Indian Economy News & Discussion - Nov 27 2017

-

Mort Walker

- BRF Oldie

- Posts: 10040

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Indian Economy News & Discussion - Nov 27 2017

Deleted

Last edited by Suraj on 21 Mar 2019 11:01, edited 2 times in total.

Reason: If it isn’t economics news ...

Reason: If it isn’t economics news ...

-

Mort Walker

- BRF Oldie

- Posts: 10040

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Indian Economy News & Discussion - Nov 27 2017

The price of oil and its import is a big driver here. More offshore oil exploration has to be explored to get oil domestically.SaiK wrote:Marc Faber is wrong. 2028 or 2038 or later, the rupee is unlikely to ever hit 100

Some of the reasons why this may not happen, include the new 4% inflation target and India's rapid growth.

https://www.moneycontrol.com/news/busin ... 01141.html

Re: Indian Economy News & Discussion - Nov 27 2017

X Posted from the Telecom Folder thread.

TRAI’s Telecom Subscription Data as on 31st Jan 2019 was released yesterday i.e. March 20th.

Total Telephone Subscribers (Million) ………. 1203.77

Overall Tele-density*(%) …………………………… 91.82

Broadband Subscribers (Million) ………………. 540.84

From TRAI here:

Clicky

TRAI’s Telecom Subscription Data as on 31st Jan 2019 was released yesterday i.e. March 20th.

Total Telephone Subscribers (Million) ………. 1203.77

Overall Tele-density*(%) …………………………… 91.82

Broadband Subscribers (Million) ………………. 540.84

From TRAI here:

Clicky

Re: Indian Economy News & Discussion - Nov 27 2017

Modi govt exceeds disinvestment target for FY19 as receipts hit Rs 85,000 crore

he government on Friday said that it has exceeded the divestment target for FY19 by Rs 5,000 crore as the receipts have touched projected Rs 85,000 crore. “As against a target of Rs 80,000 crore for disinvestment for the current year, the divestment receipts have touched Rs 85,000 crores today,” Finance Minister Arun Jaitley tweeted.

The Modi government had fixed the divestment target of Rs 90,000 crore for FY20. In FY18, the government earned Rs 1,00,056.91 crore from disinvestment against a target of Rs 72,500 crore.

.....................

Re: Indian Economy News & Discussion - Nov 27 2017

Some good news on Fiscal deficit front!Uttam wrote:Modi govt exceeds disinvestment target for FY19 as receipts hit Rs 85,000 crorehe government on Friday said that it has exceeded the divestment target for FY19 by Rs 5,000 crore as the receipts have touched projected Rs 85,000 crore. “As against a target of Rs 80,000 crore for disinvestment for the current year, the divestment receipts have touched Rs 85,000 crores today,” Finance Minister Arun Jaitley tweeted.

The Modi government had fixed the divestment target of Rs 90,000 crore for FY20. In FY18, the government earned Rs 1,00,056.91 crore from disinvestment against a target of Rs 72,500 crore.

.....................

Re: Indian Economy News & Discussion - Nov 27 2017

Quoting my earlier post data up to Dec 2018 , updating services export data for January:

Exports: $17.8 billion

Imports: $11.0 billion

Surplus: $6.8 billion

April 2018-Jan 2019

Exports: $170.3 billion

Imports: $105.2 billion

Surplus: $65.1 billion

Two more months of data for this fiscal. At an average $17 billion in exports a month, it should finish above $200 billion annual services exports for the first time.

PIB data for merchandise and overall trade:

Press Information Bureau: Foreign Trade Feb 2019

Services export data is reported with a one month lag, so PIB data reports estimated figures for February though only January services data is available.

Exports: $17.8 billion

Imports: $11.0 billion

Surplus: $6.8 billion

April 2018-Jan 2019

Exports: $170.3 billion

Imports: $105.2 billion

Surplus: $65.1 billion

Two more months of data for this fiscal. At an average $17 billion in exports a month, it should finish above $200 billion annual services exports for the first time.

PIB data for merchandise and overall trade:

Press Information Bureau: Foreign Trade Feb 2019

Services export data is reported with a one month lag, so PIB data reports estimated figures for February though only January services data is available.

Re: Indian Economy News & Discussion - Nov 27 2017

Govt extends IGST, compensation cess exemption

Capacity Report

Cold storage capacity expands, Rs 21,000 crore investment lined up by 2023Giving relief to exporters, the government has extended IGST (Integrated Goods and Service Tax) and compensation cess exemptions for goods procurement under certain export promotion schemes till March 2020.

These exemptions have been extended for exporters buying inputs domestically or importing for export purposes under export oriented unit (EOU) scheme, Export Promotion Capital Goods (EPCG) scheme and advance authorisation.

EPCG is an export promotion scheme under which an exporter can import certain amount of capital goods at zero duty for upgrading technology related with exports.

On the other hand, advance authorisation is issued to allow duty free import of inputs, which is physically incorporated in export product.

The move was aimed at giving relief to exporters as they do not have to pay IGST at the initial point itself. In the GST regime, they have to pay the indirect tax and then seek refund, which is a cumbersome process.

