Indian Economy News & Discussion - Aug 26 2015

Re: Indian Economy News & Discussion - Aug 26 2015

Gaming quarterly estimates is a time-honoured tradition among the investment banking industry.

Goal 1: preserve current value of substantial equity holdings

Tactic: estimate low, rah rah on 'estimate beat'

Goal 2: get in low on fast growing economy or sector

Tactic: estimate high, pound down stocks on 'missed estimates', buy low.

Once holdings are substantial through goal 2 tactics, switch to goal 1 tactics.

Goal 1: preserve current value of substantial equity holdings

Tactic: estimate low, rah rah on 'estimate beat'

Goal 2: get in low on fast growing economy or sector

Tactic: estimate high, pound down stocks on 'missed estimates', buy low.

Once holdings are substantial through goal 2 tactics, switch to goal 1 tactics.

Re: Indian Economy News & Discussion - Aug 26 2015

Suraj: Is their financial leverage so great that they can move markets? I don't think anybody is so big to be able to game entire sectors nor large markets.

Re: Indian Economy News & Discussion - Aug 26 2015

While manufacturing PMI for Sept was weak, Services PMI for Oct is the opposite:

Services PMI at 8-month high in Oct

Services PMI at 8-month high in Oct

Six-month limit likely to declare firms bankruptActivity in India's services sector touched an eight-month high in October as new business orders rose significantly and discounting increased, according to a Nikkei survey, issued on Wednesday. The Nikkei Business Activity Index climbed to 53.2 in October, from 51.3 in September, as fresh orders expanded at the best pace since February.

On Monday, another Nikkei survey had said India's manufacturing growth had cooled to a 22-month low in October.

"Services companies saw a faster rise in new business than their manufacturing counterparts," said Pollyanna De Lima, economist at Markit, which compiled the survey. The improvement in activity became visible as companies cut prices in October. This was the second month in a row that companies had to resort to discounting to get new business.

A sub-index measuring prices was 49.6, only marginally higher than the previous month's 49.5. A reading above 50 indicates expansion and one below it shows contraction.

The government-appointed Bankruptcy Law Committee has recommended a speedy process and a timeline of six to a maximum of nine months to deal with insolvency and enable winding-up of operations of a company or a limited liability entity. The draft law prepared by the panel has also proposed early identification of financial distress so that steps can be taken to revive the ailing company.

The committee has prescribed a timeline of 180 days for dealing with applications but it can be extended for another 90 days by the adjudicating authority, only in exceptional cases. During the insolvency resolution period, an interim resolution professional would manage the debtor. The professional would prepare a plan that needs to be approved by a majority of 75 per cent of voting share of the financial creditors. Once the plan is approved, the adjudicating authority must give its nod. However, if an insolvency resolution plan is rejected, the adjudicating authority will order for liquidation.

Re: Indian Economy News & Discussion - Aug 26 2015

Raghuram Rajan repeats: We need to resist bid to close our society

Reserve Bank of India Governor Raghuram Rajan reiterated on Wednesday that India would be “crazy to lose” its biggest advantage and emphasised the “need to keep an open society” and “resist all attempts at closing it down”.

http://indianexpress.com/article/india/ ... masNv.dpuf

Reserve Bank of India Governor Raghuram Rajan reiterated on Wednesday that India would be “crazy to lose” its biggest advantage and emphasised the “need to keep an open society” and “resist all attempts at closing it down”.

http://indianexpress.com/article/india/ ... masNv.dpuf

DAYS AFTER he called for “tolerance and mutual respect”, Reserve Bank of India Governor Raghuram Rajan reiterated on Wednesday that India would be “crazy to lose” its biggest advantage and emphasised the “need to keep an open society” and “resist all attempts at closing it down”.

“It’s very important that both fringes, extreme left and extreme right, don’t say I’m going to shut you off if you don’t say what I want to hear,” Rajan said in an interview to a Bloomberg team that included Editor-in-Chief John Micklethwait. “It has to be a genuine debate. You have to preserve that environment. Thankfully, the mainstream is well and truly supportive of this.”

Referring to his October 31 speech on tolerance at IIT-Delhi, he said: “It wasn’t a speech about here and now. It was more about where is the dialogue going and how are we going to maximise the advantage we already have. For that we need to keep this an open society and we need to resist all attempts at closing it down.”

“You cannot have a debate by screaming at one another. Let the ideas fight each other but let’s not prevent each other from saying what we think,” said Rajan, adding that everyone across the political spectrum should “calm down a bit in order to foster healthy debate.”

Rajan said India would be “crazy to lose” the biggest advantage it has over countries at a similar stage of development. Stating that India’s democracy is its greatest strength, Rajan said his speech was “an exhortation to support a fundamental future underpinning for growth.”

At the IIT-Delhi convocation on October 31, Rajan had emphasised the need to “improve the environment for ideas through tolerance and mutual respect”. He had also warned that “excessive political correctness stifles progress” and “a quick resort to bans will chill all debate”.

He had said that protection should be given “not to specific ideas and traditions, but the right to question and challenge” and the “right to behave differently so long as it does not hurt others seriously”.

“India’s tradition of debate and an open spirit of enquiry is critical for its economic progress,” he had said. “The first essential is to foster competititon in the marketplace of ideas. This means encouraging challenge to all authority and tradition, even while acknowledging that the only way of dismissing any view is through empirical tests. What this rules out is anyone imposing a particular view or ideology because of their power,” Rajan had said.

Re: Indian Economy News & Discussion - Aug 26 2015

This RR fellow is acting like he is on way to become another MMS.

In the meanwhile

http://www.business-standard.com/articl ... 036_1.html

In the meanwhile

http://www.business-standard.com/articl ... 036_1.html

Re: Indian Economy News & Discussion - Aug 26 2015

India wants people to turn in their gold

https://www.rt.com/business/320823-indi ... m-economy/

https://www.rt.com/business/320823-indi ... m-economy/

India’s Prime Minister Narendra Modi has launched a program to lure tons of gold from households into the country’s banking system. The program consists of three schemes; a gold monetization scheme, gold sovereign bonds and Indian gold coin.

The gold monetization scheme aims to unlock about 20,000 tons of gold worth over $800 billion lying idle in homes and temples. Under the plan, banks will collect gold for up to 15 years and pay 2.25-2.50 percent interest per year. This is higher than previous rates of around one percent. The government hopes that higher interest rates will help in mobilizing the gold as previous attempts have been unsuccessful.

Gold is a security, it gives you earnings and now on it is going to be a part of our nation building," Modi said.

By launching sovereign gold bonds with 2.75 percent interest, Indian authorities hope to cut the physical buying of the precious metal.

Modi has also unveiled the first Indian gold coin which is initially to be available in denominations of 5 and 10 grams

The program wants to cut the country’s reliance on gold imports, estimated at around 1,000 tons a year.

"The government wants to reduce the reliance on gold imports over time," an Indian finance ministry official said.

The Prime Minister said the country has overtaken China as the world's largest gold consumer, buying 562 tons so far this year, against China's 548 tons.

