Throw in rising oil prices with currency slide is not good sign for inflation or retail prices.The Nifty PSE Index of 20 government-run lenders’ shares slid 2.1 percent on Tuesday, the most in five months. The rupee suffered its biggest loss in nearly a month, falling as much as 1 percent. The currency slid 0.9 percent to close at 64.0425 per dollar.

“The market is taking it as the RBI may not be willing to go out of the way to help manage the losses,” said Vijay Sharma, executive vice president for fixed income at PNB Gilts Ltd. in New Delhi. “Hence, it’s expected that demand for government securities may take a further beating.”

Indian Economy News & Discussion - Nov 27 2017

-

Mort Walker

- BRF Oldie

- Posts: 10040

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Indian Economy News & Discussion - Nov 27 2017

Indian Bonds Slide as RBI Says Banks Must Manage Own Rate Risk

Re: Indian Economy News & Discussion - Nov 27 2017

^I think the financial analysts* are trying to create a gloom/doom circular statement so that they can make money on either side of the trades. Least of all Bloomberg's business week.

For example, the latest run in the bond yields is due to inflation fears and slim margin of BJP victory in Gujarat https://www.bloomberg.com/news/articles ... -worsening

Now the financial analysts and the bond traders are spooked that RBI cannot be their baby sitter and wipe their a$$e$ whenever they make a loss making trade:

RBI saw through it and indicated, go suck your thumb if you are exposed to government securities and come back to RBI and ask to spread the losses over several quarters. RBI is not going to manage your losses.

Here is a gloom and doom article: [url]https://www.bloombergquint.com/global-e ... -16-months[/quote]

But the key takeaways:

** I am dumbing it down yes, but again if you understand the core you can do away with the complexity which is generally unnecessary.

For example, the latest run in the bond yields is due to inflation fears and slim margin of BJP victory in Gujarat https://www.bloomberg.com/news/articles ... -worsening

Now the financial analysts and the bond traders are spooked that RBI cannot be their baby sitter and wipe their a$$e$ whenever they make a loss making trade:

What exactly do the banks who have invested in Indian sovereign bonds? Here is the problem:Repeated use of regulatory help “isn’t desirable from the point of view of efficient price discovery” in the bond market and effective market discipline, Viral Acharya, deputy governor of the Reserve Bank of India, said late Monday at a meeting of traders. “Interest-rate risk of banks cannot be managed over and over again by their regulator.”

In a nutshell, commercial banks and state-run banks have parked >80% of their investments back into GOI securities. So if I am running a bank and I have Rs. 100 to invest and I go and invest Rs. 80 in Government securities (instead of lending it out)** and with bond prices falling and I incur losses on my portfolio then is it right if I do the following?“With relatively high duration and concentration of government securities in investment portfolio, bank earnings and capital remain exposed to adverse yield moves,” Acharya said. Government securities made up about 82 percent of commercial banks’ total investments in the year ended March 2017, and about 84 percent for state-run banks, he said. The exposure “has noticeably increased since 2014,” he said.

Basically if you spilled some raita (yogurt based side dish) on the floor, you are asking RBI to allow you to spread the raita so that your loss appears thinner!Lenders including State Bank of India and Central Bank of India have asked the RBI to let them spread the losses incurred on the sovereign debt in the three months ended December over two quarters, the Economic Times newspaper reported on Jan. 4.

RBI saw through it and indicated, go suck your thumb if you are exposed to government securities and come back to RBI and ask to spread the losses over several quarters. RBI is not going to manage your losses.

And then the financial analysts and their cohorts in the Banks who do lazy risk-free investing scream that this will lead to inflation and hence gloom and doom. All because the RBI did not allow them to spread their Raita.“The market is taking it as the RBI may not be willing to go out of the way to help manage the losses,” said Vijay Sharma, executive vice president for fixed income at PNB Gilts Ltd. in New Delhi. “Hence, it’s expected that demand for government securities may take a further beating.”

Here is a gloom and doom article: [url]https://www.bloombergquint.com/global-e ... -16-months[/quote]

But the key takeaways:

*I do not trust financial analysts. And economists. I may be completely biased, but again I am independent and not beholden to anything.Consumer food prices went up 4.96 percent over last year compared to a 4.42 percent rise in November.

Prices of pulses and products fell 23.5 percent year-on-year. Prices have softened for the thirteenth straight month.

Fuel and light inflation stood at 7.9 percent compared to 7.92 percent in November.

Housing inflation stood at 8.25 percent, compared to 7.36 percent in November.

Prices of clothing and footwear went up 4.8 percent over last year compared to 4.96 percent in November.

** I am dumbing it down yes, but again if you understand the core you can do away with the complexity which is generally unnecessary.

