Currency Demonetisation and Future course of Indian Economy

Re: Currency Demonetisation and Future course of Indian Economy

Cross post from Economy thread:

In respect of the stimulus to the economy, many converted BM by paying people to stand in Q and also for using their accounts for deposit the BM notes. Gold was purchased at a premium also. Large amounts were spent on this. This along will be somewhere in the tune of 50K Cr.

PS: 50K Cr amount is just Guesstimate.

In respect of the stimulus to the economy, many converted BM by paying people to stand in Q and also for using their accounts for deposit the BM notes. Gold was purchased at a premium also. Large amounts were spent on this. This along will be somewhere in the tune of 50K Cr.

PS: 50K Cr amount is just Guesstimate.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

May your goats get luscious red lips from eating 2000-rupee Modinotes. The karod figure may have had a few digits after the decimal point. C above re: my usual cash limit of 100 dollars. Thx for warning about 20K rupee limit on Pay TM, no danger of storing that much. PayTM's point is precisely to have a mechanism for small payments that if compromised, does not open the door to the bank acct, so the point is to keep it non-KYC etc. Sure, gubrmint can find out what it wants, but risk of ID theft etc is reduced. For bigger transactions use ATM.

But note above that PayTM does provide swift short-term fix for ppl without immediate access to Indian bank accts, ATMs, KYC etc. (but with obliging nephews/friends). And so far, not a paisa of fees seen on any of the above transactions. OTOH, getting the ATM card apparently will cost me more than quite a few dosas.

But note above that PayTM does provide swift short-term fix for ppl without immediate access to Indian bank accts, ATMs, KYC etc. (but with obliging nephews/friends). And so far, not a paisa of fees seen on any of the above transactions. OTOH, getting the ATM card apparently will cost me more than quite a few dosas.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

My guess also is that most of the long lines and empty ATMs were caused by these paid chamchas. Cash came to banks >> ATM >> chamchas >> exchange for old BM >> back to banks.Yagnasri wrote: many converted BM by paying people to stand in Q and also for using their accounts for deposit the BM notes.

Re: Currency Demonetisation and Future course of Indian Economy

Upon actual usage of the app, it seems to have too many bugs. Just not a fully complete product that was ready for release, more like a beta or alpha really. The app has already been updated 4 times in the last 24 hours on the play store, which indicates that it is very much a WIP.Bart S wrote:Just installed it and it looks really good. Nice solid app with no unnecessary bloatware or ads.Bart S wrote:

Thanks.

BTW, here are the details of the new BHIM app launched by Modiji:

http://techapple.net/2016/12/bhim-upi-p ... ad-review/

Going to install and try it out.

One glitch is that it lists a lot of banks some of which are not UPI enabled so if you select such a bank it says transaction declined. It would be better if they only included UPI enabled banks that work with it. It also looks like you can only add one bank account at a time, it would be able to add multiple banks and accounts and use the one that you want at the time of sending or receiving payment.

Also, there are already a lot of duplicate/scam apps by the same name and the genuine app is buried beneath 10 such scam apps. Something needs to be done to make sure that people only install the legit app.

This might really backfire. The media trolls are going to get wind of this and rip it to shreds. I have no doubt that it would work reliably at some point but it would have been better if the govt had just given guidelines and authorized private players to come up with their compliant apps, or better still forced the likes of Paytm to support open standards. I guess the old issues with socialism remain, i.e the govt is never going to do a great job of developing apps.

Re: Currency Demonetisation and Future course of Indian Economy

There will be serious issues for various reasons on the new apps, card machines, ATMs, etc. all will be having some problems for few more months.

@Ulabathuri sir, I live in Bharat and know how Qs were created by paying 10% - 20% to servants, wage labours, taxi drivers, etc. to convert the old notes to new. People also "rented" their bank accounts for the deposit of the money charging similar rates. Political leaders also deposited money in the Chamchas accounts. Each person stood in the Q and done 3 to 4 deposits of old notes. The same stopped mark on the finger like they give during voting in the elections. That stopped all the old notes conversions and later the direct conversion of notes stopped and only deposit in the accounts was allowed.

@Ulabathuri sir, I live in Bharat and know how Qs were created by paying 10% - 20% to servants, wage labours, taxi drivers, etc. to convert the old notes to new. People also "rented" their bank accounts for the deposit of the money charging similar rates. Political leaders also deposited money in the Chamchas accounts. Each person stood in the Q and done 3 to 4 deposits of old notes. The same stopped mark on the finger like they give during voting in the elections. That stopped all the old notes conversions and later the direct conversion of notes stopped and only deposit in the accounts was allowed.

Re: Currency Demonetisation and Future course of Indian Economy

Would have been good if the govt had made a concerted push to improve and reinforce all that, plus had all the apps released (and debugged) before the demonetization. Would have made things smoother, averted some of the fallout and criticism and would not have given the game away.Yagnasri wrote:There will be serious issues for various reasons on the new apps, card machines, ATMs, etc. all will be having some problems for few more months.