2018 GCCA Global Cold StorageIn next 4-5 years Rs 21,000 crore will be invested in setting up or upgrading cold storages to address the problem of stockpiling of perishable commodities. There has been an urgent need to upgrade existing cold storage plant and machinery, and technology. An under-developed food processing value chain is another issue that needs to be resolved.

Currently 68 per cent of the existing cold storage capacity is used for storing potato and yet farmers are not getting the right price. The situation in other commodities no better.

Crisil Research has estimated that investment of Rs 16,000-21,000 crore is being lined up in the sector between 2019 and 2023 for optimising the domestic post-harvest value chain and to feed the downstream food processing industry.

According to Crisil Research director Hetal Gandhi, fresh investment was expected from private players, while the government typically supported the sector through subsidies. For instance, the union ministry of food processing offered subsidy at 50 per cent of the project cost with a cap of Rs 10 crore.

To set up a multi-commodity cold storage of 10,000 tonnes capacity, investment of around Rs 20 crore is needed with a payback period of 6-7 years.

Undoubtedly, cold storage forms the most vital post-harvest horticultural value chain for the downstream food processing industry. The current cold storage capacity in India is pegged at 37-39 million tonnes (MT). According to official statistics, there are about 7,645 cold storages in the country with 68 per cent of the capacity being used for potato, while 30 per cent is multi-commodity cold storage.

Capacity Report

India generated record number of jobs in January 2019, shows EPFO dataIndia has reported 150 million cubic meters of refrigerated warehousing in 2018, maintaining the position

of the largest total capacity among the countries in the GCCA database. India had 7,645 cold storages in

2018, each averaging less than 20,000 cubic meters in size. Nearly all of the cold storage facilities were

owned by private sector companies and the products stored were mainly potatoes and other vegetables.

The United States, with 131 million cubic meters of refrigerated warehouse capacity, was ranked second

behind India. Refrigerated facilities in the United States averaged approximately 113,000 cubic meters

each.

China was the third-ranked country market in 2018, at 105 million cubic meters. After several years of

rapid expansion, growth in the Chinese refrigerated warehouse industry has leveled off, according to

industry sources.

Re: Indian Economy News & Discussion - Nov 27 2017

Can we exclude import of petroleum and raw energy products such as coal from merchandise imports or have they already been excluded?

Re: Indian Economy News & Discussion - Nov 27 2017

Exclude on what basis ?hgupta wrote:Can we exclude import of petroleum and raw energy products such as coal from merchandise imports or have they already been excluded?

Re: Indian Economy News & Discussion - Nov 27 2017

Re Cold storage, don't be fooled by the fact that India is the largest in cold storage and US and China ranks behind India. China and US have honed JIT (Just in Time) warehousing to a high degree of efficiency that it lessened the need for more cold storage. A better usage of metric would be combination of cold storage with JIT warehousing and see the inflows and outflows of perishable items and the length of storage and compare each country's data. In that regards, it would show how much India needs to improve its logistics chain.

Re: Indian Economy News & Discussion - Nov 27 2017

Basis of manufactured goods and the fact that India's economy is not merely providing raw materials but manufactured goods and India is not a large oil producing nation. If we can see that India is exporting more manufactured goods than importing, it shows that India's economy is becoming well diversified and technology advanced enough to meet at least over 80% of its manufactured good needs. Exclusion of the petroleum and coal raw materials allow us to see that.Suraj wrote:Exclude on what basis ?hgupta wrote:Can we exclude import of petroleum and raw energy products such as coal from merchandise imports or have they already been excluded?

Re: Indian Economy News & Discussion - Nov 27 2017

There's nothing to 'be fooled by' in cold storage statistics. It's a piece of data, that is all. JIT requires greater and more expensive logistics infrastructure, and does not necessarily indicate a better system. The US also extensively obtains produce that is prior to full ripeness and artificially enhances ripeness prior to end customer stocking, and otherwise processes foods to an extent far beyond what happens in India .

Re: Indian Economy News & Discussion - Nov 27 2017

Why would monthly PIB data need to do that ? They just report topline data. Sounds like an exercise for someone interested in finding these out - go ahead and find out yourself.hgupta wrote:Basis of manufactured goods and the fact that India's economy is not merely providing raw materials but manufactured goods and India is not a large oil producing nation. If we can see that India is exporting more manufactured goods than importing, it shows that India's economy is becoming well diversified and technology advanced enough to meet at least over 80% of its manufactured good needs. Exclusion of the petroleum and coal raw materials allow us to see that.

Re: Indian Economy News & Discussion - Nov 27 2017

Hence my question whether the petroleum products were excluded or not. I didn't ask for the data. Just whether it was excluded or not. If they were not, I will find out out myself.Suraj wrote:Why would monthly PIB data need to do that ? They just report topline data. Sounds like an exercise for someone interested in finding these out - go ahead and find out yourself.hgupta wrote:Basis of manufactured goods and the fact that India's economy is not merely providing raw materials but manufactured goods and India is not a large oil producing nation. If we can see that India is exporting more manufactured goods than importing, it shows that India's economy is becoming well diversified and technology advanced enough to meet at least over 80% of its manufactured good needs. Exclusion of the petroleum and coal raw materials allow us to see that.

