Currency Demonetisation and Future course of Indian Economy

Re: Currency Demonetisation and Future course of Indian Economy

A digital economy is not just about buying fruit and veg with credit card. The government holds a very strong "card" if they can push it through and set up the infrastructure to make all electricity, water and gas payments digital. This is money that is going to govt agencies and they must make it more expensive to pay by cash.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

IMO, the EnnDeeYay need to make sure that the commie-pakis and BM wallahs don't pull off a classic

This time it is "Hang The Traitor Modi Who Swindled The Aam Janata" (literal translation of big poster with a noose put up by Youth Con-Gress).

Points that I see are:

1) Inside 2 months, a nation of 1.25B has been dragged kicking and screaming into the mid-21st century, AHEAD of the rest of the world in many respects. 90+ % of the population with bank accounts; dramatic elimination of queues for rail tickets, paying bills, paying taxes. Transparency in official transactions. FEAR in BM circles. Huge expansion of tax base, if I figure correctly. Drop in interest rates, not due to deflation but due to influx of liquidity available for legitimate business loans.

2) Instead, the narrative has been grabbed by "BUT HE PROMISED TO RETURN TO PRE-Nov8 STATUS QUO BY DECEMBER 31 AND SWINDLED US!"

Duh! How tough is it to turn this into "BM PARTIES BUT INDIA IS NEVER RETURING TO THEIR WORLD: The days of BM are Gone With Da Wind emanating from their musharrafs." I HOPE that is going to be the election theme.

BUT INDIA IS NEVER RETURING TO THEIR WORLD: The days of BM are Gone With Da Wind emanating from their musharrafs." I HOPE that is going to be the election theme.

So we didn't see 50% of money supply disappear. Anyone think how disastrous that would have been, hain?

What is apparent is that normality HAS been restored in an amazing 60 days, with no serious dent in any sector. The ***CASH** component of BM has been shaken to the core. But as with all investors, BM people also don't get any ROI if they keep their loot as CASH, hain? They would have invested. So their Operations would have been crimped, but the capital and facilities are all sunk and in place waiting for the Tax (wo)Man. That will occur over the next year, I hope: crackdown on real estate and other BM investments

Anything where operations suddenly went down, is suspect. Example, the present

by CoOp Banks. Also by Movie Theater operators who are on strike in Malloostan over the advent of e-Tickets. Think about that - e-Tickets should VASTLY increase their customer base as people can buy tickets from home or on the road as soon as they feel the urge, instead of getting the motivation to actually go to the movie and stand in line - but theare operators claim that they will go broke - e-tickets are traceable, not BM.

by CoOp Banks. Also by Movie Theater operators who are on strike in Malloostan over the advent of e-Tickets. Think about that - e-Tickets should VASTLY increase their customer base as people can buy tickets from home or on the road as soon as they feel the urge, instead of getting the motivation to actually go to the movie and stand in line - but theare operators claim that they will go broke - e-tickets are traceable, not BM.

So the only message is that the currency recall has been 100% success. The free-floating cash is now accounted and under control. No big holes. Conservation laws satisfied, equation closes. Next step: same exercise in real estate. Then in industry.

(PanchaTantra) stunt - as they did in 2004 while the Holy Ones stood around scratching their ****s parroting "India Shining".Turn the Horse Into a Donkey

This time it is "Hang The Traitor Modi Who Swindled The Aam Janata" (literal translation of big poster with a noose put up by Youth Con-Gress).

Points that I see are:

1) Inside 2 months, a nation of 1.25B has been dragged kicking and screaming into the mid-21st century, AHEAD of the rest of the world in many respects. 90+ % of the population with bank accounts; dramatic elimination of queues for rail tickets, paying bills, paying taxes. Transparency in official transactions. FEAR in BM circles. Huge expansion of tax base, if I figure correctly. Drop in interest rates, not due to deflation but due to influx of liquidity available for legitimate business loans.

2) Instead, the narrative has been grabbed by "BUT HE PROMISED TO RETURN TO PRE-Nov8 STATUS QUO BY DECEMBER 31 AND SWINDLED US!"

Duh! How tough is it to turn this into "BM PARTIES

So we didn't see 50% of money supply disappear. Anyone think how disastrous that would have been, hain?

What is apparent is that normality HAS been restored in an amazing 60 days, with no serious dent in any sector. The ***CASH** component of BM has been shaken to the core. But as with all investors, BM people also don't get any ROI if they keep their loot as CASH, hain? They would have invested. So their Operations would have been crimped, but the capital and facilities are all sunk and in place waiting for the Tax (wo)Man. That will occur over the next year, I hope: crackdown on real estate and other BM investments

Anything where operations suddenly went down, is suspect. Example, the present

So the only message is that the currency recall has been 100% success. The free-floating cash is now accounted and under control. No big holes. Conservation laws satisfied, equation closes. Next step: same exercise in real estate. Then in industry.

Re: Currency Demonetisation and Future course of Indian Economy

Niti Ayog Vice chairman warns govt against any tax witch hunting :

http://indianexpress.com/article/india/ ... t-4455006/

Pro RSS swarajyamag supports the warning:

http://swarajyamag.com/economy/why-it-i ... -terrorism

I intrepret Modi speech on dec 31 as heeding to that warning. And admitting defeat - those minor sops were apologies for harassing the citizens. Atleast I hope so and Modi will desist from any further aggravation of the situation.

Lets get real - there is no one time bonanza, there is no black money haul, there is no increase in electronic transactions, there is likely to be no increase in tax compliance. Instead transactions collapsed, trade collapsed, retail sales collapsed, thousands lost jobs.

Just came to know car sales collapsed by 37% in Nov at an annualized rate. This was a growing industry and a bellweather of urban consumer spend.

http://indianexpress.com/article/india/ ... t-4455006/

Pro RSS swarajyamag supports the warning:

http://swarajyamag.com/economy/why-it-i ... -terrorism

I intrepret Modi speech on dec 31 as heeding to that warning. And admitting defeat - those minor sops were apologies for harassing the citizens. Atleast I hope so and Modi will desist from any further aggravation of the situation.

Lets get real - there is no one time bonanza, there is no black money haul, there is no increase in electronic transactions, there is likely to be no increase in tax compliance. Instead transactions collapsed, trade collapsed, retail sales collapsed, thousands lost jobs.

