Indian Economy News & Discussion - Aug 26 2015

-

kapilrdave

- BRFite

- Posts: 1566

- Joined: 17 Nov 2008 13:10

Re: Indian Economy News & Discussion - Aug 26 2015

Swiss franc is just one danda away from the world powers. Current powers protecting them are not forever, nor even long term now.

They started filling their pot of sins from WW2 time and it's already overfull. Karma will catch them for sure.

They started filling their pot of sins from WW2 time and it's already overfull. Karma will catch them for sure.

Re: Indian Economy News & Discussion - Aug 26 2015

Rather extreme views being aired about Swiss and Swiss Franc. It's neither God's gift nor absolutely trash. Like every country and currency they've their share of current and historical problems.

The currency is a source of stability but economy is not very strong.

Let's leave it at that.

The currency is a source of stability but economy is not very strong.

Let's leave it at that.

Re: Indian Economy News & Discussion - Aug 26 2015

If the currency is stable but economy is not very strong as you suggest., then the question must be asked why is the currency stable and what will cause its instability? The swiss franc is stable because the surrounding countries and its banking partner nations deem it so. We can leave it that., but again to treat it as God's gift will also bring out the counterpoint on why it is a trash!JTull wrote:Rather extreme views being aired about Swiss and Swiss Franc. It's neither God's gift nor absolutely trash. Like every country and currency they've their share of current and historical problems.

The currency is a source of stability but economy is not very strong.

--

The current peg of say a franc against a rupee or icelandic krona is arbitrary. India's rupee must be pegged along with the currency of its major trading partners - the nations it exports to and the nation it imports from and the relative consumption within India. Let us say that India imports zero and exports zero and is large enough to grow within itself by trading internally., then the pegging of its currency to another nation or a unknown standard is purely arbitrary., in fact it is immaterial.

Once the above is understood, I think one can discuss economy of India on its own merits rather than seeing how bad (or good) the currency is based on some arbitrary comparison and valuation.

Re: Indian Economy News & Discussion - Aug 26 2015

I am not sure what you're trying to discuss here. If it is a philosophical discussion you're interested in, then I'd prefer to do it offline.

INR is not pegged to any currency. Some are pegged (e.g., CNY) and some have a prescribed band (e.g., HKD).

As far as valuation is concerned, USD is the defacto benchmark and all other rates are cross rates. That doesn't mean a currency is 'pegged' to USD. That's how the market quotes it. But if there was a big transaction in between two currencies without involving the USD, both their 'values' against USD will reflect that. Lack of liquidity often plays a part in valuing these 'cross' trades. If the countries involved are regularly going to be doing this and they don't want volatility versus USD, then they could create bilateral swap mechanism with appropriate netting arrangement. Unless, the bi-directional flow is balanced, there will always be an impact, eventually (e.g., INR - RUB swaps).

Prior to devaluation, CHF appreciation was not necessarily due to a 'corrupt' system. Weakness in Eurozone contributed to 'flight to quality' or 'safe heaven'. Proximity to European heartland meant that people prefer to keep it there. Switzerland is not a G7 country, and G7 has a track record of making collusive currency interventions. So CHF seemed most appropriate to these guys. Eurozone didn't mind because their exports into Schweiz were getting cheaper. But, SNB did mind this large pool of hot money and potentially changing consumption impact.

INR is not pegged to any currency. Some are pegged (e.g., CNY) and some have a prescribed band (e.g., HKD).

As far as valuation is concerned, USD is the defacto benchmark and all other rates are cross rates. That doesn't mean a currency is 'pegged' to USD. That's how the market quotes it. But if there was a big transaction in between two currencies without involving the USD, both their 'values' against USD will reflect that. Lack of liquidity often plays a part in valuing these 'cross' trades. If the countries involved are regularly going to be doing this and they don't want volatility versus USD, then they could create bilateral swap mechanism with appropriate netting arrangement. Unless, the bi-directional flow is balanced, there will always be an impact, eventually (e.g., INR - RUB swaps).

Prior to devaluation, CHF appreciation was not necessarily due to a 'corrupt' system. Weakness in Eurozone contributed to 'flight to quality' or 'safe heaven'. Proximity to European heartland meant that people prefer to keep it there. Switzerland is not a G7 country, and G7 has a track record of making collusive currency interventions. So CHF seemed most appropriate to these guys. Eurozone didn't mind because their exports into Schweiz were getting cheaper. But, SNB did mind this large pool of hot money and potentially changing consumption impact.

