Indian Economy News & Discussion - Aug 26 2015

Re: Indian Economy News & Discussion - Aug 26 2015

10% nominal growth rate and stable exchange rates will double GDP in ~7 years, so 2023-2025 timeframe.

Re: Indian Economy News & Discussion - Aug 26 2015

Kashiji, flow of technology-materials-IP is strictly governed by export control laws and not by company ownership. So, in the best case, only the know-how which can be shared or even sold to India, will have to pass this test. You may be surprised, how sensitive simple components like gyroscopes, motion trackers in HMDs, actuators in toys, etc. can be, when it comes to export control regimes.Kashi wrote:I have been trying to search for this but have not come across any meaningful links on this.

Did Tata's acquisition of Corus actually lead to the inflow of any high-end technology associated steel production into India? I would imagine that the erstwhile British Steel would have some know how on how to produce high tensile steel for railway tracks (as we have seen DFCC has been using extra long rails), commercial and military ship building among others. Did TATA transfer such know how into their India operations?

Re: Indian Economy News & Discussion - Aug 26 2015

Thanks.Suraj wrote: China has been a WTO member since 2001. Everyone is imposing steel dumping duties on them, including the US.

Re: Indian Economy News & Discussion - Aug 26 2015

Fair point Saar, but countries/companies work around these controls in their national interest all the time. A lot of such 'controlled' technology has made it to countries including China and even Pakiland. We just have to get better at legal ways of getting what we need.prahaar wrote: Kashiji, flow of technology-materials-IP is strictly governed by export control laws and not by company ownership. So, in the best case, only the know-how which can be shared or even sold to India, will have to pass this test. You may be surprised, how sensitive simple components like gyroscopes, motion trackers in HMDs, actuators in toys, etc. can be, when it comes to export control regimes.

Re: Indian Economy News & Discussion - Aug 26 2015

This article explains how fixing Mauritius tax treaty will lead to tax reform. The implication is very significant on how it will open oppurtunities to clean up tax code. People from system design background will be able to appreciate this. An incorrectly designed core system, begets half-baked patches, which in turn begets other half-thought fixes and so on complicating the system beyond control.

http://indianexpress.com/article/opinio ... y-2833238/

http://indianexpress.com/article/opinio ... y-2833238/

In January 2016, a committee constituted by the Securities Board of India (SEBI) under the chairmanship of Narayana Murthy recommended exemption of long-term (more than a year) capital gains tax on investments made in shares of private (not listed on stock exchanges) companies. The rationale was the need for a “level-playing field” for such private equity investors on par with investors in shares of publicly listed companies.

Investments in publicly listed shares were granted exemption from long-term capital gains tax in 2004. The rationale for that decision was to provide a “level-playing field” to domestic investors vis-à-vis Mauritius’ investors. A new tax called the securities transaction tax was imposed on stock market transactions to offset any loss of revenues from the exemption of capital gains. This higher transaction tax on shares triggered a massive shift by investors to investing in risky derivatives vis-à-vis shares.

The budget of 2016 increased transaction tax on derivatives to create a “level-playing field” with shares. Not to be left behind, investors in real estate through real estate investment trusts want a “level-playing field” with equity investments. The fountainhead of this vicious cycle is the India-Mauritius tax treaty of 1983, the original sin.

This treaty has led to a long tail of arbitrages across various asset classes (private vs public shares), types of investors (Mauritius vs non-Mauritius), types of income (capital gains vs dividends) etc. This treaty has hampered India’s ability to garner enough tax resources through progressive direct taxes. While it is true that this treaty provided an opportunity for illegal round tripping of domestic money, the most damaging impact has been the cascading effect on India’s tax structure.

The Modi government’s move to amend the Mauritius tax treaty is not meant to merely curb offshore black money or curtail round tripping of domestic money. Judged in the larger context of India’s skewed tax structure and its adverse impact on income inequality, threats of foreign investor pullback from India due to the amendment of this treaty seem trivial. Long-term investment flows chase economic fundamentals, not tax arbitrage. This is a first step in eliminating a tall hurdle to change India’s skewed tax structure.

Re: Indian Economy News & Discussion - Aug 26 2015

If Rajan exits, so will billions in investment

Wails as expected from the usual Congress-pasand quarters...

But, I would actually suggest extend RR's term by one more year and change his mandate from Inflation only to Inflation+growth.

Wails as expected from the usual Congress-pasand quarters...

But, I would actually suggest extend RR's term by one more year and change his mandate from Inflation only to Inflation+growth.

Re: Indian Economy News & Discussion - Aug 26 2015

I agree with the article to some extent. Rajan has credibility with the substantial number of FIIs who have purchased rupee-denominated debt in India. This gets little attention, but think about it - foreigners hold around $35 billion of Indian government debt, and another $15-20 billion of corporate debt, all in rupees. This would elicit laughter 10-15 years ago. No one would accept the currency risk. Now, instead they keep asking for an increase in the foreign debt holding limit. This extends far enough to Indian government debt soon to be traded on Euroclear by end of this year:

As the article above indicates, it's not really Rajan pushing for Euroclear integration with our debt markets. FinMin wants it, but Euroclear also wants Rajan around because of his credibility with them, even though he himself worries about capital flight. While he spends too much time talking compared to his predecessors, his presence has enabled GoI to attract billions into our debt markets without having to leverage ourselves by issuing foreign currency bonds. Anyone remember the Resurgent India Bond ? Back then we had to beg the diaspora to invest, and issue a bond in dollars, following others bond issuance rules. Now we issue government bonds in rupees at our convenience, on our terms, in our clearing system, and outsiders queue up anxious to buy.Euroclear, the world’s largest securities settlement system, is pressing ahead with plans to include Indian government bonds on its platform by the end of 2016, potentially opening the South Asian country’s debt markets to a wave of foreign investment.

Belgium-based Euroclear has been engaged in protracted discussions with the Reserve Bank of India, with the two hammering out final details last week of a plan to integrate their systems during the next financial year.

The move marks a further step in New Delhi’s opening of its bond market, and follows an RBI plan to increase the cap on the amount of government debt available to international buyers from less than 4 per cent to 5 per cent by 2018.

India’s government debt market is worth Rs43tn ($645bn). Because of regulatory limits foreign investors hold just 3.7 per cent of that amount. The RBI’s move to raise its investment cap will create space for further capital inflows.

Euroclear provides a platform for investors to store securities and settle trades. It operates in 46 countries and has about $30tn of assets under custody.

Measured by the size of its domestic debt markets, India is the largest country to sign up to Euroclear since Russia in 2012. After Russia joined, foreign holding of its government debt jumped from about 3 to 25 per cent, bringing in some $25bn.

In India foreign buyers of government bonds must go through a cumbersome registration process and use a local clearing system. Many global investors, including pension and sovereign wealth funds, have rules that prohibit securities that are not listed on platforms such as Euroclear or Clearstream, its Germany-based rival, thus precluding trading in Indian bonds.

“Getting India on Euroclear will be a big positive for opening the bond market, easing operational issues faced by foreign investors,” said Nagaraj Kulkarni, Asia rates strategist at Standard Chartered in Singapore.

Euroclear’s talks with regulators have opened rifts between India’s central bank and finance ministry. The RBI has expressed concern that opening debt markets risks sudden capital flight by foreign investors.

