Budget 2016 - news & discussions

Budget 2016 - news & discussions

Hopefully we can have Budget 2016 related news and discussions. Please use this thread for not more than one week after Budget.

FM will start presenting it from 11:00am.

Moderators: please lock and delete this, if you think it is not needed. Thanks.

FM will start presenting it from 11:00am.

Moderators: please lock and delete this, if you think it is not needed. Thanks.

Re: Budget 2016 - news & discussions

Official link: http://budgetlive.nic.in/

Live Webcast: http://budgetlive.nic.in/2015/index1.html

Economic Survey: http://indiabudget.nic.in/survey.asp

Live Webcast: http://budgetlive.nic.in/2015/index1.html

Economic Survey: http://indiabudget.nic.in/survey.asp

Re: Budget 2016 - news & discussions

x-posting:

For vinaji and others who are hoping for 'Big Bang Reforms' in the budget tomorrow, I think you will be disappointed.

Modi follows the economic philosophy of Deen Dyal Updhyaya, not that of Milton Fredman. If you want to understand Modinomics, read Deen Dayal Upadhyaya.

And no, Deen Dayal Upadhyaya's economics is not 'Cow + Marx'.

For vinaji and others who are hoping for 'Big Bang Reforms' in the budget tomorrow, I think you will be disappointed.

Modi follows the economic philosophy of Deen Dyal Updhyaya, not that of Milton Fredman. If you want to understand Modinomics, read Deen Dayal Upadhyaya.

And no, Deen Dayal Upadhyaya's economics is not 'Cow + Marx'.

Re: Budget 2016 - news & discussions

Trivia and history on the "brief case" usage : http://timesofindia.indiatimes.com/budg ... 183080.cms

Re: Budget 2016 - news & discussions

Not expecting much benefits to populace until next budget as predicted to keep the middle class in pocket for 2019 elections.

Re: Budget 2016 - news & discussions

Serious need to look into Manufacturing sector as it is not picking up. Maybe something done to help them. Agri sector may get lot of benefits etc as per this report.

http://www.ibnlive.com/news/india/a-cha ... 09354.html

http://www.ibnlive.com/news/india/a-cha ... 09354.html

Re: Budget 2016 - news & discussions

A to Z of the budget... http://indianexpress.com/article/busine ... ighlights/

Tongue in cheek type of article.

Tongue in cheek type of article.

Re: Budget 2016 - news & discussions

http://www.newindianexpress.com/busines ... 301965.ece

A guide to read the budget. Explains some of the budget terminlogies in a serious fashion.

A guide to read the budget. Explains some of the budget terminlogies in a serious fashion.

Re: Budget 2016 - news & discussions

Jaitley ji didnt mention the defence budget in his speech !

Re: Budget 2016 - news & discussions

sensex reacted positively.

Re: Budget 2016 - news & discussions

its flat wrt toRahul M wrote:sensex reacted positively.

Re: Budget 2016 - news & discussions

Budget 2016: Disappointing 4.8% hike in defence allocation, for first time pension bill added:ETimes

So one cannot complain about no hike in def allocation...As first reported by ET, the ministry has also not been able to utlilize a significant chunk of money allocated for defence modernization, resulting in a small hike in allocations

Re: Budget 2016 - news & discussions

Highlights of Union Budget for 2016-17

--------------------------------------------------------------------------------

--------------------------------------------------------------------------------

Cogencis, Monday, Feb 29

MUMBAI - Highlights of the Union Budget for 2016-17 (Apr-Mar), presented

by Finance Minister Arun Jaitley in the Lok Sabha today:

