Perspectives on the global economic changes

Re: Perspectives on the global economic changes

Don’t blame China, key to turmoil lies closer to home

Views of a global economy that is either strong enough to bounce back or where options are running out if quantitative easing fails

Views of a global economy that is either strong enough to bounce back or where options are running out if quantitative easing fails

::This article was amended to reflect the ECB has not increased QE from €60bn to €80bn a month::Our financial sector is built on sand,” Michael Lewis, the American author, told me last week. “After all, we’re in the middle of a huge monetary experiment, with central banks playing a bigger role in stimulating growth than we’ve ever seen.”

Back in 2010, Lewis wrote The Big Short – an expose of the banking shenanigans that sparked the 2008 financial crisis. It has since been made into a glitzy Hollywood movie, which enjoyed its UK premier last week.

It’s ironic the film is being released amidst serious financial volatility. Over £50bn was wiped off Britain’s biggest companies last Wednesday, as the FTSE 100 index of leading stocks plunged to a four-year low. For the first time since 2008, UK equities entered “bear market” territory, with stocks 20pc down on their previous peak.

As panic-selling spread across the world, trillions of dollars of value vanished into thin air. Investors are contemplating a re-run of the global financial crisis, with all the associated economic costs.

It’s a cliché to claim this nerve-shredding market sell-off has been caused by China. While I fully accept the second-biggest economy on earth has slowed over the past year, I’m highly sceptical that a relatively small fall in Chinese growth is the real reason investors are so spooked.

The main explanation, it seems to me, is the sharp fall in the price of oil – plus the fact that the US, Western Europe and Japan, despite years of unprecedented monetary and fiscal stimulus, have failed to stage a significant and sustainable economic recovery. In that sense, I agree with Michael Lewis.

The oil price hit its lowest level since 2003 last week. Even plunging crude is constantly attributed to China. Yes, of course, even a relatively minor slowdown in such a large, investment-heavy economy means less oil will be consumed than would otherwise have been the case, pushing the oil price down.

The reality is, though, that despite GDP growth falling to 6.9pc in 2015 from 7.3pc the year before, Chinese oil use still rose 2.5pc. This year, too, even though growth will almost certainly fall further, China’s demand for crude is still set to grow 1.5pc to 2pc.

China consumed 10.32m barrels of oil per day last year – an all-time high. The International Energy Agency, the leading oil think-tank, estimates that instead of growing by 600,000 barrels a day this year, total Chinese oil use will instead increase by around 400,000 barrels. This shortfall amounts to 0.2pc of projected global oil use in 2016 – hardly enough to drive crude to a 13-year low.

No, the main reason oil has tumbled 70pc since mid-2014, and over 40pc since early December, is the extraordinary commercial and, ultimately, geopolitical battle now ensuing between Saudi Arabia and the US.

That’s resulted in an enormous supply glut, as the Desert Kingdom has flooded global markets with crude in a bid to push upstart American “shale” companies out of production. This fight for market share has destroyed the coherence of the Opec exporters’ cartel, driving up crude inventories even more.

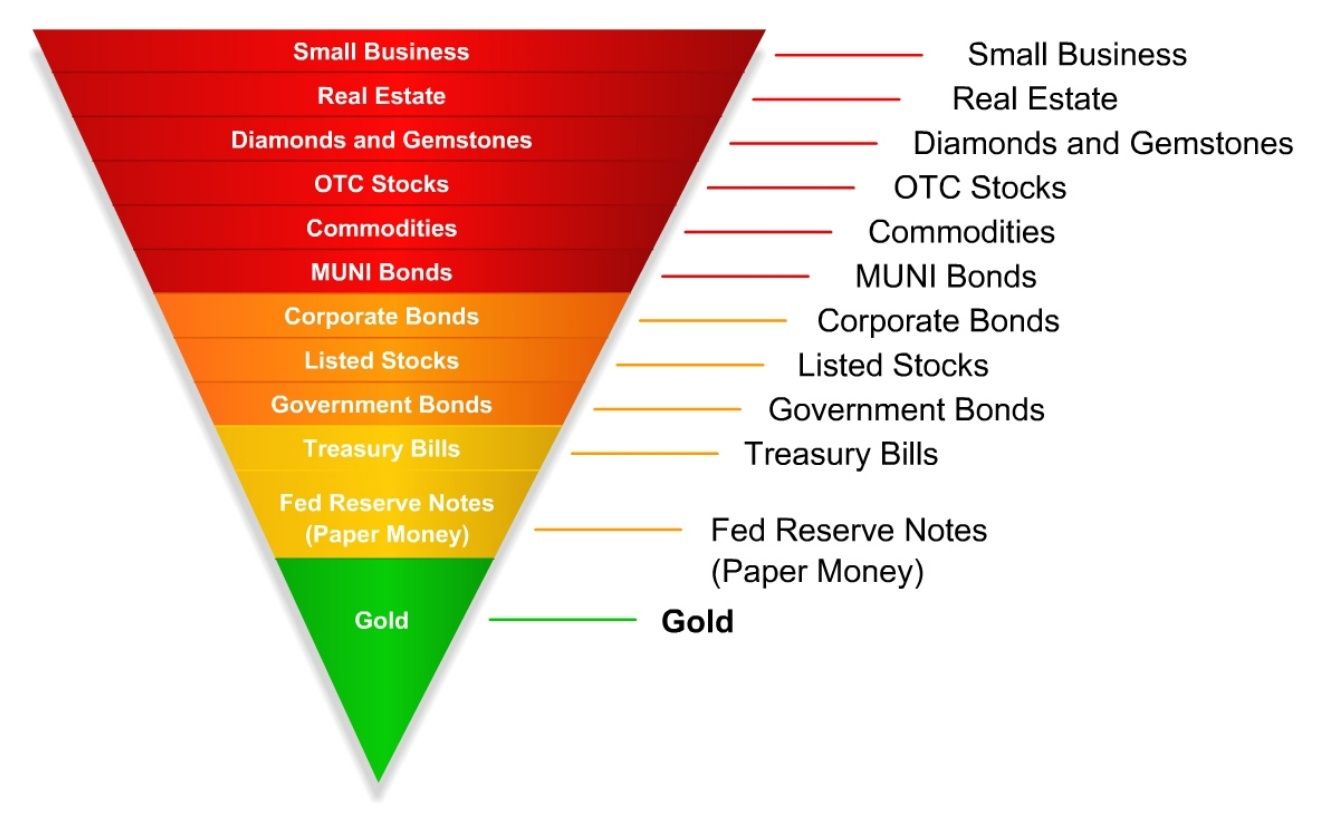

Ultra-low oil is also causing havoc in America’s “junk bond” market. Junk bonds energy spreads – the average gap between the yields demanded by creditors of America’s shale energy producers, compared to investment-grade corporate bonds or Treasuries – have widened by more than 6pc over the last two months. This has piled pressure on such companies, as rising debt service costs and collapsing revenues push them closer to bankruptcy.

