Perspectives on the global economic meltdown- (Nov 28 2010)

Re: Perspectives on the global economic meltdown- (Nov 28 20

Printing currency always helps the Rich screws the middle class and destroys the poor. That is what QE is about. Somehow all banks are clamoring that QE will help economy. QE will just pump up prices to compensate for bad bets made by the banks. If is taxation by inflation.

The other argument is that inflation is low. The real answer is that how inflation is being calculated? Secondly the prices were pumped upnso much between 2003-2007 that the while idea is to maintain that bubble.

The other argument is that inflation is low. The real answer is that how inflation is being calculated? Secondly the prices were pumped upnso much between 2003-2007 that the while idea is to maintain that bubble.

-

member_26147

- BRFite -Trainee

- Posts: 85

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

A cartel is a group of people that co-operate when they realize their collective asses are going to lose on their bad bets and gets the legislative and executive branches to work in their favor.Suraj wrote:DhruvP: 'international definition of cartel' ? A cartel requires them to cooperate to screw others. For most part the TBTF banks are busy screwing each other. The rest of us are just collateral damage, not the target. Most of us tend to think the bad service and fees are because the banks are out to screw us. We're just small fry; the average checking account is a breakeven or loss-making service. Their real game is screwing each other.

Exactly!SwamyG wrote:As per wikipedia, the Indian Shipping conference (a cartel) existed for 134 years. The cartels need not have the same players, players can change over generations. Players could come from a set of families (dynasty) or outside the closed group. In one form, the Indian caste system could be viewed as a cartel, where people were kept away from trading or other occupation. And these lasted thousands of years.

America the land where people migrate to get brainwashed

It doesn't have to end now but the rally will not last forever. Have an exit strategy.TSJones wrote:I'm not betting against Bernanke and the Fed. No way. They've been correct so far. Ride with the winners. Always.Hari Seldon wrote:The constipation of EU austerity has its complement- the diahorrea of Fed policy across the atlantic. This can only end badly. But it doesn't have to end now, hey, eh?

Re: Perspectives on the global economic meltdown- (Nov 28 20

TSJones wrote:What economic mess is that?RoyG wrote:The "winners" dragged the US into the economic mess with their quantitative easing and low interest rates.

We are already feeling the impact of low interest rates which has created bubbles, unproductive employment, and unemployment, and devalued the dollar which is reflected in the rising gold price trend. The new bubble is in the bond market and when that pops it's going to make the real estate bubble look like a firecracker. Unfortunately, those who called the housing bubble are again being ignored by mainstream media.Austin wrote:Will this have any impact on US economy in near term or will the effects will be felt long term , which is to ask will Barak Obama face the music of QE and Low Int or the next President or the one after that will have problems in hand ?RoyG wrote:The "winners" dragged the US into the economic mess with their quantitative easing and low interest rates.

-

member_26147

- BRFite -Trainee

- Posts: 85

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

My grapes are growing and sweetening up in diverse sectors and regions of the world as a hedge. The US grapes might turn sour but they will infect the chinese grapes with them.wong wrote:^^^^

Sour grapes. Keep thinking being one quarter away from a ratings downgrade or a current account deficit crisis is the "non-sucker", "smart" strategy.

By the way, the way you equate China losing one third of its reserves to a 20 sigma event makes me think how ineffective of a statistician you are. This itself discredits your argument.

Re: Perspectives on the global economic meltdown- (Nov 28 20

We are already feeling the impact of low interest rates which has created bubbles, unproductive employment, and unemployment, and devalued the dollar which is reflected in the rising gold price trend. The new bubble is in the bond market and when that pops it's going to make the real estate bubble look like a firecracker. Unfortunately, those who called the housing bubble are again being ignored by mainstream media.[/quote]Austin wrote:Will this have any impact on US economy in near term or will the effects will be felt long term , which is to ask will Barak Obama face the music of QE and Low Int or the next President or the one after that will have problems in hand ?RoyG wrote:The "winners" dragged the US into the economic mess with their quantitative easing and low interest rates.

Gold has lost 18% of its value in the last month or so.

If you think low interest rates causes unemployment then we can't have a valid economic or money and banking dialog.

