Any idea what is the break up % wise of US T Bills , Euro T Bills , Gold etc ?Suraj wrote:Just some of it .chetak wrote: aren't our forex reserves already held in amreki treasury bills??

Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

There's a weekly release by RBIAustin wrote:Any idea what is the break up % wise of US T Bills , Euro T Bills , Gold etc ?Suraj wrote: Just some of it .

Link

As per latest release

RBI doesn't give breakdown by currency but RBI has an internal currency basket benchmark. US$ is estimated to be 60-70% of the total FX assets.Foreign Exchange Reserves

Item As on December 1, 2017Code: Select all

₹ Bn. US$ Mn. 1 2 1 Total Reserves 25,894.1 401,942.0 1.1 Foreign Currency Assets 24,316.4 377,456.1 1.2 Gold 1,334.0 20,703.4 1.3 SDRs 96.8 1,502.3 1.4 Reserve Position in the IMF 146.9 2,280.2

Re: Indian Economy News & Discussion - Nov 27 2017

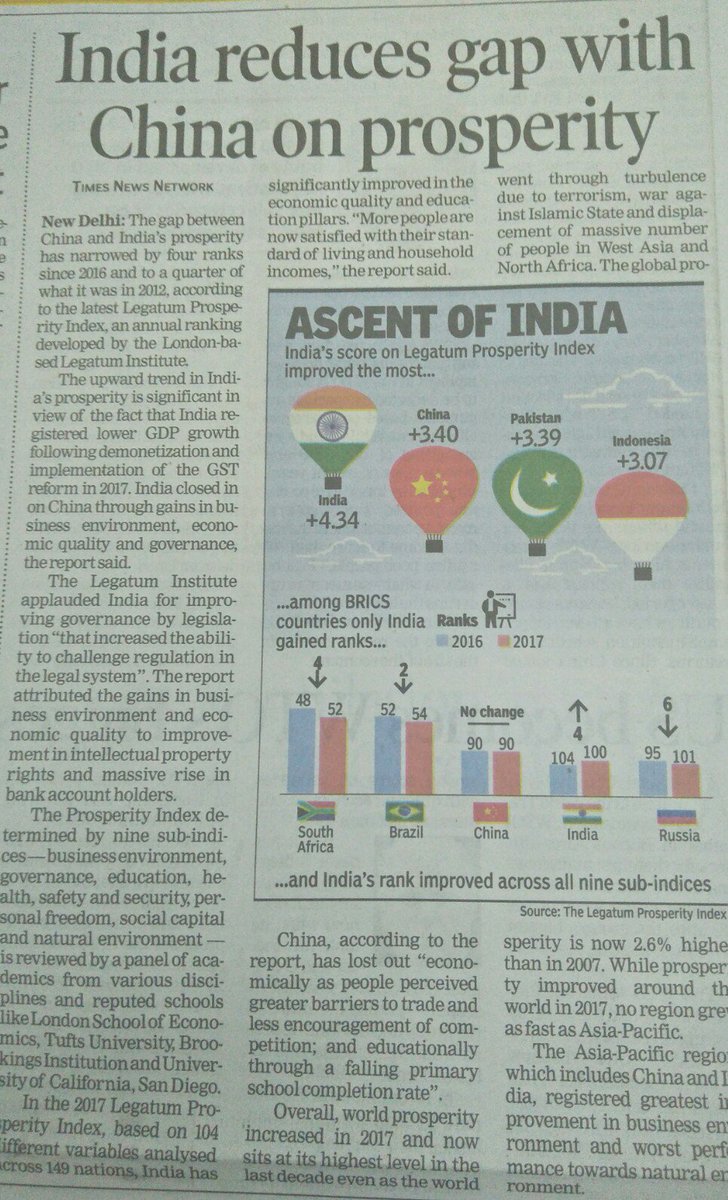

Pakistan +3.39 ????

PS: you can go to their website and look, supposedly Pakistan's adult literacy jumped 5 points from 2016 to 2017 (from 49% to 54%).

So I don't trust this Legatum stuff.

http://www.prosperity.com/data-explorer ... e&flipXY=f

PS: you can go to their website and look, supposedly Pakistan's adult literacy jumped 5 points from 2016 to 2017 (from 49% to 54%).

So I don't trust this Legatum stuff.

http://www.prosperity.com/data-explorer ... e&flipXY=f

vijayk wrote:

Re: Indian Economy News & Discussion - Nov 27 2017

Bloomberg:

https://www.bloomberg.com/news/articles ... -crop-area

India’s Cotton Output Expected to Hit a Three-Year High

https://www.bloomberg.com/news/articles ... -crop-area

India’s Cotton Output Expected to Hit a Three-Year High

Re: Indian Economy News & Discussion - Nov 27 2017

A_Gupta wrote:Bloomberg:

https://www.bloomberg.com/news/articles ... -crop-area

India’s Cotton Output Expected to Hit a Three-Year High

We should not export to the turds at all.A bigger Indian crop and low domestic prices will likely boost exports from the South Asian country amid higher demand from Pakistan, Gupta said in Mumbai on Tuesday. Shipments to Pakistan are seen rising to 1.8 million bales in 2017-18 from 790,000 bales a year earlier, she said.

