The Nikkei Manufacturing PMI in India increased to 51.6 in April of 2018 from 51.0 in the preceding month and beating market consensus of 51.3. Output and new orders rose at faster paces and sentiment hit its highest since the implementation of the Goods and Services Tax in July 2017. Also, buying activity grew the most since January and employment expanded marginally. On the price front, inflationary pressures continued to ease, with the softest increases for input costs and output charges reported since September 2017 and July 2017 respectively.

Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

https://tradingeconomics.com/india/manufacturing-pmi

Re: Indian Economy News & Discussion - Nov 27 2017

https://tradingeconomics.com/india/gove ... dget-value

India's fiscal deficit widened to INR 7.16 trillion in April-February 2017-18 from INR 6.06 trillion in the same period of the previous fiscal year. The budget gap was equivalent to 120.3 percent of the government’s target for the whole financial year, compared with 113.4 percent last year. Total expenditure rose 14 percent year-on-year to INR 19.99 trillion, equivalent to 90.14 percent of FY18 estimate. Revenues increased 11.9 percent year-on-year to INR 12.83 trillion or 79.09 percent of the estimate.

Re: Indian Economy News & Discussion - Nov 27 2017

There has been a massive erosion in public confidence in banks,esp. nationalised banks.No one's money is safe when banks do not offer any collateral for your's and my money deposited with them,while they ask us for collateral for loans!Moreover,it appears that a bank's liability is merely a couple of lakhs no matter how much you have deposited with them. In such a case,ordinary people would prefer to go back to the "cash" option instead of the digital route while transacting business. While the roots of the bank scams go back to earlier regimes,the failure of the RBI is astounding.The lack of any accountability of bankers at the top (protected by politicos?), is shocking,esp. in the case of the Kochars.In any other western country the top exec. would be in jail.

Nevertheless,it is incumbent upon the current regime to bite the bullet and take drastic measures to restore public confidence in the banking system,otherwise the economy will suffer a catastrophe.It is also amazing that just like the case of the late Quattrocchi ,the whereabouts of Nirav M allegedly still using his indian passport are unknown to the galaxy of intel orgs. of the country! We are now told that he may be seeking political asylum in Britain and join other scamster "refugees" like Mallya,the other Modi and other criminals.

https://www.deccanchronicle.com/opinion ... first.html

YOGI AGGARWAL

The writer is a Mumbai-based freelance journalist

Nevertheless,it is incumbent upon the current regime to bite the bullet and take drastic measures to restore public confidence in the banking system,otherwise the economy will suffer a catastrophe.It is also amazing that just like the case of the late Quattrocchi ,the whereabouts of Nirav M allegedly still using his indian passport are unknown to the galaxy of intel orgs. of the country! We are now told that he may be seeking political asylum in Britain and join other scamster "refugees" like Mallya,the other Modi and other criminals.

https://www.deccanchronicle.com/opinion ... first.html

YOGI AGGARWAL

The writer is a Mumbai-based freelance journalist

To fix mess in banking, admit the problem first

Published May 1, 2018,

The PNB fraud is particularly disturbing for the BJP because of Nirav Modi’s proximity to Prime Minister Narendra Modi and his close association with the party.

Banks reflect the health of an economy. When they prosper, all is well. But there are many things that could go wrong. Banks’ rising bad debts reflect on their balance sheets. In the old days, this led to a bank shutting down. But now they are supported by money from the government, which helps them survive but even though they survive, they put a strain on the fiscal deficit.

The recent fraud by Nirav Modi and his uncle Mehul Choksi resulted in a loss of over Rs 12,000 crores to Punjab National Bank. Further, dubious dealings in two leading private sector banks have led to huge losses, raising doubts over the roles played by their CEOs. These banks have been in a far more precarious situation because of the loans they have disbursed.