Just came to know car sales collapsed by 37% in Nov at an annualized rate. This was a growing industry and a bellweather of urban consumer spend.

Re: Currency Demonetisation and Future course of Indian Economy

Just finished reading the paper (ET) 15 minutes agokiranA wrote:

Just came to know car sales collapsed by 37% in Nov at an annualized rate. This was a growing industry and a bellweather of urban consumer spend.

Auto sector skirts demonetisation's deepest fears

MUMBAI: Investors, who had lost interest in auto stocks because of a sharp drop in demand post the November demonetisation, are warming up to the sector once again. The drop in sales volumes in the past two months has been less than what was feared.

But clearly investors aren't going to rush back to buy these stocks. An investor, for instance, is first likely to go for passenger car company stocks, followed by tractors and twowheeler stocks, and in the end, trucks.

What restored confidence among investors was the fact that the drop in retail sales -when dealer sells vehicles to a customer -was restricted to only 5% against an anticipated 15% post demonetisation.

India's largest car maker Maruti, which had recorded a drop of 4% in December, is picking up the pieces; even in the rural segment, Maruti grew more in December than what it did between April and November.

Re: Currency Demonetisation and Future course of Indian Economy

It is interesting how the negative reactions to the DeMo are so resonant of the parable of the six blind men and the elephant.

People only 'see' what they perceive to be the truth from their own blinkered perspective and wail loudly - oh, people are dying in ATM queues, poor are suffering, economy is collapsing, stocks are down, jobs are lost.........

People need real eyes to see and understand Modi's vision fully, it may be a bit blurry at times, but like a fine-tuned lens, things will fall into focus eventually.

People only 'see' what they perceive to be the truth from their own blinkered perspective and wail loudly - oh, people are dying in ATM queues, poor are suffering, economy is collapsing, stocks are down, jobs are lost.........

People need real eyes to see and understand Modi's vision fully, it may be a bit blurry at times, but like a fine-tuned lens, things will fall into focus eventually.

Re: Currency Demonetisation and Future course of Indian Economy

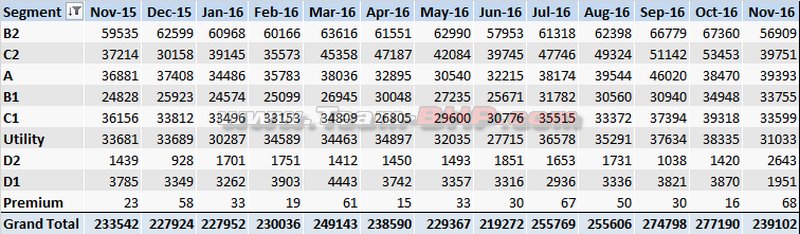

YoY car sales for November grew and there seems to be no 37% drop at an annualised rate. Pls link data to support facts. Your opinion could be right but by quoting dubious facts even the opinion seems less credible.kiranA wrote:Niti Ayog Vice chairman warns govt against any tax witch hunting :

http://indianexpress.com/article/india/ ... t-4455006/

Pro RSS swarajyamag supports the warning:

http://swarajyamag.com/economy/why-it-i ... -terrorism

I intrepret Modi speech on dec 31 as heeding to that warning. And admitting defeat - those minor sops were apologies for harassing the citizens. Atleast I hope so and Modi will desist from any further aggravation of the situation.

Lets get real - there is no one time bonanza, there is no black money haul, there is no increase in electronic transactions, there is likely to be no increase in tax compliance. Instead transactions collapsed, trade collapsed, retail sales collapsed, thousands lost jobs.

Just came to know car sales collapsed by 37% in Nov at an annualized rate. This was a growing industry and a bellweather of urban consumer spend.

http://www.team-bhp.com/forum/indian-ca ... lysis.html

Auto enthusiasts will enjoy the whole page of data. Have a look.

Re: Currency Demonetisation and Future course of Indian Economy

Other than the intial over exuberance shown by Govt by understimating the depth of fraud and corruption in the society and by assuming the hoarder with fear of being caught would destroy the currency rather than deposit it in the bank, the demonetization process is a phenomenal success. The MSM and Opposition are cynically assuming with lot of confidence that all money deposited in the bank is white which is absolutely false. Govt has all the records and time to go after them.

One instantaneous result from demonetization is clear proof of how deep the corruption is in the society - First lot many poeple hoarded the money than anybody thought and second, many people are evading tax. It is infuriating that MSM puts all its effort in criticizing Modi rather than analyzing and educating the public on these ills. With collective reporting here we collected lot more info on this message board than any MSM honestly analysed. In any case, the worst is behind us. By end of this month, I expect it would be back to normal. The real work of Demo starts now.

However I'm afraid that govt may be intimidated by ignorant media and the opportunistic opposition. It would be terrible if govt continues to print large currency and allow people to hoard the money again by removing limits. The amount of digitization that happened in the last two months would not have happened even in 5 years if this demonetization is not done. It would be shame if we lose this momentum.

There is lot of speculation in the media that once the limits on withdrawals are lifted, the black money will go back to bunkers with lightning speed. If Govt is not careful, it can happen. I strongly suggest that after printing about Rs 1lakh crores of Rs 500 notes, they should stop printing any more 500s and 2000s. They can print lower denominations but don't give any more opportunity for BM hoarders to hoard Rs 500 notes. If they want to hoard Rs 2000 notes, it is at their peril as another more aggressive demo is going to come after 2019. Also make it illegal to posess more than Rs 10 lacs of cash per household/business at any time. Set the stage for Rs2000 demo by 2019 by bringing more Rs 100/50 notes and making the cashless trnasactions mandatory for any transaction more than Rs 5000.

One instantaneous result from demonetization is clear proof of how deep the corruption is in the society - First lot many poeple hoarded the money than anybody thought and second, many people are evading tax. It is infuriating that MSM puts all its effort in criticizing Modi rather than analyzing and educating the public on these ills. With collective reporting here we collected lot more info on this message board than any MSM honestly analysed. In any case, the worst is behind us. By end of this month, I expect it would be back to normal. The real work of Demo starts now.

However I'm afraid that govt may be intimidated by ignorant media and the opportunistic opposition. It would be terrible if govt continues to print large currency and allow people to hoard the money again by removing limits. The amount of digitization that happened in the last two months would not have happened even in 5 years if this demonetization is not done. It would be shame if we lose this momentum.