Re: Indian Economy News & Discussion - Nov 27 2017

You're asking for post-processed data excluding some components that interest you specifically. Standard trade data reports all merchandise. Why is that hard to understand ?hgupta wrote:Hence my question whether the petroleum products were excluded or not. I didn't ask for the data. Just whether it was excluded or not. If they were not, I will find out out myself.Suraj wrote: Why would monthly PIB data need to do that ? They just report topline data. Sounds like an exercise for someone interested in finding these out - go ahead and find out yourself.

Re: Indian Economy News & Discussion - Nov 27 2017

No some datasets exclude petroleum imports as they are not considered merchandise but raw materials because they skew the overall manufacturing picture of a country's economy. Hence the request for clarification.Suraj wrote:You're asking for post-processed data excluding some components that interest you specifically. Standard trade data reports all merchandise. Why is that hard to understand ?hgupta wrote:

Hence my question whether the petroleum products were excluded or not. I didn't ask for the data. Just whether it was excluded or not. If they were not, I will find out out myself.

Re: Indian Economy News & Discussion - Nov 27 2017

The data reported above is trade data and not manufacturing data.hgupta wrote:No some datasets exclude petroleum imports as they are not considered merchandise but raw materials because they skew the overall manufacturing picture of a country's economy. Hence the request for clarification.

Re: Indian Economy News & Discussion - Nov 27 2017

Yes but trade data cannot indicate strength of manufacturing prowess of a country without separating raw energy materials such as petroleum. If a country export more manufactured goods than import manufacturing goods, it indicates stronger manufacturing base. If it imports more, it indicates that its manufacturing base is underdeveloped. So it helps if we can separate the petroleum imports from the trade data and determine where India's manufacturing prowess lie. It is also useful for determining the nation's economic policies wrt securing its own energy supply. If India can reduce its petroleum imports and reduce the deficit at the same time, it means that India should focus more on reducing its need for foreign oil and develop its internal energy supply whether through natural gas fields or renewable energy sectors.

Re: Indian Economy News & Discussion - Nov 27 2017

No but relying only on one piece of data doesn't paint a overall comprehensive picture of the logistics chain. It skews the picture. As for US extensively obtaining produce that is prior to full ripeness and sell it to customers while ripe, this indicates the efficiency of its logistics chain especially the JIT component whether you like it or not. Look at the length of time it takes to load and unload produce at a port and transport it halfway through the country to its distribution centers to the end stores in the US and Europe. Compare that to China and India and you would see that India has a long way to go.Suraj wrote:There's nothing to 'be fooled by' in cold storage statistics. It's a piece of data, that is all. JIT requires greater and more expensive logistics infrastructure, and does not necessarily indicate a better system. The US also extensively obtains produce that is prior to full ripeness and artificially enhances ripeness prior to end customer stocking, and otherwise processes foods to an extent far beyond what happens in India .

Re: Indian Economy News & Discussion - Nov 27 2017

You're going off on a tangent here. My point is simple - the monthly data reported is aggregate data. It always has been . Your own topic of interest is a completely separate matter. If you need the data for it, it's up to you to parse the raw data and find out what you need .hgupta wrote:Yes but trade data cannot indicate strength of manufacturing prowess of a country without separating raw energy materials such as petroleum. If a country export more manufactured goods than import manufacturing goods, it indicates stronger manufacturing base. If it imports more, it indicates that its manufacturing base is underdeveloped. So it helps if we can separate the petroleum imports from the trade data and determine where India's manufacturing prowess lie. It is also useful for determining the nation's economic policies wrt securing its own energy supply. If India can reduce its petroleum imports and reduce the deficit at the same time, it means that India should focus more on reducing its need for foreign oil and develop its internal energy supply whether through natural gas fields or renewable energy sectors.

All you're doing here is repeating the same argument. Your argument is not in question - you're being told that the trade data is aggregate, and it's up to you to find the data within it that serves your particular interest.

Re: Indian Economy News & Discussion - Nov 27 2017

Please don't derail this thread by starting commentary with strawmen like this. You're new here, so you're offered some latitude, but any further thread derailment will result in a warning or ban.hgupta wrote:No but relying only on one piece of data.

Re: Indian Economy News & Discussion - Nov 27 2017

https://swarajyamag.com/insta/delhis-ig ... third-spotDelhi’s IGI Airport Now Twelfth Busiest Globally, As Indian Aviation Market Rises To Third Spot

Delhi’s IGI Airport Now Twelfth Busiest Globally, As Indian Aviation Market Rises To Third Spot

The preliminary world airport traffic rankings for the year 2018, prepared by the Airport Council International (ACI), have seen New Delhi’s Indira Gandhi International Airport (IGI) jump four ranks from last year to become the world’s twelfth busiest airport, reports The Economic Times.

