NEW DELHI (Reuters) - India launched a $6.65 billion plan on Tuesday to boost electronics manufacturing, saying it would start by offering five global smartphone makers incentives to establish or expand domestic production.

The government is offering a production-linked incentive (PLI) involving cash worth 4% to 6% of additional sales of goods made locally over five years, with 2019-2020 as the base year, technology minister Ravi Shankar Prasad told a news conference.

Names of the five companies, which would have to meet investment and sales thresholds to be eligible, were expected to be announced in the next two months, ministry officials said.

Five Indian firms would also be selected for the PLI scheme, which, along with two other related initiatives, could help India produce smartphones and components worth 10 trillion rupees ($133 billion) by 2025, Prasad said.

The smartphone industry has become a showpiece for Prime Minister Narendra Modi's 'Make In India' drive. The government now wants to make the country an export hub.

Global players such as Samsung and Taiwanese firms Foxconn and Wistron, which both supply Apple, have already ramped up local production, attracted by India's huge market of 1.3 billion people.

The new plan also includes schemes to drive up production of components and create manufacturing clusters with pre-built factory sheds and common facilities for companies to move in immediately.

"We want the bridegrooms to come but we also want the entire wedding procession. A company coming (to India) should also bring the entire procession of its ancillaries," Prasad said.

The plan comes as more companies look for manufacturing sites outside China, where the coronavirus pandemic disrupted global supply chains. India, which offers cheap labor, has more than 1 billion mobile connections but less than half that number of smartphones, offering manufacturers a huge potential market.

Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

India launches $6.7 billion plan to boost electronics manufacturing

Re: Indian Economy News & Discussion - Nov 27 2017

India not alone to get Moody’s downgrade tag

By Surojit Gupta, TNN|Last Updated: Jun 03, 2020, 10.20 AM IST

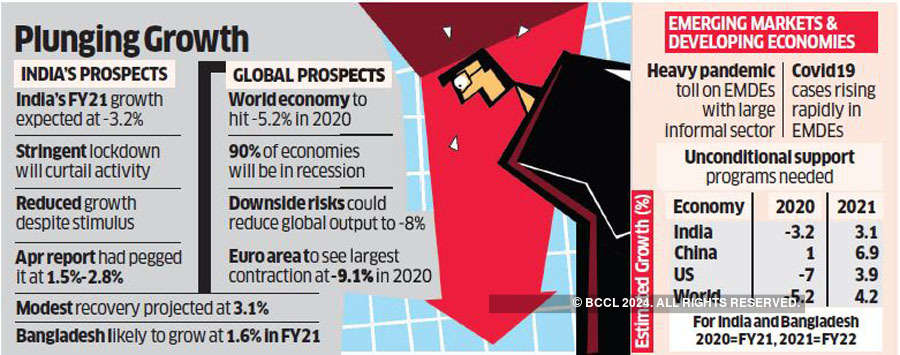

NEW DELHI: A clutch of over 30 countries, including , has seen ratings downgraded or outlook changed by global ratings agency Moody’s Investors Service this year as the Covid-19 pandemic smothered economies across the globe and governments stepped up spending to protect growth and provide relief.

On Monday, Moody’s downgraded India’s sovereign rating a notch to Baa3, which is still investment grade, and retained its outlook as negative, citing slow reforms, policy makers facing rising challenges from a prolonged period of slower growth, rising government debt and weakening debt affordability and stress in the .

South Africa, part of the BRICS group of countries, witnessed its ratings downgraded on March 27, while France saw a change in its outlook. and Mexico have also faced downgrades. Thailand, Israel and Saudi Arabia have also seen their outlook change. Argentina, which is grappling with a debt crisis and faces a contraction of 2.2% in its GDP growth, was downgraded by Moody’s on April 4.

Several economists said Moody’s had jumped the gun to upgrade India in June 2017, taking the government’s promise of reforms and prospects of growth to move ahead of other ratings agencies such as and S&P. Now, with Monday’s downgrade, it is in line with the ratings of the other agencies.

“The ratings downgrade by Moody’s is not a surprise as the agency had already downgraded India’s outlook to negative from stable in November 2019 on concerns of lower economic growth, weak reform traction and stressed financial sector. The worsening of fiscal position in Q4FY20 and the external Covid-led shock was a final nail, which led to Moody’s rating on par with peers on India’s rating status,” Madhavi Arora, economist at , said in a note.

Financial markets were muted in their reaction to the Moody’s downgrade as indications from the agency had prompted them to price in the possibility. Now, all eyes are on the action that S&P and Fitch take. Economists said emerging markets are seen to be more prone to downgrades. “So far, around 21 emerging and developing countries have registered either a rating and/ or outlook downgrade by the agency,” said Soumya Kanti Ghosh, group chief economic adviser at SBI.

https://economictimes.indiatimes.com/ne ... 168650.cms

By Surojit Gupta, TNN|Last Updated: Jun 03, 2020, 10.20 AM IST

NEW DELHI: A clutch of over 30 countries, including , has seen ratings downgraded or outlook changed by global ratings agency Moody’s Investors Service this year as the Covid-19 pandemic smothered economies across the globe and governments stepped up spending to protect growth and provide relief.

On Monday, Moody’s downgraded India’s sovereign rating a notch to Baa3, which is still investment grade, and retained its outlook as negative, citing slow reforms, policy makers facing rising challenges from a prolonged period of slower growth, rising government debt and weakening debt affordability and stress in the .

South Africa, part of the BRICS group of countries, witnessed its ratings downgraded on March 27, while France saw a change in its outlook. and Mexico have also faced downgrades. Thailand, Israel and Saudi Arabia have also seen their outlook change. Argentina, which is grappling with a debt crisis and faces a contraction of 2.2% in its GDP growth, was downgraded by Moody’s on April 4.

Several economists said Moody’s had jumped the gun to upgrade India in June 2017, taking the government’s promise of reforms and prospects of growth to move ahead of other ratings agencies such as and S&P. Now, with Monday’s downgrade, it is in line with the ratings of the other agencies.

“The ratings downgrade by Moody’s is not a surprise as the agency had already downgraded India’s outlook to negative from stable in November 2019 on concerns of lower economic growth, weak reform traction and stressed financial sector. The worsening of fiscal position in Q4FY20 and the external Covid-led shock was a final nail, which led to Moody’s rating on par with peers on India’s rating status,” Madhavi Arora, economist at , said in a note.

Financial markets were muted in their reaction to the Moody’s downgrade as indications from the agency had prompted them to price in the possibility. Now, all eyes are on the action that S&P and Fitch take. Economists said emerging markets are seen to be more prone to downgrades. “So far, around 21 emerging and developing countries have registered either a rating and/ or outlook downgrade by the agency,” said Soumya Kanti Ghosh, group chief economic adviser at SBI.

https://economictimes.indiatimes.com/ne ... 168650.cms

Re: Indian Economy News & Discussion - Nov 27 2017

Uday Kotak sells 2.8% in Kotak Mahindra Bank for 6,900 crore

BY ET BUREAU | UPDATED: JUN 03, 2020, 07.52 AM IST

Mumbai: Asia’s richest banker sold 56 million shares, or 2.8 per cent stake, for more than 6,900 crore through block deals on Tuesday to reduce his stake in to 26.1 per cent in a move to comply with Reserve Bank of India (RBI) regulations.

The buyers included a group of international and domestic investors including Fidelity Funds South East Asia, Invesco Oppenheimer, Goldman Sachs India, JP Morgan, UBS, Regents of University of California, Aberdeen, Capital Group, Canada Pension Plan Investment Board (CPPIB), Societe Generale, SBI Mutual Fund, Birla MF, Axis MF and ICICI Prudential Life Insurance, according to a BSE filing by Kotak Mahindra Bank. Sovereign wealth funds of Singapore (GIC), Kuwait (Kuwait Investment Authority) and Abu Dhabi (Abu Dhabi Investment Authority) also invested, it said. Invesco Oppenheimer already holds a 2.86 per cent stake while Capital World has 1.9 per cent. SBI MF holds a stake of 2.56 per cent and CPPIB holds 6.2 per cent.

Uday Kotak collected an estimated $918 million (6,912 crore) through such deals, said a person whose organisation is associated with the fundraising exercise.

The price band was initially pegged at Rs 1,215-1,240 apiece. The billionaire banker is said to have sold the shares at the higher end of that band, dealers said.

The placement agents for the deal were Morgan Stanley, Kotak Securities, and Goldman Sachs (India) Securities.

In January, the RBI had allowed Kotak to hold a 26 per cent stake in Kotak Mahindra Bank as long as it didn’t raise capital through a share sale. The promoter’s voting rights were restricted to 15 per cent from April. Uday Kotak is also not allowed to top up his stake if it falls below 26 per cent. He has time until September to prune his holding by another 0.1 per cent in the bank to fully comply with the RBI rules.