Many analysts see India’s addition to Euroclear as a step towards its eventual inclusion in the global bond market indices used by big international investors, a move StanChart says could bring in more than $20bn of capital.

Re: Indian Economy News & Discussion - Aug 26 2015

So are we saying debt investors are attracted to India only because inflation is under control ? I don't think so in the least....it is a combination of both strong monetary policy that has kept inflation under control (for which the RBI deserves credit) and India over the last 15 years having emerged as the best performing global economy compared to alternatives. The latter has far more todo with the current government's 'can do' image and comparative stats that every investor can access as to which BRIC remains the only one standing.

I have nothing personally against Rajan - he is suave, distinguished and has the respect of institutional investors. However, if reducing PLR by a few percentage points CAN increase growth by a couple of percentage points (with benefits tilted more to the SME space) I am all for it. Jobs and growth in a country with the demographics of India, gain priority over inflation control....

I have nothing personally against Rajan - he is suave, distinguished and has the respect of institutional investors. However, if reducing PLR by a few percentage points CAN increase growth by a couple of percentage points (with benefits tilted more to the SME space) I am all for it. Jobs and growth in a country with the demographics of India, gain priority over inflation control....

Re: Indian Economy News & Discussion - Aug 26 2015

I think Rajan has done a good job even though he has a penchant for shooting his mouth off. High inflation is a long term growth killer. Without controlling it if you just reduce interest rates it is going to only give you high growth in spurts as has happened in the last 15 years. What India needs are policies and actions that give high growth over extended periods of time e.g. 30 yrs to really become an economic story. To solve that you need systemic reforms which is what he has stressed and Modi has done to a certain extent. A well oiled economic machinery will have reasonable inflation and growth as well. He has reduced rates once the situation has improved. one can argue whether it should have been faster or more. He has done that even when there was political pressure which is what a professional should do. Some SS allegations like green card, etc are childish. I think without stern policies the landing could have been really rough given the extent of economic mess under UPA. The major criticism is whether RBI should have flagged the bank NPA issue much earlier. This IMO.

Re: Indian Economy News & Discussion - Aug 26 2015

Also the banking system has a significant NPA problem which means existing investments are not delivering not only profit but also not recovering cost. In such a situation the banks will be more concerned with fixing that first instead of fresh lending. It also means that there are systemic problems which is why they are NPAs which needs to be fixed first. Under such a situation just lowering interest rates will have limited benefits e.g. lower EMIs and govt borrowings, etc. This IMO.

-

member_28663

- BRFite -Trainee

- Posts: 18

- Joined: 11 Aug 2016 06:14

Re: Indian Economy News & Discussion - Aug 26 2015

I think that's a fair argument but my worry is that the expected growth from reducing interest rates would mostly come from the wrong places.Arjun wrote:So are we saying debt investors are attracted to India only because inflation is under control ? I don't think so in the least....it is a combination of both strong monetary policy that has kept inflation under control (for which the RBI deserves credit) and India over the last 15 years having emerged as the best performing global economy compared to alternatives. The latter has far more todo with the current government's 'can do' image and comparative stats that every investor can access as to which BRIC remains the only one standing.

I have nothing personally against Rajan - he is suave, distinguished and has the respect of institutional investors. However, if reducing PLR by a few percentage points CAN increase growth by a couple of percentage points (with benefits tilted more to the SME space) I am all for it. Jobs and growth in a country with the demographics of India, gain priority over inflation control....

1) Reducing interest rates leads benefits the highly leveraged projects most of all. For a 1x leveraged project, a 1% decline in interest rates translates to a 1% extra RoE. For 10x leverage, this is 9% extra RoE. While 1% extra RoE is nice to have, 9% RoE is make or break for most projects.

2) As far as I know, most of the SME entities are closer to 1x indebted rather than 10x (would like to hear counterexamples of this). This means their competitiveness suffers from infrastructural bottlenecks, technology, red-tape etc. rather than low rates.

3) So which are the sectors that are highly indebted? Real estate and Infrastructure are two that come to mind. Let's take them one by one:

a) IMO there has already been too much capital flow into real estate in the UPA years. The high levels of inflation and relatively low interest rates made sure that people with any kind of money were almost forced to put money into real estate even if they were reluctant. This was bad for multiple reasons.

b) We could certainly do with more money flowing into infrastructure to it would be helpful if rates were lower, but again mal-investment needs to be avoided. The number of stranded power projects from the UPA era are mostly a result of corruption, but low interest rates also played a part. Besides, infrastructure is the easiest sector to fund with loans from supranational/development agencies and this has been the focus of the govt.

4) It makes a lot of sense for cheap credit to flow to the under-privileged sections of our society, and high interest rates are a hurdle in that. On the other hand, the Mudra Yojana seems specifically designed for this purpose so that is one way around it.

We should bear in mind that all this debate is about a couple of % points reduction in RBI base rates but that would do nothing at all to reduce the risk-premia. If someone has to borrow money at 15%, most of that is just a risk-spead being charged and would not be affected by the RBI cutting rates.

Re: Indian Economy News & Discussion - Aug 26 2015

http://economictimes.indiatimes.com/new ... s?from=mdr

Government to come out with updated IIP, WPI indices by year-end

Government will come out with revised IIP and WPI indices by the end of this year with a new base year of 2011-12 in order to make them more representative of the changing economic scenario.

"IIP is due for revision, it is under process at a very advanced stage. WPI is also up for revision. Similar to IIP, it is also at the very advanced stage. Both of these will be revised, as per my expectations shortly within the current year," Chief Statistician TCA Anant told in an interview to PTI.

The present indices of IIP and WPI have base year of 2004-05.

As part of the revision, the basket of items and weightage assigned to different entries on the basis of which indices is computed will be updated, he said.

With the new series in place, both the Index of Industrial Production (IIP) and Wholesale Price Index (WPI) will become more comparable with the GDP numbers than it is currently, he said.

"All of these will become comparable to the GDP basket in the 2011-12 series. The new series will be have 2011-12 as the base year", Anant said.

The National Statistical Commission has recommended to revise the base year of all economic indices every five years.

Government had last revised these indices in 2011 with the base year of 2004-05.

In addition to this, the Chief Statistician also informed that the Ministry of Statistics and Programme Implementation (MoSPI) which releases the data of national income (GDP) as well as WPI and Consumer Price Index (CPI) is working on bringing out an index for the services sector.

"There is work is going on. There is a lot of work both on prices and on quantities. But at the moment most of these are experimental," he added.

At present there is no such index for the services sector.

Re: Indian Economy News & Discussion - Aug 26 2015

http://timesofindia.indiatimes.com/busi ... 602507.cms

India's black economy shrinking, still exceeds Thailand and Argentina's GDP

Pegging India's 'black economy' at over Rs 30 lakh crore or about 20% of total GDP, a new study says it has been contracting gradually over the years but still remains bigger than the overall economic size of countries like Thailand and Argentina.

Besides, a crackdown on black money has made the cost of capital costlier in the black economy with the lending rates having risen to as high as 34%, from about 24% a year ago, as per the study by Ambit Capital Research.

The study said that the crackdown has had some "unintended consequences" in form of an increase in preference for cash in its physical form and a notable decline in the usage of formal banking channels with record low deposit growth — which may keep the GDP growth rate flat this year.