Re: Currency Demonetisation and Future course of Indian Economy

We are simply ignoring the level of secrecy required before DeMo and the task of managing the economy which is largely cash-based after DeMo and then issue notes systematically. That being said, nothing prevented the development of apps, etc. immediately after or even before DeMo notification. It also shows the compleat lack of imagination in MoF including Jetlee.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

The ink marks etc show the sheer pakiness of India's present. Lots of people are scofflaws, consider themselves completely outside The System when the choose to be. This is what Unglization will alleviate to some extent - everyone is supposed to have a (traceable) ID. Half the way to accountability and consequences. To cite Neshantji, this is how Advanced Societies put ankle ornaments on their citjenry. You mess with the Law, they get you. 20 years from now, in a remote corner of the country, you try to buy a chappati, your Record catches up with you. No escape.

Reminds me of a drunken riot after some game, in Vancouver, Canada. The Authorities took super high-res photos of the crowd. That's it, every single one clearly identifiable. Eventually the Long Arm of The Law would get to everyone. Now in desh a RAA app will simply send the bill for damage to public property, directly to Jan Dhan account, followed by a kind vijit from the local polis.

Reminds me of a drunken riot after some game, in Vancouver, Canada. The Authorities took super high-res photos of the crowd. That's it, every single one clearly identifiable. Eventually the Long Arm of The Law would get to everyone. Now in desh a RAA app will simply send the bill for damage to public property, directly to Jan Dhan account, followed by a kind vijit from the local polis.

Re: Currency Demonetisation and Future course of Indian Economy

There are plenty of things that could have been done without compromising secrecy, that are pretty generic in nature. Like enabling e-payments (at least as an option) for all transport related areas (metro/suburban and other rail tickets, bus passes), eliminating card surcharge on fuel payments and pushing fleet operators towards e-payment methods, making all the highway toll booths fasttag enabled and capable of accepting cards etc. Getting UPI apps released and ready and the process better known, educating shop keepers on it, etc. Ensuring 100% digital payment availability across all government services at least. Pushing Rupay with attractive terms for banks and merchants.

Re: Currency Demonetisation and Future course of Indian Economy

I dont think that is the case. First the author is mixing up categories of black. The kirana stores he mentions could be generating BM for instance ( single-black ) and there is credit available in double-black cases as well. I am sure as economy evolves into a cashless system we will start seeing cashless bribes - for eg TKiran's pandu could use credit card to take his bribes and pay off his hotel property. All bribe givers will have to book hotel rooms at pandu's hotel without staying/eating there and he will take a loan which he will pay off and his interest payments will be claimed as deduction while 400% occupancy will help pay off the rest. Once the property is paid off, pandu will sell it, use that as down payment and buy a bigger property and continue building his wealth.chetak wrote:Assessing Demonetisation: Minsky Provides The Link That Traditional Economics Misses

Credit is financial money that differentiates black economy from a white/cash white economy. Black economies have very low credit. When was the last time you paid bribe in credit? Or paid dowry in credit? Or bought drugs on credit? You may have bought some regular ration on and off on credit, though.

I dont know anything about economics or Minsky or whatever and how it all relates to 2008 crash. To me it was a simple case of greed and lots of cheap and stupid credit (backed by top-notch economists) available in the system. So I dont understand why the author uses all these things and extols the virtues of credit.

I also dont understand why the author talks about cash-to-gdp ratio (12% of GDP). I have seen Gurumurthy mention this a couple of times as well. There was another article that came across a couple of days ago which provides interesting insights into the cash-to-gdp ratio

http://www.bloombergquint.com/opinion/2 ... al-nuances

the key points to me in that article were

The Committee on Payments and Market Infrastructures - Bank for International Settlements (CPMI-BIS), which calculates this ratio annually, considers currency-in-circulation (CIC), basically bank notes and coins, and divides it by nominal GDP. To enable cross-country comparison, the local currency is converted to the U.S. dollar at an average exchange rate. So, cross-country analysis of this ratio done over a period gets affected by the trajectory of the exchange rate in relation to the dollar.

For India, the latest CIC-to-GDP ratio is 12.25 percent. Despite the rise in the ratio from 2013, this is not the highest India has seen.

Possible factors driving up the ratio are:

- Sequentially lower nominal GDP growth between 2013 (13.9 percent) and 2015 (8.7 percent)

- A spike in the value of CIC during the period

It is difficult to conclude whether a lower CIC-to-GDP ratio is a sign of a more developed or structurally evolved economy. If it is, then how does one explain countries such as Japan, Hong Kong, Switzerland having ratios which are either higher or comparable to that of India? The World Bank ranks these countries higher on ease of doing business, as well as tax and regulatory compliance.

But Vidhu Shekhar uses statements like thisThere may be some truth to the assumption that higher tax compliance tends to reduce the CIC-to-GDP ratio. To that extent, efforts already underway such as the implementation of the Goods and Services Tax (GST) would be beneficial.

Sweeping statements are avoidable since Brazil, India, Canada and the U.S. have a comparable tax-to-GDP ratio but divergent CIC-to-GDP ratios.

But in the bloomberg article the image labelled "institutions offering payment services to non banks" shows Brazil to be at 542.6 while India is 1.4. I dont see how Brazil and India can be compared the way Shekhar does. And based on all this a 10+ % growth rate is predicted. Doesnt make sense to me.Thankfully, the economy has already reached around 4 per cent of remonetisation, a level at which the whole economy of Brazil runs.

