Indian Economy - News & Discussion 27 May 2012

Re: Indian Economy - News & Discussion 27 May 2012

There was an Idea to implement Expenditure Tax instead of Income tax. In any case we pay taxes for items of expenditure. Income can be hidden but not expenditure.

As gkakkad pointed out, ITax is peanuts in overall tax kitty and it sustains a big babucracy of income tax dept.

As gkakkad pointed out, ITax is peanuts in overall tax kitty and it sustains a big babucracy of income tax dept.

Re: Indian Economy - News & Discussion 27 May 2012

As per him, he has been saying it from the seventies. Somewhere? Wasn't he professor of economics at Harvard - summer courses? He is not exactly new to economics, check his qualifications and experience.Theo_Fidel wrote:Income tax is the only progressive tax out there. I find it odd to eliminate it when only about 3% of India pays income tax. So who exactly would benefit. And what would be the benefit if any. One suspects as usual SS has not thought it through and and is supplying talking points he heard from some where.

Edit 2.77% according to this article.

http://www.deccanherald.com/content/187 ... ation.html

Re: Indian Economy - News & Discussion 27 May 2012

Rajan's Indian Funeral Pyre

...He plans to make sweeping changes to the financial system and bring the hierarchical administrative make-up of the sector to its knees by introducing liberal laws that will allow banks to open up branches without gaining prior permission from the Indian central bank. He wants to free up money for the economy to inject it into the private sector.

Raghuram Rajan is the guy that put the sex back into Sansex, the Indian stock market, apparently. The Indian press are more interested in what he looks like and the fact that he woos the women while what they should be worrying about is what he will be doing to the Indian economy.

He's hailed as a sex bomb, sex bomb; a rock star from the West and not just any old Bollywood-style boy from Bombay. He has more handles and pseudonyms than a spy but he's called the Monetary James Bond, the guy that is licensed to kill on her Majesty's Service. But, just what will he be killing and will Moneypenny find out?

Re: Indian Economy - News & Discussion 27 May 2012

Is available at the same place those charts came from. Interest rates available to savers were consistently higher than inflation during the 90s. They have been lower than inflation since 2006.Theo_Fidel wrote:That would be an interesting data point.

Please post if you find it.

Re: Indian Economy - News & Discussion 27 May 2012

India-Russia trade body endorses new framework to 15 projects

NEW DELHI: India-Russia Trade and Investment Forum has selected 15 high value, high tech projects for special attention in its seventh edition at St Petersburg.

"Indo-Russian Economic & Investment Cooperation Under which a total of 15 high value, high tech projects have been selected for special attention for ministerial supervision," a Commerce Ministry statement stated here.

Some of these projects include the establishment of India-Russian Joint venture with Hindustan Aeronautics Ltd ( HAL) as joint centre of development of helicopters, joint project of Ranbaxy Laboratories Limited ( RLL) and government of Yaroslavl region, production of Nitrogen Tetra Oxide for Space programme, cooperation between MMTC and ALROSA for long term supply of rough diamonds.

The other projects are ONGC Videsh Ltd's ( OVL) prospects for further hydrocarbon collaboration with Russian energy companies, participation of Russian companies in urea production in India under new investment policy, plant construction for manufacturing butyl rubber with capacity of 100000 tons per year at the production site of Reliance Industries in Jamnagar.

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Indian Economy - News & Discussion 27 May 2012

I have a beginner's question. Request gurus to help me understand.

Premise:

1. India has put in "eminent domain" clause in the constitution in 44th amendment. It allows GoI to acquire anything from its citizenry.

2. India's net gold imports is about 800+ tons per year

Per my 2-bit knowledge, whenever RBI buys USD as foreign reserves, it will remove an equivalent of INRs from market. So if we were in 1980s where FERA was in full power, it would mean my holding say $1000 RBI would have taken say INR 50,000 from local circulation. Is this understanding correct?

Does it happen the same way with net gold imports too, for they are imported from foreign markets?

If so, can RBI count these imports as part of its national gold reserves, even though they remain in the hands of the citizenry?

Premise:

1. India has put in "eminent domain" clause in the constitution in 44th amendment. It allows GoI to acquire anything from its citizenry.

2. India's net gold imports is about 800+ tons per year

Per my 2-bit knowledge, whenever RBI buys USD as foreign reserves, it will remove an equivalent of INRs from market. So if we were in 1980s where FERA was in full power, it would mean my holding say $1000 RBI would have taken say INR 50,000 from local circulation. Is this understanding correct?

Does it happen the same way with net gold imports too, for they are imported from foreign markets?

If so, can RBI count these imports as part of its national gold reserves, even though they remain in the hands of the citizenry?

