Indian Economy - News & Discussion Oct 12 2013

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Indian Economy - News & Discussion Oct 12 2013

^^Why 'not good', sir?

This way funds don;t get crowded out and may even be available for genuine sectors like SMEs perhaps? Anyway, don;t know enough to have an opinion one way or another on this one.

This way funds don;t get crowded out and may even be available for genuine sectors like SMEs perhaps? Anyway, don;t know enough to have an opinion one way or another on this one.

-

Bade

- BRF Oldie

- Posts: 7212

- Joined: 23 May 2002 11:31

- Location: badenberg in US administered part of America

Re: Indian Economy - News & Discussion Oct 12 2013

There was an interview with Arvind Subramaniam & his young team on NDTV, where he mentioned that corporates have their hands full with debt, so investments may not be forthcoming immediately or something to that effect. I recall during the last decade there was a buying spree by the Indian Business Houses of western entities. Maybe now they are barely surviving the after effects of that with no head room for further investments back home ?

Re: Indian Economy - News & Discussion Oct 12 2013

The corporate indebtedness is driven by many investments made between 2009-2011 in the expectation of a rising investment cycle during the recovery from the great financial crisis, coupled with the strong UPA-2 mandate. Unfortunately, that government spectacularly blew it, and as a result, a large number of companies were saddled with excess capacity and debt, and even though the capacity is now well utilized, their debt overhang has not yet fallen enough, and they're still spooked by the thought of history repeating itself.

Trade volume is down significantly in dollar terms, driven by fall in oil imports and exports:

Feb exports down 15% over last year, imports show similar plunge

Rs 75,000-crore plan to free coal reserves

Trade volume is down significantly in dollar terms, driven by fall in oil imports and exports:

Feb exports down 15% over last year, imports show similar plunge

GoI continues to focus on energy independence and supply side improvements, which will generate substantial growth down the line:Merchandise exports in February contracted 15 per cent to $21.5 billion, compared to $25.35 bn in the same month last year, due to a decline in export of petroleum products, iron ore, cereals and oilmeal. It is the biggest monthly fall in 2014-15.

Total export between April 2014 and February 2015 was $286.6 bn, up a meagre 0.8 per cent compared to $284.1 bn in the corresponding period of 2013-14, according to data issued on Friday by the ministry of commerce and industry.

Imports in February also declined, by 15.7 per cent to $28.4 bn as against $33.7 bn in February 2014. Cumulative imports during April 2014-February 2015 reached $411.8 bn, about 0.7 per cent higher than $408.9 bn in the same period last year.

The silver lining was narrowing of the monthly trade deficit, to $6.85 bn from a peak of $16.9 bn in November 2014. However, the total trade deficit in April 2014-February 2015 was $125.2 bn, compared to $124.8 bn in the same 11 months of 2013-14.

Oil imports came down by a massive 55.5 per cent to $6.1 bn from $13.7 bn in the same month last year. Total oil import in April-February reached $130.8 bn, down 12.2 per cent from $149.1 bn in the comparative period.

Non-oil imports grew 11.7 per cent to $22.9 bn from close to $20 bn in February last year. Total non-oil imports rose 8.1 per cent to almost $281 bn, compared to $259.8 bn in the earlier comparative period. Exporters have been constantly urging the government to bring in the new Foreign Trade Policy, so that they could offset some of the demand-side problem.

Rs 75,000-crore plan to free coal reserves

The government is planning to float three special purpose vehicles (SPVs) to evacuate coal locked across the three mineral-rich, Naxal-hit states of Chhattisgarh, Jharkhand and Odisha. Besides the three lines, 54 projects worth Rs 75,000 crore have also been identified for facilitating evacuation.

The move is part of a bigger plan by the National Democratic Alliance government to unshackle India's energy sector from the traditional constraints of limited logistics and delays in environment clearances and land acquisition.

"Each of the three SPVs will have equity participation from Coal India Ltd (CIL), railway undertaking IRCON and the state government concerned. While CIL will contribute 66 per cent, 24 per cent will be pumped in by IRCON and 10 per cent by the state government. The memorandum of understanding for the first of these SPVs, for Chhattisgarh, could be signed as early as next week," a senior government official said on condition of anonymity.

"The government wishes the projects be implemented by a professional body instead of the railways alone. CIL is anyway sitting on about Rs 50,000 crore of cash reserves and there is no sense in keeping this in banks," the official, directly involved with the plan, added.

The coal ministry has drawn up an ambitious plan of nearly tripling India's coal output from 565 million tonnes (mt) last financial year to 1.5 billion tonnes by 2020. Of this, an estimated 500 mt will be from the captive coal blocks being auctioned, while CIL will account for the rest.

Re: Indian Economy - News & Discussion Oct 12 2013

http://www.hellenicshippingnews.com/the ... n-economy/

The long road to a $20 trillion economy

The long road to a $20 trillion economy

Economy_magnifying_glass_Blue_background_with_grid Stretch targets are cursed by hyperbole—but they also sometimes help focus the collective mind of an organization or a country. Prime Minister Narendra Modi recently asked what needs to be done to make India a $20 trillion economy. It was a question that seemingly had the word “impractical” written all over it. It looked like a stretch target for an economy that is right now barely one-tenth that size.But few seem to realize that India has already pulled off a similar growth trick since the landmark 1991 economic reforms. India had a $326 billion economy in that year of crisis. It will end 2015 with an annual economic output worth $2.2 trillion, according to estimates published by the International Monetary Fund (IMF) in October.What this means is that the Indian economy grew 6.7 times in less than 25 years. It needs to grow a further nine times to reach the $20-trillion mark. How many years could that take? Take a look at the chart. We have calculated how many years India will take to be a $20-trillion economy assuming different growth trajectories from now. Naturally, the pace at which India reaches the mark depends on the rate of economic growth: the two move in tandem. The upshot: India will need anywhere between 27 years and 35 years to become a $20 trillion economy, going by the average growth rates we have assumed.The income of an average Indian would then be around $14,500, or around the current level of per capita income in countries such as Argentina, Barbados, Latvia or Chile. There is an important rider, however. We have assumed constant exchange rates. An appreciation in the value of the rupee will help, while a depreciation will delay the progress to the $20-trillion mark. Even the famous Goldman Sachs report on the economic potential of the Bric countries—Brazil, Russia, India and China—had said that exchange rate appreciation because of higher productivity growth would help these four emerging countries close the gap with the developed countries.