Re: Perspectives on the global economic meltdown- (Nov 28 20

his business is based on doom & gloom so take it with a pinch of salt.

nevertheless, the recovery is indeed fake as he states.

nevertheless, the recovery is indeed fake as he states.

Re: Perspectives on the global economic meltdown- (Nov 28 20

I wonder if there is any thing called as middle ground when it comes to reviving the economy , something different from Europen style Austerity and US style QE/Cash flow.

Is it possible to have best of both or a middle ground ?

Is it possible to have best of both or a middle ground ?

Re: Perspectives on the global economic meltdown- (Nov 28 20

Its called "na ghar ka na ghat ka"!

Middle ground will be slow death like under UPA.

Middle ground will be slow death like under UPA.

Re: Perspectives on the global economic meltdown- (Nov 28 20

They have to reset. US with a good future with a large population will have to go for reset which will bring deep pain for the short term (2-5 years) and then will bring recovery for the future generation.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

Yes there is a middle ground. You need to understand why we got where we got. The solution is already there. Its a unrestrained price of physical gold. It is allowed to float to what ever level it wishes to get to.Austin wrote:I wonder if there is any thing called as middle ground when it comes to reviving the economy , something different from Europen style Austerity and US style QE/Cash flow.

Is it possible to have best of both or a middle ground ?

If you have a system which expands in volume than in price, you get the current scenario.

When sheeple claim that gold causes deflation, they are missing the point. The point is deflation for whom? For you and me. NO. Its deflationary for the whores in the stock market who like to bet other peoples money, keeping profits for self. The unrestrained price of gold is the way forward. It always was such for time immemorial. We will just go back to that way soon.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

So often in financial and economic commentaries of ALL sort that propose a “solution”, the authors are strangely obsessed with the notion of replacing the dollar (as a reserve currency unit) with simply another institutional emission of similar ilk (such as currencies of other nations, SDRs, bancors and whatnot). Their avoidance of any meaningful discussion of the most obvious remedy is almost pathological in the extreme. To be sure, we don’t need to invent any manner of universal reserve currency to fill the role of a unit of account because that role is already served in a fully functional capacity for any given country by its own monetary unit.

What IS desperately needed, however, is a universally respected reserve asset capable of filling our current void with a reliable presence that serves as a store of value. And far from needing to be conjured or created by complex international committees, that asset is already in existence and held in goodly store by central bankers and prudent individuals around the world — it’s known as gold. From amid the ruins of a chaotic financial crisis that was brought about by its own complexity, a degree of sanity will prevail, and gold as a freely floating asset will arise in stature as THE important element of global monetary reserves. The floating aspect is the vital evolutionary improvement over all previous structural monetary failures which tried to use a gold standard at a fixed price (i.e., unit of account) perversely joined to the very elastic money supply of any given country’s banking system.

When you understand how it is that it is economically (and therefore politically) undesirable for other major currencies to appreciate against their peer currencies (which is exactly what would happen to any currency replacing the dollar’s reserve status), you will subsequently know why gold shall continue to emerge as the de facto solution to the international reserve question.

And here I emphasize de facto rather than de jure because this has become a global phenomenon driven by a natural evolution (survival and ascent of the fittest) and does not require any additional international treaty or enabling legislation as a prerequisite or for motivation.

The breeze is fair and the road ahead is clear for the ascent of gold.

And here in lies the solution. As Indians we buy physical gold anyway. I would suggest, you buy more. Dont sell until its revalued.

At the later stages of the financial crash, the price (not value) of gold will fall to below 200$/oz. That would make many weak hands sell their stash. This fall in price will happen, 100% guaranteed. But try to buy any gold at 200$/oz from a dealer. You wont get any. The price of gold to could rise very very high. It will achieve a punctuated equilibrium. It will rise and rise and eventually stabilize but never fall back again to the pre crash prices.

What IS desperately needed, however, is a universally respected reserve asset capable of filling our current void with a reliable presence that serves as a store of value. And far from needing to be conjured or created by complex international committees, that asset is already in existence and held in goodly store by central bankers and prudent individuals around the world — it’s known as gold. From amid the ruins of a chaotic financial crisis that was brought about by its own complexity, a degree of sanity will prevail, and gold as a freely floating asset will arise in stature as THE important element of global monetary reserves. The floating aspect is the vital evolutionary improvement over all previous structural monetary failures which tried to use a gold standard at a fixed price (i.e., unit of account) perversely joined to the very elastic money supply of any given country’s banking system.