* Din in Lok Sabha amid Budget presentation

* Finance Minister Jaitley begins speech in Lok Sabha

* Financial markets battered globally

* Indian econ has held ground firmly amid global turmoil

* Had inherited an economy of low growth

* Converted difficulty into opportunity

* We converted challenge into opportunity

* Our external situation is robust

* Confidence, hope continue to be held around India

* Global economy in serious crisis

* Global trade has contracted

* IMF has held India as bright spot

* World econ forum said India's growth extraordinarily high

* Indian econ still bright spot despite challenges

* GDP grew notwithstanding global meltdown

* India GDP has accelerated to 7.6% now

* India's external situation is robust

* Must carry out reforms

* Must have prudent fisc policy, up domestic demand

* Pay panel, defence pension to add to spending in FY17

* FY16, FY17 will be extremely challenging for govt spend

* Must continue with pace of reforms

* Must ensure growth does not slow down

* Must ensure macro-economic stability

* Strengthened firewalls against global risks

* Plan spend increased under FY16 revised estimates

* Risk of global slowdown is mounting

* Money with govt belongs to people

* We had to work in unsupported global environment

* Forex reserves highest ever at $350 bln

* Foreign exchange reserves are at highest ever level

* FY16 CAD projected at 1.4% of GDP

* To make significant changes in FDI policy

* To incentivise gas exploration

* Aim to work on passage of GST, Bankruptcy Code

* FY17 priority to give additional resources to rural areas

* Need to provide for bank recapitalisation

* Must prioritise spending in FY17

* Managed to improve FY16 fincl condition on revenue buoyancy

* Infra invest to enhance quality of life

* To have prudent mgmt of govt expenses for fiscal prudence

* To focus on tax reforms

* To undertake tax reform to improve compliance

* To focus on prudent mgmt of govt finance

* To focus on governance, ease of doing business

* To focus on infra investment

* To provide dispute resolution for PPP platform

* Allotted 90 bln rupees for Swachh Bharat mission

* Allotted 1.5 bln rupee for land record digitalisation FY17

* 7.5 mln households gave up LPG subsidy

* Jaitley sits down, continues Budget speech

* 1 bln rupees for birth anniversary of Guru Gobind Singh

* 1 bln rupees for birth anniversary of Deen Dayal Upadhyay

* Interim provision made for pay panel suggestions execution

* Committed to fincl requirements of announced econ packages

* Made interim provision for seventh pay panel

* To up MSME category turnover cap to 20 mln rupees

* To drive towards self-sufficiency in hydrocarbon sector

* Jaitley stands up, continues Budget speech

FISCAL HEALTH

* To have fiscal deficit target range

* FY17 fiscal deficit target at 3.5% of GDP

* FY16 fiscal deficit pegged at 3.9% of GDP

* Prudence lies in adhering to fiscal targets

FY16 REVISED

* FY16 revenue deficit 2.5% of GDP

* Ensured development agenda is not compromised

FY17 ESTIMATES

* FY17 total expenditure 19.78 trln rupee

* FY17 total spend at 19.78 trln rupees

* FY17 non-plan expenditure 14.3 trln rupees

* FY17 plan expenditure 5.5 trln rupee

* Total resources to states in FY17 at 996 bln rupees

* To scrap plan, non-plan expenditure distinction

* To do away with plan, non-plan classification of spending

* Plan allocation to stress on rural, infra, social sectors

DIRECT TAX

* Plan simplification, rationalisation of taxes

* Tax rebate on rent paid upped to 60,000 rupees vs 24,000

* Tax changes to support Make in India, affordable housing

* To give relief to small taxpayers

* To launch steps to move towards pension society

* To give relief to small tax payers

* Withdrawal upto 40% from Natl Pension plan to be tax exempt

* To allow lower corporate tax for some cos from FY17

* Reduction in corporate tax has to be calibrated

* Faster depreciation rate under income tax act at 40% FY17

* Reduction in corporate tax has to be caliberated

* Detailing roadmap for phasing out corporate tax exemption

* Propose 0.5% Krishi Kalyan cess on all taxable svcs Jun 1

* Propose Krishi Kalyan cess

* To raise surcharge on income over 10 mln rupees to 15%

* 10% tax on recipient if got dividend over 1 mln rupees/yr

* Some home buyers to get extra exemption of 50,000 rupee/yr

* No changes in income tax slabs

* To rationalize tax deducted at source for small tax payers

* Penalty of 200% of tax for misreporting of income

* Penalty of 50% of tax for under-reporting of income

* Penalty to be 50% of tax in income under-reporting cases

* Modifying scheme of penalty under Income Tax Act

* Revenue secy to head committee on taxation

* Committed to stable, predictable taxation regime

* To focus on bringing to book people with black money

* Prosecution immunity for undisclosed income declaration

* 300,000 tax cases worth 5.5 trln rupees pending

* New dispute resolution scheme for taxation proposed

* Compliance window for undisclosed income Jun 1-Sep 30

* 7.5% surcharge on undisclosed income in compliance window

* Govt committed to removing black money

* To move towards low tax regime with non litigious approach

* Limited period compliance window on undisclosed income

* To strongly counter tax evasion

* Moving towards a low tax regime

INDIRECT TAX

* Propose changes in customs duty to push Make in India plan

* Exempt svc tax on general insurance plans in Nirmaya scheme

* Committed to implementing GAAR from Apr 1, 2017

* Asset recast cos' income to be taxed at hands of investors

* Propose special patent regime to power innovation, research

* Services provided by EPFO exempted from service tax

* STT of 0.05% on options contracts

* Service tax waiver for houses of less than 60 sq mtr

* Service Tax exempt for svc under rural electrification plan

* To give excise duty exemption to ready-mix concrete

* Excise of 12.5% with input tax credit on jewellery

* To abolish 13 cesses by ministries

* To amend Central Value Added Tax credit rules

* To amend CENVAT credit rules

* Taxation panel to fix demand under retrospective tax cases

* Hope old cases on retrospective tax reach conclusion soon

* No retrospective taxation to be undertaken

* 1-time no-interest liability in retrospective tax cases

* To up excise duty on various tobacco products by 10-15%

* Cos incorporated post Mar 1 to be taxed at 25%+ surcharge

* Doubles clean energy cess on coal to 400 rupees/tn

* To up excise duty on some tobacco pdts by 10-15%

* Infra cess of 2% on diesel cars

* 4% infra cess on high capacity vehicles, SUVs

* To levy 1% infra cess on small petrol, LPG, CNG cars

INFALTION

* CPI inflation came down to 5.4% under our govt

* Fall in CPI inflation providing big relief to public

FARM SECTOR

* Plan doubling farmers' income in 5 yrs

* Plan to up spend on farm, rural, social sectors FY17

* Need to create new infrastructure for irrigation

* Need to address water resource utilisation

* To allocate 359.8 bln rupees for farm, farmers' welfare

* Need to give income security to farmers

* Need to think beyond food security

* To allocate 4.12 bln rupees for organic farming

* Policy to convert city waste into compost

* 140 mln farms to be covered by soil health card by Mar 2017

* Fertiliser co to market city compost fertilisers

* 600 bln rupees for sustainable mgmt of water resources

* Soil health card plan being implemented with great vigour

* To form 200 bln rupee long-term irrigation fund in NABARD

* To allot 865 bln rupees in five yrs for irrigation schemes

* To bring 2.85 mln ha under PM irrigation plan

* To allocate 170 bln rupees for irrigation scheme FY17

* FY17 Crop insurance scheme allocation 55 bln rupees

* FY17 interest subvention for farmers seen 150 bln rupee

* Farm credit target for FY17 at 9 trln rupees

* 9.7 mln tn agri storage capacity added FY16

* 3.68 bln rupees provided for soil health scheme FY17

* 12 states have amended APMC Act

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Budget 2016 - news & discussions

The budget basically got the following things right.

1. Anchored the fiscal deficit to 3.5% of GDP

2. Increased spending on rural economy

3. Increased spending on Ifra (especially roads and you need to include rail as well).

The rest of it is just some random rubbish, an no real headway on anything, and kicked some real reforms (including rationalising tax rates) down the road. Other than the 3 real things above, the rest of it is just a collective yawn and a waste of time.