The PNB fraud is particularly disturbing for the BJP because of Nirav Modi’s proximity to Prime Minister Narendra Modi and his close association with the party. Nirav Modi was even a part of the official Indian delegation during the Prime Minister’s trip to Davos, Switzerland, to attend the World Economic Forum meeting earlier this year. This fraud put the tag of incompetence and corruption on nationalised banks, but the alleged corruption at two large and reputed private banks — ICICI Bank and Axis Bank — that followed the PNB fraud took the heat off the nationalised banks,

The problems at ICICI Bank and Axis Bank, with the diversion of depositors’ money to a favoured few, show that private sector banks are not immune from the problems of bad lending.Privatisation, without strengthening regulatory controls and improving governance, will neither prevent fraud nor curtail undue exposure to risk. We must remember that it was the reckless approach to risk-taking by large private sector banks that ultimately led to the collapse of Lehman Brothers in 2008 and exacerbated the global financial crises.

Though the actions of bank officials are crucial to keep public money safe and evaluate the loan requests (to ensure that loans can be paid back), it takes much more than this to keep the banks’ functioning smooth, and this includes the prospects of the world economy and various industries within it. Small failures do happen and they are expected too, and it is only when the failures cross a limit that the worry begins.

According to a September 2016 report by investment banker Credit Suisse, the health of corporate balance sheets in India remains poor and they barely earn enough to cover their interest payments. The report says 39 per cent of the debt is with companies not able to cover their interest payments. Among the poorly performing companies are metal and power companies, but while the situation of the metal companies has improved, the power sector still remains in the dumps. In an earlier report, Credit Suisse had maintained that the country’s 10 largest debtors owed the banks Rs 6.3 trillion (or lakh crores), which is about as large as the total fiscal deficit of the government, and this accounts for 13 per cent of all bank loans.

The difference is that while the likes of Nirav Modi used fraudulent means to rob the banks and the public, these companies were borrowing money for legitimate business purposes but were unable to honour their commitment to pay back the loans. The loans were largely taken when the economy was strong, such as during the period of high growth between 2004 and 2010. Large investments were made in power, steel and other infrastructure projects based on large bank borrowings. During the first decade after economic liberalisation (from 1991-92 to 2001-02), the bank credit-to-GDP ratio expanded from 19 per cent to about 25 per cent. In the next decade, that includes the boom period, this ratio more than doubled; from 25 per cent it reached 52 per cent.

This was the period that saw some of the highest GDP growth rates for the country. When the downturn happened, the government rushed in with a fiscal stimulus. This pushed up the fiscal deficit from four per cent of GDP in 2007-08 to 9.3 per cent in 2009-10, unleashing inflation but providing no relief to those wallowing in debt. Gross non-performing assets (NPAs) or bad debts increased to 10.2 per cent in September 2017. That was when the Reserve Bank cautioned against further deterioration, as it feared that gross NPAs could inch up to 10.8 per cent by March 2018. With bank loans forming over half the GDP, these NPAs would be about five per cent of GDP, a heavy price for the country to pay.

The sharp rise from 1.1 per cent of non-food credit in 1998 to 15.4 per cent by 2015 led to a buildup of bad loans and stranded assets. The new NDA government allowed the loans to grow, using bank funds to plug its investment deficit. It did not invest in vital infrastructure projects as part of the budget, leaving these to friends in the private sector.

So while low state investment reduced the deficit, huge amounts put in to recapitalise banks (around $19 billion to $21 billion) did the opposite, and increased the deficit.

What the government seems to be doing is trying to show that the fiscal deficit is not as bad as it may appear, and that it can be managed better by having a smaller rescue package for the banks. But all the fibbing about the state of the banking system only dodges the issue.

India has faced many banking crises. Hundreds of banks had shut down in the 1930s and 1940s. The country is now in the middle of its third banking mess in three decades, and those in charge of economic policy are avoiding taking the hard, but necessary, decisions.

If the banking system breaks down, we will have to forget about rapid growth, and the fight against poverty may have to be severely compromised.

Re: Indian Economy News & Discussion - Nov 27 2017

Firstly I agree that serious action on the bankers including people in RBI is needed. There are also serious systemic issues with Indian banks.both private and public. Both are needed to be addressed. I do not agree with many of the sweeping statements being made in the press from time to time. Most of them are rubbish by MSM.

