Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

This is not a unique issue. Public procurement automation processes almost everywhere takes several iterations to get right, because the two sides have radically different understandings of their needs. The procurer side wants standards, uniformity, and the ability to make the process as immune to allegations of bias or mismanagement of public funds. Therefore they'll always tend to initially overengineer and create a complex UI/UX thats initially probably unusable by the vendor. The vendor as a private party is not constrained by the same concerns as the public agency - they want a simple, clear process where they can easily interact with the government, receive funds in time and deal with any complexities with a minimum of bureaucracy.

Solving this depends on how well the system enables the vendor to offer feedback and how well the system responds and puts the feedback to effective use. So my question here is - does this provide for a way for vendors to offer feedback ? If so, do you get a timely response that the feedback has been received ? Do they offer updates regarding this feedback being taken up ?

In general, this government has been characterized by its ability to learn and adapt from the pitfalls it encountered in its initial efforts to implement some policy or framework. There was a time for example, when PMJDY was seen as a gimmick because many accounts had zero balances. But over time it's evolved into a critical part of a larger system. It's worth giving them every piece of useful feedback they could use to fix what is a system with promise.

Solving this depends on how well the system enables the vendor to offer feedback and how well the system responds and puts the feedback to effective use. So my question here is - does this provide for a way for vendors to offer feedback ? If so, do you get a timely response that the feedback has been received ? Do they offer updates regarding this feedback being taken up ?

In general, this government has been characterized by its ability to learn and adapt from the pitfalls it encountered in its initial efforts to implement some policy or framework. There was a time for example, when PMJDY was seen as a gimmick because many accounts had zero balances. But over time it's evolved into a critical part of a larger system. It's worth giving them every piece of useful feedback they could use to fix what is a system with promise.

Re: Indian Economy News & Discussion - Nov 27 2017

Interestingly, people are changing their opinion on the $5T goal:

HDFC chairman Deepak Parekh says $5 trillion economy goal achievable as slowdown will end soon

HDFC chairman Deepak Parekh says $5 trillion economy goal achievable as slowdown will end soon

Amitabh Kant on $5 trillion economy: Goal is achievable if this happensAs green shoots of economic revival have started to become visible, HDFC Chairman Deepak Parekh today said every economy goes through slowdown but there is no doubt that the slump is temporary and the USD 5 trillion economy target is achievable. He also urged the youngsters not to get consumed by the economic slowdown and low confidence. Stressing that India will be an important engine for the world, he said that the tide will change soon as the economic environment will and has to improve and thus one should not be disillusioned with the current difficulties. India’s growth has been continuously declining for six quarters, which has led to pessimism across all quarters of the economy.

Amid concerns over India becoming a $5 trillion economy, Amitabh Kant said that the goal is achievable even as it’s a tough task. However, the states would have to play a critical role for the national economy to meet the challenging target, NITI Aayog CEO Amitabh Kant also said at an event in Rajasthan. India would have to grow at 12.4 per cent in nominal and 8.4 per cent in real terms to do so, Amitabh Kant also said, adding that the target can be attained. The central government and states need to facilitate the ease of doing business, Kant also said since wealth is largely created by the private sector.

Re: Indian Economy News & Discussion - Nov 27 2017

India: Government Eyes Import Tariffs on $56 Billion in Goods, Report Says

The Indian government is planning to raise tariffs on around $56 billion of imports to boost its domestic industry amid slowing economic growth, Reuters reported Jan. 24

The Indian government is planning to raise tariffs on around $56 billion of imports to boost its domestic industry amid slowing economic growth, Reuters reported Jan. 24

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.livemint.com/industry/manuf ... 48058.htmltandav wrote:Rant on!

Such poor implementation of GST is causing massive issues to honest businesses. Ever since the introduction of GST I have been hoping that they will immediately implement online invoice generation. Instead there seems to be a ever widening cornocopia of forms and returns ranging from GST1 to GST9. A simple online method of raising invoice by vendors and online payment from client on that invoice such that GST is automatically escrowed out to the government kitty would have made this super simple. No filing nonsense, unless full payment is made GST is not assessed to vendor. Input credits are automatically seen, no leakage etc, if client does not pay full amount they cannot claim GST ITC.

Rant off!

Re: Indian Economy News & Discussion - Nov 27 2017

https://swarajyamag.com/economy/the-cas ... ow-be-over

The Cassandras Can Take A Break: The Growth Recession May Now Be Over

The Cassandras Can Take A Break: The Growth Recession May Now Be Over

By the time Finance Minister Nirmala Sitharaman presents her second budget on 1 February, she will have some good news to report on the bottoming out of the growth recession.