Last week, Kotak raised Rs 7,442.5 crore through a QIP by issuing 65 million new shares at Rs 1,145 each. This QIP helped reduce Kotak’s stake to 29 per cent. It also helped the bank buffer its capital reserves. Several global long-only investors, pension money managers, sovereign funds and top local mutual fund houses bought most of the shares.

According to RBI guidelines, private bank promoters need to lower their holding to 40 per cent within three years, 20 per cent within 10 years and 15 per cent within 15 years of obtaining the banking licence. From the bank’s perspective, the share sale helps it shore up the capital base during an economic crisis, which will hold it in good stead if provisions have to be increased later this year. Analysts said the extra capital gives Kotak Mahindra a cushion against likely defaults in loans that are under moratorium. It could also prompt other private sector lenders to raise capital.

“About 25-30 per cent of the (Kotak) loan book is under moratorium and this number could easily double as RBI has further extended the timeline. So, in this environment, it would rather prefer raising money and be more cautious,” said Suresh Ganapathy, associate director, Macquarie Capital Securities. “I will not be surprised if there is a capital raising announcement done by large private sector banks and HFCs/NBFCs (housing finance companies/nonbanking finance companies.”

https://economictimes.indiatimes.com/ma ... 161385.cms

BY ET BUREAU | UPDATED: JUN 03, 2020, 07.52 AM IST

Mumbai: Asia’s richest banker sold 56 million shares, or 2.8 per cent stake, for more than 6,900 crore through block deals on Tuesday to reduce his stake in to 26.1 per cent in a move to comply with Reserve Bank of India (RBI) regulations.

The buyers included a group of international and domestic investors including Fidelity Funds South East Asia, Invesco Oppenheimer, Goldman Sachs India, JP Morgan, UBS, Regents of University of California, Aberdeen, Capital Group, Canada Pension Plan Investment Board (CPPIB), Societe Generale, SBI Mutual Fund, Birla MF, Axis MF and ICICI Prudential Life Insurance, according to a BSE filing by Kotak Mahindra Bank. Sovereign wealth funds of Singapore (GIC), Kuwait (Kuwait Investment Authority) and Abu Dhabi (Abu Dhabi Investment Authority) also invested, it said. Invesco Oppenheimer already holds a 2.86 per cent stake while Capital World has 1.9 per cent. SBI MF holds a stake of 2.56 per cent and CPPIB holds 6.2 per cent.

Uday Kotak collected an estimated $918 million (6,912 crore) through such deals, said a person whose organisation is associated with the fundraising exercise.

The price band was initially pegged at Rs 1,215-1,240 apiece. The billionaire banker is said to have sold the shares at the higher end of that band, dealers said.

The placement agents for the deal were Morgan Stanley, Kotak Securities, and Goldman Sachs (India) Securities.

In January, the RBI had allowed Kotak to hold a 26 per cent stake in Kotak Mahindra Bank as long as it didn’t raise capital through a share sale. The promoter’s voting rights were restricted to 15 per cent from April. Uday Kotak is also not allowed to top up his stake if it falls below 26 per cent. He has time until September to prune his holding by another 0.1 per cent in the bank to fully comply with the RBI rules.

Last week, Kotak raised Rs 7,442.5 crore through a QIP by issuing 65 million new shares at Rs 1,145 each. This QIP helped reduce Kotak’s stake to 29 per cent. It also helped the bank buffer its capital reserves. Several global long-only investors, pension money managers, sovereign funds and top local mutual fund houses bought most of the shares.

According to RBI guidelines, private bank promoters need to lower their holding to 40 per cent within three years, 20 per cent within 10 years and 15 per cent within 15 years of obtaining the banking licence. From the bank’s perspective, the share sale helps it shore up the capital base during an economic crisis, which will hold it in good stead if provisions have to be increased later this year. Analysts said the extra capital gives Kotak Mahindra a cushion against likely defaults in loans that are under moratorium. It could also prompt other private sector lenders to raise capital.

“About 25-30 per cent of the (Kotak) loan book is under moratorium and this number could easily double as RBI has further extended the timeline. So, in this environment, it would rather prefer raising money and be more cautious,” said Suresh Ganapathy, associate director, Macquarie Capital Securities. “I will not be surprised if there is a capital raising announcement done by large private sector banks and HFCs/NBFCs (housing finance companies/nonbanking finance companies.”

https://economictimes.indiatimes.com/ma ... 161385.cms

Re: Indian Economy News & Discussion - Nov 27 2017

Niti aayog has sent a proposal to start privatizing public sector banks, as per ET newspaper. Also give banking license to industrial groups.

-

Raveen

- BRFite

- Posts: 841

- Joined: 18 Jun 2008 00:51

- Location: 1/2 way between the gutter and the stars

- Contact:

Re: Indian Economy News & Discussion - Nov 27 2017

About time - reverse the nonsense by IG and clanSicanta wrote:Niti aayog has sent a proposal to start privatizing public sector banks, as per ET newspaper. Also give banking license to industrial groups.

Re: Indian Economy News & Discussion - Nov 27 2017

Thinking about Indian economy, just got some insights and jotting down here. Apologies for being terse and not able to support the insights yet with links.

1. Go long on Indian economy. From October/November, Indian economy will be gaining a big boost. All the Q2/Q3 losses will be erased.

2. Monsoon is indeed a factor.

3. Importantly, all the 'migrants' are reaching their villages/towns in good time. Think about it this way, in Summer there is not much economic activity in rural India (yes farms are still a major factor) and after the spring crop is taken, the laborers provide service to Indian summer economy. Which is marriages and local gatherings and functions. In June/July several trek back to their villages to help in farm. Sometimes they leave for their villages early and stay there.

4. With Indian agro-policies opening up, a good monsoon, farmers are going to see income gains.

And states like UP/Bihar are putting in policies to attract industries.

Zoom/Zoom.

1. Go long on Indian economy. From October/November, Indian economy will be gaining a big boost. All the Q2/Q3 losses will be erased.

2. Monsoon is indeed a factor.

3. Importantly, all the 'migrants' are reaching their villages/towns in good time. Think about it this way, in Summer there is not much economic activity in rural India (yes farms are still a major factor) and after the spring crop is taken, the laborers provide service to Indian summer economy. Which is marriages and local gatherings and functions. In June/July several trek back to their villages to help in farm. Sometimes they leave for their villages early and stay there.

4. With Indian agro-policies opening up, a good monsoon, farmers are going to see income gains.

And states like UP/Bihar are putting in policies to attract industries.

Zoom/Zoom.

-

Kamran Husain

- BRFite -Trainee

- Posts: 21

- Joined: 02 Nov 2016 22:27

Re: Indian Economy News & Discussion - Nov 27 2017

^^^^

I really do not believe that we are going to bounce back by Oct./Nov.

Indian economy has been hit on various fronts, like, an already slowed economy, BS6 transition, fall in urban and rural demand, real estate slowdown, corona virus, migrant issue, latest downgrade by rating agency, etc.

What we need is a short term, medium term and long term plan to revive the economy. For long term, the GOI's 100 Billion infrastructure push seems apt, provided it is implemented in letter and in spirit over the next 5-10 years.

For medium and short term, the Government has to put money in the hands of the masses. Tax breaks to companies, to individuals, DBT to poor people. If people have money in their hands, they will either save in banks or many available saving options or they will spend. Either way, it will be a win win for the economy.

Just my suggestions, involve the companies in nation building. A company has to pay approx 25 percent tax.

Any company that spends any amount of money on CSR or on pure R&D should get the tax break on the money spend, even if it is complete 25%.

R&D will benefit the company &/or the country in the medium to long term.

For CSR, it can be defined (building road in the location the company is located, buildings schools, hospitals, spending on community upliftment etc.)

We have to recognise, that the economy was slowing down even before the virus had hit us. Just by lifting the lockdown, the economy will not bounce back. The jobs that were lost during the lockdown will have to be created again. The companies that were closed permanently during the lockdown, for any reason, will not open up.

We may lament about the lost decade between 2004-2014, but if we do not change the ways now, we will be lamenting again for the new lost decade (2016-2024).

The steps that the government has taken does not inspire confidence. Just an example, a moratorium was given on loan repayment. But what is the use of the moratorium if the interest accrued during the moratorium period will have to be paid by the loan taker? Is this a joke? Which sane person will pay more interest on the loan taken?

The 20 lakh crore package is one of the most insane thing seen during the lockdown. As per all estimates, actual government spent is averages around 1-1.5 percent of the GDP.

In normal times, the announcements made in the package would have been great, but these are not normal times.

Our FM does not understand economics, the PM will not appoint S. Swamy as the FM, neither will he appoint any knowledgeable person to head this post. Even Piyush Goyal would have been a better choice that the current FM.

Personally, I feel we will need at least 2-3 years to return to our previous growth of 6%. For the economy of the size, population and capability of India, that is just not good enough. We will forever be trapped in the middle income group because of that.