Serious accountability pm senior people will be a good starting point.

Serious accountability pm senior people will be a good starting point.

Re: Indian Economy News & Discussion - Nov 27 2017

Suraj or any body can some one tell me why the interest rate drastically fell in 2008-2010 ? From the chart it shows barely above 4 %

https://tradingeconomics.com/india/interest-rate

Did GOI reacted to 2008 financial crises by drastically reducing interest rate to ~ 4 % from 7 % or was it some other reason ?

https://tradingeconomics.com/india/interest-rate

Did GOI reacted to 2008 financial crises by drastically reducing interest rate to ~ 4 % from 7 % or was it some other reason ?

-

nandakumar

- BRFite

- Posts: 1639

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Nov 27 2017

Austin

Checked the RBI website. The 4% interest rate that you mentioned was Reverse Repo Rate which was set at that level in January 2009. But this was also accompanied by reduction in Repo Rate. In other words the spread was maintained at 1.5%. Post the collapse of Lehmann Brothers there was decline in the rate of growth in output and moderation in prices. Also liquidity was getting tighter. The RBI opened a new 14 day term Repo as an additional accommodation for banks at 5.5%. It made sense to set reverse repo at 4%. But thats about it, I think.

Checked the RBI website. The 4% interest rate that you mentioned was Reverse Repo Rate which was set at that level in January 2009. But this was also accompanied by reduction in Repo Rate. In other words the spread was maintained at 1.5%. Post the collapse of Lehmann Brothers there was decline in the rate of growth in output and moderation in prices. Also liquidity was getting tighter. The RBI opened a new 14 day term Repo as an additional accommodation for banks at 5.5%. It made sense to set reverse repo at 4%. But thats about it, I think.

Re: Indian Economy News & Discussion - Nov 27 2017

Deccan Chronicle is a well known mouthpiece of a particular party. Trying to prove a connection between Narendra and Nirav Modi will require solid evidence, not position of a particular party. The article carefully doesn't mention under whom the banking crisis started. Philip, you have to get better articles.

Meanwhile

Data on jobs, be careful what you wish for

https://www.livemint.com/Home-Page/Nj9t ... h-for.html

Meanwhile

Data on jobs, be careful what you wish for

https://www.livemint.com/Home-Page/Nj9t ... h-for.html

Re: Indian Economy News & Discussion - Nov 27 2017

What nandakumar said, generally. I'm rather surprised you're asking this, considering you post about the topic all the time on the global economy thread...Austin wrote:Suraj or any body can some one tell me why the interest rate drastically fell in 2008-2010 ? From the chart it shows barely above 4 %

https://tradingeconomics.com/india/interest-rate

Did GOI reacted to 2008 financial crises by drastically reducing interest rate to ~ 4 % from 7 % or was it some other reason ?

Re: Indian Economy News & Discussion - Nov 27 2017

China removes tariffs on 28 drugs imported from India.

https://www.news18.com/news/business/am ... _top_pos_6

https://www.news18.com/news/business/am ... _top_pos_6

Re: Indian Economy News & Discussion - Nov 27 2017

I was checking all the long term GILT fund of that time and every LT GILT fund in 2009 dropped by an average of 10-12 % , Though I was think that could be the reason but thanks for confirming nandakumarSuraj wrote:What nandakumar said, generally. I'm rather surprised you're asking this, considering you post about the topic all the time on the global economy thread...Austin wrote:Suraj or any body can some one tell me why the interest rate drastically fell in 2008-2010 ? From the chart it shows barely above 4 %

https://tradingeconomics.com/india/interest-rate

Did GOI reacted to 2008 financial crises by drastically reducing interest rate to ~ 4 % from 7 % or was it some other reason ?