After three straight months of poor collections from the goods and services tax (GST) – below Rs 1 lakh crore in August, September and October 2019 – revenue returned to levels above Rs 1 lakh crore in November and December. And a report in the Hindustan Times suggests that in January 2020 collections could reach an all-time high of Rs 1.15 lakh crore. The previous high was in April 2019, at Rs 1.13 lakh crore.

This is an important milestone. A monthly GST collection of Rs 1.14-1.15 lakh crore is the level at which the Centre can deliver 14 per cent revenue growth to states without dipping into its own pockets. This is what they were promised when they signed on for the new tax.

The bottom was probably hit between August and October, and since November the economy has been in recovery mode. The Index of Industrial Production (IIP) numbers bear this out. After declining for three straight months in August (-1.4 per cent), September (-4.3 per cent) and October (-3.8 per cent), November saw a return to positive growth of a small 1.8 per cent. A positive growth rate in December will confirm the revival.

Some bad news may still be ahead, when the third quarter gross domestic product (GDP) numbers come out by the end of February. But this number would be a reflection of the bottom of the economic cycle in a quarter that is already over. The good news may start coming in by May, when the turnaround in the fourth quarter will start reflecting in the GDP numbers of January-March 2020.

One, we can now say that the cyclical slowdown is probably over even though several sectors (real estate, construction, banks, non-banking financial companies) are still to recover fully. The focus of policy action must be sectoral.

Two, warts and all, the drop in GST revenues for a few months last year was less about a flawed and complex rate structure than the cyclical slowdown. As growth revives, GST collections should start rising too.

Three, if the budget delivers tax reform, and spends on infrastructure are raised, we should be on track for above 7 per cent growth by the second half of 2020-21. If labour and land reforms are also done, and agriculture freed from the dead hand of government intervention, India will boom.

Four, this growth should show up somewhere in jobs data, and there is some evidence of this happening. According to the Employees Provident Fund Organisation (EPFO), during April-November 2019, the organisation’s net new subscription base went up by over 7 million.

Five, this is not the year for fiscal restraint. What the Finance Minister should be aiming for is covering as much of the increased spending and fiscal slippages through asset sales as possible. This is not the time to start a hefty fiscal correction, despite an apparent slippage in the deficit. The time for a return to the fiscal roadmap is 2021-22.

Re: Indian Economy News & Discussion - Nov 27 2017

I use it. It is PoS website. No option to keep retention money or security deposit. Setting your own delivery terms is a pain.tandav wrote:The Government of India (Government E Marketplace) is a hidden game changer. As of now it is designed to handle government procurement but nothing prevents it from becoming the premier marketplace rivalling Alibaba / Amazon etc they may make it open source and similar to BHIM (which is designed for payments) GEM can be extended for (smart contracts, B2B and B2G works). Need to involve the private sector in some way to create the platform and grease faster work-money transfers, develop better trust mechanisms.

https://gem.gov.in/

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.financialexpress.com/econom ... s/1838717/

Nirmala Sitharaman’s revival efforts bear fruit; India’s quarterly growth faster than G7, BRICS

Nirmala Sitharaman’s revival efforts bear fruit; India’s quarterly growth faster than G7, BRICS

“A series of government stimulus measures, coupled with a low-interest-rate environment, are likely to spur demand and investment in 2020 and to produce a rebound in full-year real GDP growth, to 6.1% (up from an estimated 4.9% in 2019),” said a report by the Economist Intelligence Unit. Surprisingly, among the BRICS and G7 countries, India is likely to have recorded the fastest rate of quarterly growth in the October-December quarter. India is expected to retain the top spot in the January-March quarter as well.Over the December-ending quarter, India’s real GDP growth has been estimated to have grown by 1.6 per cent on-quarter and is estimated to grow further at 1.9 per cent in the current quarter. However, it is also said that the strong headline figure was artificially boosted by the dismal performance of the Indian economy in the previous quarter amid weak consumer sentiment and tepid investment. Meanwhile, India’s year-long slowdown may not continue for long as early indicators suggest a recovery in the growth. 11 of the 16 non-financial indicators such as the output of passenger vehicles, commercial vehicles, motorcycles, CIL and refinery output, hydroelectricity generation, non-oil merchandise exports, and rail freight traffic recorded an improved on-year performance in Q3 FY2020, compared to the previous quarter. Credit Rating agency ICRA has also anticipated a pickup in the real GVA and GDP growth.

