Re: Indian Economy News & Discussion - Nov 27 2017

Posted: 02 Sep 2020 09:44

Consortium of Indian Defence Websites

https://forums.bharat-rakshak.com/

The Jal Jeevan Mission (JJM) aims to supply tap water to every Indian house that will cost a whopping $51 billion to the exchequer.

All the new tap water connections are linked to a user’s Aadhar card. This new water supply infrastructure of tanks and pumps has geo-tags and bar codes, making it one of the savviest projects of digital India.

Looking at its speed, scale and efficiency this pet project of prime minister Narendra Modi, called “Nal main Jal” (water in tap), has an ambitious target to supply tap water to 15.70 crore (83%) Indian homes.

Modi’s critics find it “mission impossible” but the Indian government is pushing it like never before.

The use of cash has bounced back to pre-lockdown levels, led by e-commerce transactions and cash withdrawals through the Aadhaar-enabled Payments System (AePS) channel.

Footfalls have risen at ATMs and other points of cash withdrawal. Even so, customers who first started using digital modes to pay their bills after the lockdown have proved to be a sticky set, market players said.

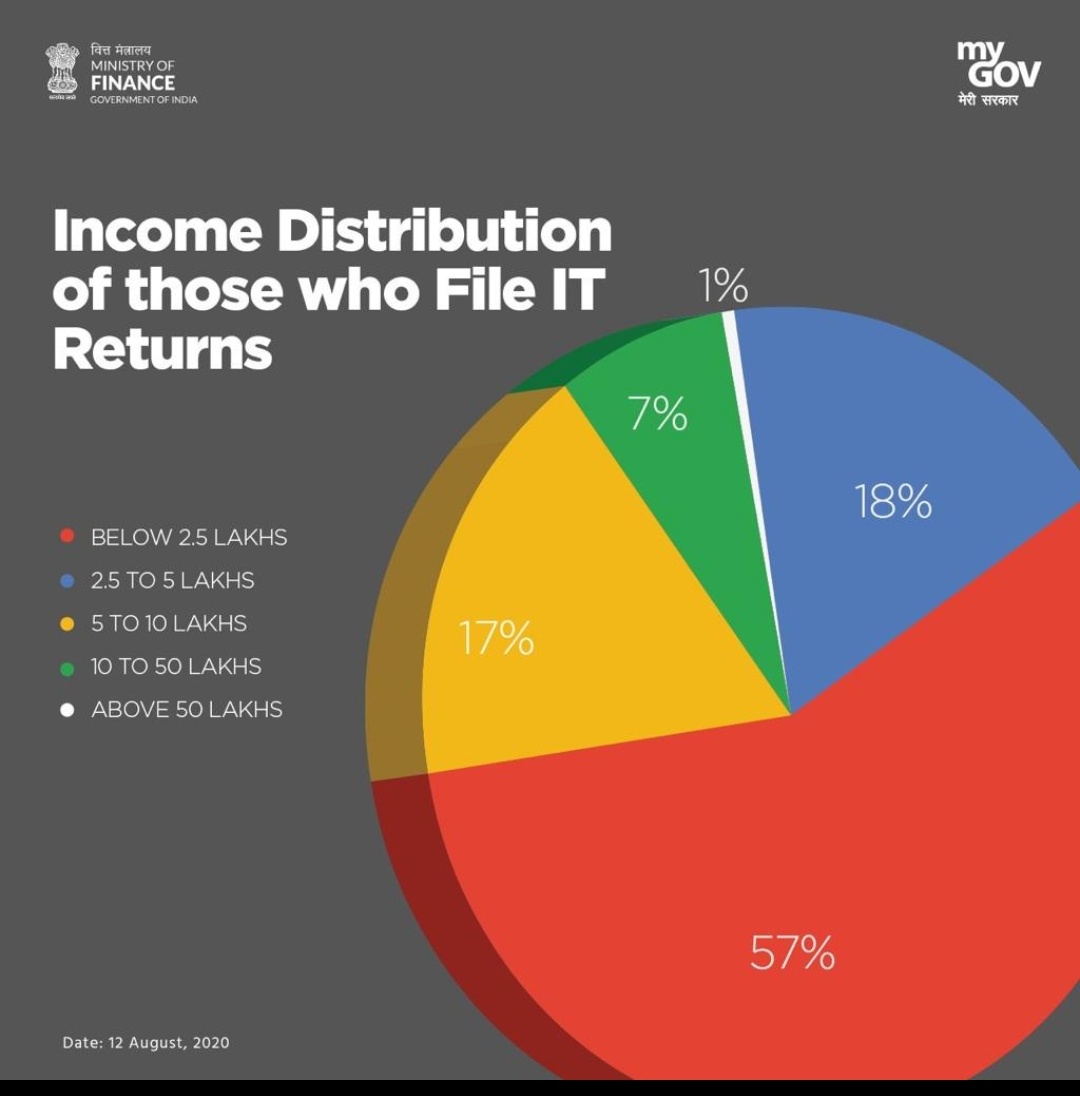

It was 3% in Q1. So around -5% (23-3/4). If the next two qtr gives +5, then it will be around -2.5% by Q4 end. Not sure if it is possible to achieve 5-7% in the next 2 qtr. I guess the value of GDP can only be found after 4 qtrs.Ambar wrote:What was India's Q2 GDP drop (not the growth but the actual GDP) ? I think Business Today as usual did a hitjob by comparing India's annualized GDP growth drop with other nation's GDP drop.

#HeroMoto sold 5.8 lakh units in Aug,7.6% YoY growth

#Hyundai sold 45809 cars,19.9% rise

#MarutiSuzuki sold 113033 cars, 21.3% rise

#TataMotors sold 18583 units,huge 154% growth

Overall,234276 units sold,with #PassengerVehicle industry growing by solid 20% in Aug'20

#Economy

3. Exports, imports doing well, export benefit cap to not affect 98% exporters: Piyush GoyalIn another blow to China, Japan has added India, Bangladesh to its relocation subsidy, resulting which Japanese manufacturers will now be eligible for subsidies if they shift production out of China to India or Bangladesh.

“The exports are approaching the last year’s levels, after making a sharp dip in April this year due to pandemic. Regarding imports, the positive thing is that the capital goods imports have not declined, and the reduction in imports has been seen mainly in crude, gold and fertilizers,” the ministry quoted Goyal in a statement.