Re: Indian Economy News & Discussion - Aug 26 2015

Inflation falls to 14-month low of 4.2% in October

Incremental stress on bank books coming down, says RBI officialInflation fell in November on both the consumer price index (CPI) and the wholesale price index (WPI), giving room to the Reserve Bank of India (RBI)-chaired panel to cut the policy rate further to improve the growth rate.

While CPI inflation was down to 4.2% in October, the lowest in the new series launched since November 2014, against 4.31% in the September, the WPI rate of price rise declined to a four-month low of 3.39% compared to 3.57%, official data released on Tuesday showed.

The inflation on both the indices decreased as the rate of price in food items declined. It fell to 3.32% in October from 3.88% in the previous month in terms of retail price index and to 4.34% from 5.75% in terms of WPI.

It is widely expected that the monetary policy committee would cut the policy rate as shrinkage of cash following demonetisation of old Rs 500 and Rs 1,000 notes is likely to further bring down inflation. It is also expected to deal a blow to economic activities. For this as well, a cut in the interest rates might become relevant.

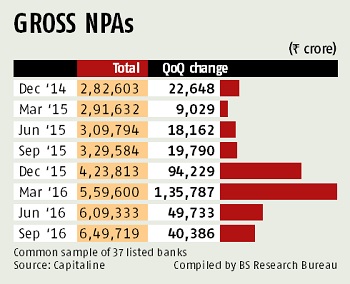

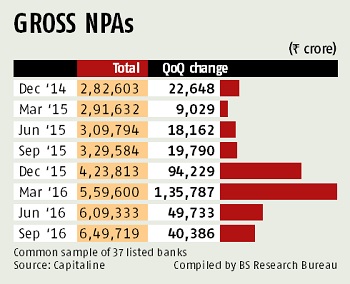

Small signs of moderation in asset quality pressure on banks are becoming visible, going by the dip in the amount of loans that got added to the pool of gross non-performing assets (GNPAs) in the quarter ended September.

This addition moderated to about Rs 40,000 crore, from Rs 47,000 crore in the June quarter, first of the current financial year, according to a review of results for 37 listed banks (from both the public and private sectors).

Re: Indian Economy News & Discussion - Aug 26 2015

Suraj,

we had a discussion regarding the amount of 500/1000 notes that wont be deposited/exchanged, lightening RBI's liabilities.

viewtopic.php?p=2075577#p2075577 (onwards)

viewtopic.php?p=2075581#p2075581

viewtopic.php?p=2075585#p2075585

viewtopic.php?p=2075589#p2075589

viewtopic.php?p=2075637#p2075637

wonder if something on these lines is doable and if so what would be benefits/problems ?

we had a discussion regarding the amount of 500/1000 notes that wont be deposited/exchanged, lightening RBI's liabilities.

viewtopic.php?p=2075577#p2075577 (onwards)

viewtopic.php?p=2075581#p2075581

viewtopic.php?p=2075585#p2075585

viewtopic.php?p=2075589#p2075589

viewtopic.php?p=2075637#p2075637

wonder if something on these lines is doable and if so what would be benefits/problems ?

Re: Indian Economy News & Discussion - Aug 26 2015

I don't think Modi is an income redistributionist in this manner . He may set up a more comprehensive general social security net, but outright cash transfers don't seem to be his style . This is mostly politics, so the why is better off discussed there further .

Re: Indian Economy News & Discussion - Aug 26 2015

Surge in iron ore output

Calcutta, Nov. 16: Domestic iron ore output has grown 25 per cent in the first half of 2016 following the Centre's focus on stepping up mineral production and lowering import.

According to market analysts, the move can put pressure on domestic prices with international rates remaining steady at around $50 per tonne.

According to mines ministry data, iron ore production in the first half of the year stood at 84 million tonnes (mt) compared with 66.85mt in the same period a year ago. "While domestic production has increased, imports have gone down. Exports have also increased,"

Re: Indian Economy News & Discussion - Aug 26 2015

SBI cuts deposit rates below 7%

http://www.financialexpress.com/industr ... -7/447603/

http://www.financialexpress.com/industr ... -7/447603/

SBI chairman Arundhati Bhattacharya had said last week that since banks have got more than R3.25 lakh crore in deposits following the de-monetisation drive, sooner or later banks will cut deposit rates.Moreover, banks need to reduce their deposit rates in order to pass on the benefits of Reserve Bank of India (RBI) rate cuts, amounting to 175 bps since January 2015, to borrowers. This means that while borrowers can avail of cheaper loans, fixed deposits will turn progressively unattractive for savers.