Re: Indian Economy News & Discussion - Nov 27 2017

Indian govt will have to plan for the global impact of this corona virus! Already, world's dependence on single nation like china is now exposed. So, after the trade war tensions, its good time to again help wean them away from China into India.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.financialexpress.com/econom ... l/1836647/

Year-long slowdown may not last longer; early indicators show green shoots of economic revival

By: Samrat Sharma

Published: January 27, 2020 7:00:11 PM

With robust sowing of rabi crops and optimistic expectations of increased production of horticulture crops, the agri sector is also likely to regain its lost momentum.

Year-long slowdown may not last longer; early indicators show green shoots of economic revival

By: Samrat Sharma

Published: January 27, 2020 7:00:11 PM

With robust sowing of rabi crops and optimistic expectations of increased production of horticulture crops, the agri sector is also likely to regain its lost momentum.

Re: Indian Economy News & Discussion - Nov 27 2017

I hope they sell Air India and break up / sell BSNL - easily frees up Rs 50,000 crore per yr. Any noise from trade unions will be minuscule compared to what GoI weathered against CAA/NRC.vijayk wrote:https://swarajyamag.com/economy/the-cas ... ow-be-over

The Cassandras Can Take A Break: The Growth Recession May Now Be Over

Re: Indian Economy News & Discussion - Nov 27 2017

Completely agree... it was down yesterday when I tried to login. However it is the idea which I find interesting, babucracy execution will only result in this. Turn it over to a startup to run (I volunteer for 26% equity) and things will be far far betterThakur_B wrote:I use it. It is PoS website. No option to keep retention money or security deposit. Setting your own delivery terms is a pain.tandav wrote:The Government of India (Government E Marketplace) is a hidden game changer. As of now it is designed to handle government procurement but nothing prevents it from becoming the premier marketplace rivalling Alibaba / Amazon etc they may make it open source and similar to BHIM (which is designed for payments) GEM can be extended for (smart contracts, B2B and B2G works). Need to involve the private sector in some way to create the platform and grease faster work-money transfers, develop better trust mechanisms.

https://gem.gov.in/

Re: Indian Economy News & Discussion - Nov 27 2017

The idea is excellent. Small departments get saved from endless tendering process to even purchase office supplies. Less manpower required, eliminates one of the biggest source of corruption.tandav wrote:Completely agree... it was down yesterday when I tried to login. However it is the idea which I find interesting, babucracy execution will only result in this. Turn it over to a startup to run (I volunteer for 26% equity) and things will be far far betterThakur_B wrote:

I use it. It is PoS website. No option to keep retention money or security deposit. Setting your own delivery terms is a pain.

In my personal experience, we have been able to get much better deals on better conditions through regular tendering process than GeM.

For eg: for complex equipment with proprietary components, we have made it a practice to include 5 year comprehensive maintenance along with procurement of equipment, thus we get to factor cheaper life cycle cost. With GeM, that is not possible. A lot of PSUs have been avoiding big ticket purchases such as fleets of cars through GeM for the same reason

Re: Indian Economy News & Discussion - Nov 27 2017

You represent a private company or a public company?Thakur_B wrote:The idea is excellent. Small departments get saved from endless tendering process to even purchase office supplies. Less manpower required, eliminates one of the biggest source of corruption.tandav wrote:

Completely agree... it was down yesterday when I tried to login. However it is the idea which I find interesting, babucracy execution will only result in this. Turn it over to a startup to run (I volunteer for 26% equity) and things will be far far better

In my personal experience, we have been able to get much better deals on better conditions through regular tendering process than GeM.

For eg: for complex equipment with proprietary components, we have made it a practice to include 5 year comprehensive maintenance along with procurement of equipment, thus we get to factor cheaper life cycle cost. With GeM, that is not possible. A lot of PSUs have been avoiding big ticket purchases such as fleets of cars through GeM for the same reason

Re: Indian Economy News & Discussion - Nov 27 2017

Public.tandav wrote:You represent a private company or a public company?Thakur_B wrote:

The idea is excellent. Small departments get saved from endless tendering process to even purchase office supplies. Less manpower required, eliminates one of the biggest source of corruption.

In my personal experience, we have been able to get much better deals on better conditions through regular tendering process than GeM.