When you understand how it is that it is economically (and therefore politically) undesirable for other major currencies to appreciate against their peer currencies (which is exactly what would happen to any currency replacing the dollar’s reserve status), you will subsequently know why gold shall continue to emerge as the de facto solution to the international reserve question.

And here I emphasize de facto rather than de jure because this has become a global phenomenon driven by a natural evolution (survival and ascent of the fittest) and does not require any additional international treaty or enabling legislation as a prerequisite or for motivation.

The breeze is fair and the road ahead is clear for the ascent of gold.

And here in lies the solution. As Indians we buy physical gold anyway. I would suggest, you buy more. Dont sell until its revalued.

At the later stages of the financial crash, the price (not value) of gold will fall to below 200$/oz. That would make many weak hands sell their stash. This fall in price will happen, 100% guaranteed. But try to buy any gold at 200$/oz from a dealer. You wont get any. The price of gold to could rise very very high. It will achieve a punctuated equilibrium. It will rise and rise and eventually stabilize but never fall back again to the pre crash prices.

Re: Perspectives on the global economic meltdown- (Nov 28 20

And you base these pearls of wisdom upon......... your many years as a financial expert, right?panduranghari wrote:So often in financial and economic commentaries of ALL sort that propose a “solution”, the authors are strangely obsessed with the notion of replacing the dollar (as a reserve currency unit) with simply another institutional emission of similar ilk (such as currencies of other nations, SDRs, bancors and whatnot). Their avoidance of any meaningful discussion of the most obvious remedy is almost pathological in the extreme. To be sure, we don’t need to invent any manner of universal reserve currency to fill the role of a unit of account because that role is already served in a fully functional capacity for any given country by its own monetary unit.

What IS desperately needed, however, is a universally respected reserve asset capable of filling our current void with a reliable presence that serves as a store of value. And far from needing to be conjured or created by complex international committees, that asset is already in existence and held in goodly store by central bankers and prudent individuals around the world — it’s known as gold. From amid the ruins of a chaotic financial crisis that was brought about by its own complexity, a degree of sanity will prevail, and gold as a freely floating asset will arise in stature as THE important element of global monetary reserves. The floating aspect is the vital evolutionary improvement over all previous structural monetary failures which tried to use a gold standard at a fixed price (i.e., unit of account) perversely joined to the very elastic money supply of any given country’s banking system.

When you understand how it is that it is economically (and therefore politically) undesirable for other major currencies to appreciate against their peer currencies (which is exactly what would happen to any currency replacing the dollar’s reserve status), you will subsequently know why gold shall continue to emerge as the de facto solution to the international reserve question.

And here I emphasize de facto rather than de jure because this has become a global phenomenon driven by a natural evolution (survival and ascent of the fittest) and does not require any additional international treaty or enabling legislation as a prerequisite or for motivation.

The breeze is fair and the road ahead is clear for the ascent of gold.

And here in lies the solution. As Indians we buy physical gold anyway. I would suggest, you buy more. Dont sell until its revalued.

At the later stages of the financial crash, the price (not value) of gold will fall to below 200$/oz. That would make many weak hands sell their stash. This fall in price will happen, 100% guaranteed. But try to buy any gold at 200$/oz from a dealer. You wont get any. The price of gold to could rise very very high. It will achieve a punctuated equilibrium. It will rise and rise and eventually stabilize but never fall back again to the pre crash prices.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

Not at all. I am no financial expert. I am no expert about anything. I am basing this purely on my understanding of the systemic faults which seem to have eluded the paid media.TSJones wrote: And you base these pearls of wisdom upon......... your many years as a financial expert, right?

Re: Perspectives on the global economic meltdown- (Nov 28 20

The market (I.e. People who have earned the wealth with their hard work) should decide what they would like to hold as money. Forcing people to transact in paper or gold is tyranny.

Inevitably a cartel of goons form to monopolize the printing press or the commodity and turn the people into serfs through their control of the monetary system. Too big to fail, bailouts and backroom dealings through political bribery follows as the govt is throughly corrupted by the vested interests.