The study said that the crackdown has had some "unintended consequences" in form of an increase in preference for cash in its physical form and a notable decline in the usage of formal banking channels with record low deposit growth — which may keep the GDP growth rate flat this year.

It said the size of the India's black economy expanded rapidly over the 1970s and 1980s, but since then had been contracting at a gradual pace and is now estimated at around 20% of the country's GDP.

The term 'black economy' typically refers to the economic activities outside formal banking channels and include cash transactions in high-value assets like gold and real estate.

"Given that India's GDP in calender year 2016 is expected to be $2.3 trillion, the size of India's black economy is about $460 billion (over Rs 30 lakh crore), which is larger than the stated GDP of emerging markets like Thailand and Argentina," Ambit Capital Research said in a research note.

Majority of this black money is locked up in physical assets such as real estate and gold, it added.

Physical savings instruments have been historically preferred to financial savings instruments in India because purchase of physical assets can be funded using black money, while the purchase of financial assets can not be funded in such a manner due to a strong paper trail.

While official figures regarding the quantum of black money flowing into real estate sector are not available, experts suggest that more than 30% of India's real estate sector is funded by black money.

The report said that since the Modi government assumed power there has been a clear step-up in checks around gold transactions and it has become increasingly difficult to park unaccounted cash in the form of jewellery or bullion.

Due to various measures taken by the government to tighten the noose around black money, there has been a clear drop in the prices of land and real estate and a decline in the appetite in gold, it said.

The crackdown has, however, also resulted in increase in the preference for cash in physical form and notable decline in the usage of formal banking channels as evinced by the decline in bank deposits as well as usage of debit cards.

"The combination of heightened interest rates in the black economy as well as the lack of liquidity in the banking system has led to the weighted average cost of debt capital in India rising by 30 bps over the last 12 months even as policy rates were cut by 100 bps," the report noted.

"As banks are unwilling to lend to sub-investment grade creditors owing to their own NPA troubles, this credit demand has shifted entirely to informal channels of lending. This, in turn, has driven increase in lending rates in the black economy to as high as about 34 per cent per annum as per our primary data sources (against about 24 per cent a year ago)," it added.

Re: Indian Economy News & Discussion - Aug 26 2015

Shaktikanta Das @DasShaktikanta 13m13 minutes ago

MOU signed between NIIF and Qatar Investment Authority(QIA) during Prime Minister's visit. Will facilitate investments in infra projects.

.Shaktikanta Das @DasShaktikanta 6m6 minutes ago

QIA MOU: 3rd MOU of NIIF after those with Rusnano of Russia and ADIA of Abu Dhabi.Things taking shape.NIIF to play big role infra sector

Re: Indian Economy News & Discussion - Aug 26 2015

That may all be true, but the big bond guys like Gundlach, Gross and Hasenstab still refer to Rajan's presence. Maybe it arguably is nothing more than a placebo factor of sorts, but it works. I don't particularly like him trying to lecture GoI in a manner no past RBI governor has, but I also don't have enough personal dogma on the matter to want him gone. I prefer to follow Deng Xiaoping's black vs white cat argument here. GoI has already used executive powers to curtail his sole rate control authority. If whatever he says or does, helps FinMin achieve even greater attractiveness for India rupee-denominated government debt, it's all the better. Soon, even state government bonds can be owned by foreign investors, if not already.Arjun wrote:So are we saying debt investors are attracted to India only because inflation is under control ? I don't think so in the least....it is a combination of both strong monetary policy that has kept inflation under control (for which the RBI deserves credit) and India over the last 15 years having emerged as the best performing global economy compared to alternatives. The latter has far more todo with the current government's 'can do' image and comparative stats that every investor can access as to which BRIC remains the only one standing.

The continuous increase in holding of government debt by foreign long term bond investors means GoI can keep shrinking SLR, freeing up banks to invest more in private sector. This will further lower rates. This attractiveness also enables GoI to propose arrangements with oil producing companies to potentially accept payment in rupees, invested into Indian government bonds. In fact, that's essentially what the US did with Saudi Arabia back in 1974.

-

subhamoy.das

- BRFite

- Posts: 1027

- Joined: 11 Aug 2016 06:14

Re: Indian Economy News & Discussion - Aug 26 2015

Paid content is trying to project RBI GOV as the reason for India's fast growth and low inflation thus trying to take credit away from the zillions of small steps that GOI has implemented to increase demand and reduce the demand supply gap. The attractive ness of india as destination investment has nothing to do with RBI but GOI.

-

subhamoy.das

- BRFite

- Posts: 1027

- Joined: 11 Aug 2016 06:14

Re: Indian Economy News & Discussion - Aug 26 2015

Also notice the paid content to put down the gdp growth as fake thus again trying to take credit away from GOI. But one thing is for sure. GOI has more money in the bank than ever before which they can now do a precision delivery to the needy using a financial network IDed by Adhar etc. This is the game changer

Re: Indian Economy News & Discussion - Aug 26 2015

http://timesofindia.indiatimes.com/busi ... 602507.cms

first things needs are banning higher currencies greater than 100 bucks. devalue 500s and 1000s, and go for JAM initiative even for a veggie vendor on the streets.

ban all cash transactions with all goods and services except for groceries. keep transactions to lower than 2k per person per day, and one can do only 5 times a day. rest must be at least rupay card.

first things needs are banning higher currencies greater than 100 bucks. devalue 500s and 1000s, and go for JAM initiative even for a veggie vendor on the streets.

ban all cash transactions with all goods and services except for groceries. keep transactions to lower than 2k per person per day, and one can do only 5 times a day. rest must be at least rupay card.

Re: Indian Economy News & Discussion - Aug 26 2015

Why China is skeptical over India's growth story

As Narendra Modi hard sells his flagship projects this week in Gulf , Europe and USA to secure much required investments, China has expressed skepticism over India's growth story by claiming that India's democratic polity, divisive politics and political divergences may not allow smooth run for South Asia's biggest economy .

A commentary in China's state-run Global Times, on the eve of Modi's five-nation tour, in fact highlighted how a different governance system has ensured better economic delivery in the world's most populous nation. "Compared with the Chinese government, the Indian government lacks rallying appeal and top-down execution," noted an article titled 'India must beware pitfalls in push for rapid growth published in Global Times on June 3.

Re: Indian Economy News & Discussion - Aug 26 2015

[quote="Kakkaji"]Why China is skeptical over India's growth story Comparable growth by a democratic polity is going to be hard for the commies to swallow. That robs the CPC of its legitimacy. Legitimacy is a very powerful perception.

Re: Indian Economy News & Discussion - Aug 26 2015

news18

Singapore: India has jumped 13 positions from 2015 to rank second among 30 developing countries in 2016 on ease of doing business, according to a study topped by China.

According to 2016 Global Retail Development Index (GRDI), which ranks top 30 developing countries for retail investment worldwide, a pick up in GDP growth and better clarity regarding FDI regulations have helped India achieve a second ranking.

"India's strong ranking reflects foreigner retailers' increased optimism in its retail market and its vast growth potential," said Debashish Mukherjee, a partner with AT Kearney and co-head of the Consumer Industries & Retail Products Practice for India and Southeast Asia.

"India has relaxed several key Foreign Direct Investment (FDI) regulations in single-brand retail and this has paved the way for multinational firms to enter the market," Mukherjee said.