The immediate outlook for the Indian economy seems brighter than that of its peers. Russia is in deep trouble because of the collapse in global oil prices. Brazil is battling stagflation, forcing its central bank to increase interest rates despite shrinking output. China could be in the early stages of a secular slowdown.The toxic combination of high inflation and high unemployment has put South Africa at third spot in a recent Bloomberg listing of the most miserable economies in the world. Indonesia is perhaps the only large emerging market economy other than India that seems to be headed for better times. It is well known that India has come a long way since the rupee scare of August 2013. The economic recovery since then has come in three stages.First came economic stabilization as the previous government moved quickly to cut the twin deficits while the Reserve Bank of India (RBI) increased interest rates to curb inflation. Then the Modi government began to deal with the policy paralysis that hurt the economy in the final years of the United Progressive Alliance (UPA) regime. The third stage involves creating a new policy framework in several areas: the structural economic reforms that India needs before it sets off on its next round of growth.The Indian economy is being supported by welcome global tailwinds, especially the collapse in crude oil prices over the past few months. The economy seems to be in the early stages of a cyclical recovery, even given the doubts about the new data released by government statisticians. Inflation has come down sharply.

The current account could be close to balance. Foreign exchange reserves are at a record high. The global capital pouring in is far more than what is needed to fund the current account gap. One big challenge for the Modi government is to grab this strategic opportunity. Finance minister Arun Jaitley has recently spoken about the need for double-digit growth. So has the Economic Survey released by the finance ministry a day before the budget. Such confidence is welcome as long as it does not convert itself into hubris.The previous government fell into that trap. Its hubristic view that rapid economic growth was inevitable in effect meant that it failed to pursue structural reforms when the going was good. And the fiscal profligacy after 2009 created economic imbalances that paved the path to the near-crisis of 2013. India essentially has to replicate the Asian economic success stories of the past few decades: sustained high growth based on the export of manufactured goods (or rapid growth of the tradables sector of the economy).The preconditions for another three decades of rapid growth are in place: a young population, a high savings rate and the possibility of rapid productivity growth. India also has an opportunity to step up its manufacturing game as China restructures its economy towards domestic consumption. But the task before India is tougher because the global economy is far more sluggish than when the East Asian countries grew on the back of exports, so the domestic market could perhaps be more important in the Indian model. The upshot: Can India become a $20 trillion economy within a generation? It’s possible.

Re: Indian Economy - News & Discussion Oct 12 2013

Interesting happenings in RBI. Not only is there talk of a rift between the RBI head and FinMin, but others in the RBI are in disagreement with Rajan's recent actions because he didn't consult them:

Rift in RBI may get worse as central bank set to clip Raghuram Rajan’s wings

Rajan Can’t Convince Indian Banks to Cut Rates as Returns Shrink

Rift in RBI may get worse as central bank set to clip Raghuram Rajan’s wings

On the other hand, the rate cuts themselves are not being passed down because banks still carry high NPAsAccording to policymakers with knowledge of RBI discussions, the move to cut rates by 25 basis points — the second cut in two months outside its normal meeting cycle — came despite concern in the bank’s senior ranks that there is no clear picture on the state of the economy or on inflationary pressures.

And since the bank will now be judged by its ability to hit a formal inflation target, officials were also worried that a cut just days after the government’s budget placed too much faith in New Delhi’s promises of fiscal responsibility.

“Now that inflation is being squarely laid at the door of RBI, this caution is warranted,” said one policymaker.

The contrast between conservative top ranks and Raghuram Rajan’s own position — more in line with the government’s — comes as the bank prepares to introduce a monetary policy committee, following a structure embraced by most global central banks, which will reduce the governor’s power to act alone.

Although supported by Rajan, who believes it will bring transparency, a committee will nonetheless put the onus on him to convince other members of his views, and divisions are likely to become public, as MPCs typically release minutes or voting patterns.

In its current top-down decision-making structure, the RBI provides limited visibility on dissent, releasing only a short statement on the votes of external technical advisers after scheduled meetings. It does not disclose the decisions of the internal RBI officials on the advisory committee.

“Once you have a MPC-related structure, all those members will also have a vote,” said Rupa Rege Nitsure, group chief economists at L&T Financial Services.

“What suggestions they have made, it will be immediately put in the public domain. So there will be a debate.”

The RBI has seen the biggest overhaul in a generation in recent weeks, rules that have introduced an official inflation target, to be followed by an MPC under terms that now need to be hammered out with the government.

This new structure will require a different approach from Rajan, a former International Monetary Fund chief economist, who is not infrequently at odds with his more cautious lieutenants.

Officials said Rajan’s first out-of-cycle cut in January was discussed with top ranks, but the March move was more guarded.

Rajan started asking for data on Friday evening, a day before the federal budget was announced. He met a few senior officials on Monday evening about the prospect of cutting interest rates, though policymakers said that by then it was clear he had already made up his mind.

“A couple of days, and the governor had decided. We had not been told that’s what he would like to do,” said another senior policymaker.

“I was not expecting a rate cut so quickly, but this was the governor’s sole decision,” said a third official.

Rajan Can’t Convince Indian Banks to Cut Rates as Returns Shrink

India’s largest lenders aren’t passing on two rounds of monetary easing to borrowers as profitability slides and bad loans surge.

State Bank of India and Bank of Baroda are among 43 of 47 lenders yet to lower base lending rates after the Reserve Bank of India cut its benchmark rate by 50 basis points to 7.5 percent in two moves this year. The three-month interbank rate has fallen only seven basis points to 8.58 percent in 2015. A similar gauge of funding costs in China is at 4.9 percent.

“So far the drop in cost of funds isn’t enough to allow us to cut lending rates,” Ranjan Dhawan, Bank of Baroda’s Mumbai-based chief executive officer, said in a March 12 phone interview. “We’re walking a thin line,” he added. “We have limited scope to cut deposit rates because competition from other savings instruments and rising equity markets is strong.”