-

Theo_Fidel

Re: Indian Economy - News & Discussion 27 May 2012

SwamyG, I am very aware of his checkered history. Some of us were here through all this.SwamyG wrote:As per him, he has been saying it from the seventies. Somewhere? Wasn't he professor of economics at Harvard - summer courses? He is not exactly new to economics, check his qualifications and experience.

If credentials and Harvard were all it took what would one say of Amartya Sen, Nah!

What come out of your mouth must work and not merely 'sound' good and please your friends and earn one a nobel price.

There is no developed country on earth that does not have income tax. Unless the Caymans, Bahamas and Saudi Arabia count as our leading lights.

Again where did he hear it would be my question and for whose ear is this message.

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Indian Economy - News & Discussion 27 May 2012

What ideas of Sri Amartya Sen's work on the ground?Theo_Fidel wrote:SwamyG, I am very aware of his checkered history. Some of us were here through all this.SwamyG wrote:As per him, he has been saying it from the seventies. Somewhere? Wasn't he professor of economics at Harvard - summer courses? He is not exactly new to economics, check his qualifications and experience.

If credentials and Harvard were all it took what would one say of Amartya Sen, Nah!

What come out of your mouth must work and not merely 'sound' good and please your friends and earn one a nobel price.

There is no developed country on earth that does not have income tax. Unless the Caymans, Bahamas and Saudi Arabia count as our leading lights.

Again where did he hear it would be my question and for whose ear is this message.

Why should india be a replica of USA or UK or another country? Or should we accept india colonizing rest of the world and develop its internal economy from the slave trade?

-

Theo_Fidel

Re: Indian Economy - News & Discussion 27 May 2012

I can't find one for the 90's. In fact I can't find one for the critical 2000-2004 NDA period either. Please post your info.vera_k wrote:Is available at the same place those charts came from. Interest rates available to savers were consistently higher than inflation during the 90s. They have been lower than inflation since 2006.

The only one I can find shows that the real deposit rates adjusted for inflation have been flirting with -ve returns.

-

Theo_Fidel

Re: Indian Economy - News & Discussion 27 May 2012

Meanwhile here is the historical inflation rate of SoKo. Above 20% till the 1980's. Which is when it became democratic IIRC.

Re: Indian Economy - News & Discussion 27 May 2012

What is so great about income tax other than it is 2 lakh cr? We can increase excise tax and wealth tax say 1% of total real estate by everyone? no exceptions. States to get half . In good old days municipal property taxes used to be like that only. We can get great amounts. Say 0.1% per month on shares and bonds etc is going to get almost same amount as income tax. u just need software for that and tax can be collected with little difficulty. There are ways.

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Indian Economy - News & Discussion 27 May 2012

Narayanrao garu,

Going away from income tax is a bad idea just because it did not come from INC for one set of people. For the other set of posters, such an idea must have come from the west (and of course GCC is not something we want to mimic).

If the objective of Govt to get enough revenues so it can use these resources for betterment of people then one should not have any issue if a given form tax is there or not. Who cares if it all comes from Income tax or BRF tax?

For someone one to understand the rationale behind Subbu Swamy's recommendation for removing income tax, one should watch the vision speech he gave, that Atriji posted in various threads.

Going away from income tax is a bad idea just because it did not come from INC for one set of people. For the other set of posters, such an idea must have come from the west (and of course GCC is not something we want to mimic).

If the objective of Govt to get enough revenues so it can use these resources for betterment of people then one should not have any issue if a given form tax is there or not. Who cares if it all comes from Income tax or BRF tax?

For someone one to understand the rationale behind Subbu Swamy's recommendation for removing income tax, one should watch the vision speech he gave, that Atriji posted in various threads.

Re: Indian Economy - News & Discussion 27 May 2012

This article backs up what I said previously - Rajan is continuing Subbarao's policies, and the FinMin hated Subbarao for it; the more Rajan pushes against inflation and fiscal profligacy by GoI, the more the chances that he too will go from sex symbol to villain.

There's nothing really wrong with his approach. The problems lie in GoI and FinMin's hands - they have not shown any tendency towards working on these lines. Since the low inflation / low interest rate environment generated by the NDA administration evaporated, fundamental driver was growth, which kept incomes above inflation. Now that growth has stalled, the high inflation bites harder.what Rajan has effectively done is to take D Subbarao’s warnings on inflation to their logical conclusion: high expectations on inflation ought to mean costlier money.

Rajan’s statement will thus not come as any balm to the finance ministry, which had earlier portrayed Subbarao as the villain of the piece. Rajan clearly said that his priority was to break the back of inflationary expectations. He said: “The current assessment is that in the absence of an appropriate policy response, WPI inflation will be higher than initially projected over the rest of the year. What is equally worrisome is that inflation at the retail level, measured by the CPI, has been high for a number of years, entrenching inflation expectations at elevated levels and eroding consumer and business confidence.”

