Indian Economy - News & Discussion Oct 12 2013

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Agreed Picklu ji. Lord Shri Vishnu is served by Shesh Naag and Garud. Shesh serves close vision - Short termism. Garuda signifies long term vision. Lakshmi (wealth) resides with Vishnu because he has ability to see both. Modi ji has a plan. And he is going about it clinically. You could say - team Modi is re writing arthashashtra which is relevant for the 21st century.

Re: Indian Economy - News & Discussion Oct 12 2013

Services PMI index contracts in May for first time in 13 months

Meanwhile roadbuilding, like rail modernization, is increasingly dependent on the ability to deploy significant amounts of capital cheaply:

Road ministry's target to build 30 km/day road in FY16 would need Rs 1.6 lakh cr ($26 billion): Report

The above also points out something I've mentioned before - we classify construction as services. So the 'manufacturing is only 22% of GDP' is partly on account of statistical classification. Adding construction to industrial activity means 30% of GDP is in the secondary industrial activity.The country’s services activities fell for the first time in 13 months in May as demand remained subdued, showed the widely-tracked HSBC Purchasing Managers’ Index (PMI). This, coupled with the news of deficient rain, does not augur well, as almost three-fourth of the economy faces problems. In fact, a reason behind low orders were heat and earthquakes.

PMI was down to 49.6 points in May from 52.4 in April. PMI below 50 means contraction and that above 50 indicates expansion. May was the third month in a row to have witnessed a fall in PMI month-on-month, though in March and April, it was above 50 points.

Services, along with agriculture, constitute 78 per cent of the gross value added (GVA) in the economy, if construction is included in the tertiary sector. However, these activities account for almost 70 per cent of GVA if construction is included in industry.

PMI manufacturing rose to 52.6 points in May from 51.3 in April as such composite PMI output index fell to a seven-month low of 51.2 points in May from 52.5 in April.

Meanwhile roadbuilding, like rail modernization, is increasingly dependent on the ability to deploy significant amounts of capital cheaply:

Road ministry's target to build 30 km/day road in FY16 would need Rs 1.6 lakh cr ($26 billion): Report

While the Road Ministry has announced an ambitious target to build 30 km of road length per day during FY16, analysts feel that not only is the target steep in relation to the peak national highway construction of 7.41 km per day (kmpd) achieved in FY13 and 3.61 kmpd achieved in 10MFY15, it will also need funds in excess of Rs 1.6 lakh crore over the next three years - FY16 to FY18 - to fund national highways alone.

According to a recent ICRA report on the sector says that against the backdrop of the announcement made by the Finance Minister during his Budget speech about revisiting the existing PPP models and the need to rebalance the risks in PPP model with the government bearing a larger part of the risks, broad guidelines for 'Hybrid Annuity' model were announced by NHAI.

The report also adds that, "During current financial year, the traffic volumes have picked up; in H1 FY 15, the traffic growth has been 4.1 per cent in PCU terms which further improved to 6.8 per cent during 9M FY 15 when compared to a de-growth of 1.1 per cent during 9M FY 14."

Re: Indian Economy - News & Discussion Oct 12 2013

India to push for cut in farm subsidies of rich nations

http://www.business-standard.com/articl ... 393_1.html

http://www.business-standard.com/articl ... 339_1.html

http://www.business-standard.com/articl ... 393_1.html

Govt forms 10-member panel to revisit PPP infra modelThe issue was expected to be raised by Minister of State for Commerce and Industry Nirmala Sitharaman at an informal meeting of trade ministers under the aegis of the World Trade Organization (WTO), on the sidelines of a meeting of the Organisation for Economic Cooperation and Development (OECD) in Paris on Wednesday.

http://www.business-standard.com/articl ... 339_1.html

The terms of reference of the Committee include measures to improve capacity building in government for effective implementation of PPP projects, review of experience of PPP policy, analysis of risks involved in such projects in different sectors and existing framework of sharing of such risks between project developer and government.

Among others, it will deliberate upon design modifications to contractual arrangements of PPP, international best practices as well as institutional context.

Re: Indian Economy - News & Discussion Oct 12 2013

Here's some spectacular development in the agricultural sector:

MP to cover 5 million hectares under irrigation

MP to cover 5 million hectares under irrigation

Buoyed with a substantial increase in area under irrigation, the Madhya Pradesh government now has plans to take this to five million hectares.

Existing irrigated area currently stands at 3.6 million hectares, and has risen almost five fold from 750,000 hectares during the past decade.

"We plan to augment our irrigation cover to five million hectares instead of four million hectares, as was targeted in our Vision Document 2018," MP Chief Minister Shivraj Singh Chouhan had recently told Business Standard. The major focus would be on minor and micro irrigation projects, he had said.

The state has so far completed 254 minor irrigation projects and 700 more are to be completed by 2018. The Vision 2018 document also mandates that state has to raise micro-irrigation projects five fold.

"The micro-irrigation project network alone envisages covering an additional area of 700,00 hectares," a well-placed government official said. "All major and medium irrigation projects would also have 10 per cent cover from micro-irrigation."

As many as 229 irrigation projects in Chambal, Betwa, Sindh, Ken, Banganga and Tons rivers have covered major irrigation area in 30 districts through World Bank-assisted water restricting projects, with an approximate investment of Rs 3,000 crore, the official said.

Re: Indian Economy - News & Discussion Oct 12 2013

Another article on the dramatic gains from the direct benefit cash transfer system implemented using PMJDY:

Govt looks to save Rs 10,000 cr in cooking gas subsidies

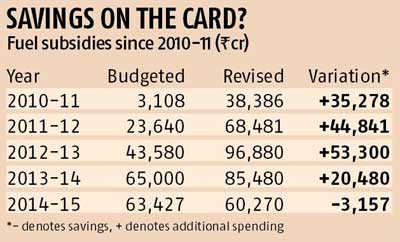

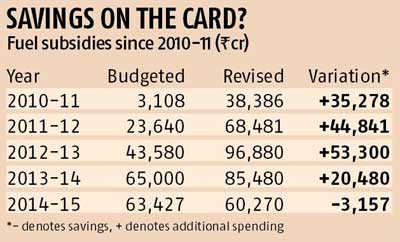

The fuel subsidy bill and wastage each year is huge, as the graph shows: $10-15 billion bill, with significant scope to waste and corruption.

States inching towards GST, says Mani

Subsidised seeds, power for farmers if rains fail

Govt looks to save Rs 10,000 cr in cooking gas subsidies

The Narendra Modi-led central government is set to save a little over Rs 10,000 crore in petroleum subsidy - a third of the budgeted Rs 30,000 crore - in the current financial year, thanks to the successful nationwide rollout of the modified direct benefits transfer (DBT) scheme for liquefied petroleum gas (LPG). The scheme has already eliminated around 40 million ghost connections.

With enrolment of beneficiaries coming to a halt after covering around 130 million registered subsidised connections, oil-marketing companies (OMCs) say the scheme has helped identify the bulk of the other consumers as duplicate entries. "This also includes people who have voluntarily surrendered subsidy or lack bank accounts or those yet to enrol," a senior executive of Indian Oil Corp (IOC), the country's largest fuel retailer, told Business Standard.

The official added at least 40 million of the original 180 million connections would cease to exist even if enrolments were to rise marginally. "The government's savings could easily be about Rs 10,000 crore linked to these 40 million connections."

The fuel subsidy bill and wastage each year is huge, as the graph shows: $10-15 billion bill, with significant scope to waste and corruption.

States inching towards GST, says Mani

Monsoon plan B:A day after pressing for modifications in the Constitution Amendment Bill on goods and services tax (GST), the Empowered Committee of Finance Ministers on Friday seemed to be striking a conciliatory note with the Centre on the roll out of the new indirect tax system.

"It is a stupendous achievement that all the states with so much diversity,...diverse political governance, have come under the umbrella of the Empowered Committee and inching towards creating a single common market in the country," said the chairman of the Committee, K M Mani, who is also the finance minister of Kerala.