4. Garment cos shift from China to IndiaAs per the statement, Goyal added that the trade deficit is reducing drastically and India’s share in the global trade is improving, and that the government is trying to generate more reliable and better trade data for improved planning and policy making.

The government has identified 24 focus manufacturing sectors which have the potential to expand, scale-up operations, improve quality, and lead enhancement of Indian share in global trade and value chain.

Is our industry ready to scale up?Vamsee wrote: 2. Major blow to China; Japan adds India, Bangladesh to relocation subsidiary

In another blow to China, Japan has added India, Bangladesh to its relocation subsidy, resulting which Japanese manufacturers will now be eligible for subsidies if they shift production out of China to India or Bangladesh.

4. Garment cos shift from China to India

That actually is very confusing.Ambar wrote:What was India's Q2 GDP drop (not the growth but the actual GDP) ? I think Business Today as usual did a hitjob by comparing India's annualized GDP growth drop with other nation's GDP drop.

On Wednesday, India banned 118 Chinese apps including major hit games from Tencent and NetEase as well as services from the likes of Baidu and Alibaba affiliate Ant Group.

The broader crackdown on Chinese technology opens opportunities for U.S. technology giants like Facebook and Apple in India.

One analyst said Washington and New Delhi “may foster one of the most important relationships in the 21st century.”

“Chinese firms are learning a painful lesson. And, that is, the foreign policy of China has hijacked their business. China’s geopolitics with India has led to a nationwide fallout for Chinese firms,” Abishur Prakash, a geopolitical specialist at the Center for Innovating the Future (CIF), a Toronto, Canada-based consulting firm, told CNBC by email.

The crackdown on Chinese technology presents opportunities for both Indian and U.S. tech firms.

“Certainly, we have seen the Indians taking even a more aggressive stance on banning Chinese apps, Chinese technology, than the United States has proffered in its battle with the Chinese,” Rodger Baker, senior vice president of strategic analysis at Stratfor, told CNBC’s “Squawk Box Asia” on Thursday.