Rajan's limited goal here is to monetarily clamp down on inflation, doing a Paul Volcker. But it requires accomodative support from FinMin and GoI implementing reforms that cut expenditure and drive growth.

Re: Indian Economy - News & Discussion 27 May 2012

Table 11 in the same linkTheo_Fidel wrote:I can't find one for the 90's. In fact I can't find one for the critical 2000-2004 NDA period either. Please post your info.

Re: Indian Economy - News & Discussion 27 May 2012

Can we have a QE type policy in India for certain time frame ( 1-2 years) where we can flood the market with cheap money ( 1-2 % interest ) to boost growth and add public debt say like 5-10 %

After all the entire EU are on an average 90 % debt and US is much above it .......so why not us add a little debt in return for Cheap Money to boose growth , is that possible in our context ?

After all the entire EU are on an average 90 % debt and US is much above it .......so why not us add a little debt in return for Cheap Money to boose growth , is that possible in our context ?

Re: Indian Economy - News & Discussion 27 May 2012

IIRC the farm workers' inflation was 14% this month,YOY, which is a very difficult situation for the very poor of India.

Re: Indian Economy - News & Discussion 27 May 2012

Gents,

1. Any talk of abolishing Income Tax is just absurd- it is the only progressive tax out there as someone has already said. ANY form of expenditure tax hurts the poor disproportionately.......abolishing Income tax is making the poor subsidize the rich. And abolishing Income tax makes absolutely no sense for a country at our stage of development even more so...

2. The only thing which GoI needs to do is stop spending its money on consumption expenditure (NREGA, Food Bill, energy subsidy) and spend the same amount on infrastructure creation (roads, power, irrigation, schools, healthcare) and ensuring public goods- spend MASSIVELY on increasing the size of our police and judiciary, creating a civil bureaucracy at the municipal level (ensuring clean towns/ villages, local policing, ityadi ityadi, public health and hygience), etc.

That would "crowd in" private sector expenditure and spark a growth cycle

This is all ECON 101.......lets stop focusing on nautankis (and with all due respect to the BJP, that is exactly what the Hon'ble and most esteemed Dr SS's suggestions amount to), and start focusing on the simple right things to do...

My 2 p

1. Any talk of abolishing Income Tax is just absurd- it is the only progressive tax out there as someone has already said. ANY form of expenditure tax hurts the poor disproportionately.......abolishing Income tax is making the poor subsidize the rich. And abolishing Income tax makes absolutely no sense for a country at our stage of development even more so...

2. The only thing which GoI needs to do is stop spending its money on consumption expenditure (NREGA, Food Bill, energy subsidy) and spend the same amount on infrastructure creation (roads, power, irrigation, schools, healthcare) and ensuring public goods- spend MASSIVELY on increasing the size of our police and judiciary, creating a civil bureaucracy at the municipal level (ensuring clean towns/ villages, local policing, ityadi ityadi, public health and hygience), etc.

That would "crowd in" private sector expenditure and spark a growth cycle

This is all ECON 101.......lets stop focusing on nautankis (and with all due respect to the BJP, that is exactly what the Hon'ble and most esteemed Dr SS's suggestions amount to), and start focusing on the simple right things to do...

My 2 p

Re: Indian Economy - News & Discussion 27 May 2012

Let every one pay say1% property tax then. No need to collect any other tax. Real estate it self will finance all local and municipal expenditure and true local rule will need there. Not allowing local revenue generation in a robust manner wherein education, medical infra works done through local govt and on locally generated revenue is very bad. In a typical town of ten lakh people 1% property tax means almost 1000 cr revenue. In major cities it will be much more. It is more equitable and will keep real estate prices under check.

-

Christopher Sidor

- BRFite

- Posts: 1435

- Joined: 13 Jul 2010 11:02

-

Bade

- BRF Oldie

- Posts: 7212

- Joined: 23 May 2002 11:31

- Location: badenberg in US administered part of America

Re: Indian Economy - News & Discussion 27 May 2012

With a flat 1% RE tax, lot of things like civic infrastructure in towns and cities can be fixed for sure.

The collateral damage if one can call it that will be, that a lot of land owners especially in states where land reforms were not fully implemented will stand to lose, as they may be land rich by inheritance but could be cash poor to pay up the yearly taxes. In states like AP, KA and TN and much of the northern states this will not fly and be acceptable to many.

The other consequence is that most land will end up in the hands of the rich. It will be like the hoarding of gold. Are people open to the idea of a gold tax to be paid every year at 1% ?