-

kapilrdave

- BRFite

- Posts: 1566

- Joined: 17 Nov 2008 13:10

Re: Indian Economy News & Discussion - Aug 26 2015

I think this demonetization will have negative impact on Chinese imports. A lot of imports are under-invoiced to evade the duty, and remaining part is paid by hawala. Mostly the invoicing is done 1/10th of the cost. Now no cash, no hawala.

Re: Indian Economy News & Discussion - Aug 26 2015

http://www.mydigitalfc.com/news/coal-do ... auxite-903Piyush Goyal @PiyushGoyal 13h13 hours ago

Govt. plans to replace gold import with mining of domestic gold to improve India's current account deficit. http://www.mydigitalfc.com/news/coal-do ... auxite-903 …

Re: Indian Economy News & Discussion - Aug 26 2015

http://www.livemint.com/Politics/ixWKGG ... bit-C.html

Hmm.. hopefully next year growth will be much better.

Hmm.. hopefully next year growth will be much better.

Re: Indian Economy News & Discussion - Aug 26 2015

India may impose curbs on domestic gold holdings: Report

http://economictimes.indiatimes.com/new ... 614499.cms

http://economictimes.indiatimes.com/new ... 614499.cms

Re: Indian Economy News & Discussion - Aug 26 2015

Unnamed source and no more?Austin wrote:India may impose curbs on domestic gold holdings: Report

http://economictimes.indiatimes.com/new ... 614499.cms

BS !

Re: Indian Economy News & Discussion - Aug 26 2015

Jim Rickards

Re: Indian Economy News & Discussion - Aug 26 2015

How can you "curb" domestic gold holdings? Even if you specify a qty.,like the rural bank accts. which held nothing,amazingly,almost overnight ( depending upon stocks of gold),almost every Indian individual/families will have lockers,Godrej cpbds filled with legit gold stocks.Plus,they will hoard gold in secret lockers,buried underground where the tax man will rarely if ever find,leading to a massive rise in the "D Co.'s" profits! Such a move to limit gold holdings will have the opposite result,leading to a huge outflow of forex in the drive to acquire gold...and silver too! Remember how the British during the infamous "Opium Wars" with China took their payment mostly in silver taels.The media has reported a massive surge in silver prices with "blackmoney-wallahs" also acquiring large silver stocks apart from gold.

Re: Indian Economy News & Discussion - Aug 26 2015

These curbs are rubbish idea of babus once again. They love their licence permit quota and control ideas.

Re: Indian Economy News & Discussion - Aug 26 2015

You were right.Rahul M wrote:66% is a bit too much IMO.

'surgical strikes' on black money holders are supposed to start tonight. we can expect an extension by a week or so to gather up some last minute holdouts.

Demonetisation Math: How Much Cash Was Part of Our Black Economy?

Three weeks after the government decided to demonetise or invalidate Rs 500 and Rs 1,000 currency notes, data on cash deposits offers early leads on the progress of one of the largest currency replacement exercises across the world.

The data, once complete, may also help answer a much debated question – what part of India’s cash economy was also part of the black economy?

Based on various studies, it has been broadly assumed that India’s parallel or ‘black’ economy is roughly a quarter of India’s gross domestic product. Bank of America-Merrill Lynch estimates the numbers as below:

India’s Nominal GDP (estimate): Rs 15,17,81,00 crore

Black Economy (25 percent of GDP): Rs 37,94,530 crore

Cash Black Economy (10 percent of black economy): Rs 3,79,450 crore

These estimates and other similar assumptions on the proportion of black money in cash will be tested against the amount of invalidated currency that does not come back into the banking system by the end of the demonetisation exercise on 30 December.

The rationale is that unaccounted cash will not be deposited for fear of prosecution by tax authorities, giving an indication of how large the black cash economy was.