When oil prices were high, lots of banks, including some of the biggest names on Wall Street, extended highly speculative loans to drilling companies in Texas, North Dakota and other centres of America’s shale boom. An estimated $500bn (£352bn) of such debt is outstanding. Those loans are rapidly going bad – which is why this sector is increasingly being talked about, in another 2008 throwback, as “the next sub-prime”.

No wonder it’s easier to point constantly to “the Chinese slowdown” as the reason for skittish financial markets.

Last week, while trimming its global growth forecasts for this year and next, the International Monetary Fund made numerous references to the People’s Republic. Yet, when you examine the fine print, the IMF’s estimate of Chinese growth in 2016 remains at 6.3pc, the same as it was back in October when markets were relatively calm. China, in fact, while it featured heavily in the IMF’s rhetoric, was one of the very few countries the fund didn’t downgrade over the last three months.

Since these latest market squalls, various economic and political luminaries have been wheeled out to assert that there is “nothing in the economic fundamentals” to justify falling equity prices. I’m not so sure. For years, Western stock markets have been pumped up by printed money, as the Federal Reserve has increased its balance sheet more than three-fold since 2009 – ably assisted in such bubble-blowing by the Bank of England and the Bank of Japan.

Now, despite all that monetary juice, and massive government borrowing, the US economy is starting to suffer. Industrial production has contracted year-on-year for three months in a row. Retail sales also fell 0.1pc in December, with consumption growing just 2.1pc during 2015 as a whole, the weakest increase in six years. And because of America’s wide share ownership, of course, falling equity prices themselves undermine consumer sentiment which, in turn, damages the economy further, feeding back into stocks.

Perhaps inevitably, the main policy response to last week’s volatility came in the form of more promised money-printing – which brought some relief to frazzled markets.

While it was initially the US and the UK which engaged in “quantitative easing” after the 2008 crash, the European Central Bank has since taken up the baton. “We will review and possibly reconsider our monetary policy”, said ECB supremo Mario Draghi on Thursday. We’re about to see even more, much of which will, one way or another, find its way into already overpriced stocks traded in London, New York and elsewhere.

The causes behind recent stomach-churning falls on stock markets world-wide are many and varied. Of course, China is slowing. And, clearly, some of the other large emerging markets are on their economic uppers, not least those such as Brazil and Russia that are major energy exporters.

It is, though, disingenuous, simplistic and plain wrong for Western analysts constantly to absolve ourselves of any responsibility, insisting that our financial and economic woes are all because of “them”.

What is really gnawing away at investors is the sense that QE must end at some stage, Western interest rates must rise and nobody knows how our bloated financial markets will react when that finally happens.

We have, engaged in an unprecedented – and, in my view, reckless – monetary experiment in an attempt to dig our way out of our post sub-prime malaise without facing up to the regulatory and structural problems which actually caused the crisis.

Since the Fed took the plunge and raised rates last month, financial markets have been extremely turbulent. That’s no coincidence. We were told, in the name of “forward guidance”, to expect four rate hikes in 2016 – yet only two are now priced in. That points to an alarming truth – that the Fed is losing credibility. As Lewis says: “Our central bank has no more ammunition.”

I sincerely hope financial markets correct gradually and a ghastly crisis is avoided. If not, though, blame must be shouldered and lessons learnt – lest the same mistakes be made again.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

Austin,

Read Flashboys- Cracking the Money code by Michael Lewis. Its just magnificent. If you have watched 'The big Short' again a ML book, the Flashboys is even better.

From Indo-Uk thread from last May.

The information about dark pools arbitrage etc. is just incredible. And its happening even now.

Read Flashboys- Cracking the Money code by Michael Lewis. Its just magnificent. If you have watched 'The big Short' again a ML book, the Flashboys is even better.

From Indo-Uk thread from last May.

The information about dark pools arbitrage etc. is just incredible. And its happening even now.

The book is called 'Flashboys - cracking the money code' by Michael Lewis.

The explanation is Americanization of Financial services. I will try to explain this in a few lines what the book took a few pages. In a stock market,, there is an exchange. The exchange with makes buying and selling of stock possible. If you want to buy 100,000 shares of microsoft but only 2000 are available. you DONT buy 2000 alone because if you buy 2000 the next 98000 will cost you a bit more than what you paid for the 2000. Now in a free market, can such a monopoly be allowed. Why should NYSE, LSE, BSE be the only designated exchanges? Now if there were more than 1 exchange where this buying is possible, how good it is for the market? More choice, right? How far can you be from the market?

The question arises 'Where is the market located'? Its everywhere in reality. The old London Stock exchange is located in central london. However, NYSE opened an exchange to compete with it in Docklands, then there is one based in Basildon, Essex. Another one is based in Slough next to Reading. To make connections to each other they needed high speed connections. It gave rise to the need of fibre-optic communications, high speed switches, faster servers. Every 2 weeks it was shaving off 0.3 microseconds of speed from the time before. If I place an order for 100000 shares, after seeing there is 100000 shares available and it took my order to get to the market 1 second. If a high frequency trader saw I was placing this order and bought those 100000 shares 0.5 millisecond before I did and then sold it 0.3 millisecond before I bought it, I lost money by buying at a higher price. It may be a small number for a small trader like me, however if a big hedge fund placed an order over the whole year worth 200 billion dollars, the costs could add up substantially. The exchanges create the market and in trying to lure us to make money by buying stock, we get screwed over.

The business location within the city of London may not give much advantage in terms of regulatory protection but they certainly do give advantage as the bourse located within the LSE sets the price i.e. the FTSE is located in theory the closest to LSE than to BATS or NASDAQ BX. There is no way one could get a huge office block adjacent to LSE like the big banks have in Docklands. So they work on arbitrage. The know they will make money as long as they can front run the order.