Re: Indian Economy News & Discussion - Aug 26 2015

Bankruptcy proposals must address existing shortages: experts

Infrastructure development top priority: PM

Faster recovery a shot in the arm for bankersThe bankruptcy law report and draft legislation given to the government on Wednesday is a timely exercise, seeking to do away with multiple jurisdictions and the existing gamut of laws to deal with insolvencies, analysts and experts told Business Standard. However, the final law won’t be effective till the legal options are strengthened further and additional resources put into the already overworked adjudicating authorities, they said.

The Bankruptcy Law Reforms Committee, headed by former Lok Sabha secretary-general T K Vishwanathan, has recommended a six to a maximum of nine months to deal with insolvency and enable winding-up of operations of a company or a limited liability entity. Their draft law has also proposed early identification of financial distress, so that steps can be taken to revive an ailing company.

The draft also consolidates the existing laws on insolvency of companies, limited liability entities, unlimited liability partnerships and individuals. These are presently scattered among a number of legislations. “It definitely looks like a good move. Right now, there are multiple jurisdictions and several laws dealing with insolvencies. You have situations where creditors approach multiple forums with their grievances and promoters seek unlimited stay to the proceedings,” said Mrityunjay Kapur, partner and head of risk consulting and strategy, KPMG in India.

Adding: “There is a need for clear law, which consolidates all the existing provisions from various legislations and removes the bottlenecks and loopholes. We have to wait for the final version of the bankruptcy bill but it looks like a comprehensive effort, which addresses a lot of issues.”

Bankruptcy law to help debt-heavy companiesThe section in the report of the committee on a new bankruptcy law, submitted on Wednesday, on speeding the process of fund recovery will be a shot in the arm for banks, if accepted. They could then take charge of the entire business for a single default by a borrower. According to the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, the trigger for a bank to enforce its security starts after 90 days, after the loan becomes non-performing.

"According to the proposals of the committee, a bankruptcy petition can be filed the next day after a company has defaulted. One single default and the promoter can lose control of his enterprise," said M R Umarji, member of the committee and former member of the Indian Banks Association. "This will make the promoters more serious about repaying their dues on time."

Modi uses the Seoul-Busan Expressway story to buttress the importance of infrastructure:Highly leveraged Indian companies, which are unable to repay bank loans in time, will get help from the new bankruptcy law. The norms will help restructure operations faster and even pave the way for a change in management to revive operations.

Chief executives say bankruptcy is a major challenge as several projects have become non-viable, especially in the infrastructure sector due to internal and external reasons. Due to this, Indian banks are inundated with bad loans which have blocked capital for creation of new assets.

Most of the existing laws have failed to either help lenders in getting their funds back or the companies in restructuring their operations. The World Bank's Doing Business sub-index on 'resolving insolvency' ranks India quite low at 136, and India's rank in 'enforcing contracts' is 170.

Infrastructure development top priority: PM

The apocryphal story goes that Park Chung Hee pushed for building the Seoul-Busan Expressway in 1965, when Korea had no automobiles to speak of. The prime contractor was Hyundai, then just a construction company. They built it on time with much effort, and at inauguration, Park was struck by the fact that there were no vehicles on the freeway, and turns to Hyundai founder Chung Joo Young and asks him 'so, do you think you can build cars now ?'Asserting that infrastructure could play a pivotal role in bolstering India's economic growth, Prime Minister Narendra Modi today said concerted efforts have led to rolling out of stuck projects worth Rs 4 lakh crore.

Modi was addressing a public rally at Sonipat in Haryana after laying the foundation stone of three major highway projects in the state - Western Peripheral Expressway, Eastern Peripheral Expressway and eight-laning of Highway section from Mukarba Chowk (Delhi) to Panipat.

No body would have imagined during 60 years that highways building would pick up such fast pace in the country under the leadership of Road Transport and Highways Minister Nitin Gadkari, the PM said, adding that the projects include Bharatmala, Sagarmala and Sethu Bharatam.

Citing example of Korea, Modi said a network of highways was the basis of modern Korea and the government would lay emphasis that a wide network of highways be created in the country, including linking of 123 districts with National Highways, which sadly were devoid of it despite over six decades of independence.

"Korea is a good example, see how it has progressed by leaps and bounds. Their rulers started a modern highway cutting through the country, but there was much controversy as it was reasoned at that time that the nation is poor...

"... It does not have schools, hospitals and spending so much money on roads was not a wise step, but rulers of that country at that time, still went ahead and did this and it changed the fate of entire Korea," Modi said.

The PM said under Sethu Bharatam, 375 bridges were needed for connectivity because the project aimed at providing vital connectivity through bridges.

Re: Indian Economy News & Discussion - Aug 26 2015

I think Eisenhower got similar blank looks when interstates were started in 1950s. But he had seen in person that quality of roads in Germany built from 1920s onward.

Re: Indian Economy News & Discussion - Aug 26 2015

If you ever wanted an example of a single road changing a country, the Seoul-Busan expressway is it. At that time it was dismissed as foolhardy and vain. 450km expressway in a country with a per capita income of $125, where most roads were dirt tracks ? What they lacked for money, they replaced with 'encouraging people to work' on the construction. Approx 9 million people worked on building that road, and it cost 25% of their annual budget each year between 1966-70. If you meet any SoKo person 60+ the odds are good that they worked on building that road. In the 7 years after its construction, their GDP grew 4x, as rate of commerce grew exponentially, and they never looked back since. It is not co-incidence that Hyundai Motor itself was founded in ~1969. Park told the Hyundai founder, who was busy with the expressway construction, to start building cars once he was done.

Modi has learned valuable lessons from these past stories, when he refers to Park's roadbuilding efforts to justify his own drive to spur infrastructure development. Infrastructure has a multiplier effect on economic activity. The gains don't come solely from the effort expended on its development, but from the savings and benefits arising out of its continued use. If anyone here will take the trouble of correlating road/rail/power development in a given state with corresponding GSDP growth in the ~10 years prior to and following the effort, there will be a substantial bump seen from that infrastructure driving growth.

Modi has learned valuable lessons from these past stories, when he refers to Park's roadbuilding efforts to justify his own drive to spur infrastructure development. Infrastructure has a multiplier effect on economic activity. The gains don't come solely from the effort expended on its development, but from the savings and benefits arising out of its continued use. If anyone here will take the trouble of correlating road/rail/power development in a given state with corresponding GSDP growth in the ~10 years prior to and following the effort, there will be a substantial bump seen from that infrastructure driving growth.

-

Melwyn

Re: Indian Economy News & Discussion - Aug 26 2015

https://twitter.com/TimesNow/status/662624906023014400

BSNL announces collaboration with facebook to set up 100 Wi-Fi Hotspots in rural areas in Southern & Western India.

Sadly, nothing for east/north.

BSNL announces collaboration with facebook to set up 100 Wi-Fi Hotspots in rural areas in Southern & Western India.

Sadly, nothing for east/north.

Re: Indian Economy News & Discussion - Aug 26 2015

Shutting out of textiles,leather & pharma where India has natural comparative advantage vis-à-vis the world is the biggest shocker - the plethora of much publicised FTAs of the UPA1&2 are now more like millstones around our exporter's necks.What’s Behind India’s Big Export Decline?

A long period of falling exports defies an easy explanation-The Diplomat.