We need to lend our ways and we need to do it now.

Also, a country aspiring to be an economic superpower cannot say that the activity in summer is low in any part of the country.

Does rural stop consumption in summer? They don't buy 2 wheelers? They don't buy tractors?

If we want to be an economic superpower, our economic activity needs to work 24/7, 365 days a year, let it be rural, semi urban or urban area.

Please understand, our main competition is China and it is far ahead of us, and they will not slow down, either in summer or in winter. They have a huge internal population to support their consumption. If push comes to shove, they will focus more internally that externally.

That is whom we are competing with. We may talk all we want, we have been taking since 2000s about the Elephant arriving, about Elephant crushing the Dragon, but the reality is very different. Let alone challange the dragon, we are getting crushed by it. Our digital infrastructure is based mainly on Chinese technology, our market is flooded with Chinese products, with better, if not equal quality and all we are doing is just talking.

I really do not believe that we are going to bounce back by Oct./Nov.

Indian economy has been hit on various fronts, like, an already slowed economy, BS6 transition, fall in urban and rural demand, real estate slowdown, corona virus, migrant issue, latest downgrade by rating agency, etc.

What we need is a short term, medium term and long term plan to revive the economy. For long term, the GOI's 100 Billion infrastructure push seems apt, provided it is implemented in letter and in spirit over the next 5-10 years.

For medium and short term, the Government has to put money in the hands of the masses. Tax breaks to companies, to individuals, DBT to poor people. If people have money in their hands, they will either save in banks or many available saving options or they will spend. Either way, it will be a win win for the economy.

Just my suggestions, involve the companies in nation building. A company has to pay approx 25 percent tax.

Any company that spends any amount of money on CSR or on pure R&D should get the tax break on the money spend, even if it is complete 25%.

R&D will benefit the company &/or the country in the medium to long term.

For CSR, it can be defined (building road in the location the company is located, buildings schools, hospitals, spending on community upliftment etc.)

We have to recognise, that the economy was slowing down even before the virus had hit us. Just by lifting the lockdown, the economy will not bounce back. The jobs that were lost during the lockdown will have to be created again. The companies that were closed permanently during the lockdown, for any reason, will not open up.

We may lament about the lost decade between 2004-2014, but if we do not change the ways now, we will be lamenting again for the new lost decade (2016-2024).

The steps that the government has taken does not inspire confidence. Just an example, a moratorium was given on loan repayment. But what is the use of the moratorium if the interest accrued during the moratorium period will have to be paid by the loan taker? Is this a joke? Which sane person will pay more interest on the loan taken?

The 20 lakh crore package is one of the most insane thing seen during the lockdown. As per all estimates, actual government spent is averages around 1-1.5 percent of the GDP.

In normal times, the announcements made in the package would have been great, but these are not normal times.

Our FM does not understand economics, the PM will not appoint S. Swamy as the FM, neither will he appoint any knowledgeable person to head this post. Even Piyush Goyal would have been a better choice that the current FM.

Personally, I feel we will need at least 2-3 years to return to our previous growth of 6%. For the economy of the size, population and capability of India, that is just not good enough. We will forever be trapped in the middle income group because of that.

We need to lend our ways and we need to do it now.

Also, a country aspiring to be an economic superpower cannot say that the activity in summer is low in any part of the country.

Does rural stop consumption in summer? They don't buy 2 wheelers? They don't buy tractors?

If we want to be an economic superpower, our economic activity needs to work 24/7, 365 days a year, let it be rural, semi urban or urban area.

Please understand, our main competition is China and it is far ahead of us, and they will not slow down, either in summer or in winter. They have a huge internal population to support their consumption. If push comes to shove, they will focus more internally that externally.

That is whom we are competing with. We may talk all we want, we have been taking since 2000s about the Elephant arriving, about Elephant crushing the Dragon, but the reality is very different. Let alone challange the dragon, we are getting crushed by it. Our digital infrastructure is based mainly on Chinese technology, our market is flooded with Chinese products, with better, if not equal quality and all we are doing is just talking.

Last edited by Kamran Husain on 06 Jun 2020 07:49, edited 2 times in total.

Re: Indian Economy News & Discussion - Nov 27 2017

If China too thought the same way about the USA twenty years ago, do you think it would be where it is now?Please understand, our main competition is China and it is far ahead of us, and they will not slow down, either in summer or in winter. They have a huge internal population to support their consumption. If push comes to shove, they will focus more internally that externally.

-

Kamran Husain

- BRFite -Trainee

- Posts: 21

- Joined: 02 Nov 2016 22:27

Re: Indian Economy News & Discussion - Nov 27 2017

China did think where the USA was 20 years ago, that is why China is where it is today.

We cannot solve the problem if we do not realise the problem.

China knows its economic strength, USA knows its economic strength and they have a roadmap to achieve their goals.

The question is that do we?

We cannot solve the problem if we do not realise the problem.

China knows its economic strength, USA knows its economic strength and they have a roadmap to achieve their goals.

The question is that do we?

Re: Indian Economy News & Discussion - Nov 27 2017

Didn't they do just that via the multiple packages announced by the FinMin and the RBI? Extra DBT, LPG, extra food allocation through PDS? Reduced EPF withholding with some GoI credit?Kamran Husain wrote:For medium and short term, the Government has to put money in the hands of the masses. Tax breaks to companies, to individuals, DBT to poor people. If people have money in their hands, they will either save in banks or many available saving options or they will spend. Either way, it will be a win win for the economy.

Was it? There were many indications (posted on this thread) that the worst was behind us and things were picking up. IIRC, PMI (both manufacturing and services) had increased, as well as earnings reports of many companies, electricity demand, GST collections, etc. Feel free to look it up.Kamran Husain wrote:We have to recognise, that the economy was slowing down even before the virus had hit us.

Fair point - I too didn't understand the logic here. Having gone this far, they could have simply announced a moratorium on interest as well. But that does not mean I am going to dismiss everything else they have done since. For example:Kamran Husain wrote:The steps that the government has taken does not inspire confidence. Just an example, a moratorium was given on loan repayment. But what is the use of the moratorium if the interest accrued during the moratorium period will have to be paid by the loan taker? Is this a joke? Which sane person will pay more interest on the loan taken?

Kindly do justify why you think this is "insane". Also, read the two Gurumurthy articles I had quoted here to understand why: a) the govt does not have fiscal space to do more, b) in the Indian context, GoI implicitly provides the backstop for increased lending by the PSBs, so all that should be counted toward this % of GDP calculation (please add all that and tell us the total %), and c) it is better to keep the printing press in reserve for now as the world is not out of the Wuhan Covid problem. If you don't agree with his contention, fine, but kindly state your reasons instead of using sweeping adjectives that anyone can use.Kamran Husain wrote:The 20 lakh crore package is one of the most insane thing seen during the lockdown. As per all estimates, actual government spent is averages around 1-1.5 percent of the GDP.

Okay, let's hear your proposals - I am sure you have some?Kamran Husain wrote:In normal times, the announcements made in the package would have been great, but these are not normal times.

Perhaps OT for this thread, but I am not sure what a Piyush Goyal would have done different. Swamy, well, thanks, but no thanks.Kamran Husain wrote:Our FM does not understand economics, the PM will not appoint S. Swamy as the FM, neither will he appoint any knowledgeable person to head this post. Even Piyush Goyal would have been a better choice that the current FM.

You are also reducing your own credibility as a new poster here (especially this thread) when, instead of critiquing policy, you make a sweeping statement about the FM "not understanding economics", though she holds multiple degrees in economics. Or maybe desi degrees don't count?

Again, how? (I am assuming you meant "mend" and not lend) As I've observed here earlier, every commentator worth a grain of salt says we have to make changes, structural reforms, blah blah, but no one gives concrete proposals with justifications as to how it would work.Kamran Husain wrote:We need to lend our ways and we need to do it now.

Perhaps you've been living under a rock (I don't blame you, wish I could do so too!), but there is a new kid on the block called Covid, who does not care for summer or winter, apparently.Kamran Husain wrote:Also, a country aspiring to be an economic superpower cannot say that the activity in summer is low in any part of the country.

Competition in what sense? How would China focusing more on their internal consumption affect our growth? I'd have understood if you'd qualified your statement to refer to exports, but it is too general. Also, if China does focus more on their internal consumption, does that not present us with an opportunity to increase our domestic manufacturing as well as exports?Kamran Husain wrote:Please understand, our main competition is China and it is far ahead of us, and they will not slow down, either in summer or in winter. They have a huge internal population to support their consumption. If push comes to shove, they will focus more internally that externally.