India's retail sector has expanded at a compound annual growth rate of 8.8% between 2013 and 2015, with annual sales crossing the $1 trillion mark, according to AT Kearney, a London-based business consultancy.

Singapore: India has jumped 13 positions from 2015 to rank second among 30 developing countries in 2016 on ease of doing business, according to a study topped by China.

According to 2016 Global Retail Development Index (GRDI), which ranks top 30 developing countries for retail investment worldwide, a pick up in GDP growth and better clarity regarding FDI regulations have helped India achieve a second ranking.

"India's strong ranking reflects foreigner retailers' increased optimism in its retail market and its vast growth potential," said Debashish Mukherjee, a partner with AT Kearney and co-head of the Consumer Industries & Retail Products Practice for India and Southeast Asia.

"India has relaxed several key Foreign Direct Investment (FDI) regulations in single-brand retail and this has paved the way for multinational firms to enter the market," Mukherjee said.

India's retail sector has expanded at a compound annual growth rate of 8.8% between 2013 and 2015, with annual sales crossing the $1 trillion mark, according to AT Kearney, a London-based business consultancy.

Re: Indian Economy News & Discussion - Aug 26 2015

And.SaiK wrote:http://timesofindia.indiatimes.com/busi ... 602507.cms

first things needs are banning higher currencies greater than 100 bucks. devalue 500s and 1000s, and go for JAM initiative even for a veggie vendor on the streets.

ban all cash transactions with all goods and services except for groceries. keep transactions to lower than 2k per person per day, and one can do only 5 times a day. rest must be at least rupay card.

Put behind bars all merchants establishments and financial establishments that put a 2% surcharge for transactions using debit/credit cards.

I don't believe GoI on black money, Modi or no Modi, till honest spenders are spared of this 2% penalty.

Re: Indian Economy News & Discussion - Aug 26 2015

^^

It is worth looking into creating a policy framework that drives cost for payments made via credit/debit cards below that of cash. People will switch away from cash soon as it starts being a little bit cheaper to pay without cash.

Would providing a 5% rebate in GST/VAT/CST for transactions made by credit/debit cards be enough to achieve this perhaps? Or perhaps an income tax rebate can be introduced based on submission of credit/debit card receipts?

It is worth looking into creating a policy framework that drives cost for payments made via credit/debit cards below that of cash. People will switch away from cash soon as it starts being a little bit cheaper to pay without cash.

Would providing a 5% rebate in GST/VAT/CST for transactions made by credit/debit cards be enough to achieve this perhaps? Or perhaps an income tax rebate can be introduced based on submission of credit/debit card receipts?

Re: Indian Economy News & Discussion - Aug 26 2015

The 2% is charged by the card issuer. No? That is how the credit cards are supposed to make money (perhaps among others) - commission, for enabling the electronic transaction.SRoy wrote:

And.

Put behind bars all merchants establishments and financial establishments that put a 2% surcharge for transactions using debit/credit cards.

I don't believe GoI on black money, Modi or no Modi, till honest spenders are spared of this 2% penalty.

Typically, the vendor absorbs that charge if the purchased items are above a certain limit (perhaps they have it built in into the price of various items).

Re: Indian Economy News & Discussion - Aug 26 2015

Let's not go into hyperbole here. The convenience fee is imposed by the card issuer. If you don't like it, don't use the card. Amex has the highest fee, followed by Visa/MC. RuPay cards have the lowest fees. What's more, the govt imposed service charge and these convenience fees are on their way out:

Soon, you won't have to pay service charge, surcharge on card and online transactions

Soon, you won't have to pay service charge, surcharge on card and online transactions

Service charge, user charge and convenience fee paid by gateways and vendors on online or card payments will be waived once steps approved by the Cabinet on Wednesday come into effect.

Also, above a threshold, one has to make payment online or through cards. The move would discourage cash payment and help tax authorities get leads on evasion. The Cabinet approved various steps in this regard to be taken in a year to two years to boost these payments.

Service charge is currently levied by payment gateways and paid to the government. The vendor using a payment gateway also pays a convenience charge. On credit cards, it is 1-2.5 per cent. The move will help the government in carrying out its financial inclusion programmes digitally. “It will help reduce transaction cost and encourage electronic mode of payment, facilitating the financial inclusion agenda of the government,” said Kalpesh Mehta, partner, Deloitte Haskins & Sells.

The official statement explained the promotion of payments through cards and digital means will be instrumental in reducing tax avoidance, migration of government payments and collections to a cashless mode. To give a perspective, 569 million transactions were made till December of the current financial year, with payments worth Rs 67.75 lakh crore.

Re: Indian Economy News & Discussion - Aug 26 2015

That BS article has a table which shows that payment card transactions for 9 months of FY16 were far below the numbers printed for the all of FY15.

Are payment card transactions falling out of favor or is the economy not doing as well as officially reported?

Are payment card transactions falling out of favor or is the economy not doing as well as officially reported?

Re: Indian Economy News & Discussion - Aug 26 2015

No idea. The latest RBI data is only upto 2014-15:

RBI Annual Report: Payment and Settlement Systems and Information Technology

RBI Annual Report: Payment and Settlement Systems and Information Technology

Re: Indian Economy News & Discussion - Aug 26 2015

Time to close the GDP discrepancies debate - MoSPI itself confirms the problem is a lag in availability of data:

GDP data discrepancies: Govt to release supply use table to tackle variation

GDP data discrepancies: Govt to release supply use table to tackle variation

Decision soon on increasing EPFO investments in ETFs to 15% from 5% currentlyThe statistics department will shortly release the supply use table (SUT) to clear GDP data discrepancies, blamed for pushing up economic growth to close to eight per cent in the March quarter of 2015-16, by this month-end.

However, the provisional estimates of GDP data, like the one which was released in May for 2015-16, would always show discrepancies in the expenditure side of the data. "There are ways to eliminate discrepancies as well. We are working on it. We will probably release SUT once it is finalised," Chief Statistician TCA Anant said.

The supply use tables are like input output matrix but cover larger data than the latter. It would cover both services as well as manufacturing, unlike input output matrix which cover only factory production.

The supply table describes the supply of goods and services, which are either produced in the domestic industry or imported. The use table shows where and how goods and services are used in the economy.

Sources said a couple of approvals have to be taken within the Ministry of Statistics and Programme Implementation (MoSPI) before releasing the table. However, only the table for 2011-12 and 2012-13 would be released by the Central Statistics Office now.

Discrepancies would be eliminated only with a lag. This means that GDP data for 2015-16, released in May, would still show discrepancies because the SUT for it would take time. "It's a very tedious exercise. Discrepancies will be zero only for the year for which we have done it. There will be a lag," Anant said.

Noting that Employees' Provident Fund Organisation's (EPFO's) investments in Exchange Traded Funds (ETFs) have given good returns during March and April this year, Union Labour Minister Bandaru Dattatreya today said these investments would be increased and the quantum for coming year would be decided soon.

"On March 31, 2016, we invested an amount of Rs 6,577 crore which gave return of Rs 6,601 crore, which is 0.37% increase. On April 30, 2016, the amount we invested was Rs 6,674 crore which gave return of Rs 6,786 crore. It is up to 1.68% plus (gain)," Dattatreya told reporters here.