Re: Indian Economy News & Discussion - Nov 27 2017

No politics here.

Re: Indian Economy News & Discussion - Nov 27 2017

http://www.dnaindia.com/business/report ... st-2567085

Indian companies rank 3rd over providing employment, Taiwan tops list

Indian companies rank 3rd over providing employment, Taiwan tops list

India is the third most optimistic nation in hiring intentions as 22 per cent of employers are expected to add more staff in the next three months while Taiwan topped the pack, says a survey.

According to the survey released today by leading staffing consultancy ManpowerGroup India, workforce gains were expected across all seven industry sectors monitored and in all four regions.

Taiwan with a net employment outlook of 25 per cent topped the list of being most optimistic in terms of hiring intentions for the next three months, followed by Japan (24 per cent) and India (22 per cent) in second and third positions, respectively.

Re: Indian Economy News & Discussion - Nov 27 2017

http://www.livemint.com/Politics/0k7vhV ... ember.html

worrying signs ?CPI-based retail inflation rose to 4.88% in November from 3.58% in October, India’s factory output measured by IIP slowed to 2.2% in October from 4.14% in September

Re: Indian Economy News & Discussion - Nov 27 2017

Both CPI and IIP data are useless on a monthly basis . They are too noisy and the best way is to use something like a 3 month trend line .

Meanwhile, demand for central and state government bonds by foreign investors continues unabated, and RBI once again raises the total limit on holdings by another ~$2 billion:

RBI raises FPI investment limit in bonds

WTO talks on brink of collapse as US rejects solution to food security

Meanwhile, demand for central and state government bonds by foreign investors continues unabated, and RBI once again raises the total limit on holdings by another ~$2 billion:

RBI raises FPI investment limit in bonds

India continues to stick to its guns on food security at the WTO Ministerial Summit, while US brinkmanship leads to near collapse of the summit:FPIs can now invest Rs 6,400 crore more in central government securities, and Rs 5,800 crore more in state bonds, over and above their existing limits. This move is part of a medium-term road map that the RBI has planned for FPI investment. From January, FPIs can invest Rs 2.56 lakh crore in central government securities, and Rs 45,100 crore in state development loans. The limits include those reserved for long-term investors. For portfolio flows, the limits for central and state government bonds stand revised at Rs 1.913 lakh crore and Rs 31,500 crore, respectively. As of December 11, FPIs have exhausted 99.21 per cent of their investment limit in central government securities but have taken up only 17.11 per cent of their limits in state loans.

WTO talks on brink of collapse as US rejects solution to food security

Talks at the 11th ministerial meeting of the World Trade Organization (WTO) is on the brink of collapse, with the US refusing to engage in the effort to find a permanent solution to the public stock-holding issue, official sources said.

India has all through been maintaining that a permanent solution to food stockpile issue was a “must have” at the ongoing ministerial and failure to do so would impact the credibility of the strong multilateral trade institution.

The Indian team, led by Commerce and Industry Minister Suresh Prabhu, in cooperation with the G33 grouping, is pitching hard for a permanent solution to food security issue as it is crucial for livelihood of 800 million people across the globe.

Re: Indian Economy News & Discussion - Nov 27 2017

Thanks , Why do they keep the IMF SDR in such low numbers considering its benchmarked against Basket of Currency with Reserve Status provided by IMF ?JTull wrote:There's a weekly release by RBIAustin wrote:

Any idea what is the break up % wise of US T Bills , Euro T Bills , Gold etc ?

Link

As per latest releaseRBI doesn't give breakdown by currency but RBI has an internal currency basket benchmark. US$ is estimated to be 60-70% of the total FX assets.Foreign Exchange Reserves

Item As on December 1, 2017Code: Select all

₹ Bn. US$ Mn. 1 2 1 Total Reserves 25,894.1 401,942.0 1.1 Foreign Currency Assets 24,316.4 377,456.1 1.2 Gold 1,334.0 20,703.4 1.3 SDRs 96.8 1,502.3 1.4 Reserve Position in the IMF 146.9 2,280.2

Re: Indian Economy News & Discussion - Nov 27 2017

India's Current Account Deficit Shrinks More Than Estimated

https://www.bloomberg.com/news/articles ... -estimated

https://www.bloomberg.com/news/articles ... -estimated

The shortfall was $7.2 billion in July-September, or 1.2 percent of gross domestic product, the Reserve Bank of India said in a statement in Mumbai on Wednesday.

That compares with a median $8.3 billion deficit projected in a Bloomberg survey of 16 economists.

The gap is smaller than the previous quarter’s revised $15 billion deficit (2.5 percent of GDP), but substantially higher than the $3.4 billion recorded in July-September 2016 as the trade deficit widened.

Re: Indian Economy News & Discussion - Nov 27 2017

Some answers:Austin wrote:Thanks , Why do they keep the IMF SDR in such low numbers considering its benchmarked against Basket of Currency with Reserve Status provided by IMF ?

