Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

+1 vijayji . As long as the fundamentals of LIC are sound, it is a smart move given that our economy is a capital starved economy.Benefits of capitalism ( for everyone espousing it ) is still possible only when there is capital.

Also the year 2018 was the highest profitability year with profits returned the shareholder in the ratio given below

Going by the LIC Act 1956, the corporation doesn’t have a concept of profit and its ‘valuation surplus’ is distributed between the central government and policy holders in the ratio of 5:95.

During 2017-18, the corporation has invested Rs 2.62 lakh crore in Central and State Government Securities with an average annualised yield of 7.63 per cent.

An investment of Rs 37,824 crore was made in corporate bonds at a yield of 7.80 per cent and an investment of Rs 88,980 crore was made in equities.

https://indianexpress.com/article/busin ... e-5485671/

Also the year 2018 was the highest profitability year with profits returned the shareholder in the ratio given below

Going by the LIC Act 1956, the corporation doesn’t have a concept of profit and its ‘valuation surplus’ is distributed between the central government and policy holders in the ratio of 5:95.

During 2017-18, the corporation has invested Rs 2.62 lakh crore in Central and State Government Securities with an average annualised yield of 7.63 per cent.

An investment of Rs 37,824 crore was made in corporate bonds at a yield of 7.80 per cent and an investment of Rs 88,980 crore was made in equities.

https://indianexpress.com/article/busin ... e-5485671/

-

Rahulsidhu

- BRFite

- Posts: 165

- Joined: 22 Mar 2017 06:19

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.livemint.com/politics/polic ... 59203.html

Some fiscal measures announced by the govt. Since I have posted several critical posts on the fiscal stance of this govt, I would like to make some comments:

1) This is a very good move. Not many were expecting it, certainly I wasn't. Uncharacteristically bold.

2) Indian economy is facing two problems

A: Low competiveness (long term, supply side)

B: Low demand (short term, demand side)

This will help alleviate A directly, and B indirectly (boosting incomes via equity holdings, wealth effect, and general higher confidence in the future)

3) Great as the move is, for me even more important is the signal that the fiscal perma-hawks within the govt. seem to have lost the debate. If so, more fiscal measures could be forthcoming. Let us see.

4) GST cuts will bring about even more bang for the buck and help solve problem B directly. Fingers crossed.

5) Govt Bond yields have spiked higher. There is no need to worry. RBI should continue cutting and buy some bonds in OMO as the curve is too steep. Also, increased Money supply growth will lead to bigger bank balance sheets and bigger demand for govt. bonds. Ignore the doom mongers.

6) For those worrying about the rupee collapsing on higher fiscal deficits, please look at how the rupee moved on this announcement (0.7 pp higher fiscal deficit projected)

Some fiscal measures announced by the govt. Since I have posted several critical posts on the fiscal stance of this govt, I would like to make some comments:

1) This is a very good move. Not many were expecting it, certainly I wasn't. Uncharacteristically bold.

2) Indian economy is facing two problems

A: Low competiveness (long term, supply side)

B: Low demand (short term, demand side)

This will help alleviate A directly, and B indirectly (boosting incomes via equity holdings, wealth effect, and general higher confidence in the future)

3) Great as the move is, for me even more important is the signal that the fiscal perma-hawks within the govt. seem to have lost the debate. If so, more fiscal measures could be forthcoming. Let us see.

4) GST cuts will bring about even more bang for the buck and help solve problem B directly. Fingers crossed.

5) Govt Bond yields have spiked higher. There is no need to worry. RBI should continue cutting and buy some bonds in OMO as the curve is too steep. Also, increased Money supply growth will lead to bigger bank balance sheets and bigger demand for govt. bonds. Ignore the doom mongers.

6) For those worrying about the rupee collapsing on higher fiscal deficits, please look at how the rupee moved on this announcement (0.7 pp higher fiscal deficit projected)

Last edited by Rahulsidhu on 20 Sep 2019 12:51, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

As promised: Summary of NBFC lending situation

Central bank canceled registrations of 1,851 non-bank finance companies in the year ended March 31, more than 8 times those in the previous year according to data received from the Reserve Bank of India in response to a Right to Information request. The number of lenders dropped to about 9,700, the lowest in at least a decade

This weed wacking that I presume was necessary due to the fact that a lot of the NBFCs could not generate the minimum required 2cr regulatory requirement capital. Unfortunately there is no medicine without side effect.

Source : https://www.business-standard.com/artic ... 131_1.html

A rather large side effect is retail business, retail consumer, msme sector is hit especially to the most important segment of the credit market : New-to-Credit consumers. Since the financially included population is much smaller - credit growth stunts the larger part of the economy in general.

NBFC's have been leading the lending to New to Credit customers (as opposed to PSU banks etc ) and provide retail loans, msme loans etc to such an extent they lend more than all the other instituions combined.

Sorry to provide a rather large source report - I haven't had a chance to figure out adding relevant attachments to the post

https://www.google.com/url?sa=t&source= ... 8962521982

Central bank canceled registrations of 1,851 non-bank finance companies in the year ended March 31, more than 8 times those in the previous year according to data received from the Reserve Bank of India in response to a Right to Information request. The number of lenders dropped to about 9,700, the lowest in at least a decade

This weed wacking that I presume was necessary due to the fact that a lot of the NBFCs could not generate the minimum required 2cr regulatory requirement capital. Unfortunately there is no medicine without side effect.