If 2008 scenario happens again then the GOI would resort to the same measure for short term that would have impact on LT GILT

Re: Indian Economy News & Discussion - Nov 27 2017

https://in.reuters.com/article/india-ec ... NKBN1I50BN

https://tradingeconomics.com/india/services-pmiThe Nikkei/IHS Markit Services Purchasing Managers’ Index rose to a three-month high at 51.4 in April from March’s 50.3, holding above the 50-mark that separates growth from contraction for a second month.

The Nikkei Services PMI in India rose to 51.4 in April of 2018 from 50.3 in the previous month. Employment increased the most since March 2011 and new orders grew at a faster pace. At the same time, outstanding business continued to increase. Despite softening from the prior month, the pace of accumulation was solid. On the price front, inflationary price pressures continued to ease further, with input and output charge inflation registering below their respective historical averages.

Re: Indian Economy News & Discussion - Nov 27 2017

Here is a news article in support of the view that Demonitization was a lot more than just capturing Black Money or removing the fake currency note. It was a lot to do with formalization of the economy.

Big winners from India's cash clampdown are private bankers

Big winners from India's cash clampdown are private bankers

Re: Indian Economy News & Discussion - Nov 27 2017

Both GST and demonetization are efforts at formalization. This isn't new, but a lot of stories about these events are deliberately obfuscated for obvious reasons. Sometimes, outright nonsensical arguments are passed off as fact, such as the time when the press ran about claiming the government 'failed with demonetization' because nearly all of the cash was indeed deposited. Well, guess what actually happened  It takes some effort to ignore the noise and focus on the facts, which is why this thread tries so hard to keep emotional political posts out entirely.

It takes some effort to ignore the noise and focus on the facts, which is why this thread tries so hard to keep emotional political posts out entirely.

Re: Indian Economy News & Discussion - Nov 27 2017

https://economictimes.indiatimes.com/ne ... 976632.cms

India's engineering exports hit an all time high of $76 billion

India's engineering exports hit an all time high of $76 billion

Engineering exports which account for over 25 per cent of the country's total merchandise exports had grown to $76.20 billion in fiscal 2017-18 against $65.23 billion in 2016-17.

"The stellar performance of the sector is mainly attributed to the metal pack even as the US remained the top market for us," EEPC India chairman Mr Ravi Sehgal said.

<snip>

Further break up of the data shows that the US was also the largest importer of Indian 'Industrial machinery' for the year under review with 25 per cent year-on-year growth, followed by UK with 44 per cent increase in shipments. Bangladesh and Germany were other key markets for Indian industrial machinery.

Re: Indian Economy News & Discussion - Nov 27 2017

BJP manifesto for Karnataka announced recently has an interesting freebie for voters- free trips to China. BJP also claims that it crowd sourced it’s manifesto so this demand came from citizens. I am certain these trips are not for pleasure or study so they must be related to economics or trade but for life of me I can’t figure out what the heck is going on here? Are these trips for small traders to go buy cheap chinese imports? Or to open markets?

Please restrict your comments to economic and business aspects only, no political commentary. Suraj pl delete it the moment posts go political

Please restrict your comments to economic and business aspects only, no political commentary. Suraj pl delete it the moment posts go political

Re: Indian Economy News & Discussion - Nov 27 2017

Why don’t you just read the news instead of posting partial hearsay and asking for details about what is a political event ? The manifesto states that they will help send 1000 farmers to Israel and China to study agricultural practices . That is all . Use the agriculture thread if you want to discuss Israeli or Chinese farming...

Re: Indian Economy News & Discussion - Nov 27 2017

Good example of why India should be judged on it's own barometers.Supratik wrote:Livemint rebuttal to The Economist.

https://www.livemint.com/Opinion/TvcFyd ... class.html

Re: Indian Economy News & Discussion - Nov 27 2017

We need to develop our own matrices, data banks and think tanks to get rid of Western lens which constantly tries to look down to India. Even without biases and prejudices there are large number of statistical matrices in Western studies which are grossly unfit for India. They almost look like a force fit.