“Part of that is the Indians trying to stir their own domestic technology, really incentivize the development of their technology sector and try to position themselves also as a place for other countries to be able to invest in technology development.”

‘Win-win’ for India and the U.S.

India has proved attractive to China’s technology firms as they have looked to expand outside their domestic market.

Chinese investors and companies have been investing in local companies, putting in an estimated $4 billion into Indian start-ups, according to think tank Gateway House. And 18 of India’s 30 so-called unicorns — or start-ups valued at over $1 billion — are now Chinese-funded.

F-ing Cheen.Rahulsidhu wrote:

as compiled by the IMF

If you go by the MNCs' numbers, Cheen has been the standout market during the pandemic they unleashed whether it is cars, iron ore or hamburgers. This has been reported for months now. Unless Tesla, BHP (Australia mining) or Starbucks are all in on the ruse then there is little doubt they are growing.amar_p wrote:Something is clearly amiss in the picture above. Chinese GDP shows growth whereas all its markets are in recession.

It must be that all other countries are faking their data

This is probably because China got into lockdown and the unlock much earlier than the rest. They started imposing lockdown/curfew from Feb, we did that in April.amar_p wrote:Something is clearly amiss in the picture above. Chinese GDP shows growth whereas all its markets are in recession.

It must be that all other countries are faking their data

India doubles steel export, China major buyer

Navtan Kumar

Published : September 6, 2020, 12:23 am | Updated : September 6, 2020, 12:23 AM

New Delhi: India’s export of finished steel grew over two-fold between April and July this year, while import of such products reduced by about 42%.

...

Out of the total 4.64 million tonnes of export, Vietnam and China bought 1.37 million tonnes and 1.3 million tonnes of steel, respectively. Sources said that though Vietnam has been buying Indian steel regularly, the fact that Chinese companies imported Indian steel in a big way despite growing tensions between the two countries has come as a surprise to many.

...

India is emerging as one of the preferred destination for International garment companies to shift their base from China.

The international garment firms are now placing large order for the products, that were till last year supplied by Chinese vendors, to their Indian vendors.

German leisure wear brand Marc O'Polo has placed a huge order for Jerseys to its Indian vendor Warsaw International. The product was earlier being supplied by the German garment firm's Chinese vendor, reports Economic Times.

“We have a huge order. It’s a litmus test for us and the country. If we crack it, then gates open for more global brands to increase their India sourcing,” Warsaw International's Raja Shanmugam was quoted as saying.

Shanmugam, who also heads the Tirupur Exporters Association, further said that a lot more sourcing from India is expected this season, which normally begins on 1 September, as brands are realising that they need to look for alternatives. He expects 25 per cent increase in sourcing this season.