Re: Indian Economy News & Discussion - Nov 27 2017

https://timesofindia.indiatimes.com/ind ... 531855.cms

Foreign tourist arrivals hit new high of one crore, earnings cross $27-billion mark

Foreign tourist arrivals hit new high of one crore, earnings cross $27-billion mark

-

A Deshmukh

- BRFite

- Posts: 522

- Joined: 05 Dec 2008 14:24

Re: Indian Economy News & Discussion - Nov 27 2017

This is one area we can easily invest a lot and attract more.vijayk wrote:https://timesofindia.indiatimes.com/ind ... 531855.cms

Foreign tourist arrivals hit new high of one crore, earnings cross $27-billion mark

Countries like Bhutan and Vietnam are falling to the lucre of Chinese tourist money.

I am not saying we go after Chinese tourists, but there a huge scope of development:

- forts - sell the history. no other country will have so many forts and historical events to hype up.

- tiger sanctuaries / wildlife safaris

- waterfalls

- kerala backwaters and other bird sanctuaries

- temples and buddhist pilgrimage centers

- himalaya and mountaineering

- water sports - Ganga and beaches

- yoga and meditation centers.

We need to think beyond goa and taj mahal.

I would like to see the next visiting dignitary taken somewhere else other than Agra.

During Rajiv Gandhi days, we had Festival of India in a lot of countries. That can be revived.

Re: Indian Economy News & Discussion - Nov 27 2017

Well Tourism can be a big job generator but it needs widespread spending on hotel industry, transport, cleanliness, connectivity and PR.

Re: Indian Economy News & Discussion - Nov 27 2017

And security for tourists.Prasad wrote:Well Tourism can be a big job generator but it needs widespread spending on hotel industry, transport, cleanliness, connectivity and PR.

Re: Indian Economy News & Discussion - Nov 27 2017

http://www.livemint.com/Opinion/WXxXhuf ... stock.html

Six months later: taking stock

Six months later: taking stock

Six months is too short a period to evaluate any mega reform, but it is a good time to take stock of what has been achieved and what can be done to make it better

Firstly, GST has economically united the country through the underlying notion of “One Nation, One Tax, One Market”. Many argue that we are still far away from the concept of “One tax” due to the presence of four GST rates. It needs to be appreciated that barring a few high-income countries, most, including developed countries, generally have two-three tax rates. What India has been able to achieve is uniform indirect tax regime throughout the country by subsuming more than a dozen central and state indirect taxes. This will reduce the compliance burden of the taxpayers in a big way.

Secondly, barring a few exceptions like Canada and Brazil, in most countries GST has been implemented as a central tax and taxes collected are subsequently devolved to the states. However, keeping in view India’s federal structure, we have been successful in rolling out GST incorporating bold concepts of dual GST and integrated GST (IGST). Dual GST has ensured that the states have constitutional power to levy GST along with the centre and IGST has ensured that GST truly remains a destination-based consumption tax.

Thirdly, in the pre-GST era, value-added tax administrations of the states operated at varied levels of efficiency and effectiveness. Post-GST, all have moved on to a uniform information technology (IT)-enabled environment wherein all taxpayers, small or big, have to transact through a single portal being managed by the Goods and Services Tax Network (GSTN). The GSTN system virtually eliminates interaction of the taxpayer with the tax authorities as all processes including registration, filing of returns and tax payments have been enabled online. The shift is a quantum leap for many states.

Fourthly, it has been possible to largely do away with interstate commercial tax barriers. Now there is no scope for tax arbitration between the states as tax rates are uniform throughout the country. This has resulted in faster movement of trucks, reduced logistic costs and led to huge energy savings.

Fifthly, the GST Council has emerged as a unique institution capable of taking quick decisions through consensus in the true spirit of cooperative federalism.

Mega economic reforms take time to stabilize, but yield long-term benefits. Such reforms stay as a work in progress for some time and the council, GSTN and the tax administrators both at the centre and the states have their task cut out for them for some time. The five key tasks for further smoothening the new tax regime are:

Firstly, GSTN has to put all the resources at its command to make its IT system more robust and user-friendly. It needs to implement remaining modules, make more offline utilities and ensure that GST Suvidha Providers develop required packages to cater to the needs of various segments of taxpayers. The group of ministers under the chairmanship of Sushil Modi, deputy chief minister of Bihar, has done commendable work by identifying the milestones, prioritizing them and closely monitoring them.

Secondly, focus has to now shift to plugging loopholes and ensuring better compliance. The GST Council, in its 24th meeting on 9 December, took a welcome decision to introduce interstate e-way bills with effect from 1 February. Flexibility has been provided to the states to implement intra-state e-way bills by 1 June. The e-way bill system is already being implemented successfully in Karnataka and is being scaled up to make it pan-India. The gradual approach adopted for e-way bills should make its roll-out smooth.