Re: Currency Demonetisation and Future course of Indian Economy

Bartji, is there a place where the security/privacy aspects of the BHIM app is discussed ?

Re: Currency Demonetisation and Future course of Indian Economy

Any guess if and when 2000 notes will be pulled back!

Re: Currency Demonetisation and Future course of Indian Economy

I have been doing some nail biting about phone segooriddy er security the era of wallets.

Paytm encouraged me to add a layer of security by using my phone lock - but I detest locking my phone - I need to look at it instantly and people of my vintage have this need to do completely idiotic time wasting stuff like putting on glasses etc bloody fossils.

So then there is a Paytm password abc123 . A misuser is welcome to spend from my wallet - it has about Rs 628.23 currently - about half of yak herder's monthly allowance.

But when it comes to pulling out money from some account and filling up my Paytm wallet I get the following choices: Debit card, credit card, Internet banking and UPI. I am too sacred to store any serious details here - although I have actually brazenly entered the "credit" card details of my ICICI Pockets wallet account which also has about Rs 800 in it which represents its credit limit.

As for my ICICI pockets wallet things are a bit more scary. It is linked to my ICICI account which can be debited to fill the wallet with a one time pwd sent to the mobile. Anyone who steals my mobile will have access to that provided he knows the 4 digit pwd to enter my wallet account. not safe enough IMO. The only redeeming feature is that this pockets account allows a maximum spend of Rs 10000 in a month - much smaller than the credit limit of my credit cards.

I installed BHIM. It looks simple. But I just wonder whether I will use it at all - seeing that the pockets wallet has a UPI payment mode.

Paytm encouraged me to add a layer of security by using my phone lock - but I detest locking my phone - I need to look at it instantly and people of my vintage have this need to do completely idiotic time wasting stuff like putting on glasses etc bloody fossils.

So then there is a Paytm password abc123 . A misuser is welcome to spend from my wallet - it has about Rs 628.23 currently - about half of yak herder's monthly allowance.

But when it comes to pulling out money from some account and filling up my Paytm wallet I get the following choices: Debit card, credit card, Internet banking and UPI. I am too sacred to store any serious details here - although I have actually brazenly entered the "credit" card details of my ICICI Pockets wallet account which also has about Rs 800 in it which represents its credit limit.

As for my ICICI pockets wallet things are a bit more scary. It is linked to my ICICI account which can be debited to fill the wallet with a one time pwd sent to the mobile. Anyone who steals my mobile will have access to that provided he knows the 4 digit pwd to enter my wallet account. not safe enough IMO. The only redeeming feature is that this pockets account allows a maximum spend of Rs 10000 in a month - much smaller than the credit limit of my credit cards.

I installed BHIM. It looks simple. But I just wonder whether I will use it at all - seeing that the pockets wallet has a UPI payment mode.

Re: Currency Demonetisation and Future course of Indian Economy

Thanks, that is what I am looking for, if the ATM route does not work.Karan M wrote:the check idea addressed to yourself will work fine.Primus wrote:

Karan Ji, thanks. I don't have any relatives in Hyd and don't have an ATM card for the bank. In the US, even when you walk into a bank with a check to withdraw money, you have to show your ATM card and swipe it at the cashier window before you hand over the withdrawal slip. I do have a check book so I can take that and write a check, have my passport to serve as ID.

I am also planning to take some left over old money (10K or so) which I will have to go to an RBI branch and change. Don't know if I will have the opportunity to do this.

Of course if the ATMs work with my BankAmerica card that would solve all the problem.

Actually I was referring to SBI checks which I have, but no ATM card.Dasari wrote:Your BOA debit card will work like any local ATM card as long as you can put up with transaction fee and foreign exchange fee. You also need to hunt for ATM that has money. I believe the situation has improved though not as much as some other parts of AP. Look for SBI or Andhra bank ATMs inside the bank. You will most likely find cash there.

Your BOA check will not work unless you have an account there.

Such fees are indeed painful, my bank charges $5 per transaction although there is no foreign exchange fee. The issue this time may also be that there may still be a limit on ATM withdrawal of Rs 2500 per day (previously it was around 10,000). However, I may also need less cash (hopefully) this time.

A silly question perhaps. Is there any value to taking USD as cash to India?

Re: Currency Demonetisation and Future course of Indian Economy

This is never a bad idea. There are always exchange counters at the airport - and it will do you no harm to exchange $30 even if the limit is a max of Rs 2000 because of demonetization chaosPrimus wrote: A silly question perhaps. Is there any value to taking USD as cash to India?

Re: Currency Demonetisation and Future course of Indian Economy

No idea about that saar, but the app itself is fairly new and it will probably take some time for all the pros and cons to be flushed out. Also, the app is being refreshed very frequently so even those discussions might quickly be outdated.RajeshG wrote:Bartji, is there a place where the security/privacy aspects of the BHIM app is discussed ?

Re: Currency Demonetisation and Future course of Indian Economy

>> The issue this time may also be that there may still be a limit on ATM withdrawal of Rs 2500 per day (previously it was around 10,000)

for the reverse scenario - indian ATM card used abroad I can confirm there is no 2500 limit per day. but in your scenario

- you will need to find a ATM with cash and less queue

- pray that demo limit does not apply to foreign debit cards...else you will get only 4500.