-

nandakumar

- BRFite

- Posts: 1641

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Aug 26 2015

The RBI Monthly Bulletin has a Table showing data on card usage at Point of Sale terminals. According to this, card usage during 2015-16 was up nearly 20% over the previous year. In volume terms too, there is an increase. The last table in the monthly bulletins of May 2015 and 2016 has that data.Suraj wrote:No idea. The latest RBI data is only upto 2014-15:

RBI Annual Report: Payment and Settlement Systems and Information Technology

http://rbidocs.rbi.org.in/rdocs/Bulleti ... 7E5425.PDF

http://rbidocs.rbi.org.in/rdocs/Bulleti ... 1DFD80.PDF

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Indian Economy News & Discussion - Aug 26 2015

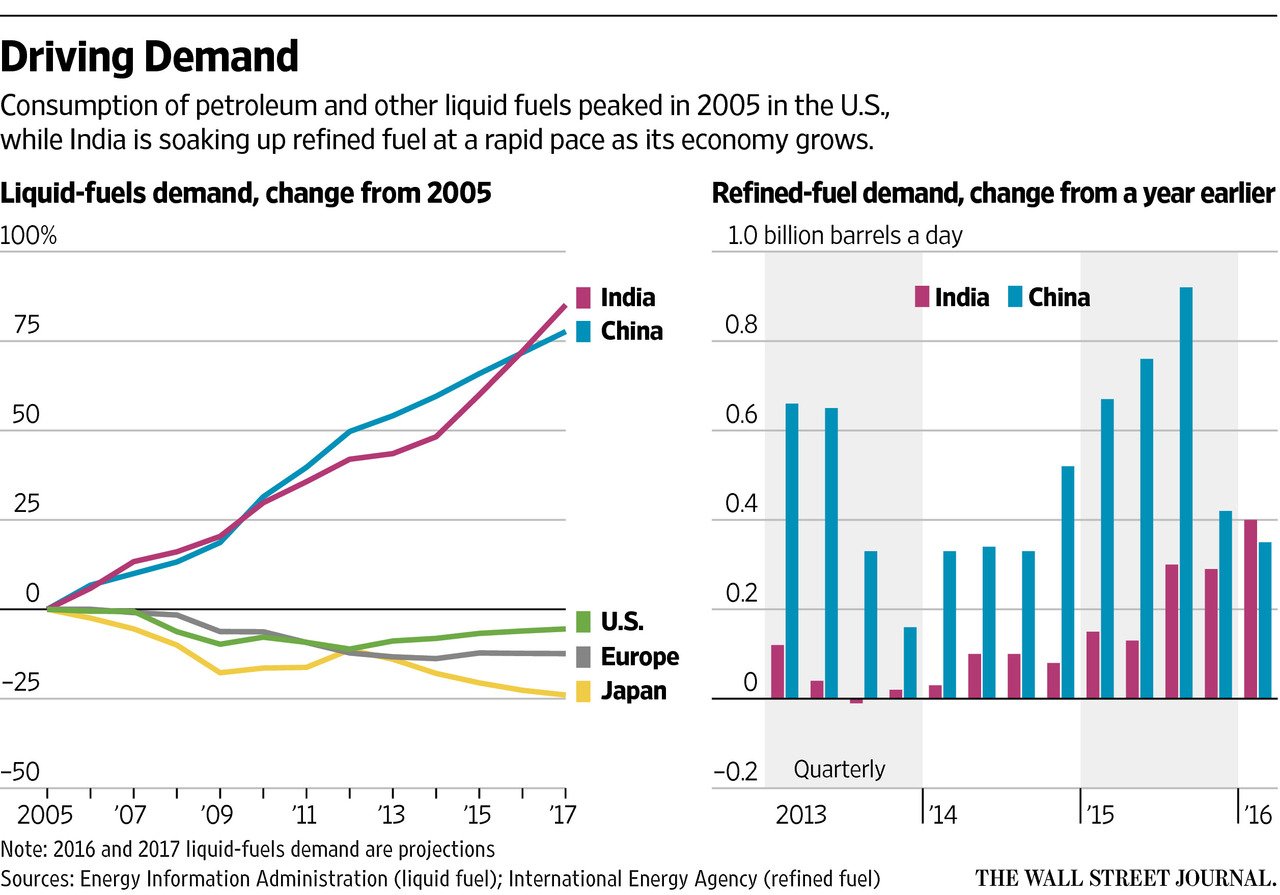

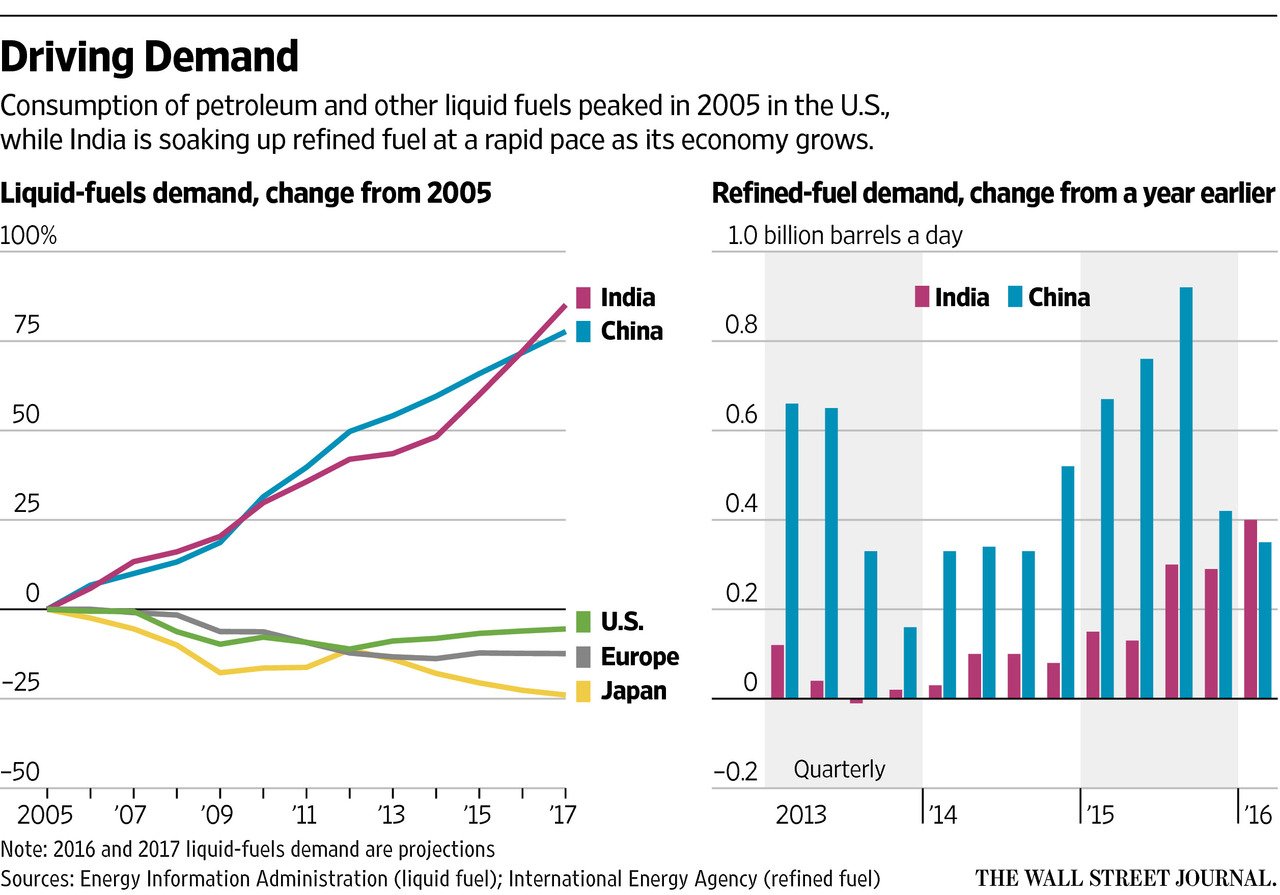

Finally, saying "India" and "China" in the same (economic) sentence is coming back invogue again, after a decade in the wilderness.