Thirdly, the launch of GST did result in initial problems for the exporting community due to blockage of their working capital. The GST Council was quick to constitute a committee under the chairmanship of revenue secretary Hasmukh Adhia to look into the problems of the exporters. The committee recommended a number of short-term measures which have been implemented and immediate concerns of the exporters have been addressed. As a long-term solution, the council also decided to introduce an e-wallet scheme for exporters. The introduction of the e-wallet scheme will ensure that the chain of free flow of input tax credit is not broken and there is an in-built self-policing mechanism.

Fourthly, the council has shown resilience in responding to the needs of the common man as well as trade and industry by rationalizing the rates of many goods and services and removing ambiguities. There is always scope for further rationalization and issuing clarifications with a view to minimizing classification disputes and bringing about a common understanding in the field. The fitment committee will have to continue to work in that direction.

Fifthly, the ultimate success of any tax regime lies in making it as simple as possible both for the taxpayers and tax administrators. The GST Council has constituted a committee under the chairmanship of A.B. Pandey, chairman of GSTN and chief executive of the Unique Identification Authority of India, to simplify filing of returns without compromising on the basic tenets of the GST regime. In addition, a law review committee consisting of senior officials of the centre and the states is in the process of recommending changes in the GST laws so as to make the regime simple, taxpayer-friendly, and to address the concerns of medium and small enterprises. The reports of the committees are to be discussed in the forthcoming meeting of the GST Council on 18 January, and taxpayers can expect further simplification and improvements.

What has been achieved in a short span of six months is indeed transformative and path-breaking. As the new tax regime stabilizes, one can expect a larger tax base, buoyancy in GST revenues, more exports and foreign direct investment, improvement in ease of doing business, and a boost to “Make in India”.

Re: Indian Economy News & Discussion - Nov 27 2017

This is an extremely important piece of news. A rise in sales of CVs, particularly M/HCVs, is an early indicator of rising economic sentiment, since it underlines that companies are investing in transport equipment having forecast greater business activity in the immediate future. The high growth of the mid 2000s were accompanied by an immediately preceding trend of rapid growth in CV sales.vijayk wrote:

Re: Indian Economy News & Discussion - Nov 27 2017

'https://mobile.apherald.com/Politics/Vi ... come-Tax-/

Modi plans to eliminate Income Tax?

Anyone heard this?

Modi plans to eliminate Income Tax?

Anyone heard this?

Re: Indian Economy News & Discussion - Nov 27 2017

That article does not cite any sources and seems to be uninformed speculation.

Re: Indian Economy News & Discussion - Nov 27 2017

^^ although I'd love for it to be true, seems unlikely. Why would jetli constitute a panel to examine possible changes to direct taxes if they had already decided to get rid of income tax?

Re: Indian Economy News & Discussion - Nov 27 2017

The article is typical kite flying from people regarding income tax.

Unless the government actually says something on income tax. Don't believe anything you hear.

Unless the government actually says something on income tax. Don't believe anything you hear.

Re: Indian Economy News & Discussion - Nov 27 2017

#Fitch

#IndRa

#IndRa

Re: Indian Economy News & Discussion - Nov 27 2017

This is more plausible:

Budget 2018: Government may tweak income tax laws for job creation

https://timesofindia.indiatimes.com/bus ... 546655.cms

Budget 2018: Government may tweak income tax laws for job creation

https://timesofindia.indiatimes.com/bus ... 546655.cms

Re: Indian Economy News & Discussion - Nov 27 2017

http://www.financialexpress.com/economy ... y/1018590/

Modi vindicated as IIM study debunks jobless growth theory, says 15 million added to labour force yearly

Modi vindicated as IIM study debunks jobless growth theory, says 15 million added to labour force yearly

The Narendra Modi-led government got a big boost as a new study finds that 15 million people are being added to the labour force every year, busting the theory that jobs are not being created in the country. The study, authored by SBI group Chief Economic Advisor Soumya Kanti Ghosh and Pulak Ghosh, said, “Given declining population, we estimate that on an average 25 million babies born per year (this has been calculated after adjusting infant morality rate from crude birth rate) has remained largely constant in the last three decades. Out of 25 million, we expect that 15 million are added to labour force (after conservatively assuming 40% of them voluntarily remain out of labour force or are involved in domestic/agriculture work).”

The study, titled “Towards a Payroll Reporting in India”, estimated that 3.68 million jobs were generated till November of FY18, which would imply 5.5 million in the entire year. “Based on all estimates, payroll of 5.9 lakh (i.e. 7 million annual) generated every month in India in current fiscal,” the report added.