We select our own shoes, our own clothes, our own tooth paste - why can't we select our medium of exchange & storage of wealth. As long as the other party voluntarily agrees to transact with us, it is nobody else's business.

What should emerge is a system of privately issued competing currencies. Gold would compete alongside such currencies.

The central bankers aka private bankers would no longer control the lives of people.

Inevitably a cartel of goons form to monopolize the printing press or the commodity and turn the people into serfs through their control of the monetary system. Too big to fail, bailouts and backroom dealings through political bribery follows as the govt is throughly corrupted by the vested interests.

We select our own shoes, our own clothes, our own tooth paste - why can't we select our medium of exchange & storage of wealth. As long as the other party voluntarily agrees to transact with us, it is nobody else's business.

What should emerge is a system of privately issued competing currencies. Gold would compete alongside such currencies.

The central bankers aka private bankers would no longer control the lives of people.

Re: Perspectives on the global economic meltdown- (Nov 28 20

I started off believing a gold standard was the answer. But I soon realized that just like paper, the vast majority of gold is only held/controlled by a few. That gives the few the ability to expand and contract the money supply when it is most advantageous to them - kind of like an OPEC cartel.panduranghari wrote: Yes there is a middle ground. You need to understand why we got where we got. The solution is already there. Its a unrestrained price of physical gold. It is allowed to float to what ever level it wishes to get to.

I eventually came to the conclusion that the best monetary system is one which let's the market choose the money. Privately issued competing currencies (competing alongside gold and all else) is the only way to put the power of money back into the hands of those who've earned it. It takes the power away from banking crooks & other thieves trying to make serfs of us all.

Bitcoin is one such example of a privately issued currency, gold and silver liberty dollars was another. Both based on people voluntarily adopting them for usage without it being forced on them. As you know, the central bankers want both shut down to preserve the monopoly of money creation for their cronies the private banks. The founder of the Liberty Dollar has been given a 15 year jail sentence under bogus charges of counterfeiting money while bitcoin is being labeled a money laundering mechanism for criminals.

Taxation and other threats of violence is the means by which private banker monopoly is enforced. Taxes can only be paid in the currency medium they issue which ensures their monopoly. Lots more to say about this but it's clear to me that anything other than the market selecting the money is a scam.

Re: Perspectives on the global economic meltdown- (Nov 28 20

The problem is you equate short term loss in value in gold to its overall performance over 30 years. Have a look at the charts below especially starting from late 90's. You are correct, the reason we can't have a dialogue is because you are too blind to see it.TSJones wrote: Gold has lost 18% of its value in the last month or so.

If you think low interest rates causes unemployment then we can't have a valid economic or money and banking dialog.

http://goldprice.org/30-year-gold-price-history.html

Re: Perspectives on the global economic meltdown- (Nov 28 20

Yeah yeah, we've heard this story time and time again. You inject money into the economy, create bubbles and inflation, it becomes unsustainable, and then a crash. Who needs fiscal responsibility? Print, tax, and enjoy onlee.TSJones wrote:Austerity can ruin a nation's health:

http://www.cnbc.com/id/100760796?__sour ... rket%20Eco

Re: Perspectives on the global economic meltdown- (Nov 28 20

So, how long have you been hoarding gold?RoyG wrote:The problem is you equate short term loss in value in gold to its overall performance over 30 years. Have a look at the charts below especially starting from late 90's. You are correct, the reason we can't have a dialogue is because you are too blind to see it.TSJones wrote: Gold has lost 18% of its value in the last month or so.

If you think low interest rates causes unemployment then we can't have a valid economic or money and banking dialog.

http://goldprice.org/30-year-gold-price-history.html

Re: Perspectives on the global economic meltdown- (Nov 28 20

Any pearls of wisdom about expertise of rating agencies personnel, since the rating agencies must be having sharpest minds and years of experience??

Any pearls of wisdom about root cause of global economic meltdown??

Any pearls of wisdom about root cause of global economic meltdown??

Re: Perspectives on the global economic meltdown- (Nov 28 20

What global economic meltdown would that be? The US is not experiencing one.vishvak wrote:Any pearls of wisdom about expertise of rating agencies personnel, since the rating agencies must be having sharpest minds and years of experience??

Any pearls of wisdom about root cause of global economic meltdown??