GST is scheduled to be rolled out from April 1, 2016.

Subsidised seeds, power for farmers if rains fail

The south-west monsoon arrived over Kerala on Friday, five days late, even as the agriculture ministry prepared plans to subsidise seeds, power and diesel for farmers if rainfall were deficient.

Agriculture Minister Radha Mohan Singh met officials to review the India Meteorological Department (IMD)'s monsoon forecast for June.

Officials said the Centre might offer a subsidy of Rs 10 a litre on diesel this year and pay for half the cost of seeds under various schemes. The Union government might also share the states' burden of free power for irrigation.

Punjab has already decided to provide cheap power for at least eight hours to farmers for 90 days, for sowing paddy. For this, the state has set aside Rs 2,000 crore.

Officials said around the first week of July, the agriculture department based on a review of actual rainfall will request the Cabinet Committee on Economic Affairs (CCEA) to approve measures such as a diesel subsidy scheme, a rise in ceiling on seed subsidy under various schemes, additional fodder production programme and special intervention for saving horticulture crops.

The Centre had supplied nine million tonnes (mt) of fertilisers to states by May, against a requirement of six mt, to ward off shortage if demand increased.

"National Seed Corporation (NSC) said adequate quantities of drought-resistant, short-duration varieties of seed had been procured along with fodder seeds," Singh said.

An agriculture ministry official said the Centre was advising farmers in the northern states to plant more maize instead of paddy.

Re: Indian Economy - News & Discussion Oct 12 2013

the tatas' seem to have pulled out of their big sikorsky project and the same has apparently been taken over by the mahindras' . The plant had been imported from japan and set up in HYD India.

A lot of suppliers have had their confirmed contracts abruptly and unilaterally terminated, issued raw materials have also been taken back.

no body wants to comment. Wonderful management style.

A lot of suppliers have had their confirmed contracts abruptly and unilaterally terminated, issued raw materials have also been taken back.

no body wants to comment. Wonderful management style.

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Indian Economy - News & Discussion Oct 12 2013

Apologies if posted/discussed already!

SSridhar wrote:China holds key to India’s energy future - Phillip M Hannam, Business LineIndia is the focus of much international attention leading up to the UN’s climate negotiations in Paris later this year. India expects to follow a carbon-intensive industrialisation path as in the case of almost every major economy, most recently China.

However, China — which consumes roughly half of global coal — is going to great lengths to cap its domestic coal consumption, aided by new policies and the dampening of economic growth rates. Following several years where nearly 1.5 GW of coal power was installed in China weekly, Chinese domestic coal consumption declined in 2014. The rate of coal power capacity addition has slowed too, though China is still expected to install 42 GW of new coal capacity this year alone. nearly half of previous capacity addition.

Just because momentum is shifting away from coal in China does not mean that the country is no longer part of the global coal boom. A glut in coal power equipment among Chinese manufacturers has led to China becoming a leading exporter — buoyed by state-affiliated banks and export-credits — with important implications for India’s power sector portfolio.

Economies of scale

India has become a new market for China’s massive coal power manufacturing base. China’s off-the-shelf equipment exports are cheaper and quicker to market than equipment made by India’s domestic producers — most notably L&T and state-owned BHEL.

Export competitors in the OECD are bound by restrictive export-credit rules, which China does not observe. China’s three largest thermal power equipment manufacturers, Shanghai Electric, Dongfang Electric and Harbin Electric began finding business abroad after China’s domestic market slowed.

Over 60 per cent of India’s coal power equipment ordered by private developers in the past decade has come from Chinese vendors, commonly with the financial backing of Chinese state banks, amounting to over 100 GW of coal power installed or in the pipeline involving Chinese firms. Even if we assume 50% of coal power equipment to come from China then we are looking at Chinese equipment for about 50GW (The excess capacity of Chinese coal capital equipment is coming to India?

Reliance Power signed a $5 billion MoU in 2011 with a consortium of Chinese state banks intending to build over 16 GW of coal power in India. This led to a rush for Chinese financing among other power developers seeking low-cost financing packages for large coal schemes, including Lanco Infratech, Adani and Jindal.

At this rate 50GW equipment may lead to ~$15-20B Chinese credit to India.

How much coal?

According to a report by the Prayas Energy Group in India, as of August 2011, 513 GW of proposed coal power capacity was under various stages of review and approval by the Ministry of Environment and Forests. Few projects have historically been rejected during this approval process, but the proposed quantity of coal power — five to six times India’s current installed capacity — far exceeds capacity additions called for in India’s power planning process.

The officially planned capacity addition in India’s 12th Five Year Plan (2012-17) is 60 per cent coal (69.8 GW out of 118.5 GW). The coal additions for the 13th Five Year Plan (2018-22) are expected to be similar.

The scale of India’s coal boom — relying just on official numbers and ignoring the 513 GW pipeline — at least keeps pace with highly ambitious plans for renewable power. The Jawaharlal Nehru Solar Mission has a target of 100 GW of solar, in addition to 60 GW of wind, planned by 2022.

Whether India’s coal future becomes a reality is an open question. The government has been sensitive to competition with domestic suppliers, but any resistance toward the Chinese success in India’s coal power market is half-hearted. Domestic manufacturers pushed vigorously and successfully for a 21 per cent tariff on Chinese coal power equipment, put in place in 2012, making Chinese imports less attractive, particularly on top of rupee depreciation.

The National Thermal Power Corporation (NTPC) and many state generation companies refuse to source equipment from China on the grounds of equipment quality, though allegiance to domestic manufacturers is likely to be a motivating factor.

But the government sees the Chinese competition with domestic manufacturers as driving generation costs down. Prime Minister Modi was just in China pushing for the acceleration of industrial parks discussed in MoUs from September 2014, which would include power equipment service centres to support China coal power equipment operating in India. However, the influx of Chinese equipment is certainly not the only variable cutting against domestic equipment manufacturers’ recent struggles. The coal block re-auctioning, weaker than expected electricity demand, coal price fluctuations for imports, and poor initial structuring of project risk have all contributed to the stalling of the coal power sector.

From a longer-term perspective, the effects of Chinese subsidised coal power equipment imports may have two countervailing effects on power sector planning. On the one hand, Chinese subsidisation of coal power makes a coal-based development model less expensive and enhances the efficiency of the domestic sector through competition.

Assuming projects in the pipeline eventually move forward, private developers purchasing inexpensive Chinese coal power equipment will feel wedded to their cost advantage, and continue investing their human and financial capital in coal development rather than alternative power sources.

On the other hand, as Indian power sector manufacturers, which are politically powerful, become less competitive against Chinese firms, their political pressure to uphold a coal-based development model decreases.

BHEL and other companies remain heavily invested in thermal power, but they are also diversified enough to benefit from growth in other sectors. Firms with diversified portfolios and capabilities will support government plans to expand solar and wind, even at the expense of the long-term market opening for coal.

The renewable angle

The delay in coal construction seems to bode well for renewable power thus far. The 22 GW Solar Mission was already seen as ambitious when it was announced in 2010, but increased to 100 GW in November 2014 (above an installed solar base of 3 GW).

An unprecedented pace of development would be required, along with $140-160 billion in funding, according to one estimate. The government’s growing confidence in the potential for solar and wind may be reflective of the challenges faced by coal.

If the coal power sector overcomes the current procedural and judicial barriers, growth could proceed quickly, aided by inexpensive imports from China. China and India’s coal power sectors are intertwined. How it plays out will have important climate impactions.