Re: Indian Economy News & Discussion - Aug 26 2015

Thanks nandakumar. Glad to have help with digging up data.

-

nandakumar

- BRFite

- Posts: 1641

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Aug 26 2015

SurajSuraj wrote:Thanks nandakumar. Glad to have help with digging up data.

Glad to be of help. I wish I could do more. Still getting around to it. Hopefully remedy the deficiency soon.

Re: Indian Economy News & Discussion - Aug 26 2015

Government looks to take share of water transport to 15% in 5 years

NEW DELHI: To ensure the success of 'Make in India' initiative, the government is committed to bring down the high logistics cost to 12 per cent and raise the share of waterways transportation to 15 per cent in the next five years, Union Minister Nitin Gadkari said today.

At present the country's logistics cost is 18 per cent while barely 3.5 per cent of goods are transported through waterways.

" Make in India scheme will be a great success if we can bring down the high logistics cost from 18 per cent to at least 12 per cent. In China , it is 8 per cent. The government is making efforts in this direction as goods transportation through water costs barely 20 paise per km in comparison to Rs 1.5 a km through road and Re 1 per km through railways," Road Transport, Highways and Shipping Minister Gadkari said.

Re: Indian Economy News & Discussion - Aug 26 2015

India Putting Floor Beneath Oil Prices As Demand Continues To Soar

http://oilprice.com/Energy/Oil-Prices/I ... -Soar.html

http://oilprice.com/Energy/Oil-Prices/I ... -Soar.html

Re: Indian Economy News & Discussion - Aug 26 2015

Govt banks on new PSU norms for higher non-tax revenue

US firms pledge $45 billion investments on Modi visit

The Centre has released a new set of guidelines on capital restructuring of state-owned companies, which will make them more accountable on matters of dividends, buybacks and bonuses, and will help the government meet its non-tax revenue and capital receipts target for the year.

The guidelines, applicable from April 1, make it mandatory for all central public sector enterprises (CPSEs) to pay a minimum annual dividend of 30 per cent of profit after tax, or five per cent of net worth, whichever is higher. If they cannot, they will have to explain to the ministry concerned if they are constrained by capacity to borrow or if the free cash is being put into capital spending and infrastructure.

US firms pledge $45 billion investments on Modi visit

Power minister estimates 1.1% energy surplus in FY17Setting aside the regulatory concerns that businesses such as Apple, Walmart or Amazon have faced in India, American companies have promised to invest at least $45 billion (Rs 3 lakh crore) over the next two to three years. The commitment came at a roundtable interaction in Washington DC between Prime Minister Narendra Modi and 20-odd chief executive officers on Tuesday night.

Modi, who had wooed top Silicon Valley majors during his US trip last year, spent 90 minutes last night with CEOs representing companies in sectors spanning new economy

to entertainment, energy to telecom, food to pharma. He told them investor confidence has returned as India is scripting a new growth story.

FM reviews sovereign wealth fund's statusThe power ministry has finalised a generation target of 1,178 billion units (BU) for 2016-17, against 1,137.5 BU in 2015-16.

The ministry has also projected energy surplus of 1.1 per cent and peak surplus of 3.1 per cent during FY17, compared with energy shortage of 2.1 per cent and peak shortage of 2.6 per cent last year.

Of the current year’s target, 999 BU was estimated to be generated through thermal power, 134 BU from hydro, 40 BU from nuclear and 5 BU imported from Bhutan.

The power ministry has firmed up these estimates based on month-wise anticipated energy requirement and availability as well as peak demand, especially in the wake of increase in generation thanks to capacity addition, coal supply and transmission network.

Monsoon arrives over Kerala after week's delayA panel headed by Finance Minister Arun Jaitley on Wednesday took stock of the progress made on operationalising India's maiden sovereign wealth fund National Investment and Infrastructure Fund (NIIF), including the selection of its CEO and projects shortlisted for making initial investments.

The second Governing Council meeting of the Rs 40,000 crore NIIF also discussed the follow-up action being taken on the MoUs signed with Rusnano of Russia, Abu Dhabi Investment Authority (ADIA) of Abu Dhabi and Qatar Investment Authority.

"The Governing Council was apprised of the interactions that have been held with a large number of long term investors, Sovereign Wealth Funds, Pension Funds from across the globe, seeking to invest in the NIIF," a finance ministry statement said.

They also discussed the guidelines for investment of the corpus of NIIF, including the investment policy, it added.

Set up in December 2015, NIIF will act as an investment vehicle for funding commercially viable greenfield, brownfield and stalled projects.

Rains reached the Kerala coast on Wednesday, a day after the India Meteorological Department (IMD) predicted southwest monsoon would hit the southern state on June 9. Even though there has been a nine-day delay in the arrival of monsoon, it’s not expected to make much difference on its progression over rest of the country barring a minor hold up over central India.

“The delayed onset of monsoon over Kerala does not mean its progression over rest of India would be tardy. In fact, all our models show that rains would pick up pace in the second half of June,” said L S Rathore, director-general of IMD. According to him, the southwest monsoon normally reaches Mumbai around June 10 and this year it might be there by June 11-12.

The met department said on Wednesday that in the next 48 hours, southwest monsoon would see progress in Karnataka, southern Andhra Pradesh besides Kerala and Tamil Nadu. Nearly half of India's farmlands, without any irrigation cover, depend on annual June-September rains to grow a number of crops. Farmers plant rice, cane, corn, cotton and oilseeds during the rainy months of June and July.