Re: Perspectives on the global economic changes

the Chinese were in on it too. they struck deals all over the globe tying up oil sources.....Iran, all over Africa, and Venezuela plus other deals that I am sure I am forgetting about....

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

From zerohedge

Yesterday, courtesy of Bank of America, we showed an extensive catalog of how a trader could, in case the market "were to crash tomorrow", hedge said crash risk crash using the cheapest derivative instruments.

But the real question of course is whether a crash is indeed coming?

As Bank of America notes, a traditional telltale sign of crashes is a surge in correlation among various otherwise uncorrelated assets. ...

Which is notable because as we showed earlier, the correlation among two key asset classes, namely stocks and oil, have soared to record highs...while the respective vol correlations is likewise surging, as one would expect, soaring.

This, to many traders, is the first clear sign that something is seriously wrong and a broad selloff may either be imminent or necessary to short circuit a market in which all correlations are converging.

And yet, as BofA shows with the chart below, option markets always underestimate the severity of market shocks, and to different degrees. In 2008, currency and equity vols were the most optimistic ahead of the Lehman crisis and the most surprised after. This time around equity vol is modestly elevated, but it is rate vol - the vol which many say is at the core of the entire financial system - that is surprisingly depressed.

So for those who are inching closer to the "crash is imminent" camp, we suggest taking a look at the chart below showing the stress levels, or rather lack thereof, 2 months prior to every major crash in the past decade, and extrapolating how far said "stress" may soar to in the coming 8 weeks if, as Citi, JPMorgan and Deutsche Bank today suggest, central banks are on the verge of losing control...

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

Hanumadu ji,hanumadu wrote:I hope they don't ask India next. If UPA is in power when the world comes to India for QE, UPA will only be glad to oblige. Anyway, India did not benefit from the QEs, so don't see why India should oblige.

Here is a link A gupta posted which proves we are doing QE - just not calling it so.

http://forums.bharat-rakshak.com/viewto ... 9#p1971849

Also another one that Suraj posted

http://forums.bharat-rakshak.com/viewto ... 9#p1971479

You may want to know where will the 70000 crores to recapitalise the banks will come from? Thin air of course. Now a days though the air is not thin any more.

Re: Perspectives on the global economic changes

^^ How do we do QE raising Public Debt or some other way ?

Re: Perspectives on the global economic changes

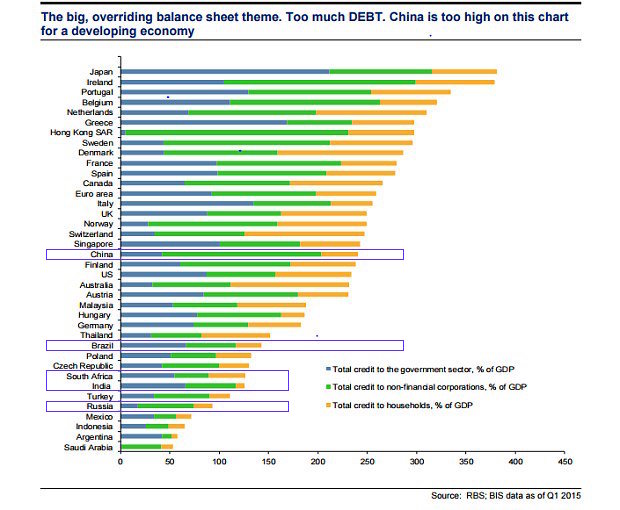

Debt Pile: BRICS v BRIS

http://trueeconomics.blogspot.hr/2016/0 ... -bris.html

http://trueeconomics.blogspot.hr/2016/0 ... -bris.html

Per chart above, China’s debt is approaching 250 percent of GDP, with second-worst BRICS performer - Brazil - sitting on a smaller pile of debt closer to 140 percent of GDP. The distance between Brazil and the less indebted economies of South Africa and India is smaller yet - at around 12-14 percentage points. Meanwhile, the least indebted (as of 1Q 2015) BRICS economy - Russia - is nursing a debt pile of just over 90 percent of GDP, and, it is worth mention - the one that is shrinking due to financial markets sanctions.

Re: Perspectives on the global economic changes

Arguably, the quality of debt in the case of India and Brazil are also better, since most of the debt is sovereign local currency debt. In the case of China, ~75% of the debt is corporate debt, which is a big red flag. In India's case, eyeballing that graph, the corporate+household debt is smaller than government debt. Government debt in local currency is the least concerning kind - the same government prints the currency and can debase it to pay down its debt. High levels of private and corporate debt, on the other hand, is a problem.

Re: Perspectives on the global economic changes

70000 cr is 11 billion which is peanuts really compared to the US, EU and Chinese QE.panduranghari wrote:Hanumadu ji,hanumadu wrote:I hope they don't ask India next. If UPA is in power when the world comes to India for QE, UPA will only be glad to oblige. Anyway, India did not benefit from the QEs, so don't see why India should oblige.

Here is a link A gupta posted which proves we are doing QE - just not calling it so.

http://forums.bharat-rakshak.com/viewto ... 9#p1971849

Also another one that Suraj posted

http://forums.bharat-rakshak.com/viewto ... 9#p1971479

You may want to know where will the 70000 crores to recapitalise the banks will come from? Thin air of course. Now a days though the air is not thin any more.

Re: Perspectives on the global economic changes

The Indian bank recapitalization program is strictly speaking, not QE. The term QE is thrown around too casually. QE is unconventional policy action taken when standard monetary policy actions do not bear results, often because the rates themselves are already so near 0% that there's no further conventional action possible.

That is not the case with India. The PSU bank recapitalization program addresses the question of recapitalizing banks with NPAs on their books, and comes together with plans to set up a SPV to take the approx. Rs.8 lakh crore of NPAs entirely off the books of the PSU banks. The cost of recapitalization is borne out of revenues to GoI and comes from the budgetary allocations.

This is a far more mundane exercise than QE. A QE-like measure would be to lower rates artificially and compel banks to lend, hoping the revenues will help pay down the NPA balance.

That is not the case with India. The PSU bank recapitalization program addresses the question of recapitalizing banks with NPAs on their books, and comes together with plans to set up a SPV to take the approx. Rs.8 lakh crore of NPAs entirely off the books of the PSU banks. The cost of recapitalization is borne out of revenues to GoI and comes from the budgetary allocations.