==> change $$ to cash at the airport - as much as you will need for this trip !! generally euros and dollars are bought at good rates in india so you will not lose much on this deal.

btw in out of airport places like thomas cook if you go with $$ and expect rupees, I think new rules dicate they can give you a rupee cheque onlee, which means deposit that into indian account, wait a day for it to clear locally, and rejoin the queue of 4500 hopefuls or go with indian bank cheque book to branch.

avoid all this by changing enough cash at the airport.

for the reverse scenario - indian ATM card used abroad I can confirm there is no 2500 limit per day. but in your scenario

- you will need to find a ATM with cash and less queue

- pray that demo limit does not apply to foreign debit cards...else you will get only 4500.

==> change $$ to cash at the airport - as much as you will need for this trip !! generally euros and dollars are bought at good rates in india so you will not lose much on this deal.

btw in out of airport places like thomas cook if you go with $$ and expect rupees, I think new rules dicate they can give you a rupee cheque onlee, which means deposit that into indian account, wait a day for it to clear locally, and rejoin the queue of 4500 hopefuls or go with indian bank cheque book to branch.

avoid all this by changing enough cash at the airport.

Re: Currency Demonetisation and Future course of Indian Economy

The daily ATM withdrawal limit from January 1 is Rs 4,500

Re: Currency Demonetisation and Future course of Indian Economy

what about foreign nationals who came to india before demo and are coming again post demo and have indian currency?

Re: Currency Demonetisation and Future course of Indian Economy

Leaning towards doing that, my first concern would be paying the taxiwallah from the airport to the hotel.shiv wrote:This is never a bad idea. There are always exchange counters at the airport - and it will do you no harm to exchange $30 even if the limit is a max of Rs 2000 because of demonetization chaosPrimus wrote: A silly question perhaps. Is there any value to taking USD as cash to India?

Yes, will change enough cash for a few days anyway. The hotel and restaurants should have no problems with CC payments but local taxi and small vendors will probably want cash (since I don't have Paytm or similar).Singha wrote:>>

==> change $$ to cash at the airport - as much as you will need for this trip !! generally euros and dollars are bought at good rates in india so you will not lose much on this deal.

btw in out of airport places like thomas cook if you go with $$ and expect rupees, I think new rules dicate they can give you a rupee cheque onlee, which means deposit that into indian account, wait a day for it to clear locally, and rejoin the queue of 4500 hopefuls or go with indian bank cheque book to branch.

avoid all this by changing enough cash at the airport.

This may well be the simplest solution for me. However, it will be a one-time deal. Don't want to try the check route. On my last visit to my horror I found out that I could not buy a mobile phone in India from the local street even with my passport in hand, was told for NRIs and foreigners you can only do it at the arrival airport.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

True confession: I have been informed by SHQ that we forgot to bring the two 500Rs notes that have been kept buried in some box along with Vishu Kainettam coins (Malloostanis will recognize this hallowed tradition of baksheesh taught as a childhood expectation - did someone diss tipping here, hain?)

What 2 do with these notes? I have no sentiment when it comes to money. Sorely regret not cashing in all the Rapid Transit tokens ($1.75 each) when they switched to plastic card: I think I missed the boat on about 10 coins!

Cannot send these notes to relatives because they, being rejidents, cannot take those to the baink after yesterday.

No way to go to Rejerb Baink.

Can I just put them in an envelope with a note and send to my desi sarkari baink mgr for deposit? Or will the poor guy have to then go stand in line at Rejerb Baink? Do they need pharms with Explanashun? Do I have to prove that I was **NOT** in desh between Nov. 8 and Dec. 30?

Confused.

What 2 do with these notes? I have no sentiment when it comes to money. Sorely regret not cashing in all the Rapid Transit tokens ($1.75 each) when they switched to plastic card: I think I missed the boat on about 10 coins!

Cannot send these notes to relatives because they, being rejidents, cannot take those to the baink after yesterday.

No way to go to Rejerb Baink.

Can I just put them in an envelope with a note and send to my desi sarkari baink mgr for deposit? Or will the poor guy have to then go stand in line at Rejerb Baink? Do they need pharms with Explanashun? Do I have to prove that I was **NOT** in desh between Nov. 8 and Dec. 30?

Confused.

Re: Currency Demonetisation and Future course of Indian Economy

PM mentioned about technology being used against black money holders. So don't know if any data analysis is being at this moment.

Re: Currency Demonetisation and Future course of Indian Economy

Shiv Sir,shiv wrote:I have been doing some nail biting about phonesegooriddyer security the era of wallets.

Paytm encouraged me to add a layer of security by using my phone lock - but I detest locking my phone - I need to look at it instantly and people of my vintage have this need to do completely idiotic time wasting stuff like putting on glasses etc bloody fossils.

So then there is a Paytm password abc123 . A misuser is welcome to spend from my wallet - it has about Rs 628.23 currently - about half of yak herder's monthly allowance.

But when it comes to pulling out money from some account and filling up my Paytm wallet I get the following choices: Debit card, credit card, Internet banking and UPI. I am too sacred to store any serious details here - although I have actually brazenly entered the "credit" card details of my ICICI Pockets wallet account which also has about Rs 800 in it which represents its credit limit.