Interestingly, the study has zeroed in only new contributors who were 18-25 years old, to ensure they were capturing only new employees. Further, new employee accounts that didn’t have steady EPFO contributions were also dropped on the grounds they may be fraud accounts. All data pertain to the formal sector as informal sector employees don’t contribute to EPFO. In addition, the authors say there is also considerable employment generated from other sectors like education. In the automobiles sector alone, based on automobile sales, they estimate this sector generated 2 million driver jobs in FY17.

The authors have also provided various suggestions to the government, reproduced below.

It should be mandatory for the professional bodies, hospitals, nursing homes etc. to submit the details of new joinees every 3 month to the local Government offices.

From April 1, 2018 Government should ask every GST filer for giving total number of permanent employees on payroll and total no of contract employees on payroll Some tax deduction (per person) may be given for domestic help, if their name and details are registered with tax authorities by the household employing them.

Currently NPS give extra tax deductions of Rs 50,000 p.a. Government should continue this incentive and provide new incentives also to encourage people to join NPS.

Re: Indian Economy News & Discussion - Nov 27 2017

https://economictimes.indiatimes.com/we ... 593024.cms

The Real Estate Regulatory Act (RERA) has acted as a great confidence booster for prospective buyers, around 45 per cent of whom are now looking to purchase homes in the first quarter of 2018, Quikr Homes Vice president Sonu Abhinandan Kumar said here today.

"Around 45 per cent of prospective buyers are looking to purchase homes in first quarter of 2018 following the great confidence boost RERA has given them. This is a positive outlook for real estate,

Kumar, also the business head of Quikr, said RERA has brought in greater transparency, timely project delivery and organised development and has acted as a confidence booster for prospective buyers.

"It has accelerated the construction process and reduced overall costs for consumers by providing attractive discounts and innovative pricing schemes," he said after releasing 2018 Quikr Homes Consumer Sentiment Report.

Kumar said granting of infrastructure status to affordable housing projects by the centre in 2017 resulted in a 27 per cent increase in supply of newly constructed affordable homes in the first three quarters of the same year to some 26,000 units

Re: Indian Economy News & Discussion - Nov 27 2017

Per a Gallup survey and other sources:

https://www.forbes.com/sites/panosmourd ... e836b8203b

Couldn't directly find the above claim, did find this doc.

https://wageindicator.org/documents/pub ... ation-2017

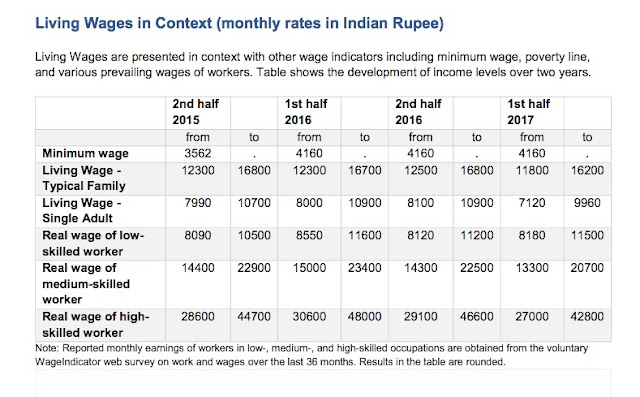

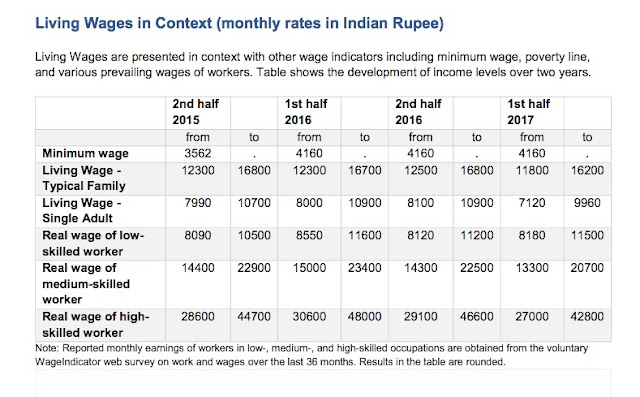

Notice how the data is collected.

https://www.forbes.com/sites/panosmourd ... e836b8203b

....only 3% of Indians consider themselves thriving in 2017 compared to 14% in 2014.

The wage data is supposed to be from wageindicator.org.Meanwhile, wages paid to low-skilled labor decreased to 10300 INR/Month in 2017 from 13300 INR/Month in 2014.

Couldn't directly find the above claim, did find this doc.

https://wageindicator.org/documents/pub ... ation-2017

Notice how the data is collected.