Source : https://www.business-standard.com/artic ... 131_1.html

A rather large side effect is retail business, retail consumer, msme sector is hit especially to the most important segment of the credit market : New-to-Credit consumers. Since the financially included population is much smaller - credit growth stunts the larger part of the economy in general.

NBFC's have been leading the lending to New to Credit customers (as opposed to PSU banks etc ) and provide retail loans, msme loans etc to such an extent they lend more than all the other instituions combined.

Sorry to provide a rather large source report - I haven't had a chance to figure out adding relevant attachments to the post

https://www.google.com/url?sa=t&source= ... 8962521982

Re: Indian Economy News & Discussion - Nov 27 2017

FM exempts cos that announced a buyback before July 5 from buyback tax

This is a huge positive for companies like Infosys and Wipro that had announced a buyback prior to the Union Budget announcement on July 5

In another relief, the minister said listed companies which had announced buyback of shares prior to July 5 would not be charged with super rich tax.

This is a huge positive for companies like Infosys and Wipro that had announced a buyback prior to the Union Budget announcement on July 5

In another relief, the minister said listed companies which had announced buyback of shares prior to July 5 would not be charged with super rich tax.

Last edited by sooraj on 20 Sep 2019 13:14, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

Govt to forego Rs 1.45 lakh cr/year, Nirmala Sitharaman slashes corporate tax rates to promote growth

Re: Indian Economy News & Discussion - Nov 27 2017

In order to promote growth and investment, Finance Minister Nirmala Sitharaman on September 20 slashed the effective corporate tax from 30 percent to 25.17 percent, inclusive of all cess and surcharges for domestic companies. However, the move, effective from April 1, is subject to the condition that they will not avail any other incentive or exemptions.

Re: Indian Economy News & Discussion - Nov 27 2017

In effect, the corporate tax rate will be 22 percent for domestic companies if they do not avail any incentive or concession. The changes in the Income Tax Act and Finance Act will be made effective through an ordinance.

Re: Indian Economy News & Discussion - Nov 27 2017

Companies opting for the 22 percent income tax slab will now not have to pay the Minimum Alternative Tax (MAT).

Will give MAT relief for those opting to continue paying surcharge and cess. MAT has been reduced to 15 percent from 18.5 percent for companies who continue to avail exemptions and incentives: Sitharaman

Will give MAT relief for those opting to continue paying surcharge and cess. MAT has been reduced to 15 percent from 18.5 percent for companies who continue to avail exemptions and incentives: Sitharaman

Last edited by sooraj on 20 Sep 2019 13:16, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

New domestic manufacturing companies incorporated after October 1 can pay the income tax at the rate of 15 percent without any incentives, the finance minister said. This means the effective tax rate for new manufacturing companies will be 17.01 percent, inclusive of all surcharge and cess.

Companies can opt for lower tax rate after the expiry of tax holidays and concessions that they are availing now, she added.

Companies can opt for lower tax rate after the expiry of tax holidays and concessions that they are availing now, she added.

Re: Indian Economy News & Discussion - Nov 27 2017

The government has also decided not to levy the enhanced surcharge introduced in Budget 2019 on capital gain arising from sale of equity shares in a company liable for the securities transaction tax (STT).

Also, the super-rich tax will not apply on capital gains arising from sale of any security including derivatives in hands of foreign portfolio investors (FPIs).

Also, the super-rich tax will not apply on capital gains arising from sale of any security including derivatives in hands of foreign portfolio investors (FPIs).

Re: Indian Economy News & Discussion - Nov 27 2017

Also, the companies have now been permitted to use their 2 percent CSR spend on incubation, IITs, NITs, and national laboratories.

Re: Indian Economy News & Discussion - Nov 27 2017

Sitharaman clarifies that foreign companies in a joint venture with Indian companies, having an office in India or arms in the country will also get tax benefits announced today.

Re: Indian Economy News & Discussion - Nov 27 2017

Govt asks banks not to declare any stressed MSME as NPA till March 2020

Re: Indian Economy News & Discussion - Nov 27 2017

To increase credit disbursement across the country ahead of the festive season, Finance Minister Nirmala Sitharaman has directed scheduled commercial banks and non-bank financial companies (NBFCs) to reach out to new customers in 400 districts in two tranches from now and 15 October. Addressing a press conference after meeting the heads of commercial banks, Sitharaman said in the first instance, the programme will be run in 200 districts from now and 29 September where banks and NBFCs will be available to disburse credit to retail customers, farmers, Micro, Small & Medium Enterprises (MSMEs). In the next phase, another 200 districts will be targeted between 10-15 October.

Indian Economy News & Discussion - Nov 27 2017

Sensex surges over 2,000 points after government slashes corporate tax rates

HIGHLIGHTS

- After a cautious start, the 30-share BSE index was trading 1198.94 points or 3.32 per cent high at 37,265.37 in morning trade

- Top gainers in the sensex pack include Maruti, Tata Steel, HDFC Bank, Yes Bank, relaince, IndusInd Bank, LT with their shares rising as much as 5.69 per cent

NEW DELHI: Domestic equity benchmark on Friday surged over 2,000 points after finance minister announced that corporate tax rates will be slashed for domestic companies and new domestic manufacturing companies.