Typical "aspiring supe-pawah" type nonsense written by Beltway policy wonks or our own Tharoorians that has no relevance to our economic policy. No one, least of all GoI, cares about arriving anywhere or crushing anyone. Our focus is on improving the lot of every Indian, and that's where it should be.Kamran Husain wrote:That is whom we are competing with. We may talk all we want, we have been taking since 2000s about the Elephant arriving, about Elephant crushing the Dragon, but the reality is very different. Let alone challange the dragon, we are getting crushed by it.

Re: Indian Economy News & Discussion - Nov 27 2017

Now, these are the kind of recommendations I am talking about. I wish more media articles took this line instead of just cribbing and complaining about a half-empty glass.

What Atmanirbhar Bharat Ought To Mean - R Jagannathan, Swarajya

What Atmanirbhar Bharat Ought To Mean - R Jagannathan, Swarajya

The best way to interpret the word is to reduce it to two essentials. It should mean an ability to cater to both domestic and export markets using the scale economies that India’s large consuming class provides. It should not mean becoming atmanirbhar in each and every product or service we can produce, for that works against the basic idea of comparative advantage.

Please read the entire article - Jaggi makes some good recommendations.We need to decisively end inverted duty structures in order to become not only atmanirbhar, but also globally competitive in areas of our comparative advantage.

Re: Indian Economy News & Discussion - Nov 27 2017

Kamran'ji I think you are going all over the place. At the very outset I disagree with your gloom and doom scenario.

And second, my post was insights and I clearly said that I do not have immediate data points to provide. At the same time, feel free to bring down my insights, not with another opinion but real data.

I am claiming that by November, India's agro-economy will grow. It will grow >5% quarter over quarter. That is a forecast. I will bring the data points later (maybe in a week). If you think it will not grow Q2Q >5% overall, then please bring equivalent data point. Not the rona-dhona of how great Chinese are and how dumb the Indian government is and how we are constrained from competing and how the Chinese will take over Indian economy. There is global economy thread for pumping up the Chinese economy.

And you are welcome to bring the data points and concrete actions Indian government is doing and can do.

For example,

1. GST was a great first step. Yes it can be always improved. But there is no denying that the GST is the best thing that should have been done in 1952 instead of 2017.

2. Insolvency and Bankruptcy code, 2016.

3. Agricultural reforms, 2020

All of the above are extremely important steps. An example of the above yielding results is that India is now a powerhouse in PPE manufacturing.

Now, I will try to address your points.

You mention rural demand. That is definitely your opinion. That is so untrue. Here are the numbers

1. Indian GDP grew by 3.1% (that is called growth. Not a 'fall'). https://www.financialexpress.com/econom ... s/1974880/

#mediapimps as their tribe is, will insert negative words like 'slowdown' for positive data and stretch adjectives like 'skyrockets' for negative data. For example, "slowdown of growth to 3.1%" is not "slowdown of economy". The later is construed to be recession. Which is definitely not the case.

2. Rural demand.

3. You mentioning downgrade by rating agency. That means you are not reading this very forum pages or news. It is useless statements. Do I notice a hint of bias here?

1. On this, have you heard of Udaan scheme? Did you fly in a regional airport to another regional airport? If not, you do not know what a game changer it is. If yes, then I am surprised why you do not consider it game changer!

In fact only a blind or a completely biased person will say that the current NaMo government does not fulfill its infrastructure promises. In ladakh, the chinese are creating a ruckus so that roads are not built. For the remaining roads, ports, rails and air- infrastructure - please go to the respective threads and educate yourself.

And again, Indian economy will zoom. Zoom. ZOOM.

And second, my post was insights and I clearly said that I do not have immediate data points to provide. At the same time, feel free to bring down my insights, not with another opinion but real data.

I am claiming that by November, India's agro-economy will grow. It will grow >5% quarter over quarter. That is a forecast. I will bring the data points later (maybe in a week). If you think it will not grow Q2Q >5% overall, then please bring equivalent data point. Not the rona-dhona of how great Chinese are and how dumb the Indian government is and how we are constrained from competing and how the Chinese will take over Indian economy. There is global economy thread for pumping up the Chinese economy.

And you are welcome to bring the data points and concrete actions Indian government is doing and can do.

For example,

1. GST was a great first step. Yes it can be always improved. But there is no denying that the GST is the best thing that should have been done in 1952 instead of 2017.

2. Insolvency and Bankruptcy code, 2016.

3. Agricultural reforms, 2020

All of the above are extremely important steps. An example of the above yielding results is that India is now a powerhouse in PPE manufacturing.

Now, I will try to address your points.

Is it a matter of opinion or do you have data backing the above? On the contrary, IMD has declared that the monsoon is going to be normal and widespread. Excellent for Indian economy. Here is the 1979 study https://www.jstor.org/stable/41142210?s ... b_contentsKamran Husain wrote: I really do not believe that we are going to bounce back by Oct./Nov.

BS6 transition? You must be kidding. I will let you dig the estimate on how the Indian GDP is correlated to air pollution as well (same is true for other countries). Here a pain felt by a kleptocratic two-wheeler company (Bajaj) is not the same as the opportunities other see.Indian economy has been hit on various fronts, like, an already slowed economy, BS6 transition, fall in urban and rural demand, real estate slowdown, corona virus, migrant issue, latest downgrade by rating agency, etc.

You mention rural demand. That is definitely your opinion. That is so untrue. Here are the numbers

1. Indian GDP grew by 3.1% (that is called growth. Not a 'fall'). https://www.financialexpress.com/econom ... s/1974880/

#mediapimps as their tribe is, will insert negative words like 'slowdown' for positive data and stretch adjectives like 'skyrockets' for negative data. For example, "slowdown of growth to 3.1%" is not "slowdown of economy". The later is construed to be recession. Which is definitely not the case.

2. Rural demand.

Above is during lockdown.Mahindra & Mahindra Ltd.’s Farm Equipment Sector (FES), a part of the USD 20.7 billion Mahindra Group, on Monday reported 2 percent growth in domestic sales at 24,017 units in May 2020.

3. You mentioning downgrade by rating agency. That means you are not reading this very forum pages or news. It is useless statements. Do I notice a hint of bias here?

Define short-, mid- and long- term. Shall we say 2, 5 and 7+ years for each? Do you think all infrastructure will pan out only 5+ or 7+ years from now? And in the process you go about castigating the GOI about 'implementation in letter and in spirit'!What we need is a short term, medium term and long term plan to revive the economy. For long term, the GOI's 100 Billion infrastructure push seems apt, provided it is implemented in letter and in spirit over the next 5-10 years.

1. On this, have you heard of Udaan scheme? Did you fly in a regional airport to another regional airport? If not, you do not know what a game changer it is. If yes, then I am surprised why you do not consider it game changer!

In fact only a blind or a completely biased person will say that the current NaMo government does not fulfill its infrastructure promises. In ladakh, the chinese are creating a ruckus so that roads are not built. For the remaining roads, ports, rails and air- infrastructure - please go to the respective threads and educate yourself.

The above is all honey and pie statements. Since you have not seen the JAM you are assuming that the govt. has to yet put money in the hands of the masses. Companies are getting very good breaks. Now either they complain or they work. Some chose to complain. Some chose to work. And some chose to do both.For medium and short term, the Government has to put money in the hands of the masses. Tax breaks to companies, to individuals, DBT to poor people. If people have money in their hands, they will either save in banks or many available saving options or they will spend. Either way, it will be a win win for the economy.

I also lament the lost decades from 1951 to 1998. The above statement shows your political bias. Since you made several 'I think' statement., Let me make one - 'I think you need to stop looking through your tinted glasses'.We may lament about the lost decade between 2004-2014, but if we do not change the ways now, we will be lamenting again for the new lost decade (2016-2024).

Yes. It is an insane amount of money that is available to give GDP a big push.The 20 lakh crore package is one of the most insane thing seen during the lockdown.

In PM I trust and I trust his appointees. NS is very fine minister. People need to get over their anti-women, anti-hindu, anti-brahmin biases.Our FM does not understand economics, the PM will not appoint S. Swamy as the FM, neither will he appoint any knowledgeable person to head this post. Even Piyush Goyal would have been a better choice that the current FM.

I would suggest that you go and plant some crop in peak summer. Rice and wheat. Looks like you are disconnected from mother earth as well.Also, a country aspiring to be an economic superpower cannot say that the activity in summer is low in any part of the country.

Does rural stop consumption in summer? They don't buy 2 wheelers? They don't buy tractors?

If we want to be an economic superpower, our economic activity needs to work 24/7, 365 days a year, let it be rural, semi urban or urban area.

If the above is true, all thanks to the lost decade of 2004-2014. Anyway, silver lining to this is India is ahead of China in space technologies.That is whom we are competing with. We may talk all we want, we have been taking since 2000s about the Elephant arriving, about Elephant crushing the Dragon, but the reality is very different. Let alone challange the dragon, we are getting crushed by it.

And again, Indian economy will zoom. Zoom. ZOOM.