By Ritesh Kumar Singh

November 06, 2015

Starting from Dec 2014, the last ten months have seen a series of contractions in India’s merchandise shipments, the last nine months by double-digit percentage points. Most analysts offer three explanations for the drops: the adverse effect of fall in crude prices; the relative appreciation of rupee against dollar vis-à-vis other currencies like the euro, real, rouble, or yuan; and slower growth in world trade.

Doubtless, the fall in crude prices has affected the dollar earnings from exports of refined petroleum products like diesel and petrol. Slower growth in world trade is an irrefutable reality that is bound to affect India’s exports.

However, India’s merchandise exports have been hovering around $300 billion for more than four years now, and that can’t fully be explained by low crude prices or slowing global trade, given India’s modest share of 1.7 percent of world exports.

Similarly, India’s top competitor in its key exports such as steel, chemicals and textiles is China, and the yuan has fallen just 3 percent against dollar (compared to the rupee’s 10 percent depreciation) since July 1, 2014.

It’s not that only exports of petroleum products are declining, exports of other items have also trended lower. For example, in Sepember shipments of engineering goods were down 23 percent, apparel 12 percent, and gems and jewellery 19 percent. Thus, the declines in India’s exports are quite broad-based.

The roots of India’s declining exports are deeper, and have no short-term fix, such as letting the rupee depreciate against the dollar, simply because India’s export basket is no longer as price elastic as it once was. Hence, currency depreciation would have to be truly dramatic to give a meaningful push to India’s exports. That may not work, as other countrys are trying to do the same thing to capture an increasing share of sluggish global demand. And one little can be done about subdued crude prices, which are likely to persist for the foreseeable future. So what’s holding up India’s exports?

Despite all attempts at diversification, India’s merchandise exports have a narrow base, with the top 20 categories accounting for 78 percent of the total. Even in top export categories like textiles, India is exporting low value commodities such as cotton yarn or apparel rather than technical textiles.

India’s manufacturing exports are fast losing price competiveness, primarily because of poor logistics infrastructure compounded by a weak trade facilitation regime. India’s over-dependence on road freight means that the cost of logistics as a percentage of GDP remains as high as 13-14 percent, compared with 7-8 percent in developed countries. Exports incentives in the range of 2 to 3 percent of export value can’t fully compensate for the additional cost incurred on account of an inefficient trade infrastructure.

Questionable Trade Pacts

Nor is the failure of India’s trade negotiators to get improved market access for the country’s exports helping. As a result, the country’s top exports are facing prohibitive tariff and non-tariff barriers in developing and emerging markets. In developed markets, where import tariffs are lower, India’s exports are subject to all kinds of non-tariff barriers.

India has signed many trade pacts, more for geo-political reasons than commercial ones{is this statement valid?}. The best example is the South Asian Free Trade Agreement, which has not resulted in any significant export gains despite the obvious logistical advantage and similar consumer preferences of the South Asian population.

The conclusion of an ASEAN-China FTA prompted India to hastily sign its on FTA with ASEAN, to protect its existing tariff advantages. Further, most of India’s preferential trade agreements (PTAs) are shallow in terms of product coverage. For example, the India-Mercosur PTA doesn’t include textiles and apparel items, which face prohibitive import duties of up to 35 percent.

India’s pharmaceutical exports have not benefited from tariff reductions under the India-Japan CEPA, mainly because it’s too cumbersome to deal with Japan’s drug regulator. Japan allows the duty free import of apparel from India only if all of the raw materials used are of either Indian or Japanese origin, with an exception of 7 percent content by weight that can be sourced from third countries. No surprise, the utilization of India’s PTAs for export promotion remains very low.

Strangely, India itself has not imposed any sourcing restrictions, even for sensitive items like textiles, granting unilateral duty free market access to countries like Bangladesh when restrictions would have helped its export of textile intermediates.

India’s ill-conceived trade pacts have also resulted in inverted duty structure – high import duties on raw materials and intermediates, and lower duties on finished goods – that discourage the production and export of value-added items. Thus, apparel can be imported into India duty free while its raw material –manmade fibres attract an import duty of 10 percent. That makes no sense. Similarly, finished products such as laptops or cell phones can be imported more cheaply than all their parts (imported) separately because of duty inversion.

Fixing the trade regime should be the top priority for the government. However, that first calls for an admission that there is a problem with the way India has negotiated its trade deals. Facing criticism that India’s FTAs are aiding imports rather than exports, the Ministry of Commerce claimed that FTAs are not being used much by traders and hence can’t be responsible for rising imports. That begs the question: Why then did India spend so much time and energy negotiating them.

India is also going slow on trade pacts that could be immensely beneficial. Vietnam has already concluded an FTA with the largely untapped Eurasian Customs Union comprising Russia, Belarus and Kazakhstan, while India has been slow to move ahead with negotiations. Meanwhile, India has been unable to bridge differences blocking a free trade deal with EU, its biggest trading partner. Worse, in a move that revealed its immaturity in trade negotiation, India recently called off the trade talks with EU.

The recently concluded Trans-Pacific Partnership (TPP) – a trade bloc that has apparently held no interest for India – could be highly damaging for its exports. A tighter intellectual property regime may adversely affect India’s export of generic medicines to TPP countries, the U.S. in particular. Given the high applied duties for apparel items in the U.S., the TPP will create a direct tariff disadvantage for India’s apparel exporters (vis-à-vis Vietnam), which operate on margins as low as 6 percent.

The imposition of yarn forward (a highly restrictive sourcing rule) will not let India benefit indirectly from supplying textile intermediates to Vietnam. Moreover, TPP may lead to investment moving out of India to TPP countries, dealing another blow to India’s future exports.

Reviving India’s exports call for a carefully considered trade strategy and a much more radical policy mix than that which India could manage during the global boom years (2000-2007), when its exports surged 20 percent a year. Any takers?

Ritesh Kumar Singh is a corporate economic advisor based in Mumbai and former assistant director of the Finance Commission of India. The article expresses the author’s personal views.

-

Rishirishi

- BRFite

- Posts: 1409

- Joined: 12 Mar 2005 02:30

Re: Indian Economy News & Discussion - Aug 26 2015

India has subsidies in the range of 60 billlion dollars per annum. That is sufficient to bulild 7000 KM of world class 4 lane highways. In 5 years India would have 35 000km of ultra modern highway, which would bring down the cost of food and other items.Suraj wrote:If you ever wanted an example of a single road changing a country, the Seoul-Busan expressway is it. At that time it was dismissed as foolhardy and vain. 450km expressway in a country with a per capita income of $125, where most roads were dirt tracks ? What they lacked for money, they replaced with 'encouraging people to work' on the construction. Approx 9 million people worked on building that road, and it cost 25% of their annual budget each year between 1966-70. If you meet any SoKo person 60+ the odds are good that they worked on building that road. In the 7 years after its construction, their GDP grew 4x, as rate of commerce grew exponentially, and they never looked back since. It is not co-incidence that Hyundai Motor itself was founded in ~1969. Park told the Hyundai founder, who was busy with the expressway construction, to start building cars once he was done.