Re: Indian Economy News & Discussion - Nov 27 2017

India Ranks Below China, Pakistan On This World Economic Forum Index

https://www.ndtv.com/business/india-ran ... eststories

https://www.ndtv.com/business/india-ran ... eststories

Re: Indian Economy News & Discussion - Nov 27 2017

Austin wrote:India Ranks Below China, Pakistan On This World Economic Forum Index

https://www.ndtv.com/business/india-ran ... eststories

The index takes into account the "living standards, environmental sustainability and protection of future generations from further indebtedness", the WEF said.

Pftooh, why did I even think of Pakistan? My apologies to all.Pakistan is better off than India on these three in somebody's dreams only. IMO, need to look at the data on which this measure is based, if we're to include it as a measure of development.

WEF has issued 2 versions of this Inclusive Development Index so far, 2017 and 2018

https://www.weforum.org/projects/inclus ... evelopment

The data for these for India is as follows:

Code: Select all

India

2017 2018 Measure

1806 1861 GDP per capita $

14681 16528 Labor productivity $

59.6 59.6 Healthy Life Expectancy, yrs

52.2 51.9 Employment %

47.9 47.9 Net income GINI

58.0 60.4 Poverty rate %

87.6 83.0 Wealth GINI

n/a 2.9 Median income

20.3 19.8 Adjusted net savings %

162.9 162.9 Carbon intensity kg per $ of GDP

69.1 69.5 Public debt %

52.4 51.5 Dependency ratio

The GDP per capita - haven't been able to find the original source, yet.

However, assumed real GDP per capita of 1806 to 1861 represents a growth of 3.05%. India's population growth rate in 2016 is said to be 1.2% (e.g., Google data), implying a real GDP growth rate of about 4.3%, (way lower than the around 7% growth rate). It would take a population growth rate of about 3.8% to make the per capita income, GDP growth rate and population growth rate square.

Re: Indian Economy News & Discussion - Nov 27 2017

So we have higher Poverty Rate % and Higher Public Debt in 2018 compared to previous year ?A_Gupta wrote: The data for these for India is as follows:Code: Select all

India 2017 2018 Measure 1806 1861 GDP per capita $ 14681 16528 Labor productivity $ 59.6 59.6 Healthy Life Expectancy, yrs 52.2 51.9 Employment % 47.9 47.9 Net income GINI 58.0 60.4 Poverty rate % 87.6 83.0 Wealth GINI n/a 2.9 Median income 20.3 19.8 Adjusted net savings % 162.9 162.9 Carbon intensity kg per $ of GDP 69.1 69.5 Public debt % 52.4 51.5 Dependency ratio

Re: Indian Economy News & Discussion - Nov 27 2017

Stupid question: how does a 5% increase in per capita income cause an increase in poverty rate despite a decrease in GINI (inequality coefficient) ?

OECD document

This strikes me as yet another stupid 'index' constituted of a collection of data from various sources that are mutually inconsistent and are nothing more than noise.

People are best of utilizing independently tracked data from GoI for both GDP, per capita income and poverty rate.

OECD document

In short, how does a country with among the fastest growth rate and a decreasing income dispersion sees a fall in median income ?A typical estimate from these cross-country studies is that a 10 per cent increase in a country’s average income will reduce the poverty rate by between 20 and 30 per cent.1

The central role of growth in driving the speed at which poverty declines is confirmed by research on individual countries and groups of countries.

This strikes me as yet another stupid 'index' constituted of a collection of data from various sources that are mutually inconsistent and are nothing more than noise.

People are best of utilizing independently tracked data from GoI for both GDP, per capita income and poverty rate.

Re: Indian Economy News & Discussion - Nov 27 2017

If you look hard you will be able to find some data to support your political agenda e.g. employment data. We had an avalanche of supposedly employment data suggesting "jobless growth" till someone looked at pension/PF data to find a whole lot of employment. The GDP will be about 2.6 trillion FY17 (from IMF rupee data) and at 1.3 billion it means about 2000 dollar per capita GDP. What is the purpose of statistical gymnastics to show a growth rate of 4.3%?

Re: Indian Economy News & Discussion - Nov 27 2017

I may be rip-wan-vinkle., did I wake up in 2019?A_Gupta wrote: The data for these for India is as follows:Code: Select all

India 2017 2018 Measure 1806 1861 GDP per capita $ 14681 16528 Labor productivity $ 58.0 60.4 Poverty rate % 87.6 83.0 Wealth GINI n/a 2.9 Median income 20.3 19.8 Adjusted net savings % 162.9 162.9 Carbon intensity kg per $ of GDP 69.1 69.5 Public debt % 52.4 51.5 Dependency ratio

When did 2018 complete and we are in 1st quarter of 2019 to get reliable 2018 data?

Re: Indian Economy News & Discussion - Nov 27 2017

One has to read the complete farticle to get at #mediapimp perfidy.