Re: Perspectives on the global economic meltdown- (Nov 28 20

ECB president Draghi warns Euros "don't get loosey-goosey, stay tight".

http://finance.yahoo.com/news/dont-too- ... 33948.html

http://finance.yahoo.com/news/dont-too- ... 33948.html

Re: Perspectives on the global economic meltdown- (Nov 28 20

Sandeep Jaitly on Austrian economics

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

Neshant ji,Neshant wrote:I started off believing a gold standard was the answer. But I soon realized that just like paper, the vast majority of gold is only held/controlled by a few. That gives the few the ability to expand and contract the money supply when it is most advantageous to them - kind of like an OPEC cartel.panduranghari wrote: Yes there is a middle ground. You need to understand why we got where we got. The solution is already there. Its a unrestrained price of physical gold. It is allowed to float to what ever level it wishes to get to.

I eventually came to the conclusion that the best monetary system is one which let's the market choose the money. Privately issued competing currencies (competing alongside gold and all else) is the only way to put the power of money back into the hands of those who've earned it. It takes the power away from banking crooks & other thieves trying to make serfs of us all.

Bitcoin is one such example of a privately issued currency, gold and silver liberty dollars was another. Both based on people voluntarily adopting them for usage without it being forced on them. As you know, the central bankers want both shut down to preserve the monopoly of money creation for their cronies the private banks. The founder of the Liberty Dollar has been given a 15 year jail sentence under bogus charges of counterfeiting money while bitcoin is being labeled a money laundering mechanism for criminals.

Taxation and other threats of violence is the means by which private banker monopoly is enforced. Taxes can only be paid in the currency medium they issue which ensures their monopoly. Lots more to say about this but it's clear to me that anything other than the market selecting the money is a scam.

I am not for gold standard. I think we will never see a gold standard. that experiment failed on 15th august 1971.

I am calling for separating unit of exchange from store of value function of money. right now its the same. later fiat as unit of account. gold as store of value.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

Jones Saheb,TSJones wrote:What global economic meltdown would that be? The US is not experiencing one.vishvak wrote:Any pearls of wisdom about expertise of rating agencies personnel, since the rating agencies must be having sharpest minds and years of experience??

Any pearls of wisdom about root cause of global economic meltdown??