Central bank Governor Raghuram Rajan said in his March 4 policy statement that further monetary easing will need prerequisites including “the pass-through of past rate cuts into lending rates.” Union Bank of India said returns in the banking system have worsened from a seven-year low, and four of the five largest lenders reported higher soured loans in 2014.

“Banks are pressed on the profitability front more than ever before,” Arun Tiwari, Union Bank chairman and managing director, said in a March 11 phone interview. “Lending-rate cuts alone won’t spur credit growth.”

Profitability, measured by the return on assets in the banking system, fell to 0.81 percent in the year ended March 2014, the lowest since at least 2007, RBI data show. Stressed assets, which include bad loans and restructured assets, are set to rise to 13 percent in the next 12 months, further eroding profitability, according to India Ratings & Research Pvt., the local unit of Fitch Ratings.

Loans in the system grew 10.4 percent in the 12 months through Feb. 20, near the 9.7 percent pace in September that was the least since October 2009.

The RBI has lowered the proportion of deposits banks must invest in safer assets three times since June, leaving more funds for lending to support growth in Asia’s third-largest economy. The statutory liquidity ratio stands at 21.5 percent.

Banks have limited room to cut deposit rates as competing instruments such as savings plans and post office accounts are offering higher rates, according to Vibha Batra, the New Delhi-based head of financial industry ratings at ICRA Ltd., the local unit of Moody’s Investors Service.

Re: Indian Economy - News & Discussion Oct 12 2013

does anyone know what benefit accrued to Tata from the JLR purchase?

it seems they had to promise not to shift production to india and not even to transfer JLR technology into their domestic product lines.

so other than scratching Ford's and british elites back what was the game plan?

why were they so keen to acquire JLR ?

does the chinese Geely co who brought volvo agree to similar conditions?

it seems they had to promise not to shift production to india and not even to transfer JLR technology into their domestic product lines.

so other than scratching Ford's and british elites back what was the game plan?

why were they so keen to acquire JLR ?

does the chinese Geely co who brought volvo agree to similar conditions?

Re: Indian Economy - News & Discussion Oct 12 2013

The optimism of the NM rule is not resulting in any new projects being created. At least as much as expected. May be huge debt levels already existing, high interest rates, waiting for rates to reduce etc may be a reason. Even with all this March off take should be much better than normal months. It is not this month. Not even in infra projects which are suppose to be thrust area.Hari Seldon wrote:^^Why 'not good', sir?

This way funds don;t get crowded out and may even be available for genuine sectors like SMEs perhaps? Anyway, don;t know enough to have an opinion one way or another on this one.

Very big bad loans in the books is one of the reasons. In fact most of the accounts are kept as performing even when they are bad. So magnitude of the problem is much bigger than everyone seems to think. Attitude of GOI babus has not changed. I am (not personally) now in the receiving end for doing some security enforcement and getting slapped with a notice from Income Tax for some 400 plus Cr notice alleging we have done something in violation of tax laws etc after the court ordered in my favor. Changing this useless ideas will take lot of time and effort.

SMEs are good for the nation and job creation. But Bankers are normally not keen on this because of licence, permit, quota systems still in place and high level of failures. They are more comfortable to lend to "big corporate". So for there is no serious pressure on Bankers to lend to this sector from GOI.

Re: Indian Economy - News & Discussion Oct 12 2013

Tata got JLR got it cheap and made a lot of money since the purchase.

http://europe.autonews.com/article/2014 ... eport-says

http://www.autoblog.com/2014/07/22/tata ... ms-report/

Added Later:

They may not cut employees in UK for now as promised, but they may establish manufacturing plants in other countries to expand capacity like they are doing in - of all places - Saudi Arabia. Perhaps they will set up a manufacturing plant in India as domestic demand grows.

http://europe.autonews.com/article/2014 ... eport-says

http://www.livemint.com/Industry/LwQprO ... R-aid.htmlIndia's Tata Motors is developing two upscale SUVs for its Tata brand using technology from its luxury carmaking unit, Jaguar Land Rover, the Mint, a Delhi-based business newspaper reported.

http://www.autoblog.com/2014/07/22/tata ... ms-report/

Added Later:

They may not cut employees in UK for now as promised, but they may establish manufacturing plants in other countries to expand capacity like they are doing in - of all places - Saudi Arabia. Perhaps they will set up a manufacturing plant in India as domestic demand grows.

-

member_28640

- BRFite

- Posts: 174

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Smart Cities project likely to be launched next month:

The much awaited Smart Cities project is likely to be rolled out next month as the extensive consultation process with all stakeholders has concluded. "We are close to launching the much awaited Smart Cities initiative on ground. Prolonged and extensive consultations on this new concept and initiative have finally concluded. We will have all the necessary approvals for this project by the end of this month and action on ground will begin next month onwards," Urban Development Minister M Venkaiah Naidu said addressing a seminar on Smart Cities on Monday.

Click to read More.However, Naidu said the selection of the Smart City will be strictly on the basis of the criteria laid out by the government and no other consideration, including political ones, will be taken into account.

Re: Indian Economy - News & Discussion Oct 12 2013

Optimism cannot fix the fact that companies are heavily indebted.Yagnasri wrote:The optimism of the NM rule is not resulting in any new projects being created. At least as much as expected. May be huge debt levels already existing, high interest rates, waiting for rates to reduce etc may be a reason. Even with all this March off take should be much better than normal months. It is not this month. Not even in infra projects which are suppose to be thrust area.

IMF warns on India corporate debt

The debt problem for Indian firms

Corporate leverage is the biggest threat to Indian economy

This cannot be fixed with 'optimism'. It takes debt restructuring and bankruptcy mechanisms, which were addressed to a significant extent in the budget, but which did not get the interest it deserves because people were looking for 'big bang reforms'. That is actually a big bang reform, because it takes on a significant problem directly.

As the previous article indicates, not just companies, but banks are indebted, as a result of which they're reluctant to pass down the rate cuts by cutting their own rates too. These debts and NPAs are a legacy of the last administrations lack of reforms, and merely the optimism of new government is not enough to make the problem go away - it takes low level tinkering with debt restructuring, enabling creditors to get some of their money back, companies to refinance down to cheaper rates, and for banks to recapitalize and lend out again.