The writer is a PhD candidate at Princeton University, where he studies China’s role in global energy governance.This article is by special arrangement with the Center for the Advanced Study of India, University of Pennsylvania

Re: Indian Economy - News & Discussion Oct 12 2013

Exports may remain flat at $310 bn in FY16: Assocham

http://economictimes.indiatimes.com/art ... aign=cppst

http://economictimes.indiatimes.com/art ... aign=cppst

NEW DELHI: India's exports are likely to remain flat at USD 310.5 billion-level

or may even fall this financial year due to slow global demand for merchandise, Assocham has said. "Overall the trade confidence is quite muted," Assocham Secretary General D S Rawat said, impressing upon government to move fast on improving ease of doing business and reducing transaction costs for

Indian shipments. The country's exports stood at USD 310.5 billion against a target of USD 340

billion for 2014-15 fiscal. While there has been a weak trend since July 2014, exports have been witnessing contractions since January this year right through April, the industry body said. In fact, generally the last quarter of the fiscal turns out to be much better to make up for the previous quarters. However, it has been a different situation in the last quarter of fiscal 2014-15 .Engineering products, gems and jewellery and petroleum products are the biggest contributors to the overall export basket in terms of value. In the previous fiscal, while engineering goods registered a modest increase, the other two segments witnessed a sharp drop. "The trend is likely to continue at least for gems and jewellery, while the situation may somewhat stabilise for the petroleum segment since after seeing a sharp fall, the crude oil prices have stopped seeing much of drop. Petroleum exports are related to the prices of crude oil," Assocham said.

Re: Indian Economy - News & Discussion Oct 12 2013

Modi government revives 42 stalled projects worth Rs 1.15 lakh crore

Project details in the article.

Project details in the article.

Re: Indian Economy - News & Discussion Oct 12 2013

tatas & reliance are masters at quietly dealing with the media...

Re: Indian Economy - News & Discussion Oct 12 2013

Rules for hiring contract workers to be eased

PM Modi seeks quick boost to irrigation as drought looms

Icra sees NPAs soaring by up to 150 bps to 5.9% this fiscal

FinMin schemes: Infrastructure push planned through NIIF, tax free bonds

SAIL targets 50MT annual output in 10 years, to invest Rs.1.5 lakh croreThe National Democratic Alliance (NDA) government at the Centre has proposed to give industries some flexibility in hiring contract workers for project-based jobs or short-term assignments, a move cheered by industry but slammed by trade unions as an entry of 'hire and fire' through the back door.

The proposal, originally mooted by the previous NDA government in 2003, was subsequently scrapped by the United Progressive Alliance (UPA) government in 2007, following pressure from central trade unions. However, the proposal was now back on the table, amid strong demand from industry players, said a labour ministry official.

The Union government has issued draft rules for inviting public comments on amending the Industrial Employment (Standing Orders) Act. Even as five days are left for receiving public feedback (proposals were mooted on April 29 for inviting comments within 45 days), central trade unions seem to lack clarity on the proposals.

According to the draft rules, factories can hire 'fixed-term' workers for a specific time. The benefits they will get and their terms - working hours, wages, allowances, etc - will be the same as those provided to permanent employees. The employer will not have to give the worker any notice period at the end of his job tenure, or when the project is completed.

The move will allow companies to hire workers for short assignments and terminate their services once the project is completed. "Fixed-term employment is needed to execute time-bound projects and short-term contracts where manpower employed could be dispensed with on completion of the project… The category of 'fixed-term employment' may be reintroduced," industry body Ficci had said in its proposal, soon after the NDA government took office in May last year.

While industry is cheering the proposal, the central trade unions are slamming the government for keeping them in the dark.

Companies, particularly those in construction and mining activities, usually refrain from hiring permanent workers for project-based requirements, as termination requires process of retrenchment under the provisions of the Industrial Disputes Act. This includes giving a notice, payment of compensation, intimation to the government, etc.

The employers will not be mandated to give a notice to a fixed-term worker on non-renewal or expiry of his or her contract. At present, there is no clarity in the Industrial Employment Act on whether there is a need to give a notice when the contract of a temporary worker expires or the employer chooses not to renew the contract.

Current annual steel output by all manufacturers is 88MT.The Union government is aiming at scaling the steel output at SAIL (Steel Authority of India Limited) to 50 million tonnes by 2025. Expansion plans of other government-owned entities are on the anvil.

"At present, the PSU has a production of 13 million tonnes which would be augmented further to 23 million tonnes by September this year. We are targetting it to take up to 50 million tonnes, with an investment of Rs 150,000 crore," Narendra Singh Tomar, Union minister for mining and steel said here today. "In order to achieve a target of producing 300 million tonnes of steel by 2025, a concept of special purpose vehicle has been proposed with state governments of Chhattisgharh, Odisha, Jharkhand and Karnataka."

Further expansion of Bhilai Steel Plant with an investment of Rs 15,000 crore approximately is on the anvil, Tomar said, adding that the expansion of SAIL's IISCO steel plant at Burnpur is also ready to be dedicated to the nation. "We have urged Prime Minister Narendra Modi to dedicate it to the nation," Tomar said.

He added that his government wanted to expedite exploration work of minerals across India, as only 800,000 sq meter of area has come under exploration, of which only one per cent is under mining. However, he pointed out that the total area was nearly 3.2 million sq km.

Tomar also said SAIL can put up a steel plant of one-million-tonne capacity in economically backward districts of Bundelkhand region like Tikamgarh and Chhatrarpur. "It can also set up a pelletisation plant if availability of ore remains 40 million tonnes," he said.

PM Modi seeks quick boost to irrigation as drought looms

PM Narendra Modi chairs high-level meeting on irrigationIndia must quickly expand its irrigation network and improve water usage to offset the impact of less monsoon rainfall than usual, Prime Minister Narendra Modi said on Monday, as the country braces for its first drought in six years.

More than half of India's farms lack irrigation and millions of farmers still depend on the vagaries of the monsoon rains that run from June to September, and hit the southern coast last week, five days later than expected.

This year, the rains are forecast to be 88% of the long-term average, which could drastically crimp farm output.

Modi asked officials to ensure quick results for farmers by reviewing administrative mechanisms, financial arrangements and technology use in irrigation, his office said in a statement.

Icra sees NPAs soaring by up to 150 bps to 5.9% this fiscal

Better to write off and clean the books rather than carry zombie loans that hamper everyone else.Domestic rating agency Icra today said gross NPAs in the system may jump up to 5.9 per cent this fiscal from 4.4 per cent despite economic growth because of lagged recognition of bad assets which is resulting in slippage of more restructured accounts into dud loans.

“Reported gross NPAs will increase in FY16 with withdrawal of regulatory forbearance for restructured advances from FY16 to 5.3-5.9 per cent by March 2016 as against 4.4 per cent as in March 2015,” the agency said in a note.

The rising NPA estimate for FY16 is primarily driven by a greater proportion of assets restructured in the past slipping into NPAs again, Icra’s senior vice-president Vibha Batra told reporters in a conference call.

“What we are experiencing is a lag in recognition of asset quality stress. Around 25-30 per cent of restructured assets have already slipped into NPAs, now we are increasing our estimate of such slippage to 35-40 per cent from the earlier 30-35 per cent,” she said.

The system of asset recasts has been discontinued by RBI, starting April 1, but banks continue to carry loans restructured in the past.

FinMin schemes: Infrastructure push planned through NIIF, tax free bonds

In a big push to core sector projects that are yet to register a revival in investments, the finance ministry is finalising the contours of the proposed National Investment Infrastructure Fund.

Additionally, the ministry could also allow public sector firms to float tax free bonds of Rs 30,000 crore to Rs 40,000 crore for infrastructure financing.

The two initiatives are expected to help boost investments in the lagging infrastructure sector, that will also get public investments worth Rs 70,000 crore this fiscal through the government.

Announced as part of the Union Budget 2015-16, the NIIF will have an allocation of Rs 20,000 crore, half of which is expected to come from blue chip public sector units.

The finance ministry is understood to have discussed the plan with cash rich PSUs, which would chip in with about Rs 10,000 crore for the fund from their dividend income. Sources said that the balance would come from budgetary allocation by the government.