1. Anchored the fiscal deficit to 3.5% of GDP

2. Increased spending on rural economy

3. Increased spending on Ifra (especially roads and you need to include rail as well).

The rest of it is just some random rubbish, an no real headway on anything, and kicked some real reforms (including rationalising tax rates) down the road. Other than the 3 real things above, the rest of it is just a collective yawn and a waste of time.

Re: Budget 2016 - news & discussions

The total allocation has thus zoomed to Rs 3.40 lakh crore but of pensions are subtracted as has been the form, this would come to only Rs 2.58 lakh crore. This would mean a meaningful hike of 4.8 percent.

So our actual defence budget is actually $50 billion, of which $12 billion goes to pensions. And yet folks don't seem to appreciate the pressing need for scaling down the IA's standing strength.

Re: Budget 2016 - news & discussions

Can our Economic Analysis Gurus read through the Jargon and tell us:-

What is the DRDO, BARC, ISRO budget/s for 2016-2017 compared to revised estimates of 2015-2016? How adding pensions will affect it?

My reading of the Budget is that "allocation" for Atomic Energy, Space is practically stagnant and for DRDO it is actually reduced. Very odd budget?

What is the DRDO, BARC, ISRO budget/s for 2016-2017 compared to revised estimates of 2015-2016? How adding pensions will affect it?

My reading of the Budget is that "allocation" for Atomic Energy, Space is practically stagnant and for DRDO it is actually reduced. Very odd budget?

Last edited by Gyan on 29 Feb 2016 21:30, edited 2 times in total.

Re: Budget 2016 - news & discussions

Budget 2016: MHA gets Rs 77,383.12 cr in 2016-17 budget, a 24.56 pc hike.

The Home Ministry has been allocated over Rs 77,000 crore in 2016-17 budget, a steep hike of 24.56 per cent, majority of which have been earmarked for paramilitary forces like CRPF and BSF, responsible for internal security and border guarding duties.

Presenting the general budget in Parliament, Finance Minister Arun Jaitley announced an outlay of Rs 77,383.12 crore to the Home Ministry of which Rs 67,408.12 crore is under non-plan and Rs 9,975 crore under plan heads. In the 2015-16 budget, Home Ministry was allocated Rs 62,124.52 crore.

The Home Ministry has been allocated over Rs 77,000 crore in 2016-17 budget, a steep hike of 24.56 per cent, majority of which have been earmarked for paramilitary forces like CRPF and BSF, responsible for internal security and border guarding duties.

Presenting the general budget in Parliament, Finance Minister Arun Jaitley announced an outlay of Rs 77,383.12 crore to the Home Ministry of which Rs 67,408.12 crore is under non-plan and Rs 9,975 crore under plan heads. In the 2015-16 budget, Home Ministry was allocated Rs 62,124.52 crore.

In the 2016-17 budget, a total of Rs 50,176.45 crore has been allocated to seven paramilitary forces.

Border security Force, which guards Indo-Pak and Indo-Bangladesh borders, will get Rs 14,652.90 crore while Central Industrial Security Force, responsible for security of country's airports, nuclear installation, key government buildings and private entities like Infosys, has been allocated Rs 6,067.13 crore.

Indo-Tibetan Border Police, tasked with protecting the Sino-Indian border, has got an outlay of Rs 4,231.04 crore and Assam Rifles, deployed in Indo-Myanmar border and dealing with insurgents in the Northeast, will get Rs 4,363.88 crore.

Sashastra Seema Bal, which guards the Indo-Nepal and Indo-Bhutan border, has been earmarked Rs 3,854.67 crore while National Security guards, the anti-terror commando force, gets an allocation of Rs 688.47 crore.

The budget allocated Rs 2,490 crore for erection of barbed wire fencing, construction of roads and induction of Hi-tech surveillance on Indo-Bangladesh and Indo-Pak borders.

Re: Budget 2016 - news & discussions

a large part of that hike would probably go to 7CPC.

Re: Budget 2016 - news & discussions

the growth we want to see at industrial, infrastructure, and defence sector to match advanced countries, it appears we have to print more money. the budget is right to focus on organic farming and advancing the organic farming with advanced machinery, management, process and tools. empowering the farming community is important for a tropical country like India, and no other nation on the world can focus on organic farming other than India. WELL DONE!

RE sector is a black mark.. we need foundations set for corrections. I am not seeing anything there. [land acquisition]

middle-class will have to improvise on savings.

we need to borrow more!

RE sector is a black mark.. we need foundations set for corrections. I am not seeing anything there. [land acquisition]

middle-class will have to improvise on savings.

we need to borrow more!

Re: Budget 2016 - news & discussions

Sectoral Allocation in Budget 2016-17(In crore of Rupees)

-----------------------------2014-2015``` 2015-2016`` 2015-2016 ```2016-2017

````````````````````````````Actuals ``` BE ``````````` RE``````` ```BE

Agriculture and Allied Activities` 9795 `````````11657 `````````10942```` 19394

Rural Development*```````````1231 ``````````3131`````````` 3027 `````2751

Irrigation and Flood Control `````910````````````772 ``````````1105````` 1024

Energy ```````````````````170812 `````````167342 ```````171519````205878

Industry and Minerals ````````44006 ``````````43113```````` 45512`````49372

Transport** ```````````````100520 `````````193417 ```````178502 ```229874

Communications ``````````````6437 ``````````12032 ````````13451 ````13806

ScienceTechnology&Environment` 14382 ````````19023 `````````17965```` 20926

General Economic Services `````16766 `````````20333 `````````38596 ````46685

Social Services*** ```````````50858`````````` 81003 ````````83535``` 100291

General Services`````````````` 5164 ``````````26559```````` 18553 ````16247

GRAND TOTAL ``````````````420881````````` 578382```````` 582707``` 706248

Compared to 2014-14(Last congi budget) allocation has been rightly prioritised.Even accounting for 7cpc allocation of 64000cr there is emphasis on agri.infra and rural devlopment/power. In Renewable Energy the allocation has been increased from 3793 to 14193

MNRE`` 3793 ``3661`` 5677 ``14193

Except for IT Slabs, on which Jaitly cheated all, the Budget had stamp of NaMo and we might see the rise of neo middle class down the line .

-----------------------------2014-2015``` 2015-2016`` 2015-2016 ```2016-2017