Modi has learned valuable lessons from these past stories, when he refers to Park's roadbuilding efforts to justify his own drive to spur infrastructure development. Infrastructure has a multiplier effect on economic activity. The gains don't come solely from the effort expended on its development, but from the savings and benefits arising out of its continued use. If anyone here will take the trouble of correlating road/rail/power development in a given state with corresponding GSDP growth in the ~10 years prior to and following the effort, there will be a substantial bump seen from that infrastructure driving growth.

In addition India could invest 50 billion in top 100 "smart cities". That would give each city 500 million dollars per annum. Within 10 years India would be transformed to a modern state with highways, modern cities and good connectivity for rural areas.

Re: Indian Economy News & Discussion - Aug 26 2015

Lots of facts and figures, hence posting in full:

PM highlights four-fold jump in highway awards to stress economic turn around

PM highlights four-fold jump in highway awards to stress economic turn around

NEW DELHI: Prime Minister Narendra Modi on Friday highlighted how the pace of award of highway works has gone up over four-fold during the current year against barely 5.2 km per day in 2012-13.

In fact, the per day award of highway projects till October end was close to 24 km and it's more than last years performance of 21 km a day during the same period. The pace of construction has also increased to 14 km a day against 9.5 km for the corresponding period last year.

PM also highlighted how major ports have registered 5% growth in traffic and an 11% increase in operating income in 2014-15 despite a global contraction in trade volume. "The Shipping Corporation of India had been making losses continuously for several years and had a loss of Rs 275 crores in 2013-14. In 2014-15 it earned a profit of Rs 201 crore a turnaround of nearly Rs 500 crore in one year," he said.

Highway ministry data shows that that there has been huge revival of the highway sector in the past one-and-a-half years. High rate of award of projects is directly linked to the accelerated construction of stretches within two to three years.

Data accessed from highway ministry shows the rate of award had declined to 1,900 km in 2012-13 and it improved to some extent in 2013-14. But the real revival happened 2014-15 when the award of works was more than double - from 3,600 km to 8,000km. This year ministry targets to award another 8,000-10,000 km and has already bid out stretches covering 5,000 km.

"The target is achievable, if we get the go ahead to clear projects quickly. We need to improve the speed further to achieve the target of building 30 km highways a day. While finance is not an issue some more decisions are needed to push award and construction," said a highway ministry official.

Sources said the ministry is setting the target of award to 10,000-12,000 km next fiscal. It's also seeking higher budgetary allocation from Rs 42,000 crore to Rs 62,000 crore next year.

Re: Indian Economy News & Discussion - Aug 26 2015

Gold monetisation may do better than expected: UBS survey

Gold schemes, including the monetisation schemes launched on Thursday, might yield better than expected results, according to a UBS survey.

“A significantly large proportion of respondents are likely or highly likely to participate in the govt’s GMS (gold monetisation scheme) and are not resistant to the idea of temple gold also being deposited. This suggests that the scheme has the potential to perform better than previous initiatives which is not in line with current consensus expectations.”

Gold monetisation scheme being implemented through banks, is aimed at mobilising idle gold in the system and use that gold for productive purpose and avoid imports.

Deposits will fetch less than one% returns for short term but for medium and long term he will get interest of 2.25 to 2.5% per annum. In most circles fears were raised about success of monetisation scheme but UBS says that the response would be better than anticipated.

Indians directly or indirectly hold an estimated 22,000 tonnes of gold ($800 bn or 39% of Indian GDP). Incremental gold demand in India is largely met by imports (1.7% of GDP in FY15), driving current account deficit (1.4% of GDP). Government has announced plans to facilitate deposit of gold as well as a gold bond, to hopefully monetise it into more productive use and also curtail imports.

UBS survey said “nearly 50 per cent of respondents were ‘likely’ or ‘highly likely’ to deposit gold/gold jewellery.” It also said awareness was quite high. 80 per cent of respondents surveyed were aware of the schemes.

Re: Indian Economy News & Discussion - Aug 26 2015

Do not buy the Sovereign gold bonds which are on sale from 5-20 Nov 2015

Reasons why one should not buy the sovereign gold bonds

The most tax efficient way to accumulate gold for a marriage is to buy it: jewels if planning for a marriage and gold bars or coins if you plan to hold it as a hedge in case of war, hyperinflation, etc.

Sovereign gold bonds are ways to invest in gold. Not accumulate it.

Gold is an extremely volatile commodity and it is ill-advised to buy these bonds which come with a lock-in which is higher than that for ELSS mutual funds (3 years).

Those who wish to benefit from gold price movements or those who to add gold for diversification in their investment portfolios are better off with a gold etf or gold funds.

ETFs would have 1% to 1.5% expense ratios and the returns would be lower by that much. However, they offer unmatched liquidity. One can buy on dips and book profits. This freedom is vital when dealing with volatile instruments and is well worth the expense ratio.

The 2.75% interest rate is on the amount invested and not on the maturity value. This interest on the gold bonds shall be taxable as per the provision of Income Tax Act, 1961 (43 of 1961) as income from other sources. Sovereign Gold Bond 2015-16. That is it would be taxed as per income slab.

Such a low post-tax interest rate is not worth it considering the associated lock-in. Imagine the price movement in gold, if these bonds were issued five years ago.

Yes, Sovereign gold bonds will beat ETF returns by about 2.4% for those in 30% slab and about 2.6% for those in 20% slab. Is that enough reward for being locked in for 5 years with a volatile asset class? A vehement no, in my opinion.

Gold is not a fixed income asset class. Investing in gold is riskier than investing in stocks! So I expect a risk premium. This risk premium should be free from constraints. The lock-in period with a small interest rate that would be taxed as per slab are not good enough for me.

Conclusions:

Buy physical gold (not ETFs) if you wish to accumulate gold for a marriage or as a hedge.

Use ETFs invest in gold to diversify your portfolio.

Do not buy the sovereign gold bonds which are currently on sale.

Re: Indian Economy News & Discussion - Aug 26 2015

Income tax reforms that will make life less taxing

T

T

axpayers will no longer need to physically go and present the case and documents to assessing officers. To make the process easy, simple and effective, the Central Board of Direct Taxes (CBDT) has come up with a proposal for paperless income tax assessment over emails. This would save taxpayers visits to the I-T office, especially in cases involving small amounts. If the response and other information are found satisfactory as per automated closure rules, the issue will be treated as closed.

Re: Indian Economy News & Discussion - Aug 26 2015

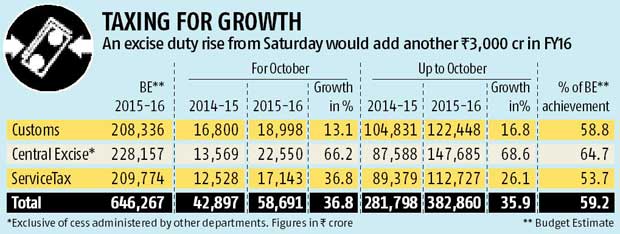

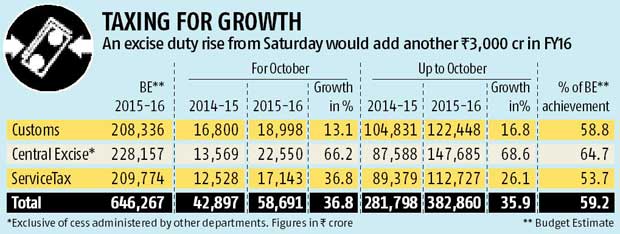

UDAY will lead to annual savings of Rs 1.8 lakh cr

Export volumes up in some sectors despite slow down in demand

Indirect tax collection up 36% in first seven monthsThe Centre’s ambitious Ujwal Discom Assurance Yojana (UDAY) will lead to annual savings of $30 billion (Rs 1.8 lakh crore) by 2018-19. The proposed saving is on account of energy efficiency to be achieved by reduction in interest rate; takeover of discoms’ debt by states; reduction in aggregate technical and commercial (AT&C) losses by discoms; increase in coal availability; coal swapping; and demand-side management.