After a cautious start, the 30-share BSE index was trading 2012.97 points or 5.58 per cent high at 38,076.94 at 1:50 pm. While, the broader NSE Nifty was up by 586.40 points or 5.48 per cent at 11,291.20.

Top gainers in the sensex pack include Maruti, Hero MotoCorp, IndusInd Bank, Bajaj Finance, Tata Steel, Tata Motors, SBI and Asian Paints with their shares rising as much as 15.76 per cent.

In a major fiscal booster, the government on Friday slashed effective corporate tax to 25.17 per cent inclusive of all cess and surcharges for domestic companies.

Making the announcement, Finance Minister Nirmala Sitharaman said the new tax rate will be applicable from the current fiscal which began on April 1.

This, she said is being done to promote investment and growth.

The government has also decided to not levy enhanced surcharge introduced in the Budget on capital gain arising from sale of equity shares in a company liable for securities transaction tax.

Also, the super-rich tax will not to apply on capital gains arising from sale of any security including derivatives in hands of foreign portfolio investors.

In Video : BSE Sensex surges over 1000 points after Finance Minister slashes corporate tax rate

Cheers

HIGHLIGHTS

- After a cautious start, the 30-share BSE index was trading 1198.94 points or 3.32 per cent high at 37,265.37 in morning trade

- Top gainers in the sensex pack include Maruti, Tata Steel, HDFC Bank, Yes Bank, relaince, IndusInd Bank, LT with their shares rising as much as 5.69 per cent

NEW DELHI: Domestic equity benchmark on Friday surged over 2,000 points after finance minister announced that corporate tax rates will be slashed for domestic companies and new domestic manufacturing companies.

After a cautious start, the 30-share BSE index was trading 2012.97 points or 5.58 per cent high at 38,076.94 at 1:50 pm. While, the broader NSE Nifty was up by 586.40 points or 5.48 per cent at 11,291.20.

Top gainers in the sensex pack include Maruti, Hero MotoCorp, IndusInd Bank, Bajaj Finance, Tata Steel, Tata Motors, SBI and Asian Paints with their shares rising as much as 15.76 per cent.

In a major fiscal booster, the government on Friday slashed effective corporate tax to 25.17 per cent inclusive of all cess and surcharges for domestic companies.

Making the announcement, Finance Minister Nirmala Sitharaman said the new tax rate will be applicable from the current fiscal which began on April 1.

This, she said is being done to promote investment and growth.

The government has also decided to not levy enhanced surcharge introduced in the Budget on capital gain arising from sale of equity shares in a company liable for securities transaction tax.

Also, the super-rich tax will not to apply on capital gains arising from sale of any security including derivatives in hands of foreign portfolio investors.

In Video : BSE Sensex surges over 1000 points after Finance Minister slashes corporate tax rate

Cheers

Re: Indian Economy News & Discussion - Nov 27 2017

Abolish CSR now

Re: Indian Economy News & Discussion - Nov 27 2017

is the reduction in corporate tax rates anyway connected to Modis visit to US and trade talks??

Re: Indian Economy News & Discussion - Nov 27 2017

IMHO, only as much as in trying to get India in better pole position to attract more investment and keep growing in cut throat global trade wars. Ease of doing business and transparency with minimal red tape is the need of the hour! having our corporate tax in line with competitive Asian tigers signals that Indian elephant can get lean and mean and can out pace everyone in growth!manjgu wrote:is the reduction in corporate tax rates anyway connected to Modis visit to US and trade talks??

Re: Indian Economy News & Discussion - Nov 27 2017

+1 Sometimes I am pinching myself to believe that the government can actually listen and solve for issues. Finance minister is earning her respect as well as the governmentsooraj wrote:To increase credit disbursement across the country ahead of the festive season, Finance Minister Nirmala Sitharaman has directed scheduled commercial banks and non-bank financial companies (NBFCs) to reach out to new customers in 400 districts in two tranches from now and 15 October. Addressing a press conference after meeting the heads of commercial banks, Sitharaman said in the first instance, the programme will be run in 200 districts from now and 29 September where banks and NBFCs will be available to disburse credit to retail customers, farmers, Micro, Small & Medium Enterprises (MSMEs). In the next phase, another 200 districts will be targeted between 10-15 October.

Re: Indian Economy News & Discussion - Nov 27 2017

+1 Looks like your thoughts have been acted upon. Very cool. Also this helps overall market not just the auto industry. One has to wonder why there was much focus only on auto industry in the last few months...but that is for another day/another timeRahulsidhu wrote:https://www.livemint.com/politics/polic ... 59203.html

Some fiscal measures announced by the govt. Since I have posted several critical posts on the fiscal stance of this govt, I would like to make some comments:

1) This is a very good move. Not many were expecting it, certainly I wasn't. Uncharacteristically bold.

I saw a comment that said - Not only is this bigger than the budget but bigger than the last 20 budgets

3) Great as the move is, for me even more important is the signal that the fiscal perma-hawks within the govt. seem to have lost the debate. If so, more fiscal measures could be forthcoming. Let us see.

5) Govt Bond yields have spiked higher. There is no need to worry. RBI should continue cutting and buy some bonds in OMO as the curve is too steep. Also, increased Money supply growth will lead to bigger bank balance sheets and bigger demand for govt. bonds. Ignore the doom mongers.