Re: Indian Economy News & Discussion - Nov 27 2017

Ohh khoda pahad nikli chuhiya. I read two news report with one liners of free China trip (no mention of Israel in those reports or I would have guessed it) and thought this is some unique Karnataka thing that only Kannada bhasi would be able to decode. Anyhow should have done a little more digging before getting worried about something more sinister......paranoia!Suraj wrote:Why don’t you just read the news instead of posting partial hearsay and asking for details about what is a political event ? The manifesto states that they will help send 1000 farmers to Israel and China to study agricultural practices . That is all . Use the agriculture thread if you want to discuss Israeli or Chinese farming...

Re: Indian Economy News & Discussion - Nov 27 2017

It's ok  Please don't use this thread for "I read XYZ somewhere !! Is it true ??" , in general.

Please don't use this thread for "I read XYZ somewhere !! Is it true ??" , in general.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.livemint.com/Opinion/QaUbaT ... ution.html

Home » Opinion » Cafe Economics

Is India on the cusp of a fiscal revolution?

Home » Opinion » Cafe Economics

Is India on the cusp of a fiscal revolution?

Global economic history suggests that income tax collections as a per cent of GDP tend to rise sharply once average incomes cross the $2,000 threshold—from 1% of GDP to around 5% of GDP. These four extra percentage points can make a world of difference. India is on the cusp of that threshold. What has happened in China is instructive. Its income tax revenue as a per cent of GDP began to climb in the early years of this century.

Many alert readers will notice that China had a lower level of per capita income at the turn of the century than India has today. Then why was there an inflexion point in its income tax collections? Piketty has argued that one reason why India has had less success in making the income tax a mass tax could be because “the proportion of formal wage earners in the labour force is ridiculously low”.

This is a very useful backdrop to examine the ongoing debate about whether India is creating adequate jobs in formal enterprises—as well as welcome the data in the Economic Survey released earlier this week on the formalization of the Indian economy. The very possibility that India is creating more formal sector jobs than most people assume, plus the fact that average incomes are close to $2,000, provides the initial conditions for a fiscal revolution.

Re: Indian Economy News & Discussion - Nov 27 2017

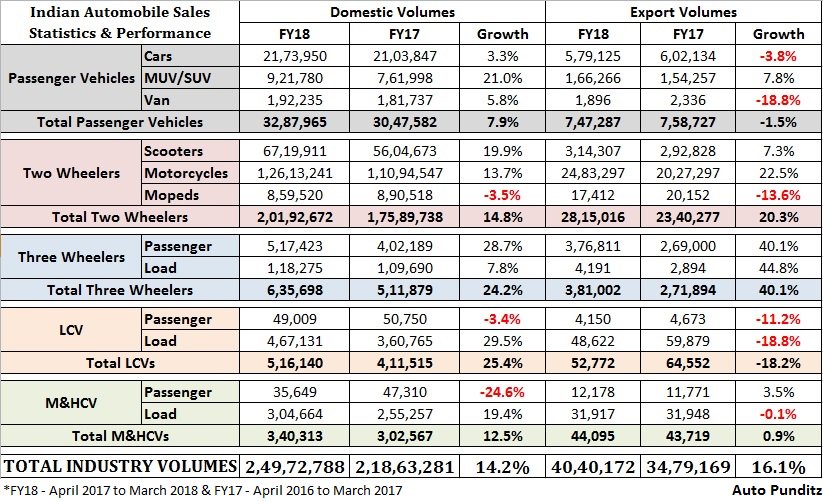

The most important figures in the above are the 20% growth in commercial M/HCVs and 30% growth in commercial LCVs .