As for my ICICI pockets wallet things are a bit more scary. It is linked to my ICICI account which can be debited to fill the wallet with a one time pwd sent to the mobile. Anyone who steals my mobile will have access to that provided he knows the 4 digit pwd to enter my wallet account. not safe enough IMO. The only redeeming feature is that this pockets account allows a maximum spend of Rs 10000 in a month - much smaller than the credit limit of my credit cards.

I installed BHIM. It looks simple. But I just wonder whether I will use it at all - seeing that the pockets wallet has a UPI payment mode.

From my experience -

1. I have a low limit credit card. Even before 8th nov. That is the card I used to use for day to day activities. I only used my high limit card for rare big ticket purchases. So I have connected that low limit card to PayTM.

2. Also - everytime I "add money" to PayTM from that card, I have to enter the CVV number. After that the ViSA 3D secure OTP number process happens. So if somebody steals my phone and access to PayTM all they will get is the Rs 1000(approx) that I have in PayTM wallet at any given moment. Nothing more.

3. My Father lost his phone(with PayTM) yesterday

Just shared my experience

Last edited by shyamal on 31 Dec 2016 20:40, edited 1 time in total.

Re: Currency Demonetisation and Future course of Indian Economy

NM had thanked Bank employees. Good thing. I expected MoF babus stopping any mentioning of bank employees most of them done good work in his speech.

Re: Currency Demonetisation and Future course of Indian Economy

to escape the Goa crowds am in Panchgani.

Bought Rs 167 worth groceries form Jayantilal Shahs's shop and .... 2 cups of very sweet tea from BEST TEA STALL for Rs 10 from a hand cart paid for by payTM.

The hand cart owner is a true son for the soul, Marathi topi wearing villager type.

Bought veggies worthnRs 160 with cash but the owner says he has applied for payTM. Bought beer, no epayment option.

Bought Rs 167 worth groceries form Jayantilal Shahs's shop and .... 2 cups of very sweet tea from BEST TEA STALL for Rs 10 from a hand cart paid for by payTM.

The hand cart owner is a true son for the soul, Marathi topi wearing villager type.

Bought veggies worthnRs 160 with cash but the owner says he has applied for payTM. Bought beer, no epayment option.

Re: Currency Demonetisation and Future course of Indian Economy

There also seem to be tax incentive for "digital transactions" for small time business men. Lower interest for home loans issued at village areas etc. etc. I was expecting some figures on the money which has come in etc. But may be it takes time to collate that information. Bank employees thanked, but also there was a "strict warning" of legal actions against wrong doers in the banks as well. Let us see how this gets into Stage II.Yagnasri wrote:NM had thanked Bank employees. Good thing. I expected MoF babus stopping any mentioning of bank employees most of them done good work in his speech.

Re: Currency Demonetisation and Future course of Indian Economy

shivering over 2x500 notes? keep them as a souvenir...decades from now, your bloodline can cash them in as antiquesUlanBatori wrote:True confession: I have been informed by SHQ that we forgot to bring the two 500Rs notes that have been kept buried in some box along with Vishu Kainettam coins (Malloostanis will recognize this hallowed tradition of baksheesh taught as a childhood expectation - did someone diss tipping here, hain?)

What 2 do with these notes? I have no sentiment when it comes to money. Sorely regret not cashing in all the Rapid Transit tokens ($1.75 each) when they switched to plastic card: I think I missed the boat on about 10 coins!

Cannot send these notes to relatives because they, being rejidents, cannot take those to the baink after yesterday.

No way to go to Rejerb Baink.

Can I just put them in an envelope with a note and send to my desi sarkari baink mgr for deposit? Or will the poor guy have to then go stand in line at Rejerb Baink? Do they need pharms with Explanashun? Do I have to prove that I was **NOT** in desh between Nov. 8 and Dec. 30?

Confused.

Re: Currency Demonetisation and Future course of Indian Economy

It takes some time may be before the system stabilises. RBI need to pump small notes like 100 or 50s to a large quantity. Once system stabilises, GOI shall stop reissuing 2000 notes initially. Once a large section of the 2000s are taken off the use, the same can be permanently stopped. It may take some months to do that. But taking out of the 2000s and later 500s is a must now. Otherwise, they will be instruments for hoarding BM like before.

Re: Currency Demonetisation and Future course of Indian Economy

He also mentioned reforms in election funding and streamlining election timings across, centre and states to align. He invited all parties to discuss and arrive on a consensus. Reforms seem imminent.

and upto 25% for business that transact in cash only.Banks have also been asked to increase working capital loans from 20% of turnover to 30% for enterprises that transact digitally: PM Modi

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

"shivering over 2x500 notes? keep them as a souvenir...decades from now, your bloodline can cash them in as antiques  "

"

Ha! As the PM said, there are 2 kinds of ppl: the scofflaws, and the decent Bharatiya. The law says Rs 10000 penalty for being in possession of banned 500Rs notes, hain?

Besides 1000 rupees will buy 500 pucca lunches at Kerala Bhavan, the Malloostani law(bre/ma)kers' cafeteria in Dilli.