Re: Indian Economy - News & Discussion Oct 12 2013

Back of the envelope calculations suggest India can reach $20 trllion economy in less than 20 yrs if it is able to maintain 15% nominal growth (9% real plus 6% inflation). But it will require a tremendous effort. In case of present circumstances if the prediction is 8% growth with all the bottlenecks imagine the possibilities.

Re: Indian Economy - News & Discussion Oct 12 2013

Following is a post I wrote two years ago on BRF when Modi had won Gujarat elections and had just begun his rise on the political horizon as potential prime-ministerial candidate of the BJP. This article is very important (from my point of view) for two reasons. Firstly, it shows a structured syntax of applying different pramaaNas and other Dharmik-concepts relating to power and how to use that syntax to arrive upon a conclusion which can be tested and verified.

Secondly this post is very important with respect to Indrashakti theory of mine which has predicted dire scenario for India from 2015 to 2018-22. We have just entered the critical phase of Indrashakti. Against what I wished two and half years ago, Narendra Modi is now a prime-minister of India and thankfully he has solid majority in the lower house along with many key states in BJP's kitty to make some moves which will have lasting effect.

Yet, the strike of Indrashakti will be hardest and NaMo will have to fight an extremely uphill battle to see himself and India through this turbulent phase. Analysis of Sonia is important in this perspective. Indrashakti that is striking India is three-pronged trident which is interconnected. The economic prong, the Jihad prong and the China prong. Now we are beginning to see the onset of Economic prong of Indrashakti.

Fortunately, NaMo witnessed sharp fall in crude-oil prices which eased pressure on our economy in this year balancing to an extent our fiscal deficit. Yet, given the cautious budget that Jaitley presented along with constant tussle of Jaitley with Reserve Bank of India and refusal of leading banks (SBI in particular along with others) to pass on the rate-cuts by RBI to end-users tell us that something is amiss. Although picture is much more clearer than the time I wrote this article and now we know that SBI (State-Bank of India) along with other public sector banks are in big trouble due to their large share of Non-performing assets. It is due to the dead loans that were distributed at behest of political interference which have now gone rancid along thus threatening the very existence of SBI (Most notable being Kingfisher airlines). All this is going to have huge impact on the growth story of India that Narendra Modi promised and is earnestly working towards achieving.

This critical state of banking sector in India due to bad loans is the first wave of Indrashakti that this ghaTotkacha (NaMo) has to face. At this backdrop, I found it essential to visit this particular post of mine where I structured a syntax of viewing at an illusive problem using vedantik glasses.

http://forums.bharat-rakshak.com/viewto ... 1#p1469561

Something is amiss and understanding and correctly appraising Sonia's bala-profile now is seriously essential towards deciphering it. Because all the recent attempts of everyone belonging to AIF camp to derail parliament sessions (from congress to BBC rape-documentary) and power realignment happening in Ganga-valley and Delhi shows an activation of some sort of system which was lying dormant since 1761.

While we know the broad strokes (AIF Vs PIF, Panipat etc), it is now time to understand the finer undercurrents and ascertain and correctly appraise the ashTa-bala profile of AIF and PIF.

Secondly this post is very important with respect to Indrashakti theory of mine which has predicted dire scenario for India from 2015 to 2018-22. We have just entered the critical phase of Indrashakti. Against what I wished two and half years ago, Narendra Modi is now a prime-minister of India and thankfully he has solid majority in the lower house along with many key states in BJP's kitty to make some moves which will have lasting effect.

Yet, the strike of Indrashakti will be hardest and NaMo will have to fight an extremely uphill battle to see himself and India through this turbulent phase. Analysis of Sonia is important in this perspective. Indrashakti that is striking India is three-pronged trident which is interconnected. The economic prong, the Jihad prong and the China prong. Now we are beginning to see the onset of Economic prong of Indrashakti.

Fortunately, NaMo witnessed sharp fall in crude-oil prices which eased pressure on our economy in this year balancing to an extent our fiscal deficit. Yet, given the cautious budget that Jaitley presented along with constant tussle of Jaitley with Reserve Bank of India and refusal of leading banks (SBI in particular along with others) to pass on the rate-cuts by RBI to end-users tell us that something is amiss. Although picture is much more clearer than the time I wrote this article and now we know that SBI (State-Bank of India) along with other public sector banks are in big trouble due to their large share of Non-performing assets. It is due to the dead loans that were distributed at behest of political interference which have now gone rancid along thus threatening the very existence of SBI (Most notable being Kingfisher airlines). All this is going to have huge impact on the growth story of India that Narendra Modi promised and is earnestly working towards achieving.

This critical state of banking sector in India due to bad loans is the first wave of Indrashakti that this ghaTotkacha (NaMo) has to face. At this backdrop, I found it essential to visit this particular post of mine where I structured a syntax of viewing at an illusive problem using vedantik glasses.

http://forums.bharat-rakshak.com/viewto ... 1#p1469561

Atri wrote: The entire chain of ideas for you to do puravapaksha analysis on me are in this post. I am not playing on pratyaksha OR Shabda pramana. I am viewing things not through Saamkhya darshana (window) this time, but through Vedanta and hence am playing on Anumaana (inference), Upamaana (comparison), Arthapatti (postulation) and Anupalabdhi (Non-Cognition) pramanas. Samkhya is not robust to process my this model.

All the arguments, postulates, comparisons and non-cognition (as to why is BJP behaving like this since 2009 - that "Maayaa" factor) are int he posts cited in the post above in chronological order. I am not Shruti so my statement cannot be considered as shabda-pramana. Nor am I direct OR indirect witness to things happening - hence I do not have Pratyaksha pramana (in all three flavors) to present. Yet, I feel something is amiss. So, I have to drop my regular world-view (saamkhya-yoga) and adopt vedaanta to allow me to use three new pramaNas which are unavailable in former.

It may seem laughable if we do not see it through vedantic window. Hence I said, Samkhya-Yoga is not useful here - It is out of scope for them. What if she is not really that much invested in INC and all she (or her handlers) want is a channel to exert their influence in India for short and mid-term? What if bringing down OR saving INC was never her interest - her primary interest was to save her life and that of her children and make sure they did not suffer the fate of their father, uncle and grandmother? If you have read GRR Martin novels of "Song of Ice and Fire" series then Sonia is like Cersie Lannister.