The collateral damage if one can call it that will be, that a lot of land owners especially in states where land reforms were not fully implemented will stand to lose, as they may be land rich by inheritance but could be cash poor to pay up the yearly taxes. In states like AP, KA and TN and much of the northern states this will not fly and be acceptable to many.

The other consequence is that most land will end up in the hands of the rich. It will be like the hoarding of gold. Are people open to the idea of a gold tax to be paid every year at 1% ?

-

Theo_Fidel

Re: Indian Economy - News & Discussion 27 May 2012

Bade saar,

Right now in metropolitan areas heavy tax is paid already. Within Chennai limits, the tax is about 0.1% of property value. What you are saying would increase RE tax 10 times! I agree it needs to be done and 1% of value type tax is inevitable. But should be increased slowly as peoples earning capacity increases. Right now if you slap a 1% tax on Chennai households, most stand alone houses are in the 1 crore + type cost range. A 1 lakh per year tax would bankrupt half the single family types, esp. retired types. Already it is close to Rs 10,000 – Rs 20,000 per year. Add to that water tax and electricity and Exnora fees and simple families struggle to make ends meet.

The real problem is rural areas and small towns. The tax on my property small house in S.TN is Rs 380 per year. Agricultural land is zero tax, the british legacy makes this a toxic tax. Even tax for property/plots near Chennai are a low Rs 800 per year type. And even this many rural type would struggle to pay. It is impossible to invest and improve development at this low taxbase level.

What would happen is more folks would be driven into renting. And even renting would be cripplingly expensive.

Right now in metropolitan areas heavy tax is paid already. Within Chennai limits, the tax is about 0.1% of property value. What you are saying would increase RE tax 10 times! I agree it needs to be done and 1% of value type tax is inevitable. But should be increased slowly as peoples earning capacity increases. Right now if you slap a 1% tax on Chennai households, most stand alone houses are in the 1 crore + type cost range. A 1 lakh per year tax would bankrupt half the single family types, esp. retired types. Already it is close to Rs 10,000 – Rs 20,000 per year. Add to that water tax and electricity and Exnora fees and simple families struggle to make ends meet.

The real problem is rural areas and small towns. The tax on my property small house in S.TN is Rs 380 per year. Agricultural land is zero tax, the british legacy makes this a toxic tax. Even tax for property/plots near Chennai are a low Rs 800 per year type. And even this many rural type would struggle to pay. It is impossible to invest and improve development at this low taxbase level.

What would happen is more folks would be driven into renting. And even renting would be cripplingly expensive.

Re: Indian Economy - News & Discussion 27 May 2012

India no longer a hot destination for jobs: NRIs disillusioned; many flee after impulsive return

Is this really true?

Sounds like shit is hitting the ceiling in India.

If so, typical story of the grasshopper and the ant.

Is this really true?

Sounds like shit is hitting the ceiling in India.

If so, typical story of the grasshopper and the ant.

Re: Indian Economy - News & Discussion 27 May 2012

There needs to an accompanying "homestead" exemption especially for senior citizens. If property tax goes up from Rs4000 to Rs, 40,000 most seniors will have no option to default or sell and move out of city.Narayana Rao wrote:Let every one pay say1% property tax then. No need to collect any other tax. Real estate it self will finance all local and municipal expenditure and true local rule will need there. Not allowing local revenue generation in a robust manner wherein education, medical infra works done through local govt and on locally generated revenue is very bad. In a typical town of ten lakh people 1% property tax means almost 1000 cr revenue. In major cities it will be much more. It is more equitable and will keep real estate prices under check.

If the related civic infrastructure improvement accompanies this 1% property tax, I doubt there will be many people who will object.

Re: Indian Economy - News & Discussion 27 May 2012

Gents, there are multiple considerations one needs to manage while looking at the taxation regime:

• Should tax on income, not assets........for a lot of people their house is the single largest asset but is self-occupied i.e. non cash generating. So any tax would pose a significant cash burden. So ideally, tax should be on the basis of dynamic platforms such as expenditure/ earnings as opposed to indexed to static items as wealth/ other assets

• In an ideal world, we would have direct progressive taxation i.e. the more you earn, the more you pay (even as a %). However, we do not live in an ideal world, so if you tax the rich at too high a level (and that level has been progressively going down the past few decades), the more evasion you promote (and also wealth fleeing to other more tax friendly destinations)

• If one is a capital scarce country (like India is), then you should tax consumption and encourage savings. But guess what- in a country with a significant proportion being poor, then any tax on consumption hits the poorest the hardest

• Taxation is normally the most effective lever for sending out policy choices i.e. encourage "public goods" such as environment friendly products/ services with a low tax base, and discourage undesirable items with high taxes ( e.g., alcohol, cigarettes). These have been found to be most effective as opposed to quantitative restrictions such as licensing...

