demographic transition, I would think.

The most recent news re: population growth is

https://www.msn.com/en-in/news/newsindi ... ar-BBVMpp9

India's population grew at 1.2% a year between 2010 and 2019, marginally higher than the global average of 1.1% a year in this period, but more than double China's 0.5% a year, according to the United Nations Population Fund's (UNFPA) State of the World Population 2018 report due to be released on Wednesday.

The world's population rose to 7.715 billion in 2019, up from 7.633 billion the year before, with the average life expectancy remaining 72 years.

Re: Indian Economy News & Discussion - Nov 27 2017

Well only 2x more despite China’s one child policy lasting until the beginning of 2016 isn’t such a bad thing . Would be interesting (in the PRC thread perhaps - not here) to see their annual figures before and after 2016 .

Re: Indian Economy News & Discussion - Nov 27 2017

Looked around a little more.

United Nations, Department of Economic and Social Affairs, Population Division (2017). World Population Prospects: The 2017 Revision, custom data acquired via website.

Methodology: https://esa.un.org/unpd/wpp/Publication ... dology.pdf (PDF file)

Data:

https://population.un.org/wpp/DataQuery/

India annual population growth rate estimates:

But they still use a total fertility rate which is greater than NFHS-4 (2015-2016).

NFHS-4 had 2.2; UN uses 2.44 from 2010-2015 and 2.30 from 2015-2020.

The 2017 UN projection has India reaching peak population of 1,678,568,000 in 2060.

United Nations, Department of Economic and Social Affairs, Population Division (2017). World Population Prospects: The 2017 Revision, custom data acquired via website.

Methodology: https://esa.un.org/unpd/wpp/Publication ... dology.pdf (PDF file)

Data:

https://population.un.org/wpp/DataQuery/

India annual population growth rate estimates:

Code: Select all

2000 - 2005 : 1.66%

2005 - 2010 : 1.46

2010 - 2015 : 1.23

2015 - 2020 : 1.10

2020 - 2025 : 0.97

2025 - 2030 : 0.82

2030 - 2035 : 0.67

2035 - 2040 : 0.52

2040 - 2045 : 0.38

2045 - 2050 : 0.27

NFHS-4 had 2.2; UN uses 2.44 from 2010-2015 and 2.30 from 2015-2020.

The 2017 UN projection has India reaching peak population of 1,678,568,000 in 2060.

Re: Indian Economy News & Discussion - Nov 27 2017

Yes, our population estimates are quite likely excessive because of the enormous drop in TFR within the past decade. Nationwide we're probably already at or close to replacement (2.1 TFR).

Re: Indian Economy News & Discussion - Nov 27 2017

Dollar swap auction boosts forex kitty by $4.7 billion to $418.5 billion.

The country's foreign exchange reserves soared by $4.368 billion to $418.515 billion in the week to April 26, helped by the second dollar-rupee swap auction, Reserve Bank of India (RBI) data showed on Friday.

In the swap auction conducted on 23 April, the Reserve Bank had received bids worth $18.65 billion against $5 billion on offer. It accepted just five bids worth $5 billion.

In the previous week, the forex reserves had declined by $739.2 million to $414.147 billion.

In the reporting week, foreign currency assets, which are a major component of the overall reserves, rose by $4.387 billion to $390.421 billion.

Expressed in the US dollar terms, foreign currency assets include the effect of appreciation/depreciation of non-US currencies like the euro, pound and yen held in the reserves.

The forex kitty had touched a life-time high of $426.028 billion in the week to 13 April, 2018.

Gold reserves remained unchanged at $23.303 billion, according to the data.

The country's foreign exchange reserves soared by $4.368 billion to $418.515 billion in the week to April 26, helped by the second dollar-rupee swap auction, Reserve Bank of India (RBI) data showed on Friday.

In the swap auction conducted on 23 April, the Reserve Bank had received bids worth $18.65 billion against $5 billion on offer. It accepted just five bids worth $5 billion.

In the previous week, the forex reserves had declined by $739.2 million to $414.147 billion.

In the reporting week, foreign currency assets, which are a major component of the overall reserves, rose by $4.387 billion to $390.421 billion.

Expressed in the US dollar terms, foreign currency assets include the effect of appreciation/depreciation of non-US currencies like the euro, pound and yen held in the reserves.

The forex kitty had touched a life-time high of $426.028 billion in the week to 13 April, 2018.

Gold reserves remained unchanged at $23.303 billion, according to the data.

Re: Indian Economy News & Discussion - Nov 27 2017

It is below 2 for Middle Class in General. This will lead to a undesirable skew in our population, it is not welcome news.Suraj wrote:Yes, our population estimates are quite likely excessive because of the enormous drop in TFR within the past decade. Nationwide we're probably already at or close to replacement (2.1 TFR).

Re: Indian Economy News & Discussion - Nov 27 2017

A trip back in time to see how global extreme poverty has evolved. Most of us remember the comments in the early 2000s as to how India still had more poor than sub-Saharan Africa. Fast forward to 2019, and the Indian subcontinent is approaching about as many poor as east Asia and the Pacific.