For eg: for complex equipment with proprietary components, we have made it a practice to include 5 year comprehensive maintenance along with procurement of equipment, thus we get to factor cheaper life cycle cost. With GeM, that is not possible. A lot of PSUs have been avoiding big ticket purchases such as fleets of cars through GeM for the same reason

Re: Indian Economy News & Discussion - Nov 27 2017

@Thakur_B

Can you make a list of improvements required better the functioning of this portal. I will write from my own perspective

1) The login had connected my IT returns where it showed there was mismatch. I was not able to register

2) Process stopped midway

3) WHo is the owner of the Company who can assign roles within GEMS to their own staff, companies have different departments (accounts, proposals, tenders, procurement) these people change over time. Is the process of changing/adding the accounts person, procurement person, owner etc easy and simple, is there scope for mischief and if yes how easy is it to correct

4) How do vendors find the tenders they are interested in?

5) Pre qualifications criteria in Govt is where all the ghotala happens... it is an insider game

Can you make a list of improvements required better the functioning of this portal. I will write from my own perspective

1) The login had connected my IT returns where it showed there was mismatch. I was not able to register

2) Process stopped midway

3) WHo is the owner of the Company who can assign roles within GEMS to their own staff, companies have different departments (accounts, proposals, tenders, procurement) these people change over time. Is the process of changing/adding the accounts person, procurement person, owner etc easy and simple, is there scope for mischief and if yes how easy is it to correct

4) How do vendors find the tenders they are interested in?

5) Pre qualifications criteria in Govt is where all the ghotala happens... it is an insider game

Re: Indian Economy News & Discussion - Nov 27 2017

It is high time that an investigation was done to uncover the possibilities of deliberate sabotage by the contractor and/or the babus of the GSTN.

such a lackadaisical approach by infosys is unacceptable, given the time that has elapsed since the commencement of the project and the constant complaints against the workings of the GST software allegedly developed by this "reputed" company

twitter

such a lackadaisical approach by infosys is unacceptable, given the time that has elapsed since the commencement of the project and the constant complaints against the workings of the GST software allegedly developed by this "reputed" company

Finance Ministry Summons Infosys Asking Explanation For Its Inability To Resolve Technical Glitches Galore In GST System https://swarajyamag.com/insta/finance-m ... gst-system via @swarajyamag

Re: Indian Economy News & Discussion - Nov 27 2017

As a practising CA trying to file Annual returns, I have it will these high Infosys- too many problems with the GST portal, I guess GST department employees are Kush.

Re: Indian Economy News & Discussion - Nov 27 2017

They should have been careful and did rectification before being summoned by GoI. Idiots must have thought they can to people like NS for a ride.

Re: Indian Economy News & Discussion - Nov 27 2017

Tonnes of info in the Economic Survey.

Here is one:

Here is one:

https://economictimes.indiatimes.com/ne ... aign=cppst"The IBC proceedings take 340 days on an average compared to 4.3 years earlier and resulted in recovery of 42.5 per cent amount involved compared to 14.5 per cent under SARFAESI Act," it said.

Last edited by Uttam on 31 Jan 2020 21:22, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

Here is another one from the Economic Survey. This absolutely needs to be addressed:

https://economictimes.indiatimes.com/sm ... 799670.cmsAccording to the National Restaurants Association of India (NRAI), a total of 36 approvals are required to open a restaurant in Bengaluru, Delhi requires 26, and Mumbai 22. Moreover, Delhi and Kolkata also require a ‘Police Eating House License’. The number of documents needed to obtain this license from Delhi Police is 45 – far more than the number of documents required for a license to procure new arms and major fireworks, 19 and 12 respectively.

https://economictimes.indiatimes.com/sm ... aign=cppstCalling it a “bewildering wide range of rules”, the Economic Survey of 2019-20 says that manufacturing units have to conform with 6,796 compliance items, which is a tedious and time consuming task.

“It must be noted that this is not a comprehensive list and not every rule applies to every manufacturer. It is just an illustration of the bewilderingly wide range of rules that the sector faces,” said the Survey.

Re: Indian Economy News & Discussion - Nov 27 2017

My thoughts: to makeup for the shortage of funds for MOD capital assets procurement the MOF in the new budges should introduce

- 1 time tax (national safety tax) of 1% on goods / services / income

( excluding people in tax bracket of Rs. 500,000 and below)

- Duration: for a period of 4 years (ending in FY 2024).

- All the revenue generated should be used to procure captiol assets for IA/IAF/INS.

- This money should not be considered as part of the regular defense budget

- Would reduce the strain on the planned budget allocations and would allow the

MOD to get what it needs at a faster pace

- 1 time tax (national safety tax) of 1% on goods / services / income

( excluding people in tax bracket of Rs. 500,000 and below)

- Duration: for a period of 4 years (ending in FY 2024).