Re: Indian Economy - News & Discussion Oct 12 2013

At least two IT "Majors" are actively working on such a scheme. As per one of those companies a project generally does not go beyond 8-9 months. So they are thinking about getting people for those fixed tenure, and extend them if they have projects in the pipe line of similar nature. Or else they would be terminated. What happens to some statutory contributions like Gratuity, PF etc. may have to be better clarified.Suraj wrote:The move will allow companies to hire workers for short assignments and terminate their services once the project is completed. "Fixed-term employment is needed to execute time-bound projects and short-term contracts where manpower employed could be dispensed with on completion of the project… The category of 'fixed-term employment' may be reintroduced," industry body Ficci had said in its proposal, soon after the NDA government took office in May last year.

But the NDA's new proposed law also has some provisions regarding extending notice period from 15 days to 45 days, and also giving permanent employment after being on contract for a year. I mean, yearly contract renewal cannot be tried out. The "hire & fire" provisions etc. can be thought of provided that the nation has a strong social security network (perhaps like in some European countries).

And looks like there are lots of confusion regarding all this. Some 4-5 labour related Acts are to be voided and a new all encompassing law is supposed to be brought out. Does any one have a link to the law's draft? Lots of conflicting plans seems to be there at the moment.

Re: Indian Economy - News & Discussion Oct 12 2013

what are the unemployment benefits in rich socialist countries like france and germany with high taxes on the rich?

Re: Indian Economy - News & Discussion Oct 12 2013

IT industry is not known for unionised labour. The contract nature of business is quite standard there. No, this reform is directed at a much larger section of industry, where the lack of hiring flexibility impacts a huge amount of business. For example, roadbuilding or construction, which entails utilizing a lot of manual labour. It could be done faster by hiring more skilled labourers operating machinery, but the nature of work is very cyclical, so fulltime hiring is not meaningful. The inability to here skilled laborers on contract means they have to resort to unskilled labor on a casual basis. That impacts productivity and timelines.

Worrying about social security is a somewhat misplaced concern today. The communists have sensitised us to that argument, but it is primarily a self serving one. We've far more direct issues to address in terms of labour flexibility to get the enormous amount of - literal - nation building done. Further, these laws are not being enacted out of the blue. Following the laboratory approach, they are laws that were trialed in Gujarat, MP and Rajasthan. Laws like these are best implemented on a small scale and their real world operation understood and finetuned, before being expanded.

Worrying about social security is a somewhat misplaced concern today. The communists have sensitised us to that argument, but it is primarily a self serving one. We've far more direct issues to address in terms of labour flexibility to get the enormous amount of - literal - nation building done. Further, these laws are not being enacted out of the blue. Following the laboratory approach, they are laws that were trialed in Gujarat, MP and Rajasthan. Laws like these are best implemented on a small scale and their real world operation understood and finetuned, before being expanded.

Re: Indian Economy - News & Discussion Oct 12 2013

Depends on type of employment contract : temporary or permanent . total number of working years , full time or part time work .In beginning one gets 75% of his last pay check for first 3-6 months as unemployment benefits later its 70% . Example : If one earned 3000 euros as his last pay check then he gets 2250 euros per month for first 3-6 months later it becomes 2100 euros per month . How long this 70% unemployment benefit continue depends on number of working years . 1 month per year is counted at worst so for example you have worked 14 years then you have right for unemployment benefits for minimum 14 months .Singha wrote:what are the unemployment benefits in rich socialist countries like france and germany with high taxes on the rich?

If during this unemployment period one fails to find job , he goes on social benefits which is usually minimum income around 1000-1400 euros depend on one's personal situation ie number of kids , married and so on .

Re: Indian Economy - News & Discussion Oct 12 2013

Modi to launch India's biggest labour overhaul in decades

Unions cry foul at govt's flexible hiring ideaPrime Minister Narendra Modi is preparing to launch India's biggest overhaul of labour laws since independence in a bid to create millions of manufacturing jobs, at the risk of stirring up a political backlash that could block other critical reforms.

Three officials at the central labour ministry told Reuters that the ministry was drafting a bill for the upcoming parliamentary session that proposes to loosen strict hire-and-fire rules and make it tougher for workers to form unions.

The changes, if approved by parliament, would be the biggest economic reform since India opened its economy in 1991, but it is likely to meet stiff opposition in parliament and from labour activists.

The prime minister enjoys a majority in the Lok Sabha, but not the Rajya Sabha, hobbling his ability to pass politically contentious measures.

ADVERTISING

That handicap has stymied his efforts to make it easier for businesses to buy farmland and convert Asia's third-largest economy into a common market.

Since taking office in May last year, Modi has taken a series of incremental steps to make labour laws less onerous for businesses, but fear of a union-led political backlash made him leave the responsibility for unshackling the labour market with Indian states.

He let his party's governments in Rajasthan and Madhya Pradesh take the lead in this area.

Encouraged by a successful and peaceful implementation of the measures in those states, the federal labour ministry now intends to replicate them at the national level, one of the ministry officials said.

Manish Sabharwal, one of the brains behind Rajasthan's labour reforms and co-founder of recruitment firm Teamlease, said the federal administration would have been better off without attempting these changes.

"Let states carry out these changes and save your political energy for other policy reforms," he said.

EASIER FIRING

As part of the proposed revamp, a factory employing fewer than 300 workers would be allowed to lay off workers without government permission. Currently, factories employing 100 workers or more need approval for layoffs.

But they will have to pay three times the current severance package, the labour ministry officials said.

Companies have long been demanding an increase in the ceiling as governments rarely grant such permissions for layoffs, making it difficult to respond to business downturns and encouraging them to stay small.

"It will facilitate ease of doing business while ensuring safety, health and social security of every worker," a senior labour ministry official involved in the deliberations said.

The official said the bill was expected to be finalised in the next three or four weeks, and would then be sent to cabinet for approval.

The planned changes would also make it tougher for employees to form unions or go on strike, but would make all employees eligible for minimum wage.

GST will lower logistics costs by 20% says CRISILThis rule was originally mooted by the previous National Democratic Alliance (NDA) government in 2003, which had held consultations with the central trade unions and industry representatives before coming up with the proposal. However, following widespread protests from the trade unions, the United Progressive Alliance (UPA) government had repealed the rule in 2007 through a gazette notification.

CRISIL Research sees rollout of goods & services tax (GST) to reduce logistics costs of companies producing non-bulk goods by as much as 20%.

The savings will accrue from a gradual phasing out of Central Sales Tax (CST), consolidation of warehouse space, and faster transit of goods since local taxes (such as octroi and local body tax) will be subsumed into GST. However, to maximise benefits from the rollout of GST, a complete phasing out of CST (currently paid for inter-state movement of goods) and dismantling of state-level check-posts are imperatives.

To get states on its side, the government has proposed allowing states to levy an additional tax of one% on supply of goods in lieu of CST for two years. "We believe this is against the core principle of GST, and will defer full benefits of the rollout. This will also delay the dismantling of check-posts so critical to ensure faster transit of goods," said CRISIL.

Re: Indian Economy - News & Discussion Oct 12 2013

I did find the draft for the one of the Labour reforms law. Check for a link, way below the page to see the actual draft.

Draft Labour Code on Wages - Suggestions are invited by the Ministry

This new law is to replace The Minimum Wages Act, 1948, (ii).The Payment of Wages Act, 1936,(iii).The Payment of Bonus Act, 1965,(iv).The Equal Remuneration Act, 1976. I had a glance of the draft, it does not talk about any hire & fire stuff. It is more on the salary & wages act. One thing I noticed is that Minimum Wages would be there, and there is a body to even review it periodically. The state gets the right to set the minimum wages as well. In Kerala a rumour is being made by the commies to say that minimum wages would not be there any more.

