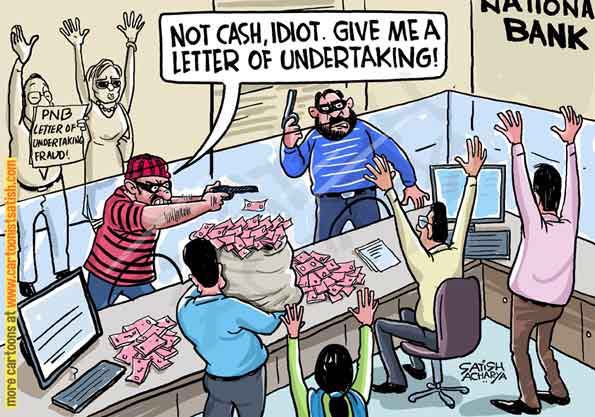

this looks like a baboo(n) inspired, specifically tailor made "loophole" of the kind that is built into any and every initiative that has money flowing in it's veins.ShauryaT wrote:^No recon between SWIFT and the internal systems? Basic reconciliation procedures should have flagged this easily.

MNREGA, "loan" waiver schemes, are notorious money bleeders, until aadhar came along and upset the politico + baboo(n)'s apple carts.

Any basic audit should have unearthed this modus operandi, unless the gang had real good "incentives" to keep silent.

Even a ordinary household, merely for balancing the checkbook, has such a reconciliation procedure and process, which may be very cursory and back of the envelope stuff but it's there.

It seems stupendously unbelievable that one piddly PSU wallah could hide a scam of this magnitude and longevity and plunge the entire industry into utter chaos, subverting multiple financial audits as well as multiple auditing companies and also the all important internal audits in which many a big boss would have had to sign off on.

what sort of a banana republic have we become?? Didn't something similar happen in the sathyam scam and scandal??

The entire phalanx of the regulatory structural edifice of financial watchdogs like the MoF, RBI, whatnot could not have missed this.

I simply do not believe it is possible without wholesale involvement of politicians as well as the IAS baboo(n)s in dilli.

BTW, great going, right under media darling and poster boy raghu ram rajan's nose.

I wonder what slick explanation he will come up with.