SDRs are not something you go buy on the market. They are allocated to countries by IMF in a ratio determined by IMF. It is based on a basket of currencies determined by their relative prominence. Currently that basket consists of USD, EUR, CNY, JPY and GBP. The amount of financial resources contributed to IMF determines the amount of SDRs one has. Further, the decision of contributing more is voted upon by those who currently hold the largest fraction of SDRs. Voting power is proportionate to resources contributed so far. Per Bretton Woods agreement, US also holds a veto power. India's voting rights were increased marginally to 2.8% in 2016.

RBI doesn't report breakdown of how it holds forex reserves, beyond currency/gold/SDR as posted above. This is standard. No central bank does so. You can go look at other parties' own breakdown of holdings of assets by foreign parties. Eg:

Major foreign holders of US treasuries

As of Sept 2017, approx $145 billion of forex reserves is held in US treasuries. Like I said earlier, just some of it, since total forex reserves are over $400 billion...

Re: Indian Economy News & Discussion - Nov 27 2017

Wrong way to Make In India: Why we must resist the temptation to return to import substitution mirage - Arvind Panagariya

Which country has trade surplus with China? And by the looks of it, they have done very well.

Aren't we then putting barriers on our industries? Import substitution by competing with importing goods will allow our industries to compete on the world stage.

The example of oil is half true. What the author does not mention is our overall exports were hit by fall in oil prices, because our biggest export is oil products. Nothing to do to our effort to reduce oil imports.

I don't understand world trade like the esteem economist, but personally i feel is a weird argument against import substitution. I am all for genuine competition in trade(except against dumping like the chinis do), but I don't see why we should allow other countries to sell us stuff at cheap, kill out local industries so that they can have revenue to buy some other stuff from us! This is not trade, it is just money exchange.Put another way, if foreigners cannot sell their goods to us, they will not have the revenues to pay for the goods they buy from us. If we cut back on their goods, they will have to cut back on ours. Even the large decline in our oil import bill during 2015-16 was accompanied by a near equivalent decline in our exports. What is added to Make in India through import substitution will get subtracted by losses in exports.

The key to the gains from international trade is that we export products that we produce at the lowest cost and import those that our trading partners produce at the lowest cost. In this way, we maximise the gains from trade. Import substitution, which relies on raising barriers against imports or subsidising our products, undermines these gains.

Which country has trade surplus with China? And by the looks of it, they have done very well.

Aren't we then putting barriers on our industries? Import substitution by competing with importing goods will allow our industries to compete on the world stage.

The example of oil is half true. What the author does not mention is our overall exports were hit by fall in oil prices, because our biggest export is oil products. Nothing to do to our effort to reduce oil imports.

Re: Indian Economy News & Discussion - Nov 27 2017

I don't agree with Panagariya's argument either, because his statement presumes that the unit of exchange is a neutral unit, .e.g gold like in the old days when someone (Pliny ?) complained that India was draining all of Rome's gold.

Instead, we are trading mostly in the other country's currency, i.e. reserve currencies like USD and EUR. They're not going to 'run out of it'. There's very little to do between oil prices falling and the claim being made, to suggestion the causation he argues. Our export promotion policies were in doldrums for a couple of years, and it just happened to be at the same time as lower oil prices.

Instead, we are trading mostly in the other country's currency, i.e. reserve currencies like USD and EUR. They're not going to 'run out of it'. There's very little to do between oil prices falling and the claim being made, to suggestion the causation he argues. Our export promotion policies were in doldrums for a couple of years, and it just happened to be at the same time as lower oil prices.

Re: Indian Economy News & Discussion - Nov 27 2017

Thanks, So are you suggesting that any country cannot buy more SDR if it wants to instead of US T Bills or Euro Equivalent and the amount of SDR any country can keep depends on its voting rights ?Suraj wrote:Some answers:Austin wrote:Thanks , Why do they keep the IMF SDR in such low numbers considering its benchmarked against Basket of Currency with Reserve Status provided by IMF ?

SDRs are not something you go buy on the market. They are allocated to countries by IMF in a ratio determined by IMF. It is based on a basket of currencies determined by their relative prominence. Currently that basket consists of USD, EUR, CNY, JPY and GBP. The amount of financial resources contributed to IMF determines the amount of SDRs one has. Further, the decision of contributing more is voted upon by those who currently hold the largest fraction of SDRs. Voting power is proportionate to resources contributed so far. Per Bretton Woods agreement, US also holds a veto power. India's voting rights were increased marginally to 2.8% in 2016.

RBI doesn't report breakdown of how it holds forex reserves, beyond currency/gold/SDR as posted above. This is standard. No central bank does so. You can go look at other parties' own breakdown of holdings of assets by foreign parties. Eg:

Major foreign holders of US treasuries

As of Sept 2017, approx $145 billion of forex reserves is held in US treasuries. Like I said earlier, just some of it, since total forex reserves are over $400 billion...

I find IMF SDR to be a better forex to keep as it is not dependent on any single country but on basket of reserves and as per Jim Rickards there is ICE-Nine documented plan to make SDR as global reserves The Ice-Nine Lockdown

Re: Indian Economy News & Discussion - Nov 27 2017

I happen to notice on twitter, that someone posted an image of Made in India Samsung charger. Gladden my heart. Nothing to do with patriotism, but the the fact it is a stepping stone towards massive growth in exports.