This is a far more mundane exercise than QE. A QE-like measure would be to lower rates artificially and compel banks to lend, hoping the revenues will help pay down the NPA balance.

Re: Perspectives on the global economic changes

That would be true for any country then that has debt in local currency and then country wont hesitate to increase their debt.Suraj wrote:Arguably, the quality of debt in the case of India and Brazil are also better, since most of the debt is sovereign local currency debt. In the case of China, ~75% of the debt is corporate debt, which is a big red flag. In India's case, eyeballing that graph, the corporate+household debt is smaller than government debt. Government debt in local currency is the least concerning kind - the same government prints the currency and can debase it to pay down its debt. High levels of private and corporate debt, on the other hand, is a problem.

Corporate debt are any ways private debt so it really does not concerns the government as the state defaulting on loans and lowering its credit ratings is non-existant

Re: Perspectives on the global economic changes

That's exactly why I said Indian and Brazilian debt composition is 'better' because the majority of it is government debt, whereas 75% of Chinese debt is corporate debt, and corporate+household debt in China together adding up to (eyeballed) 80-90% of total . Essentially states don't default on debt in their own currency, only that of debt held in another currency that they cannot debase.

Re: Perspectives on the global economic changes

But what is the downside of debasing currency , I am sure there is no free lunch for any body ? Inflation ?Suraj wrote:That's exactly why I said Indian and Brazilian debt composition is 'better' because the majority of it is government debt, whereas 75% of Chinese debt is corporate debt, and corporate+household debt in China together adding up to (eyeballed) 80-90% of total . Essentially states don't default on debt in their own currency, only that of debt held in another currency that they cannot debase.

And if Chinese Debt is corporate debt which companies have borrowed during to ZIRP due to their own business reason then why should Chinese government worry , I mean of Chinese government itself has borred say in USD from US banks then they would have to pay back in USD but of the government itself has borrowed in Renminbi like India did in Rupee then they may not worry as well

Re: Perspectives on the global economic changes

Of course, inflation is the result. Governments who hold significant debt in their currency *want* inflation. It's not a 'downside' or 'side effect'. Inflation is what keeps the servicing of debt stock manageable. I'm not making an ideological argument here, but stating how it works practically.Austin wrote:But what is the downside of debasing currency , I am sure there is no free lunch for any body ? Inflation ?

Re: Perspectives on the global economic changes

Agree but its like passing the burden to the public in form of inflation but I would also assume higher inflation rate also affects the interest rates of Central Bank which affects the rate at which you can borrow as well , so in a way its cyclicSuraj wrote:Of course, inflation is the result. Governments who hold significant debt in their currency *want* inflation. It's not a 'downside' or 'side effect'. Inflation is what keeps the servicing of debt stock manageable. I'm not making an ideological argument here, but stating how it works practically.Austin wrote:But what is the downside of debasing currency , I am sure there is no free lunch for any body ? Inflation ?

Re: Perspectives on the global economic changes

A very apt question., let me attempt to answer.Austin wrote: And if Chinese Debt is corporate debt which companies have borrowed during to ZIRP due to their own business reason then why should Chinese government worry , I mean of Chinese government itself has borred say in USD from US banks then they would have to pay back in USD but of the government itself has borrowed in Renminbi like India did in Rupee then they may not worry as well

Question is always, what is the company doing with borrowed money? The borrowed money is utilized in several ways, but primarily it is to expand business. That means either invest in R&D to create new markets for different products or address demand in existing markets or raise your productivity to make your products/services cheaper and enhance your margins.

Of course there is significant overlap on those areas, for example setting up an airline with latest boeing airplanes for reduced operating costs and service standards matching or exceeding singapore airlines may ensure that you are on path to profitability. But doing exactly the reverse will ensure that your debt goes to naught. A case in infrastructure building: ordos. Large cities that are unoccupied!

Second is debt servicing. How much of the revenue is spent to pay back the interest on the debt. With falling margins (shrinking or stalling economy for eg), the amount left for debt servicing is less and then that corporate enters into a debt spiral., that is they borrow more to pay the previous debt.

In effect, it is like the desi student who keeps on opening credit cards (lines) and takes money from new line to pay for the previous line, till either the desi student gets a job or declares bankruptcy.

Chinese corporate debt is in that spiral. As chinese companies start going into bankruptcy (in china there is no real bankruptcy)., they clog up the money supply route. Basically they owe a debt to the bank, but are not paying back and the bank stops giving credit to others. This creates demand destruction and asset deflation and we enter into 'deflation'.

Since nothing is real in Chinese numbers., there is real fear of China entering into a deflationary cycle and pulling the rest with them (commodities) and nobody knowing when!

In US, the frackers borrowed some US $400 Billion from banks., and now with fall in oil prices, their margins are squeezed (waay squeezed) which means when they are pumping more oil to meet their revenue targets and debt servicing. When the oil runs out (eventually it will be costly to get the oil out), they will go bankrupt and clog up some $400 Billion of bank debt. Of course there are others who will buy their asset at the cheap and the banks (or the current creditors to the frackers) will have to eat up the loss. And this is what is roiling the US markets.

Of course there is a silver lining somewhere.

If India grows at 7.5/8 per year for next 10-15 years., it becomes the next growth engine of the world. That is, India will need oil, gas, coal, copper, iron, cement, sand, rice, wheat, coffee... (commodities)..., planes, trains, automobiles, (infrastructure)..., banking, financial, IT, transportation services ... .

And with low commodity prices, India is at an advantage to grow and grow fast. Another feather is that Indian economy itself has internal demand. That is lot of what India produces is consumed within India (pulses for eg!)., which China does not have. The good part with internal demand is that the country does not have to depend upon an external factor to goose up the demand and also Internal demand is more equitable.

So coming back to your question, yes China can write off all the debt of its chorporates. But without internal demand (or external demand)., it will lead to stagflation. That is stagnant growth and high inflation. Something India was at (or skirted around) in 2010. And the problem persists, since there is not much demand or tepid demand and increased money flow - any shock to the economy will lead to hyper inflation (which several S. American countries are familiar with). Asian economies going into hyperinflation is unlikely (that is because of the unique indic culture imparted to the rest of Asia from India - more on it some other day)., so stagflation is what China will skirt around for a while.