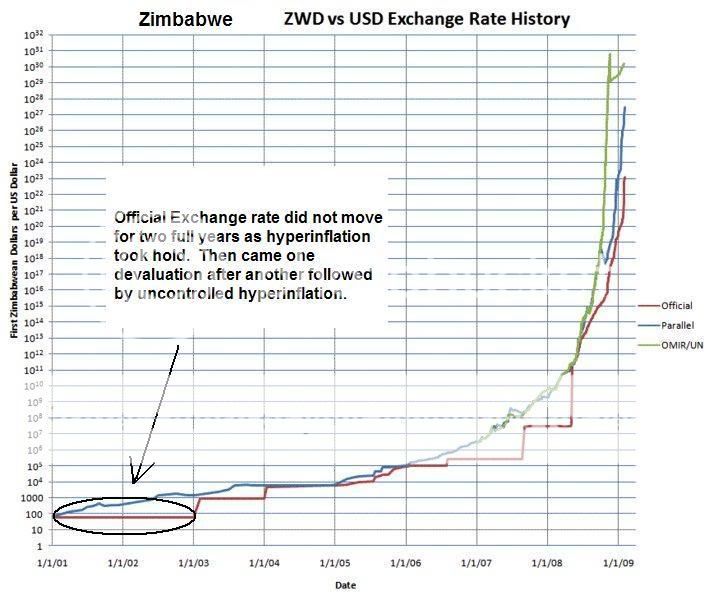

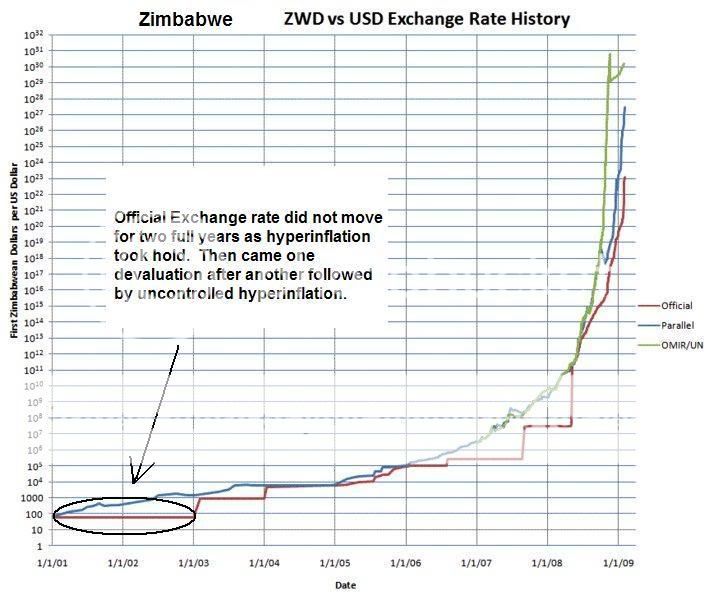

Tell me what is your understanding of the concept of 'hyperinflation'.

Is printing of a lot of money the cause of hyperinflation or the effect of hyperinflation?

Its a massive difference and will have a colossal effect to your finances if you do not understand this difference. Look I am not here to educate you, you are smart enough to make your own decisions and understand the concept of risk. But please do tell me (us) if you can about your understanding of the concept of hyperinflation.

Re: Perspectives on the global economic meltdown- (Nov 28 20

One more for the people who can 'understand' hyperinflation

Barnake during Friday Q&A on 'bubble' in Equities

key excerpt:

'.....One is that I think it would be hubristic to believe that we could always identify such deviations. On the one hand, sometimes changes in price-to-earnings ratios are justified by some fundamentals. You know, Microsoft stock is worth more than it was some time ago, and this may still yet prove to be a bubble. But so far so good, right? At the same time -- it’s not evident that having a misalignment or historically unusual relationship is a problem, though it may be. But of course, we can also miss changes in valuation that are, in some sense, not fundamentally justified.”

More@

http://www.prudentbear.com/2013/05/thou ... .html#more

------------

Re-read it TWICE

' we can also miss in valuation that are, in some sense NOT FUNDAMENTALLY JUSTIFIED"

Wow!

Just like he mistook HOUSING bubble as a sign of 'strong Economy' he is admitting HE COULD ALSO MISS EQUITY BUBBLE

Re: Perspectives on the global economic meltdown- (Nov 28 20

[quote="panduranghariJones Saheb,

Tell me what is your understanding of the concept of 'hyperinflation'.

Is printing of a lot of money the cause of hyperinflation or the effect of hyperinflation?

Its a massive difference and will have a colossal effect to your finances if you do not understand this difference. Look I am not here to educate you, you are smart enough to make your own decisions and understand the concept of risk. But please do tell me (us) if you can about your understanding of the concept of hyperinflation.[/quote]

Where do *you* think hyperinflation has occured? When you tell me that, then I will tell you what I think the concept of hyperinflation is.

Tell me what is your understanding of the concept of 'hyperinflation'.

Is printing of a lot of money the cause of hyperinflation or the effect of hyperinflation?

Its a massive difference and will have a colossal effect to your finances if you do not understand this difference. Look I am not here to educate you, you are smart enough to make your own decisions and understand the concept of risk. But please do tell me (us) if you can about your understanding of the concept of hyperinflation.[/quote]

Where do *you* think hyperinflation has occured? When you tell me that, then I will tell you what I think the concept of hyperinflation is.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

So it seems you are not sure of your understanding of this concept yet.TSJones wrote:

Where do *you* think hyperinflation has occured? When you tell me that, then I will tell you what I think the concept of hyperinflation is.

To answer your question- the g20 countries are all hyperinflated in technical sense.

My friend, debt is the very essence of fiat. As debt defaults, fiat is destroyed. This is where all these deflationists get their direction. Not seeing that hyperinflation is the process of saving debt at all costs, even buying it outright for cash. Deflation is impossible in today's dollar terms because policy will allow the printing of cash, if necessary, to cover every last bit of debt and dumping it on your front lawn!