In the latest rankings, it has overtaken major international air travel hubs such as Frankfurt, Dallas Fort Worth, Guangzhou and Istanbul’s Atatürk airports.

Moreover, the report shows that among the top 20 airports of the world, IGI has been the fastest growing in 2018, with the airport seeing 69 million domestic and international flyers in the year, up 10.2 per cent from the previous year.

Four airports which are just ahead of IGI in the rankings could have been overtaken in 2018 itself if the infrastructure expansion of the airport had not been unduly delayed, meaning that the airport could’ve already cracked the top 10.

Also, India is now the world’s third largest aviation market, and is still witnessing rapid growth.

“India became the world’s third-largest aviation market in terms of passenger throughput, behind the US and China, in 2018. India’s move towards a more liberalised aviation market and the nation’s strengthening economic fundamentals have helped it become one of the fastest-growing markets with its traffic growing rapidly in a relatively short time,” a statement from ACI said.

Re: Indian Economy News & Discussion - Nov 27 2017

I am not surprised by your reaction or your post. Going through this thread and reading all the posts has illuminated on how you have approached other people's opinions that differ from your opinions and basically turned this thread about your economic opinions and arguments and basically threaten to warn or ban anyone who dare to challenge your conventional thinking and browbeat the posters to agree to your groupthink. It is very easy to be dismissive of other opinions and call them strawman arguments or decrying derailment. Why don't you relabel this thread as Suraj's Economic Theories thread since this has what basically become.Suraj wrote:Please don't derail this thread by starting commentary with strawmen like this. You're new here, so you're offered some latitude, but any further thread derailment will result in a warning or ban.hgupta wrote:No but relying only on one piece of data.

Since you are the moderator of this forum, you will have the last word but don't ever think that you will have the last word out in the real world. I leave this thread to you. Enjoy your little pulpit.

Last edited by Rahul M on 24 Mar 2019 14:49, edited 1 time in total.

Reason: user warned. banned for a day.

Reason: user warned. banned for a day.

Re: Indian Economy News & Discussion - Nov 27 2017

I don't think Suraj can be made the scapegoat for your lack of discernment, and your general schoolboy level of argumentation. We do expect a general level of competence and expertise when it comes to posting in certain threads.

For instance:

Yes but trade data cannot indicate strength of manufacturing prowess of a country without separating raw energy materials such as petroleum. If a country export more manufactured goods than import manufacturing goods, it indicates stronger manufacturing base. If it imports more, it indicates that its manufacturing base is underdeveloped.

So a country which imports a lot of low value per unit, manufactured goods vis a vis finished items, by your standard above would not have a strong manufacturing base. This even if it makes a deliberate choice to focus on and export mostly finished complex items, while using imports for commodity products, or natural resources which are available at competitive prices due to economy of scale via other producers. And what of those countries which over leverage themselves to make "everything" but are always at risk of an economic collapse if trade barriers,hindering competition are removed?

The kind of statements you are making don't indicate any great economic understanding or expertise for this forum to tolerate you or your rants or have a moderator mollycoddle you on one of the forum's most serious threads.

For instance:

Yes but trade data cannot indicate strength of manufacturing prowess of a country without separating raw energy materials such as petroleum. If a country export more manufactured goods than import manufacturing goods, it indicates stronger manufacturing base. If it imports more, it indicates that its manufacturing base is underdeveloped.

So a country which imports a lot of low value per unit, manufactured goods vis a vis finished items, by your standard above would not have a strong manufacturing base. This even if it makes a deliberate choice to focus on and export mostly finished complex items, while using imports for commodity products, or natural resources which are available at competitive prices due to economy of scale via other producers. And what of those countries which over leverage themselves to make "everything" but are always at risk of an economic collapse if trade barriers,hindering competition are removed?

The kind of statements you are making don't indicate any great economic understanding or expertise for this forum to tolerate you or your rants or have a moderator mollycoddle you on one of the forum's most serious threads.

Re: Indian Economy News & Discussion - Nov 27 2017

hgupta, you are presenting an opinion, you have so far presented zero data to back your assertions, even after prompting by Suraj.

in stead of trying to bolster your argument with facts you are now ranting & complaining. this is unacceptable.

warning issued.

in stead of trying to bolster your argument with facts you are now ranting & complaining. this is unacceptable.

warning issued.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.business-standard.com/artic ... 623_1.html

In next 4-5 years Rs 21,000 crore will be invested in setting up or upgrading cold storages to address the problem of stockpiling of perishable commodities. There has been an urgent need to upgrade existing cold storage plant and machinery, and technology. An under-developed food processing value chain is another issue that needs to be resolved.

Currently 68 per cent of the existing cold storage capacity is used for storing potato and yet farmers are not getting the right price. The situation in other commodities no better.

Crisil Research has estimated that investment of Rs 16,000-21,000 crore is being lined up in the sector between 2019 and 2023 for optimising the domestic post-harvest value chain and to feed the downstream food processing industry.

Undoubtedly, cold storage forms the most vital post-harvest horticultural value chain for the downstream food processing industry. The current cold storage capacity in India is pegged at 37-39 million tonnes (MT). According to official statistics, there are about 7,645 cold storages in the country with 68 per cent of the capacity being used for potato, while 30 per cent is multi-commodity cold storage.