If not, it becomes slightly difficult metaphor to explain. Thus, in absence of pratyaksha pramana to validate this, and lack of data and material enough for anumaana and upamaana to lead the charge, one has to seek refuge of Bhagvatpaada Adi Shankara, and make use of Anupalabdhi and then Arthapatti pramanas.

While applying Anupalabdhi pramana, we understand that something is amiss. A rational player of game will not behave as Sonia has in your scenario. Yet she is behaving. Thus applying Arthapatti pramana here, we "assume" or "postulate" that she IS a rational player and that there are other drives OR forces which are being neglected in the course of our study. So, given these two pramanas firmly in place, we then can start cautiously using Anumaana.

What is her background? Where she comes from? What is her chitta-vritti? what is her education? What kind of people is she AND was she surrounded by, when major life-events happened? what were their motives? What was her response? How did she rise to power? What kind of people she usurped the power from? What price did she pay? What kind of people surround her now? what is their character?

Shakti OR Power exists in eight forms according to Hindu Dharma and Artha Shaastras.

1. Tapobala - power owing to long struggle and accumulated experience and gained goodwill

2. Gnyana bala - power of sharp intellect

3. Artha Bala - Power of resources, finances, acquaintances.

4. Shastra bala - Power of weapons - muscle power

5. Jana Bala - Power of public support and popularity

6. Sthaana Bala - Power owing to position

7. Aatma bala - power of one's strong will and resolution.

8. Mitra bala - POwer of allies and friends

Think, how many balas she had in 1998 at her side when she miraculously rose to power and lime-light? Apparently, only Sthaana bala (gandhi dynasty) alone. Was it enough to so spectacularly rise to power? No.. Was there any other bala? - Pratyaksha, Anumana and Upamana pramanas say "Don't know !!". But again some is amiss here - Here again comes Anupalabdhi (acknowledging something is amiss and incomplete and hence it is blocking complete cognition). Then applying Arthapatti pramana we narrow down upon some external and invisible but powerful artha-bala and mitra-bala supporting her, making all this happen. Why? Anumaana and Upamaana says, "Don't know". Again Arthapatti needs to be employed.

This explains just the complexity of situation. (this also explains, why I prefer Nirishwar-vaadi Saamkhya-yoga over theistic vedanta with three pramanas onlee). I implore you to abandon samkhya and take refuge of vedanta for grasping this sort of inquiry.

As a corollary, similar modus operandi can be applied to Lal Krishna Advani and his weird behavior prior to rise of Narendra Modi. History and Anupalabdhi tells us that he is today a rational player with tapobala, gnyaana bala, aatma-bala and sthaana-bala at his disposal. Yet he behaved like this. He may have lost jana-bala to NM (or one can say NM inherited LKA's jana-bala and added his own), but yet has other balas at his disposal. Yet his actions in past few days looked irrational. Bring in anupalabdhi and arthapatti here as well. Why did he do it? To become PM? - But he categorically stated that he is OUT of PM race in 2011 and DOES NOT want to be one. So he cannot revert from his stated position (being a rational player) without public demand (jana-bala). But NM had already accepted the LKA's jana-bala in his quiver, so LKA (being a rational player) knows that he won't have a jana-bala and hence won't be able to revert from stated position.

Yet......

Kaalaay Tasmai namaH.

Something is amiss and understanding and correctly appraising Sonia's bala-profile now is seriously essential towards deciphering it. Because all the recent attempts of everyone belonging to AIF camp to derail parliament sessions (from congress to BBC rape-documentary) and power realignment happening in Ganga-valley and Delhi shows an activation of some sort of system which was lying dormant since 1761.

While we know the broad strokes (AIF Vs PIF, Panipat etc), it is now time to understand the finer undercurrents and ascertain and correctly appraise the ashTa-bala profile of AIF and PIF.

Re: Indian Economy - News & Discussion Oct 12 2013

Tata bought JLR at a very attractive price - ~ $2.3B. The net income for FY2014 itself was $3.7B. And Tatas have not had to make any substantial investments for R&D either (but only till now) for the hugely successful models such as the Evoque or the XF, which have been raking in the moolah. Ford Motors had made significant investments in design and development of these models. But they could not make the sales and were in a hurry to offload the two brands. This is a case-study for an extremely well-timed business investment.Singha wrote:does anyone know what benefit accrued to Tata from the JLR purchase?

it seems they had to promise not to shift production to india and not even to transfer JLR technology into their domestic product lines.

AFAIK, there is nothing that stipulates that Tata's cannot transfer tech out of UK into other production lines. In fact JLR has a JV with Cherry Auto for production in China, where western companies have genuine concerns about IP theft. When the deal was being negotiated, the unions and the UK govt. put in some spanners with regards to plants cannot be closed and workers cannot be fired etc. Tatas had to give in to those, but still it was a good deal. In fact, most of the new investment / expansion in production will happen out of UK, since most of the market expansion is outside UK.

Mr. Ratan Tata (the architect of tis deal) is a true visionary and Tata Motors is very close to his heart. He knew that there is no way that TM can break into the global league on its own. He also hoped that some of the brand value of JLR will rub off on TM to make it a little more acceptable even in India.

Re: Indian Economy - News & Discussion Oct 12 2013

MUDRA Bank: A catalyst for India's 10% GDP growth

http://www.business-standard.com/articl ... 018_1.html

http://www.business-standard.com/articl ... 018_1.html

Re: Indian Economy - News & Discussion Oct 12 2013

Finance Ministry notifies rollback rules for transfer pricing cases

http://www.business-standard.com/articl ... 497_1.html

http://www.business-standard.com/articl ... 497_1.html

Move could provide tax certainty for nine year period including four prior years, say consultants

Re: Indian Economy - News & Discussion Oct 12 2013

Is there any validity to this historical view of the Indian economy?

http://indianexpress.com/article/opinio ... -the-king/

http://indianexpress.com/article/opinio ... -the-king/

Re: Indian Economy - News & Discussion Oct 12 2013

interesting perspective ...