All people have to do is look at Chinese items of export. Headphones & heaters exports runs in billions! There is tremendous scope to compete with the Chinis and does not require technology breakthroughs.

It is these "non-cool" items which is going to help us drive our exports. Just like the Samsung charger.

All people have to do is look at Chinese items of export. Headphones & heaters exports runs in billions! There is tremendous scope to compete with the Chinis and does not require technology breakthroughs.

It is these "non-cool" items which is going to help us drive our exports. Just like the Samsung charger.

Re: Indian Economy News & Discussion - Nov 27 2017

SDR is not 'bought'. It is allocated. It's not a unit of currency but of allocated power, whose value is based on a basket of currencies. The constituents of that basket is set by IMF, and the exchange rate between SDR and those currencies is also specified. IMF votes every 5 years on whether to tweak the allocations, based on geopolitical reality and economic contributions to IMF.Austin wrote:Thanks, So are you suggesting that any country cannot buy more SDR if it wants to instead of US T Bills or Euro Equivalent and the amount of SDR any country can keep depends on its voting rights ?

Re: Indian Economy News & Discussion - Nov 27 2017

India holds USD $1502.3 million worth of IMF SDR (from above).

December 13, 2017 exchange rate is 1 USD = 0.709315 SDR. (https://www.imf.org/external/np/fin/data/rms_sdrv.aspx )

Therefore India holds 1065.6 million SDR.

India is allocated 3297.1 million SDR. ( https://www.imf.org/external/np/tre/sdr ... 9/0709.htm )

So India is holding about 1/3rd SDR of what it could hold.

Why would the RBI prefer its own mix of currencies rather than SDR (which represents a basket of currencies)?

I don't know. Currently the SDR mix is:

December 13, 2017 exchange rate is 1 USD = 0.709315 SDR. (https://www.imf.org/external/np/fin/data/rms_sdrv.aspx )

Therefore India holds 1065.6 million SDR.

India is allocated 3297.1 million SDR. ( https://www.imf.org/external/np/tre/sdr ... 9/0709.htm )

So India is holding about 1/3rd SDR of what it could hold.

Why would the RBI prefer its own mix of currencies rather than SDR (which represents a basket of currencies)?

I don't know. Currently the SDR mix is:

Code: Select all

Currency Currency amount under Rule O-1

Chinese Yuan 1.0174

Euro 0.38671

Japanese Yen 11.900

U.K. Pound Sterling 0.085946

U.S. Dollar 0.58252

Re: Indian Economy News & Discussion - Nov 27 2017

What's the rate of return on SDR ?  They make interest on holding government debt of other countries, after all.

They make interest on holding government debt of other countries, after all.

Re: Indian Economy News & Discussion - Nov 27 2017

http://www.imf.org/external/np/fin/data/sdr_ir.aspx

The current interest rate is 0.744%.

How is it determined? - excerpt:

The current interest rate is 0.744%.

How is it determined? - excerpt:

So perhaps the RBI likes to keep some assets in longer-than-three-month bonds?Interest rate on the financial instrument of each component currency in the SDR basket, expressed as an equivalent annual bond yield: three-month benchmark yield for China Treasury bonds as published by China Central Depository and Clearing Co; three-month spot rate for euro area central government bonds with a rating of AA and above published by the European Central Bank; three-month Japanese Treasury Discount bills; three-month UK Treasury bills; and three-month US Treasury bills.

Rule T-1 has been amended (see Press Release) and specifies that the SDR interest rate for each weekly period commencing each Monday shall be the higher of (i) the combined market interest rate or (ii) 0.050 percent. The combined market interest rate is the sum, as of the Friday preceding each weekly period, rounded to three decimal places, of the products that result from multiplying each yield or rate listed above by the value in terms of SDRs of the amount of the corresponding currency specified in Rule O-1. If a yield or rate is not available for a particular Friday, the calculation shall be made on the basis of the latest available yield or rate.

Last edited by A_Gupta on 14 Dec 2017 00:53, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

Well, my checking account recently advertised 1.25%  Jokes apart, it doesn't look like RBI gives much importance to SDR holding. It's a relatively small number, and even if we take our full allocation it amounts to 0.7% of our forex reserves. Not something to get excited about.

Jokes apart, it doesn't look like RBI gives much importance to SDR holding. It's a relatively small number, and even if we take our full allocation it amounts to 0.7% of our forex reserves. Not something to get excited about.

Re: Indian Economy News & Discussion - Nov 27 2017

May be.Rahul M wrote:http://www.livemint.com/Politics/0k7vhV ... ember.html

worrying signs ?CPI-based retail inflation rose to 4.88% in November from 3.58% in October, India’s factory output measured by IIP slowed to 2.2% in October from 4.14% in September

Asian Development Bank lowers India’s GDP forecast for FY18 to 6.7%

New Delhi: The Asian Development Bank (ADB) on Wednesday lowered India’s GDP forecast for the current fiscal by 0.3% to 6.7 %, attributing it to tepid growth in the first half, demonetisation and transitory challenges of tax sector reforms.