Top potato producers of Uttar Pradesh and West Bengal make up 55-60 per cent of the overall domestic cold storage capacity.

Re: Indian Economy News & Discussion - Nov 27 2017

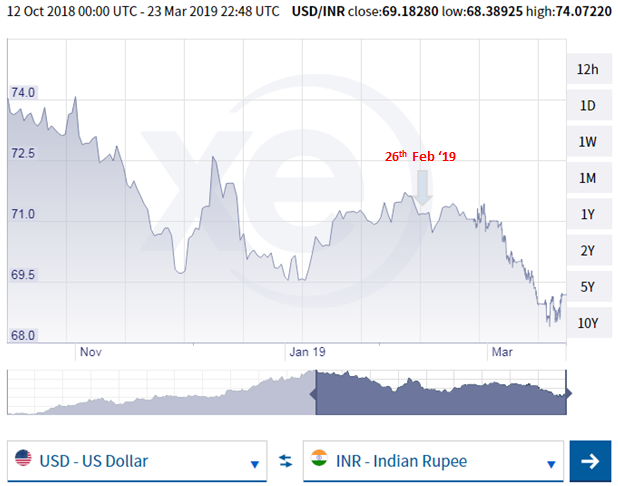

Indian Rupee has climbed to 68.38 from 74.38 (to USD). And guess what, 50% of this appreciation has come after Balakot Strikes! With close at 69.18, Indian Rupee is best performing currency in Asia over last one month

Re: Indian Economy News & Discussion - Nov 27 2017

hgupta wrote:Yes but trade data cannot indicate strength of manufacturing prowess of a country without separating raw energy materials such as petroleum. If a country export more manufactured goods than import manufacturing goods, it indicates stronger manufacturing base. If it imports more, it indicates that its manufacturing base is underdeveloped. So it helps if we can separate the petroleum imports from the trade data and determine where India's manufacturing prowess lie. It is also useful for determining the nation's economic policies wrt securing its own energy supply. If India can reduce its petroleum imports and reduce the deficit at the same time, it means that India should focus more on reducing its need for foreign oil and develop its internal energy supply whether through natural gas fields or renewable energy sectors.

Excluding petroleum imports I presume means excluding refined petroleum product exports.

But

https://www.indiatoday.in/india/story/w ... 2018-08-23

1. India is one of largest importers of crude oil but it is also one of the largest exporters of refined oil given the presence of refineries to take advantage of country's location between crude oil producing nations in the Middle East and its consumers in the rest of Asia.

2. Refined Petroleum is the among the top two exports of India. Our country is the 10th largest exporter of refined petroleum in the world. India exports refined petroleum to the USA, UK, Australia as well as oil-producing countries like Iraq and UAE. During 2017, India exported refined oil worth $24.1 billion. Its share in the world market stood at 3.9%.

Re: Indian Economy News & Discussion - Nov 27 2017

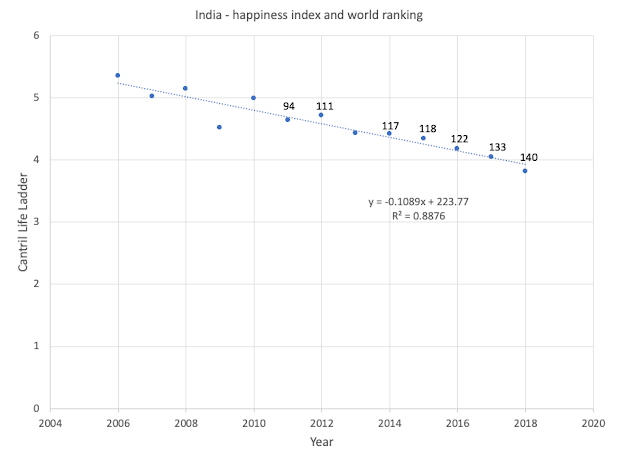

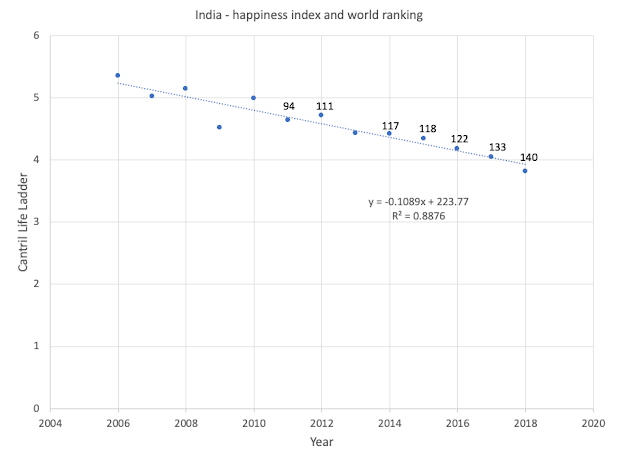

There is an outfit that publishes an annual "World Happiness Report". Its primary measure of happiness is based on a survey question, and the measure is called Cantril Life Ladder.