• And to top it all, all tax rules and administration should be as non-discriminatory and transparent and simple as possible (we all know that one, I presume)...

Keeping all these considerations in mind, our tax structure is not that bad, from at least an overall design perspective........the real only structural changes I would bring about are:

1. On direct taxes, make filing of income taxes compulsory for all citizens from the age of 18 onwards (think this will happen once a UID becomes ubiquitous, BTW)

2. Abolish all the excise/ service tax and bring in all goods and services under a unified GST, as the current structure HEAVILY penalizes manufacturing and lets off services way too lightly

3. . .....with local bodies getting a decent share (say ~ 20%). That will not only ensure their financial independence but also make them incented to improve their amenities (urban/ rural) and get into a virtuous improvement cycle- the better the quality of life, the more the people move in, and generate more GST taxes, and hence municipality gets more finds which they can invest to make things better yada yada...

On the actual slabs:

• Our direct tax rates are fair, IMHO......and I say this while being in the highest tax bracket (which holds true for all of us I think). Challenge is to make it universal, as I mentioned above

• Our indirect taxes are ALL wrong- not only are they way too high, they are cascading in nature, and bear down disproportionately on manufacturing

• We DON"T encourage investment and R&D........but again, the DTC should correct that

Sorry for the long reply........

• Should tax on income, not assets........for a lot of people their house is the single largest asset but is self-occupied i.e. non cash generating. So any tax would pose a significant cash burden. So ideally, tax should be on the basis of dynamic platforms such as expenditure/ earnings as opposed to indexed to static items as wealth/ other assets

• In an ideal world, we would have direct progressive taxation i.e. the more you earn, the more you pay (even as a %). However, we do not live in an ideal world, so if you tax the rich at too high a level (and that level has been progressively going down the past few decades), the more evasion you promote (and also wealth fleeing to other more tax friendly destinations)

• If one is a capital scarce country (like India is), then you should tax consumption and encourage savings. But guess what- in a country with a significant proportion being poor, then any tax on consumption hits the poorest the hardest

• Taxation is normally the most effective lever for sending out policy choices i.e. encourage "public goods" such as environment friendly products/ services with a low tax base, and discourage undesirable items with high taxes ( e.g., alcohol, cigarettes). These have been found to be most effective as opposed to quantitative restrictions such as licensing...

• And to top it all, all tax rules and administration should be as non-discriminatory and transparent and simple as possible (we all know that one, I presume)...

Keeping all these considerations in mind, our tax structure is not that bad, from at least an overall design perspective........the real only structural changes I would bring about are:

1. On direct taxes, make filing of income taxes compulsory for all citizens from the age of 18 onwards (think this will happen once a UID becomes ubiquitous, BTW)

2. Abolish all the excise/ service tax and bring in all goods and services under a unified GST, as the current structure HEAVILY penalizes manufacturing and lets off services way too lightly

3. . .....with local bodies getting a decent share (say ~ 20%). That will not only ensure their financial independence but also make them incented to improve their amenities (urban/ rural) and get into a virtuous improvement cycle- the better the quality of life, the more the people move in, and generate more GST taxes, and hence municipality gets more finds which they can invest to make things better yada yada...

On the actual slabs:

• Our direct tax rates are fair, IMHO......and I say this while being in the highest tax bracket (which holds true for all of us I think). Challenge is to make it universal, as I mentioned above

• Our indirect taxes are ALL wrong- not only are they way too high, they are cascading in nature, and bear down disproportionately on manufacturing

• We DON"T encourage investment and R&D........but again, the DTC should correct that

Sorry for the long reply........

Re: Indian Economy - News & Discussion 27 May 2012

More psy ops.KJoishy wrote:India no longer a hot destination for jobs: NRIs disillusioned; many flee after impulsive return

Is this really true?

Sounds like shit is hitting the ceiling in India.

If so, typical story of the grasshopper and the ant.

"for many of these executives who struggled to successfully handle their portfolio in India. "

The babyboomers are shifting (generational change) and this change will be seen in the rest of the world in supply of talent and demand of talent worldwide

Re: Indian Economy - News & Discussion 27 May 2012

Adrija: Thanks for the great set of posts on taxation.

Re: Indian Economy - News & Discussion 27 May 2012

Acharya, I don't think it is all psy ops. This is also what I hear from Indians who live in India and some who are visiting. I think they may be overreacting, but it's been a great 13 year cycle and there will be some pull back and this may be what is happening.