6) For those worrying about the rupee collapsing on higher fiscal deficits, please look at how the rupee moved on this announcement (0.7 pp higher fiscal deficit projected)

Re: Indian Economy News & Discussion - Nov 27 2017

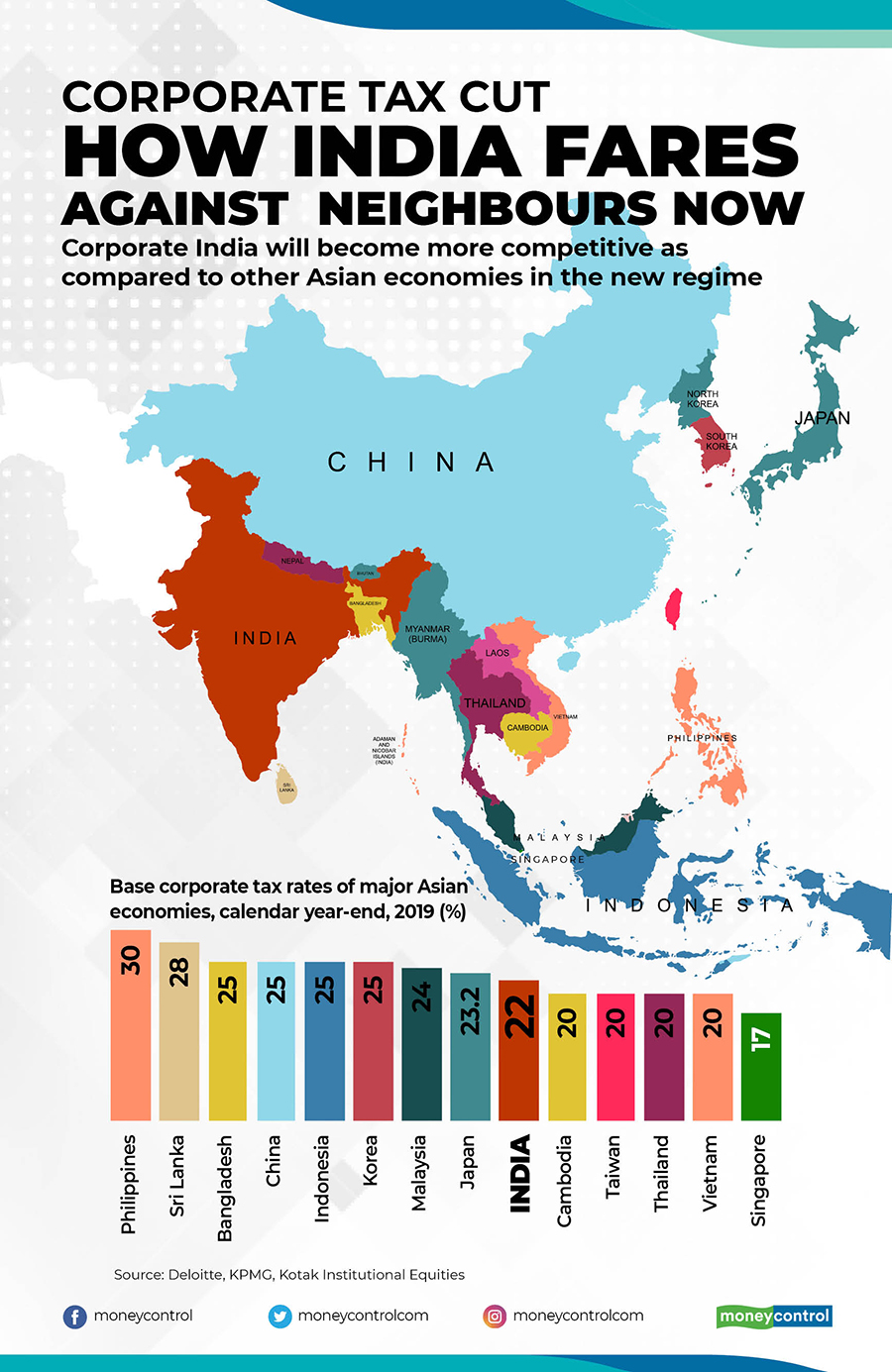

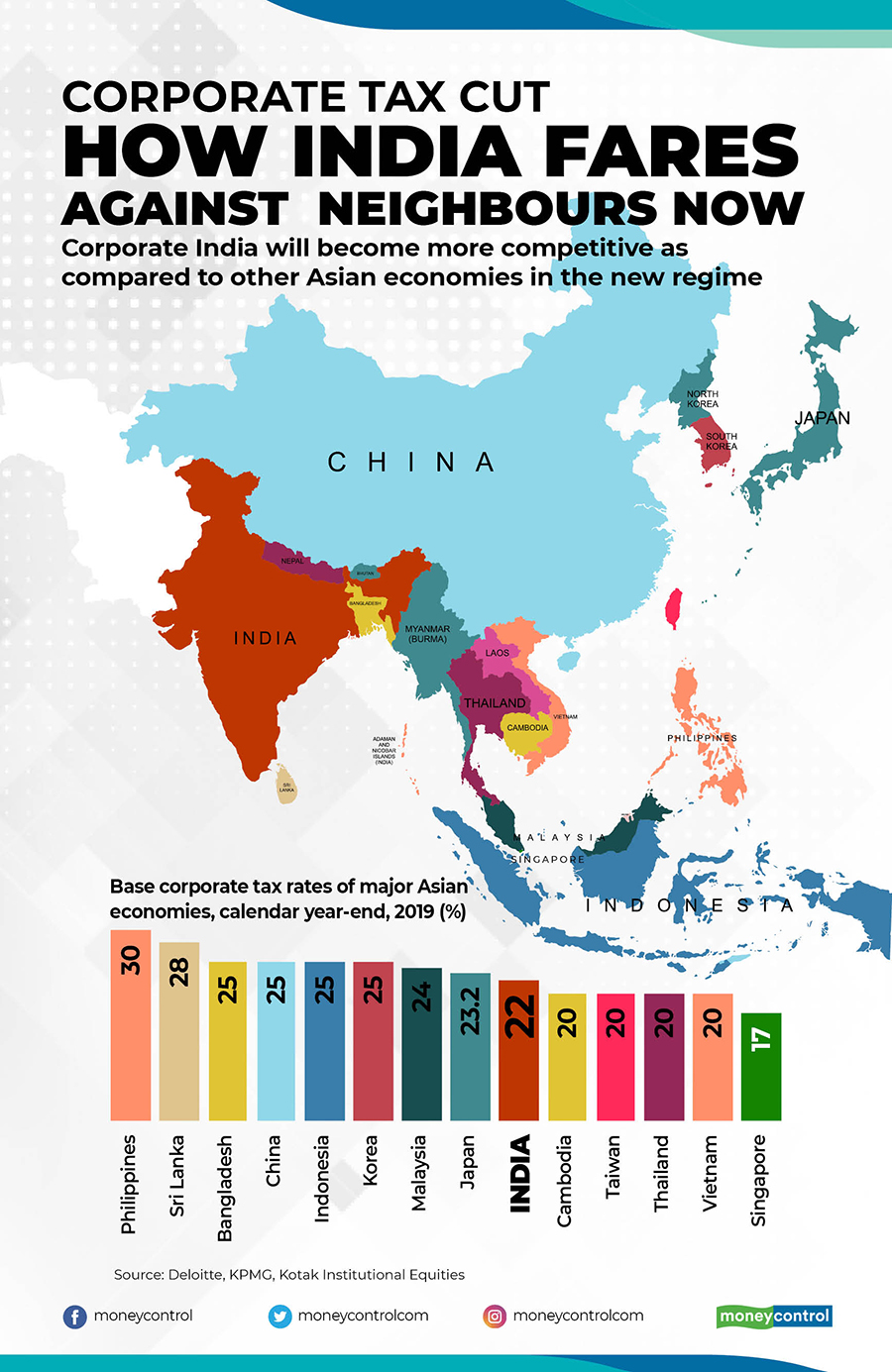

https://www.moneycontrol.com/news/busin ... 58811.html

- For some discussion on comparative corporate tax across Asian countries and capitalizing on the trade spat between china and us

- For some discussion on comparative corporate tax across Asian countries and capitalizing on the trade spat between china and us

Re: Indian Economy News & Discussion - Nov 27 2017

I think the best news here is not the news that was the news, but as rahulsidhu said, the clear indication that the fiscal policy hawks are losing out in the decisionmaking process. It takes a lot of political gumption to announce such a sweeping tax rate cut, and the fact that the government took this move is a clear sign that they have understood the fundamentals of the underlying problem, and that the question was about how much of a solution they would be willing to implement.

Policy actions can be judged on two criteria - are they aiming at the right target, and how good was the shot ? One could say they aimed at the right thing and shot the inner circle here.

Policy actions can be judged on two criteria - are they aiming at the right target, and how good was the shot ? One could say they aimed at the right thing and shot the inner circle here.

Re: Indian Economy News & Discussion - Nov 27 2017

Public sector banks barring one or two should be divested so that we never get into the NPA mess again.

Re: Indian Economy News & Discussion - Nov 27 2017