More into here.

https://arunsmusings.blogspot.com/2019/ ... ntent.html

Chart I made from the data:

The dots are the value of the Cantril Life Ladder; and the numbers are India's ranking in about 156 countries covered by the world happiness report.

It would seem that India's discontent has been steadily increasing. If it is not bad data, I just hope that this is a reflection of Indians' rising aspirations.“Please imagine a ladder, with steps numbered from 0 at the bottom to 10 at the top. The top of the ladder represents the best possible life for you and the bottom of the ladder represents the worst possible life for you. On which step of the ladder would you say you personally feel you stand at this time?”

More into here.

https://arunsmusings.blogspot.com/2019/ ... ntent.html

Chart I made from the data:

The dots are the value of the Cantril Life Ladder; and the numbers are India's ranking in about 156 countries covered by the world happiness report.

Re: Indian Economy News & Discussion - Nov 27 2017

The raw data tells me nothing useful about the trendline

Pretty much every metric shows an uptrend, not a downtrend. Except for two: "Social support" and "Negative affect", whatever the latter is. On the other hand, all public policy parameters are headed up - confidence in national govt, perception of corruption, democratic quality, delivery quality...

The top line number tells very little about how the figure came to be, since the individual components do not reflect any continuous regression across the board.

The affect data is explained as:

Re: WHR 2019

Code: Select all

Country name Year Life Ladder Log GDP per capita Social support Healthy life expectancy at birth Freedom to make life choices Generosity Perceptions of corruption Positive affect Negative affect Confidence in national government Democratic Quality Delivery Quality Standard deviation of ladder by country-year Standard deviation/Mean of ladder by country-year

India 2006 5.348258972 8.137375832 0.707318068 55.72000122 0.773737073 0.854811728 0.687016845 0.198601618 0.649276435 -0.313264072 -0.11933206 1.949234843 0.364461571

India 2007 5.02679348 8.21575737 0.568992674 56.13999939 0.728892624 -0.059457768 0.862142861 0.668467879 0.252502203 0.817411602 -0.348923355 -0.121813543 1.623953819 0.323059589

India 2008 5.145833015 8.239232063 0.683593154 56.56000137 0.755839646 -0.080736287 0.891188443 0.674159825 0.259315461 0.616264701 -0.322659373 -0.164945617 1.629505038 0.316664964

India 2009 4.521517754 8.306424141 0.652852058 56.97999954 0.678643644 -0.035369355 0.894611061 0.771342933 0.300621331 0.698452473 -0.44656074 -0.194334954 1.965485215 0.434695899

India 2010 4.989277363 8.390426636 0.604809761 57.40000153 0.783060372 0.047065463 0.862548053 0.696512341 0.266502023 0.667365491 -0.417356074 -0.214537695 1.941854835 0.389205635

India 2011 4.634871483 8.441580772 0.552593112 57.70000076 0.837551653 -0.049686003 0.907793522 0.648167193 0.231594488 0.580353677 -0.445488393 -0.241387933 1.788021326 0.385775805

India 2012 4.720146656 8.482096672 0.510574579 58 0.609320104 0.0552986 0.829614758 0.62873435 0.294841021 0.539206505 -0.444927812 -0.307233006 1.964058876 0.416101247

India 2013 4.427788734 8.531806946 0.552826345 58.29999924 0.740176618 0.07209941 0.832356334 0.679957747 0.330437362 0.532654881 -0.398196995 -0.304233044 2.085907936 0.471094728

India 2014 4.424379349 8.591399193 0.621466637 58.59999847 0.809382915 -0.038100276 0.832141995 0.71102351 0.284582049 0.733619034 -0.292308986 -0.286168903 2.344814062 0.529975832

India 2015 4.342079163 8.65811348 0.61013329 58.90000153 0.777225256 -0.017724538 0.776434958 0.70067668 0.321829438 0.694716752 -0.260329306 -0.175081849 2.102304459 0.48416999

India 2016 4.179177284 8.715342522 0.613529384 59.29999924 0.820068777 0.033954486 0.764722109 0.69450444 0.345681459 0.732104599 -0.256837368 -0.13516134 1.74134922 0.416672736

India 2017 4.046111107 8.768212318 0.606767476 59.70000076 0.88585043 -0.053620495 0.780802786 0.682090998 0.317936778 0.8392784 -0.22030808 -0.099256828 1.65982759 0.410227895

India 2018 3.818068743 8.830280304 0.638051987 60.09999847 0.890443385 0.071806304 0.80526334 0.65728718 0.357458085 0.753280878 2.212352753 0.579442859The top line number tells very little about how the figure came to be, since the individual components do not reflect any continuous regression across the board.

The affect data is explained as:

All the raw data seems to tell me is that people increasingly are getting richer, trust the institutions of the state more, and yet are less happy and more worried, and have less belief in social support. It seems simply related to the state of a nation rapidly growing, with no longer joint family structures supporting people, and everyone intent on getting ahead.Positive affect is defined as the average of three positive affect measures in

GWP: happiness, laugh and enjoyment in the Gallup World Poll waves 3-7.