I always imagined something similar..that our massive informal sector/unaccounted GDP , is basically a historic tradition of the society and not a peculiar phenomenon post independence..

This shows that India was always a capitalist state..also explains why India never Islamised ..The king never really mattered ...the country was always decentralized and went about its own business ,regardless of who fought whom..A corollary is that a war-fund could never be mobilized quickly enough...

one lesson from this is that one should not venture into universal social security or anything of that sort..can end up disastrously wrong.. because Indians are historically used to low tax and high saving and negligible social security from state ...the high savings provides a social security in itself ...while it is not necessarily good , changing it is politically difficult...this also shows how stuff like chit funds evolved...small group of people pooled savings that were used in case of emergency ...

I always imagined something similar..that our massive informal sector/unaccounted GDP , is basically a historic tradition of the society and not a peculiar phenomenon post independence..

This shows that India was always a capitalist state..also explains why India never Islamised ..The king never really mattered ...the country was always decentralized and went about its own business ,regardless of who fought whom..A corollary is that a war-fund could never be mobilized quickly enough...

one lesson from this is that one should not venture into universal social security or anything of that sort..can end up disastrously wrong.. because Indians are historically used to low tax and high saving and negligible social security from state ...the high savings provides a social security in itself ...while it is not necessarily good , changing it is politically difficult...this also shows how stuff like chit funds evolved...small group of people pooled savings that were used in case of emergency ...

Re: Indian Economy - News & Discussion Oct 12 2013

Saar, I have a dread that these behemoth NPAs are due to more than " a legacy of the last administration's lack of reforms" but rather due to some deliberate rogering of the economy using funny loans, especially by the likes of Mr.Veshti. Pliss to throw some gyaan on this topic. The signals that I am seeing, though murky for a layman like me, are ominous still. I am of course correlating this with the post of Atriji on the topic of IndraShakti.Suraj wrote: Optimism cannot fix the fact that companies are heavily indebted.

IMF warns on India corporate debt

The debt problem for Indian firms

Corporate leverage is the biggest threat to Indian economy

This cannot be fixed with 'optimism'. It takes debt restructuring and bankruptcy mechanisms, which were addressed to a significant extent in the budget, but which did not get the interest it deserves because people were looking for 'big bang reforms'. That is actually a big bang reform, because it takes on a significant problem directly.

As the previous article indicates, not just companies, but banks are indebted, as a result of which they're reluctant to pass down the rate cuts by cutting their own rates too. These debts and NPAs are a legacy of the last administrations lack of reforms, and merely the optimism of new government is not enough to make the problem go away - it takes low level tinkering with debt restructuring, enabling creditors to get some of their money back, companies to refinance down to cheaper rates, and for banks to recapitalize and lend out again.

Re: Indian Economy - News & Discussion Oct 12 2013

MUDRA bank if implemented properly may do away/be an alternative with/to microfinance firms many of which are run by thugs e.g. Subrata Roy is still in jail and the Saradha scam is still unfolding.

Re: Indian Economy - News & Discussion Oct 12 2013

Sorry, that's not enough to work with. You'll have to dig into it and post reference material too.Frederic wrote:Saar, I have a dread that these behemoth NPAs are due to more than " a legacy of the last administration's lack of reforms" but rather due to some deliberate rogering of the economy using funny loans, especially by the likes of Mr.Veshti. Pliss to throw some gyaan on this topic. The signals that I am seeing, though murky for a layman like me, are ominous still. I am of course correlating this with the post of Atriji on the topic of IndraShakti.

Re: Indian Economy - News & Discussion Oct 12 2013

Suraj wrote:Sorry, that's not enough to work with. You'll have to dig into it and post reference material too.Frederic wrote:Saar, I have a dread that these behemoth NPAs are due to more than " a legacy of the last administration's lack of reforms" but rather due to some deliberate rogering of the economy using funny loans, especially by the likes of Mr.Veshti. Pliss to throw some gyaan on this topic. The signals that I am seeing, though murky for a layman like me, are ominous still. I am of course correlating this with the post of Atriji on the topic of IndraShakti.

I am trying to find news reports about Mr.Veshti setting up some phony power plant deals and issuing loans left and right. Word on the street is that the wife too was involved. This has apparently left some big name banks with huge NPAs.

Let me do some more digging.

Re: Indian Economy - News & Discussion Oct 12 2013

Not that I am an expert in these things, but I did find an echo of what you are saying in this speech by Shri Gurumurthy. Please do watch, he states that the Indian economy is feminine in nature, as it is family oriented with savings as the main driver, which is why a rights based approach (like social security, etc.) is not a good tempalte for us to follow.gakakkad wrote:one lesson from this is that one should not venture into universal social security or anything of that sort..can end up disastrously wrong.. because Indians are historically used to low tax and high saving and negligible social security from state ...the high savings provides a social security in itself ...while it is not necessarily good , changing it is politically difficult...this also shows how stuff like chit funds evolved...small group of people pooled savings that were used in case of emergency ...

I will be remiss if I don't mention this: A hat-tip to pankajs-ji for sharing the video about Shri Gurumurthy's speech about "ten years of economic destruction under the UPA" - I have learned a lot more new things about our economy and feel more confident about its future, thanks to this video and subsequent ones I saw as a consequence.

Re: Indian Economy - News & Discussion Oct 12 2013

Ms.Lagarde is referring to PPP GDP here:

India's GDP will be bigger than Japan, Germany combined in 4 yrs: IMF

India's GDP will be bigger than Japan, Germany combined in 4 yrs: IMF

WPI-based inflation at -2.06% in FebruaryThe Indian economy, whose size is $2 trillion as of now, is poised to overtake the combined GDP of Japan and Germany in the next four years on the back of recent policy reforms and improved business confidence in the country, IMF chief Christine Lagarde said today.

"Indeed, a brighter future is being forged right before your eyes. By 2019, the economy will more than double in size compared to 2009. When adjusting for differences in purchase prices between economies, India's GDP will exceed that of Japan and Germany combined," the IMF Managing Director said at a lecture here.

Banks show sharp growth in advance tax collections for Q4The rate of Wholesale Price Index (WPI) -based inflation for February this year provisionally stood at -2.06 per cent, compared with -0.39 in January and 5.03 per cent in February last year, mainly on the back of declining in crude oil prices.