It has also revised downward the gross domestic product (GDP) outlook for next fiscal beginning from March 2018 to 7.3% from 7.4% mainly due to rising global crude oil prices and soft growth in private sector investment.

Re: Indian Economy News & Discussion - Nov 27 2017

To use a concrete example - he's not advocating that Indian manufacturers not making machinery at the same quality and price as say Germany. Just that don't put barriers on importing from Germany TODAY when Indian manufacturers are not competitive in that market and force everyone only to use Indian machines. It will hurt exporters that use those machines to make goods that India can manufacture cheaper due to say lower cost of labour.nam wrote:Wrong way to Make In India: Why we must resist the temptation to return to import substitution mirage - Arvind Panagariya

I don't understand world trade like the esteem economist, but personally i feel is a weird argument against import substitution. I am all for genuine competition in trade(except against dumping like the chinis do), but I don't see why we should allow other countries to sell us stuff at cheap, kill out local industries so that they can have revenue to buy some other stuff from us! This is not trade, it is just money exchange.Put another way, if foreigners cannot sell their goods to us, they will not have the revenues to pay for the goods they buy from us. If we cut back on their goods, they will have to cut back on ours. Even the large decline in our oil import bill during 2015-16 was accompanied by a near equivalent decline in our exports. What is added to Make in India through import substitution will get subtracted by losses in exports.

The key to the gains from international trade is that we export products that we produce at the lowest cost and import those that our trading partners produce at the lowest cost. In this way, we maximise the gains from trade. Import substitution, which relies on raising barriers against imports or subsidising our products, undermines these gains.

Re: Indian Economy News & Discussion - Nov 27 2017

In the debate of local manufacturing vs imports, the consumer is the one most hurt. Consumers lose out on choice, technology, performance, efficiency and so on. Manufacturers become LAX and quality, technology are neglected.

Whenever this debate arises think of the Fiat, Ambassador era. Or even ITI made land lines.

Think of the overall loss to the nation by use of obsolete technology.

Whenever this debate arises think of the Fiat, Ambassador era. Or even ITI made land lines.

Think of the overall loss to the nation by use of obsolete technology.

Re: Indian Economy News & Discussion - Nov 27 2017

Are you saying there is no growth and inflation? Or there is both growth and inflation? Or there is only growth but no inflation?Dipanker wrote: May be.

Re: Indian Economy News & Discussion - Nov 27 2017

Sir, why are you picking up selective data?Rahul M wrote:http://www.livemint.com/Politics/0k7vhV ... ember.html

worrying signs ?CPI-based retail inflation rose to 4.88% in November from 3.58% in October, India’s factory output measured by IIP slowed to 2.2% in October from 4.14% in September

It is fuel and food prices impacting CPIRetail inflation, which rose 3.58% in October, quickened the month after mainly on account of rising fuel and food prices. While fuel price inflation accelerated to 7.9%, food price inflation was up 4.4% in November.

Separate data released by the government showed that India’s factory output, measured by the Index of Industrial Production (IIP), slowed in October from an upwardly revised 4.14% in September.

While inflation data revealed the growing downside risk of rising crude oil prices, the deceleration in factory output suggests the turnaround in investment and demand is yet to resume in earnest.

While mining output was stagnant in October, manufacturing and electricity grew at 2.47% and 3.2%, respectively. Capital goods production, which indicates investment demand in the economy, grew for a third consecutive month in October, by 6.8%. However, consumer durable goods contracted for the second consecutive month at 6.9%.

Reserve Bank of India (RBI) had flagged the upward pressure on inflation including rising fuel prices and the increase in house rent allowance (HRA) to central government employees in its monetary policy review earlier this month, when it kept policy rates unchanged. It had estimated that retail inflation will be around 4.3-4.7% in the third and fourth quarter of 2017-18.

The central bank said that the recent rise in crude oil prices may sustain, especially on account of Organization of the Petroleum Exporting Countries’ decision to maintain production cuts through next year. “In such a scenario, any adverse supply shock due to geopolitical developments could push up prices even further,” it added.

Crude oil prices reached a 30-month high on Tuesday at $65 a barrel, indicating that pressure on inflation, at least on account of fuel, is expected to continue.

The inflation and IIP numbers were disappointing and the price rise vindicated RBI’s decision to hold rates, said Madan Sabnavis, chief economist at Care ratings Ltd.

“Fuel prices should exert upward pressure on inflation but a reduction in GST (goods and services tax) rates of many items should counteract this to some extent. We don’t expect inflation to cross 5%,” he said.

Aditi Nayar, principal economist at Icra Ltd, expected RBI’s status quo on rates to continue. “The continued impact of the HRA revision on housing inflation and elevated fuel prices suggest that CPI inflation is likely to print in a range of 4.4-4.7% in the remainder of FY2018. Our baseline expectation, heading into 2018, remains of an extended pause for policy rates,” she said in a note.

India’s gross domestic product (GDP) growth rebounded to 6.3% in the quarter ended 30 September from 5.7% in the June-ended quarter as activity in the manufacturing sector accelerated. RBI estimates that the Indian economy will grow at 6.7% in 2017-18, which suggests a significant improvement in the second half of this fiscal.