Draft Labour Code on Wages - Suggestions are invited by the Ministry

This new law is to replace The Minimum Wages Act, 1948, (ii).The Payment of Wages Act, 1936,(iii).The Payment of Bonus Act, 1965,(iv).The Equal Remuneration Act, 1976. I had a glance of the draft, it does not talk about any hire & fire stuff. It is more on the salary & wages act. One thing I noticed is that Minimum Wages would be there, and there is a body to even review it periodically. The state gets the right to set the minimum wages as well. In Kerala a rumour is being made by the commies to say that minimum wages would not be there any more.

I do agree with your point here. But the catch is that the concerns would remain in every body's mind, unless every body finds it easy to switch jobs. And for that there should be jobs aplenty. Many of the concerns from an average middle class employee would be that he may not find alternate employment easily. And with no large scale social security offered, it adds to the worries. But if people get jobs dime a dozen, nobody really would be bothered about unions etc.Suraj wrote:Worrying about social security is a somewhat misplaced concern today. The communists have sensitised us to that argument, but it is primarily a self serving one. We've far more direct issues to address in terms of labour flexibility to get the enormous amount of - literal - nation building done.

Re: Indian Economy - News & Discussion Oct 12 2013

The changes to labour law are not happening in isolation. It's an effort to generate dynamism in the formal economic sector, with the availability of jobs itself being one of the principal direct aims. Like I said, there's no point in worrying about social security and job security here. Job security should never be legislated by law. That's a function of the dynamism of the sector of economy alone. Many of us are in IT. It has none of these laws getting in the way, and no one's in a panic to gain union representation for job security. There's no reason to assume any other sector would not benefit from a similarly dynamic economic situation. If a particular industry sees cyclical job gains and losses due to the very nature of the business, then so be it. The government should not tinker with that, nor let the unions do so.

Re: Indian Economy - News & Discussion Oct 12 2013

Indirect tax collections are rising, indicating manufacturing is reviving:

Indirect tax collection up 39%; excise reflects manufacturing uptick

Indirect tax collection up 39%; excise reflects manufacturing uptick

March quarter CAD falls to 0.2% of GDPIndirect tax collection has jumped 39.2 per cent in April-May, with excise showing a smart rise reflecting pick up in manufacturing, Finance Minister Arun Jaitley said today.

The collection of indirect taxes in all three categories - customs, central excise and service tax - has shown rising trend in the current financial year, 2015-16, he said.

"This is a very healthy growth in indirect taxes and since it is spread over all sectors it initially indicates a pick up in manufacturing particularly the excise collections have moved up," he added.

The increase in excise collection was reflective of pick up in manufacturing sector, Jaitley said.

India’s current account deficit (CAD) declined sharply to $1.3 billion (0.2 per cent of gross domestic product) in the quarter ended March from $8.3 billion (1.6 per cent of GDP) in the quarter ended December.

The decline was due to a fall in gold imports and low average price of crude oil imports.

CAD for the quarter ended March of FY14 was $1.2 billion (0.2 per cent of GDP).

The Reserve Bank of India said the reduction in CAD in Q4 2014-15 was primarily due to lower trade deficit. The net earnings through services and primary income (profit, dividend & interest) witnessed a decline in a quarter-on-quarter basis.

Re: Indian Economy - News & Discussion Oct 12 2013

A significant portion of this is also due rising levies on oil last year.Suraj wrote:Indirect tax collections are rising, indicating manufacturing is reviving:

Indirect tax collection up 39%; excise reflects manufacturing uptickIndirect tax collection has jumped 39.2 per cent in April-May, with excise showing a smart rise reflecting pick up in manufacturing, Finance Minister Arun Jaitley said today.

Re: Indian Economy - News & Discussion Oct 12 2013

^^ that was exactly the right thing to do at the right time. From a situation where fiscal deficit was high, the macroeconomic situation was stagflationary, with moderate growth and high inflation (~13% nominal growth but only ~5% real growth), real interest rates were almost neutral to negative, high corporate indebtedness, we now have falling fiscal deficit under 4% (partly with all the indirect tax and non-tax revenue gains), essentially zero GDP deflator (Jan-March 2015 quarter was 7.5% real growth, 7.7% nominal growth), positive and falling real interest rates, and a concerted effort by government to kickstart spending across roads, rail and elsewhere. The monsoon and weak global conditions are wild cards, but as things stand, the economy is poised to grow strongly because the underlying investment is picking up. GDP growth is simply the return from that investment.

-

member_29058

- BRFite

- Posts: 735

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

http://www.firstpost.com/business/modi- ... 88404.html

Modi is fixing UPA's broken economy; the stagflation cycle is about to end

Modi is fixing UPA's broken economy; the stagflation cycle is about to end

While GDP at constant prices clocked in at 7.5 percent, GDP at current prices came in at 7.7 percent in the January-March quarter (Q4) of 2014-15. What this means is that there was nearly zero inflation during this quarter, for real GDP figures are calculated by deflating it with the estimated inflation rate. The GDP deflator, which is closer to the wholesale prices index (WPI) than retail prices, was clearly close to nil. WPI was negative all through January-March, and may continue to remain so in the coming months.

This achievement contrasts sharply with the April-June quarter of 2014 (the handover month from UPA to NDA), when the gap between real and nominal GDP was as high as 6.7 percent (6.7 percent real growth versus 13.4 percent nominal). Put another way, half the growth was pure inflation. The gap started narrowing every quarter after the NDA took charge, falling to 5.2 percent in Q2, 1.5 percent in Q3 and finally to a minuscule 0.2 percent in Q4.

The closing of the gap between real and nominal growth rates tells us two stories – a positive one about the NDA’s big success in killing inflation despite a weak monsoon year in 2014; and a less positive one on industry’s inability to raise prices – which is good for consumers, but bad for profitability and investment.

The NDA’s biggest economic triumph has clearly been on prices, but economists tend to attribute this purely to luck – lower oil prices. But this is only half the story. The other half of the story is bad luck with the monsoon. In short, good and bad luck cancelled each other out. The NDA’s triumph is that it managed to keep food prices low in a bad monsoon year, when rainfall was down to 88 percent of the long-period average (LPA). The government managed the food economy well by releasing stocks intelligently and by keeping minimum support prices moderate. Rahul Gandhi is now using this to criticise the government as anti-farmer, but without this policy shift, inflation could have roared back in 2014-15.

If the NDA continues its good work on efficient management of food prices this year, when too the Indian Met has forecast below normal rains at the exact level of last year (88 percent of the LPA), it will have negotiated two bad years in a row. Its achievements on inflation are noteworthy.

The NDA’s challenge is thus less on the price front and more on the growth revival front. While corporate investment has started reviving slowly, in order to accelerate, margins have to start rising. Can NDA achieve this turnaround where corporate profits rise by enough to reignite the investment cycle, and yet not lose track of price stability?

According to a report in Business Standard today (10 May), this may just be possible. The dramatic fall in input prices in 2014-15 is beginning to help, and 2015-16 should see a revival in profits – thanks, once again, to falling costs due to low inflation.

Quoting a CLSA strategist, the newspaper says: “Going forward, the benefits of falling raw material costs are expected to continue, and the potential improvement in revenue growth will likely drive operating margins. Further, the expected fall in interest costs should boost net profit margins, and return on equity (RoE) should go up.”

This bottoming out of corporate profitability will probably start reflecting in stock prices shortly, according to Morgan Stanley experts. The Economic Times quotes Ridham Desai, Managing Director and Head of Equity Research (India) at Morgan Stanley, as saying: "The bull market is likely to continue. Equities are in a sweet spot with a likely sharp decline in interest rates, and likely improvement in growth backed by rising government expenditure."

If the market revives after its ongoing phase of correction, it could mean two things: government will be able to collect more revenues from disinvestment, and companies themselves will be able to access the markets to bring down debts and start investing. Banks too will see an improvement in the trend towards more bad loans.

Good fortune and fairly effective price management, aided by prudent monetary policies have brought India back to the point where the virtuous cycle of low-inflation, higher profitability, higher tax revenues, and higher investment may be about to begin – perhaps by the second half of 2015-16.