For India, it has to put all the public sector NPA to a better use. However the currency bankruptcy laws prevent a wholesale cleanup.

Last edited by disha on 29 Jan 2016 10:46, edited 1 time in total.

Re: Perspectives on the global economic changes

When household debt is high, the public wants inflation too. Why ? Because it makes it easier to pay that mortgage and car payment and the electronics bought on credit and the home equity line of credit and more...Austin wrote:Agree but its like passing the burden to the public in form of inflation but I would also assume higher inflation rate also affects the interest rates of Central Bank which affects the rate at which you can borrow as well , so in a way its cyclic

You are assuming that debasing currency is 'bad' and should stop. I would argue that arguing whether or not it's bad is pointless. It's been going on for a long time, and it's not going to change. Not just the government, but the corporate world and public themselves in most of the west want inflation because that graph you posted itself shows why - they're indebted and need inflation in income and earnings to help pay down their debt load. Inflation is a one dimensional problem only in places like India where people don't have a significant household debt burden and instead inflation largely hits them in the form of dearer prices of essentials, without helping them with their debt load because they don't have much of it.

Re: Perspectives on the global economic changes

Makes a good read of various opinions on current crisis

http://www.theguardian.com/commentisfre ... a-slowdown

http://www.theguardian.com/commentisfre ... a-slowdown

Re: Perspectives on the global economic changes

It depends on what the debt service costs are. Even if the debt is in domestic currency a big enough debt will mean that the governmentSuraj wrote:When household debt is high, the public wants inflation too. Why ? Because it makes it easier to pay that mortgage and car payment and the electronics bought on credit and the home equity line of credit and more...

You are assuming that debasing currency is 'bad' and should stop. I would argue that arguing whether or not it's bad is pointless. It's been going on for a long time, and it's not going to change. Not just the government, but the corporate world and public themselves in most of the west want inflation because that graph you posted itself shows why - they're indebted and need inflation in income and earnings to help pay down their debt load. Inflation is a one dimensional problem only in places like India where people don't have a significant household debt burden and instead inflation largely hits them in the form of dearer prices of essentials, without helping them with their debt load because they don't have much of it.

will spend most of its revenues paying interest instead of spending them on what they are supposed to be spent on. The trick in the

west has been the near zero interest rates set by the central banks . Dialing down the interest rate dials down the interest costs. But there is no guarantee that the interest rates will stay low forever and a huge debt could lead to a debt servicing shock. As we have seen even a minuscule raise of 0.25 basis point made market panic and commodity price was racing to bottom

The only way that domestic debt (regardless if it is private or public) can be reduced without actually paying it down or defaulting is

through inflation. Foreign debt is not typically given in local currency since most foreign lenders have some content between their ears.

So the claim that the debt burden can be reduced merely by debasing the currency is not true. Forex rates have nothing to

do with domestic debt. But a forex rate drop aka "debasement" can induce inflation. A high inflation policy is rather stupid since it

undermines economic growth and government revenues and for our country where so much of poverty any inflation will lead to rise in prices of food and retail prices.

So if they think debasing currency and raising inflation can take care of its Public Debt they would simply end up making life of common man in India more miserable then it is today.

-

nandakumar

- BRFite

- Posts: 1641

- Joined: 10 May 2010 13:37

Re: Perspectives on the global economic changes

Suraj

A clarification on your point regarding inflation benefiting households with borrowings. Doesnt it depend on whether household incomes are indexed (formally or informally) to inflation? A lot depends on how the national income which is the other side of nominal GDP, gets divided between the two factors of production namely the labour and capital. If owners of capital keep getting a larger and larger share of the national income, inflation will only further impoverish the households with a debt burden.

A clarification on your point regarding inflation benefiting households with borrowings. Doesnt it depend on whether household incomes are indexed (formally or informally) to inflation? A lot depends on how the national income which is the other side of nominal GDP, gets divided between the two factors of production namely the labour and capital. If owners of capital keep getting a larger and larger share of the national income, inflation will only further impoverish the households with a debt burden.

Re: Perspectives on the global economic changes

Like Austin said, there is no free lunch. It's important to note that monetary policies don't create wealth, they merely shift it, hopefully in a way that smoothes out whatever economic turbulence the economy is encountering. What's good for the debtors is bad for the lenders (i.e. banks), though lenders, being holders of massive amounts of capital, usually find a way to pass the buck back to the debtors, e.g. government bail-outs. Financial institutions generate wealth by preventing waste, and they do so by increasing the efficiency of resource allocation. Inefficiently allocated (i.e. wasted) wealth isn't gonna magically reappear via monetary policies.Suraj wrote:When household debt is high, the public wants inflation too. Why ? Because it makes it easier to pay that mortgage and car payment and the electronics bought on credit and the home equity line of credit and more...Austin wrote:Agree but its like passing the burden to the public in form of inflation but I would also assume higher inflation rate also affects the interest rates of Central Bank which affects the rate at which you can borrow as well , so in a way its cyclic

You are assuming that debasing currency is 'bad' and should stop. I would argue that arguing whether or not it's bad is pointless. It's been going on for a long time, and it's not going to change. Not just the government, but the corporate world and public themselves in most of the west want inflation because that graph you posted itself shows why - they're indebted and need inflation in income and earnings to help pay down their debt load. Inflation is a one dimensional problem only in places like India where people don't have a significant household debt burden and instead inflation largely hits them in the form of dearer prices of essentials, without helping them with their debt load because they don't have much of it.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

DavidD,

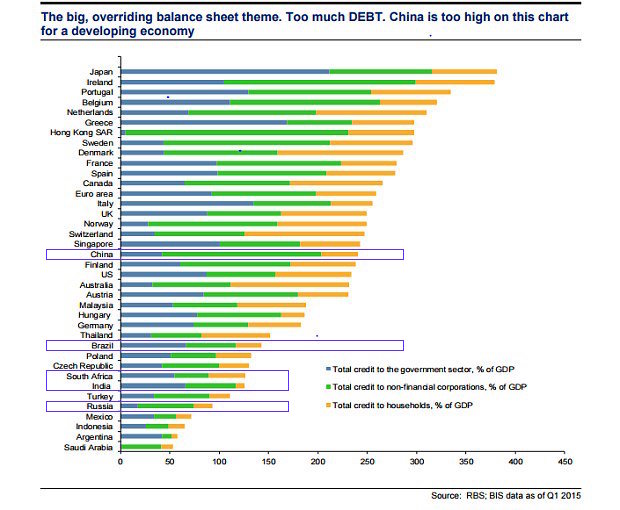

Unfortunately the understanding of the concept of wealth will take time. Some believe the notes in our wallet are wealth, some believe property is. And unless one wraps head around this important concept, when wealth destruction happens( as its happening now), we keep blaming assorted scapegoats.