The prices of fuel and power (which have a weight of 15 per cent in the index) were down 14.7 per cent on a year-on-year basis, and were lower by as much as 15.4 per cent when compared with the beginning of the 2014-15 financial year, showed data released on Monday.

The index for primarily articles, which account for 20 per cent of WPI, rose 1.43 per cent, while that for manufactured products (65 per cent weight) was almost flat when compared with a year ago.

The drop in the wholesale inflation rate was greater than expected. Analysts polled by Reuters had forecast the rate to be -0.70 per cent in February.

This is a fourth straight month of decline for WPI-based inflation. This partially makes a case for a further lowering of the repo rate by the Reserve Bank of India in the near future. Though RBI’s next monetary policy meeting is scheduled for April 7, Governor Raghuram Rajan has lately cut the rate outside of such meetings.

However, RBI primarily focuses on Consumer Price Index (CPI) -based inflation, for which it has set a target of under six per cent by January 2016, according to the Monetary Policy Framework. In February, CPI-based inflation rate rose to 5.37 per cent from 5.19 per cent in January, showed data released on Friday.

The last bit of data is strange. If banks are so profitable as to deposit high advance taxes, why are they moaning about low profitability and high NPAs ?Banks have shown healthy growth in their advance tax deposit this quarter, with the highest payer, State Bank of India, depositing Rs 1,750 crore, 20 per cent higher than in the corresponding period of the previous year.

According to sources, ICICI Bank and YES Bank have shown 32 per cent and 30 per cent jump in their tax deposit to Rs 1,295 and Rs 260 crore, respectively, in the quarter. Advance tax numbers are significant, as they are used by analysts to reverse-calculate profit before taxes.

-

member_29001

- BRFite -Trainee

- Posts: 28

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

If India's GDP (PPP) exceeds Germany + Japan, it will be real Hindu rate of growth.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Realty.Suraj wrote: The last bit of data is strange. If banks are so profitable as to deposit high advance taxes, why are they moaning about low profitability and high NPAs ?

Re: Indian Economy - News & Discussion Oct 12 2013

Deleted

Last edited by Suraj on 17 Mar 2015 06:54, edited 1 time in total.

Reason: Let's keep that in the media watch / politics threads.

Reason: Let's keep that in the media watch / politics threads.

Re: Indian Economy - News & Discussion Oct 12 2013

Disinflationary trends steepen in February

Wholesale Price Index (WPI)-based inflation was in negative territory for a fourth consecutive month, falling to -2.06 per cent year-on-year in February from -0.4 per cent in the previous month. Even if we assume inflation to be nil next month, WPI inflation for 2014-15 will stand at 2.3 per cent, compared with six per cent in 2013-15, signalling a sharp decline in inflationary pressures in the economy.

The steepest fall in inflation was in the case of aviation turbine fuel (-40 per cent), petrol (-21 per cent), diesel (-16 per cent) and liquefied petroleum gas (-9 per cent). We expect oil prices to remain benign in the coming months, averaging $60-65/barrel (Brent) in 2015-16, against an estimated average of $85/barrel in 2014-15.

Inflation for food articles moderated slightly, at 7.7 per cent (against eight per cent in January), driven by vegetables (15.5 per cent), fruit (16.8 per cent) and pulses (14.6 per cent). In the coming months, food inflation is likely to remain high, owing to inflationary pressures in the food grain category. This is because untimely rains have damaged rabi crops. While ample stocks of wheat can be deployed to curb wheat inflation, prices of chana, mustard and barley could rise.

Re: Indian Economy - News & Discussion Oct 12 2013

http://timesofindia.indiatimes.com/indi ... 589914.cms

After a successful round of auctions, the government is expected to reject two bids from Jindal Steel and Power Ltd (JSPL) for Gare Palma and Tara coal blocks citing "very low" bids and talk of cartelization.

In case of Gare Palma IV/2&3, there were three bidders - JSPL, GMR and Adani. GMR and Adani withdrew after just one round of bidding and Jindal's bid of Rs 108 a tonne, against a reserve price of Rs 100 a tonne, was accepted. Although the mine has the highest annual production capacity, it received the lowest winning bid among those reserved for the power sector.

Sources said that among the developed mines, Talabira and Sirsa Tola had received bids of Rs 478 and 470 a tonne, respectively. Even less developed ones such as Jitpur (Rs 302 a tonne) and Mandakini (Rs 650 a tonne) received higher bids.

Re: Indian Economy - News & Discussion Oct 12 2013

The article reiterates some known facets of ancient / medieval Indian society-A_Gupta wrote:Is there any validity to this historical view of the Indian economy?

http://indianexpress.com/article/opinio ... -the-king/

- - very high levels of decentralization in administration; probably unmatched for the times, anywhere else across the world

- insufficient emphasis on strong, centralized institutions

- lower level of active coordination between the Vaishyas and Kshatriyas as compared to the maritme European powers

Re: Indian Economy - News & Discussion Oct 12 2013

Good action on the part of GoI . Those winning bids raised eyebrows when it first happened. I think even R Jaggi mentioned it.hanumadu wrote:http://timesofindia.indiatimes.com/indi ... 589914.cmsAfter a successful round of auctions, the government is expected to reject two bids from Jindal Steel and Power Ltd (JSPL) for Gare Palma and Tara coal blocks citing "very low" bids and talk of cartelization.In case of Gare Palma IV/2&3, there were three bidders - JSPL, GMR and Adani. GMR and Adani withdrew after just one round of bidding and Jindal's bid of Rs 108 a tonne, against a reserve price of Rs 100 a tonne, was accepted. Although the mine has the highest annual production capacity, it received the lowest winning bid among those reserved for the power sector.

Sources said that among the developed mines, Talabira and Sirsa Tola had received bids of Rs 478 and 470 a tonne, respectively. Even less developed ones such as Jitpur (Rs 302 a tonne) and Mandakini (Rs 650 a tonne) received higher bids.