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

To add to the above bit

Re: Perspectives on the global economic meltdown- (Nov 28 20

[quote="panduranghari"

******To answer your question- the g20 countries are all hyperinflated in technical sense.********

My friend, debt is the very essence of fiat. As debt defaults, fiat is destroyed. This is where all these deflationists get their direction. Not seeing that hyperinflation is the process of saving debt at all costs, even buying it outright for cash. Deflation is impossible in today's dollar terms because policy will allow the printing of cash, if necessary, to cover every last bit of debt and dumping it on your front lawn! Worthless dollars, of course, but no deflation in dollar terms!

Worthless dollars, of course, but no deflation in dollar terms!  [/quote]

[/quote]

You see this is what i figured that you meant. You weren't defining hyperinflation in the classical sense but your own invention. Classical hyperinflation is where a country's currency becomes worthless to the point that it would take a truckload of currency to purchase anything. Or, the currency is printed with astronomical values on thm. A million dollar note of currency for example. And this happens in a short period of time. The Weimar republic comes to mind as well as Hungary. None of these countries currencies were even remotely based on the economy of the nation let alone gold or silver.

What you are proposing is that all the dveloped countries are in hyperinflation due to numerous other factors besides fantastical note printing. For instance the price of oil rose enormously due to the Iraq war taking its production off line for years. Also the rise iof China and its demand for energy helped in this perceived shortage (there wasn't an actual shortage). It wasn't only due to the growth in the money supply.

******To answer your question- the g20 countries are all hyperinflated in technical sense.********

My friend, debt is the very essence of fiat. As debt defaults, fiat is destroyed. This is where all these deflationists get their direction. Not seeing that hyperinflation is the process of saving debt at all costs, even buying it outright for cash. Deflation is impossible in today's dollar terms because policy will allow the printing of cash, if necessary, to cover every last bit of debt and dumping it on your front lawn!

You see this is what i figured that you meant. You weren't defining hyperinflation in the classical sense but your own invention. Classical hyperinflation is where a country's currency becomes worthless to the point that it would take a truckload of currency to purchase anything. Or, the currency is printed with astronomical values on thm. A million dollar note of currency for example. And this happens in a short period of time. The Weimar republic comes to mind as well as Hungary. None of these countries currencies were even remotely based on the economy of the nation let alone gold or silver.

What you are proposing is that all the dveloped countries are in hyperinflation due to numerous other factors besides fantastical note printing. For instance the price of oil rose enormously due to the Iraq war taking its production off line for years. Also the rise iof China and its demand for energy helped in this perceived shortage (there wasn't an actual shortage). It wasn't only due to the growth in the money supply.

Re: Perspectives on the global economic meltdown- (Nov 28 20

What should have happened post-2008 is that people with cash should have seen their purchasing power increase four fold.

Instead those gains are stolen from those people via the printing press to make good the gambling losses of private bankers who made bad bets. Private bankers want the things they bet on with leverage, namely real estate, to rise - which means they want someone else to eat the loss of their bad bets.

The inflation is merely being hidden as (un-payable) debt & liabilities off balance sheet. Who believes the many trillions of dollars of debt being accumulated by western countries and Japan and many more trillions of "stimulus" (aka more debt) is going to be repaid at face value ever? Its getting to the point these countries are even scared they can't afford the interest on their debt, nevermind repaying the principle.

If Mises is right, the inflation will be nothing less than the destruction of the paper currency itself. I'm sure one day before it happens, economists will still be on TV claiming there is no inflation - but in the aftermath they will claim they predicted it all.

Instead those gains are stolen from those people via the printing press to make good the gambling losses of private bankers who made bad bets. Private bankers want the things they bet on with leverage, namely real estate, to rise - which means they want someone else to eat the loss of their bad bets.

The inflation is merely being hidden as (un-payable) debt & liabilities off balance sheet. Who believes the many trillions of dollars of debt being accumulated by western countries and Japan and many more trillions of "stimulus" (aka more debt) is going to be repaid at face value ever? Its getting to the point these countries are even scared they can't afford the interest on their debt, nevermind repaying the principle.

If Mises is right, the inflation will be nothing less than the destruction of the paper currency itself. I'm sure one day before it happens, economists will still be on TV claiming there is no inflation - but in the aftermath they will claim they predicted it all.

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final total catastrophe of the currency involved."