Re: Indian Economy News & Discussion - Nov 27 2017

India's shrinking fiscal deficit. If the trend persists IMO there will be pressure on rupee to appreciate.

https://www.forbes.com/sites/salvatoreb ... ssion=true

https://www.forbes.com/sites/salvatoreb ... ssion=true

Re: Indian Economy News & Discussion - Nov 27 2017

Walmart buys majority stake in Flipkart. Sachin Bansal will make a billion from the deal.

https://timesofindia.indiatimes.com/bus ... 090452.cms

https://timesofindia.indiatimes.com/bus ... 090452.cms

Re: Indian Economy News & Discussion - Nov 27 2017

Good news and good reference, but this deficit is neither going to help nor hurt the rupee. Well, I guess it will help by allowing government to rein in inflation, but the biggest factor affecting the rupee is the trade deficit.Supratik wrote:India's shrinking fiscal deficit. If the trend persists IMO there will be pressure on rupee to appreciate.

https://www.forbes.com/sites/salvatoreb ... ssion=true

Re: Indian Economy News & Discussion - Nov 27 2017

Technically, exchange rate movements are a result of a change in underlying capital+current account situation. Just having a high trade deficit (or any other parameter) in itself doesn't impact exchange rate movement - a change in them does. The relationship is also symbiotic in that change in exchange rate changes the capital+current account situation.

Re: Indian Economy News & Discussion - Nov 27 2017

Supratik wrote:Walmart buys majority stake in Flipkart. Sachin Bansal will make a billion from the deal.

https://timesofindia.indiatimes.com/bus ... 090452.cms

A load of Made in China stuff is going to be dumped on India by Walmart.

That's their only business model - creation of large budget deficits for countries with ships arriving full and leaving empty.

Re: Indian Economy News & Discussion - Nov 27 2017

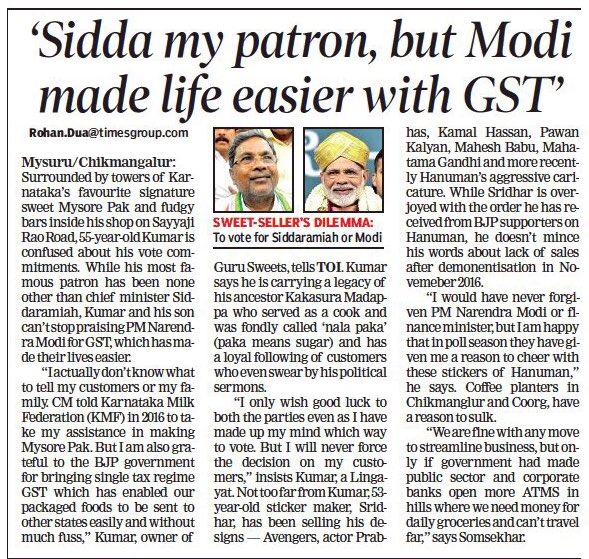

interesting perspective on GST by business folks

Re: Indian Economy News & Discussion - Nov 27 2017

Walmart India does 95% of sourcing from the country itself.Neshant wrote:Supratik wrote:Walmart buys majority stake in Flipkart. Sachin Bansal will make a billion from the deal.

https://timesofindia.indiatimes.com/bus ... 090452.cms

A load of Made in China stuff is going to be dumped on India by Walmart.

That's their only business model - creation of large budget deficits for countries with ships arriving full and leaving empty.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.cnbc.com/2018/05/07/indian- ... flows.html

The Indian rupee, which hit its lowest in 15 months against the U.S. dollar on Monday, is expected to depreciate even more, analysts said.

The weakened currency signals potential troubles that await Asia's third-largest economy amid higher oil prices and rising interest rates in the U.S., analysts said.

India's current account and fiscal deficits mean the central bank may have little room to tap into its reserves to to defend the currency.

Re: Indian Economy News & Discussion - Nov 27 2017

salaam wrote:Walmart India does 95% of sourcing from the country itself.Neshant wrote:

A load of Made in China stuff is going to be dumped on India by Walmart.

That's their only business model - creation of large budget deficits for countries with ships arriving full and leaving empty.

That is because they are forced to by the govt as a condition for operating in that sector.

On the online retailing segment however, there are few such restrictions and both Flipkart and Amazon have their own brands which are 90% dumping of Chinese goods on Indian customers.

Re: Indian Economy News & Discussion - Nov 27 2017

This is essentially a regulatory matter which can be addressed quickly by the government.