Re: Indian Economy - News & Discussion 27 May 2012

There is something else. we can discuss it in GDF

-

Bade

- BRF Oldie

- Posts: 7212

- Joined: 23 May 2002 11:31

- Location: badenberg in US administered part of America

Re: Indian Economy - News & Discussion 27 May 2012

I think India is in a hard place, it has to tax more directly to improve the infrastructure to make our cities world class, but it cannot as you rightly point out all the bare equations that this process will lead to. There is not enough churning in land holdings in existing settlements/towns to see marked improvement to quality of life. The retired folks who own homes valued at 1 crore plus in the cities, could cash out and live in cheaper towns, but the towns themselves do not have the necessary medical and other minimal infra in place for them to take this decision. But, it has to begin somewhere and at some cost to some.Theo_Fidel wrote:Bade saar,

Right now in metropolitan areas heavy tax is paid already. Within Chennai limits, the tax is about 0.1% of property value. What you are saying would increase RE tax 10 times! I agree it needs to be done and 1% of value type tax is inevitable. But should be increased slowly as peoples earning capacity increases. Right now if you slap a 1% tax on Chennai households, most stand alone houses are in the 1 crore + type cost range. A 1 lakh per year tax would bankrupt half the single family types, esp. retired types. Already it is close to Rs 10,000 – Rs 20,000 per year. Add to that water tax and electricity and Exnora fees and simple families struggle to make ends meet.

The real problem is rural areas and small towns. The tax on my property small house in S.TN is Rs 380 per year. Agricultural land is zero tax, the british legacy makes this a toxic tax. Even tax for property/plots near Chennai are a low Rs 800 per year type. And even this many rural type would struggle to pay. It is impossible to invest and improve development at this low taxbase level.

What would happen is more folks would be driven into renting. And even renting would be cripplingly expensive.

Re: Indian Economy - News & Discussion 27 May 2012

Bade

> But, it has to begin somewhere and at some cost to some.

That is the rub. Nobody wants to be the "grist for the mill" by bearing the cost. Special interest and pressure groups spring up overnight in the garb of unions and vote banks. But you are right - one way or the other the tax base for long term infra projects has to be increased and the only way it can be done is through proper RE taxes with some consideration to the senior citizens whose pensions do not keep up with inflation.

By the way, there are several third tier cities all over India that have decent medical facilities and reasonable road infrastructure. Schooling is a problem but then seniors do not have to worry about that all that much. The real problem is water on one hand and elctricity on the other. If these two problems are mitigated then third tier cities and 4th tier towns are certainly viable for senior citizens. Granted medical facilities in say Karim Nagar, Rajamundry, or Anantapur are not as good as what one would find in Hyderabad or Chennai. But then again even Apollo Hospitals chain cannot compete with hospitals in US micro-urban locales (which are similar to the three towns I mentioned above).

Each of these towns I mentioned have excellent cultural and spiritual venues and welcoming communities. Retired people from the region would fit right in and feel comfortable. It is just that they want to be near their kids out of love (and the kids want them nearby so that they can pile on the loving Moms/MILs for child care).

> But, it has to begin somewhere and at some cost to some.

That is the rub. Nobody wants to be the "grist for the mill" by bearing the cost. Special interest and pressure groups spring up overnight in the garb of unions and vote banks. But you are right - one way or the other the tax base for long term infra projects has to be increased and the only way it can be done is through proper RE taxes with some consideration to the senior citizens whose pensions do not keep up with inflation.

By the way, there are several third tier cities all over India that have decent medical facilities and reasonable road infrastructure. Schooling is a problem but then seniors do not have to worry about that all that much. The real problem is water on one hand and elctricity on the other. If these two problems are mitigated then third tier cities and 4th tier towns are certainly viable for senior citizens. Granted medical facilities in say Karim Nagar, Rajamundry, or Anantapur are not as good as what one would find in Hyderabad or Chennai. But then again even Apollo Hospitals chain cannot compete with hospitals in US micro-urban locales (which are similar to the three towns I mentioned above).

Each of these towns I mentioned have excellent cultural and spiritual venues and welcoming communities. Retired people from the region would fit right in and feel comfortable. It is just that they want to be near their kids out of love (and the kids want them nearby so that they can pile on the loving Moms/MILs for child care).

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Indian Economy - News & Discussion 27 May 2012