Re: Indian Economy News & Discussion - Nov 27 2017

Please desist from long winded emotional posts with no data reference . This thread in general really is not a place to vent your emotions.

Re: Indian Economy News & Discussion - Nov 27 2017

Two things seeing on twitter and sometimes here. One criticism of 20lakh crore package without giving details of why it is being criticized. Second , very forceful arguments on why we cannot achieve AtmaNirbharta. Just like Nitin Gadkari said once, I have people who will use all their intelligence to tell why an idea will not work but very few who will tell me how to make it work

Re: Indian Economy News & Discussion - Nov 27 2017

Yes I'm aware of that - that's the reason I stated that such posts be avoided. There's far too many contradictions in the original longwinded post for any sensible discussion and I'm not in favor of this thread being derailed by emotional handwringing.

Re: Indian Economy News & Discussion - Nov 27 2017

^There is this op-ed in marketwatch on US stock market by a desi guy Nigam Arora.

On economists, I quote him:

I have the following maxims:

1. Most of the economists are eCONomists. Particularly if they are doing only theoretical research in some ivory-tower league university in the past two (2) decades. Or are just opinion writers on twitter.

2. eCONomists come in all sizes. There are Nobel prize-winning giants and then there are garden variety pappus who roam around in chaddi and banians. But all eCONomists have one thing in common: a pessimistic view on the economy when it is going to go up and an optimistic view on economy when it is going to go down. That will bring to point number 4 below.

3. All eCONomists hate popular leaders who are democratically elected and love dictatorial, fascist, and communist regimes and extoll its virtues.

4. Go contrarian to eCONomists. Particularly when they are talking about India. In general, they are talking about India reading news from WaPo or WSJ sipping turmeric chai latte from a university subsidized Starbucks and applying their outlook biased by their environment in a developed country to the developed parts of India and applying their outlook from the worst part of sub-Saharan Africa which they never visited to the developing and under-developed parts of India of which they do not have any clue.

For example, Bangladesh which is highly affected due to coronavirus is kept in the Growth column. Case in point, none of the eCONomists have realized that currently B'Desh's both Kharif and Rabi season for agriculture has been impacted by Coronavirus. The extent remains to be seen. Check out some prelim pro-active analysis in April here [url]file:///Users/dshah/Downloads/preprints202004.0458.v1.pdf[/url]

For India, it is reverse due to its large size and more varied and increasingly vibrant agriculture sector. Current ChinaVirus pandemic opened up hitherto unknown opportunities and the government exploited it to hilt giving it major boost.

I just cited one sector Agriculture.

Just like in US, the eCONomists were predicting job losses in May but got job gains and a veritable pie on their faces, same thing awaits for the global eCONomists in Q4 2020 and Q1 2021

On economists, I quote him:

Here is the link: https://www.marketwatch.com/story/heres ... =home-pageThe stock market rallied Friday on stunningly strong May jobs data, which economists got completely backwards There were some flaws in the calculations, but bears shouldn’t take comfort.

I have the following maxims:

1. Most of the economists are eCONomists. Particularly if they are doing only theoretical research in some ivory-tower league university in the past two (2) decades. Or are just opinion writers on twitter.

2. eCONomists come in all sizes. There are Nobel prize-winning giants and then there are garden variety pappus who roam around in chaddi and banians. But all eCONomists have one thing in common: a pessimistic view on the economy when it is going to go up and an optimistic view on economy when it is going to go down. That will bring to point number 4 below.

3. All eCONomists hate popular leaders who are democratically elected and love dictatorial, fascist, and communist regimes and extoll its virtues.

4. Go contrarian to eCONomists. Particularly when they are talking about India. In general, they are talking about India reading news from WaPo or WSJ sipping turmeric chai latte from a university subsidized Starbucks and applying their outlook biased by their environment in a developed country to the developed parts of India and applying their outlook from the worst part of sub-Saharan Africa which they never visited to the developing and under-developed parts of India of which they do not have any clue.

For example, Bangladesh which is highly affected due to coronavirus is kept in the Growth column. Case in point, none of the eCONomists have realized that currently B'Desh's both Kharif and Rabi season for agriculture has been impacted by Coronavirus. The extent remains to be seen. Check out some prelim pro-active analysis in April here [url]file:///Users/dshah/Downloads/preprints202004.0458.v1.pdf[/url]

For India, it is reverse due to its large size and more varied and increasingly vibrant agriculture sector. Current ChinaVirus pandemic opened up hitherto unknown opportunities and the government exploited it to hilt giving it major boost.

I just cited one sector Agriculture.

Just like in US, the eCONomists were predicting job losses in May but got job gains and a veritable pie on their faces, same thing awaits for the global eCONomists in Q4 2020 and Q1 2021

Re: Indian Economy News & Discussion - Nov 27 2017

Then they will cry about the veracity of the datadisha wrote:^There is this op-ed in marketwatch on US stock market by a desi guy Nigam Arora.

On economists, I quote him:

Here is the link: https://www.marketwatch.com/story/heres ... =home-pageThe stock market rallied Friday on stunningly strong May jobs data, which economists got completely backwards There were some flaws in the calculations, but bears shouldn’t take comfort.

I have the following maxims:

1. Most of the economists are eCONomists. Particularly if they are doing only theoretical research in some ivory-tower league university in the past two (2) decades. Or are just opinion writers on twitter.

2. eCONomists come in all sizes. There are Nobel prize-winning giants and then there are garden variety pappus who roam around in chaddi and banians. But all eCONomists have one thing in common: a pessimistic view on the economy when it is going to go up and an optimistic view on economy when it is going to go down. That will bring to point number 4 below.

3. All eCONomists hate popular leaders who are democratically elected and love dictatorial, fascist, and communist regimes and extoll its virtues.

4. Go contrarian to eCONomists. Particularly when they are talking about India. In general, they are talking about India reading news from WaPo or WSJ sipping turmeric chai latte from a university subsidized Starbucks and applying their outlook biased by their environment in a developed country to the developed parts of India and applying their outlook from the worst part of sub-Saharan Africa which they never visited to the developing and under-developed parts of India of which they do not have any clue.

For example, Bangladesh which is highly affected due to coronavirus is kept in the Growth column. Case in point, none of the eCONomists have realized that currently B'Desh's both Kharif and Rabi season for agriculture has been impacted by Coronavirus. The extent remains to be seen. Check out some prelim pro-active analysis in April here [url]file:///Users/dshah/Downloads/preprints202004.0458.v1.pdf[/url]

For India, it is reverse due to its large size and more varied and increasingly vibrant agriculture sector. Current ChinaVirus pandemic opened up hitherto unknown opportunities and the government exploited it to hilt giving it major boost.

I just cited one sector Agriculture.

Just like in US, the eCONomists were predicting job losses in May but got job gains and a veritable pie on their faces, same thing awaits for the global eCONomists in Q4 2020 and Q1 2021

-

Manish_Sharma

- BRF Oldie

- Posts: 5128

- Joined: 07 Sep 2009 16:17

Re: Indian Economy News & Discussion - Nov 27 2017

Cross posting from China border thread:

viewtopic.php?f=3&t=7810&start=320#p2437409

viewtopic.php?f=3&t=7810&start=320#p2437409

Deans wrote:

I am X posting this from the Neutering China thread, as it would help us understand where - IMO our real leverage with the Chinese is and provide a reality check on the Govt's ability, thus far, to counter the Chinese threat. I wrote this 2 years ago for the Indian Military review and the

current situation gives me sense of Deja Vu.

The real Chinese threat.

China’s goal is to be the world’s preeminent power, replacing the US. ......

The trade deficit between India and China at $ 63 billion in 2017-8, is the 2nd highest that any country has with another – only the US, with its much larger economy has a bigger trade deficit (also with China). While India imported goods worth $ 79 billion from China, China imported only $ 16 billion from India, in 2017-18. Not only is the absolute size of the trade deficit worrying, its composition and growth has even more serious implications for the Indian economy.

In 2003-4, India’s trade deficit with China was just US$ 1 billion. This increased to US$ 16 billion in 2007-8 and US $35 billion in 2013-4 (when the current Govt. took over). Despite all the talk around `Make in India’ this deficit has almost doubled the last 3 years, to reach US$ 63 billion. Incredibly, in the year, when we had the Doklam crisis, the trade deficit increased by another $ 11 billion!

While China’s exports to India have been steadily growing, ours have stagnated. Our exports to China were actually higher in 2011-12. The problem is India’s exports to China are mostly raw materials like Diamonds, Copper & Zinc, Cotton Yarn etc. These commodities have very small margins and are subject to global prices, over which India has little control. Even when India discusses reducing the trade deficit, the items India seeks to export are agricultural commodities like sugar and grapes, which have a finite supply, because of which any change in export volumes (which China can influence), can have a sudden impact on either consumer prices or farmer incomes in India.