These measures are the responses to the following three questions, respectively:

2

“Did you experience the following feelings during A LOT OF THE DAY yesterday?

How about Happiness?”, “Did you smile or laugh a lot yesterday?”,

and “Did you experience the following feelings during A LOT OF THE DAY

yesterday? How about Enjoyment?” Waves 3-7 cover years 2008 to 2012 and

a small number of countries in 2013. For waves 1-2 and those from wave 8 on,

positive affect is defined as the average of laugh and enjoyment only, due to the

limited availability of happiness.

• Negative affect is defined as the average of three negative affect measures in

GWP. They are worry, sadness and anger, respectively the responses to “Did

you experience the following feelings during A LOT OF THE DAY yesterday?

How about Worry?”, “Did you experience the following feelings during A LOT

OF THE DAY yesterday? How about Sadness?”, and “Did you experience the

following feelings during A LOT OF THE DAY yesterday? How about Anger?”

Re: WHR 2019

Re: Indian Economy News & Discussion - Nov 27 2017

The top line is simply the average of the answers to this question: “Please imagine a ladder, with steps numbered from 0 at the bottom to 10 at the top. The top of the ladder represents the best possible life for you and the bottom of the ladder represents the worst possible life for you. On which step of the ladder would you say you personally feel you stand at this time?” based on a sample size of about 1000 of people of age above 15.

By this measure even war-torn Iraqis are happier than Indians. Though it may have changed since the surveys, Venezuelans are happier. Only countries like South Sudan, Afghanistan, Rwanda are unhappier than India. All of India's neighbors are happier than Indians.

All the other measures are what the researchers have found to be (partially) useful in constructing an explanation for the top line number. Obviously those explanations fall short for Indians. Of course, one possibility is that the survey data is seriously flawed.

By this measure even war-torn Iraqis are happier than Indians. Though it may have changed since the surveys, Venezuelans are happier. Only countries like South Sudan, Afghanistan, Rwanda are unhappier than India. All of India's neighbors are happier than Indians.

All the other measures are what the researchers have found to be (partially) useful in constructing an explanation for the top line number. Obviously those explanations fall short for Indians. Of course, one possibility is that the survey data is seriously flawed.

Re: Indian Economy News & Discussion - Nov 27 2017

^Problem is measuring econometric quantitative data using psychological subjective data points.

The data should not be on "how happy are you"., the data should be on how financially free you are (what is the burden of your loan?) and how confident you are feeling about your opportunity to achieve financial freedom (based on your current earnings and number of productive years left in your career). Both are quantitative metrics.

In that sense, all of world happiness report is garbage.

is more an effect of aspirations minus achievement. If I hope (or aspire) to have a daily wage job in a war-torn country and bring home poori-bhaji daily without losing my life or limb and achieve it for next 6 months, then of course I am a very happy person. But I aspire for a 5 BHK single family home with a merc and a bmw parked and *no* loans but achieve only 3 BHK single family home with a civic and a corolla and some loan., then of course I am unhappy. In fact my happiness will be lower than the citizen of the war torn country who is simply happy to see himself/herself and his/her family alive!!How happy are you?

The data should not be on "how happy are you"., the data should be on how financially free you are (what is the burden of your loan?) and how confident you are feeling about your opportunity to achieve financial freedom (based on your current earnings and number of productive years left in your career). Both are quantitative metrics.

In that sense, all of world happiness report is garbage.

Re: Indian Economy News & Discussion - Nov 27 2017

"Average of the answers" makes no sense to me because it offers no information on relative weightage and reasons for it, how how various scales are normalized with respect to one another. A cursory examination of the various measures shows no widespread degradation. If anything it indicates the opposite.

A measure that combines a collection of quantitative measures (e.g. GDP per capita growth) with subjective opinion of society (democratic quality and delivery quality) and personal subjective mood (are you happier or more unhappier), offers very little scope for meaningful analysis.

A measure that combines a collection of quantitative measures (e.g. GDP per capita growth) with subjective opinion of society (democratic quality and delivery quality) and personal subjective mood (are you happier or more unhappier), offers very little scope for meaningful analysis.