As of Monday the Reserve Bank of India (RBI) had released data only for the period between 10-27 November. And while it’s too early to conclude on the success of demonetisation in helping identify and extinguish black money, the data does set up goal posts to watch for.

According to the RBI, Rs 8.45 lakh crore have been deposited in banks in this period. This is about 54.6 percent of that portion of currency in circulation that was invalidated (Rs 15.45 lakh crore) by the cancellation of Rs 500 and Rs 1,000 notes.

To this, it would be prudent to add the cash that was already lying in currency chests of banks, since this is already in the banking system and some portion of this would also have been invalidated. This number – cash held by banks – can be arrived at by subtracting currency with public from currency in circulation.

For the fortnight ended 11 November, the amount of currency with banks was Rs 2.5 lakh crore. However, this is an unusually high number, mostly due to a surge in currency deposits right after the currency ban was announced. On average, in the past year, banks have held currency worth Rs 70,000 crore, for instance as of the fortnight ending 28 October, the amount was Rs 75,000 crore. Assuming that 86 percent of this amount (the ratio of banned currency) has been invalidated, banks are likely holding about Rs 64,500 crore in Rs 500 and Rs 1,000 notes.

Re: Indian Economy News & Discussion - Aug 26 2015

http://economictimes.indiatimes.com/new ... 716822.cms

I hope they give contract to an Indian company.Prime Minister Narendra Modi plans to move all government purchases, from paper clips to power plant turbines, to an Amazon-like online marketplace that could eventually be worth a fifth of the country’s $2 trillion economy.

Re: Indian Economy News & Discussion - Aug 26 2015

GDP growth rises to 7.3% in Q2 (July-September)

Infrastructure growth jumps to 6-month high of 6.6% in Oct

Public spending, salaries drive H1 fiscal deficit to 84% of Budget estimateGDP rose 7.3% in the quarter ended September, higher than the 7.1% in the previous one, as consumption improved but investment slumped, data from the Central Statistics Office showed on Wednesday. With core economic activity almost at a halt after the demonetisation of high denomination currency since November 8, the first half’s slowing is expected to increase in the rest of the financial year, putting at risk the government’s earlier forecast of 7-7.75% for 2016-17.

“Both GDP and GVA (gross value added) growth decelerated in Q2 (September quarter), relative to Q2 of FY16. The initial data for Q2 imparts a further downside to our GDP and GVA growth forecasts of 7.5% and 7.3% for FY17, which we had revised downward after demonetisation,” said Aditi Nayar, principal economist at rating agency Icra.

Growth in the third quarter (October-December) is expected to be the weakest in years, with spending hit due to unavailability of enough replacement currency. Demonetisation could also affect advance estimates for 2016-17, on which Budget assumptions would be made.

Growth in GVA - aggregate of agriculture, industry and services - declined to 7.1% in Q2, against 7.3% in Q1. This shows that GDP growth in Q2 was also contributed to by a sharp contraction in subsidies provided by the government, compared to those given in the first quarter.

Manufacturing, a focus area of the government, slowed in Q2 to 7.1%, as against 9.1% in the previous quarter. Industrial activity is expected to be subdued in the next quarter, due to the cash crunch. Industry as a whole (including mining, manufacturing and electricity) grew by 5.1%, from 6% in the same period last year.

As for investment activity, gross fixed capital formation fell by 5.6%, from a decline of 3.1% in the previous quarter. Lending rates are expected to be cut over the next few weeks, as banks are flush with deposits after the old currency ban. They’ve seen deposits of Rs 8 lakh crore since November 8.

Consumption was the bright spot in the data. Private final consumption expenditure grew 7.5%, as against 6.7% in the previous quarter. The higher salaries on account of the Pay Commission implementation from September and an early festival season might have boosted demand during the quarter-end.

Q2 agricultural growth fastest in 2 yearsThe Centre’s fiscal deficit ballooned in the first half of the fiscal year 2016-17 on account of elevated public spending and higher salaries outgo. However, revenue from divestment and other quarters including spectrum sale and black money scheme over the next few months will facilitate achievement of fiscal deficit target.

The gap between Centre’s expenditure and revenue touched 83.9% of the budget target for the year, significantly higher than 68.1% in the corresponding period of the previous fiscal. In absolute terms, the fiscal deficit was at Rs 4.47 crore in the first half of 2016-17 against Rs 5.34 lakh crore budgeted for the fiscal, according to Controller General of Accounts data released on Monday. The deficit for the full year has been pegged at 3.5 per cent of gross domestic product (GDP).