Try Exters Inverse Pyramid to understand the wealth hierarchy and protect your wealth.

Unfortunately the understanding of the concept of wealth will take time. Some believe the notes in our wallet are wealth, some believe property is. And unless one wraps head around this important concept, when wealth destruction happens( as its happening now), we keep blaming assorted scapegoats.

Try Exters Inverse Pyramid to understand the wealth hierarchy and protect your wealth.

Re: Perspectives on the global economic changes

John Exter Inverse Expansion Pyramid

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

“Amazingly, people are paying Switzerland to warehouse their money for 10 years…That makes gold a high-yielder, because it yields zero” – Jeff Gundlach

Jeff Gundlach is correct. At 0%, Gold is now yielding more than two year government bonds in many countries in Europe and has an equivalent yield to that of Japan.

Last edited by panduranghari on 02 Feb 2016 18:09, edited 1 time in total.

Re: Perspectives on the global economic changes

No, actually you and Austin both misunderstand my point. I'm not claiming that there's a free lunch. I'm claiming that the government, the companies and the citizens who have accrued debt, *all* support the debasement of currency to help repay those debts. They also know that it cannot go on forever, but they'll still do it. That is *human nature*. We've been polluting our planet for generations. We raise kids wanting the best for them, but still pollute the planet they'll have to live on. We wrack up debts they're on the hook to repay down. We are like that as a species.DavidD wrote:Like Austin said, there is no free lunch. It's important to note that monetary policies don't create wealth, they merely shift it, hopefully in a way that smoothes out whatever economic turbulence the economy is encountering. What's good for the debtors is bad for the lenders (i.e. banks), though lenders, being holders of massive amounts of capital, usually find a way to pass the buck back to the debtors, e.g. government bail-outs. Financial institutions generate wealth by preventing waste, and they do so by increasing the efficiency of resource allocation. Inefficiently allocated (i.e. wasted) wealth isn't gonna magically reappear via monetary policies.

So why do people piously talk about 'no free lunch' ? Everyone knows there's no free lunch. And guess what ? They'll still choose the short term expedient option, in this case, by debasing currency to handle their debts. Any future bailout is a future problem, not to be worried about today. Don't believe it ? It's 2016 and everyone's talking about the 2007-08 crash repeating itself all over again. Our memory is that short, and the unwillingness to institutionalize change towards a sustainable system is that entrenched.

Mankind has been prolific at repeating mistakes of the past over and over again, in this regard. Despite all the sites like Mish and zerohedge and everything else, we're extremely adept at collectively screwing up with our eyes wide open, repeatedly.

Re: Perspectives on the global economic changes

Some opinion here , What do you think panduranghari ?

Why is Inflation so Low? Debt + Demand + Oil = Central Bankers

Why is Inflation so Low? Debt + Demand + Oil = Central Bankers

Re: Perspectives on the global economic changes

Gold yield 0%? What happened to the cost of carry?

GOLD COST OF CARRY = FUNDING INTEREST RATE + COST OF STORAGE – CONVENIENCE YIELD

Didn't the gold purchase on Jan 1, 2014 underperform?

GOLD COST OF CARRY = FUNDING INTEREST RATE + COST OF STORAGE – CONVENIENCE YIELD

Didn't the gold purchase on Jan 1, 2014 underperform?

Re: Perspectives on the global economic changes

US debt hits record $19 trillion

The United States federal debt has surpassed $19 trillion for the first time in history according to the Treasury Department. However, the real figure could exceed $65 trillion, according to a former US Comptroller General.

The official debt of $19 trillion represents almost $60,000 for every man, woman and child living in America today.

President Barack Obama took office with $10.8 trillion debt that has grown more than $8 trillion in seven years. And such a record tempo is likely to continue, according to the Congressional Budget Office, quoted by the Washington Times.

This equals an additional $70,000 in net federal borrowing for each of the 117,480,000 American households, according to Census Bureau estimates.

About $13.7 trillion makes up public debt, and the rest comes from government borrowing.

The US currently functions without a debt ceiling. Legislation in November suspended it through March 2017 so borrowing can continue without a limit until that time.

According to former Comptroller General of the United States [the director of the Government Accountability Office] David Walker, analysts understate the real extent of the US government’s financial commitments, which in reality exceed $65 trillion.

“You have to consider not just the public debt; you have to consider the debt we owe to the Social Security and Medicare trust funds, as well as the huge unfunded obligations for our social insurance programs. When you add all those numbers up, the number is over $65 trillion, rather than the lower numbers a lot of the economists want to talk about,” Walker, who served as the US’ top accountant in 1998-2008, told RT.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

Hear, hear. Truer word has not been spoken.Suraj wrote:

Mankind has been prolific at repeating mistakes of the past over and over again, in this regard. Despite all the sites like Mish and zerohedge and everything else, we're extremely adept at collectively screwing up with our eyes wide open, repeatedly.

Boss, you give me too much credit. I dont understand these things. All I see if debt destruction.Austin wrote:Some opinion here , What do you think panduranghari ?

Why is Inflation so Low? Debt + Demand + Oil = Central Bankers

http://forums.bharat-rakshak.com/viewto ... 9#p1819719

http://forums.bharat-rakshak.com/viewto ... 5#p1898425What is a deflationist? It is one who looks very closely at the present structure of everything, the laws, the rules, the regulations, what is supposed to happen, who should fail, etc… but ignores the political (collective) will that backs it all up. The same political will that always changes the rules to suit its needs as surely as the sun rises. And it is this political will that makes dollar hyperinflation a certainty this time around.

It is beyond frustrating to watch all the bailouts of banks at a time like this. They should be allowed to fail! Right? But this ugly sight is only a symptom of the real problem. And it was never even a choice. As FOA warned 12 years ago, these bailouts were always baked into the cake. They are a mandatory function of the political will that backs the entire system. This is the main element that all of the deflationists miss.