"The root cause of the stagflation environment had been the sharp deterioration in the productivity dynamic that resulted from the policy mistake of focusing intensely on redistribution to households, alongside a major slowdown in productive investment trend. Specifically, four policy outcomes — a sustained rise in the fiscal deficit, high rural wages growth, negative real rate environment and corruption scandals resulting in the stalling of the investment approval process, causing declines in investment — had all combined to create the toxic mix of high inflation and low growth."

Rahul Gandhi believes that the NDA government must do precisely what brought the economy to its knees, but luckily he is not in power to implement these foolhardy policies. Modi is fixing what his government broke.

In one year of NDA, all the four indicators of decline are being reversed. The fiscal deficit is coming down; the quality of the fiscal deficit is also set to improve as more money goes to investment and less to subsidies; rural wage growth has hit a 10-year low earlier this year; the drop in inflation has made real interest rates positive once again (both as measured by CPI or WPI); project approval bottlenecks have been cleared; and corruption scandals at the top are down.

If Ahya is right, India is on the cusp of a major economic revival under Narendra Modi. The UPA, it would appear, simply blew its chances by wasting the resources generated by growth in excessive subsidy-mongering. You can’t buy growth by redirecting productive resources towards consumption. That is the real lesson the NDA has to learn from the UPA economic-miracle-to-economic-debacle cycle over 10 years.

Re: Indian Economy - News & Discussion Oct 12 2013

Focus is on clearing stuck infrastructure projects: Finance Minister

Finance Minister Arun Jaitley on Friday said that the government's focus is on to clear stalled infrastructure projects.

Over the coming weeks the ministry plans to hold meetings with various stakeholders, including banks and infrastructure companies to identify projects that are stuck due to financing issues.

Jaitley was speaking after a meeting with state-owned banks and financial institutions.

In the quarterly review meeting, the Finance Minister took stock of the Non Performing Assets (NPA) issue, and has sought an explanation on stress from banks that have high level of NPAs. Meanwhile, the government is preparing a roadmap to reduce stress on balance sheets of banks on the account of NPAs.

While addressing the media, the minister also said that the government is paying heed to the demand of public sector banks (PSBs) for capital infusion. State-owned banks have been raising concerns over the Rs 7,000 crore budgeted capital infusion stating that it is inadequate to meet their capital requirement.

“Government will look at the issue of recapitalisation of banks,” he said.

The statement is significant in light of Reserve Bank of India Governor Raghuram Rajan’s recent statement in the policy statement calling for capital infusion.

Re: Indian Economy - News & Discussion Oct 12 2013

^^^^^^^

Any PSU bank chairman who has squandered away loans and willfully created NPAs in the true congi style must be jailed.

Show these corrupted creeps no mercy.

Any PSU bank chairman who has squandered away loans and willfully created NPAs in the true congi style must be jailed.

Show these corrupted creeps no mercy.

Re: Indian Economy - News & Discussion Oct 12 2013

Bankers are too politically connected because of dirty dealings and know too much.

Congi's won't go to jail either.

Reform is the only thing that is doable.

Congi's won't go to jail either.

Reform is the only thing that is doable.

Re: Indian Economy - News & Discussion Oct 12 2013

I have pretty fundamental question: how is the bank loan different from a bond that companies issue ? And why shouldn't we force companies that need debt to issue bonds ?

If a company seeking loan issues a bond, then the market will discover the appropriate price, rt ? And it can be traded on the stock exchange. Any bank or MF or even retail investor can participate.

If a company seeking loan issues a bond, then the market will discover the appropriate price, rt ? And it can be traded on the stock exchange. Any bank or MF or even retail investor can participate.

Re: Indian Economy - News & Discussion Oct 12 2013

Companies decide whether to use bonds or a bank loan (or even issue new stock and dilute the equity of the existing holders) to fund their needs. The general rule of thumb is short term needs are covered by loans and long term requirements by bonds. However this is not written in stone. Both have different financial, legal and regulatory issues, which a company CFO has to deal with. What purpose does 'forcing' companies to do one over the other, serve ? The companies themselves should be left to decide, and the government should just enable both banks and the bond market to run as efficiently as they can.

Re: Indian Economy - News & Discussion Oct 12 2013

April IIP data was a shocker in the positive direction. On Friday morning, Reuters had an article predicting soft data, with a suitable trolling headline too:

IIP/inflation data likely to add to doubts about economic growth

They estimated 1.6% IIP growth and 5% inflation.

But the official data killed those estimates, with IIP growth at almost triple that estimate:

April IIP at 4.1%; May CPI inflation at 5.01%, Capital goods output surges 11.1%

IIP/inflation data likely to add to doubts about economic growth

They estimated 1.6% IIP growth and 5% inflation.

But the official data killed those estimates, with IIP growth at almost triple that estimate:

April IIP at 4.1%; May CPI inflation at 5.01%, Capital goods output surges 11.1%

A slight uptick in food price inflation in April is a normal phenomenon because it doesn't reflect the rabi crop harvest fully.The consumer price inflation edged up to 5.01% in May, while annual industrial output growth accelerated to a two-month high of 4.1% in April, according to the data released today by the Ministry of Statistics and Programme Implementation.

The manufacturing sector output came in at 5.1% verus 2.2% on a month on month comparison. The capital goods output which has shown signs of betterment in the recent times came in at 11.1% versus 7.6% compared monthly.

In the broad categories, apart from manufacturing, mining registered a minor growth of 0.6% while electricity generation contracted 0.5% compared to 11.9% growth in the same month last year.

The consumer price index-based inflation rose to a three-month high of 5.01%in May versus 4.87% in April. However, retail food inflation eased a little bit to 4.80% from 5.11% in April. In a year ago period, it had stood at 8.89%.

The food inflation was higher in the urban areas at 4.84% against 4.74% in the rural parts, the situation was quite opposite in case of the combined inflation. Overall inflation stood at 5.52% in villages and 4.41% in the urban areas.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Indian Economy - News & Discussion Oct 12 2013

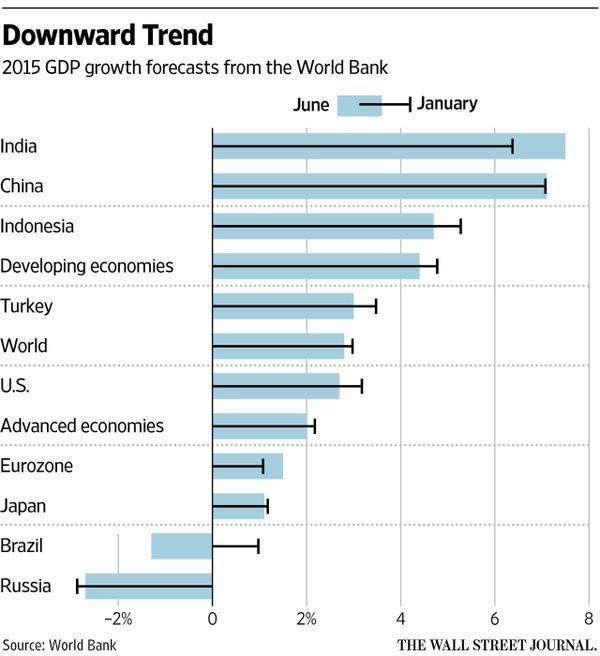

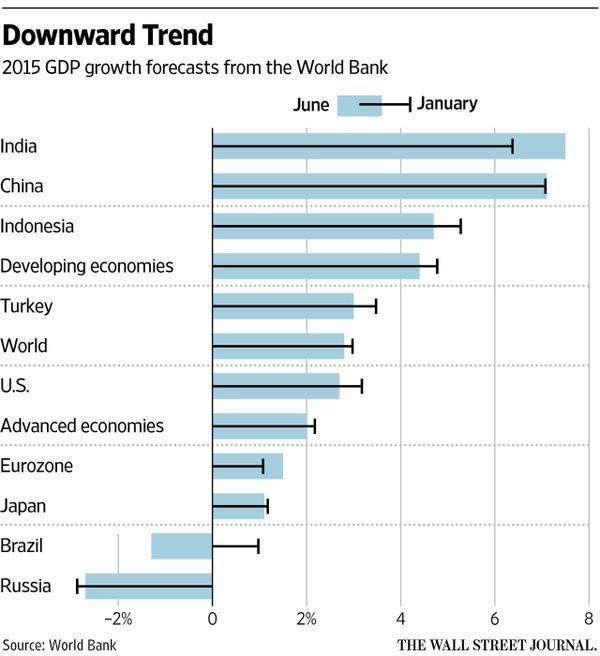

IMF updates growth forecasts (compared to its Jan 2015 forecasts)

Re: Indian Economy - News & Discussion Oct 12 2013

srin jisrin wrote:I have pretty fundamental question: how is the bank loan different from a bond that companies issue ? And why shouldn't we force companies that need debt to issue bonds ?