````````````````````````````Actuals ``` BE ``````````` RE``````` ```BE

Agriculture and Allied Activities` 9795 `````````11657 `````````10942```` 19394

Rural Development*```````````1231 ``````````3131`````````` 3027 `````2751

Irrigation and Flood Control `````910````````````772 ``````````1105````` 1024

Energy ```````````````````170812 `````````167342 ```````171519````205878

Industry and Minerals ````````44006 ``````````43113```````` 45512`````49372

Transport** ```````````````100520 `````````193417 ```````178502 ```229874

Communications ``````````````6437 ``````````12032 ````````13451 ````13806

ScienceTechnology&Environment` 14382 ````````19023 `````````17965```` 20926

General Economic Services `````16766 `````````20333 `````````38596 ````46685

Social Services*** ```````````50858`````````` 81003 ````````83535``` 100291

General Services`````````````` 5164 ``````````26559```````` 18553 ````16247

GRAND TOTAL ``````````````420881````````` 578382```````` 582707``` 706248

Compared to 2014-14(Last congi budget) allocation has been rightly prioritised.Even accounting for 7cpc allocation of 64000cr there is emphasis on agri.infra and rural devlopment/power. In Renewable Energy the allocation has been increased from 3793 to 14193

MNRE`` 3793 ``3661`` 5677 ``14193

Except for IT Slabs, on which Jaitly cheated all, the Budget had stamp of NaMo and we might see the rise of neo middle class down the line .

-

member_29172

- BRFite

- Posts: 375

- Joined: 11 Aug 2016 06:14

Re: Budget 2016 - news & discussions

Spending more on renewable is a massive waste honestly, wish that was allocated to nuclear and natural gas/shale.

Re: Budget 2016 - news & discussions

Now 40% of our PF on withdrawal is taxable. For vast segment of the middle class this represents life savings.

Nice way to screw the segment that consistently voted for you.

Nice way to screw the segment that consistently voted for you.

Re: Budget 2016 - news & discussions

renewables are important investments and not waste if you have your grids planned well for demand vs supply. otoh, nukes and nat gas can be easily be wasted when supply is constant, and people are sleeping during the night and processes are running at 20-30% use.

Re: Budget 2016 - news & discussions

What does this mean?

Is he saying the GST bill buried for the time being?4:28 PM: On GST, Jaitley says, Resource mobilisation is necessary before GST comes into force. From here: http://www.newindianexpress.com/budget- ... 302829.ece

Re: Budget 2016 - news & discussions

40% withdrawal is exempt. 60% is taxable if not invested in annuity scheme. Yes, nice way to get screwed.SRoy wrote:Now 40% of our PF on withdrawal is taxable. For vast segment of the middle class this represents life savings.

Nice way to screw the segment that consistently voted for you.

Re: Budget 2016 - news & discussions

Yes 60% is taxable. Thanks for the correction, I misunderstood the percentage.nelson wrote:40% withdrawal is exempt. 60% is taxable if not invested in annuity scheme. Yes, nice way to get screwed.SRoy wrote:Now 40% of our PF on withdrawal is taxable. For vast segment of the middle class this represents life savings.

Nice way to screw the segment that consistently voted for you.

Let's watch what happens in 2019.

Re: Budget 2016 - news & discussions

^You were misled to understand so, by the words of finance minister.

Meethi churi....Measures for moving towards a pensioned society

137. Pension schemes offer financial protection to senior citizens. I

believe that the tax treatment should be uniform for defined benefit and

defined contribution pension plans. I propose to make withdrawal up to 40%

of the corpus at the time of retirement tax exempt in the case of National

Pension Scheme.

138. In case of superannuation funds and recognized provident funds,

including EPF, the same norm of 40% of corpus to be tax free will apply in

respect of corpus created out of contributions made after 1.4.2016.

...

Re: Budget 2016 - news & discussions

^^

So, people retiring this year or attaining the requisite age for final withdrawal will get a sudden financial shock.

Many people around this age plan funding of house construction, sometimes marriages or education of their children.

All such plans will be brought to nought.

So, people retiring this year or attaining the requisite age for final withdrawal will get a sudden financial shock.

Many people around this age plan funding of house construction, sometimes marriages or education of their children.

All such plans will be brought to nought.

Re: Budget 2016 - news & discussions

Thankfully, it applies to contributions on or after 01 Apr 2016. No word on future interest on previous contribution though ie upto 31 Mar 2016.

Re: Budget 2016 - news & discussions

There’s a lot of confusion about the whole EPF taxation thing. Let us explain.

Employees put money every month into their EPF (10% of salary) and the company puts another 10%.

This money saves tax under section 80C so it’s exempt at entry

Then it accrues interest each year, but you pay no tax on that interest. (exempt on accrual)

Then when you turn 58, you get all the money, tax free. (exempt at exit)

This was the EEE regime.

This is sadly coming to an end.

Now due to Budget2016, when you exit, the amount of money you get when you exit will be taxed. But not all of it!

First, let’s understand this:

The amount of money you have put in till now, and the interest it will get till you retire – that amount is still exempt at tax when you exit. That doesn’t change.

From 1 April 2016, whatever money you put in, that money (plus it’s interest) is taxed when you exit.

How Much?

The tax is:

40% of that corpus is tax free.

60% is added to your taxable income and thus, taxed.

This is complex because you have to figure out, when you exit, how much of that money was for what you paid before 1 April 2016, and how much was after, and then apportion the amounts. This requires serious math skills especially if the amount of interest every year is different!