Unlike FOA, the deflationists never saw the bailouts or the QE coming, and they refuse to believe that it will keep on coming as long as ANYTHING keeps failing. States, pension funds, large companies, foreign entities, whatever. It's all gonna be papered over. And the choice to stop bidding on dollars rests solely in the hands of those with large stockpiles of physical gold.

Once they stop bidding for dollars with their gold, the goose is cooked.

First of all I would like to clear up probably the most common misconception about hyperinflation. What most people believe is that massive printing of base money (new cash) leads to hyperinflation. No, it's the other way around. Hyperinflation leads to the massive printing of base money (new cash).

Hyperinflation, in most people minds, conjures images of trillion dollar Zimbabwe notes. But this image is simply the government's reflexive response to the onset of hyperinflation, which is actually the loss of confidence in the currency. First comes the loss of confidence (hyperinflation), then, and only then, comes the massive printing to keep the government and its obligations afloat.

FROM USA Gold website"Somewhere in the 1970s era I was exposed to the thinking of several different deflationists. It seemed that all of their conclusions came to the same end: that dollar deflation would rule the day, no matter what. Mind you now,,,,,, most of them were split on the finer points of the issue, but for all of them; Deflation was always the final outcome.""My friend, debt is the very essence of fiat. As debt defaults, fiat is destroyed. This is where all these deflationists get their direction. Not seeing that hyperinflation is the process of saving debt at all costs, even buying it outright for cash. Deflation is impossible in today's dollar terms because policy will allow the printing of cash, if necessary, to cover every last bit of debt and dumping it on your front lawn! (smile) Worthless dollars, of course, but no deflation in dollar terms! (bigger smile)"What is a deflationist? It is one who looks very closely at the present structure of everything, the laws, the rules, the regulations, what is supposed to happen, who should fail, etc… but ignores the political (collective) will that backs it all up. The same political will that always changes the rules to suit its needs as surely as the sun rises. And it is this political will that makes dollar hyperinflation a certainty this time around.

It is beyond frustrating to watch all the bailouts of banks at a time like this. They should be allowed to fail! Right? But this ugly sight is only a symptom of the real problem. And it was never even a choice. These bailouts were always baked into the cake. They are a mandatory function of the political will that backs the entire system. This is the main element that all of the deflationists miss.

The deflationists never saw the bailouts or the QE coming, and they refuse to believe that it will keep on coming as long as ANYTHING keeps failing. States, pension funds, large companies, foreign entities, whatever. It's all gonna be papered over.I tend to agree with 99% of what the deflationists write. For the most part they are masters at analyzing the minutiae and then painting it into a grand macro picture. I like the Kondratieff cycles and I agree we are in the winter cycle. In fact, almost everything most deflationists describe will probably happen, in my view.

But they all miss the hyperinflation that is coming. And they miss it because they don't understand how perfectly it fits with a deflationary collapse. In fact, they argue vehemently against it the same as they argue against inflation, which is how I know they don't understand hyperinflation. And they miss it because they are so meticulous in their observations and calculations that they can't see that the collective will always changes the rules when things get really painful. The political will (which is the same as the collective will in my lexicon) always does whatever will lessen the immediate pain, even if it will most certainly cause greater pain later. This is the part that is as reliable as the sun rising.

Thats how traders talk. These hot shot wall street types are trying to make 50 cents on a million dollar trade.udaym wrote:Gold yield 0%? What happened to the cost of carry?

GOLD COST OF CARRY = FUNDING INTEREST RATE + COST OF STORAGE – CONVENIENCE YIELD

Didn't the gold purchase on Jan 1, 2014 underperform?

Read the whole essay by Hugo Salinas Price;

http://www.zerohedge.com/news/2016-02-0 ... ation-gold

The amount of gold held by any particular country will not be the important factor in maintaining operating economies, because even a small amount of gold will be sufficient for that purpose; the reason being, that gold coming into newly rediscovered importance, no country will be able to maintain either trade surpluses or trade deficits. The first case would imply that other countries are sending their precious gold to the surplus export countries, but the scarcity of gold and its vital importance will not permit other countries to lose their gold to the (would-be) surplus-producing countries. In the second case, the trade-deficit countries would immediately correct their activity by devaluing their currencies ipso facto, rather than continue to lose their precious gold to cover their trade-deficits: devaluation would put an immediate stop to the excess of imports over exports. Governments resorting to credit-creation to fund their deficits would find themselves limited to balanced budgets; otherwise, their budget deficits funded by credit-creation would spill over into excessive imports and the consequent necessity for immediate devaluation of their currency.

Re: Perspectives on the global economic changes

China is making a $3 trillion threat, but 'nobody' on Wall Street is scared

Some of the biggest names on Wall Street have piled into one trade: shorting the Chinese yuan.

This, despite the fact that the Chinese government has threatened to punish anyone trying to pull the currency down.

These aren't empty threats, either. China has used it's reserves to buy yuan and squeeze short sellers out of their positions. The country has $3 trillion in foreign-exchange reserves to do this.

And yet no one is afraid — especially guys with huge funds like Pershing Square's Bill Ackman and Hayman Capital's Kyle Bass, who have admitted to being on the short side.

Brian Kelly, founder of hedge fund Brian Kelly Capital and who is among those shorting the yuan, told Business Insider why that is.

He said:

Nobody cares because the bets have been placed in the derivatives markets and have been locked in for a while — which means any hedging has already taken place and there is not much the PBoC can do. They can threaten capital controls, but they already have them and they are not working and are unlikely to work even if tightened.

"I am short RMB via derivatives and I am in the camp that a 25%+ devaluation is likely in the next 12-ish months," he said.

A devaluation of that magnitude would require China to expend even more of its reserves to stabilize the currency. Barclays thinks that the country will, later this week, announce the largest single-month drop in its reserves in modern history.

Re: Perspectives on the global economic changes

^^ Excellent Interview from David Stockman , Thanks for posting it

Re: Perspectives on the global economic changes

The Japanese are being pressured by enormous capital inflows in a 'flight to safety' market action, causing the Yen to spike from 121/$ quite recently to 114 now. What's more, all those investors piling into Japanese debt caused this:

Japan 10-year bond yield goes negative for first time

Japan 10-year bond yield goes negative for first time

The yield on Japan's 10-year government bond dropped below zero Tuesday, in a first for a G7 country as panicked investors flee a bloodbath on equity markets.