If a company seeking loan issues a bond, then the market will discover the appropriate price, rt ? And it can be traded on the stock exchange. Any bank or MF or even retail investor can participate.

BONDS

in Companies Act,2013, section 2(30), debentures are defined thus- ” debenture” includes debenture stock, bonds and any other securities of a company evidencing the debt, whether constituting a charge on the assets of the company or not.

and

The section pertaining to the issue of debentures is section 71 (read with Rule 18 of Companies Share Capital and Debentures Rules,2014).

if a company issued debentures then it also needs to create a debenture redemption reserve and there are limits to the sum that can be raised.

all companies are not eligible to issue debentures and vast sectors of the economy are not companies, but firms, HUF, individuals.

Debentures can be convertible into shares. But if not they will be much like a deposit and not very tradeable like stock shares.

Loans are advanced by Banks who secure the risk in manners they deem fit.

Last edited by wig on 13 Jun 2015 18:05, edited 1 time in total.

-

member_29058

- BRFite

- Posts: 735

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

http://indiatoday.intoday.in/story/farm ... 43900.html

ndia does not need more but smarter subsidies. It is a global truism that bulk of the subsidies goes to big farmers. In India, on the contrary, it goes to big business. The entire fertiliser industry is a scandal built around this, where the fertiliser ministry dispenses the Rs 70,000 crore subsidy directly to manufacturers and becomes a big-time ATM. The farmer, meanwhile, has to beg for fertiliser. Once again, given how cheap subsidies make one kind of fertiliser, urea, there is permanent shortage, even riots for it. Since subsidy in India makes it cheaper than a third of its real price, it is smuggled to neighbours, diverted to other industries, from soap to explosives to milk adulteration, and lately, even "imported" from, say, China and "exported" back to it on high seas, with both parties splitting the subsidy.

The Narendra Modi government has a good thought in giving farmers soil health cards. But it will be defeated by the rotten subsidy economics of fertilisers. There is enormous vested interest, a mafia of profiteering built around this.

Next myth on our hitlist, therefore, is that India needs more and more grain for food security. The Shanta Kumar report put India's(drought) buffer requirement at a mere 10 million tonne, half to be stored physically and the rest in global futures and options. But that is too radical in a country where the age-old norm has been about 15-20 per cent of annual grain production, that is, 32 million tonne (2014-15 grain production 251, and 2013-14 a record 265 million tonne).

Even if you stretch it further to extrapolate the additional Food Security Act needs for PDS, it comes to 42 million tonne. Today we hold upwards of 60 million. We can easily export 10 million tonne-in fact, it was decided to do so two years ago, but the food ministry got cold feet in that CAG, CVC, CBI season. The cost of this extra inventory is more than Rs 45,000 crore, and it benefits no one. After the FCI pays farmers, it costs it another Rs 4.75 per tonne per year to carry the grain-that, even for just this additional amount of grain, adds up to Rs 7,500 crore, and please flag that number because we shall return to it in a minute.

Now, to use a Ganga-Jamuni metaphor, 80,000 tonne when we have 60 million tonne of wheat and rice in storage is not even like a cumin seed in the mouth of a camel (oont ke munh mein jeera).

You think this broken economics is insane? I will tell you more. Punjab and Haryana, which procure bulk of this grain for the FCI, charge the Centre about 15 per cent of the MSP as cess. In effect, therefore, it becomes a straight gratuity from Centre to them for growing surplus grain.

If you wanted to fix Indian farming, Punjab and Haryana must shift to cash crops, maize (with support price) and basmati, each tonne of which earns three times the revenue of plain rice and consumes two-thirds of the water. Plain rice can move to the eastern states, and for wheat check Madhya Pradesh, whose farmers, powered by Narmada waters, are clocking around 20 per cent growth.

Facts again: India farms in nearly 200 million hectares arable land-that's including land that is double-cropped -and produces grain in the ballpark of 260 million tonne. China farms 156 million hectares, and produces (exhale!) 600 million tonne. Why? It has irrigation, and 63 per cent of its rice is hybrid, while only 3 per cent of ours is. Why? You ask "jaivik kheti" (organic farming) Luddites of the Left and the Right. These broad figures I have on the authority of agricultural economist Ashok Gulati.

Here is a very short checklist of how you can fix it. First, round off the total amount of subsidies and pay them directly to the farmer, depending on his landholding. Second, let farm products discover their prices in the market. Third, with support paid in cash, all inputs, including power, should be on market prices. Fourth, all savings and additional investments should go into irrigation and technology upgrades, new seeds, research including GM.

See the wonder irrigation has done to Madhya Pradesh.

But also, don't forget that Rs 81,206 crore spent on irrigation in Maharashtra between 2000-01 and 2010-11 increased irrigated area under cotton by 5.1 per cent while half as much spent in Gujarat added 67 per cent. You can see it in the comparative fortunes of the cotton farmers of Vidarbha and Gujarat.

To fully insure about 70 per cent of all farming in India, about Rs 15,000 crore will be needed annually. A half of this will simply come from not paying the FCI for carrying that surplus grain. Remember that figure of Rs 7,500 crore we said we'd revisit. What kind of insurance? There are many models at work.

A genuinely brilliant one sits in the report by P.K. Mishra (currently additional principal secretary in the PMO) when he headed the Committee to Review the Implementation of Crop Insurance Schemes. More work is being done by other experts that envisages a combination of smartphones, GPS and drones to guarantee a quick payout. And as Gulati says, if Kenya can do it, why can't we? But before that we have to junk these myths that reduce our farmer to a beggar and give us the fake satisfaction of throwing alms that are pocketed by crooks driven by greed, not hunger.

-

member_29058

- BRFite

- Posts: 735

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

http://blogs.timesofindia.indiatimes.co ... ding-past/

Modi is building on India’s wondrous trading past

Modi is building on India’s wondrous trading past

Although the land boundary agreement was the most visible victory during Modi’s visit, other accords were equally significant. Indian goods travel via Singapore to reach Bangladesh in three weeks; now they will go directly to Bangladeshi ports in a week. Indian companies will sell electricity and make goods in special economic zones across the border, creating masses of jobs while helping reduce Bangladesh’s trade deficit. The accord signals to Nepal, Sri Lanka and Pakistan the benefits of moving from the politics of suspicion to the economics of prosperity.

If you had stood at the famous port of Muziris in Kerala 2,000 years ago, you would see a ship arriving laden with gold. Every day a ship from the Roman Empire landed in a South Indian port where it picked up fine Indian cottons, spices, and luxuries. But Indians did not care for what the Romans brought, and since accounts had to be settled, they were settled with gold and silver. Back home, Roman senators grumbled that their women used too many Indian luxuries, spices and fine cottons and two-thirds of Rome’s bullion was being lost to India. One South Indian king even sent an embassy to Rome to discuss the empire’s balance of payments problems.