A steep rise in capital expenditure in September was encouraging, considering that private investment remains muted. Capital spending grew by 20% on a year-on-year basis in September to Rs 43593 crore. In the first half of the fiscal, capital expenditure has seen a 4.6% growth to Rs 1.34 lakh crore as against Rs 1.28 lakh crore in the corresponding period of the previous year.

Capital expenditure denotes money incurred on asset generating projects, while revenue expenditure is on immediate needs such as salaries and pensions. The September figures were positive as government started paying higher salaries and pensions from August due to the implementation of the Seventh Pay Commission recommendations. The government exchequer would see a hit of ~84,000 crore this financial year.

Tax receipts during April-August of 2016-17 stood at Rs 4.48 lakh crore, representing 42.5 per cent of the Budget estimates. The proportion was higher than 40.2% in the corresponding period of the previous financial year. It is expected to get a leg up[ over the next few months with about Rs 15000 crore expected in the current year from the Black Money Scheme that ended onSeptember 30. The government saw decelarations worth Rs 65000 crore, which translates to Rs 30000 crore in revenue on account of 45% tax. Half of that will come to the government by March.

Oct surplus helps govt pare fiscal deficitAgricultural growth as measured in Gross Value Added (GVA) at constant prices was the highest in two years this July-September quarter, second (Q2) of four in this financial year. The rate of rise was 3.3 per cent, on the back of a record kharif harvest, aided by a good monsoon.

Production of foodgrains in this year's kharif rose by 8.9 per cent as compared to a decline of 3.2 per cent during the earlier one. In absolute numbers, the kharif grain production in 2016 has been estimated at a record 135.03 million tonnes (mt), with bumper rice and pulses production. Pulses output in the kharif si estimated at nine mt.

Infrastructure growth jumps to 6-month high of 6.6% in Oct

Re: Indian Economy News & Discussion - Aug 26 2015

While this is a "gloom and doom" scenario, it is incumbent upon the govt. to prepare for such an eventuality,esp. as 46%,according to one estimate of the economy runs purely on cash.

he Deep Shock of Demonetisation May Devastate the Economy

BY M.K. VENU ON 20/11/2016 •

An equity firm has estimated that GDP growth will crash to 0.5% in the second half of the current financial year.

The Reserve Bank of India headquarters in Delhi. Credit: Reuters/Files

Even the supporters of Prime Minister Narendra Modi’s demonetisation plan agree that the economy will suffer in the immediate months after the long drawn replacement of 86% of all currency with the public is concluded.

Various industry experts and equity analysts, who generally back Modi’s policies, have said businesses will be severely impacted in the short run. The business TV channels are busy estimating the damage in the next six months as cash dries up across industry segments, especially in the small and medium sector. There is talk among the manufacturers of two wheelers, sold mostly in rural areas, that they will soon scale down production and reduce the number of work shifts for some months at least. The construction sector is expected to be hit the worst and this will impact the sale of construction materials such as cement and steel. Trade and manufacturing bodies have reported an over 50% drop in economic activity due to the monetary shock.

Rural wage growth was already down to zero and the current monetary shock will lead to further shrinkage in rural incomes and is bound to result in more joblessness. The rabi sowing season is in chaos as farmers are lining before banks for cash to buy seeds, fertilisers and other materials, and have already lost half of the 20-day window available for sowing. They say productivity of the rabi crops will be much lower this time. This could cause both a demand and supply shock in the medium term.

Ambit Capital, a respected Mumbai-based equity research firm, has officially estimated that the demonetisation-driven cash crunch will result in GDP growth crashing to 0.5% in the second half of financial year 2016-17. This means the GDP growth for six months, from October 2016 to March 2017, could decelerate to 0.5%, down from 6.4% in the previous six months.

Further, Ambit Capital estimates that during the October to December quarter that we are currently in, the GDP growth may contract, thus showing negative growth. However, Ambit is hopeful that a strong formalisation of the informal economy will ensue through 2017 until 2019 and this disruption could also crimp GDP growth in 2017-18 to 5.8 % from their earlier estimate of 7.3%.