Jately was a fiscal conservative, with change of guards at finmin, approach to economy and how to prime it was going to change and it did. This is a right wing govt so i would not expect to see congress type of expenditures. IMO Controlling inflation would remain a top priority given the electoral dividends it generatedSuraj wrote:I think the best news here is not the news that was the news, but as rahulsidhu said, the clear indication that the fiscal policy hawks are losing out in the decisionmaking process. It takes a lot of political gumption to announce such a sweeping tax rate cut, and the fact that the government took this move is a clear sign that they have understood the fundamentals of the underlying problem, and that the question was about how much of a solution they would be willing to implement.

Policy actions can be judged on two criteria - are they aiming at the right target, and how good was the shot ? One could say they aimed at the right thing and shot the inner circle here.

Last thought I have is that this move would generate more revenue for govt than it is letting go. If not this year than next. It may not be correct to call tax cuts to industry as fiscal loosening, all that money would become investment and it’ll pull in a lot more investment activities as side action.

Just my thoughts.....

Re: Indian Economy News & Discussion - Nov 27 2017

Karan Bhasin on Swarajyamag quotes Surjit Bhalla's article in July where he strongly advocates a corporate tax cut to... you guessed it, 22 percent. That's exactly what FinMin has done. Bhalla has never been a fiscal conservative (400% the opposite actually), and it's good that GoI is now firmly driven by the pro-growth folks.