- All the revenue generated should be used to procure captiol assets for IA/IAF/INS.

- This money should not be considered as part of the regular defense budget

- Would reduce the strain on the planned budget allocations and would allow the

MOD to get what it needs at a faster pace

Re: Indian Economy News & Discussion - Nov 27 2017

The entire economic survey is here:

Economic Survey of India 2019-20

Economic Survey of India 2019-20

Re: Indian Economy News & Discussion - Nov 27 2017

https://swarajyamag.com/insta/cases-inv ... 0-per-cent

Cases Involving Rs 1.58 Lakh Crore Resolved By IBC Till December; Resolution Time Slashed By 340 Per Cent

Cases Involving Rs 1.58 Lakh Crore Resolved By IBC Till December; Resolution Time Slashed By 340 Per Cent

The Insolvency and Bankruptcy Code (IBC) has resolved cases worth Rs 1.58 lakh crore till December 2019 and the resolution time for each case has reduced from 4.3 years to less that a year, the Economic Survey 2019-20 has noted [PDF].

As per the survey each case takes around 340 days to be resolved, which includes the litigation period. It translates to a sharp decline of almost 340 per cent from the earlier average time period of 4.3 years.

In this financial year 2019-20 a total of Rs 7,331.90 was realised in the first quarter, Rs 27,534.48 crore in the second quarter and Rs 1,900.52 in the third quarter respectively. This has brought the total resolved figure to Rs 1.58 crore till Q3 of 2019.

The survey states that the resolution under IBC has been much higher as compared to the resolution channels which were earlier employed.

The survey adds that three years since its implementation the IBC boasts of a strong ecosystem, comprising the Adjudicating Authority, the IBBI, three insolvency professional agencies, 11 registered valuer organisations, 2,374 registered valuers and 2,911 insolvency professionals.

Re: Indian Economy News & Discussion - Nov 27 2017

Suraj wrote:The entire economic survey is here:

Economic Survey of India 2019-20

Thank you!

I have started reading it. The first one I focused is Chapter 7: Golden Jubilee of Bank Nationalisation: Taking Stock

https://www.indiabudget.gov.in/economic ... 7_vol1.pdf

The report rightfully accepts shortcomings of the Nationalized banks but totally misses the mark on it's cure. Suggestions about the use of FinTech, giving employees stock options will not work as long as the top echelons of these banks are controlled by the Government. No use of FinTech can eliminate bad loans when the people inside the banks and government connive with fraudsters. The fact that the tax payers will always rescue the bank further distorts the incentives. The only way to fix this problem is to privatize banks' ownership as well as control.

Some may argue that even the private sector banks are not fairing well. I agree but don't forget that when PSU banks control 70% of the market and are backed by the unlimited equity from tax payer, the private banks will easily be crowed out by PSU banks.

Re: Indian Economy News & Discussion - Nov 27 2017

Foreign exchange reserves up $4.5 billion to new lifetime high of $467 billion

India is in #7 position on the list of countries by forex reserves. Top 3 are China, Japan and Switzerland. Then comes (all figures US$ billion):

Not too far away from $500 billion and the #5 spot.

India is in #7 position on the list of countries by forex reserves. Top 3 are China, Japan and Switzerland. Then comes (all figures US$ billion):

Code: Select all

4 Russia 558,900

5 Saudi Arabia 488,254

6 Taiwan 478,130

7 India 466,693

8 Hong Kong 434,200

9 South Korea 408,800

10 Brazil 356,884

11 Singapore 276,795Re: Indian Economy News & Discussion - Nov 27 2017

As MoF improves NPAs in banks through cleanup and recapitalization, it needs to ensure LIC doesn't sink with poor investment decisions. Bailing out PSU IPOs and investing in questionable corporate bonds has been a big hit to LIC and will eventually be paid for by the policy buyers.

LIC Rs 11,000 crore exposure to Reliance Capital, DHFL turns to default

https://economictimes.indiatimes.com/ma ... _content=1

SBI profit rises 41% on better asset quality.

https://economictimes.indiatimes.com/ma ... 798506.cms

LIC Rs 11,000 crore exposure to Reliance Capital, DHFL turns to default

https://economictimes.indiatimes.com/ma ... _content=1

SBI profit rises 41% on better asset quality.