There is lot of speculation in the media that once the limits on withdrawals are lifted, the black money will go back to bunkers with lightning speed. If Govt is not careful, it can happen. I strongly suggest that after printing about Rs 1lakh crores of Rs 500 notes, they should stop printing any more 500s and 2000s. They can print lower denominations but don't give any more opportunity for BM hoarders to hoard Rs 500 notes. If they want to hoard Rs 2000 notes, it is at their peril as another more aggressive demo is going to come after 2019. Also make it illegal to posess more than Rs 10 lacs of cash per household/business at any time. Set the stage for Rs2000 demo by 2019 by bringing more Rs 100/50 notes and making the cashless trnasactions mandatory for any transaction more than Rs 5000.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

2000 is effectively demo already because no one wants it. NaMo shpuld pls consider stopping printing any more of the pinko notes and change to design to be a Congress symbol on a black background with the hammer,sickle and star in a corner. So that everyone knows what the 2000 note means. Pictures of RaGa and Masood Azhar on the foreground.

Re: Currency Demonetisation and Future course of Indian Economy

One GOI sanctioned report, IIRC on black money, recommended that cash in circulation be halfed or some such thing. Even when the situation normalizes I don't expect cash going back to the previous levels. The push for digital transaction will fill up the gap slowly but surely.

Re: Currency Demonetisation and Future course of Indian Economy

Do know if this was posted before for it is a week old.

http://indianexpress.com/article/busine ... p-4451990/

Notes ban: Many digital payment channels see huge jump

Summary

USSD transactions saw a whopping 5,135 % jump (Small base)

UPI transactions grew 1,342 % (Small base)

RuPay (21 lakh on December 25) witnessed 446 % jump

Mobile wallets (67 lakh) witnessed 210 % rise

Cheque Truncation System (CTS) transactions as well were up 67 %

http://indianexpress.com/article/busine ... p-4451990/

Notes ban: Many digital payment channels see huge jump

Summary

USSD transactions saw a whopping 5,135 % jump (Small base)

UPI transactions grew 1,342 % (Small base)

RuPay (21 lakh on December 25) witnessed 446 % jump

Mobile wallets (67 lakh) witnessed 210 % rise

Cheque Truncation System (CTS) transactions as well were up 67 %

Last edited by pankajs on 05 Jan 2017 12:11, edited 2 times in total.

Re: Currency Demonetisation and Future course of Indian Economy

Demonetisation complete failure? 97% of banned notes back in banks: Report

http://indianexpress.com/article/busine ... ks-report/

http://indianexpress.com/article/busine ... ks-report/

As much as 97 per cent of currency notes, outlawed by the government on November 8, 2016, have reportedly returned to banks, posing a huge question mark on Prime Minister Narendra Modi’s demonetisation move

According to a report by Bloomberg, quoting sources in the know, banks have received 14.97 trillion rupees ($220 billion) as of December 30, which was the deadline set by the government for individuals to return their currency notes. The government and the RBI faced criticism for their inability to implement the move in an efficient manner, continuing to cause hardships to citizens across the country

Re: Currency Demonetisation and Future course of Indian Economy

http://indiatoday.intoday.in/story/ten- ... 35961.html

Ten-fold jump in non-cash retail payments by 2025: Deutsche

New Delhi, Dec 16 (PTI) Demonetisation is a major change for India that will result in a significant increase in bank deposits and digital transactions with non-cash retail payments likely to see a 10-fold jump by 2025, says a report. According to global financial services major Deutsche Bank, demonetisation is an immediate catalyst for the digital payments revolution. "We forecast a 10 times jump in non-cash retail payments by 2025, with mobile becoming the dominant mode of executing transactions," Deutsche Bank said in a research note. The report further noted that "though not perfect, India does have the necessary ecosystem in place for adoption to take off". Factors like Aadhaar penetration of 93 per cent of the population, improving data speeds and connectivity and supportive regulations will help meet the above objectives. "A 70-80 per cent reduction in cost of operation and user -friendly transaction options should drive both a push and pull effect for digital payments," it added. According to RBIs estimates, the cash floating in the system is about 13 per cent of the countrys gross domestic product, making India one of the most currency dependent countries in the world. Moreover, 90 per cent of retail payments are done through cash. "Given the concerted push towards a digital economy, we expect cash in circulation to reduce from current 13 per cent," the report said, adding that "we expect non cash transactions to go up to 40 per cent of payment transactions by FY25E". Moreover, mobile is likely to become the dominant channel due to wider acceptability and lower costs. Currently, debit cards are the preferred mode of payment after cash.

----------------->>

I think GOI needs to push harder and take digital payment beyond 40% as estimated in this report.

Ten-fold jump in non-cash retail payments by 2025: Deutsche

New Delhi, Dec 16 (PTI) Demonetisation is a major change for India that will result in a significant increase in bank deposits and digital transactions with non-cash retail payments likely to see a 10-fold jump by 2025, says a report. According to global financial services major Deutsche Bank, demonetisation is an immediate catalyst for the digital payments revolution. "We forecast a 10 times jump in non-cash retail payments by 2025, with mobile becoming the dominant mode of executing transactions," Deutsche Bank said in a research note. The report further noted that "though not perfect, India does have the necessary ecosystem in place for adoption to take off". Factors like Aadhaar penetration of 93 per cent of the population, improving data speeds and connectivity and supportive regulations will help meet the above objectives. "A 70-80 per cent reduction in cost of operation and user -friendly transaction options should drive both a push and pull effect for digital payments," it added. According to RBIs estimates, the cash floating in the system is about 13 per cent of the countrys gross domestic product, making India one of the most currency dependent countries in the world. Moreover, 90 per cent of retail payments are done through cash. "Given the concerted push towards a digital economy, we expect cash in circulation to reduce from current 13 per cent," the report said, adding that "we expect non cash transactions to go up to 40 per cent of payment transactions by FY25E". Moreover, mobile is likely to become the dominant channel due to wider acceptability and lower costs. Currently, debit cards are the preferred mode of payment after cash.

----------------->>

I think GOI needs to push harder and take digital payment beyond 40% as estimated in this report.