“It will be savings worth Rs 1.8 lakh crore, which means saving of Rs 1.2 per unit when compared to business as usual. Banks do not have to take any haircut under UDAY,” minister for power, coal and renewable energy Piyush Goyal told reporters after his interaction with stake holders.

The minister said practically all states have come on board. Goyal allayed fears that state-run Power Finance Corporation (PFC) and Rural Electrification Corporation (REC) will be impacted adversely due to the implementation of UDAY as both have lent substantially to discoms. “Instead, PFC and REC will be able to unlock and lend $50-60 billion of fresh loan in transmission and renewable energy in the next five years,” he noted.

The minister said PFC and REC are not deposit-taking institutions and clarified that the government will not stress their balance sheets with eight-nine per cent bond.

Export volumes up in some sectors despite slow down in demand

OECD: India to see relatively robust growth at 7.2% in FY16The fall in Indian merchandise exports for the tenth straight month, ended September, 2015, was mainly driven by falling global commodity prices and not necessarily declining export volumes, economic research firm and ratings agency India Ratings and Research (Ind-Ra) said on Monday.

Saying the volume demand for Indian exports may not have suffered significantly during the period, Ind-Ra said a global freefall in export prices of agricultural, crude oil and related products were to blame for heavy decline in the outbound shipments, value-wise.

The rating agency said export volumes in certain categories continued to increase. For instance, it said automobiles exports rose 14.9 per cent in FY15, jumping from 7.3 per cent in FY13. Value of agriculture exports, which account for 9.7 per cent of total export in value, fell 19.1 per cent on a year-on-year basis.

Similarly, crude oil and its products, (18.3 per cent of FY15 merchandise exports) declined in value, 45.4 per cent year-on-year. The decline in these two categories alone accounted for around three-fourths of the overall decline in merchandise exports, it said.

Also, the sharp fall in the prices of other commodities along with lower crude oil rates has depressed prices of many intermediate and manufactured goods.

Consequently, the value of exported items has shrunk. A weak euro also contributed to Indian merchandise exports witnessing an aggregate 15.1 per cent year-on-year fall, in dollar terms, over eight months leading to September.

Gas price pooling leads to breakthrough in urea productionIn its latest economic outlook report, it retained India's economic growth, but cut the global growth forecast for the current year to 2.9 per cent citing a "further sharp downturn in emerging market economies and world trade". The growth rate for India projected by the Paris-based OECD, which comprises high income countries like the US, Australia, Japan as well as most European nations, would mean lower growth rate in 2015-16 than 7.3 per cent recorded in 2014-15.

OECD put future growth projection for 2016-17 at 7.3 per cent and 7.4 per cent for the succeeding year. However, the figures will be achievable only if structural reforms are further implemented, it cautioned. The report said rising public investment complemented by faster clearance of key projects has boosted growth. The private sector, on the other hand has increased investments due to better infrastructure and greater ease of doing business.

It is reassuring to know from fertiliser secretary Anuj Bishnoi that India’s urea production, which has been stagnating at 22 million tonnes (mt) for some years, is to rise to 24 mt in 2015-16.

The breakthrough in urea production, which will reduce our import dependence to some extent, is mainly due to the pooling of gas prices and promotion of energy efficiency, which in turn would reduce the government’s subsidy burden.

India is short of gas and supply of indigenous gas to fertiliser plants is unfailingly much lower than the requirement of 42.4 million standard cubic metres a day (mscmd).

-

Melwyn

Re: Indian Economy News & Discussion - Aug 26 2015

Minhaz Merchant claimed on twitter that there are lot of positive economic changes that can be done with just executive route or money bills to avoid RS. Gave example of PVNR who got a lot done through this route. Is this really true or jus another of those khayali pulaos.

Re: Indian Economy News & Discussion - Aug 26 2015

Some ideas here:amitkv wrote:Minhaz Merchant claimed on twitter that there are lot of positive economic changes that can be done with just executive route or money bills to avoid RS. Gave example of PVNR who got a lot done through this route. Is this really true or jus another of those khayali pulaos.

Post-Bihar reforms road

Check out the table in the following article:But even without legislative support, there is plenty for the BJP to do should it decide to push on the reforms agenda. Unifying central excise and service tax into a central GST requires no legislative approval, but will serve as a template for the eventual national GST. A central GST will, for instance, force the government to come out with a workable threshold for taxation where there is no revenue loss while keeping as many firms as possible away from the inspector raj – the threshold for excise is a turnover of Rs 1.5 crore while that for service tax is Rs 10 lakh; working out a revenue-neutral-rate will also save time when the national GST is rolled out. Similarly, working on making the taxman less trigger happy and burying legacy cases doesn’t require the Opposition’s cooperation – Modi did well to announce, last week, that he planned to include the success rate of tax officials in their appraisal; judging officials on this yardstick will dissuade them from issuing high-value tax notices for the sake of doing so. The power reforms announced last week involved very rigorous monitoring, but only by the executive; ditto for increasing capital expenditure on roads and railways, for pushing defence contracts, getting BJP-ruled states to pass friendly labour and land laws … How the government reacts depends on whether it sees the Bihar defeat as purely the arithmetical result of a Nitish Kumar and a Lalu Yadav tying up or whether it sees this as a compelling reason for it to have a solid jobs- and growth-based counter-narrative.

Here's why FM Arun Jaitley may be right in saying Bihar won't derail reforms

Re: Indian Economy News & Discussion - Aug 26 2015

India Inc Struggles to Escape Debt Burden As Profit Slows

Thomson Reuters | Last Updated: November 09, 2015 18:17 (IST)

http://profit.ndtv.com/news/corporates/ ... ome-latest

Thomson Reuters | Last Updated: November 09, 2015 18:17 (IST)

http://profit.ndtv.com/news/corporates/ ... ome-latest

Mumbai/Bangalore: Core profit growth at India's top companies has slowed down sharply from last year's levels, hampering efforts to cut debt in one of Asia's most leveraged corporate sectors and dampening the private investment needed to spur sluggish economic growth.

With a majority of Indian companies already reporting financial results for the quarter to end-September, 53 top firms have shown collective 9.4 per cent growth in core profit, the slowest since January-March 2013, according to Thomson Reuters data. That compared with average quarterly profit growth of 16.9 per cent in the previous financial year that ended in March, the data showed.