Re: Indian Economy News & Discussion - Nov 27 2017

data is the next oil.

these guys seem to be hell bent on making up a set of convenient rules for themselves and game the system

Will Use E-Commerce For Our Benefit, Won’t Allow Its Value To Be Appropriated By Others: India Warns US, EU

these guys seem to be hell bent on making up a set of convenient rules for themselves and game the system

Will Use E-Commerce For Our Benefit, Won’t Allow Its Value To Be Appropriated By Others: India Warns US, EU

Will Use E-Commerce For Our Benefit, Won’t Allow Its Value To Be Appropriated By Others: India Warns US, EU

by Swarajya Staff - May 06 2019,

Will Use E-Commerce For Our Benefit, Won’t Allow Its Value To Be Appropriated By Others: India Warns US, EU

Asserting its rights to use electronic data for "for its own development rather than allow its value to be appropriated by others," India on Friday (3 May) challenged proposals put forth by the US and the EU at WTO that seek to eliminate cross-border restrictions on data transfer, reports Mint.

This is the sharpest rebuke issued by India till date on the brewing tensions at the World Trade Organisation (WTO) regarding global e-commerce regulations.

In clear terms, India has signalled its intentions to the US and the EU countries that it will not surrender its independence to formulate a national e-commerce policy to restrict cross-border electronic data movement.

Rather than being tied by one-size-fits-all global WTO rules, India is looking to preserve flexibility in policy-making so that a robust domestic e-commerce sector can be developed by imposing customs duties on electronic transmissions.

"India wants to protect domestic industry by imposing customs duties and leverage technology for creating jobs and wealth, by ensuring competition and level playing field," said India's trade envoy JS Deepak.

The ambassador added that most developing countries were "not ready for binding rules" in e-commerce.

An African envoy noted that “a large majority of countries rallied around India’s stand on the need to develop strong domestic e-commerce industries to bridge the digital trade and digital-dependency.”

Re: Indian Economy News & Discussion - Nov 27 2017

I don't think you are reading the graph correctly. To clarify, each colour band represents that geographical area; it's not based from zero but from the previous band. Subcontinent has made progress but East Asia and Pacific is tapering down to zero. Also unfortunately Subcontinent includes Pak who will be providing a constant supply of poor thanks to their breeding abilities and screwed up sense of social justice.Suraj wrote:A trip back in time to see how global extreme poverty has evolved. Most of us remember the comments in the early 2000s as to how India still had more poor than sub-Saharan Africa. Fast forward to 2019, and the Indian subcontinent is approaching about as many poor as east Asia and the Pacific.

Re: Indian Economy News & Discussion - Nov 27 2017

I am not reading it incorrectly.yensoy wrote:I don't think you are reading the graph correctly. To clarify, each colour band represents that geographical area; it's not based from zero but from the previous band. Subcontinent has made progress but East Asia and Pacific is tapering down to zero. Also unfortunately Subcontinent includes Pak who will be providing a constant supply of poor thanks to their breeding abilities and screwed up sense of social justice.

Re: Indian Economy News & Discussion - Nov 27 2017

He's right in what he wrote. He's talking about the trend. Approaching is the word he uses. Look at the right side, 2030.

Re: Indian Economy News & Discussion - Nov 27 2017

EU has GDPR, so WTH are they complaining about? It's not that GDPR doesn't apply to e-com portals, it applies to *all* EU-origin data.

Now, where the heck is that data protection bill? It needs to be passed ASAP or such nonsense will only keep increasing.

Now, where the heck is that data protection bill? It needs to be passed ASAP or such nonsense will only keep increasing.

Re: Indian Economy News & Discussion - Nov 27 2017

https://asia.nikkei.com/Business/Market ... w-in-April

India services PMI slips to 7-month low in April

India services PMI slips to 7-month low in April

TOKYO-India's service sector activity slipped to a seven-month low in April, as businesses waited for the outcome of general elections taking place this spring, a survey showed Monday.

The Nikkei India services Purchasing Managers' index, or PMI, dropped to 51.0 in April from 52.0 in March. The reading came in below the average for 2018, which was 51.6, and underscored that the sector is losing momentum.

Readings above 50 points indicate expansion, while those below 50 signal contraction.

Re: Indian Economy News & Discussion - Nov 27 2017

Deposits In Jan Dhan Accounts Inch Close To Rs 1 Lakh Crore

Deposits in ‘Jan Dhan’ accounts, intended as a first step in reducing financial exclusion across India’s population, have inched close to the Rs 1 lakh crore mark, shows data available on the website of the Pradhan Mantri Jan Dhan Yojana.

Jan Dhan accounts — a version of no-frill accounts and the basic savings accounts — were launched in August 2014 and saw a big jump in deposits following demonetisation. While it was feared that these funds would flow out, increased use of direct benefit transfers for subsidy payments have helped keep deposits high.

As on May 3, 2019, deposits in Jan Dhan accounts stood at Rs. 98,874.5 crore, spread across 35.54 crore beneficiaries. Deposits in such accounts have risen by 22 percent over the previous year, marginally lower than the 25 percent growth seen in the previous years.

Average account balance in the Jan-dhan accounts stood at Rs. 2,782 in April, 2019 compared to Rs. 838.8 at the end of the scheme’s first phase in January 2015.