Re: Currency Demonetisation and Future course of Indian Economy

With economies of scale kicking in, it will become cheaper to go digital for the business community, given the relatively high costs of maintaining the digital transaction infra by a small shop owner.

SBI to end PoS transaction fees for small merchants

SBI to end PoS transaction fees for small merchants

State Bank of India (SBI) plans to remove transaction charges on point-of-sale (PoS) terminals for merchants who have an annual turnover less than Rs20 lakh, in a bid to boost cashless payments.

Currently, banks such as SBI charge an MDR of 0.25% on transactions less than Rs1,000. They charge 0.5% for transactions between Rs1,000 and Rs2,000 and 1% for those of higher value.

Re: Currency Demonetisation and Future course of Indian Economy

My suggestion would be to wait for RBI press releases to come in. Indian Express is quoting a Bloomberg report (see a few posts above to see the link), which in turn was quoting "sources who wish NOT to be identified". So it may be the standard practice in the media, one dubious report referencing an even bigger dubious report.Austin wrote:Demonetisation complete failure? 97% of banned notes back in banks: Report

Re: Currency Demonetisation and Future course of Indian Economy

If digital transactions will incur windfall gains for credit/card cos. and telecom giants through interest on transactions,then the common man once cash is available will continue to use it in preference to cards/digit. transactions. The poor infrastructure and frauds that bedevil digital transactions will deter common folk as most cannot understand the digital world.. Even in tech-savvy metros and larger cities,cash will still be preferred for almost all smaller transactions. As for BM-wallahs,their "briefcase" deliveries will just double if they have to use smaller denom notes. Those who want cash will have to take it as it comes,plus "there are over a 100 ways of skinning a cat"" what?!

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

The question to ask is why return of 97 or even 100% of old notes constitutes a failure. If 157% of currency had returned, that would be a baad sign of pakisstaniyat. If only 50% returned, that would mean that the government set unrealistic rules for return/exchange/confessions. I mean, had that been the objective, it would have been simple to set the rule as: "Ppl are allowed to return old notes consistent with their IT filings only - and that by Nov. 30". No 50% amnesty. GOI would have been perfectly within its rights to have insisted on that - scofflaws have no case.

So this definition of a successful and complete return of old currency as a "failure of Modi's policy" is just blatantly false and negative, anti-Indian reporting.

All these authors' accounts should examined for recent spikes in "donations". Oiseules!

So this definition of a successful and complete return of old currency as a "failure of Modi's policy" is just blatantly false and negative, anti-Indian reporting.

All these authors' accounts should examined for recent spikes in "donations". Oiseules!

Re: Currency Demonetisation and Future course of Indian Economy

^^

GOI needs to push harder for desi solutions. UPI transaction cost is said to be low compared to the other options. There are multiple benefit in seeing UPI grow.

1. Indian owned network fully outside the control of foreign entities.

2. Low transaction cost.

3. Cellphone driven; No special hardware cost to be incurred.

They need to get its interface available in ALL Indian languages ASAP.

GOI needs to push harder for desi solutions. UPI transaction cost is said to be low compared to the other options. There are multiple benefit in seeing UPI grow.

1. Indian owned network fully outside the control of foreign entities.

2. Low transaction cost.

3. Cellphone driven; No special hardware cost to be incurred.

They need to get its interface available in ALL Indian languages ASAP.

Re: Currency Demonetisation and Future course of Indian Economy

http://www.firstpost.com/business/demon ... 88798.html

Demonetisation: Tax collection to exceed budget estimates this fiscal, claims Jaitley

“We will end this year with higher revenues both direct and indirect taxes, higher than budgeted. Not only are we going to reach the budget estimates, we will exceed the budget estimates both in direct tax and indirect tax this year,” he told reporters here.

-------------->

That should put to rest any speculation of lasting damage because of DeMo. Dislocation? Yes. Lasting Damage? NO.

Demonetisation: Tax collection to exceed budget estimates this fiscal, claims Jaitley

“We will end this year with higher revenues both direct and indirect taxes, higher than budgeted. Not only are we going to reach the budget estimates, we will exceed the budget estimates both in direct tax and indirect tax this year,” he told reporters here.

-------------->

That should put to rest any speculation of lasting damage because of DeMo. Dislocation? Yes. Lasting Damage? NO.

Re: Currency Demonetisation and Future course of Indian Economy

http://www.thehindubusinessline.com/opi ... 459507.ece

Can’t say demonetisation has failed

To go by sums that have returned to banks would be misleading. Let’s wait till the I-T department completes investigations.

Can’t say demonetisation has failed

To go by sums that have returned to banks would be misleading. Let’s wait till the I-T department completes investigations.

Re: Currency Demonetisation and Future course of Indian Economy

http://www.firstpost.com/business/demon ... 88774.html

RBI to remove restrictions on cash withdrawals after assessment, says Jaitley

New Delhi: The Reserve Bank of India (RBI) will remove restrictions on cash withdrawals after assessing market situation, Finance Minister Arun Jaitley said on Wednesday even as he ruled out interfering with the conditions barring anyone other than NRIs and Indians returning from abroad from depositing the junked notes in select central bank branches.

"RBI will decide by assessing market situation. Many a time, actions are taken in phases, so relaxations are also done in phases," he said when asked by when restrictions on cash withdrawals are expected to be removed.

Currently, an account holder is allowed to withdraw Rs 24,000 per week from the counters and Rs 4,500 per day from ATM.

RBI to remove restrictions on cash withdrawals after assessment, says Jaitley

New Delhi: The Reserve Bank of India (RBI) will remove restrictions on cash withdrawals after assessing market situation, Finance Minister Arun Jaitley said on Wednesday even as he ruled out interfering with the conditions barring anyone other than NRIs and Indians returning from abroad from depositing the junked notes in select central bank branches.

"RBI will decide by assessing market situation. Many a time, actions are taken in phases, so relaxations are also done in phases," he said when asked by when restrictions on cash withdrawals are expected to be removed.

Currently, an account holder is allowed to withdraw Rs 24,000 per week from the counters and Rs 4,500 per day from ATM.