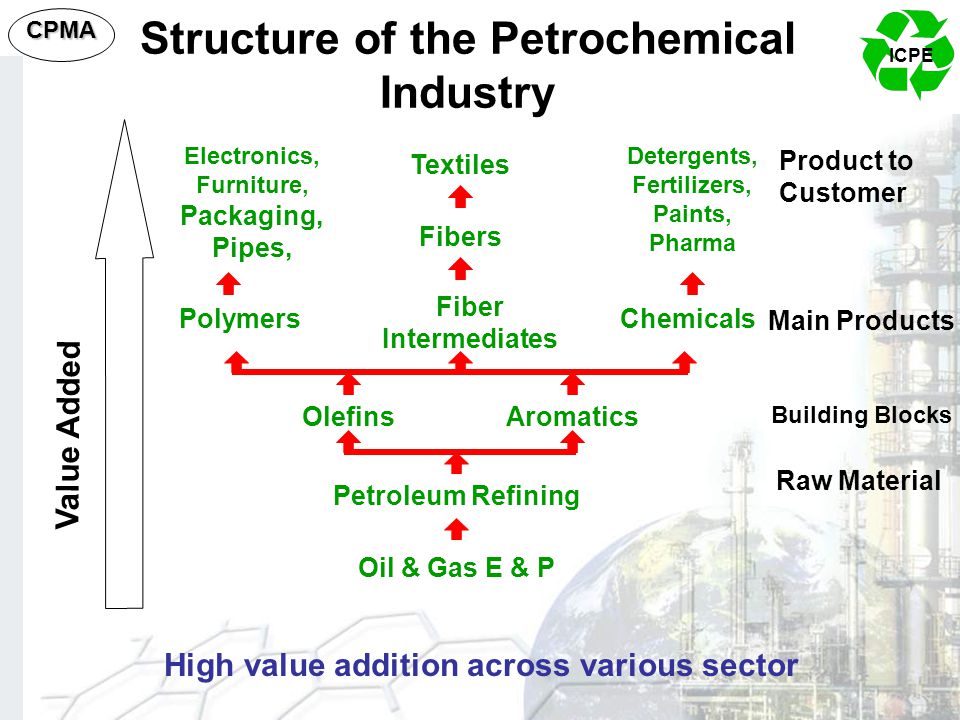

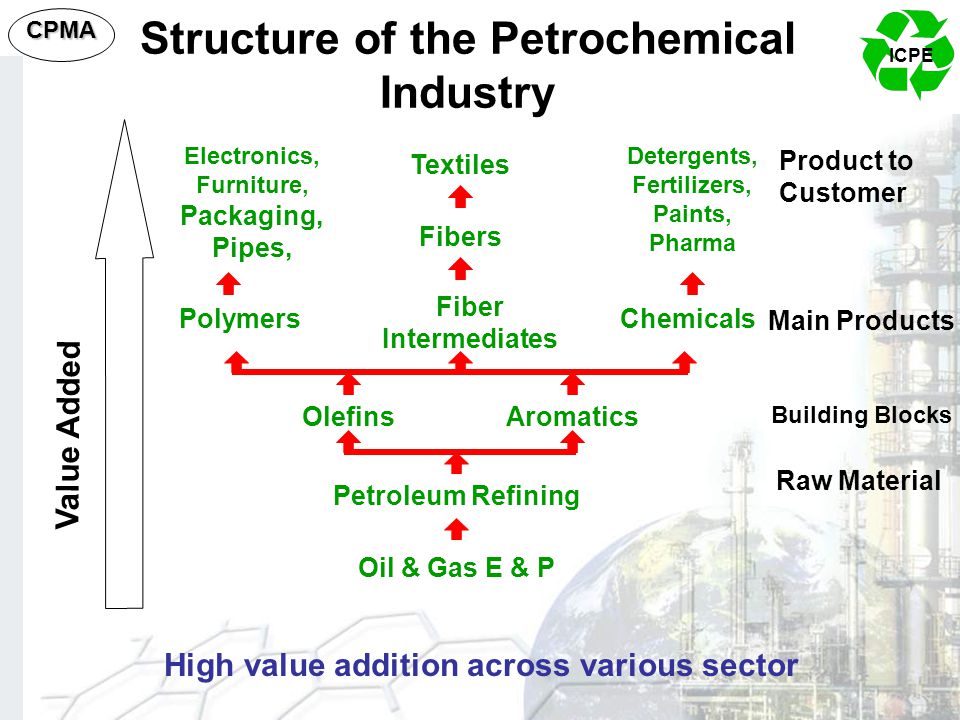

In contrast, China exports manufactured goods to India. It has been estimated (and stated by Govt.) that the price subsidy given to Chinese manufacturers is about 17% on average making them cheaper than Indian products. Over time, this has led to Indian companies preferring to trade (buy from China) instead of manufacture and a lot of `manufacturing’ that is done is really assembling of Chinese components. While we have 100+ units ‘manufacturing’ cell phones, the local value addition is under 6%.

By 2020, India’s net imports of electronics could surpass that of Oil. Half these imports come from China. While in theory, Chinese subsidies for exports mean lower prices for the Indian consumer (including lower cost of power due to for e.g. low priced Solar panels) China is known to sharply increase prices once they have established market dominance and ensured the importing country loses the capability to manufacture locally. Pharma is an example. A staggering 70%-80% of Drug intermediates & API’s (Active pharmaceutical ingredients) are imported from China. This China has the ability to destroy our export led pharma industry by simply stopping supply or increasing prices of ingredients. The capacity utilisation of Indian API units is barely 40% - the lowest in the world. India by contrast, cannot export in any significant quantity to China because of non-tariff barriers (drug approvals in China take 5-7 years).

We are repeating the mistake the US has made over decades when they preferred cheap consumer products from China at the cost of undermining their manufacturing base. The US dependence on China is what makes the imposition of tariffs by the Trump administration so difficult and unpopular.

When faced with increasing instances of dumping of Chinese goods, India has responded with anti-dumping duties and increased tariffs. However, that has a limited impact. A lot of Chinese imports (to non govt. importers) are under-invoiced. The difference between real and declared value is remitted to China, from overseas accounts by the Indian importer (getting rid of his black money), while duties are paid on the reduced price declared in the invoice.

India has duty free arrangements with neighbours like Si Lanka. Here China’s use of the Hampantota free trade zone (given to China when Sri Lanka could not pay off Chinese debt) would mean that Chinese manufactured goods can reach India duty free (because they are notionally made in Sri Lanka). An estimated 40-50% of the textiles we import duty free from Bangladesh, have fabric of Chinese origin. It is of little comfort to us that Pakistan will face the same problem with the Gwadar free trade zone developed by the Chinese (with Pakistani money, to undermine Pakistani exports).

These are recent findings of the Parliamentary standing committee for commerce. To quote them “The committee finds it unfortunate that in the name of `ease of doing business’, we are more than willing to give market access to China, while China is smartly protecting its Industry from Indian competition”. In the case of solar power, the committee found that 2 lac jobs had been lost due to cheap Chinese imports. In the last 5 years, 40% of Indian companies making toys have shut.

To put in perspective the value of the trade deficit at US$ 63 billion – It is more than the total value of Chinese investments in Pakistan under the CPEC and the value of armaments supplied by China to Pakistan. Perversely, Indians pay for Pakistan’s development & arms, by buying Chinese goods in increasing quantities, while the Indian manufacturing sector is starved of orders for a significant part of this business. The annual trade deficit with China is also more than our defence expenditure of $ 52 billion and 7 times more than our value of imported weapons.

The economic threat from China goes beyond the trade deficit. Under-invoicing reduces import duties and launder black money held abroad. Mis-declaration and smuggling brings banned goods to India, while many consumer products fail Indian safety standards.

Recently 38 Chinese apps have been classified by the Ministry of Defence as dangerous, as they pose the risk of cyber attacks against India. While Western countries are placing restrictions on Chinese telecom firm Huawei (linked to the PLA) as it represents a significant espionage risk, India has asked them be part of our 5G network.

Data of millions of Indian consumers using Chinese owner PayTM or Chinese cellphones (4 of the top 5 brands in India), are, at the time of writing this, stored in China. This can potentially cause what intelligence agencies term – Addiction, Surveillance & Manipulation by an unfriendly foreign power.

Coupled with this, is China using its increasing clout in international organisations to hurt India’s interests. For e.g. denying India admission to the Nuclear Suppliers group, or shielding terrorist Masood Azhar.

Given how much China gains from the Indian market, India needs to realise that trade can be a strong weapon against China and one not wielded so far.

Import tariffs can be raised for items imported almost entirely from China (or Hong Kong, its proxy)

India has room to do this under its WTO obligations and it will not be seen as anti-China, since in theory all countries exporting that item to India are affected. On items where it is believed China is dumping goods below price, India should not just be more aggressive in imposing anti-dumping duties, but set a floor price below which an item cannot be invoiced at. This will prevent under-invoicing and loss of customs revenue.