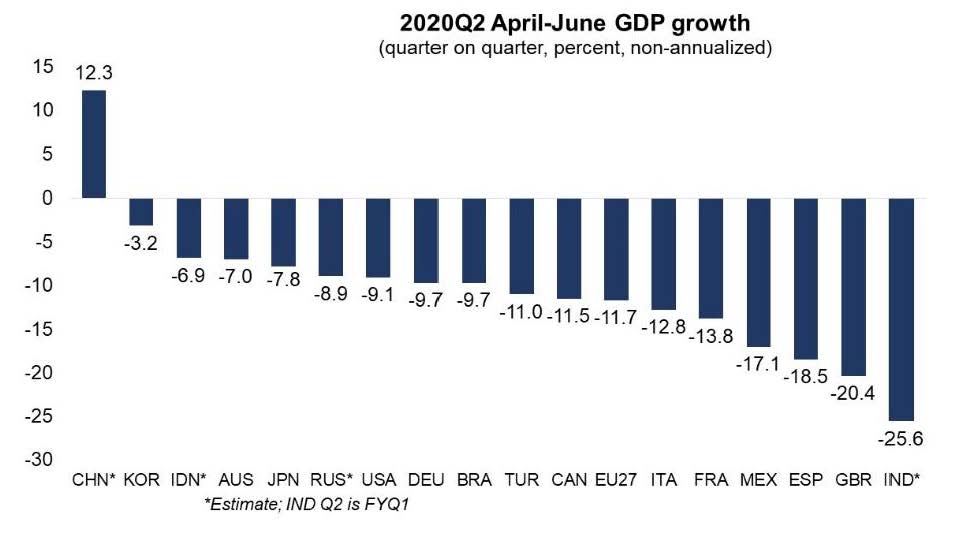

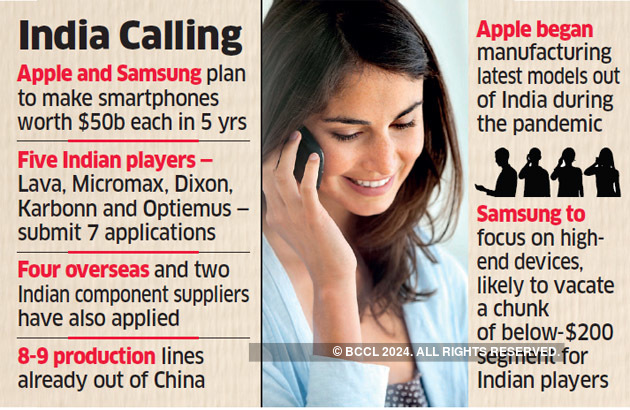

Applications by iPhone contract makers Foxconn, Pegatron and Wistron as well as Samsung, Karbonn, Lava and Dixon to export mobile phones worth around $100 billion from India have been cleared by the empowered group, said people with knowledge of the matter.

“The empowered committee has approved all applications estimated to export around $100 billion (Rs 7.3 lakh crore) worth mobile phones under the production linked incentive scheme (PLI) and all the applications will be placed before the cabinet probably this week,” a senior government official told ET.

With the acquisition of a 74 per cent stake in Mumbai airport, the Adani group is now the largest airport operator in the country. The group's airport portfolio consists of eight airports including Lucknow, Jaipur, Ahmedabad, Mangaluru, Thiruvananthapuram, Guwahati, Mumbai and the yet-to-be-constructed Navi Mumbai airport.

Collectively, these airports account for 23 per cent of passenger volumes, 22 per cent of air-transport movements and 31 per cent of cargo. Even so, the Adanis' foray into airports is not merely an aviation story. It has the designs of an ambition that is much larger.

Upon announcement of the impending privatisation, interest was shown by several parties. They included GMR, PNC Infra, AMP Capital, National Investment and Infrastructure Fund (NIIF), Zurich Airports, Kerala State Industrial Development Cooperation (KSIDC), Cochin Airport etc.

The deadline was set, 10 bidders shortlisted and 32 bids received. Upon final submission these were reviewed and analysed. But when the bids were opened the contest was not even close. Adani's bids were not only a bit higher but significantly higher. Put simply: they outbid everyone.

Adani offered a per passenger fee to the government which for certain airports was 155 per cent higher than that of the nearest competitor. Some “competing” bids were so low that they were confused for a typo. In all cases, Adani’s was the highest per passenger fee that was offered — by quite some margin.

As far as airports go, in the years ahead, the Adani group airport portfolio will account for around 100 million passengers, 2-3 million metric tonnes of cargo and 700,000 take-offs and landings. Most importantly it will own both airports in Mumbai — the commercial capital and a city where high-value cargo flows in and out.

Concurrently, the currently depressed passenger traffic will recover over a longer term and that too will add to the attractiveness of the airport portfolio.

With eight airports under their belt, the Adani group is now well on its way towards establishing a logistics behemoth that holds a strong position up and down the country’s western corridor. And analysis indicates they are not quite done yet. A bid for trains and railway stations cannot be ruled out. And these too will be integrated with the overall portfolio.