https://economictimes.indiatimes.com/ma ... 798506.cms

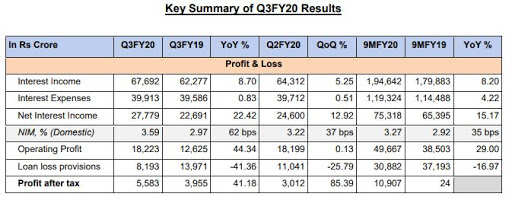

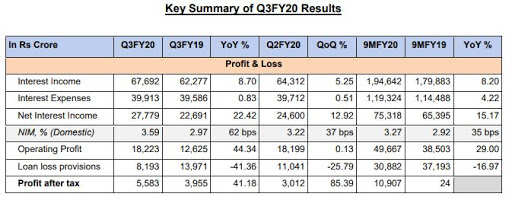

Also, here's a nice chart that shows just how profitable SBI could be if it's asset quality was better. The profit for 9 months in 2019 was Rs 38,503 crores, almost all offset by NPA provisions of Rs 37,193 crores, leaving a paltry Rs 24 crore net profit. Just a 2% NPA improvement in 2020 made it earn Rs 10,907 crore profit.Asset quality of the country’s largest lender by assets improved with gross non-performing assets falling to 6.94 per cent in the December quarter against 8.71 per cent in the corresponding period last year. The figure stood at 7.19 per cent in the sequential quarter.

Re: Indian Economy News & Discussion - Nov 27 2017

Finally! The Economic Survey recommends repeal of Essential Commodities Act, abolishment of FCI.

FYI, FCI's total debt exceeds 2.65 Lakh Crore - more than triple that of Air India!

https://theprint.in/economy/economic-su ... ci/357627/

FYI, FCI's total debt exceeds 2.65 Lakh Crore - more than triple that of Air India!

https://theprint.in/economy/economic-su ... ci/357627/

Re: Indian Economy News & Discussion - Nov 27 2017

Karan Bhasin regularly comments on Swarajyamag criticizing GoI for being too fiscally prudent at a time when greater public spending is called for to address the slowdown. He approves of the economic survey:

Economic Survey: Clear Thinking On Deficit Is Important To Ensure We Give Economy A Much Needed Breather

Economic Survey: Clear Thinking On Deficit Is Important To Ensure We Give Economy A Much Needed Breather

The volume 2 of the economic survey is often of more interest to me personally as it gives us very precise insights about a range of issues. One such issue is regarding the fiscal deficit which is provided in Chapter 2 of Volume 2 of the Economic Survey.

The record of the current government in terms of being fiscally prudent has been excellent and till fairly recently, many were concerned that the staunch commitment towards fiscal deficit could result in government reducing its expenditure in the current fiscal.

The government however, expressed its commitment to the expenditure as stated in the budget despite revenue shortfalls on account of lower growth. A consequence of this is that April to November fiscal deficit seems to have gone up to 3.8 per cent as against the target of 3.3 per cent.

But this increase is not bad, but rather a good thing as it shows that the government recognizes the need to commit itself to revival of growth rates. The purpose of a counter-cyclical fiscal policy is precisely to increase the deficit at a time of economic slowdown and to consolidate at times when the economy is growing above its potential rate of growth.

A growth projection of 6-6.5 per cent for the coming fiscal year is a conservative yet realistic estimate now and this means that we will continue to grow below potential for some time.

The chapter argues on the need to relax the fiscal deficit target for the current year. The target was 3.3 and the fact that we’re at 3.8 implies that we may have indeed relaxed it.

However, what we need is a medium-term consolidation plan along with a monetary policy response to ensure that the cost of capital can be further reduced over the coming couple of months.

...

-

Rahulsidhu

- BRFite

- Posts: 165

- Joined: 22 Mar 2017 06:19

Re: Indian Economy News & Discussion - Nov 27 2017

An interview with PEA Sanjeev Sanyal:

https://www.youtube.com/watch?v=zKWYM_jG078

It's a good watch and presumably gives some insight into the govt.'s economic framework.

Some salient points:

1) He claims that demand-led growth is not sustainable. Need investment-led growth. (I wish there had been further discussion as to why)

2) Wants private sector to invest.

3) Would like to boost exports and Indian firms to be a part of global supply chains.

4) A lot of focus seems to be on monetary transmission, and in particular through boosting bank capital (through accounting rule tweaks e.g.)

5) Another focus area is ease of doing business, e.g better logistics, easier paperwork for company formation etc.

6) Claims that the current growth levels are still pretty good, and we have great macro stability.

My comments:

1) I am puzzled by the assertions of demand/consumption led growth not being sustainable. As long as the incremental demand is accompanied by incremental production, to me it is entirely sustainable. In GDP accounting terms, this means a C increase is great as long as the CAD doesn't blow up. In fact, being a large market with huge latent demand is one of India's best assets which can be used to jump start local production as well as attract foreign capital.