Re: Currency Demonetisation and Future course of Indian Economy

Remember this is the JNU view .... Nothing to get exited about ... any thing Modi does becomes poison for these charlatans.

http://www.thehindu.com/news/national/a ... 989979.ece

Demonetisation has begun prolonged recession: Patnaik

VIJAYAWADA: Noted economist Prabhat Patnaik has asserted that by demonetising old Rs.1,000 and Rs.500 notes which constituted nearly 86 per cent of the currency in circulation, Prime Minister Narendra Modi has actually sowed the seeds of a long-drawn recession. Demonetisation has dealt a severe blow to the informal (unorganised) sector which uses most of the cash.

“Rendering the cash in their possession valueless led to a drastic contraction in demand and since their contribution to the GDP, which stands around 50 per cent, has suffered a major dent, the move (demonetisation) has hit the organised sector too. The consequence is a generalised recession. What we are going through is just the beginning of this sordid chapter in the Indian economy,” Mr. Patnaik observed.

http://www.thehindu.com/news/national/a ... 989979.ece

Demonetisation has begun prolonged recession: Patnaik

VIJAYAWADA: Noted economist Prabhat Patnaik has asserted that by demonetising old Rs.1,000 and Rs.500 notes which constituted nearly 86 per cent of the currency in circulation, Prime Minister Narendra Modi has actually sowed the seeds of a long-drawn recession. Demonetisation has dealt a severe blow to the informal (unorganised) sector which uses most of the cash.

“Rendering the cash in their possession valueless led to a drastic contraction in demand and since their contribution to the GDP, which stands around 50 per cent, has suffered a major dent, the move (demonetisation) has hit the organised sector too. The consequence is a generalised recession. What we are going through is just the beginning of this sordid chapter in the Indian economy,” Mr. Patnaik observed.

Re: Currency Demonetisation and Future course of Indian Economy

http://www.thehindu.com/news/national/a ... 990012.ece

Go cashless post demonetisation, Yunus tells India

TIRUPATI: By making use of the new vistas thrown open by demonetisation, India should get prepared for a major shift to a cashless regime, said Muhammad Yunus, Nobel laureate and a noted Bangladeshi social entrepreneur and founder of the Grameen Bank.

....

In his brief interaction with the audience after delivering a talk at the 104th Indian Science Congress here on Wednesday, he urged the Indian public to ‘go on a full blast’ towards a cashless society.

Go cashless post demonetisation, Yunus tells India

TIRUPATI: By making use of the new vistas thrown open by demonetisation, India should get prepared for a major shift to a cashless regime, said Muhammad Yunus, Nobel laureate and a noted Bangladeshi social entrepreneur and founder of the Grameen Bank.

....

In his brief interaction with the audience after delivering a talk at the 104th Indian Science Congress here on Wednesday, he urged the Indian public to ‘go on a full blast’ towards a cashless society.

Re: Currency Demonetisation and Future course of Indian Economy

in other news paytm has implemented a USSD SMS based interface and will work on feature phones also now, no need for data plan.

Re: Currency Demonetisation and Future course of Indian Economy

This claim - there is no increase in electronic transactions - simply cannot be true.kiranA wrote: Lets get real - there is no one time bonanza, there is no black money haul, there is no increase in electronic transactions, there is likely to be no increase in tax compliance. Instead transactions collapsed, trade collapsed, retail sales collapsed, thousands lost jobs.

Just came to know car sales collapsed by 37% in Nov at an annualized rate. This was a growing industry and a bellweather of urban consumer spend.

Looking at the preliminary November RBI bulletin numbers as an indication is wrong, the data there represents **four** banks only.

In the meantime, HT reported on November 21, barely 2 weeks after demonetization:

http://www.hindustantimes.com/business- ... dwiSN.html

The headline:

"Paytm transactions exceed combined usage of credit, debit cards in India "

Fuelled by a cash crunch after the demonetisation drive, people feel compelled to switch to digital wallets like Paytm.

The company is now witnessing about 7 million daily transactions worth about Rs 120 crore, helping it cross $ 5 bn Gross Merchandise Value (GMV) sales, four months ahead of its target.Last year, Paytm’s GMV was at $3 bn.

GMV, is a term used for the total worth of goods sold through a digital platform.

The Alibaba-backed company, which offers both mobile payment and e-commerce marketplace, said, “Paytm is registering over 7 million transactions worth Rs 120 crore in a day as millions of consumers and merchants across the country try mobile payments on the payment platform for the first time,” company vice-president Sudhanshu Gupta said.

The company is currently doing more transactions than the combined average daily usage of credit and debit cards in India, he added.

Paytm has served over 45 mn users in last 10 days and over 5 mn new users were added since the demonetisation decision was announced on November 8, Gupta said.Paytm has over 150 mn mobile wallet users currently.

Mobile wallet companies including Paytm have seen manifold growth in transactions and new users as people turn to digital platforms after serpentine queues outside ATMs, banks continue to hassle them.

“Offline transactions now contribute to over 65% of the overall business from 15% about six months ago. We are also working on expanding our merchant network by 150,000 additional merchants,” he said.

Gupta added that the company has now crossed the overall $5 bn GMV milestone.

-

amit

- BRF Oldie

- Posts: 4325

- Joined: 30 Aug 2007 18:28

- Location: The Restaurant at the End of the Universe

Re: Currency Demonetisation and Future course of Indian Economy

This is just all loud farts. The folks who are lamenting on 97 per cent of all cash returned are also the ones who point out (IMO correctly) that only around 5 per cent of the black economy constitutes the "cash" component. The rest resides in real estate, gold and off shore. Now it's up to the IT and other govt departments to dig out this part of the black economy. I'm sure these guys will be busy over the next few months. On the government's part, it now needs to shift into the next gear with action against benami properties. I'm sure that's going to happen once this election cycle is over and budget with a minimum basic income guarantee gets passed. [For more reading: link ].UlanBatori wrote:The question to ask is why return of 97 or even 100% of old notes constitutes a failure. If 157% of currency had returned, that would be a baad sign of pakisstaniyat. If only 50% returned, that would mean that the government set unrealistic rules for return/exchange/confessions. I mean, had that been the objective, it would have been simple to set the rule as: "Ppl are allowed to return old notes consistent with their IT filings only - and that by Nov. 30". No 50% amnesty. GOI would have been perfectly within its rights to have insisted on that - scofflaws have no case.

So this definition of a successful and complete return of old currency as a "failure of Modi's policy" is just blatantly false and negative, anti-Indian reporting.