Reforms impact: Mandis seem to lose trade share

Signs of APMC weakening are now evident across major farm production centres in the country, heralding an era of unfettered market access and bolstered bargaining strength for farmers.

https://financialexpress.com/economy/re ... e/2076555/ via @FinancialXpress

Just Apple and Samsung together can turn India from a net current account deficit nation to a trade surplus generator, which in turn will rapidly increase forex reserves past $1 trillion . It’s on the basis of the new proposals that I originally estimated we will probably reach $1 trillion in forex reserves around 2025.vijayk wrote:https://economictimes.indiatimes.com/te ... 968729.cms

Big booster: Govt panel clears $100-billion mobile export proposals from global manufacturers

Applications by iPhone contract makers Foxconn, Pegatron and Wistron as well as Samsung, Karbonn, Lava and Dixon to export mobile phones worth around $100 billion from India have been cleared by the empowered group, said people with knowledge of the matter.“The empowered committee has approved all applications estimated to export around $100 billion (Rs 7.3 lakh crore) worth mobile phones under the production linked incentive scheme (PLI) and all the applications will be placed before the cabinet probably this week,” a senior government official told ET.

Then there is also possibility of chip manufacturers going to India. Wish we can get this without any hitchSuraj wrote:Just Apple and Samsung together can turn India from a net current account deficit nation to a trade surplus generator, which in turn will rapidly increase forex reserves past $1 trillion . It’s on the basis of the new proposals that I originally estimated we will probably reach $1 trillion in forex reserves around 2025.vijayk wrote:https://economictimes.indiatimes.com/te ... 968729.cms

Big booster: Govt panel clears $100-billion mobile export proposals from global manufacturers

Apple Inc.’s major iPhone assemblers are among the companies expected to win approval to participate in a $6.6 billion stimulus program to bring manufacturing to India, according to people familiar with the matter, a potentially seismic shift as the world’s most valuable company diversifies beyond China.

At a cabinet meeting on Wednesday, the Indian government is expected to approve a plan aimed at bringing $150 billion in mobile-phone production over the next five years, said the people, asking not to be identified because the matter is private. Among the dozen phonemakers already cleared by a high-powered government committee are Apple’s primary supplier Foxconn Technology Group, which had submitted two applications, and peers Wistron Corp. and Pegatron Corp., the people said. The three companies make virtually every iPhone sold globally in sprawling factories currently located mainly in China.

Under the Production Linked Incentive program, or PLI as it’s called, manufacturing incentives will rise each year in an ongoing effort to entice the world’s biggest smartphone brands to make their products in India and export to the world. Besides the Apple contractors, Samsung Electronics Co. is the only other applicant for the five slots allotted to foreign companies. China’s largest phonemakers Huawei Technologies Co. and BBK Group, which manufactures brands like Oppo and Vivo, are conspicuous by their absence.

Amid rising trade and political tensions between the U.S. and China, India is betting that many global brands will be keen to reduce their dependence on China. If successful, the program could set in motion a shift in electronics manufacturing in the next five years.“It’s a thoughtful move by the government aimed at wooing Apple to bring significant iPhone manufacturing to India because, when the iPhone maker shifts, an entire ecosystem follows,” said Hari Om Rai, chairman and founder of Lava International Ltd., India’s largest homegrown phonemaker. “The next five years will be dramatic, and India could become the new China in phone manufacturing.”

We want to help shape (the future global order) so that it is based on rules and international cooperation, not on the law of the strong. That is why we have intensified cooperation with those countries that share our democratic and liberal values, German Foreign Minister Heiko Maas said on September 2.

That day, Germany adopted the new guidelines pertaining to the India-Pacific approach, stressing the importance of promoting the rule of law and open markets in the region. The India-Pacific strategy has been endorsed by other countries including India, Japan, Australia and ASEAN members.

According to Nikkei Asian Review, China had been Germany's diplomatic focal point in Asia, with German Chancellor

It also must be noted that China also accounts for 50 per cent of Germany's trade with the India-Pacific region.

However, as per expectations, economic growth has not opened the Chinese market. German companies operating in China have been forced to hand over technology by the Chinese government. Also, talks between the European Union (EU) and China regarding an investment treaty to resolve such issues have stalled, giving rise to concerns about Berlin's increasing economic dependence on Beijing.