Re: Indian Economy News & Discussion - Nov 27 2017

suraj

please to explain this for layman. thanks

https://economictimes.indiatimes.com/ma ... 586674.cms

please to explain this for layman. thanks

https://economictimes.indiatimes.com/ma ... 586674.cms

-

nandakumar

- BRFite

- Posts: 1640

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Nov 27 2017

Let me attempt it. RBI asked Indian banks to tell it (RBI) at what price they would sell dollar back to RBI in three years' time if RBI sold them a dollar today. They were asked to quote the price not in so many Rs per dollar but as so many extra rupees to the dollar's current rate (called premium in finance jargon). The current rate for this purpose is the one given by a company called Financial Benchmarks India Private Limited (FBIL) - a JV of RBI and the banking industry. That premium worked out to an annual interest rate of 4% (roughly). So an ICICI's customer in New York who wants to invest in Indian Government securities but wants to also hedge himself against exchange rate risk involved in investing in India, is asking ICICI to put in a bid for say, 100 million dollars. The bank dutifully puts in a bid telling RBI, "Here, I will give you $100 million. Take it." RBI credits ICICI with rupee equivalent of $100 million to ICICI. Using the rupee resources, it buys GSecs from SBI or if it has excess GSec holdings in its own account sells to the investor in New York. But importantly it now has or SBI (if the GSecs were by that bank) extra rupees that it can lend to home loan borrowers car buyers and boost up domestic credit and through that, the demand for all kinds of goods. The investor in New York is happy too. He can invest in Indian GSecs that would get him a return of 7.25% in rupee terms. Even if the 4% hedging cost (RBI swap deal, is basically a hedging instrument for the investor) is netted out, he is still left with 3.25% return per annum. He should be happy as the current yield on US Govt bonds with a residual maturity of 3 years is only 2.1%. Would RBI default in putting up dollars at the end of 3 years? Well technically yes. But the possibility is remote. While RBI is not US Fed, it is also not the State Bank of Pakistan! Also, RBI already sitting on a $400 plus billions in forex reserves and this %100 million will only add to the pile which in all probability stay invested in US bonds. Even if the election throws up a hotch potch of regional parties and a weakened Congress party economy can't be messed up to an extent the country faces a serious balance of payment crisis in this 3 year period. Meanwhile Indian economy gets a boost in lending capacity Rs 35,000 with a multiplier of a factor 3 or more. There is no reason to suppose that RBI would stop with the present tranche of $5 billion. They could float a few more. Anothe implication is that the increase in appetite for GSecs is that the Government wouldnt have to offer higher and higher rates of interest should the Govt incur higher public expenditure. Even if the forex inflow doesn't go into purchase of GSecs but into financing private borrowing that wouldn't hurt the economy either. Above all the swap deal has established a hedging cost of 4% per annum of forex. So banks would find it hard to charge a premium of 6% which they currently do for businesses that face a forex requirement in the future and would like to lock into a fixed rate to avoid uncertainty.

Re: Indian Economy News & Discussion - Nov 27 2017

ED

Verified account

@dir_ed

6h6 hours ago

More

Proactive steps taken by ED in timely freezing the shares of UBHL held by Vijay Mallya and requesting courts to allow sale of these shares have resulted in realization of NPA of Rs. 1008 crore by consortium of banks led by SBI on 27.03.2019.

Re: Indian Economy News & Discussion - Nov 27 2017

Nandakumar already gave a very detailed answer.Gus wrote:suraj

please to explain this for layman. thanks

https://economictimes.indiatimes.com/ma ... 586674.cms

End of March always sees a liquidity problem. That's because it's fiscal year end and companies rush to withdraw money from their bank accounts to pay their tax dues in time. There are several other times when liquidity is short, but this particular time is the most prominent.

RBI responds by adjusting the repo rate or by buying bonds, for which it offers Rupees to banks. That serves to help banks deal with the lack of liquidity from cash withdrawn (at tax time, in the above example). What the RBI's now done, is establish a new mechanism. They normally have banks deposit their dollars with RBI and get paid the spot rate. The new mechanism allows for hedging against future exchange rate risk, for a forward premium (about 4% from nandakumar's example).

This has several implications. Foreign investors can cheaply hedge against exchange rate risk. The existence of the hedge itself acts as a stabilizer to ensure continued interest in the Rupee, either for debt or equity purchases by foreigners. This means the hedge itself offers stabilizing power keeping the exchange rate stable or even offering an upward bias to strengthen the Rupee.

The amount by which the auction was oversubscribed just shows that there's enormous demand for an instrument like this. The likely medium term (2-5 year) result is that this will stabilize or strengthen the Rupee. Successive auctions will simply use a stronger exchange rate as the baseline, and potentially a lower premium as the market gets used to it. Just the fact that the RBI can offer what's a pretty low premium for a 3 year hold, and yet get oversubscribed over 3x indicates they've probably been a little conservative at estimating yield and can go lower.

Re: Indian Economy News & Discussion - Nov 27 2017

thanks nanda suraj.

I guess the govt is taking lots of steps to stabilize the rupee..the oil purchases, the currency swap and now this.

I guess the govt is taking lots of steps to stabilize the rupee..the oil purchases, the currency swap and now this.

Re: Indian Economy News & Discussion - Nov 27 2017

Since January, India's foreign exchange reserves have risen from $395 billion to $407 billion.

(https://tradingeconomics.com/india/fore ... e-reserves).

(https://tradingeconomics.com/india/fore ... e-reserves).

Re: Indian Economy News & Discussion - Nov 27 2017

https://in.reuters.com/article/india-ec ... NKCN1RD25V

India’s infrastructure output grew at 2.1 percent in February from a year earlier, government data showed on Monday.

During April-February, the output growth rate came in at 4.3 percent from the year-ago period, according to the data.

Infrastructure output, which comprises eight sectors - such as coal, crude oil and electricity - accounts for nearly 40 percent of India’s industrial output.