I have a proposal, we *must* not link any ndtv economic news related articles here. Here is the reason why:Austin wrote:India Ranks Below China, Pakistan On This World Economic Forum Index

https://www.ndtv.com/business/india-ran ... eststories

The above CYA statement is in the article itself. Now coming to article:(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

India Ranks Below China, Pakistan On This World Economic Forum Index

Norway remains the world's most inclusive advanced economy, while Lithuania again tops the list of emerging economies, the World Economic Forum said.

Business | Press Trust of India | Updated: January 22, 2018 15:24 IST

Norway remains the world's most inclusive advanced economy, while Lithuania again tops the list of emerging economies, the World Economic Forum (WEF) said while releasing the yearly index here before the start of its annual meeting, to be attended by several world leaders including Prime Minister Narendra Modi and US President Donald Trump.

The index takes into account the "living standards, environmental sustainability and protection of future generations from further indebtedness", the WEF said. It urged the leaders to urgently move to a new model of inclusive growth and development, saying reliance on GDP as a measure of economic achievement is fuelling short-termism and inequality.

India was ranked 60th among 79 developing economies last year, as against China's 15th and Pakistan's 52nd position.

The 2018 index, which measures progress of 103 economies on three individual pillars -- growth and development; inclusion; and inter-generational equity -- has been divided into two parts. The first part covers 29 advanced economies and the second 74 emerging economies.

The index has also classified the countries into five sub-categories in terms of the five-year trend of their overall Inclusive Development Growth score -- receding, slowly receding, stable, slowly advancing and advancing.

Despite its low overall score, India is among the ten emerging economies with 'advancing' trend. Only two advanced economies have shown 'advancing' trend.

Among advanced economies, Norway is followed by Ireland, Luxembourg, Switzerland and Denmark in the top five.

Small European economies dominate the top of the index, with Australia (9) the only non-European economy in the top 10. Of the G7 economies, Germany (12) ranks the highest. It is followed by Canada (17), France (18), the UK (21), the US (23), Japan (24) and Italy (27).

The top-five most inclusive emerging economies are Lithuania, Hungary, Azerbaijan, Latvia and Poland.

Performance is mixed among BRICS economies, with the Russian Federation ranking 19th, followed by China (26), Brazil (37), India (62) and South Africa (69).

Of the three pillars that make up the index, India ranks 72nd for inclusion, 66th for growth and development and 44th for inter-generational equity.

The neighbouring countries ranked above India include Sri Lanka (40), Bangladesh (34) and Nepal (22). The countries ranked better than India also include Mali, Uganda, Rwanda, Burundi, Ghana, Ukraine, Serbia, Philippines, Indonesia, Iran, Macedonia, Mexico, Thailand and Malaysia.

Although China ranks first among emerging economies in GDP per capita growth (6.8 per cent) and labour productivity growth (6.7 per cent) since 2012, its overall score is brought down by lacklustre performance on inclusion, the WEF said. It found that decades of prioritising economic growth over social equity has led to historically high levels of wealth and income inequality and caused governments to miss out on a virtuous circle in which growth is strengthened by being shared more widely and generated without unduly straining the environment or burdening future generations.

Excessive reliance by economists and policy-makers on Gross Domestic Product as the primary metric of national economic performance is part of the problem, the WEF said.

The GDP measures current production of goods and services rather than the extent to which it contributes to broad socio-economic progress as manifested in median household income, employment opportunity, economic security and quality of life, it added.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Re: Indian Economy News & Discussion - Nov 27 2017

As they say, there are lies, damn lies and statistics.

The poverty rate definition according to OECD is "the number of people (in a given age group) whose income falls below half the median household income of the total population".

Per capita income on the other hand is a mean value (gross national income/population), not a median (a.k.a middle value in data set). The nature of the data is not known unless the total data used to compute the median is known.

Example:

year 1

population = 10

working pop = 5

incomes: [Rs.100, Rs.120, Rs.150, Rs.160, Rs.180]

Average per capita income: Rs.71

Median income: Rs.150

year 2 (pop rises by 1, 2 people get new jobs at the low end, everyone else sees marginal pay gains)

population: 11

working pop: 7

incomes: [Rs.80, Rs.90, Rs.105, Rs.125, Rs.155, Rs.165, Rs.185]

Per capita income: Rs.82 (+15%)

Median income: Rs.125 (-16%!! ZOMG!!)

When a large number of new people start reporting new job incomes that earn less than current median pay - quite normal since the newly employed get low pay at the beginning - guess what happens ? Median falls, and 'poverty rate increases', even though mean income rises as more people are employed and making money, and the aggregate wealth is rising.

On the other hand, if you have a stagnant economy where the rich get richer and no job creation, median will rise along with mean, from the few people crossing above the median.