There are other equity research firms who also feel the economy will sharply slow down for six months, but have yet to hazard an estimate like Ambit Capital has done. What seems clear is that there will be large scale destruction of the cash-based economic activity in the medium term. The government will have to counter this with a series of new policy initiatives which can come in the Union budget or even before that. The scale of economic destruction will also depend upon how quickly the government and RBI manage to replace the currency worth Rs 14 lakh crore.

Former RBI governor Y. Venugopal Reddy, known for his sharp instincts as central banker during the 2008 global financial meltdown, has interesting advice to offer the government. He told The Wire that this scale of currency replacement is highly risky and disruptive, and it depends on how the government and RBI manage the situation from here. Reddy says the most critical challenge for the government will be to ensure that the working capital of small businesses is replenished by the banking system. “About 30% of the working capital of small and medium businesses comes from the black segment of the economy. When you pull out money of this magnitude you will have to replenish it with fresh credit,” says Reddy. This could mean banks delivering anything between Rs 4 to 5 lakh crore of fresh working capital to micro, small and medium businesses so that their production cycles are resumed. These sectors contribute to 40% of India’s GDP and over 75% of employment.

The informal and formal economies don’t exist in separate silos and are joined together in a common value chain. The Indian economy is like a big whale which has large black and white patches over its body. But it is one integrated organism. It is this complexity that the policy makers in the government will have to internalise, before coming up with follow-up policy measures. The follow-up policy measures are very critical without which demonetisation alone will not work. Economist Surjit Bhalla, who has backed Modi’s economic policies, has also said without the follow-up structural measures, including the election funding reforms, all that the current demonetisation will achieve is one big black hole.

After the painful currency replacement, which some say could last three months, what we will have is an economy whose growth rate would have shrunk to near zero. It will be like a patient in critical condition. The government may have the bonanza of Rs 2.5 to Rs.3 lakh crores as currency which gets extinguished as the owners do not come forward to replace it. This will show up as increased net worth or reserves of the RBI. The RBI may lend part of this to the government, without impacting inflation, for enhanced spending on physical and social infrastructure. These are possibilities in the longer time frame.

There is no doubt that the economy, especially the informal sector and agriculture, will have to recover from a deep shock.

The famous economist John Maynard Keynes had said in the long run we are all dead. The nature of the current demonetisation, such as it is, may even kill us in the medium term!

Re: Indian Economy News & Discussion - Aug 26 2015

In other words, the sum-total growth of the entire world's economy can only expand as fast as the rate at which this arbitrary precious metal is mined. Very scientific!Austin wrote:Jim Rickards

Re: Indian Economy News & Discussion - Aug 26 2015

Gold in your lockers? Government not to tax jewellery from disclosed, exempted incomeAustin wrote:India may impose curbs on domestic gold holdings: Report

http://economictimes.indiatimes.com/new ... 614499.cms

http://www.financialexpress.com/india-n ... ry/461420/

Jewellery and gold in all its form purchased out of disclosed income or legally inherited from ancestors is not chargeable to tax under the amended I-T law, said Finance Ministry on Thursday. Giving a major relief to the people who were anticipating that jewellery would be covered under the amended law after demonetisation of high value currency notes, the Central Board of Direct Taxes (CBDT) announced that the Gold purchased from various sources including disclosed income, income exempted from tax, agricultural income or reasonable household savings not to be taxed. Besides, the ancestral Gold jewelleries or those who have been acquired from explained sources are also not falling under the ambit of tax, announced the ministry.

“The jewellery or gold purchased out of disclosed income or out of exempted income like agricultural income or out of reasonable household savings or legally inherited which has been acquired out of explained sources is neither chargeable to tax under the existing provisions nor under the proposed amended provisions,” the CBDT said.

Prime Minister Narendra Modi on November 8 announced the ban on Rs 500 and Rs 1,000 currency notes to combat corruption and black money from the Indian economy. As India is the world’s second-biggest gold buyer, and it is estimated that one-third of its annual demand of up to 1,000 tonnes is paid for in black money – untaxed funds held in secret by citizens in cash that don’t appear in any official accounts, the ministry were reportedly monitoring gold deposits of people after the ambitious demonetisation step. However, the ministry clearified that Gold purchased out of purchased out of disclosed income or exempted income or reasonable household savings will not be chargeable to tax.