Slowing profit growth will weigh on spending by the companies, which, analysts say, are already utilising the majority of their operating profit to service interest costs. Debt for India's 963 companies covered by Thomson Reuters StarMine reached more than $640 billion or nearly Rs 42 lakh crore, or more than 40 per cent of India's gross domestic product.

Disappointment over earnings has helped send Indian shares down for two consecutive weeks now and pushed the broader market into negative territory for the year, with the main index down about 5 per cent.

"The ability to service debt, as measured by interest coverage, is continuing to deteriorate," said Rakesh Valecha, head of credit and market research at credit agency India Ratings.

Midway through India's fiscal year, debt-to-equity ratios at the 53 companies had fallen only slightly to 1.05 from 1.10 in the six months to March - still the highest in Asia, and more than double the 0.40 in China, the data showed.

But debt-to-forward core profit estimates, a broad measure of how many years it would take to pay off debt, rose to 2.39 in the April-September period from 2.30 in the previous fiscal half year. That means it could take almost five years of annual profits to pay all debts.

CONCENTRATED DEBT

Corporate debt in India is particularly high in the resources, infrastructure and construction sectors, along with telecoms, where firms paid handsomely to snap up spectrum.

Credit Suisse estimates Indian conglomerates with the biggest gross debt, including infrastructure builders Lanco Group and GVK Group, have debt that is seven times core profit, while their interest cover, a measure of their ability to pay down debt, is less than one, below the 1.5 that is generally considered as the minimum necessary.

The result is companies are focusing on cutting back that debt, at the expense of much-needed spending. India Ratings estimates two-thirds of operating profit among the country's top companies is being used to service interest.

The lack of private spending was seen as a major reason why the economy grew more slowly than expected in the first three months of India's fiscal year that runs from April to March.

The government is now stepping up to take up some of the private sector investment slack, seeking to build roads, highways and railways. But how much it can ultimately spend is in doubt given it is also diverting some of its budget funds to bail out state-owned banks and has a deficit target to hit.

"They have used the fiscal space to push their spending on building road infrastructure," said Somasekhar Vemuri, a senior director at CRISIL Ratings.

"Whether this is enough to revive animal spirits, we'll have to wait and watch." ($1 = 65.79 rupees)

Re: Indian Economy News & Discussion - Aug 26 2015

http://profit.ndtv.com/news/economy/art ... ms-1242181

"Two Days After Bihar Setback, Modi Government Unleashes Big Bang FDI Reforms"

"Two Days After Bihar Setback, Modi Government Unleashes Big Bang FDI Reforms"

Re: Indian Economy News & Discussion - Aug 26 2015

IMO, a more precise article than Thomson Reuters:

http://www.livemint.com/Companies/HUVqf ... rates.html

"The debt-servicing capabilities of India’s conglomerates

Total debt at the top 10 groups has risen 7 times over the past 8 years, and adds up to 12% of the loans in the banking system and 27% of corporate loans".

PS: I guess "core profit" in the Thomson Reuters translates to EBITDA in financial speak?

http://www.livemint.com/Companies/HUVqf ... rates.html

"The debt-servicing capabilities of India’s conglomerates

Total debt at the top 10 groups has risen 7 times over the past 8 years, and adds up to 12% of the loans in the banking system and 27% of corporate loans".

PS: I guess "core profit" in the Thomson Reuters translates to EBITDA in financial speak?

Re: Indian Economy News & Discussion - Aug 26 2015

WTF it is like do not buy sugar ...............blah blah blah and the PS: Buy the sugar if you need sweetness in foodAustin wrote:Do not buy the Sovereign gold bonds which are on sale from 5-20 Nov 2015

Reasons why one should not buy the sovereign gold bonds

The most tax efficient way to accumulate gold for a marriage is to buy it: jewels if planning for a marriage and gold bars or coins if you plan to hold it as a hedge in case of war, hyperinflation, etc.

Sovereign gold bonds are ways to invest in gold. Not accumulate it.

Gold is an extremely volatile commodity and it is ill-advised to buy these bonds which come with a lock-in which is higher than that for ELSS mutual funds (3 years).

Those who wish to benefit from gold price movements or those who to add gold for diversification in their investment portfolios are better off with a gold etf or gold funds.

ETFs would have 1% to 1.5% expense ratios and the returns would be lower by that much. However, they offer unmatched liquidity. One can buy on dips and book profits. This freedom is vital when dealing with volatile instruments and is well worth the expense ratio.

The 2.75% interest rate is on the amount invested and not on the maturity value. This interest on the gold bonds shall be taxable as per the provision of Income Tax Act, 1961 (43 of 1961) as income from other sources. Sovereign Gold Bond 2015-16. That is it would be taxed as per income slab.

Such a low post-tax interest rate is not worth it considering the associated lock-in. Imagine the price movement in gold, if these bonds were issued five years ago.

Yes, Sovereign gold bonds will beat ETF returns by about 2.4% for those in 30% slab and about 2.6% for those in 20% slab. Is that enough reward for being locked in for 5 years with a volatile asset class? A vehement no, in my opinion.

Gold is not a fixed income asset class. Investing in gold is riskier than investing in stocks! So I expect a risk premium. This risk premium should be free from constraints. The lock-in period with a small interest rate that would be taxed as per slab are not good enough for me.

Conclusions:

Buy physical gold (not ETFs) if you wish to accumulate gold for a marriage or as a hedge.

Use ETFs invest in gold to diversify your portfolio.

Do not buy the sovereign gold bonds which are currently on sale.

Re: Indian Economy News & Discussion - Aug 26 2015

Though the underlying tone is still bad, the article has very interesting Stats. Therefore posting in full

Why India is about to move to the ‘center stage’ of world energy

Why India is about to move to the ‘center stage’ of world energy

The disconnect is huge: Even as countries of the world pledge to cut their greenhouse gas emissions going into the Paris climate talks, recent analyses suggest that overall emissions will still rise through the year 2030, and current national pledges will merely blunt the force of that trend.

The key reason, highlighted in the new 2015 World Energy Outlook by the International Energy Agency, is that the coming decades will also see an incredible one-third growth in overall energy consumption through 2040, much of which will still be satisfied by coal and other fossil fuels. The agency highlights one particular country to underscore this trend – though there are many other candidates – India, home to 1.3 billion people, 240 million of whom lack electricity, most of them living in rural areas.

This, the IEA says, is why India is about to surpass China as the dominant global energy story.

“We think India is moving to the center stage of global energy,” IEA executive director Fatih Birol says. “All the numbers are indicating that India will be the number one country in terms of coal consumption worldwide. India will be the number one country for the oil demand growth worldwide. And India will be the country with more than 20 percent of the solar PV worldwide.”

This is happening, of course, because China is slowing down, nearing the end of what Birol calls the “single largest demand growth story of energy history.” Meanwhile, India’s demand is set to boom as it not only expands electricity to those who currently lack it, but as population growth and a move toward urbanization mean more cars, more appliances, and more overall fuel and electricity.