The next few months could be crucial, said Sabnavis.

“There was volatility in production data due to implementation of GST. However, it was expected that this would stabilize. If output does not pick up in November and December, the stagnation could continue till March. Only infrastructure, steel and automobiles are doing well. Rest of the sectors are lagging (behind),” he said.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Indian Economy News & Discussion - Nov 27 2017

The empire strikes back.

https://twitter.com/KanchanGupta/status ... 5698176001

https://twitter.com/KanchanGupta/status ... 5698176001

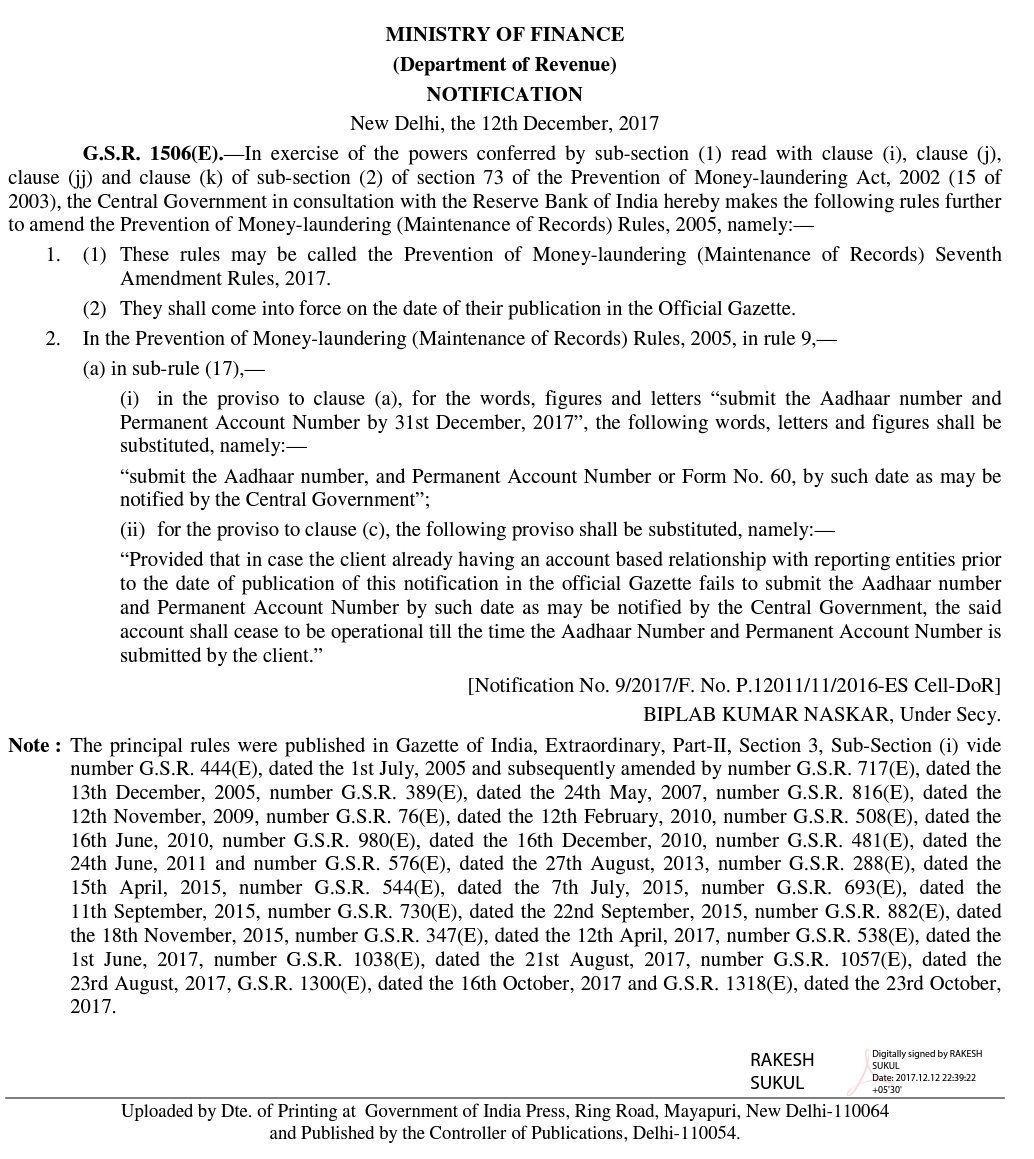

Kanchan GuptaVerified account @KanchanGupta 18h18 hours ago

A sad day. Corrupt majority stumps honest minority. Aadhar-linking of bank accounts put off indefinitely. War on black money, benami accounts and money laundering suffers a huge setback. #India deserves to wallow in filth. We are a #corrupt and loathsome people.