To prevent CAD from blowing up there are many available potent tools, such as customs (already being used quite liberally) as well as macro policy. One of the reasons for the surge in chinese imports around 2015 was excessive strength in INR due to too-high interest rates.

2) & 3) The problem of low investment is primarily a demand problem. To imagine that the Indian private sector will suddenly wake up and find huge export markets is an exercise in magical thinking - it will take a lot of fixing on supply side issues (which won't happen in one year). The one advantage that Indian businesses have - big local market -- must be leveraged to the hilt.

The limited successes that Make in India has had so far (smartphone assembly for instance) have also been due to the huge potential Indian market. And there is no shame in this! We must fight with the weapons we have.

4) Put yourself in the shoes of an industrialist. If you have production capacity sitting idle, would you borrow from a bank/market as invest further? Even if loans were readily available? Even if cost of capital was low (and it is not, currently). So, while interest rates must be brought down and bank capital freed up, this is a necessary condition but not a sufficient one.

5) This is very good, but like I said this will take a long time to fix.

6) I disagree, given our extremely low base per capita income. Macro stability is great but if it comes at the cost of jobs and income (and it does not have to!) then its not something I would highlight as an achievement.

https://www.youtube.com/watch?v=zKWYM_jG078

It's a good watch and presumably gives some insight into the govt.'s economic framework.

Some salient points:

1) He claims that demand-led growth is not sustainable. Need investment-led growth. (I wish there had been further discussion as to why)

2) Wants private sector to invest.

3) Would like to boost exports and Indian firms to be a part of global supply chains.

4) A lot of focus seems to be on monetary transmission, and in particular through boosting bank capital (through accounting rule tweaks e.g.)

5) Another focus area is ease of doing business, e.g better logistics, easier paperwork for company formation etc.

6) Claims that the current growth levels are still pretty good, and we have great macro stability.

My comments:

1) I am puzzled by the assertions of demand/consumption led growth not being sustainable. As long as the incremental demand is accompanied by incremental production, to me it is entirely sustainable. In GDP accounting terms, this means a C increase is great as long as the CAD doesn't blow up. In fact, being a large market with huge latent demand is one of India's best assets which can be used to jump start local production as well as attract foreign capital.

To prevent CAD from blowing up there are many available potent tools, such as customs (already being used quite liberally) as well as macro policy. One of the reasons for the surge in chinese imports around 2015 was excessive strength in INR due to too-high interest rates.

2) & 3) The problem of low investment is primarily a demand problem. To imagine that the Indian private sector will suddenly wake up and find huge export markets is an exercise in magical thinking - it will take a lot of fixing on supply side issues (which won't happen in one year). The one advantage that Indian businesses have - big local market -- must be leveraged to the hilt.

The limited successes that Make in India has had so far (smartphone assembly for instance) have also been due to the huge potential Indian market. And there is no shame in this! We must fight with the weapons we have.

4) Put yourself in the shoes of an industrialist. If you have production capacity sitting idle, would you borrow from a bank/market as invest further? Even if loans were readily available? Even if cost of capital was low (and it is not, currently). So, while interest rates must be brought down and bank capital freed up, this is a necessary condition but not a sufficient one.

5) This is very good, but like I said this will take a long time to fix.

6) I disagree, given our extremely low base per capita income. Macro stability is great but if it comes at the cost of jobs and income (and it does not have to!) then its not something I would highlight as an achievement.

-

Rahulsidhu

- BRFite

- Posts: 165

- Joined: 22 Mar 2017 06:19

Re: Indian Economy News & Discussion - Nov 27 2017

Agree. There have been murmurs about a new Industrial Policy to be released "soon" for well over a year. If such a thing is in the works, now would be an apt time to release it.vinod wrote:Indian govt will have to plan for the global impact of this corona virus! Already, world's dependence on single nation like china is now exposed. So, after the trade war tensions, its good time to again help wean them away from China into India.

-

Rahulsidhu

- BRFite

- Posts: 165

- Joined: 22 Mar 2017 06:19

Re: Indian Economy News & Discussion - Nov 27 2017

Please understand that taxes do not come for free. A fresh tax of x% of GDP at this time would slow the economy down by M.x where M is much higher than 1. Which would also hurt the collection on existing taxes thus not only hurting the economy but also defeating the purpose of the new tax.VinodTK wrote:My thoughts: to makeup for the shortage of funds for MOD capital assets procurement the MOF in the new budges should introduce

- 1 time tax (national safety tax) of 1% on goods / services / income

( excluding people in tax bracket of Rs. 500,000 and below)

- Duration: for a period of 4 years (ending in FY 2024).