Then, you have the big issue: Tax applies not on the gain, but on the whole amount. Take an example. Assume I put in Rs. 10,000 a month, starting 1 April 2016, for 10 years. That’s Rs. 12 lakh.

Let’s say my exit corpus is something like 20 lakh. (Note: This is a yield of 9.5%, way higher than current interest rates of about 8.8%)

You’re thinking: I put Rs. 12 lakh, it’s now Rs. 20 lakh, so I made Rs. 8 lakh, no? Even if I get taxed, I should get taxed on the Rs. 8 lakh? (Or, if you give me inflation adjustment, it might even fall to Rs. 6 lakh?)

Answer: Are you kidding me?

The EPF tax applies on the FULL amount. So of the 20 lakh, only Rs. 8 lakh (40%) is tax free. The remaining 12 lakh rupees get added to your income and taxed! If you’re in the 30% tax bracket, you will pay Rs. 4 lakh as taxes, taking your post tax return to Rs. 16 lakh – which won’t even beat inflation. Plus, note that they just taxed your half of your real gains!

You can complain but that’s how it is.

Some will tell you – look, you saved taxes when getting in, no? But EPF contribution is only one part of the 80C limit – which you can get if you have paid kids school fees too, or had a housing loan principal paid back, or invested in equity taxsaver funds, or bought insurance policies, or bank 5 year tax-saving deposits. Any of these gives you the same exemption, and if you have put in the EPF amount too, you’re hosed. Plus, if your EPF contribution exceeds 150,000 a year you never got the tax benefit getting in.

Don’t Invest For Taxes

If you invested in EPF for tax reasons, you will find it was futile. The end-tax now is very high, and the only thing which saves you is that your contributions till now are tax free on exit. But anything going forward is not worthwhile!

Sadly, EPF is compulsory. But there’s an option.

Companies have the ability to say they will cap EPF inputs at Rs. 800 or so per person. (2% of salary or Rs. 800 per month, whichever was lesser) Then no matter how much your salary is, you only pay Rs. 800. We took that option in a company I was in earlier. This option is now better since the exit option ensures your real tax is very high when you do exit – so no point paying 12% of your real salary when you can pay a max of Rs. 800. However, not every company gives you this option. ( Assertion that PF amount can be limited to Rs.800 may be wrong. It may be talking about the 12% contribution on old threshold of Rs.6,500/-. In 2014, they raised the threshold to Rs.15,000/- So, the amount is more like 1,800 now.)

But it’s clear now: Don’t invest because of the tax saving based on existing tax regimes. The government can change on you and can change fast. Your money will be at stake. This time they grandfathered the proposal (as in, allowed current corpus to be tax free) but they may not do it every time.

The Last Word on the EPF Thing

EPF is simply bad now, and companies should be allowed to shift to the NPS for superannuation. The taxes make it worthless (like I have shown earlier)

PPF is okay. It’s still exempt, in full, on maturity.

NPS is now on par with the EPF, but probably wins because its yields have been higher.

In all cases, the tax on EPF on exit, and the lack of full availability of that tax on input (since 80C limits are taken by other things also) means you get a horrible retirement package which won’t beat inflation. There’s not much you can do though – as an employee, you can’t exit easily. You don’t have to exit now, because anyhow nothing that you put in till March 31, 2016 will be taxed even on exit. But after that, you need to understand that your retirement return immediately becomes substandard.

Last edited by nawabs on 29 Feb 2016 20:33, edited 1 time in total.

Re: Budget 2016 - news & discussions

May I know the basis for following:-

a. Grandfather clause on future interest on contribution till date.

b. Exemption on PPF.

c. What about Statutory Provident Funds?

Any links or source?

a. Grandfather clause on future interest on contribution till date.

b. Exemption on PPF.

c. What about Statutory Provident Funds?

Any links or source?

Re: Budget 2016 - news & discussions

You can put up any questions here - capitalmind.in

Re: Budget 2016 - news & discussions

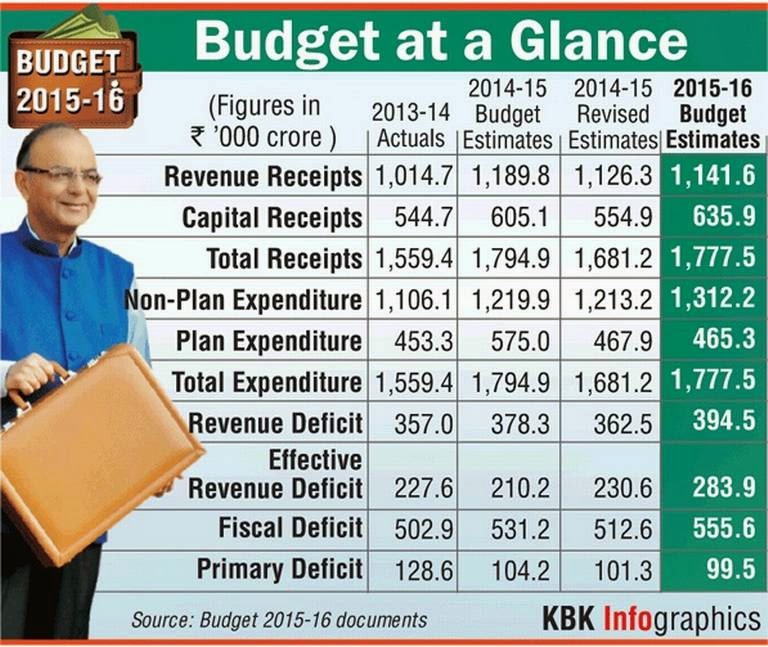

Budget at a glance, straight from the official website: http://indiabudget.nic.in/ub2016-17/bag/bag11.pdf

Budget highlights, key features: http://indiabudget.nic.in/ub2016-17/bh/bh1.pdf

Budget highlights, key features: http://indiabudget.nic.in/ub2016-17/bh/bh1.pdf

Re: Budget 2016 - news & discussions

Lot of noise on twitter regarding taxation and locking of ER contribution till 58 Yrs. Understand that that used to be My dad's savings and was tax exempt so double savings. Why was this done not sure, but Gurus can you throw some light on Impact?