All these authors' accounts should examined for recent spikes in "donations". Oiseules!

The thing to note is that "black" money even though it constitutes 5 per cent of total black money is the grease that keeps the black economy functioning. For example if you buy a benami house for 5 crores, you don't take a bank loan, you pay with a few suitcases of cash. Even when you are buying a legit property chances are you'd be asked to pay 40 per cent in cash the rest in check. This is what sustains the black economy. DeMo is going to make this a lot more difficult to do now. That itself justifies the entire exercise.

-

Rishi Verma

- BRFite

- Posts: 1019

- Joined: 28 Oct 2016 13:08

Re: Currency Demonetisation and Future course of Indian Economy

Also paying bus / train tickets. Often tickets are "sold out" and train leaves 1/2 empty. E-payment will allow gov to know which routes are profitable, which in less demand more accurately. In Maharashtra at least one gov clerk in cooperation with ST bus conductor was stealing cash from bus ticket sales by issuing fake tickets and was caught with crores.shiv wrote:A digital economy is not just about buying fruit and veg with credit card. The government holds a very strong "card" if they can push it through and set up the infrastructure to make all electricity, water and gas payments digital. This is money that is going to govt agencies and they must make it more expensive to pay by cash.

Re: Currency Demonetisation and Future course of Indian Economy

http://www.livemint.com/Industry/1XiYWh ... -demo.html

December 27, 2016 news-item, headlined "RuPay card usage at PoS terminals surges 7 times after demonetisation: NPCI"

December 27, 2016 news-item, headlined "RuPay card usage at PoS terminals surges 7 times after demonetisation: NPCI"

Re: Currency Demonetisation and Future course of Indian Economy

Explained: Has demonetisation worked

Why is 94% money returning to the banks not a surprise?

Let's try and answer this with a hypothetical situation.

Suppose I had, say, Rs 10 crore (Rs 100 million) of unaccounted money (in demonetised notes) as on November 8.

I would have panicked and scrambled for ways to get my money into the banks and probably even thought of forgoing a part of the money or paying tax plus 200% penalty on it (as was first announced).

But then the bumbling government kept changing the rules of the game on an almost daily basis.

It finally gave me an option to pay 50% tax on the unaccounted money (provided it is from a legitimate business and not from drugs/smuggling/terror etc).

The government would keep 25% interest free for four years. And I would have 25% of my money in white.

So from my original Rs 10 crore, I would get Rs 5 crore in white finally.

Then why on earth would I not return my money to the banks?

Are the banned notes that have returned to banks now white money?

No.

There are many, like the guy in the example above, that will declare that the money they have deposited in the banks is unaccounted for and pay the 50% tax and keep 25% in the Pradhan Mantri Garib Kalyan Yogana interest free for four years.

For us to know how much tax will be paid on the money returned to the banks will take many months or even years. And a humongous exercise for the tax officials (which is another story).

And with the government and the Reserve Bank of India cagey about giving us proper figures, it may take even longer for us to pry the information out of them.

Then there are guys who will brazen it out and not voluntarily declare their unaccounted money.

If caught, they will have to pay 85% taxes plus penalties. .

But catching them will take some doing and also take time and money.

So has the demonetisation exercise worked, or no?

Like we said earlier, there are going to be no quick answers. But there are some straws in the wind that we can clutch for now.

•There is not going to be a quick Rs 2 lakh crore to Rs 3.5 lakh crore windfall for the government (as some experts estimated).

•The cost of demonetisation to the economy was estimated at Rs 1.28 lakh crore by the Centre for Monitoring the Indian Economy.

•The government has already made about Rs 43,000 crore to Rs 90,000 crore, because that money did not return to the banking system.

•Between Rs 14.5 lakh crore and Rs 14.97 lakh crore has returned to the banking system. So every single rupee in that has left a trail that can be picked up. There is basically no unaccounted money any longer.

•Let's believe the experts for once and agree that 25% of the money pre-demonetisation was black. Between 3% and 6% of it has not returned to the system. So we can assume that 20% of the black money is now in the banks. That about Rs 3 lakh crore (20% of nearly 15 lakh crore that has returned). Even if the tax authorities manage to track all of that (a difficult if not impossible task), they can hope to gain a maximum of Rs 1.5 lakh crore. Plus some interest accrual to the PMGKY.

•So the maximum the government can hope to gain from our 50-day pain is about Rs 1.9 lakh crore to Rs 2.4 lakh crore. (I am rounding off and simplifying the calculations).

•Realistically, I think the figure will be closer to Rs 1 lakh crore to Rs 1.5 lakh crore. (My gut that is, no number-crunching here).

•Fake currency has been wiped out, for now. Terror funding has stopped, for now. But both will resume once the banned currency notes are replaced and banks ease withdrawal norms. It's just a one time reset.

So is there anything to smile about now?

Sure there is!

After 50 days of scrambling for money and getting used to standing in lines again, the rush at banks and ATM are thinning out and people have starting getting cash in their wallets.

And since the banks are flush with money, they have slashed interest rates on home, cars and personal loans.

If nothing, the drop in your EMI is something make you flash those our pearly whites:).

Re: Currency Demonetisation and Future course of Indian Economy

The figures of 3 LC etc not coming back into banking system was being very loudly announced in early days. For eg Gurumurthy himself was quoting SBI that 3LC wont come back. And then govt will get 2LC tax on rest of BM. Hence there would be a 5LC windfall and so on. So these numbers arent being manufactured. They were being actively talked about complete with imagerey of people having to smoke their wads of cash etc. Infact the notes floating in Ganga was a big event with people thinking this is going to be a routine affair now.

Even the cash-to-GDP ratio theory that is being propagated by Gurumurthy has a bit of statistical jugglery associated wth it. For eg he claims cash was 4 LC in 2004 or 2001 ( I forget ). But the indian economy has grown quite a bit so thinking in %age terms would be helpful. But nobody does that because that doesnt translate to high TRPs and click thrus.

https://upload.wikimedia.org/wikipedia/ ... labels.PNG

Also he keeps talking about the period 2004-2010. Because thats where cash-to-GDP ratio rose. After 2010 it actually came down. Really down in 2013-14.

http://www.bloombergquint.com/opinion/2 ... al-nuances

Gurumurthy also never says what should be the "right" number. In the interview posted here for eg he says the ratio was 13% in 2007-2008. And in another interview he clams its 12% now. And then goes on to say it will become 30 LC leading to "collapse" ( without mentioning the cash-to-GDP ratio for 30LC ). That might work for lay people but should not on BRF.