The ministry further notified that that I-T department would not seize gold jewellery to extent of 500 grams per married lady, 250 grams per unmarried lady and 100 grams per male member of the family besides the above relaxation. Also, legitimate holding of jewellery up to any extent is fully protected, said CBDT.

Earlier, the government rooted out anticipation that it might be imposing some kind of restrictions on gold holding by individuals that was hovering around after the reports that many people had converted their black money into gold after the move.

Re: Indian Economy News & Discussion - Aug 26 2015

^^ I am not sure if this will go well with Indian Public , Gold is bought by every house hold in India and to retrospectively introduce such taxes or put restriction on how much gold SHQ , Unmarried or male member can keep is hilarious. Are we back to quota raj now ?

All this would just make IT people happy , they will get to keep more bribes

All this would just make IT people happy , they will get to keep more bribes

Re: Indian Economy News & Discussion - Aug 26 2015

They're not imposing a quota. They're asking for the gold to be accounted for, with the leniency of a certain amount up to which they'll ignore lack of accounting. Unaccounted for wealth is the same issue whether it's gold or cash.

It is a fact that a lot of people rushed in to buy gold on November 8. This action is simply the flip side of that. No need to wave hands and threaten. People have no God-given right to conceal wealth. My guess is that unaccounted for gold will be compelled to be deposited in the GMS scheme.

It is a fact that a lot of people rushed in to buy gold on November 8. This action is simply the flip side of that. No need to wave hands and threaten. People have no God-given right to conceal wealth. My guess is that unaccounted for gold will be compelled to be deposited in the GMS scheme.

Re: Indian Economy News & Discussion - Aug 26 2015

Gold has to be looked at to account for the old trick of laundering black money by buying bullion landed from Dubai and crafting it into jewelry overnight...perhaps smuggling is picking up given the spotlight on jewelers.

Re: Indian Economy News & Discussion - Aug 26 2015

How do you verify how much gold a person has? How would the govt check if I sell gold tomorrow?

Re: Indian Economy News & Discussion - Aug 26 2015

http://jbnagarca.org/wp-content/uploads ... _taxes.pdfSuraj wrote:They're not imposing a quota. They're asking for the gold to be accounted for, with the leniency of a certain amount up to which they'll ignore lack of accounting. Unaccounted for wealth is the same issue whether it's gold or cash.

It is a fact that a lot of people rushed in to buy gold on November 8. This action is simply the flip side of that. No need to wave hands and threaten. People have no God-given right to conceal wealth. My guess is that unaccounted for gold will be compelled to be deposited in the GMS scheme.

You too Suraj. This instruction is from 1994. This is specifically done to put fear in those people that there exists a law about gold holdings.

Re: Indian Economy News & Discussion - Aug 26 2015

Till 2014, Indians had to file a Wealth Tax return. In this return, all assets including Gold, would be listed and a 'wealth tax' paid. If you have filed Wealth Tax returns, it should be OK. Further you should retain all original bills, make photographs of jewelry, proof of payment such as cheque, credit card.

Re: Indian Economy News & Discussion - Aug 26 2015

Gold Restrictions , How Much Gold Can You Hold Now ?

http://myinvestmentideas.com/2016/12/go ... -hold-now/

http://myinvestmentideas.com/2016/12/go ... -hold-now/

Re: Indian Economy News & Discussion - Aug 26 2015

Very limited numbers have gold over this limit. Majority may not have even 25% of this limit. so the complain will be again who converted to this type of access to save money. Loop holes are being plugged.Austin wrote:^^ I am not sure if this will go well with Indian Public , Gold is bought by every house hold in India and to retrospectively introduce such taxes or put restriction on how much gold SHQ , Unmarried or male member can keep is hilarious. Are we back to quota raj now ?

All this would just make IT people happy , they will get to keep more bribes

I am reminded of NAMO statement at Goa rally after return from Japan "Sudhar jao, Jyada koshish mat karo, maan ke chalo jo nahi declare kiya wo Raddi hai..."

Re: Indian Economy News & Discussion - Aug 26 2015

After gold, husbands are requesting limit on number of Sarees and Dresses  That is msg going on whatsapp.

That is msg going on whatsapp.

Re: Indian Economy News & Discussion - Aug 26 2015

One thing I am wondering is how would they enforce Gold declaration scheme?

Rupees could be controlled very tightly compared to gold, since the value of gold is inherent and not tied to federal liability unlike the rupee.