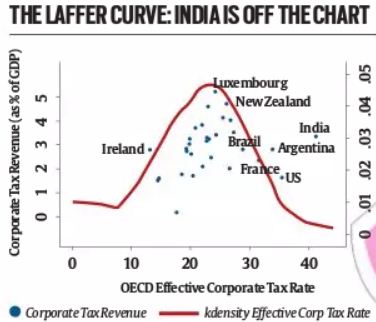

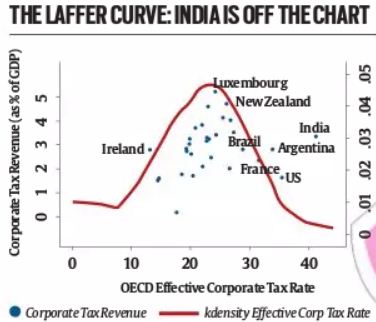

Bhalla's argument centers on what he argues is the optimal Laffer Curve position of the corporate tax rate:

The corporate tax rate cut moves us to where Luxembourg is, with hopefully a concomitant growth in tax collections driven by better compliance and strong growth in business activity, since companies across the board will see an immediate gain in their bottomline. Those starting in the next 5 years also have only a 15% rate to pay until they're at full capacity - something that should accelerate greenfield expansions.

Bhalla's argument centers on what he argues is the optimal Laffer Curve position of the corporate tax rate:

The corporate tax rate cut moves us to where Luxembourg is, with hopefully a concomitant growth in tax collections driven by better compliance and strong growth in business activity, since companies across the board will see an immediate gain in their bottomline. Those starting in the next 5 years also have only a 15% rate to pay until they're at full capacity - something that should accelerate greenfield expansions.

Re: Indian Economy News & Discussion - Nov 27 2017

I am not as excited about this move to cut corporate taxes as most people here. I'll try to lay out my line of thinking. Being a layman, it may have massive holes in it and I am happy to be corrected. So please bear with me.

It is clear from the targeted nature of this cut that the Govt. is trying to incentivize companies to invest in new manufacturing capacity. This is good and exactly what we need. However, for months now we've been told that the economy is in doldrums because of severely subdued demand, especially in but not limited to the auto-sector.

Now as long as the demand remains subdued, companies have no reason to increase their manufacturing capacity, regardless of any tax incentives they might benefit from as a result. If their products do not sell they will still lose money.

Now the government may be looking at other measures like reducing GST rates to boost demand. However, due to this massive tax cut, they have less fiscal space available to reduce GST rates than they would have had without the revenue loss from the corporate tax cut. So now there is a danger of them not going far enough with the GST cut (if indeed they do that) and any half hearted reduction will not only fail to boost demand to the required levels, but also negate any benefit from the corporate tax cut since the companies will not invest in more manufacturing capacity.

The government also needs to do something about the NBFC's which are in trouble, since that is another reason touted for the low demand. Again, they have less fiscal space to deal with that problem too.

It is clear from the targeted nature of this cut that the Govt. is trying to incentivize companies to invest in new manufacturing capacity. This is good and exactly what we need. However, for months now we've been told that the economy is in doldrums because of severely subdued demand, especially in but not limited to the auto-sector.

Now as long as the demand remains subdued, companies have no reason to increase their manufacturing capacity, regardless of any tax incentives they might benefit from as a result. If their products do not sell they will still lose money.

Now the government may be looking at other measures like reducing GST rates to boost demand. However, due to this massive tax cut, they have less fiscal space available to reduce GST rates than they would have had without the revenue loss from the corporate tax cut. So now there is a danger of them not going far enough with the GST cut (if indeed they do that) and any half hearted reduction will not only fail to boost demand to the required levels, but also negate any benefit from the corporate tax cut since the companies will not invest in more manufacturing capacity.

The government also needs to do something about the NBFC's which are in trouble, since that is another reason touted for the low demand. Again, they have less fiscal space to deal with that problem too.

Re: Indian Economy News & Discussion - Nov 27 2017

P.S: The Sensex reacting strongly to the news of the corporate tax cut is not surprising. A company's primary duty is to its investors. If a company receives any windfall due to tax cuts, they will first use it to reward their investors with higher dividends (and their top execs with higher bonuses) before using whatever is left to invest in capacity expansion. We have seen this happening in the US too after tax cuts.

Re: Indian Economy News & Discussion - Nov 27 2017

I think 'targeted' is a bad word to use here. It is the government's defined job on the economic front to stimulate and manage economic activity. In other words, it is doing its job if and when it reacts to economic issues with strong countercyclical measures, including particular incentives for those making fresh investments.

Multiple things have been done, and some recent history is useful.

Before this year's budget, the corporate tax rate was 30% plus cesses and surcharges. For small companies (under Rs.10 cr ?), it used to be 25%.

The budget lowered this to 25% for companies with under Rs.400 cr turnover, covering a much larger group of corporate taxpayers.

The latest change is to make the corporate tax rate 22% for all companies, which has an enormous impact on the largest companies who contribute the majority of taxes. I'm sure there's a chart out there showing contribution to overall tax revenue vs company turnover bucket. Please post if you can find it.

Those corporate entities set up after Oct 1 will have a 17% rate until 2023. Companies availing of exemptions and incentives will have their MAT reduced from 18.5% to 15%.

This basically makes India as competitive as Singapore from a corporate tax rate perspective related to new investments. For new entities considering investment, it's an even bigger draw.

Multiple things have been done, and some recent history is useful.

Before this year's budget, the corporate tax rate was 30% plus cesses and surcharges. For small companies (under Rs.10 cr ?), it used to be 25%.