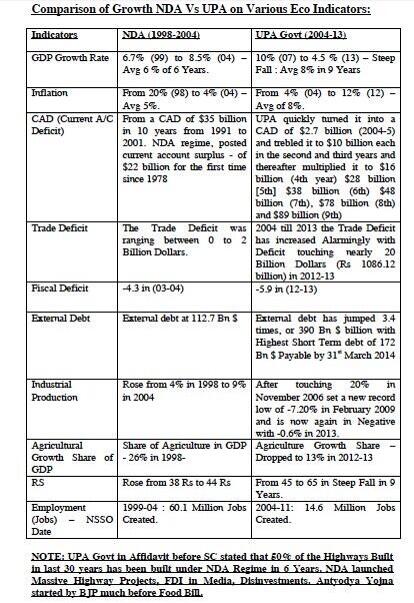

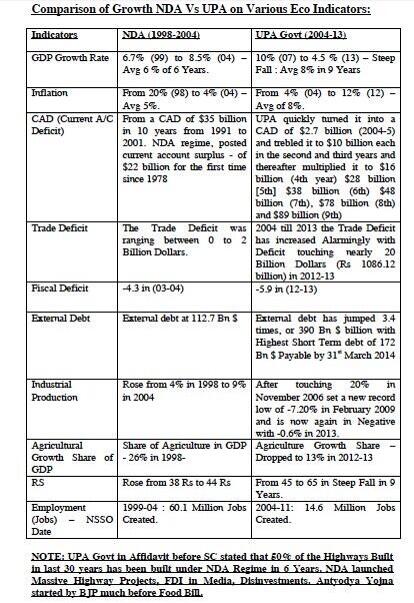

NDA vs UPA govt's fiscal performance comparison (some rebuttal to PC's tales in the media)

Re: Indian Economy - News & Discussion 27 May 2012

Thanks Suraj....Adrija: Thanks for the great set of posts on taxation.

-

Theo_Fidel

Re: Indian Economy - News & Discussion 27 May 2012

I'm not a big fan of the UPA but to be fair the price of Oil & Gold during the NDA period should also be mentioned.

Both were much lower than at present, adjusted for inflation and resulted in a huge boost to the CAD.

For instance Gold hit $300 per oz somewhere in 2002 IIRC.

An oil was testing the $20 a barrel line. I remember buying Gas in USA for 78 cents per gallon!

BTW that drop of agriculture to 13% of GDP is a good thing not a bad thing. Technically a Credit to the UPA.

The rest of it is quite damning to GOI.

Both were much lower than at present, adjusted for inflation and resulted in a huge boost to the CAD.

For instance Gold hit $300 per oz somewhere in 2002 IIRC.

An oil was testing the $20 a barrel line. I remember buying Gas in USA for 78 cents per gallon!

BTW that drop of agriculture to 13% of GDP is a good thing not a bad thing. Technically a Credit to the UPA.

The rest of it is quite damning to GOI.

-

Theo_Fidel

Re: Indian Economy - News & Discussion 27 May 2012

BTW I don't know if anyone noticed but RBI has updated its data on Sept 16 2013.

Data for 2012-2013 is now up.

GDP at market prices is Just over 100 Trillion rupees. Growth rate of 12.5% +/- in rupee terms before inflation.

http://www.rbi.org.in/scripts/AnnualPub ... %20Economy

Among other things Gross fiscal deficit is now 7.2%. For reference in 2004 it was 8.2%.

Data for 2012-2013 is now up.

GDP at market prices is Just over 100 Trillion rupees. Growth rate of 12.5% +/- in rupee terms before inflation.

http://www.rbi.org.in/scripts/AnnualPub ... %20Economy

Among other things Gross fiscal deficit is now 7.2%. For reference in 2004 it was 8.2%.

Re: Indian Economy - News & Discussion 27 May 2012

The economist who predicted the financial crisis just sounded another alarm—it would be wise to listen this time

In his first official act as the new governor of the Reserve Bank of India (RBI), Raghuram Rajan raised the benchmark interest rate from 7.25 to 7.5%, causing a ripple of surprise in financial circles and eliciting protests from various business representatives. But for people who know the current condition of emerging markets and Rajan’s professional trajectory, this was not surprising, at all.

+

Rajan has no qualms about staging such challenges. In 2005, Rajan was chief economist of the International Monetary Fund and attended the top central bankers’ get together in Jackson Hole, Wyoming, to present a paper on how the financial sector had evolved during Alan Greenspan’s era. As Rajan later described the meeting, which was to be Greenspan’s last, in his book Fault Lines: “Some of the papers in the conference, in keeping with the Greenspan-era theme, focused on whether Alan Greenspan was the best central banker in history, or just among the best.”

+

Not Rajan. He argued that under Greenspan, incentives had been artificially skewed in favor of the managers of the financial system, which reaped millenary rewards if things went fine but paid very little, if at all, when things turned sour. And he added that things were likely to turn sour because the skewed incentives were offering incentive to those managers to take excessive risks. He then focused on the “credit default swaps” which promised to repay delinquent loans in exchange for moderate insurance premiums. Noting that nobody really knew how realistically these swaps were priced, Rajan said that the banks were probably taking excessive risks because they trusted that the insurer would repay them. In these circumstances, a sudden increase in defaulting loans could exceed the reserves of the insurer, leading to a financial crisis. This is exactly what happened two years later, leading to the 2008 financial crisis.