I have always thought that economics was really not "science" but more like indology where half-truths and high falutin BS is passed off as science. If nothing else demo has made that abundantly clear to me that almost nobody had any clue even about the amount of BM.

Another eg

http://timesofindia.indiatimes.com/busi ... 576351.cms

this is just stats for shock value. Now what people will suddenly start thinking is that the low cash to GDP ratio should automagically translate to higher tax-to-GDP ratio. Atleast that is my layman interpretation. After all Brazil cash-to-GDP is around 3.8% while India is close to 12. But turns out Brazil's tax-to-GDP is around 13% while India's is 11-12% and US is 11%. Not drastically different to me. Hence it requires more nuanced thinking and a proper debate.

Even the cash-to-GDP ratio theory that is being propagated by Gurumurthy has a bit of statistical jugglery associated wth it. For eg he claims cash was 4 LC in 2004 or 2001 ( I forget ). But the indian economy has grown quite a bit so thinking in %age terms would be helpful. But nobody does that because that doesnt translate to high TRPs and click thrus.

https://upload.wikimedia.org/wikipedia/ ... labels.PNG

Also he keeps talking about the period 2004-2010. Because thats where cash-to-GDP ratio rose. After 2010 it actually came down. Really down in 2013-14.

http://www.bloombergquint.com/opinion/2 ... al-nuances

Gurumurthy also never says what should be the "right" number. In the interview posted here for eg he says the ratio was 13% in 2007-2008. And in another interview he clams its 12% now. And then goes on to say it will become 30 LC leading to "collapse" ( without mentioning the cash-to-GDP ratio for 30LC ). That might work for lay people but should not on BRF.

I have always thought that economics was really not "science" but more like indology where half-truths and high falutin BS is passed off as science. If nothing else demo has made that abundantly clear to me that almost nobody had any clue even about the amount of BM.

Another eg

http://timesofindia.indiatimes.com/busi ... 576351.cms

this is just stats for shock value. Now what people will suddenly start thinking is that the low cash to GDP ratio should automagically translate to higher tax-to-GDP ratio. Atleast that is my layman interpretation. After all Brazil cash-to-GDP is around 3.8% while India is close to 12. But turns out Brazil's tax-to-GDP is around 13% while India's is 11-12% and US is 11%. Not drastically different to me. Hence it requires more nuanced thinking and a proper debate.

Last edited by RajeshG on 05 Jan 2017 16:34, edited 1 time in total.

Re: Currency Demonetisation and Future course of Indian Economy

Note ban most disruptive policy innovation since 1991: Ex-RBI Guv Subbarao

http://www.business-standard.com/articl ... 585_1.html

http://www.business-standard.com/articl ... 585_1.html

Former Reserve Bank governor D Subbarao on Thursday termed demonetisation as "creative destruction and the most disruptive policy innovation since 1991 reforms" that has helped destroy black money.

"On November 8, the Prime Minister (Narendra Modi) and the Reserve Bank have demonetised 86 per cent of currency in circulation overnight, which is what is arguably the most disruptive policy innovation in India since the 1991 reforms," he said.

"Demonetisation, in that sense, is creative destruction. But it is a very special type of creative destruction. Because what it has destroyed is a destructive creation- black money. So, you can understand that demonetisation is the creative destruction of a destructive creation," Subbarao said.

He was addressing an international conference organised by the Institute for Development and Research in Banking Technologies (IDRBT).

He further said demonetisation is "arguably" leading to a flurry of innovations in Indian financial sector by way of digitisation of payments.

"There are two perspectives. Extension of a global trend of financial technology which is upending the finance industry and discontinuous change in a low-income country from cash incentive economy to a less-cash economy. Either way, we will have disruptive innovations in India's financial sector," he explained.

Subbarao said that though cost and benefit of this demonetisation exercise is a very contentious debate, the subject of policy innovation is not contentious.

According to him, the country witnesses a lot of disruptive innovations in finance in payment system.

The model of traditional banking has access to low-cost deposits and has an advantage over other financial institutions, including fintech companies, according to the former governor.

"That advantage is going to be neutralised by the business model of these fintech companies which will beat on efficiency, service and trust," Subbarao remarked.

He suggested the traditional banks should look into other avenues to compete by tying up with these companies or payments banks that are coming up.

He urged regulators to promote innovation and protect consumers and preserve financial stability.

"On the one hand, they have to make sure the stability is preserved and on the other hand, they should regulate tightly that innovation is not scorched. This balance is a very difficult judgement call," he added.

Re: Currency Demonetisation and Future course of Indian Economy

pankajs wrote:http://www.thehindubusinessline.com/opi ... 459507.ece

A number I havent seen before but good to remember as an upper bound.It was reported that the total currency issued over the counter was about ₹35,000 crore, which would be about 2.3 per cent of the total demonetised currency.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

That SubbaRao article should have stopped at word "former". Lots of these windbags will be "on the air" now with terms like "disruptive" (which now means Highly Innovative) and "Bad" (which in AA means "Very Good", as in "yo da maan, yo BAAD!" )

Re: Currency Demonetisation and Future course of Indian Economy

I was earlier today in conversation with a colleague - a young doctor who owns a 1.5 crore property on the outskirts of Bangalore. Th eproperty is one of 50 villas and - I think 15 remain unsold. Demonetization has hit property prices and the unsold one's are probably not going to get sold soon. That apart the residents have a different problem. The development is effectively illegal - with the villas being developed as part of a layout where each owner only has "B-khata" which means that they pay property tax but the properties are effectively illegal and cannot be sold or developed in any way unless converted to what is called an "A" khata where each property is demarcated, its ownership registered and certain charges paid.Dasari wrote:

There is lot of speculation in the media that once the limits on withdrawals are lifted, the black money will go back to bunkers with lightning speed. If Govt is not careful, it can happen. I strongly suggest that after printing about Rs 1lakh crores of Rs 500 notes, they should stop printing any more 500s and 2000s. They can print lower denominations but don't give any more opportunity for BM hoarders to hoard Rs 500 notes. If they want to hoard Rs 2000 notes, it is at their peril as another more aggressive demo is going to come after 2019. Also make it illegal to posess more than Rs 10 lacs of cash per household/business at any time. Set the stage for Rs2000 demo by 2019 by bringing more Rs 100/50 notes and making the cashless trnasactions mandatory for any transaction more than Rs 5000.