This came amid growing criticism of China's draconian national security law in

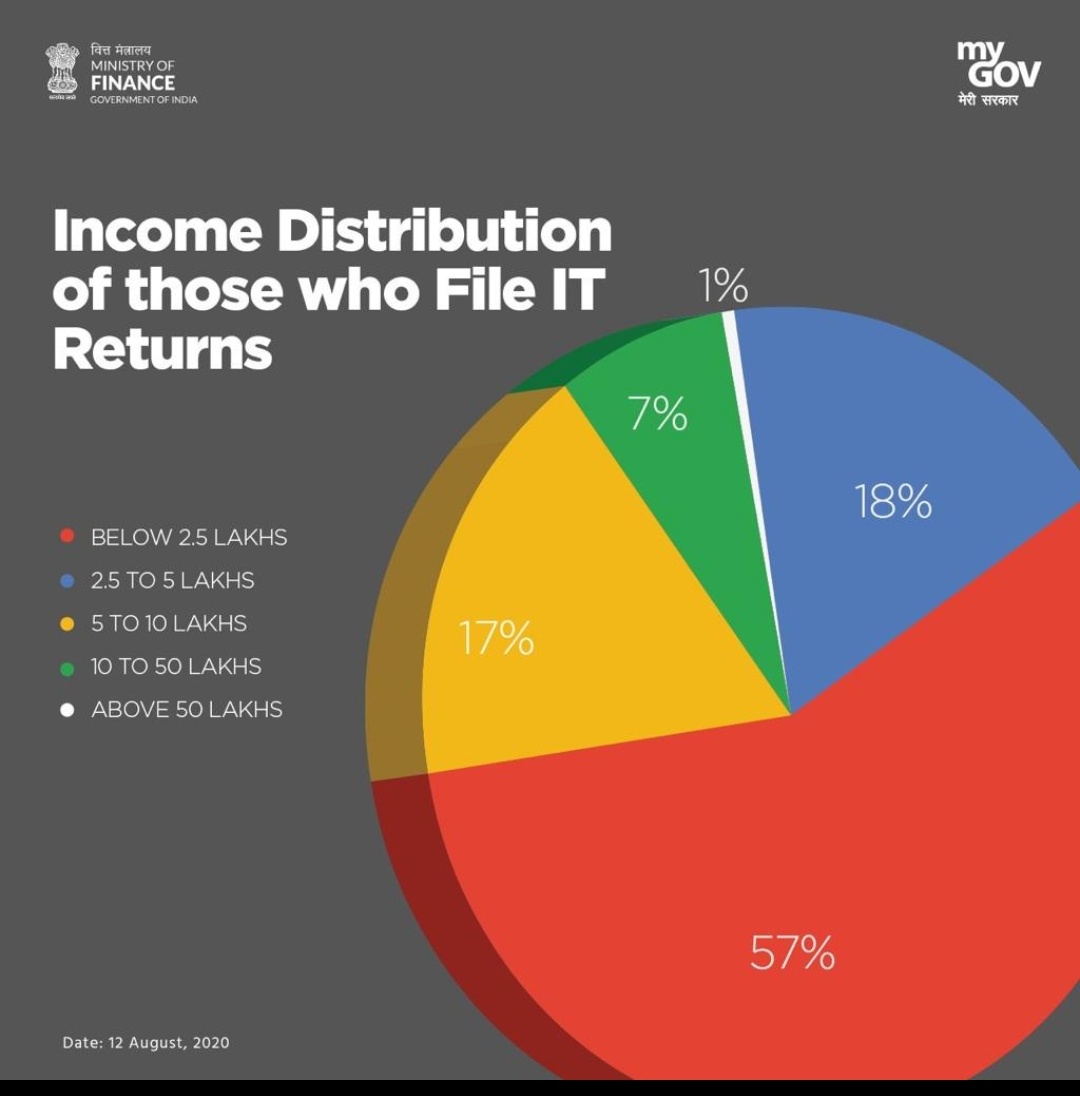

There is - TDS, the issue is the small business owners and shopkeepers show 0 sales and pay 0 tax. They want it all, world class infrastructure, clean water, 24/7 electricity, but they want it for free. Its like the guy who spits pan while badmouthing the filthy street. Who would shed a tear for this antiquated, inefficient, and tax dodging mom and pop business model as it dies at the hands of online retailers and multi-location retail? Not me.vimal wrote:More than that we need a wider tax net. There can't be just so few income tax payers in such a huge economy. I think there needs to be a payroll tax system in India.