Re: Indian Economy News & Discussion - Nov 27 2017

I came across this notification dated December 13, 2017

Aadhar linkage with Bank accounts has been extended to March 2018

http://pib.nic.in/newsite/PrintRelease. ... lid=174297

Aadhar linkage with Bank accounts has been extended to March 2018

http://pib.nic.in/newsite/PrintRelease. ... lid=174297

Press Information Bureau

Government of India

Ministry of Finance

13-December-2017 17:15 IST

Extension of deadline till 31.3.18 for submission of Aadhaar number, and Permanent Account Number or Form 60 by client to the reporting entity

After considering various representations received and inputs received from Banks, it has been decided to notify 31st March, 2018 or six months from the date of commencement of account based relationship by the client, whichever is later, as the date of submission of the Aadhaar number, and Permanent Account Number or Form 60 by the clients to the reporting entity. Necessary notification in this regard has been issued.

It may be recalled that earlier Under the provisions of Prevention of Money-laundering (Maintenance of Records) Second Amendment Rules, 2017, published in the Extraordinary Gazette of India vide G.S.R. 538 (E) dated 01.06.2017, it was provided that

i) In case the client, eligible to be enrolled for Aadhaar and obtain a Permanent Account Number does not submit the Aadhaar number or the Permanent Account Number at the time of commencement of an account based relationship with a reporting entity, the client shall submit the same within a period of six months from the date of the commencement of the account based relationship. Provided that the clients, eligible to be enrolled for Aadhaar and obtain the Permanent Account Number, already having an account based relationship with reporting entities prior to date of this notification, the client shall submit the Aadhaar number and Permanent Account Number by 31st December, 2017.

(ii) In case the client fails to submit the Aadhaar number and Permanent Account Number within the aforesaid six months period, the said account shall cease to be operational till the time the Aadhaar number and Permanent Account Number is submitted by the client. Provided that in case client already having an account based relationship with reporting entities prior to date of this notification fails to submit the Aadhaar number and Permanent Account Number by 31st December, 2017, the said account shall cease to be operational till the time the Aadhaar number and Permanent Account Number is submitted by the client.

*****

DSM/SBS/KA

Re: Indian Economy News & Discussion - Nov 27 2017

what selective data am I picking ? the IIP slowed down, that's a fact. I asked for an opinion on that.disha wrote:Sir, why are you picking up selective data?

........

It is fuel and food prices impacting CPI

you could have simply explained the nuance like Suraj did. the aggression is unwarranted.

Re: Indian Economy News & Discussion - Nov 27 2017

Rahul’ji., apologies if I came across as aggressive. I was not. I just wanted to point out that from POV the inflation was linked to fuel price spike & food price spike which I think is seasonal. Again I did not mean to be aggressive.

The inflation data was picked by Deepanker’ji & given a political hue.

Anyway., on data, I am not too concerned about IIP data. Neither inflation.

The inflation data was picked by Deepanker’ji & given a political hue.

Anyway., on data, I am not too concerned about IIP data. Neither inflation.

Re: Indian Economy News & Discussion - Nov 27 2017

My real opinion, if you ask is the article sounds like the typical US & Chinese calls on India to "open up the market further". His comment about importing at cheap is a give away in this direction. Notice the article is against the vision of Make in India and the import substitution it provides.KrishnaK wrote: To use a concrete example - he's not advocating that Indian manufacturers not making machinery at the same quality and price as say Germany. Just that don't put barriers on importing from Germany TODAY when Indian manufacturers are not competitive in that market and force everyone only to use Indian machines. It will hurt exporters that use those machines to make goods that India can manufacture cheaper due to say lower cost of labour.

Make in India is about calling on International & Indian companies to manufacture in india. It is obvious International companies cannot manufacture if there are barriers to importing essentials tools. So Make in India is not about setting up barriers, as the author tries to imply.

You can import at cheap ONLY if the exporter wants to prevent local competition. If there is something India cannot produce, it cannot be imported cheap.

Re: Indian Economy News & Discussion - Nov 27 2017

His argument is that Make in India should not be focussed on import substitution at all and should instead be on maximizing exports. He starts with an argument on how import substitution hampered India's export potential.nam wrote:My real opinion, if you ask is the article sounds like the typical US & Chinese calls on India to "open up the market further". His comment about importing at cheap is a give away in this direction. Notice the article is against the vision of Make in India and the import substitution it provides.KrishnaK wrote: To use a concrete example - he's not advocating that Indian manufacturers not making machinery at the same quality and price as say Germany. Just that don't put barriers on importing from Germany TODAY when Indian manufacturers are not competitive in that market and force everyone only to use Indian machines. It will hurt exporters that use those machines to make goods that India can manufacture cheaper due to say lower cost of labour.

Re: Indian Economy News & Discussion - Nov 27 2017

Well, you cannot have exports without import substitution. No country produces goods only for exports, without selling to it's populace first.

We would never been a car exporting country, if companies like Suzuki was not able to find market in India. Even a company like LM will only set up export unit, if GoI buys 100 F16s!

Which is why the author, with due respect is talking nonsense.

We would never been a car exporting country, if companies like Suzuki was not able to find market in India. Even a company like LM will only set up export unit, if GoI buys 100 F16s!

Which is why the author, with due respect is talking nonsense.

Re: Indian Economy News & Discussion - Nov 27 2017

Boss what are you talking about ? Why can you not have exports without import substitution ? You can most definitely produce goods exclusively for exports - ever heard of SEZs ? All the SE Asian countries constrained local consumption and used those household savings to finance the manufacturing sector - almost all of which was exports.nam wrote:Well, you cannot have exports without import substitution. No country produces goods only for exports, without selling to it's populace first.