Re: Indian Economy News & Discussion - Aug 26 2015

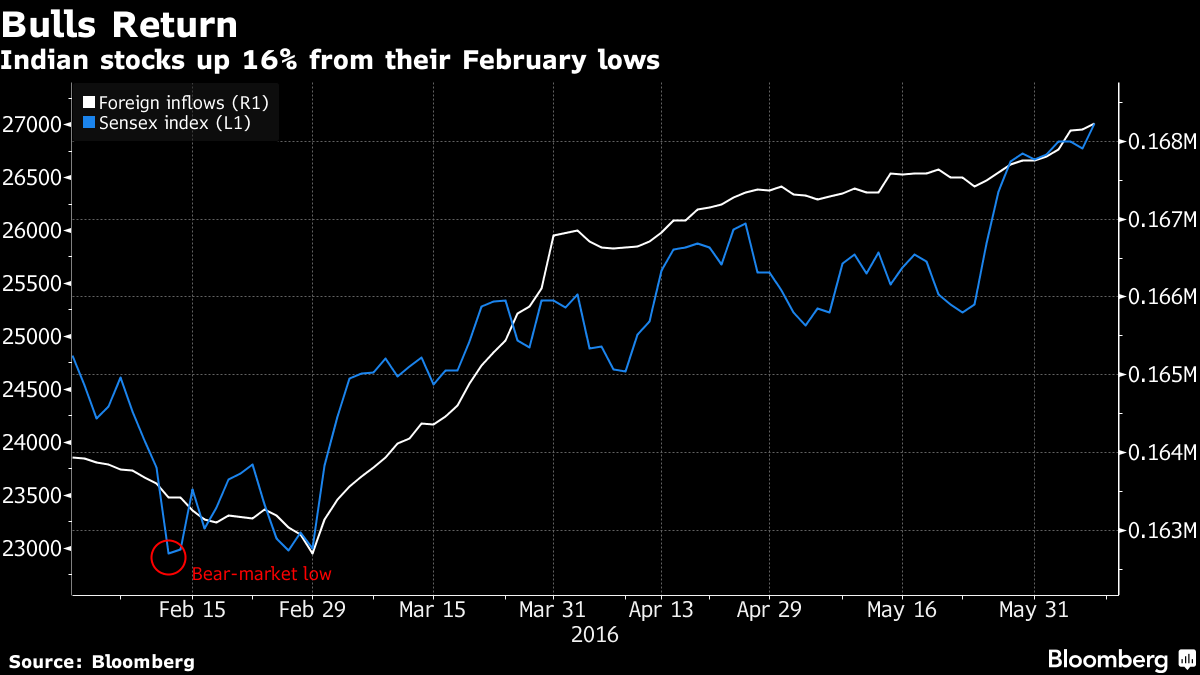

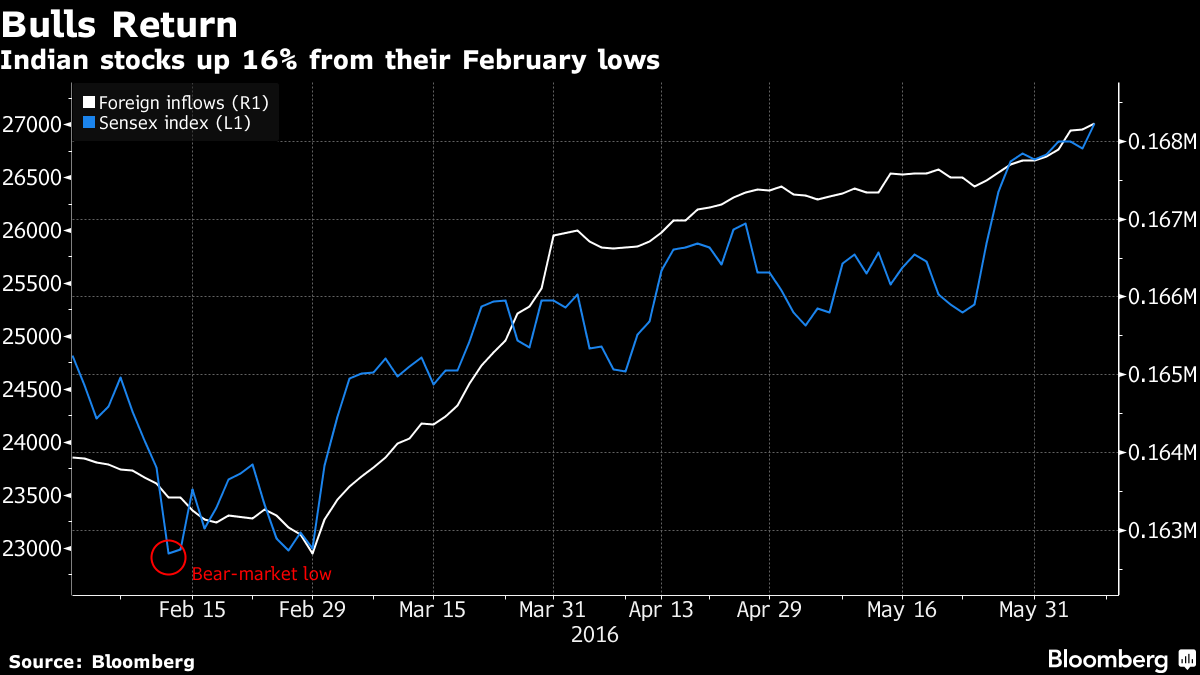

Year’s first trillion-dollar bull market is nearing in India

Stage set for GST; Govt releases draft GST law

Traders are shrugging off the most expensive stock valuations since 2011, sending Indian shares back toward a bull market amid forecasts for the strongest monsoon in two decades and data showing the nation growing faster than all other major economies. Inflows may continue as the benefits of Prime Minister Narendra Modi’s policies emerge in corporate earnings reports, investors including Mark Mobius and BNP Paribas SA said.

“Foreign investors are looking for growth; there aren’t many places to get it and that’s why India stands out,” Prashant Bhayani, chief investment officer for Asia at BNP Paribas Wealth Management, said in an interview in Singapore. “Valuations aren’t cheap relative to history but we expect earnings will start to pick up gradually from depressed levels. That’s going to provide a tailwind for the market. We are overweight on India.”

Foreign investors have bought $1.5 billion of shares since April 1, the second-highest in Asia excluding Japan, after pouring $4.1 billion in March alone as global risk appetite revived and Modi took steps to boost rural demand and investment. The benchmark S&P BSE Sensex has risen 16 percent from a low reached in February, putting India on course to become the first among markets valued at more than $1 trillion to crawl back from a bear market this year.

Stage set for GST; Govt releases draft GST law

Individuals and entities with an annual turnover of Rs 10 lakh or more could soon be under goods and service tax laws, widening the tax base of the government, according to the draft central and integrated laws released on Tuesday.

According to the proposal of the draft laws, in the northeastern states the threshold is even lower at Rs 5 lakh. The draft laws also propose collection of taxes at source for e-commerce companies, including aggregators, and simplify the definition of “services” to include intangibles such as software and work contracts.

These were released on the Union finance ministry website for public feedback, hours after a meeting of the Empowered Committee of Finance Ministers on GST. All states except Tamil Nadu were on board, Union Finance Minister Arun Jaitley told reporters.

According to the draft laws, GST shall apply to all intra-state supply of goods and services. While the supplier of goods will have to bear the tax burden in most cases, the recipient might also have to bear it in some.

Experts said releasing the draft GST laws was a positive step, as these clearly define the contours of the tax regime.