Rupees could be controlled very tightly compared to gold, since the value of gold is inherent and not tied to federal liability unlike the rupee.

Re: Indian Economy News & Discussion - Aug 26 2015

i suspect it only applies to gold seized in raids...meaning if you bought gold after DeMo and are under investigation, the gold you hold is also under things to be explained and not a loophole.

Re: Indian Economy News & Discussion - Aug 26 2015

Since the Modi sarkar does NOT do any *big bang* reforms like

1. GST

2. DeMonetization (and war on Kaala Dhan)

it has started the process of breaking up Coal India Limited. Or at least that is what media gadfly's are trying to discern

http://www.businesstoday.in/current/cor ... picks=true

1. GST

2. DeMonetization (and war on Kaala Dhan)

it has started the process of breaking up Coal India Limited. Or at least that is what media gadfly's are trying to discern

http://www.businesstoday.in/current/cor ... picks=true

Re: Indian Economy News & Discussion - Aug 26 2015

Fresh bonds to soak up cash

Mumbai, Dec. 2: The government today sharply raised the ceiling on the market stabilisation scheme (MSS) to Rs 6 lakh crore from Rs 30,000 crore to mop up additional liquidity from the banking system following demonetisation.

MSS, launched in 2004, is an instrument that allows the Reserve Bank to manage liquidity through the issue of both bills and dated securities. However, these securities are not issued to meet government's expenditure.

Since the government announced the demonetisation of Rs 500 and Rs 1,000 notes on November 8, the banking system has been awash with liquidity arising out of the huge deposits from the public.

Latest reports say that deposits of Rs 10 lakh crore have come into the system, and more deposits are expected to flow in the coming days ahead of the December-30 deadline.

The announcement of MSS should come as a huge relief to the banking system following the hike in CRR last week. This was because while they were paying interest on these deposits, it did not yield any return when parked with the RBI as CRR since there is no interest payment on such balances.

It is expected that consequent to the announcement of MSS, the central bank will reverse the CRR hike.

Re: Indian Economy News & Discussion - Aug 26 2015

In India a lot of people have gold and in numbers that would be surprising , its not for a reason we are 2nd largest importer of gold,ragupta wrote:Very limited numbers have gold over this limit. Majority may not have even 25% of this limit. so the complain will be again who converted to this type of access to save money. Loop holes are being plugged.

I am reminded of NAMO statement at Goa rally after return from Japan "Sudhar jao, Jyada koshish mat karo, maan ke chalo jo nahi declare kiya wo Raddi hai..."

What this scheme will do is just encourage those IT folks to ask for fatter bribes to let the people who are caught with gold above limits to let them go free

It is not possible to keep an account every time you buy gold over period of many years , they may not be black money but people would get easily trapped by the IT department then then forced to pay Fine and Bribe .....this is really bad scheme and home the president does not pass this.

The demonitisation was still a good initiative , but the gold one wont work out in this country

Re: Indian Economy News & Discussion - Aug 26 2015

^^ Austin, I remember our discussion on gold purchase.

Had you gone for paper gold at that time as suggested by me, you wouldn't be in trouble now

Tongue firmly in cheek, just leg pulling bro. Don't take this personally.

Had you gone for paper gold at that time as suggested by me, you wouldn't be in trouble now

Tongue firmly in cheek, just leg pulling bro. Don't take this personally.

Re: Indian Economy News & Discussion - Aug 26 2015

On a serious note, Gold and RE can not be left out of the dragnet in the war against black money. That would defeat the purpose completely.

Anything that allows to store value must be accounted for against aadhar & PAN just like cash and bank accounts. This should include all financial instruments like loans, credit card, tax, utility, hotel & medical bill payments as well as others like rail and flight tickets, vehicles, foreign currency/vacation/education/property etc.

Already there is news that iphone had bumper sells post 8th nov. You can be sure that they have been used to launder BM.

Anything that allows to store value must be accounted for against aadhar & PAN just like cash and bank accounts. This should include all financial instruments like loans, credit card, tax, utility, hotel & medical bill payments as well as others like rail and flight tickets, vehicles, foreign currency/vacation/education/property etc.

Already there is news that iphone had bumper sells post 8th nov. You can be sure that they have been used to launder BM.

Last edited by Picklu on 03 Dec 2016 14:24, edited 1 time in total.