After demonetization some people in the layout want to dump their properties - but they can't unless they get an A khata. They can't get an A khata unless they do it as a group with all residents agreeing. Into this mix has entered the Bengaluru city corporation where officials have openly attended residents meetings and asked for Rs 20,000 per property in cash for conversion to A Khata. The residents are divided about the amount.

I asked why the names of the officials cannot simply be reported. It turns out that many residents want to pay the bribe and be done with it. They fear that if the officials are reported they will simply delay the whole process and no one will get their A khata. The negotiations now are not about doing things without a bribe - they are about reducing the bribe amount to Rs 10,000 per property

On anther note I was in an Uber taxi yesterdin where the driver was overall positive about the demonetization move, but was cusring the corruption in Bangalore. But he went through a red light and got caught. He said he offered Paytm payment as fine, but the cops wanted cash. But he got a printed receipt though so I doubt if it was a bribe. He reminisced that he had applied to join the police force but failed in the physical - he was too short. But his friends who got in 5 years ago have apparently all made 2-3 crores apiece.

Re: Currency Demonetisation and Future course of Indian Economy

The way I see it is that a large number of rich folks suddenly exited the MF investments and posted profiles. But now IT will ask if no ITR was filed then what is the source of income and then all hell is going to break loose in the coming days. The real fun is about to start and the tax gains will come probably coming fiscal which will be very close to G 19. So over all demo has sealed the fat of the opps. They were caught between the devil and the deep sea!

Re: Currency Demonetisation and Future course of Indian Economy

Shivji can you please reply in appropriate thread (e.g., Nukkad) about what is A-khata and B-khata? Never heard about this semi-legal status where one pays property tax but you do not have ownership.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

And why can't the names of the bribe-demanders be sent to the PMO pronto? By paying bribe aren't these ppl setting up other poor suckers into buying some sort of illegal property? Once u pay a bribe u r hooked.

Re: Currency Demonetisation and Future course of Indian Economy

UlanBatori wrote:And why can't the names of the bribe-demanders be sent to the PMO pronto? By paying bribe aren't these ppl setting up other poor suckers into buying some sort of illegal property? Once u pay a bribe u r hooked.

Because it works well for the people too, particularly builder lobby. They get cheaper plots, by flaunting rules they can build bigger house on smaller plots so on and so forth. Building an extra floor is common in BLR, it seems. There is a whole nexus here which facilitate entire process of building such illegal houses, where you can buy plots, build more than sanctioned plan, get loans on such illegal property, get utility connections etc. Bribe rules everywhere. Just 2days ago I read in news paper that there are over 10lakh illegal properties like this in BLR. Now that's a huge number for a city with 110lakh population. BBMP is going to regularize all these properties now. Everyone will pay bribes ranging from few thousands to few lakhs. Arguably there are some who would want to be honest but they simply cannot fight with the system.

Re: Currency Demonetisation and Future course of Indian Economy

UlanBatori wrote:And why can't the names of the bribe-demanders be sent to the PMO pronto? By paying bribe aren't these ppl setting up other poor suckers into buying some sort of illegal property? Once u pay a bribe u r hooked.

But as a direct answer to your question here is the impression I got. I was told that the entire property development has occurred with a whole lot of bribes being paid over the years to the same gents who are back for more. The original bribe payer (the builder) is now totally out of the picture - having handed over the entire property to a local "society" of residents. But there is one "caretaker" who owns 15 unsold properties for which he is coughing up about 10 lakhs a year for upkeep alone - and he is also a member of this society. In order to "expedite" the legalization of this set of properties he has pulled in the original BBMP bribe takers who have promised to delay the regularization process forever unless a bribe of Rs 20k per property is paid up.

Now my friend tells me "I have spent 1.5 crores on the property and am paying heavy EMIs. We (the society) are trying to get the bribe amount down to Rs 10,000 per property. I am not going to jeopardize my chances of regularizing the property for a mere 10,000 over and above the 1.5 crores that I have already committed.. We are afraid that if any complaint is made these men will simply freeze things and esnsue that nothing moves for years. This is fine for some people who want to stay there forever - but for those of us who may want to sell that would be a disaster"

So the story is that the corrupt officials wield the power to make life difficult for a set of people who are already caught in a trap of illegal property that came up because of earlier bribes. Moving forward from here is a situation that can always be stopped by the Damocles sword of earlier irregularities for which bribes have been paid to overlook, not absolve or remove (that is typical) Those hurdles can be crossed only if the officials choose to ignore and forget earlier irregularities and sign on the dotted line - for a fee.

As a digression I want to point out that there is in Karnataka - a scheme now in progress called "Aakrama-Sakrama". Under this scheme - previously illegal constructions - like exceeding the built up area, exceeding the minimum distance from the neighbouring property,or exceeding the number of floors one is allowed to build will be legalized, after paying a penalty. It is another matter that all the corrupt officials who took bribes years ago to allows those illegal transgressions get away scot free but the owners of those properties technically face the prospect of demolition of all irregular, illegal parts of their properties. The news is that if the transgressions are 25-50% in excess of what is allowed - the owners will be allowed to make it legal after paying a penalty. If it is over 50% they will face demolition of the excess if it is a residential property. If the property has been made commercial - then no regularization will be allowed and the excess will be demolished.

Now guess what? All the buildings that have exceeded their limits who face demolition will pay hefty bribes and ensure that they remain untouched until, at some future date the BBMP wants to make more money. Yes I know its shameful. But this is the system that Modi hopes to change. He has allies. But we are weak.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

Seems to me that the scary entities such as Nirmala S. of the Central Processing Center, Eye-Tee, who live in B'luru,, can read the newspapers and figure out the identities of the ppl who sign off on these Regularizations.

Their assets also should come under some gentle scrutiny.

A few unsolicited tweets to the NaMO PMO should set the cats among the pigeons, big-time, hain?

Their assets also should come under some gentle scrutiny.

A few unsolicited tweets to the NaMO PMO should set the cats among the pigeons, big-time, hain?