Re: Indian Economy News & Discussion - Aug 26 2015

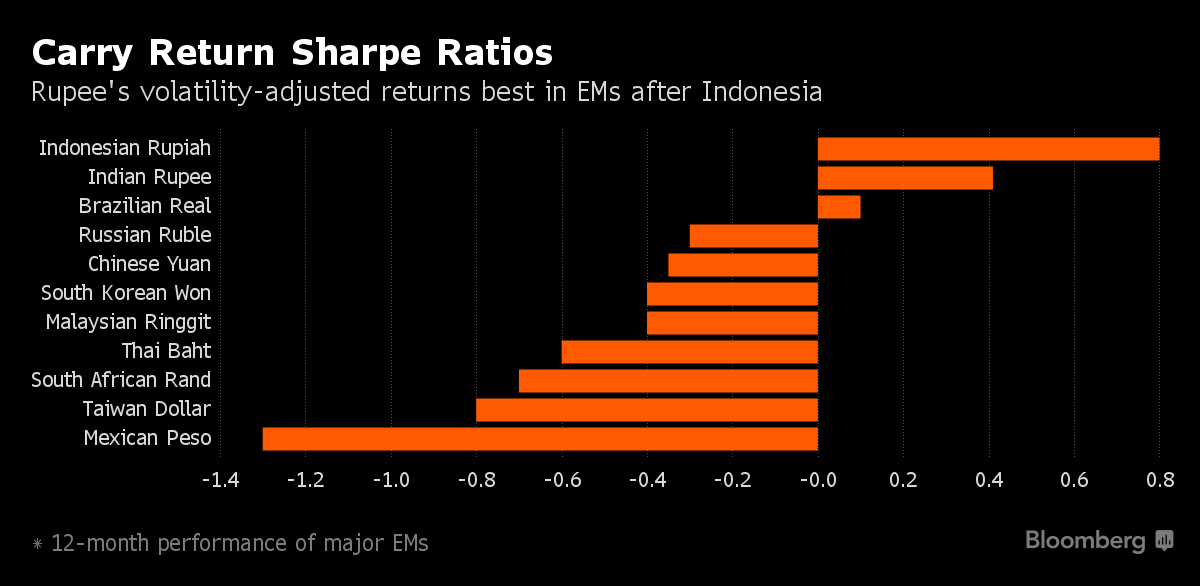

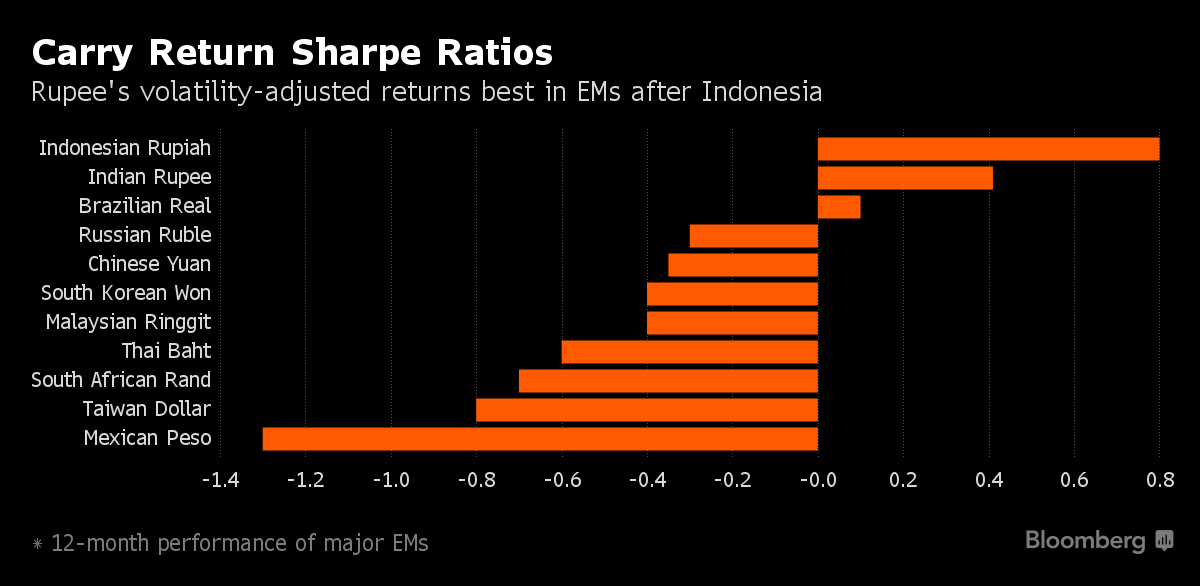

Rupee Carry Magic Looks Volatility-Proof as Funds Weigh Brexit

The Indian rupee has been the best-performing carry trade in emerging markets in the past year after the Indonesian rupiah by one measure. For some investors, that’s a reason to stick with it as storm clouds gather.

Record foreign-exchange reserves, low overseas ownership of Indian debt and high yields make the rupee one of the safest currencies in emerging markets, said Brad Gibson, a Hong Kong-based portfolio manager for AllianceBernstein LP, which oversees $487 billion globally. The rupee’s Sharpe ratio -- which gauges returns from borrowing in dollars to buy the currency adjusted for price swings -- was 0.49 in the past year, the second-highest among 23 developing-nation exchange rates tracked by Bloomberg. That for Indonesia was 0.81.

“In Asia, there aren’t many currencies that offer decent carry, so we’re content to accept the volatility of the rupee for the carry on offer,” Gibson said in an interview. “While we are not strongly positive on the bond markets at these levels, the currency in terms of the carry is probably one of the safest in emerging markets.”

AllianceBernstein joins Pacific Investment Management Co. in favoring the rupee as a target for carry trades, which are financed with lower-yielding currencies. The rupee is expected to remain stable and will most likely perform better than other Asian currencies, Luke Spajic, head of portfolio management for emerging Asia at Pimco, which oversees about $1.5 trillion in assets globally, said in an interview.

The Indian currency is forecast to deliver a 2.1 percent total return by end-2016, Asia’s best, estimates compiled by Bloomberg show, even as its spot rate has dropped 1.5 percent so far this year to 67.1250 a dollar in Mumbai on Wednesday. While the currency weakened 4.4 percent in the past 12 months, its total return was 3 percent. AllianceBernstein predicts it will end the year around 66-67 a dollar.

India’s world-beating economic growth and improvements to its current-account and fiscal deficits have burnished the appeal of the nation’s assets. Foreign funds have poured a net $2.9 billion into local shares in 2016, a fifth straight year of inflows, while overseas holdings of rupee-denominated debt surged 2.2 trillion rupees in the last two years before falling by 99 billion rupees ($1.5 billion) in 2016. Foreign-exchange reserves soared to an unprecedented $363.5 billion last week.

“Fundamentally, India has improved immensely,” said Anthony Chan, a senior economist at AllianceBernstein. “India should do better in case of an emerging-market selloff or a big risk-off event and shouldn’t deserve the same scale of a selloff as other emerging markets may see in the region. The Reserve Bank of India has enough reserves to put to work to defend the currency.’’

The investment manager isn’t holding Indian sovereign bonds as it doesn’t see the Reserve Bank of India easing monetary policy further after five interest-rate reductions since early 2015. It is betting on rising swap rates.

“We don’t think that bond yields in India are going to fall significantly," said Gibson. "The RBI is unlikely to cut rates so it’s more about carry and not rally.”

Re: Indian Economy News & Discussion - Aug 26 2015

Looks like IMD has got Monsoon wrong (as usual). Not only wrong, spectacularly wrong. The West monsoon (Arabian see one) just refuses to move. First IMD predicted a delay of 7 days, then 10 days. Its already been 13 days and now they are saying one week more. Monsoon is stuck above Kerala/Karnataka since past 5 days. Even normal rainfall looks difficult, let alone the 106% predicted by IMD. Even worse, its the Marathwara region where it refuses to come.

I get it that it's difficult to predict, but they can't predict even 1 day in advance? Every day their forecast is wrong completely.

Looks like its going to be difficult for the economy this year too. I pray for the farmers.

I get it that it's difficult to predict, but they can't predict even 1 day in advance? Every day their forecast is wrong completely.

Looks like its going to be difficult for the economy this year too. I pray for the farmers.