The poverty rate definition according to OECD is "the number of people (in a given age group) whose income falls below half the median household income of the total population".

Per capita income on the other hand is a mean value (gross national income/population), not a median (a.k.a middle value in data set). The nature of the data is not known unless the total data used to compute the median is known.

Example:

year 1

population = 10

working pop = 5

incomes: [Rs.100, Rs.120, Rs.150, Rs.160, Rs.180]

Average per capita income: Rs.71

Median income: Rs.150

year 2 (pop rises by 1, 2 people get new jobs at the low end, everyone else sees marginal pay gains)

population: 11

working pop: 7

incomes: [Rs.80, Rs.90, Rs.105, Rs.125, Rs.155, Rs.165, Rs.185]

Per capita income: Rs.82 (+15%)

Median income: Rs.125 (-16%!! ZOMG!!)

When a large number of new people start reporting new job incomes that earn less than current median pay - quite normal since the newly employed get low pay at the beginning - guess what happens ? Median falls, and 'poverty rate increases', even though mean income rises as more people are employed and making money, and the aggregate wealth is rising.

On the other hand, if you have a stagnant economy where the rich get richer and no job creation, median will rise along with mean, from the few people crossing above the median.

Re: Indian Economy News & Discussion - Nov 27 2017

I feel the lack of a GDF forum, I'll simply say (and moderator delete this if inappropriate) that there is a spate of negative articles as the Indian Prime Minister heads to World Economic Forum (WEF) at Davos. As shown above, the WEF itself is in this game. There is a Gallup survey whose results were in the US news in mid-December; the Indian component of it is being publicized now. This is all, IMO, to weaken the Indian position in whatever negotiations happen at Davos.

Re: Indian Economy News & Discussion - Nov 27 2017

This "WEF Index" is deliberately contrived so as to supply talking points to the neo-colonialist fifth column by amplifying the tired rhetoric of the global left. The principal criterion is a nebulous and virtue-signaling "inclusiveness", supposedly determined by "taking into account" living standards, environmental sustainability and protection of future generations from further indebtedness.

One of many nonsensical "HDI" contrivances that invariably place Scandinavian Welfare Paradises on the very top so that they can wag their peremptory fingers at everyone else. That itself shows who the protagonists and chief proponents of this propaganda instrument are.

One of many nonsensical "HDI" contrivances that invariably place Scandinavian Welfare Paradises on the very top so that they can wag their peremptory fingers at everyone else. That itself shows who the protagonists and chief proponents of this propaganda instrument are.

Re: Indian Economy News & Discussion - Nov 27 2017

I think that's plenty of feedback into the whole thing. Yes the general agenda is pretty clear. That's said, there's nothing of further use to this thread beyond an analysis to demonstrate that the stats for those indices are just that - statistics.

The most notable ones among them typify a technical misunderstanding of what the mathematical basis of the calculation (movement of the median due to much greater dynamic change in the working set at the lower end) implies, relation to the verbal claim (increase in poverty).

The problem lies with assigning some fancy name like 'poverty rate' to a statistical artifact that's nothing more than a median cutoff point. It works great with a stable working population with highly clustered incomes slowly rising (a.k.a standard Scandinavian paradise economic situation), and the use of median instead of mean helps smooth out skew.

It's woefully inadequate to characterize an economy rapidly gaining millions on the lower end of the employment market every year, who all add to mean income and aggregate wealth, but lower the median, unless the number of jobs above the median income exceed the ones under the median, which isn't likely for new jobs; median pay will typically be higher than mean - probably around Rs.1.5 lakh, so the 'poverty rate' bar is even higher.

Statistics are wonderful - it can be used to interpret the population as getting poorer even as they're rapidly getting richer.

Let's move on.

The most notable ones among them typify a technical misunderstanding of what the mathematical basis of the calculation (movement of the median due to much greater dynamic change in the working set at the lower end) implies, relation to the verbal claim (increase in poverty).

The problem lies with assigning some fancy name like 'poverty rate' to a statistical artifact that's nothing more than a median cutoff point. It works great with a stable working population with highly clustered incomes slowly rising (a.k.a standard Scandinavian paradise economic situation), and the use of median instead of mean helps smooth out skew.

It's woefully inadequate to characterize an economy rapidly gaining millions on the lower end of the employment market every year, who all add to mean income and aggregate wealth, but lower the median, unless the number of jobs above the median income exceed the ones under the median, which isn't likely for new jobs; median pay will typically be higher than mean - probably around Rs.1.5 lakh, so the 'poverty rate' bar is even higher.

Statistics are wonderful - it can be used to interpret the population as getting poorer even as they're rapidly getting richer.

Let's move on.