Ha! As the PM said, there are 2 kinds of ppl: the scofflaws, and the decent Bharatiya. The law says Rs 10000 penalty for being in possession of banned 500Rs notes, hain?

Besides 1000 rupees will buy 500 pucca lunches at Kerala Bhavan, the Malloostani law(bre/ma)kers' cafeteria in Dilli.

Re: Currency Demonetisation and Future course of Indian Economy

Checks are an utter disaster - don't even think about it. Cold cash is bestPrimus wrote: This may well be the simplest solution for me. However, it will be a one-time deal. Don't want to try the check route. On my last visit to my horror I found out that I could not buy a mobile phone in India from the local street even with my passport in hand, was told for NRIs and foreigners you can only do it at the arrival airport.

Re: Currency Demonetisation and Future course of Indian Economy

Sir, Hyd airport has prepaid cab facility at arrivals. They accept cards; You shouldn't have any problem paying with your international CC.Primus wrote:Leaning towards doing that, my first concern would be paying the taxiwallah from the airport to the hotel.

This prepaid cab is also more convenient, as the cab will pick you up directly from near the arrivals gate (Used to be this way a year or so back; likely to be same now also). Other cab options require you to walk to the taxi stand.

Other option you can consider is asking your hotel to send a cab to pick you up. May be they will charge a bit more but will save you the hassle of hailing a cab or finding cash.

-

Mukesh.Kumar

- BRFite

- Posts: 1246

- Joined: 06 Dec 2009 14:09

Re: Currency Demonetisation and Future course of Indian Economy

Protests and go slow at govt. printing press.

Has anyone noticed this news. Though I feel for the workers who would be under tremendous pressure, this seems to be probably politically motivated. We are not out of the De-Mo woods yet. Reproducing in full below.

Has anyone noticed this news. Though I feel for the workers who would be under tremendous pressure, this seems to be probably politically motivated. We are not out of the De-Mo woods yet. Reproducing in full below.

Cash chaos: Workers of currency printing press in Bengal refuse to work extra hours

The decision will bring down the currency production at the Reserve Bank of India press by nearly 25 per cent from 45 million units per day to around 34 million units per day.

Manogya Loiwal

| Posted by Kritika Banerjee

Kolkata | Midnapore, December 29, 2016 | UPDATED 01:55 IST

A +A -

Photo for representation.

Just when the government is trying hard address the demonetisation crisis there could be more trouble in hands for it as workers of a currency printing press in West Bengal have refused to do over time.

The employees of Salboni-based Bharitya Reserve Bank Note Mudran Private Limited (BRBNMPL) said they cannot work for 12 hours a day any longer bringing down the production of currency notes from 45 billion per day to 34 million.Â

There are about 700 employees besides 150 officers working in the Salboni Currency Printing Press.

WHY WORKERS HAVE REFUSED TO WORK EXTRA HOURS

Employees are under contract of working for 9 hours but were working for around 12 hours per day considering the crisis post the November 8 note ban decision.

More than 14 employees have fallen sick and many have complained of stress-related health issues.

"The union members are falling sick and workers are not being paid what they were promised for doing overtime. We understand the crisis and it is not due to any political affiliation but they cannot work on humanitarian ground. The employees have been working for more than 12 hours, however, now it is no more possible to continue working for 12 hours," Sishir Adhikari, TMC MP and President of Bhartiya Reserve bank Note Mudran Employees Union said.

Salboni is a Maoist infested region and employees claim that the basic minimum facilities are not enough to ensure proper health care in the premises. Even the nearest hospital is 25km away in Midnapore.

The employees, though, admitted that Assam Rifles and Air Force Base in Kalaikunda are extending all support but the basic precision and training is only given to the employees so the work cannot be shared due to the expertise required.

An employee said that there will be a shortfall of around 25 per cent of currency notes with the employees not working overtime.

POLITICS BEHIND WORKERS' REFUSAL TO WORK?

Congress MP Pradip Bhattacharya backed the decision of workers, saying if concerned authorities want them to work for extra hours then they should be paid accordingly.

"Our leader Rahul Gandhi has announced a natio-wide protest against demonetisation. We are with the workers and will take the protest to villages to explain how this note ban has hurt country's economy. The workers can only work for 8 hours and if they are required to do overtime then they should reimbursed for thei hardwork," Congress MP Pradip Bhattacharya said.

"The problem is that the government banned old notes without printing enough new notes. Now, if printing of new notes is going to get affected obviously problems will rise. There is a secret understanding between the TMC and BJP over this issue. Workers refusing to work will actually work in favour of BJP," CPI (M) leader Faud Halim said.

(With inputs from Shah Jahan)

Re: Currency Demonetisation and Future course of Indian Economy

The law says Rs 10000 penalty for being in possession of banned 500Rs notes, hain?

No i think its a crime to possess more than 10k in old notes thats all.

No i think its a crime to possess more than 10k in old notes thats all.

Re: Currency Demonetisation and Future course of Indian Economy

No defence manufacturing facility should ever be set up in West Bengal !. I would not be suprised if the West Bengal workers resort to work-strikes even when our country is in a war with China or Pakistan or with both at same time. These workers may still be talking about Workers rights and etc ... when our country would be getting invaded. Pathetic set of people !!.Mukesh.Kumar wrote:Protests and go slow at govt. printing press.