Re: Indian Economy - News & Discussion Oct 12 2013

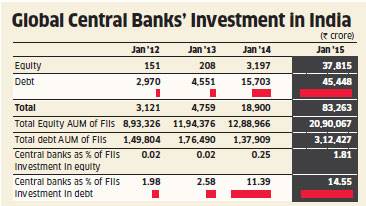

EconomicTimes @EconomicTimes 6m6 minutes ago

Global central banks increase their share of #FII investments in India's debt #markets http://ow.ly/Kqks1

Check the last line item.

Re: Indian Economy - News & Discussion Oct 12 2013

Does the winning bid require at least one other bid in the final round to remain valid? Else, how does one prove the cartelization or concerted effort to drive down prices?Suraj wrote:Good action on the part of GoI . Those winning bids raised eyebrows when it first happened. I think even R Jaggi mentioned it.After a successful round of auctions, the government is expected to reject two bids from Jindal Steel and Power Ltd (JSPL) for Gare Palma and Tara coal blocks citing "very low" bids and talk of cartelization.

(My query is mostly around the legal aspects of the bidding - can they cancel the winning bids despite receing a bid higher than the reserve price - which would indicate that the reserve price was incorrectly set! Or whether a provision exists to annul any bid on the basis of other bids being withdrawn in the final round, or say, a proviso that allows CI to take over a mine despite a winning bid meeting reserve price, by matching the price offered (since state revenue will be affected, and CI's coffers are basically a central item)?).

PS: I do hope they maintain a keen eye on anything that the Jindals have their hands on. There is absolutely no business where Sajjan saab has not had a friendly hand guiding his admittedly commendable efforts.

Re: Indian Economy - News & Discussion Oct 12 2013

They don't need to prove that there was cartelization in explicit legal terms. The parameters of the bidding mechanism allow them to reject a bid that appears unqualified. The bid documents were posted by disha earlier on this thread, about a month ago. Perhaps it offers Coal India a ROFR clause, but you're better off reading the documents in the original.

Re: Indian Economy - News & Discussion Oct 12 2013

Srivijaya expeditions by the Cholas were funded by merchant guilds iirc.Arjun wrote:The article reiterates some known facets of ancient / medieval Indian society-A_Gupta wrote:Is there any validity to this historical view of the Indian economy?

http://indianexpress.com/article/opinio ... -the-king/

The last is particularly important...the Jews (representing merchant interests) and the royals of Britain were equally responsible for making the EIC the supreme corporate entity of the 17th and 18th centuries. Indian Vaishyas were certainly working closely with the then rulers (Mughals) but why were they not actively pushing them to conquer new lands so that they themselves would benefit - is certainly a mystery.

- - very high levels of decentralization in administration; probably unmatched for the times, anywhere else across the world

- insufficient emphasis on strong, centralized institutions

- lower level of active coordination between the Vaishyas and Kshatriyas as compared to the maritme European powers

Re: Indian Economy - News & Discussion Oct 12 2013

And the Cholas were the sole Indian example of a dynasty becoming a maritime power.Prasad wrote:Srivijaya expeditions by the Cholas were funded by merchant guilds iirc.

I wonder why this was not sustained - India's history MAY well have been completely different. Were the guilds not making enough money from these conquests that they did not try to replicate more of these forays abroad ? Or was the slow Islamization of the island nations taking its toll on Indian enthusiasm ? At some point, fears of crossing the "kaala paani" became dominant in Indian society.

Re: Indian Economy - News & Discussion Oct 12 2013

Not fully true. Even Vijuayanagara had Navy. Trade etc may be quite big with many other Indic rulers at least in cases like Vijayanagara. The problem is we hardly have any records of the same. Huge wealth created in India could not have been created without wide spread trading etc. We read many stories of traders going to for off lands across the seas etc many times. For example even one of the stories in Sathyanarayana Puja had such a story.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Any recommendations on books regarding this. Thanks in advance.Arjun wrote:The article reiterates some known facets of ancient / medieval Indian society-A_Gupta wrote:Is there any validity to this historical view of the Indian economy?

http://indianexpress.com/article/opinio ... -the-king/

The last is particularly important...the Jews (representing merchant interests) and the royals of Britain were equally responsible for making the EIC the supreme corporate entity of the 17th and 18th centuries. Indian Vaishyas were certainly working closely with the then rulers (Mughals) but why were they not actively pushing them to conquer new lands so that they themselves would benefit - is certainly a mystery.

- - very high levels of decentralization in administration; probably unmatched for the times, anywhere else across the world

- insufficient emphasis on strong, centralized institutions

- lower level of active coordination between the Vaishyas and Kshatriyas as compared to the maritme European powers

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Marathas had to used British help to subdue Kanhoji Angre's Maratha navy fleet. Pity.Yagnasri wrote:Not fully true. Even Vijuayanagara had Navy. Trade etc may be quite big with many other Indic rulers at least in cases like Vijayanagara. The problem is we hardly have any records of the same. Huge wealth created in India could not have been created without wide spread trading etc. We read many stories of traders going to for off lands across the seas etc many times. For example even one of the stories in Sathyanarayana Puja had such a story.

Re: Indian Economy - News & Discussion Oct 12 2013

^^^ Thanks!

New news-item:

https://in.newshub.org/fdi-doubles-to-4 ... 32311.html

New news-item:

https://in.newshub.org/fdi-doubles-to-4 ... 32311.html

NEW DELHI: Foreign direct investment (FDI) in India more than doubled to USD 4.48 billion in January, the highest inflow in last 29 months.

Re: Indian Economy - News & Discussion Oct 12 2013

Oh, India was certainly among the leading trading nations. Gujarat, Tamil region, Kalinga, Vanga, Malabar and other regions were all trading vigoruously overseas at various points in history. The point was more about merchants (Vaishyas) strongly integrating with the rulers (Kshatriyas) and each actively supporting the other to achieve their objectives. That kind of very active partnership was not as visible in ancient / medieval India as it was in the history of the maritime European powers.Yagnasri wrote:Not fully true. Even Vijuayanagara had Navy. Trade etc may be quite big with many other Indic rulers at least in cases like Vijayanagara. The problem is we hardly have any records of the same. Huge wealth created in India could not have been created without wide spread trading etc. We read many stories of traders going to for off lands across the seas etc many times. For example even one of the stories in Sathyanarayana Puja had such a story.