The budget lowered this to 25% for companies with under Rs.400 cr turnover, covering a much larger group of corporate taxpayers.

The latest change is to make the corporate tax rate 22% for all companies, which has an enormous impact on the largest companies who contribute the majority of taxes. I'm sure there's a chart out there showing contribution to overall tax revenue vs company turnover bucket. Please post if you can find it.

Those corporate entities set up after Oct 1 will have a 17% rate until 2023. Companies availing of exemptions and incentives will have their MAT reduced from 18.5% to 15%.

This basically makes India as competitive as Singapore from a corporate tax rate perspective related to new investments. For new entities considering investment, it's an even bigger draw.

Re: Indian Economy News & Discussion - Nov 27 2017

I used "targeted" in the sense that the GOI's main motivation behind this move seems to be to stimulate investment in manufacturing, which in itself is a very good idea. My concern is about how this plays out in a low demand environment, especially when any action the government might take to boost demand is likely to incur a loss in revenues in the short term at least.

Re: Indian Economy News & Discussion - Nov 27 2017

Watch from 36:30 onwards, if i got it correctly the wind fall gain cannot be declared as dividend or else they pay 22% dividend didtribution tax so money has to be re invested to take advantge of the lower rate of tax (sorry it is from RuN-D-TV)nachiket wrote:P.S: The Sensex reacting strongly to the news of the corporate tax cut is not surprising. A company's primary duty is to its investors. If a company receives any windfall due to tax cuts, they will first use it to reward their investors with higher dividends (and their top execs with higher bonuses) before using whatever is left to invest in capacity expansion. We have seen this happening in the US too after tax cuts.

Last edited by Vips on 21 Sep 2019 02:55, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

The supply side is arguably a greater and more longer term issue here than the demand side. It is easier to revive the demand side than the supply side - something GoI has tried to do all of its first term with only limited success. Commercial vehicle sales for example did not exceed their 2011-12 peak until 2018-19.

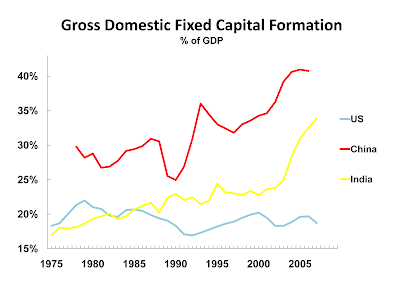

Ever since the collapse of the investment cycle in 2011-12, the revival of the supple side has been only a partial success. People talk about the animal spirits of the mid 2000s. That was driven by supply side efforts during the early days of NDA-1 on multiple fronts. Here's the huge jump in investment/GDP beginning in that era, the foundation of the 2000s growth:

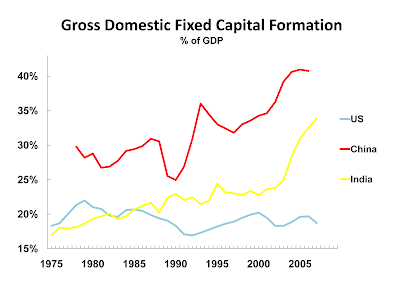

Correspondingly, corporate investments have dried up through the mid 2000s, and several legislative efforts, including GST and IBC have failed to arrest the dwindling corporate savings and investments:

The latest move avoids offering a legislative solution, i.e. it's not a simpler indirect tax regime like the GST, or a simpler bankrupcy code. It quite literally lowers the tax rate from 30%+cess for all the large companies, down to 22%+cess, an enormous 25% cut in the the prior gap between their EBITDA and net figures.

This move does several things right:

1. it's a direct stimulus. Not a new tax code, a bankruptcy code etc. It's a 'keep an extra X% - 25% for medium/large caps' immediate change.

2. It's offered to everyone, with proportionately the biggest immediate benefit to large caps. All the large companies paying 30% previously now pay 22%. Smaller companies get even more than the budget offered them, having already received 2 rounds of cuts since beginning of year.

3. It drives greenfield investment while being politically smart (the 17% rate sunsets a year before GE2024).

4. It provides a further boost to incentive driven operations

5. Most importantly it is BIG - a startlingly large cut on par with the kind of slashing of controls announced in 1991-92. There's always the problem that a tax cut will be too small to matter, forgoing revenues without substantial change in the aggregate business compensating. There's no question this rate cut is a game changer, in that regard with Sensex/Nifty posting the biggest one day gains in history or in a very long time.

Ever since the collapse of the investment cycle in 2011-12, the revival of the supple side has been only a partial success. People talk about the animal spirits of the mid 2000s. That was driven by supply side efforts during the early days of NDA-1 on multiple fronts. Here's the huge jump in investment/GDP beginning in that era, the foundation of the 2000s growth:

Correspondingly, corporate investments have dried up through the mid 2000s, and several legislative efforts, including GST and IBC have failed to arrest the dwindling corporate savings and investments:

The latest move avoids offering a legislative solution, i.e. it's not a simpler indirect tax regime like the GST, or a simpler bankrupcy code. It quite literally lowers the tax rate from 30%+cess for all the large companies, down to 22%+cess, an enormous 25% cut in the the prior gap between their EBITDA and net figures.

This move does several things right:

1. it's a direct stimulus. Not a new tax code, a bankruptcy code etc. It's a 'keep an extra X% - 25% for medium/large caps' immediate change.