The new IEA report profiles India in depth, pointing out that the country has ambitious clean energy plans, shooting for 175 gigawatts of renewable energy capacity by 2022 in the form of mass deployments of wind, solar and hydropower. However given the growth in electricity demand and that the country’s power sector is highly dependent on coal, a great deal of the expected demand growth will also mean burning more of this carbon intensive fuel.

ust how big is the growth likely to be? IEA points out that while India has 18 percent of the globe’s population, it only accounted for 5.7 percent of its energy demand in 2013.

And it’s not just lack of electricity – it’s everything that goes with it. “India also has the largest population in the world relying on the traditional use of solid biomass for cooking: an estimated 840 million people – more than the populations of the United States and the European Union combined,” the IEA notes.

This form of cooking is dangerous to health because of the indoor air pollution it creates. Getting people away from burning biomass is a very good thing, but it also means electrification and thus more use of all energy sources, including renewables but also coal.

India’s Intended Nationally Determined Contribution outlined for the Paris talks is highly detailed, outlining plans to have 40 percent of its power capacity be renewable by 2030, to plant enough trees to pull 2.5 to 3 gigatons of carbon dioxide equivalents out of the air, and to reduce the “emissions intensity” of its economy by 33 to 35 percent. So the country has clear clean energy ambitions, but it has also been faulted for failing to declare a peak for its growing emissions.

On top of that, the IEA says that to lessen the carbon implications of India’s growth – to the extent that that is possible – the country will have to take additional measures such as constructing energy efficient buildings (so as not to be locked into inefficient ones for another generation), building smart cities and striving to control air pollution.

“We will have to follow the Indian energy policies much more closely in the future,” Birol says.

India is a key focus of the IEA’s 2015 World Energy Outlook, but the agency also examines many other trends. It expects that low oil prices will gradually rise to around $80 a barrel by 2020, though it also considers a scenario in which they could stay lower for longer, harming fuel efficiency gains and also making the world more dependent on the Middle East.

IEA also says that natural gas will continue to see global growth – “among the fossil fuels … the only one that sees its share rise” — particularly thanks to liquified natural gas or LNG transport worldwide, although the required pipelines and infrastructure will be costly. Meanwhile, coal will suffer overall, satisfying only about 10 percent of the total new growth in electricity demand. That’s because even though use will rise in places like India and Southeast Asia, it will plummet in the United States and Europe and will see renewables take its place.

In the end, though, the big picture has become depressingly familiar by now – we’re changing how we get energy, but we’re not changing it fast enough for the climate. Renewables are moving too slowly, so too much of burgeoning new demand will still be met by fossil fuels, at least under current climate pledges and trends.

“The net result is that energy policies, as formulated today, lead to a slower increase in energy-related CO2 emissions, but not the full de-coupling from economic growth and the absolute decline in emissions necessary to meet the 2 °C target,” the IEA concludes.

Re: Indian Economy News & Discussion - Aug 26 2015

Govt announces FDI reforms in 15 key sectors

These involve allowing composite foreign investment to come in the private banking sector by up to 74%, easing of exit norms for construction sector, raising FDI cap in uplinking of news and current affairs in TV channels, DTH, cable network and regional airlines. In altogether, 15 areas and 32 investment points would benefit from the FDI liberlisation.

The government also increased the financial power of the Foreign Investment Promotion Board to give single window clearance for investment projects of up to Rs 5,000 crore from the current Rs 3,000 crore. This means that any proposal, which is not under the automatic route, beyond Rs 5,000 crore would now go to the Cabinet Committee on Economic Affairs (CCEA).

In a major reform, the government allowed composite foreign investment up to 74% in private sector banking. This was an area which did not see the complete fungibility of foreign investment, when the government allowed it for other areas earlier.

In the construction sector, the current conditions of area restriction of the floor area of 20,000 sq. mtrs in development projects and minimum capitalisation of $5 million to be brought in within the period of six months of the commencement of business, have been removed.

A foreign investor will be permitted to exit and repatriate foreign investment before the completion of project under the automatic route, provided a lock-in period of three years has been completed. The lock-in period will be calculated in refrerence to each tranche of foreign investment.

Besides, transfer of stake from one foreign investor to another would not be subject to lock-in period or any government approval.

However, condition of lock-in period will not apply to hotels & tourist resorts, hospitals, special economic zones (SEZs), educational institutions, old age homes and investment by non-resident Indians (NRIs).

FDI will still not be permitted in any entity, which is engaged in real estate business, construction of farm houses and trading in trasferrable development rights.

The government also allowed foreign investment up to 49% in defence sector under the automatic route from the current approval route. Besides, portfolio investment and investments by foreign capital venture investors have been raised to 49% from 24% at present.

In media, FDI cap in DTH, media networks was raised from 74% to 100%. However, condition of seeking approval from FIPB remains same.

Uplinking of news and current affairs on TV channels would draw FDI of 49% from the current 26%. In non-news, uplinking is allowed up to 100% as is the norm now, but it could be done under automatic route against the government approval at present.

Manufacturers will now be allowed to sell their products through e-commerce without the government approval.

The government can relax mandatory sourcing of 33% resources from domestic manufacturers in case of cutting technology single brand stores. Single brand companies are now allowed to sell products through e-commerce.

Besides, 100% FDI was now allowed in duty free shops located in customs bonded areas.

It has also been decided that a single entity will now be permitted to undertake both the activities of single brand retail trading and wholesale with the condition that conditions of FDI policy on wholesale and and SBRT have to be complied by both the business arms separately.

Now regional airlines were also allowed to draw 49% FDI in line with larger airlines.

Foreign equity caps of certain sectors — non-scheduled air transport service, ground handling services, satellites — establishment and operation and credit information companies were permitted to attract 100% FDI against 74%.

While 100% FDI has been allowed in DTH, cable network and plantation crop, overseas investment limit in uplinking of news and current affairs TV channels has been raised to 49% from 26%.

The government relaxed conditions for FDI in single-brand retail and allowed 100% FDI under automatic route in duty-free shops and Limited Liability Partnerships (LLP) and eased foreign investment norms in the defence sector.

-

Theo_Fidel

Re: Indian Economy News & Discussion - Aug 26 2015

This would be a good time to put this sucker on the market and see if anyone will take a flyer on it.

http://www.business-standard.com/articl ... 594_1.html

http://www.business-standard.com/articl ... 594_1.html

Air India expected to post Rs.6 crore operating profit

Minister of State for Civil Aviation Mahesh Sharma in July had informed the Lok Sabha that the net loss of the company during 2014-15 stood at Rs.5,547.40 crore down from Rs.7,559.74 crore in 2011-12.

"The company has achieved the targets set out in the TAP and has made substantial progress in both operational as well as financial areas," the minister said in a written reply.

According to the minister, the operating losses reduced to Rs.2,171.40 crore in 2014-15 from Rs.5,138.69 crore in 2011-12.

"The company has turned EBIDTA positive by Rs.541.60 crore as against the negative EBIDTA of Rs.2,236.95 crore in 2010-11," the minister said.

The minister added that the total revenue of the airline increased by 33.25 percent to Rs.4,026.31 crore as compared to levels of 2011-12.

"The total revenue during 2014-15 is Rs.19,718 crore as against Rs.14,713.81 crore in 2011-12," the minister added.

The passenger load factor which is a key indicator of the airlines performance improved to 73.1 percent in 2014-15 from 67.9 percent in 2011-12.