Re: Indian Economy News & Discussion - Nov 27 2017

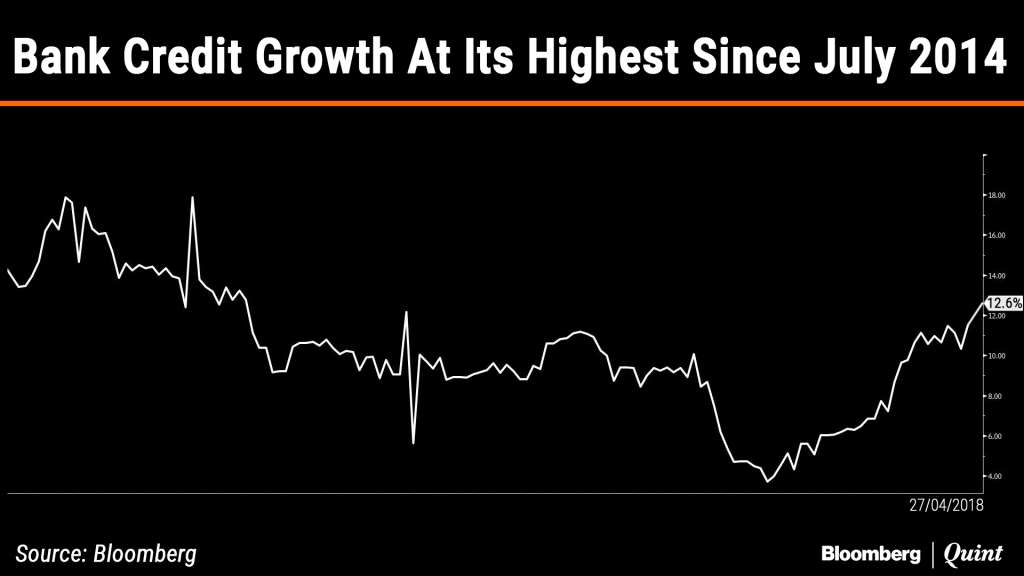

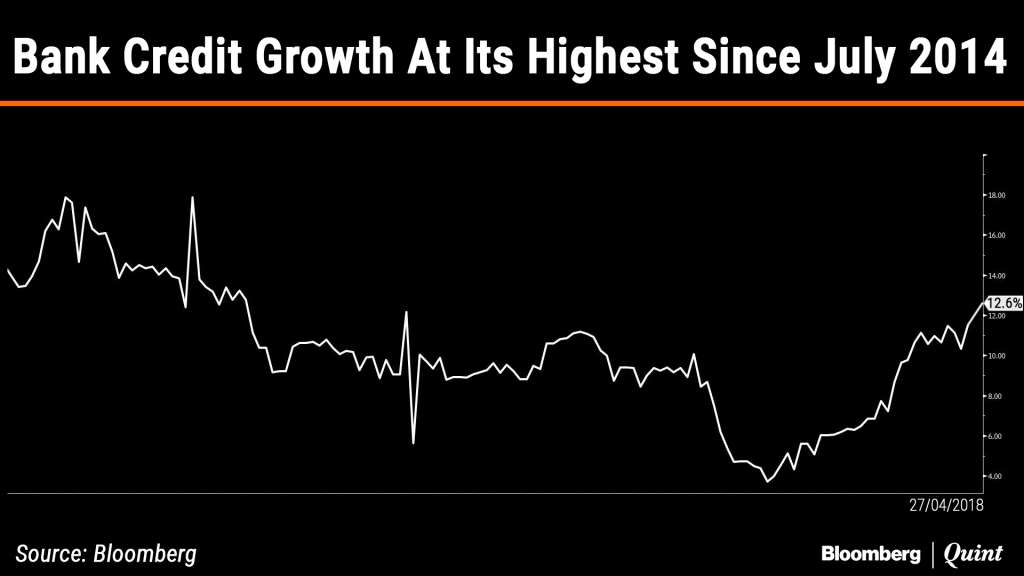

https://twitter.com/BloombergQuint/stat ... 4300697602

Bank credit growth at its highest since July 2014.

Bank credit growth at its highest since July 2014.