Chinese goods need to conform to Indian standards. Such regulations – given the ways of our bureaucracy, can be effective non-tariff barriers. Imports from countries where there is no prior history of poor quality can be spared this process (so that imports from other major trading partner

remain smooth). Similar restrictions can be placed on granting of long term visas.

A stronger signal can be sent by banning companies that work with supporters of terrorism (i.e. Pakistan Govt. or companies where the Pak govt. or its agencies e.g. Fauji foundation, have a shareholding), from doing business in India. Exceptions can be made for `friendly countries’ (as the US did for Iranian Oil imports). Where a ban is not possible e.g. a Chinese airline operating in both countries, a `security tax’(as a percentage of turnover) can be imposed.

Just a 10% increased import duty on Chinese products and imposing a floor price on some categories of import, can yield around Rs. 50,000 crore annually in duties. More realistically, it might yield a Rs 25,000 crore duty increase (enough to give 10 million people work for 100 days under MGNREGA) and a $ 35 billion reduction in the value of Chinese imports. If half of that reduction results in increased manufacturing in India, it could, given our labour productivity, provide another 2.5 million factory jobs.

The impact of a $35 billion reduction in manufacturing may not be large given the size of the Chinese economy, but it could well have a domino effect, with more countries imposing protective measures against Chinese imports (as the US has done), or refusing to repay costly Chinese loans, or continue unviable projects, under China’s OBOR initiative - which small countries like Sri Lanka, Malaysia and the Maldives are now doing. Cumulatively, the financial impact might well be a tipping point that causes the highly leveraged Chinese economy to snap. The Chinese markets fell 25% in 2018, influenced by US tariffs on Chinese imports. China may well conclude for e.g. that its support for terrorist groups in Pakistan is not worth reduced or costlier access to the huge Indian market

The way the Chinese use trade to undermine our national security is, I believe, inadequately understood by our policy makers.

Re: Indian Economy News & Discussion - Nov 27 2017

Its like UPA governments hooked the Indian consumer and industries on cheap cocaine from the chinese and the NDA government is struggling to deal with the addiction and withdrawl symptoms. Between 2004-2014 so many local manufacturers and industries have shut that there is little to no alternative but to import from China. Currently India imports over 40% of the capital goods and probably even a higher percentage in consumer goods, although the current government has nearly halved the CAD as % of GDP compared to UPA time, we can do much much better.

Re: Indian Economy News & Discussion - Nov 27 2017

This is the economy thread and political hand waving isn’t worth anything here .

Those who are interested in the topic - please dig into data and report what are Chinese imports comprised of . Eg top 5-10 items by value for the last 15 years ? Not just random news articles off google but data off commerce ministry or a similar source, please.

Solutions to problems begin with clear knowledge of the specific sources of the problem.

Those who are interested in the topic - please dig into data and report what are Chinese imports comprised of . Eg top 5-10 items by value for the last 15 years ? Not just random news articles off google but data off commerce ministry or a similar source, please.

Solutions to problems begin with clear knowledge of the specific sources of the problem.

Re: Indian Economy News & Discussion - Nov 27 2017

"Struggling to deal with" really? A 2 percent increase in GST on imported items which are locally produced, and a 2 percent decrease in GST on such locally produced items would have been a first step. In all this talk of self reliance, I don't see any concrete steps.Ambar wrote:Its like UPA governments hooked the Indian consumer and industries on cheap cocaine from the chinese and the NDA government is struggling to deal with the addiction and withdrawl symptoms. Between 2004-2014 so many local manufacturers and industries have shut that there is little to no alternative but to import from China. Currently India imports over 40% of the capital goods and probably even a higher percentage in consumer goods, although the current government has nearly halved the CAD as % of GDP compared to UPA time, we can do much much better.

I have been watching a lot of youtube videos on furniture making; many of these videos are by local furniture companies - two man shops typically. They seem to have excellent skills and good prices - yet we continue to import tons of furniture from China. Can't the skills be scaled up, designs standardized and distribution improved? This isn't rocket science but does need finesse and expertise to do a good job and clearly we have the expertise and eye for quality in India.

Re: Indian Economy News & Discussion - Nov 27 2017

Forex reserves continue to grow, now at $493.5 billion as of the latest reporting week.

Here's a primer on forex reserves, Part 1:

World War 2 is coming to an end. The US with its vast industrial base, produced enormous amounts of armaments and supplies for which it collected gold from allies. In 1944, the Allies are running out of ways to pay for this. The Bretton Woods agreement is thus put in place.

Consequences - countries no longer tied trade to gold exchange. Countries instead fixed exchanges rates to USD. USD is linked to gold by a fixed rate. Countries can redeem their USD for gold. The going rate is $35/ounce. Countries were required to maintain pegs to USD with only 1% margin of movement allowed, done by buying and selling USD with their currencies. Two organizations are created:

IMF - monitor exchange rate pegs, offer financial assistance and direct reforms required

World Bank - offer developmental loans and aid

Why did this work ? The US got a readymade worldwide demand system for its currency. Countries could not use their dollars domestically. They bought US goods with it. The US economy grew dramatically in the 1950s as a result. The countries themselves had currency stability so they could implement trade regulations in a stable manner. This would work as long as a) US can continue to supply goods demanded by the rest of world at an attractive price b) the countries don't compete with the US production capacity themselves c) the US doesn't deplete its gold.

By 1971, the system was coming apart. USD goes off the gold standard. The fixed peg system no longer works and the IMF no longer monitors exchange rates. Instead, in 1973, Nixon and the Saudis agree on the petrodollar standard, where in exchange for US security guarantorship, oil is to be traded in USD. In the process, oil exports ran up huge dollar surpluses, amounting to over $500B at that time, while correspondingly several oil importing nations faced significant debt burdens due to the oil shock causing their foreign debt to explode. The IMF set up an facility funded by the surplus accruing nations to lend to these debtors.

Some FAQs:

Q. Why did countries sign up for the Bretton Woods system rather than go alone ?

A. Their economies, industries and currencies were devastated by war. Very little to make, unable to compete globally, and no one wanted to accumulate their currency to buy their goods.

Q. What was the INR/USD original pegged rate ?

A: Rs.3.30 / $ in 1947

Q. How did countries manage the peg ?

A. They were responsible for maintaining the value of their currency relative to the dollar. They could arrange a devaluation during a BOP crisis (which occured frequently in India), but that typically came at a cost, and the arrangement was carried out with the involvement of the IMF. India had several well known devaluations. Nowadays, valuation changes occur independently of any such external involvement.

More to follow...

Here's a primer on forex reserves, Part 1:

World War 2 is coming to an end. The US with its vast industrial base, produced enormous amounts of armaments and supplies for which it collected gold from allies. In 1944, the Allies are running out of ways to pay for this. The Bretton Woods agreement is thus put in place.

Consequences - countries no longer tied trade to gold exchange. Countries instead fixed exchanges rates to USD. USD is linked to gold by a fixed rate. Countries can redeem their USD for gold. The going rate is $35/ounce. Countries were required to maintain pegs to USD with only 1% margin of movement allowed, done by buying and selling USD with their currencies. Two organizations are created:

IMF - monitor exchange rate pegs, offer financial assistance and direct reforms required

World Bank - offer developmental loans and aid

Why did this work ? The US got a readymade worldwide demand system for its currency. Countries could not use their dollars domestically. They bought US goods with it. The US economy grew dramatically in the 1950s as a result. The countries themselves had currency stability so they could implement trade regulations in a stable manner. This would work as long as a) US can continue to supply goods demanded by the rest of world at an attractive price b) the countries don't compete with the US production capacity themselves c) the US doesn't deplete its gold.

By 1971, the system was coming apart. USD goes off the gold standard. The fixed peg system no longer works and the IMF no longer monitors exchange rates. Instead, in 1973, Nixon and the Saudis agree on the petrodollar standard, where in exchange for US security guarantorship, oil is to be traded in USD. In the process, oil exports ran up huge dollar surpluses, amounting to over $500B at that time, while correspondingly several oil importing nations faced significant debt burdens due to the oil shock causing their foreign debt to explode. The IMF set up an facility funded by the surplus accruing nations to lend to these debtors.

Some FAQs:

Q. Why did countries sign up for the Bretton Woods system rather than go alone ?

A. Their economies, industries and currencies were devastated by war. Very little to make, unable to compete globally, and no one wanted to accumulate their currency to buy their goods.

Q. What was the INR/USD original pegged rate ?

A: Rs.3.30 / $ in 1947

Q. How did countries manage the peg ?

A. They were responsible for maintaining the value of their currency relative to the dollar. They could arrange a devaluation during a BOP crisis (which occured frequently in India), but that typically came at a cost, and the arrangement was carried out with the involvement of the IMF. India had several well known devaluations. Nowadays, valuation changes occur independently of any such external involvement.

More to follow...