+

His warning was not well received. Many people thought that Rajan didn’t understand modern finance. As it turned out, he understood it all too well—and it was those who looked down on him who did not.

+

Now Rajan has issued another warning by increasing the benchmark rate in India, shortly after the US Federal Reserve decided to keep on buying $85 billion of securities per month under its quantitative easing 3 program, to the general happiness of financial sector managers and traders. The Fed’s announcement spurred an immediate mini-boom in all financial instruments. The day after the announcement, I published an article in Quartz in which I argued that the current high rate of monetary creation and the extremely low interest rates caused by QE3 are unsustainable and that, sooner than later, interest rates are bound to increase. I argued further that the long prevalence of extremely low interest rates is likely to be creating the conditions for a serious financial crisis; all the economic activities that are profitable due to low rates will become unprofitable and will not be able to repay their obligations.

+

For this reason, it is necessary to prepare for such eventuality. This is what Rajan is doing by increasing interest rates in India, by easing the appetite for unsustainable activities that can survive only with low rates. The Financial Times quotes his rationale: “Let us remember that postponement of tapering is only that—a postponement…Let’s not lose the chance, the warning that we have been given, because this is going to come back and what we need to do is put our house in order before.”

+

This is a warning that the entire global economy should take seriously. Not just other emerging markets.

+

What can be done in this situation? In emerging markets, central banks should start increasing interest rates now that it can be done very gradually. Higher interest rates would deter investment in unsustainable activities and attract funds to more solid ventures. Moreover, they would help in stopping capital outflows that are seeking higher rates in the United States, and alleviating the trend toward currency devaluations, which are only accelerating those outflows. The postponement of the interest rates increases in the United States will allow these countries to go through the adjustment process in a gradual way. In a crisis, interest rates are raised in leaps, which causes considerable more damage to the economy.

+

Individual investors should see ahead of the curve, noticing that a world of higher interest rates looms. People now holding the kind of assets that would experience a sharp fall if interest rates go up should get out of them, particularly if these investments are burdened with fixed obligations that will not be reduced as interest rates go up. Of course, this is the kind of advice that cannot be useful for everybody at the same time. Aggregate losses cannot be avoided. Someone will have to absorb them because, as interest rates go up, the prices of the assets will go down. If you sell your assets before prices fall, for example, it is the buyer who will have to take the loss. This is the price that society has to pay for having unsustainably low interest rates for a long time.

2

Rajan’s warning is just one of the many that point to higher interest rates in the near future.

-

Theo_Fidel

Re: Indian Economy - News & Discussion 27 May 2012

Ah! Marten saar that is only the average.

Yes gas was 78 cents in some areas of midwest. Land of the cheapest petrol!

The story of agriculture is more complicated.

Yes it has reduced as share of GDP which is good.

The key problem I can see is that labor use has not reduced.

Meaning as labor cost has spiraled the cost of agricultural produce has spiraled as well.

I chattisgarh type areas even tractors are quite scarce. I saw a single combine in my visits there.

Everything is still done manually.

Yes gas was 78 cents in some areas of midwest. Land of the cheapest petrol!

The story of agriculture is more complicated.

Yes it has reduced as share of GDP which is good.

The key problem I can see is that labor use has not reduced.

Meaning as labor cost has spiraled the cost of agricultural produce has spiraled as well.

I chattisgarh type areas even tractors are quite scarce. I saw a single combine in my visits there.

Everything is still done manually.

Re: Indian Economy - News & Discussion 27 May 2012

About OIL Prices , GOI claimed it paid average 114 dollar this year. How is that possible when Oil was 110$ only for few weeks/days plus India but mainly Sour crude . Somewhere in between, 25-30$ Billion Dollar disappeared in the pocket of Import Lobby in Lootyn Dilli .

-

Virupaksha

- BR Mainsite Crew

- Posts: 3110

- Joined: 28 Jun 2007 06:36

Re: Indian Economy - News & Discussion 27 May 2012

When oil price is talked about, it is the texan oil market in texas which is used. It is not the sweetest oil out there. This gives a pretty good indicator of how much USA paid, but only a rough indicator of how much others paid.Jhujar wrote:About OIL Prices , GOI claimed it paid average 114 dollar this year. How is that possible when Oil was 110$ only for few weeks/days plus India but mainly Sour crude . Somewhere in between, 25-30$ Billion Dollar disappeared in the pocket of Import Lobby in Lootyn Dilli .

There are things like: whether you have paid spot prices or some other term commitment. Like for example our 20% source was iran. Last few months we have been facing problems with them due to sanctions. If we had to replace them in a pinch from soudi, which is the sweetest oil out there. India might have paid the soudi oil market price, which is different but trends along with the texas oil market price.