Has anyone noticed this news. Though I feel for the workers who would be under tremendous pressure, this seems to be probably politically motivated. We are not out of the De-Mo woods yet. Reproducing in full below.

Cash chaos: Workers of currency printing press in Bengal refuse to work extra hours

The decision will bring down the currency production at the Reserve Bank of India press by nearly 25 per cent from 45 million units per day to around 34 million units per day.

POLITICS BEHIND WORKERS' REFUSAL TO WORK?

Congress MP Pradip Bhattacharya backed the decision of workers, saying if concerned authorities want them to work for extra hours then they should be paid accordingly.

"Our leader Rahul Gandhi has announced a natio-wide protest against demonetisation. We are with the workers and will take the protest to villages to explain how this note ban has hurt country's economy. The workers can only work for 8 hours and if they are required to do overtime then they should reimbursed for thei hardwork," Congress MP Pradip Bhattacharya said.

"The problem is that the government banned old notes without printing enough new notes. Now, if printing of new notes is going to get affected obviously problems will rise. There is a secret understanding between the TMC and BJP over this issue. Workers refusing to work will actually work in favour of BJP," CPI (M) leader Faud Halim said.

(With inputs from Shah Jahan)

Re: Currency Demonetisation and Future course of Indian Economy

I read about this two days back (in a vernacular media outlet). Again this was a Kerala based news paper, so they did try to paint a picture that the great "socialist revolutionaries" are now starting a revolution. But the fact is that this printing press in West Bengal is NOT the only one printing currency notes. There are printing presses at Nashik and Mysore as well. So this slimy move of the Bengali Bhadralok workers is not going to cause much damage. From what I gleaned from my local network today; literally tonnes of *new* Rs.500 notes have landed up at cash chests in Bangalore city and adjoining districts. 5-7 days is what was stated as the time to be in 100% recovery mode.Mukesh.Kumar wrote:Has anyone noticed this news. Though I feel for the workers who would be under tremendous pressure, this seems to be probably politically motivated. We are not out of the De-Mo woods yet. Reproducing in full below.