Air India had borrowed Rs.21,412 crore to buy new aircraft and Rs.22,368 crore as working capital. Its current losses stands at Rs.22,000 crore.

-

Theo_Fidel

Re: Indian Economy News & Discussion - Aug 26 2015

Meanwhile...

http://www.btvin.com/article/read/polic ... iling-psus

http://www.btvin.com/article/read/polic ... iling-psus

With pressure mounting to meet the fiscal deficit target for FY16, the government is drawing up a policy for sale of loss making PSUs to meet the disinvestment target of Rs 69,500 crore, sources told Bloomberg TV India on Monday.

The news sent loss-making HMT shares higher by as much as 4 per cent while MTNL was up 1.1 per cent.

"Policy for sale of loss-making PSUs is likely in few weeks," an official said requesting anonymity. The sale of loss-making PSUs may include ceding management control, the official said.

In the Budget for FY16, Finance Minister Arun Jaitley projected total disinvestment receipt at Rs 69,500 crore--Rs 41,000 crore from the normal PSU stake sale and Rs 28,500 crore from "strategic" disinvestment.

Re: Indian Economy News & Discussion - Aug 26 2015

Despite the buoyant revenues, the aggressive spending on infrastructure means GoI is still mindful of the fiscal deficit target. Particularly so since the disinvestment plans were delayed by the overall market weakness since August.

-

Theo_Fidel

Re: Indian Economy News & Discussion - Aug 26 2015

Excellent write-up on the telecom twins. All sides, positive & negative of BSNL/MTNL discussed. MTNL in particular is a money destroyer...

http://www.businessworld.in/opinion-col ... EhKss.dpbs

http://www.businessworld.in/opinion-col ... EhKss.dpbs

MTNL is an abomination. It has a market capitalisation, as of Wednesday closing, of Rs 1,165 crore on an end of day price of Rs 18.50 and 34,391 employees as of December 31, 2014.

For the quarter ending June 30, 2012, its losses had overtaken its revenues - Rs 1,059 crore and Rs 833 crore, respectively. For the full year ended March 31, 2012, the story was exactly the same - revenues of Rs 3,368 crore against losses of Rs 4,018 crore.

The total debt on its books for 2011-12 was Rs 9,647 crore and its staggering wage bill was Rs 1,740 crore.

Throw in a pension bill of Rs 340 crore and you can't begin to imagine the financial burden that the running of this company places on the government. its financials for 2012-13 were a total income of Rs 3783 crore squared off against a net loss of Rs 5322 crore. For 2013-14, total income stood at Rs 3872 crore and a net profit of Rs 7820 crore for reasons explained above.

Stock broker Ramesh Damani appalled at the state of play had told me, "They are basket cases. Obviously, they have been bypassed by the telecom revolution. Both have to be sold off; there is no business case anymore for the Government to stay in the telecom sector.

"In a competitive set-up, they have seen erosion in their market share. MTNL's market cap is less than its payroll cost."

Re: Indian Economy News & Discussion - Aug 26 2015

If Air India is on a path becoming, it should now but wait fir few more years. If the profits double, then GoI would get lot more out of the sale. Why do a fire sale?

-

Theo_Fidel

Re: Indian Economy News & Discussion - Aug 26 2015

Oil price is low right now so profits up. May not last...

Re: Indian Economy News & Discussion - Aug 26 2015

But then it could be a trigger for the turn around. If there is no turnaround, then the valuation might not suffer all that much. On the other hand the upside after a turnaround would be much larger. The expected value of the differential is positive, especially some reforms have been started (what better time than when oil prices are low) which will yield results after a couple of years from now.

Re: Indian Economy News & Discussion - Aug 26 2015

AI as well as MTNL, BSNL were systematically hobbled, purposely gutted and then raped for decades by venal politicians and greedy, devious and grubbing baboo(n)s.vayu tuvan wrote:If Air India is on a path becoming, it should now but wait fir few more years. If the profits double, then GoI would get lot more out of the sale. Why do a fire sale?

the manipulative private players fed off and fattened on the carcass of these companies, drained their trained manpower and then established themselves by stealing customers, routes and infrastructure. In any other country, the whole anti national lot of them, the private players, politicos and the baboo(n)s would have been jugged a very long time ago.

I well remember a previous conversation on this very topic which ended in cautionary warnings from the mods. For all, maybe it is best to let sleeping dogs lie.

Last edited by chetak on 12 Nov 2015 00:34, edited 1 time in total.

-

Theo_Fidel

Re: Indian Economy News & Discussion - Aug 26 2015

Vayu,

At this point you are speculator with taxpayer money. You can always speculate future will be rosy but unlikely.

No, Air India will never turn around. Look at its wage bill or its per sector revenue. Look at all the free tickets and VIP privileges. Look at the fact that majority of its routes lose money even now. Look at its accumulated losses sitting with banks, RS 22,000 Crore last year. And look at who the promoter is...

At this point you are speculator with taxpayer money. You can always speculate future will be rosy but unlikely.

No, Air India will never turn around. Look at its wage bill or its per sector revenue. Look at all the free tickets and VIP privileges. Look at the fact that majority of its routes lose money even now. Look at its accumulated losses sitting with banks, RS 22,000 Crore last year. And look at who the promoter is...

Re: Indian Economy News & Discussion - Aug 26 2015

Theo_Fidel wrote:Oil price is low right now so profits up.MayWill not last...

Re: Indian Economy News & Discussion - Aug 26 2015

Theo_Fidel: In case of AI probably you are right. It has been a poor performer for a couple of decades but there was no alternative back in 1970-80s. Not too many international airlines would fly to/from India.

Added later

On the other hand, I do object (respectfully) to your characterizing my proposal to wait as speculation. Selling now is also speculation, isn't it? People have to work with expected values. Opportunity costs needs to be figured in too. Decision making under uncertainty is speculation any which way you look at it. Hold or sell? I am for the former and you are for the latter.

Added later

On the other hand, I do object (respectfully) to your characterizing my proposal to wait as speculation. Selling now is also speculation, isn't it? People have to work with expected values. Opportunity costs needs to be figured in too. Decision making under uncertainty is speculation any which way you look at it. Hold or sell? I am for the former and you are for the latter.

Last edited by Vayutuvan on 13 Nov 2015 02:18, edited 1 time in total.

Re: Indian Economy News & Discussion - Aug 26 2015

Money manager blurb: India on track to overtake Japan as world's 3rd largest economy by 2025

This is in nominal GDP terms, not PPP GDP. We are already #3 in PPP terms. Japan's current GDP is $4.6 trillion

This is in nominal GDP terms, not PPP GDP. We are already #3 in PPP terms. Japan's current GDP is $4.6 trillion

Re: Indian Economy News & Discussion - Aug 26 2015

I would first list these companies if I want to sell them or bring in a majority private partner in PPP mode. A fire sale will only bring political oppobrium.

-

member_29228

- BRFite -Trainee

- Posts: 65

- Joined: 11 Aug 2016 06:14

Re: Indian Economy News & Discussion - Aug 26 2015

Reliance still wil not reduce price of natural gas as its monopoly with KG basin and AP