2. It's offered to everyone, with proportionately the biggest immediate benefit to large caps. All the large companies paying 30% previously now pay 22%. Smaller companies get even more than the budget offered them, having already received 2 rounds of cuts since beginning of year.

3. It drives greenfield investment while being politically smart (the 17% rate sunsets a year before GE2024).

4. It provides a further boost to incentive driven operations

5. Most importantly it is BIG - a startlingly large cut on par with the kind of slashing of controls announced in 1991-92. There's always the problem that a tax cut will be too small to matter, forgoing revenues without substantial change in the aggregate business compensating. There's no question this rate cut is a game changer, in that regard with Sensex/Nifty posting the biggest one day gains in history or in a very long time.

Re: Indian Economy News & Discussion - Nov 27 2017

Which is a smart move from GoI. Drives reinvestment AND greenfield plans.Vips wrote:Watch from 36:30 onwards, if i got it correctly the wind fall gain cannot be declared as dividend or else they pay 22% dividend didtribution tax so money has to be re invested to take advantge of the lower rate of tax (sorry it is from RuN-D-TV)

It's worth noting the composition of recent gains in FDI. While we are hitting new records in annual FDI, fresh inflows are growing rather gently - it's the reinvested earnings that are contributing to most of the YoY growth in FDI data. This new tax cut should boost fresh FDI significantly, particularly at a time when companies with China operations are being given explicit political orders to base themselves elsewhere.

Re: Indian Economy News & Discussion - Nov 27 2017

For all practical puposes India had a drought in 2017-18 and 2018-19. Only reasonable moon soon before 2019-20 was 2015-16 in the last 10 years. India's economic growth in 2004-08 was 4 continuous period of good monsoons, not just agriculture almost all economic activity depends on the availability of water. Similarly some competitors like Malaysia and Indonesia have had poor moonsoon driving forest fires. It is highly likely post realization of Harvest produce in Oct-Nov -19 you will see consumer demand in India pick up.nachiket wrote:I used "targeted" in the sense that the GOI's main motivation behind this move seems to be to stimulate investment in manufacturing, which in itself is a very good idea. My concern is about how this plays out in a low demand environment, especially when any action the government might take to boost demand is likely to incur a loss in revenues in the short term at least.

-

nandakumar

- BRFite

- Posts: 1641

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Nov 27 2017

The 2000 era years of boom in investments was driven not just by 'animal spirits ' of entrepreneurs but also by the belief that they (promoters) risk nothing because their investments were next to nothing. The promoters equity was managed through various associated companies within the conglomerate. Additionally the project costs themselves were inflated with some of the kickbacks finding their way back as promoters equity. But above all the personal guarantees of the promoters were rarely invoked by the banks, prospects of jail time for the promoters due to diversion of funds and mismanagement was unthinkable. Those rules have changed. In the circumstances will entrepreneurs risk putting their own monies in new businesses now? I doubt.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.thehindu.com/business/Econo ... 468367.ece

Now, India Inc can deploy CSR funds on research

Nirmalaji is hearing us and kicking the rear end ... Come on!

Now, India Inc can deploy CSR funds on research

The Union government has decided to allow corporate India to use their mandatory corporate social responsibility spending on publicly-funded incubators and contribute to research efforts in science, technology, medicine and engineering at major institutions and bodies.

Union Finance Minister Nirmala Sitharaman said the rules governing the Corporate Social Responsibility (CSR) spending norms have been amended to pave the way for greater investment into research – a parameter the country fares poorly globally.

India’s spending on Research and Development (R&D) activities has been far less than 1% of the GDP for years, with the private sector chipping in less than half of investments. The Companies Act requires firms with a net worth of ₹500 crore, turnover of ₹1,000 crore or net profit of ₹5 crore or more to set aside 2% of their average net profits over the last three years towards ‘approved’ CSR activities.

Nirmalaji is hearing us and kicking the rear end ... Come on!

Re: Indian Economy News & Discussion - Nov 27 2017

China has ceased purchases of American oil in February as a result of an ongoing trade war between Washington and Beijing.

As a result, circumstances appear ripe for greater cooperation. Unsurprisingly, a major component of Modi’s agenda are meetings with several energy companies eyeing deals toward this end.

Howdy Modi Agenda aside from optics that benefits both sides

https://www.forbes.com/sites/ronakdesai ... ing-texas/

As a result, circumstances appear ripe for greater cooperation. Unsurprisingly, a major component of Modi’s agenda are meetings with several energy companies eyeing deals toward this end.

Howdy Modi Agenda aside from optics that benefits both sides

https://www.forbes.com/sites/ronakdesai ... ing-texas/

Re: Indian Economy News & Discussion - Nov 27 2017

twitter

Just like what Dr @Swamy39 had predicted.. GSTN headed for a disaster thanks to Infosys. Delivery issues, resource issues, delays, quality issues.. what else is left to fail in IT projects

@Infosys gets pulled up by #GST Council nominated GoM on IT issues. @TimsyJaipuria reports on this exclusive. #CNBCTV18Exclusive

https://twitter.com/CNBCTV18News/status ... 2902134785

8:11 PM - 18 Sep 2019

Re: Indian Economy News & Discussion - Nov 27 2017

Now that type of announcement would be bigger than all the budgets since the Bank Nationalization Act, before I was born!Anujan wrote:Public sector banks barring one or two should be divested so that we never get into the NPA mess again.