-

Mukesh.Kumar

- BRFite

- Posts: 1246

- Joined: 06 Dec 2009 14:09

Re: Currency Demonetisation and Future course of Indian Economy

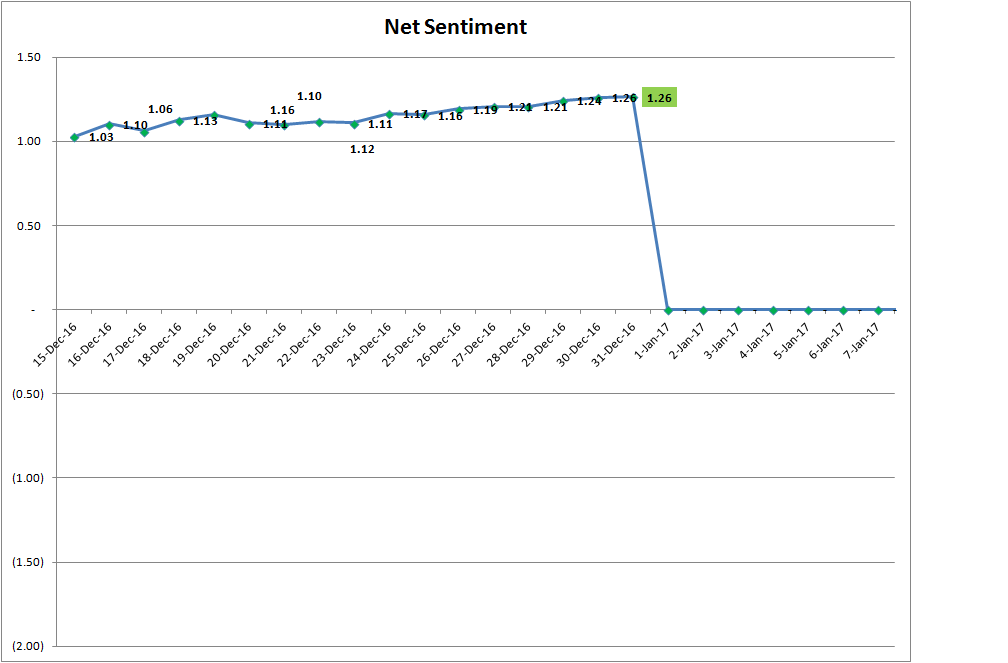

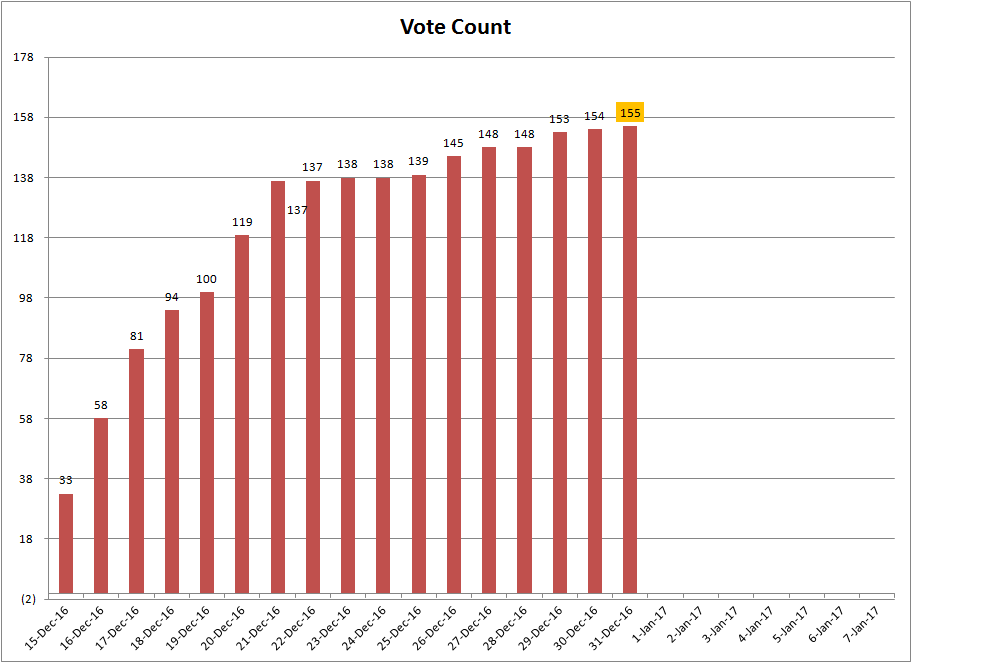

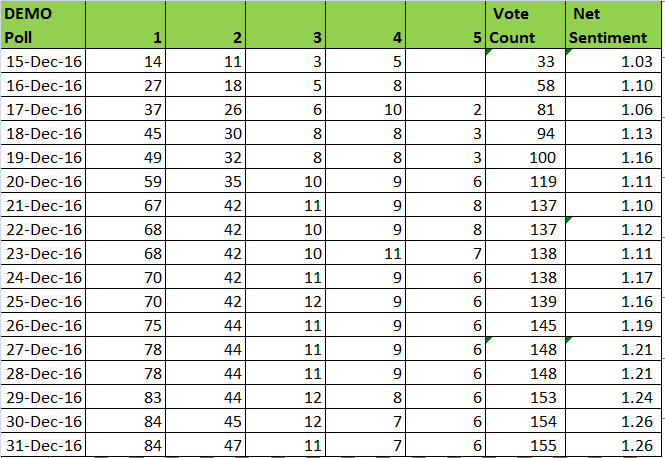

X-Post from Running Poll on DeMo Sentiment- As last update for the year at end of the fifty day period.

Mukesh.Kumar wrote:OK, here's the last update for this year

Update 31st December 2016. 2250 hrs IST

Finishing off my sojourn in Calcutta tomorrow evening. Last update from India. I changed my vote today from neutral to positive. What we see in papers, the social media chatter of Twitterati is not what the situation on the ground is. Spoke to a cross section of people from cab drivers to local grocery to local hardware/ cement/ paint store (30% biz down) to mango people like us. Overwhelming support for De-Mo, at worst neutral. But neither is the world ending nor are people dying in queues. But we are yet to get out of the woods, there's active efforts even now to stymie the cash disbursal. Heard of many ways in which cash is being converted into BM locally from govt. payouts. The whole machinery of ruling party in W.Bengal seems either unaware or complicit. Of all of NaMo's speech today the thing that seems to have resonated with people is his quote, "Do you believe that there are only 24 lacs in India who officially make more than Rs. 10lacs p.a. Met one gentleman who was the staunch bhadralok anti- Modi who was effusive in his praise of NaMo. Hoping that finally a small lotus may bloom in W.Bengal.

So here's the count: Votes in 155

Net Sentiment: 1.26 (has been marginally headed up over the last few days. Given a maximum rating of +2, if this is representative of what people are feeling on the street (i.e.our ability to read mood unbiased when we report), it should indicate a groundswell of support consolidating behind Modi.

Re: Currency Demonetisation and Future course of Indian Economy

Some level of cash $s (under $50) are required to pay off the government registered touts at the airport since they do not accept INR. Beyond that a credit card with 0 foreign transaction fees works for most places. No need to deal with phone/SIM card hassles either, since your US phone number will seamlessly work in India.Primus wrote:A silly question perhaps. Is there any value to taking USD as cash to India?

-

Mukesh.Kumar

- BRFite

- Posts: 1246

- Joined: 06 Dec 2009 14:09

Re: Currency Demonetisation and Future course of Indian Economy

OT Alert: On

OT Alert:Off

SaraLaxji, I wish I could protest that we are not like this. But then we end up pulling these stunts. Having spent my formative years in this state, I really do not understand how we came to this. In really down moments sometimes feel bad that us Bengali's keep letting the rest of India down.SaraLax wrote:No defence manufacturing facility should ever be set up in West Bengal !. I would not be suprised if the West Bengal workers resort to work-strikes even when our country is in a war with China or Pakistan or with both at same time. These workers may still be talking about Workers rights and etc ... when our country would be getting invaded. Pathetic set of people !!.Mukesh.Kumar wrote:Protests and go slow at govt. printing press.

Has anyone noticed this news.......

OT Alert:Off

Last edited by Mukesh.Kumar on 31 Dec 2016 23:57, edited 1 time in total.