Re: Indian Economy News & Discussion - Nov 27 2017

Please don’t use this thread as a platform for Rajans political ambitions . The governors of the RBI are supposed to follow the etiquette of focusing on carefully worded policy statements in the role, and then keep away from critiquing the political economy once they demit office . Same rules of public probity as what applies to retired chiefs of defense staffs. Rajans attention seeking behavior merely devalues him .

Re: Indian Economy News & Discussion - Nov 27 2017

That's typical ndtv exaggeration and spin. Look at the intv video and listen to what he says. He obviously doesn't agree with the move but that is of course his opinion.

https://www.ndtv.com/video/business/ndt ... jan-477279

https://www.ndtv.com/video/business/ndt ... jan-477279

Re: Indian Economy News & Discussion - Nov 27 2017

It does not matter either way. Radhuram Rajan was the head of the central bank of the 3rd largest economy on the planet. He was a public servant appointed by the government of India, and who served entirely at the pleasure of the government. Same as retired Army/Navy/Air Force chiefs.

The position of RBI Governor comes with responsibilities of mature behavior. One of which is, once his tenure is over, he disappears from public view. Retired Army chiefs aren't supposed to sit around offering weekly commentary on govt's defense efforts. Similarly, RBI gov isn't supposed to sit around offering statements about political economy. They respect the position of enormous power they held, know their responsibilities, and keep quiet.

It is a mistake for Rajan to behave like he does, and this thread will not be used to serve his behavior.

The position of RBI Governor comes with responsibilities of mature behavior. One of which is, once his tenure is over, he disappears from public view. Retired Army chiefs aren't supposed to sit around offering weekly commentary on govt's defense efforts. Similarly, RBI gov isn't supposed to sit around offering statements about political economy. They respect the position of enormous power they held, know their responsibilities, and keep quiet.

It is a mistake for Rajan to behave like he does, and this thread will not be used to serve his behavior.

Re: Indian Economy News & Discussion - Nov 27 2017

he is still butt hurt from his "departure" from the RBI. He probably thought that he would be having nightly fireside chats with Modi on a regular basis while thrusting his commie ideas on the Indian state.Prasad wrote:That's typical ndtv exaggeration and spin. Look at the intv video and listen to what he says. He obviously doesn't agree with the move but that is of course his opinion.

https://www.ndtv.com/video/business/ndt ... jan-477279

He has let his "TV persona" get to his gigantic ego and thinks that Indians are still interested in what he says. He is a stooge of offshore interests, just like another RBI governor was.

The very fact that he speaks on runditv betrays his agenda and his political leanings. Both of these items are not what an ex RBI should be displaying in public.

Good riddance to this guy.

Re: Indian Economy News & Discussion - Nov 27 2017

Can't compare the two. Army chiefs become chiefs at the fag end of their career, and then retire before slipping into oblivion (for the most part). Rajan is still in the prime of his professional life, and he is a professor. Expecting him to not talk or pontificate is an exercise in futility.Suraj wrote:...One of which is, once his tenure is over, he disappears from public view. Retired Army chiefs aren't supposed to sit around offering weekly commentary on govt's defense efforts.

It is a mistake for Rajan to behave like he does, and this thread will not be used to serve his behavior.

Agreed he needs to maintain professional discretion here, which includes not talking about sensitive matters he learnt in his professional capacity, and not speculating on matters related to the RBI.Suraj wrote:They respect the position of enormous power they held, know their responsibilities, and keep quiet.

Re: Indian Economy News & Discussion - Nov 27 2017

Chinese media explains MBAs are not India's strength but weakness

Partially agree with the Chinese viewpoint.

The global Indian diaspora and its success in senior management positions internationally IS a strength for India. However, the relative lack of Indian multinationals as compared to China is definitely a huge weakness.

I am disappointed by the lack of aspiration evidenced so far in the current governent to encourage the emergence of Indian multinationals and also in identifying areas of the future and strategically going after Indian leadership in those spaces.

I am certainly a strong proponent of the Centre-Right - but very soon we will need to upgrade to a Centre-Right Version 2.0 govt. The version we have seen so far has been quite disappointing in terms of its intellectual and strategic ambitions.

Partially agree with the Chinese viewpoint.

The global Indian diaspora and its success in senior management positions internationally IS a strength for India. However, the relative lack of Indian multinationals as compared to China is definitely a huge weakness.

I am disappointed by the lack of aspiration evidenced so far in the current governent to encourage the emergence of Indian multinationals and also in identifying areas of the future and strategically going after Indian leadership in those spaces.

I am certainly a strong proponent of the Centre-Right - but very soon we will need to upgrade to a Centre-Right Version 2.0 govt. The version we have seen so far has been quite disappointing in terms of its intellectual and strategic ambitions.