Re: Perspectives on the global economic meltdown- (Nov 28 20

Freak-a-nomics

Re: Perspectives on the global economic meltdown- (Nov 28 20

I'm not sure what your plan is, perhaps you can elaborate. I`m pretty sure you are proposing a gold standard, just that you are not aware of it.panduranghari wrote: I am calling for separating unit of exchange from store of value function of money. right now its the same. later fiat as unit of account. gold as store of value.

Taxation is the only thing that gives fiat its value. i.e. sales tax, capital gains tax, income tax, property tax..etc. Banking goons make sure its only payable in one medium and no other. i.e. the fiat they issue. That preserves their monopoly over the monetary system.

Without taxation and without a condition where tax is only payable in fiat money (as is the case right now), paper money would have no value.

So what you proposing

Re: Perspectives on the global economic meltdown- (Nov 28 20

What you are hoping for in your 2008 analysis is the collapse of the banking and investment systems and the destruction of the american economy. i see where you are coming from in your viewpoint.Neshant wrote:What should have happened post-2008 is that people with cash should have seen their purchasing power increase four fold.

Instead those gains are stolen from those people via the printing press to make good the gambling losses of private bankers who made bad bets. Private bankers want the things they bet on with leverage, namely real estate, to rise - which means they want someone else to eat the loss of their bad bets.

The inflation is merely being hidden as (un-payable) debt & liabilities off balance sheet. Who believes the many trillions of dollars of debt being accumulated by western countries and Japan and many more trillions of "stimulus" (aka more debt) is going to be repaid at face value ever? Its getting to the point these countries are even scared they can't afford the interest on their debt, nevermind repaying the principle.

If Mises is right, the inflation will be nothing less than the destruction of the paper currency itself. I'm sure one day before it happens, economists will still be on TV claiming there is no inflation - but in the aftermath they will claim they predicted it all.

Re: Perspectives on the global economic meltdown- (Nov 28 20

What happened after 2008 is devaluation of the dollar and printing of dollars

Hyperinflation will follow. What we see now is just a temporary period before the turbulance

Hyperinflation will follow. What we see now is just a temporary period before the turbulance

Re: Perspectives on the global economic meltdown- (Nov 28 20

Re Neshant

You are very correct. I gave a personal example of my family in Delhi. When my dad was a sole earning member in family of 4, he was able to buy and build a nice house. Now after 30 years with 3 working members in a family of 4, earning 30 times more than him, we cannot buy/ build a equivalent house in Delhi.

In Delhi NCR, around one million housing units are coming up and even at cost, around 60-90% would be unsellable as middle class cannot afford them. So everybody will have to wait for inflation to take salaries up and stagnation in property prices to make it affordable.

You are very correct. I gave a personal example of my family in Delhi. When my dad was a sole earning member in family of 4, he was able to buy and build a nice house. Now after 30 years with 3 working members in a family of 4, earning 30 times more than him, we cannot buy/ build a equivalent house in Delhi.

In Delhi NCR, around one million housing units are coming up and even at cost, around 60-90% would be unsellable as middle class cannot afford them. So everybody will have to wait for inflation to take salaries up and stagnation in property prices to make it affordable.

-

member_26147

- BRFite -Trainee

- Posts: 85

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

Apparently, he thinks that people can continue to use fiat for exchange of goods and services but keep it pegged to gold or keep the savings in gold. Basically an armchair general, nothing to see here.Neshant wrote:I'm not sure what your plan is, perhaps you can elaborate. I`m pretty sure you are proposing a gold standard, just that you are not aware of it.panduranghari wrote: I am calling for separating unit of exchange from store of value function of money. right now its the same. later fiat as unit of account. gold as store of value.

Taxation is the only thing that gives fiat its value. i.e. sales tax, capital gains tax, income tax, property tax..etc. Banking goons make sure its only payable in one medium and no other. i.e. the fiat they issue. That preserves their monopoly over the monetary system.

Without taxation and without a condition where tax is only payable in fiat money (as is the case right now), paper money would have no value.

So what you proposing

It is not him, me or you that is going to decide what the next monetary unit is going to be, like I said. Its going to be the bankers through their pet politicians.

It is pretty clear that there is a full-fledged race to the bottom though. Countries are trying to prepare for war either economically or militarily because they can't pay their debt and so they need their debt cancelled which means the whole geopolitical equation is going to change.