Re: Indian Economy News & Discussion - Nov 27 2017

Couple of notes on the article description:

1) Electronics is with electrical

2) Machinery includes mostly mechanical, boiler and nuclear components

3) Other chem is rare earth metals mostly

Re: Indian Economy News & Discussion - Nov 27 2017

Thanks Ricky ! Here are our top 10 imports -

Mineral fuels including oil: US$153.5 billion (32% of total imports)

Gems, precious metals: $60 billion (12.5%)

Electrical machinery, equipment: $50.4 billion (10.5%)

Machinery including computers: $44.1 billion (9.2%)

Organic chemicals: $20.5 billion (4.3%)

Plastics, plastic articles: $14.6 billion (3.1%)

Iron, steel: $11.6 billion (2.4%)

Animal/vegetable fats, oils, waxes: $9.6 billion (2%)

Optical, technical, medical apparatus: $9.5 billion (2%)

Fertilizers: $7.3 billion (1.5%)

The top 2 are perhaps unavoidable unless we invest heavily on alternative fuel sources but the bottom 8 are something the government must tackle head on. In the last 10 years we have consistently run a deficit with China of ~40 billion to ~50 billion/year, netting China a cool half a trillion dollars of our money.

Mineral fuels including oil: US$153.5 billion (32% of total imports)

Gems, precious metals: $60 billion (12.5%)

Electrical machinery, equipment: $50.4 billion (10.5%)

Machinery including computers: $44.1 billion (9.2%)

Organic chemicals: $20.5 billion (4.3%)

Plastics, plastic articles: $14.6 billion (3.1%)

Iron, steel: $11.6 billion (2.4%)

Animal/vegetable fats, oils, waxes: $9.6 billion (2%)

Optical, technical, medical apparatus: $9.5 billion (2%)

Fertilizers: $7.3 billion (1.5%)

The top 2 are perhaps unavoidable unless we invest heavily on alternative fuel sources but the bottom 8 are something the government must tackle head on. In the last 10 years we have consistently run a deficit with China of ~40 billion to ~50 billion/year, netting China a cool half a trillion dollars of our money.

Re: Indian Economy News & Discussion - Nov 27 2017

A significant fraction of the gems imported are reprocessed and exported, earning us a lot of forex (and the occasional Nirav Modi). Even some fraction of imported crude is refined and exported.

Re: Indian Economy News & Discussion - Nov 27 2017

The most important item missing is metal ores. We should actively work to reduce the bottom 8.Ambar wrote:Thanks Ricky ! Here are our top 10 imports -

Mineral fuels including oil: US$153.5 billion (32% of total imports)

Gems, precious metals: $60 billion (12.5%)

Electrical machinery, equipment: $50.4 billion (10.5%)

Machinery including computers: $44.1 billion (9.2%)

Organic chemicals: $20.5 billion (4.3%)

Plastics, plastic articles: $14.6 billion (3.1%)

Iron, steel: $11.6 billion (2.4%)

Animal/vegetable fats, oils, waxes: $9.6 billion (2%)

Optical, technical, medical apparatus: $9.5 billion (2%)

Fertilizers: $7.3 billion (1.5%)

The top 2 are perhaps unavoidable unless we invest heavily on alternative fuel sources but the bottom 8 are something the government must tackle head on. In the last 10 years we have consistently run a deficit with China of ~40 billion to ~50 billion/year, netting China a cool half a trillion dollars of our money.

Re: Indian Economy News & Discussion - Nov 27 2017

Not a problem Ambar sir, here is the other side for a complete perspective.

Note on listing:

1)Cement is Salt; sulphur; earths and stone; plastering materials, lime and cement

2) Slag/ash is ores, slag, ash

3) Leather is Raw hides and skins (other than furskins) and leather

4) Chem(I) is Inorganic chemicals; organic or inorganic compounds of precious metals, of rare-earth metals, of radioactive elements or of isotopes

5) Machinery is Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof

6) Electrical is Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles

Re: Indian Economy News & Discussion - Nov 27 2017v

Looking at the amount of import from China in terms of $ may be misleading as it doesn't show the real impact of the industries affected. Anecdotal evidence by quick survey of products sold in any shop shows big percentage coming from China. Long time back most of the firecrackers came from Shivakashi in TN. Now most of it is from China. This list of examples of industries collapsed due to import from China can go on and go on. Is there any website that shows the import by the quantity imported?

Re: Indian Economy News & Discussion - Nov 27 2017

Maybe so, but this thread still strives to depend on data over anecdotes so let’s focus on collecting data first .

Re: Indian Economy News & Discussion - Nov 27 2017v

Also the fact that the authorities clamped down on child labour which was the sad secret behind Sivakasi. Somehow China didn't need to use children, probably deft and productive adult fingers, or automation, to make cheap fireworks.mukkan wrote:Long time back most of the firecrackers came from Shivakashi in TN. Now most of it is from China. This list of examples of industries collapsed due to import from China can go on and go on. Is there any website that shows the import by the quantity imported?

Re: Indian Economy News & Discussion - Nov 27 2017v

cheap labour (Including prisoners as mandatory workers, I've heard) dont have any authentic reports to cite.yensoy wrote:Also the fact that the authorities clamped down on child labour which was the sad secret behind Sivakasi. Somehow China didn't need to use children, probably deft and productive adult fingers, or automation, to make cheap fireworks.mukkan wrote:Long time back most of the firecrackers came from Shivakashi in TN. Now most of it is from China. This list of examples of industries collapsed due to import from China can go on and go on. Is there any website that shows the import by the quantity imported?

Re: Indian Economy News & Discussion - Nov 27 2017v

The problem with the cheap labor argument for Cheen is that companies were leaving Cheen even before the Wuhan virus because of rapidly rising labor costs. Also their intake of consumer goods and premium food products -- cars, air-conditioners, lobsters, KFC (western fast food), poultry, pork -- is much closer to first world averages than third world. And that implies high discretionary income.Aarvee wrote:cheap labour (Including prisoners as mandatory workers, I've heard) dont have any authentic reports to cite.yensoy wrote: Also the fact that the authorities clamped down on child labour which was the sad secret behind Sivakasi. Somehow China didn't need to use children, probably deft and productive adult fingers, or automation, to make cheap fireworks.

And it is a dangerous and false argument that directly impacts our ability to compete in the global market place. Labor is actually a big advantage for India vis a vis China.

Our labor costs are MUCH lower than Cheen's and we need to leverage that to grab some of the supply chains that are migrating from there.

Re: Indian Economy News & Discussion - Nov 27 2017v

Prison labour, very true, that is a major fact. I never use disposable airline headsets and urge BRFites to please carry their own earphones on flights - these are made by Chinese prison labour, the only way it can be supplied for pennies per set. Vote with your wallet, save your ears, and save the planet by carrying your own nice set of earphones, whenever inshallah you fly next. Tell your friends and families too. https://www.scmp.com/news/china/article ... son-labourAarvee wrote:cheap labour (Including prisoners as mandatory workers, I've heard) dont have any authentic reports to cite.yensoy wrote: Also the fact that the authorities clamped down on child labour which was the sad secret behind Sivakasi. Somehow China didn't need to use children, probably deft and productive adult fingers, or automation, to make cheap fireworks.

Re: Indian Economy News & Discussion - Nov 27 2017

Anybody who visit Shenzhen can see the huge economies of scale. It is also big factor in lower cost, something India need to replicate to be competitive.

Over the past 40 years, the fishing village of Shenzhen has been reborn as a futuristic metropolis bursting with factories. Bloomberg Businessweek's Ashlee Vance travels to the heart of China's tech revolution to witness this new reality firsthand, as part of a three-episode exploration of the city. In part one of Hello World Shenzhen, Vance gets a worker's view of life in a startup and then explores one of the city's famous electronics markets to learn how people survive (and in some cases make fortunes) in such a frenetic, competitive environment

-

Rishirishi

- BRFite

- Posts: 1409

- Joined: 12 Mar 2005 02:30

Re: Indian Economy News & Discussion - Nov 27 2017

mukkan wrote:Anybody who visit Shenzhen can see the huge economies of scale. It is also big factor in lower cost, something India need to replicate to be competitive.

Over the past 40 years, the fishing village of Shenzhen has been reborn as a futuristic metropolis bursting with factories. Bloomberg Businessweek's Ashlee Vance travels to the heart of China's tech revolution to witness this new reality firsthand, as part of a three-episode exploration of the city. In part one of Hello World Shenzhen, Vance gets a worker's view of life in a startup and then explores one of the city's famous electronics markets to learn how people survive (and in some cases make fortunes) in such a frenetic, competitive environment

Have been there (first time in 1994, when HK was British). I think India can get there, but it needs to focus on producing the right environment. Roads, power, ease of doing business and a Home market etc. Leave the rest over to business houses.

-

Rishirishi

- BRFite

- Posts: 1409