After Independence we forgot our trading past, closed our borders in the name of a bogus idea called ‘import substitution’, denying ourselves the prosperity of international trade. We only opened up in 1991. Today, Modi is trying to recover that past while quietly burying the foolish protectionism of RSS’s Swadeshi Jagran Manch, even as he promotes ‘Make in India’.

In recent times our neighbours have grown suspicious of us and declare that they are ‘too close to India and too far from God.’ However, Modi’s economic diplomacy is creating new possibilities. If he is successful, India may become once again become worthy of the seventh-century Chinese traveller, Xuanzang’s description: “People of distant places with diverse customs generally designate the land they admire as India.”

Re: Indian Economy - News & Discussion Oct 12 2013

"India Chooses IPhones Over Asset Bubbles"

http://www.bloombergview.com/articles/2 ... et-bubbles

http://www.bloombergview.com/articles/2 ... et-bubbles

India's Raghuram Rajan is an outlier in Asia. Whereas other central bankers in the region are pumping ever-more air into asset bubbles -- New Zealand and South Korea further reduced interest rates last week, and Australia may be next -- Rajan has taken a go-slow approach. It's to Rajan's credit, and India's benefit, that he has shown such discipline.

The Reserve Bank of India governor has done his share of easing this year, most recently on June 2. But he hasn't tried to keep up with his peers in the region: Short term rates in India are still 7.25 percent compared to 5.10 percent in China, 3.25 percent in New Zealand and less than zero in Japan. Nor has Rajan followed others in tweaking bank reserve requirements and margin-lending rules to drive up stock prices. It's no coincidence that Mumbai shares are down 5 percent this year, while Shanghai's are up 60 percent.

Instead, Rajan, a savvy University of Chicago economist, has been holding Indian Prime Minister Narendra Modi's feet to the fire. Rajan has made more monetary stimulus contingent upon progress on the structural reforms Modi promised more than a year ago when his Bharatiya Janata Party campaigned in national elections. When he cautioned against "competitive monitoring easing" last week, Rajan was letting the government know he won't be pressured by the rate-slashing in other countries.

Specifically, Rajan is prodding the government to step up infrastructure spending. He wants to make sure Modi makes good on his proposed budget, which promises a 25 percent jump in outlays on roads, bridges and ports to increase India's competitiveness.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Thanks A Gupta ji for that post.

The kicker is at the end

The kicker is at the end

But the basics of Rajan's strategy are entirely correct. Unlike his peers in China, Japan and elsewhere in the region who have enabled the complacency of their governments, he has done the opposite. In the short term, India may miss out on the excitement of rapidly growing asset bubbles. But attracting the Foxconns of the world more than makes up for it

-

member_27845

- BRFite

- Posts: 160

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

RR has consistently adopted a cautious approach in easing interest rates ( he displays a pretty dogmatic attitude ) so much so that its a case of too little too late when he cuts rates in drips

Now with inflation ticking up again the window for dramatic lowering of rates is probably gone ( with an expected shortfall in the monsoon, increase in crude prices etc )

Please note that supply side shortages and inefficiency ( including in the food sector ) is what causes inflation in India , not demand led which can be moderated by higher rates

In India , high interest rates themselves are a major cause for inflation , rather than being a cure for it

The RBI killed the growth during the last 2-3 years of the UPA by jacking up the rates every 2 months - but did it lick inflation ?? No

THis , when every major economy had near zero rates and were actively depressing their currencies

Let RR try his stunt in US / Europe / Japan - he would be unemployed within a week if he did so

Now with inflation ticking up again the window for dramatic lowering of rates is probably gone ( with an expected shortfall in the monsoon, increase in crude prices etc )

Please note that supply side shortages and inefficiency ( including in the food sector ) is what causes inflation in India , not demand led which can be moderated by higher rates

In India , high interest rates themselves are a major cause for inflation , rather than being a cure for it

The RBI killed the growth during the last 2-3 years of the UPA by jacking up the rates every 2 months - but did it lick inflation ?? No

THis , when every major economy had near zero rates and were actively depressing their currencies

Let RR try his stunt in US / Europe / Japan - he would be unemployed within a week if he did so

Re: Indian Economy - News & Discussion Oct 12 2013

I am with RR on not reducing the rates. We do not need an asset bubble right away. Instead of moving money into RE, it is better to move money elsewhere.

First of all, the latest WPI shows downward trend. http://economictimes.indiatimes.com/new ... 683435.cms

So the contention that higher rates is leading to higher inflation is not viable.

The core of inflation in India has been the basic roti, kapda and makaan issues. That is the food inflation, the basic lifestyle and the housing. Further housing is over-hyped/over-inflated in India. That is, people speculate in RE and if they cannot, they invest in Gold. Keeping the rate high is to cool down the overly-inflated RE. This is reverse to other economies where lower rates lead to asset bubbles which when pop'ed leads to economic slowdown.

In India RE is already over-inflated, so keeping the rates up should bring down the RE from stratospheric prices to at least real prices. Of course, this can be further helped by mopping out the black money from the economy.

First of all, the latest WPI shows downward trend. http://economictimes.indiatimes.com/new ... 683435.cms

So the contention that higher rates is leading to higher inflation is not viable.

The core of inflation in India has been the basic roti, kapda and makaan issues. That is the food inflation, the basic lifestyle and the housing. Further housing is over-hyped/over-inflated in India. That is, people speculate in RE and if they cannot, they invest in Gold. Keeping the rate high is to cool down the overly-inflated RE. This is reverse to other economies where lower rates lead to asset bubbles which when pop'ed leads to economic slowdown.

In India RE is already over-inflated, so keeping the rates up should bring down the RE from stratospheric prices to at least real prices. Of course, this can be further helped by mopping out the black money from the economy.

-

member_27845

- BRFite

- Posts: 160

- Joined: 11 Aug 2016 06:14

Re: Indian Economy - News & Discussion Oct 12 2013

Got to disagree on most above points

Asset bubbles are caused by money supply + low interest rates ( meaning really low , not these reluctant cuts that RR is doing )

Inflation will pick up soon , dont worry : the main cause was reduced crude prices which also strengthened the INR , making all imports cheaper. Now with crude back at 60-62 , CPI has hit 5 % and will keep inching up

Real estate is a different beast in itself , but I do agree that RE is tremendously overvalued in India.

But the market is dead now - most urban markets have a supply overhang of 36-48 months ( built up stocks will take 3-4 years to sell at current sales levels ) - so where is the fear of an asset bubble forming in RE now !!

RE prices have to do with lack of urbanisation in India , speculation in land prices , ridiculous FSI rules , manufacturing inefficiencies and yes , high interest rates for the consumer who has to pay the mortgage.

By the way , have sustained high rates of interests brought down RE prices - NO. Even at these dismal times of low sales , developers prefer to hold on to their prices .

And what about core inflation - have higher rates helped in curbing it ? The RBI tried in 2011-2013 and failed miserably. The rates went up and so did inflation while manufacturing slowed down , and is yet to pick up.

Asset bubbles are caused by money supply + low interest rates ( meaning really low , not these reluctant cuts that RR is doing )

Inflation will pick up soon , dont worry : the main cause was reduced crude prices which also strengthened the INR , making all imports cheaper. Now with crude back at 60-62 , CPI has hit 5 % and will keep inching up

Real estate is a different beast in itself , but I do agree that RE is tremendously overvalued in India.

But the market is dead now - most urban markets have a supply overhang of 36-48 months ( built up stocks will take 3-4 years to sell at current sales levels ) - so where is the fear of an asset bubble forming in RE now !!

RE prices have to do with lack of urbanisation in India , speculation in land prices , ridiculous FSI rules , manufacturing inefficiencies and yes , high interest rates for the consumer who has to pay the mortgage.

By the way , have sustained high rates of interests brought down RE prices - NO. Even at these dismal times of low sales , developers prefer to hold on to their prices .

And what about core inflation - have higher rates helped in curbing it ? The RBI tried in 2011-2013 and failed miserably. The rates went up and so did inflation while manufacturing slowed down , and is yet to pick up.