Re: Budget 2016 - news & discussions

If I am reading it right, the IRAs (Regular not Roth)in the US work in the same way. The amount you put in is deductible from income in the year you put it in, and then the earnings compound over the years tax-free. When you take it out after age 59.5, the entire amount is taxable as ordinary income. Makes sense as you paid no income tax on both the amount you put in and the amount earned over the years.nawabs wrote:There’s a lot of confusion about the whole EPF taxation thing. Let us explain.

Employees put money every month into their EPF (10% of salary) and the company puts another 10%.

This money saves tax under section 80C so it’s exempt at entry

Then it accrues interest each year, but you pay no tax on that interest. (exempt on accrual)

Then when you turn 58, you get all the money, tax free. (exempt at exit)

This was the EEE regime.

This is sadly coming to an end.

Now due to Budget2016, when you exit, the amount of money you get when you exit will be taxed. But not all of it!

First, let’s understand this:

The amount of money you have put in till now, and the interest it will get till you retire – that amount is still exempt at tax when you exit. That doesn’t change.

From 1 April 2016, whatever money you put in, that money (plus it’s interest) is taxed when you exit.

How Much?

The tax is:

40% of that corpus is tax free.

60% is added to your taxable income and thus, taxed.

This is complex because you have to figure out, when you exit, how much of that money was for what you paid before 1 April 2016, and how much was after, and then apportion the amounts. This requires serious math skills especially if the amount of interest every year is different!

Then, you have the big issue: Tax applies not on the gain, but on the whole amount. Take an example. Assume I put in Rs. 10,000 a month, starting 1 April 2016, for 10 years. That’s Rs. 12 lakh.

Let’s say my exit corpus is something like 20 lakh. (Note: This is a yield of 9.5%, way higher than current interest rates of about 8.8%)

You’re thinking: I put Rs. 12 lakh, it’s now Rs. 20 lakh, so I made Rs. 8 lakh, no? Even if I get taxed, I should get taxed on the Rs. 8 lakh? (Or, if you give me inflation adjustment, it might even fall to Rs. 6 lakh?)

Answer: Are you kidding me?

The EPF tax applies on the FULL amount. So of the 20 lakh, only Rs. 8 lakh (40%) is tax free. The remaining 12 lakh rupees get added to your income and taxed! If you’re in the 30% tax bracket, you will pay Rs. 4 lakh as taxes, taking your post tax return to Rs. 16 lakh – which won’t even beat inflation. Plus, note that they just taxed your half of your real gains!

You can complain but that’s how it is.

Some will tell you – look, you saved taxes when getting in, no? But EPF contribution is only one part of the 80C limit – which you can get if you have paid kids school fees too, or had a housing loan principal paid back, or invested in equity taxsaver funds, or bought insurance policies, or bank 5 year tax-saving deposits. Any of these gives you the same exemption, and if you have put in the EPF amount too, you’re hosed. Plus, if your EPF contribution exceeds 150,000 a year you never got the tax benefit getting in.

Don’t Invest For Taxes

If you invested in EPF for tax reasons, you will find it was futile. The end-tax now is very high, and the only thing which saves you is that your contributions till now are tax free on exit. But anything going forward is not worthwhile!

Sadly, EPF is compulsory. But there’s an option.

Companies have the ability to say they will cap EPF inputs at Rs. 800 or so per person. (2% of salary or Rs. 800 per month, whichever was lesser) Then no matter how much your salary is, you only pay Rs. 800. We took that option in a company I was in earlier. This option is now better since the exit option ensures your real tax is very high when you do exit – so no point paying 12% of your real salary when you can pay a max of Rs. 800. However, not every company gives you this option. ( Assertion that PF amount can be limited to Rs.800 may be wrong. It may be talking about the 12% contribution on old threshold of Rs.6,500/-. In 2014, they raised the threshold to Rs.15,000/- So, the amount is more like 1,800 now.)

But it’s clear now: Don’t invest because of the tax saving based on existing tax regimes. The government can change on you and can change fast. Your money will be at stake. This time they grandfathered the proposal (as in, allowed current corpus to be tax free) but they may not do it every time.

The Last Word on the EPF Thing

EPF is simply bad now, and companies should be allowed to shift to the NPS for superannuation. The taxes make it worthless (like I have shown earlier)

PPF is okay. It’s still exempt, in full, on maturity.

NPS is now on par with the EPF, but probably wins because its yields have been higher.

In all cases, the tax on EPF on exit, and the lack of full availability of that tax on input (since 80C limits are taken by other things also) means you get a horrible retirement package which won’t beat inflation. There’s not much you can do though – as an employee, you can’t exit easily. You don’t have to exit now, because anyhow nothing that you put in till March 31, 2016 will be taxed even on exit. But after that, you need to understand that your retirement return immediately becomes substandard.

The reason people go for this is that, when in retirement, your income is much lower, so the amount you withdraw (best do it gradually over the years), even when taxed as ordinary income, is taxed at a rate lower than when you put it in your prime earning years.

In Roth IRA, on the other hand, you put in the money after paying income tax on it, and then it compounds tax free and even when you withdraw it in retirement, the entire amount of withdrawal is tax free. So you pay tax up front and never pay it afterwards.

So, even as you have described the new EPF tax rules as above, they are better the the Regular IRA in USA due to 40% exemption. Don't see much reason for whining here, unless I have understood it wrong.