To use your own example - should Suzuki be forced to use Indian manufacturing equipment by substituting imports on manufacturing equipment or should they be allowed to import those and manufacture cars of acceptable price and quality ? But even here, the argument is pretty absurd. India should focus on making shoes and phones, not cars.We would never been a car exporting country, if companies like Suzuki was not able to find market in India. Even a company like LM will only set up export unit, if GoI buys 100 F16s!

Which is why the author, with due respect is talking nonsense.

Re: Indian Economy News & Discussion - Nov 27 2017

Here Nitin Gadkari gives a good speech on his ministry efforts towards improving India economy and create over 1 crore jobs etc etc

1) Roadways- increase highways. reduce road deaths by 50%. Talks about BharatMala etc, reducing distance by over 350 kms from North India to South India bypassing Itarsi etc.

2) biofuels etc to reduce pollution

3) waterways- Both coastal and inland riverways- capitalising on lower transport costs, using biofuels to reduce , Iran chabhar port etc

4) Clean Ganga project work-

5) pilgrimage to Kedarnath Badrinath and others to have all season road with good infrastructure.

6) talks about tourism potential with high rate of employment etc.

7) many underground tunnels in Jammu Kashmir and Arunachal

8 )Water dispute between Ka and TN over cauvery- bring waters from polavaram of Godavari to krishna and to KA and TN. upto 300 tmc of water wasted to sea.

9) river linking at certain areas of the country like UP MP, GJ MH MP , AP TN KA etc etc

so many facts ideas and plans to implement them

good speech .

fully development only no politics.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Indian Economy News & Discussion - Nov 27 2017

I'd be overjoyed if a decent fraction of these eye-popping numbers could somehow precipitate into reality only. Sigh.

Eyeing $1 trillion in digital business, government works on a new electronics policy (TOI)

Eyeing $1 trillion in digital business, government works on a new electronics policy (TOI)

Proof of pudding and all that. Well just have to wait and see I guess.NEW DELHI: A new electronics manufacturing policy is on the anvil and work is also on for rolling out an upgraded software products architecture as the government lays down measures to boost India's digital economy to $1 trillion over the coming years.

The ambitious transition includes a deeper focus on boosting manufacturing within the country, while also laying down measures to push and encourage electronics and digital exports in a large way, IT Minister Ravi Shankar Prasad told TOI after holding a high-level meeting with CEOs and top representatives of the industry.

Prasad said that initiatives such as Digital India and policy benefits given to start-ups will also aid the growth of the digital sector which is currently estimated to account for a turnover of $280 billion.

"The new policy will focus majorly on new-age digital applications in the field of data analysis, artificial intelligence, internet-of-things, virtual reality, healthcare, augmented reality and robotics," the minister said.

Prasad held the meeting with representatives from sectors such as IT and financial services, electronics, healthcare, agriculture, education, skills and logistics. Apart from the industry representatives, senior officials from ministries such as telecom, human resources, defence production, commerce and skill development also participated in the meeting.

Re: Indian Economy News & Discussion - Nov 27 2017

Government To Bear MDR On Debit Card Payments Up To Rs 2,000 For Two Years

This is quite massive imo.The government will bear the merchant discount rate charges on transactions up to Rs 2,000 made through debit cards, BHIM UPI or Aadhaar-enabled payment systems to promote digital transactions, IT Minister Ravi Shankar Prasad said today.

The MDR will be borne by the government for two years with effect from Jan. 1, 2018 by reimbursing the same to the banks. The move will have an impact of Rs 2,512 crore on the exchequer.

The decision was taken at the Cabinet meeting chaired by Prime Minister Narendra Modi, Prasad said.

Re: Indian Economy News & Discussion - Nov 27 2017

I used to like Prof. Debroy before he joined the government. He was free to speak his mind for the best interests of India but not anymore. Obviously, the answers he gives to questions raised have reasonable and rational explanations, but that is what they are explanations to why objectives have not been achieved.

[youtube]M5ZVF3BGaZ0&t=2087s[/youtube]

https://www.youtube.com/watch?v=M5ZVF3BGaZ0&t=2087s

[youtube]M5ZVF3BGaZ0&t=2087s[/youtube]

https://www.youtube.com/watch?v=M5ZVF3BGaZ0&t=2087s

-

Rishirishi

- BRFite

- Posts: 1409

- Joined: 12 Mar 2005 02:30

Re: Indian Economy News & Discussion - Nov 27 2017

Even if he cant say what he wants, does not mean he cant do his best to get his will. His mind has not changed, only the language. Does it really matter ?ShauryaT wrote:I used to like Prof. Debroy before he joined the government. He was free to speak his mind for the best interests of India but not anymore. Obviously, the answers he gives to questions raised have reasonable and rational explanations, but that is what they are explanations to why objectives have not been achieved.

[youtube]M5ZVF3BGaZ0&t=2087s[/youtube]

https://www.youtube.com/watch?v=M5ZVF3BGaZ0&t=2087s