- All the revenue generated should be used to procure captiol assets for IA/IAF/INS.

- This money should not be considered as part of the regular defense budget

- Would reduce the strain on the planned budget allocations and would allow the

MOD to get what it needs at a faster pace

A plan which takes the economy back into a slump is hardly a plan for national strength.

Re: Indian Economy News & Discussion - Nov 27 2017

~Rs 80000Cr of delay in Govt projects... this affects anywhere between 5X that amount of money flow which affects GDP

Re: Indian Economy News & Discussion - Nov 27 2017

Govt nets Rs 1.1 lakh cr from GST in January

Goods and services tax (GST) collection has crossed the Rs 1 lakh crore-mark for the third month in a row in January on the back of anti-evasion steps taken by tax officers.

This is second time since introduction of GST in July 2017 that the monthly revenues have crossed Rs 1.1 lakh crore.

The GST collection is in line with the target set by Revenue Secretary Ajay Bhushan Pandey after a high-level meeting with senior tax officials earlier this month.

.........

To augment revenue collection, the Revenue Secretary revised GST collection target to Rs 1.25 lakh crore for the last month of this financial year with specific focus on fraudulent input tax credit (ITC) claims as found in data analytics review.

It was emphasised that GST authorities would look into the mismatch of supply and purchase invoices, data analytics of mismatch in GSTR-1, GSTR-2A and GSTR-3B, failure of filing returns, over invoicing, recuperation of fake or excess refunds availed beyond the permissible limits.

Around 40,000 companies have been red-flagged for excess or fraudulent ITC availment and other tax related wrongful issues through data analytics, out of 1.2 crore GST registrants and focus would be on these identified taxpayers, sources said.

https://www.moneycontrol.com/news/busin ... 89761.html

Goods and services tax (GST) collection has crossed the Rs 1 lakh crore-mark for the third month in a row in January on the back of anti-evasion steps taken by tax officers.

This is second time since introduction of GST in July 2017 that the monthly revenues have crossed Rs 1.1 lakh crore.

The GST collection is in line with the target set by Revenue Secretary Ajay Bhushan Pandey after a high-level meeting with senior tax officials earlier this month.

.........

To augment revenue collection, the Revenue Secretary revised GST collection target to Rs 1.25 lakh crore for the last month of this financial year with specific focus on fraudulent input tax credit (ITC) claims as found in data analytics review.

It was emphasised that GST authorities would look into the mismatch of supply and purchase invoices, data analytics of mismatch in GSTR-1, GSTR-2A and GSTR-3B, failure of filing returns, over invoicing, recuperation of fake or excess refunds availed beyond the permissible limits.

Around 40,000 companies have been red-flagged for excess or fraudulent ITC availment and other tax related wrongful issues through data analytics, out of 1.2 crore GST registrants and focus would be on these identified taxpayers, sources said.

https://www.moneycontrol.com/news/busin ... 89761.html

Re: Indian Economy News & Discussion - Nov 27 2017

Budget speech is going on now..

Re: Indian Economy News & Discussion - Nov 27 2017

Between 2006-16, India was able to pull 271 million people out of poverty: Finance Minister

Source: TNIE live Budget updates

Source: TNIE live Budget updates

Re: Indian Economy News & Discussion - Nov 27 2017

Quoting Kashmiri poetry to Avvaiyar's Aathichoodi in Tamil...

Re: Indian Economy News & Discussion - Nov 27 2017

Reiterated goal of doubling farmer's income by 2022. Focus on 100 water stressed districts coming to regenerate water resources. Scheme for farmers to diversify income via solar power generation and feed back into the grid.

Re: Indian Economy News & Discussion - Nov 27 2017

Allocations:

₹1.6 Lakh Crore for Agri and allied sectors

₹1.23 Lakh Crore for Rural dev

₹2.83 lakh crore total

₹59,000 crore (increase?) in health budget

₹12,300 crore allotted for SBM in 2020-21

₹3.6 lakh crore for Jal Jeevan mission

₹1.6 Lakh Crore for Agri and allied sectors

₹1.23 Lakh Crore for Rural dev

₹2.83 lakh crore total

₹59,000 crore (increase?) in health budget

₹12,300 crore allotted for SBM in 2020-21

₹3.6 lakh crore for Jal Jeevan mission

Last edited by arshyam on 01 Feb 2020 12:05, edited 1 time in total.