Re: Budget 2016 - news & discussions

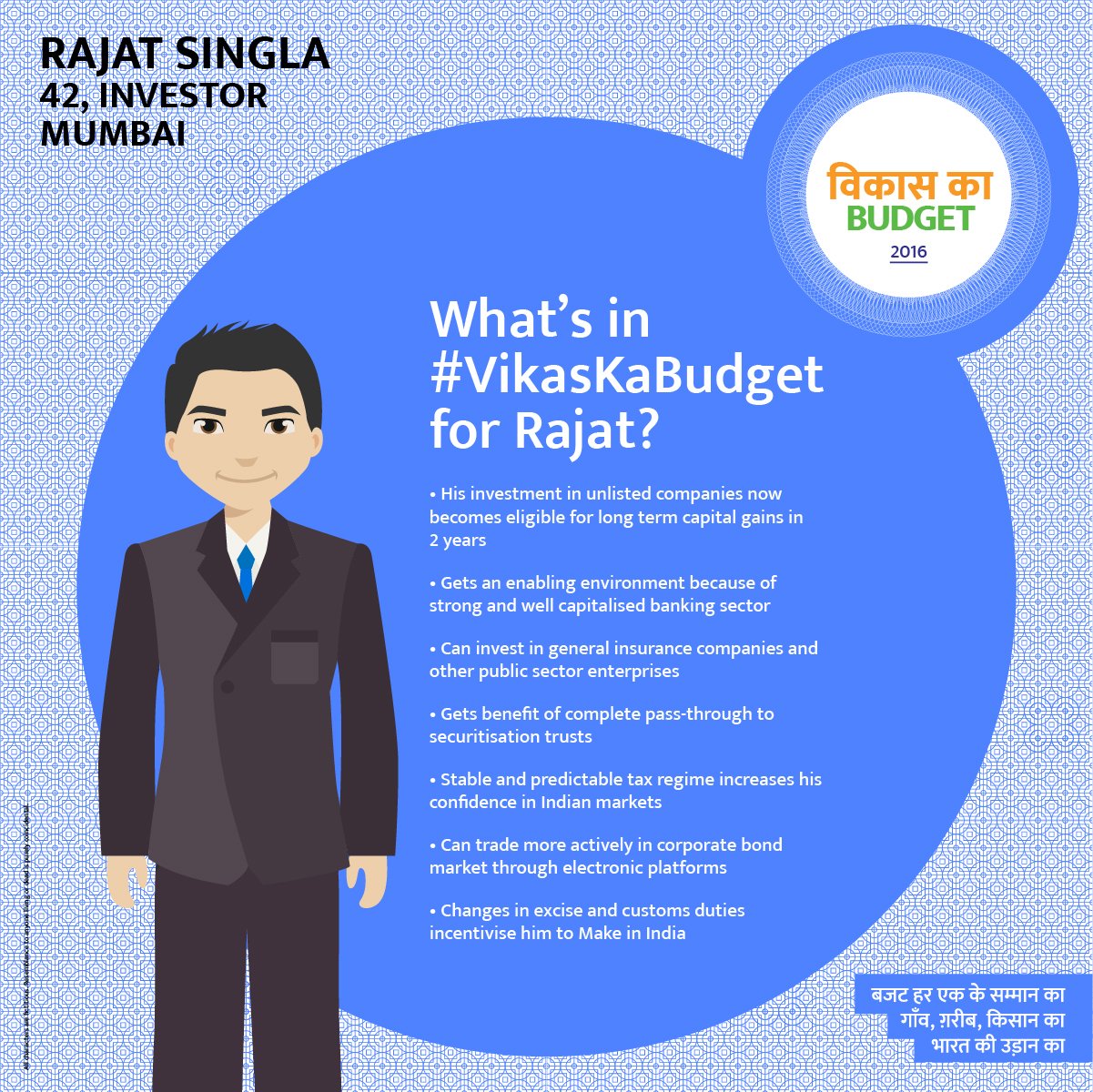

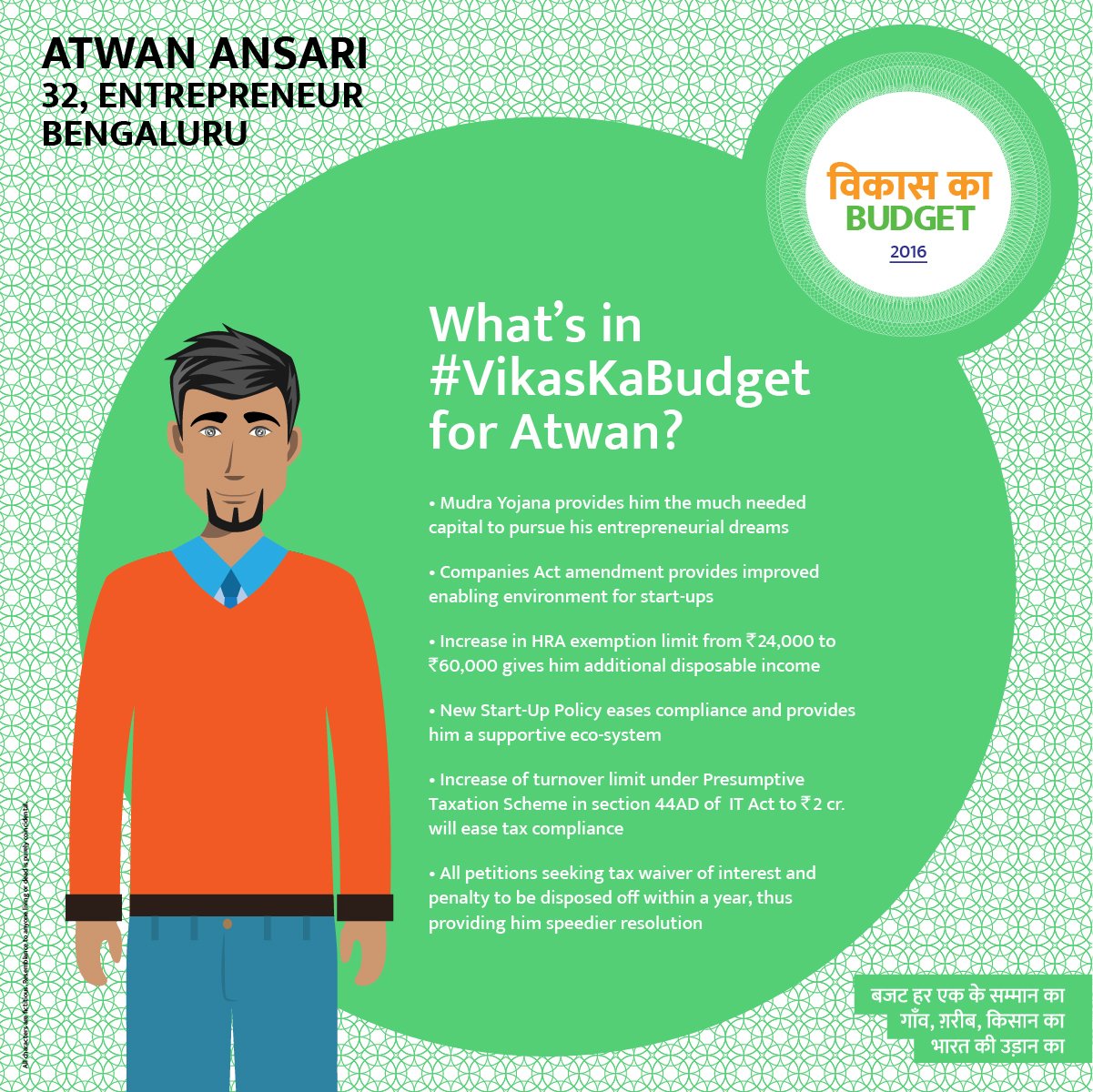

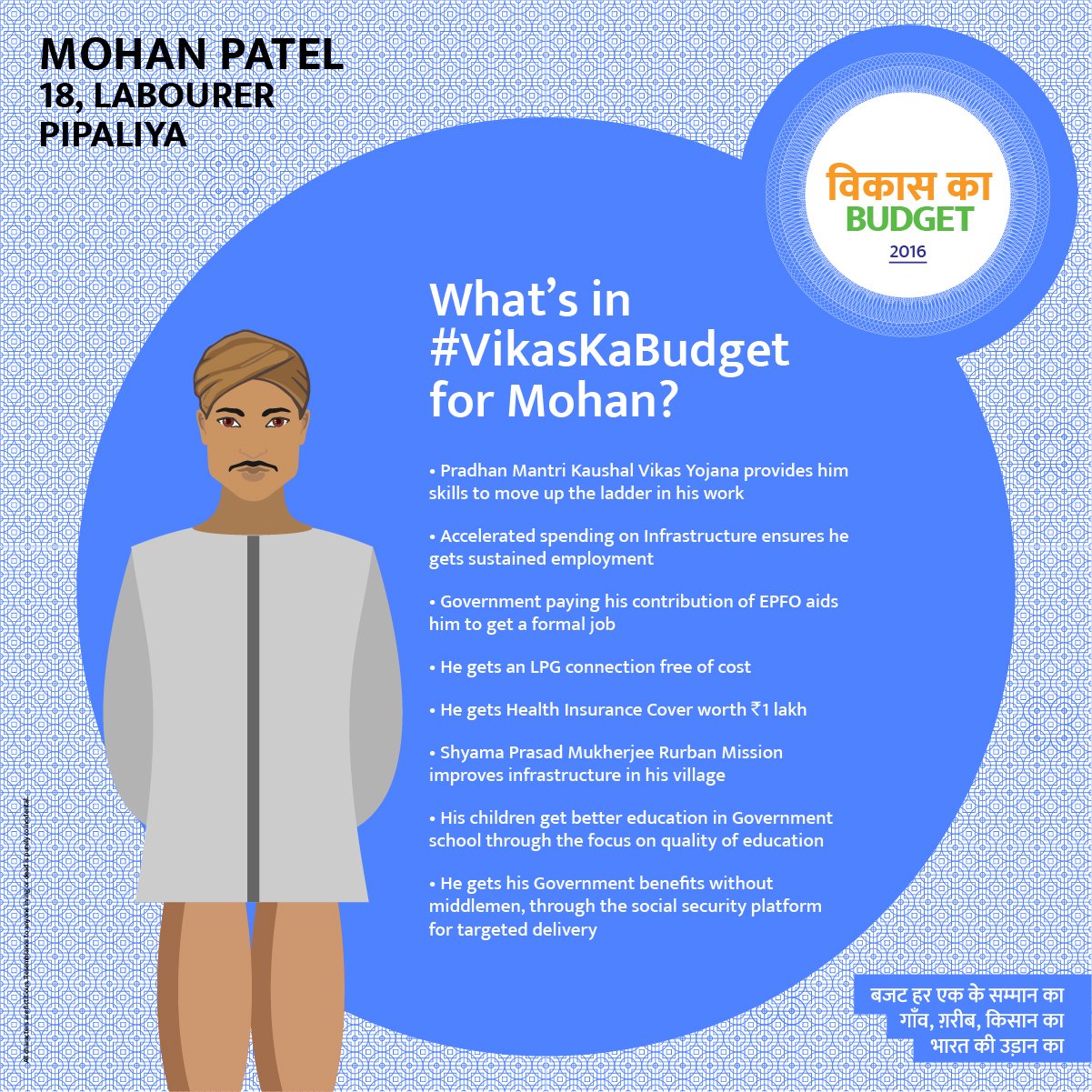

GoI has some interesting graphics to go with the budget. from sinha jr's twitter feed.

Re: Budget 2016 - news & discussions

The Provident Fund contribution is not tax exempt in its entirety. There is a limit of Rs 1.5 lakh with competion from life insurance premia, home loan principal repayment, children education expenditure, etc. So the fear is that it will be taxed thrice. From "Exempt- Exempt - Exempt " to "Tax - Tax - Tax". At the least, a sizeable portion of the corpus.