The note's effective return slipped to -0.005 percent in the afternoon, continuing a downtrend sparked by the Bank of Japan's surprise move last month to slap a negative interest rate on some commercial lenders' deposits.

Before the unexpected decision, Japan's 10-year bond was paying a yield of about 0.2 percent, similar to the current payout on a comparable German government bond.

By comparison, the United States pays about 1.7 percent on a 10-year bond while hard-hit Greece must pay a nearly 10 percent yield on its decade-long notes to attract wary investors.

The decline in the yield -- effectively the rate of return for a bond if held to maturity -- reflects rising demand for Japanese government debt, and investors' worries about putting more money into equities.

"It's almost like a panic," said Hideo Shimomura, the chief fund investor in Tokyo at Mitsubishi UFJ Kokusai Asset Management.

"The flight to quality is exaggerated."

Bonds, and especially government bonds, are generally seen as super safe investments where capital is all-but guaranteed, even if they pay very little -- or no -- interest.

Re: Perspectives on the global economic changes

Is there any doubt that central banking is a theft operation that destroys the productive economy and promotes the growth of the useless middleman "industry" called banking which produces zero value.

------

http://www.zerohedge.com/news/2016-02-1 ... tion-slide

With central bankers losing credibility left and right, and failing outright to boost the "wealth effect" no matter what they throw at it, the next big question is when will central planners around the world unveil the cashless society which is a necessary and sufficient condition to a regime of global NIRP.

And while in recent days we have seen op-eds by both Bloomberg and FT urging the banning of cash, the most disturbing development we have seen yet in the push for a cashless society has come from the following slide in a Morgan Stanley presentation, one in which the bank's head of EMEA equity research Huw van Steenis, pointed out the following...

------

http://www.zerohedge.com/news/2016-02-1 ... tion-slide

With central bankers losing credibility left and right, and failing outright to boost the "wealth effect" no matter what they throw at it, the next big question is when will central planners around the world unveil the cashless society which is a necessary and sufficient condition to a regime of global NIRP.

And while in recent days we have seen op-eds by both Bloomberg and FT urging the banning of cash, the most disturbing development we have seen yet in the push for a cashless society has come from the following slide in a Morgan Stanley presentation, one in which the bank's head of EMEA equity research Huw van Steenis, pointed out the following...

One of the most surprising comments this year came from a closed session on fintech where I sat next to someone in policy circles who argued that we should move quickly to a cashless economy so that we could introduce negative rates well below 1% – as they were concerned that Larry Summers' secular stagnation was indeed playing out and we would be stuck with negative rates for a decade in Europe. They felt below (1.5)% depositors would start to hoard notes, leading to yet further complexities for monetary policy.

Re: Perspectives on the global economic changes

Neshant ,Pandu Check David Stockman interview with Bloomberg

Re: Perspectives on the global economic changes

Behold! The useless middleman "industry" called banking.

It's only means of survival is by stealing wealth from the productive economy. It produces nothing of value except financial chicanery which is a cover for the theft of wealth from productive society.

------

E Dollar Concept is Being Pursued by The BOE, PBOC, and Yes, The Fed.

http://www.debtcrash.report/all-posts-l ... r-update-2

It's only means of survival is by stealing wealth from the productive economy. It produces nothing of value except financial chicanery which is a cover for the theft of wealth from productive society.

------

E Dollar Concept is Being Pursued by The BOE, PBOC, and Yes, The Fed.

http://www.debtcrash.report/all-posts-l ... r-update-2

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

In 2007, the market crashed when S&P was at this level. But that level is now support. Ominous times.

I do find Stockman intriguing. He says the central banking is failing. I agree. Then he says NIRP is not going to work. Who would disagree? It worked for a day in Japan and market crashed. The offshore yuan is now way below the on-shore yuan, when China reopens after 2 week holiday they will probably devalue. And how long will banking liabilities of 34trillion be covered by 3 trillion of reserves? There is only one thing that can rescue Chinese balance sheet.

And I find Stockman still does not say allocate more to gold. He calls it insurance. But later he says why- he is calling for deflation. Stockman is a DEFLATIONIST.

Just in the last post I quoted this from USA gold

I do find Stockman intriguing. He says the central banking is failing. I agree. Then he says NIRP is not going to work. Who would disagree? It worked for a day in Japan and market crashed. The offshore yuan is now way below the on-shore yuan, when China reopens after 2 week holiday they will probably devalue. And how long will banking liabilities of 34trillion be covered by 3 trillion of reserves? There is only one thing that can rescue Chinese balance sheet.

And I find Stockman still does not say allocate more to gold. He calls it insurance. But later he says why- he is calling for deflation. Stockman is a DEFLATIONIST.

Just in the last post I quoted this from USA gold

What is a deflationist? It is one who looks very closely at the present structure of everything, the laws, the rules, the regulations, what is supposed to happen, who should fail, etc… but ignores the political (collective) will that backs it all up. The same political will that always changes the rules to suit its needs as surely as the sun rises. And it is this political will that makes dollar hyperinflation a certainty this time around.

It is beyond frustrating to watch all the bailouts of banks at a time like this. They should be allowed to fail! Right? But this ugly sight is only a symptom of the real problem. And it was never even a choice. As FOA warned 12 years ago, these bailouts were always baked into the cake. They are a mandatory function of the political will that backs the entire system. This is the main element that all of the deflationists miss.

Unlike FOA, the deflationists never saw the bailouts or the QE coming, and they refuse to believe that it will keep on coming as long as ANYTHING keeps failing. States, pension funds, large companies, foreign entities, whatever. It's all gonna be papered over. And the choice to stop bidding on dollars rests solely in the hands of those with large stockpiles of physical gold.

Once they stop bidding for dollars with their gold, the goose is cooked.

First of all I would like to clear up probably the most common misconception about hyperinflation. What most people believe is that massive printing of base money (new cash) leads to hyperinflation. No, it's the other way around. Hyperinflation leads to the massive printing of base money (new cash).

Hyperinflation, in most people minds, conjures images of trillion dollar Zimbabwe notes. But this image is simply the government's reflexive response to the onset of hyperinflation, which is actually the loss of confidence in the currency. First comes the loss of confidence (hyperinflation), then, and only then, comes the massive printing to keep the government and its obligations afloat.

Re: Perspectives on the global economic changes

Fed Is Trying Everything They Can to Delay the Day of Reckoning